UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

OR |

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________to___________

Commission File Number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

|

| | |

| The Netherlands | | 98-1189497 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707-853-000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | þ | | Accelerated filer | | ¨ |

| | | | | | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

| | | | | | | |

| | | | | Emerging growth company | | ¨ |

| | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of October 31, 2018, there were 515,631,491 of the issuer’s €0.01 nominal value ordinary shares outstanding.

MYLAN N.V. AND SUBSIDIARIES

INDEX TO FORM 10-Q

For the Quarterly Period Ended

September 30, 2018

|

| | |

| | Page |

| | PART I — FINANCIAL INFORMATION | |

| ITEM 1. | Condensed Consolidated Financial Statements (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ITEM 2. | | |

| | | |

| ITEM 3. | | |

| | | |

| ITEM 4. | | |

| | | |

| | PART II — OTHER INFORMATION | |

| ITEM 1. | | |

| | | |

| ITEM 1A. | | |

| | | |

| ITEM 5. | | |

| | | |

| ITEM 6. | | |

| | | |

| | |

PART I — FINANCIAL INFORMATION

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited; in millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues: | | | | | | | |

| Net sales | $ | 2,827.3 |

| | $ | 2,956.3 |

| | $ | 8,233.2 |

| | $ | 8,570.2 |

|

| Other revenues | 35.1 |

| | 30.8 |

| | 122.0 |

|

| 98.6 |

|

| Total revenues | 2,862.4 |

| | 2,987.1 |

| | 8,355.2 |

| | 8,668.8 |

|

| Cost of sales | 1,823.2 |

| | 1,809.0 |

| | 5,369.2 |

| | 5,180.3 |

|

| Gross profit | 1,039.2 |

| | 1,178.1 |

| | 2,986.0 |

| | 3,488.5 |

|

| Operating expenses: | | | | | | | |

| Research and development | 144.1 |

| | 182.3 |

| | 555.7 |

| | 580.9 |

|

| Selling, general and administrative | 577.3 |

| | 664.1 |

| | 1,808.1 |

| | 1,915.4 |

|

| Litigation settlements and other contingencies, net | (20.4 | ) | | 15.2 |

| | (50.6 | ) | | (25.8 | ) |

| Total operating expenses | 701.0 |

| | 861.6 |

| | 2,313.2 |

| | 2,470.5 |

|

| Earnings from operations | 338.2 |

| | 316.5 |

| | 672.8 |

| | 1,018.0 |

|

| Interest expense | 136.2 |

| | 131.8 |

| | 407.1 |

| | 406.3 |

|

| Other expense, net | 9.8 |

| | 5.1 |

| | 44.3 |

| | 35.8 |

|

| Earnings before income taxes | 192.2 |

| | 179.6 |

| | 221.4 |

| | 575.9 |

|

| Income tax provision (benefit) | 15.5 |

| | 91.3 |

| | (79.9 | ) | | 124.2 |

|

| Net earnings | $ | 176.7 |

| | $ | 88.3 |

| | $ | 301.3 |

| | $ | 451.7 |

|

| Earnings per ordinary share: | | | | | | | |

| Basic | $ | 0.34 |

| | $ | 0.17 |

| | $ | 0.59 |

| | $ | 0.84 |

|

| Diluted | $ | 0.34 |

| | $ | 0.16 |

| | $ | 0.58 |

| | $ | 0.84 |

|

| Weighted average ordinary shares outstanding: | | | | | | | |

| Basic | 514.5 |

| | 535.2 |

| | 514.4 |

| | 534.9 |

|

| Diluted | 516.5 |

| | 537.0 |

| | 516.5 |

| | 537.0 |

|

See Notes to Condensed Consolidated Financial Statements

3

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Earnings

(Unaudited; in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Net earnings | $ | 176.7 |

| | $ | 88.3 |

| | $ | 301.3 |

| | $ | 451.7 |

|

| Other comprehensive (loss) earnings, before tax: | | | | | | | |

| Foreign currency translation adjustment | (270.8 | ) | | 423.0 |

| | (1,097.6 | ) | | 1,831.9 |

|

| Change in unrecognized (loss) gain and prior service cost related to defined benefit plans | (6.8 | ) | | 1.1 |

| | (8.3 | ) | | 2.4 |

|

| Net unrecognized (loss) gain on derivatives in cash flow hedging relationships | (51.9 | ) | | (4.5 | ) | | (146.1 | ) | | 29.2 |

|

| Net unrecognized gain (loss) on derivatives in net investment hedging relationships | 18.8 |

| | (72.1 | ) | | 78.7 |

| | (203.2 | ) |

| Net unrealized (loss) gain on marketable securities | — |

| | (8.9 | ) | | (0.1 | ) | | 3.5 |

|

| Other comprehensive (loss) earnings, before tax | (310.7 | ) | | 338.6 |

| | (1,173.4 | ) | | 1,663.8 |

|

| Income tax (benefit) provision | (19.1 | ) | | (5.8 | ) | | (51.2 | ) | | 11.3 |

|

| Other comprehensive (loss) earnings, net of tax | (291.6 | ) | | 344.4 |

| | (1,122.2 | ) | | 1,652.5 |

|

| Comprehensive (loss) earnings | $ | (114.9 | ) | | $ | 432.7 |

| | $ | (820.9 | ) | | $ | 2,104.2 |

|

See Notes to Condensed Consolidated Financial Statements

4

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited; in millions, except share and per share amounts)

|

| | | | | | | |

| | September 30,

2018 | | December 31,

2017 |

| ASSETS |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 449.2 |

| | $ | 292.1 |

|

| Accounts receivable, net | 2,948.7 |

| | 3,612.4 |

|

| Inventories | 2,560.6 |

| | 2,542.7 |

|

| Prepaid expenses and other current assets | 583.2 |

| | 766.1 |

|

| Total current assets | 6,541.7 |

| | 7,213.3 |

|

| Property, plant and equipment, net | 2,119.6 |

| | 2,339.1 |

|

| Intangible assets, net | 14,239.0 |

| | 15,245.8 |

|

| Goodwill | 9,796.6 |

| | 10,205.7 |

|

| Deferred income tax benefit | 514.0 |

| | 496.8 |

|

| Other assets | 244.7 |

| | 305.6 |

|

| Total assets | $ | 33,455.6 |

| | $ | 35,806.3 |

|

| | | | |

| LIABILITIES AND EQUITY |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,401.1 |

| | $ | 1,452.5 |

|

| Short-term borrowings | 0.4 |

| | 46.5 |

|

| Income taxes payable | 75.7 |

| | 112.9 |

|

| Current portion of long-term debt and other long-term obligations | 1,176.4 |

| | 1,808.9 |

|

| Other current liabilities | 2,528.4 |

| | 2,964.5 |

|

| Total current liabilities | 5,182.0 |

| | 6,385.3 |

|

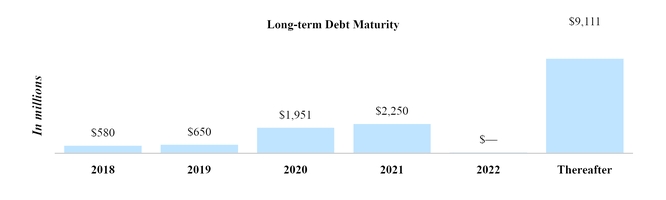

| Long-term debt | 13,291.4 |

| | 12,865.3 |

|

| Deferred income tax liability | 1,764.4 |

| | 2,012.4 |

|

| Other long-term obligations | 1,151.6 |

| | 1,235.7 |

|

| Total liabilities | 21,389.4 |

| | 22,498.7 |

|

| Equity | | | |

| Mylan N.V. shareholders’ equity | | | |

| Ordinary shares — nominal value €0.01 per ordinary share | | | |

| Shares authorized: 1,200,000,000 | | | |

| Shares issued: 539,104,104 and 537,902,426 as of September 30, 2018 and December 31, 2017 | 6.0 |

