- BKI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Black Knight (BKI) DEF 14ADefinitive proxy

Filed: 28 Apr 21, 4:17pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |||

| Filed by a Party other than the Registrant o | |||

| Check the appropriate box: | |||

| o | Preliminary Proxy Statement | ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x | Definitive Proxy Statement | ||

| ¨ | Definitive Additional Materials | ||

| o | Soliciting Material under §240.14a-12 | ||

| Black Knight, Inc. | |||

| (Name of Registrant as Specified In Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| x | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

NOTICE OF ANNUAL

MEETING OF SHAREHOLDERS

To the Shareholders of Black Knight, Inc.:

Notice is hereby given that the 2021 Annual Meeting of Shareholders of Black Knight, Inc. will be held via live webcast on June 16, 2021 at 11:00 a.m., Eastern Time. The meeting can be accessed by visiting www.virtualshareholdermeeting.com/BKI2021 and using your 16-digit control number, where you will be able to listen to the meeting live and vote online. We encourage you to allow ample time for online check-in, which will open at 10:45 a.m. Eastern Time. Please note that there will not be a physical location for the 2021 Annual Meeting and that you will only be able to attend the meeting by means of remote communication. We designed the format of our virtual annual meeting to ensure that our shareholders who attend the virtual annual meeting will have the same rights and opportunities to participate as they would at an in-person meeting, including the ability to ask questions. We have chosen to hold a virtual rather than an in-person meeting due to the continuing public health impact of COVID-19. The meeting is being held in order to:

1. Elect seven directors to serve until the 2022 Annual Meeting of Shareholders or until their successors are duly elected and qualified or until their earlier death, resignation or removal; 2. Approve a non-binding advisory resolution on the compensation paid to our named executive officers; and 3. Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2021 fiscal year.

At the meeting, we will also transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

The board of directors set April 19, 2021 as the record date for the meeting. This means that owners of Black Knight, Inc. common stock at the close of business on that date are entitled to:

• Receive notice of the meeting; and

• Vote at the meeting and any adjournments or postponements of the meeting. | All shareholders are cordially invited to attend the annual meeting. Even if you plan to attend the annual meeting virtually, please read these proxy materials and cast your vote on the matters that will be presented at the annual meeting. You may vote your shares through the Internet, by telephone or by mailing the enclosed proxy card. Instructions for our registered shareholders are described under the question “How do I vote?” on page 4 of the proxy statement.

Sincerely,

Colleen E. Haley Corporate Secretary

Jacksonville, FL

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE (OR VOTE VIA TELEPHONE OR INTERNET) TO ASSURE REPRESENTATION OF YOUR SHARES. |

i | Black Knight, Inc. |

Black Knight, Inc. | ii |

PROXY STATEMENT

The enclosed proxy is solicited by the board of directors of Black Knight, Inc. for use at the Annual Meeting of Shareholders to be held on June 16, 2021 at 11:00 a.m., Eastern Time, or at any postponement or adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The annual meeting will be held virtually at www.virtualshareholdermeeting.com/BKI2021.

It is anticipated that such proxy, together with this proxy statement, will first be mailed on or about April 28, 2021 to all shareholders entitled to vote at the meeting.

The Company’s principal executive offices are located at 601 Riverside Avenue, Jacksonville, Florida 32204, and its telephone number at that address is (904) 854-5100.

We are an award-winning software, data and analytics company that drives innovation in the mortgage lending and servicing and real estate industries, as well as the capital and secondary markets. Businesses leverage our robust, integrated solutions across the entire homeownership life cycle to help retain existing clients, gain new clients, mitigate risk and operate more effectively. Our clients rely on our proven, comprehensive, scalable products and our unwavering commitment to delivering exceptional client support to achieve their strategic goals and better serve their customers.

We have market-leading vertical software solutions combined with comprehensive real estate data and extensive analytic capabilities. Our solutions are utilized by U.S. mortgage originators and servicers, as well as other financial institutions, investors and real estate professionals, to support mortgage lending and servicing operations, analyze portfolios and properties, operate more efficiently, meet regulatory compliance requirements and mitigate risk.

We believe the breadth and depth of our comprehensive end-to-end, integrated solutions and the insight we provide to our clients differentiate us from other software providers and position us particularly well for emerging opportunities. We have served the mortgage and real estate industries for over 55 years and utilize this experience to design and develop solutions that fit our clients’ ever-evolving needs. Our proprietary software solutions and data and analytics capabilities are designed to reduce manual processes, support compliance and quality, mitigate risk and deliver significant cost savings to our clients. Our scale allows us to

1 | Black Knight, Inc. |

continually and cost-effectively invest in our business in order to meet industry requirements and maintain our position as a provider of industry-standard platforms for mortgage market participants.

Except as otherwise indicated or unless the context otherwise requires, all references to Black Knight, the Company, we, us or our (1) prior to the Spin-Off (as described below), are to Black Knight Financial Services, Inc., or BKFS, and its subsidiaries, and (2) after the Spin-Off are to Black Knight, Inc. and our subsidiaries. We sometimes refer to Black Knight Financial Services, LLC and BKFS as our predecessors.

Our History

Our business generally represents a reorganization of the former Technology, Data and Analytics segment of Lender Processing Services, Inc., or LPS, a former provider of integrated technology, data and services to the mortgage industry in the United States. LPS, a business that was struggling with legal, regulatory and reputational issues, was acquired by Fidelity National Financial, Inc., or FNF, in January 2014. The transaction was led by our Chairman, William P. Foley, II. Mr. Foley unlocked the value of our software, data and analytics businesses by separating Black Knight’s businesses from LPS’ transaction services businesses that are now part of ServiceLink, a majority-owned subsidiary of FNF. Mr. Foley, together with a leadership team handpicked by himself and our board, executed on his strategic vision for Black Knight, including maximizing operational efficiencies, creating a culture of cross-selling across our businesses and accelerating the pace of innovation. We were a majority-owned subsidiary of FNF prior to the Spin-Off (as defined below) on September 29, 2017.

Prior to the Spin-Off, BKFS was a holding company, and our sole asset was our interest in, and our business was conducted through, Black Knight Financial Services, LLC, or BKFS LLC, and its subsidiaries. BKFS had a sole managing member interest in BKFS LLC, which granted us the exclusive authority to manage, control and operate the business and affairs of BKFS LLC and its subsidiaries. BKFS shareholders indirectly controlled BKFS LLC through its managing member interest.

On May 26, 2015, BKFS completed its initial public offering, or IPO, in which it issued and sold 20,700,000 shares of Class A common stock at a price of $24.50 per share. Subsequently, on September 29, 2017, FNF completed a tax-free distribution of BKFS and the formation of Black Knight as the new publicly-trading holding company of BKFS, which we refer to as the Spin-Off.

2020 Highlights

2020 was another solid year for Black Knight as we continued to execute against our long-term strategic objectives to drive growth through winning new clients, cross selling to existing clients, innovating with urgency and through acquisitions to further enhance our offerings. While we faced significant challenges related to the COVID-19 pandemic, we continued to focus on taking care of our employees and our clients, innovation, and executing against our strategic initiatives to drive long-term, sustainable growth and value for our clients and other stakeholders.

Black Knight, Inc. | 2 |

In 2020, we completed three acquisitions, including the strategically significant acquisition of Optimal Blue – the largest acquisition in our history. We also launched several innovative products, completed the implementation of Bank of America onto MSP® and exceeded our new sales contract value goal for 2020. In addition, following the successful initial public offering of DNB, we had an unrealized pre-tax gain of $873.2 million on our investment in DNB as of December 31, 2020, which had a market value of $1.4 billion based on DNB’s closing price of $24.90 on December 31, 2020.

