Q3 2022 Shareholder Letter

Dear Shareholders As we close the third quarter of 2022, Upwork has clear indicators that both our business and our value proposition continue to be critical to customers in times of economic uncertainty. Revenue grew 24% year-over-year to $158.6 million, Gross Services Volume (GSV) grew 14% year-over-year to exceed $11 billion in the quarter once again, GAAP net loss was $(24.8) million, and adjusted EBITDA was $(2.9) million. We are focused on making prudent and sustainable investments in our business to drive steady, durable growth, even against a backdrop of challenging macroeconomic conditions. Importantly, our customers continue to count on us to enable their critical work and their businesses during these uncertain times. Upwork has both pioneered and benefited from the major paradigm shifts around remote work and hybrid workforces—fundamental changes that have shaped the new reality of work as we know it today. This sea change is illustrated by the fact that one-fourth of American workers are now working remote-first or mostly remote, while 71% of companies expect remote work to be part of their standard operations moving forward . This new work reality opens up a2 vast opportunity for Upwork to introduce ourselves to the 90% or more of companies and hiring managers who have not been aware of or considered Upwork and to bring them into the fold as customers. Nowhere has that opportunity been more apparent and central to our priorities than the late-September launch of our new brand campaign, “This Is How We Work Now.” Appearing across TV, online video, streaming audio, digital, and social media, the campaign reinforces Upwork’s belief that work should unleash human potential instead of limit it and emphasizes that now is the time to embrace the new ways of working that have emerged over the past few years. It targets mainstream prospects—clients and talent alike—who largely aren’t yet aware of Upwork but, like us, recognize that the world of work has changed forever. Our strong business position and resonant value proposition allow us to remain on offense, evident through both our new brand campaign as well as our amplification of benefits most valuable to our clients: flexibility in hiring, expert talent at their fingertips, operational agility, and bottom-line savings. Our solution satisfies the tight budgets that many organizations are implementing amid economic uncertainty—clients find that they can realize cost savings upwards of 50% by using Upwork compared with traditional staffing alternatives. By delivering highly skilled, diverse talent from more than 180 countries affordably and quickly, clients can have greater flexibility with their cost structure and reduce operating costs through talent innovation. As a result, we are helping companies improve their EBITDA and generate value-added growth while maintaining the optionality that has been shown by McKinsey to be vitally important in weathering—or even accelerating during—economic downturns. Notable brands that we welcomed as Enterprise Clients in the quarter include Anheuser-Busch InBev (AB InBev), Constellation Brands, Cushman & Wakefield, iCIMS, and Marriott International. These companies are leveraging our platform to deliver on their business plans; tap new sources of scalable, flexible remote talent; and retain a competitive advantage. 2 According to Upwork Future Workforce Report 2022 data. 1 GSV represents the total amount that clients spend on both our marketplace offerings and our managed services offering as well as additional fees we charge to talent for services. 2

Market makers like these new customers contributed to Enterprise Revenue growing a healthy 41% year-over-year to $12.5 million in the third quarter. Coupled with continued strong growth of clients spending $1 million or more, this underscores how our value proposition resonates with Enterprise Clients. We continue to invest in innovating the work marketplace with the goal of helping clients and talent start work more easily on the Upwork platform and return to Upwork time after time for a consistent and productive experience. Upwork delivers critical and differentiated value not just in matching clients and talent, but also in serving as the hub for seamless “back office” tasks for talent around invoicing and getting paid and, equally, contract management and payment activities for clients. We enhanced these core experiences in the third quarter, debuting improvements to our Contract Workroom that reduce friction and allow clients and talent to manage contracts, navigate all their contract actions, and more easily review weekly billings, earnings, contract terms, and feedback. Additionally, we made enhancements to our Enterprise Suite by enabling multi-approver, team-based approvals that support large-scale and complex workflows and adding more refined search functionality for faster access to our global pool of Expert-Vetted Talent who are ready and pre-approved to work with these companies. Project CatalogTM Consultations—made available across all 90+ categories of work during the third quarter—continue to drive effective connections and collaboration between clients and talent. Enhancements this quarter improve the experience, allowing them to confirm scope, skills required, feasibility, and timeline for a potential project, driving speed in starting work together, which can be 50% faster than on Talent Marketplace. These enhancements also enable customers to establish longer-term relationships that go beyond an initial project engagement. Ultimately, this drives elevated client spend on Project Catalog. In fact, 30-day spend by customers who use Consultations is nearly three times what customers who only purchase on Project Catalog spend. Lastly, thousands of talented professionals on our marketplace are adding profile badges that display and validate their expertise through our budding partnership with Credly, the market leader in digital workforce credentialing, enabling talent and clients to match faster and with more confidence. Equipped with access to a vast supply of talent and job posts and the technological capabilities to engage more effectively and efficiently, clients and talent are together defining the new reality of work, blazing the trail regardless of the economic uncertainty that may persist. To be sure, as we expected since our second-quarter earnings, our customers are not fully immune to that uncertainty, evidenced by the softness we continue to see in some metrics. Nonetheless, revenue impact in the third quarter from these conditions was in line with our previously-shared expectations. We have seen the softer client acquisition and retention trends that we observed in the second quarter stabilize in the third quarter, with the softness continuing to be more pronounced in Europe and with small- and medium-sized businesses. Our Enterprise Land team also saw elongated sales cycles due to the macroeconomic outlook for a handful of accounts. This, plus some operational growing pains, resulted in fewer Enterprise Clients signed in the third quarter than targeted. We are remedying the operational growing pains and believe the Enterprise opportunity remains as attractive as ever for Upwork. Additionally, we continue to manage our own business with discipline. Being prudent with resources has always been a guiding principle at Upwork, and as the economic outlook evolves, we have several measures underway, including evaluating budgets; adjusting hiring timing and prioritizing roles more aggressively; reviewing and reducing vendor spend; and ensuring we have a tight operating cadence around cost management with a high degree of visibility and internal partnership toward our goals. Due to the largely recurring and programmatic nature of the majority of customer activity on our platform, we are able to monitor for changes in behavior as they occur and be nimble in making adjustments to our plans as needed. This gives us further confidence in our ability to 3

manage the business responsibly through a dynamic environment. We still view this period of macroeconomic uncertainty as a critical time for us to be focused on expanding our position as a market leader and cementing new, integral ways of working across the work ecosystem. We see businesses continuing to turn to Upwork as the always-on source for highly skilled remote workers, regardless of their industry, whether their business need is project-based or ongoing, where they stand in their workforce transformation, or the current economic climate. We also know that Upwork fosters a deep, diverse, and highly skilled talent community across the globe. The world’s work marketplace remains the center of gravity for these work and career innovators to build trusted, lasting relationships and get more done together, and we will continue to innovate, evangelize, and scale it in the fourth quarter and beyond. 4

