UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2023

ARMA SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-202398 | 32-0449388 |

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer |

| of Incorporation) | File Number) | Identification No.) |

Suite 140-920 7260 West Azure Drive

Las Vegas, Nevada 89130

(Address of principal executive offices (zip code))

1-416-881-2275

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

JUMPSTART OUR BUSINESS STARTUPS ACT

The Company qualifies as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (the “JOBS Act”) as we do not have more than $1,070,000,000 in annual gross revenue and did not have such amount as of October 31, 2022 our last fiscal year. We are electing to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act.

We may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $2,000,000,000 or (ii) we issue more than $2,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

As an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”) and Section 14A(a) and (b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such sections are provided below:

Section 404(b) of the Sarbanes-Oxley Act requires a public company’s auditor to attest to, and report on, management’s assessment of its internal controls.

Sections 14A(a) and (b) of the Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

As long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act and Section 14A(a) and (b) of the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K or Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

Item 1.01 Entry into Material Definitive Agreement

On February 27, 2023, Arma Services Inc. (“ARMV,” or the “Company”) entered into a share exchange agreement (the “Share Exchange Agreement”) with Wenflor International Inc. and Bret International Holding Corp., owner of 100% of Bret Consultores, SAPI de CV: Carbon Capture (“Bret”), a Mexican corporation, and Ecapfin Sapi de Cv., and Eric Eastwood Nixon (“Appointee”), as the President, & CEO and director of ARMV. Under the Share Exchange Agreement, One Hundred Percent (100%) of the ownership interest of Bret was exchanged for 6,000,000 shares of common stock of ARMV issued to Wenflor International Inc. The former stockholders of Bret will acquire a majority of the issued and outstanding common stock as a result of the share exchange transaction. The transaction has been accounted for as a recapitalization of the Company, whereby Bret is the accounting acquirer.

Immediately after completion of such share exchange, the Company has a total of 12,240,000 issued and outstanding shares, with authorized share capital for common shares of 75,000,000.

Consequently, the Company has ceased to fall under the definition of shell company as define in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”) and Bret is now a wholly owned subsidiary.

Item 2.01 Completion of Acquisition or Disposition of Assets

As described in Item 1.01 above, on 27 February we acquired all the issued and outstanding shares of Bret pursuant to the Share Exchange Agreement and Bret became our wholly owned subsidiary. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Bret is considered the acquirer for accounting and financial reporting purposes.

As a result of the acquisition of all the issued and outstanding shares of Bret, we have now assumed Bret’s business operations as our own.

FORM 10 DISCLOSURE

As mentioned in Item 1.01, on February 27, 2023, the Company effectively acquired Bret in a Reverse Merger business combination transaction and of which the Company was a shell company prior to such acquisition is now entering into a business combination, other than a business combination with a shell company, as those terms are defined in Rule 12b-2 under the Exchange Act, according to Item 2.01(f) of Form 8-K, the registrant is required to disclose the information that would be required if the registrant were filing a general form for registration of securities under the Exchange Act on Form 10.

We hereby provide below information that would be included in a Form 10 registration statement.

Description of Business

Corporate History

Arma Services, Inc. was incorporated by our director in the State of Nevada on September 2, 2014. Our primary business was to be destination management and event management services initially in the Russian Federation, but with plans at a later stage to spread our business to America and China. We attempted to provide a full range of services in the field of Meeting, Incentive, Conference, and Exhibition tourism in Russia for corporate customers from United States, China and Russia.

Prior management was comprised of one person, Sergey Gandin. Mr. Sergey Gandin resign from the positions of the Director, CEO and CFO of the Company and be appointed solely as Secretary of Arma Services Inc. The Company and Mr. Gandin are in agreement that these changes were effective from March 26, 2022. The Company appointed Clive Hill, 66, from the United Kingdom to the positions of Director, CEO and CFO of the Company. This appointment was effective from March 26, 2022. On August 17, 2022, Clive Hill resigned as President, Chief Executive Officer, Chief Financial Officer, and as a Member of the Board of Directors of the Company. Also on August 17, 2022, B. Maria Teresa Tattersfield consented to act as a Member of the Board of Directors of the Company, Alberto Ramirez consented to act as a Member of the Board of Directors of the Company, Eduardo Piquero consented to act as a Member of the Board of Directors of the Company, and Jaime Sanchez Cortina consented to act as the new President, CEO, CFO, and Member of the Board of Directors of the Company. On January 27, 2023, Jaime Sanchez Cortina resigned immediately as CEO, CFO, President and a member of the Board of Directors. Also on January 27, 2023, Eric Nixon agreed to be appointed the President, Chief Executive Officer, Chief Financial Officer, and as a Member of the Board of Directors of the Company.

On March 2, 2015, the Company filed a Form S-1 for registration of securities under the Securities Act of 1933. The S-1 was eventually declared effective on August 12, 2016, and at that time the Company became a fully reporting public company.

On March 28, 2022, the management of the Company, approved the engagement of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the Company’s fiscal year ended October 31, 2022, effective immediately, and dismissed Zia Masood Kiani & Co. Chartered Accountants (“ZMK”), as the Company's independent registered public accounting firm.

The reports of ZMK on the Company's consolidated financial statements as of and for the years ended October 31, 2021 and 2020 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. ZMK reports for the fiscal years ended October 31, 2021 and 2022 included an explanatory paragraph indicating that there was substantial doubt about the Company’s ability to continue as a going concern.

ZMK was dismissed as the Company’s CPA through a mutual agreement between Arma Services, Inc. and the ZMK.

On June 20, 2022, the there was a change of control of the company Mr. Corin Bailey purchased Four Million Shares (4,000,000) from Ruslan Mishin the control shareholders.

On December 14, 2022, the there was a change of control of the company Mr. Ronny Fabien Suarez Araya purchased Three Million Shares (3,000,000) from Corin Bailey the control shareholders.

On January 26, 2023, Arma Services, Inc. (the “Company”) terminated its engagement with BF Borgers CPA PC (“BFB”), the Registrant’s prior independent registered public accounting firm, and thereafter provided BFB with its disclosures in the Current Report on Form 8-K disclosing the termination of the engagement of BFB and requested in writing that BFB furnish the Company with a letter addressed to the Securities and Exchange Commission stating whether or not they agree with such disclosures. BFB's response is filed as an exhibit to this Current Report on Form 8-K.

