Mylan & Perrigo: It's Now All About The Immediate Value For The Perrigo Shareholder and Better Long-Term Sustainable Growth and Value Creation For The Combined Company November 2015 Filed by Mylan N.V. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Perrigo Company plc Commission File No. 001-36353 |

Legal Matters 2 Mylan N.V.’s (“Mylan”) offer for Perrigo Company plc (“Perrigo”) is governed by the Irish Takeover Panel Act, 1997, Takeover Rules 2013 (the “Irish Takeover Rules”). Under the Irish Takeover Rules, Mylan management is prohibited from discussing any material information or significant new opinions which have not been publicly announced. Any person interested in shares of Mylan or Perrigo is encouraged to consult their professional advisers. This communication contains "forward-looking statements." Such forward-looking statements may include, without limitation, statements about the proposed acquisition of Perrigo by Mylan (the "Perrigo Proposal"), Mylan's acquisition (the "EPD Transaction") of Mylan Inc. and Abbott's non-U.S. developed markets specialty and branded generics business (the “EPD Business”), the benefits and synergies of the Perrigo Proposal or EPD Transaction, future opportunities for Mylan, Perrigo, or the combined company and products, any other statements regarding Mylan's, Perrigo's, or the combined company's future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods, and statements about Mylan remaining very well-positioned to supply the anticipated customer and patient demand for the EpiPen® Auto-Injector and that Mylan sees an additional $0.25 benefit to adjusted diluted EPS in 2016 with respect to the EpiPen® Auto-Injector. These may often be identified by the use of words such as "will," "may," "could," "should," "would," "project," "believe," "anticipate," "expect," "plan," "estimate," "forecast," "potential," "intend," "continue," "target" and variations of these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: uncertainties related to the Perrigo Proposal, including as to the timing of the offer and a compulsory acquisition, whether Perrigo will cooperate with Mylan and whether Mylan will be able to consummate the offer and a compulsory acquisition, the possibility that competing offers will be made, the possibility that the conditions to the consummation of the offer will not be satisfied, and the possibility that Mylan will be unable to obtain regulatory approvals for the offer or be required, as a condition to obtaining regulatory approvals, to accept conditions that could reduce the anticipated benefits of the offer; the ability to meet expectations regarding the accounting and tax treatments of a transaction relating to the Perrigo Proposal and the EPD Transaction; changes in relevant tax and other laws, including but not limited to changes in healthcare and pharmaceutical laws and regulations in the U.S. and abroad; the integration of Perrigo and the EPD Business being more difficult, time-consuming, or costly than expected; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients, or suppliers) being greater than expected following the Perrigo Proposal and the EPD Transaction; the retention of certain key employees of Perrigo and the EPD Business being difficult; the possibility that Mylan may be unable to achieve expected synergies and operating efficiencies in connection with the Perrigo Proposal and the EPD Transaction within the expected time- frames or at all and to successfully integrate Perrigo and the EPD Business; expected or targeted future financial and operating performance and results; the capacity to bring new products to market, including but not limited to where Mylan uses its business judgment and decides to manufacture, market, and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent infringement(s) have not been finally resolved by the courts (i.e., an "at-risk launch"); any regulatory, legal, or other impediments to our ability to bring new products to market; success of clinical trials and our ability to execute on new product opportunities; any changes in or difficulties with our inventory of, and our ability to manufacture and distribute, the EpiPen® Auto-Injector; the scope, timing, and outcome of any ongoing legal proceedings and the impact of any such proceedings on financial condition, results of operations, and/or cash flows; the ability to protect intellectual property and preserve intellectual property rights; the effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; the impact of competition; changes in the economic and financial conditions of the businesses of Mylan, Perrigo, or the combined company; the inherent challenges, risks, and costs in identifying, acquiring, and integrating complementary or strategic acquisitions of other companies, products, or assets and in achieving anticipated synergies; uncertainties and matters beyond the control of management; and inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements, and the providing of estimates of financial measures, in accordance with accounting principles generally accepted in the United States (“GAAP”) and related standards or on an adjusted basis. For more detailed information on the risks and uncertainties associated with Mylan's business activities, see the risks described in Mylan’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015 and our other filings with the Securities and Exchange Commission ("SEC"). These risks, as well as other risks associated with Mylan, Perrigo, and the combined company are also more fully discussed in the Registration Statement on Form S-4 (which includes an offer to exchange/prospectus and was declared effective on September 10, 2015, the "Registration Statement") in connection with the Perrigo Proposal. You can access Mylan's filings with the SEC through the SEC website at www.sec.gov, and Mylan strongly encourages you to do so. Mylan undertakes no obligation to update any statements herein for revisions or changes after the date of this communication. IRISH LAW RESTRICTIONS ON CERTAIN INFORMATION FORWARD-LOOKING STATEMENTS |

Legal Matters 3 RESPONSIBILITY STATEMENT The directors of Mylan accept responsibility for the information contained in this communication, save that the only responsibility accepted by the directors of Mylan in respect of the information in this communication relating to Perrigo, Perrigo’s subsidiaries and subsidiary undertakings, the Perrigo board of directors and the persons connected with them, which has been compiled from published sources, has been to ensure that such information has been correctly and fairly reproduced or presented (and no steps have been taken by the directors of Mylan to verify this information). To the best of the knowledge and belief of the directors of Mylan (who have taken all reasonable care to ensure that such is the case) the information contained in this communication is in accordance with the facts and does not omit anything likely to affect the import of such information. DEALING DISCLOSURE REQUIREMENTS Under the provisions of Rule 8.3 of the Irish Takeover Rules, if any person is, or becomes, ‘interested’ (directly or indirectly) in, 1% or more of any class of ‘relevant securities’ of Perrigo or Mylan, all ‘dealings’ in any ‘relevant securities’ of Perrigo or Mylan (including by means of an option in respect of, or a derivative referenced to, any such ‘relevant securities’) must be publicly disclosed by not later than 3:30 pm (New York time) on the ‘business’ day following the date of the relevant transaction. This requirement will continue until the date on which the ‘offer period’ ends. If two or more persons co-operate on the basis of any agreement, either express or tacit, either oral or written, to acquire an ‘interest’ in ‘relevant securities’ of Perrigo or Mylan, they will be deemed to be a single person for the purpose of Rule 8.3 of the Irish Takeover Rules. Under the provisions of Rule 8.1 of the Irish Takeover Rules, all ‘dealings’ in ‘relevant securities’ of Perrigo by Mylan or ‘relevant securities’ of Mylan by Perrigo, or by any party acting in concert with either of them, must also be disclosed by no later than 12 noon (New York time) on the ‘business’ day following the date of the relevant transaction. A disclosure table, giving details of the companies in whose ‘relevant securities’ ‘dealings’ should be disclosed, can be found on the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie. Interests in securities arise, in summary, when a person has long economic exposure, whether conditional or absolute, to changes in the price of securities. In particular, a person will be treated as having an ‘interest’ by virtue of the ownership or control of securities, or by virtue of any option in respect of, or derivative referenced to, securities. Terms in quotation marks are defined in the Irish Takeover Rules, which can also be found on the Irish Takeover Panel’s website. If you are in any doubt as to whether or not you are required to disclose a dealing under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie or contact the Irish Takeover Panel on telephone number +353 1 678 9020 or fax number +353 1 678 9289. Goldman Sachs, which is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting for Mylan and no one else in connection with the Perrigo Proposal and will not be responsible to anyone other than Mylan for providing the protections afforded to clients of Goldman Sachs, or for giving advice in connection with the Perrigo Proposal or any matter referred to herein. Goldman Sachs does not accept any responsibility whatsoever for the contents of this communication or for any statement made or purported to be made by them or on their behalf in connection with the offer. Goldman Sachs accordingly disclaims all and any liability whether arising in tort, contract, or otherwise which it might otherwise have in respect of this communication or any such statement. |