Q3’22 Business Highlights Innovating the Work Marketplace In the third quarter we continued to innovate the work marketplace and execute against our three-pronged product strategy of: 1) making it easy for clients and talent to get started on the Upwork platform, 2) ensuring they have a delightful experience when completing their first job, and 3) establishing Upwork as the place clients and talent come back to again and again for work. We redesigned the Contract Workroom to make it easier for all Upwork users to manage their work agreements. All transactions on the platform will now use this Contract Workroom. When customers now click on an active contract, they will see a refreshed user interface that will help them easily navigate all their contract actions; find their recent files, weekly billings, and earnings; and easily surface their contract terms and feedback, allowing for a much more seamless and streamlined experience. As mentioned earlier, talent on our marketplace have the ability to add profile badges that display and validate their expertise through our partnership with Credly. Credly works with leading organizations that share our focus on unleashing the potential of the workforce via digital credentials. This partnership allows talent to import their Credly certification badges into their Upwork profile, giving them more credibility when clients seek out certain skill sets, as well as enables talent and clients to connect faster and with more confidence. On the heels of Consultations and Project Tiers (that give talent the ability to add a custom title or description to each “tier” of service they offer), Career Innovator: Kate L. Harrison With a bachelor’s degree from Vassar College, a master’s degree from Yale, and a law degree from Pace Law School, Expert-Vetted marketing strategist Kate L. Harrison has a storied career, deep expertise, and unlimited opportunities. Yet Upwork is her favorite place to meet and work with new clients. “I was working with nonprofits and tech companies, doing work I love, but everything was very local,” Kate said. “I saw the opportunity to freelance on Upwork, and it immediately provided me with access to interesting clients all around the country exactly at the moment when they are actively looking for support.” Today, Kate works with a mix of Fortune 500 clients, leading nonprofits, and tech startups through the platform. “I never have to pay for Google Ads. I don’t drive traffic to my website. I just point people to my Upwork profile. It’s great!” she noted. “Another benefit of Upwork is that it has helped me build my own talent bench of specialists who I can bring in as needed to help support my clients. My clients love the end-to-end branding and marketing services we are able to provide—usually at a fraction of the cost of doing things in-house. “A lot of my Upwork project clients turn into long-term relationships. We all love the easy billing and tracking that is baked into the system. The platform makes it all seamless.” 5

which we implemented in the second quarter, we continued to innovate Project Catalog to make it easier for talent and clients to connect. Through upgrades to the platform’s interface, talent can now more clearly highlight and communicate the services they offer through their Project Catalog posts, which allows clients to know exactly what they are ordering and how much it will cost up front. We continued to see strong performance of Consultations in the third quarter, with the average 30-day spend of customers who use Consultations nearly three times that of customers who only buy on Project Catalog.3 We rolled out a new Rate Calculator across Upwork to help first-time talent establish the rates for their work and assist existing talent when thinking about changing their rates. The Rate Calculator allows talent to input monthly expense inputs and the amount of hours talent would like to work every month, to help talent easily calculate the minimum rate they may want to charge their clients. Talent can then compare this rate to the rate of other professionals on Upwork with roughly similar skill sets and services. In addition, we added project management and product management categories to Talent ScoutTM. Talent Scout recruiters are now able to help match clients with the project management or product management professionals they seek by providing a list of qualified talent based on the client’s needs. These product and project managers are pre-vetted and available for jobs of at least 30 days in length. To continue serving Enterprise customers with the powerful tools they need, we made several enhancements throughout the quarter. First, we introduced powerful new search, approval, and reporting and intelligence tools for our Enterprise Suite. Within search, we enhanced functionality to help Enterprise Clients find the top talent they need, when they need it, as smoothly as possible. This enhanced search functionality will help Enterprise Clients find talent with emerging and niche expertise more easily, identify more specific and informative terms for their talent search with help from auto-suggest, and discover talent who are more closely aligned with their Career Innovator: Shantanu Jain “I was in my second semester of my MBA program when COVID hit and we all went home,” said Shantanu Jain, a data analyst based in Indore, India. “It forced me to rethink everything. I borrowed $15 so I could create an Upwork account and send proposals. Four days later, I earned my first $100 project.” Shantanu continued accepting projects on Upwork throughout the pandemic, increasing his earnings and his skill set each time. When graduation finally approached in May 2021, a fintech company offered him an annual salary that was about double the average annual salary for a data analyst in his region. His family considered it a dream job. “I saw an ocean of opportunities with Upwork, and the full-time opportunity to me felt like a small pond. I turned it down. I chose the ocean. It’s now two years later, and I’ve surpassed $100,000 in earnings through Upwork, earning triple the amount that company offered to pay me each year. That was the best $15 I ever spent, as it probably would have taken me nine or 10 years to achieve the same earnings without Upwork.” “Upwork has enabled me and many like me to live our dream. Because of Upwork, I’m able to live close to my parents, rather than 500 kilometers away working for a local company. On top of that, I feel like I am adding value, which provides not just a sense of fulfillment, but drives me to learn and do more and be my best each day.” 3 This is based on the 30 days after the client’s first spend on Project Catalog or a Consultation. 6

needs. Enterprise Clients can now also filter search results for Expert-Vetted Talent, a shortcut to look beyond skill set to include experience and soft skills. As a reminder, Expert-Vetted Talent represents the top 1% of talent within the most in-demand categories on Upwork. They have been pre-screened by Upwork talent managers for both their technical and soft skills. With respect to approvals, Enterprise Clients are now able to set up multi-approver workflows that enable multiple authorized users to sign off on offers before they are sent to freelance professionals. They can now define approval criteria to ensure company policies are being met, set departmental requirements, and help control risk. With team-based approvals, administrators can configure settings differently for each team within a company account. This feature also enables sequential and simultaneous approvals, as well as better visibility into requests through the approvals dashboard. Example of an Enterprise Client’s approval workflow And within reporting and intelligence, we’ve made it even easier for Enterprise Clients to understand how their company is using the platform by introducing new talent characteristics and outcome reporting features. Workplace Innovator: UST Headquartered in Aliso Viejo, Calif., UST is a multinational provider of digital technology. For more than 20 years, UST has worked with the world’s best companies to solve their biggest business challenges. “The total cost of ownership that we've seen with freelancers is unbelievable. It’s anywhere from one-third to one-fifth of the cost of a full-time hire,” said Vinod Kartha, vice president–strategic initiatives at UST. “The thing is, when you have critical projects, when you have a limited budget and you are competing in the same space, your go-to-market is important and predictability is important. And personally, we’ve had zero failures in our use of open talent. I think it's because it’s not just their general expertise we are getting. It’s that they’ve likely solved exactly what we need them to solve a thousand times.” “Now is the time to take the plunge and wake up to the reality check we are experiencing right now. Talent have choices and have made it abundantly clear that they want flexibility, their corner office in the comfort of their home or vacation spot. That’s where the best talent is available. Trying to do more of the same is not going to get you a different result. So take the plunge.” 7

