| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-197550-02 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$875,766,284

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$754,253,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2014-C25

as Issuing Entity

RBS Commercial Funding Inc.

as Depositor

Wells Fargo Bank, National Association

The Royal Bank of Scotland plc

Rialto Mortgage Finance, LLC

Silverpeak Real Estate Finance LLC

Basis Real Estate Capital II, LLC

C-III Commercial Mortgage LLC

Liberty Island Group I LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2014-C25

| | |

Co-Lead Manager and

Co-Bookrunner | | Co-Lead Manager and

Co-Bookrunner |

Deutsche Bank Securities |

| | Co-Manager | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-197550) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-866-884-2071 (8 a.m. – 5 p.m. EST) or by emailing rbscmbs@rbs.com.

Nothing in this document constitutes an offer to sell or a solicitation to buy securities in any jurisdiction where such offer, solicitation or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of RBS Securities Inc. (“RBSSI”), Wells Fargo Securities, LLC (“WFS”), any other underwriter or dealer participating in this offering, or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC carries and provides clearing services for Wells Fargo Institutional Securities, LLC customer accounts. Wells Fargo Securities, LLC, Wells Fargo Institutional Securities, LLC, and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the offered certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued that differ from the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the offered certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

I. Certificate Structure

| | Class | Expected Ratings (DBRS/Moody’s/Morningstar)(1) | Approximate Initial Certificate Principal Balance or Notional Amount(2) | Approx. Initial Credit Support(3) | Pass-Through Rate Description | Weighted Average

Life

(Years)(4) | Expected

Principal

Window(4) | Certificate Principal to

Value Ratio(5) | Certificate

Principal

U/W NOI

Debt Yield(6) | |

| | | Offered Certificates | | | | | | | | |

| | A-1 | AAA(sf)/Aaa(sf)/AAA | $31,829,000 | 30.000% | (7) | 3.02 | 01/15 - 11/19 | 39.3% | 16.1% | |

| | A-2 | AAA(sf)/Aaa(sf)/AAA | $42,727,000 | 30.000% | (7) | 4.96 | 11/19 - 12/19 | 39.3% | 16.1% | |

| | A-3 | AAA(sf)/Aaa(sf)/AAA | $35,436,000 | 30.000% | (7) | 6.93 | 11/21 - 11/21 | 39.3% | 16.1% | |

| | A-4 | AAA(sf)/Aaa(sf)/AAA | $210,000,000 | 30.000% | (7) | 9.82 | 09/24 - 11/24 | 39.3% | 16.1% | |

| | A-5 | AAA(sf)/Aaa(sf)/AAA | $235,917,000 | 30.000% | (7) | 9.93 | 11/24 - 11/24 | 39.3% | 16.1% | |

| | A-SB | AAA(sf)/Aaa(sf)/AAA | $57,127,000 | 30.000% | (7) | 7.44 | 12/19 - 9/24 | 39.3% | 16.1% | |

| | A-S(8) | AAA(sf)/Aa1(sf)/AAA | $73,345,000 | 21.625% | (7) | 9.93 | 11/24 - 11/24 | 44.0% | 14.4% | |

| | B(8) | AA(low)(sf)/Aa3(sf)/AA- | $38,315,000 | 17.250% | (7) | 9.93 | 11/24 - 11/24 | 46.4% | 13.6% | |

| | C(8) | A(low)(sf)/A3(sf)/A- | $29,557,000 | 13.875% | (7) | 9.93 | 11/24 - 11/24 | 48.3% | 13.1% | |

| | PEX(8) | A(low)(sf)/A1(sf)/A- | $141,217,000 | 13.875% | (7) | 9.93 | 11/24 - 11/24 | 48.3% | 13.1% | |

| | X-A | AAA(sf)/Aaa(sf)/AAA | $686,381,000(9) | N/A | Variable(10) | N/A | N/A | N/A | N/A | |

| | X-B | AAA(sf)/NR/AAA | $129,176,000(11) | N/A | Variable(12) | N/A | N/A | N/A | N/A | |

| | Non-Offered Certificates | | | | | | | |

| | X-C | AAA(sf)/NR/AAA | $10,947,000(13) | N/A | Variable(14) | N/A | N/A | N/A | N/A | |

| | X-D | AAA(sf)/NR/AAA | $20,799,000(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A | |

| | X-E | AAA(sf)/NR/AAA | $28,463,284(17) | N/A | Variable(18) | N/A | N/A | N/A | N/A | |

| | D | BBB(low)(sf)/NR/BBB- | $61,304,000 | 6.875% | (7) | 9.95 | 11/24 - 12/24 | 52.3% | 12.1% | |

| | E | BB(sf)/NR/BB | $10,947,000 | 5.625% | (7) | 10.01 | 12/24 - 12/24 | 53.0% | 11.9% | |

| | F | B(sf)/NR/B | $20,799,000 | 3.250% | (7) | 10.01 | 12/24 - 12/24 | 54.3% | 11.6% | |

| | G | NR/NR/NR | $28,463,284 | 0.000% | (7) | 10.01 | 12/24 - 12/24 | 56.1% | 11.3% | |

Notes: | | | | | | | | | | |

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Moody’s Investors Service, Inc. (“Moody’s”), and Morningstar Credit Ratings, LLC (“Morningstar”) which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act or otherwise to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors—Risks Related to the Offered Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the free writing prospectus, dated November 12, 2014 (the “Free Writing Prospectus”). | | |

| | | | |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. | | |

| | | | |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates in the aggregate. The approximate initial credit support with respect to each of the Class C Certificates and Class PEX Certificates is equal to the approximate initial credit support of the Class C regular interest, which will have an initial outstanding principal balance of the closing date of $29,557,000. | | |

| | | | |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex D to the Free Writing Prospectus. | | |

| | | | |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates (other than the Exchangeable Certificates and other than the Class X-A, X-B, X-C, X-D and, X-E Certificates, which are notional amount certificates and will not have principal balances), if any, that are senior to such class by the aggregate appraised value of approximately $1,560,217,380 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans (excluding, with respect to each pari passu loan combination, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates by such aggregate appraised value (excluding, with respect to each pari passu loan combination, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratio for each of the Class A-S, B and C Certificates is calculated by dividing the aggregate principal balance of the Class A-S regular interest, the Class B regular interest or the Class C regular interest, as applicable, and all other classes of certificates (other than the Exchangeable Certificates) and the regular interests that are senior to such class, by such aggregate appraised value (excluding, with respect to each pari passu loan combination, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratio of the Class PEX Certificates is equal to the Certificate Principal to Value Ratio of the Class C Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. | | |

| | | | |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated by dividing the underwritten net operating income (which excludes, with respect to each pari passu loan combination, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of approximately $98,663,486 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of such class of certificates and all classes of certificates (other than the Class X-A, X-B, X-C, X-D, and X-E Certificates, which are notional amount certificates and will not have principal balances, and other than the Exchangeable Certificates), if any, that are senior to such class of certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates is calculated by dividing such mortgage pool underwritten net operating income (which excludes, with respect to each pari passu loan combination, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) by the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-S, B and C Certificates is calculated by dividing the underwritten net operating income (which excludes, with respect to each pari passu loan combination, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of approximately $98,663,486 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of the Class A-S regular interest, the Class B regular interest or the Class C regular interest, as applicable, and all other classes of certificates (other than the Exchangeable Certificates) and the regular interests that are senior to such class. The Certificate Principal U/W NOI Debt Yield of the Class PEX Certificates is equal to the Certificate Principal U/W NOI Debt Yield for the Class C Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-5, A-SB, D, E, F and G Certificates and the Class A-S, B and C regular interests, in each case, will be one of the following: (i) a fixed rate per annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rate per annum equal to the WAC Rate for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. The Class PEX Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, B and C regular interests represented by the Class PEX Certificates. The pass-through rates on the Class A-S, B and C Certificates will at all times be the same as the pass-through rates of the Class A-S, B and C regular interests. | | |

| | | | |

| (8) | The Class A-S, B, C and PEX Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, B and C regular interests (each a “regular interest”) which will have outstanding principal balances on the closing date of $73,345,000, $38,315,000 and $29,557,000, respectively. The regular interests will be held in a grantor trust for the benefit of the holders of the Class A-S, B, C and PEX Certificates. The Class A-S, B, C and PEX Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those regular interests. Each class of the Class A-S, B and C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balance of the regular interest with the same alphabetical class designation. The Class PEX Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding certificate principal balances of the Class A-S, B and C regular interests and which portions of those regular interests are referred to in this Term Sheet as the Class PEX Component A-S, Class PEX Component B and Class PEX Component C (collectively, the “Class PEX Components”). Following any exchange of Class A-S, B and C Certificates for Class PEX Certificates or any exchange of Class PEX Certificates for Class A-S, B and C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, B and C regular interest that is represented by the Class A-S, B, C and PEX Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, B and C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any exchange. The initial certificate principal balance of the Class PEX Certificates is equal to the aggregate of the initial certificate principal balance of the Class A-S, B and C Certificates and represents the maximum certificate principal balance of the Class PEX Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, B and C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PEX Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, B, C and PEX Certificates” and under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PEX Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. | | |

| | | | |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. | | |

| | | | |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | | |

| | | | |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B and C regular interests and the Class D Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. | | |

| | | | |

| (12) | The pass-through rate for the Class X-B certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D certificates and the Class B and Class C regular interests for the related distribution date, weighted on the basis of their respective aggregate certificate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis and. | | |

| | | | |

| (13) | The Class X-C Certificates are notional amount certificates. The Notional Amount of the Class X-C Certificates will be equal to the principal balance of the Class E Certificates outstanding from time to time. The Class X-C Certificates will not be entitled to distributions of principal. | | |

| | | | |

| (14) | The pass-through rate for the Class X-C Certificate for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | | |

| | | | |

| (15) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate principal balance of the Class F Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. | | |

| | | | |

| (16) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | | |

| | | | |

| (17) | The Class X-E Certificates are notional amount certificates. The Notional Amount of the Class X-E Certificates will be equal to the aggregate principal balance of the Class G Certificates outstanding from time to time. The Class X-E Certificates will not be entitled to distributions of principal. | | |

| | | | |

| (18) | The pass-through rate for the Class X-E Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class G Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

