Exhibit 99.2

Kornit Digital. All Rights Reserved. Kornit Digital. All Rights Reserved. Kornit Digital (NASDAQ: KRNT) Third Quarter 2024 Earnings Conference Call Supporting Slides November 6, 2024 Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. On Today’s Call Ronen Samuel CEO Lauri Hanover CFO Jared Maymon Investor Relations

Kornit Digital. All Rights Reserved. Safe Harbor This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U . S . securities laws . Forward - looking statements are characterized by the use of forward - looking terminology such as “will,” “expects,” “anticipates,” “continue,” “believes,” “should,” “intended,” “guidance,” “preliminary,” “future,” “planned,” or other words . These forward - looking statements include, but are not limited to, statements relating to the Company’s objectives, plans and strategies, statements of preliminary or projected results of operations or of financial condition and all statements that address activities, events, or developments that the Company intends, expects, projects, believes or anticipates will or may occur in the future . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties . The Company has based these forward - looking statements on assumptions and assessments made by its management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate . Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward - looking statements include, among other things : the duration and severity of adverse macro - economic headwinds that were caused by inflationary pressures and higher interest rates, which have impacted, and may continue to impact, in an adverse manner, the Company’s operations, financial position and cash flows, in part due to the adverse impact on the Company’s customers and suppliers ; the Company’s degree of success in developing, introducing and selling new or improved products and product enhancements including specifically the Company’s Poly Pro and Presto products, and the Company’s Apollo direct - to - garment platform ; the extent of the Company’s ability to consummate sales to large accounts with multi - system delivery plans ; the degree of the Company’s ability to fill orders for its systems and consumables ; the extent of the Company’s ability to increase sales of its systems, ink and consumables ; the extent of the Company’s ability to leverage its global infrastructure build - out ; the development of the market for digital textile printing ; the availability of alternative ink ; competition ; sales concentration ; changes to the Company’s relationships with suppliers ; the extent of the Company’s success in marketing ; and those additional factors referred to under “Risk Factors” in Item 3 . D of the Company’s Annual Report on Form 20 - F for the year ended December 31 , 2023 , filed with the SEC on March 28 , 2024 . Any forward - looking statements in this press release are made as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law . In addition to U . S . GAAP financials, this presentation includes certain non - GAAP financial measures . These non - GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U . S . GAAP . Please see the reconciliation table that appears among the financial tables in our earnings release being issued today, which earnings release is attached as Exhibit 99 . 1 to our report of foreign private issuer on Form 6 - K being furnished to the SEC today, which reconciliation table is incorporated by reference in this presentation . This presentation contains statistical data that we obtained from industry publications and reports generated by third parties . Although we believe that the publications and reports are reliable, we have not independently verified this statistical data . Kornit, Kornit Digital, the K logo, and NeoPigment are trademarks of Kornit Digital Ltd . All other trademarks are the property of their respective owners and are used for reference purposes only . Such use should not be construed as an endorsement of our products or services .

