|

Exhibit 99.1

|

Piper Jaffray Consumer Conference 2016

June 14-15, 2016

Forward Looking Statements

Forward Looking Statements

Some of the statements contained in this presentation constitute forward looking statements. Forward looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or

trends and similar expressions concerning matters that are not historical facts, such as statements regarding the

Company’s future financial condition or results of operations, its prospects and strategies for future growth, the

development and introduction of new products, and the implementation of its marketing and branding strategies.

In many cases, you can identify forward looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” “seeks,” “intends,” “targets” or the negative of these terms or other comparable terminology.

The forward looking statements contained in this presentation reflect the Company’s current views about future events and are

subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or its actual activities

or results to differ significantly from those expressed in any forward looking statement. Although the Company believes that its assumptions are reasonable, it cannot guarantee future events,

results, actions, levels of activity, performance or achievements. You are accordingly cautioned not to place undue

reliance on these forward looking statements. A number of important factors could cause actual results to differ materially from those indicated

by the forward looking statements, including, but not limited to, those factors described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in its Annual Report on form 10 K for its year ended January 3,2016. These factors include without limitation: changes in general economic or market

conditions, both in the United States and Brazil; increased competition in the Company’s industry; risk associated with

its Brazilian operations and any other future international operations; its ability to manage operations at its current size

or manage growth effectively; its ability to successfully expand in the United States and other new markets; its ability to locate suitable locations to open new restaurants and to attract guests to its restaurants; its ability to open

new restaurants is subject to factors outside the Company’s control including weather conditions and factors under the

control of the landlords, contractors, and regulatory authorities; the fact that it will rely on its operating subsidiaries to

provide it with distributions to fund its operating activities, which could be limited by law, regulation or otherwise; its

ability to continually innovate and provide its consumers with innovative dining experiences; its ability to maintain

recent levels of comparable revenue or average revenue per square foot; the ability of its suppliers to deliver beef in

a timely or cost effective manner; its lack of long term supplier contracts, its concentration of suppliers and distributors and potential increases in the price of beef; its

ability to raise money and maintain sufficient levels of cash flow; conflicts of interest with the THL Funds; the

Company is considered a “controlled company” and exempt from certain corporate governance rules primarily

relating to board independence, and its use of some or all of these exemptions; its ability to effectively market

and maintain a positive brand image; changes in government regulation; the Company’s ability to attract and maintain the services of its senior management and

key employees; the availability and effective operation of management information systems and other technology;

changes in consumer preferences or changes in demand for upscale dining experiences; the Company’s ability to

accurately anticipate and respond to seasonal or quarterly fluctuations in its operating results; its ability to maintain

effective internal controls or the identification of additional material weaknesses; the Company’s expectations

regarding the time during which it will be an emerging growth company under the JOBS Act; changes in accounting standards; and other risks described in the “Risk Factors” section of its

Annual Report.

Although the Company believes that the assumptions inherent in the forward looking statements contained in this presentation are reasonable, undue reliance should not be placed on these statements, which only apply as of the date hereof. Except as

required by applicable securities law, the Company undertakes no obligation to update any forward looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events.

Non GAAP Financial Measures

This presentation contains certain non GAAP financial measures. A “non GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets

or statements of cash flow of the company. The Company has provided a reconciliation of Restaurant Contribution and

Adjusted EBITDA, non GAAP financial measures, in the Appendix to this presentation. Adjusted EBITDA is presented because management

believes that such financial measure, when viewed with the Company’s results of operations in accordance with GAAP

and the reconciliation of Adjusted EBITDA to net income (loss), provides additional information to investors about

certain material non cash items and about unusual items that the Company does not expect to continue at the same level in the future.

Adjusted EBITDA is used by investors as a supplemental measure to evaluate the overall operating performance of

companies in the Company’s industry, you should not consider it in isolation, or as a substitute for analysis of results

as reported under GAAP. Our calculation of Adjusted EBITDA may not be comparable to that reported by other

companies. For additional information about our non GAAP financial measures, see our filings with the Securities and Exchange Commission.

JOBS Act

The Company is an “emerging growth company” within the meaning of the Jumpstart Our Business Startups Act.

As a result, the Company complies with reduced public company reporting requirements.

