Exhibit 99.2

©2023 Kornit Digital. All rights reserved. KORNIT DIGITAL (NASDAQ : KRNT) 1 Fourth Quarter & Full Year 2022 Earnings Conference Call Supporting Slides February 15, 2023

©2023 Kornit Digital. All rights reserved. ON T O D A Y ’S CALL Ronen Samuel CEO Lauri Hanover CFO Amir Shaked Mandel EVP Corp Dev Andrew Backman Global Head of IR

SAFE HARBOR ©2023 Kornit Digital. All rights reserved. 3 ©2023 Kornit Digital. All rights reserved. This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U . S . securities laws . Forward - looking statements are characterized by the use of forward - looking terminology such as “will,” “expects,” “anticipates,” “continue,” “believes,” “should,” “intended,” “guidance,” “preliminary,” “future,” “planned,” or other words . These forward - looking statements include, but are not limited to, statements relating to the Company’s objectives, plans and strategies, statements of preliminary or projected results of operations or of financial condition and all statements that address activities, events, or developments that the Company intends, expects, projects, believes or anticipates will or may occur in the future . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties . The Company has based these forward - looking statements on assumptions and assessments made by its management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate . Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward - looking statements include, among other things : the duration and severity of current adverse macro - economic headwinds being caused by supply - chain delays, inflationary pressures, and rising interest rates, which have been impacting, and may continue to impact, in an adverse manner, the Company’s operations, financial position and cash flows, in part due to the adverse impact on the Company’s customers and suppliers ; the Company’s degree of success in developing, introducing and selling new or improved products and product enhancements including specifically the Company’s Poly Pro and Presto products ; the extent of the Company’s ability to consummate sales to large accounts with multi - system delivery plans ; the degree of the Company’s ability to fill orders for its systems ; the extent of the Company’s ability to increase sales of its systems, ink and consumables ; the extent of the Company’s ability to leverage its global infrastructure build - out ; the development of the market for digital textile printing ; the availability of alternative ink ; competition ; sales concentration ; changes to the Company’s relationships with suppliers ; the extent of the Company’s success in marketing ; and those additional factors referred to under “Risk Factors” in Item 3 . D of the Company’s Annual Report on Form 20 - F for the years ended December 31 , 2021 and December 31 , 2022 , filed with the SEC on March 30 , 2022 , and to be filed with the SEC in the coming weeks, respectively . Any forward - looking statements in this presentation are made as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law . In addition to U . S . GAAP financials, this presentation includes certain non - GAAP financial measures . These non - GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U . S . GAAP . Please see the reconciliation table that appears among the financial tables in our earnings release being issued today, which earnings release is attached as Exhibit 99 . 1 to our report of foreign private issuer on Form 6 - K being furnished to the SEC today, which reconciliation table is incorporated by reference in this presentation . This presentation contains statistical data that we obtained from industry publications and reports generated by third parties . Although we believe that the publications and reports are reliable, we have not independently verified this statistical data . Kornit, Kornit Digital, the K logo, and NeoPigment are trademarks of Kornit Digital Ltd . All other trademarks are the property of their respective owners and are used for reference purposes only . Such use should not be construed as an endorsement of our products or services .

BUSINESS HIGHLIGHTS RONEN SAMUEL Chief Executive Officer ©2023 Kornit Digital. All rights reserved. 4 ©2023 Kornit Digital. All rights reserved.

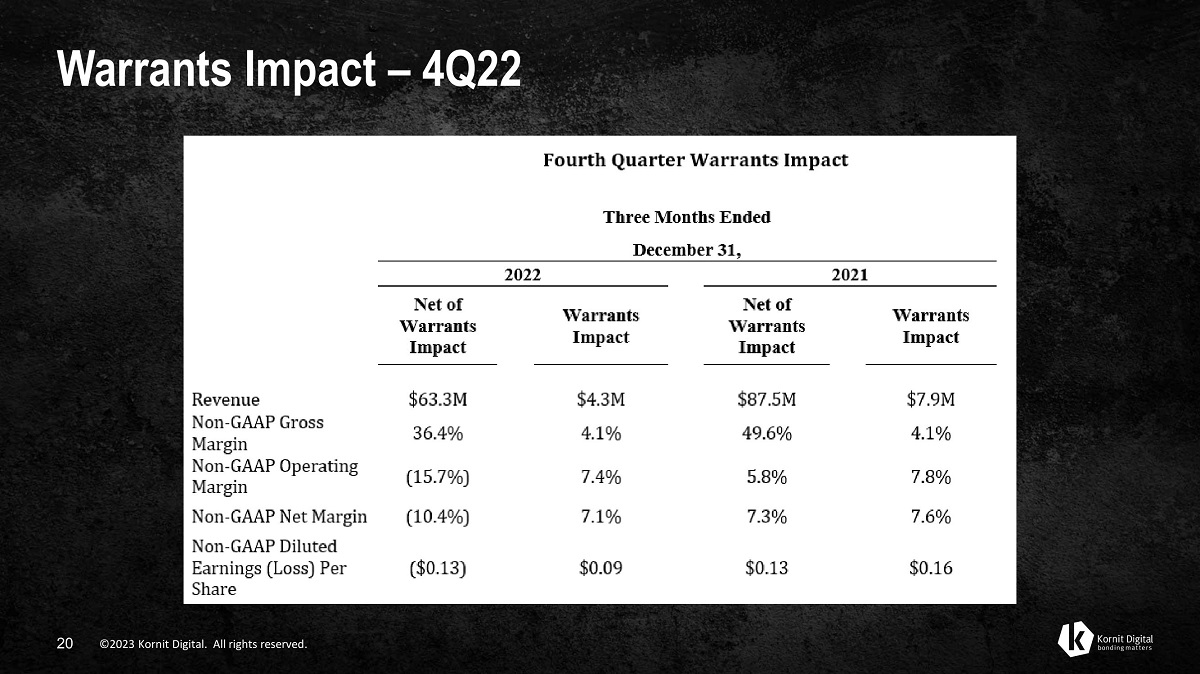

Fourth Quarter – Recap ©2023 Kornit Digital. All rights reserved. 5 ©2023 Kornit Digital. All rights reserved. • Total revenues $63.3 million, net of $4.3 million of non - cash warrants impact • In line with revenue guidance range provided in November, which assumed zero impact from the fair value of issued warrants • Consumables and Services revenues up from the third quarter, year - over - year, and on a full year basis as compared to 2021 • Some of our largest strategic accounts, mainly in the Americas, experienced a very good peak season • Others, especially in Europe, were generally flat in terms of impressions and consumables • Systems revenues down meaningfully given the ongoing macroeconomic backdrop