Kornit Digital. All Rights Reserved. Business Highlights

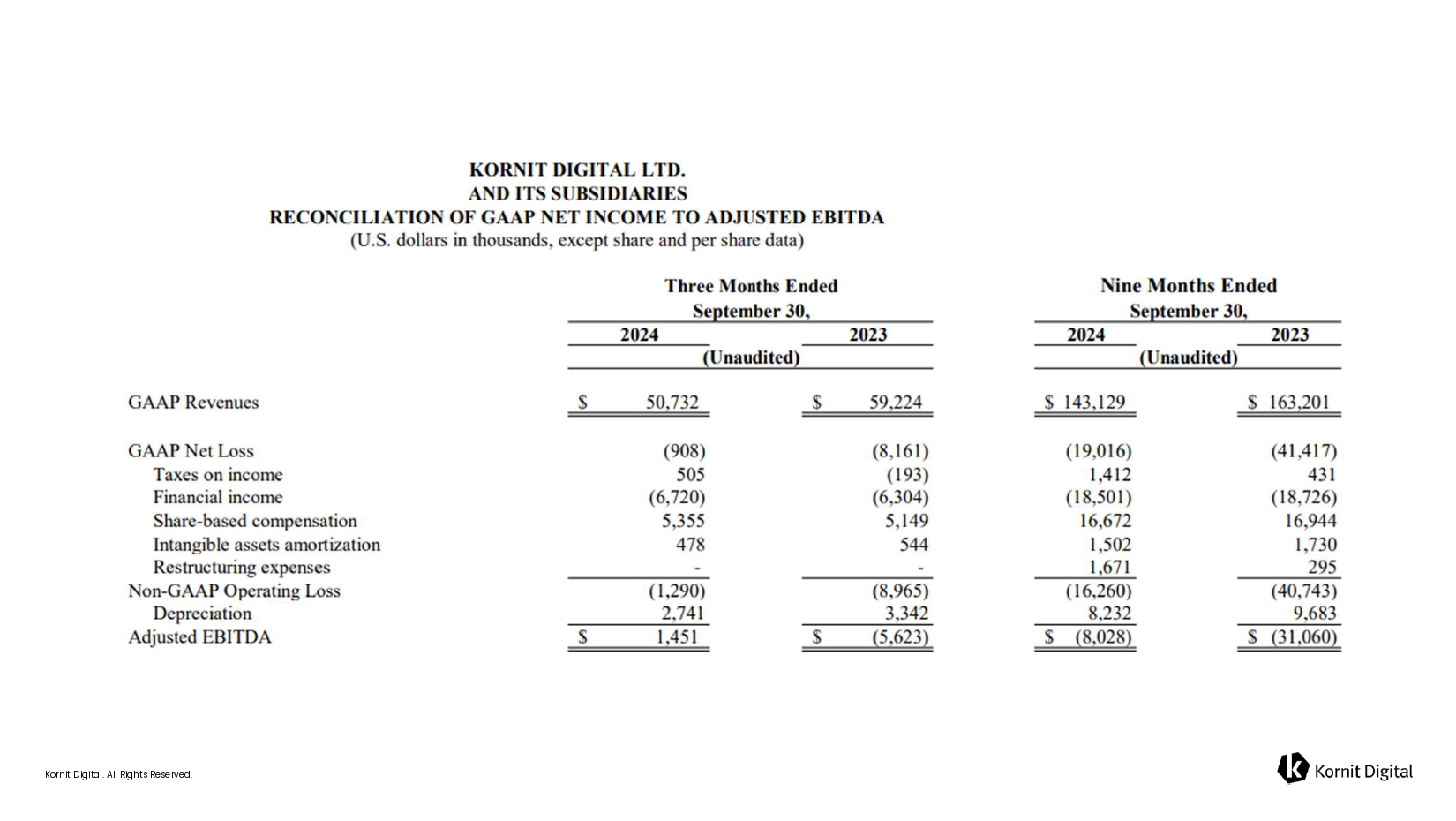

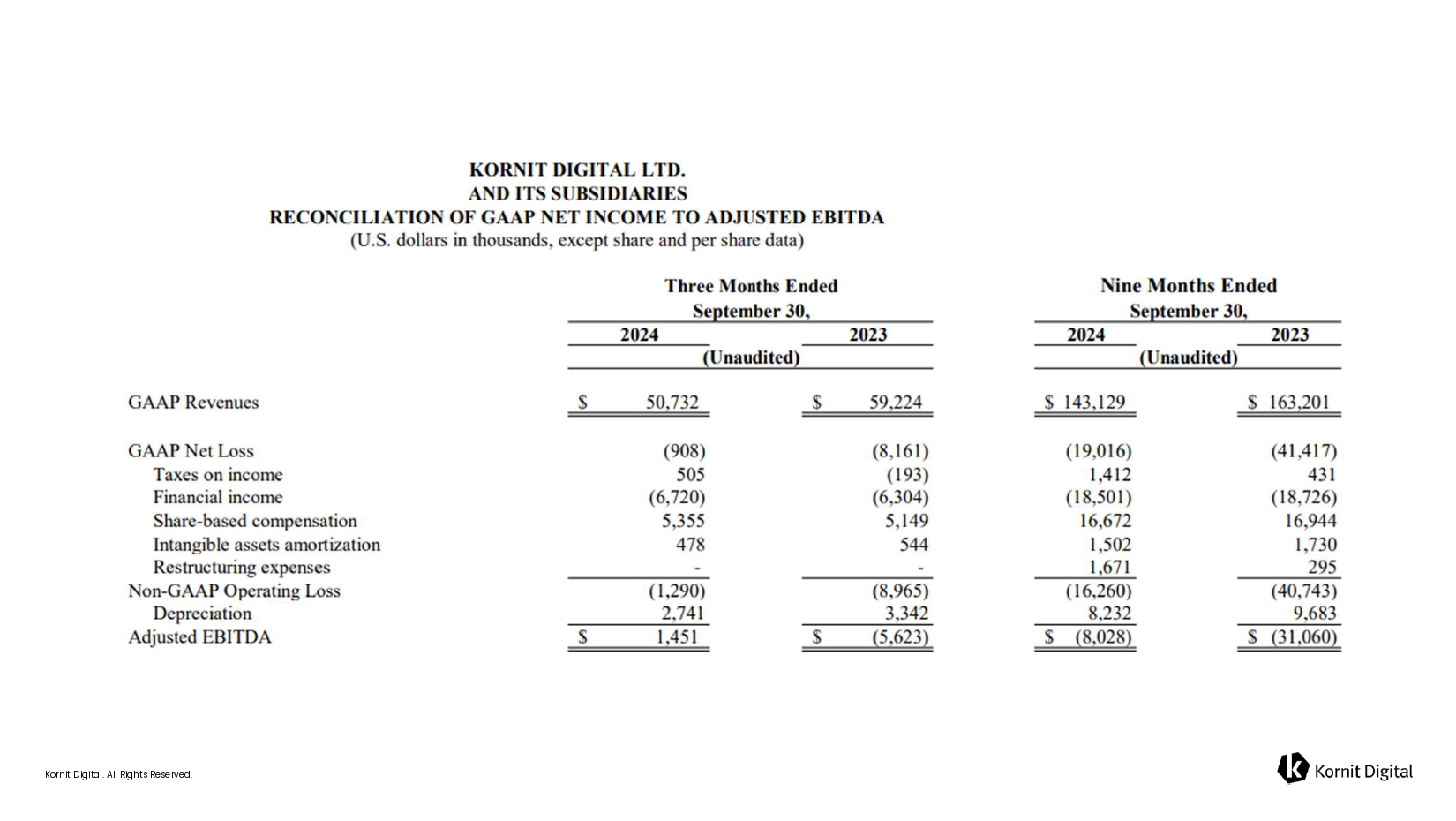

Kornit Digital. All Rights Reserved. ― Revenues of $ 50.7 million and adjusted EBITDA margin of 2.9 % ― Within the guidance range provided in August ― Generated positive cash from operations for Q � 2024 ― Gross margin improved significantly year - over - year, climbing to upwards of 50 % Third Quarter 2024 Recap

Kornit Digital. All Rights Reserved. ― Traditionally analog - centric producers are realizing the benefits of speed, creativity, and sustainability ― Apollo coupled with AIC is driving the shift ― 12 out of 15 Apollos have been shipped this year ― The remainder is scheduled for deployment before the peak season ― Recent collaborations include industry leaders like Print Palace, T - Formation, Custom Ink, and more ― Adding to our pipeline of pure - play analog producers making decisive investments in digital Market update

Kornit Digital. All Rights Reserved. ― Directly addresses a multi - billion impression market of longer runs ― Removes barriers to entry and provides a predictable cost structure ― Shipped a number of Atlas MAX units on the model in addition to the 12 Apollos YTD ― Remain on track to ship 30 Apollos in 2025, with approximately 20 on the AIC model ― Firm visibility on more than half of 2025 shipments ― Progress aligns with the LT targets provided at our recent Investor Event in September ― LT targets highlighted revenue growth, more recurring revenue, and enhanced profitability All - inclusive Click (AIC) Pilot Program Recap & Update

Kornit Digital. All Rights Reserved. ― During the quarter, we upgraded some of the Atlas fleet of our global strategic account to the Atlas MAX ― Advancing and seeing momentum in R2R, especially in the footwear market ― In China, we made additional progress with new and existing customers ― A strategic customer in the region already using Kornit technology received a large order from a major footwear brand and is now ramping production with our Presto MAX ― Growth with this customer presents additional systems/consumables opportunities in 2025 ― Secured an order from a second prominent player in China’s footwear market, also supply major brands Additional Positive Signals from Q3

