SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | [X] | |

| Filed by a Party other than the Registrant | [ ] | |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

Resource Credit Income Fund

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

| | | |

| | | |

Resource Credit Income Fund

Principal Executive Offices

717 Fifth Avenue, 18th Floor

New York, NY 10022

1-855-747-9559

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held September 23, 2020 at 11:00 a.m.

Dear Shareholders:

The Board of Trustees of Resource Credit Income Fund, a continuously offered, diversified, closed-end management investment company operating as an interval fund organized as a Delaware statutory trust (the “Trust” or the “Fund”), has called a special meeting of the Fund’s shareholders (the “Meeting”), to be held at the offices of Thompson Hine LLP, at 335 Madison Avenue, 12th Floor, New York, NY 10017, on September 23, 2020 at 11:00 a.m.

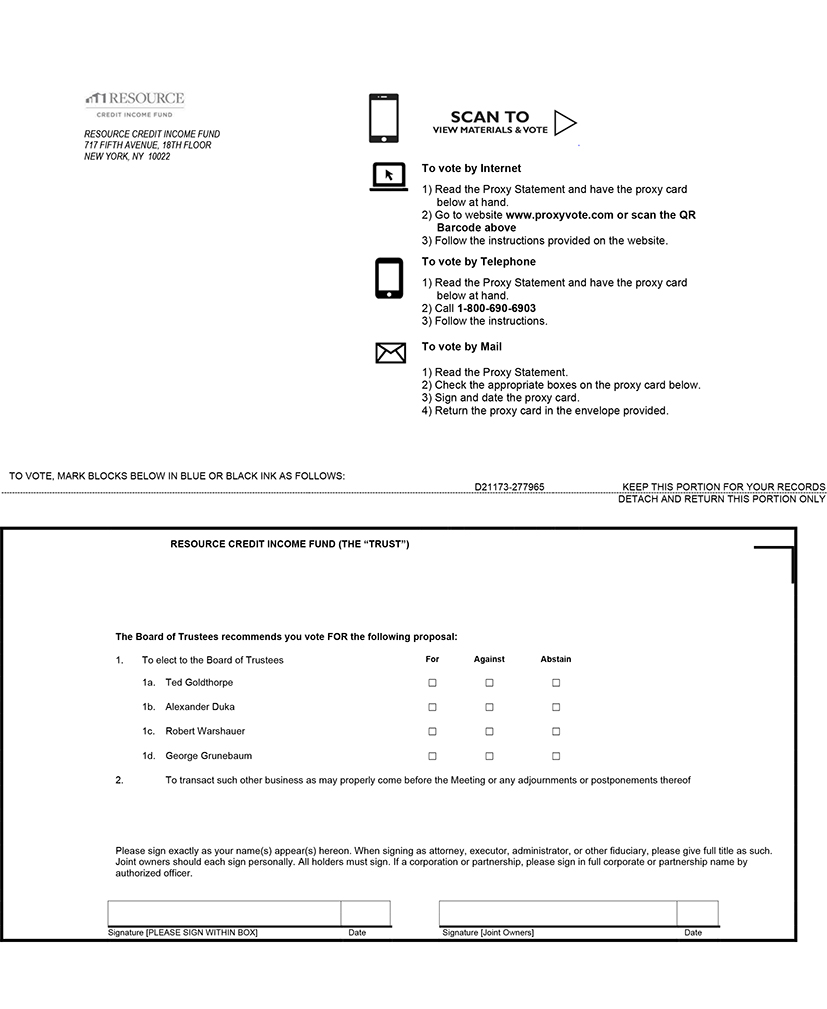

Whether or not a shareholder plans to attend the Meeting, the Fund urges shareholders to vote and authorize the shareholder’s proxy in advance of the Meeting by one of the methods described in the Proxy Statement for the Meeting. The Proxy Statement is available on the Internet at www.resourcealts.com.

The Meeting will be held for the following purposes:

| Proposals | Recommendation of the Board of Trustees |

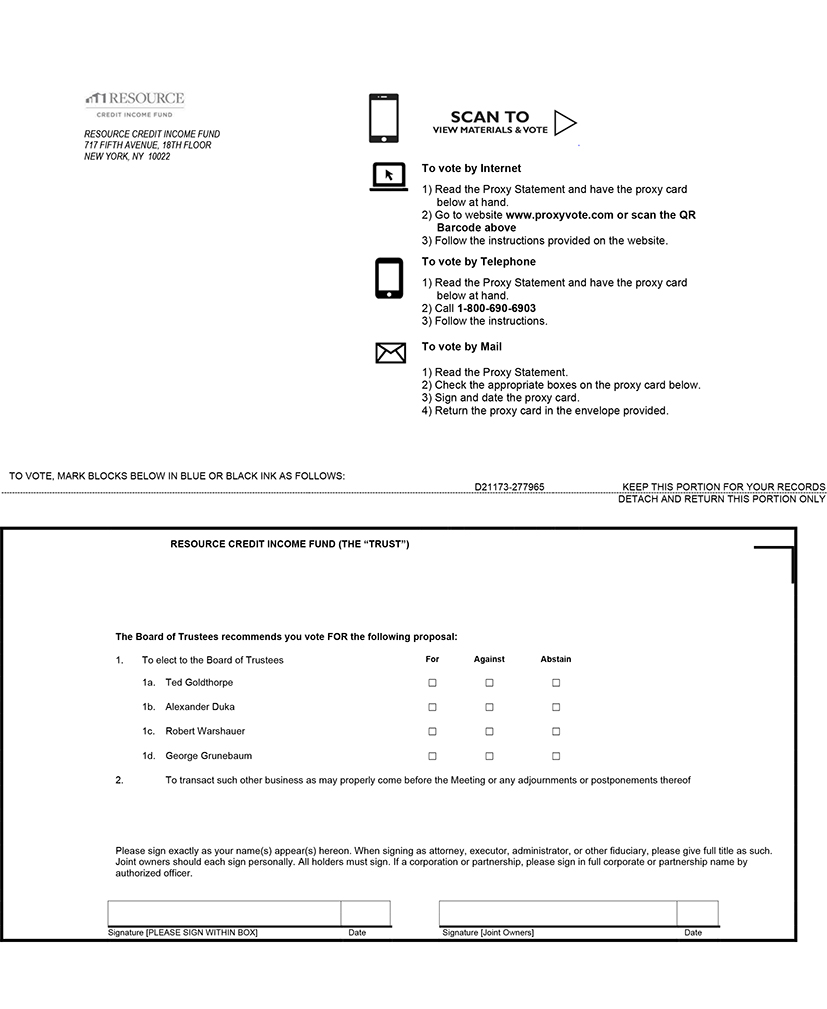

| 1. | To elect Ted Goldthorpe, Alexander Duka, Robert Warshauer and George Grunebaum to the Board of Trustees. | FOR |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | |

Only shareholders of record at the close of business on July 17, 2020 are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof.

In addition, Fund shareholders (by separate proxy statement) are also being asked to approve a new management agreement between Sierra Crest Investment Management LLC and the Fund (the “Proposed Management Agreement”). Please note that the Meeting will not be held if, at the time of the Meeting, the Proposed Management Agreement has not yet been approved. Instead, the Meeting will be adjourned to a future date and held once such approval has been obtained.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on September 23, 2020 at 11:00 a.m.

A copy of the Notice of Shareholder Meeting, the Proxy Statement and Proxy Voting Ballot are available at www.resourcealts.com.

By Order of the Board of Trustees

Lawrence S. Block

Secretary

August 20, 2020

YOUR VOTE IS IMPORTANT

To assure your representation at the meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You also may vote by telephone or via the Internet by following the instructions on the enclosed proxy card. Whether or not you plan to attend the meeting in person, please vote your shares; if you attend the meeting, you may revoke your proxy and vote your shares in person. For more information or assistance with voting, please call 1-855-973-0089.

Resource Credit Income Fund

with its principal offices at

717 Fifth Avenue, 18th Floor

New York, NY 10022

1-855-747-9559

____________

PROXY STATEMENT

____________

SPECIAL MEETING OF SHAREHOLDERS

To Be Held September 23, 2020

at 11:00 a.m.

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees” or the “Board of Trustees”) of Resource Credit Income Fund (the “Trust” or the “Fund”), for use at the Special Meeting of Shareholders of the Trust (the “Meeting”), to be held at the offices of Thompson Hine LLP, at 335 Madison Avenue, 12th Floor, New York, NY 10017, on September 23, 2020 at 11:00 a.m.

Whether or not a shareholder plans to attend the Meeting, the Fund urges shareholders to vote and authorize the shareholder’s proxy in advance of the Meeting by one of the methods described in this Proxy Statement for the Meeting. This Proxy Statement is available on the Internet at www.resourcealts.com.

The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about August 20, 2020. The Meeting will be held for the following purposes:

| 1. | To elect Ted Goldthorpe, Alexander Duka, Robert Warshauer and George Grunebaum to the Board of Trustees. |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

Shareholders of record at the close of business on July 17, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

In addition, Fund shareholders (by separate proxy statement) are also being asked to approve a new management agreement between Sierra Crest Investment Management LLC and the Fund (the “Proposed Management Agreement”). Please note that the Meeting will not be held if, at the time of the Meeting, the Proposed Management Agreement has not yet been approved. Instead, the Meeting will be adjourned to a future date and held once such approval has been obtained.