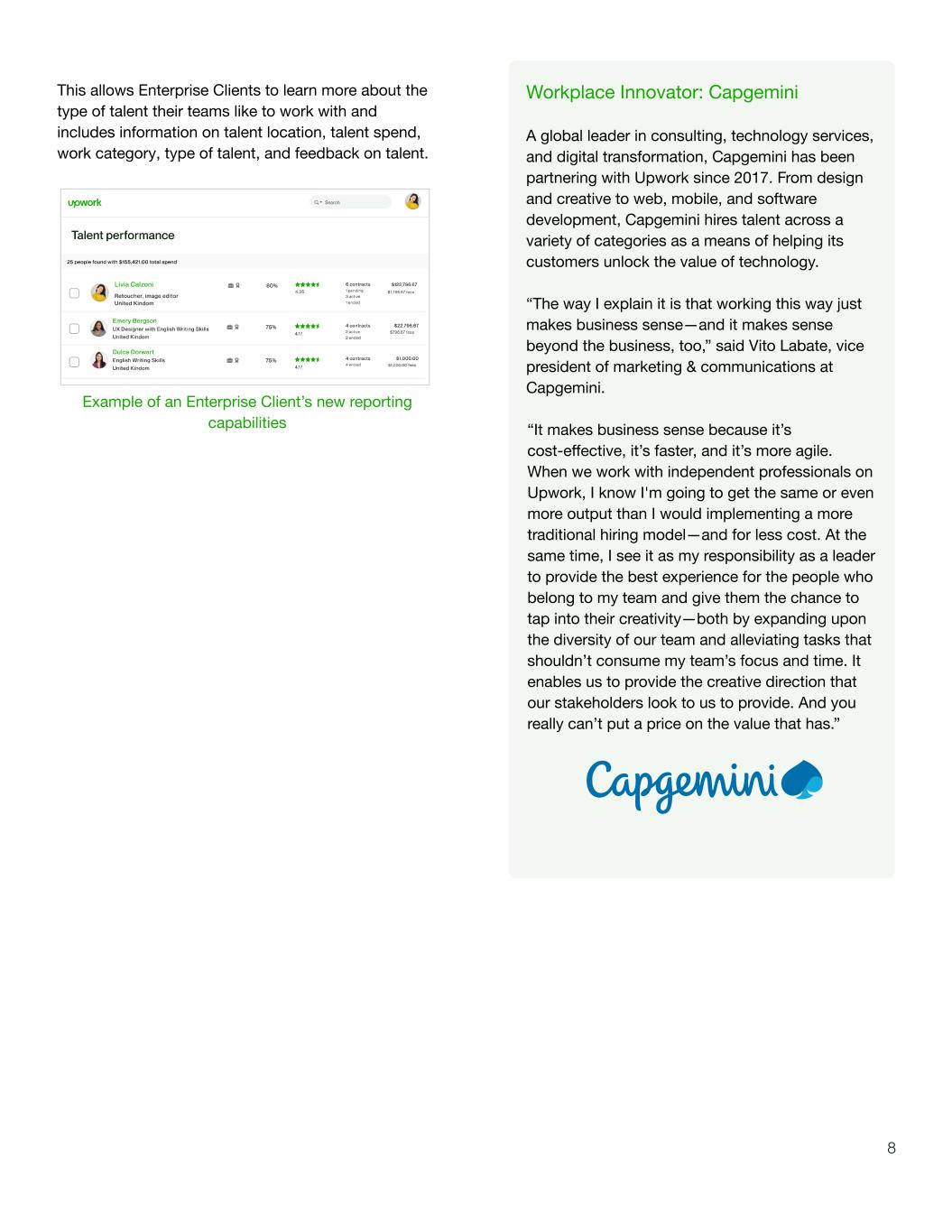

This allows Enterprise Clients to learn more about the type of talent their teams like to work with and includes information on talent location, talent spend, work category, type of talent, and feedback on talent. Example of an Enterprise Client’s new reporting capabilities Workplace Innovator: Capgemini A global leader in consulting, technology services, and digital transformation, Capgemini has been partnering with Upwork since 2017. From design and creative to web, mobile, and software development, Capgemini hires talent across a variety of categories as a means of helping its customers unlock the value of technology. “The way I explain it is that working this way just makes business sense—and it makes sense beyond the business, too,” said Vito Labate, vice president of marketing & communications at Capgemini. “It makes business sense because it’s cost-effective, it’s faster, and it’s more agile. When we work with independent professionals on Upwork, I know I'm going to get the same or even more output than I would implementing a more traditional hiring model—and for less cost. At the same time, I see it as my responsibility as a leader to provide the best experience for the people who belong to my team and give them the chance to tap into their creativity—both by expanding upon the diversity of our team and alleviating tasks that shouldn’t consume my team’s focus and time. It enables us to provide the creative direction that our stakeholders look to us to provide. And you really can’t put a price on the value that has.” 8

Evangelizing the Work Marketplace During the third quarter of 2022, we continued to take important steps in building a robust foundation for turning Upwork into a world-renowned brand. In late September, we launched our new “This Is How We Work Now” brand campaign. It is appearing across TV, online video, streaming audio, digital, and social media and targets mainstream prospects—clients and talent alike—who largely are not yet aware of Upwork but, like us, recognize that the world of work has changed forever. In an effort to break through the noise and significant spend by others in the work category, we are illustrating how the old rules of work are dead. While it is too early to measure the impact the campaign is having on our unaided awareness, early indicators are promising, such as an increase in traffic to the homepage. We invested approximately $19 million in brand marketing during the third quarter and expect a similar level of investment in the fourth quarter of 2022. This continues to be a critical time to educate our target customers and introduce ourselves to the 90% or more of companies and hiring managers who are not aware of or have not considered Upwork. As we have stated previously, it will take several quarters before we can fully measure the return on this investment. Work Without Limits 2022 In August, Upwork convened its sixth annual Work Without Limits Executive Summit, returning to an in-person experience for the first time since the COVID-19 pandemic and supplemented by a virtual livestream. Nearly 100 hand-selected executive decision-makers, from both current customers and prospects, joined us in Chicago for a full day of keynote presentations, panel discussions, and lively networking, with hundreds more tuning into programming online. The audience heard from executives at Johnson & Johnson, Nestlé Health Science, PepsiCo, and others about how their organizations have embraced remote work and hybrid teams consisting of full-time employees and freelancers to supercharge their product and engineering, marketing, HR, operations, and other business-critical efforts. Upwork CEO Hayden Brown, Chief Sales Officer Eric Gilpin, and VP of Client Strategy Tim Sanders, NYU Stern School of Business professor Scott Galloway, and University of Pennsylvania Wharton School professor Jonah Berger gave inspiring keynotes addressing dramatic changes to the way we work, whom we work with, and how the workplace is evolving. Several sessions are available to view on demand here. Attendees enjoyed opportunities to learn from each other’s experiences, connect with Expert-Vetted Talent invited to participate in the summit, and chart the new rules of work by engaging with the team behind the world’s work marketplace. We look forward to furthering the relationships developed at this year’s Work Without Limits event and continuing to build on the momentum in 2023. 9