Legal Matters 4 ADDITIONAL INFORMATION In connection with the Perrigo Proposal, Mylan has filed certain materials with the SEC (and anticipates filing further materials), including, among other materials, the Registration Statement. In connection with the Perrigo Proposal, Mylan also filed with the SEC on September 14, 2015 a Tender Offer Statement on Schedule TO, which includes the offer to exchange / prospectus (the “Offer to Exchange / Prospectus”), form of letter of transmittal and other related offer documents. Mylan has mailed the Offer to Exchange / Prospectus to Perrigo shareholders in connection with the Perrigo Proposal. This communication is not intended to be, and is not, a substitute for such filings or for any other document that Mylan may file with the SEC in connection with the Perrigo Proposal. INVESTORS AND SECURITYHOLDERS OF MYLAN AND PERRIGO ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY (IF AND WHEN THEY BECOME AVAILABLE) BEFORE MAKING AN INVESTMENT DECISION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MYLAN, PERRIGO AND THE PERRIGO PROPOSAL. Such documents will be available free of charge through the website maintained by the SEC at www.sec.gov or by directing a request to Mylan at 724-514-1813 or investor.relations@mylan.com. Any materials filed by Mylan with the SEC that are required to be mailed to shareholders of Perrigo and/or Mylan will also be mailed to such shareholders. This communication has been prepared in accordance with U.S. securities law, Irish law, and the Irish Takeover Rules. NON-SOLICITATION This communication is not intended to, and does not, constitute or form part of (1) any offer or invitation to purchase or otherwise acquire, subscribe for, tender, exchange, sell, or otherwise dispose of any securities, (2) the solicitation of an offer or invitation to purchase or otherwise acquire, subscribe for, sell, or otherwise dispose of any securities, or (3) the solicitation of any vote or approval in any jurisdiction pursuant to this communication or otherwise, nor will there be any acquisition or disposition of the securities referred to in this communication in any jurisdiction in contravention of applicable law or regulation. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. FURTHER INFORMATION The distribution of this communication in certain jurisdictions may be restricted or affected by the laws of such jurisdictions. Accordingly, copies of this communication are not being, and must not be, mailed or otherwise forwarded, distributed or sent in, into, or from any such jurisdiction. Therefore, persons who receive this communication (including, without limitation, nominees, trustees and custodians) and are subject to the laws of any such jurisdiction will need to inform themselves about, and observe, any applicable restrictions or requirements. Any failure to do so may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law, Mylan disclaims any responsibility or liability for the violations of any such restrictions by any person. |

Legal Matters NON-GAAP FINANCIAL MEASURES 5 This communication includes the presentation and discussion of certain financial information that differs from what is reported under GAAP. These non-GAAP financial measures, including, but not limited to, adjusted diluted EPS, adjusted cash provided by operating activities, adjusted third party net sales from Europe, adjusted Generics segment third party net sales, adjusted third party net sales, adjusted total revenues, adjusted gross profit, adjusted gross margins, adjusted net earnings attributable to Mylan, adjusted constant currency total revenues, adjusted constant currency third party net sales, EBITDA, adjusted EBITDA, adjusted R&D, adjusted SG&A, and adjusted effective tax rate, are presented in order to supplement investors' and other readers' understanding and assessment of the Company's financial performance. Mylan has also presented certain non-GAAP financial measures for Perrigo, including, but not limited to, adjusted diluted EPS and adjusted EBITDA margin, which have been taken from published sources. Management uses these measures internally for forecasting, budgeting and measuring its operating performance. In addition, primarily due to acquisitions, Mylan believes that an evaluation of its ongoing operations (and comparisons of its current operations with historical and future operations) would be difficult if the disclosure of its financial results were limited to financial measures prepared only in accordance with GAAP. In addition, Mylan believes that including EBITDA and supplemental adjustments applied in presenting adjusted EBITDA pursuant to our debt agreements is appropriate to provide additional information to investors to demonstrate the Company's ability to comply with financial debt covenants (which are calculated using a measure similar to adjusted EBITDA) and assess the Company's ability to incur additional indebtedness. We also report sales performance using the non-GAAP financial measure of "constant currency" total revenues, adjusted total revenues, third party net sales, and adjusted third party net sales. This measure provides information on the change in net sales assuming that foreign currency exchange rates had not changed between the prior and current period. The comparisons presented as constant currency rates reflect comparative local currency sales at the prior year's foreign exchange rates. We routinely evaluate our third party net sales performance at constant currency so that sales results can be viewed without the impact of foreign currency exchange rates, thereby facilitating a period-to-period comparison of our operational activities, and we believe that this presentation also provides useful information to investors for the same reason. The "Summary of Adjusted Revenues by Segment" table in the Appendix compares adjusted third party net sales on an actual and constant currency basis for each reportable segment and the geographic regions within the Generics segment for the three and nine months ended September 30, 2015 and 2014. Also, set forth below, Mylan has provided reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures (which in the case of Perrigo’s reconciliations, have been taken from published sources), other than Perrigo’s adjusted diluted EPS company guidance and Thomson Reuters consensus estimates of adjusted EBITDA and adjusted diluted EPS which cannot be reconciled as they are from a third party source. Mylan does not endorse or adopt Thomson Reuters consensus estimates. Investors and other readers are encouraged to review the related GAAP financial measures and the reconciliations of the non-GAAP measures to their most directly comparable GAAP measures set forth in the Appendix, and investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with GAAP. |

Legal Matters 6 All trademarks, trade names, product names, graphics and logos of Mylan or any of its affiliates contained herein are trademarks, registered trademarks or trade dress of Mylan or such affiliate in the United States and/or other countries. This communication is neither endorsed, nor sponsored, nor affiliated with Perrigo or any of its affiliates. Perrigo is a registered trademark of L. Perrigo Company. Abbott is a registered trademark of Abbott Laboratories. Actavis is a registered trademark of Actavis, Inc. Abbvie is a registered trademark of Abbvie Inc. Advair is a registered trademark of Glaxo Group Limited. Akorn is a registered trademark of Akorn, Inc. Allergan is a registered trademark of Allergan, Inc. APP is a registered trademark of Fresenius Kabi USA, LLC. Bayer is a registered trademark of Bayer Aktiengesellschaft. Bristol-Myers Squibb is a registered trademark of Bristol-Myers Squibb Company. Celgene is a registered trademark of Celgene Corporation. Colgate is a registered trademark of the Colgate Palmolive Company. Endo is a registered trademark of Endo Pharmaceuticals Inc. Famy Care Ltd is a trademark of Famy Care Limited. Flixotide is a trademark of Glaxo Group Limited. Flovent is a registered trademark of Glaxo Group Limited. Fresenius Kabi is a trademark of Fresenius Kabi AG. GSK is a registered trademark of SmithKline Beecham Limited. Hospira is a registered trademark of Hospira, Inc. Jazz is a registered trademark of Jazz Pharmaceuticals, Inc. Mallinckrodt is a registered trademark of Mallinckrodt Brand Pharmaceuticals, Inc. Mead Johnson Nutrition is a registered trademark of Mead Johnson & Company, LLC. Merck is a registered trademark of Merck Sharpe & Dohme Corp. Novator is a registered trademark of Novator International Holdings Ltd. Omega Pharma is a trademark of Omega Pharma Invest NV. Par is a registered trademark of Par Pharmaceutical Companies, Inc. Pfizer is a registered trademark of Pfizer Inc. Regeneron is a registered trademark of Regeneron Pharmaceuticals, Inc. Seretide is a trademark of Glaxo Group Limited. Shire is a registered trademark of Shire Pharmaceuticals Holdings Ireland Limited. Teva is a registered trademark of Teva Pharmaceutical Industries Ltd. Tysabri is a registered trademark of Biogen MA Inc. United Therapeutics Corporation is a registered trademark of United Therapeutics Corporation. Valeant is a registered trademark of Valeant Pharmaceuticals International. Zoetis is registered trademark of Zoetis Products LLC. All other trademarks, trade names, product names and logos contained herein are the property of their respective owners. The use or display of other parties' trademarks, trade names, product names or logos is not intended to imply, and should not be construed to imply, a relationship with or endorsement or sponsorship of Mylan by such other party. Save for the Mylan calendar year 2015 guidance (in respect of which additional information required by the Irish Takeover Rules has been mailed to Perrigo shareholders, to the extent required), no statement in this communication is intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Mylan or Perrigo as appropriate. No statement in this communication constitutes an asset valuation. There are various material assumptions underlying the statement relating to “at least US $800 million of annual pre-tax operational synergies” (the “Synergy Statement”), which may result in the value in the Synergy Statement being materially greater or less than estimated. The Synergy Statement should therefore be read in conjunction with the key assumptions underlying such estimates which are set out in Mylan’s announcement pursuant to Rule 2.5 of the Irish Takeover Rules on April 24, 2015. The Synergy Statement should not be construed as a profit forecast or interpreted to mean that the combined earnings of Mylan and Perrigo in any period following this communication would necessarily match or be greater than or be less than those of Mylan and/or Perrigo for the relevant preceding financial period or any other period. A copy of the Offer to Exchange/Prospectus (being the offer document for the purposes of the Irish Takeover Rules) is available for inspection at the offices of Arthur Cox, Earlsfort Centre, Earlsfort Terrace, Dublin 2, Ireland. TRADEMARK DISCLAIMER NO PROFIT FORECAST / ASSET VALUATIONS SYNERGY STATEMENT AVAILABILITY OF THE OFFER TO EXCHANGE/PROSPECTUS (OFFER DOCUMENT) |

