UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

_______________________________________

|

| | |

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | o |

Check the appropriate box: |

| | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

|

|

| EndoChoice Holdings, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

| | | |

| x | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | Title of each class of securities to which transaction applies: |

| | | | |

| | | (2) | Aggregate number of securities to which transaction applies: |

| | | | |

| | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | (4) | Proposed maximum aggregate value of transaction: |

| | | | |

| | | (5) | Total fee paid: |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | Amount Previously Paid: |

|

| | | |

| | | | |

| | | (2) | Form, Schedule or Registration Statement No.: |

| | | | |

| | | (3) | Filing Party: |

| | | | |

| | | (4) | Date Filed: |

| | | | |

EndoChoice Holdings, Inc.

11405 Old Roswell Road

Alpharetta, Georgia 30009

Notice of 2016 Annual Meeting of Stockholders

|

| | |

| Date and Time: | | April 29, 2016 at 8:00 a.m local time

|

| Place: | | EndoChoice Holdings, Inc. 11405 Old Roswell Road Alpharetta, Georgia 30009

|

| Record Date: | | March 16, 2016

|

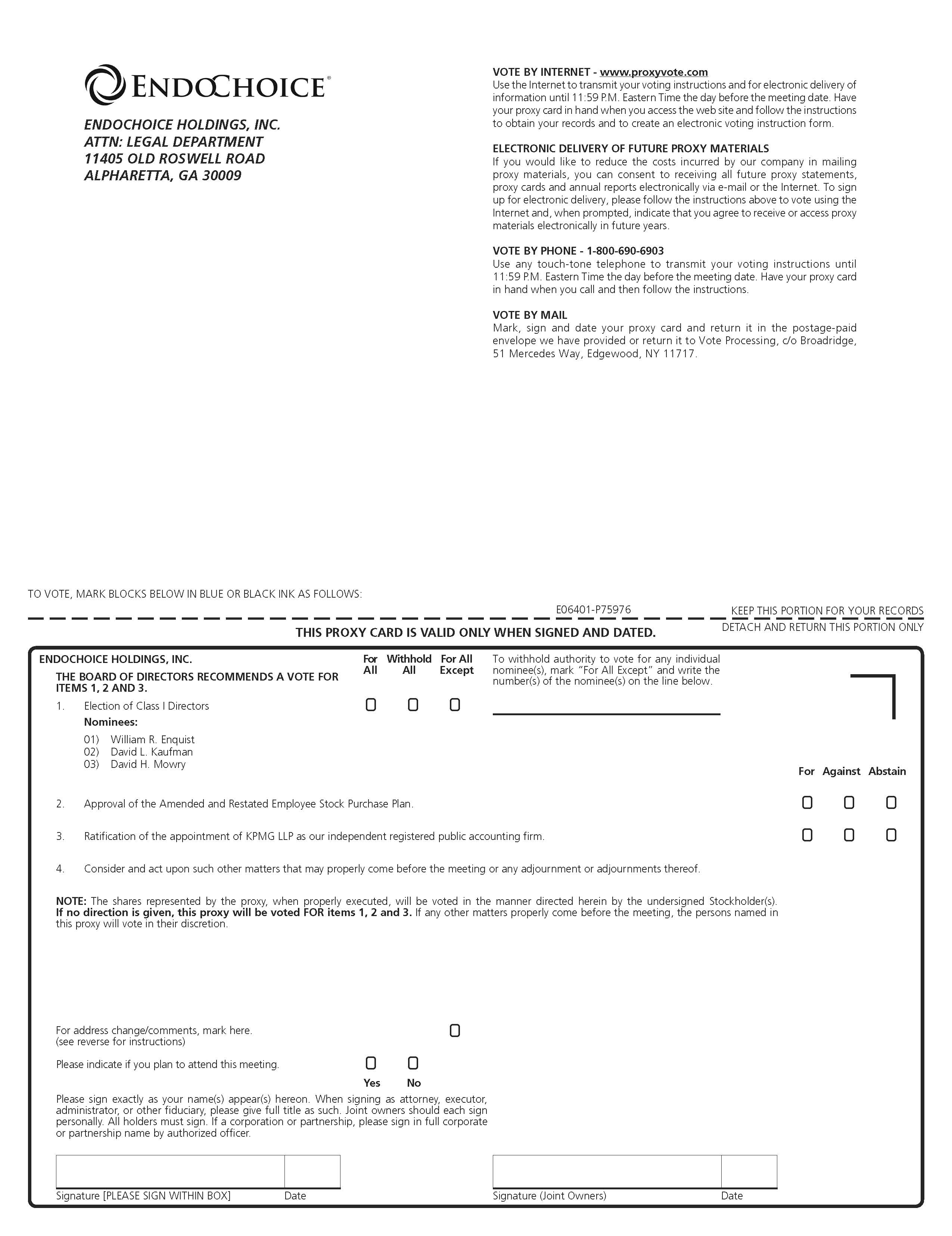

| Items of Business: | | (1) Election of three Class I directors with terms expiring at the 2019 annual meeting; (2) Approval of the Amended and Restated Employee Stock Purchase Plan; (3) Ratification of the appointment of our independent registered public accounting firm; and (4) Consider and act upon any other business properly brought before the meeting or any adjournments or postponements of the meeting. |

Dear Stockholder:

You are cordially invited to attend the 2016 Annual Meeting of the Stockholders of EndoChoice Holdings, Inc. Details regarding the business items of the meeting are described in the accompanying Proxy Statement.

We are mailing our proxy materials to you on or about March 29, 2016. Stockholders of record at the close of business on March 16, 2016 will be entitled to vote at our 2016 Annual Meeting or any adjournments or postponements of the meeting. You have a choice of voting in person, over the Internet, by telephone, or by executing and returning your proxy card. In order to ensure a quorum, please vote over the Internet or by telephone, or return your proxy card, whether or not you plan to attend the meeting.

By order of the Board of Directors,

/s/ James B. Young, Jr.

James B. Young, Jr.

General Counsel and Corporate Secretary

March 29, 2016

The Company's 2016 Proxy Statement and 2015 Annual Report

are available on the following website: www.proxyvote.com

EndoChoice Holdings, Inc.

Proxy Statement

Table of Contents

Proxy Summary

Summary of Proposals

PROPOSAL 1 - ELECTION OF DIRECTORS (see page 10)

We are seeking election of three Class I directors whose terms will expire at the 2019 Annual Meeting. The following table provides summary information about each of our Class I director nominees. For more complete information about each of the director nominees, see page 11.

|

| | | | | | | | | | |

| Name | | Age | | Director Since | | Primary Occupation | | Committee Service | | Number of Other Public Company Boards |

| | | | | | | | | | | |

| William R. Enquist | | 59 | | Sept. 2015 | | Former President of Global Endoscopy, Stryker Corporation | | Compensation & Governance and Compliance Committees | | 1 |

| David L. Kaufman | | 60 | | Jan. 2013 | | Senior Managing Director, Envest Holdings, LLC | | Audit Committee | | — |

| David H. Mowry | | 53 | | Sept. 2015 | | Executive Vice President & Chief Operating Officer, Wright Medical Group, N.V. | | Compensation & Governance and Compliance Committees | | — |

| | | | | | | | | | | |

PROPOSAL 2 - APPROVAL OF AMENDED AND RESTATED EMPLOYEE STOCK PURCHASE PLAN (see page 19)

We are seeking approval of our amended and restated Employee Stock Purchase Plan, or the Amended and Restated ESPP, for the sole purpose of increasing the number of shares of our common stock reserved for issuance under the Amended and Restated ESPP by 343,934 shares. We believe our success is tied to our ability to attract and retain high caliber personnel and the Amended and Restated ESPP is designed to more closely align the interests of our employees with those of our stockholders by encouraging investment in our common stock, thus allowing our employees to share in the Company's success through the appreciation in the value of the stock purchased through this plan. The Amended and Restated ESPP will be an important employee retention and recruitment vehicle.

