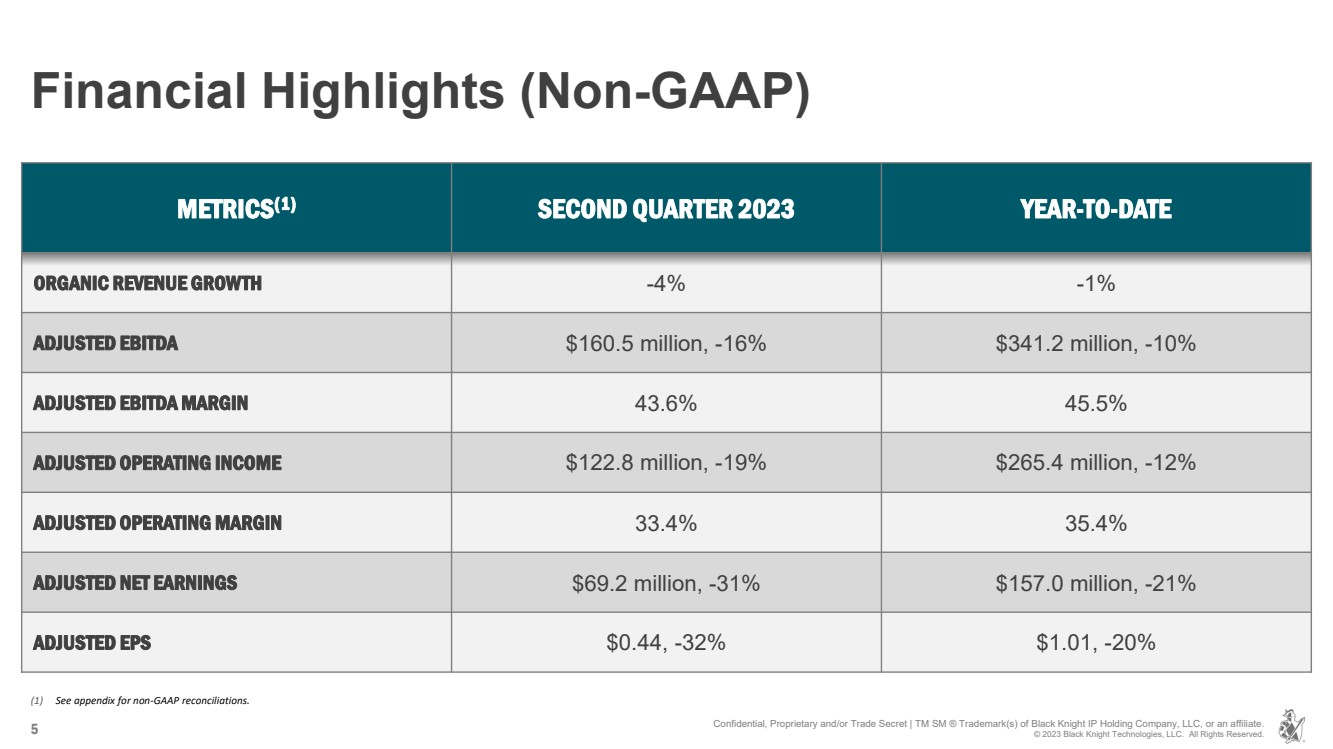

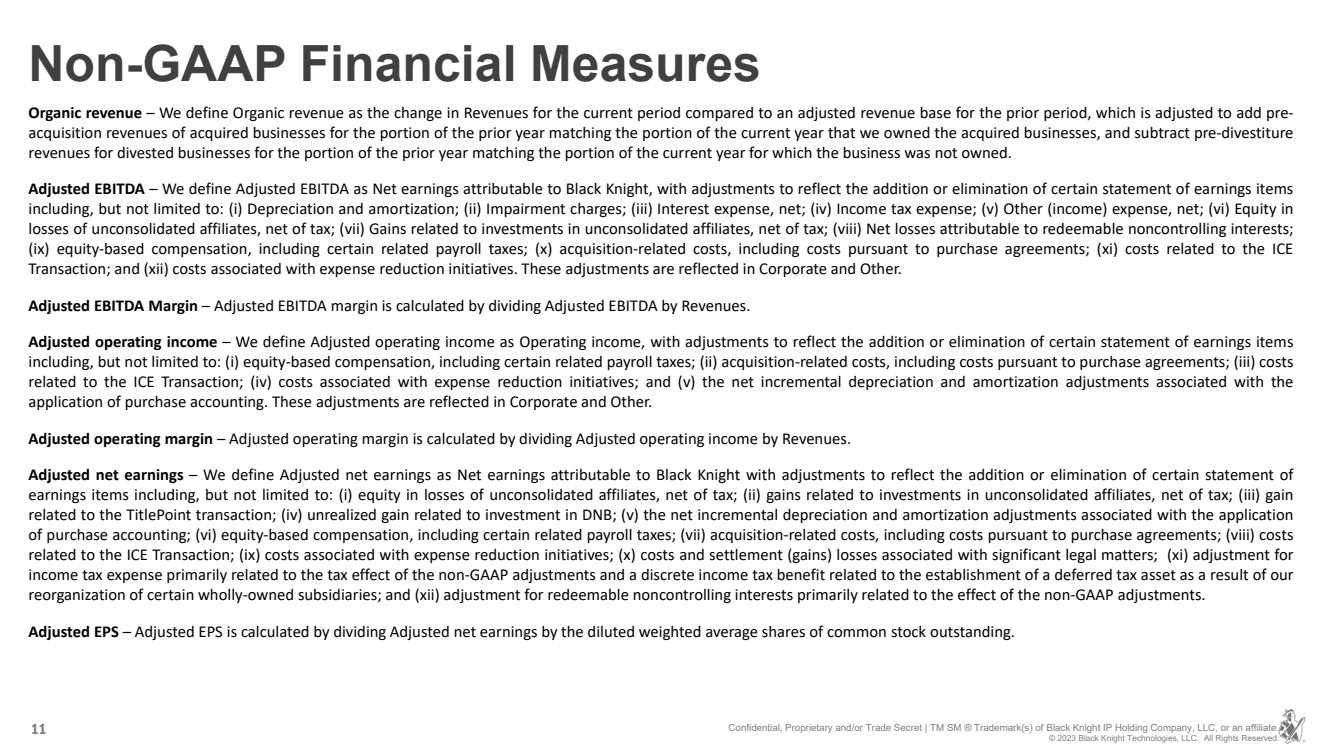

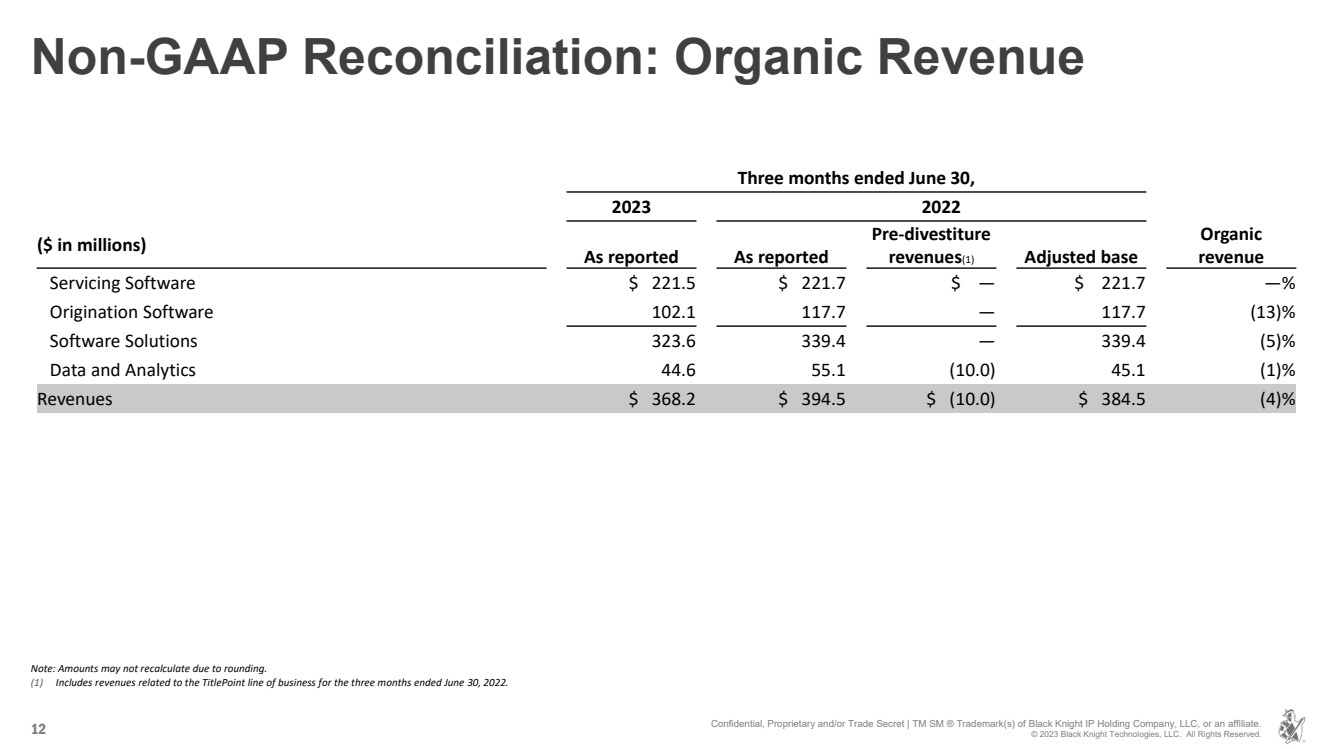

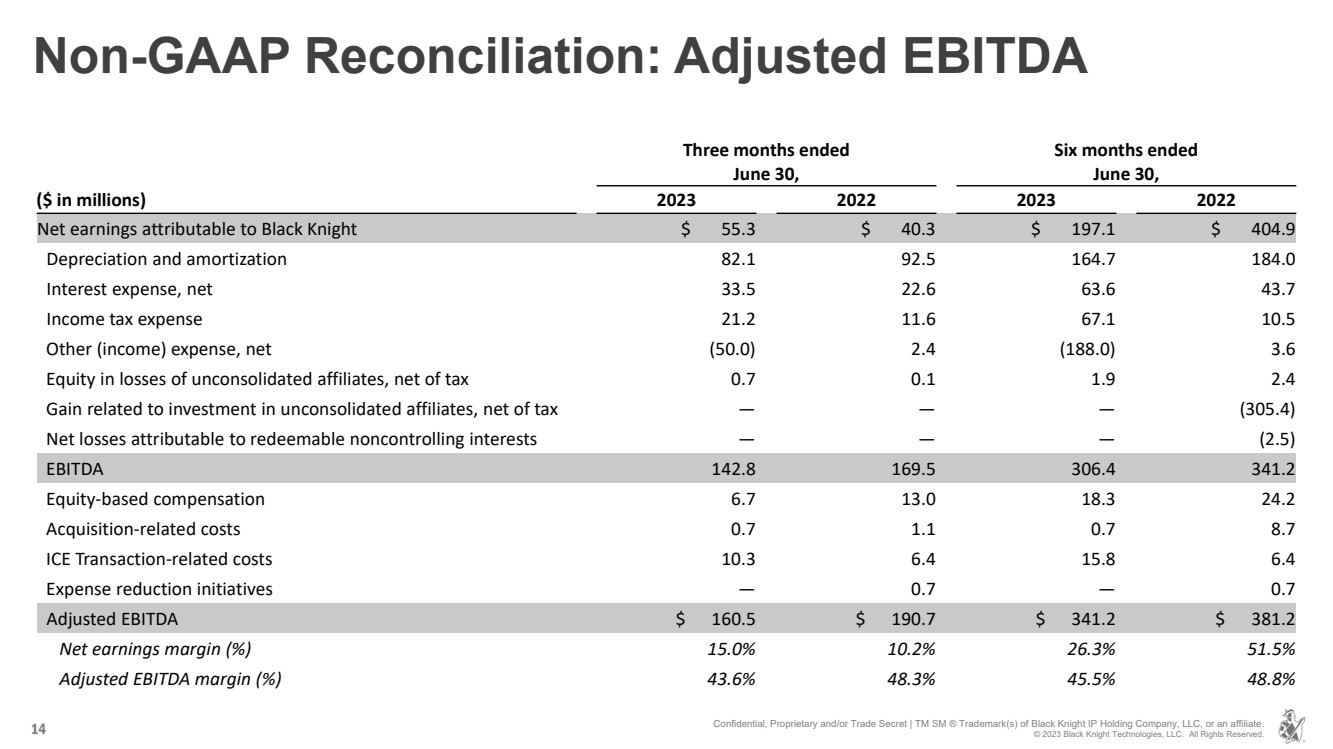

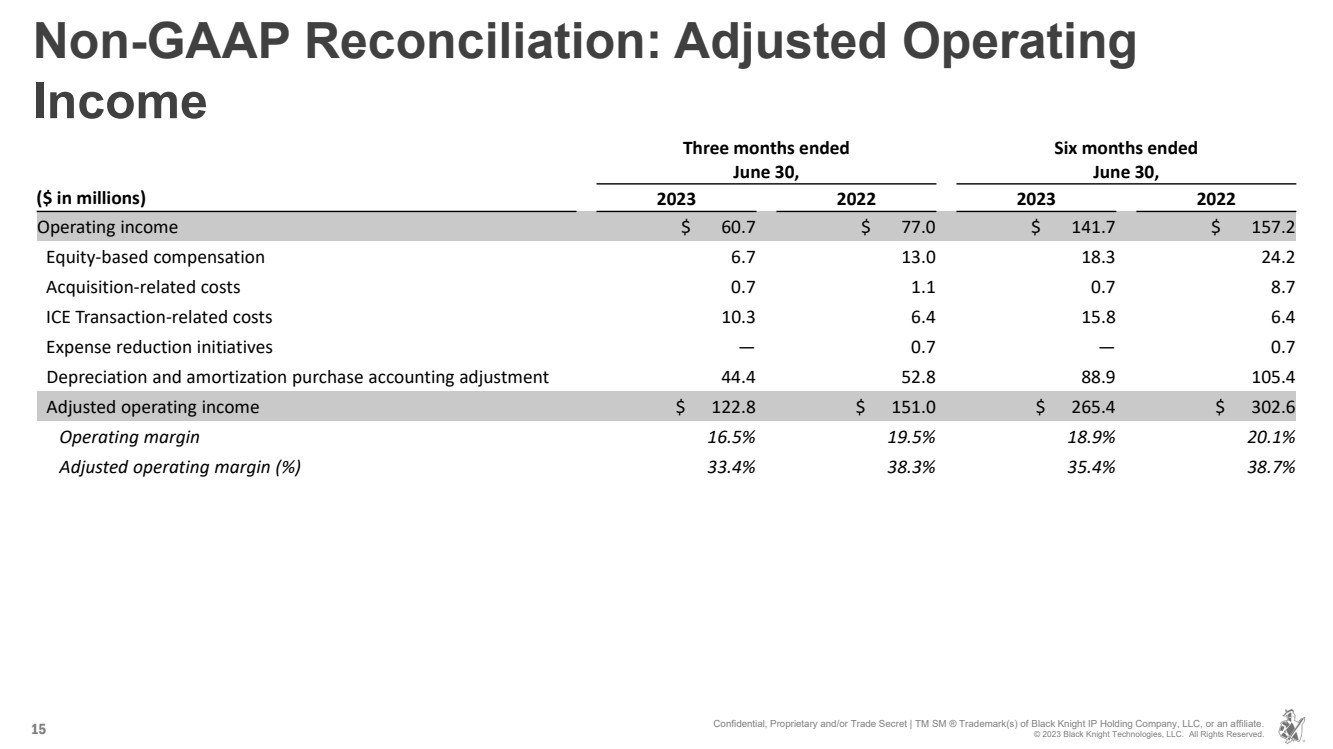

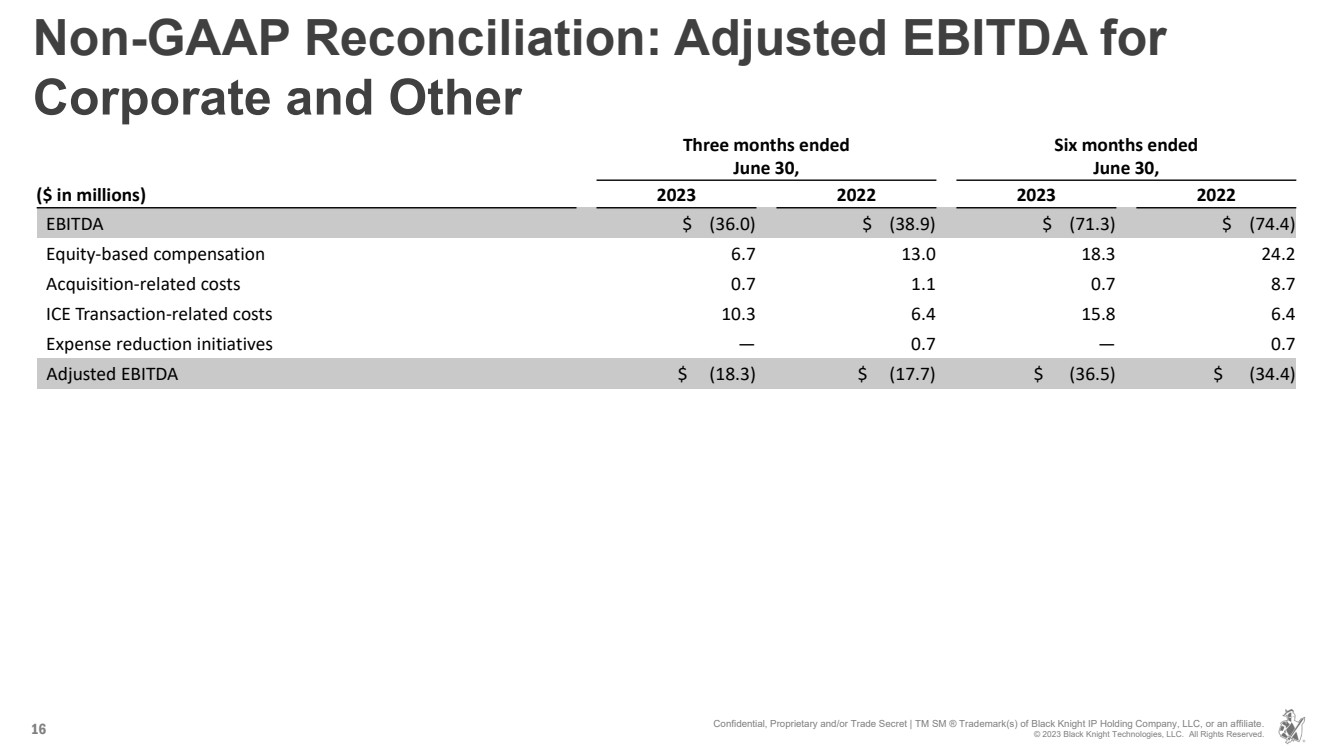

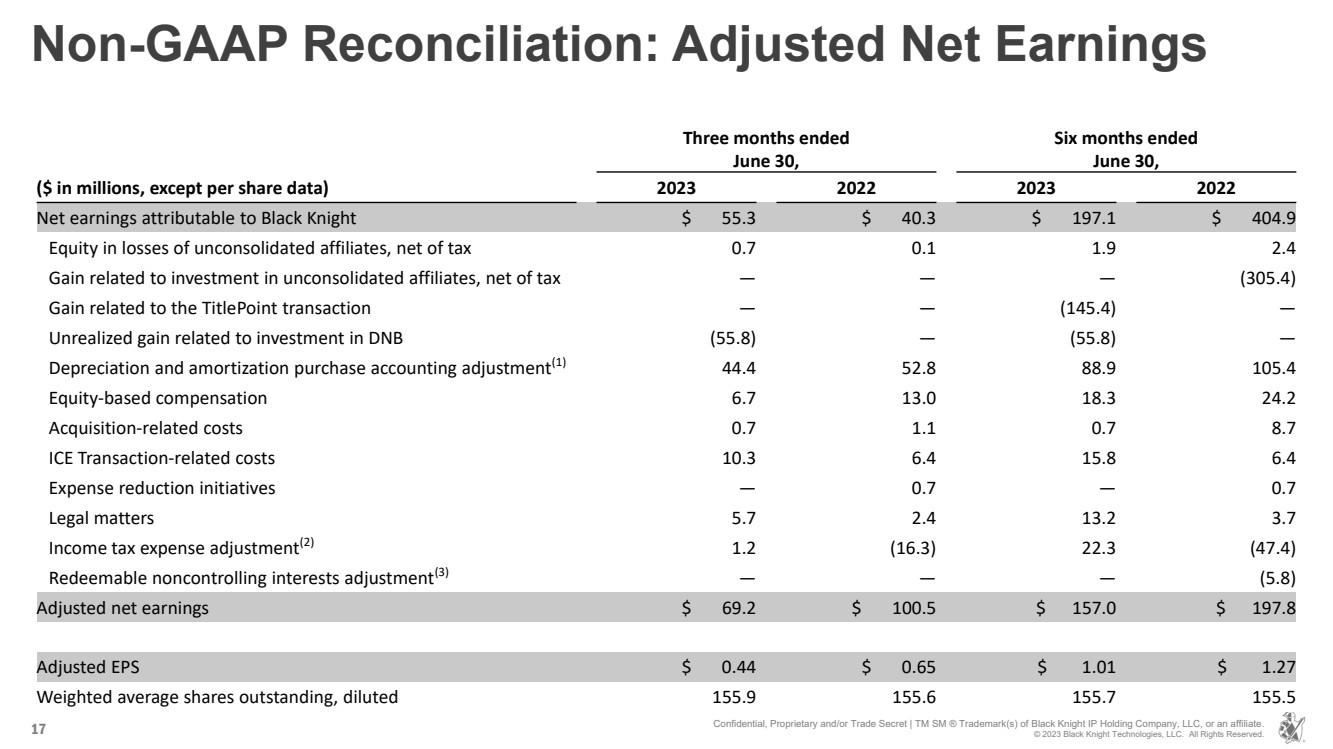

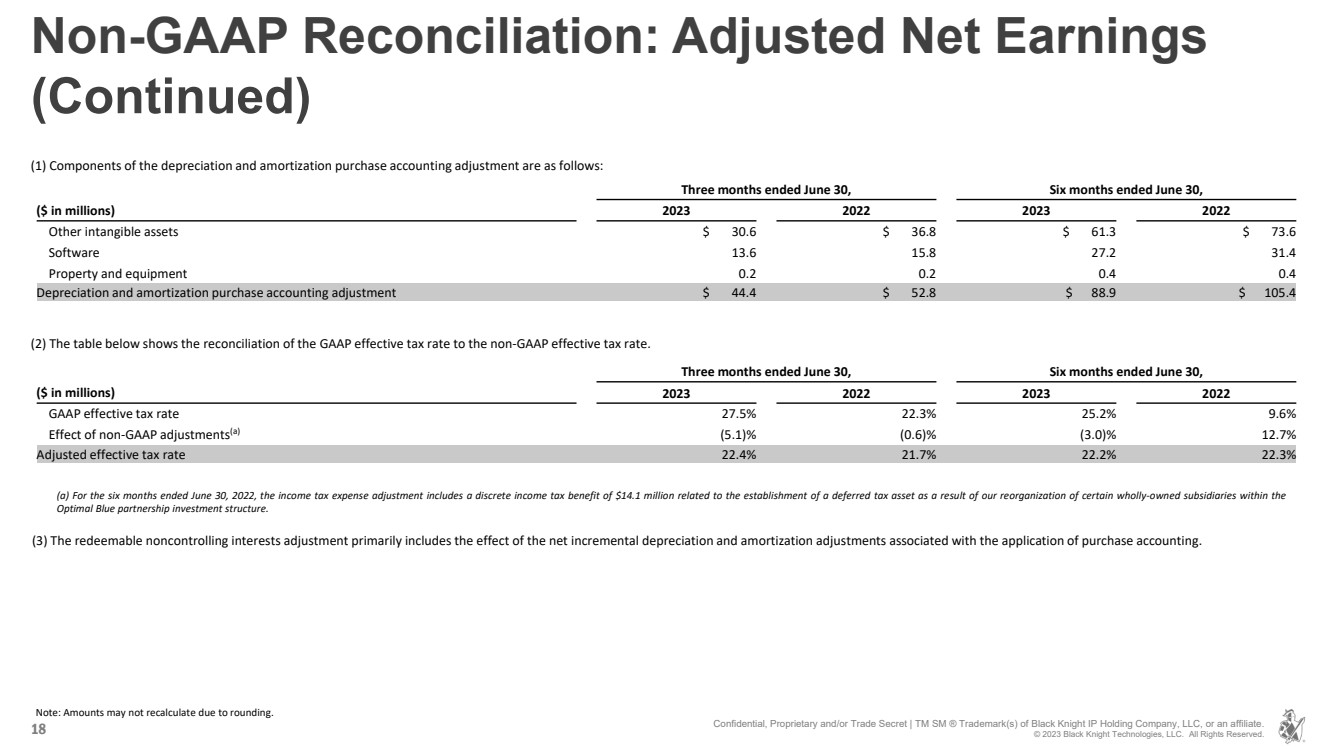

| Forward-Looking Statements This presentation contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on Black Knight management's beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Black Knight undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties that forward-looking statements are subject to include, but are not limited to: the occurrence of any event, change, or other circumstance that could give rise to a right in favor of Intercontinental Exchange, Inc. (“ICE”) or us to terminate the definitive merger agreement governing the terms and conditions of the proposed acquisition by ICE of Black Knight (the “ICE Transaction”); the possibility that the proposed ICE Transaction, Empower® divestiture transaction or the Optimal Blue divestiture transaction do not close when expected or at all because required regulatory or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect ICE or us or the expected benefits of the proposed ICE Transaction); the outcome of the United States Federal Trade Commission’s (the “FTC”) lawsuits filed against us and ICE seeking to block the consummation of the ICE Transaction and of any other legal proceedings that may be instituted against us or ICE; business uncertainties and contractual restrictions while the ICE Transaction is pending, which could adversely affect our business and operations; the diversion of management’s attention and time from ongoing business operations and opportunities on merger-related matters; changes to our relationships with our top clients, whom we rely on for a significant portion of our revenues and profit; our ability to comply with or changes to the laws, rules and regulations that affect our and our clients’ businesses; our ability to adapt our solutions to technological changes or evolving industry standards or to achieve our growth strategies; increase in the availability of free or relatively inexpensive information; our ability to protect our proprietary software and information rights; our dependence on our ability to access data from external sources; delays or difficulty in developing or implementing new, enhanced or existing software, data or hosting solutions; changes in general economic, business, regulatory and political conditions, particularly as they affect the mortgage industry; risks associated with the recruitment and retention of our skilled workforce; impacts to our business operations caused by the occurrence of a catastrophe or global crisis; our investment in Dun & Bradstreet Holdings, Inc. (“DNB”); security breaches against our information systems or breaches involving our third-party vendors; our ability to successfully