Scaling the Work Marketplace Within Sales, the Expand team continued its strong progress of growing Enterprise Revenue in the third quarter, highlighting the Enterprise opportunity in front of us. However, the Land team faced some internal operational growing pains and external headwinds that drove lower-than-expected new deals. In spite of this, Enterprise Revenue was $12.5 million in the third quarter of 2022, a 41% year-over-year increase. We also continue to generate strong growth in clients spending $1 million or more. An exciting example of the growth opportunity Enterprise continues to represent is a leading tech company operating in the business-to-consumer space that moved from outside our top five spenders a year ago to become our largest spender, with almost $40 million of spend in the past 12 months. The Land team signed 25 new Enterprise Clients during the third quarter. Our lower-than-expected performance was driven by both internal and external factors. At the top of the funnel, the team saw lower lead volume due to operational growing pains including an email marketing system migration. Externally, sales cycles elongated during the quarter, particularly during the contracting phase, as companies are adopting more internal processes in light of the changing macroeconomic environment. We have already begun taking action on executional improvement regarding these factors. For example, we hired our first VP of Enterprise Marketing, whose responsibilities include enhancing our top-of-funnel marketing efforts. With these changes, we expect to see improvements over the next few quarters. Given our continued confidence in our sales model and the Enterprise opportunity ahead of us, we remain on track to achieve our goal of doubling the size of the Land team from the third quarter of 2021 by the end of this year. Welcome: New Enterprise Clients Upwork welcomed AB InBev, a Fortune Global 500 company and the world’s largest brewer, with familiar brands such as Budweiser, Corona, Natural Light, and Stella Artois, as one of our Enterprise Compliance customers during the third quarter. We are starting this partnership with its internal agency teams across 12 global markets, centered around creative use cases. AB InBev is using Upwork as a critical way to drive toward initiatives such as extending its workforce, globalizing talent, and increasing diversity. We are excited to continue to grow our partnership with AB InBev as its needs for on-demand talent expand across the globe and its need for agility increases in order to stay ahead of the changing workforce. We are equally excited to welcome all 25 of our new Enterprise Clients from the third quarter of 2022, some of which include: 10

Q3’22 Enterprise Sales Performance Enterprise Revenue Enterprise Revenue grew 41% year-over-year to $12.5 million in the third quarter of 2022. We define Enterprise Revenue as revenue from our Upwork Enterprise offering, including all related client fees, subscriptions, and talent service fees. We are seeing meaningful contributions from larger, recently acquired Enterprise cohorts as they grow into their potential as well as more mature cohorts continuing to expand their spend. New Enterprise Clients We signed 25 new Enterprise Clients in the third quarter of 2022, a decrease of (26)% year-over-year. We define an Enterprise Client as a client that has entered into a contract for its use of our Upwork Enterprise offering. Our lower performance for signing new Enterprise Clients was driven by a combination of internal operational growing pains and external sales cycle elongation. The team is remedying those operational growing pains and we expect them to be addressed over the next several quarters. 11

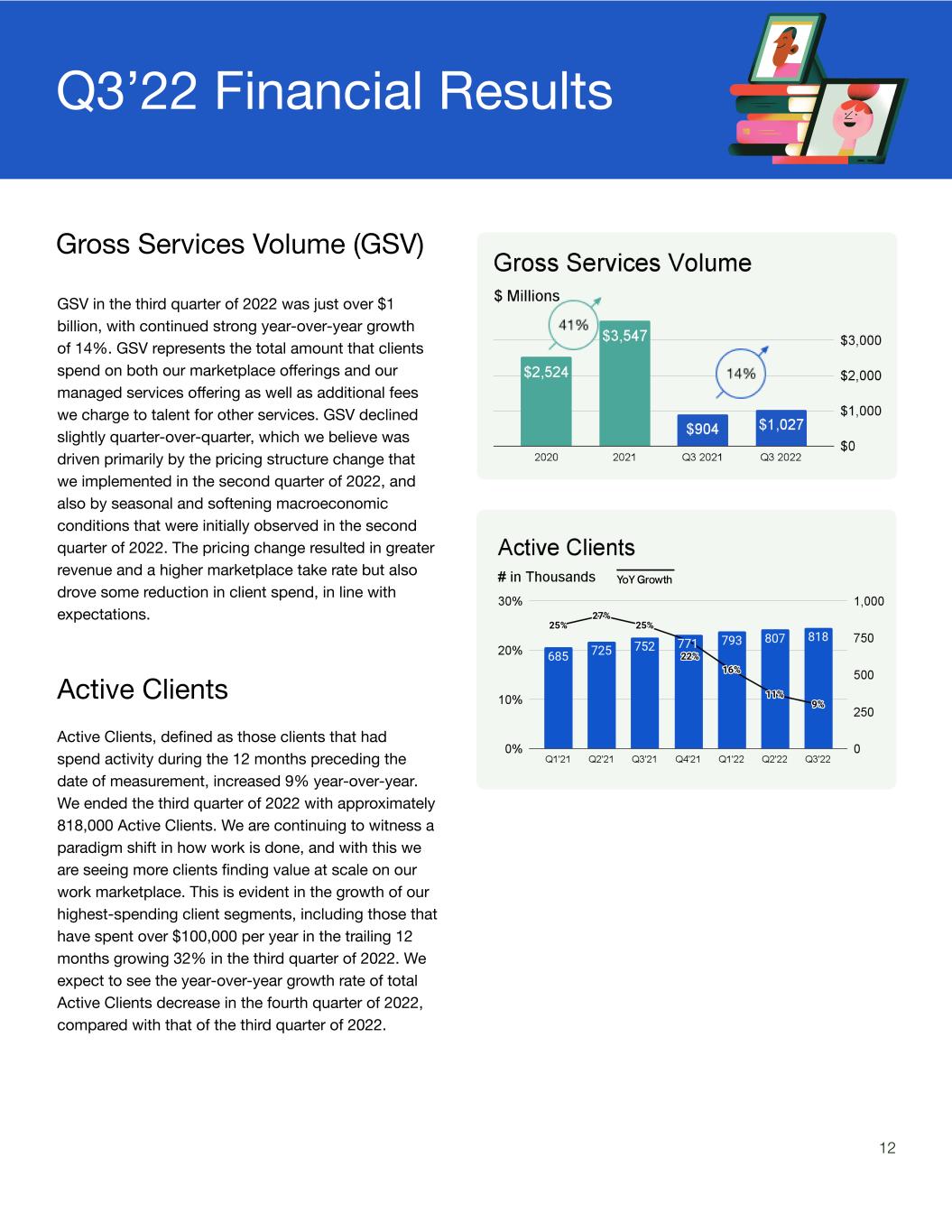

Q3’22 Financial Results Gross Services Volume (GSV) GSV in the third quarter of 2022 was just over $1 billion, with continued strong year-over-year growth of 14%. GSV represents the total amount that clients spend on both our marketplace offerings and our managed services offering as well as additional fees we charge to talent for other services. GSV declined slightly quarter-over-quarter, which we believe was driven primarily by the pricing structure change that we implemented in the second quarter of 2022, and also by seasonal and softening macroeconomic conditions that were initially observed in the second quarter of 2022. The pricing change resulted in greater revenue and a higher marketplace take rate but also drove some reduction in client spend, in line with expectations. Active Clients Active Clients, defined as those clients that had spend activity during the 12 months preceding the date of measurement, increased 9% year-over-year. We ended the third quarter of 2022 with approximately 818,000 Active Clients. We are continuing to witness a paradigm shift in how work is done, and with this we are seeing more clients finding value at scale on our work marketplace. This is evident in the growth of our highest-spending client segments, including those that have spent over $100,000 per year in the trailing 12 months growing 32% in the third quarter of 2022. We expect to see the year-over-year growth rate of total Active Clients decrease in the fourth quarter of 2022, compared with that of the third quarter of 2022. 12