BFB had not provided any reports to the financial statements of the Company but reviewed the reports for the quarters ended January 31, 2022, April 30, 2022 and September 30, 2022. There had been no disagreements with BFB on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure during the fiscal year ended October 31, 2022, nor in the subsequent periods through January 26, 2023.

On January 26, 2023, the Board of Directors of the Company engaged OLAYINKA OYEBOLA & CO. (“OOC”) as its independent accountant to provide auditing services for going forward for the Company. The Company has terminated the engagement of BFB. The decision to hire OOC was approved by the Company’s Board of Directors.

On February 27, 2023, Arma Services Inc. (“ARMV,” or the “Company”) entered into a share exchange agreement (the “Share Exchange Agreement”) with Wenflor International Inc. and Bret International Holding Corp., owner of 100% of Bret Consultores, SAPI de CV: Carbon Capture (“Bret”), a Mexican corporation, and Ecapfin Sapi de Cv., and Eric Eastwood Nixon (“Appointee”), as the President, & CEO and director of ARMV. Under the Share Exchange Agreement, One Hundred Percent (100%) of the ownership interest of Bret was exchanged for 6,000,000 shares of common stock of ARMV issued to Wenflor International Inc. The former stockholders of Bret will acquire a majority of the issued and outstanding common stock as a result of the share exchange transaction. The transaction has been accounted for as a recapitalization of the Company, whereby Bret is the accounting acquirer.

Immediately after completion of such share exchange, the Company has a total of 12,240,000 issued and outstanding shares, with authorized share capital for common share of 75,000,000.

Business Overview

ARMA Services Inc. (“ARMV” or the “Company”) is a US holding company incorporated in Nevada on September 2, 2014, entered into an agreement on February 27, 2023 to acquire all the outstanding shares of Bret International Holding Corp which operates through the Company’s wholly owned subsidiary Bret Consultores, SAPI de CV: Carbon Capture (“Bret”), a Mexican corporation incorporated on August 2, 2021 and Ecapfin Sapi de Cv (Mexico) a company specialized in developing methodologies of carbon capture in agricultural applications.

The company seeks to promote healthy, sustainable, and resilient rural economies through the carbon market, while strengthening the participation of rural communities in project development and decision-making. At the same time, companies, organizations and individuals can offset their emissions and meet their climate goals.

The company assists in the re-foresting, forest management and monetization of the Carbon Captured. It promotes healthy, sustainable, and resilient rural economies through the carbon market, while strengthening the participation of communities and private landowners in project development and decision-making. At the same time, companies, organizations and individuals can offset their emissions and meet their climate goals. The company works under international standards such as CAR and Verra, and social and environmental safeguards with rural communities to issue carbon credits to be sold in the Global Carbon Market.

Businesses and other organizations buy carbon credits for three reasons; a) to comply with a regulated market, b) to speculate trading with them c) to offset a carbon footprint voluntarily, and to contribute to conservate forests, mangroves and other important ecosystems.

Bret’s carbon credits (one carbon credit equals one metric ton of CO2 removed or avoided) are verified by an independent third party the certifies them, following a robust carbon standard, such as CAR or Verra. This ensures: i) Additionality - the reductions in emissions must be “above business as usual” – they would not have happened unless the project was implemented. ii) Permanence - the GHGs must be permanently reduced or sequestered. Permanence is defined as providing lasting benefits to the environment. iii) Leakage - there can be no shifting of emissions from one place to another due to a project. Bret provides training on climate change issues, building of inventories, generation of offsets, carbon market basics and community empowerment, transferring know-how to locales and providing them with additional revenue streams.

The Bret team has over 12 years of experience in the implementation of community carbon capture projects in Mexico. They are pioneers in developing specialized standards in the Mexican context of land tenure, communal land, and integration of indigenous minorities.

A.I. Addressing the Compliance Accountability in the Carbon Market

Arma Services Inc has a clear mission: to develop Artificial Intelligence Software that streamlines compliance accountability in the carbon forestry, agriculture, and technology industries. Their work is aimed at tackling a significant issue raised by The Integrity Council for the Voluntary Carbon Market that pertains to accountability. To this end, the company is working on setting a global standard for high-integrity carbon credits that relies on rigorous scientific research and data that is both measurable and verifiable.

Addressing the Deforestation Challenge

The world needs carbon markets in a large, transparent, verifiable, and environmentally robust way for regenerative, nature-based solutions.

Our ambition is to accelerate climate neutrality providing expertise to value native vegetation and encourage reforestation, as well as carbon fixation in the soil, rewarding farmers and communities for their contribution to nature preservation.

Over the last four decades, Mexico has suffered the loss of 350,000 hectares of forest per annum, resulting in a loss of carbon stock of approximately 336 m metric tons of carbon (T.C) (Instituto Nacional de Ecologia y Cambio Climatico, Mexico, 2020)

The Company

The Company, or Bret International Holding Corp is committed to self-sustainable rural development and addressing the issue of climate change through carbon capture, addressing issues of desertification and reforestation using forests, Succulent , mangrove and methane projects.

Bret contributes towards atmospheric carbon dioxide (CO2) drawdown by developing and supplying carbon offsets from restoration and conservation of Succulent, forests and natural habitats at the regional scale through the maintenance of the crops in production or maintenance of forestry hectares.

Bret manages carbon capture projects through all its phases, from design to planning, execution, and generation of high-quality offsets. Bret ensures transparency, permanence and win-win for the actors involved, with a 100% success rate of projects developed.

Bret partners up with local organizations, linked to forest owners and communities in Mexico, and works in the capacity building of these, assisting organizations to become forest carbon project developers and strengthening the landowner’s capacities to take part in the carbon market. The process involves training the communities and organizations, monitoring projects, providing the necessary equipment, assisting in the generation of a strategy to generate additionality by reducing vulnerability and the possibility of deforestation, and following through the process of generating carbon credits until completion, assisting the organizations in selling high quality offsets at a fair price.

We are following the Climate Action Reserve standards in forestry Capture (Carbon Dioxide Capture) specifically CAR’s Mexico Forest Protocol, tailored to the Mexican context, by members of the Bret team. We generate most of our carbon credits from improved forest management (IFM), restoration and reforestation.