7 Who Is Mylan? Mylan’s Q3 2015 Earnings Sustainable Value for Mylan and Perrigo Shareholders 1) Highly Attractive Multiple and Premium to Standalone Value 2) Meaningfully and Immediately Accretive to Perrigo Shareholders 3) Well Positioned to Integrate and Aligned with Mylan’s Core Competencies 4) Transaction Delivers Immediate Value to Perrigo Shareholders Agenda |

8 Who Is Mylan? Mylan’s Q3 2015 Earnings Sustainable Value for Mylan and Perrigo Shareholders 1) Highly Attractive Multiple and Premium to Standalone Value 2) Meaningfully and Immediately Accretive to Perrigo Shareholders 3) Well Positioned to Integrate and Aligned with Mylan’s Core Competencies 4) Transaction Delivers Immediate Value to Perrigo Shareholders Agenda |

9 More than 50 Years of Unconventional Success ‘61 FOUNDED FIRST FDA APPROVAL MYLAN GOES PUBLIC ‘66 ‘73 ‘84 NEW DRUG APPROVAL ‘89 BLOWING THE WHISTLE ‘92 $100M IN REVENUE ‘02 $1B IN REVENUE ‘07 MYLAN GOES GLOBAL ‘08 $5B IN REVENUE ‘12 FDASIA/GDUFA ‘13 GLOBAL INJECTABLES ‘15 BROADER REACH |

10 Leading portfolio and pipeline, complemented by a powerful commercial platform ~1,400 global marketed products, 3,400 product submissions pending regulatory approval globally, more than 260 ANDAs pending FDA approval and 50 potential first-to-file opportunities Value-creating M&A and business development, ensuring future financial flexibility Acquisitions and partnerships driving synergistic growth with existing core operations Track record of execution driving exceptional shareholder return 27% Adjusted diluted EPS CAGR since 2008¹ and strong focus on optimal capital allocation Significant investment in future growth drivers Billions of anticipated spend fueling an extensive technology platform Differentiated, large-scale global operating platform World Class Global Supply Chain with excellent service record High quality, vertically integrated development and manufacturing operations 1 Mylan’s Long-Standing Strategy and Track Record of Success Mylan’s Strategy for Success Source: Mylan prospectus supplement dated March 30, 2015 and earnings release dated August 6, 2015. Note: 2015 figure represents the mid-point of the updated 2015 financial guidance range. Note: CAGR is calculated based on 2008 – 2015 guidance mid-point data. Adjusted diluted EPS is a non-GAAP financial measure. See Appendix for reconciliation of adjusted diluted EPS to the most directly comparable GAAP measure. |

11 Scientists, researchers, technicians, sales, manufacturing and marketing professionals – the men and women of Mylan are committed to setting new standards in healthcare Around the corner or around the globe, you’ll find innovative Mylan medicines and products Large-Scale Global Platform |

Growing Portfolio Powerful global R&D driving broad and growing product portfolio Robust product pipeline New Product Submissions Pending Regulatory Approval Around the World SEPARATE PRODUCTS Global Market Portfolio 12 |

13 Vast Manufacturing Network OSD 14 Injectables 12 Complex products 3 API 9 Total 29 FDF 9 API |

14 * Vertically Integrated *Metric applies to the Mylan legacy business prior to Mylan’s acquisition of Abbott’s non-U.S. developed markets specialty and branded generics business |

15 Integrated R&D Network ~3,000 3 6 Scientists and regulatory professionals Global R&D centers of excellence Technology-focused development sites |

16 Significant R&D Investment Mylan invests in future growth ~$2.8B cumulative spend from 2014 to 2018 fueling pipeline diversification* *Source: Mylan’s 2013 Investor Day Presentation, August 1, 2013. 2014 2018 |

17 Robust Product Portfolio Mylan offers products in all of the world’s top therapeutic classes. |

18 Who We Serve Physicians Pharmacists & Retailers Wholesalers Governments Institutions |

19 Strategic Growth Drivers 2014 - 2018 |

20 Continued Execution of Our Growth Drivers *CCG = clinic commission group Sirdupla - Sirdupla™ pMDI continues to perform and has received majority endorsement from UK CCG* Revefenacin - Entered into Phase III clinical program expected to complete in Q3 2016 Generic Flovent® / Flixotide® - Completed pilot pharmacokinetic studies for US program. Progressing with manufacturing activities; generic Flixotide® is on track to be approved in Q1 2016 in the EU Generic Advair® / Seretide® • Formulation developed to be qualitatively and quantitatively the same as RLD • Completed our clinical endpoint study and have shown product to meet all draft guideline criteria • Human Factors Studies demonstrate our DPI device can be used as successfully with new patients as those on RLD device • Two PK studies complete with final PK study ongoing and will support our December ANDA submission • Recently completed a collaborative pre-ANDA meeting with the FDA Respiratory Biologics & Insulin Analogs Robust portfolios with six biosimilars and three insulin analogs in active development, in collaboration with Biocon Plan to file three biosimilar applications and an application for an interchangeable glargine (US) during 2016 • Trastuzumab - Completed enrollment of our Phase III study. Currently commercialized Hertraz™ in ten countries with multiple new launches planned in 2016 • Pegfilgrastim - Completed Phase I clinical trial and enrollment in our Phase III trials • Adalimumab - Phase I clinical trial completed and have initiated our Phase III clinical program • Glargine - Completed recruitment for both the Type 1 and the Type 2 diabetes trials. Continue to pursue our discussions with FDA regarding interchangeability. Completion and qualification of state-of-the-art facility in Malaysia and activities to transfer product into that facility |

21 2007 2010 2013 2015 Next 2015 $0.80 $1.30 $1.61 $2.04 $2.59 $2.89 $3.56 $4.25 2008-2015 adjusted diluted EPS Growth = 27% CAGR¹ Mylan’s Long-Standing Strategy and Track Record of Success Outstanding Shareholder Returns by Looking Years Ahead and Executing 1 Source: Mylan prospectus supplement dated March 30, 2015 and earnings release dated August 6, 2015. Note: 2015 figure represents the mid-point of the updated 2015 financial guidance range. Note: CAGR is calculated based on 2008 – 2015 guidance mid-point data. Adjusted diluted EPS is a non-GAAP financial measure. See Appendix for reconciliation of adjusted diluted EPS to the most directly comparable GAAP measure. 2 Acquisition of Famy Care Ltd. expected to close in the fourth quarter of 2015. 2008 2009 2010 2011 2012 2013 2014 2015E |

22 Who Is Mylan? Mylan’s Q3 2015 Earnings Sustainable Value for Mylan and Perrigo Shareholders 1) Highly Attractive Multiple and Premium to Standalone Value 2) Meaningfully and Immediately Accretive to Perrigo Shareholders 3) Well Positioned to Integrate and Aligned with Mylan’s Core Competencies 4) Transaction Delivers Immediate Value to Perrigo Shareholders Agenda |

23 Q3 2015 Highlights • Adjusted constant currency revenues grew 36%* compared to the prior year • Mylan legacy adjusted constant currency revenues grew 14%*, reflecting continued strength in our legacy business • Generics segment adjusted constant currency revenues grew 48%* and the legacy Mylan Generics segment grew 19%*, with positive growth across all regions • Adjusted diluted EPS grew 23%* compared to the prior year *Adjusted metrics and constant currency measures are non-GAAP financial measures. Please see the Appendix for reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures. |

24 Q3 2015 Financial Results & 2015 Guidance $ millions, except EPS Q3 2015 Q-o-Q Growth 2015 Guidance Y-o-Y Growth*** Total Revenue* $2,712 36% (cc)** $9,600-$10,100 33% (cc)** Gross Margin* 58% +400 bps 53%-55% +160 bps R&D as % of Revenue* 6.4% (110) bps 6.5%-7.5% (30) bps SG&A as % of Revenue* 18.2% (80) bps 19%-21% 70 bps EBITDA* $987 34% $2,900-$3,300 31% Net Earnings* $734 59% $2,075-$2,175 50% Diluted EPS* $1.43 23% $4.15-$4.35 23% (cc)** Operating Cash Flow* $1,125 139% $1,600-$1,800 40% Capital Expenditures $85 27% $350-$450 23% Effective Tax Rate* 17% (800) bps 18% (700) bps Diluted Share Count 514 29% 495-500 25% *Adjusted metrics **(cc) refers to constant currency ***Year-on-year growth is calculated from the midpoint of the 2015 guidance ranges Adjusted metrics and constant currency measures are non-GAAP financial measures. Please see the Appendix for reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures. Note: Quarter-over-Quarter (Q-o-Q) growth compares Q3 2015 actual results to Q3 2014 actual results. |