II. Transaction Highlights

Mortgage Loan Sellers:

| | | | Number of Mortgaged Properties | | Aggregate Cut-off Date Balance | | % of Cut-off Date Pool Balance |

| Wells Fargo Bank, National Association | | 17 | | 20 | | $373,046,122 | | | 42.6 | % |

| The Royal Bank of Scotland plc | | 4 | | 4 | | 148,750,000 | | | 17.0 | |

| Rialto Mortgage Finance, LLC | | 13 | | 17 | | 147,165,654 | | | 16.8 | |

| Silverpeak Real Estate Finance, LLC | | 9 | | 15 | | 105,911,164 | | | 12.1 | |

| Basis Real Estate Capital II, LLC | | 6 | | 6 | | 55,865,402 | | | 6.4 | |

| C-III Commercial Mortgage LLC | | 9 | | 10 | | 35,777,944 | | | 4.1 | |

Liberty Island Group I LLC | | | | | | | | | | |

| Total | | | | | | | | | | % |

Loan Pool:

| Cut-off Date Balance: | $875,766,284 |

| Number of Mortgage Loans: | 59 |

| Average Cut-off Date Balance per Mortgage Loan: | $14,843,496 |

| Number of Mortgaged Properties: | 73 |

Average Cut-off Date Balance per Mortgaged Property(1): | $11,996,798 |

| Weighted Average Mortgage Interest Rate: | 4.411% |

| Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | 56.4% |

| Weighted Average Original Term to Maturity or ARD (months): | 115 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 114 |

Weighted Average Original Amortization Term (months)(2): | 358 |

Weighted Average Remaining Amortization Term (months)(2): | 357 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

Weighted Average U/W Net Cash Flow DSCR(1): | 1.91x |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | 11.3% |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 62.0% |

Weighted Average Balloon Loan-to-Value Ratio(1): | 55.0% |

| % of Mortgage Loans with Additional Subordinate Debt: | 16.2% |

% of Mortgage Loans with Single Tenants(2): | 6.9% |

| (1) | With respect to each of the St. Johns Town Center mortgage loan, the Colorado Mills mortgage loan and the AMCP Portfolio mortgage loan, with respect to each of which the related mortgaged property secures one or more pari passu companion loans, and, in the case of the St. Johns Town Center mortgage loan, a related trust subordinate companion loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated) in total debt but do not include the trust subordinate companion loan. The debt service coverage ratio and debt yield calculations for each residential cooperative mortgage loan are calculated using underwritten net cash flow for the related residential cooperative property, which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to value ratio information for each residential cooperative mortgage loan is based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. See Annex A to the Free Writing Prospectus. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account any subordinate debt (whether or not secured by the mortgaged property) that is allowed under the terms of any mortgage loan. |

| (2) | Excludes mortgage loans that are secured by multiple single-tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

Loan Structural Features:

Amortization: Based on the Cut-off Date Pool Balance, 79.5% of the mortgage pool (55 mortgage loans) have scheduled amortization, as follows:

27.5% (28 mortgage loans) require amortization during the entire loan term

52.0% (27 mortgage loans) provide for an interest-only period followed by an amortization period

Interest-Only: Based on the Cut-off Date Pool Balance, 20.5% of the mortgage pool (4 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans is 43.5% and 3.03x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 46.4% of the mortgage pool (17 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 62.3% of the pool |

| Insurance Premiums: | 52.3% of the pool |

| Capital Replacements: | 73.8% of the pool |

| TI/LC: | 18.7% of the pool(1) |

| (1) The percentage of the Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail, industrial, other, and mixed use properties. |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool has the following call protection and defeasance features:

96.8% of the mortgage pool (54 mortgage loans) features a lockout period, then defeasance only until an open period;

3.2% of the mortgage pool (five mortgage loans) feature a lockout period, then require greater of yield maintenance or prepayment premium for a period until an open period;

Please refer to Annex A to the Free Writing Prospectus for further description of individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

| III. | Issue Characteristics | |

| | | |

| | Securities Offered: | $754,253,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of twelve classes (Classes A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, PEX, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC. |

| | | |

| | Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”); The Royal Bank of Scotland plc (“RBS”); Rialto Mortgage Finance, LLC (“RMF); Silverpeak Real Estate Finance LLC (SPREF); Basis Real Estate Capital II, LLC (“Basis”); C-III Commercial Mortgage LLC (“CIIICM”); and Liberty Island Group I LLC (“LIG I”) |

| | | |

| | Co-lead Bookrunning Managers: | RBS Securities Inc. and Wells Fargo Securities, LLC |

| | | |

| | Co-Managers: | Deutsche Bank Securities Inc. |

| | | |

| | Rating Agencies: | DBRS, Inc., Moody’s Investors Service, Inc., and Morningstar Credit Ratings, LLC |

| | | |

| | Master Servicer: | Wells Fargo Bank, National Association |

| | | |

| | Special Servicer: | CWCapital Asset Management, LLC |

| | | |

| | Certificate Administrator: | Wells Fargo Bank, National Association |

| | | |

| | Trustee: | Wilmington Trust, National Association |

| | | |

| | Trust Advisor: | Trimont Real Estate Advisors, Inc. |

| | | |

| | Initial Majority Subordinate Certificateholder: | An affiliate of Seer Capital Management, LP |

| | | |

| | Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in December 2014 (or, in the case of any mortgage loan that has its first due date in January 2015, the date that would have been its due date in December 2014 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | |

| | Expected Closing Date: | On or about December 12, 2014. |

| | | |

| | Determination Dates: | The eleventh day of each month (or if that day is not a business day, the next succeeding business day), commencing in January 2015. |

| | | |

| | Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in January 2015. |

| | | |

| | Rated Final Distribution Date: | The Distribution Date in November 2047. |

| | | |

| | Interest Accrual Period: | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

| | | |

| | Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | |

| | Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and Class X-B Certificates) and $1,000,000 for the Class X-A and Class X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | |

| | Clean-up Call: | 1% |

| | | |

| | Delivery: | DTC, Euroclear and Clearstream Banking |

| | | |

| | ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | |

| | Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| | | |

| | Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date settlements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg Financial Markets L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc. and CMBS.com, Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

Mortgage Loan Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Cut- off Date Pool Balance (%) | Property Type | Number of SF, Rooms, or Units | Cut-off Date Balance Per Unit of Measure($) | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

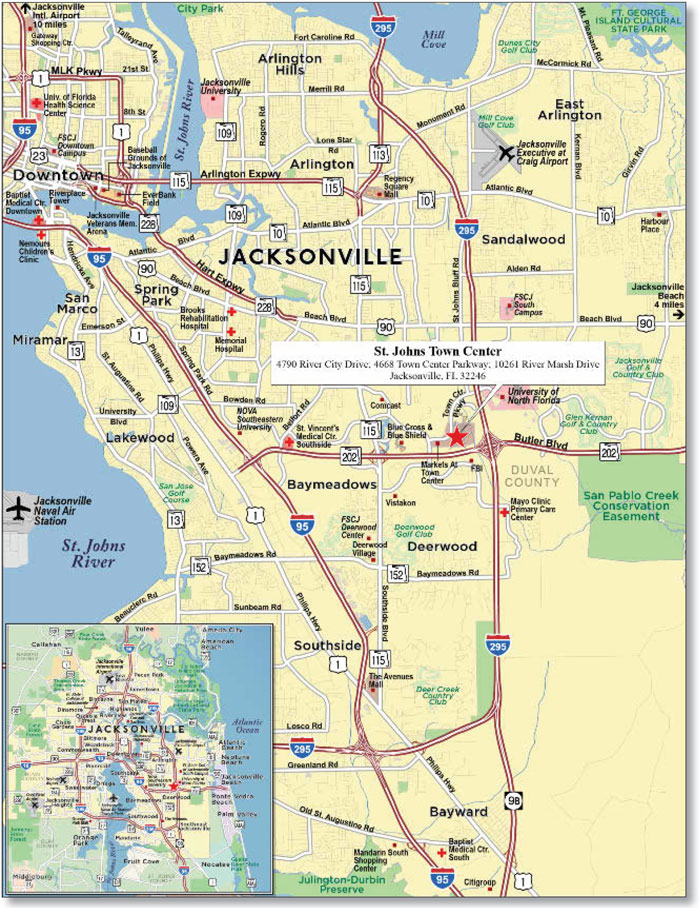

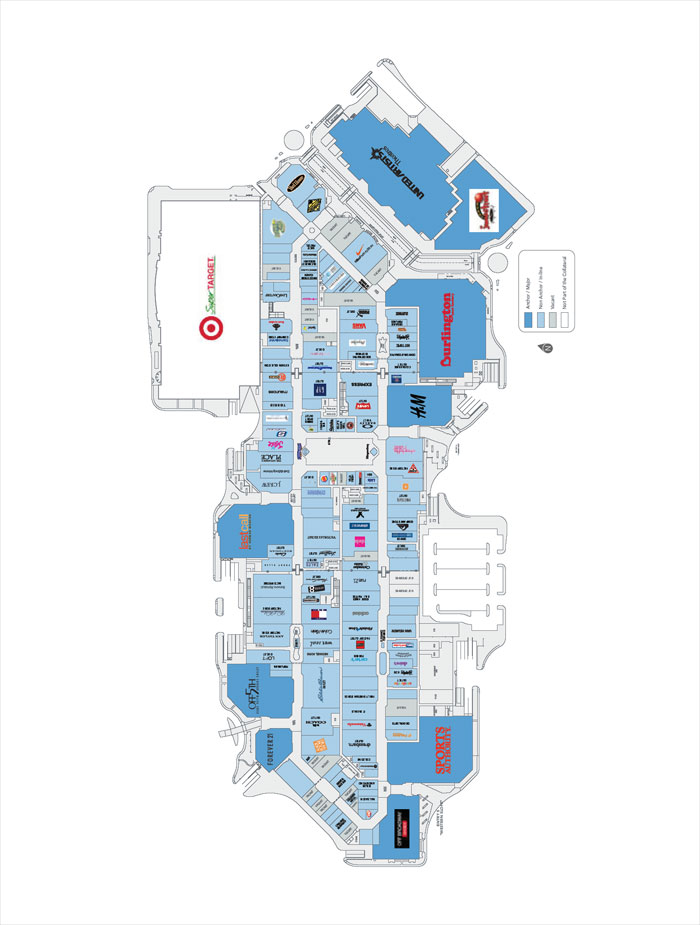

| WFB | St. Johns Town Center | Jacksonville | FL | 1 / 1 | $100,000,000 | 11.4 | % | Retail | 981,157 | $207 | 26.8 | % | 26.8 | % | 3.81 | x | 15.4 | % |