Some of the key provisions of the Amended and Restated ESPP are:

| |

| • | Broad-based plan currently offered to eligible employees in U.S. and Israel |

| |

| • | Qualifies under Internal Revenue Code (the Code) Section 423 (Section 423) and is compliant with Israel Income Tax Ordinance (New Version) 1962 (ITO) |

| |

| • | Shareholder approval is required to increase the number of shares of common stock available for purchase, to change the employees eligible to participate, or if an amendment to the plan would cause the Amended and Restated ESPP to cease being qualified under Section 423 |

| |

| • | Purchase price of shares purchased under the plan is the lower of 85% of the closing trading price on the first trading day of the purchase period or 85% of the closing trading price per share on the last trading day of each offering period |

| |

| • | Administered by the Compensation Committee, which is composed of independent non-employee directors |

If the Amended and Restated ESPP is approved, there will be a total of 470,000 shares available for purchase. Of this total, 55,508 were purchased by approximately 110 participants on December 31, 2015. There were 70,558 shares available for purchase as of date of this Proxy Statement. If stockholders do not approve the Amended and Restated ESPP, we will continue to allow purchases of our common stock in our currently approved ESPP until the shares remaining for purchase thereunder are exhausted, which we estimate will occur during the current purchase period ending on June 30, 2016.

PROPOSAL 3 - RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (see page 24)

We are seeking ratification of the appointment of KPMG LLC (KPMG) as the independent registered public accounting firm to audit our financial statements for the year ending December 31, 2016. Total fees paid to KPMG during our fiscal years ended December 31, 2015 and December 31, 2014 were $1,210,675 and $400,360, respectively. KPMG has been our independent registered public accounting firm since October 2013.

Executive Compensation Summary

The table below shows the 2015 compensation for each of our named executive officers calculated pursuant to Securities and Exchange Commission (SEC) rules. For complete information about the compensation of our named executive officers, see the Fiscal 2015 Summary Compensation Table, including the footnotes thereto, on page 30.

|

| | | | | | | | | | | | | | | | | | | | |

| Name | | Year | | Salary ($) | | Stock awards ($) | | Option awards ($) | | Nonequity incentive plan compensation ($) | | All other compensation ($) | | Total ($) |

| | | | | | | | | | | | | | | |

| Mark G. Gilreath | | 2015 | | 412,333 |

| | 2,285,672 |

| | 903,544 |

| | 92,780 |

| | 14,675 |

| | 3,709,004 |

|

| David N. Gill | | 2015 | | 308,333 |

| | 1,049,481 |

| | 345,557 |

| | 67,494 |

| | 2,426 |

| | 1,773,291 |

|

| Kevin V. Rubey | | 2015 | | 250,000 |

| | 426,608 |

| | 160,500 |

| | 32,588 |

| | 1,749 |

| | 871,445 |

|

| | | | | | | | | | | | | | | |

Governance Highlights

We are committed to good corporate governance, which promotes the long term interests of our stockholders, strengthens the accountability of our Board of Directors and our management team, and helps build trust in our Company. Highlights include:

| |

| • | Substantial majority of independent directors, including our Chairman |

| |

| • | Stock ownership guidelines for officers and directors |

| |

| • | Policy restricting hedging, short sale and pledging of Company common stock by officers and directors |

Important dates for our 2017 Annual Meeting of Stockholders

Stockholder proposals submitted for inclusion in our 2017 proxy statement pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, must be received by us no later than November 29, 2016. Notice of stockholder proposals to be raised from the floor of the 2016 Annual Meeting of Stockholders outside of Rule 14a-8 must be received by us no later than January 28, 2017.

Proxy Solicitation and Voting Information

Owners of our common stock at the close of business on the record date, March 16, 2016, may vote at our 2016 Annual Meeting, or at any adjournments or postponements of the meeting. Each owner of record on the record date is entitled to one vote for each share of common stock held. There were 26,009,146 shares of common stock issued and outstanding as of the close of business on the record date. A list of stockholders entitled to vote will be available at the 2016 Annual Meeting and during ordinary business hours ten days prior to the 2016 Annual Meeting at the Company's principal executive offices. Any stockholder of record may examine the list for any legally valid purpose.

Our Board is soliciting your proxy to vote at our 2016 Annual Meeting, and at any adjournment or postponement of the meeting. We will bear all expenses incurred in connection with the solicitation of proxies. Our directors, officers and associates may solicit proxies by mail, telephone and personal contact. They will not receive any additional compensation for these activities. We will reimburse brokers, fiduciaries and custodians for their costs in forwarding proxy materials to beneficial owners of common stock.

To conduct the business of the 2016 Annual Meeting, we must have a quorum. The presence, in person or by proxy, of stockholders holding at least a majority of the shares of our common stock outstanding will constitute a quorum. Broadridge Investor Communications Services will tabulate the votes and a representative of the Company will serve as the inspector of elections during the 2016 Annual Meeting. Abstentions, broker non-votes and votes withheld from director nominees count as shares present for the purpose of determining a quorum. A broker non-vote occurs when a broker, bank or other nominee holder does not vote on a particular item because the nominee holder does not have discretionary authority to vote on that item and has not received instructions from the beneficial owner of the shares. In the absence of voting instructions from the beneficial owner of the shares, nominee holders will not have discretionary authority to vote the shares at the 2016 Annual Meeting in the election of directors or for the approval the an amendment to our Employee Stock Purchase Plan, but will have discretionary authority to vote on the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2016. Proxies that are transmitted by nominee holders for beneficial owners will count toward a quorum and will be voted as instructed by the nominee holder.

According to our Bylaws, each of the proposed items will be determined as follows:

Election of Directors: The election of directors will be determined by a plurality of votes cast, which means the three persons receiving the greatest number of affirmative votes cast at the 2016 Annual Meeting will be elected as directors. As a result, abstentions and broker non-votes will have no effect on the outcome of the election of directors. We do not allow cumulative voting in the election of directors. A properly executed proxy marked "withhold authority" with respect to the election of one or more directors will not be voted with respect to the director nominee or director nominees indicated, although it will be counted for purposes of determining a quorum.

Approval of the Amended and Restated Employee Stock Purchase Plan, Ratification of the Independent Registered Public Accounting Firm and Other Matters: The outcome of the approval of the amendment of our Employee Stock Purchase Plan, the ratification of the appointment of our independent registered public accounting firm and all other matters submitted for a vote will be determined by a majority of votes cast affirmatively or negatively, except as may otherwise be required by law. As a result, abstentions and broker non-votes will not affect the outcome of votes on these matters.

Questions and Answers Regarding this Proxy Statement

Who is entitled to vote at the Annual Meeting?

If you owned shares of our common stock at the close of business on March 16, 2016, the record date, you may vote at the 2016 Annual Meeting. Each share is entitled to one vote on each matter presented for consideration and action at the 2016 Annual Meeting.

In order to vote, you must either designate a proxy to vote on your behalf, or attend the 2016 Annual Meeting and vote your shares in person. Even if you plan to attend the 2016 Annual Meeting in person, our board of directors (Board) requests your proxy to ensure your shares are counted towards a quorum and to ensure they are voted at the meeting.

What matters are scheduled to be presented?

Proposal 1 – The election of three Class I directors nominated and recommended by our Board with terms expiring at the 2019 Annual Meeting or until his successor is duly elected and qualified or until his earlier death, resignation or removal.

Proposal 2 – The approval of an amended and restated Employee Stock Purchase Plan requesting an increase in the number of shares available for issuance in that plan.

Proposal 3 – The ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2016.

