Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on July 5, 2019

Registration No. 333-232320

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

OSISKO GOLD ROYALTIES LTD

(Exact name of registrant as specified in its charter)

Québec, Canada

(Province or other jurisdiction of incorporation or organization)

1040

(Primary Standard Industrial Classification Code Number, if applicable)

Not applicable

(I.R.S. Employer Identification No., if applicable)

1100 avenue des Canadiens-de-Montréal

Suite 300, Montreal, Québec

H3B 2S2

Tel: (514)940-0670

(Address and telephone number of Registrant's principal executive offices)

C T Corporation System

28 Liberty Street

New York, New York 10005

Tel: (212) 894-8940

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

| | | | | | |

| Copies to: |

André Le Bel

Osisko Gold Royalties Ltd

1100 avenue des Canadiens-de-

Montréal, Suite 300

Montreal, Québec

Canada, H3B 2S2

Tel: (514) 940-0670 |

|

Adam M. Givertz

Paul, Weiss, Rifkind,

Wharton & Garrison LLP

Toronto-Dominion Centre

77 King Street West, Suite 3100

Toronto, Ontario

Canada, M5K 1J3

Tel: (416) 504-0520 |

|

Sander A.J.R. Grieve

Bennett Jones LLP

3400 One First Canadian Place

P.O. Box 130

Toronto, Ontario

Canada, M5X 1A4

(416) 777-4826 |

|

Jason Comerford

Osler, Hoskin & Harcourt LLP

620 Eighth Avenue, 36th Floor

New York, New York 10018

(212) 867-5800 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

Province of Québec, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| | | | | | |

| A. | | ý | | upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

B. |

|

o |

|

at some future date (check the appropriate box below): |

|

|

1. |

|

o |

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

|

|

2. |

|

o |

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

|

|

3. |

|

o |

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

|

|

4. |

|

o |

|

after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. o

Table of Contents

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

I-1

Table of Contents

SHORT FORM PROSPECTUS

| | |

| Secondary Offering | | July 5, 2019 |

OSISKO GOLD ROYALTIES LTD

$110,685,000

7,850,000 Common Shares

This short form prospectus qualifies the distribution (the "Offering") of 7,850,000 common shares (the "Common Shares" or the "Offered Shares") of Osisko Gold Royalties Ltd ("Osisko" or the "Corporation") to be sold by Betelgeuse LLC (the "Selling Shareholder"), a Delaware limited liability company, at a price of $14.10 per Common Share (the "Offering Price"), representing gross proceeds of $110,685,000 to the Selling Shareholder. The Corporation will not be entitled to any of the proceeds from the sale of the Offered Shares offered by this short form prospectus. All of the expenses incurred in connection with the Offering, the Concurrent Share Repurchase (as defined below) and the Concurrent Investment Disposition will be paid by the Selling Shareholder.The Corporation will not be receiving any of the proceeds of the Offering.See "Plan of Distribution", "Use of Proceeds" and "Selling Shareholder".

The Offered Shares are being offered pursuant to an underwriting agreement dated June 25, 2019 (the "Underwriting Agreement") between the Corporation, the Selling Shareholder and CIBC World Markets Inc. and BMO Nesbitt Burns Inc. (together, the "Lead Underwriters") together with Desjardins Securities Inc., National Bank Financial Inc., Raymond James Ltd., RBC Dominion Securities Inc., Scotia Capital Inc., TD Securities Inc., Cormark Securities Inc. and Paradigm Capital Inc. (collectively, together with the Lead Underwriters, the "Underwriters"). The Offering Price was determined based on arm's length negotiations between the Selling Shareholder and the Lead Underwriters, on behalf of the Underwriters, with reference to the prevailing market prices of the issued and outstanding Common Shares. See"Plan of Distribution".

The outstanding Common Shares, including the Offered Shares, are listed and posted for trading on the Toronto Stock Exchange (the "TSX") and the New York Stock Exchange (the "NYSE") under the trading symbol "OR". On June 24, 2019, the last trading day prior to the announcement of the Offering, the closing price of the Common Shares on the TSX and the NYSE was $15.07 and US$11.45, respectively. On July 3, 2019, the last trading day on the NYSE prior to the date of this short form prospectus, the closing price of the Common Shares was US$10.41. On July 4, 2019, the last trading day on the TSX prior to the date of this short form prospectus, the closing price of the Common Shares was $13.56.

In connection with the Offering, the Corporation has agreed to repurchase for cancellation 12,385,717 Common Shares from the Selling Shareholder (the "Concurrent Share Repurchase"). The purchase price per Common Share to be paid by Osisko under the Concurrent Share Repurchase will be the same as the Offering Price, and the aggregate purchase price of approximately $174.6 million will be satisfied by a combination of cash in the amount of approximately $129.5 million from the sale to separate entities managed by an affiliate of the Selling Shareholder of all of the common shares of Victoria Gold Corp. ("Victoria") (the "Victoria Gold Disposition") and Dalradian Resources Inc. ("Dalradian") (the "Dalradian Resources Disposition") currently held by Osisko (together, the "Concurrent Investment Disposition"), and through the transfer of equity securities of exploration and development companies currently held by Osisko (the "Transferred Securities"), including all of the common shares of Aquila Resources Inc. ("Aquila"), Ascot Resources Ltd. ("Ascot"), Highland Copper Company Inc. ("Highland Copper") and TerraX Minerals Inc. ("TerraX"), in addition to certain other equity securities, currently held by Osisko. The Concurrent Share Repurchase is being completed in two tranches. The first tranche being 7,319,499 Common Shares, representing Common Shares acquired in exchange for the Transferred Securities and with the proceeds from the Dalradian Resources Disposition (the "Initial Repurchase"), was completed on June 28, 2019. The second tranche is expected to be completed shortly after the Initial Repurchase with respect to 5,066,218 Common Shares, representing Common Shares acquired with the proceeds from the Victoria Gold Disposition. Completion of the Victoria Gold Disposition is conditional upon receipt of approval under theCompetition Act (Canada) (the "Competition Act"). Completion of the Offering is conditional on the Concurrent Share Repurchase having occurred, other than the portion of the Concurrent Share Repurchase being funded using proceeds from the Victoria Gold Disposition. (and such condition has been fulfilled as a result of the Initial Repurchase). If the Victoria Gold Disposition is not completed, this would result in the Corporation having purchased 7,319,499 Common Shares having an aggregate purchase price of $103,204,936 pursuant to the Initial Repurchase, unless the Corporation would determine to complete such second portion of the Concurrent Share Repurchase and fund same through alternative arrangements, which are not guaranteed to be available. The second tranche of the Concurrent Share Repurchase and the Victoria Gold Disposition are expected to be completed following the date of this short form prospectus, subject to customary closing conditions, including the receipt of approval under the Competition Act in the case of the Victoria Gold Disposition. See "Recent Developments—Concurrent Share Repurchase" and "Risk Factors".

Immediately following the completion of the Concurrent Share Repurchase, and after giving effect to the Offering, but before giving effect to any exercise of the Over-Allotment Option (as defined herein), the Selling Shareholder will have beneficial ownership and control over 10,007,058 Common Shares, representing approximately 7% of the outstanding Common Shares (or 8,829,558 Common Shares, representing approximately 6.18% of the outstanding Common Shares if the Over-Allotment Option is exercised in full). If the portion of the Concurrent Share Repurchase being funded using proceeds from the Victoria Gold Disposition is not completed, after giving effect to the Initial Repurchase and the Offering, but before giving effect to any exercise of the Over-Allotment Option, the Selling Shareholder will have beneficial ownership and control over 15,073,276 Common Shares, representing approximately 10.19% of the outstanding Common Shares (or 13,895,776 Common Shares, representing approximately 9.39% of the outstanding Common Shares if the Over-Allotment Option is exercised in full).