Kornit Digital. All Rights Reserved. ― Now entering the peak season in Q4, and the market is showing signs of improvement ― Improvement is validated by strong consumables ordering, and systems orders from Q3 planned to be delivered in Q4 ― Better visibility paired with the growing momentum of AIC & Apollo supports expectation of year - over - year growth in Q4 ― Continue to expect H2 to be at least 20% higher than H1 sequentially Fourth Quarter & H 2 view

Kornit Digital. All Rights Reserved. ― We are seeing signs of stabilization and recovery which are building confidence in our ability to achieve profitable growth ― Kornit is well - positioned to lead the digital transformation with the right products and model ― Expecting to deliver strong value for our customers, shareholders, and employees alike in 2025 Concluding Remarks

Kornit Digital. All Rights Reserved. Financial Highlights

Kornit Digital. All Rights Reserved. ― Q ʦ 2024 revenues were $ ʨʣ . ʪ million ― Within the guidance range of $ ʧʫ - $ 52 million ― Systems sales declined year - over - year, as expected ― Consumables sales and impressions grew year - over - year Revenues $59.2 $50.7 Q3 Revenues ($M) 2023 2024 64% 26% 10 % Revenues By Region Americas EMEA Asia Pacific

Kornit Digital. All Rights Reserved. ― Q3 2024 non - GAAP gross margin of 50.3% compared to 37.4% in Q3 2023 ― Improvement again attributable to better mix between comparatively higher - margin consumables and systems ― Q3 2024 margin also benefitted from lack of warrant expense, as the first tranche of our warrant agreement with our largest global strategic account concluded in H1 Gross Margins 37.4% 50.3% Q3 Non - GAAP Gross Margin 2023 2024

Kornit Digital. All Rights Reserved. ― Q3 2024 Non - GAAP Operating Expenses: $26.8 million, down from $31.1 million in Q3 2023 ― Reduction reflects cost - savings and restructuring initiatives ― Including workforce reductions, consolidation of facilities, and phasing - out legacy platforms ― We continue to target FY24 non - GAAP OPEX to be ~$20 million lower versus FY23 Operating Expenses Non - GAAP Operating Expenses ($ in millions) Q3 2024 Q 3 2023 $8.6 $10.6 Research & Development $12.7 $13.7 Sales & Marketing $5.5 $6.8 General & Administrative $26.8 $31.1 Total Operating Expenses (1)

Kornit Digital. All Rights Reserved. P&L KPI’s Q3 2024 Q3 2023 ($1.3) ($9.0) Non - GAAP Operating Loss $1.5 ($5.6) Adjusted EBITDA (Loss) $5.5 ($3.4) Non - GAAP Net Income (Loss) $0.11 ($0.07) Non - GAAP Diluted income (loss) per share ($0.9) ($8.2) GAAP Net Loss ($0.02) ($0.17) GAAP Diluted loss per share $ in millions, except per share amounts

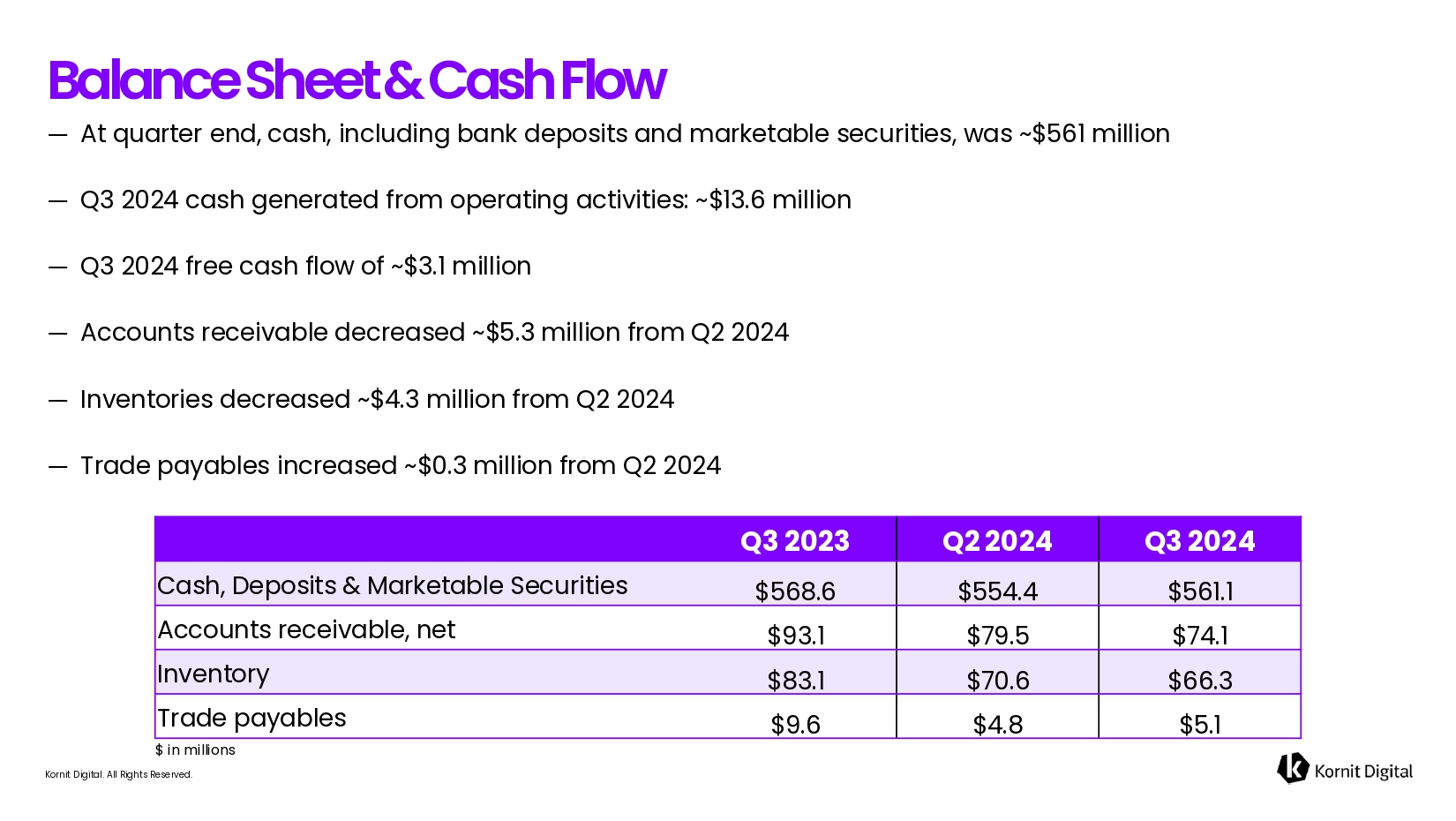

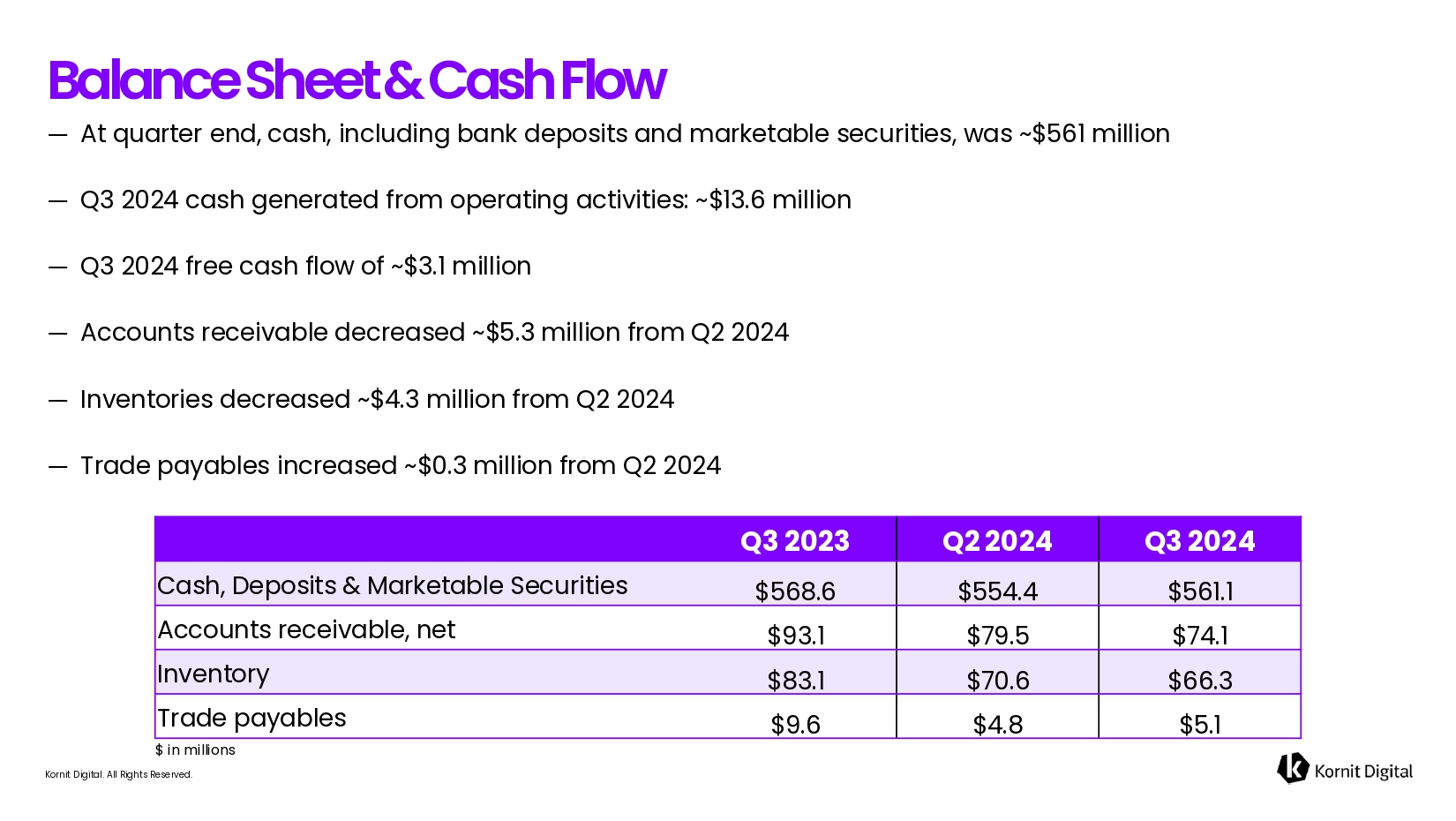

Kornit Digital. All Rights Reserved. ― At quarter end, cash, including bank deposits and marketable securities, was ~$561 million ― Q3 2024 cash generated from operating activities: ~$13.6 million ― Q3 2024 free cash flow of ~$3.1 million ― Accounts receivable decreased ~$5.3 million from Q2 2024 ― Inventories decreased ~$4.3 million from Q2 2024 ― Trade payables increased ~$0.3 million from Q2 2024 Balance Sheet & Cash Flow Q3 2024 Q2 2024 Q3 2023 $561.1 $554.4 $568.6 Cash, Deposits & Marketable Securities $74.1 $79.5 $93.1 Accounts r eceivable, net $66.3 $70.6 $83.1 Inventory $5.1 $4.8 $9.6 Trade p ayables $ in millions

Kornit Digital. All Rights Reserved. ― According to Israeli law, we were subject to a 30 - day waiting period ― The end of this 30 - day period landed within our Q3 blackout window ― We will be able to begin execution of the new $100m program following the conclusion of the blackout period Share Repurchase Program