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Total Mylan North American Generics European Generics Rest of World Generics Specialty Q3 2015 Highlights By Region *Total Mylan growth reflects the quarter-over-quarter comparison of total adjusted revenues. Segment and region growth reflects the quarter-over-quarter comparison of adjusted third-party net sales. All growth rates are stated on a constant currency basis. Adjusted metrics and constant currency growth rates are non-GAAP financial measures. Please see the Appendix for reconciliations of such non-GAAP financial measures to the most direct comparable GAAP financial measures. **EPD Business growth reflects the quarter-over-quarter comparison under Mylan in Q3 2015 versus Q3 2014 under Abbott Laboratories, on a constant currency basis. Q3 2014 Q3 2015 $ in millions +36% +95% +29% +47% -5% Adjusted Revenue* Growth Legacy Mylan EPD Business** North American Generics +24% +3% European Generics +6% +3% ROW Generics +21% +14% Specialty -5% N/A Total Mylan +14% +5% 25 |

2015 Financial Guidance 2015 adjusted diluted EPS is now expected to be at the upper end of the $4.15 to $4.35 guidance range *The 20% year-on-year growth rate referred to in this slide is illustrative only, and is intended to convey Mylan’s year-on-year adjusted diluted EPS growth rate in the event that Mylan achieves 2015 adjusted diluted EPS which is marginally above the midpoint of its existing $4.15 to $4.35 guidance range. This represents, once again, greater than 20%* year-over-year growth 26 |

EpiPen® Auto-Injector • With 85% market share, we continue to see positive script volume on a year-to-date basis. • Mylan remains very well-positioned to supply the anticipated customer and patient demand, as we have consistently done for over 25 years. • Based on recent events, we see EpiPen® Auto-Injector contributing additional $0.25 to $0.30 benefit to adjusted diluted EPS in 2016. *Illustrative impact of recent long-term landscape changes in the EpiPen® Auto-Injector market on Mylan adjusted diluted EPS in 2016. This illustrative EPS growth is not intended to constitute a profit forecast for any period nor should it be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods of Mylan. 27 |

Who Is Mylan? Mylan’s Q3 2015 Earnings Sustainable Value for Mylan and Perrigo Shareholders 1) Highly Attractive Multiple and Premium to Standalone Value 2) Meaningfully and Immediately Accretive to Perrigo Shareholders 3) Well Positioned to Integrate and Aligned with Mylan’s Core Competencies 4) Transaction Delivers Immediate Value to Perrigo Shareholders Agenda 28 |

Sustainable Value for Perrigo and Mylan Shareholders 1 2 3 4 Offer Represents a Highly Attractive Multiple and Premium to Standalone Value Transaction is Meaningfully and Immediately Accretive to Perrigo Shareholder Adjusted Diluted EPS and Adjusted Diluted EPS Growth Mylan Well Positioned to Integrate Complementary Businesses, Aligned with Its Core Competencies Transaction Delivers Immediate Value to Perrigo Shareholders 29 |

Perrigo’s Decelerating Core Highlights Weakness in Standalone Strategy Mylan Transaction Creates a Stronger and More Competitive Platform to Drive Growth Significant Underperformance Deceleration of Consumer Facing Business Concerns Regarding Tysabri Sustainability New EPS Guidance Relies on One-Time Cost Cuts, Financial Engineering, and Masks Underperformance Declining Consumer Facing Business Comprises ~75% 4 of Perrigo’s Revenue Tysabri, Which Goes Off- Patent By 2023, Comprises ~28% 6 of Perrigo’s Adj. Diluted EPS U.S. Patients on Tysabri (000s) 20.7 18.4 19.9 19.0 17.4 2010 2011 2012 2013 2014 2014 YTD 2015 YTD % Change $ 2,108 $ 2,107 (0.1)% 1,277 1,088 (15)% 671 790 18 % 231 250 8 % 89 75 (16)% Previous Guidance / Consensus Revised Guidance $5.4-$5.7 $5.3-$5.45 $8.90 $8.66 Declining Tysabri usage Failed phase 3 trial for SPMS Any off-label SPMS usage may be at risk 1 1 2 3 3 5 Source: Public filings, Wall Street Research (08-Sep-2015 Jefferies Biogen report), Thomson Reuters consensus estimates as used by Perrigo in its September 17, 2015 Investor Presentation and Perrigo Investor Presentation “Creating Value for Shareholders: Now and for the Long Term”, filed October 22, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. 1 2016E Adjusted diluted EPS Thomson Reuters Consensus Estimate as used by Perrigo as of September 16, 2015. 2 Calculated by taking Thomson Reuters 2016E adjusted diluted EPS consensus estimate of $9.30 and subtracting $0.64, calculated using post-tax income of $94mm (as per slide 32 of Perrigo’s investor presentation dated October 22, 2015) assuming 147mm of Perrigo diluted shares outstanding. 3 Based on Perrigo and Omega public filings except for Q1 2015 Branded Consumer, which is based on Wall Street Research. Pro forma for Omega acquisition assuming a January 1, 2014 close; actual transaction close occurred on March 30, 2015. 4 As used by Perrigo in its September 17, 2015 Investor Presentation titled “Responding to Mylan’s Inadequate Tender Offer,” page 29. 5 Reflects estimated U.S. MS market based upon Wall Street Research. Figures in thousands. 6 Assumes ~$314mm net income impact of Specialty Sciences in CY2015. Net income impact calculated as post tax adjusted EBITDA assuming 1% tax rate of Specialty Sciences and FY15 revenue contribution of Specialty Sciences applied to CY15 revenue for Perrigo based on midpoint of company guidance. Adjusted diluted EPS impact of Specialty Sciences assumes Perrigo standalone adjusted diluted EPS of $7.75 (midpoint of 2015E adjusted diluted EPS company guidance) and Perrigo share count of 144mm (based on company guidance). Nothing on this slide is intended to be a profit forecast or a target. 2015 Sales (Mgmt. Guidance) ($bn) Adjusted Diluted Consensus 2016E EPS, Ex- new Initiatives Consumer Branded Consumer Healthcare Rx (Incl. Acquisitions) Specialty Sciences Other and API 30 |

Mylan Offer for Perrigo Represents A Highly Attractive Multiple 1 1 2 3 Mylan Current Share Price October 30, 2015 Mylan Average Share Price Last 30 Trading Days As of October 30, 2015 Mylan Closing Price Prior to Release of Initial Proposal April 7, 2015 Mylan Share Price $ 44.09 $ 43.01 $ 59.57 Implied Value of Mylan Offer for Perrigo $ 176.41 $ 173.92 $ 212.01 Implied Perrigo Enterprise Value (in billions) $ 30.5 $ 30.1 $ 35.7 Implied EV / 2015E Perrigo Adjusted EBITDA (Calendar Year) 18 x 18 x 22 x Source: Public filings, Thomson Reuters consensus estimates for Perrigo CY2015E adjusted EBITDA as of October 30, 2015 and April 7, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. Note: Adjusted EBITDA is a non-GAAP financial measure. Reflects CY2015E Perrigo adjusted EBITDA of $1.7bn per Thomson Reuters consensus estimates as of October 30, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates. Cash and debt as of latest Perrigo Annual Report on Form 10-K filed August 13, 2015 of $0.8bn and $5.3bn respectively. Assumes 147mm diluted Perrigo shares outstanding. 31 |

