Therapeutics segment—2016 vs. 2017

External revenues in our Therapeutics segment decreased by $22.9 million, or 41.0%, from $55.9 million for the year ended December 31, 2016 to $33.0 million for the year ended December 31, 2017. The decrease was primarily due to a decrease of $19.1 million in collaboration agreement revenues and lower subsidies revenue and research tax credit, as described in sections “Revenues” and “Other income” of the consolidated operating result analysis.

The decrease in operating expenses of $7.6 million, or 6.6%, from the year ended December 31, 2016 to the year ended December 31, 2017 resulted primarily from lower personnel expenses, mainly attributable to the decrease innon-cash stock-based compensation expenses and social charges on stock options grants, and is partially offset by the increase in purchases and external expenses for product development.

Segment operating loss before tax for the Therapeutics segment increased by $15.3 million, or 26.2%, from the year ended December 31, 2016 to the year ended December 31, 2017.

Therapeutics segment—2015 vs. 2016

External revenues in our Therapeutics segment decreased by $6.7 million, or 10.6%, from $62.5 million for the year ended December 31, 2015 to $55.9 million for the year ended December 31, 2016. The decrease was primarily due to a decrease of $11.7 million in collaboration agreement revenues and higher research tax credit, as described in sections “Revenues” and “Other income” of the consolidated operating result analysis.

The increase in operating expenses of $25.8 million, or 29.1%, from the year ended December 31,2015 to the year ended December 31, 2016 resulted primarily from higher personnel expenses, attributable, among other things, to the increase innon-cash stock-based compensation expenses, as well as the increase in external expenses for product development.

Segment operating loss before tax for the Therapeutics segment increased by $32.4 million, or 124.5%s from the year ended December 31, 2015 to the year ended December 31, 2016.

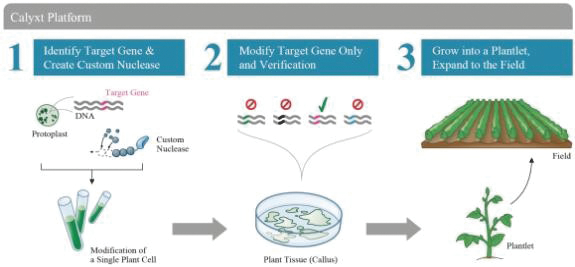

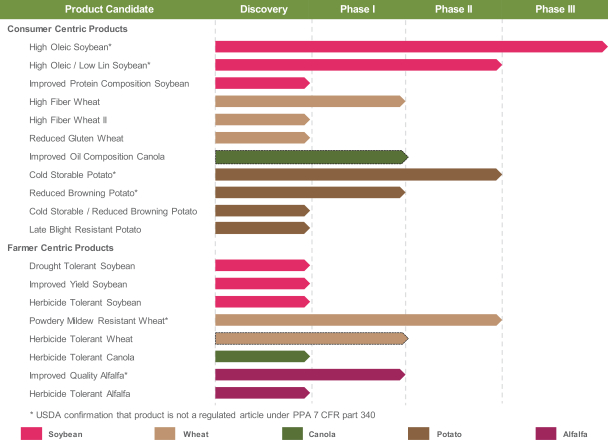

Plants segment—2016 vs. 2017

External revenues in our Plants segment increased by $0.2 million, or 27.6%, from $0.6 million for the year ended December 31, 2016 to $0.7 million for the year ended December 31, 2017.

The increase in operating expenses of $10.2 million, or 108.4%, from the year ended December 31, 2016 to the year ended December 31, 2017 resulted primarily from a significant increase in Calyxt’s activities, higher professional fees related to the cost of becoming a Nasdaq listed company, as well as an increase innon-cash stock-based compensation expenses.

Segment operating loss before tax for the Plants segment increased by $10.0 million, or 113.8%, from $8.8 million for the year ended December 31, 2016 to $18.8 million for the year ended December 31, 2017.

Plants segment—2015 vs. 2016

External revenues in our Plants segment increased by $0.5 million, from $49 thousand for the year ended December 31, 2015 to $0.6 million for the year ended December 31, 2016.

The increase in operating expenses of $4.4 million, or 88.7%, from the year ended December 31, 2015 to the year ended December 31, 2016 resulted primarily from a significant increase in Calyxt’s activities, as well as an increase innon-cash stock-based compensation expenses.

138