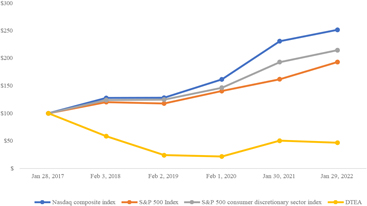

Comparison of trend in stock performance to trend in compensation of executive officers

During the fiscal year ended February 3, 2018, the Corporation paid aggregate compensation of $4,563,676 to its then- Named Executive Officers. During the fiscal year ended February 2, 2019, the Corporation paid an aggregate of $2,408,147 to its then-Named Executive Officers, including a severance payment to the former Chief Executive Officer, decreasing by 14.1% to $2,068,876 for the fiscal year ended February 1, 2020. During the fiscal year ended January 30, 2021, the Corporation paid an aggregate of $2,923,552 to its Named Executive Officers, representing an increase of $854,676 or 41.3% from the previous year. During the fiscal year ended January 29, 2022, the Corporation paid an aggregate of $3,501,908 to its Named Executive Officers, including one-time equity grants for the appointments of the Chief Executive Officer and President, respectively, representing an increase of $578,356 or 19.8% from the previous year. The aggregate compensation paid during the fiscal year ended January 29, 2022 represents 76.7% of the aggregate compensation paid during the fiscal year ended February 3, 2018. The percentage decline in the Corporation’s stock price over the five-year period exceeds the percentage decrease in aggregate annual compensation paid to the Named Executive Officers.

APPOINTMENT OF AUDITOR

Except where authorization to vote with respect to the appointment of the auditor is withheld, the persons named in the accompanying form of proxy intend to vote for the appointment of Ernst & Young LLP, Chartered Professional Accountants, as the auditor of the Corporation until the next annual meeting of shareholders. Ernst & Young LLP, Chartered Professional Accountants, have served as auditor of the Corporation since the Corporation’s 2011 fiscal year.

INFORMATION ON THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is currently comprised of Pat De Marco (chair), Susan L. Burkman and Peter Robinson, all of whom are “independent” directors within the meaning of National Instrument 52-110 Audit Committees. The Board of Directors has determined that each of the three current members of the Audit Committee is “financially literate” within the meaning of section 1.6 of National Instrument 52-110 Audit Committees, that is, each member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. Reference is made to the section entitled “Information on the Audit Committee” of the Corporation’s Annual Report on Form 10-K for the fiscal year ended January 29, 2022 for required disclosure relating to the Audit Committee. The Annual Report on Form 10-K is available under the Corporation’s profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov and on the Corporation’s Investor Relations website at http://ir.davidstea.com.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No executive officer, director or employee, former or present, of the Corporation or a subsidiary thereof, no person who is a nominee for election as a director of the Corporation, and no associate of such persons, is, or was at any time since the beginning of the fiscal year ended January 29, 2022, indebted to the Corporation or a subsidiary thereof, nor has any such person been indebted at any time since the beginning of the fiscal year ended January 29, 2022 to any other entity where such indebtedness is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or a subsidiary thereof, other than as set out below under “Interest of Informed Persons in Material Transactions”.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Corporation, none of the persons who have been directors or executive officers of the Corporation at any time since the beginning of the fiscal year ended January 29, 2022, none of the proposed nominees for election as a director of the Corporation and none of the associates or affiliates of any of the foregoing has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter scheduled to be acted upon at the Meeting.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No “informed person” of the Corporation, that is: (a) the directors and executive officers of the Corporation; (b) any person who beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the Corporation’s outstanding voting shares; (c) any director or executive officer of a person referred to in (b) above; or (d) any associate or affiliate of any “informed person” of the Corporation, has any material interest, direct or indirect, in any transaction since the beginning of the fiscal year ended January 29, 2022 or in any proposed transaction which has materially affected or would materially affect the Corporation.

19