|

| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

| |

| FORM 10-K |

| |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2015 |

| OR |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from _________ to ___________ |

|

| | |

Commission File Number | Registrant; State of Incorporation; Address and Telephone Number | IRS Employer Identification No. |

| | | |

| 1-37388 | Talen Energy Corporation (Exact name of Registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 835 Hamilton Street Suite 150 Allentown, PA 18101-1179 (888) 211-6011 | 47-1197305 |

| 1-32944 | Talen Energy Supply, LLC (Exact name of Registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 835 Hamilton Street Suite 150 Allentown, PA 18101-1179 (888) 211-6011 | 23-3074920 |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| | | |

| Common Stock of Talen Energy Corporation | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

|

| | |

| Talen Energy Corporation | Yes | No X |

| Talen Energy Supply, LLC | Yes | No X |

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

| | |

| Talen Energy Corporation | Yes | No X |

| Talen Energy Supply, LLC | Yes X | No |

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days.

|

| | |

| Talen Energy Corporation | Yes X | No |

| Talen Energy Supply, LLC | Yes | No X |

(Note: Talen Energy Supply has filed all reports required under section 13 or 15(d) of the Exchange Act during the preceding 12 months, but since January 1, 2016, has not been subject to the filing requirements of Section 13 or 15(d) of the Exchange Act.)

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web sites, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files).

|

| | |

| Talen Energy Corporation | Yes X | No |

| Talen Energy Supply, LLC | Yes X | No |

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of each of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

| |

| Talen Energy Corporation | [ X ] |

| Talen Energy Supply, LLC | [ X ] |

Indicate by check mark whether the registrants are large accelerated filers, accelerated filers, non-accelerated filers, or smaller reporting companies. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

| | Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company |

| Talen Energy Corporation | [ ] | [ ] | [ X ] | [ ] |

| Talen Energy Supply, LLC | [ ] | [ ] | [ X ] | [ ] |

Indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act).

|

| | |

| Talen Energy Corporation | Yes | No X |

| Talen Energy Supply, LLC | Yes | No X |

As of June 30, 2015, Talen Energy Corporation had 128,508,921 shares of its $0.001 par value Common Stock outstanding. The aggregate market value of these common shares (based upon the closing price of these shares on the New York Stock Exchange on that date) held by non-affiliates was $1,429,161,711. In determining this figure, the registrant has assumed that the executive officers of the registrant, the registrant's directors, and affiliates of Riverstone Holdings LLC are affiliates of the registrant. Such assumptions shall not be deemed to be conclusive for any other purpose. As of January 29, 2016, Talen Energy Corporation had 128,526,720 shares of its $0.001 par value Common Stock outstanding.

There is no established public trading market for Talen Energy Supply's membership interests, and Talen Energy Corporation indirectly holds all of the membership interests in Talen Energy Supply, LLC.

Talen Energy Supply, LLC meets the conditions set forth in General Instructions (I)(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format.

Documents incorporated by reference:

Talen Energy Corporation has incorporated herein by reference certain sections of Talen Energy Corporation's proxy statement related to its 2016 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2015. Such proxy statement will provide certain of the information required by Part III of this Report.

TALEN ENERGY CORPORATION

TALEN ENERGY SUPPLY, LLC

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

This combined Form 10-K is separately filed by the following registrants in their individual capacity: Talen Energy Corporation and Talen Energy Supply, LLC. Information contained herein relating to any individual registrant is filed by such registrant solely on its own behalf, and neither registrant makes any representation as to information relating to the other registrant except that information relating to Talen Energy Supply, LLC and its subsidiaries is also attributed to Talen Energy Corporation and information relating to the subsidiaries of Talen Energy Supply, LLC is also attributed to Talen Energy Supply, LLC.

As Talen Energy Corporation is substantially comprised of Talen Energy Supply, LLC and its subsidiaries, to avoid repetition, most disclosures refer to Talen Energy which indicates the disclosure applies to each of the registrants, Talen Energy Corporation and Talen Energy Supply, LLC. This presentation has been applied where identification of particular subsidiaries is not material to the matter being disclosed, and to conform narrative disclosures to the presentation of financial information on a consolidated basis. When identification of a particular entity is considered important to understanding the matter being disclosed, the specific entity's name is used, in particular, for those few disclosures that apply only to Talen Energy Corporation. References, individually, to Talen Energy Corporation and Talen Energy Supply, LLC are references to such entities directly or to one or more of their subsidiaries, as the case may be, the financial results of which subsidiaries are consolidated into such registrant's financial results in accordance with GAAP. However, specific references to Talen Energy Supply, LLC also apply to Talen Energy Corporation through consolidation.

TABLE OF CONTENTS

|

| | |

| Item | | Page |

| PART I |

| | EXPLANTORY NOTE | |

| | GLOSSARY OF TERMS AND ABBREVIATIONS | |

| | FORWARD-LOOKING INFORMATION | |

| 1. | Business | |

| 1A. | Risk Factors | |

| 1B. | Unresolved Staff Comments | |

| 2. | Properties | |

| 3. | Legal Proceedings | |

| 4. | Mine Safety Disclosures | |

| | PART II | |

| 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| 6. | Selected Financial Data | |

| 7. | Combined Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | Overview | |

| | Results of Operations | |

| | Financial Condition | |

| | New Accounting Guidance | |

| | Application of Critical Accounting Policies | |

| | Other Information | |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| | Reports of Independent Registered Public Accounting Firm | |

| | | |

|

| | |

| 8. | Financial Statements and Supplementary Data | |

| | FINANCIAL STATEMENTS | |

| | Talen Energy Corporation and Subsidiaries | |

| | Consolidated Statements of Income | |

| | Consolidated Statements of Comprehensive Income | |

| | Consolidated Statements of Cash Flows | |

| | Consolidated Balance Sheets | |

| | Consolidated Statements of Equity | |

| | Talen Energy Supply, LLC and Subsidiaries | |

| | Consolidated Statements of Income | |

| | Consolidated Statements of Comprehensive Income | |

| | Consolidated Statements of Cash Flows | |

| | Consolidated Balance Sheets | |

| | Consolidated Statements of Equity | |

| | COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |

| | 1. Summary of Significant Accounting Policies | |

| | 2. Segment and Related Information | |

| | 3. Earnings (Loss) Per Share for Talen Energy Corporation | |

| | 4. Income and Other Taxes | |

| | 5. Financing Activities | |

| | 6. Acquisitions, Development and Divestitures | |

| | 7. Leases | |

| | 8. Stock-Based Compensation | |

| | 9. Retirement and Postemployment Benefits | |

| | 10. Jointly Owned Facilities | |

| | 11. Commitments and Contingencies | |

| | 12. Related Party Transactions | |

| | 13. Other Income (Expense) - net | |

| | 14. Fair Value Measurements and Credit Concentration | |

| | 15. Derivative Instruments and Hedging Activities | |

| | 16. Goodwill and Other Asset Impairments | |

| | 17. Other Intangible Assets | |

| | 18. Asset Retirement Obligations | |

| | 19. Available-for-Sale Securities | |

| | 20. Accumulated Other Comprehensive Income (Loss) | |

| | 21. New Accounting Guidance Pending Adoption | |

| | SUPPLEMENTARY DATA | |

| | Schedule I - Talen Energy Corporation Condensed Unconsolidated Financial Statements | |

| | Quarterly Financial and Common Stock Price - Talen Energy Corporation | |

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| 9A. | Controls and Procedures | |

| 9B. | Other Information | |

| | | |

|

| | |

| | PART III | |

| 10. | Directors, Executive Officers and Corporate Governance | |

| 11. | Executive Compensation | |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| 13. | Certain Relationships and Related Transactions, and Director Independence | |

| 14. | Principal Accounting Fees and Services | |

| | PART IV | |

| 15. | Exhibits, Financial Statement Schedules | |

| | Signatures | |

| | Exhibit Index | |

EXPLANATORY NOTE

In June 2014, PPL and Talen Energy Supply executed definitive agreements with the Riverstone Holders to combine their competitive power generation businesses into a new, stand-alone, publicly traded company named Talen Energy Corporation. On June 1, 2015, PPL completed the spinoff to PPL shareowners of a newly formed entity, Talen Energy Holdings, Inc. (Holdco), which at such time owned all of the membership interests of Talen Energy Supply and all of the common stock of Talen Energy Corporation. Immediately following the spinoff, Holdco merged with a special purpose subsidiary of Talen Energy Corporation, with Holdco continuing as the surviving company to the merger and as a wholly owned subsidiary of Talen Energy Corporation and the sole owner of Talen Energy Supply. PPL does not have an ownership interest in Talen Energy Corporation or Talen Energy Supply after completion of the spinoff. Substantially contemporaneous with the spinoff and merger, RJS Power was contributed by the Riverstone Holders to become a subsidiary of Talen Energy Supply (referred to as the "combination" or the "acquisition"). Subsequent to the acquisition, RJS Power was merged into Talen Energy Supply. Talen Energy has treated the combination with RJS Power as an acquisition, with Talen Energy Supply considered the accounting acquirer, in accordance with business combination accounting guidance. See Notes 1, 3 and 6 to the Financial Statements for additional information on the spinoff and acquisition.

