Exhibit 99.2

KORNIT DIGITAL (NASDAQ: KRNT) Q2 2020 Earnings Call – Supporting Slides

SAFE HARBOR This presentation contains forward - looking statements within the meaning of U.S. securities laws. All statements other than statements of historical fact contained in this presentation are forward - looking statements. In some cases, you can identify forward - looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements reflect our current views with respect to future events and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward - looking statements. Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance or events or circumstances described in the presentation will occur or be achieved. Yo u should read the Company’s most recent quarterly report on Form 6 - K filed with the U.S. Securities and Exchange Commission on May 19, 2020, including the Risk Factors set forth therein, completely and with the understanding that our actual future results may be materially different from what we expect. Specifically, we face the risk that the duration of the global COVID - 19 pandemic may be extensive, which could continue to impact, in a material adverse manner, our operations, financial position and cash flows, and those of our customers and suppliers. Except as required by law, we undertake no obligation to update or revise any of the forward - looking statements, whether as a result of new information, future events or otherwise, after the date of this presentation. In addition to U.S. GAAP financials, this presentation includes certain non - GAAP financial measures. These non - GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. Reconciliation between results on a GAAP and non - GAAP basis is provided in Slide 17. This presentation contains statistical data that we obtained from industry publications and reports generated by third parties. Although we believe that the publications and reports are reliable, we have not independently verified this statistical data. Kornit, Kornit Digital, the K logo, and NeoPigment are trademarks of Kornit Digital Ltd. All other trademarks are the property of their respective owners and are used for reference purposes only. Such use should not be construed as an endorsement of our products or services. 2 © 2020 Kornit Digital. All rights reserved.

SPEAKERS ON TODAY’S CALL Ronen Samuel Guy Avidan A

OUR VISION CREATE A BETTER WORLD WHERE EVERYBODY CAN BOND, DESIGN AND EXPRESS THEIR IDENTITIES, ONE IMPRESSION AT A TIME

BUSINESS HIGHLIGHTS RONEN SAMUEL CEO

KORNIT DIGITAL ACQUIRES CUSTOM GATEWAY

ON - LINE SALES ARE EXCESS MANUFACTURING & OVER PRODUCTION INDUSTRY AT AN BOOMING B2C B2B INFLECTION POINT WHILE EXCESS INVENTORY TRADITIONAL RETAIL A MAJOR PAIN POINT FOR BRANDS AND RETAILRS DOWN

KORNIT DIGITAL ACQUIRES CUSTOM GATEWAY EXPANDING CLOUD SOFTWARE WORKFLOW PORTFOLIO FOR END - TO - END MANAGEMENT OF ON - DEMAND APPAREL AND HOME DÉCOR PRODUCTION

TOGETHER WE WILL ENABLE ON - DEMAND MANUFACTURING FOR BRANDS AND RETAILERS EFFICIENT SCALE UP OF ON - DEMAND PRODUCTION FLOORS • Bring a unique, end - to - end solution for on - demand production to the market • Revolutionize how global brands and fulfillers transforming their supply chain in to sustainable on - demand production to meet consumer’s needs © 2020 Kornit Digital. All rights reserved. © 2020 Kornit Digital. All rights reserved.

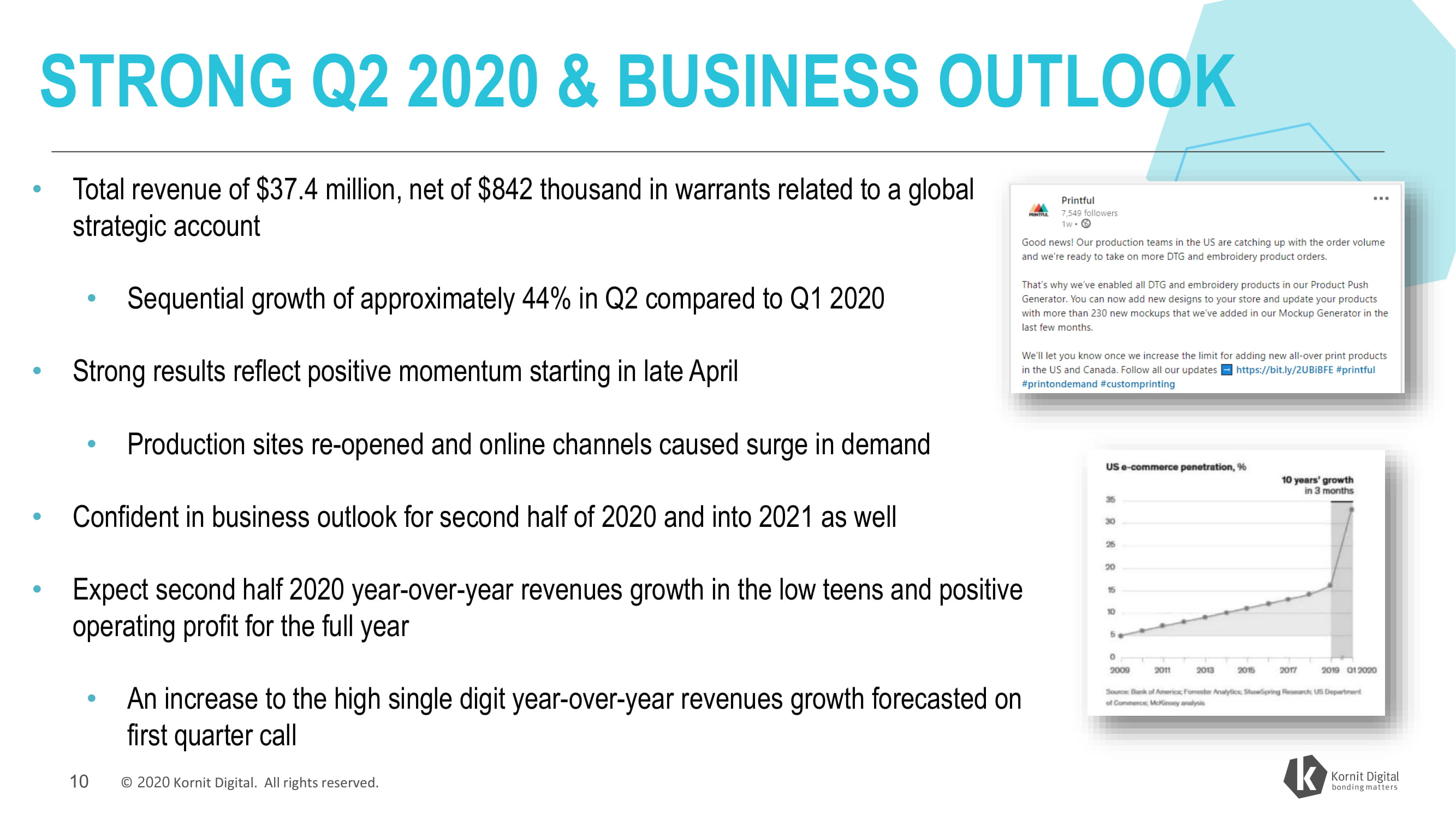

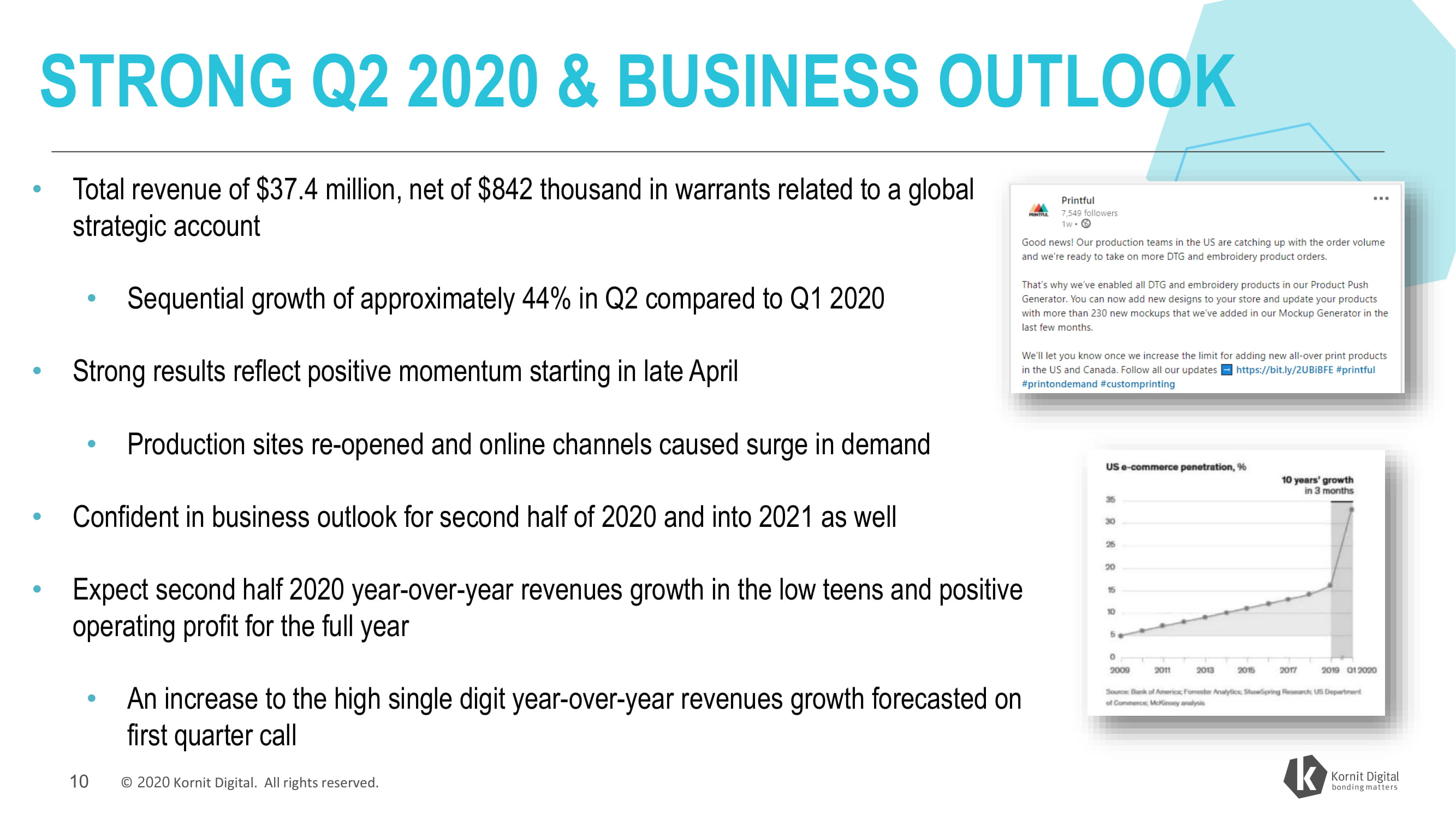

STRONG Q2 2020 & BUSINESS OUTLOOK • Total revenue of $37.4 million, net of $842 thousand in warrants related to a global strategic account • Sequential growth of approximately 44% in Q2 compared to Q1 2020 • Strong results reflect positive momentum starting in late April • Production sites re - opened and online channels caused surge in demand • Confident in business outlook for second half of 2020 and into 2021 as well • Expect second half 2020 year - over - year revenues growth in the low teens and positive operating profit for the full year • An increase to the high single digit year - over - year revenues growth forecasted on first quarter call 10 © 2020 Kornit Digital. All rights reserved.