| | 6.0 |

|

| Additional paid-in capital | 8,585.0 |

| | 8,586.0 |

|

| Retained earnings | 5,965.8 |

| | 5,644.5 |

|

| Accumulated other comprehensive loss | (1,490.9 | ) | | (361.2 | ) |

| | 13,065.9 |

| | 13,875.3 |

|

| Less: Treasury stock — at cost | | | |

| Ordinary shares: 23,490,867 and 13,695,251 as of September 30, 2018 and December 31, 2017 | 999.7 |

| | 567.7 |

|

| Total equity | 12,066.2 |

| | 13,307.6 |

|

| Total liabilities and equity | $ | 33,455.6 |

| | $ | 35,806.3 |

|

See Notes to Condensed Consolidated Financial Statements

5

MYLAN N.V. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited; in millions)

|

| | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2018 | | 2017 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 301.3 |

| | $ | 451.7 |

|

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 1,501.0 |

| | 1,279.8 |

|

| Share-based compensation (income) expense | (8.6 | ) | | 64.2 |

|

| Deferred income tax (benefit) expense | (149.9 | ) | | 17.4 |

|

| Loss from equity method investments | 58.6 |

| | 77.2 |

|

| Other non-cash items | 238.3 |

| | 265.4 |

|

| Litigation settlements and other contingencies, net | (40.9 | ) | | (45.2 | ) |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 262.2 |

| | 216.2 |

|

| Inventories | (425.5 | ) | | (87.9 | ) |

| Accounts payable | (14.1 | ) | | (187.4 | ) |

| Income taxes | (97.4 | ) | | (149.3 | ) |

| Other operating assets and liabilities, net | 80.6 |

| | (332.8 | ) |

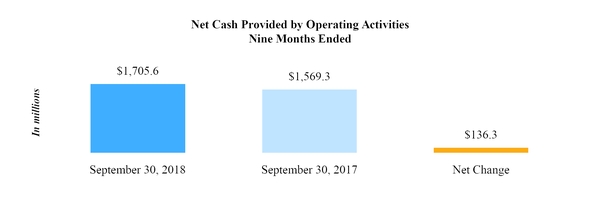

| Net cash provided by operating activities | 1,705.6 |

| | 1,569.3 |

|

| Cash flows from investing activities: | | | |

| Cash paid for acquisitions, net | (65.9 | ) | | (71.6 | ) |

| Capital expenditures | (137.4 | ) | | (156.4 | ) |

| Proceeds from the sale of assets | — |

| | 31.1 |

|

| Purchase of available for sale securities and other investments | (49.4 | ) | | (8.9 | ) |

| Proceeds from the sale of marketable securities | 72.1 |

| | 8.9 |

|

| Payments for product rights and other, net | (854.2 | ) | | (558.8 | ) |

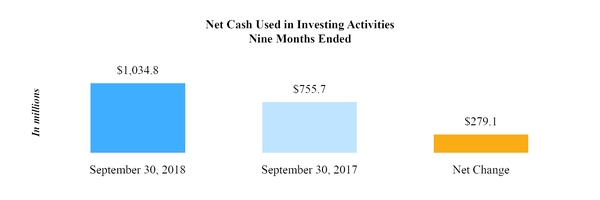

| Net cash used in investing activities | (1,034.8 | ) | | (755.7 | ) |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | 2,577.7 |

| | 555.8 |

|

| Payments of long-term debt | (2,598.6 | ) | | (1,747.3 | ) |

| Purchase of ordinary shares | (432.0 | ) | | — |

|

| Change in short-term borrowings, net | (45.9 | ) | | (48.3 | ) |

| Taxes paid related to net share settlement of equity awards | (10.1 | ) | | (7.4 | ) |

| Contingent consideration payments | (0.2 | ) | | (10.1 | ) |

| Payments of financing fees | (20.8 | ) | | (8.7 | ) |

| Proceeds from exercise of stock options | 15.6 |

| | 12.8 |

|

| Other items, net | (0.4 | ) | | (0.7 | ) |

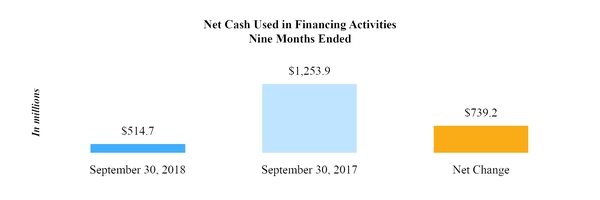

| Net cash used in financing activities | (514.7 | ) | | (1,253.9 | ) |

| Effect on cash of changes in exchange rates | (22.9 | ) | | 44.1 |

|

| Net increase (decrease) in cash, cash equivalents and restricted cash | 133.2 |

| | (396.2 | ) |

| Cash, cash equivalents and restricted cash — beginning of period | 369.9 |

| | 1,147.0 |

|

| Cash, cash equivalents and restricted cash — end of period | $ | 503.1 |

| | $ | 750.8 |

|

See Notes to Condensed Consolidated Financial Statements

6

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

1.General

The accompanying unaudited Condensed Consolidated Financial Statements (“interim financial statements”) of Mylan N.V. and subsidiaries (“Mylan” or the “Company”) were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for reporting on Form 10-Q; therefore, as permitted under these rules, certain footnotes and other financial information included in audited financial statements were condensed or omitted. The interim financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the interim results of operations, comprehensive earnings, financial position and cash flows for the periods presented.

These interim financial statements should be read in conjunction with the Consolidated Financial Statements and Notes thereto in Mylan N.V.’s Annual Report on Form 10-K for the year ended December 31, 2017, as amended (the “2017 Form 10-K”). The December 31, 2017 Condensed Consolidated Balance Sheet was derived from audited financial statements.

The interim results of operations and comprehensive earnings for the three and nine months ended September 30, 2018, and cash flows for the nine months ended September 30, 2018 are not necessarily indicative of the results to be expected for the full fiscal year or any other future period. Certain prior year amounts have been reclassified to conform to the current year presentation.

| |

| 2. | Revenue Recognition and Accounts Receivable |

On January 1, 2018, the Company adopted Accounting Standards Codification (“ASC”) Topic 606 Revenue from Contracts with Customers (“ASC 606”) using the modified retrospective method applied to those contracts which were not completed as of the date of adoption. Results for reporting periods beginning on January 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported in accordance with ASC Topic 605 Revenue Recognition (“ASC 605”). Under ASC 605, the Company recognized net sales when title and risk of loss passed to its customers and when provisions for estimates, as described below, were reasonably determinable.

Under ASC 606, the Company recognizes net revenue for product sales when control of the promised goods or services is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. Revenues are recorded net of provisions for variable consideration, including discounts, rebates, governmental rebate programs, price adjustments, returns, chargebacks, promotional programs and other sales allowances. Accruals for these provisions are presented in the interim financial statements as reductions in determining net sales and as a contra asset in accounts receivable, net (if settled via credit) and other current liabilities (if paid in cash). The following briefly describes the nature of our provisions for variable consideration and how such provisions are estimated:

| |

| • | Chargebacks: the Company has agreements with certain indirect customers, such as independent pharmacies, managed care organizations, hospitals, nursing homes, governmental agencies and pharmacy benefit managers, which establish contract prices for certain products. The indirect customers then independently select a wholesaler from which to purchase the products at these contracted prices. Alternatively, certain wholesalers may enter into agreements with indirect customers that establish contract pricing for certain products, which the wholesalers provide. Under either arrangement, Mylan will provide credit to the wholesaler for any difference between the contracted price with the indirect party and the wholesaler’s invoice price. Such credits are called chargebacks. The provision for chargebacks is based on expected sell-through levels by our wholesaler customers to indirect customers, as well as estimated wholesaler inventory levels. |

| |

| • | Rebates, promotional programs and other sales allowances: this category includes rebate and other programs to assist in product sales. These programs generally provide that the customer receives credit directly related to the amount of purchases or credits upon the attainment of pre-established volumes. Also included in this category are prompt pay discounts, administrative fees and price adjustments to reflect decreases in the selling prices of products. |

| |

| • | Returns: consistent with industry practice, Mylan maintains a return policy that allows customers to return a product, which varies country by country in accordance with local practices, generally within a specified period prior (six months) and subsequent (twelve months) to the expiration date. The Company’s estimate of the provision for returns is generally based upon historical experience with actual returns. |

| |

| • | Governmental rebate programs: government reimbursement programs include Medicare, Medicaid, and State Pharmacy Assistance Programs established according to statute, regulations and policy. Manufacturers of |