Full Year 2022 – Snapshot • Like the broader global technology environment 2022 was a tough year for all of us • Started the year with strong momentum and growth: • Introduced groundbreaking new products • Closed acquisition of Tesoma • Opened new ink plant • Cemented position of MAX technology as new industry standard for quality • Despite the macro backdrop, experienced good demand and encouraging results for DTF solutions • Latin America, and in important European fashion production countries • Results in Japan are trending well, and new opportunities beginning to develop in India and in China • Long - term partnership with largest global strategic customer remains very strong ©2023 Kornit Digital. All rights reserved. 6 ©2023 Kornit Digital. All rights reserved.

2023 – A Year of Transition and Execution • Focusing on three key areas to support long - term growth: 1) Returning to Profitability: • Implemented decisive actions to reduce OPEX, improve margins, adjust operations to current market conditions • Should turn corner during 2H’23 and approach breakeven, and later on move to profitability 2) Successfully Launching Apollo: • Expect to gain traction with retail brands and fulfillers, helping to transform retail industry’s supply chain • Apollo beta trials begin over next several months with a formal unveiling in June at the ITMA tradeshow in Milan • ITMA: Demonstrate how Kornit is leading the retail transformation with full suite of DTG, DTF, KornitX solutions 3) Scaling Kornit X : • Pursuing demand generators and further building Kornit’s GFN of on demand digital fulfillers • Added several key customers and partners, most recently with a number of global brands and marketplaces ©2023 Kornit Digital. All rights reserved. 7 ©2023 Kornit Digital. All rights reserved.

Long - Term Growth Drivers Remain Firmly Intact ©2023 Kornit Digital. All rights reserved. ©2023 Kornit Digital. All rights reserved. 8 ©2023 Kornit Digital. All rights reserved. • Digital production penetration remains low • Expect demand for DTG systems to resume growth as capacity utilization and market conditions improve • New market opportunities with Apollo, Atlas MAX Poly, DTF, and scaling Kornit X • Meaningful system upgrade and replacement opportunities across the customer base • Higher mix of consumables revenues to drive additional operating leverage on adjusted cost structure over time • Current market dynamics impacted the timing of reaching 2026 financial objectives • Believe we can achieve long - term financial goals in years to come as we lead the retail and supply chain transformation

Vision to Transform Fashion Industry Is Happening • Customized design to resume growth and remain a meaningful part of our business • Expect very meaningful growth opportunities in several new markets to really drive and accelerate long - term growth • Mid - size retailers all over the world shifting business models and transforming supply chains with vertical on - demand digital production, or by using Kornit X • Massive opportunities within surging creator economies, influencers and their communities, large digital, social and content generation platforms – all of whom can benefit from productizing / monetizing their individual brands • Supply chains in the broader apparel industry, including for large traditional brands, are broken and reliant on antiquated production cycles • Believe Kornit is best positioned to lead the retail transformation to a more efficient, profitable, and sustainable business model for years to come Kornit is a resilient company, with a strong balance sheet, and remain fully committed to long - term profitable growth ©2023 Kornit Digital. All rights reserved. 9 ©2023 Kornit Digital. All rights reserved.

FINANCIAL HIGHLIGHTS LAURI HANOVER Chief Financial Officer ©2023 Kornit Digital. All rights reserved. 10 ©2023 Kornit Digital. All rights reserved.

