2Q 2024 Earnings Supplemental ©2024 Caliber Building on a 15-year track record of profitable growth and success

Forward-Looking Statements This presentation includes statements concerning CaliberCos Inc.’s (the “Company,” or “Caliber”) expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events, future financial performance, or growth and other statements that are not historical facts. These statements are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, readers and the audience can identify these forward-looking statements through the use of words or phrases such as "estimate,“ "expect," "anticipate," "intend," "plan," "project," "believe," "forecast," "should," "could," and other similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward-looking statements. The Company's expectations, beliefs, and projections are expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that management's expectations, beliefs, or projections will be achieved or accomplished. Factors that may cause actual results to differ materially from those included in the forward-looking statements include, but are not limited to, factors affecting the Company’s ability to successfully operate and manage its business, including, among others, title disputes, weather conditions, shortages, delays, or unavailability of equipment and services, property management, brokerage, investment and fund operations, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; changes in costs of operations; loss of markets; volatility of asset prices; imprecision of asset valuations; environmental risks; competition; inability to access sufficient capital; general economic conditions; litigation; changes in regulation and legislation; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities, acts of war, cyber attacks, or pest infestation; increasing costs of insurance, changes in coverage and the ability to obtain insurance; and other presently unknown or unforeseen factors. Other risk factors are detailed from time to time in the Company's reports filed with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to update the information contained in any forward-looking statements to reflect developments or circumstances occurring after the statement is made or to reflect the occurrence of unanticipated events. Past performance is not indicative of future results. There is no guarantee that any specific outcome will be achieved. Investment may be speculative and illiquid and there is a total risk of loss. There is no guarantee that any specific investment will be suitable or profitable. This presentation does not constitute an offering of, nor does it constitute the solicitation of an offer to buy, securities of the Company. This presentation is provided solely to introduce the Company to the recipient and to determine whether the recipient would like additional information regarding the Company and its anticipated plans. Any investment in the Company or sale of its securities will only take place pursuant to an appropriate, private placement memorandum and a detailed subscription agreement. Some of the information contained herein is confidential and proprietary to the Company and the presentation is provided to the recipient with the express understanding that without the prior written permission of the Issuer, such recipient will not distribute or release the information contained herein, make reproductions of, or use it for any purpose other than determining whether the recipient wishes additional information regarding the Company or its plans. By accepting delivery of this presentation, the recipient agrees to return same to the Company if the recipient does not wish to receive any further information regarding the Company. We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. The registration statement has not yet become effective. Before you invest, you should read the preliminary prospectus in that registration statement (including the risk factors described therein) and other documents that we have filed with the SEC for more complete information. You may access these documents for free by visiting Edgar on the SEC website at httpp://www.sec.gov CALIBERCO.COM | 8901 E MOUNTAIN VIEW RD, STE 150, SCOTTSDALE, AZ 85258 | 480.295.7600 2 T H E W E A L T H D E V E L O P M E N T C O M P A N Y Disclaimers

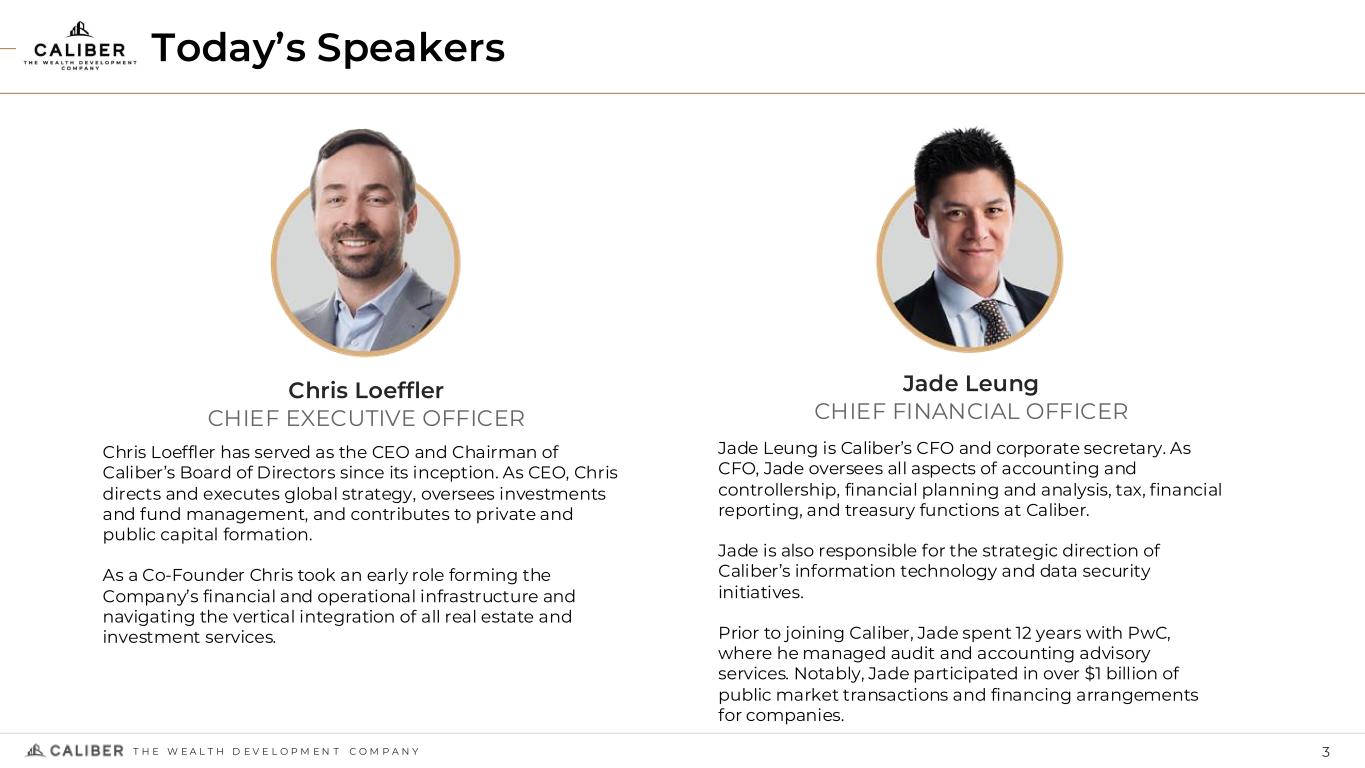

Today’s Speakers 3T H E W E A L T H D E V E L O P M E N T C O M P A N Y Chris Loeffler CHIEF EXECUTIVE OFFICER Jade Leung CHIEF FINANCIAL OFFICER Chris Loeffler has served as the CEO and Chairman of Caliber’s Board of Directors since its inception. As CEO, Chris directs and executes global strategy, oversees investments and fund management, and contributes to private and public capital formation. As a Co-Founder Chris took an early role forming the Company’s financial and operational infrastructure and navigating the vertical integration of all real estate and investment services. Jade Leung is Caliber’s CFO and corporate secretary. As CFO, Jade oversees all aspects of accounting and controllership, financial planning and analysis, tax, financial reporting, and treasury functions at Caliber. Jade is also responsible for the strategic direction of Caliber’s information technology and data security initiatives. Prior to joining Caliber, Jade spent 12 years with PwC, where he managed audit and accounting advisory services. Notably, Jade participated in over $1 billion of public market transactions and financing arrangements for companies.

CEO Commentary 4T H E W E A L T H D E V E L O P M E N T C O M P A N Y

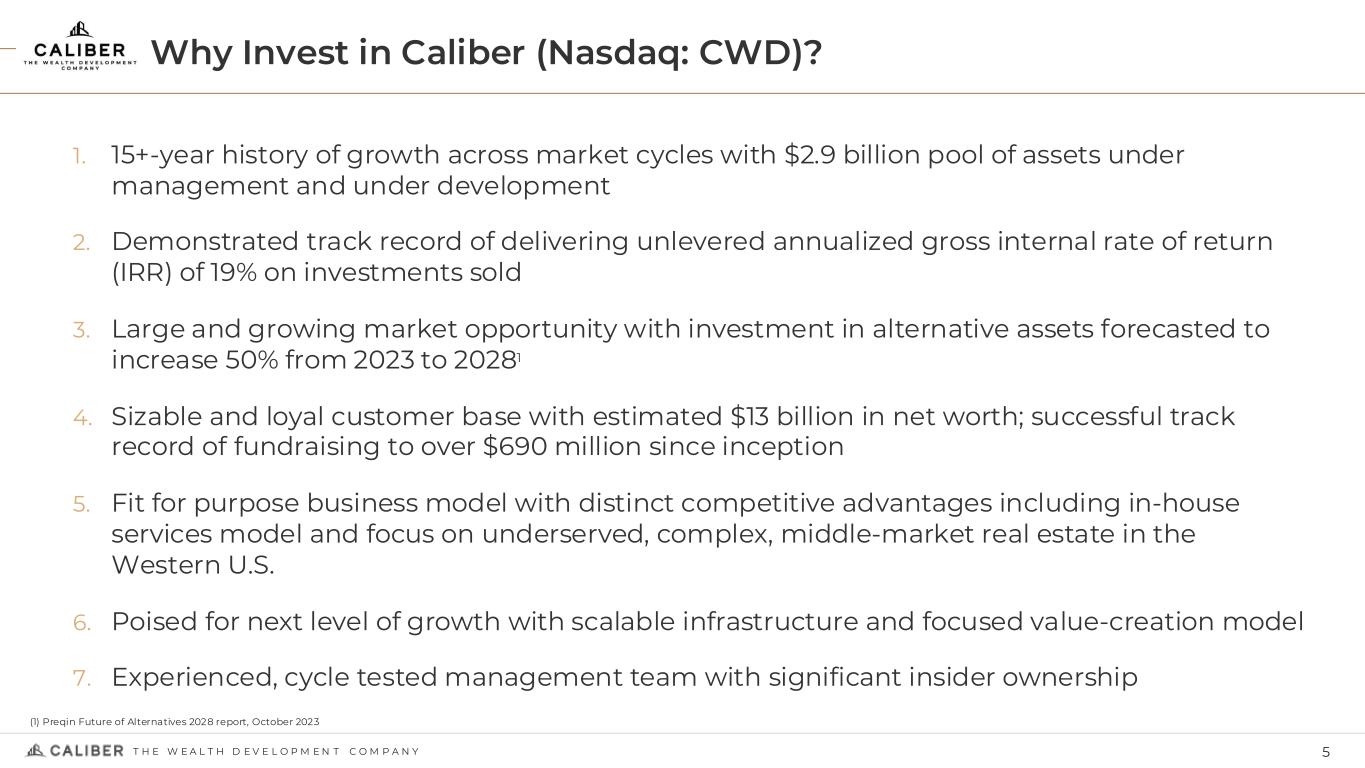

1. 15+-year history of growth across market cycles with $2.9 billion pool of assets under management and under development 2. Demonstrated track record of delivering unlevered annualized gross internal rate of return (IRR) of 19% on investments sold 3. Large and growing market opportunity with investment in alternative assets forecasted to increase 50% from 2023 to 20281 4. Sizable and loyal customer base with estimated $13 billion in net worth; successful track record of fundraising to over $690 million since inception 5. Fit for purpose business model with distinct competitive advantages including in-house services model and focus on underserved, complex, middle-market real estate in the Western U.S. 6. Poised for next level of growth with scalable infrastructure and focused value-creation model 7. Experienced, cycle tested management team with significant insider ownership Why Invest in Caliber (Nasdaq: CWD)? 5T H E W E A L T H D E V E L O P M E N T C O M P A N Y (1) Preqin Future of Alternatives 2028 report, October 2023