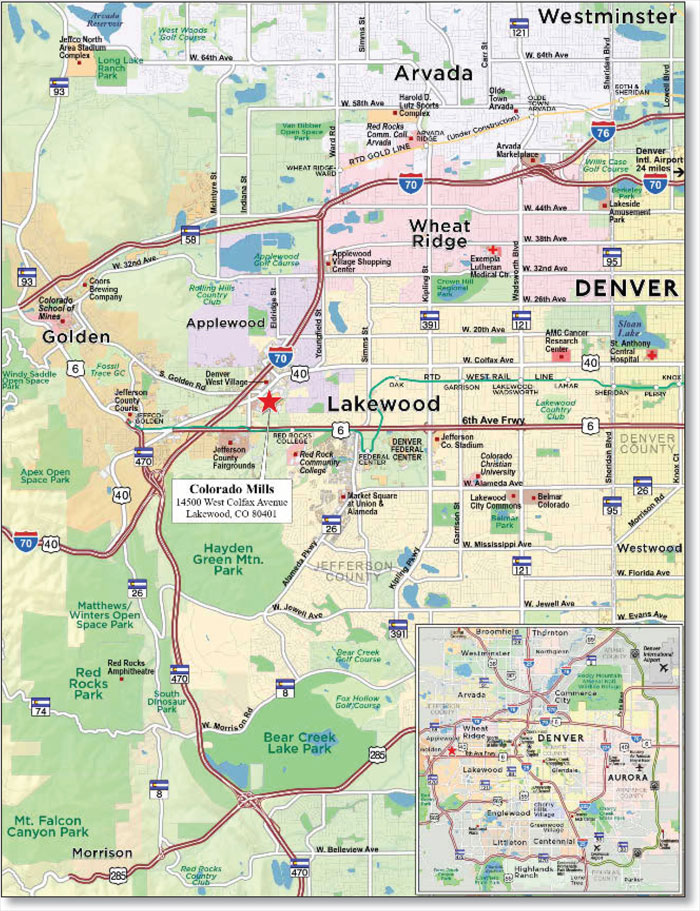

| RBS | Colorado Mills | Lakewood | CO | 1 / 1 | 100,000,000 | 11.4 | | Retail | 918,448 | 148 | 63.3 | | 55.1 | | 1.91 | | 12.0 | |

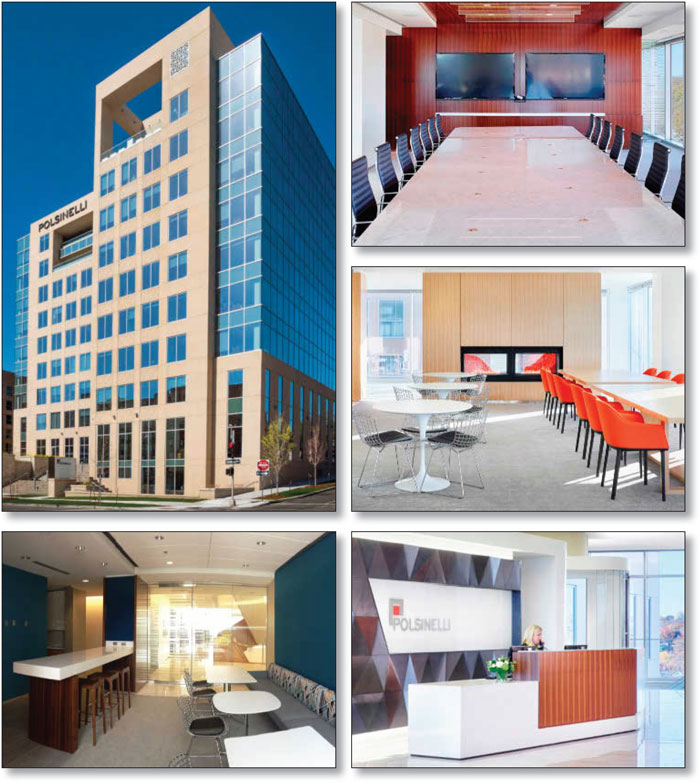

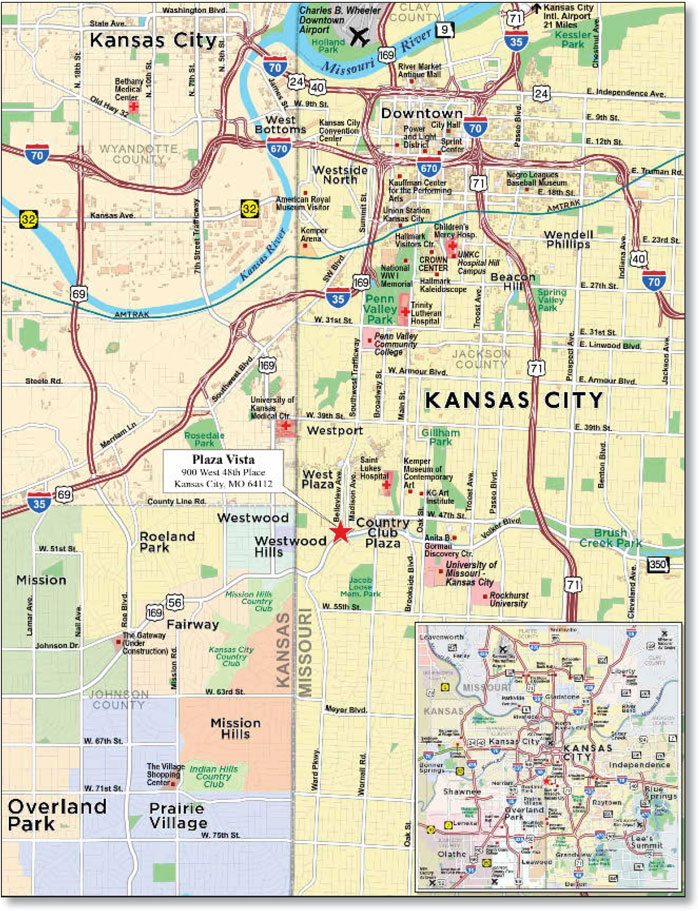

| WFB | Plaza Vista | Kansas City | MO | 1 / 1 | 67,600,000 | 7.7 | | Office | 253,720 | 266 | 64.6 | | 64.6 | | 2.10 | | 9.9 | |

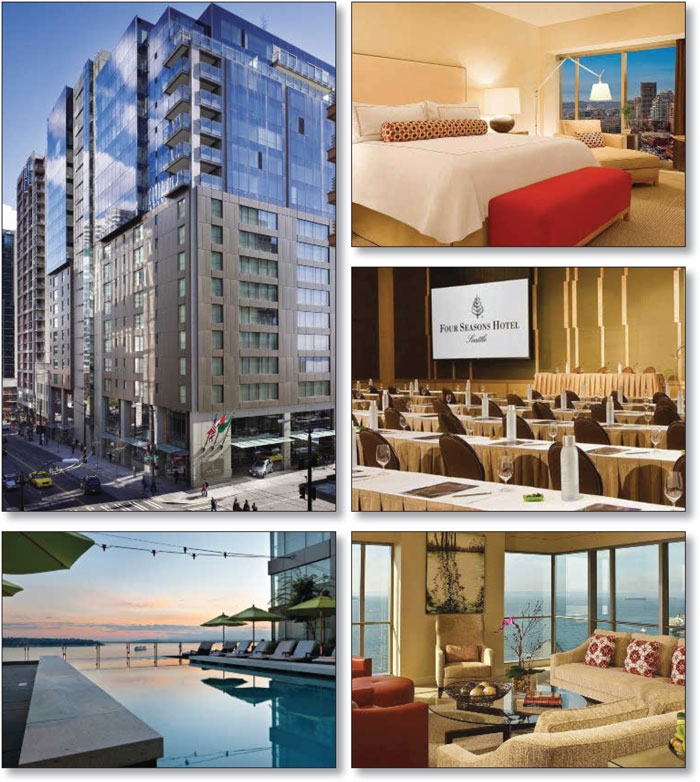

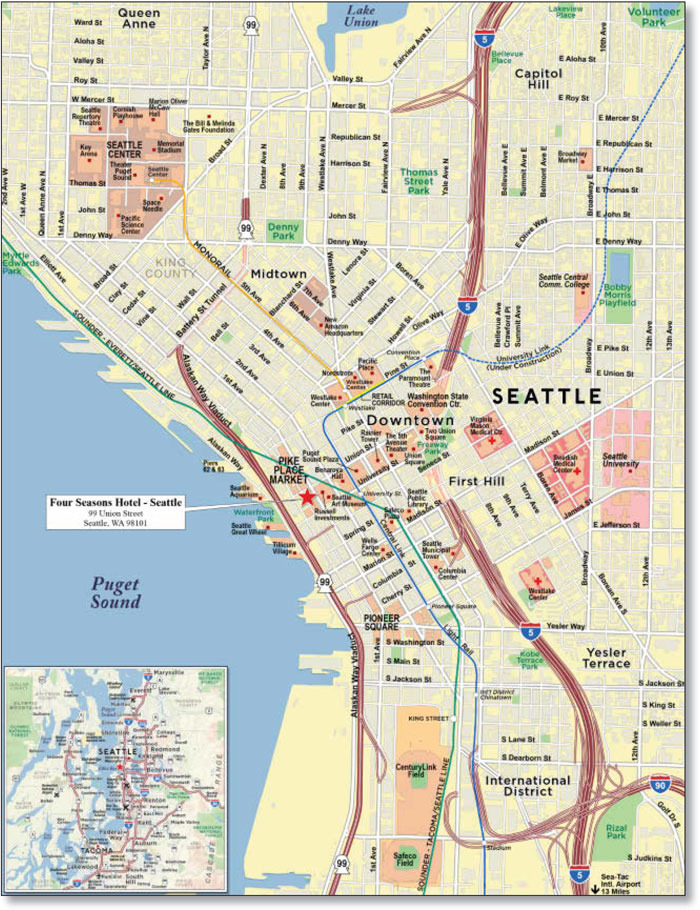

| WFB | Four Seasons Hotel – Seattle | Seattle | WA | 1 / 1 | 42,000,000 | 4.8 | | Hospitality | 147 | 285,714 | 52.9 | | 45.8 | | 1.88 | | 15.1 | |