This Offering is made by a Canadian issuer that is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this short form prospectus in accordance with Canadian disclosure requirements. Purchasers of the Offered Shares should be aware that such requirements are different from those of the United States. Financial statements incorporated herein by reference have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board ("IFRS"), and may be subject to foreign auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Purchasers of the Offered Shares should be aware that the acquisition of the Offered Shares may have tax consequences both in the United States and in Canada. Such consequences for purchasers who are resident in, or citizens of, the United States or who are resident in Canada may not be described fully herein. Purchasers of the Offered Shares should read the tax discussion contained in this short form prospectus with respect to the Offered Shares and consult their own tax advisors. See "Certain Canadian Federal Income Tax Considerations" and "Certain U.S. Federal Income Tax Considerations".

The enforcement by investors of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of a province of Canada, that most of its officers and directors are not residents of the United States, that some or all of the underwriters or experts named herein are not residents of the United States, and that a substantial portion of the assets of the Corporation and said persons are located outside the United States. See "Enforceability of Civil Liabilities".

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC") NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE OFFERED SHARES NOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS SHORT FORM PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Table of Contents

Price: $14.10 per Offered Share

| | | | | | |

| | | | | | |

| |

| | Price to the Public

| | Underwriters'

Fee(1)(2)

| | Net Proceeds to

Selling

Shareholder(2)(3)

|

|---|

| |

Per Offered Share | | $14.10 | | $0.564 | | $13.536 |

| |

Total Offering | | $110,685,000 | | $4,427,400 | | $106,257,600 |

|

Notes:

- (1)

- In consideration for the services rendered by the Underwriters in connection with the Offering, the Selling Shareholder has agreed to pay the Underwriters a cash commission equal to 4.00% (the "Underwriters' Fee") of the gross proceeds of the Offering (including, for greater certainty, on any exercise of the Over-Allotment Option (as defined herein)).See "Plan of Distribution".

- (2)

- The Selling Shareholder has granted the Underwriters an over-allotment option (the "Over-Allotment Option"), exercisable in whole or in part in the sole discretion of the Underwriters at any time on or prior to the 30th day from and including the Closing Date (as defined herein), to purchase up to 1,177,500 Common Shares (the "Over-Allotment Shares"), at the Offering Price, to cover over-allocations, if any, and for market stabilization purposes. The grant of the Over-Allotment Option is qualified by this short form prospectus. The Over-Allotment Option may be exercised by the Underwriters to acquire Over-Allotment Shares at a price of $14.10 per Over-Allotment Share. A person who acquires securities forming part of the Underwriters' over-allocation position acquires those securities under this short form prospectus regardless of whether the Underwriters' over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. If the Over-Allotment Option is exercised in full for Over-Allotment Shares, the total price to the public, Underwriters' Fee and net proceeds to the Selling Shareholder (before payment of the expenses of the Offering) will be $127,287,750, $5,091,510 and $122,196,240, respectively. See"Plan of Distribution" and the table below.

- (3)

- After deducting the Underwriters' Fee but before deducting the expenses of the Offering estimated to be $1,028,815. The Underwriters' Fee and all expenses incurred in connection with the Offering, the Concurrent Share Repurchase and the Concurrent Investment Disposition will be paid by the Selling Shareholder from the proceeds of the Offering. See"Plan of Distribution" and"Selling Shareholder".

The following table sets forth certain terms of the Over-Allotment Option, including the maximum size, the exercise period and the exercise price:

| | | | | | |

Underwriters' Position | | Maximum Size or

Number of

Securities Available | | Exercise Period | | Exercise Price(1) |

|---|

Over-Allotment Option | | 1,177,500 Over-Allotment Shares | | At any time up to 30 days after the Closing Date | | $14.10 per Over-Allotment Share |

- (1)

- The Selling Shareholder has agreed to sell the Over-Allotment Shares to the Underwriters for an amount equal to the Offering Price and pay the Underwriters an amount equal to the Underwriters' Fee per Over-Allotment Share sold pursuant to this short form prospectus. See"Plan of Distribution".

Unless the context otherwise requires, all references to the "Offering" and the "Offered Shares" in this short form prospectus shall include the Over-Allotment Option and the Over-Allotment Shares.

The Underwriters propose to offer the Offered Shares initially at the Offering Price. After the Underwriters have made commercially reasonable efforts to sell all of the Offered Shares qualified by this short form prospectus at the Offering Price, the Offering Price may be decreased, and further changed from time to time, to an amount not greater than the Offering Price, and the compensation realized by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers of Offered Shares is less than the gross proceeds to be paid by the Underwriters to the Selling Shareholder. However, in no event will the Selling Shareholder receive less than net proceeds of $13.54 per Offered Share (before expenses of the Offering). Subject to applicable laws and in connection with the Offering, the Underwriters may over-allot or effect transactions which stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail on the open market. Such transactions, if commenced, may be discontinued at any time. See"Plan of Distribution".

An investment in the Offered Shares is highly speculative and involves a high degree of risk, and should only be made by persons who can afford the total loss of their investment. The risk factors included or incorporated by reference in this short form prospectus should be carefully reviewed and considered by purchasers in connection with an investment in the Common Shares. See"Notice to Investors—Forward-Looking Information" and"Risk Factors" in this short form prospectus and in the AIF (as defined herein), which is available electronically on SEDAR (as defined herein) at www.sedar.com.

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when sold by the Selling Shareholder and delivered to and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under"Plan of Distribution" and subject to the approval of certain legal matters relating to the Offering on behalf of the Corporation by Bennett Jones LLP and Paul, Weiss, Rifkind, Wharton & Garrison LLP, on behalf of the Selling Shareholder by Torys LLP and on behalf of the Underwriters by Osler, Hoskin & Harcourt LLP.

Subscriptions for the Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is anticipated that the Offered Shares will be delivered under the book based system through CDS Clearing and Depository Services Inc. ("CDS") or its nominee and deposited in registered or electronic form with CDS on the closing of the Offering, which is expected to be on July 11, 2019, or such other date as may be agreed upon by the Corporation, the Selling Shareholder and the Underwriters, but in any event not later than 42 days following the date of the receipt for the short form prospectus (the "Closing Date"). A purchaser of Offered Shares will receive only a customer confirmation from the registered dealer through which the Offered Shares are purchased.

The Selling Shareholder and the below directors of the Corporation are organized under the laws of a foreign jurisdiction or reside outside of Canada, as applicable, and have appointed the following agents for service of process:

| | |

Name of Persons | | Name and Address of Agent |

|---|

Christopher C. Curfman and Oskar Lewnowski | | Osisko Gold Royalties Ltd, 1100 avenue des Canadiens-de-Montréal, Suite 300, P.O. Box 211, Montréal, Québec, Canada, H3B 2S2 |

Betelgeuse LLC | | Torys LLP, 79 Wellington St. W., Suite 3300, Toronto, ON, Canada M5K 1N2, |

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

The Corporation's head and registered office is located at 1100 avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, Canada, H3B 2S2.

