Filed Pursuant to 424(b)(3)

Registration File No. 333-217220

The information in this preliminary prospectus supplement is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 8, 2017

PRELIMINARY PROSPECTUS SUPPLEMENT

(to Prospectus dated April 28, 2017)

4,500,000 Shares

Fogo de Chão, Inc.

Common Stock

The selling stockholders named in this prospectus supplement are offering 4,500,000 shares of our common stock. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders. See “Use of Proceeds.”

Our common stock is listed on The NASDAQ Global Select Market (“NASDAQ”) under the symbol “FOGO”. On May 5, 2017, the last sale price of our common stock as reported on NASDAQ was $16.90 per share.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on pageS-10 of this prospectus and in our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017 (which documents are incorporated by reference herein) to read about factors you should consider before making a decision to invest in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per

Share | | | Total | |

Public offering price | | $ | | | | $ | | |

Discounts and commissions(1) | | $ | | | | $ | | |

Proceeds, before expenses, to the selling stockholders | | $ | | | | $ | | |

| (1) | We refer you to “Underwriting” for additional information regarding total underwriter compensation. |

Delivery of the shares of common stock is expected to be made on or about , 2017. The selling stockholders have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase an additional 675,000 shares of our common stock.

| | | | | | |

| | | |

| Credit Suisse | | Piper Jaffray | | RBC Capital Markets | | Wells Fargo Securities |

| | | | | | |

Deutsche Bank Securities | | | | | | Macquarie Capital |

Prospectus Supplement dated , 2017

TABLE OF CONTENTS

TRADEMARKS AND TRADE NAMES

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. Our principal trademarks include FOGO, FOGO DE CHÃO, BAR FOGO, and our campfire design, which we have registered with the United States Patent and Trademark Office. We have also registered or applied for registration of the FOGO EXPRESS, FOGO GRILL, BAR FOGO, FOGO TO GO, THE GAUCHO WAY OF PREPARING MEAT, and various designs as trademarks in the U.S. In addition, we have registered or applied for FOGO DE CHÃO, FOGO’S, various FOGO and FOGO DECHÃO-formative terms, our campfire design, and other terms as trademarks in Brazil. Several of our principal marks are also registered orapplied-for in numerous foreign countries. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus or in documents incorporated by reference into this prospectus without the TM, SM and® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this prospectus or used in documents incorporated by reference into this prospectus are the property of their respective owners. As indicated in this prospectus, we have included market data and industry forecasts that were obtained from industry publications and other sources.

MARKET AND INDUSTRY INFORMATION

Market data used throughout this prospectus or used in documents incorporated by reference into this prospectus is based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys and publications and other publicly available information prepared by a number of sources. All of the market data used in this prospectus or used in documents incorporated by reference into this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We are responsible for all the disclosure contained in this prospectus, and, although we believe that these sources are reliable, neither we nor the underwriters can guarantee the accuracy or completeness of this information, and neither we nor the underwriters have independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this prospectus or used in documents incorporated by reference into this prospectus is reliable, such information, which in part is derived from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this prospectus and under the heading “Risk Factors” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017 (which documents are incorporated by reference herein). These and other factors could cause results to differ materially from those expressed in the estimates prepared by independent parties and by us.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference herein and therein. The second part is the accompanying prospectus, which provides more general information, some of which does not apply to this offering. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or documents previously filed with the U.S. Securities and Exchange Commission (the “SEC”), that are incorporated by reference herein, the information in this prospectus supplement will supersede such information. For a more detailed understanding of an investment in our common stock, you should read both this prospectus supplement and the accompanying prospectus, together with documents incorporated by reference that are described under “Incorporation By Reference” and the additional information described under the heading “Where You Can Find More Information.”

This prospectus supplement is part of a shelf registration statement on FormS-3 (FileNo. 333-217220) that we filed with the SEC on April 7, 2017, and which was declared effective on April 28, 2017. Under the shelf registration process, we may from time to time offer and sell any combination of the securities described in the accompanying prospectus with an aggregate initial offering price of up to $250,000,000. In addition, under this shelf registration process, certain of our stockholders may from time to time offer and sell up to an aggregate of 23,649,853 shares of our common stock in one or more offerings.

You should rely only on the information contained in this prospectus, including the documents incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free-writing prospectus we may authorize to be delivered or made available to you. Neither we, the selling stockholders, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders, nor the underwriters (or any of our or their respective affiliates) take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters (or any of our or their respective affiliates), are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and any free-writing prospectus prepared by or on behalf of us is accurate only as of the date of the respective document in which the information appears, and that the information in documents incorporated by reference, is only accurate as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

S-1

PROSPECTUS SUPPLEMENT SUMMARY

This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risks of investing in our common stock discussed under “Risk Factors,” the detailed information that is incorporated into this prospectus by reference to our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017 (including without limitation the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections included in such Form10-K and10-Q), before making an investment decision. Unless the context requires otherwise, references to “Fogo,” “our company,” “we,” “us” and “our” refer to Fogo de Chão, Inc. and its direct and indirect subsidiaries. Fiscal years 2016 and 2015 were a52-week period ending on January 1, 2017 (“Fiscal 2016”) and a53-week period ending on January 3, 2016 (“Fiscal 2015”), respectively.

Our Company

Fogo de Chão(fogo-dee-shoun) is a leading Brazilian steakhouse, orchurrascaria, which has specialized for more than 37 years in fire-roasting high-quality meats utilizing thecenturies-old Southern Brazilian cooking technique of churrasco. We deliver a distinctive and authentic Brazilian dining experience through the combination of our high-quality Brazilian cuisine and our differentiated service model known asespeto corrido (Portuguese for “continuous service”) delivered by ourchurrasqueiros, which we refer to as ourgaucho chefs. We offer our guests a variety of menu choices including our most popular offering, the FullChurrasco Experience, as well asGaucho Lunch, Weekend Brazilian Brunch and Bar Fogo menu items. The FullChurrasco Experience, our prix fixe menu, provides the opportunity to experience a variety of meats including beef, lamb, pork and chicken, simply seasoned and carefully fire-roasted to expose their natural flavors, as well as a selection of fresh seasonal salads and specialty items at the Market Table.

Throughout our history, we have been recognized for our leading consumer appeal by both national and local media in the markets where we operate, including winning multiple “best of” restaurant awards from one of Brazil’s most prominent lifestyle publications,Veja Magazine, and numerous accolades in the U.S., including awards fromNation’s Restaurant News,Zagat andWine Spectator Magazine. We were also recently recognized in November of 2016 as the best steakhouse in the U.S. in a comprehensive survey conducted by one of America’s leading consumer magazines.