We have developed a methodology to measure the plant growth on a yearly basis to calculate the amount of captured CO2 using Succulent and the sale of Carbon Credits to companies identified in the Carbon Disclosure Project Report (CDP), Price Waterhouse Cooper report on Carbon obligations of over 5,000 Multi-National Corporations.

Our ambition is to accelerate climate neutrality providing expertise to value native vegetation and encourage reforestation, as well as carbon fixation in the soil, rewarding farmers and communities for their contribution to nature preservation and replanting process.

We support over 40 forestry projects, encompassing 156,000 hectares in the states of Chihuahua, Durango, Jalisco, Quintana Roo and Oaxaca. We work with ejidos,(Indigenous People), on communal lands and on private properties, generating carbon credits through internationally recognized protocols, such as CAR and Verra.

We advise companies, organizations and individuals who want to offset their emissions through projects that provide not only carbon mitigation, but also other environmental co-benefits, such as water infiltration, biodiversity conservation, landscape values, among other key environmental services.

Bret purchased Ecapfin, which developed the following methodology for agriculture applications using Succulents and Farming Carbon Capture applications company, on July 12, 2022, for the total sum of Fifty Thousand USD (US$50,000).

Our Mission

To promote healthy, sustainable development, and resilient rural agriculture development through the carbon market, while strengthening the participation of communities and private landowners in project development and decision-making. At the same time, companies, organizations and individuals can offset their emissions and meet their climate goals.

| | · | We focus on solving challenges at the intersection of sustainability and human wellbeing, generating quality offsets in cooperation with forest communities and landowners |

| · | We develop and support projects that provide multiple environmental, social, and economic benefits |

| · | We work with companies, governments and individuals who want to have a positive impact on the planet |

Our projects and activities:

| · | Improve the quality of life of natural resource owners through Nature-based Solutions (NbS). |

| · | Preserve and increase forest biomass and, therefore, carbon reserves. |

| · | Promote activities for the preservation of ecosystem services such as water supply, soil conservation, and biodiversity. |

| · | Develop project development and monitoring capacities among local communities, partners and allies. |

| · | Develop quality forest carbon capture projects under Verra and CAR standards. |

| · | Contribute to the construction of a carbon market that reflects social and environmental safeguards. |

| · | Recognize that most of the profits belong to land and forest owners and promote their use for the maintenance and preservation of ecosystems. |

Our Model

We combine traditional and scientific knowledge, and engagement with land owners and inhabitants, with advanced satellite monitoring and data analytics to achieve carbon drawdown at the ecosystem level.

We mitigate the risk of carbon project development and make simple to aggregate landowners under our payment for carbon removal programs.

We manage four types of carbon capture programs; Forestry, Succulents, Sustainable Agriculture development, Mangroves and Methane Capture to produce alternative energy financed through the sale of Carbon Offsets in the Carbon Markets. Each has its unique aspects, but in general the model can be apply to all, engagement with the communities and local organizations.

Forest Carbon projects are not without their challenges. The rural areas of Mexico experience a plethora of social, environmental, and political shortcomings. Drug-related violence and land tenure are some of the key issues facing offset generation. Many productive and conservation projects have failed because of this.

We must also ensure communities are autonomous on their decision making, while being consistent with agreements and contracts.

Bret does not develop projects in territories affected by narcotraffic or violence. In the territories we do work, our project design generates an effective shield, ensuring forest owners are the ones who defend the projects, as our model generates ownership, builds capacities and provides revenue streams, generating employment options.

The process involves training the communities and organizations, providing the necessary equipment, assisting in the generation of a strategy to generate additionality by reducing vulnerability and the possibility of deforestation, and following through the process of generating carbon credits until completion, assisting the organizations in selling high quality offsets at a fair price.

Depending on the extension of the area of activity, we hire between 8 to 12 people per project with the best daily payment conditions, including accident and life insurance.

We provide each community with equipment looking to build local monitoring capacity, so they will continue to be involved in the project, generating ownership and involvement.

All programs started in Mexico, with the objective of expanding our Carbon projects internationally. We are currently in discussions with indigenous communities in Panama, Colombia, Brazil, Peru, and Paraguay.

Our Succulent Carbon Program

Bret, though Ecapfin, is committed to self-sustainable rural development, addressing the issue of climate change through Carbon Capture, the production of renewable energy addressing issues of desertification and food security, producing organic fertilizer and animal feed for sustainable development using our Succulent Breed.

The advantage of using Succulent is 600% more efficient per Hectare than harvesting CO2 using forests management programs.

The Company’s goals are to:

| 1. | Position Bret as a leading forest carbon offset developer and supplier from restoration and conservation of forests and natural habitats in Mexico in terms of tCO2e transacted. |

| 2. | Reach 800,000 tCO2e transacted by 1Q of 2023 from our forest carbon programs. |

| 3. | Become a reference of technology driven innovation for forest carbon monitoring and community engagement and capacity building. |

| 4. | Identify additional income revenue stream from ecosystem services to implement from 2023 onward, including sourcing REDD+ credits at subnational level with State Governments and with Indigenous Communities. |

Our Approach for Achieving Business Goals

Our approach is focused on:

| 1. | Understanding and assessing the ample carbon absorption potential at a regional scale with a top-down perspective. |

| 2. | Realizing forest carbon offset transactions through a network of alliances with universities, NGOs, local carbon developers, and local communities and forest owners the realize the offset potential from bottom up. |

| 3. | Providing an economic improvement of livelihoods for forest communities and owners through our forest carbon programs. |

| 4. | Devising Emission Reductions Payment Agreement (ERPA) contracts hand in hand with solid mechanisms to build long term relations with counterparts and allies to facilitate forest carbon permanence and environmental and social integrity. |

| 5. | Drive innovation in ecosystems services monitoring and forest carbon accounting through technology. |