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

pharmaceutical products that are covered by the Medicaid program are required to pay rebates to each state based on a statutory formula set forth in the Social Security Act. Medicare beneficiaries are eligible to obtain discounted prescription drug coverage from private sector providers. In addition, certain states have also implemented supplemental rebate programs that obligate manufacturers to pay rebates in excess of those required under federal law. Our estimate of these rebates is based on the historical trends of rebates paid as well as on changes in wholesaler inventory levels and increases or decreases in the level of sales. Also, includes price reductions that are mandated by law outside of the U.S.

Wholesaler and distributor inventory levels of our products can fluctuate throughout the year due to the seasonality of certain products, the timing of product demand and other factors. Such fluctuations may impact the comparability of our net sales between periods.

Consideration received from licenses of intellectual property is recorded as revenue. Royalty or profit share amounts, which are based on sales of licensed products or technology, are recorded when the customer’s subsequent sales or usages occur. Such consideration is included in other revenue in the Consolidated Statements of Operations.

The Company elected to apply the following practical expedients and elections in connection with the adoption of ASC 606: i) taxes collected from customers and remitted to government authorities and that are related to the sales of the Company’s products, primarily in Europe, are excluded from revenues, and ii) shipping and handling activities are accounted for as fulfillment costs and are recorded in selling, general and administrative expense (“SG&A”). Payment terms related to product sales vary by jurisdiction and customer, but revenue for product sales has not been adjusted for the effects of a financing component as we expect that the period between when we transfer control of the product and when we receive payment to be one year or less.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Revenue Disaggregation

The following table presents the Company’s net sales by therapeutic franchise for each of our reportable segments for the three and nine months ended September 30, 2018:

|

| | | | | | | | | | | | | | | |

| (In millions) | North America | | Europe | | Rest of World | | Total |

| Three Months Ended September 30, 2018 | | | | | | | |

| Central Nervous System & Anesthesia | $ | 154.7 |

| | $ | 219.6 |

| | $ | 92.4 |

| | $ | 466.7 |

|

| Infectious Disease | 63.1 |

| | 157.8 |

| | 223.2 |

| | 444.1 |

|

| Respiratory & Allergy | 161.8 |

| | 94.8 |

| | 47.4 |

| | 304.0 |

|

| Cardiovascular | 95.9 |

| | 147.3 |

| | 40.9 |

| | 284.1 |

|

| Gastroenterology | 24.5 |

| | 150.0 |

| | 91.1 |

| | 265.6 |

|

| Diabetes & Metabolism | 94.9 |

| | 73.9 |

| | 43.8 |

| | 212.6 |

|

| Dermatology | 86.7 |

| | 62.8 |

| | 18.0 |

| | 167.5 |

|

| Women’s Healthcare | 83.1 |

| | 61.3 |

| | 28.1 |

| | 172.5 |

|

| Oncology | 171.0 |

| | 18.2 |

| | 31.9 |

| | 221.1 |

|

| Immunology | 8.0 |

| | 2.3 |

| | 10.0 |

| | 20.3 |

|

Other (1) | 68.6 |

| | 53.3 |

| | 146.9 |

| | 268.8 |

|

| Total | $ | 1,012.3 |

| | $ | 1,041.3 |

| | $ | 773.7 |

| | $ | 2,827.3 |

|

| | | | | | | | |

| Nine Months Ended September 30, 2018 | | | | | | | |

| Central Nervous System & Anesthesia | $ | 554.2 |

| | $ | 665.7 |

| | $ | 251.7 |

| | $ | 1,471.6 |

|

| Infectious Disease | 172.1 |

| | 280.5 |

| | 643.8 |

| | 1,096.4 |

|

| Respiratory & Allergy | 457.3 |

| | 351.8 |

| | 147.7 |

| | 956.8 |

|

| Cardiovascular | 262.4 |

| | 443.2 |

| | 126.6 |

| | 832.2 |

|

| Gastroenterology | 102.5 |

| | 448.3 |

| | 249.3 |

| | 800.1 |

|

| Diabetes & Metabolism | 318.6 |

| | 227.9 |

| | 102.1 |

| | 648.6 |

|

| Dermatology | 265.7 |

| | 217.4 |

| | 70.1 |

| | 553.2 |

|

| Women’s Healthcare | 261.4 |

| | 198.1 |

| | 69.5 |

| | 529.0 |

|

| Oncology | 382.5 |

| | 55.4 |

| | 95.6 |

| | 533.5 |

|

| Immunology | 36.1 |

| | 7.3 |

| | 29.1 |

| | 72.5 |

|

Other (1) | 185.6 |

| | 174.7 |

| | 379.0 |

| | 739.3 |

|

| Total | $ | 2,998.4 |

| | $ | 3,070.3 |

| | $ | 2,164.5 |

| | $ | 8,233.2 |

|

| |

(1) | Other consists of numerous therapeutic franchises, none of which individually exceeds 5% of consolidated net sales. |

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Variable Consideration and Accounts Receivable

The following table presents a reconciliation of gross sales to net sales by each significant category of variable consideration during the three and nine months ended September 30, 2018:

|

| | | | | | | |

| (In millions) | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| Gross sales | $ | 4,861.4 |

| | $ | 14,419.0 |

|

| Gross to net adjustments: | | | |

| Chargebacks | (835.7 | ) | | (2,524.2 | ) |

| Rebates, promotional programs and other sales allowances | (1,025.6 | ) | | (3,144.2 | ) |

| Returns | (59.4 | ) | | (160.5 | ) |

| Governmental rebate programs | (113.4 | ) | | (356.9 | ) |

| Total gross to net adjustments | $ | (2,034.1 | ) | | $ | (6,185.8 | ) |

| Net sales | $ | 2,827.3 |

| | $ | 8,233.2 |

|

No significant revisions were made to the methodology used in determining these provisions or the nature of the provisions during the three and nine months ended September 30, 2018. Such allowances were comprised of the following at September 30, 2018 and December 31, 2017, respectively:

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31,

2017 |

| Accounts receivable, net | $ | 1,642.2 |

| | $ | 1,977.2 |

|

| Other current liabilities | 631.9 |

| | 818.0 |

|

| Total | $ | 2,274.1 |

| | $ | 2,795.2 |

|

Accounts receivable, net was comprised of the following at September 30, 2018 and December 31, 2017, respectively:

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31,

2017 |

| Trade receivables, net | $ | 2,591.0 |

| | $ | 3,173.1 |

|

| Other receivables | 357.7 |

| | 439.3 |

|

| Accounts receivable, net | $ | 2,948.7 |

| | $ | 3,612.4 |

|

Through its wholly owned subsidiary Mylan Pharmaceuticals Inc. (“MPI”), the Company has access to a $400 million accounts receivable securitization facility (the “Receivables Facility”). The receivables underlying any borrowings are included in accounts receivable, net, in the Condensed Consolidated Balance Sheets. There were $464.0 million and $1.04 billion of securitized accounts receivable at September 30, 2018 and December 31, 2017, respectively.