Table of Contents

TABLE OF CONTENTS

| | | | |

NOTICE TO INVESTORS | | | 2 | |

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING PREPARATION OF FINANCIAL INFORMATION | | | 5 | |

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING THE USE OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES | | | 6 | |

NON-IFRS FINANCIAL PERFORMANCE MEASURES | | | 6 | |

ENFORCEABILITY OF CIVIL LIABILITIES | | | 7 | |

CURRENCY PRESENTATION, FINANCIAL INFORMATION AND EXCHANGE RATE INFORMATION | | | 7 | |

DOCUMENTS INCORPORATED BY REFERENCE | | | 8 | |

MARKETING MATERIALS | | | 9 | |

WHERE YOU CAN FIND MORE INFORMATION | | | 9 | |

ELIGIBILITY FOR INVESTMENT | | | 10 | |

THE CORPORATION | | | 10 | |

SUMMARY DESCRIPTION OF THE BUSINESS | | | 11 | |

MATERIAL MINERAL PROJECTS | | | 12 | |

RECENT DEVELOPMENTS | | | 12 | |

CONSOLIDATED CAPITALIZATION | | | 15 | |

USE OF PROCEEDS | | | 15 | |

PLAN OF DISTRIBUTION | | | 16 | |

SELLING SHAREHOLDER | | | 19 | |

PRIOR SALES | | | 20 | |

TRADING PRICE AND VOLUME | | | 22 | |

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | | | 24 | |

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | | | 27 | |

RISK FACTORS | | | 31 | |

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT | | | 33 | |

LEGAL MATTERS | | | 33 | |

INTERESTS OF EXPERTS | | | 33 | |

AUDITORS, TRANSFER AGENT AND REGISTRAR | | | 33 | |

SCHEDULE A

TECHNICAL INFORMATION UNDERLYING THE MANTOS BLANCOS MINE | | | A-1 | |

1

Table of Contents

NOTICE TO INVESTORS

About this Short Form Prospectus

Readers should rely only on the information contained in this short form prospectus (including the documents incorporated by reference) and should not rely on some parts of the short form prospectus to the exclusion of others. None of the Corporation, the Selling Shareholder or the Underwriters have authorized any other person to provide investors with additional or different information. If anyone provides you with additional, different or inconsistent information, including information or statements in articles about the Corporation or through other forms of media, readers should not rely on it. None of the Corporation, the Selling Shareholder or the Underwriters are offering the securities in any jurisdiction in which the Offering is not permitted. Investors should assume that the information contained in this short form prospectus is accurate only as of the date on the front of this short form prospectus and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this short form prospectus or of any sale of the securities pursuant thereto. The Corporation's business, financial condition, results of operations and prospects may have changed since the date on the front of this short form prospectus.

For investors outside Canada, none of the Corporation, the Selling Shareholder or any of the Underwriters has done anything that would permit the direct or indirect offer, sale or delivery of any Offered Shares or the delivery of this short form prospectus to any person in any jurisdiction outside of Canada, except in a manner which will not require the Corporation or the Selling Shareholder to comply with the registration, prospectus, continuous disclosure, filing or other similar requirements under the applicable securities laws of such other jurisdiction or would otherwise require the Corporation or the Selling Shareholder to appoint an agent for service in such other jurisdiction. Investors are required to inform themselves about, and to observe any restrictions relating to, the Offering and the possession or distribution of this short form prospectus.

Information contained in this short form prospectus should not be construed as legal, tax or financial advice and readers are urged to consult their own professional advisors in connection therewith.

Technical Information

Guy Desharnais, Ph.D., P.Geo, who is a "qualified person" for the purpose of National Instrument 43-101—Standards of Disclosure for Mineral Projects ("NI 43-101"), has reviewed and approved the scientific and technical information set out herein, and is named in the AIF (as defined herein) as having reviewed and approved certain scientific and technical information as set out under the heading"Material Mineral Projects—The Canadian Malartic Royalty" with respect to the 5% net smelter return royalty on the producing Canadian Malartic mine (the "Canadian Malartic Royalty");"Material Mineral Projects—The Éléonore Royalty" with respect to the 2 to 3.5% net smelter return royalty on the producing Éléonore mine (the "Éléonore Royalty"); and"Material Mineral Projects—The Renard Stream" with respect to the 9.6% diamond stream on the Renard diamond mine (the "Renard Stream"); and he has reviewed and approved the scientific and technical information included in Schedule A to this short form prospectus with respect to the 100% silver stream on the Mantos Blancos copper mine in Chile (the "Mantos Stream"). As such, Guy Desharnais, Ph.D., P.Geo, will deliver the expert consent to be filed with the final short form prospectus and with the Corporation's registration statement on Form F-10, of which this short form prospectus forms a part, relating to the scientific and technical information included in this short form prospectus with respect to the Canadian Malartic Royalty, the Éléonore Royalty, the Renard Stream and the Mantos Stream. Attached hereto as Schedule A is a summary in respect of the Mantos Stream based on the technical report entitled "NI 43-101 Technical Report on the Mantos Blancos Mine II Region, Chile", dated June 23, 2017,

2

Table of Contents

prepared by Golder Associates S.A and authored by Leonardo Leite, MAusIMM CP (Min) and Ronald Turner, MAusIMM CP (Geo), both independent qualified persons under NI 43-101.

The disclosure in these sections is generally based on information publicly disclosed by the owner or operator of the Canadian Malartic mine, the Éléonore mine, the Renard diamond mine and the Mantos Blancos copper mine, as the case may be, and information/data available in the public domain as at June 24, 2019, and none of this information has been independently verified by Osisko. Specifically, as a royalty, stream or other interest holder, Osisko has limited, if any, access to properties underlying its asset portfolio. Additionally, Osisko may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. Osisko is dependent on the operators of the properties and their qualified persons to provide information to Osisko or on publicly available information to prepare required disclosure pertaining to properties and operations on the properties on which Osisko holds royalty, stream or other interests and generally has limited or no ability to independently verify such information. Although Osisko does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Osisko's royalty, stream or other interests. Osisko's royalty, stream or interests often cover less than 100%, and sometimes only a portion of, the publicly reported mineral reserves, mineral resources and production of the property.

Forward-Looking Information

This short form prospectus contains certain statements which contain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (each, a "forward-looking statement"). No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this short form prospectus should not be unduly relied upon. Forward-looking information is by its nature prospective and requires the Corporation to make certain assumptions and is subject to inherent risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. The use of any of the words "anticipate", "plan", "contemplate", "continue", "estimate", "expect", "intend", "propose", "might", "may", "will", "shall", "project", "should", "could", "would", "believe", "predict", "forecast", "pursue", "potential", "capable", "budget", "pro forma" and similar expressions are intended to identify forward-looking statements. Forward-looking statements include, among others, statements pertaining to:

- •

- the Corporation's future operating and financial results;

- •

- schedules and timing of certain projects with respect to which the Corporation receives (or is entitled to receive) royalty, stream or other revenues and the Corporation's strategy for growth, including the acquisition of future royalties, streams or other interests;

- •

- projected royalty, stream or other revenues and the life of mines with respect to which the Corporation receives (or is entitled to receive) royalty, stream or other revenues;

- •

- production, capital and operating cash flow estimates for royalties, streams or other interests;

- •

- anticipated cash needs and needs for additional financing;

- •

- the Corporation's competitive position and its expectations regarding competition;

- •

- treatment under governmental and other regulatory regimes and tax, environmental and other laws;

- •

- completion of the Offering, Concurrent Share Repurchase and Concurrent Investment Disposition; and

3

Table of Contents

- •

- the anticipated financial and other impacts of the Concurrent Share Repurchase and Concurrent Investment Disposition.