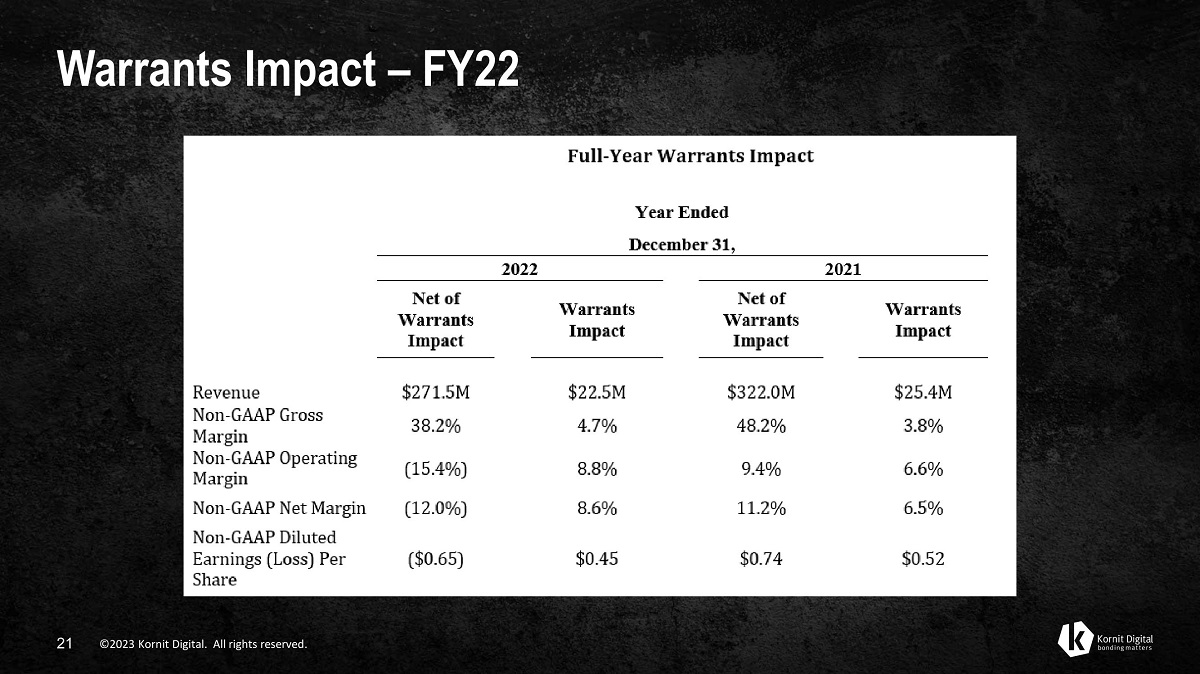

Revenues • Q4 revenues of $63.3 million, net of $4.3 million non - cash warrant impact related to a global strategic account • FY22 revenues of $271.5 million, net of $22.5 million non - cash warrant impact related to a global strategic account • Consumables and Services revenues each rose year - over - year and on a full - year basis as compared with 2021 • Systems revenues down meaningfully in the quarter, as expected, and for the full year 2022 ©2023 Kornit Digital. All rights reserved. 11 ©2023 Kornit Digital. All rights reserved.

Regional Overview (4Q22) • Americas: • Solid Consumables and Services revenue growth; Some customers experienced strong peak season; Others work through excess capacity • Overall System sales remain challenging; Continue to gain traction for DTF solutions in Latin America with another encouraging quarter of growth • EMEA: • Consumables and Services revenue generally flat • System sales continue to be impacted by capacity utilization and higher financing costs • Encouraging results and opportunities in Italy, Iberia, and Turkey • Additional opportunities opening - up in the UAE and northwest Africa • Asia Pacific: and Australia; • Delivered stable performance, despite tough macro backdrop driven by China’s Zero Covid Policy • Consumables and Services revenues flat to slightly up; System sales lower year - over - year • Encouraging penetration of MAX technology in APAC, with installations in Japan Meaningful opportunities in India and China ©2023 Kornit Digital. All rights reserved. 12 ©2023 Kornit Digital. All rights reserved.

Gross Margins ©2023 Kornit Digital. All rights reserved. 13 ©2023 Kornit Digital. All rights reserved. • Q4 Non - GAAP Gross Margins, net of 4.1 margin - point warrants impact: 36.4% (as compared with 49.6% in Q4’21) • 2022 Non - GAAP Gross Margins, net of 4.7 margin - point warrants impact: 38.2% (as compared with 48.2% in 2021) • Gross margins negatively impacted year - over - year due to: • Reduced sales volumes as compared with the same period last year • Inventory write - offs associated with older generation systems and spare parts as customers move to our newer generation systems • Continue to examine bill of materials; Selectively raise prices; Generate efficiencies within Services • Expect Gross Margins to improve over time, particularly as system sales volumes recover to a run - rate that generates operating leverage on reduced cost structure