Highlights

Differentiated, Award Winning Concept with Broad Appeal

Industry Leading Restaurant Level Financials

Proven ability to finance growth and generate strong free cash flow

Proven Portability with Significant Whitespace

2

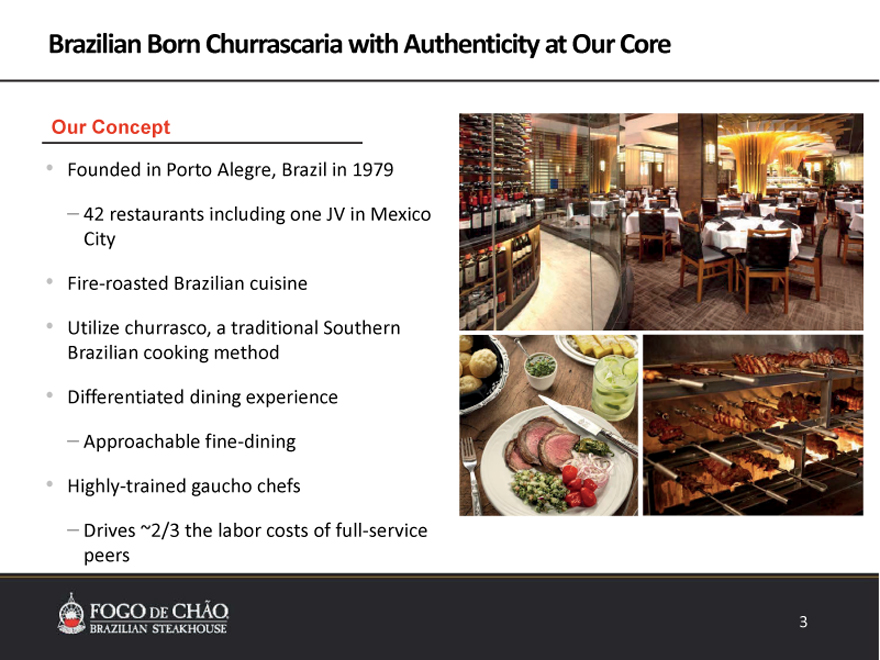

Brazilian Born Churrascaria with Authenticity at Our Core

Our Concept

Founded in Porto Alegre, Brazil in 1979

– 42 restaurants including one JV in Mexico City

Fire roasted Brazilian cuisine

Utilize churrasco, a traditional Southern Brazilian cooking method

Differentiated dining experience

– Approachable fine dining

Highly trained gaucho chefs

– Drives ~2/3 the labor costs of full service peers

3

A High Energy, Differentiated Dining Experience

High Quality

Authentic Interactive

Continuous

Control

Service

Customization

4

Industry Leading Financials

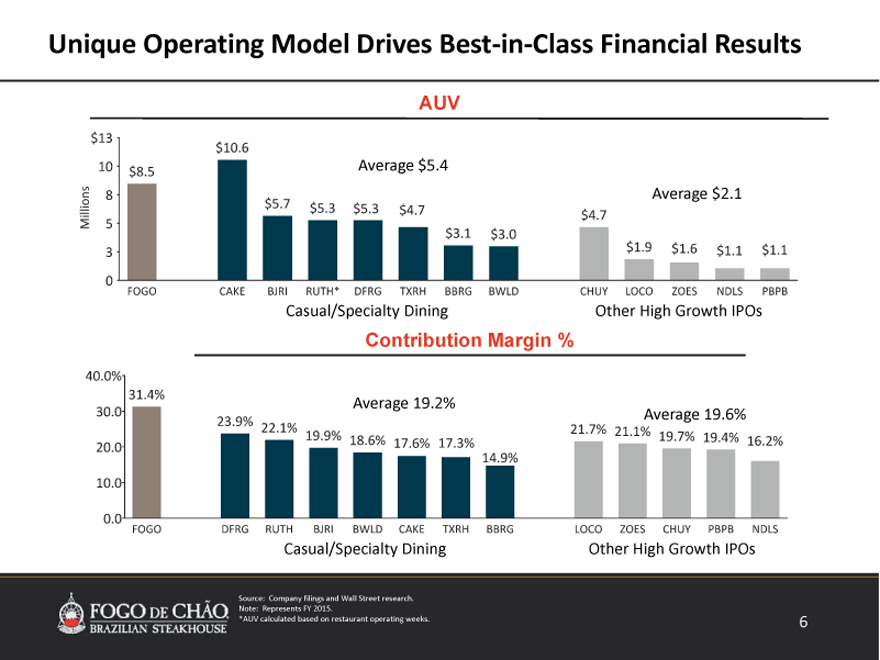

Unique Operating Model Drives Best?in?Class Financial Results

AUV

Average $5.4

Average $2.1

Casual/Specialty Dining Other High Growth IPOs

Contribution Margin %

Average 19.2%

Average 19.6%

Casual/Specialty Dining Other High Growth IPOs

Source: Company filings and Wall Street research. Note: Represents FY 2015.

*AUV calculated based on restaurant operating weeks.

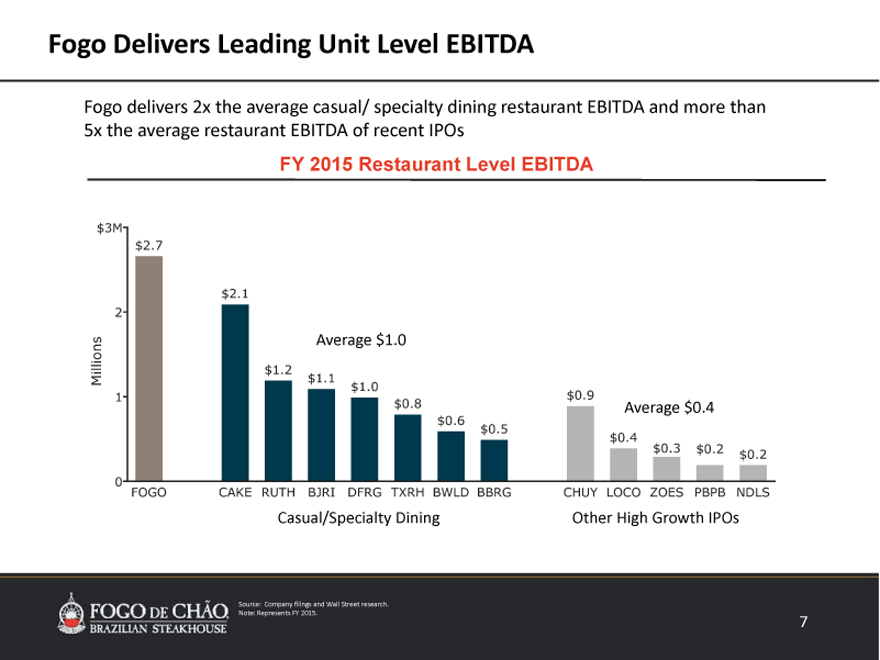

Fogo Delivers Leading Unit Level EBITDA

Fogo delivers 2x the average casual/specialty dining restaurant EBITDA and more than 5x the average restaurant EBITDA of recent IPOs

FY 2015 Restaurant Level EBITDA

Average $1.0

Average $0.4

Casual/Specialty Dining

Other High Growth IPOs

Source: Company filings and Wall Street research. Note: Represents FY 2015.

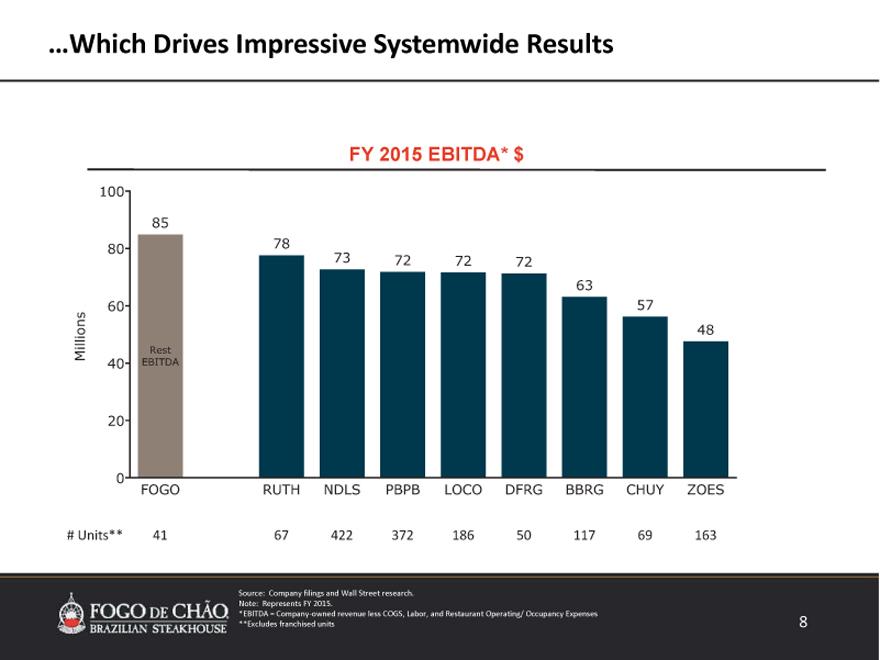

…Which Drives Impressive Systemwide Results

FY 2015 EBITDA* $

Source: Company filings and Wall Street research. Note: Represents FY 2015.

*EBITDA = Company?owned revenue less COGS, Labor, and Restaurant Operating/ Occupancy Expenses **Excludes franchised units

8

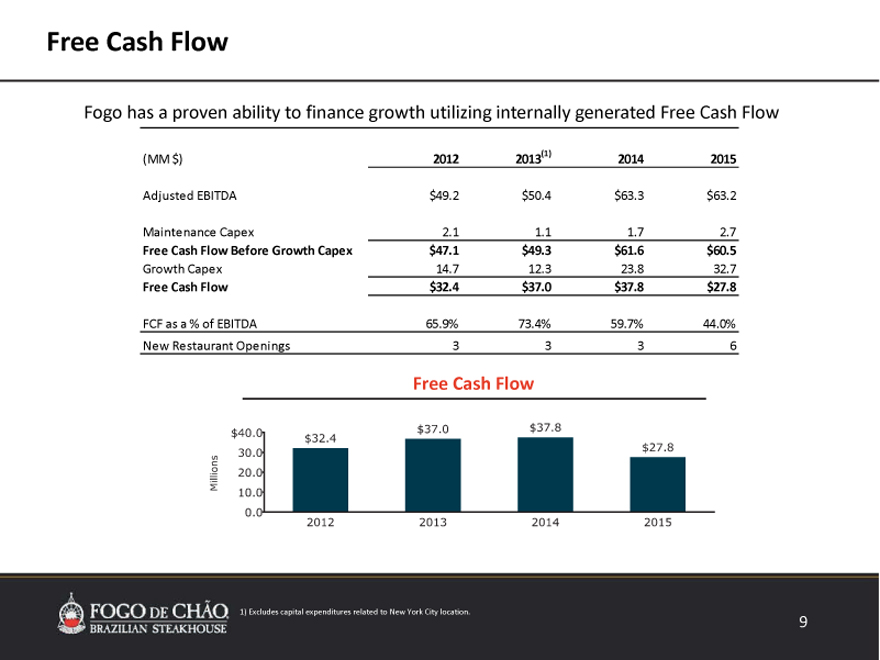

Free Cash Flow

Fogo has a proven ability to finance growth utilizing internally generated Free Cash Flow

(MM $)

2012

2013(1)

2014

2015

Adjusted EBITDA

$49.2

$50.4

$

63.3

$63.2

Maintenance Capex

2.1

1.1

1.7

2.7

Free Cash Flow Before Growth Capex

$47.1

$

49.3

$61.6

$

60.5

Growth Capex

14.7

12.3

23.8

32.7

Free Cash Flow

$32.4

$37.0

$

37.8

$27.8

FCF as a % of EBITDA

65.9%

73.4%

59.7%

44.0%

New Restaurant Openings

Free Cash Flow

1) Excludes capital expenditures related to New York City location.