Financial Highlights

*The effect of our DNB Investment was an increase in Net earnings attributable to Black Knight of $62.1 million, or $0.41 per diluted share, primarily related to a non-cash gain recognized as a result of DNB’s initial public offering and concurrent private placement, compared to a reduction in Net earnings attributable to Black Knight of $73.9 million, or $0.50 per diluted share, in 2019.

In 2020, we generated Revenues of $1,238.5 million, an increase of 5% compared to 2019, Earnings before equity in earnings (losses) of unconsolidated affiliates of $178.7 million, a decrease of 2% compared to 2019, and Net earnings attributable to Black Knight of $264.1 million, or $1.73 per diluted share, compared to $108.8 million, or $0.73 per diluted share, in 2019.

Adjusted revenues in 2020 were $1,238.9 million, an increase of 5% over the prior year, and Adjusted EBITDA was $609.9 million, an increase of 4.5% compared to 2019. Adjusted EPS was $2.11, an increase of 6% compared to 2019. Our growth in 2020 was primarily driven by our origination software and data and analytics businesses.

Reflecting the solid financial results, strong new sales wins, and strength of our business model, our share price appreciated significantly during 2020 and since our initial public offering in May 2015. The closing price of our stock on December 31, 2020 was $88.35, an increase of 37% above our closing price on December 31, 2019, and 261% above our initial public offering price.

Adjusted revenues, Adjusted EBITDA, Adjusted net earnings and Adjusted EPS are non-GAAP financial measures. Please refer to Appendix A for a reconciliation of these measures to the most directly comparable GAAP measures.

3 | Black Knight, Inc. |

Your shares can be voted at the virtual annual meeting only if you vote by proxy or if you are present and vote at the meeting. Even if you expect to attend the virtual annual meeting, please vote by proxy to assure that your shares will be represented.

Why did I receive this proxy statement?

The board is soliciting your proxy to vote at the virtual annual meeting because you were a holder of our common stock at the close of business on April 19, 2021, which we refer to as the record date, and therefore you are entitled to vote at the annual meeting. This proxy statement contains information about the matters to be voted on at the annual meeting, and the voting process, as well as information about the Company’s directors and executive officers.

Who is entitled to vote?

All record holders of common stock as of the close of business on April 19, 2021 are entitled to vote. As of the close of business on that day, 156,614,664 shares of common stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the virtual annual meeting.

If you hold your shares of common stock through a broker, bank or other holder of record, you are considered a “beneficial owner,” of shares held in street name. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction form included in the mailing or by following their instructions for voting via the Internet or by telephone.

What shares are covered by the proxy card?

The proxy card covers all shares of common stock held by you of record (i.e., shares registered in your name).

How do I vote?

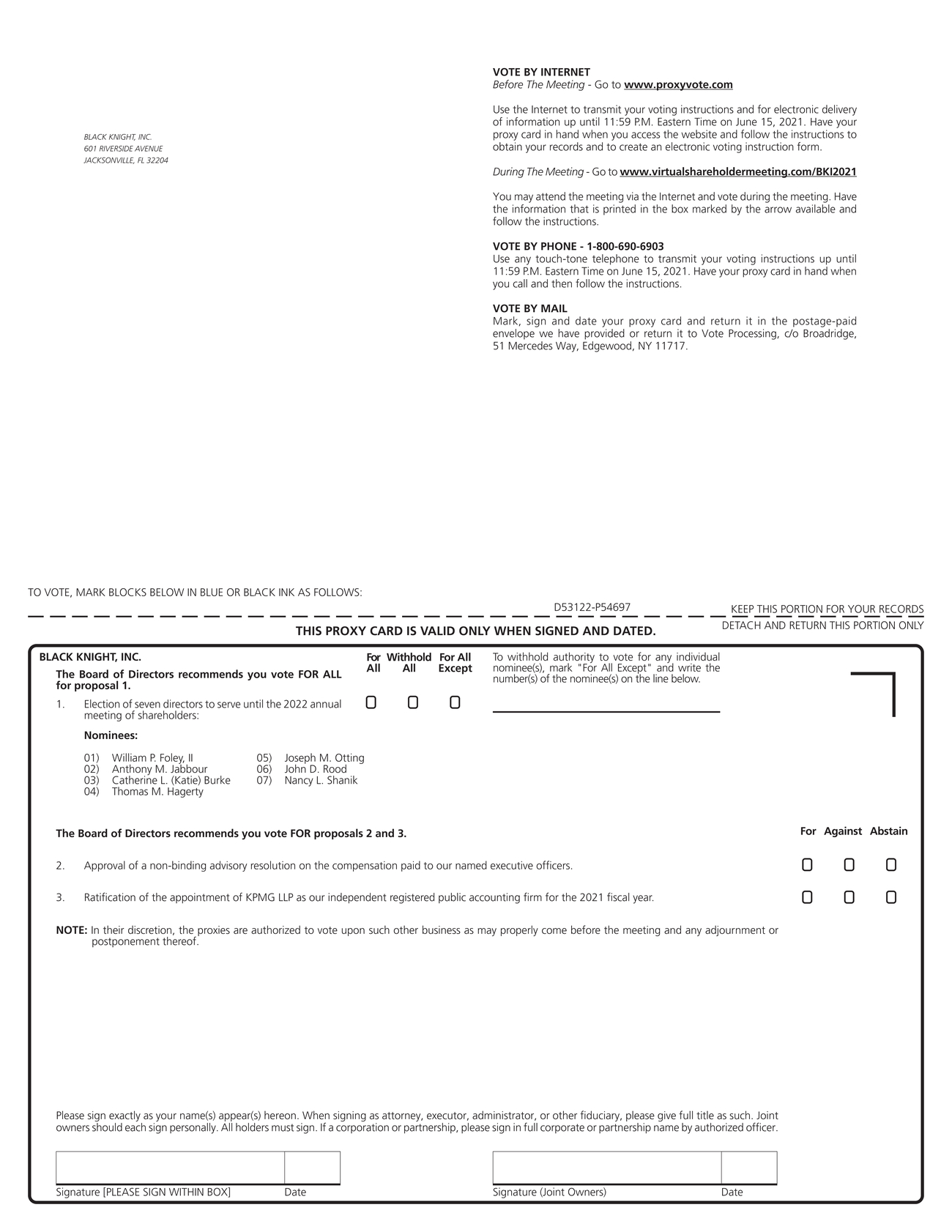

You may vote using any of the following methods:

| • | At the virtual annual meeting. All shareholders may vote at the virtual annual meeting. Please see “How do I access the virtual annual meeting? Who may attend?” for additional information on how to vote at the annual meeting. |

| • | By proxy. There are three ways to vote by proxy: |

| » | By mail, using the enclosed proxy card and return envelope; |

Black Knight, Inc. | 4 |

| » | By telephone, using the telephone number printed on the proxy card and following the instructions on the proxy card; or |

| » | By the Internet, using a unique password printed on your proxy card and following the instructions on the proxy card. |

Even if you expect to attend the annual meeting virtually, please vote by proxy to assure that your shares will be represented.

What does it mean to vote by proxy?

It means that you give someone else the right to vote your shares in accordance with your instructions. In this case, we are asking you to give your proxy to our Chief Executive Officer and Corporate Secretary, who are sometimes referred to as the “proxy holders.” By giving your proxy to the proxy holders, you assure that your vote will be counted even if you are unable to attend the annual meeting. If you give your proxy but do not include specific instructions on how to vote on a particular proposal described in this proxy statement, the proxy holders will vote your shares in accordance with the recommendation of the board for such proposal.