GSV per Active Client GSV per Active Client increased 13% year-over-year to $4,958. We continue to see growth of GSV per Active Client as more-tenured clients continue to expand their spend and the large number of clients acquired in the past year begin to mature into higher-value clients. Take Rate Our overall take rate in the third quarter of 2022 was 15.4%, up from 15.0% in the previous quarter and from 14.2% in the third quarter of 2021. Marketplace take rate for the third quarter of 2022 was 14.3%, up from 14.0% in the previous quarter and from 13.2% in the third quarter of the prior year. Marketplace take rate measures the correlation between marketplace revenue and marketplace GSV and is calculated by dividing marketplace revenue by marketplace GSV. The increase was primarily driven by a full quarter’s benefit from our new Client Marketplace Plan, partially offset by existing clients maturing into higher-value clients and continuing to increase their spend with particular talent, which resulted in a higher proportion of talent at the lower rates of our tiered service fee structure. 13

Revenue Total revenue grew 24% year-over-year to $158.6 million in the third quarter of 2022. Marketplace revenue for the third quarter of 2022 was $145.1 million, reflecting a year-over-year increase of 23%. Marketplace revenue consists of revenue derived from our marketplace offerings. Our marketplace offerings include offerings other than our managed services offering, such as our Client Marketplace Plan, Upwork Enterprise, Project Catalog, and Talent Scout, among others. We generate marketplace revenue from both talent and clients. Managed services revenue grew 30% year-over-year to $13.5 million for the third quarter of 2022. As anticipated, we saw a slightly smaller impact to revenue directly attributable to the war in Ukraine in the third quarter compared to the second quarter of 2022. In the third quarter of 2022, the growth of total revenue was primarily driven by a full quarter’s benefit from our new Client Marketplace Plan, partially offset by the seasonal and softening macroeconomic conditions that were initially observed in the second quarter continuing to negatively impact client acquisition and retention. The revenue impact in the third quarter from these conditions was in line with our expectations. 14

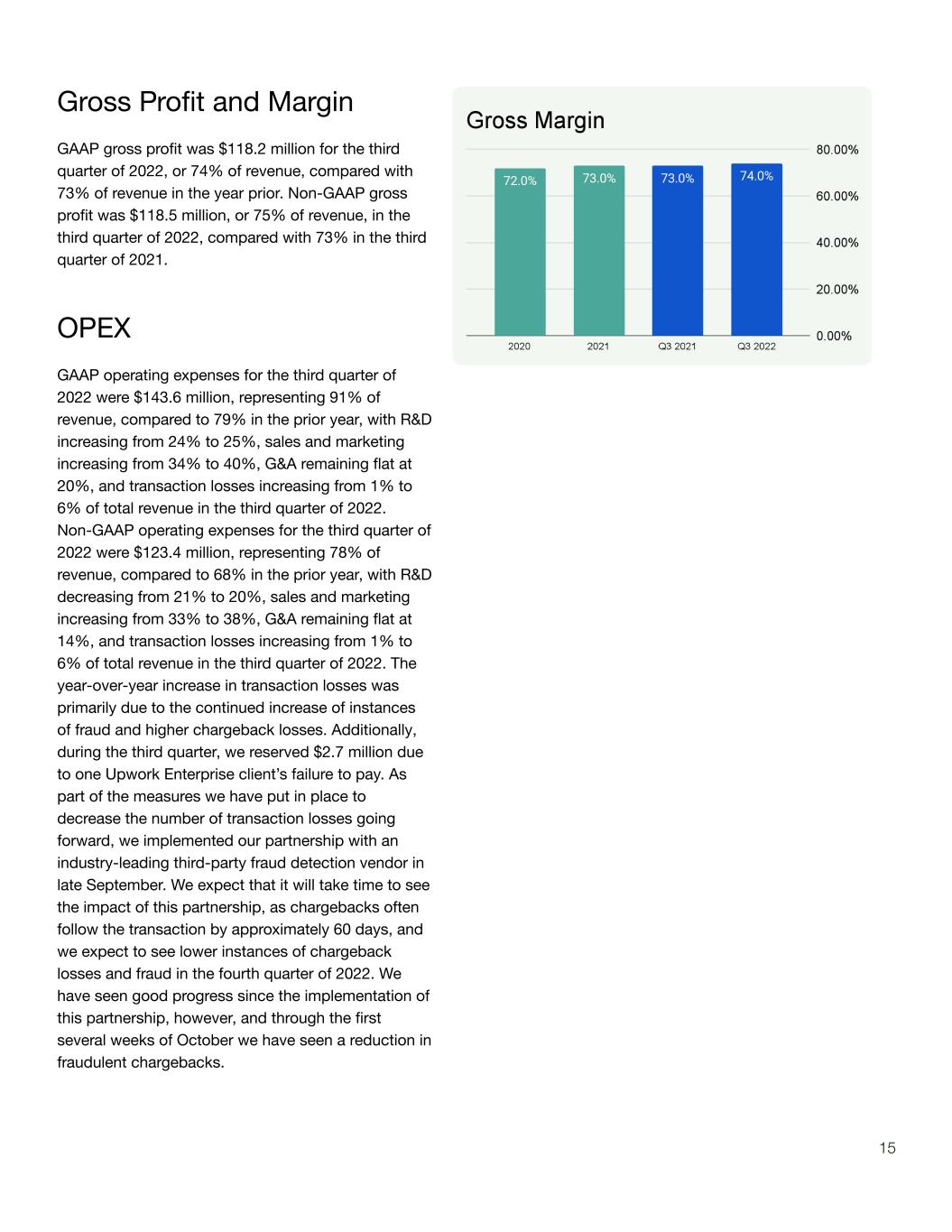

Gross Profit and Margin GAAP gross profit was $118.2 million for the third quarter of 2022, or 74% of revenue, compared with 73% of revenue in the year prior. Non-GAAP gross profit was $118.5 million, or 75% of revenue, in the third quarter of 2022, compared with 73% in the third quarter of 2021. OPEX GAAP operating expenses for the third quarter of 2022 were $143.6 million, representing 91% of revenue, compared to 79% in the prior year, with R&D increasing from 24% to 25%, sales and marketing increasing from 34% to 40%, G&A remaining flat at 20%, and transaction losses increasing from 1% to 6% of total revenue in the third quarter of 2022. Non-GAAP operating expenses for the third quarter of 2022 were $123.4 million, representing 78% of revenue, compared to 68% in the prior year, with R&D decreasing from 21% to 20%, sales and marketing increasing from 33% to 38%, G&A remaining flat at 14%, and transaction losses increasing from 1% to 6% of total revenue in the third quarter of 2022. The year-over-year increase in transaction losses was primarily due to the continued increase of instances of fraud and higher chargeback losses. Additionally, during the third quarter, we reserved $2.7 million due to one Upwork Enterprise client’s failure to pay. As part of the measures we have put in place to decrease the number of transaction losses going forward, we implemented our partnership with an industry-leading third-party fraud detection vendor in late September. We expect that it will take time to see the impact of this partnership, as chargebacks often follow the transaction by approximately 60 days, and we expect to see lower instances of chargeback losses and fraud in the fourth quarter of 2022. We have seen good progress since the implementation of this partnership, however, and through the first several weeks of October we have seen a reduction in fraudulent chargebacks. 15