Value Proposition

The successful development, sourcing and supply of carbon offsets from restoration and conservation of forest requires a value proposition that:

| 1. | Reduces transactional costs related to project documentation and monitoring through state-of-the-art data acquisition and analysis; and streamlined aggregation of landowners under our forest carbon programs. |

| 2. | Focus on a continuous engagement with forest owners and inhabitants through strong long-term partnerships and alliances with technical partners including NGOs, academia and local project developers that enables carbon permanence and improves communities livelihoods. |

| 3. | Legal document in which the Seller (such as a REDD+ country) and the Buyer agree on the commercial terms (e.g. volume, price, options, etc.) of the sale and payment for Emission Reductions to be generated and verified under an Emission Reductions Program” (Forest Carbon Partnership, 2022) |

| 4. | Mitigate delivery risks of forest carbon projects with the support of emission tracking per hectare of Forestry or Agriculture Production undermanagement accumulated on a balance sheet with delivery dates and third-party verification to facilitate upfront payments to finance project activities. |

Key Functions and Resources

Functions

| · | Source forest carbon offsets from local partners and allies |

| · | Build carbon project development and monitoring capacities amongst local communities, partners and allies. |

| · | Develop carbon projects whenever is required. |

| · | Monitor projects performance through drone and satellite data acquisition and big data analysis techniques. |

| · | Lead new methodologies development under specific registries as Climate Forward, Carbon Action Reserve, Verra and the Mexican Carbon Protocol. |

Resources

| · | Multiple geospatial data layers |

| · | Big data analysis capabilities |

| · | Personal Software and Hardware |

| · | Office in México City |

Key Partnerships

ONGs

| · | MexiCo2 |

| · | Cool Effect |

| · | Climate Impact Partners |

| · | Mirova |

| · | Climate Partners |

Governments

| · | CONANP |

| · | State Governments |

| · | Durango, Chihuahua, Jalisco, Oaxaca, Hidalgo, CDMX, Yucatán |

Private Sector

| · | Boomitra – Succulent |

| · | NCX – Forestry |

| · | CAR |

| · | Verra |

| · | Freepoint |

Technical Private Sector

| · | Bioforestal |

| · | Unidad Topia |

| · | Sendas |

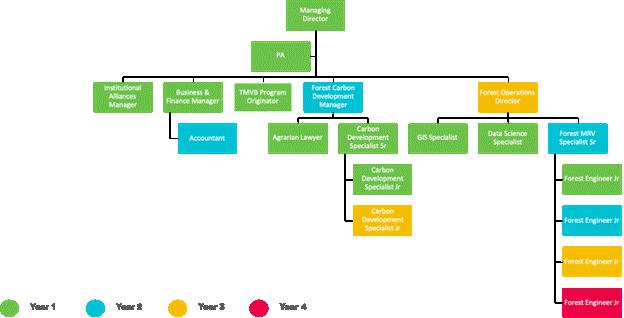

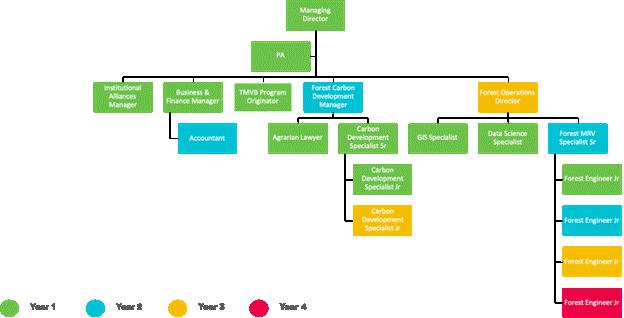

Our Organization

Employees

We currently have three employee’s working for the Arma Services Inc, Eric Eastwood Nixon our President & Chief Financial Officer, Teresa Tattersfield, Program Originator, Alberto Ramirez, we have for four employees working for Bret Consultores SAPI de CV, Forest Carbon Developer, Rene Ibarra, Finance and Business, Valeria Lopez Porttillo, Institutional Alliance Manager, Yazmin Pimentel, Carbon Development Specialist, and one Employee working for Ecapfin SAPI de CV. Eric Gordillo, Succulent Carbon Coordinator.

ARMA Services Inc has also engaged Ten Independent International Consultants evaluating global carbon development opportunities in the green energy sector working on several continents. We anticipate hiring additional employees in the next twelve months and the necessary personnel based on an as needed basis only on a per contract basis to be compensated directly from revenues.

Intellectual Property

The Company’s methodology has been registered as a new methodology by Verified Carbon Standard. The methodology is explained in more detail in Exhibit 99.1 attached hereto

CARBON AGRICULTURAL METHODOLGY

Article 1. Summary Description of the Proposed Methodology

| Additionality and Crediting Method |

| Additionality | Project |

| Crediting Baseline | Project |

This methodology describes steps for estimating and monitoring carbon dioxide capture and biomass in Succulent crops. The protocol is based on guidance provided in the IPCC 2003 Good Practice Guidance for Land Use, Land-Use Change and Forestry. The methodology has been designed to be applicable to estimate CO2 s sequestration by Crassulacean Acid Metabolism (CAM) plant Succulent under field growing conditions. It is important to mention that CAM metabolism can be very variable depending on the taxonomic scale to which we are limiting (e. g, families, subfamilies, genera and species) (see Nobel and Harstock 1986); in particular, among Succulent species, the CAM metabolism can present important changes that affect the CO2 capture rates, therefore not conforming to the models and equations described here. This is very important, since around the world not only O. ficus indica species is cultivated, in a much smaller proportion other congenerics are also used. Because of these reasons, it is recommended to use this method, only for Succulent crops. If the methodology is used for other species, genera or some other taxonomic category of CAM plants, the results should be interpreted with caution considering the above.

The intention of the developers has been to create an easy methodology which includes sufficient detail on methods to allow to evaluate a wide range of environmental and crop conditions in which this member of Opuntiodeae is cultivated. However, accurately estimating and projecting the values of the various Succulent carbon pools does require a level of technical ability on the part of the project proponent team. It is therefore expected that in many cases landowners and farmers may need to work with people with specific technical skills to complete the development of an O. ficus-indica carbon project using this methodology.