On what am I voting?

You will be asked to consider three proposals at the annual meeting:

| • | Proposal No. 1 asks you to elect seven directors to serve until the 2022 Annual Meeting of Shareholders. |

| • | Proposal No. 2 asks you to approve a non-binding advisory resolution on the compensation paid to our named executive officers. |

| • | Proposal No. 3 asks you to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2021 fiscal year. |

How does the board recommend that I vote on these proposals?

The board recommends that you vote “FOR ALL” director nominees in Proposal 1, and “FOR” proposals 2 and 3.

What happens if other matters are raised at the meeting?

Although we are not aware of any matters to be presented at the virtual annual meeting other than those contained in the Notice of Annual Meeting, if other matters are properly raised at the virtual annual meeting in accordance with the procedures specified in Black Knight’s certificate of incorporation and bylaws, or applicable law, all proxies given to the proxy holders will be voted in accordance with their best judgment.

5 | Black Knight, Inc. |

What if I submit a proxy and later change my mind?

If you have submitted your proxy and later wish to revoke it, you may do so by doing one of the following: giving written notice to the Corporate Secretary prior to the virtual annual meeting; submitting another proxy bearing a later date (in any of the permitted forms) prior to the virtual annual meeting; or casting a ballot at the virtual annual meeting.

Who will count the votes?

Broadridge Investor Communications Services will serve as proxy tabulator and count the votes, and the results will be certified by the inspector of election.

How many votes must each proposal receive to be adopted?

The following votes must be received:

| • | For Proposal No. 1 regarding the election of directors, a majority of votes of our common stock cast is required to elect a director. Abstentions and broker non-votes are not counted as a vote cast and will therefore have no effect. |

| • | For Proposal No. 2 regarding a non-binding advisory vote on the compensation paid to our named executive officers, the affirmative vote of a majority of the shares of our common stock represented and entitled to vote is required to approve this proposal. Even though your vote is advisory and therefore will not be binding on the Company, the board will review the voting result and take it into consideration when making future decisions regarding the compensation paid to our named executive officers. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect. |

| • | For Proposal No. 3 regarding the ratification of the appointment of KPMG LLP, the affirmative vote of a majority of the shares of our common stock represented and entitled to vote is required to approve this proposal. Abstentions will have the effect of a vote against this proposal. Because this proposal is considered a “routine” matter under the rules of the New York Stock Exchange, or NYSE, nominees may vote in their discretion on this proposal on behalf of beneficial owners who have not furnished voting instructions, and, therefore, there will be no broker non-votes on this proposal. |

What constitutes a quorum?

A quorum is present if a majority of the outstanding shares of our common stock entitled to vote at the annual meeting are present in person or represented by proxy. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum is present.

What are broker non-votes? If I do not vote, will my broker vote for me?

Broker non-votes occur when nominees, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners at least 10 days before the meeting. If that happens, the nominees may vote those shares only on matters deemed “routine” by the SEC and the rules promulgated by NYSE thereunder.

Black Knight, Inc. | 6 |

We believe that all the proposals to be voted on at the annual meeting, except for the appointment of KPMG LLP as our independent registered public accounting firm, are not “routine” matters. On non-routine matters, such as Proposals No. 1 and 2, nominees cannot vote unless they receive voting instructions from beneficial owners. Please be sure to give specific voting instructions to your nominee so that your vote can be counted.

What effect does an abstention have?

With respect to Proposal No. 1, abstentions or directions to withhold authority will not be included in vote totals and will not affect the outcome of the vote. With respect to Proposals No. 2 and 3, abstentions will have the effect of a vote against such proposals.

Who pays the cost of soliciting proxies?

We pay the cost of the solicitation of proxies, including preparing and mailing the Notice of Annual Meeting of Shareholders, this proxy statement and the proxy card. Following the mailing of this proxy statement, directors, officers and employees of the Company may solicit proxies by telephone, facsimile transmission or other personal contact. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians who are holders of record of shares of our common stock will be requested to forward proxy soliciting material to the beneficial owners of such shares and will be reimbursed by the Company for their charges and expenses in connection therewith at customary and reasonable rates. In addition, the Company has retained Georgeson Inc. to assist in the solicitation of proxies for an estimated fee of $10,000 plus reimbursement of expenses.

What if I share a household with another shareholder?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our annual report and proxy statement unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Shareholders who participate in householding will continue to receive separate proxy cards. If you are a shareholder who resides in the same household with another shareholder, or if you hold more than one account registered in your name at the same address and wish to receive a separate proxy statement and annual report or Notice of Internet Availability of Proxy Materials for each account, please contact Broadridge toll free at 1.866.540.7095. You may also write to Broadridge, Householding Department, at 51 Mercedes Way, Edgewood, New York 11717. Beneficial shareholders can request information about householding from their banks, brokers or other holders of record. We hereby undertake to deliver promptly upon written or oral request, a separate copy of the annual report to shareholders, or this proxy statement, as applicable, to a shareholder at a shared address to which a single copy of the document was delivered.

7 | Black Knight, Inc. |

How do I access the virtual annual meeting? Who may attend?

At the virtual annual meeting, shareholders will be able to listen to the meeting live and vote. To be admitted to the virtual annual meeting at www.virtualshareholdermeeting.com/ BKI2021, you must enter the 16-digit control number available on your proxy card if you are a shareholder of record or included in your voting instruction card and voting instructions you received from your broker, bank or other nominee. Although you may vote online during the annual meeting, we encourage you to vote via the Internet, by telephone or by mail as outlined in the Notice of Internet Availability of Proxy Materials or on your proxy card to ensure that your shares are represented and voted.

The meeting webcast will begin promptly at 11:00 a.m., Eastern Time, on June 16, 2021, and we encourage you to access the meeting prior to the start time.

Will I be able to ask questions during the virtual annual meeting?

Shareholders will be able to ask questions through the virtual meeting website during the meeting through www.virtualshareholdermeeting.com/BKI2021. The Company will respond to as many appropriate questions during the annual meeting as time allows.

How can I request technical assistance during the virtual annual meeting?

A technical support line will be available on the meeting website for any questions on how to participate in the virtual annual meeting or if you encounter any difficulties accessing the virtual meeting.

AND RELATED MATTERS

2020 Shareholder Engagement and Governance Response

We are committed to hearing and responding to the views of our shareholders. In 2020, our officers met with investors on numerous occasions, both in group and one-on-one settings. The investors with whom we met in 2020 represented 10 of our top 15 shareholders, who collectively owned more than 35% of our shares as of December 31, 2020. At these meetings, our officers discuss a variety of topics, including our operational and stock performance, corporate governance and executive compensation matters. We report and discuss these meetings with our board or applicable board committees, as appropriate.

Black Knight, Inc. | 8 |

During May and June 2020, we reached out to our top 10 institutional investors who collectively owned approximately 56% of our outstanding shares, requesting to speak with each to discuss executive compensation and governance matters. We spoke with three of our top 10 investors and received their views on various matters, including board diversity and refreshment, as well as our executive compensation programs.