ACTIVITY & BUSINESS MOMENTUM • Global operations are fully operating in - line with safety guidelines • Sales and service personnel supporting customers onsite when needed • All our manufacturing and R&D sites in Israel are fully staffed. • Exceptionally strong performance in North America across both new and existing customers • Continued growth in Central and Latin America • Region will become increasingly strategic in the coming years as brands and retailers look into onshoring and nearshoring as necessary evolution to existing supply chains • Lingering impact from COVID in Europe and Asia, but mega trends propelling industry similar to those serving as a tailwind in the US • Expect increased demand from these regions as we move through the year • Accelerating investments in these regions through larger direct touch presence in the UK, Germany and Japan, in conjunction with local partnerships; infrastructure will allow supporting growth of strategic accounts expanding into new territories 11 © 2020 Kornit Digital. All rights reserved.

ACTIVITY & BUSINESS MOMENTUM • Another excellent quarter for the Atlas, a huge success across both new and existing customers • Customers making significant investments • Projects identified on first quarter call proving to be larger than anticipated • Demand for Vulcan Plus introduced in Q1 2020 is strong • Follow - on orders placed in the quarter • Technological enhancements to the Poly Pro expected during the first half 2020 • Encouraged by building pipeline • Presto performing beyond expectations • Believe we have the best technology in the market to capture the huge opportunity for sustainable on - demand manufacturing in the fashion and home décor markets. 12 © 2020 Kornit Digital. All rights reserved.

WELL POSITIONED FOR GROWTH • Our teams globally are focused on customer excellence delivering on the numerous large - scale implementations we have in place • Expected to drive revenue for the second half • Creating demand for ink and supplies in 2021 and beyond. • Our partnership with our global strategic account continues to be very strong, and we are successfully working with them on their ambitious growth plans while expanding globally • Strong progress with leading global brands • Transforming supply chains into on - demand production for both B2C and B2B business models • The market shifting in our direction strongly • Ready to execute on the massive opportunity ahead of us 13 © 2020 Kornit Digital. All rights reserved.