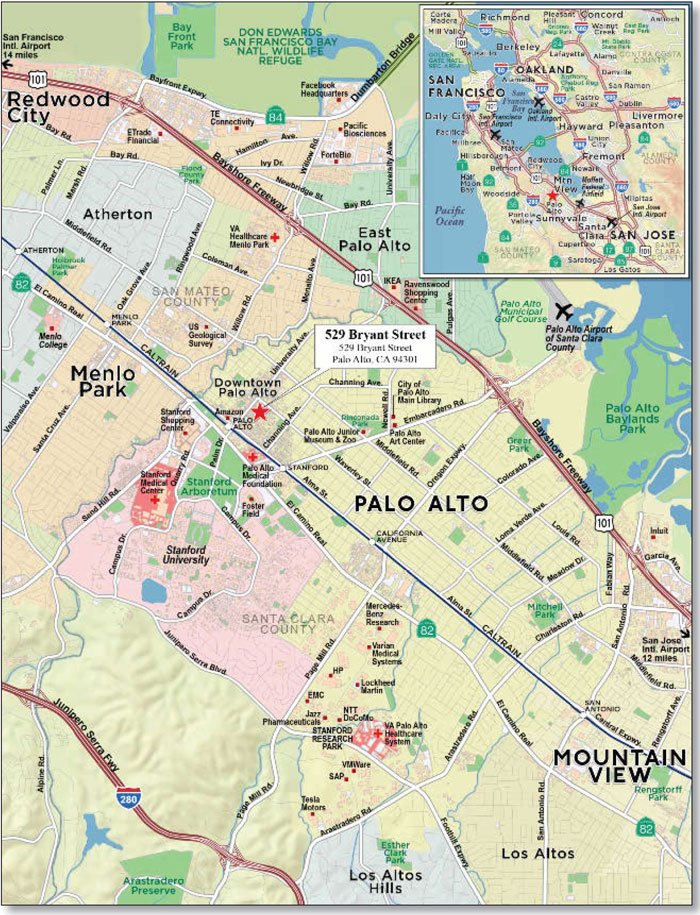

| WFB | 529 Bryant Street | Palo Alto | CA | 1 / 1 | 38,600,000 | 4.4 | | Other | 45,319 | 852 | 70.2 | | 64.9 | | 1.33 | | 8.3 | |

| RMF | Granada Gardens | Warrensville Heights | OH | 1 / 1 | 34,500,000 | 3.9 | | Multifamily | 940 | 36,702 | 73.4 | | 64.4 | | 1.50 | | 9.9 | |

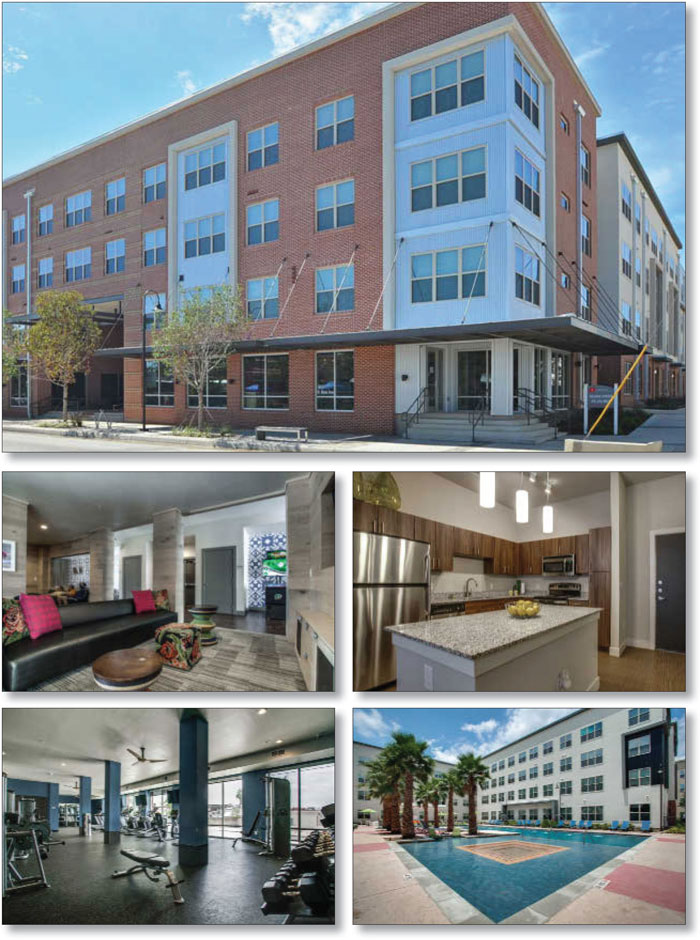

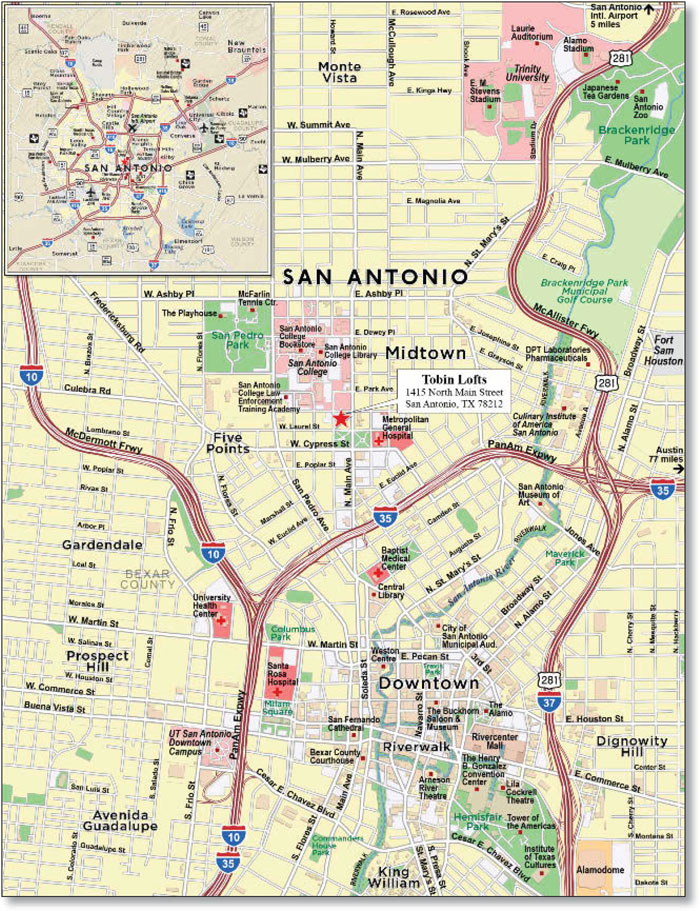

| SPREF | Tobin Lofts | San Antonio | TX | 1 / 1 | 34,457,384 | 3.9 | | Multifamily | 552 | 62,423 | 69.5 | | 56.9 | | 1.37 | | 8.9 | |

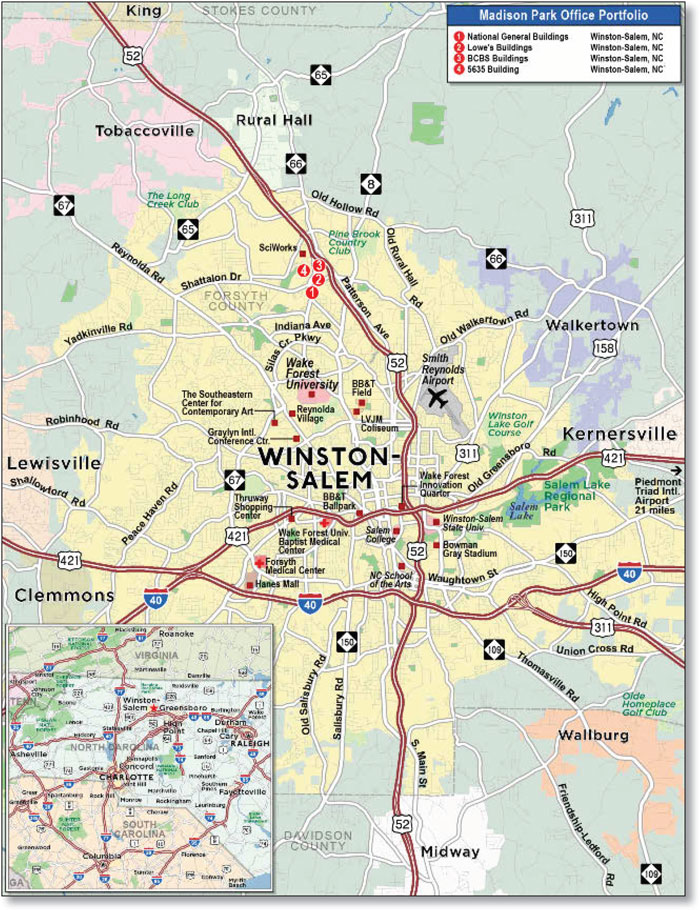

| WFB | Madison Park Office Portfolio | Winston-Salem | NC | 1 / 4 | 29,000,000 | 3.3 | | Various | 482,835 | 60 | 72.5 | | 63.6 | | 1.31 | | 10.0 | |