S-2

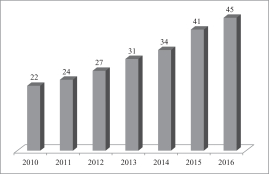

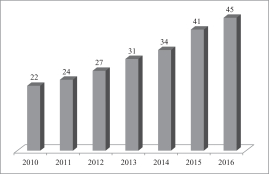

We opened our first restaurant in 1979 in Porto Alegre, Brazil. In 1986, we expanded to São Paulo, Brazil, a city in which we now operate five restaurants. Encouraged by our growth in Brazil, we opened our first restaurant in the U.S. in 1997 in Addison, Texas, a suburb of Dallas, and have since expanded our footprint nationwide. As of the date of this prospectus, we operate 35 restaurants in the U.S., including our newest restaurants opened in Tysons, Virginia in January 2017, our second location in the Washington DC Metropolitan Area, and in Dallas, Texas, our second location in the Dallas-Fort Worth Metropolitan Area, in February 2017, 10 restaurants in Brazil and through a joint venture, two restaurants in Mexico. From our 2010 to 2016 fiscal years, we grew our restaurant count by a compound annual growth rate (“CAGR”) of 12.7%.

| | |

Restaurant Count | | Revenue |

| |  |

We believe our dedication to serving high-quality Brazilian cuisine and our differentiated service model, combined with our disciplined focus on restaurant operations, have resulted in strong financial results in Fiscal 2016 illustrated by the following:

| | • | | We generated average unit volumes (“AUVs”) of approximately $7.8 million in the U.S. and approximately R$15.0 million (Brazilian Real) in Brazil, and a consolidated restaurant contribution margin of 29.8%; |

| | • | | We opened four restaurants, increasing our restaurant base 9.8% from 41 restaurants at the end of Fiscal 2015 to 45 at the end of Fiscal 2016. Openings included Naperville (Illinois), King of Prussia Town Center (Pennsylvania), Dunwoody (Georgia), and our second joint venture restaurant in Mexico in the Santa Fe business district of Mexico City; and |

| | • | | From Fiscal 2015 to Fiscal 2016, revenue grew 8.9% to $288.3 million, excluding the $6.8 million impact of the 53rd week in Fiscal 2015. |

AUVs and restaurant contribution margin are key metrics we use in evaluating the performance of our restaurants. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017 for explanations of how these metrics are calculated and how we use these metrics in evaluating the performance of our restaurants.

Our Competitive Strength

We believe the following strengths differentiate us from our competitors and serve as the foundation for our continued growth:

Authentic Cuisine—A Culinary Journey to Brazil

We provide our guests with an experience that is distinctly Brazilian, and our food is at the heart of that experience. Our traditional Brazilian cuisine has been passed down from generation to generation in Brazil and lives on in the way ourgaucho chefs prepare, season and continuously fire-roast our meats utilizing the

S-3

traditional cooking method ofchurrasco—fire-roasted on skewers over an open flame to expose the natural flavors. Our entrée selection features a variety of carefully cooked and seasoned meats including Brazilian style cuts of beef such as thefraldinha and thepicanha, our signature cut of steak, as well as other premium beef cuts such as filet mignon and rib eye, lamb, chicken, pork and seafood items. Each cut is carved table-side by ourgaucho chefs in a manner designed to both enhance the tenderness of each slice and meet our guests’ desired portion size and temperature. At Fogo de Chão, every table is a chef’s table. To complement our meat selection, a variety of sharable side dishes, including warm cheese bread, fried bananas and crispy polenta, are brought to each table and replenished throughout the meal. For guests preferring lighter fare, we also offer Brazilian-inspired à la carte seafood options, a “Market Table” only option and a selection of small plates. Our Market Table, which features a variety of gourmet side dishes, seasonal salads, Brazilian hearts of palm,fresh-cut vegetables, aged cheeses and cured meats is immediately available once our guests are seated. We believe it pays homage to the kitchen tables of Southern Brazil where families share fresh produce and seasonal salads grown locally. Our menu is enhanced by an award-winning wine list and a full bar complete with a selection of signature Brazilian drinks such as thecaipirinha.

Interactive, Approachable Fine-Dining Experience Delivered By Our Gaucho Chefs

We believe that we offer our guests an upscale, approachable and friendly atmosphere in elegant dining rooms that is complemented by the personalized, interactive experience with ourgaucho chefs and team members. Skilled artisans trained in thecenturies-old Southern Brazilian cooking tradition ofchurrasco and the culture and heritage of Southern Brazil, the home ofchurrasco, ourgaucho chefs are central to our ability to maintain consistency and authenticity throughout our restaurants in Brazil and the US. Due to our significant operations in Brazil, we are able to place many of our native Braziliangaucho chefs in restaurants in the U.S., which we believe preserves the distinctly Brazilian attributes of our brand. Our team members focus on anticipating guests’ needs and helping guests navigate our unique dining experience for a memorable visit.

Ourgaucho chefs butcher, prepare, cook and serve our premium meats to each guest, as well as engage and interact with them. We utilize a continuous style of service, where each of our gaucho chefs approaches guests at their table with various selections of meat, providing our guests with the cut, temperature and quantity they desire. During these interactions, ourgaucho chefs learn each guest’s specific preferences and are able to tailor their dining experience accordingly. In addition to providing an entertaining and engaging experience, our continuous service allows our guests to control the entrée variety, portions and pace of their meal, which we believe maximizes the customization of their experience and the satisfaction they receive from dining at our restaurants.

Award-Winning Concept with a Compelling Value Proposition and Broad Appeal

We believe that the combination of our high-quality Brazilian cuisine, differentiated dining experience and value proposition with menu price options like our FullChurrasco Experience prix fixe menu,Gaucho Lunch, Weekend Brazilian Brunch and Happy Hour leads our restaurants to appeal to a wide range of demographics, including both men and women, and socioeconomic groups. We believe our restaurants provide a preferred venue for various dining occasions, including intimate gatherings, familyget-togethers, business functions, convention banquets and other celebrations. Many of our guests dine at our restaurants multiple times per year. In Fiscal 2016, our averageper-person spend was $58.56, which we estimate is approximately 25% less than the traditionalhigh-end steakhouse category.

Our restaurants have received numerous awards and accolades from critics and reviewers in the U.S. and Brazil. For example, we have been nationally recognized byNation’s Restaurant News,Zagat andWine Spectator Magazine, and we have received awards from local media in the markets we operate, includingAtlanta Magazine,Chicago Tribune,Dallas Observer andHouston Business Journal. Additionally, our restaurants are consistently included among the top upscale dining options by reputable online reviewers such asYelp and

S-4

Urban Spoon. We believe that the authenticity of our brand is demonstrated by the fact that we have received multiple “best of” restaurant awards fromVeja Magazine. We were also recently recognized in November of 2016 as the best steakhouse in the U.S. in a comprehensive survey conducted by one of America’s leading consumer magazines.