All the operations involved in the estimation method described here are based on data consulted from the scientific articles cited in this report (Acevedo et al 1983; Ligouri et al 2013; Nobel and Harstock 1983, 1986; Nobel and Valenzuela 1987; Nobel 1988; Nobel et al.1992, 1993, 2002; Nobel and Israel 1994; Nobel and Bobich 2002; Pimienta-Barrios et al., 2000, 2001, 2005). The CO2 capture values in O. ficus-indica correspond to theoretical data that were obtained under “controlled” or more stable conditions than those that can be found directly in the field. Although in these studies the effect of different factors that can affect the capture of CO2 in Succulent is already part of the evaluation, -environmental (temperature, humidity, photosynthetic active radiation, CO2 concentration), growth (development stage) and of the life cycle (in vegetative or sexual reproduction) – these factors, particularly the environmental ones, represent a small range of variation compared to the spectrum to which crops can be confronted at bigger spatial scales (throughout the geography) and much more extensive temporary (from one to ten years).

The output values of method VM000XX, Version 1. 0. must be interpreted as a conservative estimate based on the average CO2 capture under controlled conditions, with adjustments that involve some factors that potentially affect the capture efficiency of this plant, since closely related to their physiology. To have a much more accurate data and in accordance with the conditions of the problem plantation, different studies were carried out in the field considering the spatial and temporal environmental variation, making capture measurements on the cladodes and trees.

The estimates of captured CO2 and biomass are derived from the morphological variables of the cladodes. With the width, length and thickness of the cladodes, the respective calculation of the area of the two faces of each cladode, of the surface corresponding to the edge and its volume is performed.

This methodology is focused on addressing the following key variables:

| · | Estimating the amount of carbon in the Succulent crops at the start of the project. |

| · | Estimating the amount of CO2 captured by total photosynthetic surface in the crop. |

| · | Estimating the value of CO2 and biomass per crop of Succulent (base line) for year during for ten years. |

| · | Monitoring and documenting changes in Succulent carbon for ten years under the project scenario |

The methodology has been designed using a modular approach. This methodology document lays out the steps required to fulfil estimation, projection and quantification requirements for projects wishing to register credits under the VCS program.

The methodology requires the completion of 7 main tasks, each of which is comprised of a number of sub-tasks:

| – | Task 1: Identification of limits and extension of project area. |

| – | Task 2: Determining the baseline scenario |

| – | Task 3: Measuring morphological variables of cladodes and trees of project area. |

| – | Task 4: Estimating biomass (tons at T0) corresponding to all plants in the project area |

| – | Task 5: Estimating CO2 capture. |

| – | Task 6: Projecting Carbon accumulation per year in project area for 10 years. The overall process used by the methodology is shown in the following methodology map. |

| – | Task 7. Monitoring and estimation. |

An Opuntia's methodology for accrediting carbon sequestration in crops (OMC) project involves management activities that maintain and increase the carbon stocks in the Succulent -in crops, in relation to the levels of carbon stored at the zero time of the project. Thus, initial conditions at cero time of the project are estimated: the amount of carbon in the Succulent crops at the start of the project, the amount of CO2 captured by total photosynthetic surface in the crop, the value of CO2 and cacti biomass per crop of O. ficus-indica (base line) for year during the project and monitoring and documenting changes in Succulent carbon during the project scenario.

Furthermore, actions are carried out that focus on maintaining the structure of the crops, i.e. dimensions of the project area, number of plants per unit area, baseline of plants within the project area; the latter corresponds to the number of cladodes that have to be maintained per plant so that it ensures with an appropriate volume and baseline area that it maintains the growth, capture and storage of carbon, as well as allows the harvest of the plant for human consumption (without affecting the estimates during the project's accreditation period).

Article 2. Pending Methodologies

Approved and pending methodologies under the VCS and approved GHG programs, that fall under the same combination of sectoral scopes or AFOLU project categories, were reviewed to determine whether an existing methodology could be reasonably revised to meet the objective of the proposed methodology.

Article 3. Project Activities and Applicability Conditions

This methodology is global in scope and applies to estimate CO2 capture correspond to the CAM metabolism of the Succulent species under growing conditions. CAM metabolism can be very variable depending on the taxonomic scale to which we are limiting (e. g, families, subfamilies, genera and species).

All projects using this methodology must meet the following conditions:

| 1. | Projects must meet the most recent VCS requirements for one of the following two Agricultural Land Management activities: |

| · | Improved Cropland Management (ICM) |

| · | Cropland and Grassland Land-use Conversions (CGLC) |

| 2. | Project activities must be implemented on land that is cropland at the project start date and remains cropland throughout the project crediting period (i.e., land use change is not eligible, including conversion from cropland to grassland and grassland to cropland). |

| 3. | As of the project start date entire project area consists in croplands of Succulent . Crops may include Succulent grown for food products (Succulent , fruits, vegetable, prickly pear) or other derivate products of this cacti. |

| 4. | The conditions of project (number of trees per area unity, levels of growing in all trees, trees of the same age, equidistant crop lines) must be homogenously maintained by the next ten years to ensure the CO2 assimilation calculated by mean the methodology. |

| 5. | Project activities must not include changes in project area, and the conditions of the crop at the moment of the accreditation: e. g. number of trees in the project, number of growth levels per tree (no more tree levels), soil water regimes or other significant anthropogenic changes in the crop as changes in fertilization. |

| 6. | The project must meet with an annual evaluation to verify the biomass and CO2 accredited and to ensure that the project area maintain homogeneous conditions respect to those at moment of accreditation. |

| 7. | The biomass accredited in the project area excludes that which is harvested per season to human use (Succulent , fruits, vegetable, or prickly pear). |

Article 4. Demonstration of Additionality

Succulent methodology offers a cost-effective option for projects to yield surplus GHG reductions that and demonstrate additionality to what would have occurred in the absence of the project.

The approach to additionality for Succulent methodology for accrediting carbon sequestration in crops projects recognizes increases in the amount of CO2 removed from the atmosphere relative to “business as usual” management. It also considers the long-term risks to carbon sequestered in the project area presented by “business as usual” management and the potential emissions of carbon into the atmosphere. Under this approach, additionality takes into account the following:

| · | Onsite carbon stocks are at risk on a 20-year time scale. |

| · | Land ownership and management direction are not permanent, except in cases where binding commitments limit management options, such as conservation easements (CA). |

| · | Management goals and objectives are likely to change over time, especially as: ownership of a crop changes hands, as often happens between generations of family crop owners or between entities owning crops as a financial investment. |

| · | Over the length of a project lifetime and in the absence of a long-term commitment to a project and associated conservation easement, emissions may have resulted from the clearing of Succulent trees to convert a crop to another crop type or from harvest. |

| · | Activities that reduce average onsite carbon stocking. |

| · | Committing a site to crop cover in perpetuity |

Furthermore, this methodology acknowledges that the project’s baseline, as the way “business as usual” management is represented for quantification purposes, is a counterfactual scenario, i.e., a representation of what may have actually occurred if the project had never happened. Additionality is assured over the 20-year crediting period, during which the terms of the CA ensure carbon stocks increase compared to the baseline.