The forward-looking statements within this document are based on information currently available and what management believes are reasonable assumptions. Forward-looking statements speak only as of the date of this short form prospectus. In addition, this short form prospectus may contain forward-looking statements attributed to third party industry sources, the accuracy of which has not been verified by the Corporation.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements in this short form prospectus, including, but not limited to, the following material factors:

- •

- the speculative nature of mining operations;

- •

- the Corporation having no control over mining operations and having limited access to data regarding the operation of mines in which it only holds a royalty, stream or other interest, making the Corporation dependent on the owners and operators of certain properties;

- •

- the failure of operators of properties in which the Corporation holds royalties, streams or other interests to abide by their contractual obligations with respect to royalty, stream or other payments;

- •

- in respect of mines in which the Corporation only holds royalties, streams or other interests, the Corporation having no contractual rights relating to the operation or development of such mines and, therefore, not having control over the operators or their decisions and activities relating to properties in which the Corporation holds royalties, streams or other interests, and more particularly, the Corporation not being entitled to any material compensation, control or input in decision-making if these mining operations do not commence production within the time frames that are anticipated or meet their forecasted production targets in any specified period or if the operators, or any other person or entity having such authority, decide to shut down the mine or discontinue operations on a temporary or permanent basis;

- •

- the ability of the Corporation to attract and retain qualified management to grow its business;

- •

- fluctuations in currencies;

- •

- whether or not Osisko is determined to have "passive foreign investment company" status ("PFIC") as defined in Section 1297 of theUnited States Internal Revenue Code of 1986, as amended;

- •

- changes in gold and other metal prices on which the Corporation's royalty, stream or other interests are paid or prices associated with the primary metals mined at properties in which the Corporation holds royalties, streams or other interests;

- •

- the availability of royalties, streams and other interests for acquisition or other acquisition opportunities and the availability of debt or equity financing necessary to complete such acquisitions;

- •

- the performance of the companies in the investment portfolio of the Corporation;

- •

- failure to complete future acquisitions;

- •

- economic and market conditions;

4

Table of Contents

- •

- future financial needs and availability of adequate financing;

- •

- laws governing the Corporation or the operators of properties where the Corporation holds royalties, streams or other interests;

- •

- the Corporation's ability to make accurate assumptions regarding the valuation, timing and amount of payments in respect of royalties, streams or other interests relating to properties in which it holds an interest;

- •

- the production at or performance of properties where the Corporation holds royalties, streams or other interests;

- •

- changes in estimates of mineral resources of properties where the Corporation holds royalties, streams or other interests;

- •

- acquisition and maintenance of permits and authorizations, completion of construction and commencement and continuation of production at the properties where the Corporation holds royalties, streams or other interests;

- •

- ramp-up risks relating to operations at the properties where the Corporation holds royalties, streams or other interests;

- •

- risks relating to environmental or social factors or incidents which may adversely impact operations at the properties where the Corporation holds royalty, stream or other interests;

- •

- mine operating and ore processing facility problems (including, but not limited to, labour disputes resulting in work stoppages and/or delays), pit wall or tailings dam failures, natural catastrophes such as floods or earthquakes and access to raw materials, water and power on the properties in which the Corporation holds royalty, stream or other interests;

- •

- royalty interests are subject to title and other defects and contest by operators of mining projects and holders of mining rights, and these risks may be difficult to identify; and

- •

- publication of inaccurate or unfavourable research by securities analysts or other third parties.

Such factors are discussed in more detail under the heading"Risk Factors" in this short form prospectus and in the AIF (as defined herein). New factors emerge from time to time, and it is not possible for management to predict all of those factors or to assess in advance the impact of each such factor on the Corporation's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The forward-looking statements contained in this short form prospectus are expressly qualified by the foregoing cautionary statements and are made as of the date of this short form prospectus. Except as may be required by applicable securities laws, the Corporation does not undertake any obligation to publicly update or revise any forward-looking statement to reflect events or circumstances after the date of this short form prospectus or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results, or otherwise. Readers should read this entire short form prospectus and consult their own professional advisors to ascertain and assess the income tax and legal risks and other aspects of their investment in the Offered Shares.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING PREPARATION OF FINANCIAL INFORMATION

As a Canadian company, Osisko prepares its financial statements in accordance with IFRS. Consequently, all of the financial statements and financial information of Osisko included or incorporated herein is prepared in accordance with IFRS, which is materially different than financial

5

Table of Contents

statements and financial information prepared in accordance with U.S. generally accepted accounting principles.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING THE USE OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Osisko is subject to the reporting requirements of the applicable Canadian securities laws, and as a result reports the mineral reserves and mineral resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by NI 43-101 and are different from U.S. reporting standards. The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"). U.S. reporting requirements are currently governed by Industry Guide 7. This short form prospectus includes or incorporates by reference estimates of mineral reserves and mineral resources reported in accordance with NI 43-101. These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. For example, under Industry Guide 7, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Consequently, the definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" under CIM standards differ in certain respects from the standards of Industry Guide 7. Osisko also reports estimates of "mineral resources" in accordance with NI 43-101. While the terms "Mineral Resource," "Measured Mineral Resource," "Indicated Mineral Resource" and "Inferred Mineral Resource" are recognized by NI 43-101, they are not defined terms under Industry Guide 7 and, generally, U.S. companies reporting pursuant to Industry Guide 7 are not permitted to report estimates of mineral resources of any category in documents filed with the SEC. As such, certain information included or incorporated by reference in this short form prospectus concerning descriptions of mineralization and estimates of mineral reserves and mineral resources under Canadian standards is not comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC pursuant to Industry Guide 7. Readers are cautioned not to assume that all or any part of Measured Mineral Resources or Indicated Mineral Resources will ever be converted into Mineral Reserves. Readers are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable. Further, an "Inferred Mineral Resource" has a great amount of uncertainty as to its existence and as to its economic and legal feasibility, and a reader cannot assume that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

Osisko has included certain non-IFRS measures including "Adjusted Earnings" and "Adjusted Earnings per basic share" (which have no standard definitions under IFRS) to supplement its consolidated financial statements, incorporated by reference herein, which are presented in accordance with IFRS.

Osisko believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of Osisko. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and, therefore, they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

For information regarding the non-IFRS financial measures used by Osisko, see "Non-IFRS Financial Performance Measures" in the Annual MD&A and the Interim MD&A (each, as defined herein), which is incorporated by reference herein.

6

Table of Contents

ENFORCEABILITY OF CIVIL LIABILITIES

The Corporation is incorporated under and governed by theBusiness Corporations Act (Québec). Most of the Corporation's directors and officers, and some or all of the underwriters or experts named in this short form prospectus, are residents of Canada or otherwise reside outside of the United States, and a substantial portion of their assets, and a substantial portion of the Corporation's assets, are located outside the United States. The Corporation has appointed an agent for service of process in the United States, but it may be difficult for holders of Common Shares who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for holders of Common Shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon the Corporation's civil liability and the civil liability of the Corporation's directors and officers and experts under the United States federal securities laws. The Corporation has been advised by its Canadian counsel, Bennett Jones LLP, that a judgment of a United States court predicated solely upon civil liability under United States federal securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that would be recognized by a Canadian court for the same purposes. The Corporation has also been advised by Bennett Jones LLP, however, that there is substantial doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon United States federal securities laws.