9

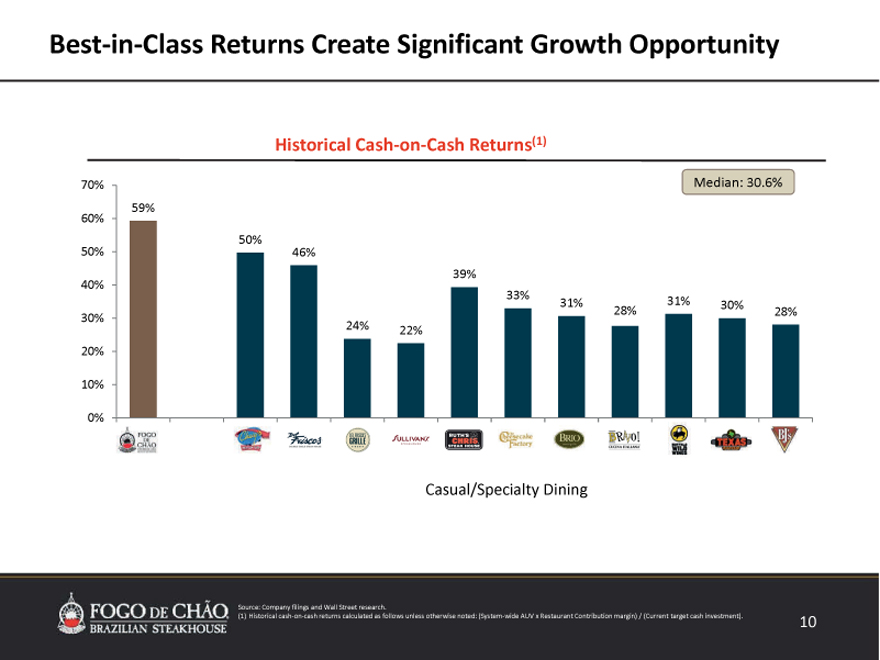

Best in Class Returns Create Significant Growth Opportunity

Historical Cash on Cash Returns(1)

70% Median: 30.6%

59%

60%

50%

50% 46%

39%

40%

33% 31% 31% 30%

30% 28% 28%

24% 22%

20%

10%

0%

Casual/Specialty Dining

Source: Company filings and Wall Street research.

(1) Historical cash on cash returns calculated as follows unless otherwise noted: (System wide AUV x Restaurant Contribution margin) /(Current target cash investment).

10

Our Growth Strategies

Expand Our Restaurant Base with a Focus on Top 50 DMA’s

Grow Internationally by Leveraging our Joint Venture Partnerships

Increase Our Comparable Restaurant Sales

Improve Margins by Leveraging Our Infrastructure and Investments in Human Capital to Support Growth

11

Development

12

Our Global Growth Plan

At Least 10% Annual Company owned Restaurant Growth plus Accelerating JV Development

U.S. Development

Brazil Development

Other International Development

Primary market for new restaurant growth

Potential for 100+ new restaurants

– Mix of large and mid size markets across urban and suburban locations

Focus on the top 50 DMAs

– Over 25 markets we believe are multi unit markets

Opened 5 U.S. restaurants in 2015, including San Juan

Continue to opportunistically open restaurants in Brazil

Maintains authentic and distinctive heritage and supports global growth

Opened one restaurant in 2015 (Rio de Janeiro)

Targeting growth in large “Capital Cities”

Grow utilizing a combination of asset light joint ventures and company owned development

First JV restaurant opened in Mexico City in May 2015

13

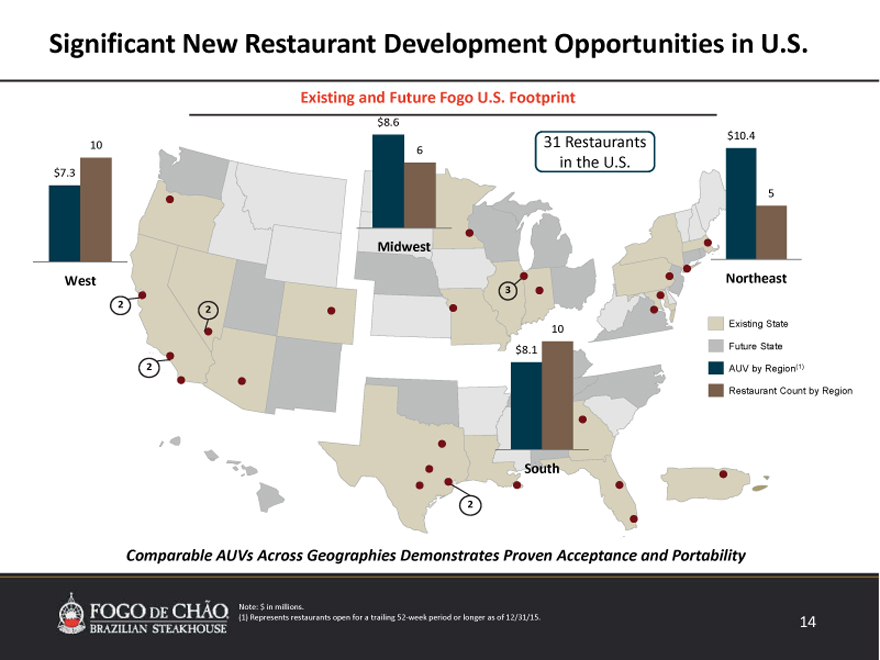

Existing and Future Fogo U.S. Footprint

$8.6

$10.4

10 31 Restaurants

6

in the U.S.

$7.3

5

Midwest

West Northeast

3

2 2

10 Existing State

$8.1 Future State

2 AUV by Region(1)

Restaurant Count by Region

South

2

Comparable AUVs Across Geographies Demonstrates Proven Acceptance and Portability

Note: $ in millions.

(1) Represents restaurants open for a trailing 52?week period or longer as of 12/31/15.