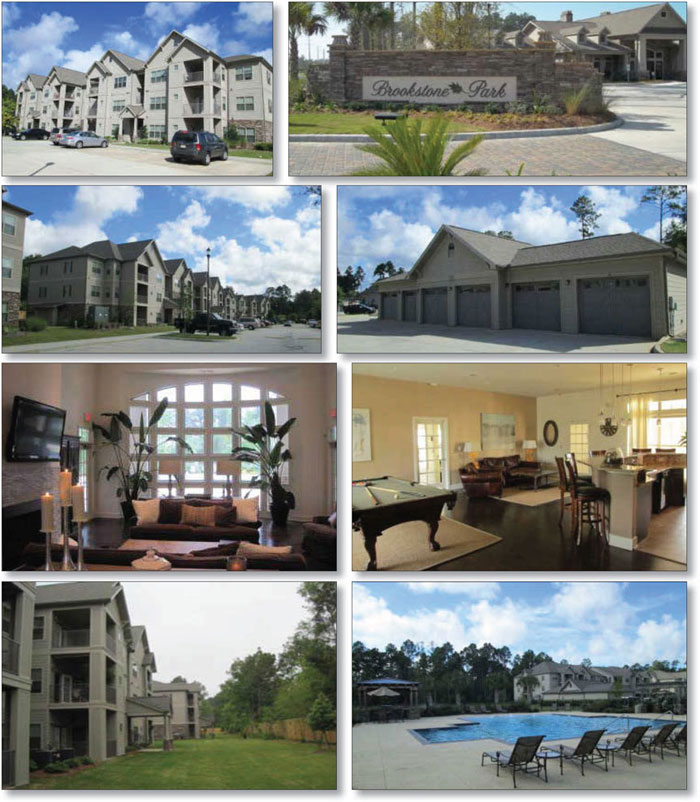

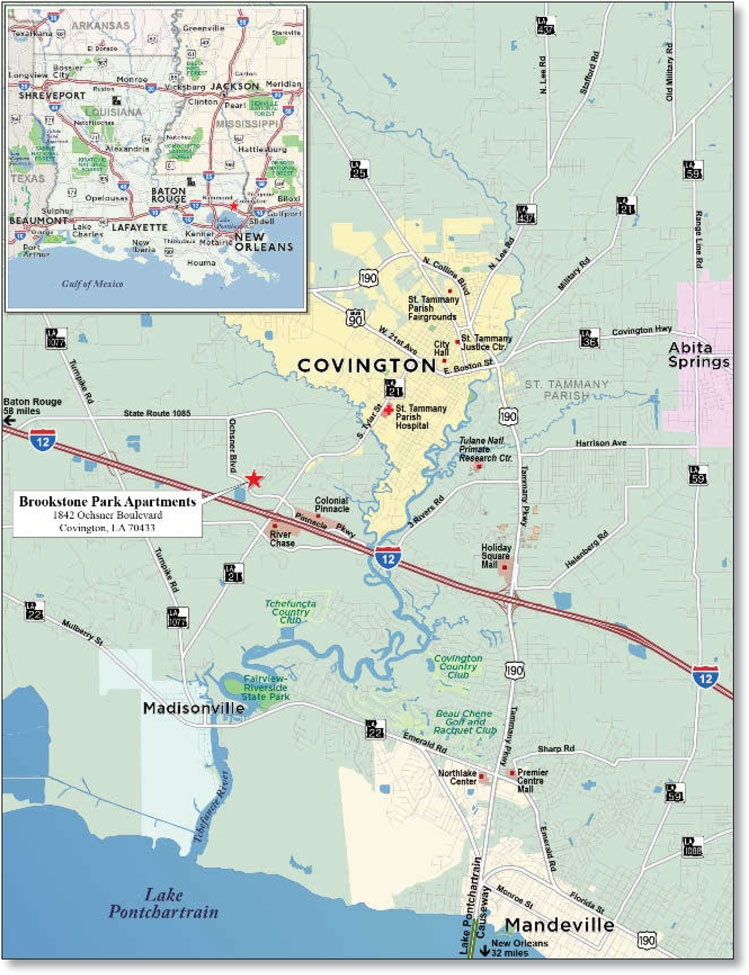

| RBS | Brookstone Park Apartments | Covington | LA | 1 / 1 | 24,500,000 | 2.8 | | Multifamily | 240 | 102,083 | 74.2 | | 67.7 | | 1.35 | | 8.1 | |

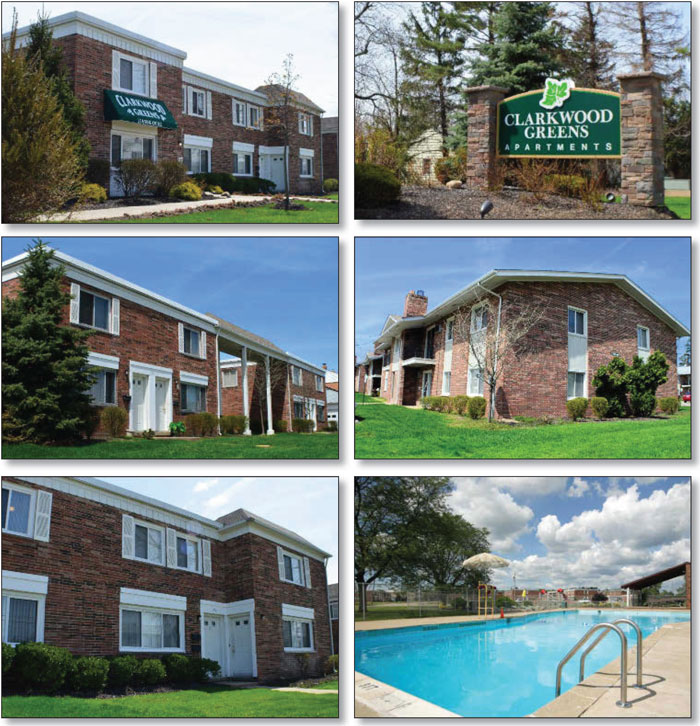

| RMF | Clarkwood Greens | Warrensville Heights | OH | 1 / 1 | 23,600,000 | 2.7 | | Multifamily | 568 | 41,549 | 74.9 | | 65.7 | | 1.45 | | 9.5 | |

| Top Three Total/Weighted Average | | 3 / 3 | $267,600,000 | 30.6 | % | | | | 50.0 | % | 46.9 | % | 2.67 | x | 12.7 | % |

| Top Five Total/Weighted Average | | 5 / 5 | $348,200,000 | 39.8 | % | | | | 52.6 | % | 48.8 | % | 2.42 | x | 12.5 | % |

| Top Ten Total/Weighted Average | | 10 / 13 | $494,257,384 | 56.4 | % | | | | 58.5 | % | 53.1 | % | 2.12 | x | 11.6 | % |

| Non-Top Ten Total/Weighted Average | | 49 / 60 | $381,508,900 | 43.6 | % | | | | 66.6 | % | 57.5 | % | 1.64 | x | 10.8 | % |

| (1) | With respect to the St. Johns Town Center mortgage loan, the Colorado Mills mortgage loan and the AMCP Portfolio mortgage loan, for which the related mortgaged properties secure one or more pari passu companion loans, and, in the case of the St. Johns Town Center mortgage loan, which also has a non-trust related subordinate companion loan, Cut-off Date Balance per unit of measure, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt but do not include the related non-trust subordinate companion loan. With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of any mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

B. Summary of Pari Passu Split Loan Structures

| Mortgage Loan Name | Mortgage Loan Seller | Related Notes in Loan Group (Original Balance) | Holder of Note | Whether Note is Lead Servicing for the Entire Loan Combination | Current Master Servicer Under Related Securitization PSA | Current Special Servicer Under Related Securitization PSA |

St. Johns Town Center(1) | WFB | $100,000,000 | WFRBS 2014-C25 | No | Wells Fargo Bank, National Association | CWCapital Asset Management, LLC |

| WFB | $103,500,000 | WFRBS 2014-C24(2) | Yes(3) | Rialto Capital Management | Rialto Capital Advisors, LLC |

| Colorado Mills | RBS | $100,000,000 | WFRBS 2014-C25 | Yes | Wells Fargo Bank, National Association | CWCapital Asset Management, LLC |

| RBS | $36,000,000 | (4) | No | TBD | TBD |

AMCP Portfolio(5) | SPREF | $8,000,000 | WFRBS 2014-C25 | (5) | Wells Fargo Bank, National Association | CWCapital Asset Management, LLC |

| SPREF | $16,050,000 | (6) | (5) | TBD | TBD |

(1) | St. Johns Town Center also includes a non-trust subordinate companion loan. See “C. Mortgage Loans with Additional Secured and Mezzanine Financing” below. |

(2) | The WFRBS 2014-C24 transaction is scheduled to close on November 18, 2014. |

(3) | The St. Johns Town Center note included in the WFRBS 2014-C24 trust fund and the related subordinate companion loan note, which is an asset of the WFRBS 2014-C24 trust fund together constitute the lead servicing note for the St Johns Center loan combination. |

(4) | The related pari passu companion loan Note A-2 is expected to be contributed to a future securitization. No assurance can be provided that Note A-2 will not be split further. |

(5) | The AMCP Portfolio will be serviced under the WFRBS 2014-C25 pooling and servicing agreement until the securitization of the related pari passu companion loan, after which such loan combination will be serviced under the pooling and servicing agreement related to the securitization of the pari passu companion loan. The master servicer under the latter pooling and servicing agreement will be identified in a notice, report or statement to holders of the WFRBS 2014-C25 certificates after the securitization of the pari passu companion loan. |