Subsequently, in the first quarter of 2021, we reached out to our 20 largest shareholders to update them on the steps we have taken to address the feedback provided through our shareholder engagement process.

| • | Board refreshment and diversity: As part of our ongoing board refreshment process and our commitment to having a board of directors and board committees that reflect diversity of background, skills, age, gender, nationality, race, ethnicity and sexual orientation, we have added several new highly talented directors to our board in the last two years. Each of these directors is independent and has no prior relationships as directors or employees with any of the companies with which we have had relationships in the past, including FNF, Dun & Bradstreet Holdings, Inc. (DNB), Cannae Holdings, Inc. (Cannae) or Trasimene Capital Management, LLC (Trasimene). For additional information about each of these directors, please see “Certain Information about our Directors.” |

| » | In December 2019, Nancy L. Shanik was elected as the first woman to serve on our board, and in February 2020, Ms. Shanik was appointed to serve on our audit committee. Ms. Shanik has a strong background in risk management and is an audit committee financial expert. |

| » | In June 2020, Joseph M. Otting was elected to our board, and in July 2020, Mr. Otting was appointed to serve as Chairman of our audit committee. Mr. Otting, who is the former Comptroller of the Currency, brings strong financial expertise, as well as significant industry and regulatory experience. |

| » | In October 2020, Catherine L. Burke was elected as the second woman to serve on our board and in February 2021, Ms. Burke was appointed to serve on our corporate governance and nominating committee. She diversifies the talent set on our board through her extensive leadership experience in marketing and communications strategy and execution. |

| • | Board Oversight of ESG: In April 2020, we assigned responsibility for oversight of environmental, social and governance (ESG) risk to our risk committee in addition to their responsibility for data privacy and information security risk. |

| • | Changes to our long-term incentive program: For our 2020 performance-based restricted stock awards, we implemented: |

| » | Performance-based restrictions that apply to each of the three years of the vesting period; and |

| » | Double-trigger vesting upon a change in control (a change in control and a termination of employment). |

9 | Black Knight, Inc. |

These significant changes to our governance approach follow our implementation of majority voting in uncontested director elections and de-classifying our board of directors following strong support of our management proposals on those matters at our 2019 annual meeting of shareholders.

Corporate Governance Guidelines

Our corporate governance guidelines provide, along with the charters of the committees of the board of directors, a framework for the functioning of the board of directors and its committees and establish a common set of expectations as to how the board of directors should perform its functions. These guidelines cover a number of areas including the size and composition of the board, board membership criteria and director qualifications (including consideration of all aspects of diversity when considering new director nominees, including diversity of age, gender, nationality, race, ethnicity and sexual orientation), director responsibilities, board agenda, roles of the Chairman of the board of directors, Chief Executive Officer and Lead Independent Director, meetings of independent directors, committee responsibilities and assignments, board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. The board reviewed our corporate governance guidelines in February 2021. A copy of our corporate governance guidelines is posted on the Investors page of our website which is located at www.BlackKnightInc.com.

Code of Ethics and Business Conduct

Our board of directors has adopted a Code of Ethics for Senior Financial Officers, which is applicable to our Chief Executive Officer, our Chief Financial Officer and our Chief Accounting Officer, and a Code of Business Conduct and Ethics, which is applicable to all our directors, officers and employees. The purpose of these codes is to: (i) promote honest and ethical conduct, including the ethical handling of conflicts of interest; (ii) promote full, fair, accurate, timely and understandable disclosure; (iii) promote compliance with applicable laws and governmental rules and regulations; (iv) ensure the protection of our legitimate business interests, including corporate opportunities, assets and confidential information; and (v) deter wrongdoing. Our codes of ethics were adopted to reinvigorate and renew our commitment to our longstanding standards for ethical business practices. Our reputation for integrity is one of our most important assets and each of our employees and directors is expected to contribute to the care and preservation of that asset. Under our codes of ethics, an amendment to or a waiver or modification of any ethics policy applicable to our directors or executive officers must be disclosed to the extent required under SEC and/or NYSE rules. We intend to disclose any such amendment or waiver by posting it on the Investors page of our website at www.BlackKnightInc.com.

Copies of our Code of Business Conduct and Ethics and our Code of Ethics for Senior Financial Officers are available for review on the Investors page of our website at www.BlackKnightInc.com.

Black Knight, Inc. | 10 |

Corporate Responsibility

We are committed to addressing ESG risks and opportunities. The risk committee of our board oversees our ESG risk. We consider ESG in various areas of our business and at every level of our Company and approach our business and our communities through community engagement, diversity and inclusion, sustainability and risk management. We have provided a brief summary of how we manage our ESG risks and opportunities through our corporate responsibility programs below. For additional information on Black Knight’s corporate responsibility efforts, please see our 2020 Corporate and Social Responsibility Report, which will be available on the Investors page of our website at www.BlackKnightInc.com by June 1, 2021.

Proactively Addressing COVID-19

We are proud of the way our team has navigated the COVID-19 pandemic, which has had a profound impact on our employees, communities, and clients. Our success is due in large part to preparedness planning that began long before the current pandemic. Black Knight conducts an Annual Pandemic Exercise to review the three phases of our Pandemic Plan, to educate managers across the enterprise on how to manage the impact of a pandemic, and to gather feedback on how to improve our response.

On January 14, 2020, we conducted our Annual Pandemic Exercise, led by members of our Enterprise Business Continuity Office (EBCO) and select other employees from varying levels and functions. In response to the exercise, and as the incident rates of COVID-19 began to expand, we took a series of steps to prepare for the potential heightened risk:

| • | In late January, the EBCO began daily monitoring of the COVID-19 situation. |

| • | In February, we put into place travel restrictions, internal update briefings and monitoring, and began ordering safety equipment that might be needed to maintain operations. |

| • | By early March, the EBCO began preparing Black Knight locations for the possibility of moving to Phase II of the Pandemic Plan and a work-from-home strategy. |

| • | In Mid-March, the World Health Organization officially characterized COVID-19 as a pandemic, and soon after, Black Knight announced a work-from-home option that swiftly transitioned to a work-from-home order for our employees. |

As part of our pandemic protocols, Black Knight’s EBCO put in place measures to monitor and report on the status of the pandemic. These included weekly reporting, news updates, vaccine data and variant tracking. Management has made decisions during the course of the pandemic in accordance with Black Knight’s Crisis Management Process and communications with our stakeholders were managed by our Crisis Management and Corporate Communications teams.

11 | Black Knight, Inc. |

Protecting Our Employees During COVID-19

Black Knight also took many steps to address employee health and safety during this period. We disseminated periodic communications covering remote working and provided employees with access to the tools they required to continue to work successfully. For essential onsite staff, we created posters and provided training for CDC-based health, safety, and social distancing guidelines.

We took the following additional steps to protect our employees, which are described in more detail in our 2020 Sustainability Report:

| • | Frequent Town Hall calls to connect, thank and encourage our employees, and promote awareness of the resources available to them. |

| • | Online resources including COVID-19 intranet pages that provide resources on managing stress, virtual coaching tips, meeting planners, free online wellness/mental health workshops, and yoga classes. |

| • | COVID-19 testing, contact tracing of COVID-19 exposure, and recommended employee travel guidelines. |

| • | Full pay for employees who contracted COVID-19, including employees who are not able to work remotely. |

| • | Free Teledoc visits, virtual physician visits, and Employee Assistance Program (EAP) grief counseling sessions. |

| • | Subsidized Weight Watchers subscriptions, at-home biometric screenings, and held a virtual benefits fair to introduce our open benefits enrollment period. |

| • | Covered medical care transportation and virtual medical care to our employees in India. |

We believe that the above efforts have led to our continued success during an unprecedented year and have provided our employees with the appropriate resources to work effectively in a remote environment. In our Quarterly Employee Engagement Check- Ins and Pulse Surveys, 93% of employees responded they felt equally or more productive working from home compared to in the office, and 96% responded they had adequate tools and resources to work from home.

