| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | Eleazer.Klein@srz.com |

November 22, 2019

VIA E-MAIL AND EDGAR

Tina Chalk Special Counsel, Office of Mergers and Acquisitions Division of Corporate Finance U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | | Re: | Enzo Biochem, Inc. Preliminary Proxy Statement on Schedule 14A filed by Harbert Discovery Fund GP, LLC, Harbert Discovery Co-Investment Fund I, LP et al. Filed November 15, 2019 File No. 1-09974 Soliciting Material filed pursuant to Exchange Act Rule 14a-12 filed by Harbert Discovery Fund GP, LLC, Harbert Discovery Co-Investment Fund I, LP et al. Filed September 17, 2019 File No. 1-09974 |

| | | | | |

Dear Ms. Chalk:

On behalf of Harbert Discovery Fund, LP; Harbert Discovery Co-Investment Fund I, LP; Harbert Discovery Fund GP, LLC; Harbert Discovery Co-Investment Fund I GP, LLC; Harbert Fund Advisors, Inc.; Harbert Management Corporation; Jack Bryant; Kenan Lucas; Raymond Harbert; Fabian Blank; and Peter J. Clemens, IV (collectively, the “Filing Persons”), we are responding to your letter dated November 20, 2019 (the “SEC Comment Letter”) in connection with the Preliminary Proxy Statement on Schedule 14A filed on November 20, 2019 (the “Preliminary Proxy Statement”) with respect to Enzo Biochem, Inc. (the “Company”), and the soliciting material filed pursuant to Rule 14a-12 on September 17, 2019 (the “Soliciting Materials”). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) and respond below. For your convenience, the comments are restated below in italics, with our responses following.

Preliminary Proxy Statement

Proposal 2: Advisory Vote on the Company’s Named Executive Officer Compensation, page 8.

1. Please update the disclosure and the card to specify whether the participants are voting for or against Proposal 2.

In response to the Staff’s Comment, the Filing Persons have revised the disclosure to specify that the participants intend to vote against Proposal 2.

Where can I find additional information concerning Enzo?

2. Please advise us when the participants anticipate distributing their proxy statement. Given that reliance on Exchange Act Rule 14a-5(c) is impermissible at any time before the registrant distributes its proxy statement, the participants will accept all legal risk in connection with distributing the initial definitive proxy statement without all required disclosures and should undertake to subsequently provide any omitted information in a supplement in order to mitigate that risk.

In response to the Staff’s Comment, the Filing Persons acknowledge the Staff’s comments and advise the Staff that they do not currently intend to distribute their definitive proxy statement prior to the Company’s distribution of its definitive proxy statement. However, in the event the Filing Persons subsequently determine to distribute their definitive proxy statement prior to the Company’s distribution of its definitive proxy statement, the Filing Persons confirm their understanding that they must provide any omitted information to security holders in the form of a proxy supplement, that they will accept all legal risk in connection with the distribution of the initial definitive proxy statement without all of the required disclosure, and will subsequently provide any omitted information in a supplement to its proxy statement after the information has been made public by the Company in order to mitigate such risk.

Soliciting Material Filed on September 17, 2019 Pursuant to Exchange Act Rule 14a-12

3. Revise to clarify what is meant by the phrase “lifestyle business” and provide support for such meaning. Statements including this phrase on pages 1 and 5, without greater clarity as to their meaning, appear to impugn the character, integrity and personal reputation of the Board without adequate factual foundation. Please do not use these or similar statements in the proxy statement without providing a proper factual foundation for the statements. In addition, as to matters for which the filing persons do have a proper factual foundation, please avoid making statements about those matters that go beyond the scope of what is reasonably supported by the factual foundation. Please note that characterizing a statement as one’s opinion or belief does not eliminate the need to provide a proper factual foundation for the statement; there must be a reasonable basis for each opinion or belief that the filing persons express. Please refer to Note (b) to Rule 14a-9.

In response to the Staff’s Comment, the Filing Persons respectfully submit that the phrase “lifestyle business” was intended to convey the Filing Persons’ belief that some of the Board’s actions suggest that they may have been more concerned with their personal interests rather than those of shareholders.