consummate, integrate and achieve the intended benefits of acquisitions; and our existing indebtedness and any additional significant debt we incur; and other risks and uncertainties detailed in the "Statement Regarding Forward-Looking Information," "Risk Factors" and other sections of our Annual Report on Form 10-K for the year ended December 31, 2022 and other filings with the Securities and Exchange Commission ("SEC"). Non-GAAP Financial Measures This presentation contains non-GAAP financial measures, including Organic revenue, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted operating income, Adjusted operating margin, Adjusted net earnings and Adjusted EPS. These are important financial measures for us but are not financial measures as defined by generally accepted accounting principles ("GAAP"). The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making, including determining a portion of executive compensation. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider them useful in measuring our ability to meet our debt service obligations. By disclosing these non-GAAP financial measures, we believe we offer investors a greater understanding of, and an enhanced level of transparency into, the means by which our management operates the company. These non-GAAP financial measures are not measures presented in accordance with GAAP, and our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to revenues, operating income, operating margin, net earnings, net earnings per share, net earnings margin or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the attached schedules. See the Appendix for further information. Revenues, EBITDA and EBITDA margin, Operating income and Operating margin for the Software Solutions and Data and Analytics segments are presented in conformity with Accounting Standards Codification Topic 280, Segment Reporting. These measures are reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For these reasons, these measures are excluded from the definition of non-GAAP financial measures under the SEC's Regulation G and Item 10(e) of Regulation S-K. 2 Disclaimer Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2023 Black Knight Technologies, LLC. All Rights Reserved. |