1Black Knight Financial Services TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2016 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affili te. © 2017 Bl ck Knight Financial Tech ology Solutions, LLC. All Rights Reserved. Black Knight Financial Services, Inc. First Quarter 2017 Earnings Results May 3, 2017

2Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Disclaimer Forward-Looking Statements This presentation contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on Black Knight management's beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Black Knight undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties that forward-looking statements are subject to include, but are not limited to: our ability to successfully achieve the conditions to and consummate the tax-free spin-off of Black Knight from FNF; electronic security breaches against our information systems; our ability to maintain and grow our relationships with our customers; changes to the laws, rules and regulations that impact our and our customers’ businesses; our ability to adapt our services to changes in technology or the marketplace; the impact of any potential defects, development delays, installation difficulties or system failures on our business and reputation; changes in general economic, business, regulatory and political conditions, particularly as they affect the mortgage industry; risks associated with the availability of data; the effects of our substantial leverage on our ability to make acquisitions and invest in our business; risks associated with our structure and status as a “controlled company;” our ability to successfully integrate strategic acquisitions; and other risks and uncertainties detailed in the “Statement Regarding Forward-Looking Information,” “Risk Factors” and other sections of our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation contains non-GAAP financial information, including Adjusted Revenues, Adjusted Revenues excluding the effect of the Property Insight realignment, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Earnings and Adjusted Net Earnings Per Share. These are important financial performance measures for Black Knight, but are not financial measures as defined by generally accepted accounting principles ("GAAP"). The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Black Knight uses these non-GAAP financial performance measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. Black Knight believes they provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making, including determining a portion of executive compensation. Black Knight has not provided a reconciliation of forward-looking Adjusted Net Earnings Per Share and Adjusted EBITDA growth to the most directly comparable GAAP financial measures, due primarily to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise, as not all of the information necessary for a quantitative reconciliation is available to Black Knight without unreasonable effort. See the Appendix for further information.

3Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. GAAP Financial Results Metrics First Quarter Revenues $258.1 million, +7% Net Earnings Attributable to Black Knight Financial Services, Inc. $12.2 million Net Earnings Per Share Attributable to Black Knight Financial Services, Inc. - Diluted $0.18

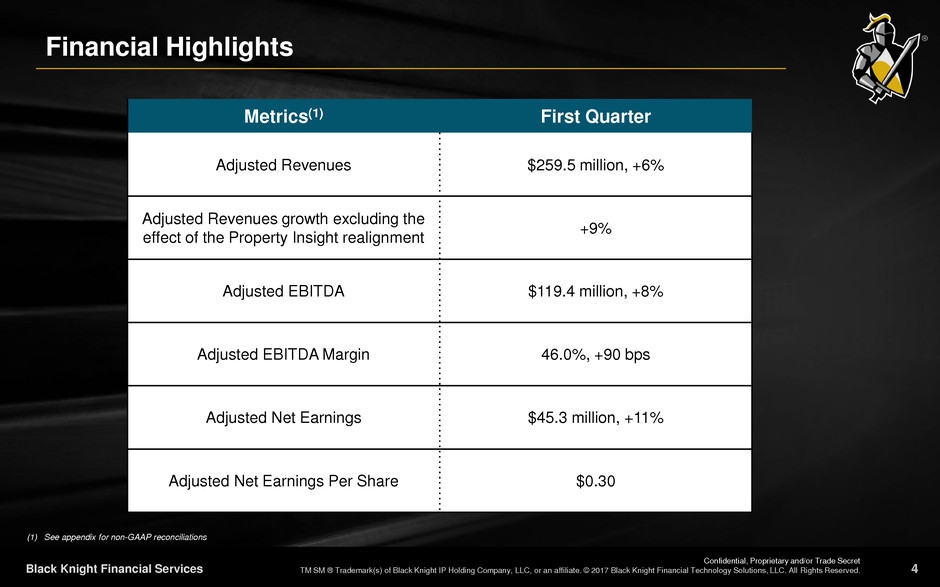

4Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Financial Highlights Metrics(1) First Quarter Adjusted Revenues $259.5 million, +6% Adjusted Revenues growth excluding the effect of the Property Insight realignment +9% Adjusted EBITDA $119.4 million, +8% Adjusted EBITDA Margin 46.0%, +90 bps Adjusted Net Earnings $45.3 million, +11% Adjusted Net Earnings Per Share $0.30 (1) See appendix for non-GAAP reconciliations

5Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Technology (1) Adjusted Revenues and Adjusted EBITDA Margin for the Technology segment presented in conformity with Accounting Standards Codification 280, Segment Reporting. Therefore, these measures are excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K. 57.0% 57.5% Q1 2016 Q1 2017 $202 $221 Q1 2016 Q1 2017 +50 bps Y/Y expansion +9% Y/Y growth Adjusted EBITDA Margin(1) (%) Strong loan count growth, price increases and transaction volumes in Core Servicing Origination Technology growth driven by revenues from eLynx acquisition, partially offset by lower consulting revenues, client contract termination fees and Exchange volumes due to a decline in refinancing originations Adjusted EBITDA Margin expanded to 57.5% First Quarter HighlightsAdjusted Revenues(1) ($ in millions)

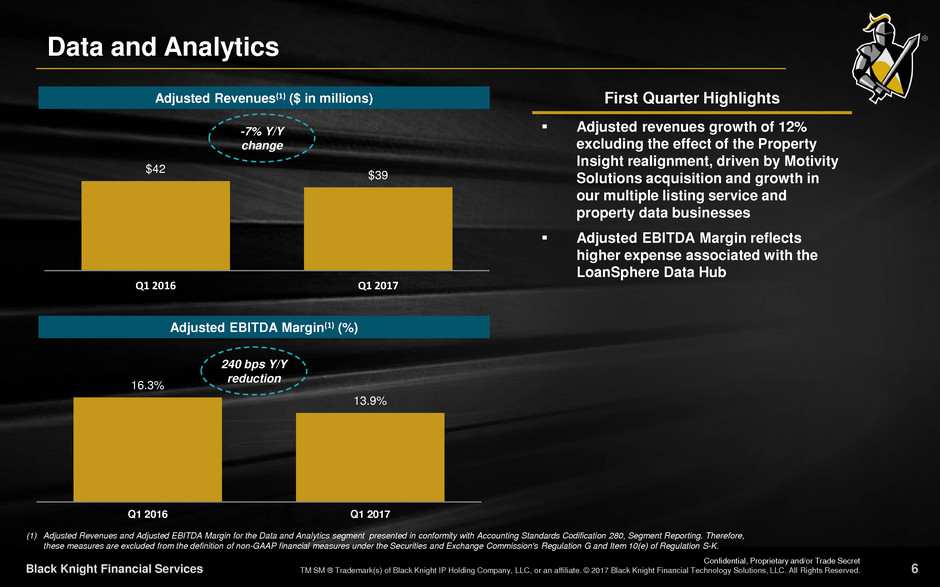

6Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Data and Analytics (1) Adjusted Revenues and Adjusted EBITDA Margin for the Data and Analytics segment presented in conformity with Accounting Standards Codification 280, Segment Reporting. Therefore, these measures are excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K. 16.3% 13.9% Q1 2016 Q1 2017 $42 $39 Q1 2016 Q1 2017 240 bps Y/Y reduction -7% Y/Y change Adjusted EBITDA Margin(1) (%) Adjusted revenues growth of 12% excluding the effect of the Property Insight realignment, driven by Motivity Solutions acquisition and growth in our multiple listing service and property data businesses Adjusted EBITDA Margin reflects higher expense associated with the LoanSphere Data Hub First Quarter HighlightsAdjusted Revenues(1) ($ in millions)

7Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Capital Structure (1) Excludes unamortized bond premium, original issue discount and debt issuance costs (2) See appendix for non-GAAP reconciliations ($ in millions) As of 3/31/17 Maturity Interest Rate Cash and Cash Equivalents $ 108 Revolver ($400mm) 50 2020 LIBOR + 200bps Term A Loan 730 2020 LIBOR + 200bps Term B Loan 393 2022 LIBOR + 225bps / 75bps floor Senior Notes 390 2023 5.75% Total Long-term Debt(1) $1,563 Capital Lease Obligation 9 2017 0.00% Total Debt $1,572 Net Debt $1,464 LTM 3/31/17 Adjusted EBITDA(2) $ 472 Total Debt / LTM Adjusted EBITDA 3.3x Net Debt / LTM Adjusted EBITDA 3.1x

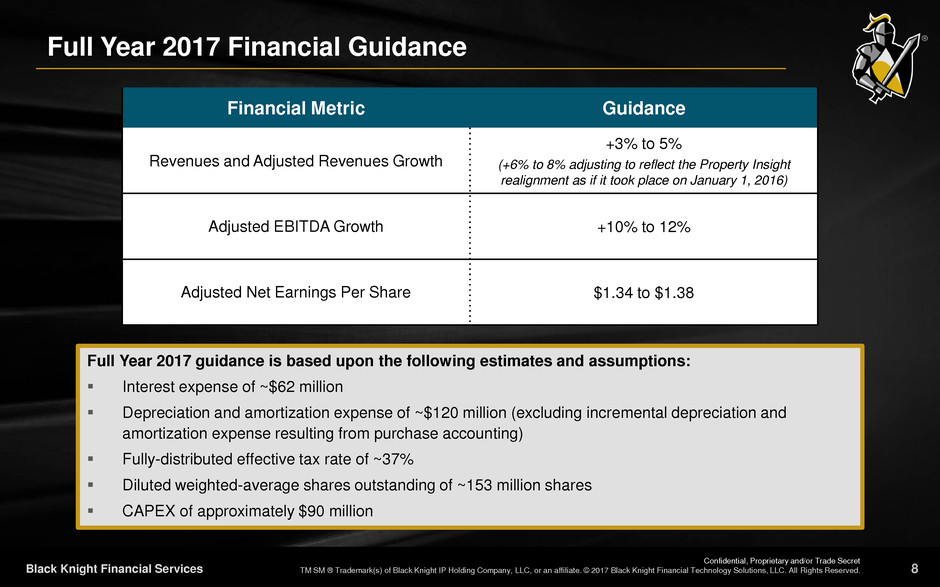

8Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Full Year 2017 Financial Guidance Financial Metric Guidance Revenues and Adjusted Revenues Growth +3% to 5% (+6% to 8% adjusting to reflect the Property Insight realignment as if it took place on January 1, 2016) Adjusted EBITDA Growth +10% to 12% Adjusted Net Earnings Per Share $1.34 to $1.38 Full Year 2017 guidance is based upon the following estimates and assumptions: Interest expense of ~$62 million Depreciation and amortization expense of ~$120 million (excluding incremental depreciation and amortization expense resulting from purchase accounting) Fully-distributed effective tax rate of ~37% Diluted weighted-average shares outstanding of ~153 million shares CAPEX of approximately $90 million

9Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Appendix

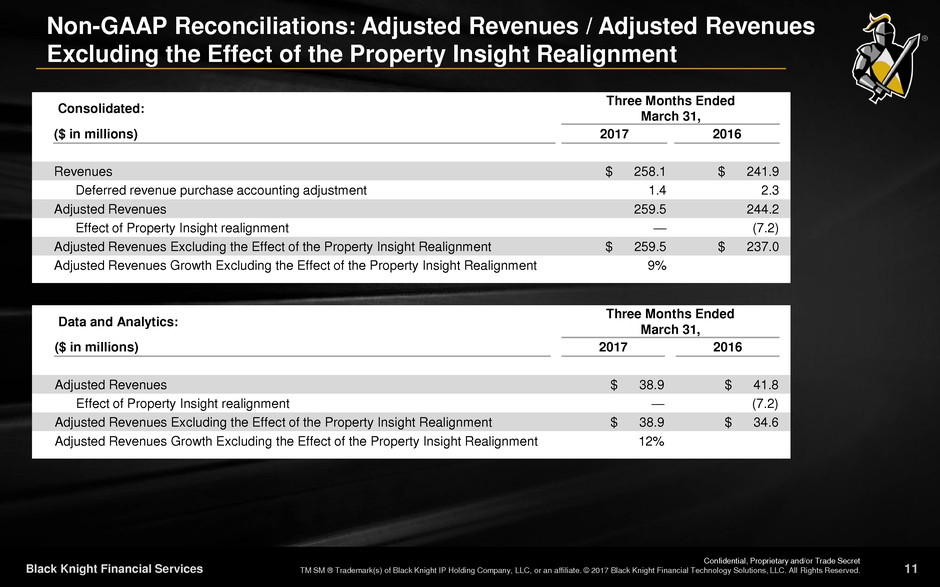

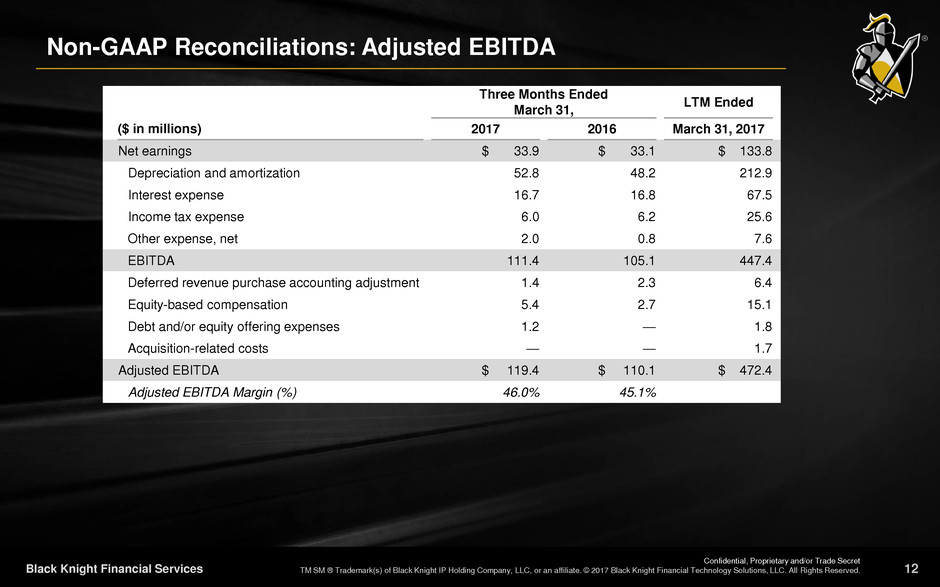

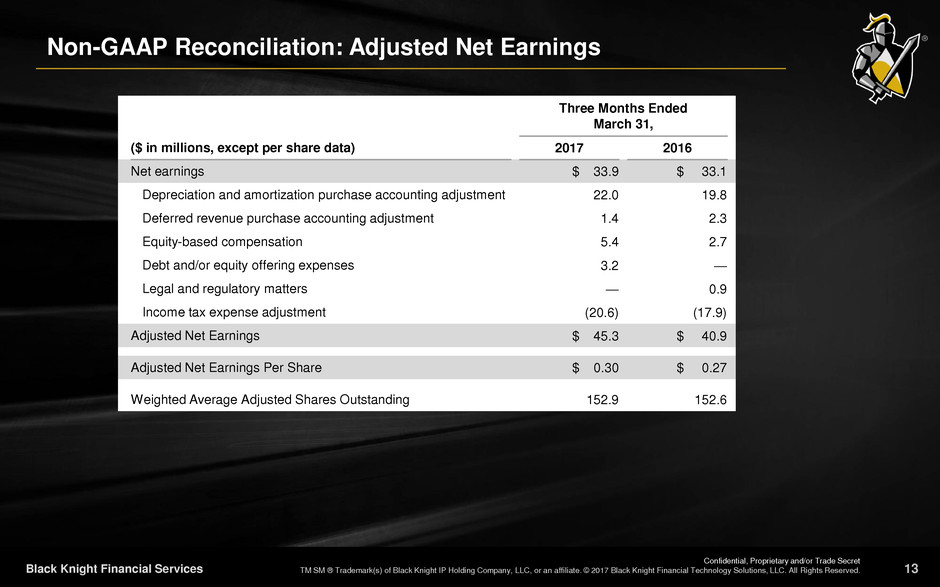

10Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Non-GAAP Financial Measures Adjusted Revenues –We define Adjusted Revenues as Revenues adjusted to include the revenues that were not recorded by Black Knight during the periods presented due to the deferred revenue purchase accounting adjustment recorded in accordance with GAAP. These adjustments are reflected in Corporate and Other. This adjustment for the full year 2017 is expected to be approximately $4.5 million. Adjusted Revenues Excluding the Effect of the Property Insight Realignment –We define Adjusted Revenues excluding the effect of the Property Insight realignment as Adjusted Revenues for the respective 2016 period determined on the basis as if the Property Insight realignment had taken place on January 1, 2016. Adjusted EBITDA –We define Adjusted EBITDA as Net earnings, with adjustments to reflect the addition or elimination of certain income statement items including, but not limited to: (i) Depreciation and amortization; (ii) Interest expense; (iii) Income tax expense; (iv) Other expense, net; (v) Loss (gain) from discontinued operations, net of tax; (vi) deferred revenue purchase accounting adjustment recorded in accordance with GAAP; (vii) equity-based compensation, including related payroll taxes; (viii) costs associated with debt and/or equity offerings, including the planned tax-free spin-off of Black Knight from FNF; and (ix) acquisition-related costs. These adjustments are reflected in Corporate and Other. Adjusted EBITDA Margin – Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by Adjusted Revenues. Adjusted Net Earnings –We define Adjusted Net Earnings as Net earnings with adjustments to reflect the addition or elimination of certain income statement items including, but not limited to: (i) the net incremental depreciation and amortization adjustments associated with the application of purchase accounting; (ii) deferred revenue purchase accounting adjustment recorded in accordance with GAAP; (iii) equity-based compensation, including related payroll taxes; (iv) costs associated with debt and/or equity offerings, including the planned tax-free spin-off of Black Knight from FNF; (v) significant legal and regulatory matters; and (vi) adjustment for income tax expense at our full year estimated effective tax rate of 37.0% for the three months ended March 31, 2017 and 2016, assuming the conversion of all the shares of Class B common stock into shares of Class A common stock, assuming that Black Knight was a taxable entity as of the beginning of the earliest period presented and assuming the effect of the non-GAAP adjustments. Adjusted Net Earnings Per Share –We calculate per share amounts assuming the exchange of all shares of Class B common stock into shares of our Class A common stock at the beginning of the respective period, as well as the dilutive effect of any unvested restricted shares of Class A common stock.

11Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Non-GAAP Reconciliations: Adjusted Revenues / Adjusted Revenues Excluding the Effect of the Property Insight Realignment Consolidated: Three Months Ended March 31, ($ in millions) 2017 2016 Revenues $ 258.1 $ 241.9 Deferred revenue purchase accounting adjustment 1.4 2.3 Adjusted Revenues 259.5 244.2 Effect of Property Insight realignment — (7.2) Adjusted Revenues Excluding the Effect of the Property Insight Realignment $ 259.5 $ 237.0 Adjusted Revenues Growth Excluding the Effect of the Property Insight Realignment 9% Data and Analytics: Three Months Ended March 31, ($ in millions) 2017 2016 Adjusted Revenues $ 38.9 $ 41.8 Effect of Property Insight realignment — (7.2) Adjusted Revenues Excluding the Effect of the Property Insight Realignment $ 38.9 $ 34.6 Adjusted Revenues Growth Excluding the Effect of the Property Insight Realignment 12%

12Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Non-GAAP Reconciliations: Adjusted EBITDA Three Months Ended March 31, LTM Ended ($ in millions) 2017 2016 March 31, 2017 Net earnings $ 33.9 $ 33.1 $ 133.8 Depreciation and amortization 52.8 48.2 212.9 Interest expense 16.7 16.8 67.5 Income tax expense 6.0 6.2 25.6 Other expense, net 2.0 0.8 7.6 EBITDA 111.4 105.1 447.4 Deferred revenue purchase accounting adjustment 1.4 2.3 6.4 Equity-based compensation 5.4 2.7 15.1 Debt and/or equity offering expenses 1.2 — 1.8 Acquisition-related costs — — 1.7 Adjusted EBITDA $ 119.4 $ 110.1 $ 472.4 Adjusted EBITDA Margin (%) 46.0% 45.1%

13Black Knight Financial Services Confidential, Proprietary and/or Trade Secret TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2017 Black Knight Financial Technology Solutions, LLC. All Rights Reserved. Non-GAAP Reconciliation: Adjusted Net Earnings Three Months Ended March 31, ($ in millions, except per share data) 2017 2016 Net earnings $ 33.9 $ 33.1 Depreciation and amortization purchase accounting adjustment 22.0 19.8 Deferred revenue purchase accounting adjustment 1.4 2.3 Equity-based compensation 5.4 2.7 Debt and/or equity offering expenses 3.2 — Legal and regulatory matters — 0.9 Income tax expense adjustment (20.6) (17.9) Adjusted Net Earnings $ 45.3 $ 40.9 Adjusted Net Earnings Per Share $ 0.30 $ 0.27 Weighted Average Adjusted Shares Outstanding 152.9 152.6