32 Mylan Offer for Perrigo Represents A Highly Attractive Multiple 1 Selected Specialty Pharma Acquisitions ($ in billions) No Other Bidder for Perrigo Has Yet Emerged Source: SDC, public company filings and other publicly available information. Adjusted EBITDA is a non-GAAP financial measure and a company’s use of this non-GAAP financial measure may differ from an adjusted EBITDA measure used by other companies, and should not be assumed to be calculated on the same basis. ¹ Mylan / Perrigo offer based on Mylan current and undisturbed share prices of $44.09 and $59.57 as of October 30, 2015 and April 7, 2015, respectively, as well as Perrigo’s CY2015E adjusted EBITDA based on Thomson Reuters consensus estimates as of October 30, 2015, which are used for illustrative purposes only. Mylan does not endorse or adopt Thomson Reuters consensus estimates. Nothing on this slide is intended to be a profit forecast or a target. ² Adjusted EBITDA for Allergan Generics transaction represents disclosed 2015E adjusted EBITDA of $2.4bn as per Allergan investor presentation “Accelerating Transformation to Branded Growth Pharma Leader,” dated July 27, 2015. ³ Assumes Enterprise Value of €3.6bn from 06-Nov-2014 Perrigo press release. Assumes adjusted EBITDA of €265mm from 2014 Omega Annual Report. Assumes EUR/USD exchange rate of 1.25. 4 For Perrigo, 2015E adjusted EBITDA of $1.7bn based on Thomson Reuters consensus estimates as of October 30, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. Date Announced 2015 Nov-14 May-14 Jul-15 Jul-08 Jul-15 May-15 May-07 May-07 Nov-14 Acquiror Mylan Actavis Bayer Pfizer Fresenius Kabi Teva Endo Novator Mylan Perrigo Target Perrigo Allergan Merck Consumer Hospira APP Allergan Generics Par Actavis Merck KGaA Omega Pharma³ Deal Value¹ $30.1– $35.7 $66.0 $14.2 $17.0 $4.6 $40.5 $8.1 $6.4 $6.6 $4.5 Adj. EBITDA $1.7 $2.6 $0.7 $0.8 $0.3 $2.4² $0.5 $0.4 $0.4 $0.3 18 x 22 x 25 x 21 x 20 x 17 x 17 x 16 x 16 x 15 x 14 x 4 |

Perrigo Undisturbed 2016E P/E Multiple on April 7, 2015 3 18.3 x Change in Selected Peer Average 2016E P/E since April 7, 2015 1 (29.8)% Implied Perrigo Unaffected 2016E P/E 12.8 x Perrigo 2016E Adjusted Diluted EPS 3 as of October 30, 2015 $ 9.30 Implied Hypothetical Unaffected Perrigo Share Price $119.04 Implied 2015E EV / EBITDA 4 13 x 33 Perrigo Average Implied Hypothetical Unaffected Stock Price based on: Perrigo’s Average Implied Hypothetical Unaffected Stock Price of ~$134 Mylan’s Offer Has Been Supporting The Perrigo Share Price Change in Perrigo’s Proxy Peers Average 2 2016E P/E Multiple Share Price Indexed to S&P Pharmaceuticals Index Change in Selected Peer Average 1 2016E P/E Multiple Perrigo Undisturbed 2016E P/E Multiple on April 7, 2015 3 18.3 x Change in Perrigo Proxy Peer Average 2016E P/E since April 7, 2015 (11.2)% Implied Perrigo Unaffected 2016E P/E 16.3 x Perrigo 2016E Adjusted Diluted EPS 3 as of October 30, 2015 $ 9.30 Implied Hypothetical Unaffected Perrigo Share Price $ 151.59 Implied 2015E EV / EBITDA 4 16 x Perrigo Undisturbed Share Price (as of April 7, 2015) $ 164.71 S&P Pharmaceuticals Index (since April 7, 2015) (20.9)% Implied Hypothetical Unaffected Perrigo Share Price $ 130.29 Implied 2015E EV / EBITDA 4 14 x 3 4 Source: Thomson Reuters as of October 30, 2015 Note: Average hypothetical share price is based on the average of abovementioned three calculation methods outlined on this slide. Undisturbed share price and P/E are as of April 7, 2015. Average change in share price and changes in average P/E multiplies shown in A,B,C above are for the period starting April 7, 2015 and ending October 30, 2015. Other factors also impact Perrigo’s share price and Mylan’s offer should not be considered to be the sole factor impacting Perrigo’s share price. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. 2016 P/E multiple calculated as share price divided by 2016E Thomson Reuters consensus estimate adjusted diluted EPS as of October 30, 2015. Adjusted diluted EPS is a non-GAAP measure. 1 Based on Selected Peer Average 2016E P/E Multiple to Thomson Reuters’s Current 2016E Adjusted Diluted EPS Estimate for Perrigo. Selected peers consist of Valeant, Mallinckrodt, Endo, Jazz, Teva, Akorn and Mead Johnson. 2 Based on Perrigo’s public Proxy Peers Average 2016E P/E Multiple to Thomson Reuters’s Current 2016E Adjusted Diluted EPS Estimate for Perrigo. Perrigo’s Peers per Perrigo’s definitive proxy statement, filed September 25, 2015, and consist of Abbvie, Mallinckrodt, Actavis, Mead Johnson, Allergan, Mylan, Bristol-Myers Squibb, Regeneron, Celgene, Cubist, Shire, United Therapeutics, Thomson Reuters consensus estimate as of October 30, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. Adjusted diluted EPS and adjusted EBITDA are non-GAAP financial measures. Calculated as [(HUSP * diluted shares outstanding) + net debt] / 2015E adjusted EBITDA. Reflects CY2015E Perrigo adjusted EBITDA of $1.7bn per Thomson Reuters consensus estimates as of April 7, 2015 and October 30, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates. Adjusted EBITDA is a non-GAAP financial measure. Cash and debt as of latest Perrigo Annual Report on Form 10-K filed August 13, 2015 of $0.8bn and $5.3bn respectively. Assumes 147mm diluted Perrigo shares outstanding. Endo, Valeant, Hospira, Zoetis, and Jazz Pharmaceuticals. Excludes Allergan due to sale of generics business to Teva as well as recently acquired Actavis, Cubist and Hospira. A B C 1 |

34 Mylan Offer: An Attractive Premium to Perrigo Standalone Value Attractive Premium When Calculated on Consistent and Comparable Dates 46% of Undisturbed Perrigo Share Price Incremental Value: $47 per Share ($6.9bn) 2 28% Premium Incremental Value: $42 per Share ($6.2bn) 2 31% Premium Based on Undisturbed Share Prices as of April 7, 2015 Based on Average Implied Hypothetical Unaffected Perrigo Share Price as of October 30, 2015 As shown above, the offer provides $42 – $47 per share of incremental value to Perrigo shareholders Mylan Share Price of $44.09 x 2.3 + $75 in cash Mylan Share Price of $59.57 x 2.3 + $75 in cash 56% of Hypothetical Unaffected Perrigo Share Price Source: Bloomberg and Thomson Reuters as of October 30, 2015 ¹ For calculation of Perrigo��s Average Implied Hypothetical Unaffected Share Price please refer to previous slide. 2 Assumes 147mm diluted Perrigo shares outstanding. $ 75 $101 $ 134 $ 176 Perrigo Average Implied Hypothetical Unaffected Share Price¹ Offer Price $ 75 $ 137 $ 165 $ 212 Perrigo Undisturbed Share Price as of April 7, 2015 Offer Price 1 |

Here’s Another Way for Perrigo Shareholders to Think About It… 1 …You Get to “Buy” Mylan Shares Below Market at $26 per Mylan Share ! Perrigo’s Implied Average Hypothetical Unaffected Stock Price 1 $134 Less: Cash Per Share Received in the Offer $(75) Offer Value Received in Mylan Stock for Each Perrigo Share $59 Number of Mylan Shares Received for Each Perrigo Share 2 2.3 Implied Value at Which Perrigo Shareholders Receive Mylan Share $26 Mylan Share Price (as of October 30, 2015) $ 44 Implied Discount to Mylan Share Price (as of October 30, 2015) 41% Average Analyst Price Target for Mylan (as of October 30, 2015) 3 $65 Implied Discount to Average Analyst Price Target for Mylan (as of October 30, 2015) 60% 35 1 See slide 33 for calculation of Perrigo’s Average Implied Hypothetical Unaffected Stock Price of $134. 2 3 This information is based on targets provided by various analysts. The information is not intended to constitute a profit forecast for any period, nor should it be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Mylan or Perrigo as appropriate. Average analyst price target estimate per Thomson Reuters as of October 30, 2015. Analyst price is calculated by taking the average of the following price target estimates: $57 (Barclays), $58 (Citi), $60 (Leerink), $60 (Bernstein), $60 (Susquehanna), $64 (RBC), $65 (Cowen and Company), $66 (Deutsche Bank), Represents Exchange Ratio of Mylan Offer Assumed at 2.3 Mylan Shares + $75.00 Cash Per Perrigo Ordinary Share. $70 (BTIG), $72 (Evercore), $75 (Bank of America), $77 (UBS). |