Unique Operating Model Drives Attractive Restaurant-Level Profitability

Through the consistent execution of our unique business model, we are able to produce what we believe is attractive restaurant-level profitability by optimizing labor and food costs. For Fiscal 2016, the sum of our food and beverage costs and compensation and benefits costs (or “prime costs”) as a percentage of revenue was 51.5%. Our favorable performance on the largest components of a restaurant’s cost structure, which drives our restaurant contribution margins, is due to the following unique structural characteristics of our operational model:

| | • | | The dual role ourgaucho chefs play as both chef and server significantly reducesback-of-the-house labor costs; |

| | • | | Simple cooking technique and streamlined food offering, combined with table-side service and plating, allow for efficient kitchen and server operations, reducing labor costs; |

| | • | | Ourgaucho chefs work as a team with cross-functional roles and responsibilities, increasing productivity, speed of service and guest satisfaction, while reducing labor costs; |

| | • | | Simple, space-efficient cooking technique and streamlined menu reduces our kitchen’s footprint and maximizes space devoted tofront-of-the-house tables, which allows our restaurants to achieve higher sales per square foot and enables us to leverage our fixed costs such as occupancy; |

| | • | | Our self-service Market Table requires minimal staffing and kitchen preparation, thereby reducing labor costs, and provides us flexibility in the range of items we offer, which helps us manage food costs through seasons and market cycles; |

| | • | | In-house butchering by our highly skilledgaucho chefs maximizes the yield on our meat cuts, thereby reducing food costs; and |

| | • | | Our wide variety of proteins offered provides us flexibility in sourcing our meat selection, which help us optimize food costs. |

AttractiveCash-on-Cash Returns Create New Restaurant Growth Opportunity

Our business model produces attractive unit volumes and restaurant contribution margins that drive attractivecash-on-cash returns in excess of 40%. For Fiscal 2016, we generated AUVs of approximately $7.8 million in the U.S. and approximately R$15.0 million (Brazilian Real) in Brazil, and a consolidated restaurant contribution margin of 29.8%. We targetcash-on-cash returns in excess of 40% for new restaurant development by the end of the third full year of operation. We calculatecash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net ofpre-opening costs and tenant allowances). Our restaurants perform well across a diverse range of geographic regions, population densities and real estate settings, which we believe demonstrates the portability of our concept to new markets. We believe the combination of our attractivecash-on-cash returns, proven concept portability, and current footprint, supports further use of cash flow to grow our restaurant base and creates an attractive new restaurant growth opportunity.

Highly Attractive Concept for Domestic and International Real Estate Developers Supports Growth

Due to the broad appeal of our brand, the diversity of our guest base and the relatively high number of weekly visits to our restaurants, our concept is a preferred tenant for real estate developers. Landlords and developers, both in the U.S. and internationally, seek out our restaurants to be anchors for their developments as they are highly complementary to national retailers. Our ability to achieve AUVs that are comparable to those of

S-5

otherhigh-end steakhouses despite our lower average check demonstrates our capacity to attract more guests than many of our competitors. Our AUVs, brand recognition and relatively high guest traffic position us well to negotiate the prime location within a development and favorable lease terms, which enhance our return on invested capital.

We believe our concept has international appeal and makes us an attractive tenant for international real estate developers. We also believe we will be able to leverage our brand strength to negotiate attractive terms in desirable locations as we grow outside the US and Brazil. We have entered into joint ventures to expand our operations in Mexico, where there are currently two joint venture restaurants located in Mexico City, and in certain locations in the United Arab Emirates, Qatar, Kuwait, Oman, Bahrain, the Kingdom of Saudi Arabia and Lebanon.

Our Growth Strategies

We plan to continue to expand our restaurant footprint and drive revenue growth, improve margins and enhance our competitive positioning by executing on the following strategies:

Grow Our Restaurant Base

We believe we are in the early stages of our growth with 47 current restaurants, 35 in the U.S., 10 in Brazil and two in Mexico. Based on internal analysis and a study prepared by an independent third party, we believe there is long-term potential for more than 100 domestic restaurant sites, with additional new restaurants internationally, due to the broad appeal of our differentiated concept, attractivecash-on-cash returns, flexible real estate strategy and successful history of opening new restaurants. We have a long track record of successful new restaurant development, evidenced by having grown our restaurant count by a multiple of 10 since 2000 and at a 12.7% CAGR since 2010. We targetcash-on-cash returns in excess of 40% for new restaurant development by the end of the third full year of operation. We calculate ourcash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net ofpre-opening costs and tenant allowances). We believe our concept has proven portability, with attractive AUVs andcash-on-cash returns across a diverse range of geographic regions, population densities and real estate settings.

We will continue to pursue a disciplined new restaurant growth strategy primarily in the U.S. in both new and existing markets where we believe we are capable of achieving sales volumes and restaurant contribution margins that generate attractivecash-on-cash returns. We opened four restaurants during Fiscal 2016, including our second joint venture restaurant in Mexico City, which opened in October 2016. Over the next five years, we plan to increase our company-owned restaurant count by at least 10% annually, with North America being our primary market for new restaurant development. In addition, we plan to grow in other international markets.

| | • | | Open New Restaurants in the U.S. We believe the US can support a considerable number of additional Fogo de Chão restaurants and will continue to be our primary market for new restaurant development. Based on internal analysis and a study prepared by an independent third party, we believe there is long-term potential for more than 100 domestic sites across large- andmid-sized markets as well as urban and suburban locations that can support Fogo de Chão restaurants. |

| | • | | Open New Restaurants in Brazil. Based on analysis performed by our development team, we believe there is an opportunity to open additional restaurants in Brazil, the birthplace of Fogo de Chão. Over the next five years, we plan to opportunistically open new restaurants throughout the country as attractive real estate locations become available. In addition to providing attractive returns on invested capital, our operations in Brazil allow us to maintain our authentic and distinctivechurrasco heritage and support the global growth of our brand. |

| | • | | Open New Restaurants in Other International Markets. We will selectively consider other international markets, as we believe attractive opportunities for opening new restaurants exist in large cities and business centers in certain international markets including Asia, Australia, Canada, Europe, the Middle |

S-6

| | East and South America. We will pursue growth in these markets through a combination of company-owned restaurant development and joint ventures, which we believe allows us to expand our brand with limited capital investment by us. In October 2016, we opened our second joint venture restaurant in Mexico City. |

Our current restaurant investment model targets an average cash investment of $4.5 million per restaurant, net of tenant allowances andpre-opening costs, assuming an average restaurant size of approximately8,500-10,000 square feet, an AUV of $7.0 million and acash-on-cash return in excess of 40% by the end of the third full year of operation.