(6) | The related pari passu companion loan Note A-2 is expected to be contributed to a future securitization. No assurance can be provided that Note A-2 will not be split further. |

C. Mortgage Loans with Additional Secured and Mezzanine Financing

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) | % of Cut-

off Date

Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt

Interest

Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan

Cut-off Date

LTV Ratio (%) | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | WFB | St. Johns Town Center | $100,000,000 | 11.4% | $146,500,000 | $0 | 3.819% | 3.81x | 2.22x | 15.4% | 8.9% | 26.8% | 46.1% |

| 4 | WFB | Four Seasons Hotel – Seattle(2) | 42,000,000 | 4.8 | 21,050,000(3) | 9,450,000(3) | 5.457 | 1.88 | 1.04 | 15.1 | 6.6 | 52.9 | 91.3 |

| | Total/Weighted Average | $142,000,000 | 16.2% | $167,550,000 | $9,450,000 | 4.303% | 3.24x | 1.87x | 15.3% | 8.2% | 34.5% | 59.5% |

(1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

(2) | The Four Seasons Hotel - Seattle Property has a subordinate second mortgage and the equity interests in the Four Seasons Hotel - Seattle Mortgage Loan borrowers and certain affiliates have been pledged to secure additional subordinate indebtedness. All subordinate debt payments are currently accruing and are only required to be paid to the extent there is excess cash flow after payment of debt service on the Four Seasons Hotel – Seattle Mortgage Loan. |

(3) | Subordinate debt cut-off balances for the Four Seasons Hotel – Seattle are as of 6/30/2014. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

D. Previous Securitization History(1)

Loan No. | Mortgage Loan Seller | Mortgage Loan or Mortgaged Property Name | City | State | Property Type | Mortgage Loan or Mortgaged Property Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Previous Securitization |

| 1 | WFB | St. Johns Town Center | Jacksonville | FL | Retail | $100,000,000 | 11.4% | CSFB 2005-C5 |

| 12 | RBS | All Storage Keller Haslet & Katy | Keller | TX | Self Storage | 19,850,000 | 2.3 | JPMCC 2004-CBX |

| 16.01 | RMF | Hunteridge | Jonesboro | GA | Manufactured Housing Community | 10,224,885 | 1.2 | BALL 2007-BMB1; MLCFC 2007-8; MLCFC 2007-9; MLMT 2008-C1 |

| 16.02 | RMF | Riverdale | Riverdale | GA | Manufactured Housing Community | 5,410,527 | 0.6 | BALL 2007-BMB1; MLCFC 2007-8; MLCFC 2007-9; MLMT 2008-C1 |

| 16.03 | RMF | Jonesboro | Jonesboro | GA | Manufactured Housing Community | 843,637 | 0.1 | BALL 2007-BMB1; MLCFC 2007-8; MLCFC 2007-9; MLMT 2008-C1 |

| 18 | Basis | Six Trails Apartments | Saline | MI | Multifamily | 13,125,000 | 1.5 | WFRBS 2012-C6 |

| 25 | LIG I | The Village at Mirror Lake | Villa Rica | GA | Retail | 9,250,000 | 1.1 | WBCMT 2005-C16 |

| 28 | SPREF | 276 Post Road West | Westport | CT | Office | 8,750,000 | 1.0 | CSFB 2002-CP3 |

| 30 | WFB | Abbey Park Apartments | Grand Blanc | MI | Multifamily | 7,957,705 | 0.9 | MSC 2005-T17 |

| 31 | RMF | Hawthorne 40 Shopping Center | Kansas City | MO | Retail | 7,715,156 | 0.9 | JPMCC 2005-LDP1 |

| 50.02 | CIIICM | Mooresville II & III | Mooresville | IN | Retail | 1,605,000 | 0.2 | MSC 2005-IQ9 |

| 56 | Basis | Shops at Bay City Mall | Bay City | MI | Retail | 2,147,255 | 0.2 | JPMCC 2004-CBX |

| 59 | CIIICM | Honeydale MHP | Brownsville | TX | Manufactured Housing Community | 1,498,241 | 0.2 | JPMCC 2005-LDP1 |

| Total | | | | $188,377,406 | 21.5% | |

(1) The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan paid off a mortgage loan in another securitization. The information in the table above has not otherwise been confirmed by the mortgage loan sellers.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

Class A-2(1) |

Loan

No. | Mortgage

Loan

Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan

Cut-off Date

Balance ($) | % of

Cut-off

Date

Pool

Balance

(%) | Mortgage Loan

Balance at

Maturity ($) | % of Class A-2 Certificate Principal Balance (%)(2) | Units/SF /Rooms | Loan per Unit/SF/ Room ($) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to Maturity (mos.) |

| 17 | SPREF | Sharon Park | TX | Multifamily | $16,475,328 | 1.9% | $14,920,148 | 34.9% | 636 | $25,905 | 1.98x | 12.2% | 59.9% | 54.3% | 0 | 59 |

| 20 | Basis | Elsinore Courtyard Apartments | DC | Multifamily | 12,200,000 | 1.4 | 11,303,174 | 26.5 | 152 | 80,263 | 1.24 | 8.7 | 69.3 | 64.2 | 0 | 60 |

| 21 | RMF | Kensington Commons | OH | Multifamily | 12,000,000 | 1.4 | 11,413,322 | 26.7 | 264 | 45,455 | 1.43 | 9.2 | 69.6 | 66.2 | 23 | 59 |

| 50 | CIIICM | Stones Crossing II & Mooresville II & III | IN | Retail | 3,725,000 | 0.4 | 3,316,907 | 7.8 | 36,516 | 102 | 1.43 | 10.9 | 70.3 | 62.6 | 0 | 60 |

| Total/Weighted Average | | $44,400,328 | 5.1% | $40,953,551 | 95.8% | | | 1.58x | 10.3% | 66.0% | 60.9% | 6 | 59 |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

| (2) | Reflects the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance expressed as a percentage. |

Class A-3(1) |

Loan

No. | Mortgage

Loan

Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan

Cut-off Date

Balance ($) | % of

Cut-off

Date

Pool

Balance

(%) | Mortgage Loan

Balance at

Maturity ($) | % of Class

A-3

Certificate

Principal

Balance

(%)(2) | Units/SF

/Pads | Loan per

Unit/SF/

Pads ($) | U/W NCF

DSCR (x) | U/W NOI

Debt Yield

(%) | Cut-off

Date LTV

Ratio (%) | Balloon

LTV Ratio

(%) | Rem. IO

Period

(mos.) | Rem.

Term to

Maturity

(mos.) |

| 15 | WFB | Vista Verde Apartments | FL | Multifamily | $16,650,000 | 1.9% | $15,807,961 | 44.6% | 200 | $83,250 | 1.26x | 7.8% | 74.3% | 70.6% | 47 | 83 |

| 23 | WFB | The Falls at Tampa Bay | FL | Multifamily | 11,000,000 | 1.3 | 10,422,432 | 29.4 | 241 | 45,643 | 1.44 | 8.9 | 75.9 | 71.9 | 47 | 83 |

| 24 | RMF | Creekside Village of Fairfield | OH | Multifamily | 9,800,000 | 1.1 | 9,206,162 | 26.0 | 229 | 42,795 | 1.62 | 10.5 | 73.7 | 69.2 | 35 | 83 |

| Total/Weighted Average | | $37,450,000 | 4.3% | $35,436,354 | 100.0% | | | 1.41x | 8.8% | 74.6% | 70.6% | 44 | 83 |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

| (2) | Reflects the Mortgage Loan Balance at Maturity divided by the initial Class A-3 Certificate Principal Balance expressed as a percentage. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

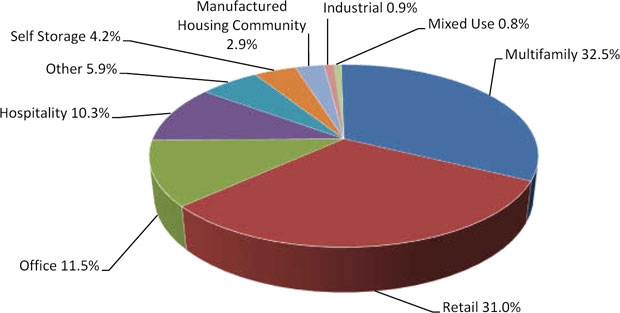

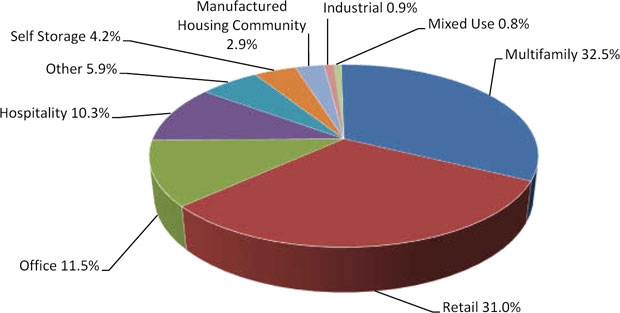

F. Property Type Distribution(1)

| Property Type | Number of Mortgaged Properties | Aggregate Cut- off Date Balance