The Corporation filed with the SEC, concurrently with the Corporation's registration statement on Form F-10 of which this short form prospectus forms a part, an appointment of agent for service of process on Form F-X. Under the Form F-X, the Corporation appointed C T Corporation System as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving the Corporation in a United States court arising out of or related to or concerning the Offering.

CURRENCY PRESENTATION, FINANCIAL INFORMATION AND EXCHANGE

RATE INFORMATION

Unless otherwise indicated, all references to monetary amounts in this short form prospectus are denominated in Canadian dollars. The financial statements of the Corporation incorporated herein by reference are reported in Canadian dollars and are prepared in accordance with IFRS. Unless otherwise indicated, all references to "$","C$" and "dollars" in this short form prospectus refer to Canadian dollars. References to "US$" in this short form prospectus refer to United States dollars.

The following table sets forth, for each period indicated, the low and high exchange rates for United States dollar expressed in Canadian dollars, the exchange rate at the end of such period and the average of such exchange rates for each day during such period, based on the rate of exchange as reported by the Bank of Canada for the conversion of one United States dollar into Canadian dollars:

| | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

|---|

| | Year Ended

December 31, | | Three Months

Ended

March 31, | |

|---|

| | 2018 | | 2017 | | 2016 | | 2019 | | 2018 | |

|---|

| |

| |

|---|

| | ($)

| | ($)

| | ($)

| |

| | ($)

| | ($)

| |

|---|

Low | | | 1.2288 | | | 1.2128 | | | 1.2544 | | | | | 1.3095 | | | 1.2288 | |

High | | | 1.3642 | | | 1.3743 | | | 1.4589 | | | | | 1.3600 | | | 1.3088 | |

Period End | | | 1.3642 | | | 1.2545 | | | 1.3427 | | | | | 1.3363 | | | 1.2894 | |

Average | | | 1.2957 | | | 1.2986 | | | 1.3248 | | | | | 1.3295 | | | 1.2647 | |

7

Table of Contents

On July 4, 2019, the rate of exchange for the Canadian dollar, expressed in United States dollars, based on the Bank of Canada, daily exchange rate, was US$1.00=C$1.3059 (or C$1.00=US$0.7658).

DOCUMENTS INCORPORATED BY REFERENCE

The following documents filed by the Corporation with, or furnished to, securities commissions or similar authorities in Canada, and with the SEC, are specifically incorporated into this short form prospectus:

- (a)

- the annual information form of the Corporation for the financial year ended December 31, 2018, dated March 28, 2019, excluding Schedule E thereto (the "AIF");

- (b)

- the audited consolidated financial statements of the Corporation as at and for the years ended December 31, 2018 and December 31, 2017, together with the notes thereto (the "Annual Financial Statements") and the auditors' report thereon, dated February 20, 2019;

- (c)

- the management's discussion and analysis of the Corporation relating to the Annual Financial Statements, dated February 20, 2019 (the "Annual MD&A");

- (d)

- the unaudited condensed interim consolidated financial statements of the Corporation as at and for the three month period ended March 31, 2019 and March 31, 2018, together with the notes thereto dated May 1, 2019 (the "Interim Financial Statements");

- (e)

- the management's discussion and analysis of the Corporation relating to the Interim Financial Statements, dated May 1, 2019 (the "Interim MD&A");

- (f)

- the management information circular of the Corporation dated March 21, 2019 and filed on SEDAR on March 27, 2019, distributed in connection with the annual and special meeting of shareholders of the Corporation held on May 1, 2019;

- (g)

- the "template version" (as such term is defined in National Instrument 41-101—General Prospectus Requirements) of the term sheets for the Offering dated June 25, 2019, available electronically on SEDAR at www.sedar.com; and

- (h)

- the material change report of the Corporation dated June 28, 2019 relating to the Offering, Concurrent Share Repurchase and Concurrent Investment Disposition.

Any documents of the type required by National Instrument 44-101—Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus, including those types of documents referred to above and press releases issued by the Corporation specifically referencing incorporation by reference into this short form prospectus, if filed by the Corporation with the provincial securities commissions or similar authorities in Canada after the date of this short form prospectus and before the distribution of the securities being qualified hereunder, are deemed to be incorporated by reference in this short form prospectus. In addition, any similar documents filed or furnished by the Corporation with the SEC in its periodic reports on Form 6-K or annual reports on Form 40-F and any other documents filed with or furnished to the SEC pursuant to Section 13(a), 13(c) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in each case after the date of this short form prospectus, shall be deemed to be incorporated by reference into this short form prospectus and the registration statement of which this short form prospectus forms a part if and to the extent expressly provided in such reports. To the extent that any document or information incorporated by reference into this short form prospectus is included in a report that is filed with or furnished to the SEC on Form 40-F, 20-F, 10-K, 10-Q, 8-K or 6-K (or any respective successor form), such document or information shall also be deemed to be incorporated by reference as an exhibit to the registration statement of which this short form prospectus forms a part.

8

Table of Contents

Documents referenced in any of the documents incorporated by reference in this short form prospectus but not expressly incorporated by reference therein or herein and not otherwise required to be incorporated by reference therein or in this short form prospectus are not incorporated by reference in this short form prospectus.

Any statement contained in this short form prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this short form prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein, modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this short form prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it is made.

MARKETING MATERIALS

Any "template version" of "marketing materials" (as such terms are defined in National Instrument 41-101—General Prospectus Requirements) will be incorporated by reference in the final short form prospectus. However, such "template version" of "marketing materials" will not form part of the final short form prospectus to the extent that the contents of the "template version" of "marketing materials" are modified or superseded by a statement contained in the final short form prospectus. Any "template version" of "marketing materials" filed on SEDAR after the date of the final short form prospectus and before the termination of the distribution under the Offering will be deemed to be incorporated into the final short form prospectus.

WHERE YOU CAN FIND MORE INFORMATION

The Corporation has filed with the SEC, under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), a registration statement on Form F-10 relating to the Offered Shares. This short form prospectus does not contain all of the information contained in the registration statement, certain items of which are contained in the exhibits to the registration statement as permitted by the rules and regulations of the SEC. Statements included in this short form prospectus or the documents incorporated by reference herein about the contents of any contract, agreement or other document referred to are not necessarily complete, and in each instance, prospective investors should refer to the exhibits for a complete description of the matter involved. Each such statement is qualified in its entirety by such reference.

The Corporation will provide to each person to whom this short form prospectus is delivered, without charge, upon request to the Corporate Secretary of the Corporation at 1100 avenue des Canadiens-de-Montréal, Suite 300, P.O. Box 211, Montréal, Québec, Canada, H3B 2S2, Telephone: (514) 940-0670, copies of the documents incorporated by reference in this short form prospectus. The Corporation does not incorporate by reference in this short form prospectus any of the information on, or accessible through, its website.

The Corporation files certain reports with, and furnishes other information to, each of the SEC and certain securities commissions or similar regulatory authorities of Canada. Under a multi-jurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure requirements of the securities regulatory authorities in the applicable provinces of Canada, which requirements are different from

9

Table of Contents

those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and the Corporation's officers and directors are exempt from the reporting and short swing profit recovery provisions contained in Section 16 of the Exchange Act. The Corporation's reports and other information filed or furnished with or to the SEC are available from the SEC's Electronic Document Gathering and Retrieval System ("EDGAR") at www.sec.gov, as well as from commercial document retrieval services. You may also read (and by paying a fee, copy) any document the Corporation files with or furnishes to the SEC at the SEC's public reference room in Washington, D.C. (100 F Street N.E., Washington, D.C. 20549). Please call the SEC at 1-800-SEC-0330 for more information on the public reference room. The Corporation's Canadian filings are available on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com. Unless specifically incorporated by reference herein, documents filed or furnished by the Corporation on SEDAR or EDGAR are neither incorporated in nor part of this short form prospectus.