The investment targets for our new restaurants do not consider any allocations of corporate support expense,non-cash items such as depreciation, amortization and equity-related compensation expense, or income taxes, and do not represent a targeted return on an investment in our common stock. Additionally, the actual performance of any new restaurant may differ from the originally targeted performance due to a variety of factors, many of which are outside of our control, and such differences may be material. There can be no assurance that any new restaurant opened will have similar operating results to those of established restaurants. See “Risk Factors—Risks Related to Our Business and Industry—Our historical revenue and AUVs may not be indicative of our future financial performance” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017.

Grow Our Comparable Restaurant Sales

We believe the following strategies will allow us to grow our comparable restaurant sales:

| | • | | Food and Beverage Innovation. We seek to introduce innovative items that we believe align with evolving consumer preferences and broaden our appeal, and we will continue to explore ways to increase the number of occasions for guests to visit our restaurants. In order to drive guest frequency and broaden the appeal of our menu, we have added our newGaucho Lunch menu, Weekend Brazilian Brunch, seafood items andon-trend seasonal food and beverage offerings. Additionally, we believe there are significantday-part opportunities with our Bar Fogo concept, a “small plates” menu served at the bar, Happy Hour and special occasion menus. |

| | • | | Increase Our Per Person Average Spend. We believe there are opportunities to drive comparable restaurant sales growth through incremental food and beverage sales. For example, our guests may order a Malagueta Shrimp Cocktail or a Seafood Tower for larger groups in addition to our traditional prix fixe menu. Through Bar Fogo, we plan to generate incremental food sales as well as increase our alcohol sales by improving our guest experience in our bar. |

| | • | | Further Grow Our Large Group Dining Sales. We believe our differentiated dining experience, open restaurant layout, speed of service and compelling value proposition make us a preferred destination for group dining occasions of all types. We currently have the group sales manager positions at all of our US restaurants who introduce large group reception and meeting packages, which have generated significant momentum in group sales growth. We believe the investments we have made in our group sales business will continue to yield positive results. |

| | • | | Continue to Invest in Our Marketing to Drive Traffic. We will continue to invest in marketing and advertising to drive guest trial and frequency. We continue to introduce new marketing initiatives through various channels, including social, online, print, digital advertising, TV and radio media, with the intent to promote brand awareness. We will continue to harness word of mouth and grow our social media ande-mail marketing fan base through thoughtful planning, unique promotions and rich content that reward loyalty and increase guest engagement with our brand. We believe we drive repeat traffic by becoming our guests’ preferred upscale restaurant destination and believe targeted marketing investments that heighten awareness and increase trial and frequency reinforce the premium image of our brand and highlight the authenticity of our dining experience will continue to generate guest loyalty and promote brand advocacy. |

S-7

| | • | | Remodel Select Restaurants. We will continue to remodel select restaurants to enhance the guest experience, highlight our brand attributes and encourage guest trial and frequency. We also believe there are opportunities to optimize restaurant capacity and enhance merchandising to maximize sales per square foot. |

Improve Margins by Leveraging Our Infrastructure and Investments in Human Capital

To support our future growth and improve our operations and management team, we continue to incrementally add positions to our corporate team in executive positions and key functional areas and have added local sales manager positions and assistant manager positions at the restaurant level. These hires have bolstered key functional areas and supported future growth initiatives including senior leadership, new restaurant site selection and analysis, new restaurant design, group dining, product innovation andin-restaurant employee training. In addition, we have implemented initiatives in our restaurants to improve labor productivity, which we believe will further enhance restaurant profitability and the guest experience. These investments and initiatives have yielded positive results and we believe we will continue to benefit from these investments as we grow our business in the long-term. Furthermore, we expect our general and administrative expenses to decrease as a percentage of total revenue over time as we are able to leverage these investments by growing revenue faster than our fixed cost base. In addition, we have made substantial investments in our IT systems, and we expect to utilize our IT infrastructure for continued improvements in operational efficiency and margins through the use of labor productivity and training tools.

Our Private Equity Sponsor

Thomas H. Lee Partners, L.P. (“THL”) is one of the world’s oldest and most experienced private equity firms. Founded in 1974, THL has raised over $20 billion of equity capital and invested in more than 130 portfolio companies with an aggregate value of over $150 billion. THL invests in growth-oriented businesses, headquartered primarily in North America, across three sectors: Business & Financial Services, Consumer & Healthcare, and Media, Information Services & Technology. The firm partners with portfolio company management to identify and implement operational and strategic improvements for long-term growth.

As of the date of this prospectus, funds affiliated with THL (the “THL Funds”) own approximately 79.1 % of our common stock. The THL Funds engage in a range of investing activities, including investments in restaurants and other consumer-related companies in particular that could directly or indirectly compete with us. In the ordinary course of its business activities, the THL Funds may engage in activities where its interests conflict with our interests or those of our stockholders. See “Risk Factors—Risks Related to Ownership of Our Common Stock—We are a “controlled company” within the meaning of the NASDAQ rules and, as a result, are exempt from certain corporate governance requirements” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017.

Corporate Information

Fogo de Chão, Inc. was incorporated as a Delaware corporation as Brasa (Parent) Inc. on May 24, 2012 in connection with the acquisition on July 21, 2012 of Fogo de Chão Churrascaria (Holdings) LLC, a Delaware limited liability company, and its parent company, FC Holdings Inc., a Cayman Islands exempt company, by the THL Funds and other minority investors. On December 17, 2014 we changed our corporate name from Brasa (Parent) Inc. to Fogo de Chão, Inc. Our principal executive offices are located at 14881 Quorum Drive, Suite 750, Dallas, Texas 75254, and our telephone number is (972) 960 9533. The address of our website is www.fogodechao.com. The information contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus.