Talen Energy Corporation's obligation to report under the Securities and Exchange Act of 1934, as amended, commenced on May 1, 2015, the date Talen Energy Corporation's Registration Statement on Form S-1 relating to the spinoff transaction was declared effective by the SEC. Talen Energy Supply is a separate registrant and considered the predecessor of Talen Energy Corporation, therefore, the financial information prior to June 1, 2015 presented in this Annual Report on Form 10-K for both registrants includes only legacy Talen Energy Supply information. From June 1, 2015, upon completion of the spinoff and acquisition, Talen Energy Corporation's and Talen Energy Supply's consolidated financial information also includes RJS. As such, Talen Energy Corporation's and Talen Energy Supply's consolidated financial information presented in this Annual Report on Form 10-K for 2015 represents twelve months of legacy Talen Energy Supply information consolidated with seven months of RJS information from June 1, 2015, while 2014 and earlier periods represent only legacy Talen Energy Supply information.

GLOSSARY OF TERMS AND ABBREVIATIONS

Talen Energy and its subsidiaries

Athens - New Athens Generating Company, LLC, an indirect subsidiary of Talen Energy Supply that owns generating operations in New York.

Harquahala - New Harquahala Generating Company, LLC, an indirect subsidiary of Talen Energy Supply that owns generating operations in Arizona.

Holdco - Talen Energy Holdings, Inc., a Delaware corporation, which was formed for the purposes of the spinoff transaction.

Jade - Jade Power Generation Holdings LLC, a subsidiary of Talen Energy Supply that, through its subsidiaries, owns generating operations in Texas.

MACH Gen - MACH Gen, LLC, a subsidiary of Talen Energy Supply and parent of New MACH Gen.

Millennium - Millennium Power Partners, L.P., an indirect subsidiary of Talen Energy Supply that owns generating operations in Massachusetts.

New MACH Gen - New MACH Gen, LLC, an indirect subsidiary of Talen Energy Supply and a direct subsidiary of MACH Gen that, through its subsidiaries, owns generating operations in Arizona, Massachusetts and New York.

Raven - Raven Power Generation Holdings LLC, a subsidiary of Talen Energy Supply that, through its subsidiaries, owns generating operations in Maryland.

RJS - Raven, Jade and Sapphire, collectively.

RJS Power - RJS Generation Holdings LLC, a Delaware limited liability company and former parent of RJS that was contributed by the Riverstone Holders to Talen Energy on June 1, 2015 in exchange for 35% of Talen Energy Corporation's common stock. Following the contribution, RJS Power was merged into Talen Energy Supply.

Sapphire - Sapphire Power Generation Holdings LLC, a subsidiary of Talen Energy Supply that owns generating operations in Massachusetts, New Jersey and Pennsylvania.

Susquehanna Nuclear - Susquehanna Nuclear, LLC, a subsidiary of Talen Generation that owns a nuclear-powered generating station in Pennsylvania.

Talen Energy - Talen Energy Corporation and Talen Energy Supply, LLC.

Talen Energy Corporation - a publicly traded Delaware corporation and the indirect parent of Talen Energy Supply following the spinoff from PPL.

Talen Energy Supply - Talen Energy Supply, LLC, formerly PPL Energy Supply, LLC, an indirect subsidiary of Talen Energy Corporation and the parent company of Talen Generation, Talen Energy Marketing, RJS and other subsidiaries.

Talen Energy Marketing - Talen Energy Marketing, LLC, formerly PPL EnergyPlus, LLC, a subsidiary of Talen Energy Supply that markets and trades wholesale and retail electricity and gas, and supplies energy and energy services in competitive markets.

Talen Generation - Talen Generation, LLC, a subsidiary of Talen Energy Supply that owns and operates generating facilities through various subsidiaries primarily in Pennsylvania.

Talen Montana - Talen Montana, LLC, an indirect subsidiary of Talen Generation that owns generating operations in Montana.

Talen Renewable Energy - Talen Renewable Energy, LLC, a former subsidiary of Talen Energy Supply that owned Talen Energy's renewable energy business.

Other terms and abbreviations

401(h) account - a sub-account established within a qualified pension trust to provide for the payment of retiree medical costs.

Adjusted EBITDA - see Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations - Statement of Income Analysis, Margins, EBITDA and Adjusted EBITDA - EBITDA and Adjusted EBITDA.

Amended STF Agreement - Amended and Restated Common Agreement dated as of December 15, 2015, among Talen Energy Marketing, Talen Energy Supply, as guarantor, Brunner Island, LLC, Montour, LLC, Wilmington Trust, National Association, as agent, and the secured counterparties thereto.

AOCI - accumulated other comprehensive income or loss.

ARO - asset retirement obligation.

Basis - when used in the context of derivatives and commodity trading, the commodity price differential between two locations, products or times.

CCR(s) - Coal Combustion Residual(s), including fly ash, bottom ash and sulfur dioxide scrubber wastes.

Clean Air Act - federal legislation enacted to address certain environmental issues related to air emissions, including acid rain, ozone and toxic air emissions.

COBRA - Consolidated Omnibus Budget Reconciliation Act.

COLA - license application for a combined construction permit and operating license from the NRC for a nuclear plant.

CRRs - congestion revenue rights, which are financial instruments established to manage price risk related to electricity transmission congestion that entitle the holder to receive compensation or require the holder to remit payment for certain congestion-related transmission charges based on the level of congestion between two pricing locations, known as source and sink.

CSAPR - Cross-State Air Pollution Rule.

DDCP - Directors Deferred Compensation Plan.

Dodd-Frank Act - the Dodd-Frank Wall Street Reform and Consumer Protection Act that was signed into law in July 2010.

DOE - U.S. Department of Energy.

DR - demand response, a program designed to induce, through the use of incentive payments, retail electricity consumers to lower electricity use at times of high wholesale market prices or when system reliability is jeopardized.

EBITDA - see Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations - Statement of Income Analysis, Margins, EBITDA and Adjusted EBITDA - EBITDA and Adjusted EBITDA.

ELG - Effluent Limitations Guidelines.

EPA - U.S. Environmental Protection Agency.

EPS - earnings per share.

ERCOT - the Electric Reliability Council of Texas, operator of the electricity transmission network and electricity energy market in most of Texas.

EWG - exempt wholesale generator.

FERC - U.S. Federal Energy Regulatory Commission.

FTRs - financial transmission rights, which are financial instruments established to manage price risk related to electricity transmission congestion that entitle the holder to receive compensation or require the holder to remit payment for certain congestion-related transmission charges based on the level of congestion between two pricing locations, known as source and sink.

First Lien Credit and Guaranty Agreement- the First Lien Credit and Guaranty Agreement dated as of April 28, 2014, among New MACH Gen, as borrower, the guarantors named therein, the lenders party thereto and CLMG Corp., as administrative agent.

GAAP - Generally Accepted Accounting Principles in the U.S.