The Filing Persons respectfully direct the Staff’s attention to the following factual foundations in support of their contention that the Board has been running the business for their own benefit at the expense of shareholders: 1) from July 31, 2003 to July 31, 2019 total shareholder returns were negative 80% (approximately (9.6%) annualized); 2) with the exception of 2005 and 2016, the Company has reported operating losses every year since 20041, with a cumulative negative operating income of approximately $206 million, excluding the cost of legal fees and settlements; 3) in that same time, the Board approved paying Chairman/CEO Elazar Rabbani and his brother-in-law, CFO Barry Weiner, nearly $35 million, including nearly $7.4 million bonuses during the concurrent time frame2; 4) in addition to the seemingly excessive compensation package Messrs. Rabbani and Weiner were receiving, relative to the poor performance of the Company, Messrs. Rabbani and Weiner each received roughly $600,000 in connection with their leasing of the Farmingdale lab facility to the Company3; 5) Messrs. Rabbani and Weiner were paid approximately $2.76 million4 in fiscal 2019 despite the fact that the Company’s stock has declined approximately 11.5% over the course of the year. In light of the preceding facts, the Filing Persons respectfully believe that the actions of the Board demonstrate a pattern of practice of prioritizing their own interests, over those of shareholders, in a manner consistent with running a “lifestyle business”. Nevertheless, out of respect for the Staff’s comment, the Filing Persons do not intend to use such phrase again during the course of the solicitation.

The Case for Change at Enzo, page 3

4. With a view towards disclosure, please explain the meaning of “equal weight index” in the Note at the bottom of page 3.

In response to the Staff’s Comment, the Filing Persons would like to clarify that as used in Footnote 1 on page 3, an “equal weight index” is an index which ascribes the same weight or importance to each index or portfolio constituent regardless of stock price, market capitalization, etc. For example, a Company with a $10 stock price would have the same impact on an index or portfolio as a Company with a $100 stock price. Likewise, a Company with a $100 million market capitalization would have the same impact on an index or portfolio as a Company with a $100 billion market capitalization. The Filing Persons note that in the event they use “equal weight index” in any future filings, they will include additional disclosure regarding the meaning.

History of Overpromising and Underdelivering, page 3

5. Refer to the statement on page 5, “[w]e have identified dozens of Company quotes substantively similar to the above.” Please provide support for this statement.

In response to the Staff’s Comment, the Filing Persons respectfully direct the Staff’s attention to the quotes attached as Exhibit A attached herewith. Exhibit A contains excerpted quotes from the Company’s representatives given during various earnings calls provided in support for the Filing Persons’ contention that they “have identified dozens of Company quotes substantively similar to the above.” The Filing Persons are willing to furnish the full reported transcripts of each of the calls referenced in the exhibit upon the Staff’s request.

_____________________________

1 See, Company’s Annual Reports on Form 10K from 2019-2004.

2 See, Company’s Proxy Statements on Schedule 14 A from 2019-2017.

3 See, Company Preliminary Proxy Statement filed on Schedule 14A with the SEC on Nov. 11, 2019. The Company’s Preliminary Proxy notes that approximately $1.8 million was paid to a company equally owned by Dr. Rabbani, his wife, and Mr. Weiner.