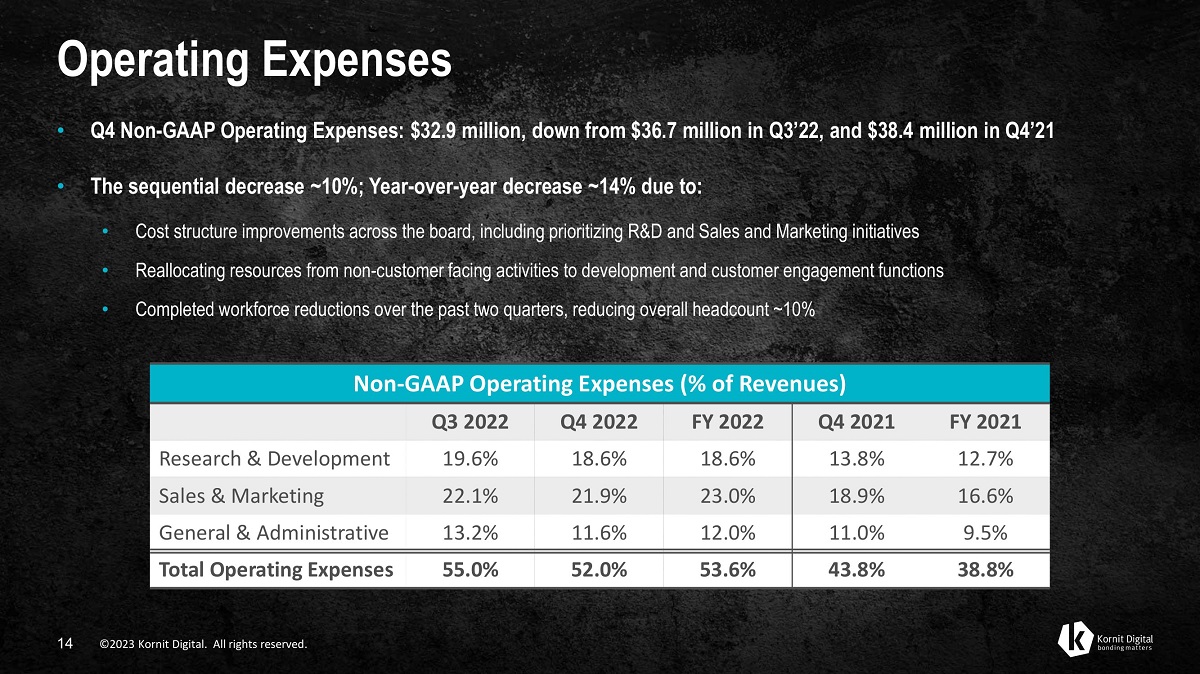

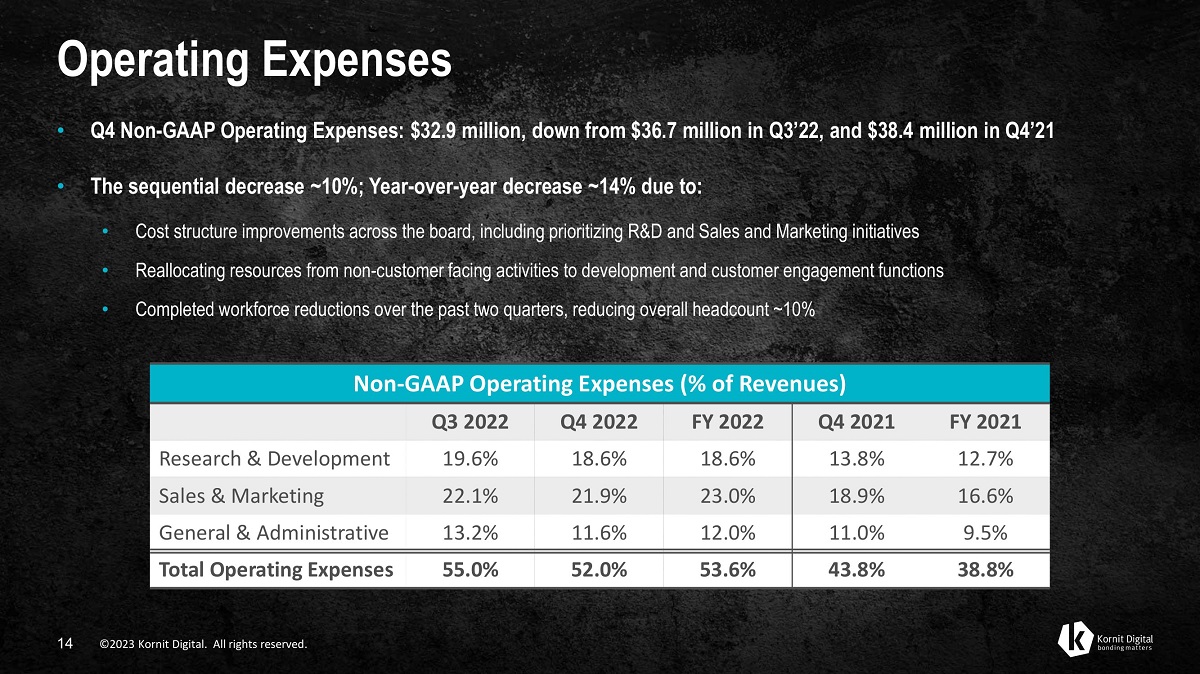

Operating Expenses ©2023 Kornit Digital. All rights reserved. 14 ©2023 Kornit Digital. All rights reserved. • Q4 Non - GAAP Operating Expenses: $32.9 million, down from $36.7 million in Q3’22, and $38.4 million in Q4’21 • The sequential decrease ~10%; Year - over - year decrease ~14% due to: • Cost structure improvements across the board, including prioritizing R&D and Sales and Marketing initiatives • Reallocating resources from non - customer facing activities to development and customer engagement functions • Completed workforce reductions over the past two quarters, reducing overall headcount ~10% Non - GAAP Operating Expenses (% of Revenues) Q3 2022 Q4 2022 FY 2022 Q4 2021 FY 2021 Research & Development 19.6% 18.6% 18.6% 13.8% 12.7% Sales & Marketing 22.1% 21.9% 23.0% 18.9% 16.6% General & Administrative 13.2% 11.6% 12.0% 11.0% 9.5% Total Operating Expenses 55.0% 52.0% 53.6% 43.8% 38.8%