GHG - greenhouse gas(es).

GWh - gigawatt-hour, one million kilowatt-hours.

IBEW - International Brotherhood of Electrical Workers.

Ironwood Facility - a natural gas combined-cycle unit in Lebanon, Pennsylvania.

IRS - U.S. Internal Revenue Service.

ISO - Independent System Operator.

ISO-NE - ISO New England Inc., oversees the bulk power generation and transmission system that serves Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont.

kWh - kilowatt-hour, basic unit of electrical energy.

LIBOR - London Interbank Offered Rate.

MATS - Mercury and Air Toxics Standards.

MDE - Maryland Department of Environment.

MDEQ - Montana Department of Environmental Quality.

MEIC - Montana Environmental Information Center.

MMBtu - One million British Thermal Units.

Moody's - Moody's Investors Service, Inc., a credit rating agency.

MW - megawatt, one thousand kilowatts.

MWh - megawatt-hour, one thousand kilowatt-hours.

NAAQS - National Ambient Air Quality Standard.

NDT - Susquehanna Nuclear's plant decommissioning trust.

NERC - North American Electric Reliability Corporation.

New MACH Gen RCF - revolving credit facility within the First Lien Credit and Guaranty Agreement.

NorthWestern - NorthWestern Corporation, a Delaware corporation, and successor in interest to Montana Power's electricity delivery business, including Montana Power's rights and obligations under contracts with Talen Montana.

NPNS - the normal purchases and normal sales exception as permitted by derivative accounting rules. Derivatives that qualify for this exception may receive accrual accounting treatment.

NRC - U.S. Nuclear Regulatory Commission.

NYISO - the New York Independent System Operator, which operates competitive wholesale markets to manage the flow of electricity across New York.

OCI - other comprehensive income or loss.

Opacity - the degree to which emissions reduce the transmission of light and obscure the view of an object in the background. There are emission regulations that limit the opacity of power plant stack gas emissions.

PADEP - the Pennsylvania Department of Environmental Protection.

PEDFA - Pennsylvania Economic Development Financing Authority.

PJM - PJM Interconnection, L.L.C., operator of the electricity transmission network and electricity market in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

PLR - Provider of Last Resort, the role of PPL Electric in providing default electricity supply within its delivery area to retail customers who have not chosen to select an alternative electricity supplier under the Customer Choice Act.

PP&E - property, plant and equipment.

PPL - PPL Corporation, the former indirect parent holding company of Talen Energy and its subsidiaries prior to the completion of the spinoff.

PPL Electric - PPL Electric Utilities Corporation, a public utility subsidiary of PPL and former affiliate of Talen Energy engaged in the regulated transmission and distribution of electricity in its Pennsylvania service area and that provides electricity supply to its retail customers in this area as a PLR.

PPL Services - PPL Services Corporation, a subsidiary of PPL and former affiliate of Talen Energy that provided services prior to the spinoff and currently provides services under a transition services agreement.

PUC - Pennsylvania Public Utility Commission, the state agency that regulates certain ratemaking, services, accounting and operations of Pennsylvania utilities.

PUCT - Public Utility Commission of Texas.

RCRA - Resource Conservation and Recovery Act of 1976.

RECs - Renewable Energy Credits.

Regional Haze Program - the EPA program that requires states to develop and implement air quality protection plans to reduce pollution that causes visibility impairment in national parks and wilderness areas.

RGGI - Regional Greenhouse Gas Initiative.

Riverstone - Riverstone Holdings LLC, a Delaware limited liability company.

Riverstone Holders - Raven Power Holdings LLC, C/R Energy Jade, LLC and Sapphire Power Holdings LLC, affiliates of Riverstone that formerly owned RJS Power and contributed RJS Power to Talen Energy on June 1, 2015 in exchange for 35% of Talen Energy Corporation's common stock.

RTO - Regional Transmission Organization.

S&P - Standard & Poor's Ratings Services, a credit rating agency.

Sarbanes-Oxley - Sarbanes-Oxley Act of 2002, which sets requirements for management's assessment of internal controls for financial reporting. It also requires an independent auditor to make its own assessment.

Scrubber - an air pollution control device that can remove particulates and/or gases (primarily sulfur dioxide) from exhaust gases.

SEC - the U.S. Securities and Exchange Commission.

SIFMA Index - the Securities Industry and Financial Markets Association Municipal Swap Index.

Spark Spread - a measure of gross margin representing the price of power on a per MWh basis less the equivalent measure of the natural gas cost to produce that power. This measure is used to describe the gross margin of Talen Energy's competitive natural gas-fired generating fleet. This term is also used to describe a derivative contract in which Talen Energy subsidiaries sell power and buy natural gas on a forward basis in the same contract.

Superfund - federal environmental statute that addresses remediation of contaminated sites; states also have similar statutes.

Talen Energy Supply RCF - the $1,850,000,000 Credit Agreement dated as of June 1, 2015 among Talen Energy Supply, as borrower, the guarantors party thereto, the lenders party thereto and Citibank, N.A., as administrative agent.

Term Loan B - New MACH Gen debt secured under the First Lien Credit and Guaranty Agreement.

Tolling agreement - agreement whereby the owner of an electricity generating facility agrees to use that facility to convert fuel provided by a third party into electricity for delivery back to the third party.

TSR - Total Stockholder Return. The change in market value of a share of a company's common stock plus the value of all dividends paid on a share of the common stock during the applicable performance period, divided by the price of the common stock as of the beginning of the performance period.

Treasury Stock Method - a method applied to calculate diluted EPS that assumes any proceeds that could be obtained upon exercise of options and warrants (and their equivalents) would be used to purchase common stock at the average market price during the relevant period.

TSA - as applicable, the Transition Services Agreement, dated June 1, 2015, by and between PPL and Talen Energy Supply and the Transition Services Agreement, dated May 4, 2015, by and between Talen Energy Supply and Topaz Power Management, LP.

VaR - value-at-risk, a statistical model that attempts to estimate the value of potential loss over a given holding period under normal market conditions at a given confidence level.

VEBA - Voluntary Employee Benefit Association Trust, accounts for health and welfare plans for future benefit payments for employees, retirees or their beneficiaries.

VIE - variable interest entity.

Volumetric risk - the risk that the actual load volumes provided under full-requirement sales contracts could vary significantly from forecasted volumes.

WECC - the Western Electricity Coordinating Council, which develops and implements regional reliability standards for the western interconnection from Canada to Mexico and includes the provinces of Alberta and British Columbia, the northern portion of Baja California, Mexico and all or portions of the 14 states in between.

FORWARD-LOOKING INFORMATION

Statements contained in this Form 10-K concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are other than statements of historical fact are "forward-looking statements" within the meaning of the federal securities laws. These statements often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "target," "project," "forecast," "seek," "will," "may," "should," "could," "would" or similar expressions. Although Talen Energy believes that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that these expectations will prove to be correct. Forward-looking statements are subject to many risks and uncertainties, and actual results may differ materially from the results discussed in forward-looking statements. In addition to the specific factors discussed in "Item 1A. Risk Factors" and in "Item 2. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Form 10-K, the following are among the important factors that could cause actual results to differ materially from the forward-looking statements:

| |

| • | adverse economic conditions; |

| |

| • | changes in commodity prices and related costs; |

| |

| • | the effectiveness of Talen Energy's risk management techniques, including hedging, with respect to electricity and fuel prices, interest rates and counterparty credit and non-performance risks; |

| |

| • | methods of accounting and developments in or interpretations of accounting requirements that may impact reported results, including with respect to, but not limited to, hedging activity; |

| |

| • | operational, price and credit risks in the wholesale and retail electricity markets; |

| |

| • | Talen Energy's ability to forecast the actual load needed to perform full-requirements sales contracts; |

| |

| • | disruptions in fuel supply; |

| |

| • | unforeseen circumstances may impact the levels of coal inventory that Talen Energy holds; |

| |

| • | the performance of transmission facilities and any changes in the structure and operation of, or the pricing limitations imposed by, the RTOs and ISOs that operate those facilities; |