Stakeholder and Community Engagement

Through our charitable giving program, Black Knight Cares, we proudly support through corporate and employee financial donations and volunteer efforts a number of causes focused on the following areas to make our communities stronger:

| • | Childhood development |

| • | Community health and wellness |

Black Knight, Inc. | 12 |

| • | Housing assistance |

| • | Support for our military families |

The United Way, a nonprofit that works in communities across the country to help eradicate poverty, increase high school graduation rates and eliminate unsafe living conditions, is an important community partner for Black Knight. Our employees are able to donate to their local United Way chapter through payroll deductions, helping to do the most good in the communities where they work and live.

We are also proud to be an underwriting sponsor of The Folded Flag Foundation, a nonprofit that provides educational scholarships to the spouses and children of our nation’s fallen service members. Because all administrative costs for The Folded Flag Foundation are paid for by Black Knight and other underwriting sponsors, the foundation is able to donate 100% of all public donations to the families it serves.

Our stakeholders include our shareholders, our employees, our board of directors, our clients, and the communities where our employees live and work. We engage in an ongoing dialogue with our various stakeholders regarding our business and how it impacts them, including with respect to governance, executive compensation and ESG matters. We consider all stakeholders when evaluating ESG risks and are considering reporting on ESG matters in a manner that is aligned with an accepted standard such as the Sustainability Accounting Standards Board (SASB) in the future.

Diversity and Inclusion

Our individual differences strengthen us collectively, which is why we are committed to diversity in our workforce and promoting a business culture that is representative of the unique values, opinions, cultures and needs of our employees, clients, communities and suppliers.

Black Knight seeks talented, creative individuals from a variety of backgrounds, worldviews and life circumstances to work with us. It is our priority that our workplace is inclusive, welcoming to new ideas and appreciative of valuable experiences. In support of this commitment, we work hard to create a diverse and inclusive environment. In 2020, our efforts included:

| • | Our CEO Anthony M. Jabbour joined the CEO Action for Diversity & Inclusion, the largest CEO-driven business commitment to advance diversity and inclusion within the workplace. |

| • | We created Knights of the D&I Roundtable, an internal diversity and inclusion alliance group, to help promote our diversity efforts and support our culture of inclusion. |

| • | We strongly value diversity and have many women in senior leadership positions, and we continue our efforts to create a more balanced and fair environment for women in technology. For our employees, we do this through our Women’s Internal Networking Group (WINGs) program. We also promote careers in technology for young high school and college-aged women by holding an annual career day through our Women in Technology (WIT) program. |

13 | Black Knight, Inc. |

| • | Our board’s commitment to consider all aspects of diversity when selecting new director nominees, including candidates with a diversity of age, gender, nationality, race, ethnicity, and sexual orientation. |

Sustainability

Black Knight is dedicated to promoting environmental sustainability and providing our employees with the opportunity to make a positive impact on the environment on campus. As a leading provider of software, data and analytics solutions to the mortgage industry, we believe we have a reasonably light environmental footprint. Our efforts to reduce our environmental impact include:

| • | Reduce Energy Consumption: We implemented various initiatives to reduce our energy consumption, including retrofitting the lighting in our parking garages with LED lighting, with a target of reducing energy consumption by up to 50% while providing our employees with a bright, safe environment. Through this and other energy conservation efforts, we reduced the amount of electricity used on our corporate campus by approximately 9% in 2020 compared to 2019. |

| • | Waste Reduction and Management: We have taken a number of actions to reduce the waste we generate and dispose of it in an environmentally responsible manner, including replacing Styrofoam cups and containers with recyclable paper and cardboard products, removing plastic water bottles from our breakrooms in favor of filtered water dispensers, and partnering with an eSteward certified end-of-life equipment disposal company so that disposed technology is responsibly recycled or repurposed and sold or donated. |

| • | Water Conservation: We use faucet flow restrictors in our breakrooms and restrooms and use soil-moisture managed campus irrigation and have a no-concrete watering policy. Through these efforts, we reduced the water consumed on our corporate campus by approximately 16% in 2020 compared to 2019. |

We are pleased with our progress in these areas and will continue to work to limit our energy and water consumption in the future.

Information Security and Risk Management

We are highly dependent on information technology networks and systems to securely process, transmit and store electronic information. Attacks on information technology systems continue to grow in frequency, complexity and sophistication. Such attacks have become a point of focus for individuals, businesses and governmental entities.

These attacks can create system disruptions, shutdowns or unauthorized disclosure of confidential information, including non-public personal information, consumer data and proprietary business information.

Black Knight, Inc. | 14 |

We remain focused on making strategic investments in information security to protect our clients and our information systems. This includes both capital expenditures and operating expenses for hardware, software, personnel and consulting services. As our primary solutions and services evolve, we apply a comprehensive approach to the mitigation of identified security risks. We have established policies, including those related to privacy, information security and cybersecurity, and we employ a broad and diversified set of risk monitoring and risk mitigation techniques.

Our risk management framework is aligned to the Committee of Sponsoring Organizations of the Treadway Commission (COSO) integrated framework. Additionally, industry frameworks including FFIEC guidelines, (ISO/IEC) 27000, NIST SP 800-53, COBIT 5 and ITIL are leveraged to inform our Information Security and Information Technology policies and standards.

Internal audits, external audits and self-assessments are conducted to assess the effectiveness and maturity of the Enterprise Risk Management and Information Security Program on a recurring basis. We also maintain errors and omissions coverage for cybersecurity incidents as part of our insurance program.

Our board is focused on cybersecurity. At each regular meeting of the risk committee of our board of directors, of which there were four in 2020, our Chief Risk Officer, Chief Compliance Officer and Chief Information Security Officer provide reports relating to our cyber and data security practices, risk assessments, emerging issues and any security incidents, and each of them has an opportunity to engage with the risk committee individually in executive session.

Our risk committee chairman reports on these discussions to our board of directors on a quarterly basis. We also provide quarterly opportunities for continuing education to our risk committee members on various matters relating to cybersecurity, including emerging risks and trends, regulatory changes, and changes to our internal practices. In addition, Mr. Rood and Mr. Hunt, who serve on our risk committee, have attended third-party director education courses on cybersecurity and privacy issues and trends.

Our employees are one of our strongest assets in protecting our clients’ information and mitigating risk. We maintain comprehensive and tailored training programs that focus on applicable privacy, security, legal and regulatory requirements that provide ongoing enhancement of the security and risk culture at Black Knight. Our required annual employee compliance training and new hire onboarding process covers risk, security, and safety training. All employees receive a phishing test every month, and those who fail a phishing test receive training on phishing attacks. Additionally, our ERM administers monthly spear phishing tests to highly targeted or high-risk Black Knight employees based on their job function.

In 2020, our compensation committee included a qualitative risk-based performance criteria to our annual incentives based on the importance our board places on management’s actions to manage and mitigate risk across Black Knight. We continue to provide strong

15 | Black Knight, Inc. |

focus on all areas of cybersecurity including information security governance, threat and vulnerability management, security monitoring, identity and access management, phishing awareness, risk oversight, third-party risk management, disaster recovery and business continuity management.

The Board

Our board is currently composed of William P. Foley, II, Anthony M. Jabbour (Chief Executive Officer), Catherine L. Burke, Thomas M. Hagerty, David K. Hunt, Joseph M. Otting, Ganesh B. Rao, John D. Rood and Nancy L. Shanik.

Our board met five times in 2020. All directors attended at least 75% of the meetings of the board and of the committees on which they served during 2020. Our non-management directors also met periodically in executive sessions without management. In 2020, our board appointed Thomas M. Hagerty to serve as Lead Independent Director. Mr. Hagerty presides over each executive session of our independent directors. We do not, as a general matter, require our board members to attend our annual meeting of shareholders, although each of our directors is invited to attend our 2021 annual meeting. One of our directors attended our 2020 annual meeting.

Board Governance and Independence

Our nominating and corporate governance committee evaluates our relationships with each director and nominee and makes a recommendation to our board of directors as to whether to make an affirmative determination that such director or nominee is independent. Under our corporate governance guidelines, an “independent” director is one who meets the qualification requirements for being independent under applicable laws and the corporate governance listing standards of NYSE.

During the first quarter of 2021, our board of directors determined that Catherine L. Burke, Thomas M. Hagerty, David K. Hunt, Joseph M. Otting, Ganesh B. Rao, John D. Rood and Nancy L. Shanik, or 78% of our board, are independent. The board of directors also determined that Messrs. Hagerty and Hunt meet the additional independence standards of NYSE for compensation committee members.

In determining independence, the board of directors considered all relationships that might bear on our directors’ independence from Black Knight. The board of directors determined that Anthony M. Jabbour is not independent because he is Chief Executive Officer and an employee of Black Knight. The board also determined that William P. Foley, II is not independent because he serves as the Chairman and is an employee of Black Knight.

In considering the independence of Catherine L. Burke, Thomas M. Hagerty, David K. Hunt, Joseph M. Otting, Ganesh B. Rao, John D. Rood, and Nancy L. Shanik, the board of directors considered the following factors:

Black Knight, Inc. | 16 |

| • | Mr. Hagerty and Mr. Rao are each Managing Directors of Thomas H. Lee Partners, L.P. (THL), which owned more than 10% of our common stock until March 15, 2018. In connection with Black Knight’s acquisition of a majority interest in Optimal Blue Holdco, LLC (Optimal Blue), on September 15, 2020, THL acquired 20% of the Class A Units of Optimal Blue for a purchase price of $289 million pursuant to a Forward Purchase Agreement dated July 26, 2020. In addition, in the past we have purchased software and systems services from certain entities over which THL exercises control. |

| • | Messrs. Hagerty and Rood each serve as directors of and own minority equity interests in FNF, our former parent. |

| • | We own approximately 13% of the outstanding common stock of Dun & Bradstreet Holdings, Inc. (DNB). THL owns almost 25% of DNB’s common stock, and Messrs. Hagerty and Rao each serve on the board of directors of DNB. We, THL and certain other investors in DNB are party to a letter agreement regarding voting pursuant to which the parties agreed to vote their shares in DNB as a group on all matters relating to the election of directors to the DNB board, including the election of our Chairman, Mr. Foley, and Messrs. Hagerty and Rao, for a period of three years. |

| • | Messrs. Hagerty, Hunt, and Rood each own a minority interest in Black Knight Sports and Entertainment LLC, which owns the Vegas Golden Knights. Mr. Foley is the majority interest holder and is Executive Chairman and Chief Executive Officer of Black Knight Sports and Entertainment LLC, a private company. |

Following consideration of these matters, the board of directors determined that these relationships were not of a nature that would impair Mr. Hagerty’s, Mr. Hunt’s, Mr. Rao’s or Mr. Rood’s independence. Ms. Burke, Mr. Otting, and Ms. Shanik had no relationships with Black Knight that required consideration in determining their independence.

Committees of the Board

The board has four standing committees: an audit committee, a compensation committee, a corporate governance and nominating committee and a risk committee. The charter of each committee is available on the Investors page of our website at www.BlackKnightInc.com.

Shareholders also may obtain a copy of any of these charters by writing to the Corporate Secretary at the address set forth under “Available Information” below.

Corporate Governance and Nominating Committee

The members of the corporate governance and nominating committee are David K. Hunt (Chair), Catherine L. Burke and Thomas M. Hagerty. Our corporate governance and nominating committee met two times in 2020.

The primary functions of the corporate governance and nominating committee, as identified in its charter, are to:

17 | Black Knight, Inc. |

| • | Identify individuals qualified to become members of our board of directors (or to fill vacancies), consistent with the criteria approved by our board of directors, and to recommend to the board the nominees to stand for election as directors. In doing so, the committee considers characteristics of directors and director nominees with the goal of maintaining a mix of skills, background, gender diversity, ethnic diversity and tenure on the board to support and promote the Company’s strategic vision. |

| • | Make recommendations to our board of directors as to changes to the size of the board or any committee thereof. |

| • | Review the independence of each director in light of the independence criteria of NYSE and any other independence standards applicable to directors and submit a recommendation to our board of directors with respect to each director’s independence. |

| • | Make recommendations to the board regarding the composition of the board’s committees. |

| • | Review and monitor the Company’s policies and initiatives addressing human capital matters, including diversity, equity and inclusion. |

| • | Develop, review annually and recommend to the board any revisions to the Company’s Corporate Governance Guidelines. |

| • | Oversee the evaluation of the performance of the board and its committees. |

| • | Review our overall corporate governance and report to the board on a regular basis, but not less than once per year, on committee findings, recommendations and any other matters that the committee deems appropriate or the board requests. |

The corporate governance and nominating committee reviewed its charter in February 2021 without material change.

Audit Committee

The members of our audit committee are Joseph M. Otting (Chair), John D. Rood and Nancy L. Shanik. The board has determined that each of the audit committee members is financially literate and independent as required by the rules of the SEC and NYSE, and that each of Mr. Otting, Mr. Rood and Ms. Shanik is an audit committee financial expert, as defined by the rules of the SEC. Our audit committee met a total of eight times in 2020.

The primary functions of the audit committee include:

| • | Appointing, compensating and overseeing our independent registered public accounting firm; |

| • | Overseeing the integrity of our financial statements and our compliance with legal and regulatory requirements; |

| • | Discussing the annual audited financial statements and unaudited quarterly financial statements with management and the independent registered public accounting firm; |

Black Knight, Inc. | 18 |

| • | Establishing procedures for the receipt, retention and treatment of complaints (including anonymous complaints) we receive concerning accounting, internal accounting controls, auditing matters or potential violations of law; |

| • | Approving audit and non-audit services provided by our independent registered public accounting firm; |

| • | Discussing earnings press releases and financial information provided to analysts and rating agencies; |

| • | Discussing with management our policies and practices with respect to risk assessment and risk management; |

| • | Reviewing any material transaction between our chief financial officer or chief accounting officer that has been approved in accordance with our Code of Ethics for Senior Financial Officers, and providing prior written approval of any material transaction between us and our chief executive officer; and |

| • | An annual report for inclusion in our proxy statement, in accordance with applicable rules and regulations. |

Report of the Audit Committee

The audit committee of the board of directors submits the following report on the performance of certain of its responsibilities for the year 2020:

The primary function of the audit committee is oversight of (i) the quality and integrity of the Company’s consolidated financial statements and related disclosures, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent registered public accounting firm’s qualifications and independence, and (iv) the performance of the Company’s internal audit function and the independent registered public accounting firm.

Our audit committee acts under a written charter, which the audit committee reviewed in February 2021 without material change. We review the adequacy of our charter at least annually. Our audit committee is comprised of the three directors named below. Each of our audit committee members have been determined by the board of directors to be independent as defined by NYSE independence standards. In addition, our board of directors has determined that each of Mr. Otting, Mr. Rood and Ms. Shanik is an audit committee financial expert as defined by the rules of the SEC.

