March 13, 2015

| Mr. Jeffrey P. Riedler |

| Assistant Director |

| Securities and Exchange Commission |

| Washington D.C. 20549 |

| Re: | Till Capital Ltd. |

| | Amendment No. 1 to Registration Statement on Form 20-F |

| | Filed February 17, 2015 |

| | File No. 000-55324 |

Dear Mr. Riedler,

Till Capital Ltd. (“Till” or the “Company”) has received and reviewed your letter dated March 9th, 2015, regarding the Commission’s review of Till’s Amendment No. 1 to Registration Statement on Form 20-F (File No. 000-55324) (the “Form 20-F”). Till has withdrawn the Registration Statement pending clearance of all of the Commission’s comments, and has filed a revised Form 20-F today reflecting responses to your letter dated March 9th, 2015 and as set forth below:

SEC Comment 1:

| | 1. | Please refer to prior comment 2. Please expand your disclosure to include the $16.9 million of royalty and mineral interests at September 30, 2014. Explain to us your basis for excluding these assets in your evaluation of the 30% investment limitation. Also, explain your statement that “we do not expect the impact of the Properties to be significant to our business after the current fiscal period,” when you plan to divest these interest in order to “maximize RRL’s return on investment.” In addition, describe any known uncertainties governing the Properties and explain how the planned management of these assets is intended to affect your future liquidity and results of operations. |

Company Response to Comment 1:

We have revised page 31 of the Form 20-F to include the additionalitalicized disclosure:

In Canada, there are approximately 200 publicly traded major resource companies, 400 intermediate sized resource companies and 1,200 junior resource companies. We believe that many intermediate and junior resource companies have limited access to the capital market. For such companies, raising equity capital can be highly dilutive, and bank financing is often not available or acceptable. We believe that investing in resource companies can lead to enhanced returns by providing levered exposure to the underlying commodity. In addition, junior and intermediate companies often trade at a discount from the book value of their proven reserves, and sometimes even at a discount to their cash value. We believe that favorable investment opportunities can be obtained by exploiting market inefficiencies in the junior and intermediate resource markets. These investments may include joint ventures, royalty interests, equity investments, mining and mineral projects, debt financing arrangements and other structured investments with holding periods expected to range from one to three years. We expect the percentage of RRL’s investments allocated to this strategy to range between 10% and 30% of the fair market value of our portfolio.

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e | 2

In monitoring our exposure to investments in the resource sector, we value each investment, including the securities of SPD and GPY, at fair market value, measured at period end. As of September 30, 2014, the fair market value of our investments in the natural resources sector was $16.9 million. For purposes of that calculation, we do not separately include the book value of royalties and mineral interests for companies in our investment portfolio, including SPD and GPY. All material royalties and mineral interests reflected in our financial statements are owned by either SPD or GPY. Till and RRL do not directly own a material amount of royalties or mineral interests.

As of the date of this Registration Statement, we hold controlling interests in SPD and GPY, each of which owns certain mining properties which are currently under exploration.Although we currently hold a controlling interest in each of SPD and GPY, the strategy and operations of each of these entities is determined by each entity’s respective board of directors.Consistent with RRL’s investment strategy, we intend to exit some or all of the investments within the next one to three years, subject to market conditions, the market value of the SPD and GPY shares and RRL’s capital requirements.

As discussed in the response to Comment 2 below, we have revised page 34 of the Form 20-F to include disclosures regarding our expectations of the impact of the mineral properties described on page F-18 of the Form 20-F (the “Properties”) on our financial condition, liquidity and operating results after the current fiscal period.

SEC Comment 2:

| | 2. | Please refer to prior comment 3. Please expand your proposed disclosure to include the assertion in your response that “we do not expect the impact of the Properties to be significant to our business after the current fiscal period.” Explain the factors considered in concluding that the divestiture of these Properties would not result in additional impairment losses or reversal of previously-recorded impairment losses that would be material to your future operating results. |

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

|

P a g e | 3

Company Response to Comment 2:

We have revised page 34 of the Form 20-F to include disclosures regarding our expectations of the impact of the Properties on our financial condition, liquidity and operating results after the current fiscal period.