| |

| • | blackouts due to disruptions in neighboring interconnected systems; |

| |

| • | competition in the power generation market, including in the expansion of alternative sources of electricity generation and in the development of new projects, markets and technologies; |

| |

| • | federal and state legislation and regulation, including costs to comply with governmental permits and approvals; |

| |

| • | costs of complying with environmental and related worker health and safety laws and regulations; |

| |

| • | the impacts of climate change; |

| |

| • | the availability and cost of emission allowances; |

| |

| • | changes in legislative and regulatory policy, including the promotion of renewable energy, energy efficiency, conservation and self-generation; |

| |

| • | security and safety risks associated with nuclear generation; |

| |

| • | Talen Energy's level of indebtedness; |

| |

| • | the terms and conditions of debt instruments that may restrict Talen Energy's ability to operate its business; |

| |

| • | the performance of Talen Energy's subsidiaries and affiliates, on which its cash flow and ability to meet its debt obligations largely depend; |

| |

| • | the risks inherent with variable rate indebtedness; |

| |

| • | disruption in financial markets; |

| |

| • | Talen Energy's ability to access capital markets; |

| |

| • | acquisition or divestiture activities, including Talen Energy's ability to realize expected synergies and other benefits from such business transactions; |

| |

| • | any failure of Talen Energy's facilities to operate as planned, including the duration of and cost, including lost revenue, associated with scheduled and unscheduled outages at Talen Energy's generating facilities; |

| |

| • | Talen Energy's ability to optimize its competitive power generation operations and the costs associated with any capital expenditures; |

| |

| • | significant increases in operation and maintenance expenses, such as health care and pension costs, including as a result of changes in interest rates; |

| |

| • | the loss of key personnel, the ability to hire and retain qualified employees and the impact of collective labor bargaining negotiations; |

| |

| • | war, armed conflicts or terrorist attacks, including cyber-based attacks; |

| |

| • | risks associated with federal and state tax laws and regulations; |

| |

| • | any determination that the transaction that formed Talen Energy does not qualify as a tax-free distribution under the Internal Revenue Code; |

| |

| • | Talen Energy's ability to successfully integrate the RJS Power businesses and to achieve anticipated synergies and cost savings as a result of the spinoff transaction and combination with RJS Power; |

| |

| • | costs of complying with reporting requirements as a newly public company and any related risks of deficiencies in disclosure controls and internal control over financial reporting as a standalone entity; and |

| |

| • | the ability of the Riverstone Holders to exercise influence over matters requiring Board of Directors and/or stockholder approval. |

Any such forward-looking statements should be considered in light of such important factors and in conjunction with other documents of Talen Energy on file with the SEC. New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time to time, and it is not possible for Talen Energy to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made, and Talen Energy undertakes no obligation to update the information contained in such statement to reflect subsequent developments or information.

PART I

ITEM 1. BUSINESS

GENERAL

Capitalized terms and abbreviations are defined in the glossary. Dollars are in millions, unless otherwise noted.

Talen Energy Corporation, through its principal subsidiary Talen Energy Supply, is a North American competitive energy and power generation and marketing company headquartered in Allentown, Pennsylvania. Talen Energy produces and sells electricity, capacity and ancillary services from its fleet of power plants totaling approximately 17,400 MW of generating capacity. Talen Energy's portfolio of generation assets is principally located in the Northeast, Mid-Atlantic and Southwest regions of the U.S. See "Item 2. Properties" for additional information on Talen Energy's plants.

Talen Energy's business was formed on June 1, 2015 by the spinoff of Talen Energy Supply, the competitive power generation business owned by PPL, and the substantially contemporaneous combination of that business with RJS Power, the competitive power generation business controlled by Riverstone Holdings LLC, under a new holding company, Talen Energy Corporation. See Notes 1, 3 and 6 to the Financial Statements for additional information on the spinoff and acquisition.

Talen Energy seeks to optimize the value from its competitive power generation assets and marketing portfolio while mitigating near-term volatility in both cash flow and earnings metrics. Talen Energy endeavors to accomplish this by matching projected output from its generation assets with forward power sales in the wholesale and retail markets while effectively managing exposure to fuel price volatility, counterparty credit risk and operational risk. Talen Energy is focused on safe, reliable, and resilient operations, disciplined capital investment, portfolio optimization, cost management and the pursuit of value-enhancing growth opportunities.

To manage financing costs and access to credit markets, and to fund capital expenditures and growth opportunities, a key objective of Talen Energy is to maintain adequate liquidity capacity. In addition, Talen Energy has a financial risk management policy and operational procedures that, among other things, are designed to monitor and manage exposure to earnings and cash flow volatility related to, as applicable, changes in energy and fuel prices, interest rates, counterparty credit quality and the operating performance of generating units. To manage these risks, Talen Energy generally uses contracts such as forwards, options, swaps and insurance contracts primarily focused on mitigating cash flow volatility within the next 12 month period.

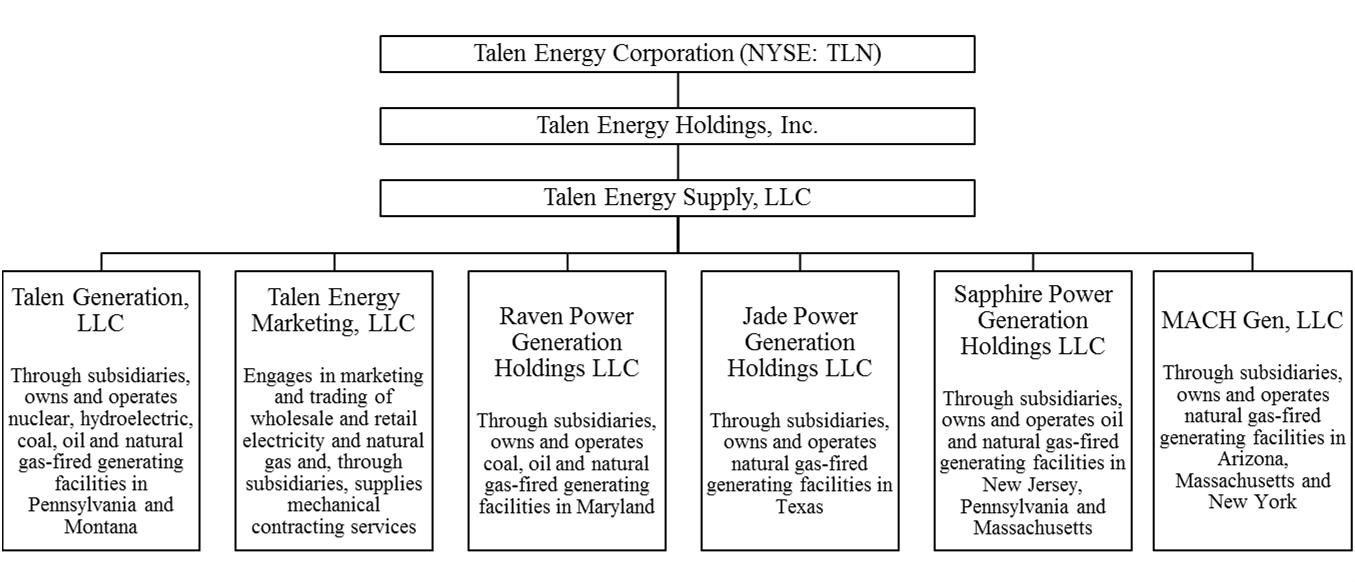

The following chart illustrates Talen Energy's organizational structure as of December 31, 2015.

Talen Energy's subsidiaries, Talen Generation, Raven, Jade, Sapphire, and MACH Gen, own and operate competitive power generation facilities. Another Talen Energy subsidiary, Talen Energy Marketing, markets the output of Talen Energy's plants, electricity, capacity and ancillary services, and other energy-related products in competitive wholesale and retail markets.

Talen Energy Marketing sells the output of its affiliated generation facilities to a diverse group of wholesale customers, including RTOs and ISOs, utilities, cooperatives, municipalities, power marketers, and financial counterparties. Talen Energy Marketing also sells the output of its affiliated generation plants to commercial, industrial and residential retail customers.