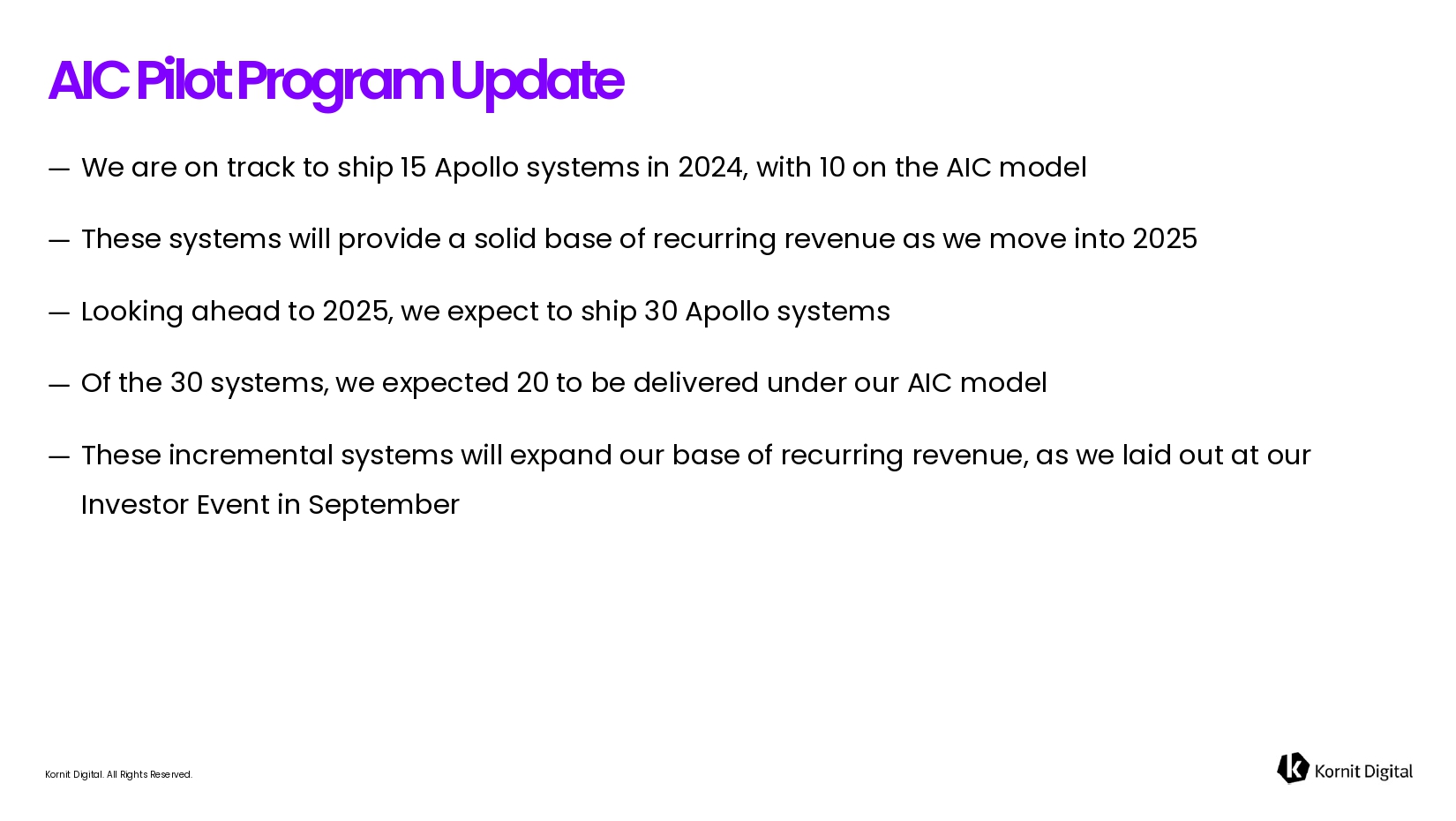

Kornit Digital. All Rights Reserved. ― We are on track to ship 15 Apollo systems in 2024, with 10 on the AIC model ― These systems will provide a solid base of recurring revenue as we move into 2025 ― Looking ahead to 2025, we expect to ship 30 Apollo systems ― Of the 30 systems, we expected 20 to be delivered under our AIC model ― These incremental systems will expand our base of recurring revenue, as we laid out at our Investor Event in September AIC Pilot Program Update

Kornit Digital. All Rights Reserved. ― Q4 2024 Revenues: ― Expected to be in the range of $58 million to $63 million ― Q4 2024 Adjusted EBITDA margin: ― Expected to be in the range of 12% to 16% of revenue Fourth Quarter 2024 Guidance

Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. Thank You!