We expect that SPD and GPY will continue to incur exploration and other costs in connection with their operations as junior mineral resource exploration companies. However, we do not expect to make additional capital contributions to either entity or fund operational deficits of either entity. As the financial statements of SPD and GPY are consolidated with Till’s financial statements, any operating losses or impairment charges incurred by SPD and GPY will be reflected in our results of operations. If any of the mineral properties held by SPD or GPY is not commercially viable, or if SPD or GPY incurs impairment losses in respect of their assets, we could incur additional write-offs or impairment losses. If SPD or GPY make recoveries of previously recorded impairment losses, we could recover such impairment losses. Consequently, during the period in which we are majority owners of SPD and GPY, our financial condition and operating results may be materially impacted by SPD and GPY.

In addition, reductions in the market value of the SPD and GPY securities we own may also impact our financial condition and results of operations. Our investments in junior and intermediate resource companies involve a high degree of risk. See “Item 3.D—Risk factors—Investments in junior and intermediate resource companies such as SPD and GPY may have a significantly higher degree of risk than many other types of investments. This risk may arise from numerous factors, including, but not limited to the following factors” on page 9 of this Form 20-F for a full discussion of the risks involved with such investments. If we exit some or all of our investments in resource companies, including SPD and GPY, such transactions may have a material impact on our liquidity, financial condition and results of operations.

SEC Comment 3:

| | 3. | Your pro forma presentation appears to be intended to provide investors with information about the continuing impact of the business activities of entities included in the Arrangement and Omega Insurance Holdings. Please explain how this presentation differs from the expected results of your planned reinsurance operations, which at present appears to have no meaningful impact on your pro forma presentation. Revise your disclosure accordingly. |

Company Response to Comment 3:

The Company has inserted the following additional risk factor on page 10 in the revised Form 20-F.

Because we do not have an operating history as a reinsurance company, our historical and pro forma financial information may not be indicative of our future results.

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e | 4

The historical and pro forma financial information we have included in this registration statement has been derived from the historical financial information of Till, AMB, SPD, GPY and Omega and may not reflect what our results of operations, financial position and cash flows would have been had the Reorganization and Omega Acquisition been consummated during the periods presented or be indicative of what our results of operations, financial position, and cash flows may be as a reinsurance company in the future. Assumptions and adjustments have been made regarding the Company after giving effect to the Reorganization and Omega Acquisition, and these assumptions and adjustments may not prove to be accurate. Our actual financial condition and results of operations following the completion of the Reorganization and Omega Acquisition may not be consistent with, or evident from, the pro forma financial information.

Our historical and pro forma financial information reflect AMB, SPD and GPY’s operations as mineral resource exploration companies and Omega’s operations as an insurance business, but do not reflect our operations as a reinsurance business. Until April 17, 2014, AMB was a mineral resource exploration company. After April 17, 2014, we began to transition to a reinsurance business. Our historical and pro forma financial information does not reflect changes that we expect to experience and are currently experiencing as a result of our transition to a reinsurance company, including changes in our cost structure, financing, personnel needs, tax structure, business operations and management. We have no history of operating as a reinsurance company. Our lack of an operating history as a reinsurance business will make it difficult for investors to assess our ability to operate profitably as a reinsurance business.

We have also inserted this additional paragraph at page 82:

The unaudited pro forma consolidated financial information set forth below does not represent the actual financial position or results of operations of the Company as at and for the dates indicated and is being furnished solely for illustrative purposes. Further, the unaudited pro forma financial consolidated financial information does not purport to project the Company’s results of operations or financial position for any future period or for any future date. The unaudited pro forma financial consolidated financial information reflects AMB, SPD and GPY’s operations as mineral resource exploration companies and Omega’s operations as an insurance business, but do not reflect our operations as a reinsurance business. As we have no operating history as a reinsurance business, it may be difficult to assess our ability to operate profitably as a reinsurance business.

SEC Comment 4:

The Arrangement, page 17

| | 4. | Please revise your disclosure to include your response to prior comment 5. Additionally please provide organizational charts for the companies prior to the arrangement and reorganization and after the completion of the arrangement and reorganization. The organizational charts should show the connections and percentage ownership of the various entities and Mr. Sheriff. |

Company Response to Comment 4:

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e | 5

We have inserted the following sentence and chart on Page 17 of the revised Form 20-F:

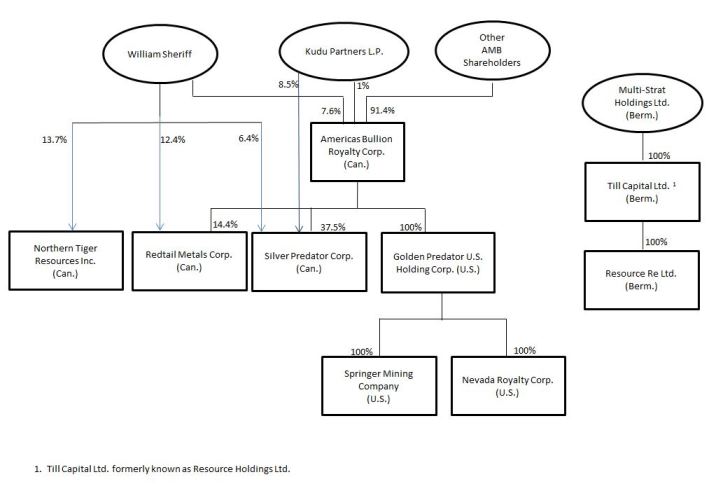

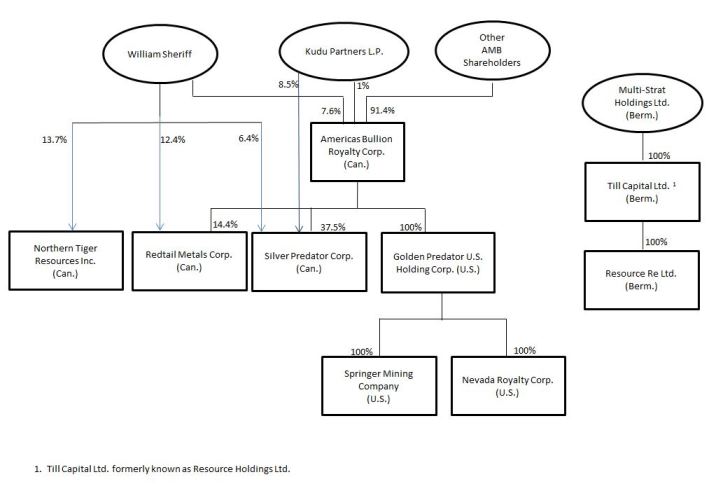

The following chart summarizes the ownership and organizational structure of the entities immediately prior to the Arrangement:

We have also inserted the following sentence and chart on Page 18 of the revised Form 20-F:

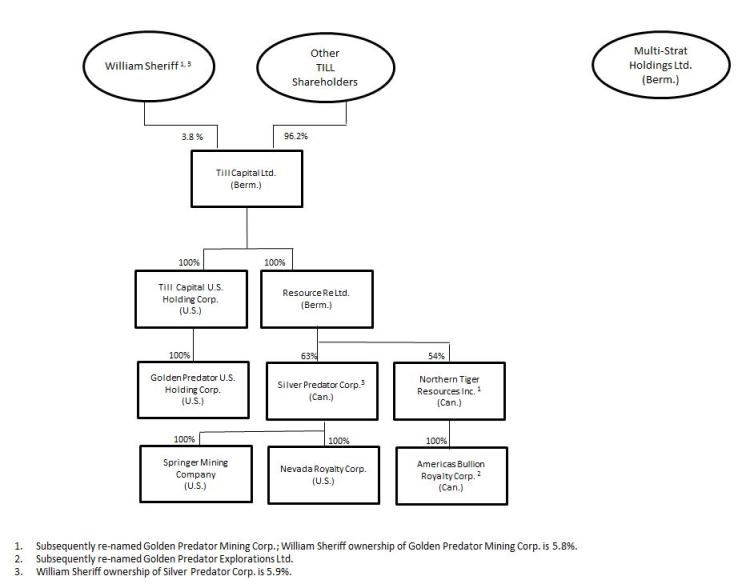

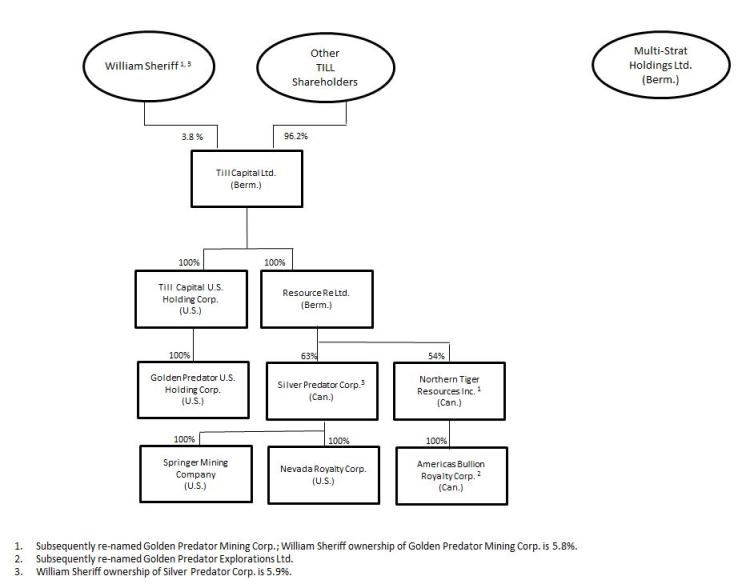

Following completion of the Arrangement, the following chart summarizes the ownership and organizational structure of the entities that were associated with the Arrangement:

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e |6

SEC Comment 5:

Investments, page F-14

| | 5. | Please refer to prior comment 13. As requested, please describe any known uncertainties governing the investments made by Courant and explain how the planned management of these assets is intended to affect your future liquidity and results of operations. |

Company Response to Comment 5:

Our investments made through Courant are subject to a number of risks, including the risk of a significant loss. Although we will attempt to mitigate those risks, there can be no assurance that our investments made through Courant will not negatively impact our future liquidity, financial position and results of operations. We have added the following risk factor on page 9 of the Form 20-F which addresses these risks.

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e |7

Our investments made through Courant Capital Management LLC involve taking long and short positions in large-cap equities, which positions are speculative and could result in losses, which may be significant.

We have invested a portion of our investment portfolio with Courant Capital Management LLC (“Courant”). Courant uses a proprietary trading strategy to invest in large-cap equities. Courant employs a statistical approach to take long and short positions in these equities, investing at times at which it considers the equity to be over-sold or over-bought in the short-term. However, Courant’s investment strategy is subject to market volatility, and there can be no assurance that this strategy will achieve expected gains. We may incur losses in the current or future periods as a result of Courant’s investment strategies, including significant losses, which could materially and adversely affect our liquidity, financial condition and results of operations.

The extent of our exposure to this risk is limited by the size of our investment in the Courant fund. We do not finance our investments in Courant with debt in order to apply financial leverage. We have daily visibility into the accounts in which Courant’s portfolio investments are held and can monitor Courant’s performance on a daily basis. Our portfolio managed by Courant is diversified among large-cap equities, and we can liquidate our entire position in the Courant portfolio into cash at any time within a three-day settlement period. However, there can be no assurances that these risk management strategies will be effective or that our investments made through Courant will not negatively impact our future liquidity, financial position and results of operations.

SEC Comment 6:

| | 6. | Please note that your registration statement will automatically become effective 60 days after filing. Upon effectiveness, you will become subject to the reporting requirements of the Securities Exchange Act of 1934, even if we have not cleared comments. In the event it appears that you will not be able to respond by the 60th day, you may wish to consider withdrawing your registration statement and refiling when all of our comments are cleared. |

Company Response to Comment 6:

As noted above, we have withdrawn the original Form 20-F in order to avoid the automatic effectiveness of the Form 20-F sixty days after the initial filing, and we have filed a revised Form 20-F today in response to your comments.

SEC Comment 7:

| | 7. | Comments to your application for confidential treatment will be delivered under separate cover. |

Company Response to Comment 7:

We acknowledge that comments to our application for confidential treatment will be delivered under separate cover.

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |

P a g e |8

* * * * * * * * * * * * * * * * * * * * * * * * *

In connection with our response to your comments, we acknowledge that:

We are responsible for the adequacy and accuracy of the disclosure in its filings;

Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and

We may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please contact me at 208-719-0134 if you have any additional questions or need any further clarification.

Sincerely,

“/s/ Timothy P. Leybold”

Timothy P. Leybold

Chief Financial Officer

Till Capital Ltd.

| Till Capital Ltd. |

| Continental Building, 25 Church Street, Hamilton HM 12, Bermuda | Tel: 208-635-5415 | www.tillcap.com |