Q2 2020 FINANCIAL OVERVIEW GUY AVIDAN CFO

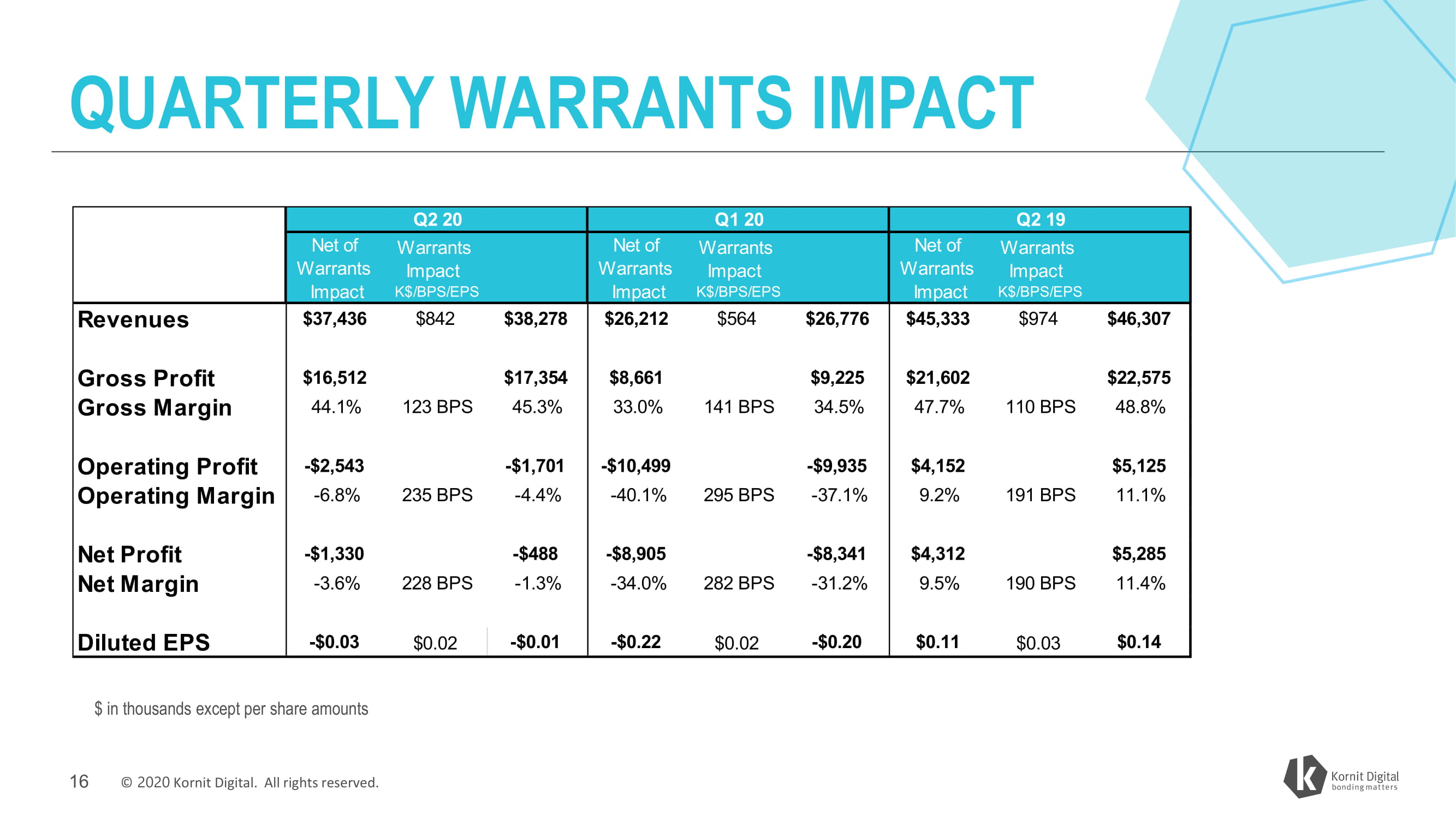

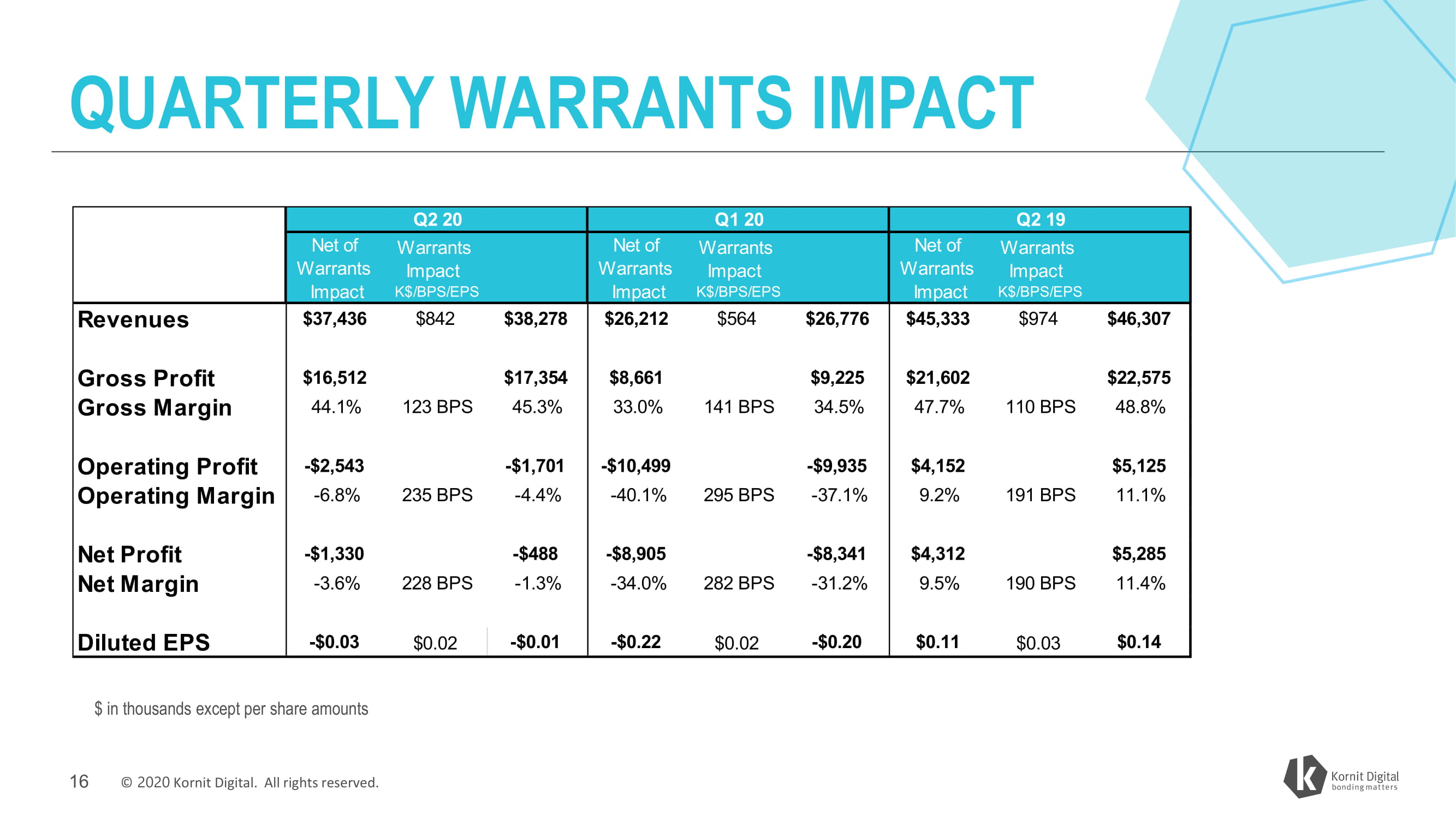

QUARTERLY WARRANTS IMPACT Q2 20 Q1 20 Q2 19 Net of Warrants Im pac t Net of Warrants Im pac t Net of Warrants Im pac t Warrants Im pac t Warrants Im pac t Warrants Im pac t K$/BPS/EPS K$/BPS/EPS K$/BPS/EPS Revenues $37,436 $842 $38,278 $26,212 $564 $26,776 $45,333 $974 $46,307 Gross Profit $16,512 $17,354 $8,661 $9,225 $21,602 $22,575 Gross Margin 44.1% 123 BPS 235 BPS 45.3% 33.0% 141 BPS 295 BPS 34.5% 47.7% 110 BPS 191 BPS 48.8% Operating Profit Operating Margin - $2,543 - $1,701 - $10,499 - $9,935 $4,152 $5,125 - 6.8% - 4.4% - 40.1% - 37.1% 9.2% 11.1% Net Profit - $1,330 - $488 - $8,905 - $8,341 $4,312 $5,285 Net Margin - 3.6% 228 BPS $0.02 - 1.3% - 34.0% 282 BPS $0.02 - 31.2% 9.5% 190 BPS $0.03 11.4% Diluted EPS - $0.03 - $0.01 - $0.22 - $0.20 $0.11 $0.14 $ in thousands except per share amounts 16 © 2020 Kornit Digital. All rights reserved.

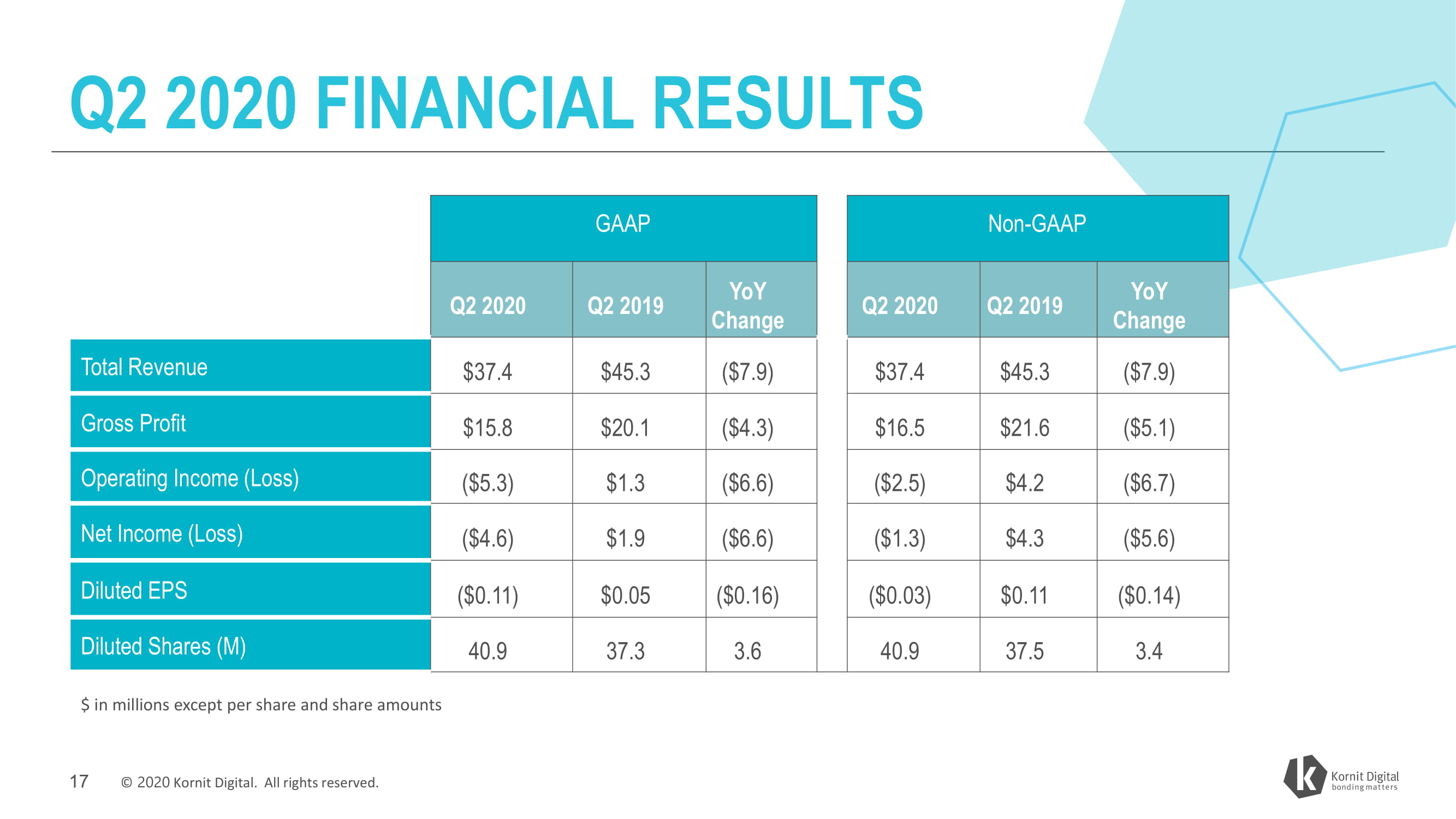

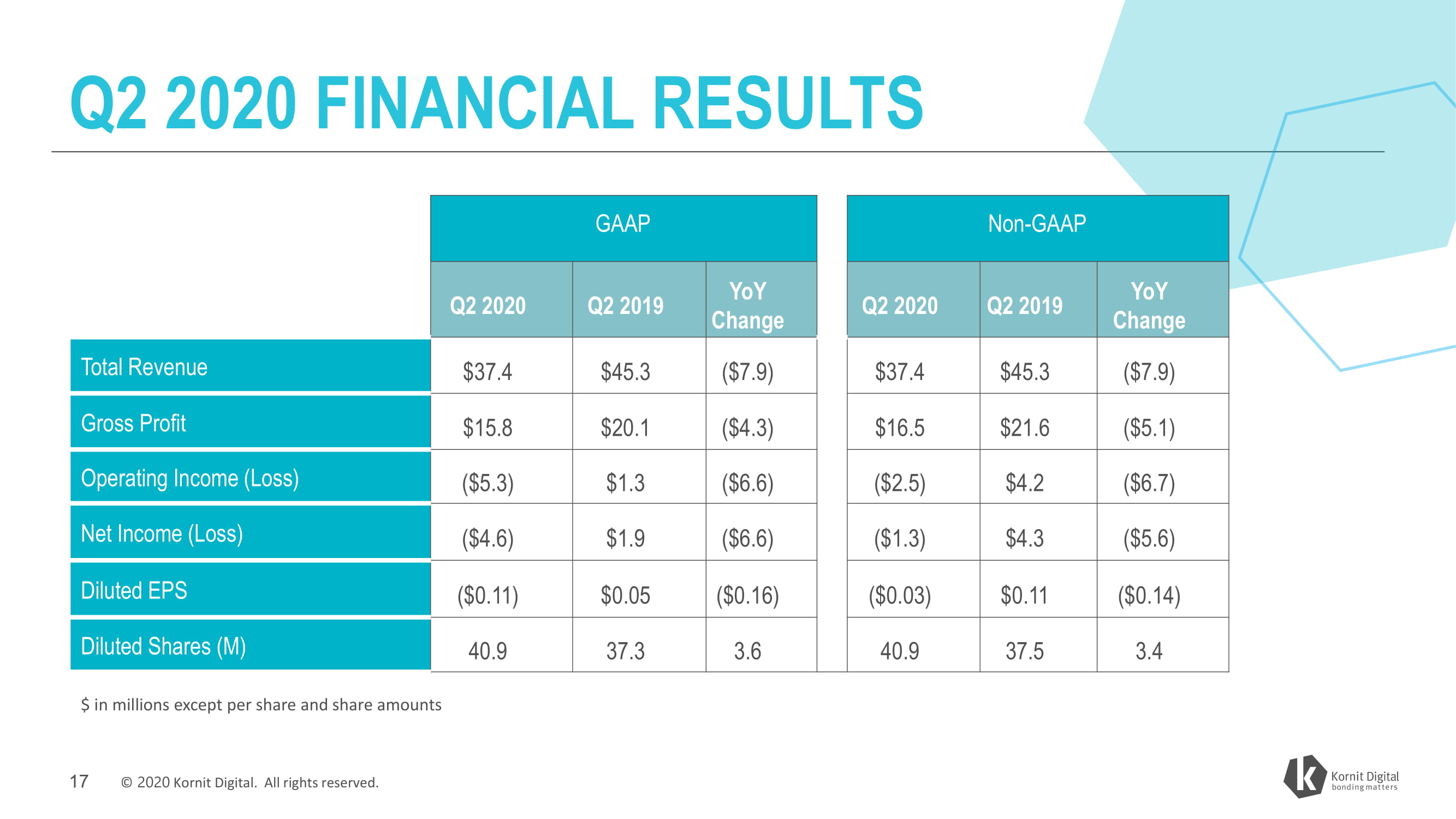

Q2 2020 FINANCIAL RESULTS GAAP Non - GAAP YoY Change YoY Change Q2 2020 Q2 2019 Q2 2020 Q2 2019 Total Revenue $37.4 $15.8 ($5.3) ($4.6) ($0.11) 40.9 $45.3 $20.1 $1.3 ($7.9) $37.4 $16.5 ($2.5) ($1.3) ($0.03) 40.9 $45.3 $21.6 $4.2 ($7.9) ($5.1) ($6.7) ($5.6) ($0.14) 3.4 Gross Profit ($4.3) ($6.6) ($6.6) ($0.16) 3.6 Operating Income (Loss) Net Income (Loss) Diluted EPS $1.9 $4.3 $0.05 37.3 $0.11 37.5 Diluted Shares (M) $ in millions except per share and share amounts 17 © 2020 Kornit Digital. All rights reserved.