36 Transaction is Immediately Accretive to Earnings and Value for the Perrigo Shareholders Perrigo Standalone Mylan / Perrigo (2.30 Shares + $75 Cash) Mylan / Perrigo (4.00 Shares + $0 Cash) 4 2016 Phased-in 2016 Run-rate 2016 Phased-in 2016 Run-rate 2016 Phased-in 2016 Run-rate $ 4.72 $ 4.72 $ 4.72 $ 4.72 (12)% 0% 5 (12)% 0% 5 $ 4.15 $ 4.71 $ 4.15 $ 4.71 2.30 x 2.30 x 4.00 x 4.00 x $ 9.45 $ 9.83 $ 9.55 $ 10.83 $ 16.60 $ 18.84 3 % 16 % 78 % 103 % 16.0 x $ 151 $ 157 $ 228 $ 248 $ 266 $ 301 14.0 x $ 132 $ 138 $ 209 $ 226 $ 232 $ 264 12.0 x $ 113 $ 118 $ 190 $ 205 $ 199 $ 226 Illustrative Value to Perrigo Shareholders at Various CY2016E P/E Multiples 2 1 1 Source: Perrigo public filings and Thomson Reuters consensus estimates as used by Perrigo in its September 17, 2015 Investor Presentation and Perrigo Investor Presentation “Creating Value for Shareholders: Now and for the Long Term”, filed October 22, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. This is a Pro-Forma estimate and indicative only and not a target or profit forecast. Nothing in this slide is intended to be a profit forecast. Pro-Forma values are illustrative only and any references to value per share, adjusted diluted EPS, share price and P/E should not be treated as targets or profit forecasts. Adjusted diluted EPS is a non-GAAP financial measure. Implied Mylan Pro-Forma adjusted diluted EPS is based on accretion / (dilution) and phasing in of synergies per Perrigo’s presentation released September 17, 2015, titled “Responding to Mylan’s Inadequate Tender Offer.” Assumes phased-in synergies for the combined company per September 17, 2015 Perrigo Investor presentation. Full run-rate synergies for the combined company are not expected to be realized until the end of year four following the consummation of the offer. Implied Mylan / Perrigo PF adjusted diluted EPS assumes that Mylan acquires 100% of Perrigo ordinary shares in the offer and that Mylan shareholders realize the benefit of all synergies realized in the transaction. 1 Per Perrigo Investor Presentation “Creating Value for Shareholders: Now and for the Long Term”, filed October 22,2015. 2 Thomson Reuters Consensus Estimate as Used by Perrigo as of September 16, 2015 3 Accretion to Perrigo shareholders calculated comparing pro forma adjusted diluted EPS to Perrigo shareholders to standalone Perrigo adjusted diluted EPS per Thomson Reuters as of October 30, 2015. 4 Assumes $75 / share is received by Perrigo shareholders is reinvested at Mylan current share price of $44.09 as of October 30, 2015. 5 Run-rate synergies implied based on difference between “No Synergies” and “Ramped Synergies” of 25% per Perrigo’s presentation filed September 17, 2015. With no synergies, 16% dilution on $4.72 of 2016E EPS implies $3.96 PF adjusted diluted EPS. With ramped synergies, 12% dilution on $4.72 of 2016E adjusted diluted EPS implies $4.15 PF adjusted diluted EPS. Thus the 25% synergy ramp produced ($4.15 - $3.96) = $0.19 of earnings. If $0.19 of earnings is 25% of run-rate synergies, then implied 2016E run-rate synergies is (4*$0.19) = $0.74 of earnings. 2016E adjusted diluted EPS with run-rate synergies then are ($3.96 + $0.74) = $4.71 2016E adjusted diluted EPS. Mylan Standalone Adj. Diluted EPS 2 Acc. / Dil. (Phased-In Synergies Adjusted Diluted EPS to Perrigo Shareholders Accretion to Perrigo 2016E Adjusted Diluted EPS per Consensus ($9.30) 3 per Perrigo Presentation page 26) Implied Mylan PF Adj. Diluted EPS |

Source: Perrigo Annual Reports on Form 10-K filed August 13, 2015 and August 14, 2014, Perrigo Company (“Perrigo Co”) Annual Reports on Form 10-K filed on August 15, 2013 and August 16, 2012, and Perrigo investor presentation dated September 17, 2015, titled “Responding to Mylan’s Inadequate Tender Offer” Mylan Well Positioned to Integrate Complementary Businesses, Aligned With Its Core Competencies Private Label Manufacturing (Consumer Healthcare) • US consumer healthcare contract manufacturing portfolio • Mylan’s global supply chain and manufacturing platform represents a core competency of Mylan with the highest level of operational excellence serving the same customer base Omega (Branded Consumer Healthcare) • Legacy Omega operations • Mylan’s established commercial platform in Europe (Rx and Gx) in both the physician and retail channels allows Mylan to optimize Omega’s OTC product portfolio Generics (Rx Pharmaceuticals) • Prescription generic pharmaceuticals business • Mylan has been a generics leader for decades and is well-equipped to enhance Perrigo’s prescription portfolio and its specialty sales force Non-Core Royalty Asset (Specialty Sciences) • Primarily the Tysabri royalty stream from the Elan acquisition • Mylan could maximize the use of cash from this asset by better reinvesting in the business API (Other) • Can be effectively integrated with Mylan’s existing API business, which includes sourcing within our internal network and external customers Perrigo Segment Overview: 3 37 |

Mylan Today: Global and Scalable Supply Chain 38 Ability and agility to respond to large and small volume orders with short lead times Manufacturing & Supply Capabilities Serving Market Needs Global Supply Chain and Operational Excellence More than 40 internal manufacturing sites more than 1,400 3P suppliers and CMOs Broad range of dosage forms: tablets, capsules, powders, injectables, aerosols, patches, gums, creams, liquids and ointments Vendor managed inventory for select accounts Ship to more than 35,000 customers Delivery of 56 billion doses to patients annually Direction of 55+ distribution centers Packaging, labeling and artwork meeting local requirements (language, design) 1,400+* products 15,000+ SKUs 145 markets ~40 languages 3 Manufacturing strategically located to support markets *Including FamyCare (pending deal closure) |

39 60 Day Plan • Ranjan Chaudhuri will join Mylan as the commercial lead for our OTC business. Ranjan has extensive experience in this space, most recently in the smoking reduction and cessation category, leading the recent divestiture of this business to Perrigo. • Created a Governance team including an interim CFO as well as Commercial, Operations, HR, OTC, Compliance, Legal, Security, IT, and Communications Leads • Third party advisors have been identified to partner with and support the integration and OTC commercial execution on Day 1 • Leverage Mylan’s existing Integration Office First 60 Days Pre-Close Activities Underway • If needed, management team prepared to be deployed to Allegan, MI immediately • Get to know key talent and engage Perrigo and Omega management and employees in our due diligence efforts and share our vision for the combined entities and their role in the success as well as opportunities for their future growth. • Further due diligence to assess additional opportunities for the combined company • Begin to develop integration and synergy realization roadmaps 3 |

40 Bottom Line: The MATH is a Clear and Compelling Value Proposition Relative to Standalone Plan 1 No Deal Mylan Offer 2 Mylan / Perrigo (2.30 Shares + $75 Cash) Mylan / Perrigo (4.00 Shares + $0 Cash) 3 Illustrative Standalone P/E 14 x 16 x Standalone Value Per Perrigo Share 1 $9.45 $ 132 $ 151 Illustrative Mylan / Perrigo 2016 P/E 12 x 14 x Total Value Per Perrigo Share 2 $9.55 $ 190 $ 209 Illustrative Mylan / Perrigo 2016 P/E 12 x 14 x Total Value Per Perrigo Share 2 $16.60 $199 $232 Perrigo Standalone Source: Perrigo public filings and Thomson Reuters consensus estimates as used by Perrigo in its September 17, 2015 Investor Presentation and Perrigo Investor Presentation “Creating Value for Shareholders: Now and for the Long Term”, filed October 22, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. This is a Pro- Forma estimate and indicative only and not a target or profit forecast. Nothing in this slide is intended to be a profit forecast. Pro-Forma values are illustrative only and any references to value per share, adjusted diluted EPS, share price and P/E should not be treated as targets or profit forecasts. Adjusted diluted EPS is a non-GAAP financial measure. Mylan Pro-Forma adjusted diluted EPS based on accretion / (dilution) and phasing in of synergies per Perrigo’s presentation released September 17, 2015, titled “Responding to Mylan’s Inadequate Tender Offer.” Assumes phased-in synergies per Perrigo presentation. 1 Calculation is based on 2016E adjusted diluted EPS of $9.45 for Perrigo assuming phased-in synergies as used by Perrigo in Perrigo Investor Presentation “Creating Value for Shareholders: Now and for the Long Term”, filed October 22, 2015. Please refer to slide 31 of Perrigo’s investor presentation dated October 22, 2015. 2 Calculation is based on 2016E adjusted diluted EPS Thomson Reuters Consensus Estimate as used by Perrigo as of September 16, 2015. 3 Assumes $75 / share is received by Perrigo shareholders is reinvested at Mylan current share price of $44.09 as of October 30, 2015. 4 |