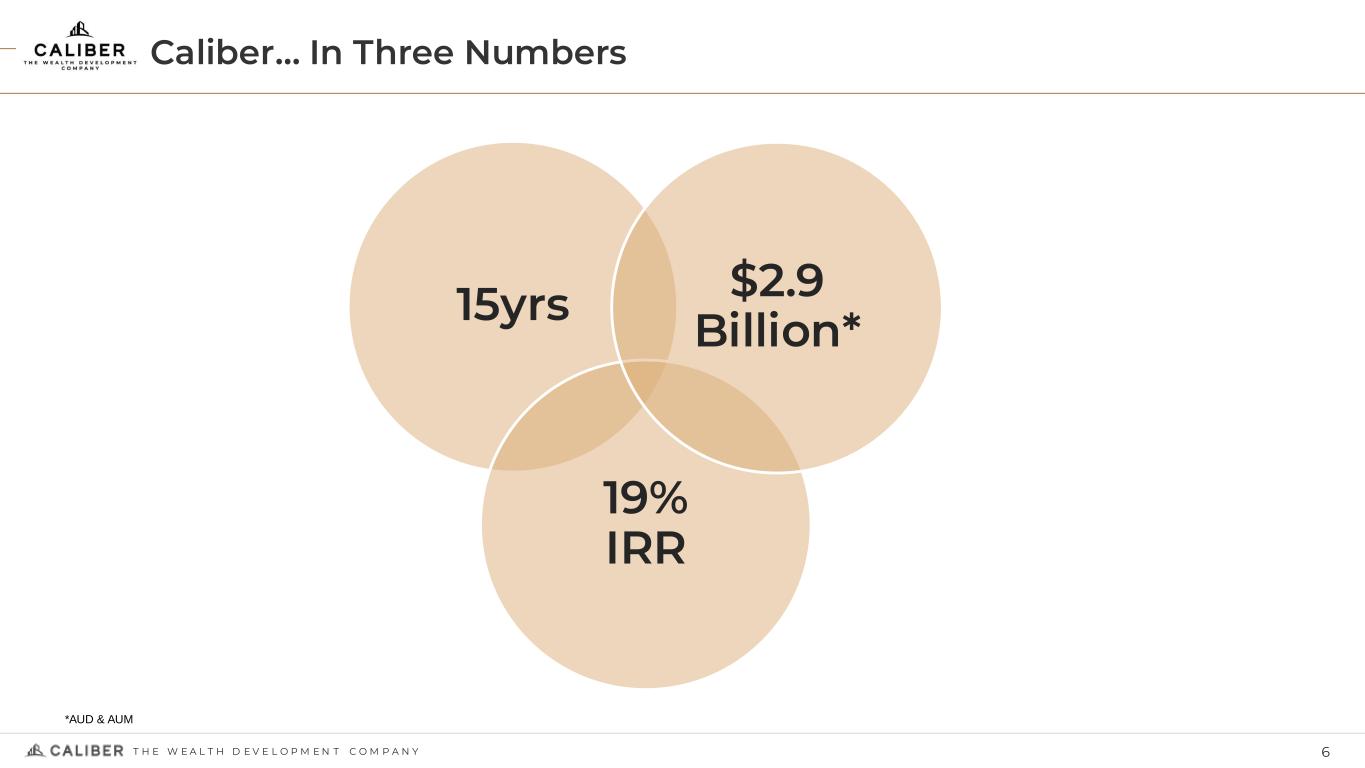

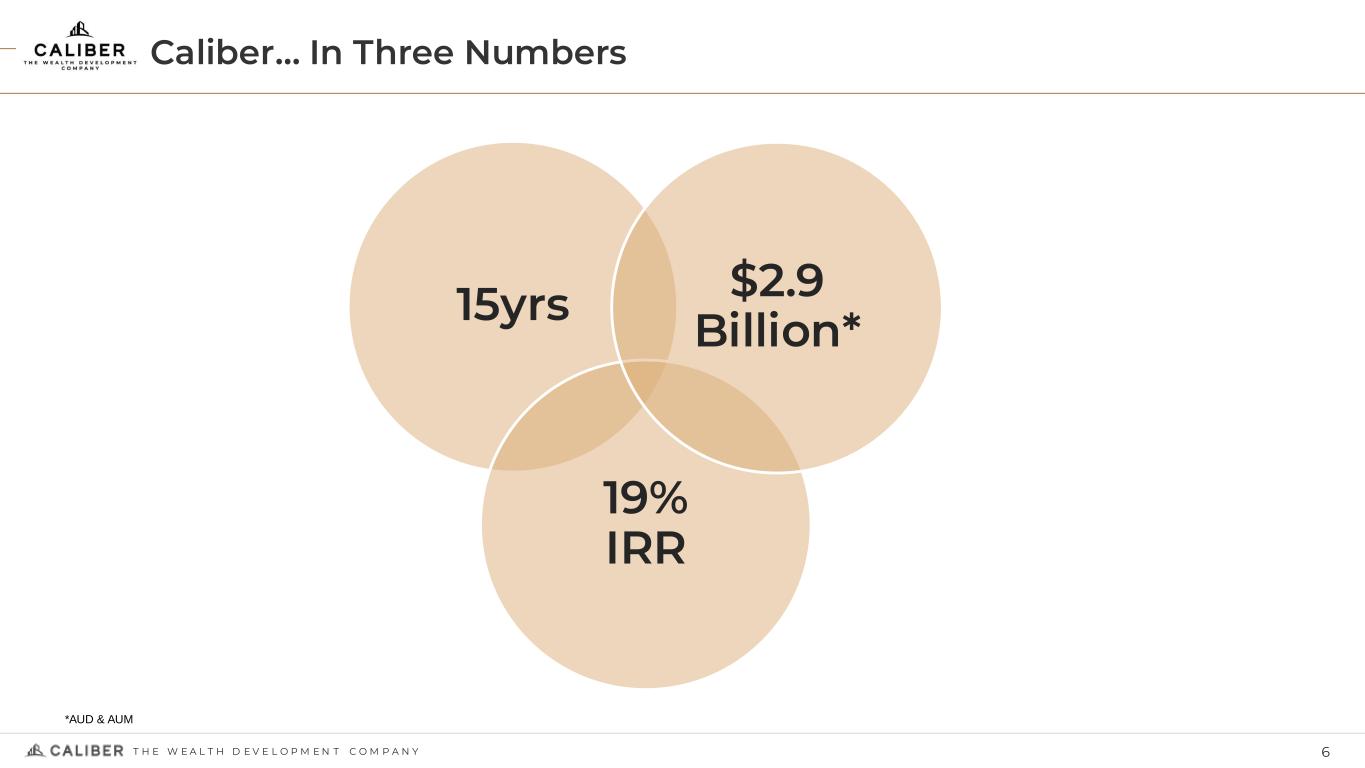

Caliber… In Three Numbers 6T H E W E A L T H D E V E L O P M E N T C O M P A N Y 15yrs 19% IRR $2.9 Billion* *AUD & AUM

Publicly Traded Parent Operates Investment Funds 7T H E W E A L T H D E V E L O P M E N T C O M P A N Y Caliber Nasdaq: CWD RE Fund 1 RE Fund 2 Hotel UPREIT

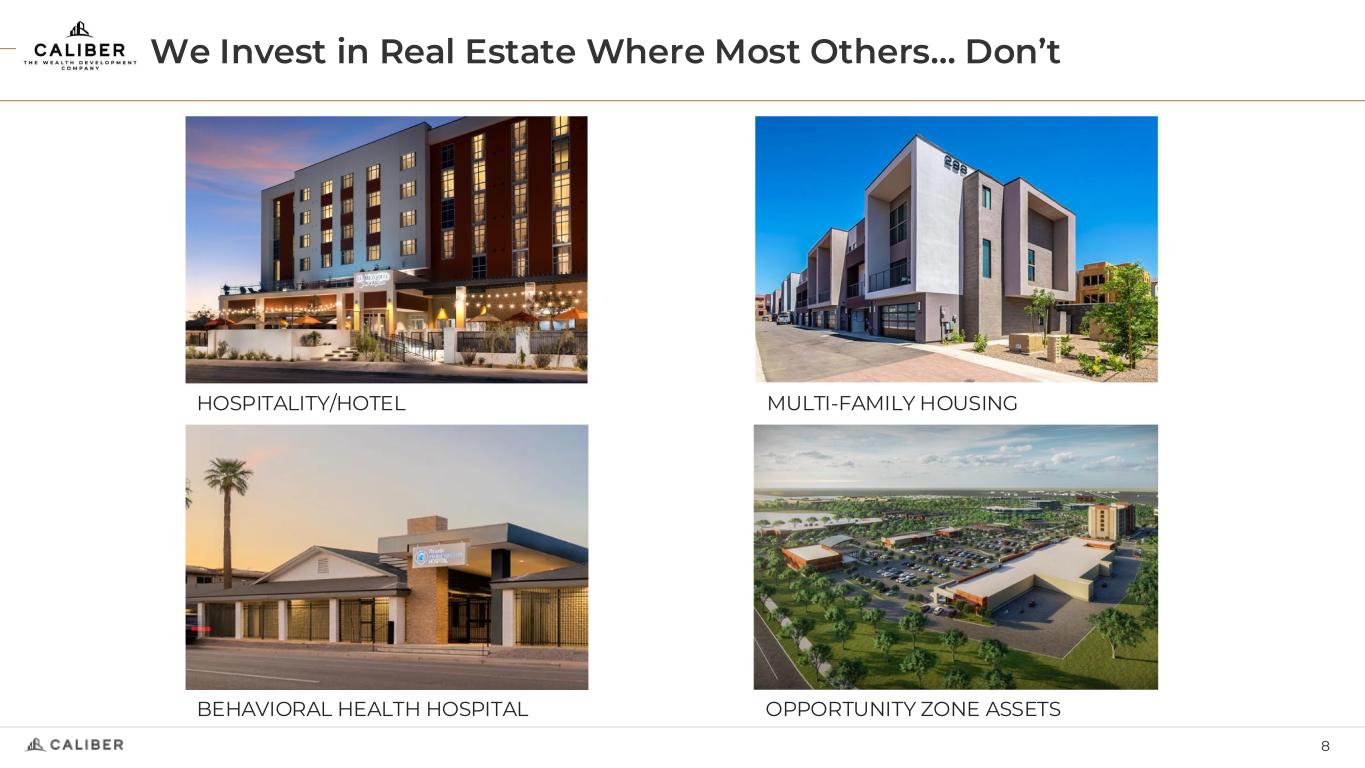

8 BEHAVIORAL HEALTH HOSPITAL HOSPITALITY/HOTEL MULTI-FAMILY HOUSING OPPORTUNITY ZONE ASSETS We Invest in Real Estate Where Most Others… Don’t

9T H E W E A L T H D E V E L O P M E N T C O M P A N Y The Best Opportunities are in the Middle-Market Middle-Market Assets • $5 to $50 million per project • Large opportunity set • Highly-fragmented market • Less competition • Caliber’s in-house services model enables access Middle Market Geographies • Demonstrated Population & Job Growth • Underserved in terms of financing options • Opportunity Zone tax incentives • Local tax incentives • Trends post-pandemic

10T H E W E A L T H D E V E L O P M E N T C O M P A N Y Income Lending, CORE Plus, Value Add Growth Distressed and Special Situations, Adaptive Re-Use & Development Tax Planning/Reduction Opportunity Zone Funds, 1031 Investments We Solve Our Clients’ Financial Needs Desired Outcome Caliber Product Our Job Is Simple: Deliver Returns Clients Expect In All Market Conditions Clients who invest in Caliber’s Funds seek three primary outcomes:

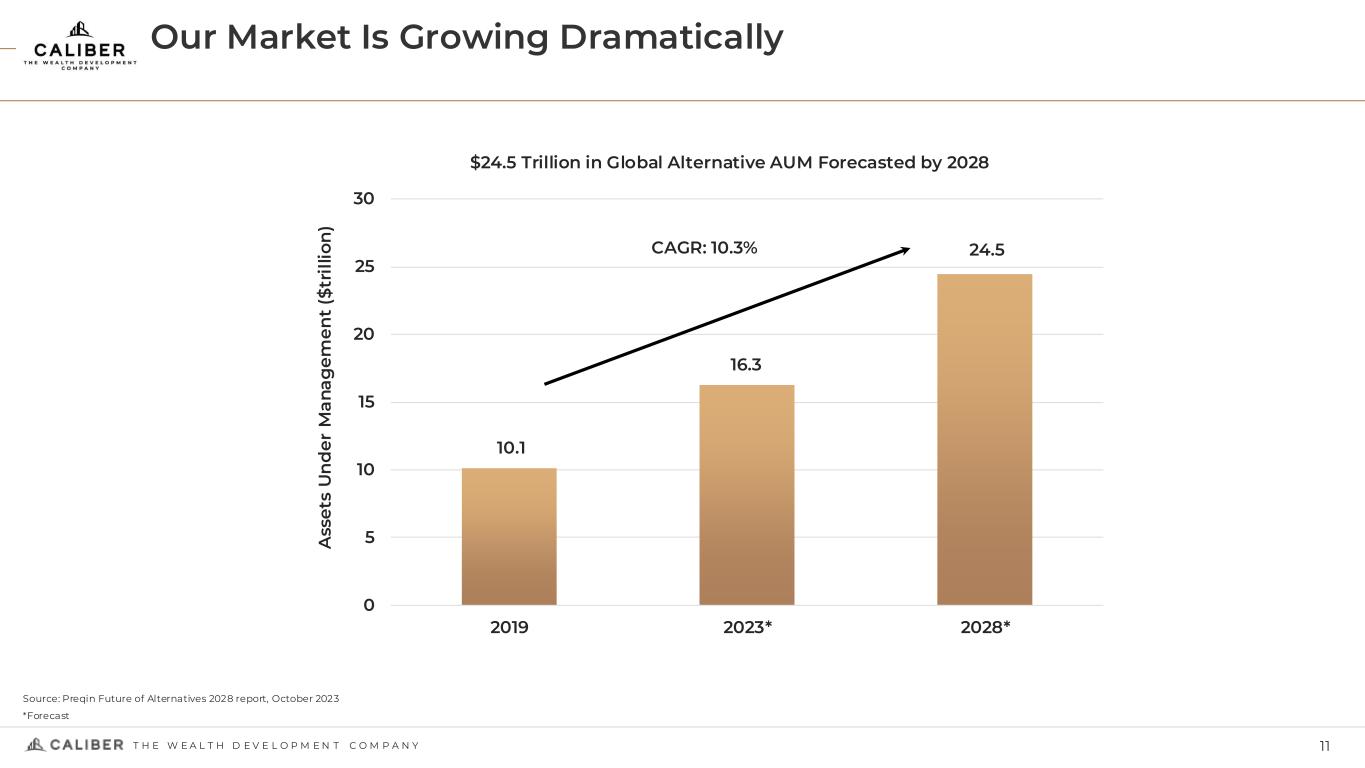

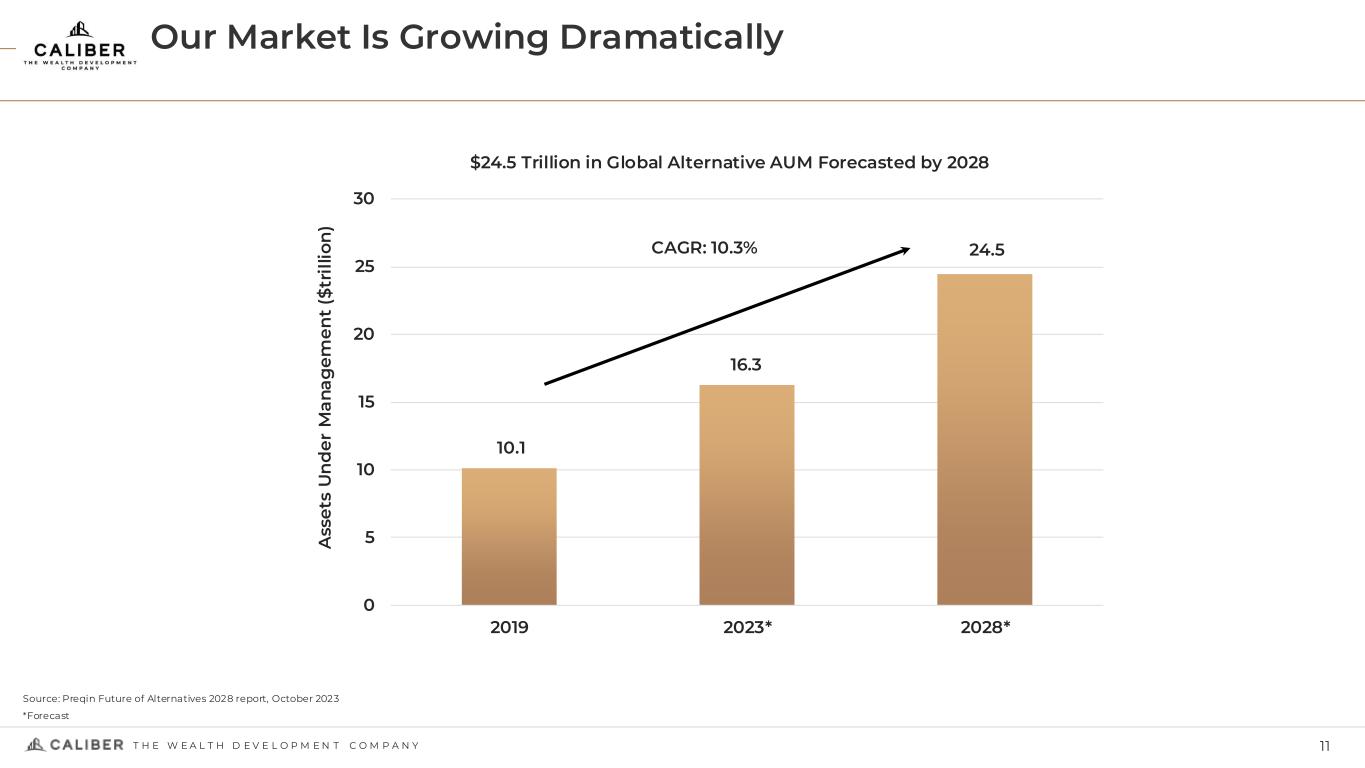

Our Market Is Growing Dramatically 11T H E W E A L T H D E V E L O P M E N T C O M P A N Y Source: Preqin Future of Alternatives 2028 report, October 2023 *Forecast 10.1 16.3 24.5 0 5 10 15 20 25 30 2019 2023* 2028* A ss e ts U n d e r M a n a g e m e n t ($ tr il lio n ) $24.5 Trillion in Global Alternative AUM Forecasted by 2028 CAGR: 10.3%

Performance Allocations Asset Management Revenue We Have Multiple Revenue Streams 12T H E W E A L T H D E V E L O P M E N T C O M P A N Y Note: asset services performed in-house at market rates.

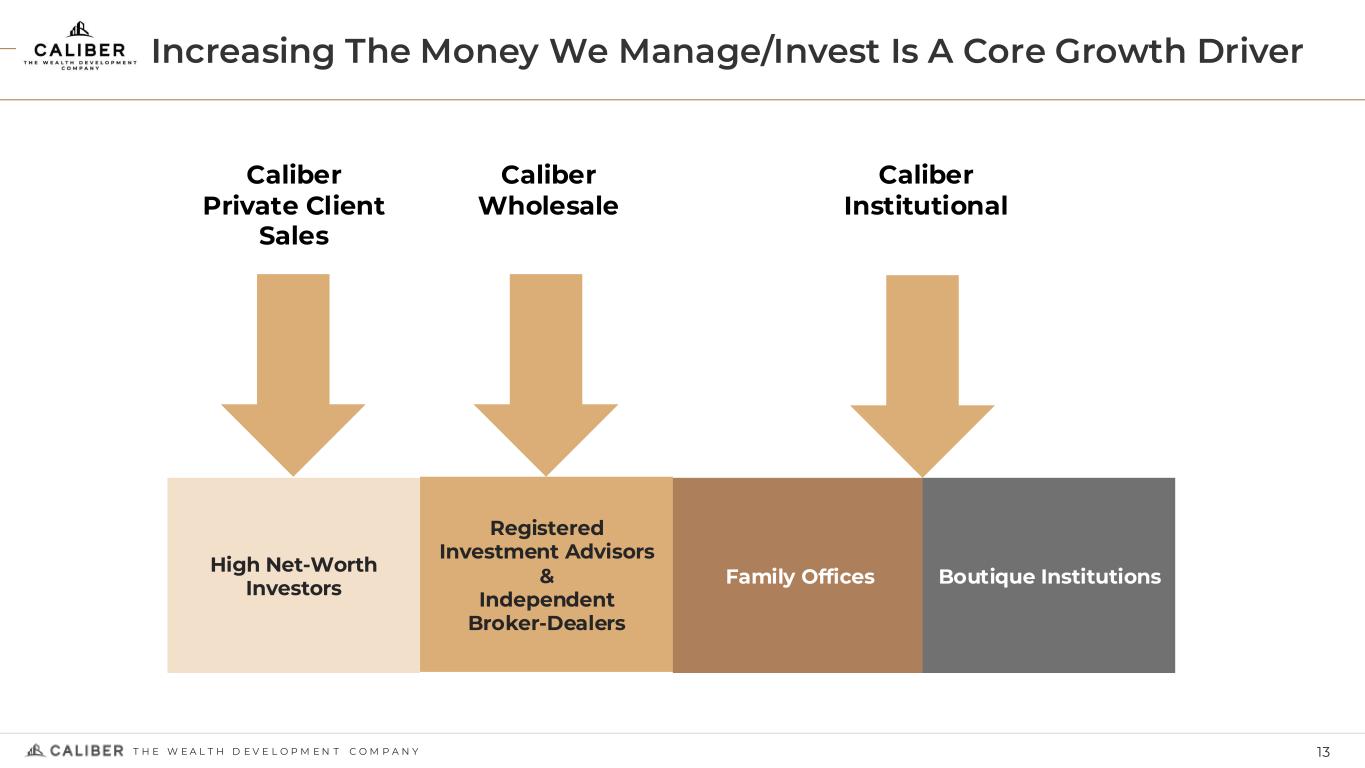

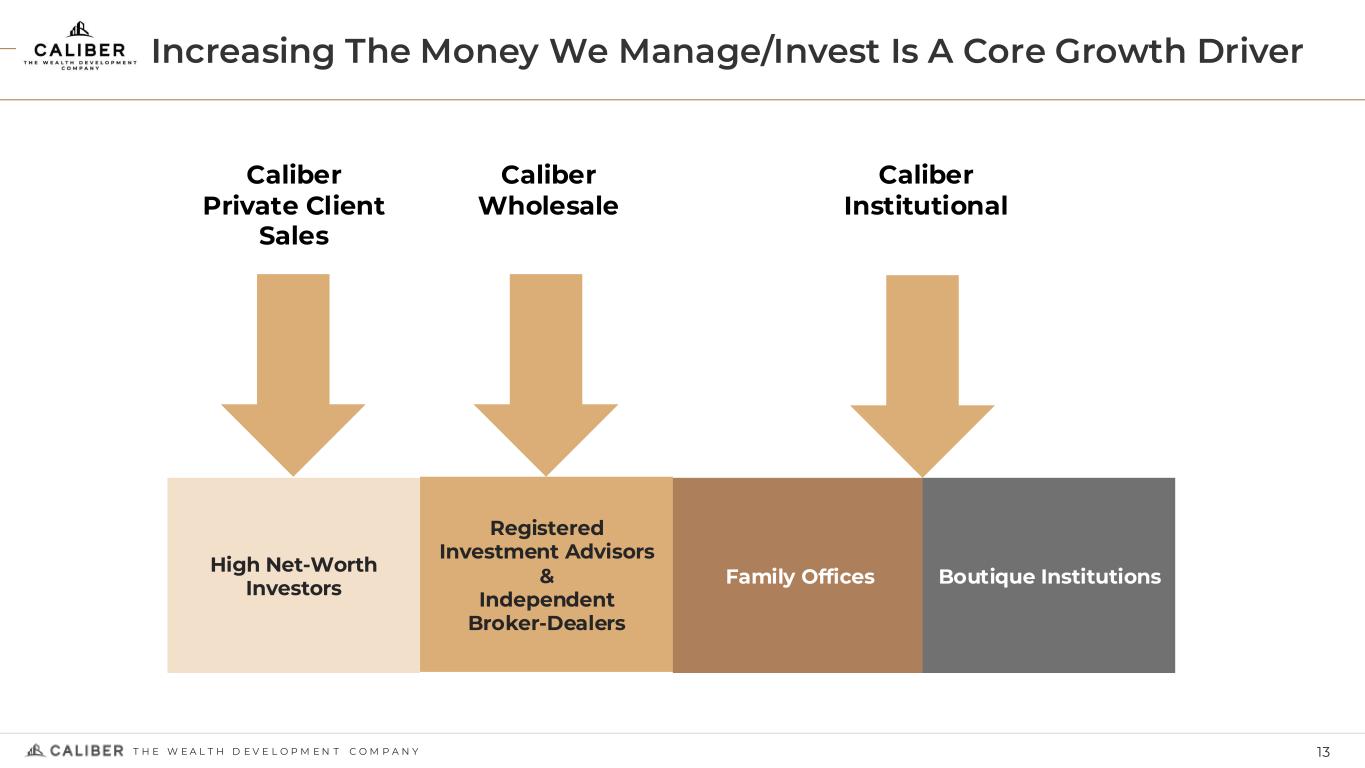

Increasing The Money We Manage/Invest Is A Core Growth Driver 13T H E W E A L T H D E V E L O P M E N T C O M P A N Y High Net-Worth Investors Registered Investment Advisors & Independent Broker-Dealers Family Offices Boutique Institutions Caliber Private Client Sales Caliber Wholesale Caliber Institutional

Caliber Hospitality Trust – Another Path To Revenue Growth 14T H E W E A L T H D E V E L O P M E N T C O M P A N Y Using the Caliber infrastructure to launch public investment products

Consistent Growth – A Model We’ve Succeeded With For 15 Years 15T H E W E A L T H D E V E L O P M E N T C O M P A N Y Raise Capital Grow Assets Under Management Grow Revenue

Source: Caliber’s estimates and internal research reviewing comparable business models Caliber Earns More Per Dollar in AUM 16T H E W E A L T H D E V E L O P M E N T C O M P A N Y Caliber’s In-House Services Model: Increased Control & Multiple Revenue Streams Traditional Asset Managers: Lower Control & Fewer Revenue Opportunities Fund Management Fees Performance Allocations (Carried Interest) Fund Set-Up Fees Financing Fees Real Estate Development Fees Brokerage Fees Low-Margin, High-Volume Services In-House Revenues Outsourced Asset Management Performance Fees (Carried Interest) All Additional Services Outsourced In-House Revenues Caliber has optimized in-house and third-party services to maximize control and profitability

2026 Financial Targets* 17T H E W E A L T H D E V E L O P M E N T C O M P A N Y Cumulative Fundraising of $750M Annualized Platform Revenue of $50M Assets Under Management (AUM) of $3B * End of 2026

Path Forward for Enterprise Value Growth 18T H E W E A L T H D E V E L O P M E N T C O M P A N Y Fundraising Product Innovation Acquisitions