Talen Energy earns revenue primarily by participating in energy and capacity markets and by providing related ancillary services.

| |

| • | The energy markets in which Talen Energy participates are designed to meet the short-term needs for electricity. They include day-ahead markets, where hourly prices are calculated for the next operating day based on bids and offers, and real-time spot markets, in which energy is continuously bought and sold based on actual grid operating conditions. |

| |

| • | The capacity markets in which Talen Energy participates are designed to procure sufficient generating capacity to meet forecasted peak demand to ensure that the longer-term needs for electricity are met to keep the applicable power grids operating reliably. PJM and ISO-NE procure capacity three years in advance whereas NYISO conducts three nearer term auctions; a six-month summer and winter strip auction, a monthly auction and a spot auction. Capacity markets provide generation owners, such as Talen Energy, some forward-looking revenue visibility. |

| |

| • | Ancillary services, such as non-spinning reserves, responsive reserves and regulation up/down, are supplied in some of the markets in which Talen Energy operates to help maintain system reliability by compensating generators for being available during short-term capacity shortage conditions. |

Talen Energy's generation fleet is diverse in terms of fuel, technology, dispatch characteristics and location. A majority of Talen Energy's revenue comes from the sale of electricity produced by its generation facilities. Talen Energy also produces additional revenue from the sale of capacity within the PJM, ISO-NE and NYISO markets as well as by providing ancillary services.

The charts below illustrate the composition and diversity of Talen Energy's generation portfolio capacity (summer rating) by market and fuel type as of December 31, 2015:

The charts above do not reflect the completed or announced divestitures of approximately 1,400 MW of generation capacity to satisfy the FERC approved mitigation in connection with the RJS Power acquisition. See "Acquisitions and Divestitures" below and Notes 1 and 6 to the Financial Statements for additional information.

MARKETS

Included in the table below are the markets in which Talen Energy operates and the revenue opportunities presented by each:

|

| | | | | | | | | | |

| | | | | | | Revenue Opportunities |

| Markets | | Category | | Location | | Energy

Market | | Capacity

Market | | Ancillary

Services |

| PJM | | RTO | | All or part of thirteen states in the Northeast U.S. and the District of Columbia (DE, IL, IN, KY, MD, MI, NC, NJ, OH, PA, TN, VA & WV) | | X | | X | | X |

| ERCOT | | ISO | | Majority of the State of Texas | | X | | - | | X |

| NYISO | | ISO | | State of New York | | X | | X | | X |

| ISO-NE | | RTO | | New England states (CT, MA, ME, NH, RI & VT) | | X | | X | | X |

| WECC (a) | | Investor Owned Utilities | | 14 States in the Western U.S., 2 Canadian provinces and northern Baja Mexico (AZ, CA, CO, ID, MT, NE, NM, NV, OR, SD, portion of TX, UT, WA & WY) | | X | | - | | X |

| |

| (a) | Members are uniquely structured in that they typically do not have organized markets, but rather, are organized into 38 separate Balancing Authorities (BAs). Each BA is responsible for balancing loads and resources within their respective boundaries. |

See "Item 2. Properties" for additional information on Talen Energy's generating plants, including each plants' market location.

Recent Market Developments

PJM

As a result of unusual market and weather volatility in the first quarter of 2014, PJM determined that changes were necessary to ensure system reliability. In December 2014, PJM proposed to add an enhanced Capacity Performance (CP) product to the capacity market structure to permit additional compensation for generation owners/operators to make the necessary investments to maintain system reliability in exchange for stronger performance requirements, with higher penalties for non-performers. For more information on recent PJM market developments, see "Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information.

ERCOT

The PUCT and ERCOT have taken significant measures to improve scarcity pricing in ERCOT. ERCOT's system-wide offer cap was increased from $7,000 per MWh to $9,000 per MWh effective June 1, 2015. An operating reserve demand curve (ORDC) was implemented in June 2014, which is intended to produce longer periods of gradually increasing scarcity prices, and the PUCT and ERCOT are currently evaluating whether any changes need to be made to improve the operation of the ORDC during scarcity conditions.

NYISO

The NYISO will be undertaking its triennial Demand Curve Reset (DCR) process, which will reset the capacity auction parameters, potentially impacting compensation to capacity resources. Draft tariff sheets reflecting recommended changes to the DCR process are to be presented to the NYISO's Installed Capacity Working Group in February 2016.

Two major initiatives, Reform the Energy Vision and the Clean Energy Standard are being pursued in New York State. Both of these initiatives are long term endeavors and either or both could have impacts on the overall New York energy market. Talen Energy is still assessing any potential impacts to both the market and its portfolio.

ISO-NE

ISO-NE added an enhanced Performance Incentive (PI) product to the capacity market structure to permit additional compensation for generation owners/operators to make the necessary investments to maintain system reliability in exchange for stronger performance requirement, with higher penalties for non-performers without exception. The PI product was first implemented in the ninth forward capacity auction for delivery year 2018/19, which was held in February 2015. ISO-NE merged the Northeast Massachusetts zone with the Southeastern Massachusetts/Rhode Island capacity zone to create the import-constrained Southern New England (SENE) zone. The tenth forward capacity auction will now only consist of two zones: SENE and Rest of Pool (including Maine, Western/Central Massachusetts, New Hampshire and Vermont). In addition,

ISO-NE has unveiled a new, sloped demand curve design that could be implemented for the eleventh forward capacity auction and would likely put downward pressure on clearing prices.

RESERVE MARGINS

Reserve margin is a measure of generation capacity available to meet peak demand. Each ISO/RTO sets a target reserve margin to ensure grid reliability, which is used as an indicator of a supply surplus or deficit based on the requirement. If the actual reserve margin exceeds the requirement, the system is in a surplus and energy prices should remain lower and stable. A deficit to the required reserve margin could trigger energy price spikes and volatility, sending a signal to the market that more capacity is needed. PJM, NYISO, and ISO-NE have forward looking capacity markets to procure sufficient capacity to meet forecasted demand. ERCOT operates in an energy only market, where scarcity pricing sends the signal to develop more capacity. Each market is currently well supplied and reserve margins exceed their targets and low energy prices are reflective of the adequate reserves. The table below contains the target reserve margin and the expected reserve margin for the 2015/16 planning year for each of the aforementioned ISOs/RTOs:

|

| | | | | | |

| ISO/RTO | | Target Reserve Margin (a) | | 2015/16 Planning Year Reserve Margin (a) |

| PJM (b) | | 15.6 | % | | 20.2 | % |

| NYISO | | 17.0 | % | | 24.7 | % |

| ISO-NE | | 15.0 | % | | 22.8 | % |

| ERCOT | | 13.8 | % | | 15.7 | % |

| |

| (a) | Source: data obtained from applicable ISO/RTO or other federal agency publications. |

| |

| (b) | PJM announced that the target reserve margin increased to 16.5% for planning year 2019/20. |

OPERATIONS

Revenues by Segment

Talen Energy is organized in two segments: East and West, based on geographic location. The East segment includes the generating, marketing and trading activities in PJM, NYISO and ISO-NE. The West segment includes the generating, marketing and trading activities located in ERCOT and WECC. See Note 2 to the Financial Statements for additional information on Talen Energy's segments and the segment reevaluation.

Details of revenue by segment for the years ended December 31 as adjusted to reflect the November 2015 segment reevaluation referenced above, are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 | | 2014 | | 2013 |

| | East | | West | | Total | | East | | West | | Total | | East | | West | | Total |

| Energy | | | | | | | | | | | | | | | | | |

| Wholesale energy (a) | $ | 2,631 |

| | $ | 211 |

| | $ | 2,842 |

| | $ | 2,609 |

| | $ | 128 |

| | $ | 2,737 |

| | $ | 2,846 |

| | $ | 95 |

| | $ | 2,941 |

|

| Retail energy | 1,022 |

| | 73 |

| | 1,095 |

| | 1,162 |

| | 81 |

| | 1,243 |

| | 945 |

| | 82 |

| | 1,027 |

|

| Total Energy | 3,653 |

| | 284 |

| | 3,937 |

| | 3,771 |

| | 209 |

| | 3,980 |

| | 3,791 |

| | 177 |

| | 3,968 |

|

| Energy-related businesses (b) | 544 |

| | — |

| | 544 |

| | 601 |

| | — |

| | 601 |

| | 527 |

| | — |

| | 527 |

|

| Total | $ | 4,197 |

| | $ | 284 |

| | $ | 4,481 |

| | $ | 4,372 |

| | $ | 209 |

| | $ | 4,581 |

| | $ | 4,318 |

| | $ | 177 |

| | $ | 4,495 |

|

| |

| (a) | Included in these amounts for 2015, 2014 and 2013 are $14 million, $84 million and $51 million of wholesale electricity sales to a former affiliate, PPL Electric. |

| |

| (b) | Energy-related businesses are mechanical contracting and services subsidiaries that primarily support the generation and marketing businesses in Talen Energy's East segment. Activities of these businesses include developing renewable energy projects and providing energy-related products and services to commercial and industrial customers. |

Power Generation by Fuel Source and Segment

During 2015, Talen Energy owned or controlled power plants (including facilities for which Talen Energy has the rights to the output) that generated the following amounts of electricity (by segment):

|

| | | | | | | | |

| | GWh |

| Fuel Source | East | | West | | Total |

| Nuclear (a) | 18,505 |

| | — |

| | 18,505 |

|

| Natural Gas/Oil | 15,320 |

| | 2,470 |

| | 17,790 |

|

| Coal | 18,181 |

| | 3,775 |

| | 21,956 |

|

| Hydro | 903 |

| | — |

| | 903 |

|

| Renewables (b) | 293 |

| | — |

| | 293 |

|

| Total | 53,202 |

| | 6,245 |

| | 59,447 |

|

| |

| (a) | Represents Talen Energy's share of the total output. |

| |

| (b) | In 2015, Talen Energy owned or controlled renewable energy projects (including facilities for which Talen Energy has the rights to the output) located in Pennsylvania, New Jersey, Vermont and New Hampshire with an aggregate generating capacity (summer rating) of 26 MW. Talen Energy Marketing sold the energy, capacity and RECs produced by these plants into the wholesale market as well as to commercial and industrial customers. In November 2015, projects that had an aggregate generating capacity of 19 MW were sold. For the projects sold, the above generation amounts include generation through their date of sale. |

Fuel Supply

See "Item 2. Properties" for information on the fuel source for each of Talen Energy's plants.

Nuclear

The nuclear fuel cycle consists of several material and service components: the mining and milling of uranium ore to produce uranium concentrates; the conversion of these concentrates into uranium hexafluoride, a gas component; the enrichment of the hexafluoride gas; the fabrication of fuel assemblies for insertion and use in the reactor core; and the temporary storage and final disposal of spent nuclear fuel.

Susquehanna Nuclear has a portfolio of supply contracts, with varying expiration dates, for nuclear fuel materials and services. These contracts are expected to provide sufficient fuel to permit Unit 1 to operate into the first quarter of 2020 and Unit 2 to operate into the first quarter of 2019. Susquehanna Nuclear anticipates entering into additional contracts to ensure continued operation of the nuclear units.

Susquehanna Nuclear has an on-site spent fuel storage facility employing dry cask fuel storage technology, which, together with the spent fuel pools, has the capacity to accommodate spent fuel expected to be discharged through 2017. This spent fuel storage facility is currently in the process of being expanded to accommodate additional spent fuel storage, and assuming appropriate approvals are obtained, additional expansion will take place in the future such that, together, the spent fuel pools and the expanded dry fuel storage facility will accommodate all of the spent nuclear fuel expected to be discharged through 2044, the current licensed life of the plant.

In May 2011, Susquehanna Nuclear entered into a settlement agreement with the U.S. Government relating to Susquehanna Nuclear's 2004 lawsuit against the U.S. Government for partial breach of the standard contract for disposal of spent nuclear fuel. The settlement included reimbursement of certain costs to store spent nuclear fuel at the Susquehanna nuclear plant incurred through December 31, 2013, and Susquehanna Nuclear received payments for its claimed costs for those periods. In exchange, Susquehanna Nuclear waived any claims against the U.S. Government for costs paid or injuries sustained related to storing spent nuclear fuel at the Susquehanna nuclear plant through December 31, 2013. In January 2014, Susquehanna Nuclear entered into an addendum to that agreement to extend the settlement agreement on the same terms for an additional three years to the end of 2016. Susquehanna Nuclear expects to enter into discussions with the DOE this year to further extend the settlement agreement beyond 2016.

Natural Gas and Oil

Talen Energy manages natural gas and oil supply utilizing a combination of contracted purchases, spot market purchases and storage for the commodities and pipeline capacity. The amount and duration of contracted capacity varies due to factors including fuel availability, economic considerations and plant location on the pipeline grid. Talen Energy has various short and

long-term natural gas supply and transportation contracts in place; however, the majority of the natural gas supply needs are satisfied with short-term transactions on a spot basis.

Oil requirements are normally supplied by inventory and replenished through purchases on the spot market.

Coal

Talen Energy actively manages its coal requirements by purchasing coal from mines located in central and northern Appalachia and Colorado for its plants located within PJM and from mines located adjacent to the Colstrip facility in Montana. Coal is delivered by rail, barge or conveyor. Reliability of coal deliveries can be affected from time to time by a number of factors including fluctuations in demand, coal mine production issues and other supplier or transporter operating difficulties. Coal inventory is maintained at levels estimated to be necessary to avoid operational disruptions at coal-fired generating units. Long-term supply contracts support adequate levels of coal inventory and are augmented with spot market purchases, as needed. Talen Energy has long-term supply agreements through 2018 for plants located in PJM and for the Colstrip plant through 2019. The contracts in place are expected to provide 62% of 2016 requirements.

In addition, certain of Talen Energy's plants are equipped with flue gas desulfurization equipment or Scrubbers, which use limestone in their operations. Talen Energy has entered into limestone contracts with suppliers that will provide limestone for the plants located in PJM through 2016 and for the Colstrip plant through 2030 and are expected to provide 100% of 2016 requirements.

See Note 10 to the Financial Statements for additional information on Talen Energy's ownership interest in and cost sharing arrangement related to Colstrip.

ACQUISITIONS AND DIVESTITURES

|

| | | | | | |

| | | Completion Date | | Capacity (a) | | Markets |

| Acquisitions: | | | | | | |

| MACH Gen | | November 2015 | | 2,344 MW | | NYISO, ISO-NE, WECC |

| RJS Power | | June 2015 | | 5,182 MW | | PJM, ERCOT, ISO-NE |

| Divestitures: | | | | | | |

| Ironwood | | February 2016 | | 661 MW | | PJM |

| C.P. Crane | | February 2016 | | 402 MW | | PJM |

| Talen Renewable Energy | | November 2015 | | 19 MW | | Various |

| Montana Hydroelectric Business | | November 2014 | | 633 MW | | WECC |

| Announced Divestitures: | | | | | | |

| Holtwood and Lake Wallenpaupack | | March 2016 (b) | | 308 MW | | PJM |

| |

| (a) | Based on summer rating. |

| |

| (b) | Anticipated closing date. |

See Note 6 to the Financial Statements for additional information on acquisitions and divestitures.

FRANCHISES AND LICENSES

Talen Energy Marketing has a license from the DOE to export electricity to Canada. Talen Energy Marketing also has a permit from the National Energy Board of Canada to export firm and interruptible electricity from Canada to the United States.

Susquehanna Nuclear operates Units 1 and 2 pursuant to NRC operating licenses that expire in 2042 for Unit 1 and in 2044 for Unit 2. In 2008, a Talen Energy subsidiary, Bell Bend, LLC, submitted a COLA to the NRC for a new nuclear generating unit (Bell Bend) to be built adjacent to the Susquehanna nuclear plant. Also in 2008, the COLA was formally docketed and accepted for review by the NRC. Talen Energy does not expect the COLA review process with the NRC to be completed prior to 2018. See Note 6 to the Financial Statements for additional information.

Holtwood, LLC, a subsidiary of Talen Generation that owns hydroelectric generating operations in Pennsylvania, operates the Holtwood and Lake Wallenpaupack hydroelectric generating plants pursuant to FERC-granted licenses that expire in 2030 and 2045, respectively. In 2015, Talen Energy announced that it agreed to sell these facilities. The sale is expected to close in March 2016. In connection with the relicensing of these generating facilities, applicable law permits the FERC to relicense the original licensee or license a new licensee or allow the U.S. government to take over the facility. If the original licensee is not

relicensed, it is compensated for its net investment in the facility, not to exceed the fair value of the property taken, plus reasonable damages to other property affected by the lack of relicensing.

COMPETITION

Since the early 1990s, there has been increased competition in U.S. energy markets because of federal and state competitive market initiatives. Although some states have created a competitive market for electricity generation, other states continue to consider different types of regulatory initiatives concerning competition in the power and gas industries. Some states that were considering creating competitive markets have slowed their plans or postponed further consideration. In addition, states that have created competitive markets have, from time to time, considered new market rules and re-regulation measures that could result in more limited opportunities for competitive energy suppliers. However, these initiatives have not fully developed as a result of various efforts by industry participants to prevent the erosion of the competitive market structure. As such, the markets in which Talen Energy participates are highly competitive.

The power generation business is a regional business that is diverse in terms of industry structure and fundamentals. Demand for electricity may be met by generation capacity based on several competing generation technologies, such as natural gas-fired, coal-fired or nuclear generation, as well as power generation facilities fueled by alternative energy sources, including hydro power, synthetic fuels, solar, wind, wood, geothermal, waste heat and solid waste sources. Talen Energy faces competition in wholesale markets for available energy, capacity and ancillary services. Competition is impacted by electricity and fuel prices, congestion along the power grid, subsidies provided by state and federal governments for new generation facilities, new market entrants, construction of new generating assets, technological advances in power generation, the actions of environmental and other regulatory authorities and other factors. In retail power markets, Talen Energy primarily competes with other electricity suppliers based on its ability to aggregate generation supply at competitive prices from different sources and to efficiently utilize transportation from third-party pipelines and transmission from electric utilities, ISOs and RTOs. Competitors in wholesale power markets include regulated utilities, industrial companies, NUGs, competitive subsidiaries of regulated utilities, financial institutions and other energy marketers. See "Item 1A. Risk Factors-Risks Related to Our Business," "Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations" and Notes 11 and 15 to the Financial Statements for more information concerning the risks faced with respect to competitive energy markets.

SEASONALITY

The demand for and market prices of electricity and natural gas are affected by weather. As a result, Talen Energy's operating results in the future may fluctuate substantially on a seasonal basis, especially when more severe weather conditions such as heat waves or extreme winter weather make such fluctuations more pronounced. The pattern of this fluctuation may change depending on the type and location of the facilities owned, the retail load served and the terms of contracts to purchase or sell electricity. See "Item 1A. Risk Factors - Risks Related to Our Business" and "Environmental Matters" below for additional information regarding climate change.

FINANCIAL CONDITION

See "Financial Condition" in "Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations" for this information.

CAPITAL EXPENDITURE REQUIREMENTS

See "Financial Condition - Liquidity and Capital Resources - Forecasted Uses of Cash - Capital Expenditures" in "Item 7. Combined Management's Discussion and Analysis of Financial Condition and Results of Operations" for information concerning the $2.4 billion of projected capital expenditure requirements for 2016 through 2020. Included in the projections are $137 million of expenditures to comply with environmental requirements, which reflect Talen Energy's best estimate of capital expenditures that may be required within the next five years. Actual costs (including capital, emission allowance purchases and operational modifications) may be significantly lower or higher depending on the final compliance requirements and market conditions. Talen Energy also may incur environmental-related capital expenditures and operating expenses, which are not now determinable, but could be significant. See "Environmental Matters" below for additional information on the potential impact on capital expenditures from environmental matters.

ENVIRONMENTAL MATTERS

Environmental Laws and Regulations

Extensive federal, state and local environmental laws and regulations are applicable to Talen Energy's air emissions, water discharges and the management of hazardous and solid waste, as well as other aspects of its business. In addition, many of these environmental considerations are also applicable to the operations of key suppliers, or customers, such as coal producers and industrial power users, and may impact the cost for their products or their demand for Talen Energy's services.

It may be necessary for Talen Energy to modify, curtail, replace or cease operation of certain facilities or performance of certain operations to comply with statutes, regulations and other requirements imposed by regulatory bodies, courts or environmental groups. Talen Energy may incur costs to comply with environmental laws and regulations, including increased capital expenditures or operating and maintenance expenses, monetary fines, penalties or other restrictions, which could be material. Legal challenges to environmental permits or rules add to the uncertainty of estimating the future cost of complying with these permits and rules. In addition, costs may increase significantly if the requirements or scope of environmental laws or regulations, or similar rules, are expanded or changed.

The following is a discussion of the more significant environmental matters impacting Talen Energy's business.

CSAPR

The EPA's CSAPR addresses the interstate transport of fine particulates and ozone by regulating emissions of sulfur dioxide and nitrogen oxide. CSAPR establishes interstate allowance trading programs for sulfur dioxide and nitrogen oxide emissions from fossil-fuel fired plants for 28 states in two phases: Phase 1 trading commenced in January 2015, and Phase 2 trading is expected to commence in 2017. Although Talen Energy does not currently anticipate significant costs to comply with these programs, changes in market or operating conditions, or significant regulatory changes, could result in impacts that are greater than anticipated. Talen Energy is evaluating the EPA's recently released "CSAPR Update Rule" proposal which recommends more stringent ozone season nitrogen oxide budgets for 23 states, including several where Talen Energy owns affected generation. Additional capital and/or operating and maintenance expenses could be imposed on Talen Energy plants in Maryland, New Jersey, New York, Pennsylvania and Texas as a result of this action. Legal challenges to CSAPR are on-going in federal and state court.

NAAQS

In 2008, the EPA revised downward the NAAQS for ozone. As a result, states in the ozone transport region (OTR), including Pennsylvania, Maryland, Massachusetts, New York and New Jersey, are required by the Clean Air Act to impose additional reductions in nitrogen oxide emissions based upon reasonably available control technologies (RACT). PADEP is expected to finalize a RACT rule by the end of the first quarter of 2016 that requires some fossil-fuel fired power plants in Pennsylvania to operate at more stringent nitrogen oxide emission rates starting in 2017. Maryland coal plants operated at reduced nitrogen oxide emission rates during the 2015 ozone season as a result of an emergency action issued by the Governor of Maryland (which later became a final rule) and in November 2015 the MDE promulgated additional nitrogen oxide regulations for Maryland coal plants that require even more stringent operations starting no later than June 2020. In October 2015, the EPA released a final rule that strengthened the NAAQS for ozone. This could lead to even further nitrogen oxide reductions for Talen Energy's fossil-fuel fired plants within and outside of the OTR. State and federal efforts to address interstate transport issues associated with ozone NAAQS, including increased pressure by state environmental agencies and environmental groups to further reduce nitrogen oxide emissions from plants with selective catalytic reduction technology, and updated transport rules such as that proposed by EPA in December 2015 (as discussed above), could additionally lead to further emission reductions and increased compliance costs.

In 2010, the EPA finalized a more stringent NAAQS for sulfur dioxide and required states to identify areas that meet the standard and areas that are in non-attainment or are unclassifiable. In July 2013, the EPA finalized non-attainment designations for parts of the country where attainment is due by 2018. States are working on designations for other areas pursuant to a consent decree between the EPA and Sierra Club approved in March 2015 with 2017 or 2020 deadlines, depending on which designation methodology (modeling or monitoring) is selected. Several of Talen Energy's plants are in areas being evaluated for designation.

Until final rules are promulgated, all non-attainment designations are finalized, and state compliance plans are developed, Talen Energy cannot predict the ultimate outcome of the new NAAQS for ozone and sulfur dioxide on its fleet or plants, or whether they may have a material adverse effect on Talen Energy's financial condition or results of operations. Talen Energy anticipates

that some of the measures required for compliance with the CSAPR (as discussed above) or the MATS and Regional Haze Rules (as discussed below), will help to achieve compliance.

MATS

In February 2012, the EPA finalized a rule (known as the MATS Rule) requiring reductions of mercury and other hazardous air pollutants from fossil-fuel fired power plants by April 2015 with one-and two-year extension opportunities. Subsequently, the U.S. Supreme Court determined that the EPA acted unreasonably by refusing to consider costs when determining whether the MATS regulation was appropriate and necessary. To address the Supreme Court action, the DC Circuit in December 2015 remanded the MATS Rule to the EPA to incorporate a revised appropriate and necessary finding. The EPA has since issued a proposed supplemental finding on cost, claiming that the regulation was appropriate and necessary. The EPA has committed to finalizing the Rule by April 2016. The existing MATS Rule remains in effect. Separate from the EPA's MATS Rule, several states, including Montana and Maryland where Talen Energy owns affected facilities, have enacted regulations requiring mercury emission reductions from coal plants. Talen Energy cannot currently predict whether any costs necessary to comply with the EPA's MATS Rule or similar regulations will have a material adverse effect on Talen Energy's financial condition or results of operations.

Regional Haze

The EPA's regional haze programs were developed under the Clean Air Act to eliminate man-made visibility degradation by 2064. Under the programs, states are required to make reasonable progress every decade, through the application of, among other things, Best Available Retrofit Technology (BART) on power plants commissioned between 1962 and 1977. The primary power plant emissions affecting visibility are sulfur dioxide, nitrogen oxides and particulates. While the focus of regional haze regulation previously was on the western U.S., in December 2015, a final federal implementation plan for Texas was released with an emphasis on coal plants. Minimal impacts are anticipated to Talen Energy's gas fleet in Texas.

As for the eastern U.S., the EPA had determined that region-wide reductions under the CSAPR trading program could, in most instances, be utilized under state programs to satisfy BART requirements for sulfur dioxide and nitrogen oxides. However, the EPA's determination is being challenged by environmental groups. In September 2015, the Third Circuit Court of Appeals vacated portions of the EPA's approval of Pennsylvania's regional haze state implementation plan and remanded the rule to the EPA for further consideration. Talen Energy is unable to determine at this time if the future impacts of regional haze regulation on Talen Energy plants in the eastern U.S. will have a material adverse effect on Talen Energy's financial condition or results of operations. See Note 11 to the Financial Statements for information on a legal decision issued by the Ninth Circuit Court of Appeals in a case involving Talen Montana challenging the EPA's final Regional Haze Federal Implementation Plan for Montana.

New Source Review (NSR)

The EPA has continued its NSR enforcement efforts targeting coal-fired generating plants. The EPA has alleged that modification of these plants has increased their emissions and, consequently, that they are subject to stringent NSR requirements under the Clean Air Act. Talen Energy has responded to several information requests from the EPA, but has received no further substantive communications from the EPA related to those requests since providing its responses. See Note 11 to the Financial Statements for information on a lawsuit filed by environmental groups in March 2013 against Talen Montana and other owners of Colstrip related to NSR.

Climate Change

Physical effects associated with climate change could include the impact of changes in weather patterns, such as storm frequency and intensity, and the resultant potential damage to Talen Energy's generation assets, as well as impacts on Talen Energy's customers. In addition, changed weather patterns could potentially reduce annual rainfall in areas where Talen Energy's generation facilities use river water for cooling. Federal and state initiatives to prepare energy assets and infrastructure for the impacts of climate change, such as those actions driven by President Obama's 2013 Climate Action Plan (discussed further below), could result in binding obligations to physically protect Talen Energy's generation assets from climate change impacts.

Talen Energy cannot currently predict whether its businesses will experience these potential risks or whether any related costs will have a material adverse effect on Talen Energy's financial condition or results of operations.

GHG Regulations & Tort Litigation

In April 2010, the EPA and the U.S. Department of Transportation issued new light-duty vehicle emissions standards that applied beginning with 2012 model year vehicles. The EPA stated that this standard authorizes regulation of carbon dioxide emissions from stationary sources under the NSR and Title V operating permit provisions of the Clean Air Act. Following legal challenges, in June 2014, the U.S. Supreme Court ruled that the EPA has the authority to regulate carbon dioxide emissions under the Clean Air Act, but only for stationary sources that would otherwise have been subject to these provisions due to significant increases in emissions of other regulated pollutants. As a result, any new sources or major modifications to an existing GHG source causing a net significant increase in carbon dioxide emissions must comply with best achievable control technology (BACT) permit limits for carbon dioxide if it would otherwise be subject to BACT or lowest achievable emissions rate limits due to significant increases in other regulated pollutants. EPA is expected to propose a de minimis threshold for such permits in June 2016.

In June 2013, President Obama released his Climate Action Plan reiterating the goal of reducing GHG emissions in the U.S. through such actions as regulating power plant emissions, promoting increased use of renewables and clean energy technology, and establishing more restrictive energy efficiency standards. In October 2015, the EPA finalized carbon dioxide regulations for new and existing power plants, and the EPA has proposed a federal implementation plan that would apply to any states that fail to submit an acceptable state plan for the existing plant rule. EPA's existing plant rule has been stayed by the U.S. Supreme Court until all legal challenges to the rule have been resolved. The new plant rule remains in effect and challenges are also outstanding in federal court. Implementation of the new and existing power plant rules could have a significant industry-wide impact, but at this time Talen Energy is unable to determine if the rules will have a material adverse effect on Talen Energy's financial condition or results of operations.

A number of lawsuits have been filed asserting common law claims including nuisance, trespass and negligence against various companies with GHG emitting plants and, although the decided cases to date have not sustained claims brought on the basis of these theories of liability, the law remains unsettled on these claims.

Exemptions for Startup, Shutdown and Malfunction Events

In May 2015, the EPA released a final rule which prohibits states from exempting startup, shutdown and malfunction (SSM) events from compliance requirements in State Implementation Plans (SIPs). The Rule issues a SIP call for each of those states where the SSM provisions in the SIPs of those states fail to meet the EPA's requirements. Affected states, including Arizona, New Jersey, Montana and Texas where Talen Energy owns generation facilities, must submit revised provisions to the EPA in November 2016. Revisions to a SIP or other regulations in other non-affected states where Talen Energy operates could result from this action. The EPA's final rule is being challenged in federal court. Talen Energy cannot currently predict whether revisions to SIPs or other similar regulations will have a material adverse effect on Talen Energy's financial condition or results of operations.

CCRs

The EPA's final rule regulating CCRs, including fly ash, bottom ash and sulfur dioxide scrubber wastes became effective in October 2015. It imposes extensive new requirements, including location restrictions, design and operating standards, groundwater monitoring and corrective action requirements and closure and post-closure care requirements on CCR impoundments and landfills that are located at active power plants and not closed. Under the rule, the EPA will regulate CCRs as non-hazardous under Subtitle D of RCRA and allow beneficial use of CCRs, with some restrictions. This self-implementing rule requires posting of compliance documentation on a publicly accessible website and is only enforceable through citizen suits. Talen Energy expects that its plants using surface impoundments for management and disposal of CCRs, or that previously managed CCRs and continue to manage wastewaters, will be most impacted by the rule. Requirements for covered CCR impoundments and landfills include commencement or completion of closure activities generally between three and ten years from certain triggering events. Talen Energy anticipates incurring capital or operation and maintenance costs prior to that time to address other requirements of the rule, such as groundwater monitoring and disposal facility modifications, or to implement various compliance strategies. The final CCR Rule is being challenged in federal court.

Talen Energy continues to review the Rule and evaluate financial and operational impacts. During 2015, an increase of $41 million was recorded to existing AROs. Further changes to AROs may be required as estimates are refined and compliance with the rule continues. See Note 18 for information on AROs.

ELGs and Standards