Net Income (Loss) GAAP net loss was $(24.8) million in the third quarter of 2022 compared to GAAP net loss of $(9.3) million in the third quarter of 2021. GAAP net loss per basic share was $(0.19) in the third quarter of 2022 compared to GAAP net loss per basic share of $(0.07) in the third quarter of 2021. Non-GAAP net loss of $(4.2) million in the third quarter of 2022 compared to non-GAAP net income of $4.8 million in the third quarter of 2021. Our non-GAAP net loss per basic and diluted share was $(0.03) in the third quarter of 2022 compared with non-GAAP net income per basic and diluted share of $0.04 in the third quarter of 2021. Adjusted EBITDA Adjusted EBITDA loss was $(2.9) million in the third quarter of 2022, compared to $8.2 million in the third quarter of 2021. We define adjusted EBITDA as net income (loss) adjusted for: stock-based compensation expense; depreciation and amortization; interest expense; other (income) expense, net; income tax (benefit) provision; and if applicable, other noncash transactions. Cash Flow and Balance Sheet Cash, cash equivalents, and marketable securities were approximately $675.8 million at the end of the third quarter of 2022. 16

Guidance We are guiding fourth-quarter 2022 revenue to be between $158 million and $160 million, which is a 16% year-over-year increase at the midpoint. The deceleration of our quarter-over-quarter and year-over-year growth rates from the third quarter to the fourth quarter that we are guiding reflect continued softness in seasonal and macroeconomic conditions and the lapping of a strong fourth quarter of 2021, respectively. We are narrowing our full-year 2022 revenue guidance to between $615 million and $617 million, which represents 23% year-over-year growth at the midpoint. We expect fourth-quarter 2022 adjusted EBITDA to be a loss of between $(1) million and $(3) million. In the fourth quarter we expect to invest approximately $19 million in brand marketing, bringing our total brand investment in 2022 to just under $80 million. We are also providing an updated full-year 2022 adjusted EBITDA guidance loss of between $(6) million and $(8) million. Additionally, we reiterate our target to be adjusted EBITDA positive on an annual basis starting in 2023 and thereafter aim to increase our adjusted EBITDA margin by a few hundred basis points per year as we progress toward our previously communicated long-term target of an adjusted EBITDA margin of 30%-35%. We are raising our estimate for fourth-quarter 2022 non-GAAP basic loss per share to be between $(0.01) and $(0.03) and basic weighted-average shares outstanding in the range of 131 million to 133 million. For full-year 2022, we expect non-GAAP basic loss per share to be between $(0.11) and $(0.13) and basic weighted-average shares outstanding in the range of 130 million to 132 million. We have not reconciled our adjusted EBITDA guidance to GAAP net income (loss), non-GAAP diluted EPS to GAAP diluted EPS, or non-GAAP basic loss per share to GAAP basic loss per share because certain items that impact GAAP net income (loss), GAAP diluted EPS, and GAAP basic loss per share are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2022 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of adjusted EBITDA to net income (loss), non-GAAP basic loss per share to GAAP basic loss per share, and non-GAAP diluted EPS to GAAP diluted EPS is not available without unreasonable effort. Q4 2022 Guidance FY 2022 Guidance Revenue $158 million - $160 million $615 million - $617 million Adjusted EBITDA $(1) million - $(3) million $(6) million - $(8) million Basic weighted-average shares outstanding 131 million - 133 million 130 million - 132 million Non-GAAP basic and diluted loss per share $(0.01) - $(0.03) $(0.11) - $(0.13) 17

Q3 2022 Conference Call and Webcast Upwork will host a conference call today, October 26, 2022, at 2 p.m. Pacific Time/5 p.m. Eastern Time to discuss the company’s third-quarter 2022 financial results. An audio webcast archive will be available following the live event for approximately one year at investors.upwork.com. We use our Investor Relations website (investors.upwork.com), our blog (upwork.com/blog), our Twitter handle (twitter.com/Upwork), and Hayden Brown’s Twitter handle (twitter.com/hydnbrwn) and LinkedIn profile (linkedin.com/in/haydenlbrown) as a means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases and as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD. The content of our websites and information that we may post on or provide to online and social media channels, including those mentioned above, and information that can be accessed through our websites or these online and social media channels are not incorporated by reference into this press release or in any report or document we file with the SEC, and any references to our websites or these online and social media channels are intended to be inactive textual references only. Thank you, Hayden Brown President & CEO Jeff McCombs CFO 18

UPWORK INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except for per share data) (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Revenue Marketplace $ 145,143 $ 117,783 $ 418,893 $ 336,913 Managed services 13,498 10,358 37,983 29,028 Total revenue 158,641 128,141 456,876 365,941 Cost of revenue 40,470 34,933 119,243 98,457 Gross profit 118,171 93,208 337,633 267,484 Operating expenses Research and development 38,898 30,873 112,889 85,610 Sales and marketing 63,171 43,192 184,096 128,613 General and administrative 31,407 26,083 93,872 81,969 Provision for transaction losses 10,137 1,377 18,918 3,701 Total operating expenses 143,613 101,525 409,775 299,893 Loss from operations (25,442) (8,317) (72,142) (32,409) Interest expense 1,117 746 3,362 1,055 Other (income) expense, net (1,772) 222 (2,215) 161 Loss before income taxes (24,787) (9,285) (73,289) (33,625) Income tax provision (40) (26) (96) (59) Net loss $ (24,827) $ (9,311) $ (73,385) $ (33,684) Net loss per share, basic and diluted $ (0.19) $ (0.07) $ (0.56) $ (0.27) Weighted-average shares used to compute net loss per share, basic and diluted 130,830 127,915 130,083 126,651 19

UPWORK INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) (Unaudited) September 30, 2022 December 31, 2021 ASSETS Current assets Cash and cash equivalents $ 156,423 $ 187,205 Marketable securities 519,383 497,566 Funds held in escrow, including funds in transit 169,966 160,813 Trade and client receivables, net 67,070 66,826 Prepaid expenses and other current assets 16,860 17,243 Total current assets 929,702 929,653 Property and equipment, net 21,487 21,329 Goodwill 118,219 118,219 Operating lease asset 8,387 10,682 Other assets, noncurrent 1,431 1,178 Total assets $ 1,079,226 $ 1,081,061 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 5,354 $ 4,996 Escrow funds payable 169,966 160,813 Accrued expenses and other current liabilities 51,781 45,742 Deferred revenue 24,910 22,083 Total current liabilities 252,011 233,634 Debt, noncurrent 563,520 561,299 Operating lease liability, noncurrent 12,619 16,753 Other liabilities, noncurrent 8,493 9,858 Total liabilities 836,643 821,544 Stockholders’ equity Common stock 13 13 Additional paid-in capital 571,636 511,096 Accumulated other comprehensive loss (4,617) (528) Accumulated deficit (324,449) (251,064) Total stockholders’ equity 242,583 259,517 Total liabilities and stockholders’ equity $ 1,079,226 $ 1,081,061 20