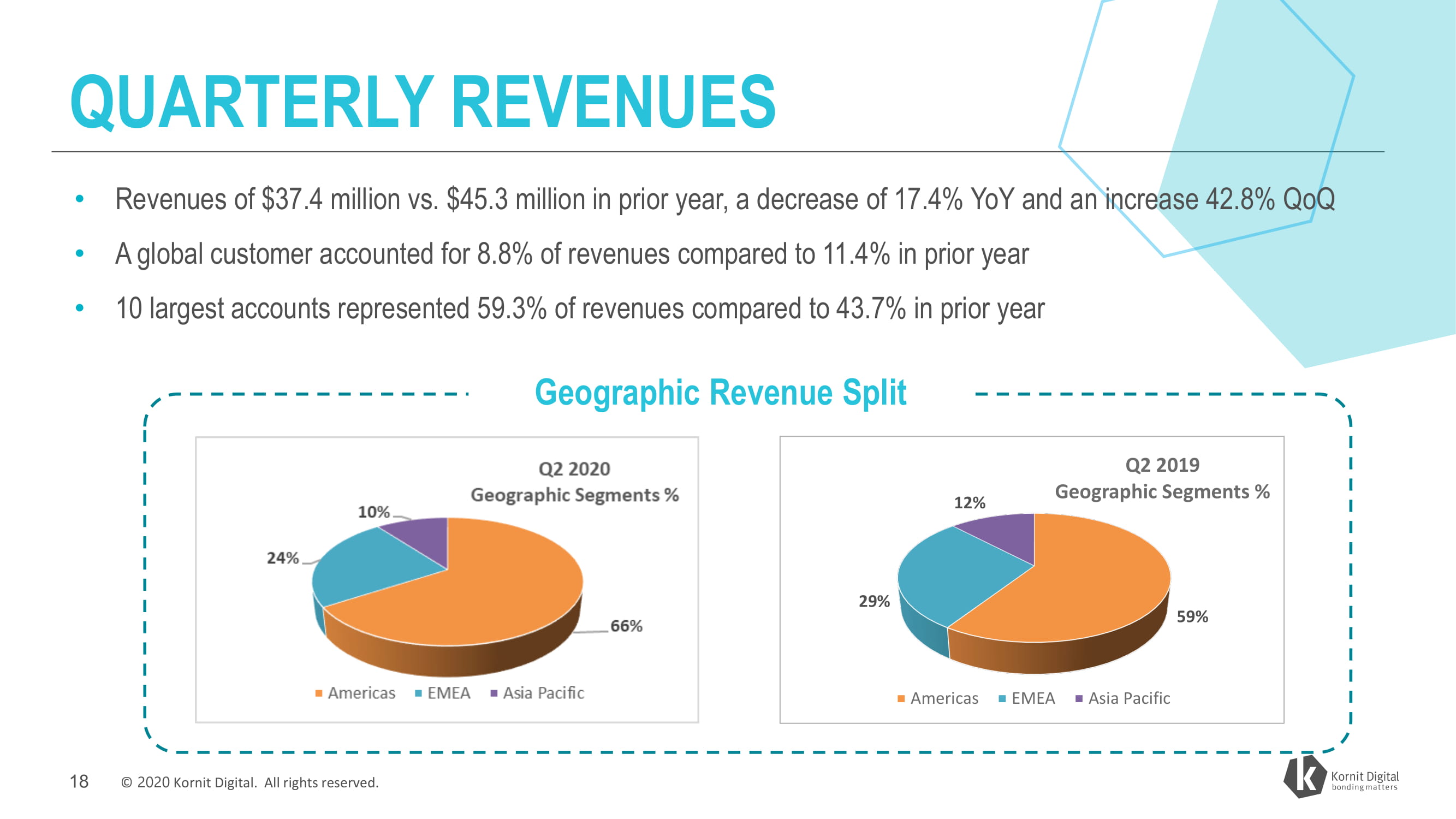

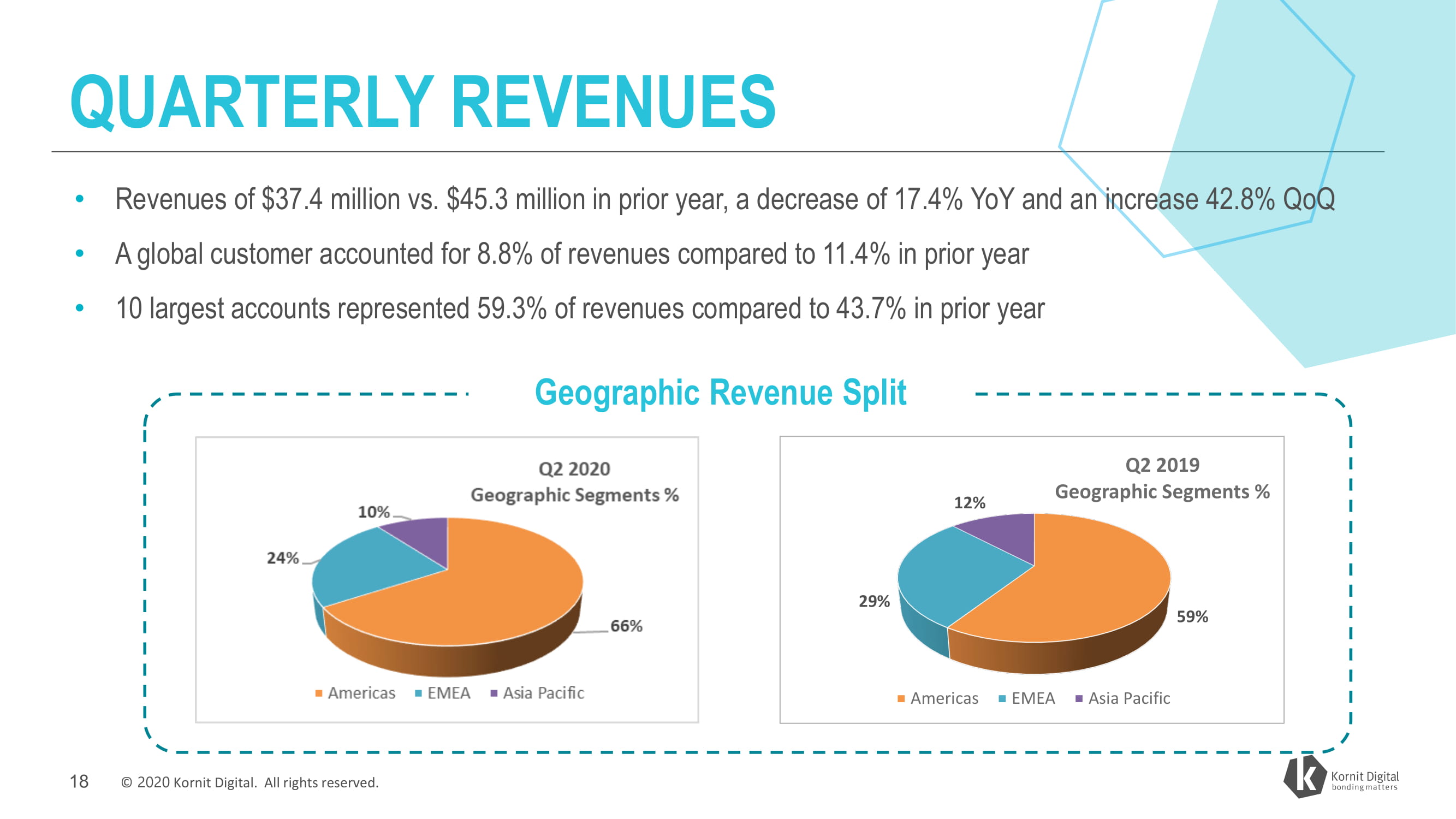

QUARTERLY REVENUES • Revenues of $37.4 million vs. $45.3 million in prior year, a decrease of 17.4% YoY and an increase 42.8% QoQ • A global customer accounted for 8.8% of revenues compared to 11.4% in prior year • 10 largest accounts represented 59.3% of revenues compared to 43.7% in prior year Geographic Revenue Split Q2 2019 Geographic Segments % 12% 29% 59% Americas EMEA Asia Pacific 18 © 2020 Kornit Digital. All rights reserved.