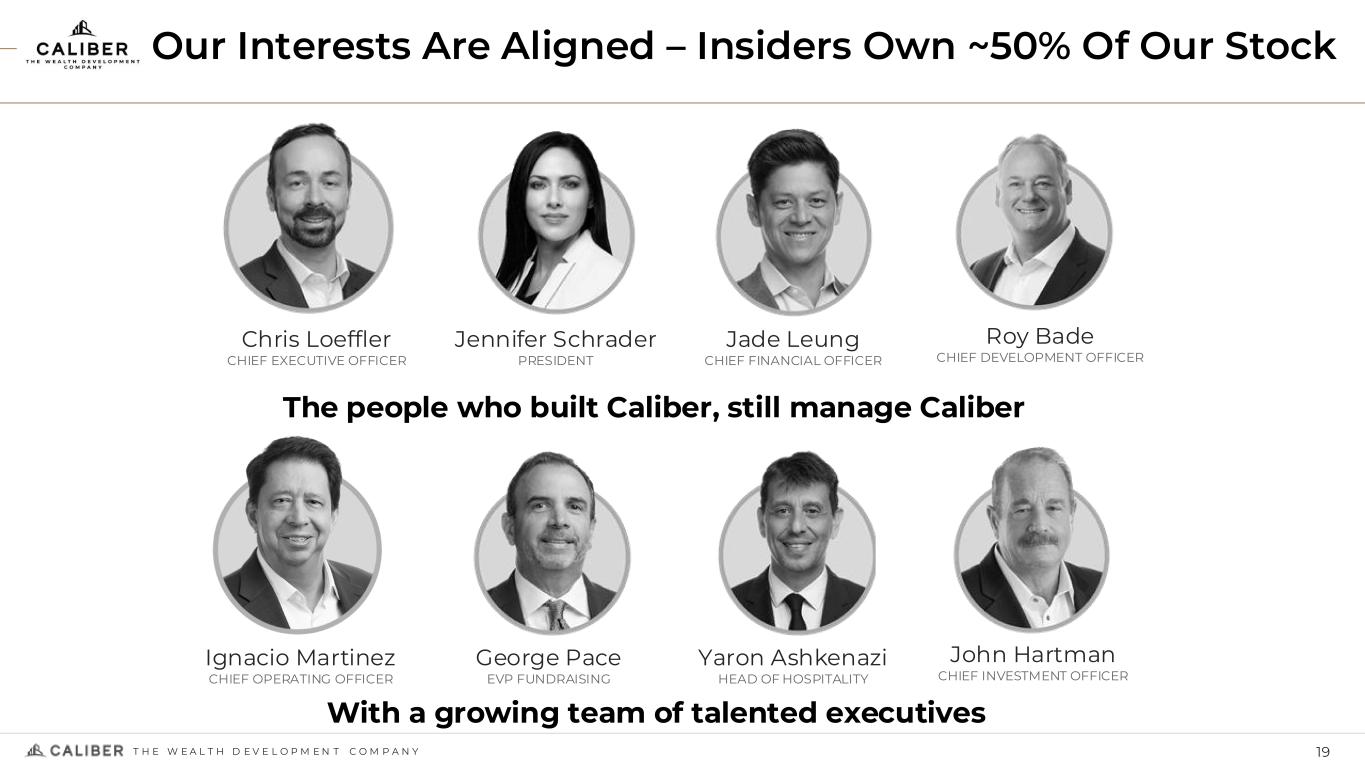

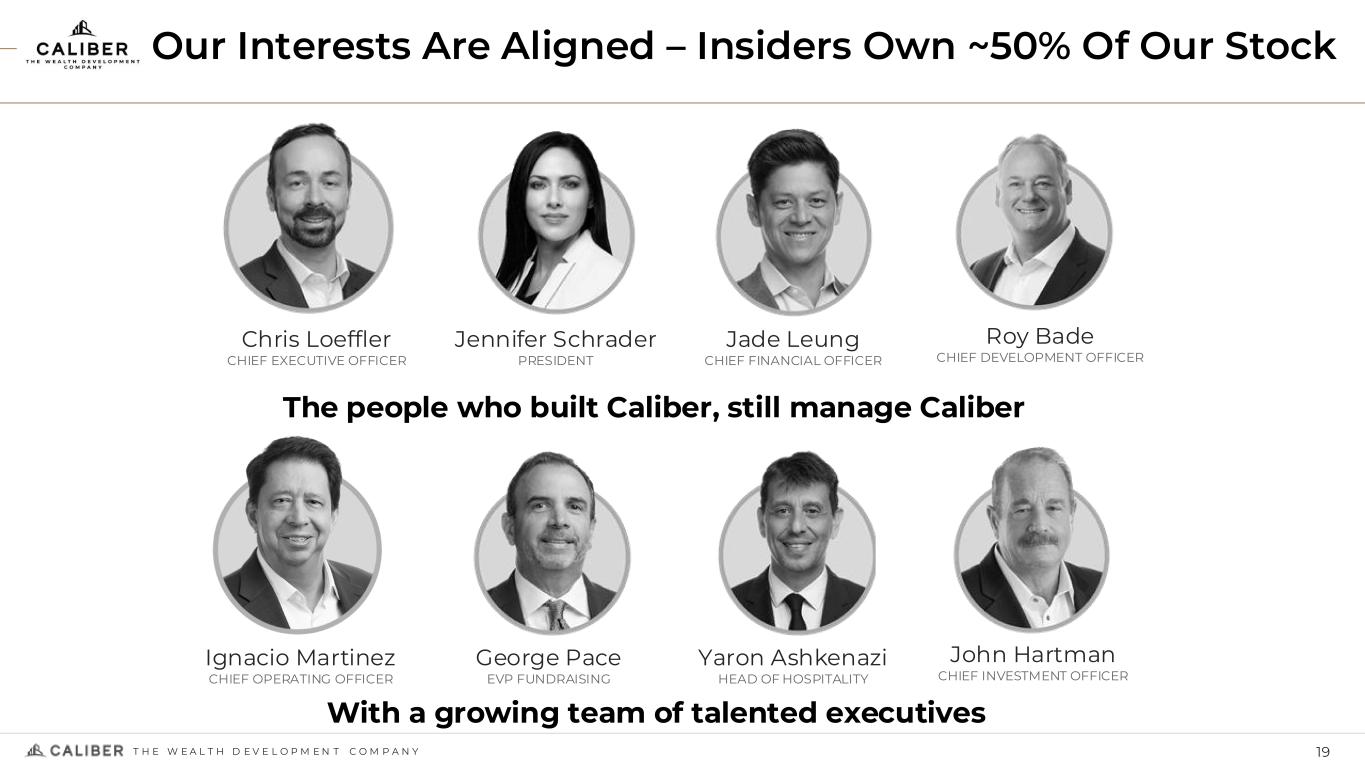

Our Interests Are Aligned – Insiders Own ~50% Of Our Stock 19T H E W E A L T H D E V E L O P M E N T C O M P A N Y The people who built Caliber, still manage Caliber Chris Loeffler CHIEF EXECUTIVE OFFICER Jennifer Schrader PRESIDENT Jade Leung CHIEF FINANCIAL OFFICER Roy Bade CHIEF DEVELOPMENT OFFICER With a growing team of talented executives Ignacio Martinez CHIEF OPERATING OFFICER George Pace EVP FUNDRAISING Yaron Ashkenazi HEAD OF HOSPITALITY John Hartman CHIEF INVESTMENT OFFICER

Independent Board Committed to Strong Corporate Governance 20T H E W E A L T H D E V E L O P M E N T C O M P A N Y • Chris Loeffler – Chief Executive Officer & Co-Founder • Jennifer Schrader – President & Co-Founder • Dan Hansen – Lead Independent Director • William J. Gerber – Director • Michael Trzupek – Director • Lawrence X. Taylor – Director Commitment to Corporate Governance ✓ 5+ year history of public company reporting; Big 4 auditor ✓ Established Board Committees and Charters ✓ Commitment to sustainable business practices Public Company, Asset Management, Real Estate and Public Company Experience Our Directors

2Q 2024 Financial Highlights 21T H E W E A L T H D E V E L O P M E N T C O M P A N Y

2nd Quarter – Summary Highlights 22T H E W E A L T H D E V E L O P M E N T C O M P A N Y Financial Measures Metrics Corporate • Fair value assets under management of $773.2 million • Managed capital of $469.8 million • Total revenues of $8.2 million • Platform revenue of $4.2 million, primarily driven by an increase in asset management revenue • Net loss attributable to Caliber of $4.7 million, or $0.22 per diluted share • Caliber Adjusted EBITDA loss of $2.5 million • On April 29, 2024, Caliber announced the sale of Areas B and C of The Ridge development, each approximately 20-acre parcels of land in Johnstown, CO, for an aggregate $12.3 million. • On May 1, 2024, Caliber closed on the capitalization of Phase 1 of the Company’s SP10 project, which includes the conversion of an existing hotel to apartments along with the development of new townhomes surrounding the site, producing 188 units in total. Demolition is nearly complete, and construction is expected to begin in the third quarter 2024. • On May 7, 2024, Caliber announced the sale of an approximately 50-acre parcel of land in Johnstown, CO to the Archdiocese of Denver for $7.7 million. • In May 2024, the Caliber Hospitality Trust (CHT) received a $10 million investment into its Series D preferred equity. This investment nearly doubles the current total of preferred equity invested into CHT and will help advance the business plans of Caliber and CHT. • On June 25, 2024, Caliber completed construction on Jordan’s Lofts, a 48-unit Class A multifamily property in Downtown Bryan, Texas. 96% of the residential units are leased and the building also features 6,500 square feet of retail space on the ground floor, which is seeking tenants. • As of June 30, 2024, Caliber was actively developing 1,940 multifamily units, 1,942 single family units, 2.6 million square feet of commercial and industrial, and 0.8 million square feet of office and retail.

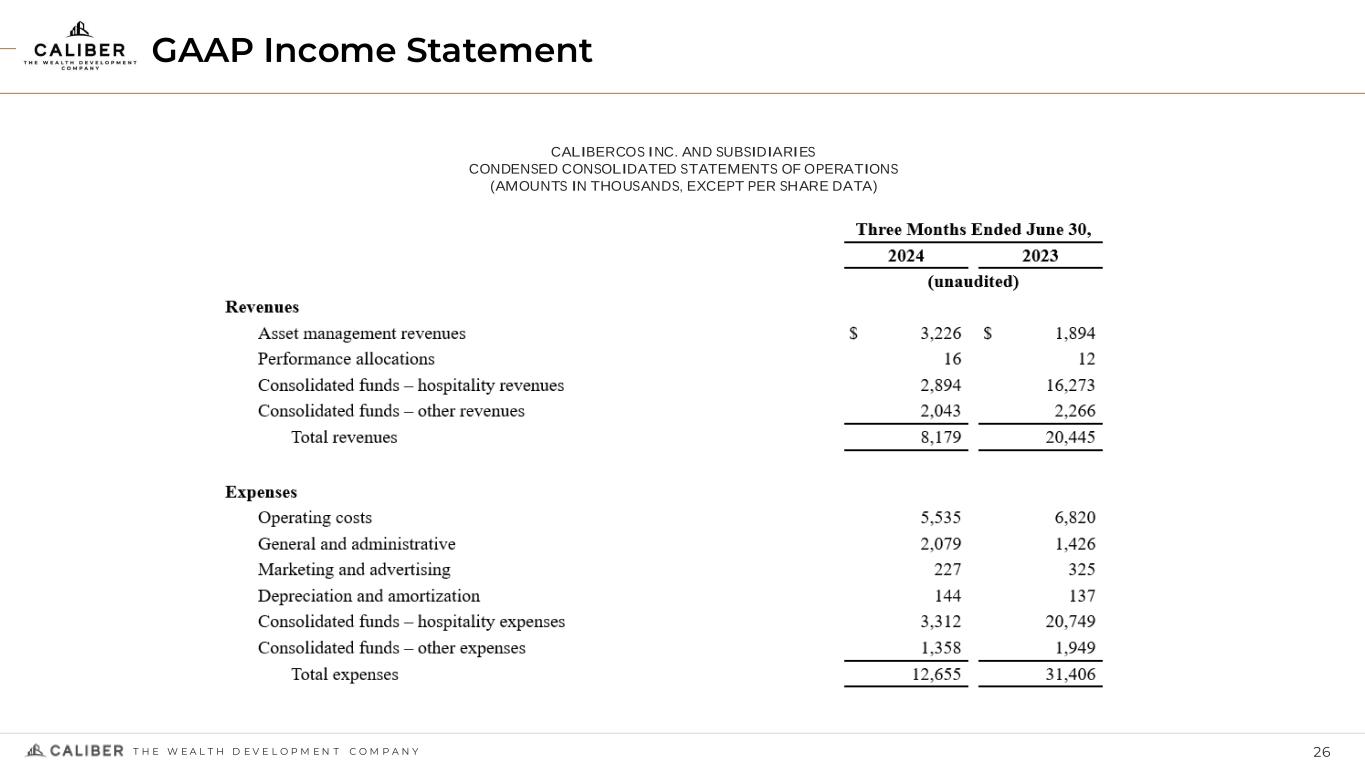

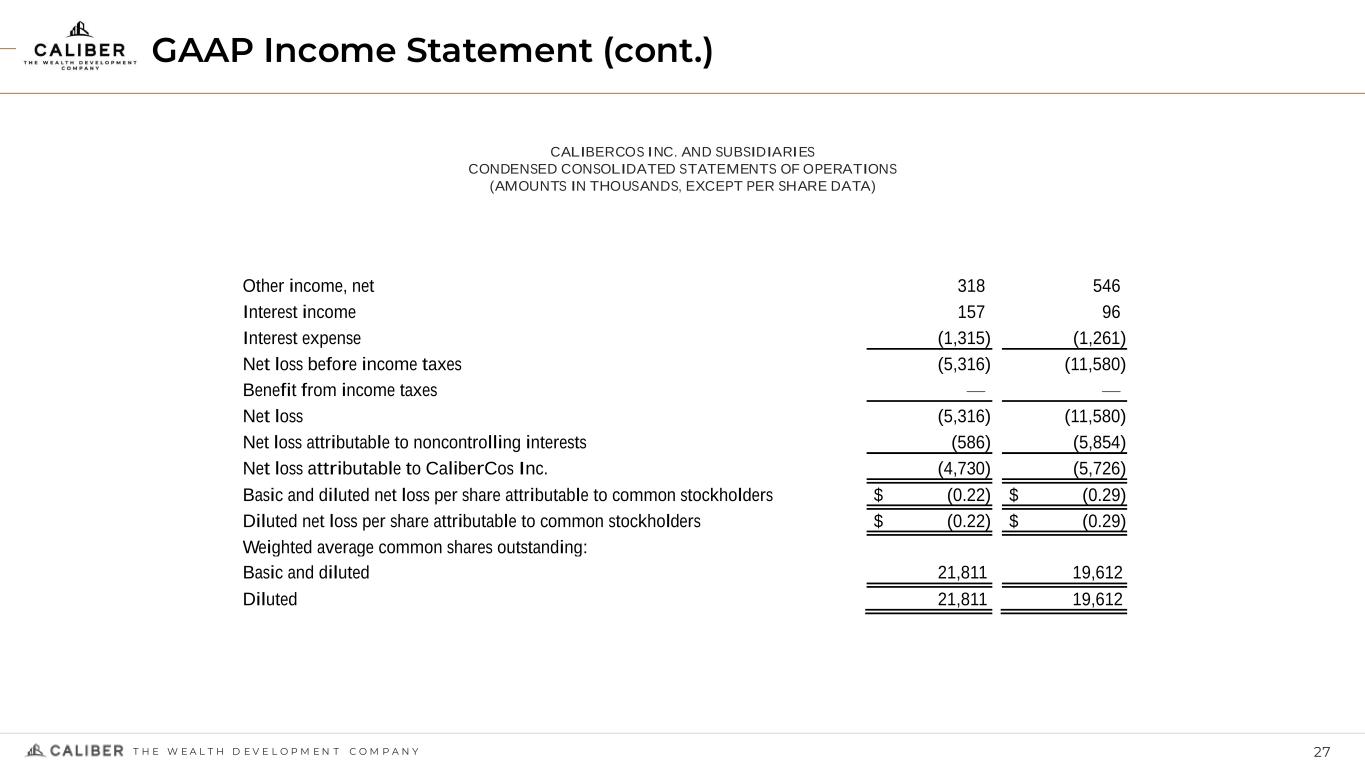

$20,445 $8,179 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 Q2'23 Q2'24 (0 0 0 s) Total Consolidated Revenue* 2nd Quarter Summary Results 23T H E W E A L T H D E V E L O P M E N T C O M P A N Y Source: Caliber reports Net Income (Loss) (per common share) $(0.22) Q2’23 $(0.29) Q2’24 $3,372 $4,212 $- $2,000 $4,000 $6,000 $8,000 $10,000 Q2'23 Q2'24 (0 0 0 s) Total Platform Revenue Asset Mgmt Fees Performance Allocations Caliber Adj. EBITDA (Loss) (000’s) $(2,451) Q2’23 $(2,327) Q2’24 *As previously communicated, Caliber has simplified the presentation of its financial performance by deconsolidating certain assets from the Company’s financials. As a result, the year-over-year comparisons of Caliber’s GAAP financial performance are not meaningful.