14

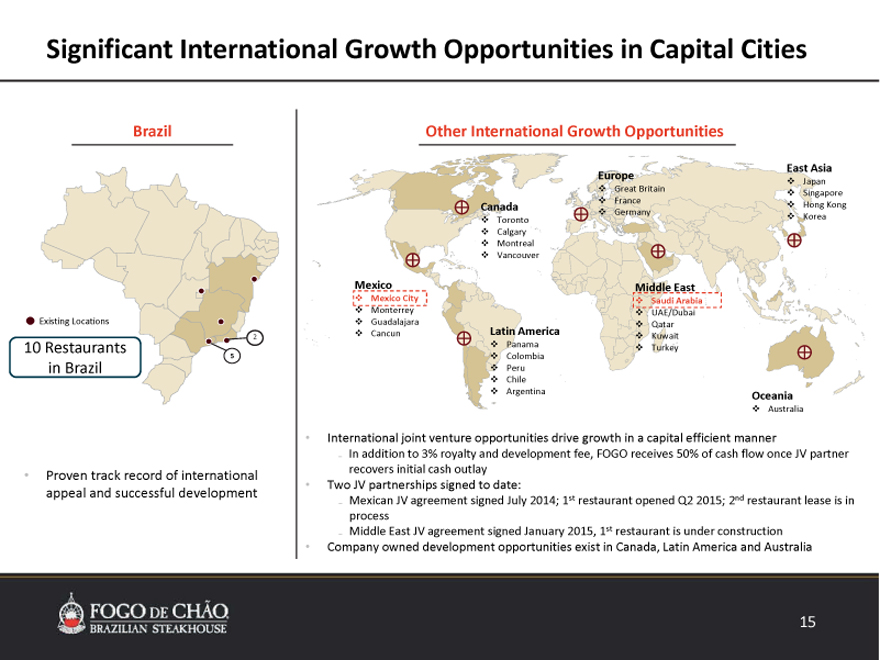

Significant International Growth Opportunities in Capital Cities

Brazil

Existing Locations

2

10 Restaurants

5

in Brazil

Proven track record of international

appeal and successful development

Other International Growth Opportunities

East Asia

Europe Japan

Great Britain Singapore

Canada France Hong Kong

Germany

Toronto Korea

Calgary

Montreal

Vancouver

Mexico Middle East

Mexico City Saudi Arabia

Monterrey UAE/Dubai

Guadalajara Qatar

Cancun Latin America Kuwait

Panama Turkey

Colombia

Peru

Chile

Argentina Oceania

Australia

International joint venture opportunities drive growth in a capital efficient manner

In addition to 3% royalty and development fee, FOGO receives 50% of cash flow once JV partner recovers initial cash outlay

Two JV partnerships signed to date:

Mexican JV agreement signed July 2014; 1st restaurant opened Q2 2015; 2nd restaurant lease is in process

Middle East JV agreement signed January 2015, 1st restaurant is under construction

Company owned development opportunities exist in Canada, Latin America and Australia

15

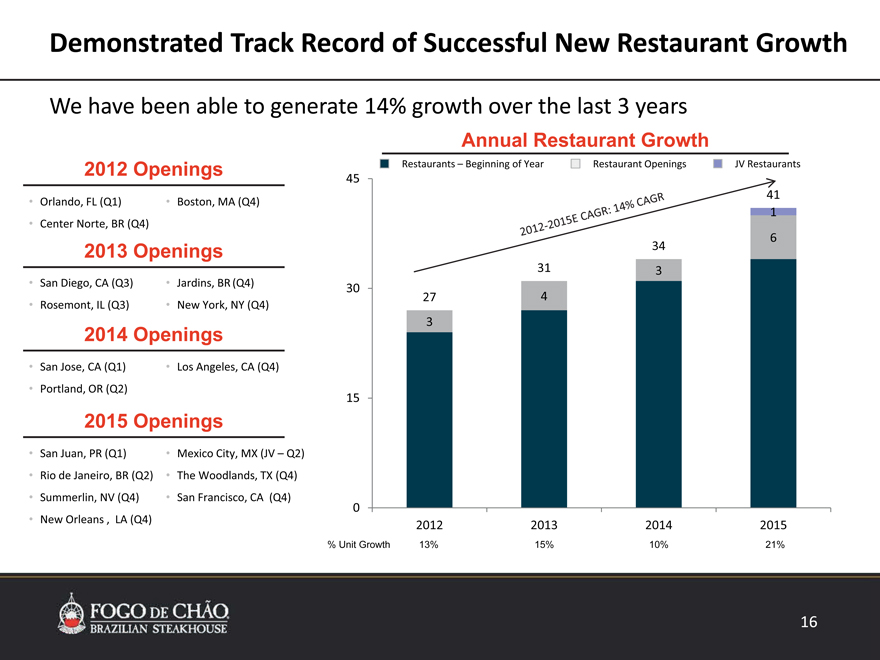

Demonstrated Track Record of Successful New Restaurant Growth

We have been able to generate 14% growth over the last 3 years

2012 Openings

Orlando, FL (Q1) Boston, MA (Q4)

Center Norte, BR (Q4)

2013 Openings

San Diego, CA (Q3) Jardins, BR (Q4)

Rosemont, IL (Q3) New York, NY (Q4)

2014 Openings

San Jose, CA (Q1) Los Angeles, CA (Q4)

Portland, OR (Q2)

2015 Openings

San Juan, PR (Q1) Mexico City, MX (JV – Q2)

Rio de Janeiro, BR (Q2) The Woodlands, TX (Q4)

Summerlin, NV (Q4) San Francisco, CA (Q4)

New Orleans , LA (Q4)

Annual Restaurant Growth

Restaurants – Beginning of Year Restaurant Openings JV Restaurants

45

41

1

6

34

31 3

30

27 4

3

15

0

2012 2013 2014 2015

% Unit Growth 13% 15% 10% 21%

Well Established Pipeline Provides Long?term Visibility

We plan to open 5 to 6 restaurants in FY’16, including at least one additional JV restaurant in the Middle East or Mexico

Near?term Development Pipeline

New vs Existing

Location Site Name Country Ownership Status

Market

Naperville, IL Naperville USA Existing Company Open

Philadelphia, PA King of Prussia USA Existing Company Under construction

Atlanta, GA Dunwoody USA Existing Company Under construction

Dallas, TX Uptown Dallas USA Existing Company Signed lease

Washington, DC Tysons Corner USA Existing Company Signed lease

Rio de Janeiro, BR Rio Leblon Brazil Existing Company Lease in process

Jeddah, SA Jeddah Saudi Arabia New Joint venture Under construction

Mexico City, MX Santa Fe Mexico Existing Joint venture Signed JV agreement

Bellevue, WA Lincoln Square USA New Company Signed lease

Pittsburgh, PA 350 Oliver USA New Company Signed lease

Plano, TX Legacy West USA Existing Company Signed lease

Fort Worth, TX Fort Worth USA New Company LOI in process

Framingham, MA Framingham USA Existing Company LOI in process

17

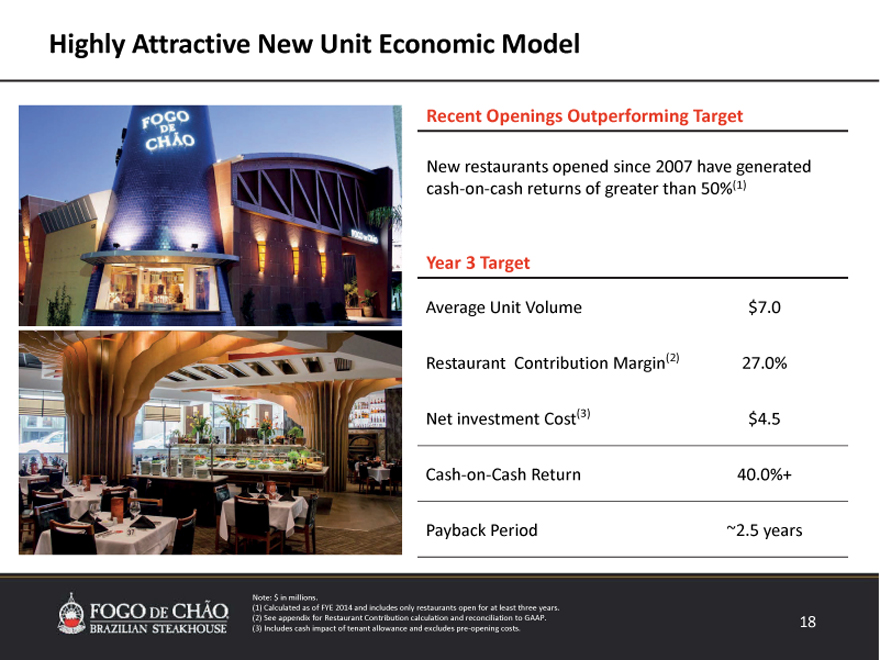

Highly Attractive New Unit Economic Model

Recent Openings Outperforming Target

New restaurants opened since 2007 have generated

cash on cash returns of greater than 50%(1)

Year 3 Target

Average Unit Volume

$7.0

Restaurant Contribution Margin(2)

27.0%

Net investment Cost(3)

$4.5

Cash on Cash Return

40.0%+

Payback Period

~2.5 years

Note: $ in millions.