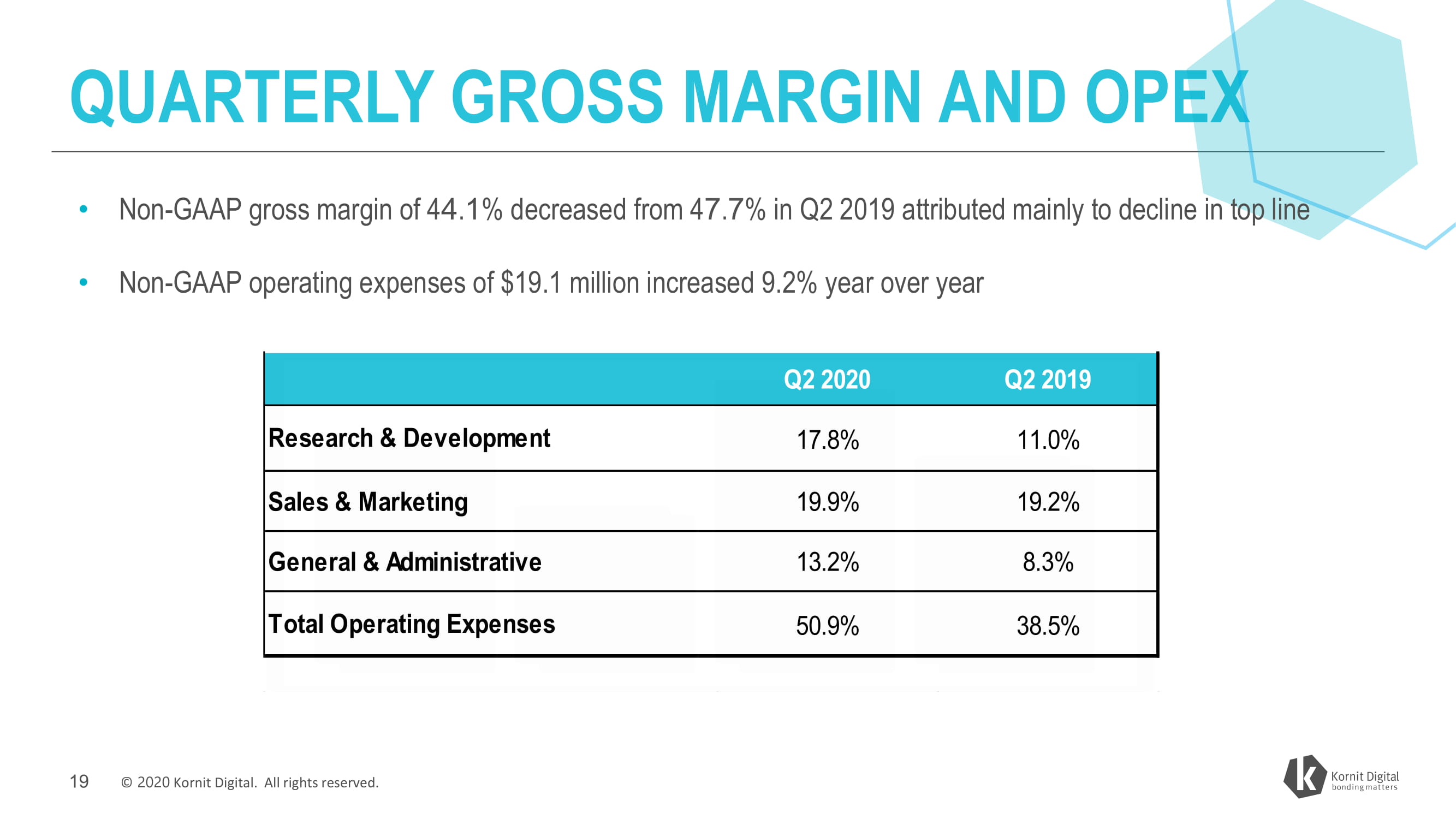

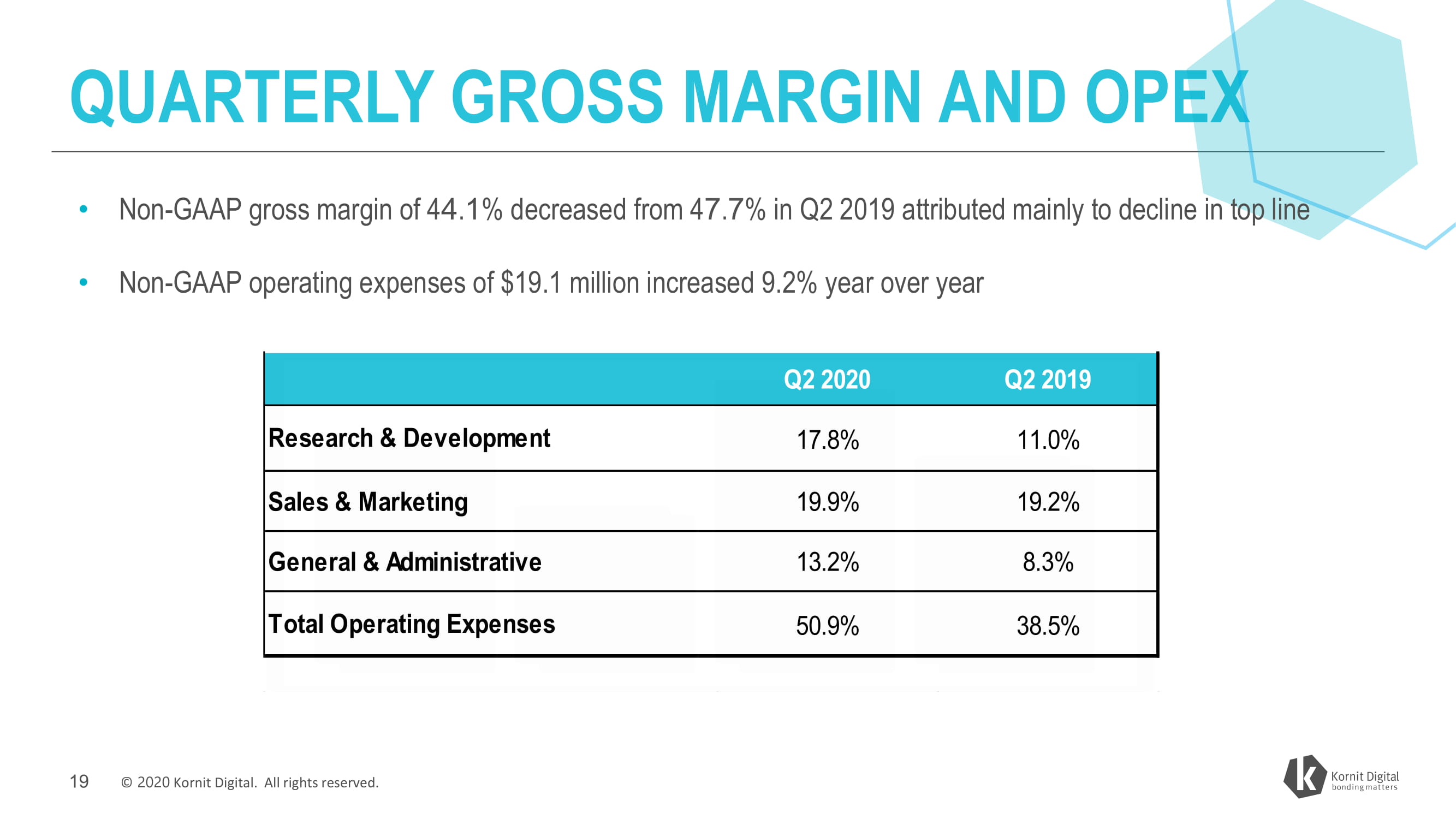

QUARTERLY GROSS MARGIN AND OPE • Non - GAAP gross margin of 44.1% decreased from 47.7% in Q2 2019 attributed mainly to decline in top line • Non - GAAP operating expenses of $19.1 million increased 9.2% year over year Q2 2020 17.8% 19.9% 13.2% 50.9% Q2 2019 11.0% 19.2% 8.3% Research & Development Sales & Marketing General & Administrative Total Operating Expenses 38.5% 19 © 2020 Kornit Digital. All rights reserved.

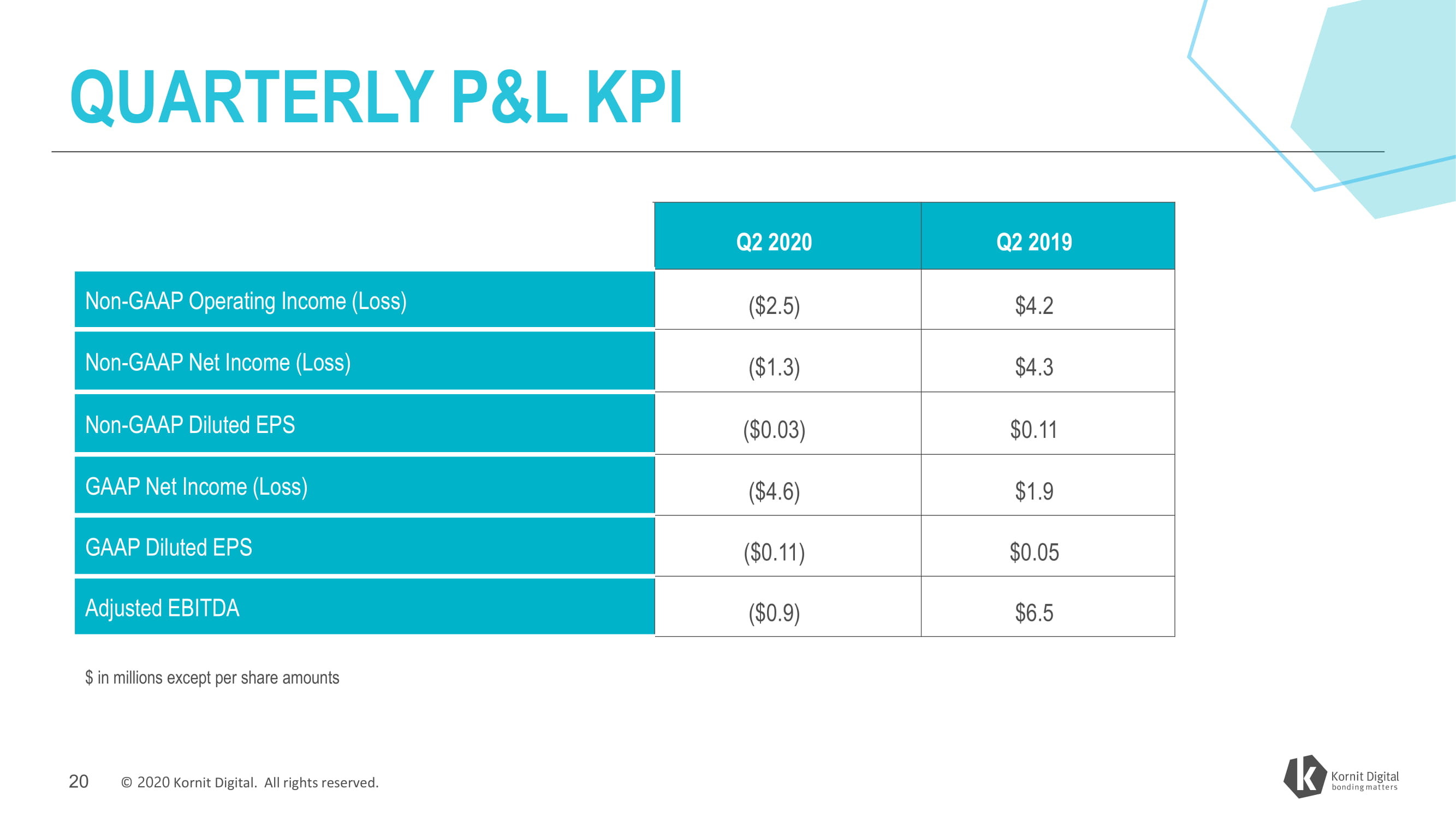

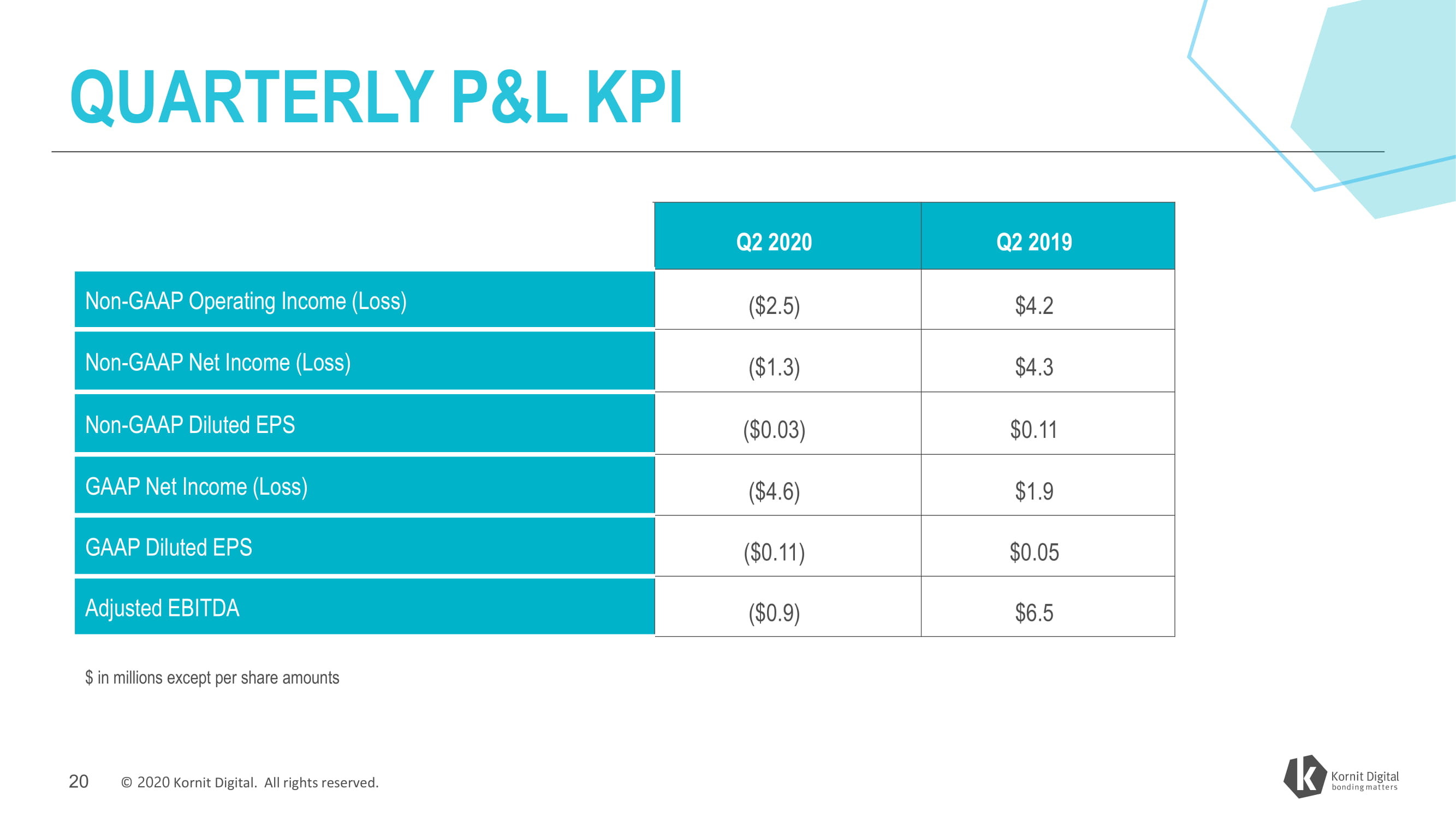

QUARTERLY P&L KPI Q2 2020 ($2.5) Q2 2019 $4.2 Non - GAAP Operating Income (Loss) Non - GAAP Net Income (Loss) Non - GAAP Diluted EPS GAAP Net Income (Loss) GAAP Diluted EPS ($1.3) $4.3 ($0.03) ($4.6) $0.11 $1.9 ($0.11) ($0.9) $0.05 $6.5 Adjusted EBITDA $ in millions except per share amounts 20 © 2020 Kornit Digital. All rights reserved.