4 Company Preliminary Proxy Statement filed on Schedule 14A with the SEC on Nov. 11, 2019.

The Opportunity at Enzo, page 5

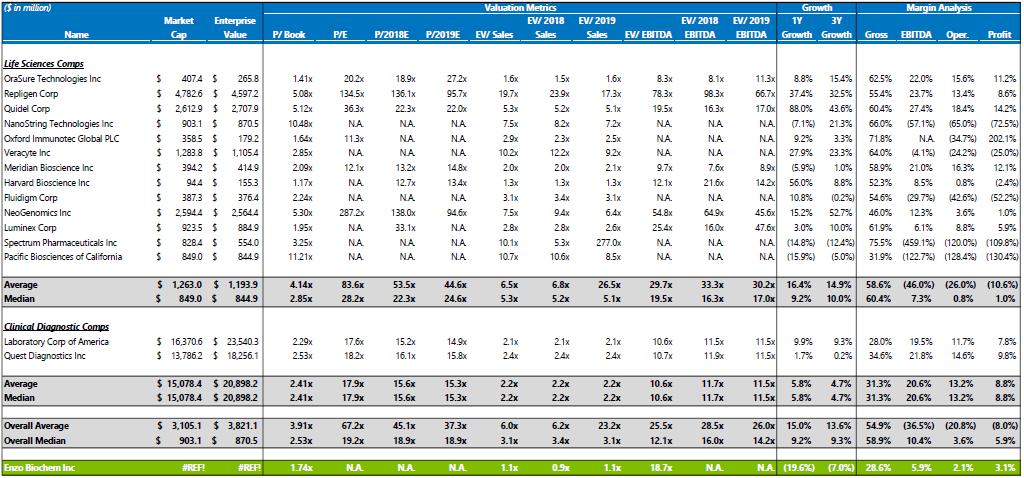

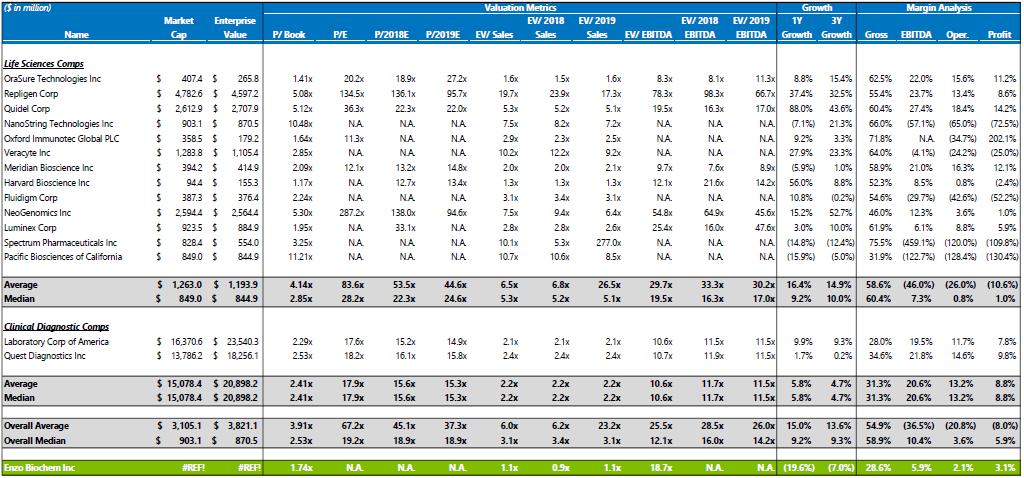

6. Refer to the statement “…peers for the clinical services division and life sciences division trade for roughly 2.2x revenue and 6.5x revenue, respectively.” With a view towards disclosure, please provide support for these financial metrics.

In response to the Staff’s Comment, the Filing Persons respectfully direct the Staff’s attention to the document attached as Exhibit B herein. Within Exhibit B, the Filing Persons would respectfully note that support for the 2.2x revenue and 6.5x revenue figures are contained in the greyed rows indicating the average and median corresponding with the clinical services division and life sciences division headings respectively. The Filing Persons confirm that in any future filings that make such references to peers, the Filing Persons will include disclosure identifying the relevant peers.

Our Solution for Enzo, page 7

7. Refer to the statement “During [Mr. Clemen’s] tenures, shareholders of his past companies saw annualized returns of 33.7% and 38.0%, respectively.” With a view towards disclosure, please provide support for these claimed returns.

In response to the Staff’s Comment, the Filing Persons respectfully direct the Staff’s attention to the performance of Caremark Rx, Inc. (NYSE: CMX) and Surgical Care Affiliates, Inc. during Mr. Clemens’ tenure with those companies. From June 21, 2005, the date Mr. Clemens joined the company as Executive Vice President and Chief Financial Officer5, until March 21, 2007, the closing date of the CVS/Caremark merger6, Caremark Rx, Inc. annualized returns were 33.7%. Mr. Clemens joined Surgical Care Affiliates, Inc. (“SCA”) as Executive Vice President and Chief Financial Officer on October 11, 20117. During Mr. Clemens’ tenure as CFO, SCA went public on October 29, 2013, and from that date until April 17, 2015, the date of the announcement of Tom De Weerdt’s succession to Mr. Clemens’ role as Executive Vice President and Chief Financial Officer in light of Mr. Clemens’ planned retirement8, SCA stocks experienced annualized returns of 37.95%. When rounded to the nearest tenth of a percent, as consistent with the rest of the Soliciting Materials, it is fairly described as 38.0%. The Filing Persons confirm that in any future filings that make such reference to Mr. Clemens’ tenures at other companies, the Filing Persons will include the foregoing disclosure.