UPWORK INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2021 2020 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (24,827) $ (9,311) $ (73,385) $ (33,684) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Provision for transaction losses 10,102 1,097 18,412 3,004 Depreciation and amortization 1,982 2,439 6,007 8,187 Amortization of debt issuance costs 740 402 2,221 441 Amortization of premium of purchases of marketable securities, net (315) 81 485 103 Amortization of operating lease asset 777 938 2,295 2,712 Tides Foundation common stock warrant expense 188 188 563 563 Stock-based compensation expense 20,404 13,906 56,119 38,666 Impairment expense — — — 7,389 Changes in operating assets and liabilities: Trade and client receivables (6,903) 2,868 (17,764) (13,967) Prepaid expenses and other assets 1,586 708 380 (2,163) Operating lease liability (1,380) 975 (3,994) 114 Accounts payable (2) (5,356) 278 (3,188) Accrued expenses and other liabilities 5,667 10,260 2,202 9,987 Deferred revenue 2,007 1,669 4,285 5,120 Net cash provided by (used in) operating activities 10,026 20,864 (1,896) 23,284 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of marketable securities (166,909) (78,861) (398,259) (108,828) Proceeds from maturities of marketable securities 180,272 23,000 371,879 87,500 Purchases of property and equipment (291) (231) (893) (565) Internal-use software and platform development costs (2,336) (640) (5,160) (4,221) Net cash provided by (used in) investing activities 10,736 (56,732) (32,433) (26,114) CASH FLOWS FROM FINANCING ACTIVITIES: Changes in escrow funds payable (18,479) 7,609 9,153 37,649 Proceeds from exercises of stock options 291 909 1,335 6,636 Proceeds from employee stock purchase plan — — 2,462 2,688 Repayment of debt — (6,964) — (10,750) Proceeds from issuance of convertible senior notes — 575,000 — 575,000 Payment of debt issuance costs — (14,855) — (14,855) Purchases of capped calls related to convertible senior notes — (49,393) — (49,393) Net cash provided by (used in) financing activities (18,188) 512,306 12,950 546,975 21

NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH 2,574 476,438 (21,379) 544,145 Cash, cash equivalents, and restricted cash—beginning of period 328,105 300,170 352,058 232,463 Cash, cash equivalents, and restricted cash—end of period $330,679 $ 776,608 $ 330,679 $ 776,608 The following table reconciles cash, cash equivalents, and restricted cash as reported in the condensed consolidated balance sheets to the total of the same amounts shown in the condensed consolidated statements of cash flows as of the following (in thousands): September 30, 2022 December 31, 2021 Cash and cash equivalents $ 156,423 $ 187,205 Restricted cash 4,290 4,040 Funds held in escrow, including funds in transit 169,966 160,813 Total cash, cash equivalents, and restricted cash as shown in the condensed consolidated statement of cash flows $ 330,679 $ 352,058 22

UPWORK INC. COST OF REVENUE AND GROSS MARGIN (In thousands, except percentages) (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 Change 2022 2021 Change Cost of revenue $ 40,470 $ 34,933 $ 5,537 16 % $119,243 $ 98,457 $20,786 21 % Components of cost of revenue: Cost of talent services to deliver managed services 9,591 8,189 1,402 17 % 27,822 23,192 4,630 20 % Other components of cost of revenue 30,879 26,744 4,135 15 % 91,421 75,265 16,156 21 % Total gross margin 74 % 73 % 74 % 73 % 23

UPWORK INC. RECONCILIATION OF GAAP TO NON-GAAP RESULTS (In thousands, except for percentages and share data) (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Net Loss $ (24,827) $ (9,311) $ (73,385) $ (33,684) Add back (deduct): Stock-based compensation expense 20,404 13,906 56,119 38,666 Depreciation and amortization 1,982 2,439 6,007 8,187 Interest expense 1,117 746 3,362 1,055 Other (income) expense, net (1,772) 222 (2,215) 161 Income tax provision 40 26 96 59 Tides Foundation common stock warrant expense 188 188 563 563 Impairment expense — — — 7,389 Humanitarian response efforts — — 4,287 — Adjusted EBITDA $ (2,868) $ 8,216 $ (5,166) $ 22,396 Cost of revenue, GAAP $ 40,470 $ 34,933 $ 119,243 $ 98,457 Stock-based compensation expense (376) (202) (962) (582) Humanitarian response efforts — — (89) — Cost of revenue, Non-GAAP 40,094 34,731 118,192 97,875 As a percentage of total revenue, GAAP 26 % 27 % 26 % 27 % As a percentage of total revenue, Non-GAAP 25 % 27 % 26 % 27 % Gross profit, GAAP $ 118,171 $ 93,208 $ 337,633 $ 267,484 Stock-based compensation expense 376 202 962 582 Humanitarian response efforts — — 89 — Gross profit, Non-GAAP 118,547 93,410 338,684 268,066 Gross margin, GAAP 74 % 73 % 74 % 73 % Gross margin, Non-GAAP 75 % 73 % 74 % 73 % Research and development, GAAP $ 38,898 $ 30,873 $ 112,889 $ 85,610 Stock-based compensation expense (7,337) (4,036) (19,517) (11,321) Humanitarian response efforts — — (2,653) — Research and development, Non-GAAP 31,561 26,837 90,719 74,289 As a percentage of total revenue, GAAP 25 % 24 % 25 % 23 % As a percentage of total revenue, Non-GAAP 20 % 21 % 20 % 20 % Sales and marketing, GAAP $ 63,171 $ 43,192 $ 184,096 $ 128,613 24