ELIGIBILITY FOR INVESTMENT

In the opinion of Bennett Jones LLP, counsel to the Corporation, and Osler, Hoskin & Harcourt LLP, counsel to the Underwriters, based on the current provisions of theIncome Tax Act (Canada) and the regulations thereunder (collectively, the "Tax Act"), the Offered Shares, if issued on the date hereof, would be "qualified investments" under the Tax Act at a particular time for a trust governed by a registered retirement savings plan ("RRSP"), a registered retirement income fund ("RRIF"), a registered education savings plan ("RESP"), a registered disability savings plan ("RDSP"), a tax-free savings account ("TFSA") (each, a "Registered Plan") or a trust governed by a deferred profit sharing plan, provided that, at all material times, in the case of the Offered Shares, either (i) the Offered Shares are listed on a "designated stock exchange" as defined in the Tax Act (which currently includes the TSX); or (ii) the Corporation is a "public corporation" as defined in the Tax Act.

Notwithstanding that the Offered Shares may be "qualified investments" for a Registered Plan as described above TFSA, the holder of, or annuitant or subscriber under, a Registered Plan (the "Controlling Individual") will be subject to a penalty tax in respect of the Offered Shares held in a registered Plan if such Offered Shares are a "prohibited investment" for the particular Registered Plan. An Offered Share generally will be a prohibited investment for a Registered Plan if the Controlling Individual does not deal at arm's length with the Corporation for the purposes of the Tax Act or the Controlling Individual has a "significant interest" (as defined for purposes of the prohibited investment rules in the Tax Act) in the Corporation. Generally, a Controlling Individual will not have a "significant interest" in the Corporation unless the Controlling Individual and/or persons not dealing at arm's length with the Controlling Individual owns, directly or indirectly, 10 percent or more of the issued shares of any class of the capital stock of the Corporation or of a corporation related to the Corporation. In addition, the Offered Shares will not be a prohibited investment if such securities are "excluded property" (as defined in the Tax Act for purposes of the prohibited investment rules) for a Registered Plan.

Prospective purchasers who intend to invest through a Registered Plan should consult their own tax advisers with respect to whether Offered Shares would be a prohibited investment having regard to their particular circumstances.

THE CORPORATION

The Corporation was incorporated on April 29, 2014 under the name "Osisko Gold Royalties Ltd" pursuant to theBusiness Corporations Act (Québec), as a wholly-owned subsidiary of Canadian Malartic Corporation ("CMC"). Following the completion on June 16, 2014 of a plan of arrangement pursuant to theCanada Business Corporations Act involving, among others, CMC, Agnico Eagle Mines Limited and Yamana Gold Inc., the Corporation became a reporting issuer in the provinces of British

10

Table of Contents

Columbia, Alberta, Saskatchewan, Manitoba, Ontario and Québec, and the Common Shares were listed on the TSX under the symbol "OR". On July 6, 2016, the Common Shares began trading on the NYSE under the symbol "OR". Common share purchase warrants of the Corporation are listed on the TSX under the symbol "OR.WT" (exercise price: $36.50; expiry date: March 5, 2022). Convertible debentures of the Corporation are listed on the TSX under the symbol "OR:DB" (4% interest; convertible at 43.6872 Common Shares per $1,000 principal amount of Debenture; expiry date: December 31, 2022).

As of the date of this short form prospectus, the Corporation is a reporting issuer in each of the provinces of Canada and in the United States.

The Corporation's head and registered office is located at 1100 avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, Canada, H3B 2S2.

SUMMARY DESCRIPTION OF THE BUSINESS

Osisko is a growth-oriented and Canadian-focused precious metal royalty and streaming company. The Corporation's cornerstone assets are: (i) the Canadian Malartic Royalty; (ii) the Éléonore Royalty; (iii) the Renard Stream; and (iv) the Mantos Stream.

Background

The Corporation was formed on April 29, 2014 in conjunction with the acquisition of CMC, which held the Canadian Malartic mine and other assets in development, by a partnership formed by Agnico Eagle Mines Limited and Yamana Gold Inc. Following its formation, Osisko began as a royalty company as of June 16, 2014 with the Canadian Malartic Royalty, other non-cash-flowing royalties and $157 million in cash. Osisko's market capitalization was initially valued at approximately $500 million.

Over the past 5 years, Osisko further transformed itself by, among other things, strategically acquiring Virginia Mines Inc. (February 2015) and in 2017, a portfolio of 74 assets (including 61 royalties, 7 precious metal offtakes and 6 streams), directly or indirectly, from the Selling Shareholder, including the Renard Stream and the Mantos Stream, following which Osisko now holds over 135 royalties, streams and precious metal offtakes. During that period, Osisko advanced its own "accelerator" investment model, through which the Corporation was able to contribute to the reinvigoration of the mining exploration sector in Canada. Through its investments in Osisko Mining Inc., Barkerville Gold Mines Ltd., Falco Resources Ltd. ("Falco"), Osisko Metals Incorporated and numerous other mining companies, Osisko was able to acquire strategic royalties and stream financing rights on prospective land packages and projects. The accelerator model also enabled Osisko to gain a competitive advantage by maintaining its dynamic technical team and leveraging its extensive expertise in exploration, engineering, construction, operations and financing.

Objectives

Osisko's objective is to maximize returns for its shareholders by growing its asset base, both organically and through accretive acquisitions of precious metal and other high-quality royalties, streams or other interests, and by returning capital to its shareholders through a quarterly dividend payment and share purchases. Osisko has a unique growth strategy that consists not only of acquiring and structuring both producing and late-stage development royalty and stream products, but also of investing in longer term assets where Osisko feels it is uniquely positioned to create value and realize returns through the development of these assets. Osisko has a successful track-record of strong technical capabilities, which it puts to work creating its own pipeline of organic growth opportunities that provide exposure to the upside of commodity prices and to the optionality of mineral reserve and resource growth.

11

Table of Contents

Osisko's main focus is on high quality, long-life precious metals assets located in favourable jurisdictions and operated by established mining companies, as these assets provide the best risk/return profile. Osisko also evaluates and invests in opportunities in other commodities and jurisdictions. Given that a core aspect of Osisko's business is the ability to compete for investment opportunities, Osisko plans to maintain a strong balance sheet and ability to deploy capital.

MATERIAL MINERAL PROJECTS

The Corporation has the following royalty and stream interests which are considered to be material: (i) the Canadian Malartic Royalty; (ii) the Éléonore Royalty; (iii) the Renard Stream; and (iv) the Mantos Stream. Information with respect to each of the above has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101 and may be reviewed under the headings"Material Mineral Projects—The Canadian Malartic Royalty", "Material Mineral Projects—The Éléonore Royalty","Material Mineral Projects—The Renard Stream" and"Material Mineral Projects—The Mantos Stream", respectively, in the AIF. The Corporation has no other material mineral projects.

RECENT DEVELOPMENTS

2019 Developments

Repaid Credit Facility

Osisko fully repaid its credit facility in January 2019 (repaying $71.7 million in the fourth quarter 2018 for a total of $123.5 million for 2018, in addition to a payment of $30.0 million in January 2019), and extended the maturity date of this facility by one year to November 14, 2022. Osisko now has up to $450.0 million available under its credit facility, including an uncommitted accordion of up to $100 million.