The Fund’s most recent semi-annual and annual reports, including financial statements and schedules, are available at no charge by calling 1-855-747-9559 or by visiting www.resourcealts.com.

Dear Shareholder,

Since launching the Fund in 2015, Resource America, Inc. and its subsidiary, Resource Alternative Advisor, LLC (the “Current Manager” and, together with Resource America, Inc., “Resource”) have been committed to meeting the Fund’s investment objectives to produce current income and achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. Resource is pleased that the Fund’s shareholders have benefited from the Fund’s outperformance relative to its primary benchmark, the S&P/LSTA Leveraged Loan Index, from inception through March 31, 2020 (on an annualized basis).

Resource believes that, in connection with its strategic business decision to exit the business of advising the Fund, it has identified a partner that will continue to implement the Fund’s investment objectives and strategies and serve shareholder interests. In this regard, Resource believes that it is in the best interest of the Fund and its shareholders for the Fund to engage Sierra Crest Investment Management LLC (“Sierra Crest”) as the investment adviser to the Fund under a new management agreement (the “Proposed Management Agreement”). As a result of its diligence, Resource determined that Sierra Crest would be able to meet the needs of the Fund and its shareholders. Sierra Crest, which is an affiliate of BC Partners Advisors L.P. (“BC Partners”), brings significant resources and expertise in its capacity as an affiliate of an international advisory firm, and such capacities offer the potential for increased asset growth that Resource believes will benefit the Fund and its shareholders. BC Partners operates a private equity investment platform, a credit investment platform (“BCP Credit”) and a real estate investment platform as fully integrated businesses. Sierra Crest’s investment activity takes place within the BCP Credit platform. Integration with the broader BC Partners platform allows BCP Credit to leverage a team of investment professionals across its private equity platform including its operations team. In addition to acting as the investment adviser to Portman Ridge Finance Corporation, a publicly traded business development company, BCP Credit, through Sierra Crest, currently manages two private credit opportunity funds along with several separate managed accounts focused on credit investments and BC Partners Lending Corporation, a private business development company.

To effect the new relationship with Sierra Crest, the Fund needs your vote to elect Ted Goldthorpe, Alexander Duka, Robert Warshauer and George Grunebaum to the Board of Trustees (the “Nominees”). The members of the Fund’s Board of Trustees (the “Current Trustees”) have nominated the Nominees for election and, if shareholders vote in favor of electing the Nominees to the Board of Trustees, the Current Trustees will resign from the Board of Trustees.

Thank you, and please return your YES proxy vote to the proposal promptly.

Please note that shareholders are also being asked, by means of a separate proxy statement that will be mailed to you, to vote for the approval of a new management agreement between the Fund and Sierra Crest (the “Proposed Management Agreement”). Contingent upon approval by Fund shareholders of the Proposed Management Agreement, the Nominees (if approved pursuant to this proxy solicitation) would replace the Current Trustees. We ask that you return your YES proxy vote to the Proposed Management Agreement, as well.

Regards,

Lawrence S. Block

Secretary, Chief Compliance Officer and Senior Vice President

PROPOSAL 1

Approval of Election of

Ted Goldthorpe, Alexander Duka, Robert Warshauer and George Grunebaum

to the Board of Trustees

In this proposal, shareholders of the Fund are being asked to elect Ted Goldthorpe, Alexander Duka, Robert Warshauer and George Grunebaum (each, a “Nominee” and collectively, the “Nominees”) to the Board. Each Nominee has agreed to serve on the Board for an indefinite term.

On June 19, 2020, Resource America, Inc., Resource Alternative Advisor, LLC ( hereinafter “Resource”), Sierra Crest Investment Management LLC (“Sierra Crest”) and Mount Logan Capital, Inc. entered into a separate purchase agreement (the “Purchase Agreement”) pursuant to which Sierra Crest will acquire certain assets related to the Current Manager’s business of providing investment management services to the Fund if Sierra Crest becomes the investment adviser of the Fund pursuant to a new management agreement between Sierra Crest and the Fund (the “Proposed Management Agreement”) and upon receipt of the necessary approvals of the Proposed Management Agreement and satisfaction or waiver of certain other conditions. None of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act), of the Fund (the “Independent Trustees”) or the Independent Trustee Nominees have any interest in the Purchase Agreement.

The Fund is not a party to the Purchase Agreement; however, the closing of the Purchase Agreement (the “Closing”) is subject to certain conditions, including shareholder approval of Proposal 1 as described in this Proxy Statement and the approval of the Proposed Management Agreement (as described in a separate proxy statement). Therefore, if shareholders do not approve the Proposed Management Agreement and elect the Nominees, or if the other conditions in the Purchase Agreement are not satisfied or waived, then the transactions contemplated by the Purchase Agreement will not close and the Purchase Agreement will terminate, the Current Manager will continue as the Fund’s adviser, and the Fund’s current Trustees will continue to serve on the Fund’s Board of Trustees.

During a meeting held on June 17, 2020, the current Board, in reviewing the Proposed Management Agreement, noted that the Fund would likely undergo changes in its operations, insofar as various functions will be performed by different organizations and personnel, were the Closing to be completed. In this context, each Nominee was nominated for election to the Board by Fred Berlinksy, Enrique Casanova and David Burns, each of whom is an Independent Trustee, serving as an ad hoc nominating committee, and the Board, including the Independent Trustees, unanimously determined to submit each Nominee to the Fund’s shareholders for election. The current Board noted these factors as consistent with good governance and that the transition to the Nominees was not likely to adversely affect the Fund. If the Nominees are elected by shareholders, (i) Mr. Duka, Mr. Warshauer and Mr. Grunebaum will be considered Independent Trustees, (ii) Mr. Goldthorpe will be considered a Trustee who is an “interested person” as that term is defined in the 1940 Act, due to his affiliation with Sierra Crest, as further discussed below, and (iii) all of the current Trustees (Fred Berlinksy, Enrique Casanova, David Burns and Alan Feldman) will cease to be Trustees.

Information about the Nominees

Below is information about each Nominee and the attributes that qualify each to serve as a Trustee. The information provided below is not all-inclusive. Many Trustee attributes involve intangible elements, such as intelligence, work ethic and the willingness to work together, as well as the ability to communicate effectively, exercise judgment, ask incisive questions, manage people and problems, and develop solutions. The Board does not believe any one factor is determinative in assessing a Trustee’s qualifications.

The Board believes each Nominee possesses experiences, qualifications, and skills valuable to the Fund. Each Nominee has substantial business experience, effective leadership skills and an ability to critically review, evaluate and assess information.

Mr. Ted Goldthorpe has significant experience in the investment management and financial services industry. Mr. Goldthorpe is currently a Partner at BC Partners, having launched the BC Partners Credit platform in February 2017, and also serves as the CEO and Chairman of Mount Logan Capital Inc. Mr. Goldthorpe was previously President at Apollo Investment Corporation and the Chief Investment Officer of Apollo Investment Management where he was the head of its US Opportunistic Platform and also oversaw the Private Origination business. He was also a member of the Senior Management Committee. Prior to Apollo, he worked at Goldman Sachs for 13 years where he most recently ran the bank loan distressed investing desk. He was previously the head of Principal Capital Investing for the Special Situations Group. Mr. Goldthorpe currently serves on the boards of directors for Crescent Point Energy, Her Justice, and Capitalize for Kids. Mr. Goldthorpe holds a Bachelor of Commerce from Queen’s University.

Mr. Alexander Duka has a broad business background across multiple industries and significant leadership experience. Mr. Duka is currently a Senior Advisor for Acceleration Bay LLC, a patent investment and technology acceleration business headquartered in San Mateo, CA. He joined Acceleration Bay LLC in September 2017. Mr. Duka previously spent 20 years at Citigroup and was a Managing Director in the Financial Institutions group in Global Banking, retiring in February 2017. Mr. Duka was the senior banker responsible for managing Citi’s banking relationships with a number of high profile traditional and alternative asset management companies. Mr. Duka oversaw all financings, capital markets activity, M&A and the provision of other banking services and advice for this client base. Mr. Duka also worked with these asset managers to develop a new generation of permanent capital vehicles, including business development companies (“BDCs”), real estate investment trusts, closed-end funds, and European listed vehicles. Prior to Citi, Mr. Duka worked at Bank of New York and United Jersey Bank. Mr. Duka received his B.A. from Rutgers College and his MBA from Rutgers Graduate School of Management. Mr. Duka currently serves as a member of the board of directors of BC Partners Lending Corporation and Portman Ridge Finance Corp., two BDCs affiliated with BC Partners.

Mr. Robert Warshauer is a Managing Director and Co- Head of Restructuring in Imperial Capital’s New York Investment Banking Group. He has over 25 years of experience in financings, mergers and acquisitions, and restructurings, which has provided him with an extensive business background across several industries. Prior to joining Imperial Capital, he was a Managing Director at Kroll Zolfo Cooper, where he advised clients on operational issues, acquisitions and recapitalizations. He was a Managing Director and member of the Board of Directors and the Commitment Committee of Giuliani Capital Advisors LLC, and its predecessor firm, Ernst & Young Corporate Finance LLC. He has also held the position of CEO and President of a branded retail business with over 500 locations and 5,000 employees, been the CEO of an international business services and manufacturing company with operations in 16 countries, and served as President and a member of the Board of Directors of a publicly traded technology company. He is a former member of the board of directors of the American Bankruptcy Institute and currently serves on several corporate and charitable boards of directors, including the board of directors of BC Partners Lending Corporation and Portman Ridge Finance Corp., two BDCs affiliated with BC Partners.

Mr. George Grunebaum has broad financial services experience and significant investment management expertise, including experience serving as a fund director. He currently serves as President and CEO of Ashmore Funds, and he serves as an independent director for BC Partners, a private business development company, as well as for Portman Ridge Finance Corp., a closed-end business development company. Since 2000, Mr. Grunebaum has served as the Director and President of the Gordonstound American Foundation, a non-profit entity focused on education.

Additional information about each Nominee is set forth in the following table:

| Name, Address* and Year of Birth | Position and Term of Office** | Principal Occupation During the Past Five Years | Number of Portfolios in the Fund Complex*** to be Overseen by Nominee | Other Directorships Held by Nominee |

| Independent Trustee Nominees |

Alexander Duka Birth year: 1966 | Trustee Nominee | Senior Advisor, Acceleration Bay LLC (a patent investment and technology acceleration business), January 2020 to present; Executive Vice President of Corporate Development, Acceleration Bay, 2017 to 2019; Senior Advisor, Texas Fabco Solutions LLC (oilfield services), 2019 to present; Bank/Managing Director, Citigroup Inc. (1997 to 2017). | 1 | BC Partners Lending Corp, 2018 to present Portman Ridge Finance Corp, 2019 to present Bondhouse Investment Trust, 2019 to present |

| Name, Address* and Year of Birth | Position and Term of Office** | Principal Occupation During the Past Five Years | Number of Portfolios in the Fund Complex*** to be Overseen by Nominee | Other Directorships Held by Nominee |

Robert Warshauer Birth year: 1958 | Trustee Nominee | Managing Director and Co- Head of Restructuring, Imperial Capital (an investment banking company), 2007 to present; Board Member, MD America (energy company), April 2020 to present; Board Member, Estrella Broadcasting, 2019 to present; Board Member, Global Knowledge (education service), May 2020 to present). | 1 | BC Partners Lending Corp, 2018 to present Portman Ridge Finance Corp, 2019 to present |

George Grunebaum Birth year: 1963 | Trustee Nominee | President, Ashmore Funds, 2010 to present; CEO, Ashmore Funds, 2008 to present; Director/President, Gordonstoun American Foundation (non-profit education), 2000 to present. | 1 | BC Partners Lending Corp, 2018 to present Portman Ridge Finance Corp, 2019 to present |

| Interested Trustee Nominee |

Ted Goldthorpe Birth year: 1976 | Trustee Nominee | Partner and Head of Credit, BC Partners (an asset management firm), 2017 to present; Senior Partner and Chief Investment Officer, Apollo Global Management (an asset management firm), 2012 to 2016. | 1 | BC Partners Lending Corp, 2018 to present Portman Ridge Finance Corp, 2019 to present |

| * | The address for the Nominees listed above is c/o Sierra Crest Investment Management LLC, 650 Madison Avenue, 23rd Floor, New York, NY 10022. |

| ** | The term of office for the Nominees listed above will continue indefinitely. |

| *** | The term “Fund Complex” refers to the Trust. |

Board Leadership Structure

The Trust is led by Fred Berlinsky, who has served as the Chairman of the Board of Trustees since February 3, 2015 and is also an Independent Trustee. Additionally, under certain 1940 Act governance guidelines that apply to the Fund, the Independent Trustees meet in executive session, at least quarterly. Under the Fund’s governing documents, the Chairman of the Board is responsible for (a) presiding at meetings of the Board of Trustees, (b) calling special meetings on an as-needed basis, and (c) execution and administration of Fund policies including (i) setting the agendas for meetings of the Board of Trustees and (ii) providing information to Trustees in advance of each meeting of the Board of Trustees and between meetings of the Board of Trustees. Generally, the Fund believes it best to have a non-executive Chairman of the Board of Trustees, who together with the President and Principal Executive Officer, are seen by shareholders, business partners and other stakeholders as providing strong leadership. The Fund believes that its Chairman, the chair of the Audit Committee, and, as an entity, the full Board of Trustees, provide effective leadership that is in the best interests of the Fund and each shareholder. During the fiscal year ended September 30, 2019, the Board held six meetings.

Board Risk Oversight

The Board of Trustees is comprised of three Independent Trustees and one interested Trustee, with a standing independent Audit Committee with a separate chair. The Board of Trustees is responsible for overseeing risk management, and the full Board of Trustees regularly engages in discussions of risk management and receives compliance reports that inform its oversight of risk management from its Chief Compliance Officer at quarterly meetings and on an ad hoc basis, when and if necessary. The Audit Committee considers financial and reporting risk within its area of responsibilities. Generally, the Board of Trustees believes that its oversight of material risks is adequately maintained through the compliance-reporting chain where the Chief Compliance Officer is the primary recipient and communicator of such risk-related information.

Board Committees

Audit Committee

The Board of Trustees has an Audit Committee that consists of three Trustees, each of whom is not an “interested person” of the Fund within the meaning of the 1940 Act. The Audit Committee’s responsibilities include: (i) recommending to the Board of Trustees the selection, retention or termination of the Fund’s independent auditors; (ii) reviewing with the independent auditors the scope, performance and anticipated cost of their audit; (iii) discussing with the independent auditors certain matters relating to the Fund’s financial statements, including any adjustment to such financial statements recommended by such independent auditors, or any other results of any audit; (iv) reviewing on a periodic basis a formal written statement from the independent auditors with respect to their independence, discussing with the independent auditors any relationships or services disclosed in the statement that may impact the objectivity and independence of the Fund’s independent auditors and recommending that the Board of Trustees take appropriate action in response thereto to satisfy itself of the auditor’s independence; and (v) considering the comments of the independent auditors and management’s responses thereto with respect to the quality and adequacy of the Fund’s accounting and financial reporting policies and practices and internal controls. The Audit Committee is also responsible for reviewing and setting Independent Trustee compensation from time to time when considered necessary or appropriate. During the fiscal year ended September 30, 2019, the Audit Committee met four times. The Audit Committee operates pursuant to an Audit Committee Charter, a copy of which is available at www.resourcealts.com.

With respect to the fiscal year ended September 30, 2019, the Audit Committee has: (i) reviewed and discussed the audited financial statements with Fund management; (ii) discussed with the Fund’s independent auditors the matters to be discussed by the statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T; (iii) received the written disclosures and the letter from the Fund’s independent accountant required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence; and (iv) based on such reviews and discussions, recommended to the Board that the audited financial statements be included in the Fund’s annual report to shareholders required by Section 30(e) of the 1940 Act and filed with the SEC.

The Audit Committee members are Fred Berlinksy, Enrique Casanova and David Burns.

Due to the size of the Board of Trustees, the Audit Committee is also responsible for seeking and reviewing nominee candidates for consideration as Independent Trustees as is from time to time considered necessary or appropriate. The Audit Committee reviews all nominations of potential trustees made by Fund management and by Fund shareholders, which includes all information relating to the recommended nominees that is required to be disclosed in solicitations or proxy statements for the election of directors, including without limitation the biographical information and the qualifications of the proposed nominees. Shareholders interested in nominating potential trustees should submit their nominations to Lawrence S. Block, Secretary, Resource Credit Income Fund, 717 Fifth Avenue, 18th Floor, New York, NY 10022. Nomination submissions must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders, and such additional information must be provided regarding the recommended nominee as reasonably requested by the Audit Committee.

Nominee Ownership

The following table shows the dollar range of the Fund shares beneficially owned by each Nominee as of the Record Date:

| Name of the Trustee or Nominee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen or to be Overseen by the Nominee in Family of Investment Companies |

| Alexander Duka | None | None |

| Robert Warshauer | None | None |

| Ted Goldthorpe | None | None |

| George Grunebaum | None | None |

Compensation

None of the Nominees has served as a Trustee of the Fund. Therefore, none of the Nominees has received any compensation from the Fund. Each Independent Trustee Nominee who takes office with the Board will be paid by the Fund as a Trustee. If the Nominees are elected and take office, the new Board may establish a new compensation schedule for its Independent Trustees. The new compensation schedule for the Nominees may take into account their services provided to other funds in the Fund Complex, if any.

During the last fiscal year, none of the Fund’s officers received any compensation from the Fund.

The Board, including the Independent Trustees, recommends that shareholders of the Fund vote “FOR” the election of each Nominee to the Board of Trustees.

OTHER INFORMATION

OPERATION OF THE FUND

The Fund is a continuously offered, diversified, closed-end management investment company operating as an interval fund organized as a Delaware statutory trust. The Trust’s principal executive offices are located at 717 Fifth Avenue, 18th Floor, New York, NY 10022, and its telephone number is 1-855-747-9559. The Board supervises the business activities of the Fund. Like other investment companies, the Fund retains various organizations to perform specialized services. The Fund currently retains the Current Manager as the investment adviser for the Fund. ALPS Distributors, Inc., located at 1290 Broadway, Suite 1000, Denver, CO 80203, serves as the Fund’s principal underwriter and acts as the distributor of the Fund’s shares. ALPS Fund Services, Inc., located at 1290 Broadway, Suite 1000, Denver, CO 80203, serves as the administrator and accounting agent for the Fund. DST Systems, Inc., located at PO Box 219169, Kansas City, MO 64121, serves as the transfer agent of the Fund.

THE PROXY

The Board solicits proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Meeting. A proxy for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted (i) for approval of Proposal 1; and (ii) at the discretion of the holder(s) of the proxy on any other matter that may come before the Meeting that the Fund did not have notice of by a reasonable time prior to the mailing of this Proxy Statement. You may revoke your proxy at any time before it is exercised by (i) submitting a duly executed proxy bearing a later date, (ii) submitting a written notice to the Secretary of the Fund revoking the proxy, or (iii) attending and voting in person at the Meeting.

VOTING SECURITIES AND VOTING

As of the Record Date, the following numbers of shares of beneficial interest of the Fund were issued and outstanding:

| Class A | Class C | Class I | Class L | Class W |

| 3,867,630.547 | 4,358,911.129 | 8,366,410.718 | 1,286,483.297 | 7,500,734.832 |

All shareholders of record of the Fund on the Record Date are entitled to vote at the Meeting on each Proposal. Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting. There are no dissenters’ rights of appraisal in connection with any shareholder vote to be taken at the Meeting.

Approval of Proposal 1

Approval of Proposal 1 requires the affirmative vote of a plurality of all votes at the Meeting. Under this plurality system, Trustee positions are filled by the nominees who receive the largest number of votes, with no majority approval requirement, until all vacancies are filled. Because Trustees are elected by a plurality, non-votes and abstentions will have no effect on Proposal 1. For Proposal 1, the holders of thirty-three and one-third percent (33-1/3%) of the outstanding shares of the Fund (including broker non-votes and abstentions) entitled to vote at the meeting (in person or by proxy) constitutes a quorum.

The Closing is contingent upon shareholders approving Proposal 1 and the Proposed Management Agreement (by separate proxy statement). If Proposal 1 and the Proposed Management Agreement are not approved by shareholders of the Fund, the Closing will not occur.

Security Ownership of Management AND Certain Beneficial Owners

As of the Record Date, the following shareholders of record owned 5% or more of the outstanding shares of a class of the Fund:

| Name and Address | Number and Class of Shares | Percentage of the Fund | Percentage of the Class |

PERSHING LLC P.O. BOX 2052 JERSEY CITY NJ 07303-2052 | 1,192,042.59 (Class A) | 4.70% | 30.82% |

NATIONAL FINANCIAL SERVICES LLC 499 WASHINGTON BLVD JERSEY CITY NJ 07310-1995 | 526,798.67 (Class A) | 2.08% | 13.62% |

COR CLEARING LLC 1200 LANDMARK CTR STE 800 OMAHA NE 68102-1916 | 290,425.95 (Class A) | 1.14% | 7.51% |

EQUITY TRUST CO. CUSTODIAN PO BOX 451249 CLEVELAND OH 44145-0632 | 237,744.51 (Class A) | 0.94% | 6.15% |

RESOURCE FINANCIAL FUND MANAGEMENT LLC 1845 WALNUT ST. FL 17 PHILADELPHIA PA 19103-4720 | 205,063.67 (Class A) | 0.81% | 5.30% |

EQUITY TRUST CO. PO BOX 451249 CLEVELAND OH 44145-0632 | 1,449,408.38 (Class C) | 5.71% | 33.25% |

PERSHING LLC P.O. BOX 2052 JERSEY CITY NJ 07303-2052 | 1,179,725.12 (Class C) | 4.65% | 27.06% |

NATIONAL FINANCIAL SERVICES LLC 499 WASHINGTON BLVD JERSEY CITY NJ 07310-1995 | 1,081,892.34 (Class C) | 4.26% | 24.82% |

NATIONAL FINANCIAL SERVICES LLC 499 WASHINGTON BLVD JERSEY CITY NJ 07310-1995 | 3,336,255.05 (Class I) | 13.15% | 39.88% |