Stock-based compensation expense (3,055) (1,472) (7,983) (4,363) Humanitarian response efforts — — (260) — Sales and marketing, Non-GAAP 60,116 41,720 175,853 124,250 As a percentage of total revenue, GAAP 40 % 34 % 40 % 35 % As a percentage of total revenue, Non-GAAP 38 % 33 % 38 % 34 % General and administrative, GAAP $ 31,407 $ 26,083 $ 93,872 $ 81,969 Stock-based compensation expense (9,636) (8,196) (27,657) (22,400) Amortization of intangible assets — — — (667) Tides Foundation common stock warrant expense (188) (188) (563) (563) Impairment expense — — — (7,389) Humanitarian response efforts — — (1,285) — General and administrative, Non-GAAP 21,583 17,699 64,367 50,950 As a percentage of total revenue, GAAP 20 % 20 % 21 % 22 % As a percentage of total revenue, Non-GAAP 14 % 14 % 14 % 14 % Total operating expenses, GAAP $ 143,613 $ 101,525 $ 409,775 $ 299,893 Stock-based compensation expense (20,028) (13,704) (55,157) (38,084) Amortization of intangible assets — — — (667) Tides Foundation common stock warrant expense (188) (188) (563) (563) Impairment expense — — — (7,389) Humanitarian response efforts — — (4,198) — Total operating expenses, Non-GAAP 123,397 87,633 349,857 253,190 As a percentage of total revenue, GAAP 91 % 79 % 90 % 82 % As a percentage of total revenue, Non-GAAP 78 % 68 % 77 % 69 % Loss from operations, GAAP $ (25,442) $ (8,317) $ (72,142) $ (32,409) Stock-based compensation expense 20,404 13,906 56,119 38,666 Amortization of intangible assets — — — 667 Tides Foundation common stock warrant expense 188 188 563 563 Impairment expense — — — 7,389 Humanitarian response efforts — — 4,287 — Income (loss) from operations, Non-GAAP (4,850) 5,777 (11,173) 14,876 Net loss, GAAP $ (24,827) $ (9,311) $ (73,385) $ (33,684) Stock-based compensation expense 20,404 13,906 56,119 38,666 Amortization of intangible assets — — — 667 Tides Foundation common stock warrant expense 188 188 563 563 Impairment expense — — — 7,389 Humanitarian response efforts — — 4,287 — Net income (loss), Non-GAAP (4,235) 4,783 (12,416) 13,601 25

Weighted-average shares outstanding used in computing earnings (loss) per share, GAAP Basic (in millions) 130.8 127.9 130.1 126.7 Basic loss per share, GAAP $ (0.19) $ (0.07) $ (0.56) $ (0.27) Weighted-average shares outstanding used in computing earnings (loss) per share, Non-GAAP Basic (in millions) 130.8 127.9 130.1 126.7 Diluted (in millions) 130.8 134.3 130.1 134.5 Basic earnings (loss) per share, Non-GAAP $ (0.03) $ 0.04 $ (0.10) $ 0.11 Diluted earnings (loss) per share, Non-GAAP $ (0.03) $ 0.04 $ (0.10) $ 0.10 26

About Upwork Upwork is the world’s work marketplace. We serve everyone from one-person startups to over 30% of the Fortune 100 with a powerful, trust-driven platform that enables companies and talent to work together in new ways that unlock their potential. Our talent community earned over $3.3 billion on Upwork in 2021 across more than 10,000 skills in categories including website & app development, creative & design, customer support, finance & accounting, consulting, and operations. Learn more at upwork.com and join us on LinkedIn, Twitter, Facebook, Instagram, and TikTok. Contact: Evan Barbosa Investor Relations investor@upwork.com Safe Harbor Statement This shareholder letter includes forward-looking statements, which are statements other than statements of historical facts, and statements in the future tense. These statements include, but are not limited to, statements regarding the future performance of Upwork and its market opportunity, including expected financial results for the fourth quarter and full year of 2022, expectations regarding the impact of the Russian invasion of Ukraine and our decision to suspend our business operations in Russia and Belarus and the COVID-19 pandemic on our business and industry, and expectations for capturing market share and regarding the changing landscape of work, as well as statements regarding our planned investments to support growth. Accordingly, actual results could differ materially or such uncertainties could cause adverse effects on our results. Forward-looking statements are based upon various estimates and assumptions, as well as information known to Upwork as of the date of this shareholder letter, and are subject to risks and uncertainties, including but not limited to: the impact of the ongoing macroeconomic uncertainty, the impact of the ongoing Russian invasion of Ukraine, our decision to suspend our business operations in Russia and Belarus, and the COVID-19 pandemic on our business and global economic conditions; the impact, severity, and duration of safety measures put in place to mitigate the impact of the COVID-19 pandemic; our ability to attract and retain a community of talent and clients; our limited operating history under our current business strategy and pricing model; our focus on the long term and our investments in sustainable, profitable growth; our ability to develop and release new products and services, and develop and release successful enhancements, features, and modifications to our existing products and services; the impact of new and existing laws and regulations; our ability to generate revenue from our marketplace offerings and the effects of fluctuations in our level of client spend retention; our ability to develop, maintain, and enhance our brand and reputation cost-effectively; competition; challenges to contractor classification or employment status of talent on our work marketplace; the possibility that the market for 27

Safe Harbor Statement (Cont.) talent and the services they offer will develop more slowly than we expect; user circumvention of our work marketplace; our ability to sell to large enterprise and clients with larger, longer-term independent talent needs; the success of our investments in our Enterprise sales organization and our related marketing efforts, and expectations for the ability for Enterprise sales to drive incremental revenue and GSV growth; changes in the amount and mix of services facilitated through our work marketplace from period to period; the success of our investments in brand marketing and the growth of our sales team; changes in our level of investment in sales and marketing, research and development, and general and administrative expenses, and our hiring plans for sales personnel; the market for information technology; future changes to our pricing model; payment and fraud risks, including our ability to reduce transaction losses; security breaches; privacy; litigation and related costs; changes in management; and other general market, political, economic, and business conditions. Actual results could differ materially from those predicted or implied, and reported results should not be considered as an indication of future performance. Additionally, these forward-looking statements, particularly our guidance, involve risks, uncertainties, and assumptions, including those related to the impacts of the Russian invasion of Ukraine and our decision to suspend our business operations in Russia and Belarus and the COVID-19 pandemic on our clients’ spending decisions. Significant variation from the assumptions underlying our forward-looking statements could cause our actual results to vary, and the impact could be significant. Additional risks and uncertainties that could affect our financial results are included under the caption “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed with the SEC on February 15, 2022, our Quarterly Report on Form 10-Q for the three months ended June 30, 2022, filed with the SEC on July 27, 2022, and our other SEC filings, which are available on the Investor Relations page of our website at investors.upwork.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the three months ended September 30, 2022, when filed. All forward-looking statements contained herein are based on information available to us as of the date hereof, and we do not assume any obligation to update these statements as a result of new information or future events. Undue reliance should not be placed on the forward-looking statements in this shareholder letter. These statements are based on information available to Upwork on the date hereof, and Upwork assumes no obligation to update such statements. 28

Non-GAAP Financial Measures To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present non-GAAP cost of revenue (and as a percentage of revenue), non-GAAP gross profit (and as a percentage of revenue), non-GAAP operating expenses (total and each line item, and total and each non-GAAP operating expense item as a percentage of revenue), non-GAAP income (loss) from operations, non-GAAP net income (loss) (and on a per share basis), non-GAAP gross margin, and adjusted EBITDA in this shareholder letter. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP. We use these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization (non-cash expense), interest expense, other (income) expense, net, income tax (benefit) provision, and, if applicable, other non-cash transactions. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; (c) tax payments that may represent a reduction in cash available to us; (d) expense from our common stock warrant issued to the Tides Foundation, which is recurring and will be reflected in our financial results for the foreseeable future; or (e) certain incremental expenses associated with our humanitarian response efforts in response to Russia’s invasion of Ukraine, as these expenses are not representative of our ongoing operations. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. A reconciliation of these non-GAAP measures has been provided in the financial statement tables included in this shareholder letter, and investors are encouraged to review the reconciliation. 29