_____________________________

5 See, Caremark Rx, Inc. Announces Management Changes, Business Wire, June 21, 2005, https://www.businesswire.com/news/home/20050621006060/en/Caremark-Rx-Announces-Management

6 See, Exhibit 99.1 to Current Report on Form 8-K filed by Caremark Rx, Inc. with the SEC on March 21, 2007

7 See, Pete Clemens Joins Surgical Care Affiliates as Chief Financial Officer, Business Wire, Oct. 11, 2011, https://www.prnewswire.com/news-releases/pete-clemens-joins-surgical-care-affiliates-as-chief-financial-officer-131518613.html

8 See, Surgical Care Affiliates, Inc. Announces New Chief Financial Officer, Global Newswire, April 17, 2015, https://www.globenewswire.com/news-release/2015/04/17/725626/10129362/en/Surgical-Care-Affiliates-Inc-Announces-New-Chief-Financial-Officer.html

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein

Exhibit A

The Filing Persons respectfully note that quote presented in bold were included in their September 17, 2019 letter filed as soliciting material on Schedule 14A.

Q1 2017 Earnings Call: <Q - Norman Hale>: Okay. Good. And on the partnership front, without giving any specific details, are you guys having discussions with other companies relative to potential partnerships?<A - Barry W. Weiner>: Yes, on multiple fronts. I mean, we actually are partners with many companies today in product introductions, we represent many companies in our marketplace, and we have continuous dialogue with parties to help expand our base of activity. It is a core function within our business.

Q3 2014 Earnings Call: “The aggressive streamlining of the company that took place over the last 24 months is now showing positive economic results. The novel product platforms we've been working on are now positioned to address a growing economic challenge in the market. We continue to look for effective least dilutive ways to monetize many of the transformational technologies we have developed. And as such, we continue to explore joint ventures and other forms of partnerships as a way to help advance technologies and benefit all of us as shareholders.”

Q4 2015 Earnings Call: “In terms of our platform and technology development, we also see interesting potential collaborative opportunities. I've mentioned historically that the AmpiProbe platform has utility not only in human healthcare. It has application in veterinary diagnostics, it has application in bio warfare utility, it has application in water and product purification. All these areas are outside of our targeted direction and potentially offer avenues of both collaboration, licensing or partnering, and we are exploring them today.”

Q1 2016 Earnings Call: “We have dialogue continuously. And certainly, with the approval of AmpiProbe it has given us a very interesting product to discuss with other parties at this point in time. So, we are actively engaged in dialogue. We also are a company that is very fortunate that we have so much technology wealth. We have today no less than five or six platforms, from which we are able to drive products. We're only limited by our size and scale at this point in time. We're trying to address it. And certainly, we will be able to address it better as our capital structure improves.”

Q2 2016 Earnings Call: “We are already in dialogue. As our system gets better recognized, we're presenting indifferent conferences today, we have been engaged in dialogue for a period of time with different parties over different opportunities. So, the answer is fundamentally yes. But in response, it is something that we are continuously exploring and attempting to put into place.”

Q4 2016 Earnings Call: “Establishing business relationships on many fronts is a key goal of the many goals that we have set forth for our team here. We are in dialog with multiple parties.

We are fortunate that we have many platform technologies that appeal and touch on different segments of this particular marketplace and we are looking to expand those platforms into areas where we may not have the interest or the time or the focus to expand the utility of the platforms. And so we are in dialog. And you could very well see the consummation of relationships with a number of parties out there in the near future.”

Q3 2018 Earnings Call: “We are engaged in a growing number of meetings and activities around potential partnerships as well as collaborations with hospital networks, diagnostic manufacturers and laboratories, with specific emphasis on the use of Enzo diagnostic reagents in existing automated systems commonly available.”

Q4 2018 Earnings Call: “I think we have reached a stage where we believe it merits carrying this product forward to explore its utility in humans, the targets will involve immune-mediated targets, as well as cancers. It is a pathway that inhibits cellular replication or activity and one that we are quite excited about. Our goals here are to bring this into a potential partnership with certain parties out there, we are in dialog in that area at this point in time.”

Q4 2018: “Finally, we have been developing cost effective approaches on various platforms, not only in molecular, but in the area of anatomical pathology, immunohistochemistry, in flow cytometry these various platforms and business opportunities that are under development, provide from multiple unique opportunities to partner and joint venture to exploit the commercialization capability that they present and dialog is now currently underway to try to move these products in a more expeditious way.”

Q1 2019 Earnings Call: “And our interest is to look to sophisticated partners that can help to expedite the development of this particular molecule in specific areas. And so that will be one area that I would look towards.”

Q1 2019 Earnings Call: “The company expects the commercialization from the developments of its initiatives will begin over the next year at which time it anticipates returning to growth. The significant implementation steps include, one, the validation through clinical trials of Enzo's fully automated high-throughput instrumentation including sample collection and sample processing and reagent systems both for New York State and the FDA, completion of the build-out of the GMP manufacturing facilities, the approval of additional assays to expand Enzo's test menu, the expansion of our sales, marketing, logistics and IT efforts to grow national reference laboratory accounts; and partnerships and collaborations with potential strategic and institutional partners to enhance commercialization and market penetration of Enzo's high technology platforms and products.”

Q2 2019 Earnings Call: “We are working with equipment manufacturers in the development of our new platforms to drive our systems, and already we have engaged certain parties who are working with us to design, develop, and produce these particular products. At the same time, our interest in the business develop area is far reaching in that we are speaking with potential partners in a number of different areas.”

Q2 2019 Earnings Call: “We have been actively working quietly in the therapeutic area. It is a program that has not required a lot of capital investment at this point in time. We're actually looking to outside sources to support that activity. But there is an interesting active approach which is being explored at this point in time. It's too early to comment on that.

We believe our therapeutic assets are meaningful. We don't believe we are getting much credit for that within the company at this point in time. I'm optimistic that you will see activity there that will create value generation for us as a company.”

Q2 2019 Earnings Call: “Enzo's business development efforts are ongoing with potential partners that would accelerate market access and penetration to provide much needed marginal relief to small and mid-sized clinical and hospital laboratories.”

Q2 2019 Earnings Call: “Going back specifically to your question, do we look at the value proposition of the assets today and what we believe the future value could be, the board reviews that continuously. I mean, that is something that is the responsibility of the board; they take it seriously and it is always an issue and a dialogue that takes place. So we are looking at our structure, our value, the way that we believe we can optimize value for our shareholders. It's interesting to note in one of the earlier questions when I delineated the different areas of product development that we are engaged in, each one of those entities in of its own right could be the basis of a relationship, a partnership, an independent company. And we have assets that we are looking to bring in and to partner with. That partnership may take various forms. The partnerships can take place at the clinical lab which may, in some respects, drive the interest that you are questioning on in terms of how do you build partnerships or value from the clinical laboratory asset. So there are multiplicity of ways that are being explored right now to create value. Certainly, the market value of the company as we see it today is not reflective of the assets and we recognize that.”

Q2 2019 Earnings Call: “As we noted, our commercial efforts towards implementing our marketing plan is twofold, expanding our internal highly trained and technical sales teams and supplementing this effort with a focused business development program to partner, collaborate and/or combine with companies in the diagnostic testing market. In the past quarter alone we've held numerous discussions with many strategic partners, many of whom we've met with over the last year. Defining the scope of new relationships and building collaborations and partnerships takes time. However, Enzo's disruptive strategic plan is gaining market awareness and acceptance and we are confident new relationships will materialize.”

Q3 2019 Earnings Call: “we recognize the need for strategic partners to be able to enhance the rapidity of introduction of these products. And that is why we're so focused in that area right now.”

Q4 2014 Earnings Call: “Our translational diagnostics teams have developed an impressive pipeline of products and services based on AmpiProbe, including panels for both infectious and sexually-transmitted diseases related to women's health, general infectious disease, and those potentially related to cancer, both diagnostic and prognostic. At this time, a number of these products are in development and undergoing validation and are moving though the regulatory approval process. We hope to see the first of these tests available for marketing sometime after the first of the calendar year.”

Q1 2015 Earnings Call: “All these approvals are a process. And in many ways, it's an iterative process of back and forth question and response. I'm not aware of any response that would be a response that would be negative to the ultimate authorization to approve any of these products. I think it's a process. I know we've – this platform has been well tested. It's been utilized by others outside of our company. So, we have a high level of confidence in its quality and its faith in performing what it needs to do. So, I really don't – I'm not aware of anything that would be blocking it at this point in time.”

Q3 2015 Earnings Call: “As you are aware, the AmpiProbe system is pending regulatory approval.”

Q3 2015 Earnings Call: “Basically, we are looking for submissions of these particular women's health analytes within the course of this year. I am optimistic that once we see the initial approval, secondary approvals will be more rapid. We are hoping to begin to see the introduction of some of these products within this calendar year.”

Q3 2015 Earnings Call: “Well, the approval that we are awaiting covers the use of AmpiProbe in the detection of hepatitis C virus. So, it is a specific product, a specific test. Coupled with that, the next level of testing products will cover women's health, as I mentioned. There are about 14 of them. They are in various levels of completion today for submission, and we hope to start to see them obtain approvals before the year-end.”

Q3 2016 Earnings Call: “So, I think we are in a fairly good shape to hopefully see a comprehensive product sometime by year end or soon thereafter. And what I mean by comprehensive product is a panel that can potentially generate revenue growth for us as a company of some size.”

Q4 2017 Earnings Call: “We are awaiting the launch of the final four analytes. The product is being assembled. We have a program in place that is beginning to market. We're actually expanding our sales group to address some of the needs on a nationwide basis. We have done a fair amount of premarketing work in this area. We're awaiting the final assembly and comprehensive launch of this product. We hope to have it out by the end of the year.”

Q1 2019 Earnings Call: “We have been working to now build systems that not only will be approved for a New York State approval, but also for an FDA approval and that is very important in the totality of this process and we are moving forward in that.”

Q2 2016 Earnings Call: “The strategic plan for the corporation is to move Enzo Clinical Labs into a national reference laboratory, specialty testing. We believe we will be able to do that with some partnerships and extension of our businesses through other labs around the country, such that we can work on the principle of providing low cost testing solutions.”

Q1 2017 Earnings Call: “We certainly are looking at lots of strategies. I mean, the whole national rollout strategy that we have been speaking about encompasses the utilization of Enzo core science product services to be able to provide a solution to laboratories around the country.

And there are many forms that that solution can take place ranging from a simple negotiated reference agreement to a partnership or consortium perspective in driving a more global or national solution.”

Q4 2017 Earnings Call: “So, we have been targeting on the high-volume molecular tests. We have partnership relationship with many other providers of tests within the industry. As you're aware, we work with companies such as Counsyl and Progenity in the women's health area. And we are continuing to bring on relationships with other developers and we're serving as very much a logistics and service provider for them.”

Q2 2018 Earnings Call: “As you well know because you asked the question, we do have a number of therapeutic compounds under development. Most of these are being developed in the form of funded partnerships with different entities. One was with NIH. Others are under other grant processes. I can't say too much but I hope you will begin to hear more about these into the future as they are beginning to emerge from the testing protocols that they have been undergoing. I believe that there is asset value here and it is something that we as a company are absolutely focused on and we hope to create shareholder value from that. I think it's probably wise to just not say too much more about it and wait the evolution of this, but it is definitely in the vision of where we are moving right now.”

Q2 2018 Earnings Call: “Finally, Enzo has been in discussions with a number of laboratories, product and instrument developers, and suppliers about potential business development opportunities. These discussions have included and are not limited to third-party distribution of Enzo's products, providing an expanded test menu to laboratories with up to now limited opportunities for growth and strategic opportunities to expand Enzo's ability to provide cost relief to partners.”

Q4 2018 Earnings Call: “Most importantly, it is also dependent on partnerships in collaborations with potential strategic partners, both institutional and industry-wide, to enhance commercialization and market penetration of Enzo's high technology platforms and products.”

Exhibit B