The methodology has been designed using a modular approach and lays out the steps required to fulfill estimation, projection and quantification requirements for projects wishing to register credits under the VCS program.

The methodology requires the completion of 11 main tasks, each of which is comprised of a number of sub-tasks:

| · | Task 1: Identification of limits and extension of project area. |

| · | Task 2: Determining the baseline scenario |

| · | Task 3: Measuring morphological variables of cladodes and trees of project area. (Quantification) |

| · | Task 4. Social and Environmental Safeguards |

| · | Task 5: Estimating biomass (tons at T0) corresponding to all plants in the project area |

| · | Task 6: Estimating CO2 capture. |

| · | Task 7: Projecting Carbon accumulation per year in project area for 10 years. The overall process used by the methodology is shown in the following methodology map. |

| · | Task 8. Monitoring and estimation |

| · | Task 9. Permanence |

| · | Task 10. Verification process |

| · | Task 11. Credits emission |

Article 5 Quantification of Emission Reductions

This section provides requirements and guidance for quantifying an OMC project’s net GHG reductions. The Verified Carbon Units (VCUs) will be issued to an OMC project upon confirmation for ISO- accredited and Verra-approved verification body that the OMC project’s GHG reductions and removals have been quantified following the applicable requirements of this methodology.

The estimates of captured CO2 and biomass are derived from the morphological variables of the cladodes. With the width, length and thickness of the cladodes, the respective calculation of the area of the two faces of each cladode, of the surface corresponding to the edge and its volume is performed. It has to be mentioned that for these calculations, + the formula of the area of a regular ellipse was considered, because in general the cladodes are oval (like an ellipse); however, its shape is much more complex, especially in the proximal region, so the calculated values of area and volume do not represent the actual area of a racket. In this sense, the VM000XX, Version 1. 0 include a size adjustment based in a geometric morphometric study in thousands of cladodes of this species (in process).

This methodology is focused on addressing the following key variables:

| · | Estimating the amount of carbon in the Succulent crops at the start of the project. |

| · | Estimating the amount of CO2 captured by total photosynthetic surface in the crop. |

| · | Estimating the value of CO2 and biomass per crop of Succulent (base line) for year during for ten years. |

| · | Monitoring and documenting changes in Succulent carbon for ten years under the project scenario |

Article 6 Monitoring

The monitoring plan must be prepared using module VMD0034 Methods for Developing a Monitoring Plan. This module includes specifications on quality assurance and quality control that must be followed during development of the project description and other project documents.

Reports to Security Holders

You may read and copy any materials the Company files with the Commission in the Commission’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this report before deciding to invest in our common stock.

Risks Related to our Business

Bret a limited operating history

Bret has limited operating history. We will, in all likelihood, sustain operating expenses without corresponding revenues, at least for the foreseeable future. We can make no assurances that we will be able to effectuate our strategies or otherwise to generate sufficient revenue to continue operations.

During the year ended October 31, 2021, Bret’s total revenue was $6,812, and had a net loss of $94,548. During the twelve months ended October 31, 2022, Bret’s total revenue was $59,745, and had a net loss of $619,899.

Our estimates of capital, personnel, equipment, and facilities required for our proposed operations are based on certain other existing businesses operating under projected business conditions and plans. We believe that our estimates are reasonable, but it is not possible to determine the accuracy of such estimates at this point. In formulating our business plan, we have relied on the judgment of our officers and directors and their experience in developing businesses. We can make no assurances that we will be able to obtain sufficient financing or implement successfully the business plan we have devised. Further, even with sufficient financing, there can be no assurance that we will be able to operate our business on a profitable basis. We can make no assurances that our projected business plan will be realized or that any of our assumptions will prove to be correct.

We are subject to a variety of possible risks that could adversely impact our revenues, results of operations or financial condition. Some of these risks relate to general economic and financial conditions, while others are more specific to us and the industry in which we operate. The following factors set out potential risks we have identified that could adversely affect us. The risks described below may not be the only risks we face. Additional risks that we do not yet know of, or that we currently think are immaterial, could also have a negative impact on our business operations or financial condition. See also Statement Regarding Forward-Looking Disclosure.

We operate in a highly competitive industry.

The climate and carbon treatment business is highly competitive and constantly changing. Our competitors include not only other large multinational companies, but also smaller entities that operate in local or regional markets as well as new forms of market participants.

Competitive challenges also arise from rapidly-evolving and new technologies in the carbon capture space, creating opportunities for new and existing competitors and a need for continued significant investment in research and development.

A number of our existing or potential competitors may have substantially greater financial, technical, and marketing resources, larger investor bases, greater name recognition, and more established relationships with their investors, and more established sources of deal flow and investment opportunities than we do. This may enable our competitors to: develop and expand their services and develop infrastructure more quickly and achieve greater scale and cost efficiencies; adapt more quickly to new or emerging markets and opportunities, strategies, techniques, technologies, and changing investor needs; take advantage of acquisitions and other market opportunities more readily; establish operations in new markets more rapidly; devote greater resources to the marketing and sale of their products and services; adopt more aggressive pricing policies; and provide clients with additional benefits at lower overall costs in order to gain market share. If our competitive advantages are not compelling or sustainable and we are not able to effectively compete with larger competitors, then we may not be able to increase or sustain cash flow.

Cross Border Sales Transactions

Cross border sales transactions carry a risk of changes in import tax and/or duties related to the import and export of our product, which can result in pricing changes, which will affect revenues and earnings. Cross border sales transactions carry other risks including, but not limited to, changing regulations, wait times, customs inspection and lost or damaged product

Our independent public accountants have provided their report with a going concern opinion.