(1) Calculated as of FYE 2014 and includes only restaurants open for at least three years. (2) See appendix for Restaurant Contribution calculation and reconciliation to GAAP. (3) Includes cash impact of tenant allowance and excludes pre opening costs.

18

Top Line Growth

19

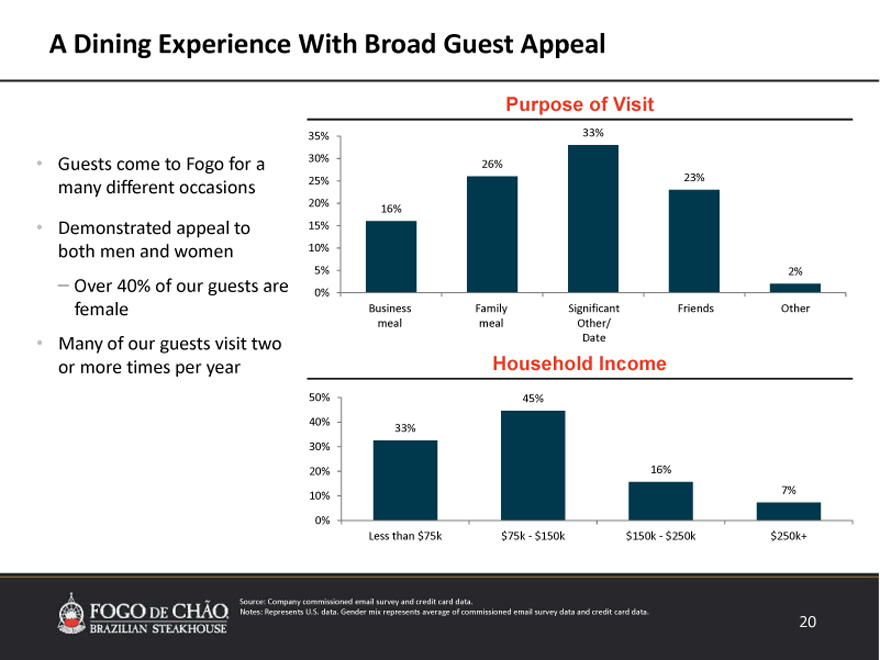

A Dining Experience With Broad Guest Appeal

Guests come to Fogo for a many different occasions

Demonstrated appeal to both men and women

– Over 40% of our guests are female

Many of our guests visit two or more times per year

Purpose of Visit

35% 33%

30% 26%

25% 23%

20% 16%

15%

10%

5% 2%

0%

Business Family Significant Friends Other

meal meal Other/

Date

Household Income

50% 45%

40% 33%

30%

20% 16%

10% 7%

0%

Less than $75k $75k ? $150k $150k ? $250k $250k+

Source: Company commissioned email survey and credit card data.

Notes: Represents U.S. data. Gender mix represents average of commissioned email survey data and credit card data.

20

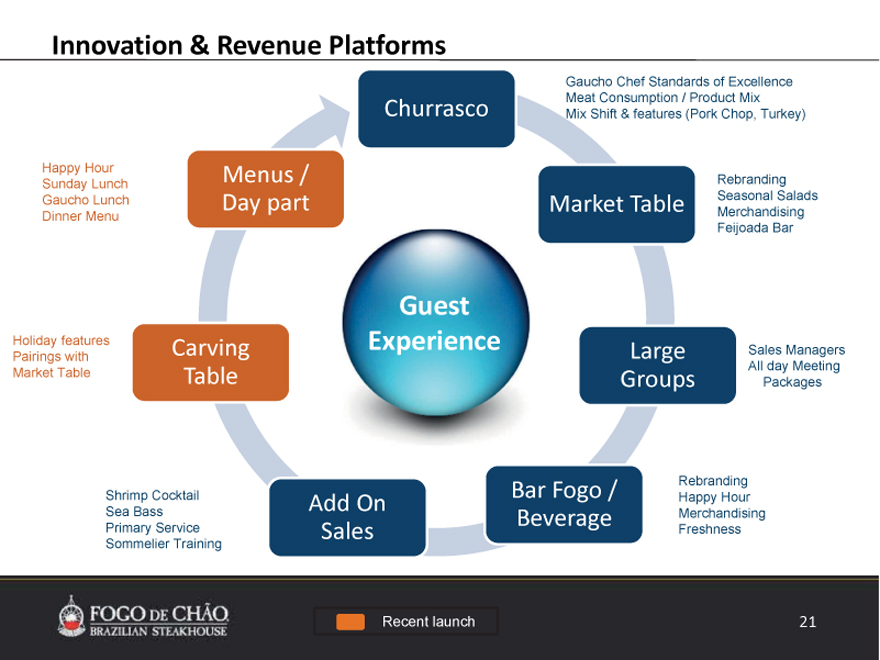

Innovation & Revenue Platforms

Gaucho Chef Standards of Excellence

Meat Consumption / Product Mix

Churrasco Mix Shift & features (Pork Chop, Turkey)

Sunday Happy Hour Lunch Menus / Rebranding

Gaucho Lunch Day part Market Table Merchandising Seasonal Salads

Dinner Menu

Feijoada Bar

Guest

Holiday features Carving Experience Large Sales Managers

Pairings with

All day Meeting

Market Table Table Groups Packages

Shrimp Cocktail Bar Fogo / Happy Rebranding Hour

Add On

Sea Bass Beverage Merchandising

Primary Service Sales Freshness

Sommelier Training

Recent launch

21

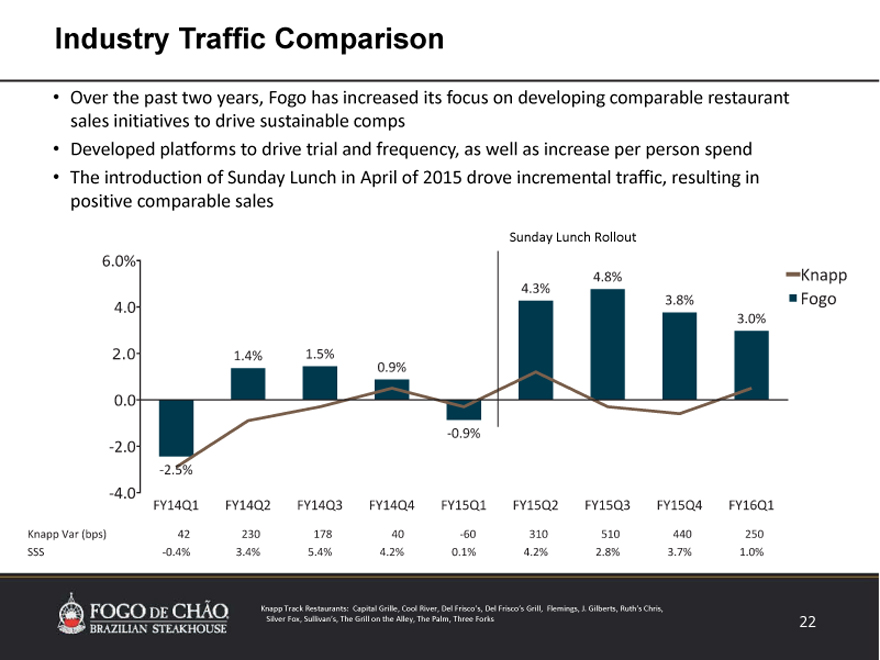

Industry Traffic Comparison

Over the past two years, Fogo has increased its focus on developing comparable restaurant sales initiatives to

drive sustainable comps

Developed platforms to drive trial and frequency, as well as increase per person spend