| |

| 3. | Recent Accounting Pronouncements |

Accounting Standards Issued Not Yet Adopted

In August 2018, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update 2018-14 (“ASU 2018-14”), Compensation-Retirement Benefits-Defined Benefit Plans-General (Subtopic 715-20): Disclosure Framework-Changes to the Disclosure Requirements for Defined Benefit Plans. ASU 2018-14 removes certain disclosures that are not considered cost beneficial, clarifies certain required disclosures and added additional disclosures. The new standard is effective for fiscal years, including interim periods within those fiscal years, beginning after December 15, 2020 with early adoption in any interim period permitted. The amendments in ASU 2018-14 would need to be applied on a retrospective basis. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820) Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements on fair value measurements. The updated guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted for any removed or modified disclosures. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In June 2018, the FASB issued Accounting Standards Update 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting, which expands the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from nonemployees. The changes take effect for public companies for fiscal years starting after December 15, 2018, including interim periods within that fiscal year. Early adoption is permitted, but no earlier than an entity’s adoption date of ASC 606. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In February 2018, the FASB issued Accounting Standards Update 2018-02, Income Statement - Reporting Comprehensive Income, (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which allows a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the newly enacted federal corporate income tax rate under the comprehensive tax legislation enacted by the U.S. government on December 22, 2017 commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). The amount of the reclassification would be the difference between the historical corporate income tax rate and the newly enacted 21% corporate income tax rate. The new standard is effective for fiscal years, including interim periods within those fiscal years, beginning after December 15, 2018 with early adoption in any interim period permitted. The Company is currently assessing the impact of the adoption of this guidance on its consolidated financial statements and disclosures.

In February 2016, the FASB issued Accounting Standards Update 2016-02, Leases (Topic 842) which supersedes FASB Topic 840, Leases (Topic 840) and provides principles for the recognition, measurement, presentation and disclosure of leases for both lessees and lessors. The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight-line basis over the term of the lease, respectively. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than twelve months regardless of classification. Leases with a term of twelve months or less will be accounted for similar to existing guidance for operating leases. In July 2018, the FASB issued Accounting Standards Update 2018-10, Codification Improvements to Topic 842 (Leases), and Accounting Standards Update 2018-11, Leases (Topic 842), Targeted Improvements, which provide (i) narrow amendments to clarify how to apply certain aspects of the new lease standard, (ii) entities with an additional transition method to adopt the new standard, and (iii) lessors with a practical expedient for separating components of a contract. All Accounting Standards Updates related to Topic 842 will be effective for annual and interim periods beginning after December 15, 2018, with early adoption permitted upon issuance. While the Company is continuing to assess the impact of the adoption of this guidance on its consolidated financial statements and disclosures, we expect that the adoption will result in an increase in total assets and total liabilities. For reference, as disclosed in the 2017 Form 10-K, total undiscounted minimum lease payments remaining at December 31, 2017 were approximately $280 million. In addition, we expect to present additional qualitative and quantitative disclosures. The Company is in the process of analyzing its lease portfolio, implementing systems and processes and updating its accounting policies to comply with Topic 842.

Adoption of New Accounting Standards

In August 2017, the FASB issued Accounting Standards Update 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities (“ASU 2017-12”). The objective of this update is to improve the financial reporting of hedging relationships to better portray the economic results of an entity’s risk management activities in its financial statements. The amendments in this update also make certain targeted improvements to simplify the application of the hedge accounting guidance in current U.S. GAAP based on feedback received from preparers, auditors, users, and other stakeholders. This guidance is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years, with early adoption permitted, including adoption in any interim period. The Company has elected to early adopt this guidance as of January 1, 2018 and is applying it on a prospective basis. Upon adoption, the Company recorded a cumulative effect adjustment.

In May 2017, the FASB issued Accounting Standards Update 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting (“ASU 2017-09”), which amends the scope of modification accounting for share-based

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

payment arrangements. ASU 2017-09 provides guidance on the types of changes to the terms or conditions of share-based payment awards to which an entity would be required to apply modification accounting under Topic 718. Specifically, an entity would not apply modification accounting if the fair value, vesting conditions and classification of the awards are the same immediately before and after the modification. As required, the Company applied the provisions of ASU 2017-09 on a prospective basis as of January 1, 2018 and the adoption did not have a material impact on its condensed consolidated financial statements.

In March 2017, the FASB issued Accounting Standards Update 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost (“ASU 2017-07”), which requires companies to disaggregate the service cost component from the other components of net benefit cost and disclose the amount of net benefit cost that is included in the income statement or capitalized in assets, by line item. This guidance requires companies to report the service cost component in the same line item(s) as other compensation costs and to report other pension-related costs (which include interest costs, amortization of pension-related costs from prior periods and gains or losses on plan assets) separately and exclude them from the subtotal of operating income. This guidance also allows only the service cost component to be eligible for capitalization when applicable. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. This guidance should be applied retrospectively for the presentation of the service cost component and the other components of net periodic pension cost and net periodic postretirement benefit cost in the income statement and prospectively, on and after the effective date, for the capitalization of the service cost component of net periodic pension cost and net periodic postretirement benefit in assets. The update allows a practical expedient that permits a company to use the amounts disclosed in its pension and other postretirement plan note for the prior comparative periods as the estimation basis for applying the retrospective presentation requirements. As required, the Company applied the provisions of ASU 2017-07 as of January 1, 2018 and the adoption did not have a material impact on its condensed consolidated financial statements.

In November 2016, the FASB issued Accounting Standards Update 2016-18, Statement of Cash Flows (Topic 230) Restricted Cash (“ASU 2016-18”), which requires that the reconciliation of the beginning of period and end of period amounts shown in the statement of cash flows include restricted cash and restricted cash equivalents. If restricted cash is presented separately from cash and cash equivalents on the balance sheet, companies will be required to reconcile the amounts presented on the statement of cash flows to the amounts on the balance sheet. This guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. As required, the Company applied the provisions of ASU 2016-18 as of January 1, 2018. As a result, the change in restricted cash has been excluded from investing activities and included in the change in cash, cash equivalents and restricted cash and the prior year period has been recast to reflect the new presentation.

In January 2016, the FASB issued Accounting Standards Update 2016-01, Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”), which supersedes the current guidance to classify equity securities with readily determinable fair values into different categories and requires equity securities to be measured at fair value with changes in the fair value recognized through net income (loss). In February 2018, the FASB issued Accounting Standards Update 2018-03, Technical Corrections and Improvements to Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, which clarifies the guidance in ASU 2016-01. The standards are effective for annual and interim periods beginning after December 15, 2017. As required, the Company applied the provisions of ASU 2016-01 as of January 1, 2018. Upon adoption, the Company recorded a cumulative effect adjustment.

In May 2014, the FASB issued Accounting Standards Update 2014-09 (“ASU 2014-09”), Revenue from Contracts with Customers (updated with Accounting Standards Update 2015-14, 2016-08, 2016-10, 2016-12 and 2016-20), which revises accounting guidance on revenue recognition that will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of this guidance is that an entity should recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services. This guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. This guidance is effective for fiscal years beginning after December 15, 2017, and for interim periods within those fiscal years, and can be applied using a full retrospective or modified retrospective approach. The Company adopted this standard and its updates as of January 1, 2018 and elected to apply the modified retrospective transition approach. As a result, the Company is recognizing revenue on certain arrangements upon the transfer of control of product shipments rather than upon sell-through by the customer, and is recording certain costs historically in cost of sales as contra revenue.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

The cumulative effect of the changes made to our consolidated January 1, 2018 balance sheet for the adoption of ASU 2014-09, ASU 2016-01 and ASU 2017-12 were as follows:

|

| | | | | | | | | | | | | | | | | | | |

| (In millions) | Balance as of December 31, 2017 | | Adjustments Due to ASU 2014-09 | | Adjustments Due to ASU 2016-01 | | Adjustments Due to ASU 2017-12 | | Balance as of January 1, 2018 |

| Condensed Consolidated Balance Sheet | | | | | | | | | |

| Assets | | | | | | | | | |

| Prepaid expenses and other current assets | $ | 766.1 |

| | $ | 18.5 |

| | $ | — |

| | $ | — |

| | $ | 784.6 |

|

| | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Deferred income tax liability | 2,012.4 |

| | 5.7 |

| | — |

| | — |

| | 2,018.1 |

|

| | | | | | | | | | |

| Equity | | | | | | | | | |

| Retained earnings | 5,644.5 |

| | 12.8 |

| | 10.0 |

| | (2.5 | ) | | 5,664.8 |

|

| Accumulated other comprehensive loss | (361.2 | ) | | — |

| | (10.0 | ) | | 2.5 |

| | (368.7 | ) |

In accordance with ASU 2014-09, the disclosure of the impact of adoption on our condensed consolidated statements of operations and balance sheet was as follows:

|

| | | | | | | | | | | |

| | For the Three Months Ended September 30, 2018 |

| (In millions) | As Reported | | Balances Without Adoption of ASC 606 | | Effect of Change Increase (Decrease) |

| Condensed Consolidated Statement of Operations | | | | | |

| Revenues | $ | 2,862.4 |

| | $ | 2,914.0 |

| | $ | (51.6 | ) |

| Cost of sales | 1,823.2 |

| | 1,876.4 |

| | (53.2 | ) |

| Income tax provision | 15.5 |

| | 15.0 |

| | 0.5 |

|

| Net earnings | 176.7 |

| | 175.6 |

| | 1.1 |

|

| | | | | | |

| | For the Nine Months Ended September 30, 2018 |

| (In millions) | As Reported | | Balances Without Adoption of ASC 606 | | Effect of Change Increase (Decrease) |

| Condensed Consolidated Statement of Operations | | | | | |

| Revenues | $ | 8,355.2 |

| | $ | 8,454.0 |

| | $ | (98.8 | ) |

| Cost of sales | 5,369.2 |

| | 5,475.5 |

| | (106.3 | ) |

| Income tax benefit | (79.9 | ) | | (82.3 | ) | | 2.4 |

|

| Net earnings | 301.3 |

| | 296.2 |

| | 5.1 |

|

| | | | | | |

| | September 30, 2018 |

| (In millions) | As Reported | | Balances Without Adoption of ASC 606 | | Effect of Change Increase (Decrease) |

| Condensed Consolidated Balance Sheet | | | | | |

| Prepaid expenses and other current assets | $ | 583.2 |

| | $ | 575.7 |

| | $ | 7.5 |

|

| Income taxes payable | 75.7 |

| | 73.3 |

| | 2.4 |

|

| Retained earnings | 5,965.8 |

| | 5,960.7 |

| | 5.1 |

|

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

| 4. | Acquisitions and Other Transactions |

Apicore Inc.

On October 3, 2017, the Company completed the acquisition of Apicore, Inc. (“Apicore”), a U.S. based developer and manufacturer of active pharmaceutical ingredient (“API”) for approximately $174.9 million, net of cash acquired, which included estimated contingent consideration of approximately $4.0 million related to the potential $15.0 million payment contingent on the achievement of certain 2017 financial results of the acquired business. As of December 31, 2017, the contingent consideration liability was zero as Apicore did not achieve the financial results that would have triggered the contingent consideration payment.

The allocation of the $174.9 million purchase price to the assets acquired and liabilities assumed for this business is as follows:

|

| | | |

| (In millions) | |

| Current assets (net of cash acquired) | $ | 6.5 |

|

| Identified intangible assets | 121.0 |

|

| Goodwill | 92.2 |

|

| Other assets | 1.9 |

|

| Total assets acquired | 221.6 |

|

| Current liabilities | (4.1 | ) |

| Deferred tax liabilities | (40.9 | ) |

| Other non-current liabilities | (1.7 | ) |

| Net assets acquired | $ | 174.9 |

|

The acquisition of Apicore added a diversified portfolio of API products to the Company’s existing portfolio. The identified intangible assets of $121.0 million are comprised of product rights and licenses with a weighted average useful life of seven years and includes in-process research and development (“IPR&D”) with a fair value of $9.0 million at the date of the acquisition. Significant assumptions utilized in the valuation of identified intangible assets were based on company specific information and projections which are not observable in the market and are thus considered Level 3 measurements as defined by U.S. GAAP. The goodwill of $92.2 million arising from the acquisition consisted largely of the value of the employee workforce and the expected value of products to be developed in the future. All of the goodwill was allocated to the North America segment. None of the goodwill recognized in this transaction is currently expected to be deductible for income tax purposes. The acquisition did not have a material impact on the Company’s results of operations since the acquisition date or on a pro forma basis for the three and nine months ended September 30, 2018 and 2017.

Other Transactions

On December 25, 2017, the Company entered into an agreement to reacquire certain intellectual property rights and marketing authorizations related to a product commercialized in Japan for $90.0 million, which was paid during the second quarter of 2018. The Company recognized a liability in its Condensed Consolidated Balance Sheet as of December 31, 2017 for the reacquisition of these rights. The Company accounted for this transaction as an asset acquisition and the asset is being amortized over a useful life of five years.

On February 28, 2018, the Company and Revance Therapeutics, Inc. (“Revance”) entered into a collaboration agreement (the “Revance Collaboration Agreement”) pursuant to which the Company and Revance will collaborate exclusively, on a world-wide basis (excluding Japan), to develop, manufacture and commercialize a biosimilar to the branded biologic product (onabotulinumtoxinA) marketed as BOTOX®.

Under the Revance Collaboration Agreement, the Company will be primarily responsible for (a) clinical development activities outside of North America (excluding Japan) (the “ex-U.S. Mylan territories”), (b) regulatory activities, and (c) commercialization for any approved product. Revance will be primarily responsible for (a) non-clinical development activities, (b) clinical development activities in North America, and (c) manufacturing and supply of clinical drug substance and drug product; Revance will be solely responsible for an initial portion of non-clinical development costs. The remaining portion of any non-clinical development costs and clinical development costs for obtaining approval in the U.S. and Europe

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

will be shared equally between the parties, and the Company will be responsible for all other clinical development costs and commercialization expenses. Upon closing, Revance received a non-refundable upfront payment of $25.0 million. In addition, under the Revance Collaboration Agreement, Revance can receive potential development milestone payments of up to $100.0 million, in the aggregate, upon the achievement of specified clinical and regulatory milestones and potential tiered sales milestones of up to $225.0 million. In addition, Mylan will pay Revance royalties on sales of the biosimilar in the ex-U.S. Mylan territories. The Company accounted for this transaction as an asset acquisition of IPR&D and the total upfront payment was expensed as a component of research and development (“R&D”) expense.

On August 31, 2018, the Company completed an agreement with certain subsidiaries of Novartis AG (“Novartis”) to purchase the worldwide rights to their global cystic fibrosis products consisting of the TOBI Podhaler® and TOBI® solution. Tobramycin is the standard of care for treatment of pseudomonas aeruginosa, a leading driver of infection in cystic fibrosis. These products further strengthen our existing presence in cystic fibrosis, especially with our Creon Franchise in Europe, Australia, Japan and Canada. The asset acquisition allows us to further extend our respiratory franchise into rare/orphan disease indications and broaden our portfolio into dry powdered inhalers and nebulized products. Tobi Podhaler™ is manufactured using a proprietary Pulmosphere technology for which we have acquired exclusive rights for use, hence we expect a high barrier for generic entry.

Under the terms of the agreement, Novartis is owed fixed consideration of $463.0 million which consists of $240.0 million which was paid at closing and deferred payments of $130.0 million included in other current liabilities and $93.0 million included in other long-term obligations, due in 2019 and 2020, respectively. Novartis is also eligible to receive a contingent payment of up to $20 million. The Company also entered into a supply agreement with Novartis to purchase the products for up to three years from the date of closing. The Company has recorded a liability of approximately $91 million related to supply obligations.

The Company accounted for this transaction as an asset acquisition and recognized an intangible asset for the product rights of $574.8 million. The intangible asset is being amortized over a useful life of ten years.

During the nine months ended September 30, 2018, the Company completed four agreements to acquire certain intellectual property rights and marketing authorizations for products that were in the development stage, including agreements with Fujifilm Kyowa Kirin Biologics Co., Ltd., Mapi Pharma Ltd., and Lupin Limited. The Company also completed the acquisition of intellectual property rights and marketing authorizations related to a commercialized product in certain rest of world markets for $220.0 million, of which $160.0 million was paid at closing with the remaining amount due within twelve months of the closing of the transaction and included in other current liabilities. The Company is accounting for these transactions as asset acquisitions and a useful life of five years is being used to amortize the asset related to the commercialized product. The Company recorded expense of approximately $53.7 million as a component of R&D expense related to non-refundable upfront payments for agreements for products in development during the nine months ended September 30, 2018. Certain of the agreements include additional development and commercial milestones.

| |

| 5. | Share-Based Incentive Plan |

The Company’s shareholders have approved the 2003 Long-Term Incentive Plan (as amended, the “2003 Plan”). Under the 2003 Plan, 55,300,000 ordinary shares are reserved for issuance to key employees, consultants, independent contractors and non-employee directors of the Company through a variety of incentive awards, including: stock options, stock appreciation rights (“SAR”), restricted ordinary shares, restricted stock units, performance awards (“PSU”), other stock-based awards and short-term cash awards. Stock option awards are granted with an exercise price equal to the fair market value of the ordinary shares underlying the stock options at the date of the grant, generally become exercisable over periods ranging from three to four years, and generally expire in ten years. Since approval of the 2003 Plan, no further grants of stock options have been made under any other previous plan.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

The following table summarizes stock option and SAR (together, “stock awards”) activity:

|

| | | | | | |

| | Number of Shares Under Stock Awards | | Weighted Average Exercise Price per Share |

| Outstanding at December 31, 2017 | 7,198,684 |

| | $ | 35.17 |

|

| Granted | 847,590 |

| | 40.92 |

|

| Exercised | (720,226 | ) | | 21.77 |

|

| Forfeited | (286,473 | ) | | 48.37 |

|

| Outstanding at September 30, 2018 | 7,039,575 |

| | $ | 36.69 |

|

| Vested and expected to vest at September 30, 2018 | 6,821,737 |

| | $ | 36.48 |

|

| Exercisable at September 30, 2018 | 5,335,545 |

| | $ | 34.76 |

|

As of September 30, 2018, stock awards outstanding, stock awards vested and expected to vest and stock awards exercisable had average remaining contractual terms of 5.5 years, 5.4 years and 4.4 years, respectively. Also, at September 30, 2018, stock awards outstanding, stock awards vested and expected to vest and stock awards exercisable each had an aggregate intrinsic value of $41.1 million, $41.1 million and $40.9 million, respectively.

A summary of the status of the Company’s nonvested restricted ordinary shares and restricted stock unit awards, including PSUs (collectively, “restricted stock awards”), as of September 30, 2018 and the changes during the nine months ended September 30, 2018 are presented below:

|

| | | | | | |

| | Number of Restricted Stock Awards | | Weighted Average Grant-Date Fair Value per Share |

| Nonvested at December 31, 2017 | 5,964,207 |

| | $ | 41.92 |

|

| Granted | 1,542,727 |

| | 41.03 |

|

| Released | (682,557 | ) | | 50.06 |

|

| Forfeited | (257,208 | ) | | 44.88 |

|

| Nonvested at September 30, 2018 | 6,567,169 |

| | $ | 40.79 |

|

As of September 30, 2018, the Company had $99.1 million of total unrecognized compensation expense, net of estimated forfeitures, related to all of its stock-based awards, which we expect to recognize over the remaining weighted average vesting period of 1.6 years. The total intrinsic value of stock awards exercised and restricted stock units released during the nine months ended September 30, 2018 and 2017 was $42.8 million and $34.7 million, respectively.

In February 2014, Mylan’s Compensation Committee and the independent members of the Board of Directors adopted the One-Time Special Performance-Based Five-Year Realizable Value Incentive Program (the “2014 Program”) under the 2003 Plan. Under the 2014 Program, certain key employees received a one-time, performance-based incentive award (the “Awards”) either in the form of a grant of SARs or PSUs. The initial Awards were granted in February 2014 and contain a five-year cliff-vesting feature based on the achievement of various performance targets, external market conditions and the employee’s continued services. Additional Awards were granted in 2016 and 2017 and are subject to the same performance conditions as the Awards granted in February 2014 and with a service vesting condition of between two and six years. The market condition was met on June 10, 2015 and is therefore no longer applicable to any of the Awards. During the three months ended June 30, 2018, the Company revised its estimates for the amount of Awards that it expects will ultimately vest under the 2014 Program and recognized a reduction in share-based compensation expense of approximately $23.5 million. During the three months ended September 30, 2018, the Company determined that it was no longer probable that the minimum performance condition would be met and therefore reversed all of the remaining cumulative expense related to the Awards resulting in a reduction in share-based compensation expense of approximately $47.1 million. In addition, during the three months ended September 30, 2018, the Company recorded $20.0 million of compensation expense as an additional discretionary bonus for a certain group of employees. None of the employees who will receive this bonus are named executive officers. As of September 30, 2018, there are approximately 2.6 million Awards outstanding under the 2014 Program. Each Award is equal to one ordinary share with the maximum value of each Award upon vesting subject to varying limitations.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

| 6. | Pensions and Other Postretirement Benefits |

Defined Benefit Plans

The Company sponsors various defined benefit pension plans in several countries. Benefits provided generally depend on length of service, pay grade and remuneration levels. The Company maintains two fully frozen defined benefit pension plans in the U.S., and employees in the U.S. and Puerto Rico are generally provided retirement benefits through defined contribution plans.

The Company also sponsors other postretirement benefit plans including plans that provide for postretirement supplemental medical coverage. Benefits from these plans are provided to employees and their spouses and dependents who meet various minimum age and service requirements. In addition, the Company sponsors other plans that provide for life insurance benefits and postretirement medical coverage for certain officers and management employees.

Net Periodic Benefit Cost

Components of net periodic benefit cost for the three and nine months ended September 30, 2018 and 2017 were as follows:

|

| | | | | | | | | | | | | | | |

| | Pension and Other Postretirement Benefits |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (In millions) | 2018 | | 2017 | | 2018 | | 2017 |

| Service cost | $ | 5.0 |

| | $ | 5.0 |

| | $ | 15.1 |

| | $ | 15.1 |

|

| Interest cost | 3.6 |

| | 3.7 |

| | 10.9 |

| | 11.2 |

|

| Expected return on plan assets | (3.6 | ) | | (3.5 | ) | | (10.9 | ) | | (10.6 | ) |

| Amortization of prior service costs | 0.1 |

| | 0.1 |

| | 0.3 |

| | 0.2 |

|

| Recognized net actuarial losses | 0.1 |

| | 0.2 |

| | 0.1 |

| | 0.5 |

|

| Net periodic benefit cost | $ | 5.2 |

| | $ | 5.5 |

| | $ | 15.5 |

| | $ | 16.4 |

|

The Company is making the minimum mandatory contributions to its U.S. defined benefit pension plans in the 2018 plan year. The Company expects to make total benefit payments of approximately $31.1 million from pension and other postretirement benefit plans in 2018. The Company anticipates making contributions to pension and other postretirement benefit plans of approximately $29.9 million in 2018.

| |

| 7. | Balance Sheet Components |

Selected balance sheet components consist of the following:

Cash and restricted cash

|

| | | | | | | | | | | |

| (In millions) | September 30,

2018 | | December 31,

2017 | | September 30,

2017 |

| Cash and cash equivalents | $ | 449.2 |

| | $ | 292.1 |

| | $ | 614.9 |

|

| Restricted cash, included in prepaid expenses and other current assets | 53.9 |

| | 77.8 |

| | 135.9 |

|

| Cash, cash equivalents and restricted cash | $ | 503.1 |

| | $ | 369.9 |

| | $ | 750.8 |

|

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Inventories

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31,

2017 |

| Raw materials | $ | 926.0 |

| | $ | 895.5 |

|

| Work in process | 369.5 |

| | 384.7 |

|

| Finished goods | 1,265.1 |

| | 1,262.5 |

|

| Inventories | $ | 2,560.6 |

| | $ | 2,542.7 |

|

Prepaid and other current assets

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31, 2017 |

| Prepaid expenses | $ | 117.1 |

| | $ | 119.8 |

|

| Restricted cash | 53.9 |

| | 77.8 |

|

| Available-for-sale fixed income securities | 25.3 |

| | 31.5 |

|

| Fair value of financial instruments | 7.1 |

| | 88.9 |

|

| Equity securities | 36.6 |

| | 79.1 |

|

| Other current assets | 343.2 |

| | 369.0 |

|

| Prepaid expenses and other current assets | $ | 583.2 |

| | $ | 766.1 |

|

Prepaid expenses consist primarily of prepaid rent, insurance and other individually insignificant items.

Property, plant and equipment, net

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31, 2017 |

| Machinery and equipment | $ | 2,365.2 |

| | $ | 2,414.5 |

|

| Buildings and improvements | 1,170.4 |

| | 1,191.7 |

|

| Construction in progress | 221.1 |

| | 252.9 |

|

| Land and improvements | 133.8 |

| | 143.1 |

|

| Gross property, plant and equipment | 3,890.5 |

| | 4,002.2 |

|

| Accumulated depreciation | 1,770.9 |

| | 1,663.1 |

|

| Property, plant and equipment, net | $ | 2,119.6 |

| | $ | 2,339.1 |

|

Other assets

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31, 2017 |

| Equity method investments, clean energy investments | $ | 149.5 |

| | $ | 226.0 |

|

| Other long-term assets | 95.2 |

| | 79.6 |

|

| Other assets | $ | 244.7 |

| | $ | 305.6 |

|

Accounts payable

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31,

2017 |

| Trade accounts payable | $ | 963.7 |

| | $ | 976.0 |

|

| Other payables | 437.4 |

| | 476.5 |

|

| Accounts payable | $ | 1,401.1 |

| | $ | 1,452.5 |

|

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Other current liabilities

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31, 2017 |

| Accrued sales allowances | $ | 631.9 |

| | $ | 818.0 |

|

| Legal and professional accruals, including litigation accruals | 131.4 |

| | 241.1 |

|

| Payroll and employee benefit liabilities | 372.4 |

| | 404.6 |

|

| Contingent consideration | 223.3 |

| | 167.8 |

|

| Accrued interest | 193.8 |

| | 42.3 |

|

| Restructuring | 80.9 |

| | 91.5 |

|

| Equity method investments, clean energy investments | 38.1 |

| | 56.7 |

|

| Fair value of financial instruments | 114.4 |

| | 31.1 |

|

| Other | 742.2 |

| | 1,111.4 |

|

| Other current liabilities | $ | 2,528.4 |

| | $ | 2,964.5 |

|

In April 2018, the State of New York passed a budget which included the Opioid Stewardship Fund (the “Fund”) pursuant to a law that became effective July 1, 2018. The Fund created an aggregate $100 million annual assessment on all manufacturers and distributors licensed to sell or distribute opioids in New York. Each licensed manufacturer and distributor will be required to pay a portion of the assessment based on its ratable share, as determined by the state, of the total morphine milligram equivalents first sold or distributed within, or into, New York during the applicable calendar year. The initial payment is due on January 1, 2019 for opioids sold or distributed during calendar year 2017. Based upon initial correspondence received from the State of New York, the Company believes its amount related to the Fund for calendar year 2017 will be immaterial.

On March 31, 2017, the Company announced that Meridian Medical Technologies (“Meridian”), a Pfizer company that manufactures the EpiPen® Auto-Injector, expanded a voluntary recall of select lots of EpiPen® Auto-Injector and EpiPen Jr® Auto-Injector to include additional lots distributed in the U.S. and other markets in consultation with the U.S. Food and Drug Administration (“FDA”) (the “EpiPen® Auto-Injector Recall”). This recall was conducted as a result of the receipt of two previously disclosed reports outside of the U.S. of the failure to activate the device due to a potential defect in a supplier component. Both reports were related to the single lot that was previously recalled. The expanded voluntary recall was initiated in the U.S. and also extends to additional markets in Europe, Asia, North and South America. The Company is replacing recalled devices at no cost to the consumer. Estimated costs to Mylan related to product recalls are based on a formal campaign soliciting return of the product and are accrued when they are deemed to be probable and can be reasonably estimated. As of September 30, 2018, the Company recorded an accrual for certain costs of the recall but there can be no assurance that future costs related to the recall will not exceed amounts recorded. In addition, Meridian is contractually obligated to reimburse Mylan for costs related to the EpiPen® Auto-Injector Recall, and the Company has recorded an asset for the recovery of such costs.

Other long-term obligations

|

| | | | | | | |

| (In millions) | September 30,

2018 | | December 31, 2017 |

| Employee benefit liabilities | $ | 411.7 |

| | $ | 408.2 |

|

| Contingent consideration | 195.5 |

| | 285.9 |

|

| Equity method investments, clean energy investments | 151.4 |

| | 171.8 |

|

| Tax related items, including contingencies | 155.6 |

| | 237.7 |

|

| Other | 237.4 |

| | 132.1 |

|

| Other long-term obligations | $ | 1,151.6 |

| | $ | 1,235.7 |

|

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

| 8. | Equity Method Investments |

The Company currently has three equity method investments in limited liability companies that own refined coal production plants (the “clean energy investments”) whose activities qualify for income tax credits under Section 45 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). The Company does not consolidate these entities as we have determined that we are not the primary beneficiary of these entities and do not have the power to individually direct the activities of these entities. Accordingly, these investments are accounted for under the equity method of accounting. For each of the clean energy investments, the Company has entered into notes payable with the respective project sponsor, which in part will be paid to the sponsor as certain production levels are met.

During the third quarter of 2018, the Company and a project sponsor agreed to terminate two previous investments. Under the termination agreements, the Company returned its ownership interest in the projects to the sponsor and in exchange the Company will have no further obligations with respect to the notes payable for these projects.

Also, during the third quarter of 2018, the Company entered into amended agreements related to the three remaining investments. These amendments effectively reduce the amount of expected future variable debt payments to the respective project sponsor.

As a result of these transactions, during the third quarter of 2018, the Company impaired its investment balance and other assets by approximately $39 million and reduced the related long-term obligations for these investments by approximately $40 million resulting in a net gain of approximately $1 million, which was recognized as a component of the net loss of the equity method investments in the Condensed Consolidated Statement of Operations.

Summarized financial information, in the aggregate, for the Company’s significant equity method investments on a 100% basis for the three and nine months ended September 30, 2018 and 2017 are as follows:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (In millions) | 2018 | | 2017 | | 2018 | | 2017 |

| Total revenues | $ | 128.6 |

| | $ | 129.3 |

| | $ | 376.8 |

| | $ | 352.0 |

|

| Gross loss | (1.3 | ) | | (2.4 | ) | | (20.0 | ) | | (8.8 | ) |

| Operating and non-operating expense | 5.9 |

| | 6.5 |

| | 16.5 |

| | 16.9 |

|

| Net loss | $ | (7.2 | ) | | $ | (8.9 | ) | | $ | (36.5 | ) | | $ | (25.7 | ) |

The Company’s net losses from its equity method investments include amortization expense related to the excess of the cost basis of the Company’s investment over the underlying assets of each individual investee. For the three months ended September 30, 2018 and 2017, the Company recognized net losses from equity method investments of $12.6 million and $22.4 million, respectively. For the nine months ended September 30, 2018 and 2017, the Company recognized net losses from equity method investments of $58.6 million and $77.2 million, respectively, which were recognized as a component of other expense, net in the Condensed Consolidated Statements of Operations. The Company recognizes the income tax credits and benefits from the clean energy investments as part of its provision for income taxes.

| |

| 9. | Earnings per Ordinary Share |

Basic earnings per ordinary share is computed by dividing net earnings by the weighted average number of ordinary shares outstanding during the period. Diluted earnings per ordinary share is computed by dividing net earnings by the weighted average number of ordinary shares outstanding during the period increased by the number of additional shares that would have been outstanding related to potentially dilutive securities or instruments, if the impact is dilutive.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

Basic and diluted earnings per ordinary share are calculated as follows:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (In millions, except per share amounts) | 2018 | | 2017 | | 2018 | | 2017 |

| Basic earnings (numerator): | | | | | | | |

| Net earnings | $ | 176.7 |

| | $ | 88.3 |

| | $ | 301.3 |

| | $ | 451.7 |

|

| Shares (denominator): | | | | | | | |

| Weighted average ordinary shares outstanding | 514.5 |

| | 535.2 |

| | 514.4 |

| | 534.9 |

|

| Basic earnings per ordinary share | $ | 0.34 |

| | $ | 0.17 |

| | $ | 0.59 |

| | $ | 0.84 |

|

| | | | | | | | |

| Diluted earnings (numerator): | | | | | | | |

| Net earnings | $ | 176.7 |

| | $ | 88.3 |

| | $ | 301.3 |

| | $ | 451.7 |

|

| Shares (denominator): | | | | | | | |

| Weighted average ordinary shares outstanding | 514.5 |

| | 535.2 |

| | 514.4 |

| | 534.9 |

|

| Share-based awards | 2.0 |

| | 1.8 |

| | 2.1 |

| | 2.1 |

|

| Total dilutive shares outstanding | 516.5 |

| | 537.0 |

| | 516.5 |

| | 537.0 |

|

| Diluted earnings per ordinary share | $ | 0.34 |

| | $ | 0.16 |

| | $ | 0.58 |

| | $ | 0.84 |

|

Additional stock awards and restricted stock awards were outstanding during the three and nine months ended September 30, 2018 and 2017, but were not included in the computation of diluted earnings per ordinary share for each respective period because the effect would be anti-dilutive. Excluded shares at September 30, 2018 include certain share-based compensation awards and restricted ordinary shares whose performance conditions had not been fully met. Such excluded shares and anti-dilutive awards represented 9.3 million shares and 8.9 million shares for the three and nine months ended September 30, 2018, respectively and 8.9 million shares and 8.6 million shares for the three and nine months ended September 30, 2017, respectively.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

| |

| 10. | Goodwill and Intangible Assets |

The changes in the carrying amount of goodwill for the nine months ended September 30, 2018 are as follows:

|

| | | | | | | | | | | | | | | |

| (In millions) | North America Segment | | Europe Segment | | Rest of World Segment | | Total |

| Balance at December 31, 2017: | | | | | | | |

| Goodwill | $ | 3,934.6 |

| | $ | 4,967.1 |

| | $ | 1,689.0 |

| | $ | 10,590.7 |

|

| Accumulated impairment losses | (385.0 | ) | | — |

| | — |

| | (385.0 | ) |

| | 3,549.6 |

| | 4,967.1 |

| | 1,689.0 |

| | 10,205.7 |

|

| Foreign currency translation | (16.8 | ) | | (255.1 | ) | | (137.2 | ) | | (409.1 | ) |

| | $ | 3,532.8 |

| | $ | 4,712.0 |

| | $ | 1,551.8 |

| | $ | 9,796.6 |

|

| Balance at September 30, 2018: | | | | | | | |

| Goodwill | $ | 3,917.8 |

| | $ | 4,712.0 |

| | $ | 1,551.8 |

| | $ | 10,181.6 |

|

| Accumulated impairment losses | (385.0 | ) | | — |

| | — |

| | (385.0 | ) |

| | $ | 3,532.8 |

| | $ | 4,712.0 |

| | $ | 1,551.8 |

| | $ | 9,796.6 |

|

Intangible assets consist of the following components at September 30, 2018 and December 31, 2017:

|

| | | | | | | | | | | | | |

| (In millions) | Weighted Average Life (Years) | | Original Cost | | Accumulated Amortization | | Net Book Value |

| September 30, 2018 | | | | | | | |

Product rights, licenses and other (1) | 15 | | $ | 20,407.7 |

| | $ | 6,857.5 |

| | $ | 13,550.2 |

|

| In-process research and development | | | 688.8 |

| | — |

| | 688.8 |

|

| | | | $ | 21,096.5 |

| | $ | 6,857.5 |

| | $ | 14,239.0 |

|

| December 31, 2017 | | | | | | | |

Product rights, licenses and other (1) | 15 | | $ | 20,338.7 |

| | $ | 5,906.1 |

| | $ | 14,432.6 |

|

| In-process research and development | | | 813.2 |

| | — |

| | 813.2 |

|

| | | | $ | 21,151.9 |

| | $ | 5,906.1 |

| | $ | 15,245.8 |

|

| |

(1) | Represents amortizable intangible assets. Other intangible assets consists principally of customer lists and contractual rights. |

In December 2011, the Company completed the acquisition of the exclusive worldwide rights to develop, manufacture and commercialize a generic equivalent to GlaxoSmithKline’s Advair® Diskus and Seretide® Diskus incorporating Pfizer Inc.’s proprietary dry powder inhaler delivery platform (the “respiratory delivery platform”). The Company accounted for this transaction as a purchase of a business and utilized the acquisition method of accounting. As of September 30, 2018, the Company has an IPR&D asset of $347.2 million and a related contingent consideration liability of $326.6 million. The Company performed an analysis and valuation of the IPR&D asset and the fair value of the related contingent consideration liability using a discounted cash flow model. The model contained certain key assumptions including: the expected product launch date, the number of competitors, the timing of competition and a discount factor based on an industry specific weighted average cost of capital. Based on the analysis performed, the Company determined that the fair value of the IPR&D asset was substantially in excess of its carrying value, and the asset was not impaired at September 30, 2018. Additionally, fair value adjustments of $19.3 million and $49.3 million were recorded for the three and nine months ended September 30, 2018, respectively, to reduce the contingent consideration liability. The fair value of the contingent consideration liability was determined based upon detailed valuations employing the income approach which utilized Level 3 inputs, as defined in Note 11 - Financial Instruments and Risk Management. Resolution of the matters with the FDA, market conditions and other factors may result in significant future changes in the projections and assumptions utilized in the discounted cash flow model, which could lead to material adjustments to the amounts recorded for IPR&D and contingent consideration.

MYLAN N.V. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

During the three and nine months ended September 30, 2018, the Company recognized impairment charges of $15.5 million and $87.5 million, respectively, which has been recorded as a component of amortization expense, for the impairment of certain IPR&D assets. The impairment charge recorded during the third quarter of 2018 related to certain assets acquired as part of the acquisition of Agila Specialties Private Limited (“Agila”). The remaining impairment charges during the nine months ended September 30, 2018 related to certain assets acquired as part of the acquisition of the non-sterile, topicals-focused business (the “Topicals Business”) of Renaissance Acquisition Holdings, LLC. The impairment charges resulted from the Company’s updated estimate of the fair value of certain assets, which were based upon revised forecasts and future development plans. The Company performed its annual impairment testing of IPR&D assets acquired as part of the Topicals Business acquisition during the three months ended June 30, 2018. The impairment testing involved calculating the fair value of the assets based upon detailed valuations employing the income approach which utilized Level 3 inputs, as defined in Note 11 - Financial Instruments and Risk Management. These valuations reflect, among other things, the impact of changes to the development programs, the projected development and regulatory time frames and the current competitive environment. Changes in any of the Company’s assumptions may result in a further reduction to the estimated fair values of these IPR&D assets and could result in additional future impairment charges.