The Company’s financial statements were prepared on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. During the twelve-month period ended October 31, 2022, the Company incurred a net loss of $619,899 and as of that date, the Company’s accumulated deficit was $831,785 There are no assurances that it will be able to achieve level of revenues adequate to generate sufficient cash flow from operations or obtain additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors to lose their entire investment. The accompanying condensed consolidated financial statements do not include any adjustments that might result relating to the recoverability and classification of the asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this risk and uncertainty.

We will need to raise funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We will need to seek funds soon, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances or a combination of these approaches. Raising funds in the current economic environment may present additional challenges. It is not certain that we have accounted for all costs and expenses of future development and regulatory compliance. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Our future growth may be limited.

The Company’s ability to achieve its expansion objectives and to manage its growth effectively depends upon a variety of factors, including the Company’s ability to further develop use of methodology, to attract and retain skilled employees, to successfully position and market the Company, to protect its existing intellectual property, to capitalize on the potential opportunities it is pursuing with third parties, and sufficient funding. To accommodate growth and compete effectively, the Company will need working capital to maintain adequate operating levels, develop additional procedures and controls and increase, train, motivate and manage its work force. There is no assurance that the Company’s personnel, systems, procedures and controls will be adequate to support its potential future operations.

We are reliant on a small number of customers for the majority of our revenue.

We have developed key partnerships with Non-Government Organizations (NGOs) , governments, and companies in the private sector. The loss of any of these partnerships would materially effect or revenue. The loss of any of these could have an adverse effect on the Company’s business.

We rely on key personnel.

The Company’s success also will depend in large part on the continued service of its key operational and management personnel, including executive staff, research and development, engineering, marketing and sales staff. Most specifically, this includes its Director Teresa Tattersfield who oversees new partnerships, as well as implementation of our methodology, partnership retention, overall management and future growth. The Company faces intense competition from its competitors, customers and other companies throughout the industry. Any failure on the Company’s part to hire, train and retain a sufficient number of qualified professionals could impair the business of the Company.

We depend on intellectual property rights that may be infringed upon or infringe upon the intellectual property rights of others.

The Company’s success depends to a significant degree upon its ability to develop, maintain and protect proprietary products and methodology. The Company has registered its carbon capture methodology with Verified Carbon Standard. The assertion of intellectual property protection involves complex legal and factual determinations and is therefore uncertain and potentially expensive. The Company cannot provide assurance that intellectual property will be granted with respect to its methodology application, that the scope of any intellectual property it might obtain will be sufficiently broad to offer meaningful protection, or that it will develop additional proprietary products that are patentable. Losing significant intellectual property protection could have a material adverse effect on the Company’s business.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may own or obtain intellectual property or other proprietary rights that would prevent or limit our ability to make, use, develop or sell our concept, which could make it more difficult for us to operate our business. We may receive inquiries from intellectual property owners inquiring whether we infringe their proprietary rights.

Our business may be adversely affected if we are unable to protect our intellectual property rights from unauthorized use by third parties.

Failure to adequately protect our intellectual property rights could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantage, and a decrease in our revenue which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core methodology and intellectual property. To accomplish this, we will rely on a combination of intellectual property, trade secrets (including know-how), employee and third-party nondisclosure agreements, copyright, trademarks, intellectual property licenses and other contractual rights to establish and protect our rights in our technology. Patent, trademark, and trade secret laws vary significantly throughout the world.

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In order to protect our proprietary technology and processes, we also rely in part on confidentiality agreements with our employees, consultants, outsource manufacturers and other advisors. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover trade secrets and proprietary information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

We may not be successful in our potential business combinations.

The Company may, in the future, pursue acquisitions of other complementary businesses and technology licensing arrangements. The Company may also pursue strategic alliances and joint ventures that leverage its core products and industry experience to expand its product offerings and geographic presence. The Company has limited experience with respect to acquiring other companies and limited experience with respect to forming collaborations, strategic alliances and joint ventures.

If the Company were to make any acquisitions, it may not be able to integrate these acquisitions successfully into its existing business and could assume unknown or contingent liabilities. Any future acquisitions the Company makes, could also result in large and immediate write-offs or the incurrence of debt and contingent liabilities, any of which could harm the Company’s operating results. Integrating an acquired company also may require management resources that otherwise would be available for ongoing development of the Company’s existing business.

We may experience intellectual property enforcement and infringement which could force us to spend on legal fees.

The environmental protection industry has been characterized by significant litigation and other proceedings regarding intellectual property rights. The situations in which we may become parties to such litigation or proceedings may include:

1. litigation or other proceedings we may initiate against third parties to enforce our intellectual property rights;

2. litigation or other proceedings we or our licensee(s) may initiate against third parties seeking to invalidate the patents held by such third parties or to obtain a judgment that our products do not infringe such third parties’ intellectual property; and

3. litigation or other proceedings, third parties may initiate against us to seek to invalidate our intellectual property.

If third parties initiate litigation claiming that our products infringe their intellectual property rights, we will need to defend against such proceedings.

The costs of resolving any patent litigation or other intellectual property proceeding, even if resolved in our favor, could be substantial. Many of our potential competitors will be able to sustain the cost of such litigation and proceedings more effectively than we can because of their substantially greater resources. In some instances competitors may proceed with litigation or other proceedings pertaining to infringement of their intellectual property as a means to hinder or devaluate the target defendant company, with no intention of the matter being resolved in their favor. Uncertainties resulting from the initiation and continuation of patent litigation or other intellectual property proceedings could have a material adverse effect on our ability to compete in the marketplace. Intellectual property proceedings may also consume significant management time and costs.

Global economic conditions, such as COVID-19, may adversely affect our industry, business and results of operations.

Our overall performance depends, in part, on worldwide economic conditions which historically is cyclical in character. Key international economies continue to be impacted by a recession, characterized by falling demand for a variety of goods and services, restricted credit, going concern threats to financial institutions, major multinational companies and medium and small businesses, poor liquidity, declining asset values, reduced corporate profitability, extreme volatility in credit, equity and foreign exchange markets and bankruptcies. In markets where our revenue occurs go into recession, these conditions affect the rate of spending and could adversely affect our customers’ ability or willingness to purchase our concept which could adversely affect our operating results.