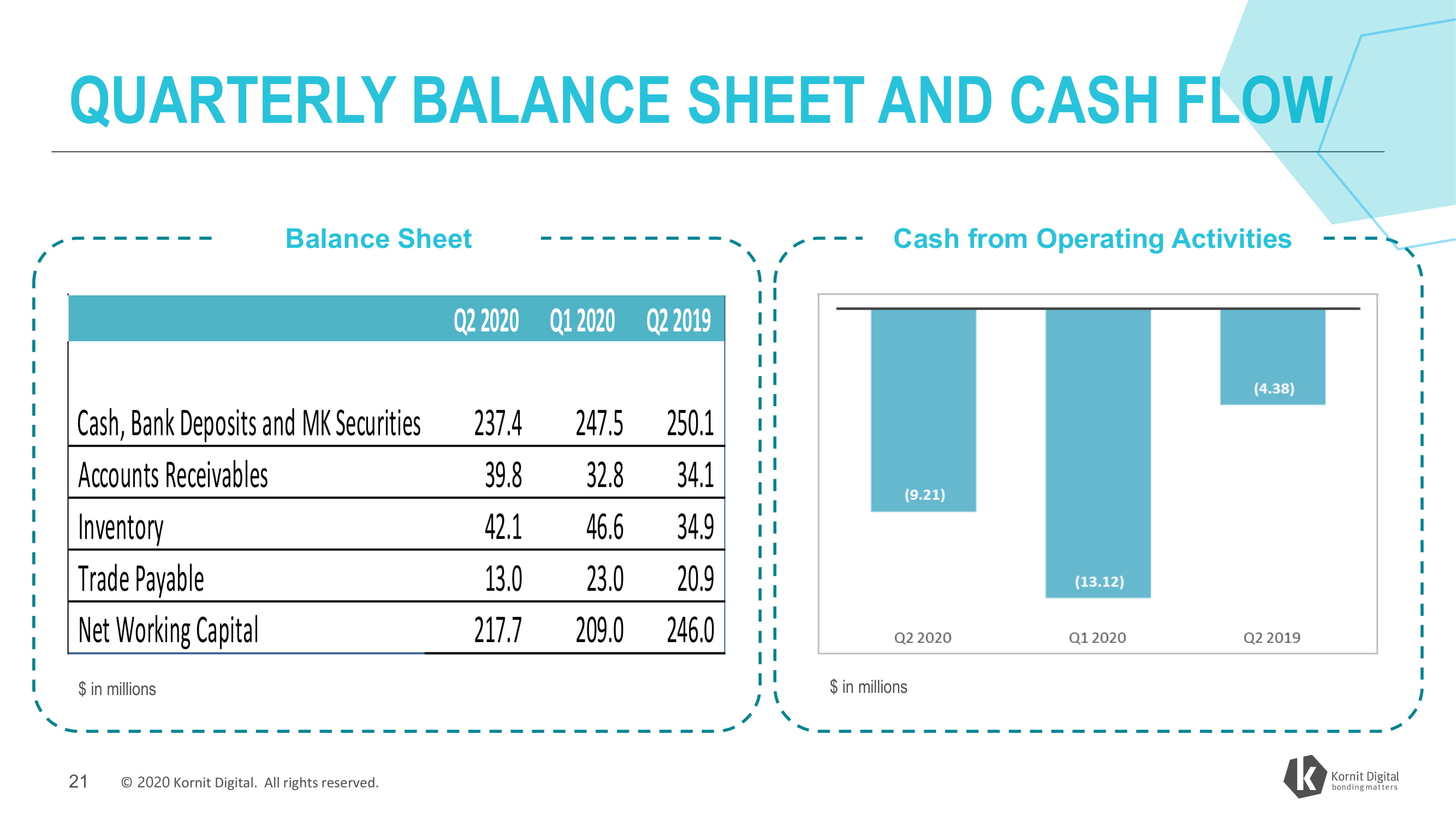

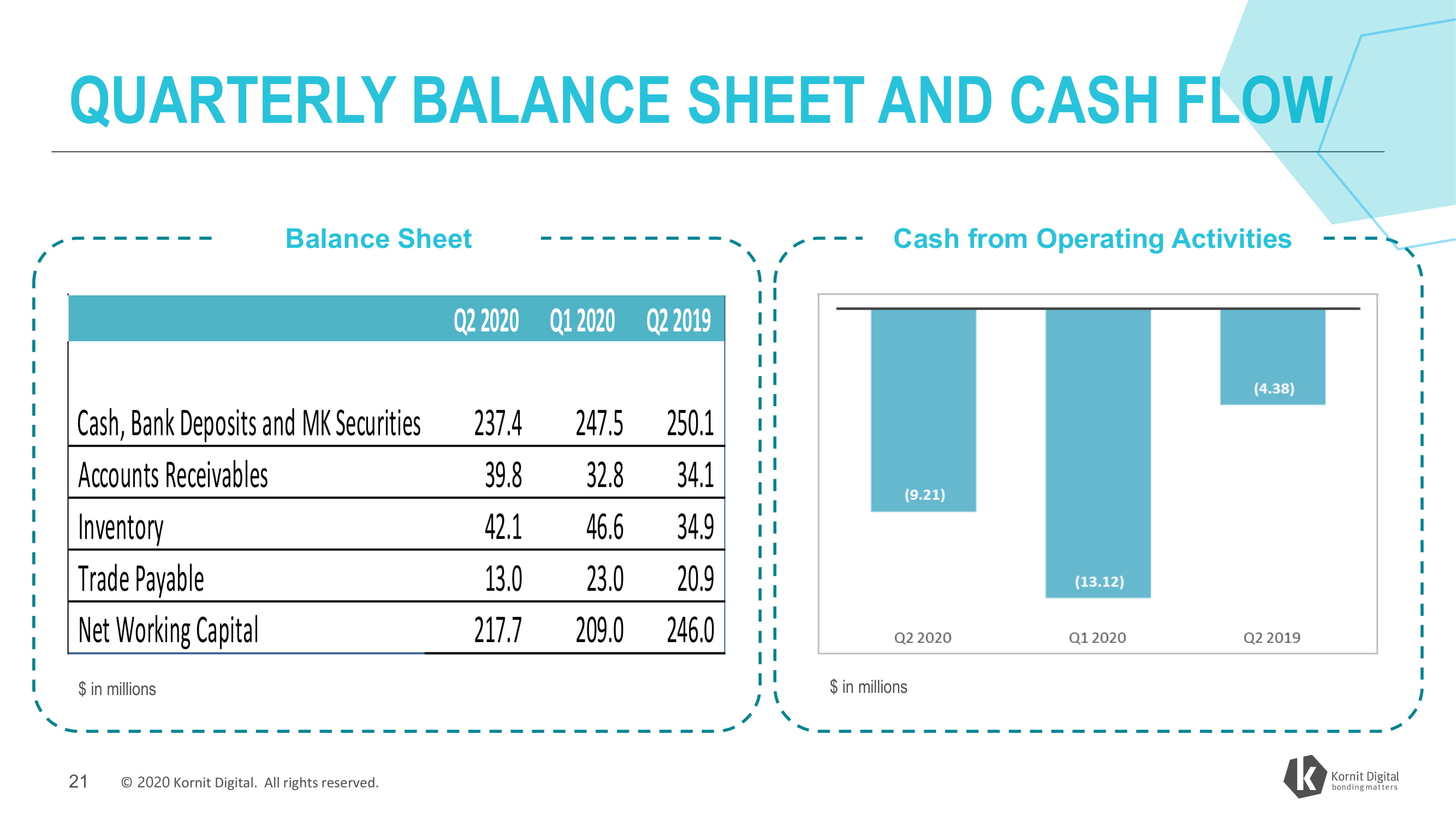

QUARTERLY BALANCE SHEET AND CASH FL Balance Sheet Q2 2020 Q1 2020 Q2 2019 Cash from Operating Activities Cash, Bank Deposits and MK Securities 237. 4 39. 8 247. 5 250. 1 Accounts Recei vabl es I nvent ory 32. 8 46. 6 23. 0 34. 1 34. 9 20. 9 42. 1 Trade Payabl e Net Working Capital $ in millions 13. 0 217. 7 209. 0 246. 0 $ in millions 21 © 2020 Kornit Digital. All rights reserved.

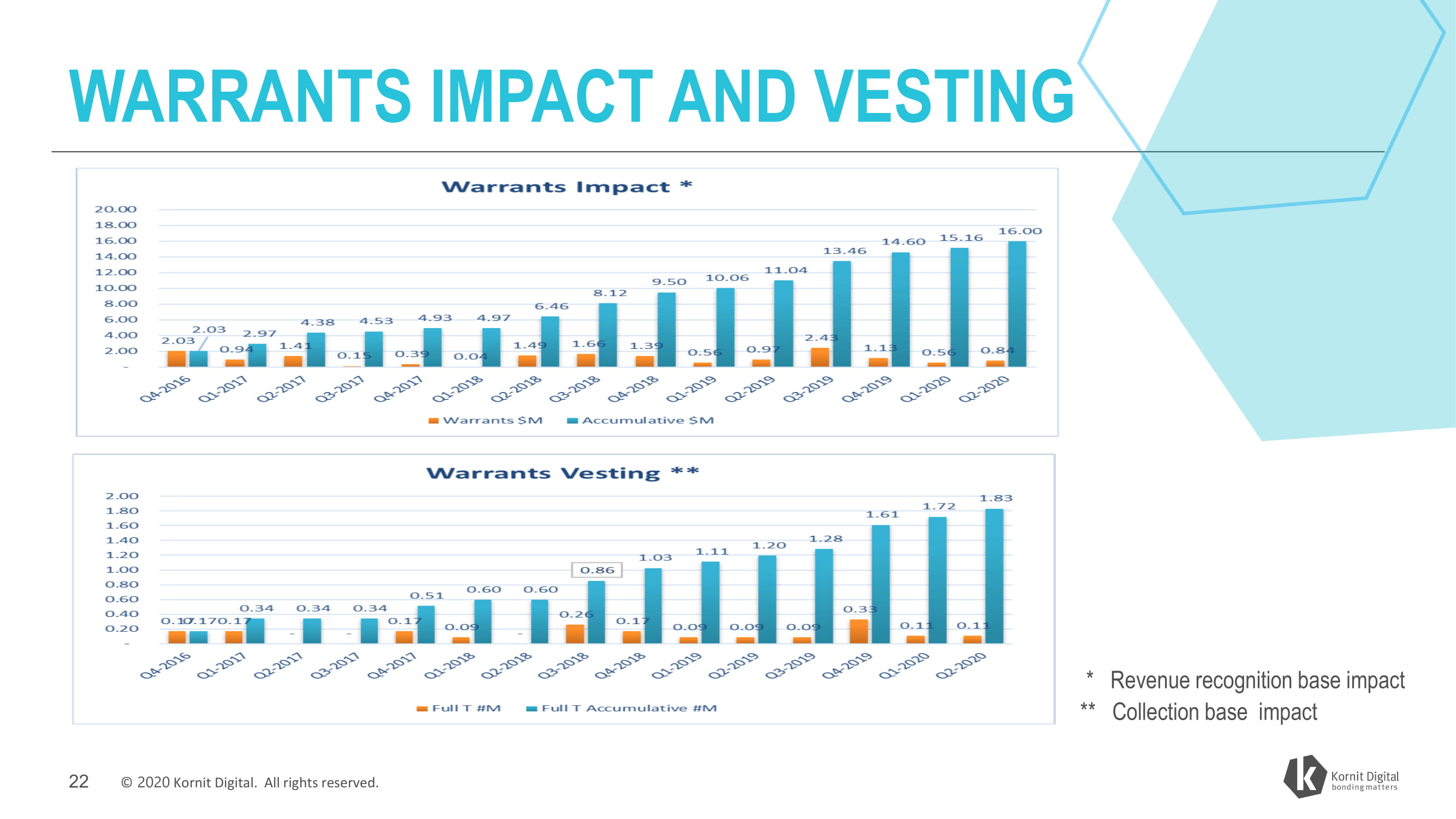

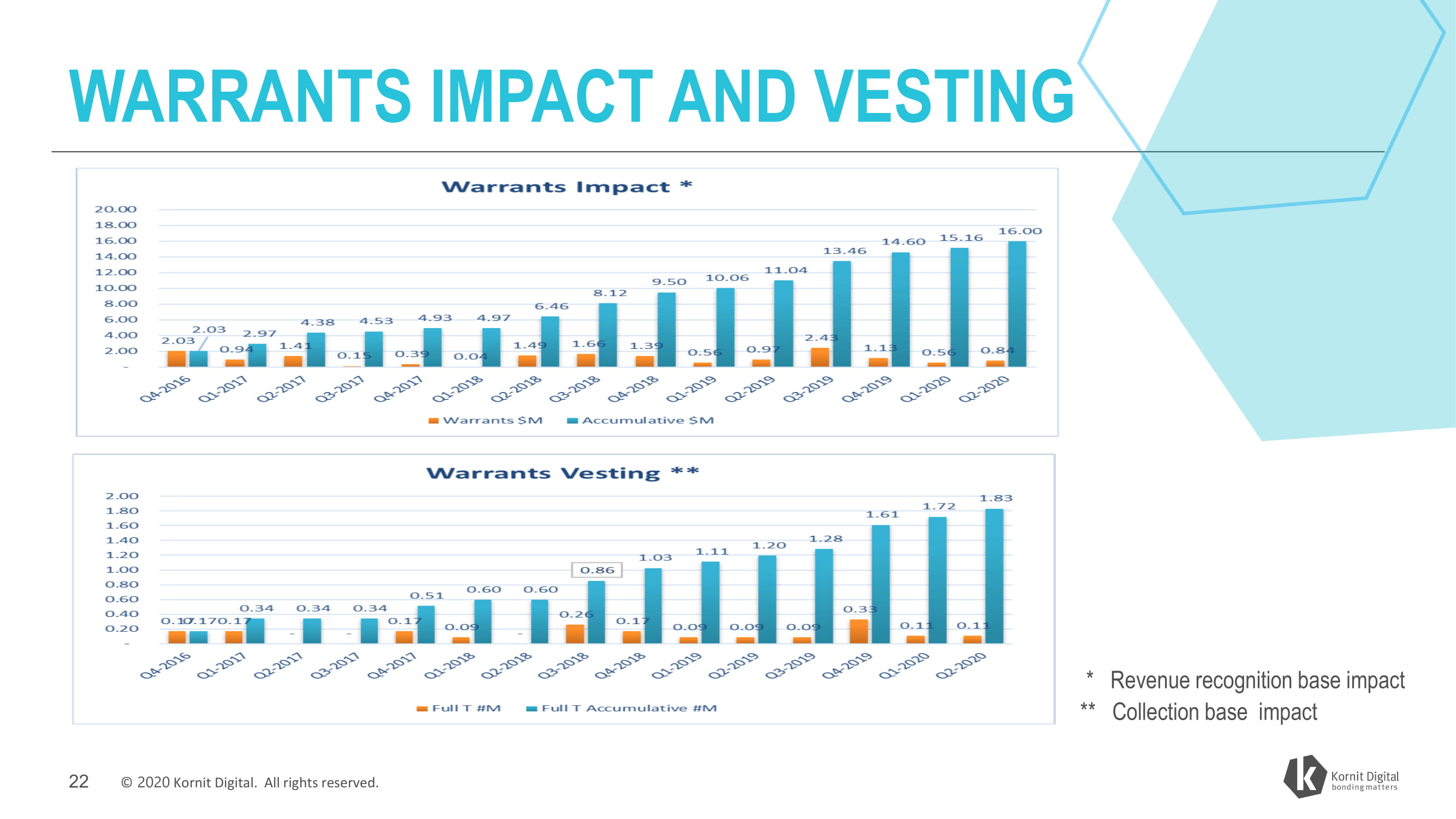

WARRANTS IMPACT AND VESTING * Revenue recognition base impact ** Collection base impact 22 © 2020 Kornit Digital. All rights reserved.