The introduction of Sunday Lunch in April of 2015 drove incremental traffic, resulting in positive comparable sales

Sunday Lunch Rollout

Knapp Track Restaurants: Capital Grille, Cool River, Del Frisco’s, Del Frisco’s Grill, Flemings, J. Gilberts, Ruth’s Chris, Silver Fox, Sullivan’s, The Grill on the Alley, The Palm, Three Forks

22

Financials

23

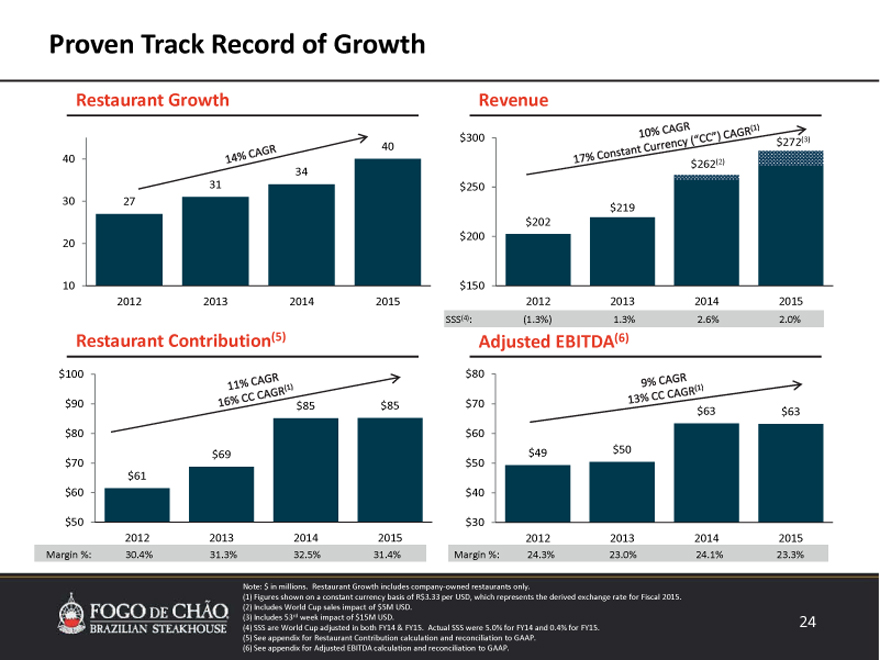

Proven Track Record of Growth

Restaurant Growth Revenue

$ 300 $272(3)

40

40 $262(2)

34

31 $ 250

30 27 $219

$ 202

$ 200

20

10 $ 150

2012 2013 2014 2015 2012 2013 2014 2015

SSS(4):(1.3%) 1.3% 2.6% 2.0%

Restaurant Contribution(5) Adjusted EBITDA(6)

$100 $ 80

$90 $ 85 $ 85 $ 70 $ 63 $ 63

$80 $ 60

$69 $ 49 $ 50

$70 $ 50

$61

$60 $ 40

$50 $ 30

2012 2013 2014 2015 2012 2013 2014 2015

Margin %: 30.4% 31.3% 32.5% 31.4% Margin %: 24.3% 23.0% 24.1% 23.3%

Note: $ in millions. Restaurant Growth includes company?owned restaurants only.

(1) Figures shown on a constant currency basis of R$3.33 per USD, which represents the derived exchange rate for Fiscal 2015. (2) Includes World Cup sales impact of $5M USD.

(3) Includes 53rd week impact of $15M USD.

(4) SSS are World Cup adjusted in both FY14 & FY15. Actual SSS were 5.0% for FY14 and 0.4% for FY15. (5) See appendix for Restaurant Contribution calculation and reconciliation to GAAP.

(6) See appendix for Adjusted EBITDA calculation and reconciliation to GAAP.

24

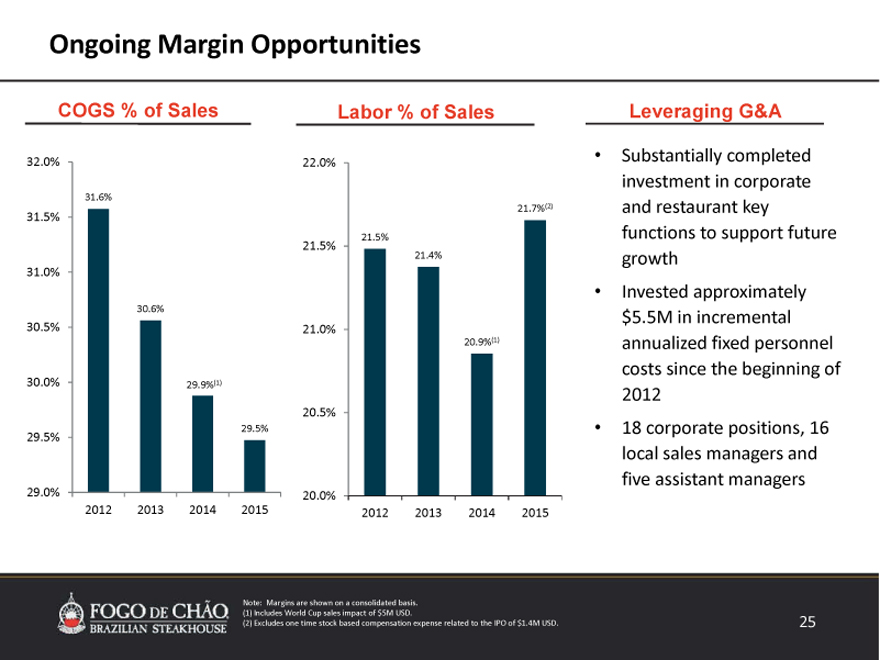

Ongoing Margin Opportunities

COGS % of Sales Labor % of Sales

32.0% 22.0%

31.6%

21.7%(2)

31.5%

21.5%

21.5%

21.4%

31.0%

30.6%

30.5% 21.0%

20.9%(1)

30.0% 29.9%(1)

20.5%

29.5%

29.5%

29.0% 20.0%

2012 2013 2014 2015 2012 2013 2014 2015

Leveraging G&A

Substantially completed investment in corporate and restaurant key functions to support future growth

Invested approximately $5.5M in incremental annualized fixed personnel costs since the beginning of 2012

18 corporate positions, 16 local sales managers and five assistant managers

Note: Margins are shown on a consolidated basis. (1) Includes World Cup sales impact of $5M USD.

(2) Excludes one time stock based compensation expense related to the IPO of $1.4M USD.