2nd Quarter – Historical Summary Results 24T H E W E A L T H D E V E L O P M E N T C O M P A N Y $349 $383 $392 $402 $412 $438 $454 $470 $- $100 $200 $300 $400 $500 $600 $700 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 (0 0 0 ,0 0 0 s) Managed Capital $5,659 $(1,766) $1,034 $(2,327) $(1,511) $1,553 $(1,669) $(2,451) $(3,000) $(2,000) $(1,000) $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 (0 0 0 s) Adjusted EBITDA $8,399 $5,422 $6,350 $3,373 $3,728 $7,187 $4,726 $4,212 $- $2,000 $4,000 $6,000 $8,000 $10,000 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 (0 0 0 s) Total Platform Revenue Asset Mgmt Performance $686 $746 $807 $825 $823 $741 $767 $773 $- $100 $200 $300 $400 $500 $600 $700 $800 $900 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 (0 0 0 s) FV AUM

2Q 2024 Financial Review 25T H E W E A L T H D E V E L O P M E N T C O M P A N Y

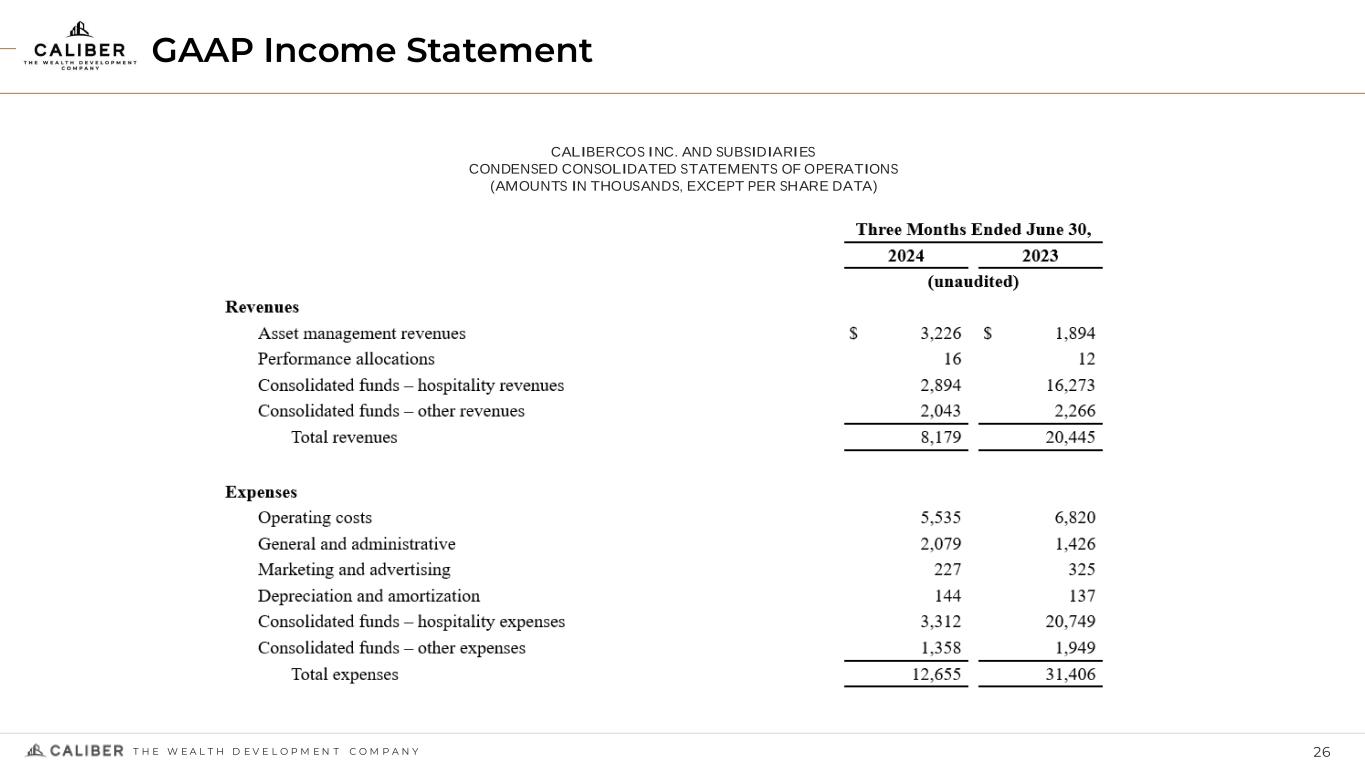

GAAP Income Statement 26T H E W E A L T H D E V E L O P M E N T C O M P A N Y CALIBERCOS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (AMOUNTS IN THOUSANDS, EXCEPT PER SHARE DATA)

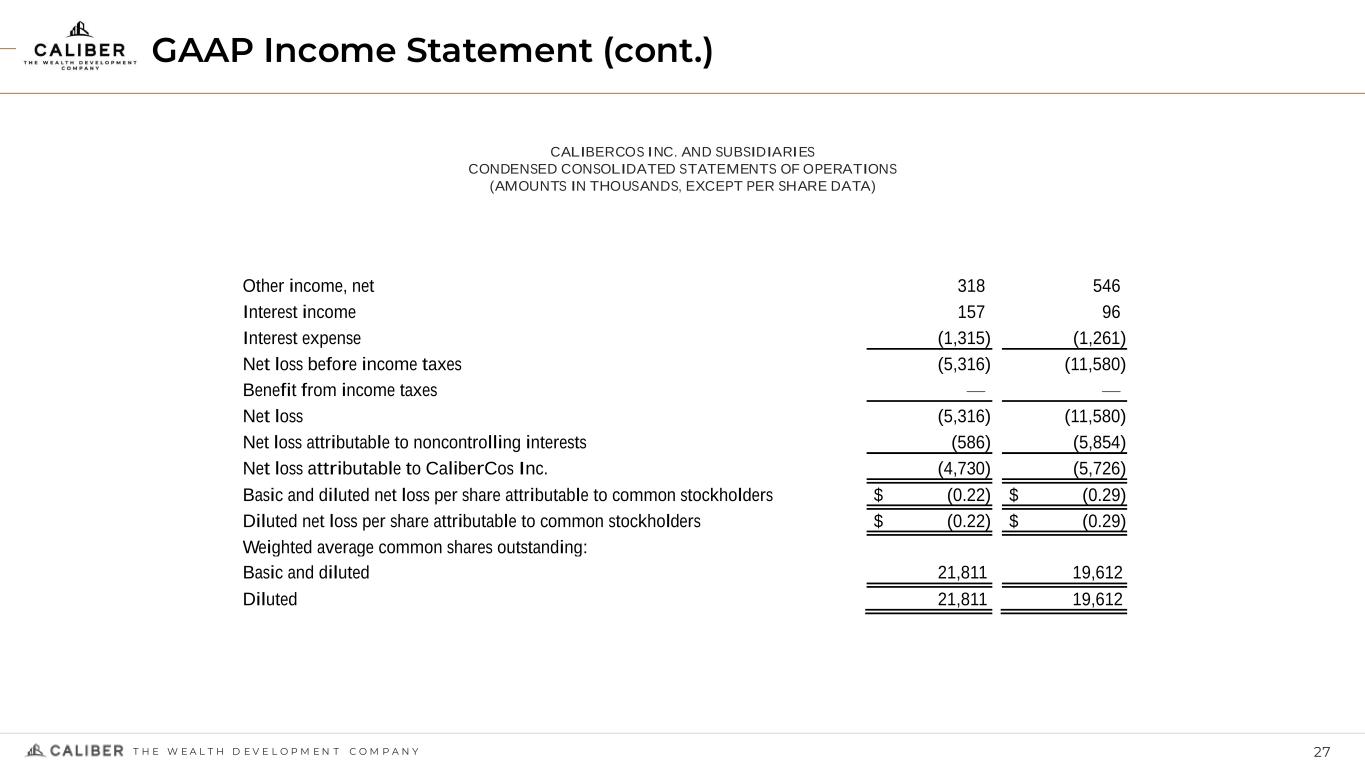

GAAP Income Statement (cont.) 27T H E W E A L T H D E V E L O P M E N T C O M P A N Y CALIBERCOS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (AMOUNTS IN THOUSANDS, EXCEPT PER SHARE DATA) Other income, net 318 546 Interest income 157 96 Interest expense (1,315) (1,261) Net loss before income taxes (5,316) (11,580) Benefit from income taxes — — Net loss (5,316) (11,580) Net loss attributable to noncontrolling interests (586) (5,854) Net loss attributable to CaliberCos Inc. (4,730) (5,726) Basic and diluted net loss per share attributable to common stockholders $ (0.22) $ (0.29) Diluted net loss per share attributable to common stockholders $ (0.22) $ (0.29) Weighted average common shares outstanding: Basic and diluted 21,811 19,612 Diluted 21,811 19,612

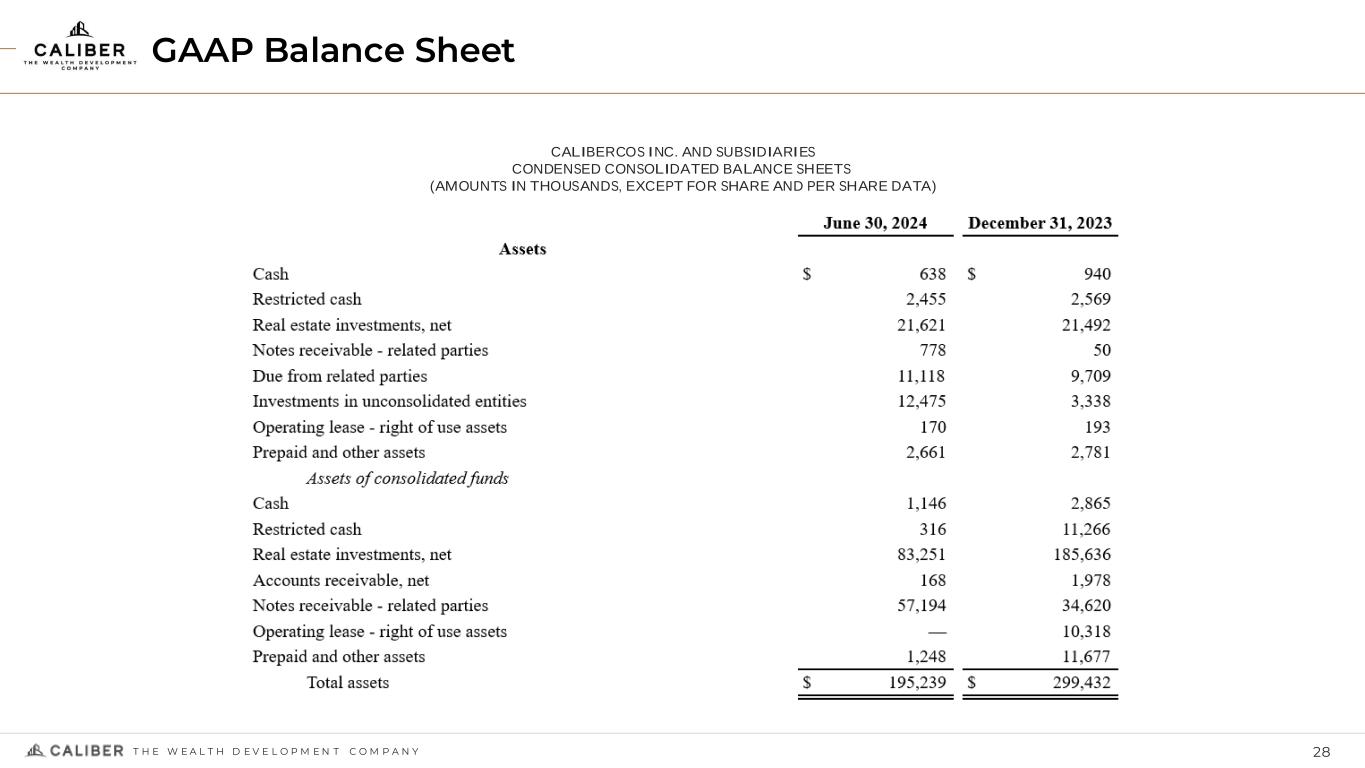

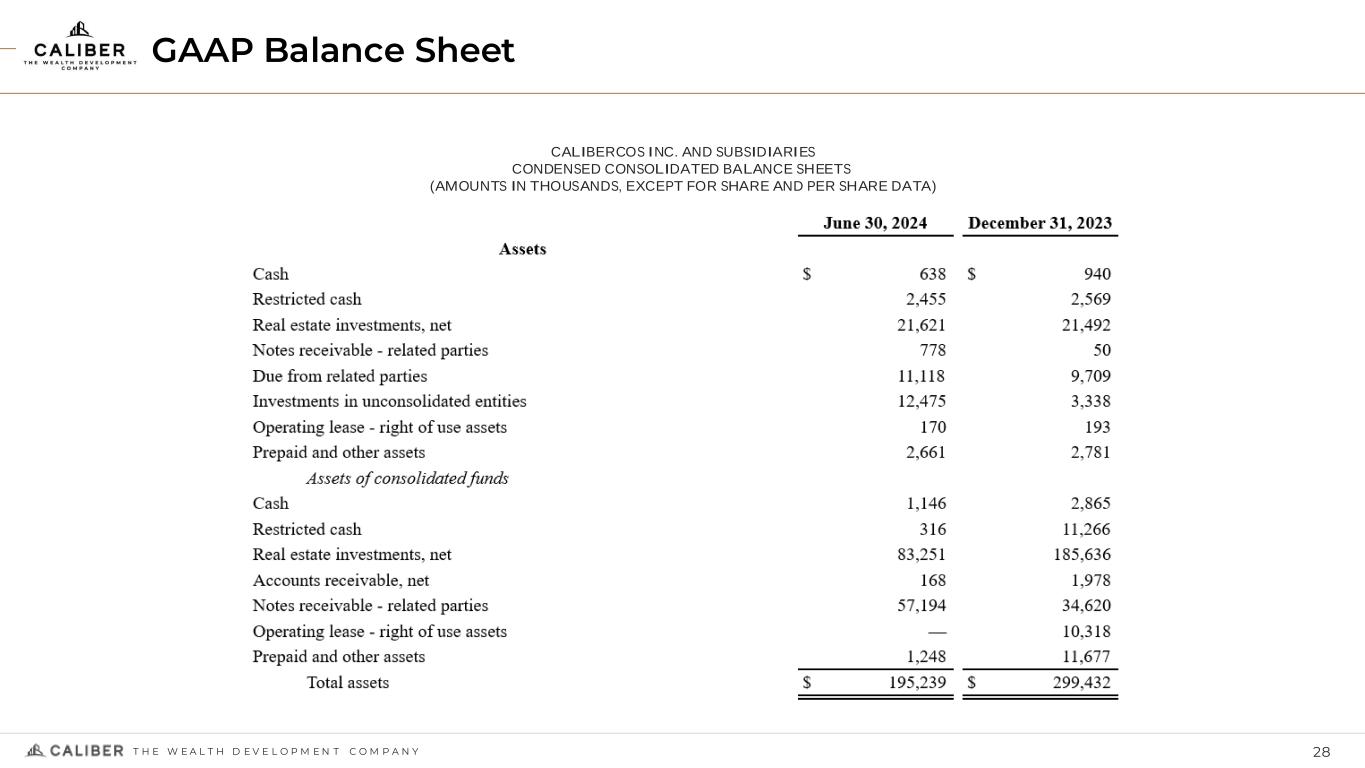

GAAP Balance Sheet 28T H E W E A L T H D E V E L O P M E N T C O M P A N Y CALIBERCOS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (AMOUNTS IN THOUSANDS, EXCEPT FOR SHARE AND PER SHARE DATA)

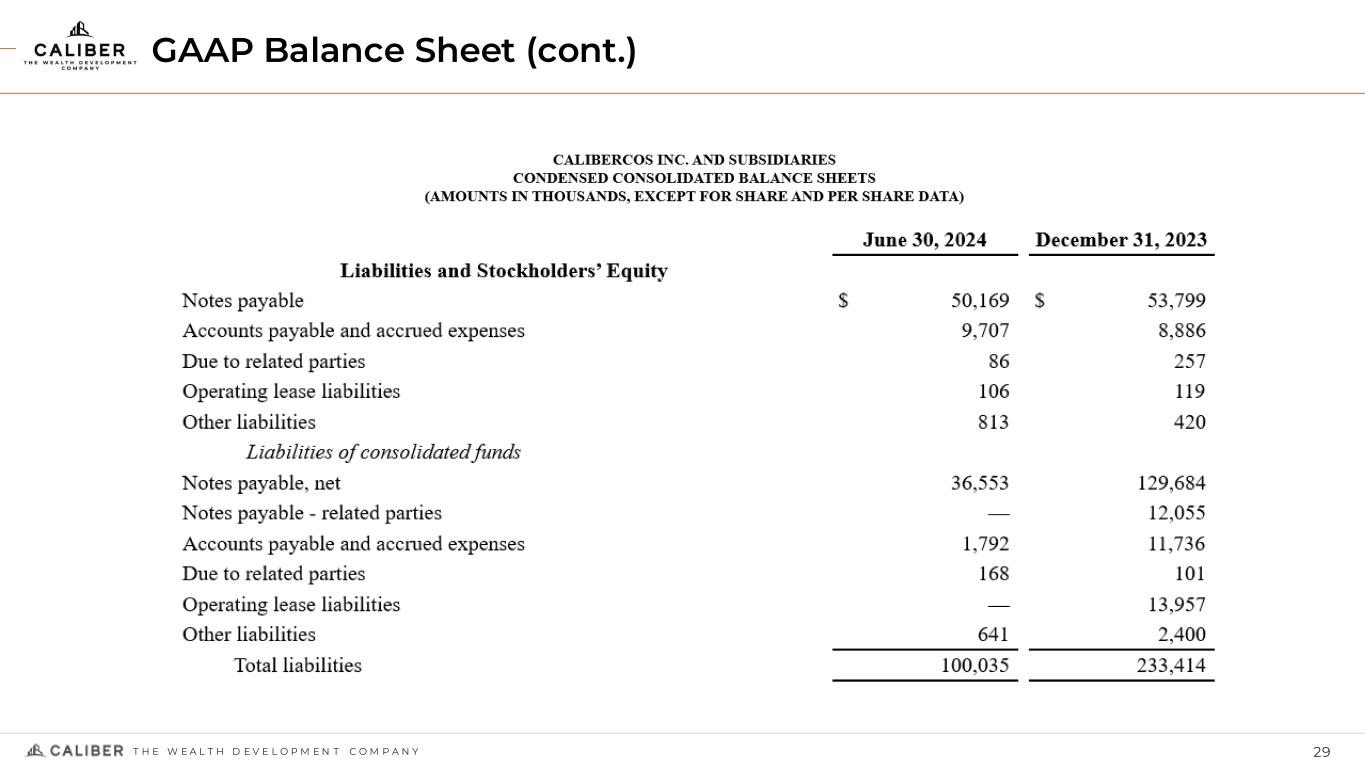

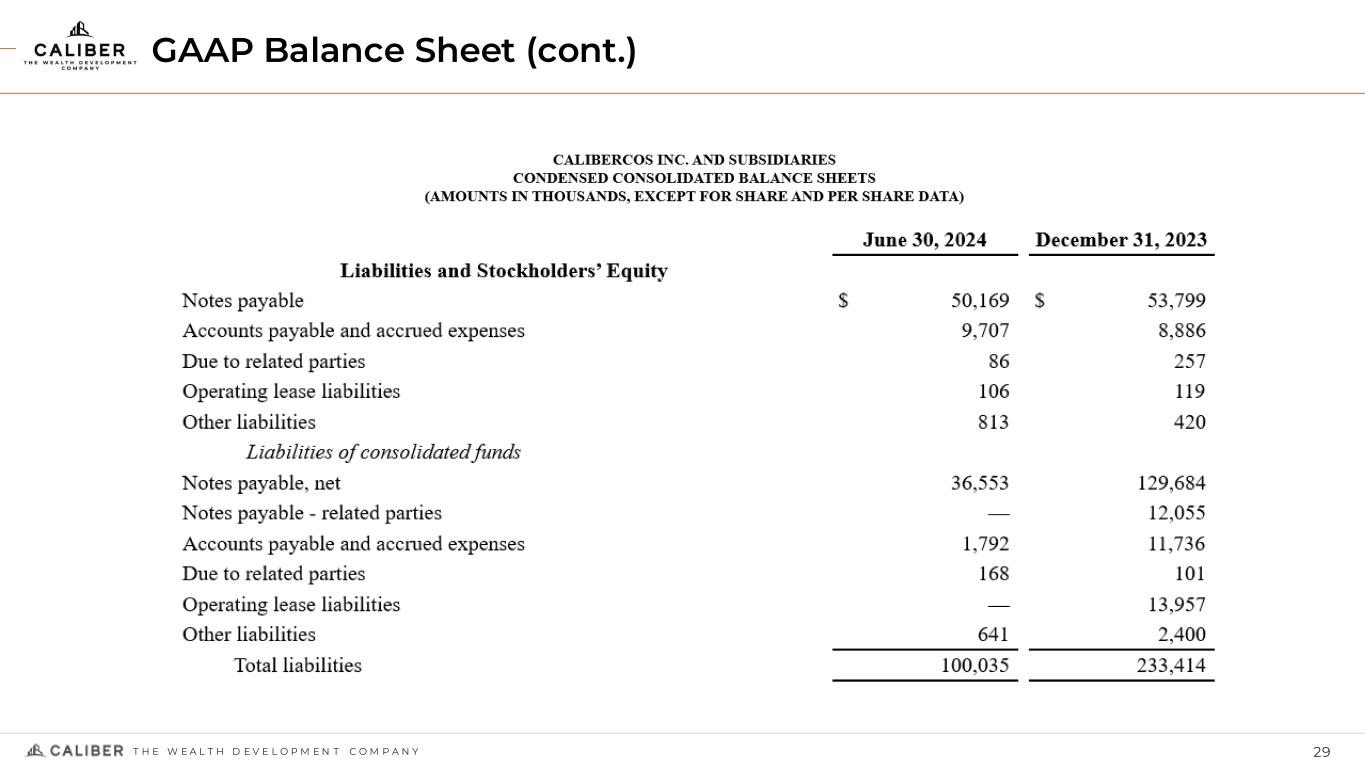

GAAP Balance Sheet (cont.) 29T H E W E A L T H D E V E L O P M E N T C O M P A N Y

GAAP Balance Sheet (cont.) 30T H E W E A L T H D E V E L O P M E N T C O M P A N Y CALIBERCOS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (AMOUNTS IN THOUSANDS, EXCEPT FOR SHARE AND PER SHARE DATA) Commitments and Contingencies Common stock Class A, $0.001 par value; 100,000,000 shares authorized, 14,628,638 and 13,872,671 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively 15 14 Common stock Class B, $0.001 par value; 15,000,000 shares authorized, 7,416,414 shares issued and outstanding as June 30, 2024 and December 31, 2023 7 7 Paid-in capital 40,599 39,432 Accumulated deficit (45,365) (36,830) Stockholders’ equity (deficit) attributable to CaliberCos Inc. (4,744) 2,623 Stockholders’ equity attributable to noncontrolling interests 99,948 63,395 Total stockholders’ equity 95,204 66,018 Total liabilities and stockholders’ equity $ 195,239 $ 299,432

https://www.caliberco.com/ CaliberCos NASDAQ: CWD Contacts: Chris Loeffler, CEO Chris.Loeffler@CaliberCo.com Lisa Fortuna, Investor Relations, Financial Profiles lfortuna@finprofiles.com