Silver Stream Transaction with Falco

On February 27, 2019, Falco announced the closing of a silver stream transaction pursuant to which the Corporation has agreed to commit up to $180 million towards the funding of the development, subject to achieving key milestones, of the Horne 5 Project of Falco in exchange for the purchase of 100% of the refined silver from the Horne 5 Project at an amount equal to 20% of the spot price of silver on the day of delivery, subject to a maximum payment of US$6 per silver ounce.

Declared 19th Consecutive Quarterly Dividend

On May 1, 2019, Osisko declared a first quarter 2019 dividend of $0.05 per common share. The dividend is the 19th consecutive quarterly dividend announced by Osisko. The dividend is to be paid on July 15, 2019 to shareholders of record as of the close of business on June 28, 2019.

Bridge Financing Extended to Stornoway

On June 11, 2019, Osisko announced that the buyers (the "Buyers") under the amended and restated purchase and sale agreement entered into on October 2, 2018 (the "Stream Agreement") in relation to the Renard Stream (including Osisko), entered into a binding bridge financing term sheet whereby the Buyers agreed to provide a senior-secured bridge credit facility (the "Bridge Facility") to Stornoway Diamond Corporation ("Stornoway") together with certain secured lenders and key stakeholders (collectively the "Bridge Lenders"). The Bridge Facility is being provided to Stornoway by the Bridge Lenders in order to support Stornoway during its strategic review process (the "Strategic Process").

Under the terms of the Bridge Facility, the Buyers, in proportion to their respective commitments, will advance an amount equivalent to the stream net proceeds payable under the Stream Agreement to

12

Table of Contents

Stornoway, up to an estimated amount of $5.9 million ($2.8 million attributable to Osisko). The Bridge Facility also provides that Diaquem, Inc. ("Diaquem"), an affiliate of Investissement Québec, has agreed to advance to Stornoway an amount of up to $11.7 million by way of access to the funds available in a senior loan reserve account maintained by Stornoway's subsidiary, Stornoway Diamond (Canada) Inc. ("SDCI"). In addition, amounts equivalent to royalty payments to be made by SDCI to Diaquem under the existing royalty agreement, up to an estimated amount of $1.9 million, and to interest payments accruing under the senior loan agreement between SDCI and Diaquem (the "Senior Loan"), up to an estimated amount of $2.5 million, have agreed to be advanced by Diaquem.

The Bridge Facility will be secured by a first-ranking security interest over all present and after-acquired assets and property of Stornoway and will accrue interest at a rate equal to 8.25%per annum. Amounts owing under the Bridge Facility will become due and repayable in full upon the maturity date, being the earliest to occur of certain stated events, including (i) the completion of a restructuring or other material transaction pursuant to the Strategic Process or the sale of all or substantially all of the property, assets and undertakings of Stornoway, and (ii) September 16, 2019 (the maturity date being subject to 30-day extensions by unanimous consent of the Bridge Lenders).

Concurrently with the entering into of the Bridge Facility, Stornoway also entered into a binding term sheet with the holders of more than 75% of the outstanding principal amount of the convertible debentures, pursuant to which such holders have consented to postpone interest payments on the convertible debentures from June 30 to December 31, 2019. Stornoway also obtained a waiver from Fonds de Solidarité des Travailleurs du Québec, Fonds Régional de Solidarité F.T.Q. Nord-du-Québec, S.E.C. and Diaquem of the requirement to make interest payments under theConvention de prêt dated as of May 3, 2012 from May 1, 2019 until December 31, 2019, inclusively. In addition, the Buyers under the Stream Agreement, Diaquem under the Senior Loan and Caterpillar Financial Services Limited under its master lease agreement with SDCI have each agreed to waive the requirement for Stornoway to have a minimum tangible net worth of $225 million, calculated on a consolidated basis, until July 15, 2019.

Concurrent Share Repurchase

In connection with the Offering, the Corporation has agreed to repurchase for cancellation 12,385,717 Common Shares from the Selling Shareholder pursuant to the Concurrent Share Repurchase, with 7,319,499 Common Shares having been purchased for cancellation on June 28, 2019 pursuant to the Initial Repurchase. The purchase price per Common Share to be paid by Osisko under the Concurrent Share Repurchase will be the same as the Offering Price, and the aggregate purchase price of approximately $174.6 million will be satisfied by a combination of cash in the amount of approximately $129.5 million from the Concurrent Investment Disposition, and through the transfer of the Transferred Securities, including all of the common shares of Aquila, Ascot, Highland Copper and TerraX, in addition to certain other equity securities, currently held by Osisko. Completion of the Victoria Gold Disposition is conditional upon receipt of approval under the Competition Act. Completion of the Offering is conditional on the Concurrent Share Repurchase having occurred, other than the portion of the Concurrent Share Repurchase being funded using proceeds from the Victoria Gold Disposition (and such condition has been fulfilled as a result of the Initial Repurchase). If the Victoria Gold Disposition is not completed, this would result in the Corporation having purchased 7,319,499 Common Shares having an aggregate purchase price of $103,204,936 pursuant to the Initial Repurchase, unless the Corporation would determine to complete such second portion of the Concurrent Share Repurchase and fund same through alternative arrangements, which are not guaranteed to be available. The second tranche of the Concurrent Share Repurchase and the Concurrent Investment Disposition are expected to be completed following the date of this short form prospectus, subject to customary closing conditions, including the receipt of approval under the Competition Act in respect of the Victoria Gold Disposition.

13

Table of Contents

To review and evaluate the merits of the Concurrent Share Repurchase and Concurrent Investment Disposition, the board of directors of Osisko established a special committee of independent directors (the "Special Committee"). The Special Committee was chaired by Mrs. Joanne Ferstman and included Messrs. Pierre Labbé and Charles E. Page. Stikeman Elliott LLP acted as legal advisor to Osisko in connection with the Concurrent Share Repurchase and Concurrent Investment Disposition and the Special Committee retained National Bank Financial Inc. as its independent financial advisor. The Special Committee undertook a deliberate and full consideration of the Concurrent Share Repurchase and Concurrent Investment Disposition with the assistance of such advisors, and, upon the recommendation of the Special Committee that, among other things, the Concurrent Share Repurchase and Concurrent Investment Disposition are in the best interests of Osisko, the board of directors of Osisko (other than one interested director who abstained from voting) unanimously approved the Concurrent Share Repurchase and the Concurrent Investment Disposition.

The Selling Shareholder is a "related party" of Osisko within the meaning of Multilateral Instrument 61-101—Protection of Minority Security Holders in Special Transactions ("MI 61-101") since it holds Common Shares entitling it to more than 10% of the voting rights attached to all the issued and outstanding voting securities of Osisko. Therefore, the Concurrent Share Repurchase and the Concurrent Investment Disposition constitute "related party transactions" within the meaning of MI 61-101. Osisko is exempted from the formal valuation and minority approval requirements pursuant to MI 61-101 since neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the Concurrent Share Repurchase, together with the fair market value of the subject matter of, or the fair market value of the consideration for, the Concurrent Investment Disposition (or, for greater certainty, any of the Dalradian Disposition or Victoria Gold Disposition), represent more than 25% of the market capitalization of Osisko.