S-8

THE OFFERING

Common stock offered by the selling stockholders | 4,500,000 shares (5,175,000 shares if the underwriters’ option to purchase additional shares is exercised in full). |

Common stock to be outstanding after this offering | 28,236,594 shares. |

Option to purchase additional shares of common stock | The underwriters may also purchase up to a maximum of 675,000 additional shares of common stock from the selling stockholders named in this prospectus supplement. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

Use of proceeds | We will not receive any proceeds from the sale of shares of our common stock in this offering. See “Use of Proceeds.” |

Dividend policy | We do not anticipate paying any dividends on our common stock in the foreseeable future; however, we may change this policy in the future. See “Dividend Policy.” |

Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on pageS-10 of this prospectus, and the “Risk Factors” section of our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017 incorporated by reference herein, for a discussion of factors you should carefully consider before investing in our common stock. |

NASDAQ trading symbol | “FOGO” |

Unless otherwise indicated, the number of shares of our common stock to be outstanding after this offering is based on 28,236,594 shares of common stock outstanding as of April 30, 2017, and:

| | • | | excludes 1,958,381 shares of our common stock issuable upon the exercise of stock options at a weighted average exercise price of $10.12 per share under our Brasa (Parent) Inc. 2012 Omnibus Equity Incentive Plan (the “2012 Incentive Plan”); |

| | • | | excludes 134,500 shares of our common stock issuable upon the exercise of stock options at a weighted average exercise price of $18.17 per share under our Fogo de Chão, Inc. 2015 Omnibus Incentive Plan (the “2015 Incentive Plan”) |

| | • | | excludes an aggregate of 302,572 shares of common stock that are available for future equity awards under the 2012 Incentive Plan; |

| | • | | excludes an aggregate of 1,065,500 shares of common stock that are available for future equity awards under the 2015 Incentive Plan; |

| | • | | includes 23,850 shares of outstanding restricted stock; and |

| | • | | assumes no exercise of the underwriters’ option to purchase up to 675,000 additional shares from the selling stockholders. |

S-9

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the specific risks described under the heading “Risk Factors” in this prospectus and under the caption “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, without limitation, our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017, incorporated by reference in this prospectus. If any of these risks, as well as other risks and uncertainties that are not yet identified or that we currently think are immaterial, actually occur, our business, results of operations or financial condition could be materially and adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to our Common Stock and this Offering

The market price of our common stock may decline, and you could lose all or a significant part of your investment.

The market price of, and trading volume for, our common stock may be influenced by many factors, some of which are beyond our control, including, among others, the following:

| | • | | variations in our quarterly or annual operating results; |

| | • | | changes in our earnings estimates (if provided) or differences between our actual financial and operating results and those expected by investors and analysts; |

| | • | | initiatives undertaken by our competitors, including, for example, the opening of restaurants in our existing markets; |

| | • | | actual or anticipated fluctuations in our or our competitors’ results of operations, and our and our competitors’ growth rates; |

| | • | | the failure of securities analysts to cover our common stock, or changes in estimates by analysts who cover us and competitors in our industry; |

| | • | | recruitment or departure of key personnel; |

| | • | | adoption or modification of laws, regulations, policies, procedures or programs applicable to our business or announcements relating to these matters; |

| | • | | any increased indebtedness we may incur in the future; |

| | • | | actions by stockholders; |

| | • | | announcements by us or our competitors of significant contracts, acquisitions, dispositions, strategic relationships, joint ventures or capital commitments; |

| | • | | the expiration oflock-up agreements entered into by our existing stockholders in connection with our initial public offering; |

| | • | | geopolitical incidents; and |

| | • | | investor perceptions of us, our competitors and our industry. |

As a result of these and other factors, our stockholders may experience a decrease, which could be substantial, in the value of their shares of our common stock, including decreases unrelated to our financial performance or prospects.

S-10

The market price and trading volume of our common stock may be volatile, which could result in rapid and substantial losses for our stockholders.

The market price of our common stock may be highly volatile and could be subject to wide fluctuations. In addition, the trading volume in our common stock may fluctuate and cause significant price variations to occur. If the market price of our common stock declines significantly, stockholders may be unable to resell shares of our common stock at or above their purchase price, if at all. The market price of our common stock may fluctuate or decline significantly in the future.

Certain broad market and industry factors may materially decrease the market price of our common stock, regardless of our actual operating performance. The stock market in general has from time to time experienced extreme price and volume fluctuations, including recently. In addition, in the past, following periods of volatility in the overall market and decreases in the market price of a company’s securities, securities class action litigation has often been instituted against these companies. This litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources.

Future sales of our common stock could cause the market price of such shares to fall.

If our existing stockholders sell substantial amounts of our common stock, the market price of our common stock could decrease significantly. The perception in the public market that major stockholders might sell substantial amounts of our common stock could also depress the market price of our common stock. A decline in the market price of our common stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities.

Future offerings of equity by us may adversely affect the market price of our common stock.

In the future, we may attempt to obtain financing or to further increase our capital resources by issuing additional shares of our common stock or by offering debt or other equity securities, including senior or subordinated notes, debt securities convertible into equity or shares of preferred stock. Opening new restaurants in existing and new markets could require substantial additional capital in excess of cash from operations. We would expect to finance the capital required for new restaurants through a combination of additional issuances of equity, corporate indebtedness and cash from operations.

Issuing additional shares of our common stock or other equity securities or securities convertible into equity may dilute the economic and voting rights of our existing stockholders or reduce the market price of our common stock or both. Upon liquidation, holders of such debt securities and preferred shares, if issued, and lenders with respect to other borrowings would receive a distribution of our available assets prior to the holders of our common stock. Debt securities convertible into equity could be subject to adjustments in the conversion ratio pursuant to which certain events may increase the number of equity securities issuable upon conversion. Preferred shares, if issued, could have a preference with respect to liquidating distributions or a preference with respect to dividend payments that could limit our ability to pay dividends to the holders of our common stock. Our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, which may adversely affect the amount, timing or nature of our future offerings. Thus, holders of our common stock bear the risk that our future offerings may reduce the market price of our common stock and dilute their stockholdings in us.

We do not intend to pay cash dividends for the foreseeable future.

We intend to retain all of our earnings for the foreseeable future to fund the operation and growth of our business and to repay indebtedness, and therefore, we do not anticipate paying any cash dividends to holders of our capital stock for the foreseeable future. Any future determination regarding the payment of any dividends will be made at the discretion of our board of directors and will depend on our financial condition, results of

S-11

operations, capital requirements, liquidity, contractual restrictions, general business conditions and other factors that our board of directors may deem relevant. Consequently, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not invest in our common stock.

The market price of our common stock could decline if securities or industry analysts do not publish research or reports about our company or if they downgrade us or other restaurant companies in our industry.

The market price of our common stock depends, in part, on the research and reports that securities or industry analysts publish about us or our business. We do not influence or control the reporting of these analysts. In addition, if no analysts provide coverage of our company or if one or more of the analysts who do cover us downgrade shares of our company or other companies in our industry, the market price of our common stock could be negatively impacted. If one or more of these analysts cease coverage of our company, we could lose visibility in the market, which could, in turn, cause the market price of our common stock to decline.

The future issuance of additional common stock in connection with our incentive plans, acquisitions or otherwise will dilute all other stockholdings.

We have an aggregate of 1.4 million shares of common stock authorized but unissued and not reserved for issuance under our equity incentive plans. We may issue all of these shares of common stock without any action or approval by our stockholders, subject to certain exceptions. Any common stock issued in connection with our equity incentive plans, the exercise of outstanding stock options or otherwise would dilute the percentage ownership held by our stockholders.

S-12

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and in any prospectus supplement contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, the development and introduction of new products, and the implementation of our marketing and branding strategies. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “seeks,” “intends,” “targets” or the negative of these terms or other comparable terminology.

The forward-looking statements contained in this prospectus reflect our current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that our assumptions are reasonable, we cannot guarantee future events, results, actions, levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to, those factors discussed under the caption entitled “Risk Factors” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017. These factors include without limitation:

| | • | | changes in general economic, political or market conditions, both in the U.S. and Brazil; |

| | • | | increased competition in our industry; |

| | • | | risk associated with our Brazilian operations and any other future international operations; |

| | • | | our ability to manage operations at our current size or manage growth effectively; |

| | • | | our ability to successfully expand in the U.S. and other new markets; |

| | • | | our ability to locate suitable locations to open new restaurants and to attract guests to our restaurants; |

| | • | | the fact that we will rely on our operating subsidiaries to provide us with distributions to fund our operating activities, which could be limited by law, regulation or otherwise; |

| | • | | our ability to continually innovate and provide our consumers with innovative dining experiences; |

| | • | | our ability to maintain recent levels of comparable revenue or average revenue per square foot; |

| | • | | the ability of our suppliers to deliver beef in a timely or cost-effective manner; |

| | • | | our lack of long-term supplier contracts, our concentration of suppliers and distributors and potential increases in the price of beef; |

| | • | | our ability to raise money and maintain sufficient levels of cash flow; |

| | • | | conflicts of interest with the THL Funds; |

| | • | | our status as a “controlled company” which means that we are exempt from certain corporate governance rules primarily relating to board independence, and we intend to use some or all of these exemptions; |

| | • | | the terms and conditions we are subject to under our credit facilities; |

| | • | | our ability to effectively market and maintain a positive brand image; |

| | • | | changes in government regulation |

| | • | | our ability to attract and maintain the services of our senior management and key employees; |

S-13

| | • | | the availability and effective operation of management information systems and other technology; |

| | • | | changes in consumer preferences or changes in demand for upscale dining experiences; |

| | • | | our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; |

| | • | | our ability to maintain effective internal controls or the identification of additional material weaknesses; |

| | • | | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

| | • | | changes in accounting standards; and |

| | • | | other risks described in the “Risk Factors” section of our Annual Report on Form10-K for the fiscal year ended January 1, 2017 and our Quarterly Report on Form10-Q for the quarter ended April 2, 2017. |

Although we believe that the assumptions inherent in the forward-looking statements contained in this prospectus are reasonable, undue reliance should not be placed on these statements, which only apply as of the date hereof. Except as required by applicable securities law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

S-14

USE OF PROCEEDS

All shares of common stock offered by this prospectus will be sold by the selling stockholders, which include entities affiliated with members of our board of directors. We will not receive any proceeds from the sale of shares by the selling stockholders. The selling stockholders will pay any customary underwriting discounts and commissions and expenses incurred by such selling stockholder in disposing of these shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares of common stock covered by this prospectus.

S-15

MARKET PRICE OF OUR COMMON STOCK

Our common stock has traded on NASDAQ under the symbol “FOGO” since June 19, 2015. Prior to that time, there was no public market for our shares. As of April 30, 2017, there were 32 holders of record of our common stock. The following table sets forth for the periods indicated the high and low sales prices of our common stock on NASDAQ.

| | | | | | | | |

| | | High | | | Low | |

Year Ending December 31, 2017 | | | | | | | | |

2nd Quarter (through May 5, 2017) | | $ | 17.05 | | | $ | 15.10 | |

1st Quarter | | $ | 16.35 | | | $ | 13.10 | |

| | |

Year Ending January 1, 2017 | | | | | | | | |

4th Quarter | | $ | 14.95 | | | $ | 10.50 | |

3rd Quarter | | $ | 14.18 | | | $ | 10.51 | |

2nd Quarter | | $ | 17.89 | | | $ | 12.00 | |

1st Quarter | | $ | 16.95 | | | $ | 13.40 | |

| | |

Year Ending January 3, 2016 | | | | | | | | |

4th Quarter | | $ | 17.20 | | | $ | 14.12 | |

3rd Quarter | | $ | 23.94 | | | $ | 15.86 | |

2nd Quarter (beginning June 19, 2015 (first trading date after our initial public offering) | | $ | 27.19 | | | $ | 21.85 | |

On May 5, 2017, the closing price of our common stock as reported on NASDAQ was $16.90 per share. American Stock Transfer & Trust Company, LLC is the transfer agent and registrar for our common stock.

S-16

DIVIDEND POLICY

We intend to retain all of our earnings for the foreseeable future to fund the operation and growth of our business and to repay indebtedness, and therefore, we do not anticipate paying any cash dividends to holders of our capital stock for the foreseeable future. See “Risk Factors—Risks Related to our Common Stock and this Offering—We do not intend to pay cash dividends for the foreseeable future.” Any future determination regarding the payment of any dividends will be made at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, liquidity, contractual restrictions, general business conditions and other factors that our board of directors may deem relevant. Our credit facility restricts, and debt instruments that we may enter into in the future may contain, restrictions on our ability to pay dividends on our common stock.

We consider the undistributed net earnings of our Brazilian subsidiaries to be indefinitely reinvested. Although there are no known restrictions that would prohibit the repatriation of cash and cash equivalents from our Brazilian subsidiaries to the U.S., such repatriation would constitute a change in our assertion regarding indefinite reinvestment and as a result we would be required to record a tax liability attributable to those undistributed earnings. Additionally, cash and cash equivalents of our joint venture in Mexico can only be used to settle the obligations of the joint venture. See “Liquidity and Capital Resources” in our Annual Report on Form10-K for the fiscal year ended January 1, 2017 (which document is incorporated by reference herein).

S-17

SELLING STOCKHOLDERS

The following table shows information as of April 30, 2017 regarding the beneficial ownership of our common stock (1) immediately prior to and (2) as adjusted to give effect to this offering by the selling stockholders.

As of April 30, 2017, we had 32 holders of record.

Beneficial ownership of shares is determined under rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Except as noted by footnote, and subject to community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the table below have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them. Percentage of beneficial ownership is based on 28,236,594 shares of common stock outstanding as of April 30, 2017. Shares of common stock subject to options currently exercisable or exercisable within 60 days of the date of this prospectus are deemed to be outstanding and beneficially owned by the person holding the options for the purposes of computing the percentage of beneficial ownership of that person and any group of which that person is a member, but are not deemed outstanding for the purpose of computing the percentage of beneficial ownership for any other person. Except as otherwise indicated, the persons named in the table below have sole voting and investment power with respect to all shares of capital stock held by them.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares of

Common Stock

Beneficially owned

before this Offering | | | Number of

Shares

Offered | | | Number of

Shares

subject

to Underwriters’

Option | | | Shares of

Common Stock

Beneficially

Owned

after this

Offering

(assuming no

exercise

of the Option to

purchase

additional

Shares) | | | Shares of

Common Stock

Beneficially

Owned

after this

Offering

assuming full

exercise of

the Option to purchase

additional

shares | |

Name and Address Of Beneficial Owner | | Number of

Shares | | | Percentage

of Shares | | | | | Number of

Shares | | | Percentage of

Shares | | | Number of

Shares | | | Percentage of

Shares | |

Funds affiliated with Thomas H. Lee Partners, L.P.(1) | | | 22,324,323 | | | | 79.1 | % | | | 4,500,000 | | | | 675,000 | | | | 17,824,323 | | | | 63.1 | % | | | 17,149,323 | | | | 60.7 | % |

| (1) | Consists of: (i) 12,055,476 shares held by Thomas H. Lee Equity Fund VI, L.P.; (ii) 8,163,328 shares held by Thomas H. Lee Parallel Fund VI, L.P.; (iii) 1,425,975 shares held by Thomas H. Lee Parallel (DT) Fund VI, L.P. (the foregoing, collectively, the “THL VI Funds”); (iv) 415,870 shares held by THL Coinvestment Partners, L.P.; (v) 72,990 shares held by THL Operating Partners, L.P.; (vi) 62,730 shares held by Great-West Investors, LP; (vii) 62,501 shares held by Putnam Investments Employees’ Securities Company III, LLC; (viii) 58,911 shares held by THL Equity Fund VI Investors (Fogo), LLC and (ix) 6,542 shares held by THL Equity Fund VI Investors (Fogo) II, LLC (the foregoing, excluding the THL VI Funds collectively, the “THLCo-Investors”). The THLCo-Investors areco-investors of the THL VI Funds, are contractually obligated to coinvest and dispose of their shares alongside the THL VI Funds on a pro rata basis and look to the THL VI Funds with respect to voting and investment determinations with respect to their shares. THL Holdco, LLC is the managing member of Thomas H. Lee Advisors, LLC, which is the general partner of Thomas H. Lee Partners, L.P., which is the sole member of THL Equity Advisors VI, LLC, which is the general partner of the THL VI Funds. Voting and investment determinations with respect to the shares held or controlled by the THL VI Funds are made by the private equity management committee of THL Holdco, LLC (the “THL Committee”). Todd M. Abbrecht, Anthony J. DiNovi, Thomas M. Hagerty, Soren L. Oberg, Scott M. Sperling and Kent R. Weldon are the members of the THL Committee, and as such are the individuals who may be deemed to share beneficial ownership of the shares held or controlled by the THL VI Funds. Each member of the THL Committee disclaims beneficial ownership of such securities. The address of each of the THL VI Funds, the THLCo-Investors (other than those listed in the following two sentences) and each member of the THL Committee is c/o Thomas H. Lee Partners, L.P., 100 |

S-18

| | Federal Street, Boston, Massachusetts 02110. The address of Great-West Investors, LP is 8515 East Orchard Road, Greenwood Village, Colorado 80111. The address of Putnam Investments Employees’ Securities Company III LLC is c/o Putnam Investment, Inc., 1 Post Office Square, Boston, Massachusetts 02109. Thomas H. Lee Partners, L.P. and their affiliates did not purchase shares of our company’s common stock outside the ordinary course of business as an investor or with, at the time of its acquisition of shares of our company’s common stock, any agreements, understandings, or arrangements with any other persons, directly or indirectly, to dispose of the shares. Each member of the THL Committee disclaims beneficial ownership of the shares referred to in this footnote. |

S-19

DESCRIPTION OF CAPITAL STOCK

The following description of the material terms of our capital stock is qualified by the more complete description contained in our amended and restated certificate of incorporation and our amended and restated bylaws, and is subject to the provisions of the Delaware General Corporate Law (the “DGCL”).

Authorized Capitalization

Our authorized capital stock consists of 200,000,000 shares of our common stock, par value $0.01 per share, and 15,000,000 shares of preferred stock, par value $0.01 per share. As of April 30, 2017, our common stock was held by approximately 32 holders of record. No shares of preferred stock were issued or outstanding as of April 30, 2017. The following description summarizes the terms of our capital stock. Because it is only a summary, it does not contain all the information that may be important to you. For a complete description, you should refer to our amended and restated certificate of incorporation and our amended and restated bylaws.

Common Stock

Holders of our common stock are entitled to one vote for each share held of record on all matters on which stockholders are generally entitled to vote.

Holders of our common stock are entitled to receive dividends when and if declared by our board of directors out of funds legally available therefor, subject to any statutory or contractual restrictions on the payment of dividends and to any restrictions on the payment of dividends imposed by the terms of any outstanding preferred stock.

Holders of our common stock do not have preemptive, subscription, redemption or conversion rights.

The rights, preferences and privileges of holders of common stock are subject to the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Preferred Stock

Under our amended and restated certificate of incorporation, our board of directors has the authority, without action by our stockholders, to designate and issue shares of preferred stock in one or more series and to designate the rights, preferences and privileges of each series, which may be greater than the rights of our common stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock upon the rights of holders of the common stock until our board of directors determines the specific rights of the holders of such preferred stock. However, the effects might include, among other things:

| | • | | restricting dividends on the common stock; |

| | • | | diluting the voting power of the common stock; |

| | • | | impairing the liquidation rights of the common stock; or |

| | • | | delaying or preventing a change in our control without further action by the stockholders. |

The issuance of our preferred stock could have the effect of delaying, deferring, or preventing a change in our control. Upon the completion of the offering, no shares of preferred stock will be outstanding, and we have no present plans to issue any shares of preferred stock.

Options to Purchase Common Stock

There are outstanding options to purchase 1,958,381 shares of our common stock at a weighted average exercise price of $10.12 per share under our 2012 Incentive Plan and 134,500 shares of our common stock issuable upon the exercise of stock options granted to employees at a weighted average exercise price of $18.17 under our 2015 Incentive Plan.

S-20

Anti-Takeover Effects of Provisions of Our Charter, Our Bylaws and Delaware Law

Certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws, and applicable provisions of the Delaware General Corporation Law may make it more difficult for or prevent a third party from acquiring control of us or changing our board of directors and management. These provisions may have the effect of deterring hostile takeovers or delaying changes in our control or in our management. These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and in the policies furnished by them and to discourage certain types of transactions that may involve an actual or threatened change in our control. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal. The provisions also are intended to discourage certain tactics that may be used in proxy fights. However, these provisions could have the effect of discouraging others from making tender offers for our shares and, as a consequence, they also may inhibit fluctuations in the market price of our shares that could result from actual or rumored takeover attempts. Such provisions may also have the effect of preventing changes in our management.