Appendix 32T H E W E A L T H D E V E L O P M E N T C O M P A N Y

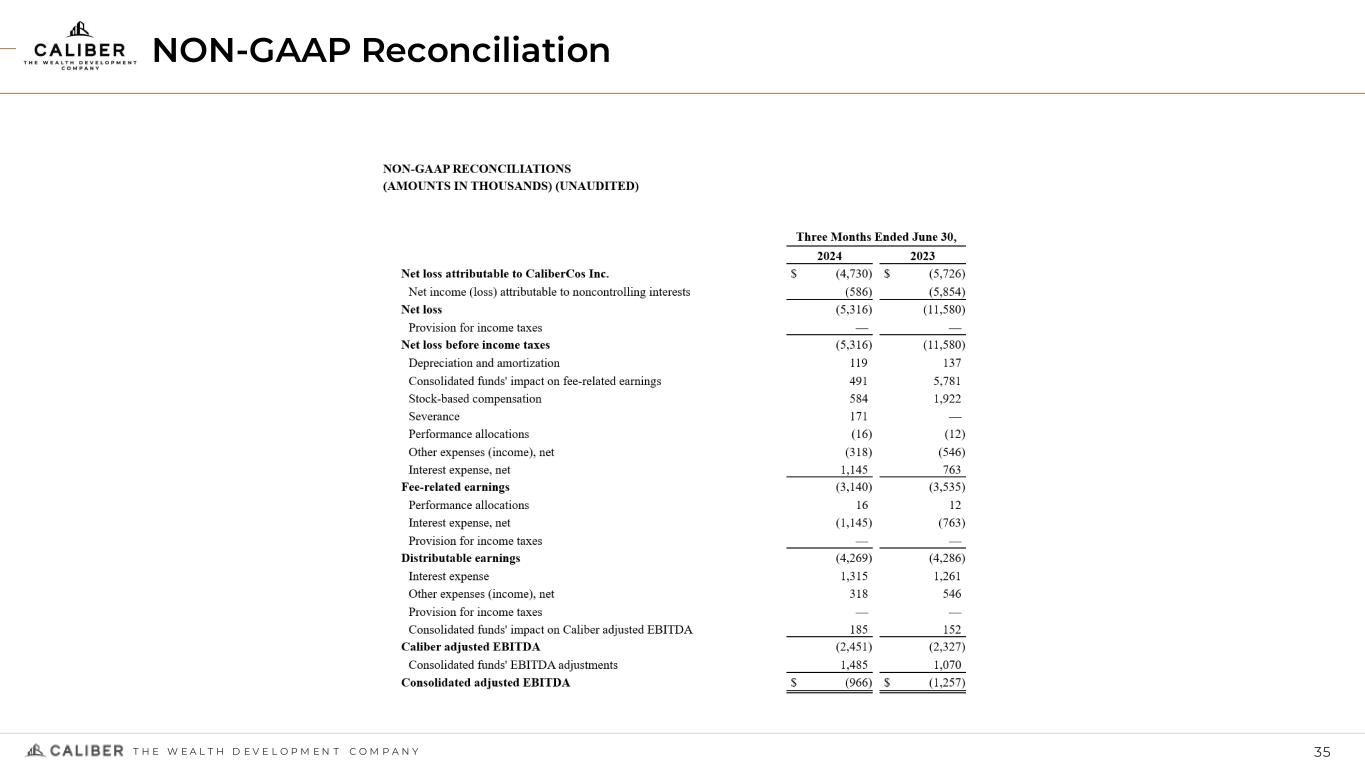

33T H E W E A L T H D E V E L O P M E N T C O M P A N Y Non-GAAP Measures We use non-GAAP financial measures to evaluate operating performance, identify trends, formulate financial projections, make strategic decisions, and for other discretionary purposes. We believe that these measures enhance the understanding of ongoing operations and comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they provides investors a view of the performance attributable to CaliberCos Inc. When analyzing our operating performance, investors should use these measures in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. Our presentation of non- GAAP measures may not be comparable to similarly identified measures of other companies because not all companies use the same calculations. These measures may also differ from the amounts calculated under similarly titled definitions in our debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments. Fee-Related Earnings and Related Components Fee-Related Earnings is a supplemental non-GAAP performance measure used to assess our ability to generate profits from fee-based revenues, focusing on whether our core revenue streams, are sufficient to cover our core operating expenses. Fee-Related Earnings represents the Company’s net income (loss) before income taxes adjusted to exclude depreciation and amortization, stock-based compensation, interest expense and extraordinary or non-recurring revenue and expenses, including performance allocation revenue and gain (loss) on extinguishment of debt, public registration direct costs related to aborted or delayed offerings and our Reg A+ offering, the share repurchase costs related to the Company’s Buyback Program, litigation settlements, and expenses recorded to earnings relating to investment deals which were abandoned or closed. Fee-Related Earnings is presented on a basis that deconsolidates our consolidated funds (intercompany eliminations) and eliminates noncontrolling interest. Eliminating the impact of consolidated funds and noncontrolling interest provides investors a view of the performance attributable to CaliberCos Inc. and is consistent with performance models and analysis used by management. Distributable Earnings Distributable Earnings is a supplemental non-GAAP performance measure equal to Fee-Related Earnings plus performance allocation revenue and less interest expenses and provision for income taxes. We believe that Distributable Earnings can be useful as a supplemental performance measure to our GAAP results assessing the amount of earnings available for distribution. Caliber Adjusted EBITDA Caliber Adjusted EBITDA represents the Company’s Distributable Earnings adjusted for interest expense, the share repurchase costs related to the Company’s Buyback Program, other income (expense), and provision for income taxes on a basis that deconsolidates our consolidated funds (intercompany eliminations), Loss on CRAF Investment Redemption, Gain on extinguishment of Payroll Protection Program loans, and eliminates noncontrolling interest. Eliminating the impact of consolidated funds and noncontrolling interest provides investors a view of the performance attributable to CaliberCos Inc. and is consistent with performance models and analysis used by management. NON-GAAP Measures

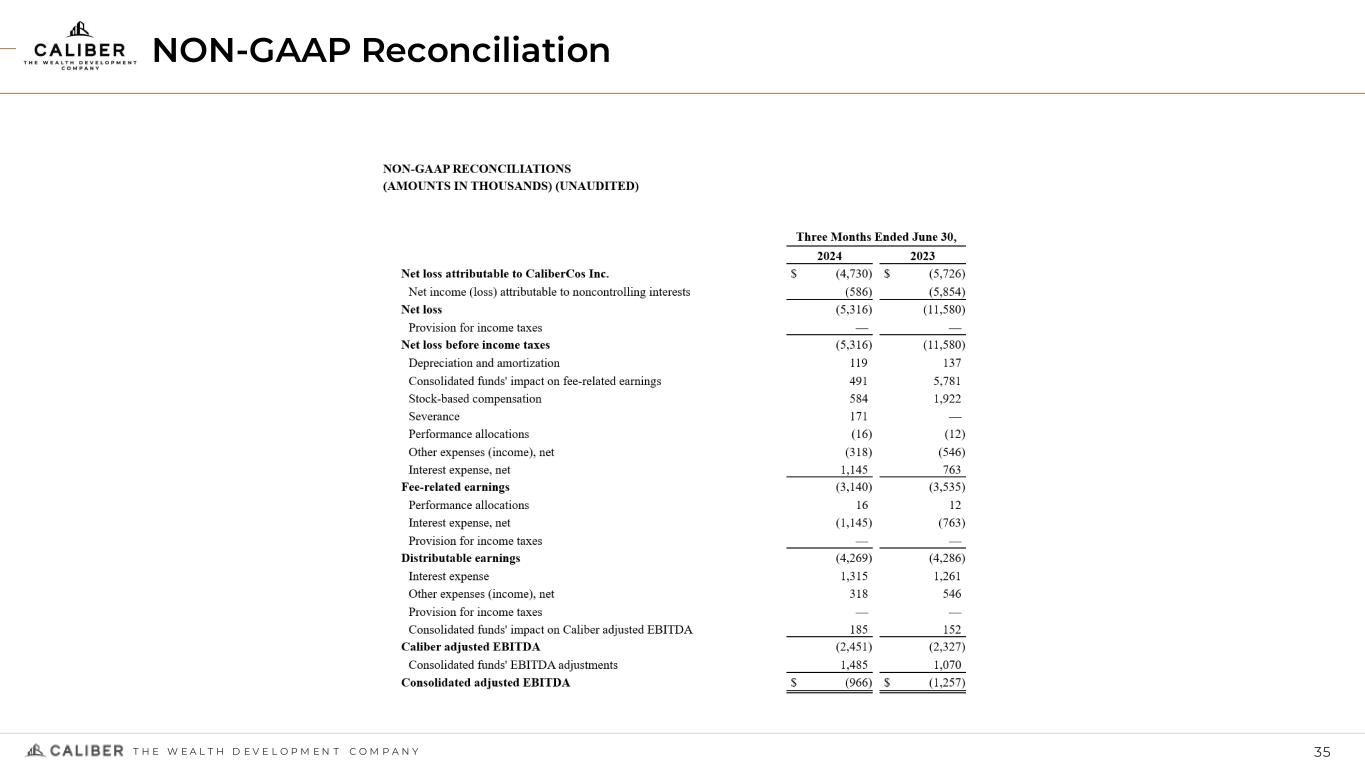

34T H E W E A L T H D E V E L O P M E N T C O M P A N Y Consolidated Adjusted EBITDA Consolidated Adjusted EBITDA represents the Company’s and the consolidated funds’ earnings before net interest expense, income taxes, depreciation and amortization, further adjusted to exclude stock-based compensation, transaction fees, expenses and other public registration direct costs related to aborted or delayed offerings and our Reg A+ offering, the share repurchase costs related to the Company’s Buyback Program, litigation settlements, expenses recorded to earnings relating to investment deals which were abandoned or closed, any other non-cash expenses or losses, as further adjusted for extraordinary or non-recurring items. The following tables presents a reconciliation of net (loss) income attributable to CaliberCos Inc. to Fee-Related Earnings, Distributable Earnings, Caliber Adjusted EBITDA, and Consolidated Adjusted EBITDA for the quarters ended June 30, 2024, and 2023 (in thousands): NON-GAAP Measures

NON-GAAP Reconciliation 35T H E W E A L T H D E V E L O P M E N T C O M P A N Y

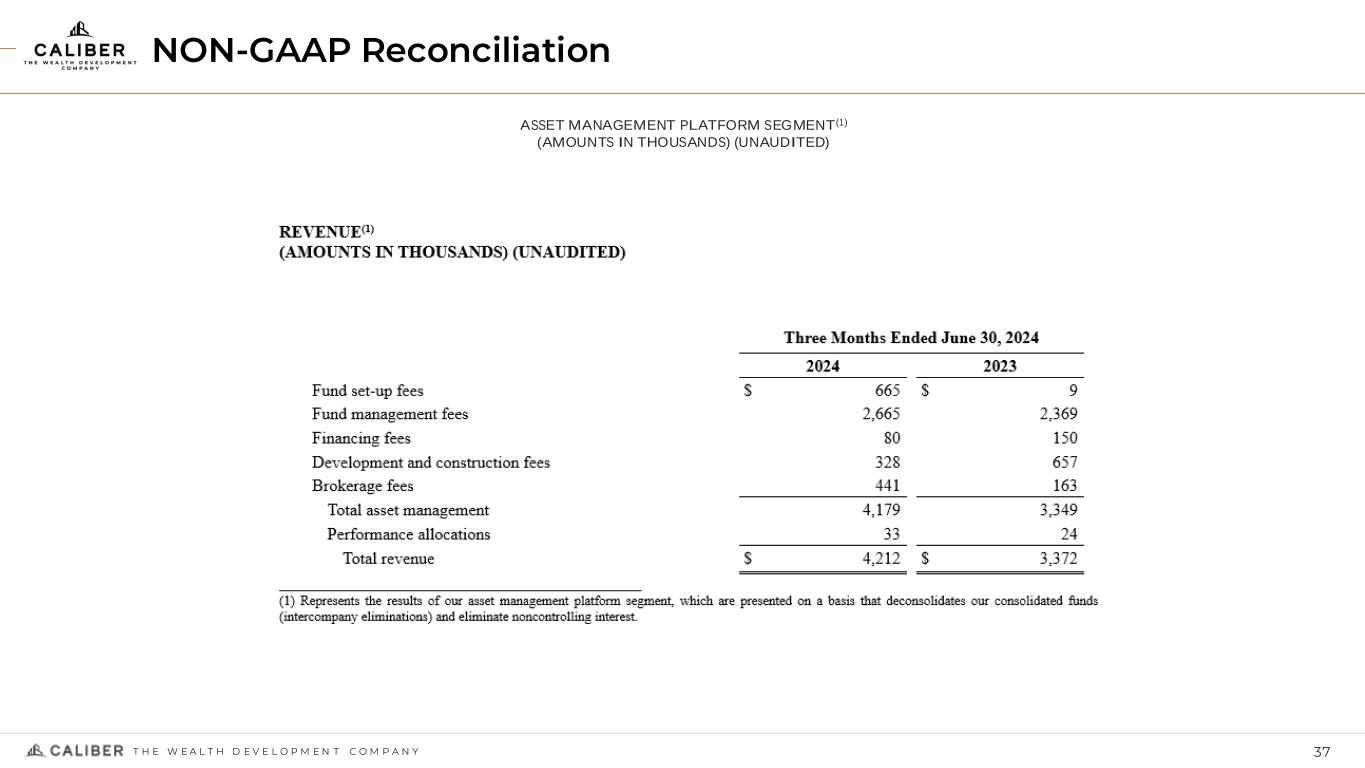

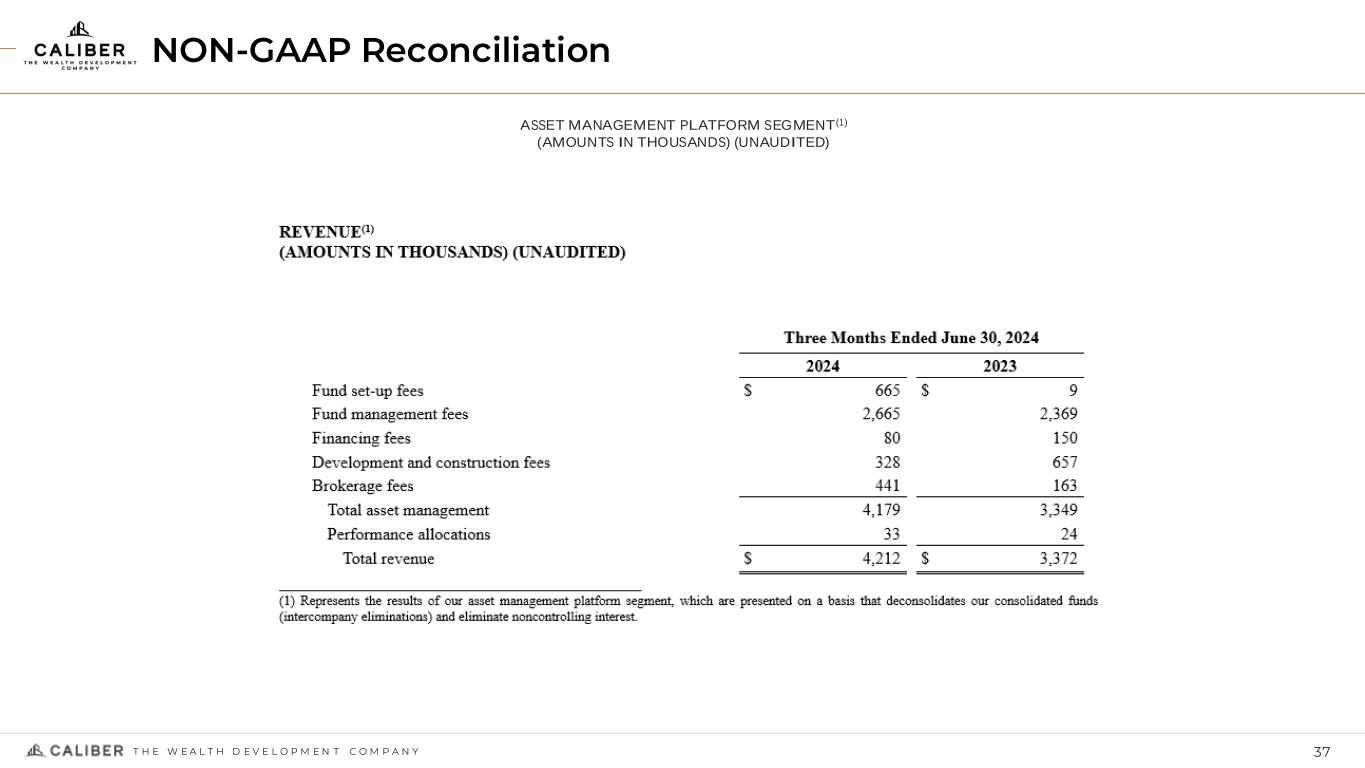

NON-GAAP Reconciliation 36T H E W E A L T H D E V E L O P M E N T C O M P A N Y ASSET MANAGEMENT PLATFORM SEGMENT(1) (AMOUNTS IN THOUSANDS) (UNAUDITED)

NON-GAAP Reconciliation 37T H E W E A L T H D E V E L O P M E N T C O M P A N Y ASSET MANAGEMENT PLATFORM SEGMENT(1) (AMOUNTS IN THOUSANDS) (UNAUDITED)

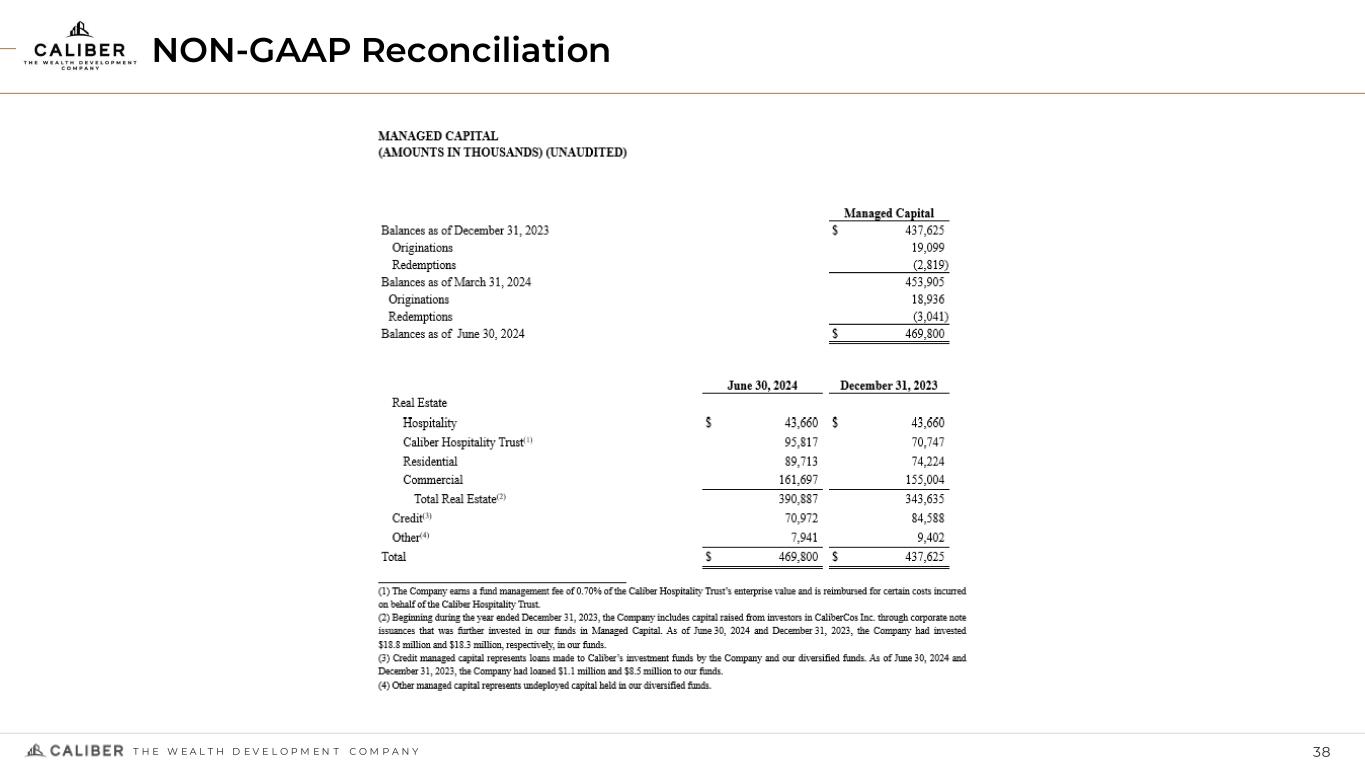

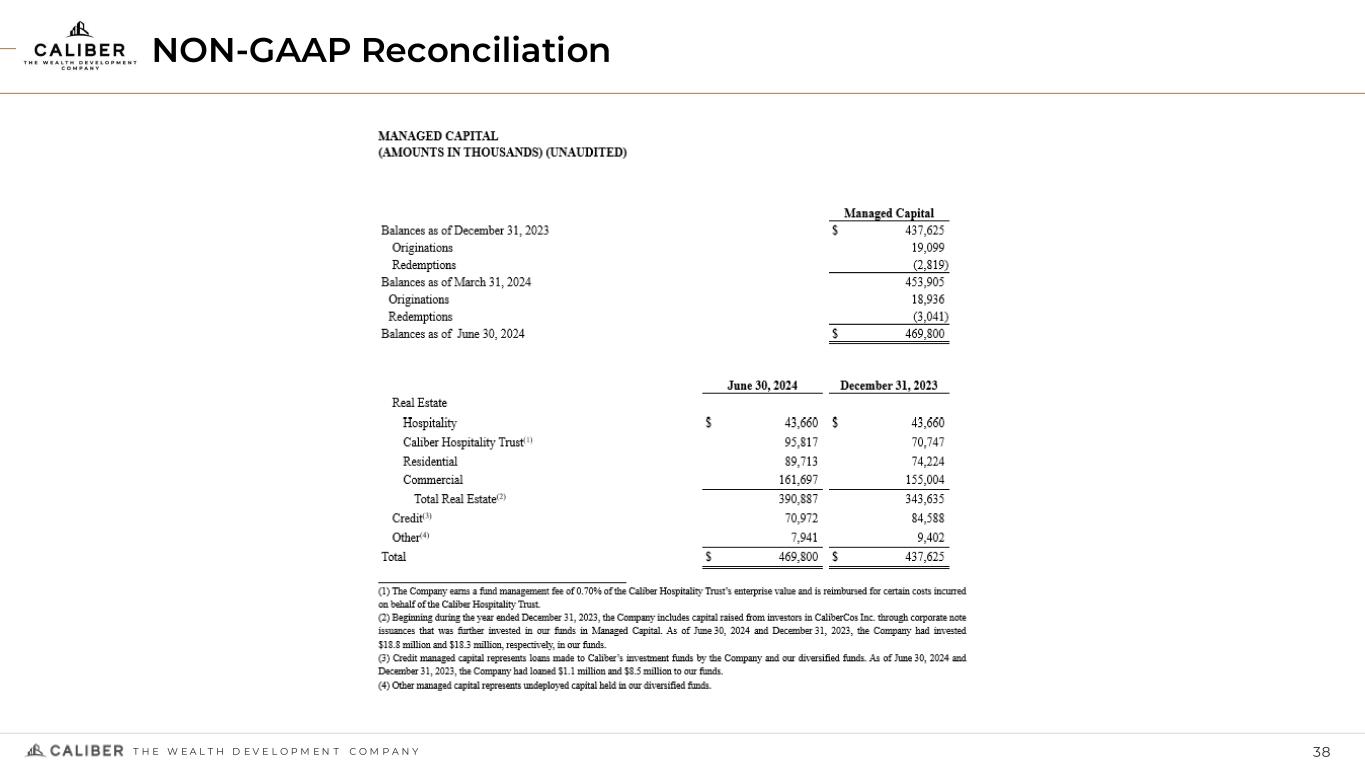

NON-GAAP Reconciliation 38T H E W E A L T H D E V E L O P M E N T C O M P A N Y

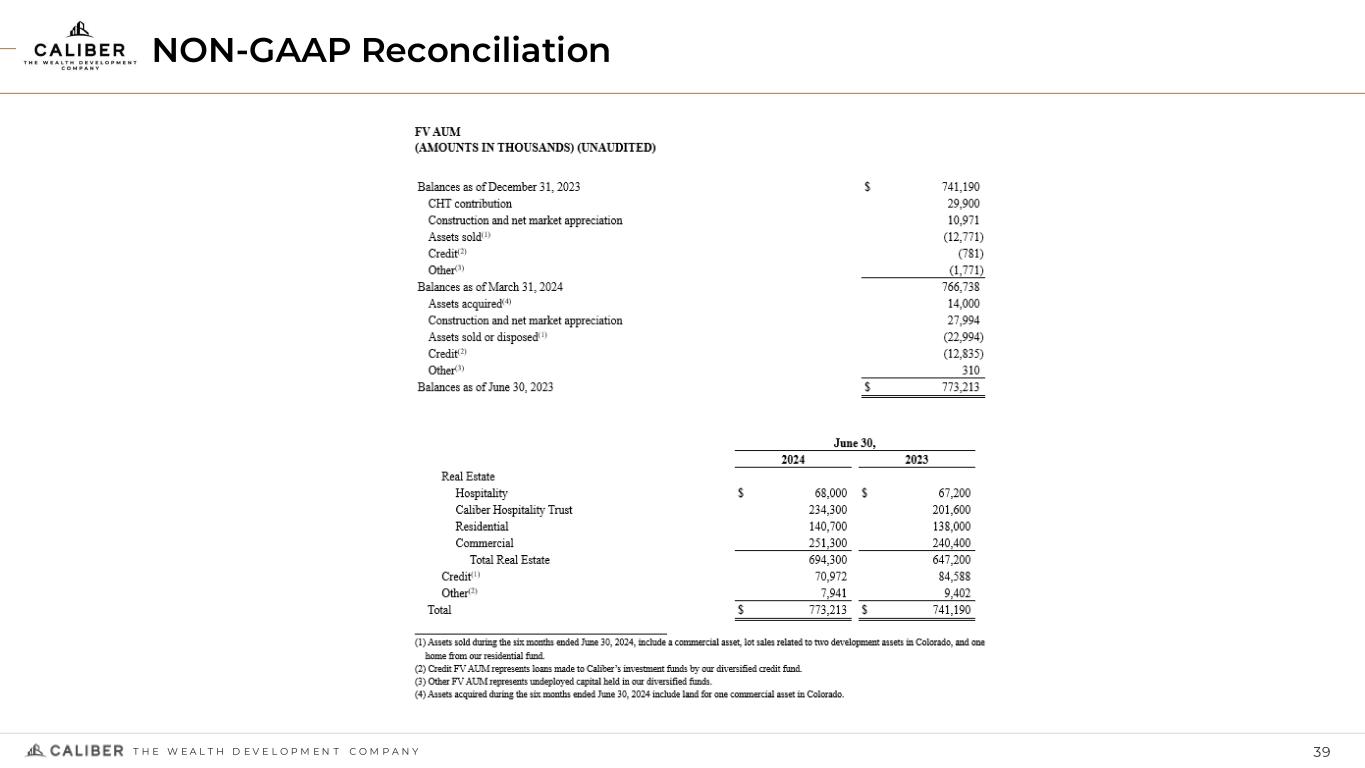

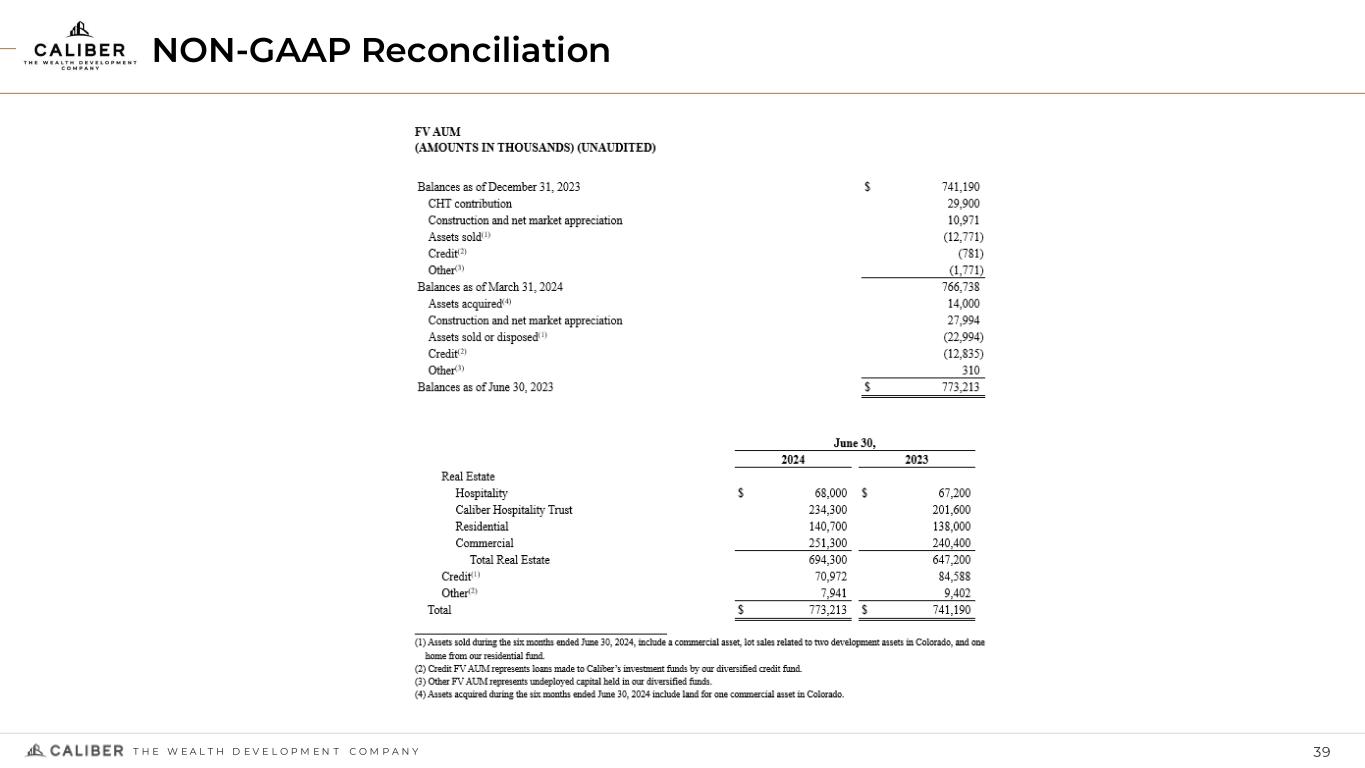

NON-GAAP Reconciliation 39T H E W E A L T H D E V E L O P M E N T C O M P A N Y