41 Clear Path to Completion 4 • Mylan commenced the tender offer for Perrigo shares on September 14, 2015. • The offer and withdrawal rights are scheduled to expire on November 13, 2015 at 8:00am ET. • The acceptance condition for the offer requires more than 50% of Perrigo ordinary shares to be tendered into the offer. • Mylan has received U.S. FTC clearance, which represents the final regulatory clearance needed by Mylan to close its acquisition of Perrigo. • Once the offer has become unconditional in all respects, Mylan is obliged to purchase all Perrigo ordinary shares tendered with the goal to achieve 100% ownership of Perrigo. • Mylan believes it will reach at least 80% acceptances once it crosses the 50% acceptance condition • Otherwise, Mylan is prepared to manage the business as a controlled subsidiary. • Mylan is confident it will maintain an investment grade credit profile. |

42 Mylan’s Offer Is A Clear Choice for Perrigo Shareholders 4 Mylan Offers Perrigo PLUS! vs. Perrigo’s “Base plus plus plus” Compelling Profile Large, Diversified Global Generics and OTC Platform with Strong Performance Track Record Regional OTC Company with Challenges Around Standalone Operating and Growth Profile Value Realization Benefits Immediately Upon Transaction Close Uncertain and Dependent on M&A and Multi-Year Execution Risk Higher Value Per Share Incremental Value of $42 per Share ($6.2bn) (31% Premium vs. Stand-Alone Value)¹ Drop to Stand-Alone Value Hypothetical Perrigo Value Per Share at Mylan’s Current Share Price $176 1 $134 2 Illustrative Value per Perrigo Share Over Time ~$190 - $301 3 Perrigo Stand-Alone Value 2016 Adjusted Diluted EPS for Perrigo Shareholders No Reinvestment: $9.55 + $75 in Cash $9.30 5 Reinvestment: $16.60 + $0 in Cash 4 $9.30 5 Higher Adjusted Diluted EPS CAGR off Higher Base 13% 6 10% 6 “Specialty Sciences” (Primarily Tysabri) Contribution to Adjusted Diluted EPS 8% 7 28% 7 Pro-Forma Ownership of Mylan / Perrigo Entity 40% 8 0% Perrigo: “Base plus plus plus” Perrigo: “Base plus plus plus” Mylan Offers Perrigo PLUS! Mylan Offers Perrigo PLUS! Note: This slide is a summary of the information contained in the previous slides. All information should be read in the context in which it was provided in the earlier slides. Selected peers consist of Valeant, Mallinckrodt, Endo, Jazz, Teva, Akorn and Mead Johnson. Perrigo’s proxy peers consist of Abbvie, Mallinckrodt, Actavis, Mead Johnson, Allergan, Mylan, Bristol-Myers Squibb, Regeneron, Celgene, Cubist, Shire, United Therapeutics, Endo, Valeant, Hospira, Zoetis, and Jazz Pharmaceuticals. Excludes Allergan due to sale of generics business to Teva as well as recently acquired Actavis, Cubist and Hospira. ¹ Premium calculated by using Perrigo’s average implied hypothetical share price of $134. See slide 33 and slide 34 for calculation of premium and of hypothetical Perrigo Value Per Share of Mylan’s current share price. Represents Perrigo’s average implied hypothetical share price based on change in selected peer and Perrigo’s proxy peer average 2016E P/E multiple to Thomson Reuters’s Current 2016E Adjusted Diluted EPS Estimate for Perrigo since April 07, 2015. Perrigo value range is calculated by reference to the Pro-Forma Mylan adjusted diluted EPS for 2016E, as implied by Perrigo’s own calculation methodologies using illustrative P/E multiples of 12x and 16x. These valuations are for illustrative purposes only and are not intended to represent a profit forecast or a target. See slide 36 for further detail. Assumes reinvestment of $75.00 cash portion in Mylan Pro-Forma and phased-in synergies. Thomson Reuters consensus estimate as of October 30, 2015. Mylan does not endorse or adopt Thomson Reuters consensus estimates, which are used for illustrative purposes only. Nothing on this slide is intended to be a profit forecast or a target. Adjusted diluted EPS is a non-GAAP financial measure. Please refer to slide 16 of Mylan’s October 14, 2015 presentation for further detail. Please refer to slide 21 of Mylan’s October 14, 2015 presentation for further detail. 40% ownership assumes base deal of $75 cash + 2.3 Mylan shares per Perrigo share with no reinvestment of the $75.00 cash portion. 2 3 4 5 6 7 8 |

Appendix |

44 Reconciliation of Non-GAAP Metrics (Unaudited; USD in millions, except per share amounts) GAAP net earnings (loss) attributable to Mylan N.V. and GAAP diluted EPS 929 $ 2.34 $ 624 $ 1.58 $ 641 $ 1.52 $ 537 $ 1.22 $ 224 $ 0.68 $ 94 $ 0.30 $ (335) $ (1.10) $ Purchase accounting related amortization (primarily included in cost of sales) (a) 419 371 391 365 309 283 489 Goodwill Impairment Charges - - - - - - 385 Bystolic Revenue - - - - - - (468) Litigation settlements, net 48 (10) (3) 49 127 226 17 Interest expense, primarily amortization of convertible debt discount 46 38 36 49 60 43 30 Non-cash accretion and fair value adjustments of contingent consideration liability 35 35 39 - - - - Clean energy investments pre-tax loss (b) 79 22 17 - - - - Financing related costs (included in other income (expense), net) 33 73 - 34 37 - - Acquisition related costs (primarily included in cost of sales and selling, general and administrative expense) 140 50 - - - - - Acceleration of deferred revenue - - - - - (29) - Non-controlling interest - - - - - 9 - Restructuring and other special items included in: Cost of sales 45 49 66 8 7 33 53 Research and development expense 18 52 12 4 10 49 14 Selling, general and administrative expense 67 71 105 45 63 22 89 Other income (expense), net (11) 25 (1) - 1 (13) 1 Tax effect of the above items and other income tax related items (c) (432) (260) (216) (198) (253) (273) (31) Preferred dividend (d) - - - - 122 139 - Adjusted net earnings attributable to Mylan N.V. and adjusted diluted EPS 1,416 $ 3.56 $ 1,140 $ 2.89 $ 1,087 $ 2.59 $ 893 $ 2.04 $ 707 $ 1.61 $ 583 $ 1.30 $ 244 $ 0.80 $ Year Ended December 31, 2014 2013 2012 2011 2010 2009 2008 (a) Adjustment for purchase accounting related amortization expense for the year ended December 31, 2014, 2013, 2012, and 2011, respectively include $28 million, $18 million, $42 million and $16 million of intangible asset impairment charges. (b) Adjustment represents exclusion of the pre-tax loss related to Mylan's clean energy investments, the activities of which qualify for income tax credits under section 45 of the U.S. Internal Revenue Code. The amount is included in other expense (income), net. (c) Adjustment for other income tax related items includes the exclusion from adjusted net earnings for the year ended December 31, 2014 of the tax benefit of approximately $150 million related to the merger of the Company's wholly owned subsidiaries, Agila Specialties Private Limited and Onco Therapies Limited, into Mylan Laboratories Limited. (d) Adjusted diluted EPS for the year ended December 31, 2010, includes the full effect of the conversion of the company's preferred stock into 125.2 million shares of common stock on November 15, 2010. Adjusted diluted EPS for the period ended December 31, 2009 was calculated under the "if-converted method" which assumes conversion of the Company's preferred stock into shares of common stock, based on an average share price, and excludes the preferred dividend from the calculation, as the "if-converted method" is more dilutive. |

45 Reconciliation of Non-GAAP Metrics |

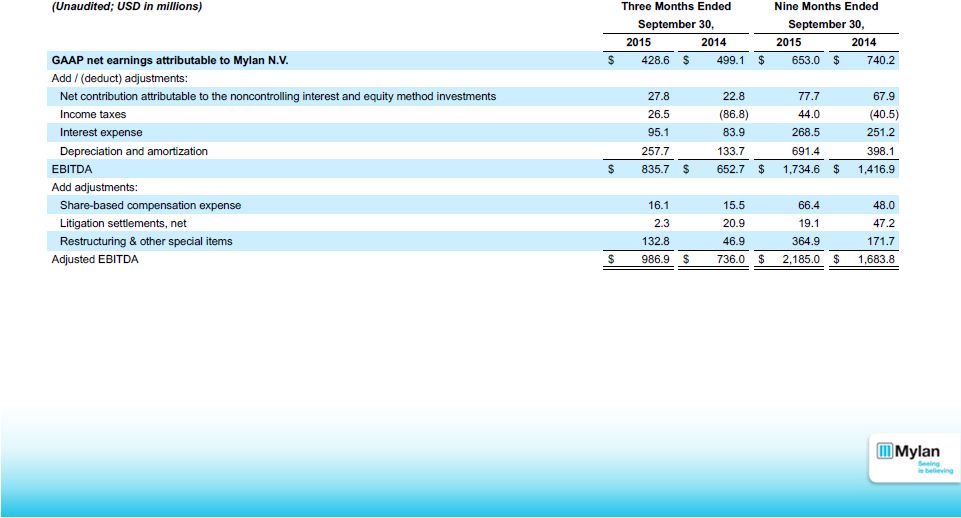

46 Reconciliation of Non-GAAP Metrics Below is a reconciliation of GAAP net earnings attributable to Mylan N.V. to EBITDA and adjusted EBITDA for the three and nine month period compared to the respective prior year period: |

47 Reconciliation of Non-GAAP Metrics Below are reconciliations of key non-GAAP financial metrics for the three and nine month period compared to the respective prior year period. The non-GAAP financial metrics are presented in order to supplement investors and other readers’ understanding and assessment of company financial performance. |

48 Reconciliation of Non-GAAP Metrics |

49 Reconciliation of Non-GAAP Metrics |

50 Summary of Adjusted Total Revenues by Segment |

51 Reconciliation of Forecasted Guidance |

52 Reconciliation of Forecasted Guidance (Unaudited; USD in millions) Twelve Months Ended December 31, 2015 Lower Upper GAAP net earnings $ 1,005 $ 1,080 Add adjustments: Net contribution attributable to the noncontrolling interest and equity method investees 80 100 Income taxes 245 300 Interest expense 285 335 Depreciation and amortization 1,000 1,090 EBITDA $ 2,615 $ 2,905 Add adjustments: Stock-based compensation expense 65 90 Restructuring & other special items 200 260 Other expense, net 20 45 Adjusted EBITDA $ 2,900 $ 3,300 |

53 Perrigo: Reconciliation of Non-GAAP Measures Calendar Year 2014 Actuals and 2015 Guidance Source: Perrigo investor presentation dated April 21, 2015 “Perrigo Fiscal 2015 Third Quarter Earnings Slides” 1 Amounts may not sum or cross-foot due to rounding. 2 Ratios calculated using exact numbers. ³ Non-GAAP guidance for calendar 2015 excludes amortization of intangibles, restructuring, and unusual litigation charges, along with transaction and financing costs related to the Omega Pharma Invest NV (“Omega”) acquisition. At this time, a reconciliation to GAAP earnings per share guidance for calendar 2015 is not available without unreasonable effort. As noted in Perrigo’s third quarter 2015 press release dated April 21, 2015, Perrigo expects that the unavailable reconciling items,which primarily include the amortization of intangibles and non-cash charges related to Omega, along with other expenses not related to Perrigo’s core operations, which may be related to the integration of Omega, Perrigo’s change in fiscal year and Mylan’s bid to acquire Perrigo, could significantly impact Perrigo’s financial results. 4 D&A includes $502.2mm of depreciation and amortization net of acquisition related amortization expenses within cost of goods sold ($395.5mm), selling costs ($22.4mm) and administration costs ($6.2mm). Twelve Months Ended December 31, 2014 (in millions except per share) (unaudited) GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) Consolidated Net sales $ 4,171.6 $ – $ 4,171.6 Cost of sales 2,735.3 395.5 (a) 2,339.7 Gross profit $ 1,436.3 $ 395.5 $ 1,831.9 (a) Acquisition-related amortization expense Operating expenses (b) Distribution 57.2 – 57.2 Research and development 172.6 10.0 (b) 162.6 (c) Selling 206.4 22.4 (a) 184.0 Administration 343.7 44.8 (a,c,d,e,f) 298.9 (d) Write-up of Restructuring 34.1 34.1 (g) – (e) Litigation settlement of $2.0 million Total operating expenses $ 814.0 $ 111.3 $ 702.7 (f) Loss contingency accrual of $15.0 million Operating income $ 622.3 506.8 1,129.2 (g) Interest expense, net 109.2 5.0 (h) 104.2 Other expense, net 69.3 63.6 (I,j,k) 5.7 (h) Loss on sale of investment 12.7 12.7 – (i) Loss on extinguishment of debt 9.6 9.6 (l) – Income before income taxes 421.5 597.7 1,019.3 (j) Income tax expense 75.2 101.5 (m) 176.6 Net income $ 346.3 $ 496.2 $ 842.7 (k) Diluted earnings per share 2.57 6.27 Diluted weighted average shares outstanding 135.0 (0.6) (n) 134.4 (l) Selected ratios as a percentage of net sales (2) Distribution, selling, and adminstrative 14.6% 12.9% (m) Tax effect of non-GAAP adjustments Research and development 4.1% 3.9% (n) Operating income 14.9% 27.1% Effective tax rate 17.8% 17.3% Calculation of adjusted diluted EPS guidance growth Calendar Year 2014 adjusted diluted EPS $ 6.30 Calendar Year 2015 adjusted diluted EPS range (3) $ 7.50 - 8.00 % change 20% - 28% Calculation of adjusted EBITDA calculation Calendar Year 2015 net sales range (3) $ 5,300 - 5,450 Calendar Year 2015 adjusted operating margin (3) 28.0% Implied Calendar Year 2015 adjusted operating margin 1,484 - 1,526 Calendar Year 2014 D&A (4) $ 78.1 Calendar Year 2014 D&A margin 1.9% Implied Calendar Year 2015 adjusted EBITDA margin 29.9% Implied Calendar Year 2015 adjusted EBITDA $ 1,606 Weighted average effect of 6.8 million shares issued on November 26, 2014 to finance the pending Omega acquisition Income of $12.5 million from transfer of a rights agreement Bridge fees and extinguishment of debt in connection with Omega financing R&D payment of $10.0 million made in connection with collaborative arrangement Acquisition and integration-related charges totaling $15.8 million related primarily to Restructuring and other integration-related charges due primarily to Elan Omega financing fees Elan equity method investment losses totaling $11.4 million Loss on derivatives associated with the pending Omega acquisition totaling $64.7 |

54 Perrigo: Reconciliation of Adjusted EBITDA Margin Source: Perrigo Annual Reports on Form 10-K filed August 13, 2015 and August 14, 2014, Perrigo Co.’s Annual Reports on Form 10-K filed August 15, 2013 and August 16, 2012, and Perrigo investor presentation dated September 17, 2015, titled “Responding to Mylan’s Inadequate Tender Offer” ¹ Amortization of acquired intangible assets related to business combinations and asset acquisitions Twelve Months Ended June (Unaudited; USD in millions) 2011 2012 2013 2014 2015 Perrigo Reported net sales $ 2,755 $ 3,173 $ 3,540 $ 4,061 $ 4,604 Reported operating income $ 490 $ 569 $ 679 $ 567 $ 748 Acquisition-related amortization (1) 47 75 94 281 464 Acquisition costs 3 9 10 109 34 Restructuring charges 1 9 3 47 7 Loss contingency accrual - - - 15 2 Write-offs of in-process R&D - 2 9 6 - Litigation settlements - - - 5 - Contingent consideration adjustment - - - 1 1 Escrow settlement - - - (3) - Inventory step-ups - 27 11 - 16 Impairment of intangible asset - - - - 0 Impairment of fixed assets - - - - - Loss on asset exchange - - - - - Proceeds from sale of pipeline development projects - (5) - - - Legal and consulting fees related the Mylan N.V. defense - - - - 13 Initial payments made in connection with R&D arrangements - - - - 28 Year end change - - - - 1 Adjusted operating income $ 541 $ 687 $ 805 $ 1,029 $ 1,314 Depreciation and amortization excluding acquisition-related amortization (1) 56 61 66 78 85 Perrigo adjusted EBITDA 597 747 871 1,107 1,398 Perrigo adjusted EBITDA margin 22 % 24 % 25 % 27 % 30 % Specialty Sciences Reported net sales - - - $ 147 $ 344 Reported operating income - - - (69) 36 Depreciation and amortization - - - 154 292 Transaction costs - - - 12 0 Restructuring charges - - - 39 0 Specialty Sciences adjusted EBITDA - - - 137 328 Specialty Sciences adjusted EBITDA margin - - - 93 % 95 % Perrigo Excluding Specialty Sciences Reported net sales $ 2,755 $ 3,173 $ 3,540 $ 3,914 $ 4,260 Adjusted EBITDA 597 747 871 971 1,070 Adjusted EBITDA margin 22 % 24 % 25 % 25 % 25 % |

|