Classified Board of Directors

In accordance with the terms of our amended and restated certificate of incorporation and amended and restated bylaws, our board of directors is divided into three classes, class I, class II and class III, with members of each class serving staggered three-year terms. Our amended and restated certificate of incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist ofone-third of the directors. Our amended and restated certificate of incorporation and our bylaws also provide that, prior to the date on which THL owns less than 50% of our outstanding common stock, a director may be removed with or without cause by the affirmative vote of the holders of a majority of the voting power of our outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class. At and following the date on which THL owns less than 50% of our outstanding common stock a director may be removed only for cause by the affirmative vote of the holders of at least 75% of the voting power of our outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class. Any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by vote of a majority of our directors then in office. Our classified board of directors could have the effect of delaying or discouraging an acquisition of us or a change in our management.

Special Meetings of Stockholders

Our bylaws provide that a special meeting of stockholders may be called only by the chairman of our board of directors or by a resolution adopted by a majority of our board of directors. Stockholders are not permitted to call a special meeting of stockholders, to require that the chairman call such a special meeting, or to require that our board request the calling of a special meeting of stockholders.

No Stockholder Action by Written Consent

Our amended and restated certificate of incorporation provides that, for so long as we remain a “controlled company” under the NASDAQ rules, stockholder action may be taken only at an annual meeting or special meeting of stockholders and may not be taken by written consent instead of a meeting, unless the action to be taken by written consent of stockholders and the taking of this action by written consent has been expressly approved in advance by the board of directors. Failure to satisfy any of the requirements for a stockholder meeting could delay, prevent or invalidate stockholder action.

Stockholder Advance Notice Procedure

Our amended and restated bylaws establish an advance notice procedure for stockholders to make nominations of candidates for election as directors or to bring other business before an annual meeting of our

S-21

stockholders. The amended and restated bylaws provide that any stockholder wishing to nominate persons for election as directors at, or bring other business before, an annual meeting must deliver to our secretary advanced written notice of the stockholder’s intention to do so.

Registration Rights

Certain of our existing stockholders have certain registration rights with respect to our common stock pursuant to the Registration Rights Agreement. The Registration Rights Agreement provides for customary registration rights, including demand and short-form registration rights for the THL Funds and piggyback registration rights for such stockholders party to the Registration Rights Agreement. We shall not be obligated to effect (i) more than one demand registration during any180-day period; (ii) any demand registration unless the value of the securities to be registered are at least $50 million or such lower amount as agreed by the holders of a majority of the shares held by the THL Funds and other investors; or (iii) any demand registration during the effectiveness of alock-up agreement entered into in connection with a public offering of securities for our own account.

The THL Funds may assign all or any portion of its rights under the Registration Rights Agreement to its affiliates. No transfer of rights by any stockholder (other than the THL Funds) will be permitted if, after giving effect to any such transfers, such stockholder and his/her permitted transferee pursuant to the terms of the Registration Rights Agreement would hold that percentage of the shares such group held immediately prior to our initial public offering which is less than the “minimum percentage.” The Minimum percentage means, at any given time, a fraction (expressed as a percentage), with the numerator being the number of shares held by the THL Funds at such time and the denominator being the number of shares held by the THL Funds immediately prior to our initial public offering.

Section 203 of the Delaware General Corporation Law

We have opted out of Section 203 of the Delaware General Corporation Law (the “DGCL”). However, our amended and restated certificate of incorporation contains similar provisions providing that we may not engage in certain “business combinations” with any “interested stockholder” for a three-year period following the time that the stockholder became an interested stockholder, unless:

| | • | | prior to such time, our board of directors approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; |

| | • | | upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced, excluding certain shares; or |

| | • | | at or subsequent to that time, the business combination is approved by our board of directors and by the affirmative vote of holders of at least 66 2⁄3% of the outstanding voting stock that is not owned by the interested stockholder. |

Generally, a “business combination” includes a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an “interested stockholder” is a person who, together with that person’s affiliates and associates, owns, or within the previous three years owned, 15% or more of our voting stock.

Under certain circumstances, this provision will make it more difficult for a person who would be an “interested stockholder” to effect various business combinations with a corporation for a three-year period. This provision may encourage companies interested in acquiring our company to negotiate in advance with our board of directors because the stockholder approval requirement would be avoided if our board of directors approves either the business combination or the transaction which results in the stockholder becoming an interested

S-22

stockholder. These provisions also may have the effect of preventing changes in our board of directors and may make it more difficult to accomplish transactions which stockholders may otherwise deem to be in their best interests.

Our amended and restated certificate of incorporation provides that THL, their respective affiliates and associates, and any of their respective direct or indirect transferees of at least 5% of our outstanding common stock and any group as to which such persons are party to, do not constitute “interested stockholders” for purposes of this provision.

Exclusive Forum

Our amended and restated bylaws provide that unless we consent to the selection of an alternative forum, a state or federal court located within the state of Delaware will, with certain limited exceptions, be the sole and exclusive forum for any stockholder (including any beneficial owner) to bring (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the DGCL, or (iv) any action asserting a claim governed by the internal affairs doctrine, in each such case subject to said Delaware court having personal jurisdiction over the indispensable parties named as defendants therein. Any person or entity purchasing or otherwise acquiring or holding any interest in shares of our capital stock shall be deemed to have notice of and consented to the forum provisions in our amended and restated bylaws. However, the enforceability of similar forum provisions in other companies’ certificates of incorporation or bylaws has been challenged in legal proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable.

Listing

Our common stock is listed on NASDAQ under the symbol “FOGO.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC.

S-23

SHARES ELIGIBLE FOR FUTURE SALE

Sale of Restricted Securities

As of April 30, 2017, we have 28,236,594 shares of our common stock outstanding. Of these shares, all of the shares of our common stock sold in this offering will be freely tradable in the public market without further restriction or registration under the Securities Act, except that any shares purchased by our affiliates may generally only be sold in compliance with Rule 144, which is described below. Of the remaining outstanding shares, shares will be deemed “restricted securities” under the Securities Act.

Lock-Up Arrangements and Registration Rights

In connection with this offering, we, our executive officers and directors, and the selling stockholders, representing 18,065,180 shares of our common stock after giving effect to this offering and assuming no exercise of the underwriter’s option to purchase additional shares from the selling stockholders, will enter intolock-up agreements described under “Underwriting” that restrict the sale of our securities for up to 90 days after the date of this prospectus, subject to certain exceptions or an extension in certain circumstances.