($) | % of Cut- off Date Pool Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Multifamily | 24 | $284,937,132 | 32.5% | 69.2% | 61.1% | 1.53x | 10.0% | 9.4% | 4.517% |

| Garden | 18 | 202,386,770 | 23.1 | 71.3 | 63.9 | 1.53 | 9.8 | 9.2 | 4.454 |

| Student Housing | 2 | 51,307,384 | 5.9 | 69.7 | 59.2 | 1.36 | 8.7 | 8.5 | 4.653 |

| Low Rise | 2 | 14,197,366 | 1.6 | 67.7 | 61.7 | 1.25 | 8.7 | 8.3 | 5.196 |

| Mid Rise | 1 | 9,087,907 | 1.0 | 58.1 | 47.0 | 1.31 | 8.2 | 7.9 | 4.450 |

| Senior Housing | 1 | 7,957,705 | 0.9 | 28.9 | 17.7 | 3.41 | 25.7 | 25.1 | 4.100 |

| Retail | 16 | 271,532,792 | 31.0 | 51.0 | 45.2 | 2.52 | 12.9 | 12.2 | 4.198 |

| Regional Mall | 2 | 200,000,000 | 22.8 | 45.1 | 41.0 | 2.86 | 13.7 | 13.1 | 4.051 |

| Anchored | 7 | 46,336,248 | 5.3 | 69.6 | 57.7 | 1.54 | 10.8 | 9.7 | 4.643 |

| Shadow Anchored | 4 | 16,891,544 | 1.9 | 63.9 | 53.9 | 1.58 | 10.5 | 9.6 | 4.520 |

| Unanchored | 2 | 4,705,000 | 0.5 | 73.2 | 63.4 | 1.38 | 9.4 | 8.8 | 4.701 |

| Single Tenant | 1 | 3,600,000 | 0.4 | 52.2 | 52.2 | 2.24 | 10.3 | 10.2 | 4.500 |

| Office | 6 | 100,700,000 | 11.5 | 66.7 | 64.3 | 1.89 | 10.0 | 8.8 | 4.400 |

| Suburban | 5 | 96,550,000 | 11.0 | 66.5 | 64.7 | 1.90 | 9.8 | 8.8 | 4.387 |

| CBD | 1 | 4,150,000 | 0.5 | 69.2 | 56.3 | 1.60 | 13.5 | 10.0 | 4.700 |

| Hospitality | 7 | 90,293,374 | 10.3 | 58.0 | 49.3 | 1.80 | 13.5 | 11.1 | 4.551 |

| Full Service | 2 | 62,000,000 | 7.1 | 55.0 | 47.8 | 1.82 | 14.1 | 11.1 | 4.468 |

| Limited Service | 5 | 28,293,374 | 3.2 | 64.6 | 52.7 | 1.75 | 12.4 | 11.0 | 4.732 |

| Other | 3 | 51,657,500 | 5.9 | 70.1 | 63.8 | 1.34 | 8.7 | 8.2 | 4.476 |

| Data Center | 2 | 47,400,000 | 5.4 | 70.6 | 64.7 | 1.33 | 8.6 | 8.1 | 4.494 |

| Leased Fee | 1 | 4,257,500 | 0.5 | 64.5 | 54.7 | 1.53 | 9.2 | 9.1 | 4.270 |

| Self Storage | 5 | 36,733,924 | 4.2 | 69.6 | 56.5 | 1.62 | 10.2 | 9.9 | 4.561 |

| Self Storage | 5 | 36,733,924 | 4.2 | 69.6 | 56.5 | 1.62 | 10.2 | 9.9 | 4.561 |

| Manufactured Housing Community | 6 | 25,070,500 | 2.9 | 62.2 | 50.7 | 1.96 | 13.1 | 12.2 | 4.659 |

| Manufactured Housing Community | 6 | 25,070,500 | 2.9 | 62.2 | 50.7 | 1.96 | 13.1 | 12.2 | 4.659 |

| Industrial | 5 | 8,000,000 | 0.9 | 70.7 | 64.6 | 1.63 | 10.5 | 9.8 | 4.394 |

| Warehouse | 5 | 8,000,000 | 0.9 | 70.7 | 64.6 | 1.63 | 10.5 | 9.8 | 4.394 |

| Mixed Use | 1 | 6,841,061 | 0.8 | 71.3 | 57.8 | 1.39 | 9.4 | 8.5 | 4.550 |

| Retail/Office | 1 | 6,841,061 | 0.8 | 71.3 | 57.8 | 1.39 | 9.4 | 8.5 | 4.550 |

| Total/Weighted Average | 73 | $875,766,284 | 100.0% | 62.0% | 55.0% | 1.91x | 11.3% | 10.4% | 4.411% |

| | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the St. Johns Town Center mortgage loan, the Colorado Mills mortgage loan and the AMCP Portfolio mortgage loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan (unless otherwise stated) in total debt but, with respect to the St. Johns Town Center mortgage loan, do not include the related non-trust subordinate companion loan (unless otherwise stated). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

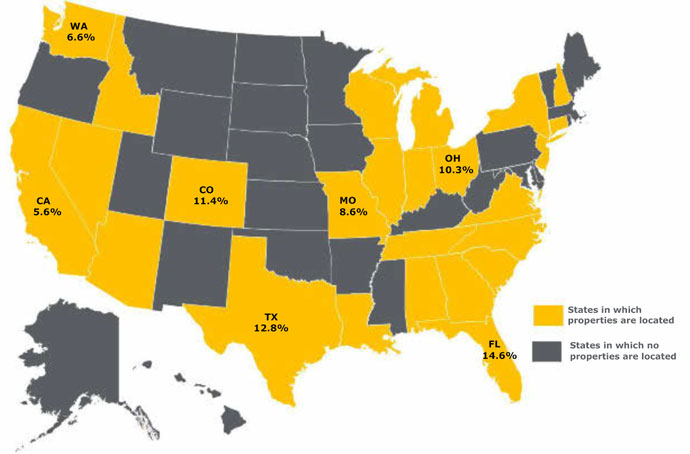

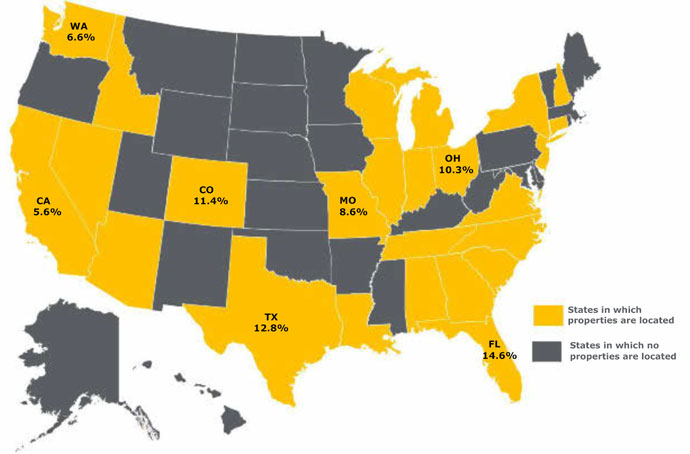

G. Geographic Distribution(1)(2)

| | Location(3) | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off Date Pool Balance | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted

Average U/W

NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| | Florida | 3 | $127,650,000 | 14.6% | 37.2% | 36.4% | 3.27x | 13.8% | 13.3% | 3.901% |

| | Texas | 13 | 111,742,561 | 12.8 | 67.9 | 56.9 | 1.57 | 10.2 | 9.6 | 4.547 |

| | Colorado | 1 | 100,000,000 | 11.4 | 63.3 | 55.1 | 1.91 | 12.0 | 11.3 | 4.282 |

| | Ohio | 6 | 90,393,210 | 10.3 | 72.6 | 64.6 | 1.50 | 9.8 | 9.2 | 4.594 |

| | Missouri | 2 | 75,315,156 | 8.6 | 65.7 | 64.2 | 2.04 | 10.0 | 9.1 | 4.330 |

| | Washington | 4 | 57,629,549 | 6.6 | 53.6 | 45.6 | 1.79 | 13.8 | 10.9 | 4.512 |

| | California | 3 | 49,116,215 | 5.6 | 70.0 | 63.0 | 1.34 | 8.5 | 8.2 | 4.483 |

| | Northern | 2 | 45,441,061 | 5.2 | 70.4 | 63.8 | 1.34 | 8.5 | 8.2 | 4.482 |

| | Southern | 1 | 3,675,154 | 0.4 | 65.7 | 53.2 | 1.33 | 8.6 | 8.1 | 4.500 |

| | Other States(4) | 41 | 263,919,593 | 30.1 | 66.7 | 57.8 | 1.63 | 11.0 | 10.1 | 4.573 |

| | Total/Weighted Average | 73 | $875,766,284 | 100.0% | 62.0% | 55.0% | 1.91x | 11.3% | 10.4% | 4.411% |

(1) | The mortgaged properties are located in 25 states and the District of Columbia. |

(2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the St. Johns Town Center mortgage loan, the Colorado Mills mortgage loan and the AMCP Portfolio mortgage loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan in total debt but, with respect to the St. Johns Town Center mortgage loan, do not include the related non-trust subordinate companion loan (unless otherwise stated). |

(3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

(4) | Includes 18 other states and the District of Columbia. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 1,498,241 - 2,000,000 | 2 | $3,495,607 | 0.4% |

| 2,000,001 - 3,000,000 | 3 | 7,134,255 | 0.8 |

| 3,000,001 - 4,000,000 | 6 | 20,952,154 | 2.4 |

| 4,000,001 - 5,000,000 | 11 | 48,522,730 | 5.5 |

| 5,000,001 - 6,000,000 | 4 | 22,013,647 | 2.5 |

| 6,000,001 - 7,000,000 | 2 | 13,091,061 | 1.5 |

| 7,000,001 - 8,000,000 | 3 | 23,672,861 | 2.7 |

| 8,000,001 - 9,000,000 | 2 | 17,733,388 | 2.0 |

| 9,000,001 - 10,000,000 | 3 | 28,137,907 | 3.2 |

| 10,000,001 - 15,000,000 | 6 | 71,994,962 | 8.2 |

| 15,000,001 - 20,000,000 | 7 | 124,760,329 | 14.2 |

| 20,000,001 - 30,000,000 | 3 | 77,100,000 | 8.8 |

| 30,000,001 - 50,000,000 | 4 | 149,557,384 | 17.1 |

| 50,000,001 - 90,000,000 | 1 | 67,600,000 | 7.7 |

| 90,000,001 - 100,000,000 | 2 | 200,000,000 | 22.8 |

| Total | 59 | $875,766,284 | 100% |

| Average | $14,843,496 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI DSCRs (x) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 1.21 - 1.30 | 1 | $12,200,000 | 1.4% |