AMAZON WARRANTS AGREEMENT • 2,932,176 warrants to purchase ordinary shares of the Company at an exercise price of $13.04 were issued to Amazon as a customer incentive. The warrants are subject to vesting as a function of payments for purchased products and services of up to $150 million beginning on May 1, 2016, with the shares vesting incrementally each time Amazon makes a payment totaling $5 million to the Company. As of June 30, 2020, 1,832,595 warrants are exercisable • The Company utilized the Monte Carlo simulation approach to estimate the fair value of the warrants. We early adopted the new guidance as of January 1, 2019 and will use the fair value of the unvested warrants on the adoption date rather than upon the later vesting dates in order to determine the reduction of the transaction price • The Company recognized a reduction to revenues of $0.8 million during the second quarter of 2020 and $1.0 million during the second quarter of 2019 ($5.1 million during the year ended December 31, 2019) 23 © 2020 Kornit Digital. All rights reserved.

Q3 2020 GUIDANCE* • Revenue is expected to be between $53.5 million to $57.5 million • Non - GAAP operating income is expected to be between 8% to 11% of revenue *we assume zero impact on revenue and operating margin for the purposes of guidance 24 © 2020 Kornit Digital. All rights reserved.

THANK YOU OUR VISION CREATE A BETTER WORLD WHERE EVERYBODY CAN BOND, DESIGN AND EXPRESS THEIR IDENTITIES, ONE IMPRESSION AT A TIME

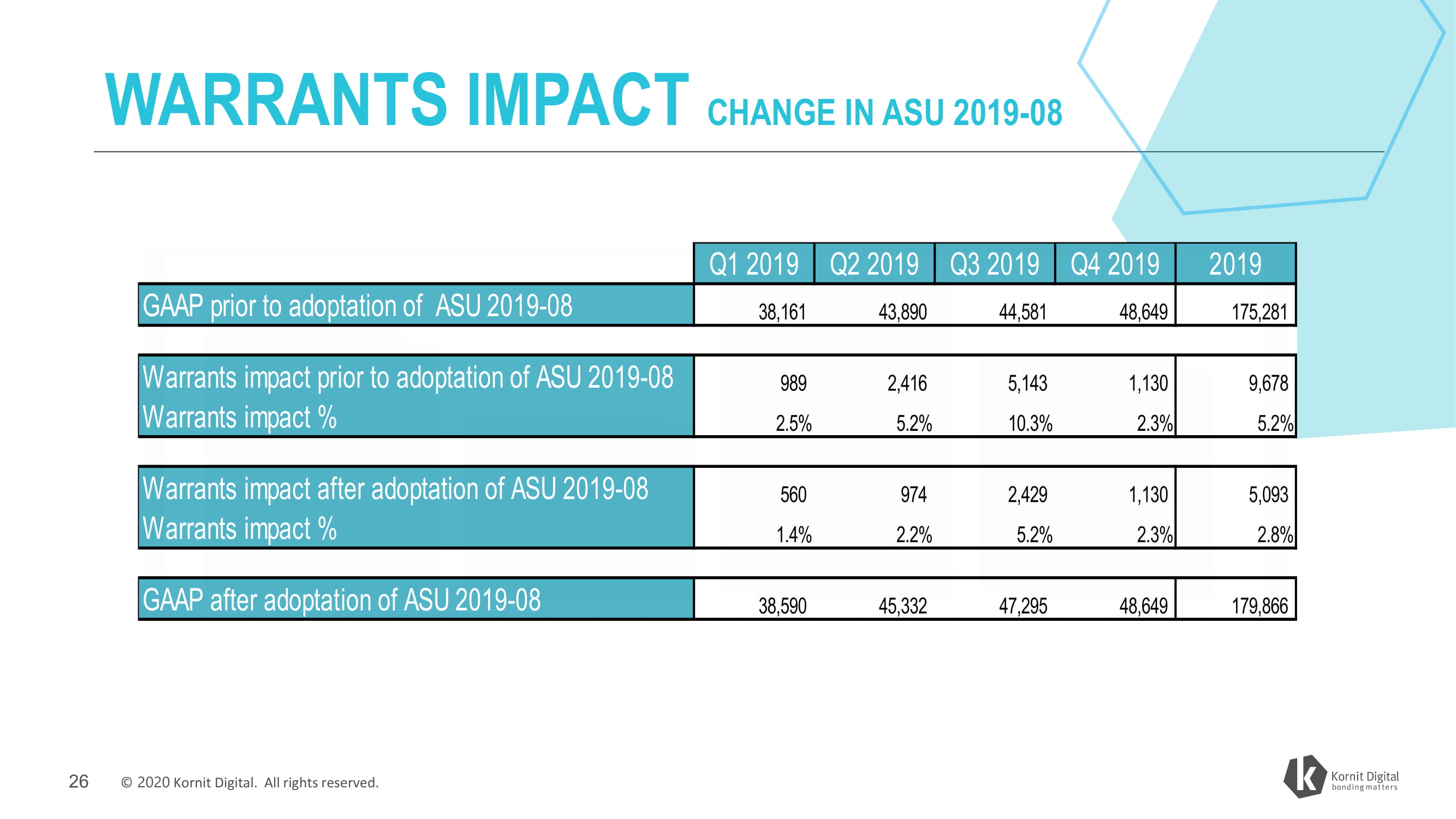

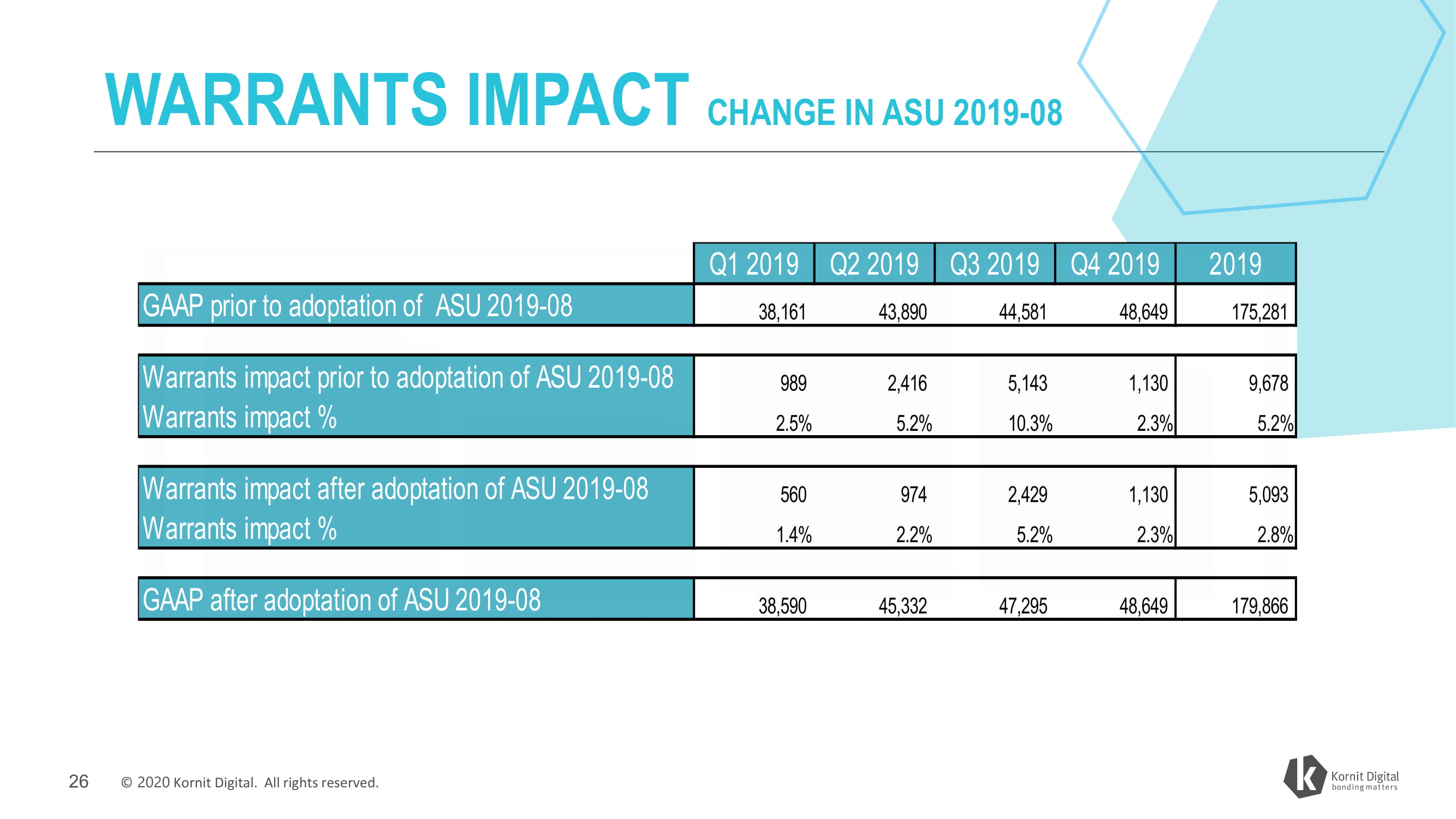

WARRANTS IMPACT CHANGE IN ASU 2019 - 08 Q1 2019 Q2 2019 Q3 2019 Q4 2019 GAAP prior to adoptation of ASU 2019 - 08 2019 38,161 43,890 44,581 48,649 175,281 Warrants impact prior to adoptation of ASU 2019 - 08 Warrants impact % 989 2,416 5.2% 5,143 1,130 2.3% 9,678 5.2% 2.5% 10.3% Warrants impact after adoptation of ASU 2019 - 08 Warrants impact % 560 974 2,429 5.2% 1,130 2.3% 5,093 2.8% 1.4% 2.2% GAAP after adoptation of ASU 2019 - 08 38,590 45,332 47,295 48,649 179,866 26 © 2020 Kornit Digital. All rights reserved.