Initial Repurchase

On June 28, 2019, Osisko announced that it had completed the purchase for cancellation of 7,319,499 Common Shares from the Selling Shareholder pursuant to the Initial Repurchase. The aggregate purchase price of $103,204,936 of the Initial Repurchase was satisfied by a combination of cash received from the Dalradian Resources Disposition and the transfer from Osisko to the Selling Shareholder of the Transferred Securities, including (i) 49,651,857 common shares of Aquila, (ii) 74,420,434 common shares of Highland Copper, and (iii) 11,883,848 common shares of TerraX. Immediately following the closing of the Initial Repurchase, Osisko had beneficial ownership of, or control and direction over (i) no common shares of Aquila, (ii) no common shares of Highland Copper, and (iii) no common shares of TerraX.

14

Table of Contents

CONSOLIDATED CAPITALIZATION

Other than as described in this short form prospectus, there have been no material changes in the Corporation's share and loan capital, on a consolidated basis, since the date of the Corporation's Interim Financial Statements. The following table sets forth our consolidated capitalization as of March 31, 2019: (i) on an actual basis; and (ii) on a pro forma basis to give effect to the Offering, the Concurrent Share Repurchase and the Concurrent Investment Disposition:

| | | | | | | |

| | As at

March 31, 2019

(000s) | | As at

March 31, 2019

after giving

effect to

the Offering, the

Concurrent Share

Repurchase

and the

Concurrent

Investment

Disposition(1)

(000s) | |

|---|

Long-Term Debt | | $ | 324,355 | | $ | 324,355 | |

Shareholders' Equity | | | | | | | |

Share capital | | $ | 1,609,435 | | $ | 1,480,952 | |

Warrants | | $ | 18,072 | | $ | 18,072 | |

Contributed surplus | | $ | 33,987 | | $ | 33,987 | |

Equity component of convertible debentures | | $ | 17,601 | | $ | 17,601 | |

Accumulated other comprehensive income | | $ | 21,090 | | $ | 22,120 | |

Retained earnings (deficit) | | $ | 27,211 | | $ | (23,424 | ) |

Total Shareholders' Equity | | $ | 1,727,396 | | $ | 1,549,308 | |

Note:

- (1)

- The aggregate purchase price under the Concurrent Share Repurchase will be satisfied by a combination of cash (funded through the proceeds of the Concurrent Investment Disposition in the amount of approximately $129.5 million), and through the transfer of the Transferred Securities.

As of the date of this short form prospectus, there were 147,984,438 Common Shares issued and outstanding on a non-diluted basis (on a fully-diluted basis, assuming exercise in full of outstanding options, there were 152,798,819. Common Shares issued and outstanding). Upon completion of the Offering and the Concurrent Share Repurchase there will be 142,896,914 Common Shares issued and outstanding on a non-diluted basis (on a fully-diluted basis, assuming exercise in full of outstanding options, there will be 147,724,628 Common Shares issued and outstanding).

USE OF PROCEEDS

The Corporation will not receive any proceeds from the sale of the Offered Shares by the Selling Shareholder pursuant to this Offering.

The estimated net proceeds of the Offering to the Selling Shareholder will be $106,257,600, after deducting the aggregate Underwriters' Fee in the amount of $4,427,400 and before deducting the expenses of the Offering, which are estimated to be $1,028,815. If the Over-Allotment Option is exercised in full, the total net proceeds to the Selling Shareholder, after deducting the Underwriters' Fee in respect of the Over-Allotment Option, and before deducting the expenses of the Offering will be $122,196,240. The Selling Shareholder has agreed to pay the Corporation's reasonable, out-of-pocket expenses related to the Offering, the Concurrent Share Repurchase and the Concurrent Investment Disposition.

15

Table of Contents

PLAN OF DISTRIBUTION

Pursuant to the Underwriting Agreement, among the Corporation, the Selling Shareholder and the Underwriters, the Selling Shareholder has agreed to sell and the Underwriters have agreed severally, and not jointly or jointly and severally, to purchase or arrange for the purchase, on the Closing Date, of an aggregate of 7,850,000 Offered Shares at the Offering Price for gross proceeds of $110,685,000 payable in cash to the Selling Shareholder against delivery of the Offered Shares, subject to the terms and conditions of the Underwriting Agreement. The obligations of the Underwriters under the Underwriting Agreement may be terminated at their discretion on the basis of "disaster out", "regulatory out", "material change out" and "breach out" provisions in the Underwriting Agreement and may also be terminated upon the occurrence of certain other stated events. The Underwriters are, however, obligated to take up and pay for all of the Offered Shares if any of the Offered Shares are purchased under the Underwriting Agreement. Completion of the Offering is conditional on the Concurrent Share Repurchase having occurred, other than the portion of the Concurrent Share Repurchase being funded using proceeds from the Victoria Gold Disposition (and such condition has been fulfilled as a result of the Initial Repurchase). If the Victoria Gold Disposition is not completed, this would result in the Corporation having purchased 7,319,499 Common Shares having an aggregate purchase price of $103,204,936 pursuant to the Initial Repurchase, unless the Corporation would determine to complete such second portion of the Concurrent Share Repurchase and fund same through alternative arrangements, which are not guaranteed to be available.

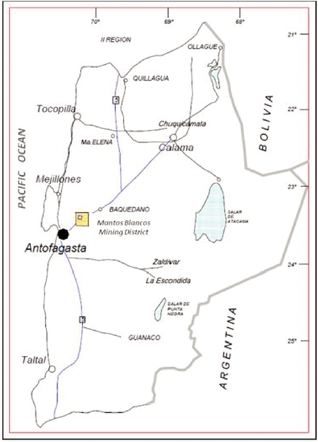

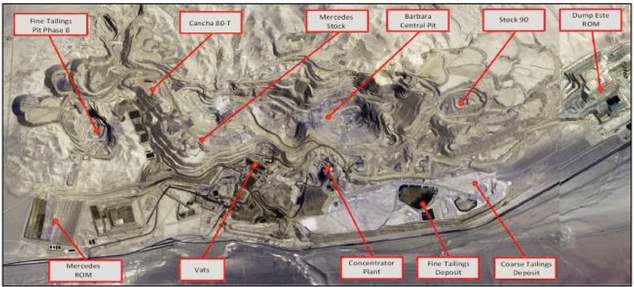

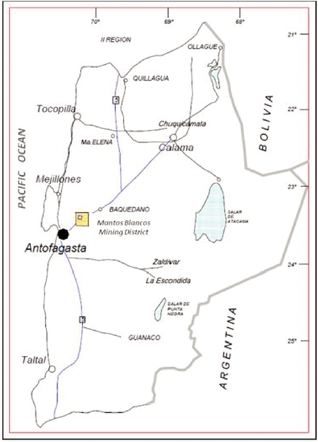

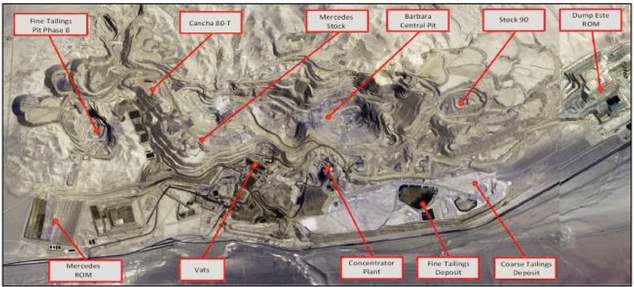

The Offering Price was determined by arm's length negotiation between the Selling Shareholder and the Lead Underwriters, on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares.