Exhibit 99.3

OTCQX: SHWZ Investor Presentation December 7 th , 2021 GROWTH BY DESIGN

OTCQX: SHWZ | 2 SAFE HARBOR This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements can be identified by words such as “believes,” “plan”, “expects,” “anticipates,” “will,” “should,” ”positioned” and words of similar import . Examples of forward - looking statements include, among others, statements regarding Medicine Man Technologies, Inc . ’s dba Schwazze (the “Company”) operations, financial performance, business or financial strategies, or achievements . Forward - looking statements are neither historical facts or assurances of future results of performance . Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the Company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control . Actual outcomes and results and the Company’s financial performance and condition may differ materially from those indicated in the forward - looking statements . Therefore, you should not rely on any of these forward - looking statements . Important factors that could cause actual results and financial conditions to differ materially from those indicated in the forward - looking statements include, among others, the following : The Company’s ability to finance any of its proposed acquisitions ; the Company’s ability to close on any of its proposed acquisitions ; the Company’s ability to successfully integrate and achieve synergies and its objectives with respect to any of its proposed acquisitions ; the Company’s ability to successfully execute its business, financial and growth strategies ; the Company’s ability to successfully identify future acquisition targets, expand into additional states, open new dispensaries, and offer new products, services and other offerings ; the U . S . federal government’s enforcement priorities regarding the cannabis industry ; changes in laws and regulations applicable to cannabis and the cannabis industry, including the classification of cannabis as a Schedule I controlled substance under the Controlled Substances Act and Section 208 E of the Internal Revenue Code of 1986 , as amended ; and the demand for cannabis products . Any forward - looking statement in this presentation is based only on information currently available to the Company and speaks only as of the date of this presentation . The Company disclaims any obligation to update any forward - looking statement or to announce publicly the results of any revisions to any forward - looking statement to reflect future events or developments except as required by law . The unaudited preliminary pro forma results, projections and other financial information discussed in this presentation consists of estimates derived from the Company’s and the acquisitions targets’ internal books and records and are based on various assumptions that have been prepared and made by the Company’s management . Such financial information is subject to the completion of financial closing procedures, final adjustments and other developments that may arise between now and the time such financial information is finalized . Further, the assumptions used in developing such financial information are subject to significant uncertainties and contingencies and may not prove to be correct . Therefore, actual results may differ materially from such financial information and such financial information is subject to change .

OTCQX: SHWZ | 3 OUR STRATEGIC VISION Leading, Vertically Integrated Operator in our Markets Clear Acquisition & Growth Strategy Consciously Sourced Brands & Products Value Creation & Community Support for all Stakeholders

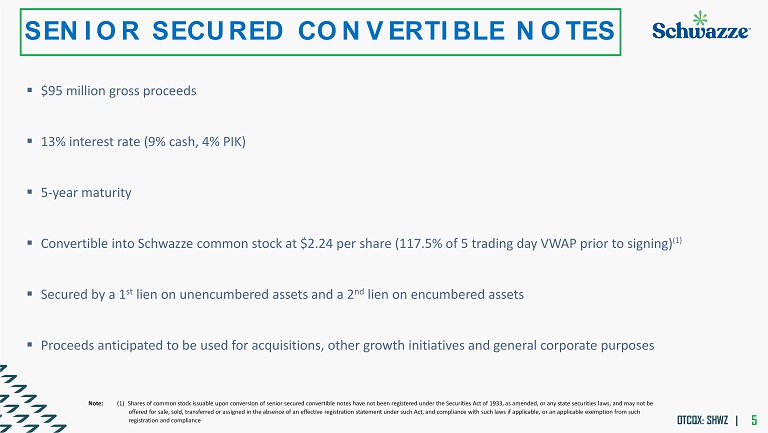

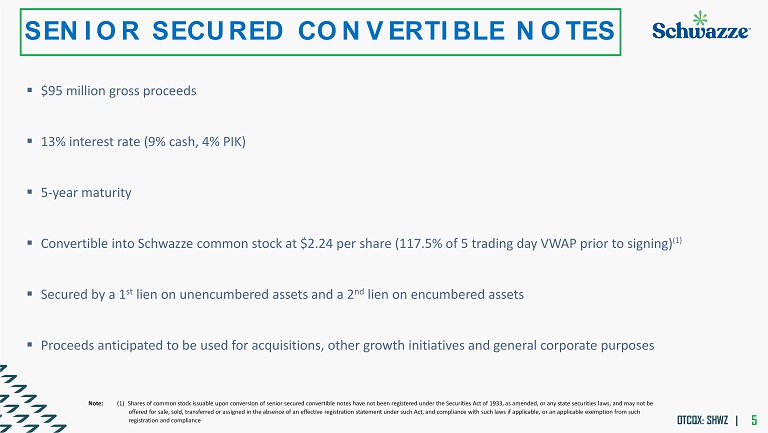

OTCQX: SHWZ | 4 STRATEGIC BUSINESS UPDATE ▪ Announced capital raise of $95 million from investors on December 3, 2021 – Senior secured convertible notes ▪ Signed definitive documentation to acquire Reynold Greenleaf & Associates, LLC (“RGA”) on November 29, 2021 – Leading cannabis cultivation, manufacturing and retail operations in New Mexico ▪ Announced 7 acquisitions over last twelve months (2 closed) – Solidifying leadership in Colorado – Entry into New Mexico – Financing in place to close pending acquisitions and fund future growth

OTCQX: SHWZ | 5 SENIOR SECURED CONVERTIBLE NOTES ▪ $95 million gross proceeds ▪ 13% interest rate (9% cash, 4% PIK) ▪ 5 - year maturity ▪ Convertible into Schwazze common stock at $2.24 per share (117.5% of 5 trading day VWAP prior to signing) (1) ▪ Secured by a 1 st lien on unencumbered assets and a 2 nd lien on encumbered assets ▪ Proceeds anticipated to be used for acquisitions, other growth initiatives and general corporate purposes Note: (1) Shares of common stock issuable upon conversion of senior secured convertible notes have not been registered under the Secur ities Act of 1933, as amended, or any state securities laws, and may not be offered for sale, sold, transferred or assigned in the absence of an effective registration statement under such Act, and com pli ance with such laws if applicable, or an applicable exemption from such registration and compliance

OTCQX: SHWZ | 6 ENTRY INTO NEW MEXICO Schwazze announces definitive agreement to acquire Reynold Greenleaf & Associates, LLC and Elemental Kitchen and Laboratories,LLC RETAIL CULTIVATION MANUFACTURING 10 Retail Locations 26K+ ft 2 26K+ ft 2 of Cannabis Production 65K ft 2 incremental being developed 1 Facility 6K ft 2 Manufacturing ▪ Significant presence in Albuquerque metropolitan area ▪ Opportunity to expand to new locations ▪ Supports goal to vertically integrate ▪ Cultivation will be used to support MIP production as well as flower (and associated products) sales at the dispensaries ▪ MIP production will be used to support dispensaries ▪ Located near the RGA headquarters

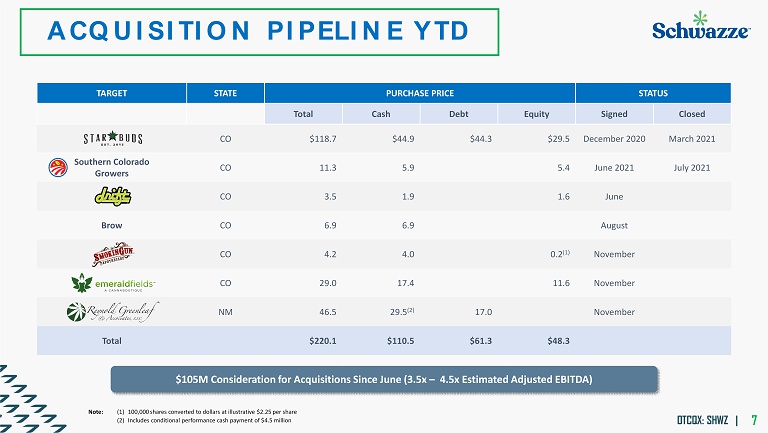

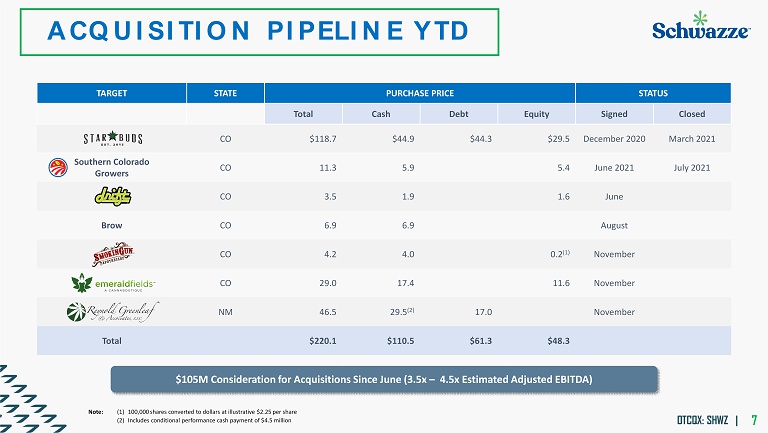

OTCQX: SHWZ | 7 ACQUISITION PIPELINE YTD TARGET STATE PURCHASE PRICE STATUS Total Cash Debt Equity Signed Closed CO $118.7 $44.9 $44.3 $29.5 December 2020 March 2021 Southern Colorado Growers CO 11.3 5.9 5.4 June 2021 July 2021 CO 3.5 1.9 1.6 June Brow CO 6.9 6.9 August CO 4.2 4.0 0.2 (1) November CO 29.0 17.4 11.6 November NM 46.5 29.5 (2) 17.0 November Total $220.1 $110.5 $61.3 $48.3 Note: (1) 100,000 shares converted to dollars at illustrative $2.25 per share (2) Includes conditional performance cash payment of $4.5 million $105M Consideration for Acquisitions Since June (3.5x – 4.5x Estimated Adjusted EBITDA)

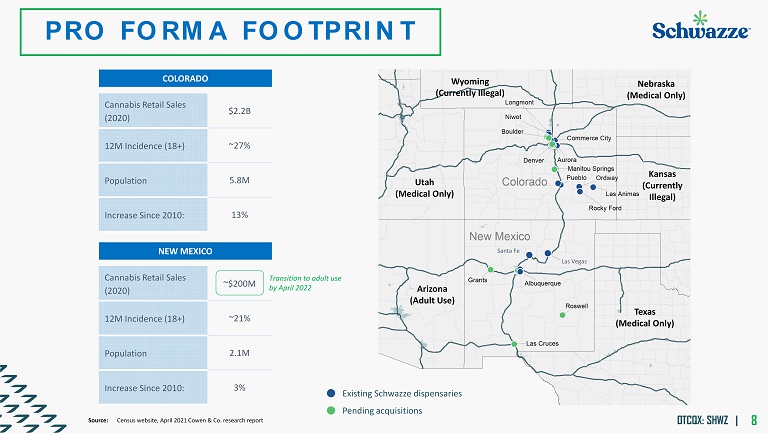

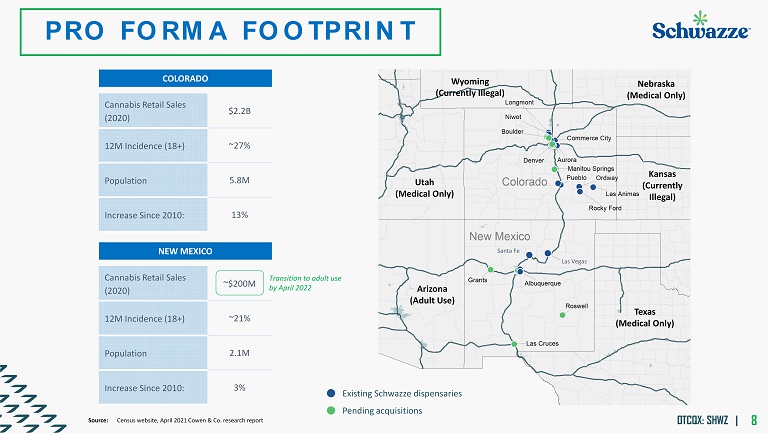

OTCQX: SHWZ | 8 PRO FORMA FOOTPRINT Existing Schwazze dispensaries Pending acquisitions COLORADO Cannabis Retail Sales (2020) $2.2B 12M Incidence (18+) ~27% Population 5.8M Increase Since 2010: 13% NEW MEXICO Cannabis Retail Sales (2020) ~$200M 12M Incidence (18+) ~21% Population 2.1M Increase Since 2010: 3% Transition to adult use by April 2022 Source: Census website, April 2021 Cowen & Co. research report Utah (Medical Only) Arizona (Adult Use) Texas (Medical Only) Wyoming (Currently Illegal) Nebraska (Medical Only) Las Vegas Kansas (Currently Illegal) Santa Fe

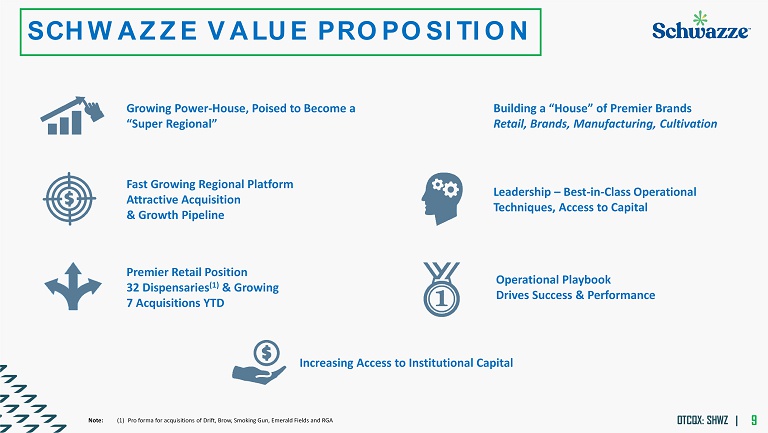

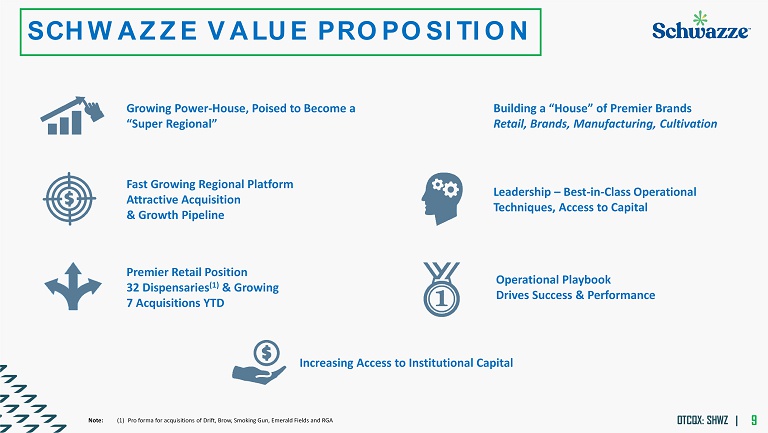

OTCQX: SHWZ | 9 SCHWAZZE VALUE PROPOSITION Note: (1) Pro forma for acquisitions of Drift, Brow, Smoking Gun, Emerald Fields and RGA Fast Growing Regional Platform Attractive Acquisition & Growth Pipeline Leadership – Best - in - Class Operational Techniques, Access to Capital Operational Playbook Drives Success & Performance Premier Retail Position 32 Dispensaries (1) & Growing 7 Acquisitions YTD Growing Power - House, Poised to Become a “Super Regional” Building a “House” of Premier Brands Retail, Brands, Manufacturing, Cultivation Increasing Access to Institutional Capital

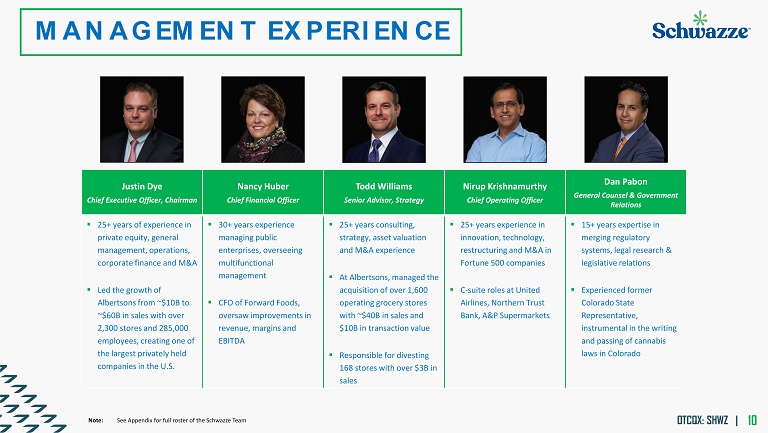

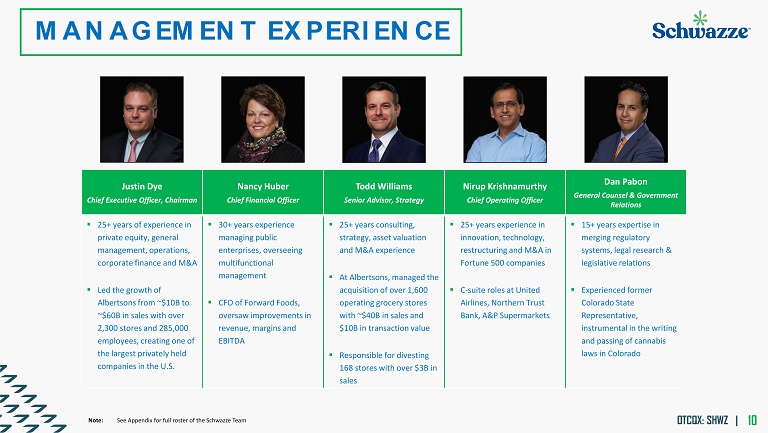

OTCQX: SHWZ | 10 Justin Dye Chief Executive Officer, Chairman Nancy Huber Chief Financial Officer Todd Williams Senior Advisor, Strategy Nirup Krishnamurthy Chief Operating Officer Dan Pabon General Counsel & Government Relations ▪ 25+ years of experience in private equity, general management, operations, corporate finance and M&A ▪ Led the growth of Albertsons from ~$10B to ~$60B in sales with over 2,300 stores and 285,000 employees, creating one of the largest privately held companies in the U.S. ▪ 30+ years experience managing public enterprises, overseeing multifunctional management ▪ CFO of Forward Foods, oversaw improvements in revenue, margins and EBITDA ▪ 25+ years consulting, strategy, asset valuation and M&A experience ▪ At Albertsons, managed the acquisition of over 1,600 operating grocery stores with ~$40B in sales and $10B in transaction value ▪ Responsible for divesting 168 stores with over $3B in sales ▪ 25+ years experience in innovation, technology, restructuring and M&A in Fortune 500 companies ▪ C - suite roles at United Airlines, Northern Trust Bank, A&P Supermarkets ▪ 15+ years expertise in merging regulatory systems, legal research & legislative relations ▪ Experienced former Colorado State Representative, instrumental in the writing and passing of cannabis laws in Colorado MANAGEMENT EXPERIENCE Note: See Appendix for full roster of the Schwazze Team

COMPANY + INDUSTRY OVERVIEW Building a “Super Regional” Retail – Manufacturing – Cultivation OTCQX: SHWZ | 11

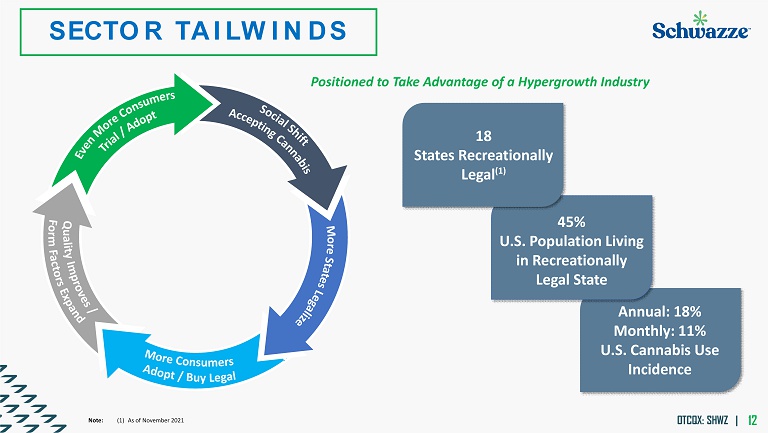

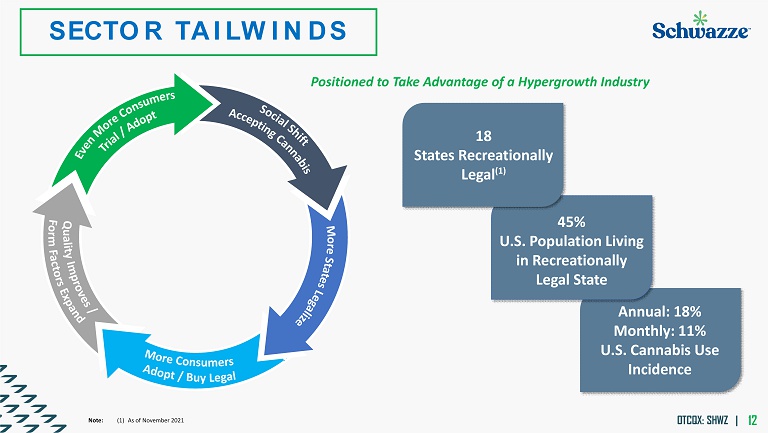

OTCQX: SHWZ | 12 SECTOR TAILWINDS Annual: 18% Monthly: 11% U.S. Cannabis Use Incidence Positioned to Take Advantage of a Hypergrowth Industry 45% U.S. Population Living in Recreationally Legal State Note: (1) As of November 2021 18 States Recreationally Legal (1)

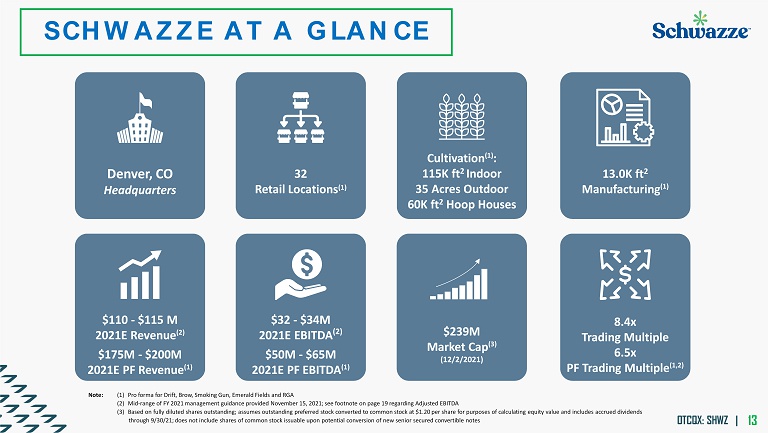

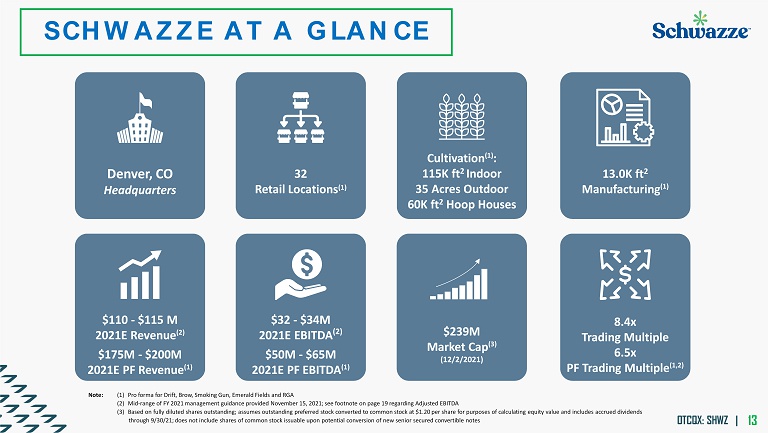

OTCQX: SHWZ | 13 SCHWAZZE AT A GLANCE Cultivation (1) : 115K ft 2 Indoor 35 Acres Outdoor 60K ft 2 Hoop Houses $239M Market Cap (3) (12/2/2021) 32 Retail Locations (1) $32 - $34M 2021E EBITDA (2) $50M - $65M 2021E PF EBITDA (1) Denver, CO Headquarters $110 - $115 M 2021E Revenue (2) $175M - $200M 2021E PF Revenue (1) 13.0K ft 2 Manufacturing (1) 8.4x Trading Multiple 6.5x PF Trading Multiple (1,2) Note: (1) Pro forma for Drift, Brow, Smoking Gun, Emerald Fields and RGA (2) Mid - range of FY 2021 management guidance provided November 15, 2021; see footnote on page 19 regarding Adjusted EBITDA (3) Based on fully diluted shares outstanding; assumes outstanding preferred stock converted to common stock at $1.20 per shar e for purposes of calculating equity value and includes accrued dividends through 9/30/21; does not include shares of common stock issuable upon potential conversion of new senior secured convertible notes

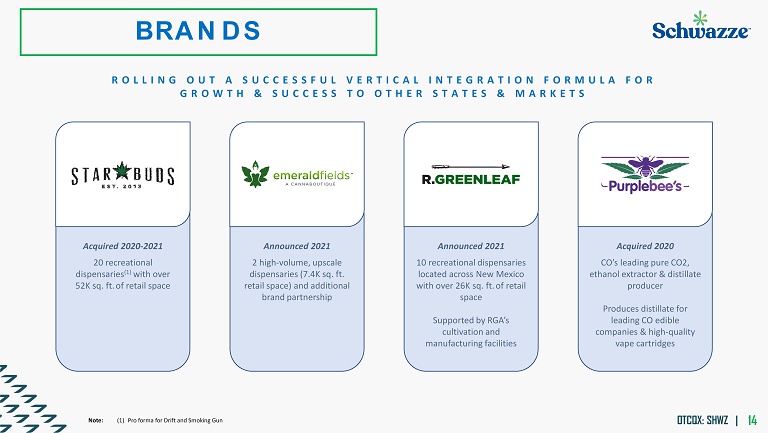

OTCQX: SHWZ | 14 BRANDS ROLLING OUT A SUCCESSFUL VERTICAL INTEGRATION FORMULA FOR GROWTH & SUCCESS TO OTHER STATES & MARKETS Note: (1) Pro forma for Drift and Smoking Gun Announced 2021 2 high - volume, upscale dispensaries (7.4K sq. ft. retail space) and additional brand partnership Acquired 2020 - 2021 20 recreational dispensaries (1) with over 52K sq. ft. of retail space Announced 2021 10 recreational dispensaries located across New Mexico with over 26K sq. ft. of retail space Supported by RGA’s cultivation and manufacturing facilities Acquired 2020 CO’s leading pure CO2, ethanol extractor & distillate producer Produces distillate for leading CO edible companies & high - quality vape cartridges

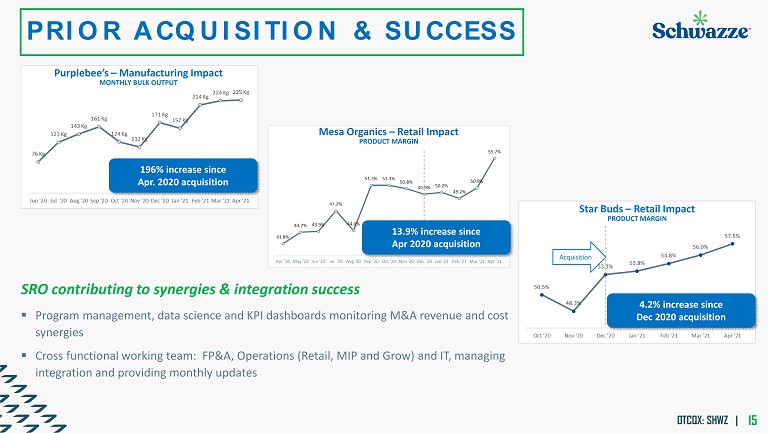

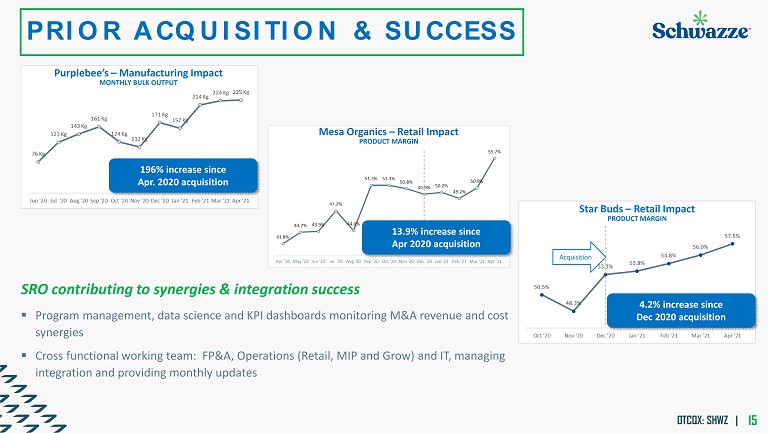

OTCQX: SHWZ | 15 PRIOR ACQUISITION & SUCCESS Mesa Organics – Retail Impact PRODUCT MARGIN Acquisition Star Buds – Retail Impact PRODUCT MARGIN Purplebee’s – Manufacturing Impact MONTHLY BULK OUTPUT 196% increase since Apr. 2020 acquisition 13.9% increase since Apr 2020 acquisition 4.2% increase since Dec 2020 acquisition SRO contributing to synergies & integration success ▪ Program management, data science and KPI dashboards monitoring M&A revenue and cost synergies ▪ Cross functional working team: FP&A, Operations (Retail, MIP and Grow) and IT, managing integration and providing monthly updates

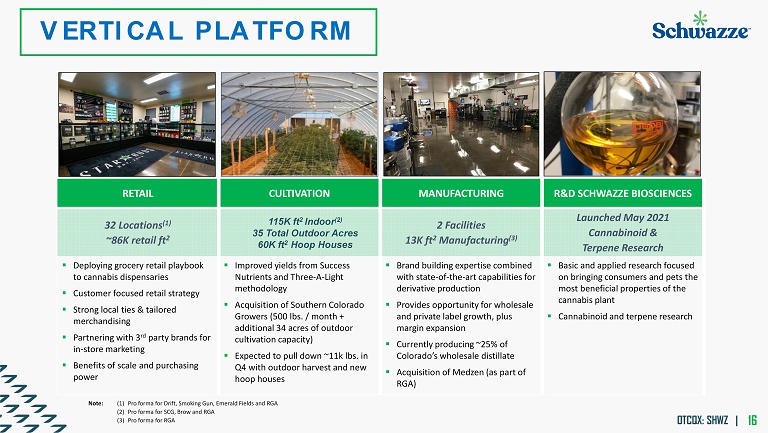

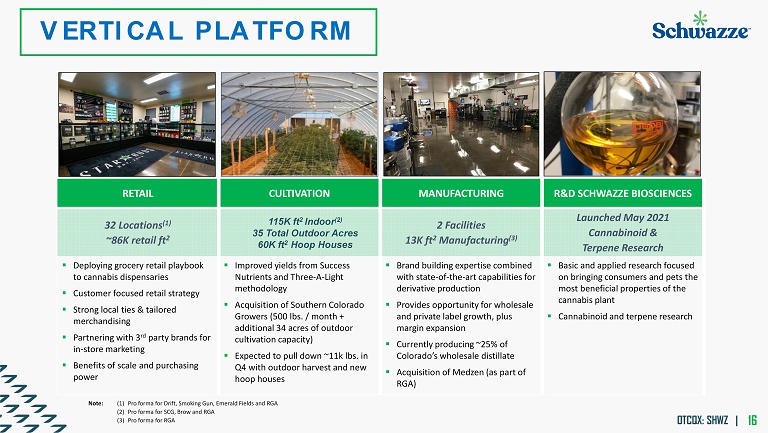

OTCQX: SHWZ | 16 RETAIL CULTIVATION MANUFACTURING R&D SCHWAZZE BIOSCIENCES 32 Locations (1) ~86K retail ft 2 2 Facilities 13K ft 2 Manufacturing (3) Launched May 2021 Cannabinoid & Terpene Research ▪ Deploying grocery retail playbook to cannabis dispensaries ▪ Customer focused retail strategy ▪ Strong local ties & tailored merchandising ▪ Partnering with 3 rd party brands for in - store marketing ▪ Benefits of scale and purchasing power ▪ Improved yields from Success Nutrients and Three - A - Light methodology ▪ Acquisition of Southern Colorado Growers (500 lbs. / month + additional 34 acres of outdoor cultivation capacity) ▪ Expected to pull down ~11k lbs. in Q4 with outdoor harvest and new hoop houses ▪ Brand building expertise combined with state - of - the - art capabilities for derivative production ▪ Provides opportunity for wholesale and private label growth, plus margin expansion ▪ Currently producing ~25% of Colorado’s wholesale distillate ▪ Acquisition of Medzen (as part of RGA) ▪ Basic and applied research focused on bringing consumers and pets the most beneficial properties of the cannabis plant ▪ Cannabinoid and terpene research Note: (1) Pro forma for Drift, Smoking Gun, Emerald Fields and RGA (2) Pro forma for SCG, Brow and RGA (3) Pro forma for RGA VERTICAL PLATFORM 115K ft 2 Indoor (2) 35 Total Outdoor Acres 60K ft 2 Hoop Houses

OTCQX: SHWZ | 17 Operational Excellence ▪ We understand that diversity and engagement makes a better and more enriched Company ▪ We are dedicated to making a difference in the communities and neighborhoods in which we operate and serve ▪ We listen to our customers’ needs and wants and make intelligent data - driven decisions ▪ We thrive in a team - oriented culture QUALITY Craftsmanship Quality Control Stewardship SOCIAL Community Relations Health & Safety Employee Relations/Opportunities Diversity & Gender Equality ENVIRONMENT Climate Change Production Consumption Waste & Pollution Environmental Protections GOVERNANCE Board & Management Diversity Stakeholder Relations Regulatory Adherence MAKING A DIFFERENCE

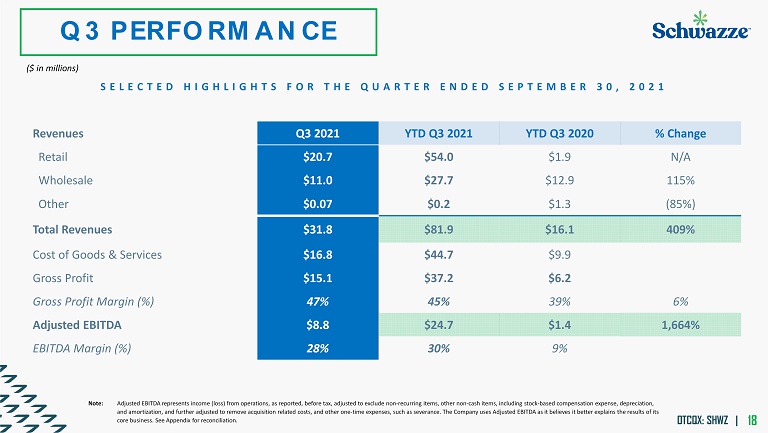

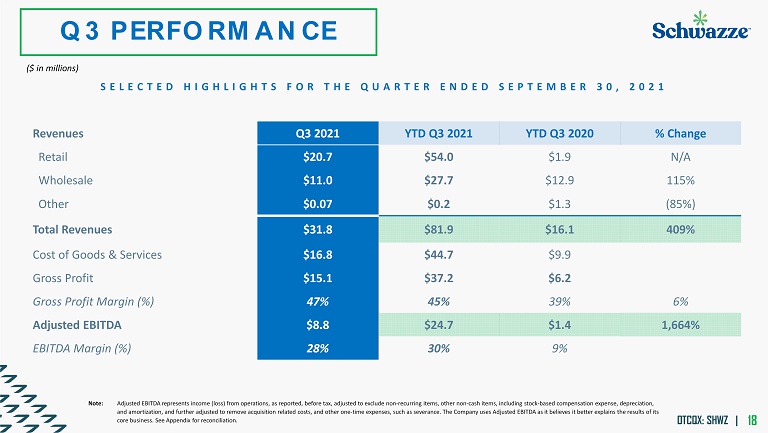

OTCQX: SHWZ | 18 Q3 PERFORMANCE Revenues Q3 2021 YTD Q3 2021 YTD Q3 2020 % Change Retail $20.7 $54.0 $1.9 N/A Wholesale $11.0 $27.7 $12.9 115% Other $0.07 $0.2 $1.3 (85%) Total Revenues $31.8 $81.9 $16.1 409% Cost of Goods & Services $16.8 $44.7 $9.9 Gross Profit $15.1 $37.2 $6.2 Gross Profit Margin (%) 47% 45% 39% 6% Adjusted EBITDA $8.8 $24.7 $1.4 1,664% EBITDA Margin (%) 28% 30% 9% SELECTED HIGHLIGHTS FOR THE QUARTER ENDED SEPTEMBER 30, 2021 ($ in millions) Note: Adjusted EBITDA represents income (loss) from operations, as reported, before tax, adjusted to exclude non - recurring items, othe r non - cash items, including stock - based compensation expense, depreciation, and amortization, and further adjusted to remove acquisition related costs, and other one - time expenses, such as severance. The Company uses Adjusted EBITDA as it believes it better explains the results of its core business. See Appendix for reconciliation.

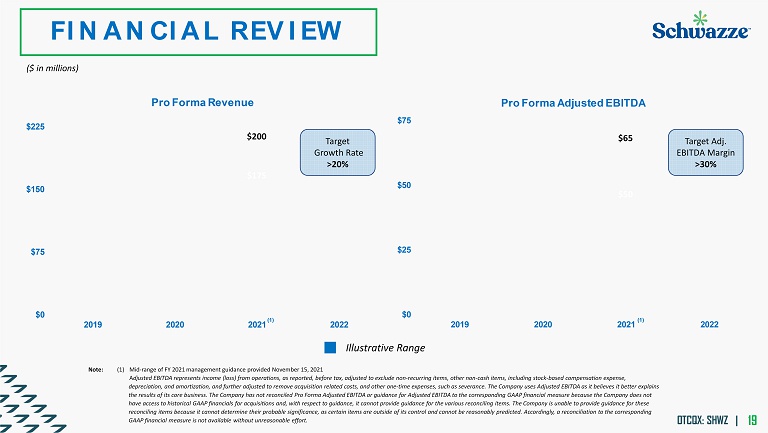

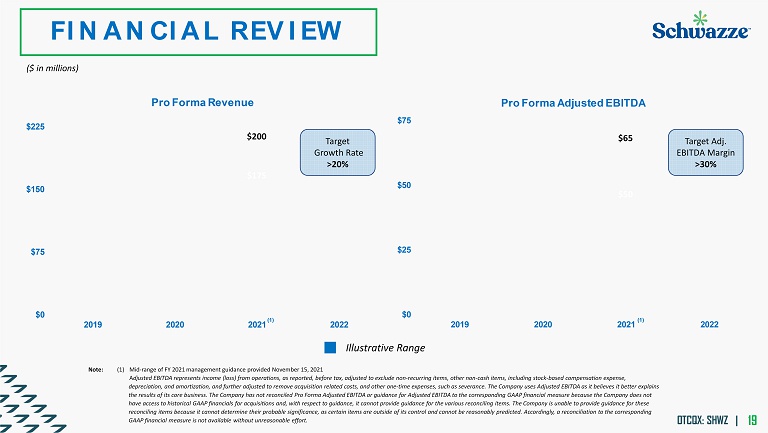

OTCQX: SHWZ | 19 FINANCIAL REVIEW Illustrative Range $0 $75 $150 $225 2019 2020 2021 2022 Pro Forma Revenue $0 $25 $50 $75 2019 2020 2021 2022 Pro Forma Adjusted EBITDA Target Growth Rate >20% Target Adj. EBITDA Margin >30% Note: (1) Mid - range of FY 2021 management guidance provided November 15, 2021 A djusted EBITDA represents income (loss) from operations, as reported, before tax, adjusted to exclude non - recurring items, other non - cash items, including stock - based compensation expense, depreciation, and amortization, and further adjusted to remove acquisition related costs, and other one - time expenses, such as s everance. The Company uses Adjusted EBITDA as it believes it better explains the results of its core business. The Company has not reconciled Pro Forma Adjusted EBITDA or guidance for Adjusted EBITDA to th e corresponding GAAP financial measure because the Company does not have access to historical GAAP financials for acquisitions and, with respect to guidance, it cannot provide guidance for the var ious reconciling items. The Company is unable to provide guidance for these reconciling items because it cannot determine their probable significance, as certain items are outside of its control and ca nno t be reasonably predicted. Accordingly, a reconciliation to the corresponding GAAP financial measure is not available without unreasonable effort. (1) (1) ($ in millions) $175 $200 $50 $65

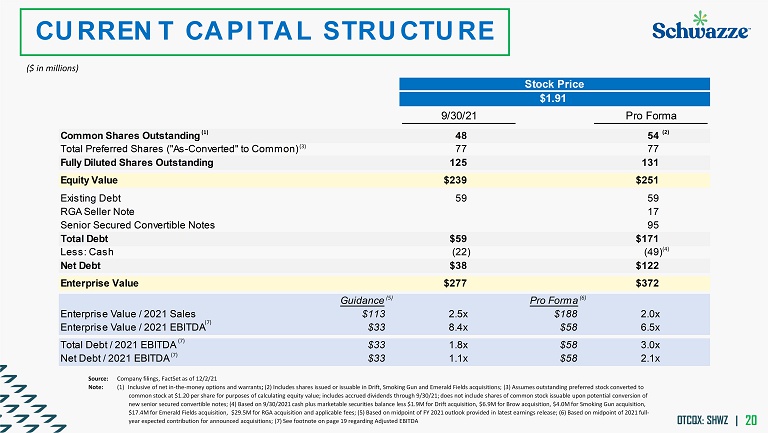

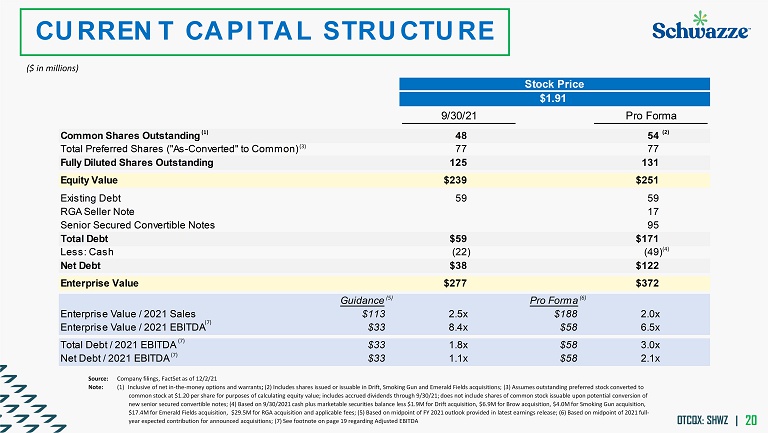

OTCQX: SHWZ | 20 Stock Price $1.91 9/30/21 Pro Forma Common Shares Outstanding 48 54 Total Preferred Shares ("As-Converted" to Common) 77 77 Fully Diluted Shares Outstanding 125 131 Equity Value $239 $251 Existing Debt 59 59 RGA Seller Note 17 Senior Secured Convertible Notes 95 Total Debt $59 $171 Less: Cash (22) (49) Net Debt $38 $122 Enterprise Value $277 $372 Guidance Pro Forma Enterprise Value / 2021 Sales $113 2.5x $188 2.0x Enterprise Value / 2021 EBITDA $33 8.4x $58 6.5x Total Debt / 2021 EBITDA $33 1.8x $58 3.0x Net Debt / 2021 EBITDA $33 1.1x $58 2.1x CURRENT CAPITAL STRUCTURE (5) (1) (4) (6) Source: Company filings, FactSet as of 12/2/21 Note: (1) Inclusive of net in - the - money options and warrants ; (2) Includes shares issued or issuable in Drift, Smoking Gun and Emerald Fields acquisitions; (3) Assumes outstanding preferred stock converted to common stock at $1.20 per share for purposes of calculating equity value; includes accrued dividends through 9/30/21; does no t i nclude shares of common stock issuable upon potential conversion of new senior secured convertible notes; (4) Based on 9/30/2021 cash plus marketable securities balance less $1.9M for Drift acquisition, $6.9M for Brow acquisition, $4. 0M for Smoking Gun acquisition , $17.4M for Emerald Fields acquisition, $29.5M for RGA acquisition and applicable fees; (5) Based on midpoint of FY 2021 outlook provided in latest earnings release; (6) Based on midpoint of 2 021 full - year expected contribution for announced acquisitions ; (7) See footnote on page 19 regarding Adjusted EBITDA ($ in millions) (2) (3) (7) (7) (7)

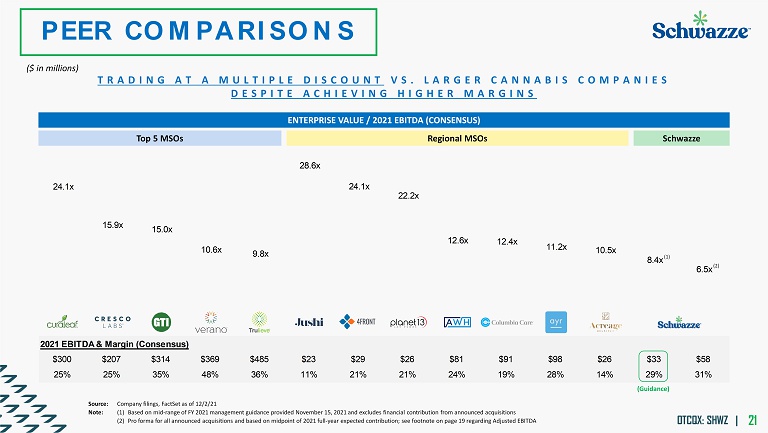

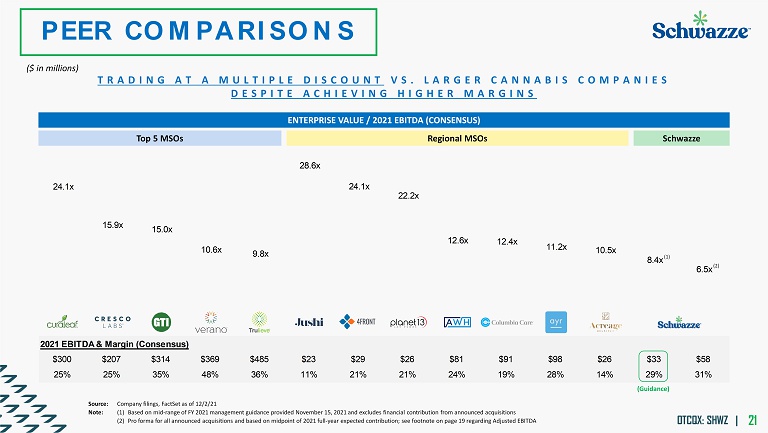

OTCQX: SHWZ | 21 2021 EBITDA & Margin (Consensus) $300 $207 $314 $369 $485 $23 $29 $26 $81 $91 $98 $26 $33 $58 25% 25% 35% 48% 36% 11% 21% 21% 24% 19% 28% 14% 29% 31% 24.1x 15.9x 15.0x 10.6x 9.8x 28.6x 24.1x 22.2x 12.6x 12.4x 11.2x 10.5x 8.4x 6.5x PEER COMPARISONS ENTERPRISE VALUE / 2021 EBITDA (CONSENSUS) Top 5 MSOs Regional MSOs Schwazze Source: Company filings, FactSet as of 12/2/21 Note: (1) Based on mid - range of FY 2021 management guidance provided November 15, 2021 and excludes financial contribution from annou nced acquisitions (2) Pro forma for all announced acquisitions and based on midpoint of 2021 full - year expected contribution; see footnote on page 19 regarding Adjusted EBITDA (1) ($ in millions) TRADING AT A MULTIPLE DISCOUNT VS. LARGER CANNABIS COMPANIES DESPITE ACHIEVING HIGHER MARGINS (Guidance) (2)

“We are committed to unlocking the full potential of the cannabis plant to improve the human condition.” Justin Dye Chief Executive Officer Information Contact Joanne Jobin, Investor Relations T 647 964 0292 E ir@Schwazze.com W Schwazze.com Corporate Office Schwazze 4880 Havana St., Ste 201 Denver, CO 80239 T 303 - 371 - 0387

OTCQX: SHWZ | 23 APPENDIX

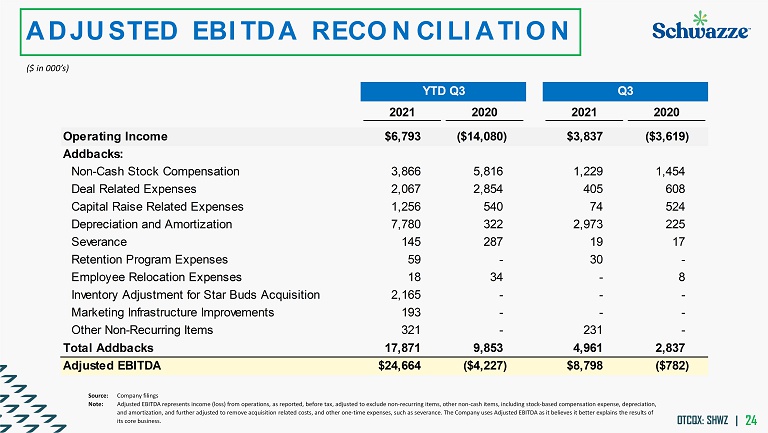

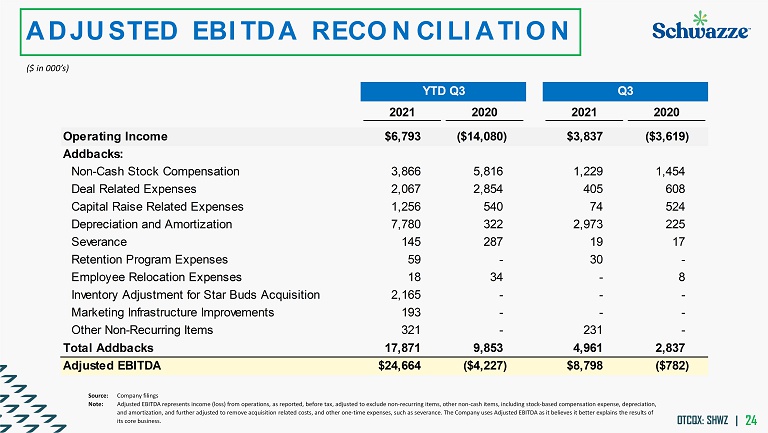

OTCQX: SHWZ | 24 ADJUSTED EBITDA RECONCILIATION Source: Company filings Note: Adjusted EBITDA represents income (loss) from operations, as reported, before tax, adjusted to exclude non - recurring items, oth er non - cash items, including stock - based compensation expense, depreciation, and amortization, and further adjusted to remove acquisition related costs, and other one - time expenses, such as severance. The Company uses Adjusted EBITDA as it believes it better explains the results of its core business. ($ in 000’s) YTD Q3 Q3 Quarter 2 2021 2020 2021 2020 Operating Income $6,793 ($14,080) $3,837 ($3,619) Addbacks: Non-Cash Stock Compensation 3,866 5,816 1,229 1,454 Deal Related Expenses 2,067 2,854 405 608 Capital Raise Related Expenses 1,256 540 74 524 Depreciation and Amortization 7,780 322 2,973 225 Severance 145 287 19 17 Retention Program Expenses 59 - 30 - Employee Relocation Expenses 18 34 - 8 Inventory Adjustment for Star Buds Acquisition 2,165 - - - Marketing Infrastructure Improvements 193 - - - Other Non-Recurring Items 321 - 231 - Total Addbacks 17,871 9,853 4,961 2,837 Adjusted EBITDA $24,664 ($4,227) $8,798 ($782)

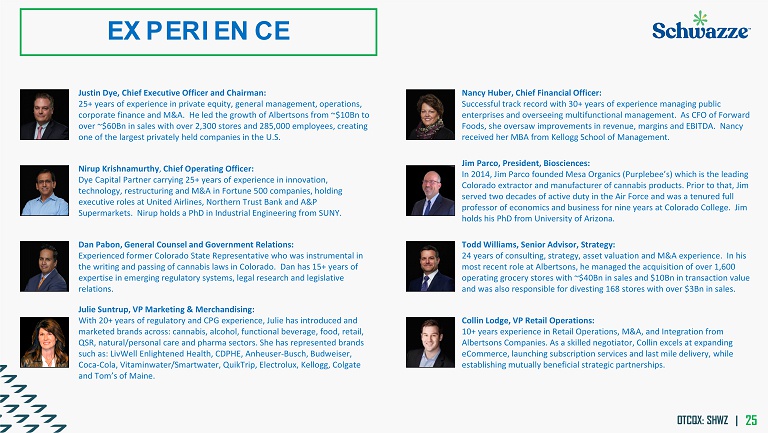

OTCQX: SHWZ | 25 EXPERIENCE Dan Pabon, General Counsel and Government Relations: Experienced former Colorado State Representative who was instrumental in the writing and passing of cannabis laws in Colorado. Dan has 15+ years of expertise in emerging regulatory systems, legal research and legislative relations. Justin Dye, Chief Executive Officer and Chairman: 25+ years of experience in private equity, general management, operations, corporate finance and M&A. He led the growth of Albertsons from ~$10Bn to over ~$60Bn in sales with over 2,300 stores and 285,000 employees, creating one of the largest privately held companies in the U.S. Nirup Krishnamurthy , Chief Operating Officer: Dye Capital Partner carrying 25+ years of experience in innovation, technology, restructuring and M&A in Fortune 500 companies, holding executive roles at United Airlines, Northern Trust Bank and A&P Supermarkets. Nirup holds a PhD in Industrial Engineering from SUNY. Nancy Huber, Chief Financial Officer: Successful track record with 30+ years of experience managing public enterprises and overseeing multifunctional management. As CFO of Forward Foods, she oversaw improvements in revenue, margins and EBITDA. Nancy received her MBA from Kellogg School of Management. Jim Parco, President, Biosciences: In 2014, Jim Parco founded Mesa Organics (Purplebee’s) which is the leading Colorado extractor and manufacturer of cannabis products. Prior to that, Jim served two decades of active duty in the Air Force and was a tenured full professor of economics and business for nine years at Colorado College. Jim holds his PhD from University of Arizona. Todd Williams, Senior Advisor, Strategy: 24 years of consulting, strategy, asset valuation and M&A experience. In his most recent role at Albertsons, he managed the acquisition of over 1,600 operating grocery stores with ~$40Bn in sales and $10Bn in transaction value and was also responsible for divesting 168 stores with over $3Bn in sales. Collin Lodge, VP Retail Operations: 10+ years experience in Retail Operations, M&A, and Integration from Albertsons Companies. As a skilled negotiator, Collin excels at expanding eCommerce, launching subscription services and last mile delivery, while establishing mutually beneficial strategic partnerships. Julie Suntrup, VP Marketing & Merchandising: With 20+ years of regulatory and CPG experience, Julie has introduced and marketed brands across: cannabis, alcohol, functional beverage, food, retail, QSR, natural/personal care and pharma sectors. She has represented brands such as: LivWell Enlightened Health, CDPHE, Anheuser - Busch, Budweiser, Coca - Cola, Vitaminwater / Smartwater , QuikTrip, Electrolux, Kellogg, Colgate and Tom’s of Maine.

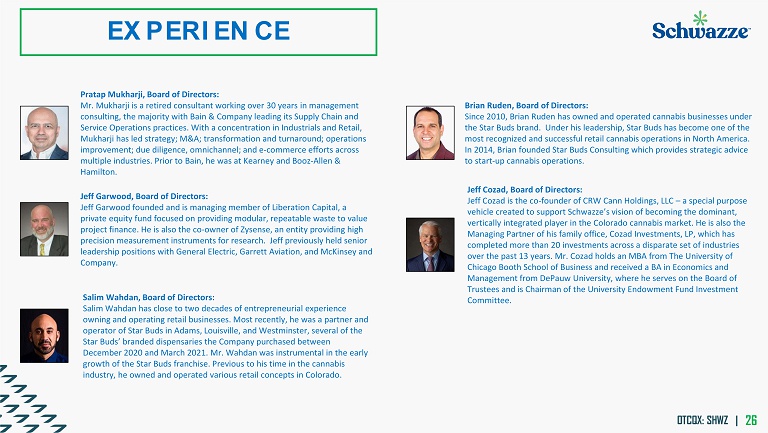

OTCQX: SHWZ | 26 EXPERIENCE Brian Ruden , Board of Directors: Since 2010, Brian Ruden has owned and operated cannabis businesses under the Star Buds brand. Under his leadership, Star Buds has become one of the most recognized and successful retail cannabis operations in North America. In 2014, Brian founded Star Buds Consulting which provides strategic advice to start - up cannabis operations. Jeff Garwood, Board of Directors: Jeff Garwood founded and is managing member of Liberation Capital, a private equity fund focused on providing modular, repeatable waste to value project finance. He is also the co - owner of Zysense , an entity providing high precision measurement instruments for research. Jeff previously held senior leadership positions with General Electric, Garrett Aviation, and McKinsey and Company. Jeff Cozad, Board of Directors: Jeff Cozad is the co - founder of CRW Cann Holdings, LLC – a special purpose vehicle created to support Schwazze’s vision of becoming the dominant, vertically integrated player in the Colorado cannabis market. He is also the Managing Partner of his family office, Cozad Investments, LP, which has completed more than 20 investments across a disparate set of industries over the past 13 years. Mr. Cozad holds an MBA from The University of Chicago Booth School of Business and received a BA in Economics and Management from DePauw University, where he serves on the Board of Trustees and is Chairman of the University Endowment Fund Investment Committee. Salim Wahdan, Board of Directors: Salim Wahdan has close to two decades of entrepreneurial experience owning and operating retail businesses. Most recently, he was a partner and operator of Star Buds in Adams, Louisville, and Westminster, several of the Star Buds’ branded dispensaries the Company purchased between December 2020 and March 2021. Mr. Wahdan was instrumental in the early growth of the Star Buds franchise. Previous to his time in the cannabis industry, he owned and operated various retail concepts in Colorado. Pratap Mukharji, Board of Directors: Mr. Mukharji is a retired consultant working over 30 years in management consulting, the majority with Bain & Company leading its Supply Chain and Service Operations practices. With a concentration in Industrials and Retail, Mukharji has led strategy; M&A; transformation and turnaround; operations improvement; due diligence, omnichannel; and e - commerce efforts across multiple industries. Prior to Bain, he was at Kearney and Booz - Allen & Hamilton.