In performing our oversight function, we reviewed and discussed with management and KPMG LLP (KPMG), the independent registered public accounting firm, the Company’s audited consolidated financial statements as of and for the year ended December 31, 2020. Management and KPMG reported to us that the Company’s consolidated financial statements present fairly, in all material respects, the consolidated financial position and results of operations and cash flows of Black Knight and its subsidiaries in conformity with generally accepted accounting principles. We also discussed with KPMG matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

19 | Black Knight, Inc. |

We have received and reviewed the written disclosures and the letter from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence and have discussed with KPMG their independence. In addition, we have considered whether KPMG’s provision of non-audit services to the Company is compatible with their independence.

Finally, we discussed with the Company’s internal auditors and KPMG the overall scope and plans for their respective audits. We met with KPMG at each meeting. Management was present for some, but not all, of these discussions. These discussions included the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting.

Based on the reviews and discussions referred to above, we recommended to the board of directors that the audited consolidated financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, and that KPMG be appointed independent registered public accounting firm for Black Knight for 2021.

In carrying out our responsibilities, we look to management and the independent registered public accounting firm. Management is responsible for the preparation and fair presentation of the Company’s annual consolidated financial statements. The independent registered public accounting firm is responsible for auditing the Company’s annual consolidated financial statements and expressing an opinion as to whether these consolidated financial statements are presented fairly, in all material respects, in conformity with U.S. generally accepted accounting principles.

Management is also responsible for maintaining and assessing the effectiveness of its internal control over financial reporting, including providing Management’s Report on Internal Control over Financial Reporting. The independent registered public accounting firm is responsible for auditing these internal controls and expressing an opinion as to whether the Company maintained, in all material respects, effective internal control over financial reporting based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

The independent registered public accounting firm performs its responsibilities in accordance with the standards of the Public Company Accounting Oversight Board. Our members are not professionally engaged in the practice of accounting or auditing, and are not experts under the Securities Exchange Act of 1934, as amended, in either of those fields or in auditor independence.

The foregoing report is provided by the following directors:

AUDIT COMMITTEE

Joseph M. Otting (Chair)

John D. Rood

Nancy L. Shanik

Black Knight, Inc. | 20 |

Compensation Committee

The members of the compensation committee are Thomas M. Hagerty (Chair) and David K. Hunt, each of whom were deemed to be independent by the board, as required by NYSE. Our compensation committee met four times during 2020. The functions of the compensation committee include the following:

| • | Reviewing and approving the corporate goals and objectives relevant to compensation of the company’s CEO, evaluating the CEO’s performance in light of those goals and objectives and determining and approving the CEO’s compensation level based on this evaluation; |

| • | Setting salaries and approving incentive compensation awards other than equity-based awards, as well as compensation policies for all Section 16 officers as designated by our board of directors, and recommending to our board of directors equity-based incentive awards for board approval; |

| • | Reviewing and recommending to our board of directors policies with respect to equity compensation arrangements that are subject to board approval; |

| • | Overseeing our compliance with the requirement under applicable stock exchange rules that, with limited exceptions, shareholders approve equity compensation plans; |

| • | Evaluating and approving the equity incentive plans, compensation plans and similar programs advisable for us, as well as modification or termination of existing plans and programs; |

| • | Authorizing and approving any employment or severance agreements and amendments with all designated Section 16 officers; |

| • | Reviewing, discussing with management and recommending to our board of directors for inclusion in our annual proxy statement or annual report on Form 10-K the compensation discussion and analysis section; |

| • | Reviewing and approving the annual compensation risk assessment conducted by management and the Chief Executive Officer pay ratio for inclusion in our proxy statement or annual report on Form 10-K; |

| • | Preparing the report of the compensation committee that the SEC requires in our annual proxy statement; |

| • | Considering the results of shareholder say-on-pay votes and recommending to our board of directors any change to the frequency of say-on-pay votes; |

| • | Reviewing and approving the form and amount of compensation of our board of directors’ non-management directors; |

| • | Evaluating and recommending to our board of directors the type and amount of compensation to be paid or awarded to board members; |

21 | Black Knight, Inc. |

| • | Reporting to our board of directors; |

| • | Reviewing the adequacy of its charter on an annual basis; and |

| • | Reviewing and evaluating, at least annually, the performance of the compensation committee, including compliance of the compensation committee with its charter. |

Our compensation committee reviewed its charter in February 2021 without material change. For more information regarding the responsibilities of the compensation committee, please refer to the section of this proxy statement entitled “Compensation Discussion and Analysis and Executive and Director Compensation.”

Risk Committee

The members of the risk committee are John D. Rood (Chair), David K. Hunt and Ganesh B. Rao, each of whom were determined by the board to be independent. Our risk committee met four times in 2020.

The primary functions of the risk committee include providing oversight of our risk management and compliance efforts, as well as oversight of our material risks. Our risk committee’s functions include, among other things:

| • | Oversight of our enterprise risk management program, including data privacy, information security and ESG risk; |

| • | Oversight of our compliance program; and |

| • | Oversight of the enterprise risk management and compliance functions. |

Our risk committee reviewed its charter in February 2021 without material change.

Board Leadership Structure and Role in Risk Oversight

We have separated the positions of CEO and Chairman of the board of directors in recognition of the differences between the two roles. We believe this leadership structure is appropriate and allows our CEO and Chairman to focus on the responsibilities of their respective offices while creating a collaborative relationship that benefits our Company.

In February 2020, our board appointed Thomas M. Hagerty, one of our independent directors, to serve as our Lead Independent Director. Following engagement and feedback from our shareholders, the board determined it to be useful and appropriate to designate a Lead Independent Director to coordinate the activities of the other non-employee directors and to perform such other duties and responsibilities as the board may determine. The responsibilities of our Lead Independent Director include:

| • | Preside at meetings of the board of directors in the absence of, or upon the request of, the Chairman; |

Black Knight, Inc. | 22 |

| • | Call and preside over all executive meetings of non-employee directors and independent directors and report to the board, as appropriate, concerning such meetings; |

| • | Review information sent to the board, as well as board meeting agendas and schedules in collaboration with the Chairman to ensure that there is sufficient time for discussion of all agenda items and recommend matters for the board to consider and information to be provided to the board; |

| • | Serve as a liaison and supplemental channel of communication between non-employee/ independent directors and the Chairman without inhibiting direct communications between the Chairman and other directors; |

| • | Serve as the principal liaison for consultation and communication between the non-employee/independent directors and shareholders; |

| • | Advise the Chairman concerning the retention of advisors and consultants who report directly to the board; and |

| • | Be available to major shareholders for consultation and direct communication. |

The board of directors administers its risk oversight function directly and through committees. Our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also oversees the performance of the independent auditor, our internal audit function and monitors compliance with legal and regulatory requirements.

Our risk committee has the responsibility to assist our board of directors in overseeing our enterprise risk management framework, including ESG risk, and our comprehensive compliance program, and to review and approve our risk governance policies and procedures. At each regular meeting of the risk committee, our Chief Risk Officer, Chief Compliance Officer and Chief Information Security Officer provide reports relating to our cyber and data security practices, risk assessments, emerging issues and any security incidents, and each of them has an opportunity to engage with the risk committee individually in executive session. Our Chief Risk Officer also reports to the risk committee on matters relating to our environmental sustainability policies and programs. Our risk committee chairman reports on these discussions to our board of directors on a quarterly basis. We also provide opportunities for continuing education to our risk committee members on various matters relating to cyber security, including emerging risks and trends, regulatory changes, and changes to our internal practices to address emerging risks.