Action may also be taken at the 2016 Annual Meeting with respect to any other business that properly comes before the meeting, and the proxy holders have the right to vote and will vote in accordance with their judgment on any additional business. As of the date of this proxy statement, we do not know of any other business to be brought before the 2016 Annual Meeting.

What is the record date and what does it mean?

The record date for the 2016 Annual Meeting is March 16, 2016. The record date was established by our Board as required by the Delaware General Corporation Law. Owners of record of shares of our common stock at the close of business on the record date are entitled to receive notice of the meeting and are entitled to vote at the meeting and at any adjournments or postponements of the meeting.

What is the difference between a stockholder of record and a stockholder who holds stock in street name?

If your shares are registered in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are a stockholder of record. If your shares are held in the name of your broker, bank, trustee or other nominee, your shares are held in street name. If you hold your shares in street name, you will have the opportunity to instruct your broker, bank, trustee or other nominee as to how to vote your shares. Street name stockholders may only vote in person if they have a legal proxy as discussed in detail below.

How do I vote as a stockholder of record?

As a stockholder of record, you may vote by one of the following four methods:

| |

| • | Internet Voting. You may use the Internet as described on the proxy card to vote your shares of our common stock by giving us a proxy. You will be able to vote your shares by the Internet and confirm that your vote has been properly recorded. Please see your proxy card for specific instructions. |

| |

| • | Telephone Voting. You may vote your shares of our common stock by giving us a proxy using the toll-free number listed on the proxy card. The procedure allows you to vote your shares and to confirm that your vote was recorded. Please see your proxy card for specific instructions. |

| |

| • | Voting By Mail. You may sign, date, and mail your proxy card in the postage-paid envelope provided. |

| |

| • | Voting In Person. You may vote in person at the meeting. |

How do I vote as a street name stockholder?

If your shares are held through a broker, bank, trustee or other nominee, you will receive a request for voting instructions with respect to your shares of our common stock from the broker, bank, trustee or other nominee. You should respond to the request for voting instructions in the manner specified by the broker, bank, trustee or other nominee. If you have questions about voting your shares, you should contact your broker, bank, trustee or other nominee.

If you hold your shares through a broker, bank, trustee or other nominee and you wish to vote in person at the meeting, you will need to bring a legal proxy to the meeting. You must request a legal proxy through your broker, bank, trustee or other nominee. Please note that if you request a legal proxy, any proxy with respect to your shares of our common stock previously executed by your broker, bank, trustee, or other nominee will be revoked and your vote will not be counted unless you appear at the meeting and vote in person or legally appoint another proxy to vote on your behalf.

What if I sign and return my proxy, but do not provide voting instructions?

If you return your signed proxy card but do not mark the boxes showing how you wish to vote, your shares will be voted FOR the election of each of the Class I director nominees named in this Proxy Statement, FOR the approval of the amendment and restatement of our Employee Stock Purchase Plan and FOR the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2016.

How do I revoke or change my vote?

If you have returned a proxy via mail, telephone or Internet, you may revoke your proxy at any time before it is voted at the 2016 Annual Meeting by notifying the General Counsel at the Company's headquarters office, by sending another proxy dated later than your prior proxy either by Internet, telephone or mail, or by attending the 2016 Annual Meeting and voting in person by ballot or by proxy.

What if I receive more than one Proxy Card?

If your shares are registered separately or are in more than one account, you may receive more than one Proxy Card the Company or a broker, bank, trustee or other nominee account with respect to your shares held in street name. Please carefully follow the instructions on each Proxy Card you receive and return all of the requests for voting instructions to ensure that all your shares are voted.

How can I find out the results of the voting at the 2016 Annual Meeting?

Preliminary voting results will be announced at the meeting, In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file the Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What are the implications of being an "emerging growth company?"

We are an "emerging growth company," as defined in Section 101(a)(19)(C) of the Jumpstart Our Business Startups Act, also known as the JOBS Act. As an emerging growth company, under SEC rules, we are not required to include a Compensation Discussion and Analysis section in this Proxy Statement, are subject to reduced compensation disclosure requirements, and are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more that $1 billion in non-convertible debt during the prior three-year period.

Questions and Answers Regarding the Governance of the Company

We take seriously our responsibility to represent the interests of stockholders, and we are committed to good corporate governance. We have adopted a number of policies and processes to ensure our effective governance. The following questions and answers relate to the governance of the Company.

How do I contact the Board of Directors?

Stockholders and other interested parties may communicate directly with any member of the Board and may communicate directly with members of the Audit Committee by writing to the Board or Audit Committee in care of the General Counsel at EndoChoice Holdings, Inc., 11405 Old Roswell Road, Alpharetta, Georgia 30009. In addition, stockholders and other interested parties may email the Board or Audit Committee as outlined on the Company’s website (www.endochoice.com) under Investors, then Corporate Governance. In either instance, communications, other than solicitations or general advertising, will be forwarded promptly.

Where can I see the Company’s corporate documents and SEC filings?

The following governance documents are available on the Company’s website (www.endochoice.com) under Investors, then Corporate Governance.

| |

| • | Certificate of Incorporation |

| |

| • | Corporate Governance Guidelines |

| |

| • | Charters of the Audit, the Compensation and the Governance and Compliance Committees |

| |

| • | Code of Conduct and Ethics, Code of Conduct and Ethics for Members of the Board of Directors, and Code of Ethics for Senior Executive and Financial Officers |

Any interested party may receive printed copies of these documents by requesting them in writing. Such request should be directed to the General Counsel, EndoChoice Holdings, Inc., 11405 Old Roswell Road, Alpharetta, Georgia 30009. Our SEC filings, including Section 16 filings, are available on the Company’s website under Investors, then SEC Filings.

Information on or connected to our website is not, and should not, be considered part of this Proxy Statement.

How do we nominate directors?

The Governance and Compliance Committee, comprised solely of independent directors, is responsible for identifying, reviewing each individual’s qualifications and recommending a slate of director nominees to the Board for its consideration for further recommendation to the stockholders. In addition, the Governance and Compliance Committee is responsible for recommending to the Board nominees for appointment to fill a new Board seat or any Board vacancy. To fulfill these responsibilities, the Governance and Compliance Committee annually assesses the requirements of the Board and makes recommendations to the Board regarding its size, composition, and structure. In determining whether to nominate an incumbent director for reelection, the Governance and Compliance Committee evaluates each incumbent director's continued service in light of the current assessment of the Board's requirements, taking into account factors such as evaluations of the incumbent's performance.

When the need to fill a new Board seat or vacancy arises, the Governance and Compliance Committee proceeds by whatever means it deems appropriate to identify a qualified candidate or candidates, which may include engaging an outside search firm. The Governance and Compliance Committee reviews the qualifications of each potential candidate, which may include, but are not limited to, the candidate's integrity, character, independent judgment, breadth of experience, insight, knowledge and business acumen. Leadership skills and executive experience, expertise in medical technology or devices, medical knowledge, familiarity with issues affecting global businesses, financial and accounting knowledge, prior experience in the Company’s core markets, expertise in capital markets, strategic planning and marketing expertise, among others, may also be among the relevant selection criteria. The Governance and Compliance Committee strives to recommend candidates

that will maintain a Board that reflects a diversity of experience and personal backgrounds. The selection criteria may vary over time depending on the needs of the Board.

Final candidates are generally interviewed by one or more Governance and Compliance Committee members. The Governance and Compliance Committee makes a recommendation to the Board based on its review, the results of interviews with the candidates, and all other available information. The Board makes the final decision on whether to invite a candidate to join the Board based on the totality of the merits of each candidate and not based upon any minimum qualifications or attributes. The Board approved invitation is extended by the Chairman of the Board.

Director Recommendations by Stockholders. The Governance and Compliance Committee will consider recommendations for director nominees from stockholders made in writing and addressed to the attention of the Chairman of the Governance and Compliance Committee, care of the General Counsel/Director Candidate Recommendation, EndoChoice Holdings, Inc., 11405 Old Roswell Road, Alpharetta, Georgia 30009. The Governance and Compliance Committee will consider and evaluate such recommended candidates in the same manner as those from other sources. Stockholders making recommendations for director nominees to the Governance and Compliance Committee should provide the same information required for nominations by stockholders at an annual meeting, as explained below.

How can a stockholder nominate someone for election as a Director?

Our Governance and Compliance Committee recommends potential candidates for nomination as director based on a number of criteria, including the needs outlined by the Board. Any stockholder who would like the Governance and Compliance Committee to consider a candidate for Board membership should send a letter of recommendation setting forth:

As to each person whom a stockholder proposes to nominate for election or re-election as a director of the Company:

| |

| • | the name, age, business address and residence address of the person, |

| |

| • | the principal occupation or employment of the person, |

| |

| • | the class or series and number of shares of capital stock of the Company which are directly or indirectly owned beneficially or of record by the person, |

| |

| • | the date such shares were acquired and the investment intent of such acquisition and |

| |

| • | any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitation of proxies or consents for a contested election of directors (even if an election contest or proxy solicitation is not involved), or is otherwise required, pursuant to Section 14 of the Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder (including such person’s written consent to being named in the proxy statement as a nominee, if applicable, and to serving if elected); and |

As to a stockholder giving the notice:

| |

| • | the name and address of such stockholder, as they appear on the Company’s books, the residence name and address (if different from the Company’s books) of such proposing stockholder, and the name and address of any stockholder associated person (as defined in the Company’s bylaws), |

| |

| • | the class and number of shares of stock of the Company which are directly or indirectly held of record or beneficially owned by such stockholder or by any stockholder associated person with respect to the Company’s securities, a description of any derivative positions (as defined in the Company’s bylaws) directly or indirectly held or beneficially held by the stockholder or any stockholder associated person, and whether and the extent to which a hedging transaction (as defined in the Company’s bylaws) has been entered into by or on behalf of such stockholder or any stockholder associated person, |

| |

| • | a description of all arrangements or understandings (including financial transactions and direct or indirect compensation) between such stockholder or any stockholder associated person and each proposed nominee and any other person or entity (including their names) pursuant to which the nomination(s) is/are to be made by such stockholder, |

| |

| • | a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice, |

| |

| • | any other information relating to such stockholder or any stockholder associated person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitation of proxies or consents for a contested election of directors (even if an election contest or proxy solicitation is not involved), or otherwise required, pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder, and |

| |

| • | a representation as to whether such stockholder or any stockholder associated person intends to deliver a proxy statement or form of proxy to the holders of a sufficient number of the Company’s outstanding shares to elect each proposed nominee or otherwise to solicit proxies from stockholders in support of the nomination. |

The information outlined above should be sent to the General Counsel, EndoChoice Holdings, Inc., 11405 Old Roswell Road, Alpharetta, Georgia 30009. To allow for timely consideration, recommendations must be received not less than 90 days and not more than 120 days prior to the first anniversary of the date of our most recent annual meeting, which will take place on April 29, 2016. The Company may request additional information regarding any proposed candidates as may be deemed appropriate. In addition, any stockholder of record entitled to vote for the election of directors may nominate persons for election to our Board if that stockholder complies with the notice procedures set forth under the caption "What are the requirements for submitting a Stockholder Proposal at next year's Annual Meeting?"

What are the requirements for submitting a Stockholder Proposal at next year’s Annual Meeting?

If you wish to have a stockholder proposal included in the Company's proxy soliciting materials for the 2017 Annual Meeting of Stockholders, you must submit the proposal by our deadline, which is 120 days prior to the first anniversary of the mailing of this Proxy Statement, or November 29, 2016. For any other business to be properly brought before the 2017 Annual Meeting by a stockholder, notice in writing must be delivered to the Company in accordance with the Company's Bylaws not less than 90 days nor more than 120 days prior to the first anniversary of the 2016 Annual Meeting, or between December 28, 2016 and January 28, 2017. Any stockholder proposals should be addressed to our General Counsel, EndoChoice Holdings, Inc. 11405 Old Roswell Road, Alpharetta, Georgia 30009. All such proposals should be sent by certified mail, return receipt requested.

What is the leadership structure of our Board of Directors?

Our Board is led by a non-executive Chairman that is chosen by the Board from its members. According to our Corporate Governance Guidelines, the Chief Executive Officer may not serve as Chairman. The Corporate Governance Guidelines calls for the Board to periodically review its leadership structure to ensure it is continuing to meet the Company’s needs and may in the future determine that the Chief Executive Officer of the Company may serve as Chairman of the Board.

How does the Board manage risk?

One of the key functions of our Board is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Governance and Compliance Committee monitors compliance with legal and regulatory requirements and the effectiveness of our corporate governance practices, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Governance and Compliance Committee is also responsible for overseeing our risk management efforts generally, including the allocation of risk management functions among our Board and its committees. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Audit Committee periodically reviews the general process for the oversight of risk management by our Board.

Proposal 1 – Election of Directors

The Board has nominated each of William R. Enquist, David L. Kaufman and David H. Mowry for election to our Board at this Annual Meeting to serve as Class I directors with a new term expiring at the 2019 Annual Meeting or until his successor is duly elected and qualified or until his earlier death, resignation or removal. As previously announced on September 9, 2015, Dr. Uri Geiger and Mr. Rurik G. Vandevenne, the other Class I directors, will not stand for re-election at this Annual Meeting.

The persons named as proxies in the accompanying proxy card, or their substitutes, will vote for the election of the Board’s nominees, except to the extent authority to vote for any or all of the nominees is withheld. No proposed nominee is being elected pursuant to any arrangement or understanding between the nominee and any other person or persons. All nominees have consented to stand for election at this meeting. If any of the nominees become unable or unwilling to serve, the persons named as proxies in the accompanying proxy card, or their substitutes, shall have full discretion and authority to vote or refrain from voting for any substituted nominees in accordance with their judgment.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

EACH OF THE CLASS I DIRECTOR NOMINEES

Board of Directors

The members of our Board are divided into three classes serving staggered three-year terms. Directors for each class are elected at the annual meeting of stockholders for the year in which the term for their class expires. Our Bylaws provide that the number of directors constituting the Board shall be fixed from time to time by resolution of a majority of the directors then in office. On September 9, 2015, the Board increased the size of the Board to ten until the 2016 Annual Meeting, at which time the size of the Board will automatically be decreased to eight following the departure of Dr. Uri Geiger and Mr. Rurik G. Vandevenne. The current term of the Class I directors expires this year, and their successors are to be elected at 2016 Annual Meeting for a three-year term expiring at the annual meeting of stockholders to be held in 2019 or until each of their successors is duly elected and qualified or until their earlier death, resignation or removal. The terms of the Class II and Class III directors do not expire until the annual meeting of stockholders to be held in 2017 and 2018, respectively.

The Board has reviewed the independence of its members and determined that all of its current members, except Mr. Gilreath, have no material relationship with us, and are therefore independent based on the listing standards of the New York Stock Exchange, or NYSE, and the categorical standards set forth in our Corporate Governance Guidelines (available on our website (www.endochoice.com) under Investors, then Corporate Governance).

The following is a list of individuals who will comprise our Board as of the 2016 Annual Meeting, subject to the election of each of Messrs. Enquist, Kaufman and Mowry, and information regarding the committees of our Board on which each continuing director served as of December 31, 2015:

|

| | | | | | | | | | |

| Name | | Age | | Class | | Director Since | | Current Term Expires | | Committee(1)(2) |

| | | | | | | | | | | |

| James R. Balkcom | | 71 | | III | | Jan. 2013 | | 2018 | | A, G (Chair) |

| J. Scott Carter | | 46 | | II | | Sept. 2012 | | 2017 | | C, G |

| D. Scott Davis | | 64 | | II | | Dec. 2013 | | 2017 | | A (Chair) |

| William R. Enquist | | 59 | | I | | Sept. 2015 | | 2016 | | C, G |

| Mark G. Gilreath | | 49 | | III | | Sept. 2012 | | 2018 | | — |

| R. Scott Huennekens(3) | | 51 | | III | | Apr. 2013 | | 2018 | | C (Chair), G |

| David L. Kaufman | | 60 | | I | | Jan. 2013 | | 2016 | | A |

| David H. Mowry | | 53 | | I | | Sept. 2015 | | 2016 | | C, G |

| | | | | | | | | | | |

|

| |

| (1) | A=Audit Committee; C=Compensation Committee; and G=Governance and Compliance Committee. |

| (2) | Mr. Gilreath is not a member of the Audit, Compensation or Governance and Compliance Committee; however, at their invitation, he routinely attends meetings of each such committee. |

| (3) | Mr. Huennekens is the Chairman of our Board. |

Set forth below is a brief biography of each of the nominees and each person whose term of office as a director will continue after the annual meeting. Each biography also includes certain information regarding our directors' individual experience, qualifications, attributes and skills that led the Governance and Compliance Committee and the Board to conclude they are well qualified to serve as directors.

Class I Directors – Terms Expiring at 2016 Annual Meeting

William R. Enquist formerly served as the President of Global Endoscopy for Stryker Corporation (Stryker) from 1998 until 2013 and served as an advisor to Stryker through 2014. From 1998 to 2013, Mr. Enquist led Stryker’s Global Endoscopy group to the number one market share position in the rigid endoscopic video market with global sales exceeding $1.2 billion. Mr. Enquist joined Stryker’s sales and marketing organization in 1986. He serves on the board of directors for Firefly Medical, Inc. Mr. Enquist earned a BBA from the University of San Diego and completed Harvard University's Program for Management Development.

Mr. Enquist’s more than 30 years of experience in the medical device industry provides him with the qualifications and skills to serve as a director.

David L. Kaufman has served as a director of our subsidiary, EndoChoice, Inc., since October 2009. Mr. Kaufman is a founding Member and Senior Managing Director of Envest Holdings LLC, a private equity firm, and serves as a member of the Envest II and Envest III Investment Committees. He previously served as Chairman and Chief Executive Officer of The Vacation Store, which he co-founded in 1994. Mr. Kaufman was employed with Cunard Line Ltd. from 1987 to 1994, where he started as Staff Vice President, Finance, and rose to the position of Senior Vice President, Business Groups. He started his career with IBM, serving for 7 years in various financial management positions. Mr. Kaufman is a member of the board of directors of America's Swimming Pool Co., Cannonball, CoEnvest, EdLogics, Envest Holdings, and NuScriptRx. He also serves on the board of Old Dominion University Educational Foundation and is Vice Chairman of Virginia Wesleyan College. Mr. Kaufman earned a BBA from Emory University and a MBA from the University of Michigan.

Mr. Kaufman’s experience as a senior executive officer and other senior management roles and knowledge of corporate finance provide him with valuable and relevant experience in strategic planning, corporate finance, and leadership of complex organizations and provides him with the qualifications and skills to serve as a director.

David H. Mowry has served as the Executive Vice President and Chief Operating Officer of Wright Medical Group, N.V. (Wright) since October 2015, and as an Executive Director of Wright since June 2013. He served as the President and

Chief Executive Officer of Tornier N.V. (Tornier) from February 2013 to October 2015, having joined Tornier in July 2011 as Chief Operating Officer, and being subsequently appointed Interim President and Chief Executive Officer in November 2012. Prior to joining Tornier, Mr. Mowry served as President of the Global Neurovascular Division of Covidien plc, a global provider of healthcare products, from July 2010 to July 2011. He served as Senior Vice President and President, Worldwide Neurovascular of ev3 Inc. (“ev3”), a global endovascular device company, from January 2010 to July 2010. Mr. Mowry served as Senior Vice President of Worldwide Operations of ev3, from August 2007 to January 2010. Prior to this position, Mr. Mowry was Vice President of Operations for ev3 Neurovascular from November 2006 to October 2007. Before joining ev3, Mr. Mowry served as Vice President of Operations and Logistics at the Zimmer Spine Division of Zimmer Holdings Inc., a reconstructive and spinal implants, trauma and related orthopedic surgical products company, from February 2002 to November 2006. Prior to Zimmer, he was President and Chief Operating Officer of HeartStent Corp., a medical device company. Mr. Mowry received a degree in Engineering and Mathematics from the United States Military Academy at West Point.

Mr. Mowry’s operational experience in the medical device industry, including in the areas of manufacturing, logistics, quality assurance and general management, provides him with the qualifications and skills to serve as a director.

Class II Directors – Terms to Expire at the 2017 Annual Meeting

J. Scott Carter was formerly a managing member of Sequoia Capital Operations, LLC, a venture capital firm, from June 2006 until November 2015, where he focused on services, software and healthcare investments. Prior to joining Sequoia Capital, Mr. Carter was with Summit Partners where he focused on investments in the financial services and technology sectors. Earlier, he was with J.P. Morgan and its predecessor entities and served in various staff positions with former U.S. Senator Phil Gramm. Mr. Carter received a B.A. in Political Science from Texas A&M University and a MBA from the Darden School of Business at the University of Virginia.

Mr. Carter's involvement with his respective firms' investments in many healthcare companies over the past 12 years, including investments in the medical device industry, in-depth knowledge and industry experience, coupled with his skills in corporate finance and strategic planning, provides him with the qualifications and skill to serve as a director.

D. Scott Davis formerly served as Non-Executive Chairman of United Parcel Service of North America, Inc. (UPS), one of the world’s largest publicly-traded logistics companies, from October 2014 until February 2016. Prior to serving as Non-Executive Chairman at UPS, Mr. Davis served as Chairman and Chief Executive Officer of UPS from 2008 until 2014, retiring as Chief Executive Officer in September 2014. He has held a variety of other leadership positions at UPS, including Vice Chairman and Chief Financial Officer, since joining the Company in 1986. Mr. Davis previously served on the President's Intelligence Advisory Board, which provides the President with an independent source of advice on the effectiveness with which the Intelligence Community is meeting the nation's intelligence needs, and on the President’s Export Council, the principal national advisory committee on international trade. In addition, he is a member of the Business Roundtable, serves as a trustee of the Annie E. Casey Foundation and is a member of The Carter Center Board of Councilors. At the end of 2009, he completed a term as chairman of the Federal Reserve Bank of Atlanta. Mr. Davis serves on the boards of Johnson & Johnson and Honeywell International, Inc. He earned a B.Sc. in Accounting from Portland State University.

Mr. Davis’ experience as a chief executive officer and chairman of a leading logistics company and years of experience in senior management roles provide him with valuable and relevant experience in management, strategy, and leadership of complex organizations and provide him with the qualifications and skills to serve as a director.

Class III Directors – Terms to Expire at the 2018 Annual Meeting

James R. Balkcom served as Chairman of our Board from January 2013 until February 2015. In addition to being a member of the CEO Council of Council Capital, Mr. Balkcom currently serves as Civilian Aid to the Secretary of The Army, a position he has held since 2001. Prior to that, he served as Chairman and Chief Executive Officer of Pameco Corporation, a distribution company, from 1999 to 2000. He served as Chairman and Chief Executive Officer of Techsonic Industries, a sonar imaging company, from 1976 until its sale in 1994. Mr. Balkcom is on the board of directors of State Bank Financial Corporation. He has also served on the board of directors and as Chairman at several commercial banks, distribution and high-tech companies. Mr. Balkcom received a B.Sc. in Engineering from the United States Military Academy at West Point and a MBA in Finance from Harvard Business School.

Mr. Balkcom’s experience as a chief executive officer and as chairman of industry-leading companies across different industries provides him with valuable and relevant experience in management, strategy and leadership of complex organizations and provide him with the qualifications and skills to serve as a director.

Mark G. Gilreath has served as our Chief Executive Officer since January 2013 and as our President from January 2013 until March 3, 2016. Mr. Gilreath founded our subsidiary, EndoChoice, Inc., in October 2007 and has served as its President and Chief Executive Officer since inception. Prior to founding EndoChoice, Inc., Mr. Gilreath served on the Executive Committee, as the President of the Americas and as the Chief Marketing Officer at Given Imaging from 1999 to 2008. During his tenure at Given Imaging, the company launched the PillCam® Video Capsule and was transformed from a pre-revenue startup to a Nasdaq-listed company delivering $120 million in annual revenue, all through organic growth. From 1992 to 1999, Mr. Gilreath served in commercial leadership roles for PENTAX Medical, a public company manufacturing video endoscopes for GI endoscopy. Mr. Gilreath served in the U.S. Navy in naval intelligence, from 1989 to 1992, including during Operation Desert Storm. He currently serves on the board of directors of the Metro Atlanta Chamber of Commerce and the Medical Device Manufacturers Association (MDMA). Mr. Gilreath holds a MBA from the Fuqua School of Business at Duke University and a B.Sc. in business finance from Winthrop University. .

Mr. Gilreath’s experience as a chief executive officer and senior executive of different health care companies and his service in senior management provide him with valuable and relevant experience in business development, strategic planning, and marketing in our industry and provide him with the qualifications and skills to serve as a director.

R. Scott Huennekens has served as Chairman of our Board since February 2015. Mr. Huennekens also serves as President and Chief Executive Officer of Verb Surgical, Inc., a collaboration between Alphabet Inc. (formerly Google Life Sciences) and Johnson & Johnson focused on developing a comprehensive robotic surgical solutions platform. Previously, he served as President and Chief Executive Officer of Volcano Corporation, a medical imaging company, from April 2002 to February 2015. Mr. Huennekens served as the President and Chief Executive Officer of Digirad Corporation, a medical imaging company, from May 1999 to 2002, and from June 1999 to 2002, respectively. He originally joined Digirad when it was a start-up in 1997 as Chief Operating Officer; serving as its Chief Financial Officer and Vice President of Sales and Marketing from March 1997 to April 1999. From 1993 to 1997, Mr. Huennekens worked at Baxter International, Inc., a global health care company, holding positions of increasing responsibility including serving as division Vice President of Sales and Marketing. Mr. Huennekens is a member of the board of directors of Verb Surgical, Inc. and REVA Medical, Inc. He also serves on the board of the Medical Device Manufacturers Association (MDMA), is a member of Advisory Board of Ferrer Freeman & Company, LLC and is a member of the board of Scripps Translational Science Institute. Mr. Huennekens received a B.Sc. in Business Administration from the University of Southern California and a MBA from Harvard Business School. He is a Certified Public Accountant.

Mr. Huennekens’ experience as a chief executive officer and chairman of various health care companies and his service in senior management roles provide him with valuable and relevant experience in business development, strategic planning, and operational management in our industry and provide him with the qualifications and skills to serve as a director.

Information Concerning the Board and Its Committees

Our Board met eleven times during 2015. During 2015, each director attended more than 90% of the meetings held by the Board and more than 88% of their respective committee meetings. At each quarterly Board meeting, the Board meets in executive session without management present for a portion of the meeting. The Company does not have a policy regarding director attendance at its annual meetings; however, it is expected that each continuing director will attend each annual meeting of stockholders, absent unusual circumstances.

The Board has delegated certain functions to the Audit Committee, the Compensation Committee and the Governance and Compliance Committee.

Audit Committee

Our Audit Committee currently consists of Messrs. Balkcom, Davis and Kaufman, with Mr. Davis serving as chairman. The Audit Committee held eight meetings during 2015.

Our Board has affirmatively determined that each member of the Audit Committee meets the definition of “independent director” for purposes of the rules and the independence requirements of Rule 10A-3 of the Exchange Act and each is financially literate. Our Board has also determined that Messrs. Balkcom, Davis and Kaufman each qualify as an “audit committee financial expert” under SEC rules and regulations.

Our Board adopted a written charter for the Audit Committee which is available on our website (www.endochoice.com) under Investors, then Corporate Governance. As set forth in the Charter, our Audit Committee is responsible for, among other matters:

| |

| • | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| |

| • | discussing with our independent registered public accounting firm their independence from management; |

| |

| • | reviewing with our independent registered public accounting firm the scope and results of their audit; |

| |

| • | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| |

| • | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; |

| |

| • | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal control or auditing matters; and |

| |

| • | reviewing and approving related person transactions. |

Compensation Committee

Our Compensation Committee currently consists of Messrs. Carter, Enquist, Huennekens, Mowry and Vandevenne, with Mr. Huennekens serving as chairman. The Compensation Committee held eight meetings during 2015.

Our Board has affirmatively determined that each member of the Compensation Committee meets the heightened definition of “independent director” for purposes of the NYSE rules applicable to members of the Compensation Committee, the definition of “non-employee director” for purposes of Section 16 of the Exchange Act and is an outside director under Section 162(m) of the Code.

Our Board adopted a written charter for the Compensation Committee, which is available on our website (www.endochoice.com) under Investors, then Corporate Governance. As set forth in the charter, our Compensation Committee is responsible for, among other matters:

| |

| • | annually reviewing and approving our goals and objectives for executive compensation; |

| |

| • | annually reviewing and approving for the chief executive officer and other executive officers the annual base salary level, the annual cash incentive opportunity level, the long-term incentive opportunity level, and any special or supplemental benefits or perquisites; |

| |

| • | reviewing and approving employment agreements, severance arrangements and change of control agreements for the chief executive officer and other executive officers, as appropriate; |

| |

| • | making recommendations and reports to the Board concerning matters of executive compensation; |

| |

| • | administering our executive incentive plans; |

| |

| • | reviewing compensation plans, programs and policies; and |

| |

| • | handling such other matters that are specifically delegated to the Compensation Committee by the Board from time to time. |

Governance and Compliance Committee

Our Governance and Compliance Committee currently consists of Messrs. Balkcom, Carter, Enquist, Huennekens, Mowry and Vandevenne, with Mr. Balkcom serving as chairman. The Governance and Compliance Committee met four times during 2015.

Our Board adopted a written charter for the Governance and Compliance Committee, which is available on our website (www.endochoice.com) under Investors, then Corporate Governance. The Governance and Compliance Committee is responsible for, among other matters:

| |

| • | identifying the requisite skills and characteristics to be found in individuals qualified to serve as members of the Board; |

| |

| • | conducting inquiries into the background and qualifications of possible candidates; |

| |

| • | recruiting of qualified candidates for membership on the Board; |

| |

| • | conducting meetings with potential candidates for membership on the Board; |

| |

| • | overseeing the annual review of the Board’s performance; |

| |

| • | recommending for selection by the Board, nominees to the Board and committee members for each committee of the Board; |

| |

| • | overseeing the corporate governance of the Company; |

| |

| • | overseeing the Company’s compliance programs; |

| |

| • | evaluating the performance of the committee and its charter on an annual basis; and |

| |

| • | handling such other matters that are specifically delegated to the Governance and Compliance Committee by the Board from time to time. |

Compensation Committee Interlocks and Insider Participation

The directors who served on the Compensation Committee of the Board during 2015 were Messrs. Carter, Enquist, Huennekens, Mowry and Vandevenne. None of these directors are or were officers of the Company. There were no compensation committee interlocks during 2015.

Director Compensation

Our non-employee directors are compensated as described below. Our compensation program is designed to achieve the following goals:

| |

| • | compensation should fairly pay directors for work required by a company of our size and scope; |

| |

| • | compensation should align directors' interests with the long-term interests of stockholders; and |

| |

| • | the structure of the compensation should be simple, transparent and easy for stockholders and directors to understand. |

Mr. Gilreath, as an employee, receives no additional compensation for service as a member of the Board.

2015 Director Fees

The compensation we pay our non-employee directors for their service on our Board and its committees is reviewed periodically using market-based information presented by Willis Towers Watson, the independent compensation consultant to our Compensation Committee. In addition to an annual cash retainers for serving on our Board, on our committees and as chairman of our Board or any of its committees, as may be applicable, each non-employee director receives an annual equity award and is reimbursed for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including without limitation travel expenses in connection with their attendance in-person at Board and committee meetings.

In 2014, the Board set the annual cash retainer at $40,000 for the chairman and at $20,000 for our other non-employee directors. In April 2015, the Board approved our current compensation structure for non-employee directors as set forth in the table below. In connection with Mr. Huennekens' appointment as chairman on April 1, 2015, the Board agreed to pay him an additional cash retainer of $60,000 for his service as chairman during the period from April 1, 2015 to September 30, 2015.

|

| | | | | |

| Description of Fee | | Amount |

| | | |

| Annual Board Retainer | | |

| | Chairman | | $ | 80,000 |

|

| | Member | | $ | 40,000 |

|

| Audit Committee Retainer | | |

| | Chairman | | $ | 20,000 |

|

| | Member | | $ | 10,000 |

|

| Compensation Committee Retainer | | |

| | Chairman | | $ | 15,000 |

|

| | Member | | $ | 7,500 |

|

| Governance and Compliance Committee Retainer | | |

| | Chairman | | $ | 10,000 |

|

| | Member | | $ | 5,000 |

|

| Equity Awards (1) | | |

| | Annual Award - Chairman | | $ | 135,000 |

|

| | Annual Award - Member | | $ | 90,000 |

|

| | Other Award - Appointment/Election | | $ | 180,000 |

|

| | | | |

| |

| (1) | Each non-employee director will receive an annual equity award, which may consist of one or more of the following award types: restricted stock awards, restricted stock units, or stock options as may be determined by the Board at the time of grant. It is anticipated that these awards will be granted on the date of the Company's annual shareholder meeting each year and vest on the earlier of the first anniversary of the grant date or the next occurring annual shareholder meeting. In addition, each director upon their appointment or election to the board will receive an equity award, which may consist of any of the award types outlined above. It is anticipated that any award granted upon a director's appointment or election will vest annually over a three-year period beginning on the grant date. |

2015 Equity Awards

In August 2015, Messrs. Balkcom, Carter, Davis, Kaufman, Vandevenne and Dr. Geiger, each received an award for 5,625 restricted shares, and Mr. Huennekens received an award for 8,479 restricted shares. These restricted stock awards vest in full on August 14, 2016, which is one year after the grant date. Subsequently in September 2015, the Board amended the awards granted to Dr. Geiger and Mr. Vandevenne to modify the vesting provisions of the original award agreement so that the awards would vest on the earlier of August 14, 2016, or the date on which Dr. Geiger or Mr. Vandevenne cease to serve on the Board. In addition, in November 2015, the award granted in August 2015 to Dr. Geiger was rescinded and he received a replacement award of restricted shares. This action was taken in order to ensure that Dr. Geiger's award was in compliance with Israeli tax regulations, but did not result in a change in the number of restricted shares granted or in the other material terms of the award.

In connection with Mr. Huennekens' appointment as chairman in April 2015, he also received a grant of incentive units on our corporate predecessor, ECPM Holdings, LLC, which was converted in to a time-vesting restricted stock award of 22,771 shares. The converted restricted stock award will vest in equal annual installments over a 3-year period beginning on April 14, 2016 in accordance with terms of the original incentive unit award. The incentive units were converted into a time-vesting restricted stock award using a conversion factor determined in accordance with a formula set forth in the plan of conversion. For more information, see Related Party Transactions–Conversion of Corporation.

Effective with their appointment to the Board in September 2015, Messrs. Enquist and Mowry each received a restricted stock award for 11,250 restricted shares, which will vest at a rate of one-third per year on September 9 in each of 2016, 2017 and 2018.

The directors are entitled to vote the shares underlying their restricted stock awards during the vesting period unless forfeited.

Stock Ownership Guidelines

Each non-employee director is required to own shares of the Company’s common stock with a value equal to at least three times (3X) his or her annual cash retainer for Board services, which is currently $240,000 for Mr. Huennekens and $120,000 for each of the other directors. Shares of the Company’s common stock held directly, restricted shares of the Company’s common stock (whether vested or unvested) and restricted stock units (whether vested or unvested) are considered to be owned for purposes of these stock ownership requirements. Directors are required to meet these stock ownership guidelines within five years of becoming subject to them. These stock ownership guidelines were first made effective on June 4, 2015. As of December 31, 2015, Messrs. Balkcom, Davis and Huennekens have achieved their ownership requirement.

2015 Director Compensation

The following table sets forth information concerning the 2015 compensation of our non-employee directors. Our directors did not receive any stock option awards, did not have any non-equity compensation plan compensation, did not have any earnings in a non-qualified deferred compensation plan in excess of the applicable federal rate, and did not have any other compensation to be report other that the amounts set forth below.

|

| | | | | | | |

| Name | | Fees earned or paid in cash ($)(1) | | Stock awards ($)(2) | | Total ($) |

| | | | | | | | |

| James R. Balkcom | | $55,000 | | $90,056 | | $145,056 | |

| J. Scott Carter | | 39,375 | | 90,056 | | 129,431 | |

| D. Scott Davis | | 55,000 | | 90,056 | | 145,056 | |

| William R. Enquist | | 13,125 | | 183,825 | | 196,950 | |

| Dr. Uri Geiger | | 30,000 | | 91,913 | | 121,913 | |

| R. Scott Huennekens | | 145,000 | | 327,136 | | 472,136 | |

| David L. Kaufman | | 37,500 | | 90,056 | | 127,556 | |

| David R. Mowry | | 13,125 | | 183,825 | | 196,950 | |

| Rurik G. Vandevenne | | 39,375 | | 91,913 | | 131,288 | |

| | | | | | | | |

| |

| (1) | Represents fees earned during 2015 by each of our non-employee directors pursuant to the compensation plans described above for such period. Messrs. Enquist and Mowry joined the Board in September 2015. Mr. Geiger donates all cash fees received for his service on the Board to the Friends of Poriya Hospital Association, a non-profit public registered association located in Israel. |

| |

| (2) | Represents restricted stock awards granted to the non-employee directors during 2015 pursuant to either the 2013 Plan or the 2015 Omnibus Equity Incentive Plan as described above in 2015 Equity Awards. Each annual award generally vests in full one year after the grant date and each grant issued upon being appointed to the Board generally vests ratably over three years. However, the awards granted to Dr. Geiger and Mr. Vandevenne, provide for the awards to vest on the earlier of August 14, 2016 or the date on which they cease to serve on the Board. The aggregate grant date fair value for restricted stock awards are computed in accordance with FASB ASC Topic 718 (ASC 718). The original valuation of the awards granted on August 14, 2016 was $90,056 in accordance with ASC 718. Effective September 9, 2016, the awards to Dr. Geiger and Mr. Vandevenne were revalued for accounting purposes to $91,913 in accordance with ASC 718 to reflect the modification of the vesting terms as described above in 2015 Equity Awards. For a discussion of our valuation assumptions, see notes to our audited financial statements included in our Annual Report on Form 10-K for the period ended December 31, 2015 as filed with the SEC. |

Proposal 2 – Approval of Amended and Restated Employee Stock Purchase Plan

Background

Our Employee Stock Purchase Plan, or ESPP, is designed to provide our eligible employees and those of our participating subsidiaries with the opportunity to purchase shares of our common stock on periodic purchase dates through their accumulated payroll deductions. Each offering under the ESPP is for a period of six months and consists of consecutive offering periods of approximately six months in length. Offering periods begin on January 1 and July 1, or if such date is not a “trading day” as defined in the plan document, the next trading day. Each participant in the ESPP will be granted an option on the first trading day of the offering period and the option will be automatically exercised on the last trading day of each offering period using the contributions the participant has made for this purpose. The purchase price for our common stock purchased under the ESPP is 85% of the lesser of the fair market value of the common stock on the first trading day of the applicable offering period or on the last trading day of the applicable offering period. The ESPP Administrator (as described below) has the power to change the duration of the offering periods.

We believe our success is due to our highly talented employee base and that future success depends on the ability to attract and retain high caliber personnel. The ESPP is designed to more closely align the interests of our employees with those of our stockholders by encouraging employees to invest in our common stock, and to help our employees share in the Company’s success through the appreciation in value of such purchased stock. The ESPP, together with our equity plan, are important employee retention and recruitment vehicles.

Summary of the Proposal

Our Board approved an Amended and Restated ESPP on February 18, 2016, subject to approval by our stockholders at our 2016 annual meeting. We are seeking stockholder approval of the Amended and Restated ESPP that includes an increase in the maximum number of shares that will be made available for sale thereunder by 343,934 shares. If approved, the total number of shares that will be available for purchase under the Amended and Restated ESPP will be 470,000

When the ESPP was adopted and approved by our stockholders on June 4, 2015, the ESPP had a maximum number of shares available for sale of 126,066 shares of common stock. As of December 31, 2015, an aggregate of 70,558 shares of common stock remained available for future issuance under the ESPP. We estimate that, with an increase of 343,934 shares, we will have a sufficient number of shares of common stock to cover purchases under the ESPP through December 2018. Consequently, our Board has, subject to stockholder approval, increased the aggregate number of shares that may be sold under the ESPP by 343,934 shares of common stock. Our Board believes it is in our best interest and the interests of our stockholders to continue to provide our employees with the opportunity to acquire an ownership interest in the Company through their participation in the ESPP, encouraging them to remain in our employ and more closely aligning their interests with those of our stockholders.

The Importance of the Proposed Increase in Shares

We believe that increasing the number of shares that may be sold under the ESPP is necessary for us to continue to offer a competitive equity incentive program in the future. Based upon recent requirements, we believe that the addition of 343,934 shares to the maximum number of shares that may be sold under the ESPP will provide us with enough shares to continue to offer competitive equity compensation through December 2018.

Summary Description of Our Amended and Restated ESPP

The Amended and Restated ESPP is designed to allow eligible employees to purchase shares of our common stock with accumulated payroll deductions and is intended to qualify under Section 423 of the Code and is compliant with ITO. A full copy of the Amended and Restated ESPP is attached to this proxy statement as Annex A.

Plan administration. Subject to the terms and conditions of the Amended and Restated ESPP, our Compensation Committee will administer the Amended and Restated ESPP, and have full and exclusive authority to interpret the terms of

the Amended and Restated ESPP and determine eligibility to participate. Our Compensation Committee may delegate, in whole or in part, administrative tasks under the Amended and Restated ESPP to the services of an agent and/or employees to assist in the administration of the Amended and Restated ESPP. Interpretations and constructions of the administrator of any provision of the Amended and Restated ESPP or of any rights thereunder will be conclusive and binding on all persons.

Shares available under the Amended and Restated ESPP. The maximum number of shares of common stock authorized for sale under the Amended and Restated ESPP will be 470,000. The shares made available for sale under the Amended and Restated ESPP may be authorized but unissued shares or reacquired shares reserved for issuance under the Amended and Restated ESPP.

Eligible employees. Employees eligible to participate in the Amended and Restated ESPP for a given offering period generally include employees who are employed by us or one of our subsidiaries on the first day of the offering period, or the enrollment date. Our employees and any employees of our subsidiaries who customarily work less than five months in a calendar year or customarily work less than 20 hours per week will not be eligible to participate in the Amended and Restated ESPP. Finally, an employee who owns (or is deemed to own through attribution) 5% or more of the combined voting power or value of all our classes of stock or of one of our subsidiaries will not be allowed to participate in the Amended and Restated ESPP. The Compensation Committee may, from time to time and in its sole discretion, designate any of our subsidiaries as eligible to participate in the Amended and Restated ESPP.

Participation. Employees will enroll under the Amended and Restated ESPP by completing a payroll deduction form permitting the deduction from their compensation of at least 1% of their compensation but not more than the lesser of 15% of their compensation or $25,000 per offering period. Such payroll deductions may be expressed as a whole number percentage and the accumulated deductions will be applied to the purchase of shares on each semi-annual purchase date. However, a participant may not purchase more than 5,000 shares in each offering period, and may not subscribe for more than $25,000 in fair market value of shares of our common stock (determined at the time the option is granted) during any calendar year. The administrator has the authority to change these limitations for any subsequent offering period, in compliance with the rules prescribed by the Amended and Restated ESPP and Section 423 of the Code.

Offering. Under the Amended and Restated ESPP, participants are offered the option to purchase shares of our common stock at a discount during a series of successive offering periods, which will commence and end on such dates as determined by our Compensation Committee. In no event, however, may an offering period be longer than 27 months in length. The administrator has determined that each offering period will have a six month duration.

The option price will be the lower of 85% of the closing trading price per share of our common stock on the first trading date of an offering period in which a participant is enrolled or 85% of the closing trading price per share on the purchase date, which will occur on the last trading day of each offering period.

Unless a participant has previously canceled his or her participation in the Amended and Restated ESPP before the purchase date, the participant will be deemed to have exercised his or her option in full as of each purchase date. Upon exercise, the participant will purchase the number of whole shares that his or her accumulated payroll deductions will buy at the option purchase price, subject to the participation limitations described above and the shares available for purchase under the Amended and Restated ESPP.

A participant may cancel his or her payroll deduction authorization at any time prior to the end of the offering period. Upon cancellation, the participant will be paid his account balance in cash without interest. A participant may decrease (but not increase) his or her payroll deduction authorization once during any offering period. If a participant wants to increase or decrease the rate of payroll withholding, he or she may do so effective for the next offering period by submitting a new form before the offering period for which such change is to be effective; otherwise, a participant will automatically participate in the next offering period at the same rate of payroll withholding as in effect at the end of the prior offering period (so long as the participant remains eligible to participate in the Amended and Restated ESPP).

A participant may not assign, transfer, pledge or otherwise dispose of (other than by will or the laws of descent and distribution) payroll deductions credited to a participant’s account or any rights to exercise an option or to receive shares of our common stock under the Amended and Restated ESPP, and during a participant’s lifetime, options in the Amended and

Restated ESPP shall be exercisable only by such participant. Any such attempt at assignment, transfer, pledge or other disposition will not be given effect.

Termination of employment. If an individual’s eligibility status terminates for any reason before the last day of the purchase period, the termination will cause payroll deductions to cease immediately. If the eligible employee’s subscription account has a cash balance remaining when he or she terminates, this balance will be refunded to the eligible employee in cash (without interest) within 30 days of such cessation of eligibility status.