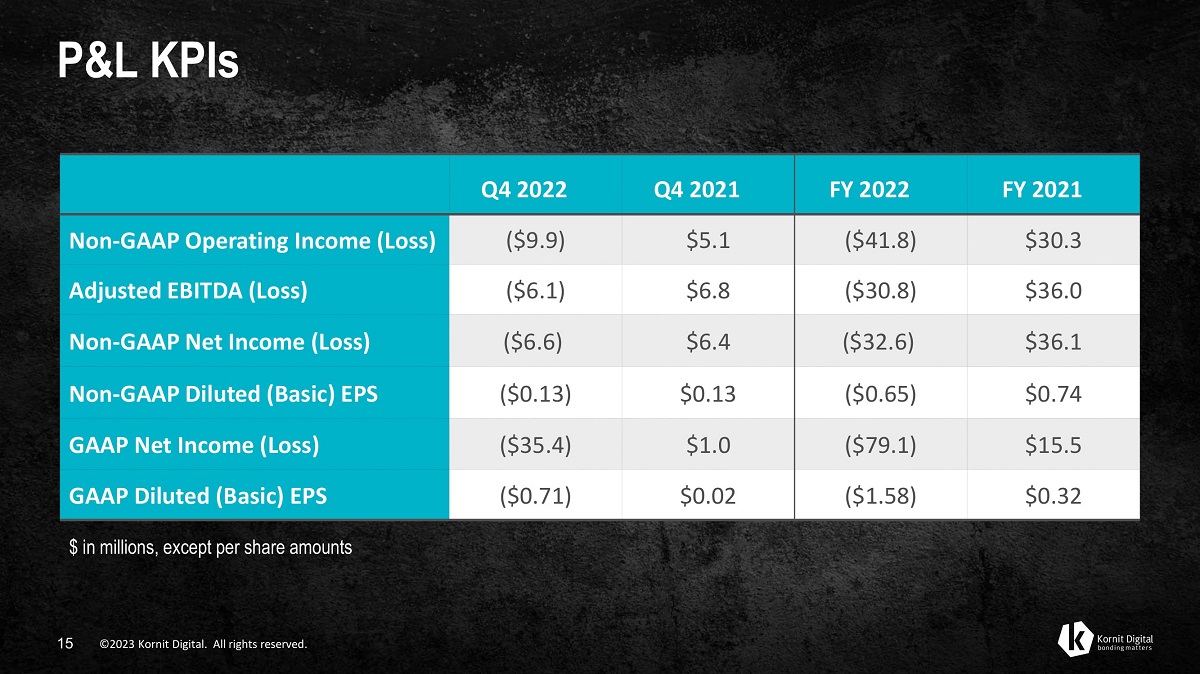

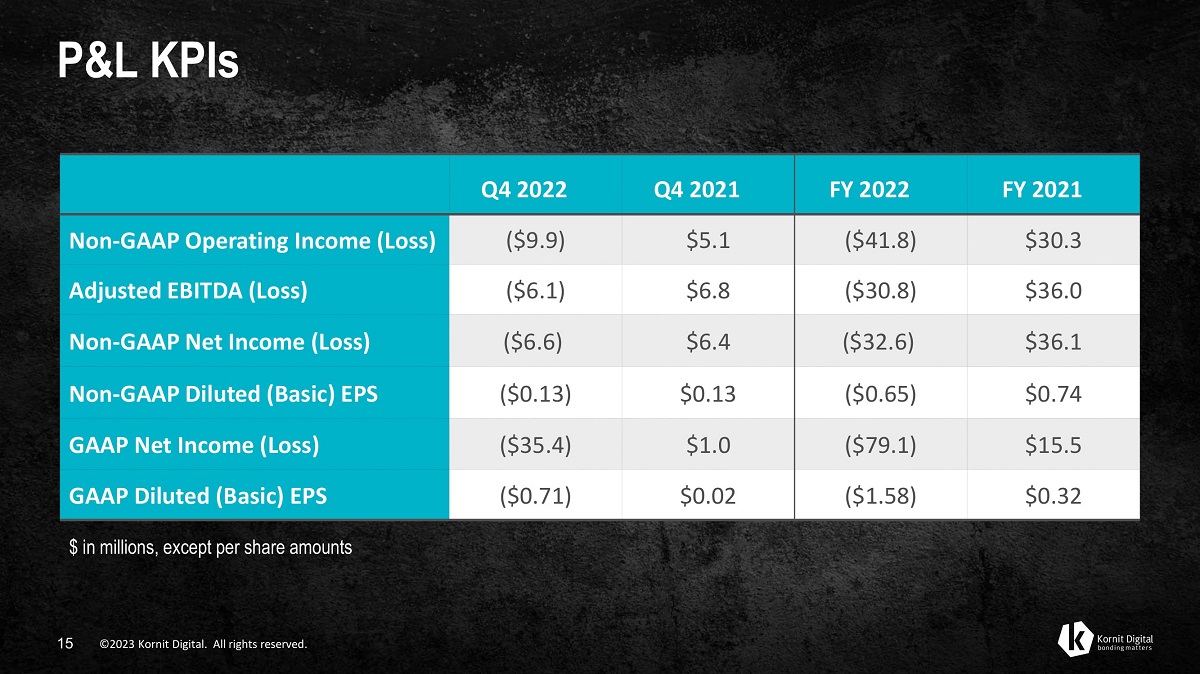

Q4 2022 Q4 2021 FY 2022 FY 2021 Non - GAAP Operating Income (Loss) ($9.9) $5.1 ($41.8) $30.3 Adjusted EBITDA (Loss) ($6.1) $6.8 ($30.8) $36.0 Non - GAAP Net Income (Loss) ($6.6) $6.4 ($32.6) $36.1 Non - GAAP Diluted (Basic) EPS ($0.13) $0.13 ($0.65) $0.74 GAAP Net Income (Loss) ($35.4) $1.0 ($79.1) $15.5 GAAP Diluted (Basic) EPS ($0.71) $0.02 ($1.58) $0.32 ©2023 Kornit Digital. All rights reserved. 15 ©2023 Kornit Digital. All rights reserved. $ in millions, except per share amounts P&L KPIs

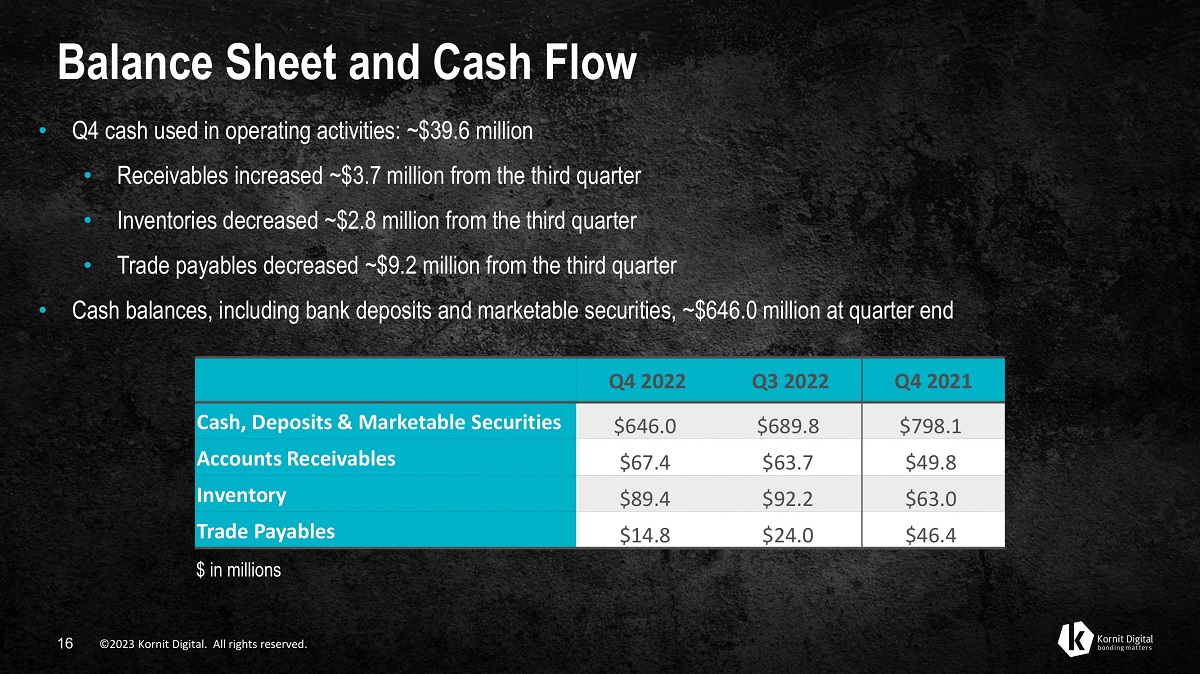

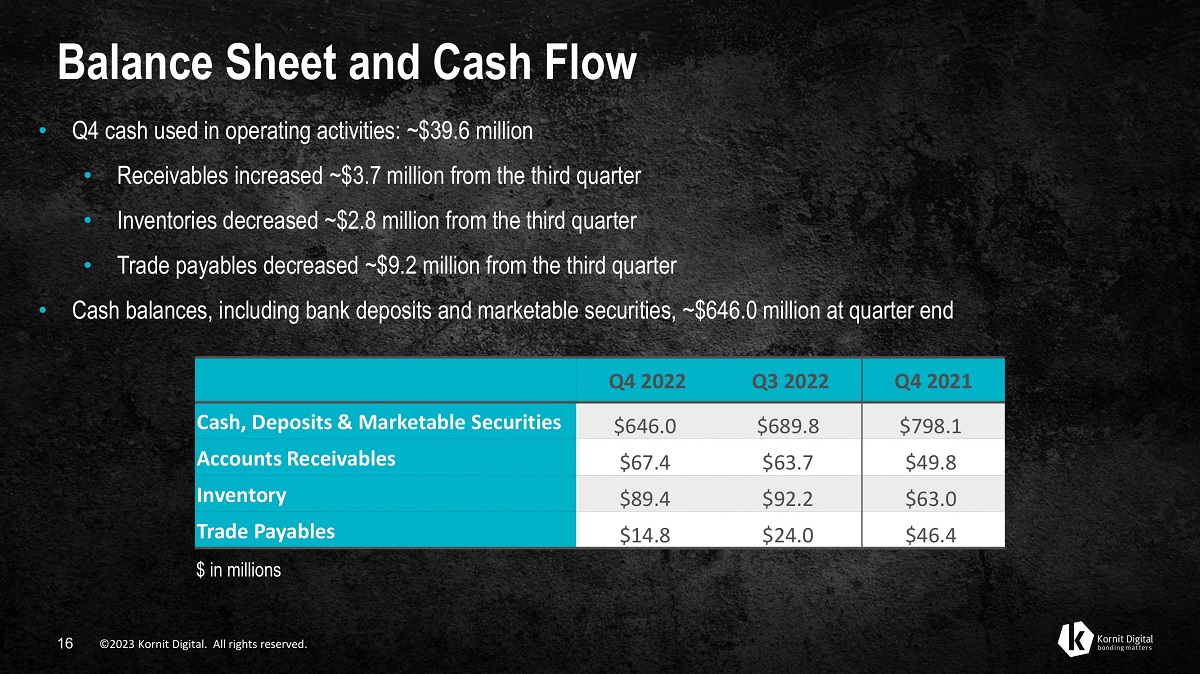

Balance Sheet and Cash Flow ©2023 Kornit Digital. All rights reserved. 16 ©2023 Kornit Digital. All rights reserved. • Q4 cash used in operating activities: ~$39.6 million • Receivables increased ~$3.7 million from the third quarter • Inventories decreased ~$2.8 million from the third quarter • Trade payables decreased ~$9.2 million from the third quarter • Cash balances, including bank deposits and marketable securities, ~$646.0 million at quarter end Q4 2022 Q3 2022 Q4 2021 Cash, Deposits & Marketable Securities $646.0 $689.8 $798.1 Accounts Receivables $67.4 $63.7 $49.8 Inventory $89.4 $92.2 $63.0 Trade Payables $14.8 $24.0 $46.4 $ in millions

Share Repurchase Program – Update ©2023 Kornit Digital. All rights reserved. 17 ©2023 Kornit Digital. All rights reserved. • August: Board of Directors approved the repurchase of up to $75 million of the Company’s ordinary shares • December: Israeli court approved the Company’s request to authorize a share repurchase program • Believe opportunistically repurchasing shares is in best interests of the Company and shareholders • Will not impact ability to execute on growth initiatives given strong balance sheet

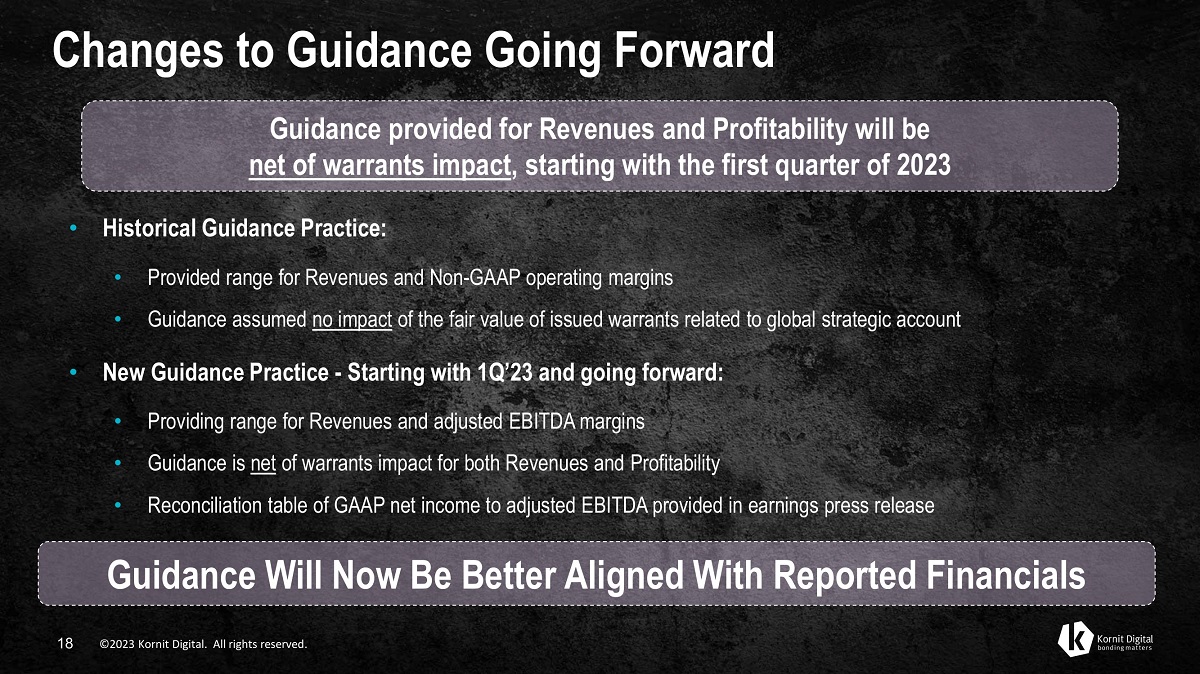

Changes to Guidance Going Forward Guidance provided for Revenues and Profitability will be net of warrants impact , starting with the first quarter of 2023 • Historical Guidance Practice: • Provided range for Revenues and Non - GAAP operating margins • Guidance assumed no impact of the fair value of issued warrants related to global strategic account • New Guidance Practice - Starting with 1Q’23 and going forward: • Providing range for Revenues and adjusted EBITDA margins • Guidance is net of warrants impact for both Revenues and Profitability • Reconciliation table of GAAP net income to adjusted EBITDA provided in earnings press release Guidance Will Now Be Better Aligned With Reported Financials ©2023 Kornit Digital. All rights reserved. 18 ©2023 Kornit Digital. All rights reserved.

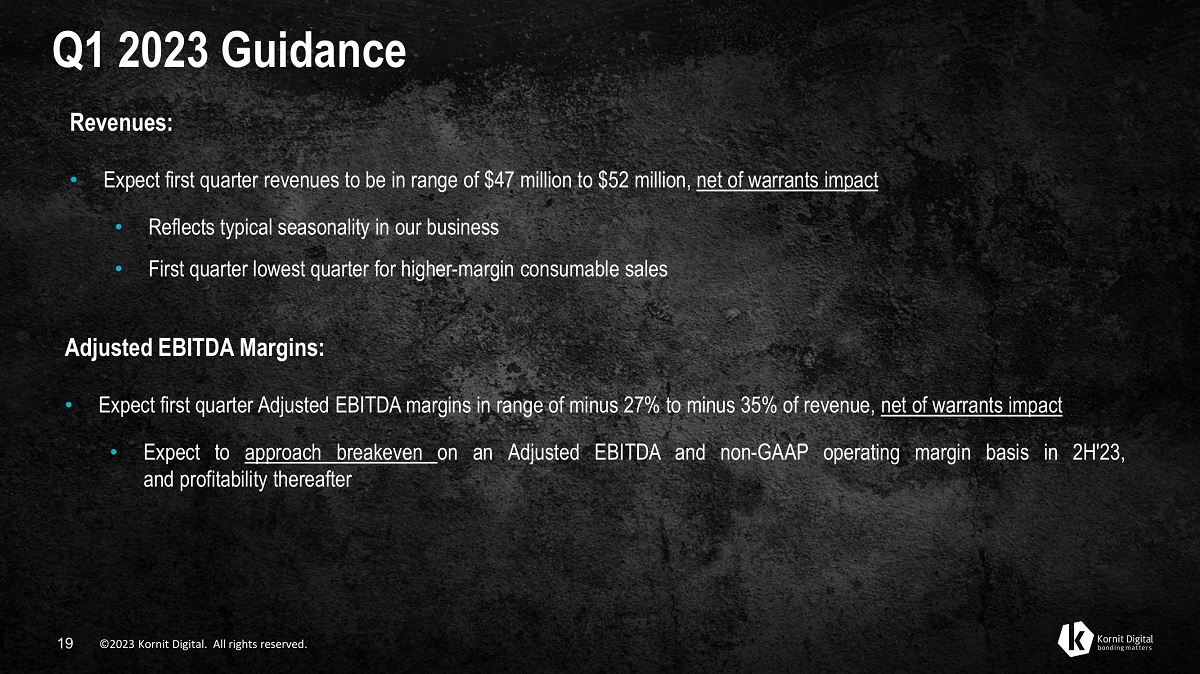

Q1 2023 Guidance Revenues: • Expect first quarter revenues to be in range of $47 million to $52 million, net of warrants impact • Reflects typical seasonality in our business • First quarter lowest quarter for higher - margin consumable sales Adjusted EBITDA Margins: • Expect first quarter Adjusted EBITDA margins in range of minus 27% to minus 35% of revenue, net of warrants impact • Expect to approach breakeven on an Adjusted EBITDA and non - GAAP operating margin basis in 2H'23, and profitability thereafter ©2023 Kornit Digital. All rights reserved. 19 ©2023 Kornit Digital. All rights reserved.

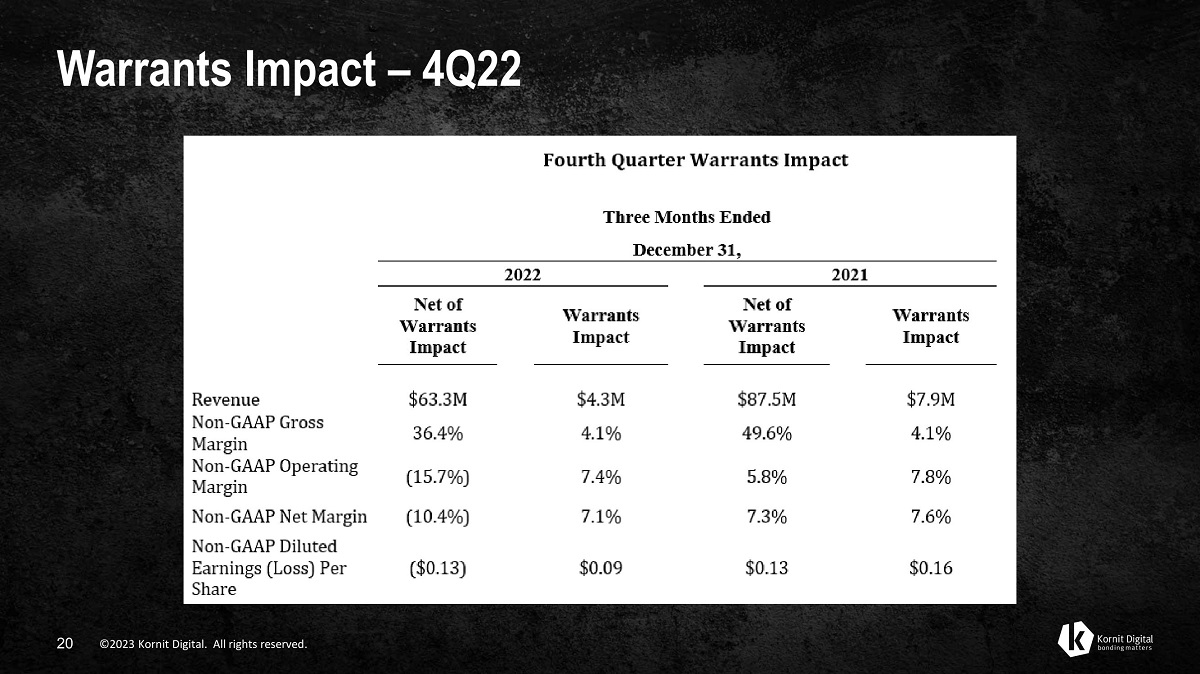

Warrants Impact – 4Q22 ©2023 Kornit Digital. All rights reserved. 20 ©2023 Kornit Digital. All rights reserved.

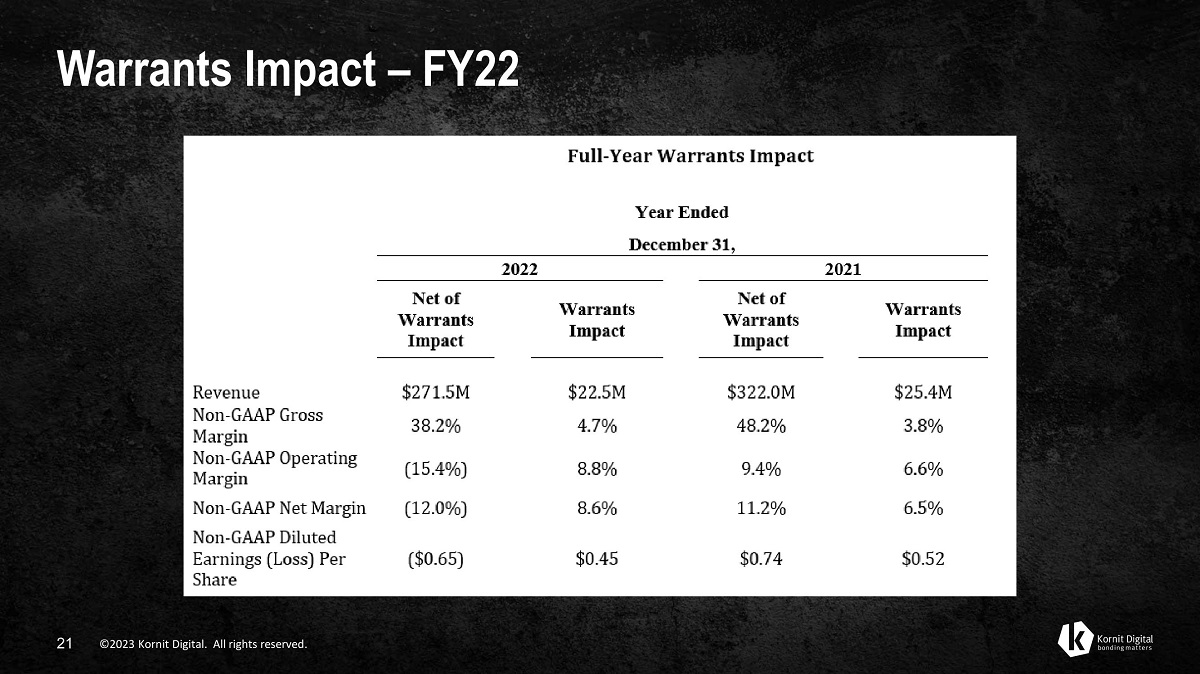

Warrants Impact – FY22 ©2023 Kornit Digital. All rights reserved. 21 ©2023 Kornit Digital. All rights reserved.

THANK YOU ©2023 Kornit Digital. All rights reserved. 22 ©2023 Kornit Digital. All rights reserved.