The corporate governance and nominating committee considers the adequacy of our governance structures and policies, including as they relate to our environmental, social and governance practices. The compensation committee reviews and approves our compensation and other benefit plans, policies and programs and considers whether any of those plans, policies or programs creates risks that are likely to have a material adverse effect on Black Knight. Each committee provides reports on its activities to the full board of directors.

23 | Black Knight, Inc. |

Black Knight's commitment to corporate responsibility means integrating it throughout our business, including how we manage ESG topics. Our board and its committees oversee the execution of Black Knight’s ESG strategies and initiatives as an integrated part of our oversight of the overall strategy and risk management for the Company. Our management team is actively engaged on related topics including innovation of our software, data and analytics solutions and client, investor and other stakeholder expectations. In addition, our management team actively manages our approach to our corporate social responsibilities, public policy issues, human capital issues, environmental, health and safety matters, as well as the environmental impact of the Company’s operations, and will discuss these matters with the board and appropriate committees. The Corporate Responsibility section, beginning on page 11 and our 2020 Corporate and Social Responsibility Report available on the Investors page of our website at www.BlackKnightInc.com further outline our approach to these issues.

Contacting the Board

Any shareholder or other interested person who desires to contact any member of the board or the non-management members of the board as a group may do so by writing to: Board of Directors, c/o Corporate Secretary, Black Knight, Inc., 601 Riverside Avenue, Jacksonville, Florida 32204. Communications received are distributed by the Corporate Secretary to the appropriate member or members of the board.

ABOUT OUR DIRECTORS

Director Criteria, Qualifications and Experience and Process for Selecting Directors

Our board and the corporate governance and nominating committee is committed to include the best available candidates for nomination to election to our board based on merit. Our board and our corporate governance and nominating committee regularly evaluate our board’s composition with the goal of developing a board that will meet our strategic goals, and one that includes diverse, experienced and highly qualified individuals.

The corporate governance and nominating committee does not set specific, minimum qualifications that nominees must meet in order for the committee to recommend them to the board, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account our needs and the overall composition of the board. In accordance with our Corporate Governance Guidelines, the corporate governance and nominating committee considers, among other things, the following criteria in fulfilling its duty to recommend nominees for election as directors:

Black Knight, Inc. | 24 |

| • | Personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | Current knowledge and contacts in the communities in which we do business and in our industry or other industries relevant to our business; |

| • | Ability and willingness to commit adequate time to the board and committee matters; |

| • | The fit of the individual’s skills and personality with those of other directors and potential directors in building a board that is effective, collegial and responsive to our needs; and |

| • | Diversity of viewpoints, background, experience, and other demographics, and all aspects of diversity in order to enable the board to perform its duties and responsibilities effectively, including candidates with a diversity of age, gender, nationality, race, ethnicity, and sexual orientation. |

Each year in connection with the nomination of candidates for election to the board, the corporate governance and nominating committee evaluates the background of each candidate, including candidates that may be submitted by shareholders.

Composition, Tenure, Recent Refreshment and Diversity

We believe that the current composition of our board includes directors who possess relevant experience, skills and qualifications that contribute to a well-functioning board that effectively oversees our long-term strategy. Black Knight has undergone significant change over the past six years, including FNF’s acquisition of LPS in January 2014, the IPO in May 2015, the Spin-Off from FNF in September 2017, and a CEO transition in April 2018. Our board includes five directors who have been on our board since 2014 and have a strong understanding of our business, operational and strategic goals, as well as our industry and the risks we face. Having directors with a longevity of service and deep understanding of our business has been critical to our ability to smoothly and successfully navigate through this time of transition. The success of their leadership is evidenced by the increase in the trading price for our stock from $24.50 at IPO, to $43.05 at Spin-Off, to $88.35 on December 31, 2020, which represents an increase of $10.1 billion in shareholder value.

In 2019 and 2020, our board focused on refreshment and diversity. In furtherance of our commitment to having a board of directors and board committees that reflect diversity of background, skills, age, gender, nationality, race, ethnicity and sexual orientation, we have added three new highly talented directors to our board in the last two years:

| • | In December 2019, Nancy L. Shanik was elected as the first woman to serve on our board, and in February 2020, Ms. Shanik was appointed to serve on our audit committee. Ms. Shanik has a strong background in risk management and is an audit committee financial expert. |

| • | In June 2020, Joseph M. Otting was elected to our board, and in July 2020, Mr. Otting was appointed to serve as Chairman of our audit committee. Mr. Otting, who is the former Comptroller of the Currency, brings strong financial expertise, as well as significant industry and regulatory experience. |

25 | Black Knight, Inc. |

| • | In October 2020, Catherine L. Burke was elected as the second woman to serve on our board and in February 2021, she was appointed to serve on our corporate governance and nominating committee. Ms. Burke diversifies the talent set on our board through her extensive leadership experience in marketing and communications strategy and execution. |

Each of these directors possesses skills and qualifications that augment those of our other directors, is independent and has no prior relationships as directors or employees with any of the companies with which we have had relationships in the past, including FNF, DNB, Cannae or Trasimene. For additional information about each of these directors, please see “Certain Information about our Directors.”

In 2021, we expect our board will focus on the execution of our strategy to drive growth by selling our products and solutions to new clients, cross-selling additional services to existing clients, innovating through the development of new solutions and refining our current offerings to provide better insight to our clients, and selectively pursuing strategic acquisitions. We also expect our board to focus on our integration of Optimal Blue and execution of the strategies that we outlined when we acquired Optimal Blue.

Our board is committed to examining ways to continue to foster the diversity of our board across many dimensions to ensure that it operates at a high functioning level and reflects the board’s commitment to inclusiveness. Our Corporate Governance Guidelines expressly include diversity of age, gender, nationality, race, ethnicity, and sexual orientation as a part of the criteria the committee may consider when selecting nominees for election to the board, all in the context of the needs of our board at any given point in time. Specifically, the corporate governance and nominating committee is focused on considering highly qualified women and individuals from minority groups as candidates for nomination as directors.

The corporate governance and nominating committee considers qualified candidates suggested by current directors, management and our shareholders. Shareholders can suggest qualified candidates for director to the corporate governance and nominating committee by writing to our Corporate Secretary at 601 Riverside Avenue, Jacksonville, Florida 32204. The submission must provide the information required by, and otherwise comply with the procedures set forth in, Section 3.1 of our bylaws. Section 3.1 also requires that the nomination notice be submitted by a prescribed time in advance of the meeting. See “Shareholder Proposals” below.

Information About the Director Nominees and Continuing Directors

Declassification of our Board of Directors and Majority Voting

Following strong support from our shareholders at our 2019 annual meeting, our board approved an amendment to our certificate of incorporation to eliminate the classification of our board over a three-year period beginning at the 2020 annual meeting and provide for the annual election of all directors beginning at the 2022 annual meeting. This year, Class II and Class III directors will be nominated for election for terms expiring at the 2022 annual meeting of shareholders.

Black Knight, Inc. | 26 |

Also following strong support from our shareholders at our 2019 annual meeting, our board approved changes to our bylaws to implement majority voting in uncontested director elections. As a result, our directors will be elected by a majority of the votes cast in an uncontested director election, that is, where the number of nominees for director equals the number of directors to be elected by the shareholders at a meeting. In the event of a contested director election, that is where the number of nominees for director exceeds the number of directors to be elected by the shareholders at a meeting, directors would be elected by a plurality of the votes cast.

Director Skills and Experience

The matrix below lists the skills and experience that we consider most important for our directors in light of our current business and structure. In addition, biographical information concerning our nominees proposed for election at the annual meeting, as well as our continuing Class I directors, including each directors’ relevant experience, qualifications, skills and diversity, is included below.