Any further disruptions from an uptick in new infections related to COVID-19 may materially harm out business prospects.

Further upticks in infection, and the related enforcement of governmental restrictions would materially hinder our ability to grow, as it would make it could interrupt our supply chain, as well as the financial condition of our intended customer base.

Any future indebtedness reduces cash available for distribution and may expose us to the risk of default under debt obligations that we may incur in the future.

Payments of principal and interest on borrowings that we may incur in the future may leave us with insufficient cash resources to operate the business. Our level of debt and the limitations imposed on us by debt agreements could have significant material and adverse consequences, including the following:

| · | our cash flow may be insufficient to meet our required principal and interest payments; |

| · | we may be unable to borrow additional funds as needed or on favorable terms, or at all; |

| · | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; |

| · | to the extent we borrow debt that bears interest at variable rates, increases in interest rates could materially increase our interest expense; |

| · | we may default on our obligations or violate restrictive covenants, in which case the lenders may accelerate these debt obligations; and |

| · | our default under any loan with cross default provisions could result in a default on other indebtedness. |

If any one of these events were to occur, our financial condition, results of operations, cash flow, and our ability to make distributions to our shareholders could be materially and adversely affected.

Our results of operations are highly susceptible to unfavorable economic conditions.

We are exposed to risks associated with weak or uncertain regional or global economic conditions and disruption in the financial markets. The global economy continues to be challenging in some markets. Uncertainty about the strength of the global economy generally, or economic conditions in certain regions or market sectors, and a degree of caution on the part of some marketers, can have an effect on the demand for advertising and marketing communication services. In addition, market conditions can be adversely affected by natural and human disruptions, such as natural disasters, severe weather events, military conflict or public health crises. Our industry can be affected more severely than other sectors by an economic downturn and can recover more slowly than the economy in general. In the past, some clients have responded to weak economic and financial conditions by reducing their marketing budgets, which include discretionary components that are easier to reduce in the short term than other operating expenses. This pattern may recur in the future. Furthermore, unexpected revenue shortfalls can result in misalignments of costs and revenues, resulting in a negative impact to our operating margins. If our business is significantly adversely affected by unfavorable economic conditions or other market disruptions that adversely affect client spending, the negative impact on our revenue could pose a challenge to our operating income and cash generation from operations.

International business risks could adversely affect our operations.

We intend to be a global business. Operations outside Mexico and the United States could represent a significant portion of our net revenues. These operations are exposed to risks that include local legislation, currency variation, exchange control restrictions, local labour and employment laws that hinder workforce flexibility, large-scale local or regional public health crises, and other difficult social, political or economic conditions. We also must comply with applicable U.S., local and other international anti-corruption laws. These restrictions can place us at a competitive disadvantage with respect to those competitors who may not be subject to comparable restrictions. Failure to comply or to implement business practices that sufficiently prevent corruption or violation of sanctions laws could result in significant remediation expense and expose us to significant civil and criminal penalties and reputational harm.

We may not be able to meet our performance targets and milestones.

From time to time, we communicate to the public certain targets and milestones for our financial and operating performance that are intended to provide metrics against which to evaluate our performance. They should not be understood as predictions or guidance about our expected performance. Our ability to meet any target or milestone is subject to inherent risks and uncertainties, and we caution investors against placing undue reliance on them. See Statement Regarding Forward-Looking Disclosure.

We have limited personal liability.

Our Certificate of Incorporation and Bylaws generally provide that the liability of our officers and directors will be eliminated to the fullest extent allowed under law for their acts on behalf of our Company.

There are implications of being an emerging growth company.

As a company with less than $2.0 billion in revenue during its last fiscal year, we qualify as an “emerging growth company” as defined in the JOBS Act. For as long as a company is deemed to be an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| · | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis included in an initial public offering registration statement; |

| · | an exemption to provide less than five years of selected financial data in an initial public offering registration statement; |

| · | an exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; |

| · | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| · | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| · | reduced disclosure about our executive compensation arrangements. |

An emerging growth company is also exempt from Section 404(b) of the Sarbanes Oxley Act, which requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a Smaller Reporting Company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a Smaller Reporting Company.

As an emerging growth company, we are exempt from Section 14A (a) and (b) of the Exchange Act which require stockholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We would cease to be an emerging growth company upon the earliest of:

| · | the first fiscal year following the fifth anniversary of the filing of this Form 10; |

| · | the first fiscal year after our annual gross revenues are $2 billion or more; |

| · | the date on which we have, during the previous three-year period, issued more than $2 billion in non-convertible debt securities; or |

| · | as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year. |

Risks Related to Regulation

Applicable state and international laws may prevent us from maximizing our potential income.

Depending on the laws of each particular State and country, we may not be able to fully realize our potential to generate profit. Furthermore, cities and counties are being given broad discretion to use other carbon capture methodologies. Depending on the laws of international countries and the States, we might not be able to fully realize our potential to generate profit.

Compliance with environmental laws could materially increase our operating expenses.

There may be environmental conditions associated with businesses we acquire of which we are unaware. Such environmental liability exposure associated with properties we acquire could harm our business, financial condition, liquidity and results of operations.

Risks Related to the Market for our Stock

The OTC and share value

Our Common Stock trades over the counter, which may deprive stockholders of the full value of their shares. Our stock is quoted via the Over-The-Counter (“OTC”) Pink Sheets under the ticker symbol “ARMV”. Therefore, our Common Stock is expected to have fewer market makers, lower trading volumes, and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for our Common Stock.

Low market price

A low market price would severely limit the potential market for our Common Stock. Our Common Stock is expected to trade at a price substantially below $5.00 per share, subjecting trading in the stock to certain Commission rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-NASDAQ equity security that has a market price share of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our Common Stock.

Lack of market and state blue sky laws

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws. The holders of our shares of Common Stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares available for trading on the OTC, investors should consider any secondary market for our securities to be a limited one. We intend to seek coverage and publication of information regarding our Company in an accepted publication which permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin.

Accordingly, our shares of Common Stock should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Penny stock regulations

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our Common Stock. The Commission has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our Common Stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the Commission relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our Common Stock will qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the Commission the authority to restrict any person from participating in a distribution of penny stock, if the Commission finds that such a restriction would be in the public interest.

Rule 144 Risks