25

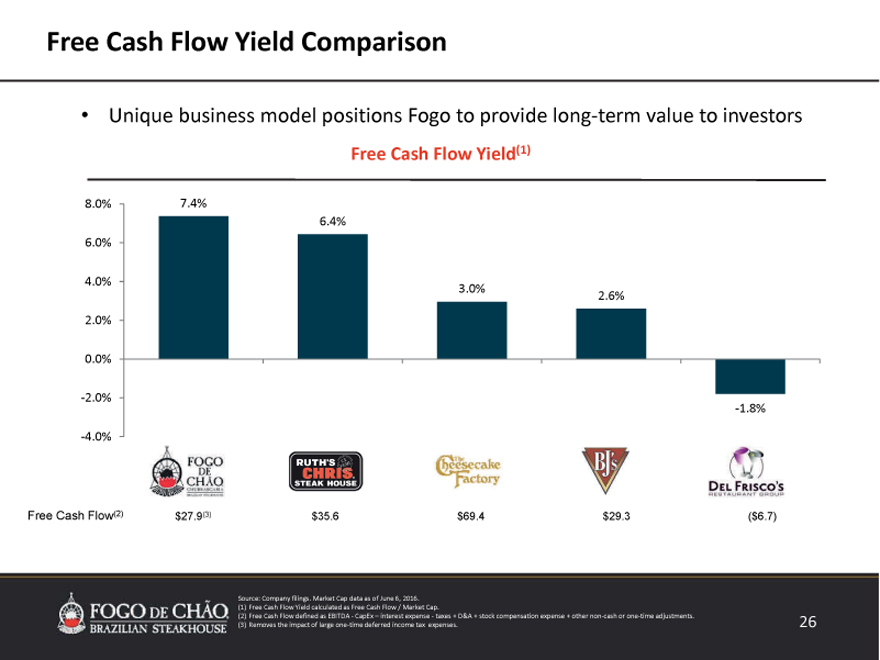

Free Cash Flow Yield Comparison

Unique business model positions Fogo to provide long?term value to investors

Free Cash Flow Yield(1)

8.0% 7.4%

6.4%

6.0%

4.0%

3.0% 2.6%

2.0%

0.0%

?2.0%

?1.8%

?4.0%

Free Cash Flow(2) $27.9(3) $35.6 $69.4 $29.3($6.7)

Source: Company filings. Market Cap data as of June 6, 2016. (1) Free Cash Flow Yield calculated as Free Cash Flow /Market Cap.

(2) Free Cash Flow defined as EBITDA ?CapEx – interest expense ?taxes + D&A + stock compensation expense + other non?cash or one?time adjustments. (3) Removes the impact of large one?time deferred income tax expenses.

26

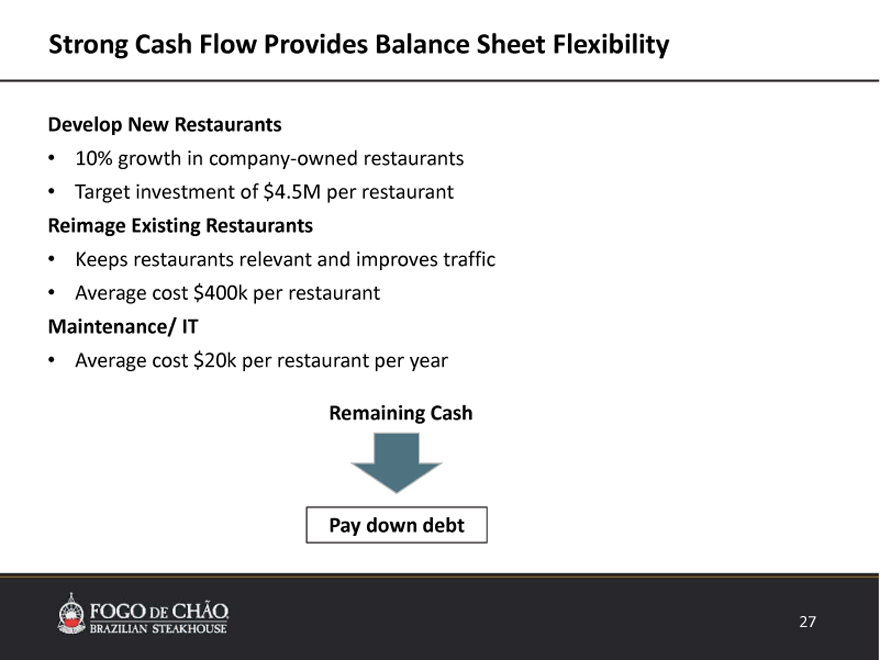

Strong Cash Flow Provides Balance Sheet Flexibility

Develop New Restaurants

10% growth in company owned restaurants

Target investment of $4.5M per restaurant

Reimage Existing Restaurants

Keeps restaurants relevant and improves traffic

Average cost $400k per restaurant

Maintenance/ IT

Average cost $20k per restaurant per year

Remaining Cash

Pay down debt

27

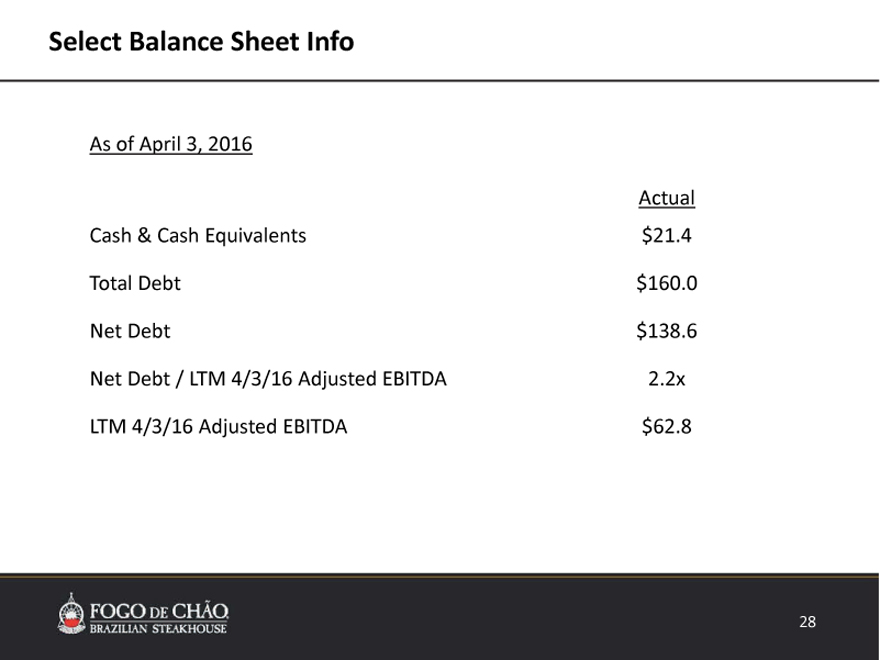

Select Balance Sheet Info

As of April 3, 2016

Actual

Cash & Cash Equivalents $21.4

Total Debt $160.0

Net Debt $138.6

Net Debt / LTM 4/3/16 Adjusted EBITDA 2.2x

LTM 4/3/16 Adjusted EBITDA $62.8

28

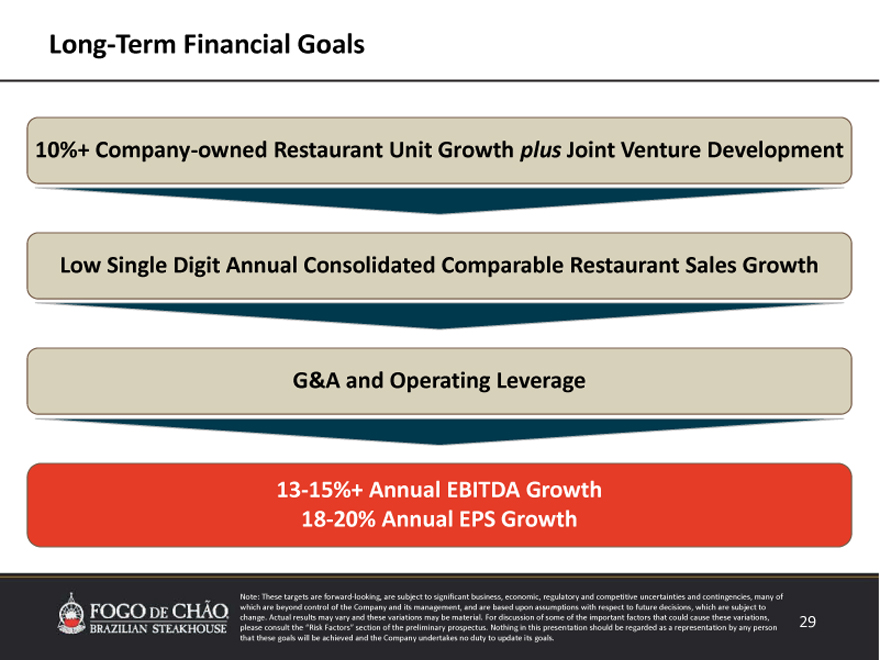

Long Term Financial Goals

10%+ Company owned Restaurant Unit Growth plus Joint Venture Development Low Single Digit Annual Consolidated Comparable Restaurant Sales Growth G&A and Operating Leverage

13 15%+ Annual EBITDA Growth

18 20% Annual EPS Growth

Note: These targets are forward looking, are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond control of the Company and its management, and are based upon assumptions

with respect to future decisions, which are subject to change. Actual results may vary and these variations may be material.

For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the preliminary prospectus. Nothing in this presentation

should be regarded as a representation by any person that these goals will be achieved and the Company undertakes no duty to update its goals.

29

Appendix

30

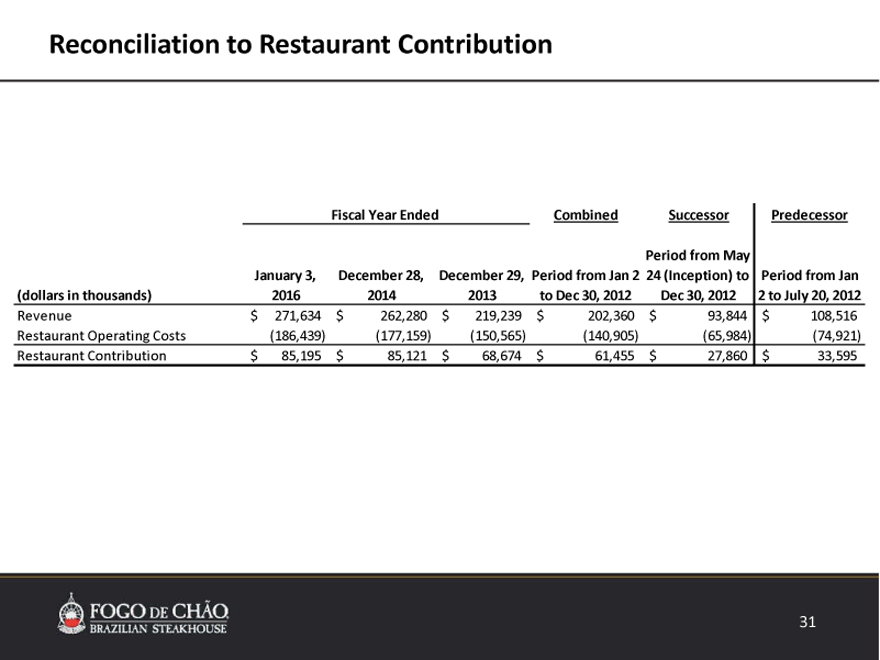

Reconciliation to Restaurant Contribution

Fiscal Year Ended Combined Successor Predecessor

Period from May

January 3, December 28, December 29, Period from Jan 2 24 (Inception) to Period from Jan

(dollars in thousands) 2016 2014 2013 to Dec 30, 2012 Dec 30, 2012 2 to July 20, 2012

Revenue $ 271,634 $ 262,280 $ 219,239 $ 202,360 $ 93,844 $ 108,516

Restaurant Operating Costs (186,439) (177,159) (150,565) (140,905) (65,984) (74,921)

Restaurant Contribution $ 85,195 $ 85,121 $ 68,674 $ 61,455 $ 27,860 $ 33,595

31

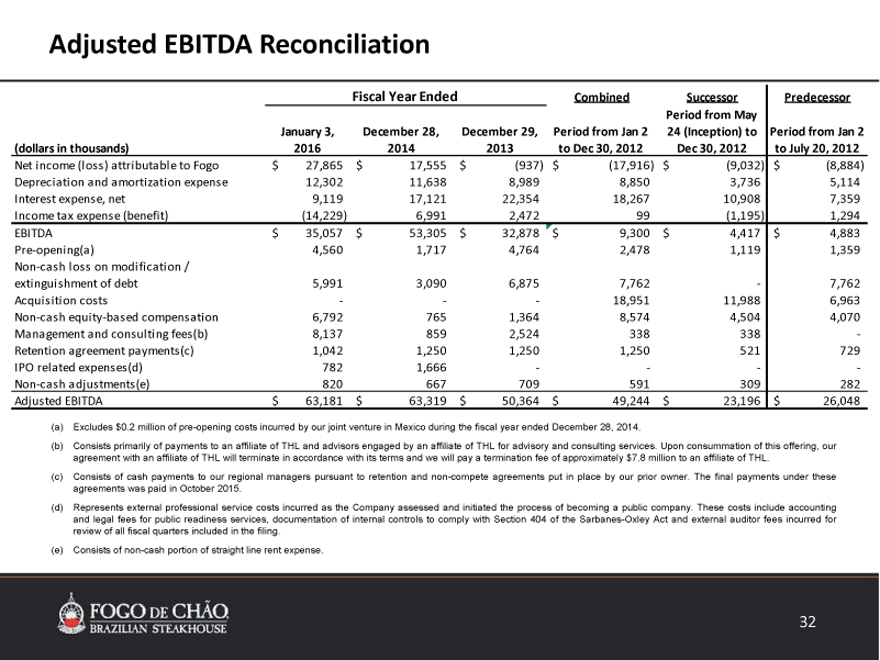

Adjusted EBITDA Reconciliation

Fiscal Year Ended Combined Successor Predecessor

Period from May

January 3, December 28, December 29, Period from Jan 2 24 (Inception) to Period from Jan 2

(dollars in thousands) 2016 2014 2013 to Dec 30, 2012 Dec 30, 2012 to July 20, 2012

Net income (loss) attributable to Fogo $ 27,865 $ 17,555 $ (937) $ (17,916) $ (9,032) $ (8,884)

Depreciation and amortization expense 12,302 11,638 8,989 8,850 3,736 5,114

Interest expense, net 9,119 17,121 22,354 18,267 10,908 7,359

Income tax expense (benefit) (14,229) 6,991 2,472 99 (1,195) 1,294

EBITDA $ 35,057 $ 53,305 $ 32,878 $ 9,300 $ 4,417 $ 4,883

Pre opening(a) 4,560 1,717 4,764 2,478 1,119 1,359

Non cash loss on modification /

extinguishment of debt 5,991 3,090 6,875 7,762 7,762

Acquisition costs 18,951 11,988 6,963

Non cash equity based compensation 6,792 765 1,364 8,574 4,504 4,070

Management and consulting fees(b) 8,137 859 2,524 338 338

Retention agreement payments(c) 1,042 1,250 1,250 1,250 521 729

IPO related expenses(d) 782 1,666

Non cash adjustments(e) 820 667 709 591 309 282

Adjusted EBITDA $ 63,181 $ 63,319 $ 50,364 $ 49,244 $ 23,196 $ 26,048

(a) Excludes $0.2 million of pre-opening costs incurred by our joint venture in Mexico during the fiscal year ended December 28, 2014.

(b) Consists primarily of payments to an affiliate of THL and advisors engaged by an affiliate of THL for advisory and consulting services. Upon consummation of this offering, our agreement with an affiliate of THL will terminate in accordance with its terms and we will pay a termination fee of approximately $7.8 million to an affiliate of THL.

(c) Consists of cash payments to our regional managers pursuant to retention and non-compete agreements put in place by our prior owner. The final payments under these agreements was paid in October 2015.

(d) Represents external professional service costs incurred as the Company assessed and initiated the process of becoming a public company. These costs include accounting and legal fees for public readiness services, documentation of internal controls to comply with Section 404 of the Sarbanes-Oxley Act and external auditor fees incurred for review of all fiscal quarters included in the filing.

(e) | | Consists of non-cash portion of straight line rent expense. |

32