| 1.31 - 1.40 | 8 | 151,126,045 | 17.3 |

| 1.41 - 1.50 | 6 | 34,448,395 | 3.9 |

| 1.51 - 1.60 | 9 | 72,905,381 | 8.3 |

| 1.61 - 1.70 | 9 | 127,489,424 | 14.6 |

| 1.71 - 1.80 | 5 | 33,788,537 | 3.9 |

| 1.81 - 1.90 | 5 | 40,120,363 | 4.6 |

| 1.91 - 2.00 | 3 | 30,293,147 | 3.5 |

| 2.01 - 2.25 | 6 | 142,804,378 | 16.3 |

| 2.26 - 2.75 | 3 | 114,144,275 | 13.0 |

| 2.76 – 3.00 | 1 | 4,194,667 | 0.5 |

| 3.01 – 3.50 | 1 | 7,957,705 | 0.9 |

| 3.51 – 3.97 | 2 | 104,293,968 | 11.9 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 2.06x | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF DSCRs (x) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 1.24 - 1.30 | 3 | $37,833,388 | 4.3% |

| 1.31 - 1.40 | 14 | 196,176,933 | 22.4 |

| 1.41 - 1.50 | 8 | 97,012,000 | 11.1 |

| 1.51 - 1.60 | 7 | 36,878,156 | 4.2 |

| 1.61 - 1.70 | 12 | 123,334,458 | 14.1 |

| 1.71 - 1.80 | 2 | 10,286,356 | 1.2 |

| 1.81 - 1.90 | 2 | 47,000,000 | 5.4 |

| 1.91 - 2.00 | 2 | 116,475,328 | 13.3 |

| 2.01 - 2.25 | 5 | 94,323,325 | 10.8 |

| 2.26 - 2.50 | 1 | 4,194,667 | 0.5 |

| 2.51 - 3.50 | 2 | 12,251,674 | 1.4 |

| 3.51 - 3.81 | 1 | 100,000,000 | 11.4 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 1.91x | | |

| LOAN PURPOSE |

| Loan Purpose | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| Refinance | 40 | $674,122,201 | 77.0% |

| Acquisition | 19 | 201,644,083 | 23.0 |

| Total: | 59 | $875,766,284 | 100.0% |

| MORTGAGE RATE |

Range of Mortgage Rates (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 3.791 - 4.000 | 2 | $116,475,328 | 13.3% |

| 4.001 - 4.250 | 5 | 64,601,674 | 7.4 |

| 4.251 - 4.500 | 16 | 345,613,814 | 39.5 |

| 4.501 - 4.750 | 25 | 242,658,035 | 27.7 |

| 4.751 - 5.000 | 7 | 85,194,193 | 9.7 |

| 5.001 - 5.250 | 3 | 9,023,241 | 1.0 |

| 5.251 - 5.310 | 1 | 12,200,000 | 1.4 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 4.411% | | |

| | | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI Debt Yields (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 7.8 - 8.9 | 14 | $203,242,812 | 23.2% |

| 9.0 - 9.9 | 12 | 174,562,009 | 19.9 |

| 10.0 - 10.9 | 13 | 117,476,924 | 13.4 |

| 11.0 - 11.9 | 8 | 73,289,547 | 8.4 |

| 12.0 - 12.9 | 3 | 121,475,328 | 13.9 |

| 13.0 - 13.9 | 1 | 4,150,000 | 0.5 |

| 14.0 - 14.9 | 3 | 23,123,325 | 2.6 |

| 15.0 - 16.9 | 2 | 142,000,000 | 16.2 |

| 17.0 - 17.9 | 1 | 4,194,667 | 0.5 |

| 18.0 - 25.7 | 2 | 12,251,674 | 1.4 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 11.3% | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF Debt Yields (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 7.5 - 7.9 | 3 | $50,237,907 | 5.7% |

| 8.0 - 8.9 | 18 | 243,124,172 | 27.8 |

| 9.0 - 9.9 | 15 | 180,472,685 | 20.6 |

| 10.0 - 10.9 | 12 | 98,886,525 | 11.3 |

| 11.0 - 11.9 | 4 | 163,475,328 | 18.7 |

| 12.0 - 12.9 | 1 | 16,479,050 | 1.9 |

| 13.0 - 13.9 | 2 | 6,644,275 | 0.8 |

| 14.0 - 25.1 | 4 | 116,446,341 | 13.3 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 10.4% | | |

| (1) | The information in this “Characteristics of the Mortgage Pool” section has been calculated in accordance with the methodologies specified in footnote (1) to the table captioned “Credit Statistics” under the “Transaction Highlights” section above. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| WFRBS Commercial Mortgage Trust 2014-C25 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Range of Original Terms to Maturity (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 60 | 4 | $44,400,328 | 5.1% |

| 84 | 3 | 37,450,000 | 4.3 |

| 120 | 52 | 793,915,956 | 90.7 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 115 months | |

| REMAINING TERM TO MATURITY |

| Range of Remaining Terms to Maturity (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 59 - 60 | 4 | $44,400,328 | 5.1% |

| 61 - 84 | 3 | 37,450,000 | 4.3 |

| 85 - 120 | 52 | 793,915,956 | 90.7 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 114 months | |

ORIGINAL AMORTIZATION TERM(2) |

Range of Original Amortization Terms (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off

Date Pool

Balance |

| Non-Amortizing | 4 | $179,950,000 | 20.5% |

| 240 | 1 | 7,957,705 | 0.9 |

| 241 - 300 | 2 | 12,708,388 | 1.5 |

| 301 - 360 | 52 | 675,150,192 | 77.1 |

| Total: | 59 | $875,766,284 | 100.0% |

Weighted Average(3): | 358 months | |

(2) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (3) Excludes the non-amortizing loans. |

REMAINING AMORTIZATION TERM(4) |

Range of Remaining Amortization Terms (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off

Date Pool

Balance |

| Non-Amortizing | 4 | $179,950,000 | 20.5% |

| 238 | 1 | 7,957,705 | 0.9 |

| 241 - 300 | 2 | 12,708,388 | 1.5 |

| 301 - 360 | 52 | 675,150,192 | 77.1 |

| Total: | 59 | $875,766,284 | 100.0% |

Weighted Average(5): | 357 months | |

(4) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (5) Excludes the non-amortizing loans. |

| Type of Lockbox | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off

Date Pool Balance |

| Springing (W/Out Estab Account) | 31 | $307,516,207 | 35.1% |

| Hard/Springing Cash Management | 13 | 287,530,793 | 32.8 |

| Hard/Upfront Cash Management | 4 | 118,550,000 | 13.5 |

| Soft/Upfront Cash Management | 2 | 76,457,384 | 8.7 |

| Soft/Springing Cash Management | 4 | 57,673,871 | 6.6 |

| None | 4 | 22,744,884 | 2.6 |

| Springing (With Estab. Account) | 1 | 5,293,147 | 0.6 |

| Total: | 59 | $875,766,284 | 100.0% |

PREPAYMENT PROVISION SUMMARY

| Prepayment Provision | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| Lockout/Defeasance/Open | 54 | $847,901,038 | 96.8% |

| Lockout/GRTR 1% or YM%/Open | 5 | 27,865,246 | 3.2 |

| Total: | 59 | $875,766,284 | 100.0% |

| CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off Date LTV Ratios (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 26.8 - 40.0 | 2 | $107,957,705 | 12.3% |

| 40.1 - 45.0 | 1 | 4,293,968 | 0.5 |

| 45.1 - 50.0 | 2 | 8,738,943 | 1.0 |

| 50.1 - 55.0 | 2 | 45,600,000 | 5.2 |

| 55.1 - 60.0 | 7 | 60,903,811 | 7.0 |

| 60.1 - 65.0 | 9 | 208,097,226 | 23.8 |

| 65.1 - 70.0 | 13 | 148,080,707 | 16.9 |

| 70.1 - 75.0 | 20 | 267,915,717 | 30.6 |

| 75.1 - 75.9 | 3 | 24,178,207 | 2.8 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 62.0% | | |

| BALLOON OR ARD LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 17.7 - 35.0 | 2 | $107,957,705 | 12.3% |

| 35.1 - 45.0 | 3 | 13,032,911 | 1.5 |

| 45.1 - 50.0 | 5 | 63,078,484 | 7.2 |

| 50.1 - 55.0 | 13 | 94,928,351 | 10.8 |

| 55.1 - 60.0 | 10 | 215,624,359 | 24.6 |

| 60.1 - 65.0 | 16 | 249,582,475 | 28.5 |

| 65.1 - 70.0 | 8 | 103,912,000 | 11.9 |

| 70.1 - 71.9 | 2 | 27,650,000 | 3.2 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 55.0% | | |

| AMORTIZATION TYPE |

| Type of Amortization | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| Interest-only, Amortizing Balloon | 26 | $447,367,000 | 51.1% |

| Amortizing Balloon | 28 | 240,449,284 | 27.5 |

| Interest-only, Balloon | 4 | 179,950,000 | 20.5 |

| Interest-only, Amortizing ARD | 1 | 8,000,000 | 0.9 |

| Total: | 59 | $875,766,284 | 100.0% |

| ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Term (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 12 | 1 | $2,100,000 | 0.2% |

| 13 - 24 | 5 | 29,407,500 | 3.4 |

| 25 - 36 | 13 | 296,122,500 | 33.8 |

| 37 - 48 | 2 | 27,650,000 | 3.2 |

| 49 - 60 | 5 | 61,487,000 | 7.0 |

| 61 - 66 | 1 | 38,600,000 | 4.4 |

| Total: | 27 | $455,367,000 | 52.0% |

| Weighted Average: | 41 months | | |

| SEASONING |

| Seasoning (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance ($) | % of Cut-off Date Pool Balance |

| 0 | 11 | $118,050,000 | 13.5% |

| 1 - 3 | 48 | 757,716,284 | 86.5 |

| Total: | 59 | $875,766,284 | 100.0% |

| Weighted Average: | 1 month | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

WFRBS Commercial Mortgage Trust 2014-C25 | Certain Terms and Conditions |

V. Certain Terms and Conditions