TD AMERITRADE TD AMERITRADE CLEARING CUSTODIAN 1663 N 113TH AVE AVONDALE, AZ 85392-5222 | 2,308,050.82 (Class I) | 9.09% | 27.59% |

PERSHING LLC P.O. BOX 2052 JERSEY CITY NJ 07303-2052 | 1,664,035.91 (Class I) | 6.56% | 19.89% |

MILLENIUM TRUST CO LLC 2001 SPRING RD STE 700 OAK BROOK IL 60523-1890 | 507,186.93 (Class I) | 2.00% | 6.06% |

CHARLES SCHWAB & CO INC SPECIAL CUSTODY A/C FBO CUSTOMERS ATTN MUTUAL FUNDS 211 MAIN STREET SAN FRANCISCO CA 94105-1905 | 3,380,446.22 (Class W) | 13.32% | 45.07% |

NATIONAL FINANCIAL SERVICES LLC 499 WASHINGTON BLVD JERSEY CITY NJ 07310-1995 | 1,933,254.95 (Class W) | 7.62% | 25.77% |

TD AMERITRADE TD AMERITRADE CLEARING CUSTODIAN 1663 N 113TH AVE AVONDALE, AZ 85392-5222 | 852,180.66 (Class W) | 3.36% | 11.36% |

WELLS FARGO CLEARING SERVICES 2801 MARKET ST SAINT LOUIS MO 63103-2523 | 539,948.30 (Class W) | 2.13% | 7.20% |

PERSHING LLC P.O. BOX 2052 JERSEY CITY NJ 07303-2052 | 448,175.96 (Class W) | 1.77% | 5.98% |

PERSHING LLC P.O. BOX 2052 JERSEY CITY NJ 07303-2052 | 550,830.77 (Class L) | 2.17% | 42.82% |

CETERA INVESTMENT SVCS 4600 S. SYRACUSE STREET SUITE 600 DENVER CO 80237 | 300,062.80 (Class L) | 1.18% | 23.32% |

The following table provides information about Fund shares held by the Nominees, Trustees, and executive officers of the Fund as of the Record Date (percentages are rounded to nearest hundredth):

| Name | Number and Class of Shares | Percentage of the Fund | Percentage of the Class |

| Ted Goldthorpe1 | 0% | 0% | 0% |

| Alexander Duka1 | 0% | 0% | 0% |

| Robert Warshauer1 | 0% | 0% | 0% |

| George Grunebaum1 | 0% | 0% | 0% |

| Fred Berlinsky2 | 6,824.29 (Class A) | 0.03% | 0.18% |

| Enrique Casanova2 | 0% | 0% | 0% |

| David Burns2 | 0% | 0% | 0% |

| Alan Feldman2 | 5,459.43 (Class A) | 0.02% | 0.14% |

| Justin Milberg2,3 | 6,701.45 (Class A) | 0.03% | 0.17% |

| Brian Hawkins2 | 0% | 0% | 0% |

| Lawrence S. Block2 | 0% | 0% | 0% |

| 1 | The address of the Nominee is c/o Sierra Crest Investment Management LLC, 650 Madison Avenue, 23rd Floor, New York, NY 10022. |

| 2 | The address of the Trustee or officer is c/o Resource Credit Income Fund, 717 Fifth Avenue, 18th Floor, New York, NY 10022. |

| 3 | Justin Milberg served as President of the Fund from 2015 until June 1, 2020. On June 1, 2020, Alan Feldman was appointed President of the Fund. |

Shareholders owning more than 25% of the shares of the Fund are considered to “control” the Fund, as that term is defined under the 1940 Act. Persons controlling the Fund may determine the outcome of any proposal submitted to the shareholders for approval. As of the Record Date, National Financial Services LLC owned of record or beneficially 25% or more of the outstanding shares of the Fund, and no other shareholder owned more than 25% of the Fund. As a group, the Trustees, Nominees and officers of the Trust owned less than 1% of the outstanding shares of the Fund as of the Record Date.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Fund’s directors and executive officers, Trustees, investment adviser, affiliates of the investment adviser, and persons who own more than ten percent of a registered class of the Fund’s equity securities, to file with the Securities and Exchange Commission (“SEC”) initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Fund. Such persons are required by the SEC regulations to furnish each Fund with copies of all such filings.

Based solely on a review of the copies of such reports that have been filed with the SEC and written representations that no other reports were required, all Section 16(a) filing requirements were complied with during the Fund’s fiscal year ended September 30, 2019. However, during the Fund’s fiscal year ended September 30, 2019, the following filings were made to cure past deficiencies: (i) initial Forms 3 filed on behalf of James A. Aston, Mary Foynes Gaza, and Matthew J. Stern, (ii) amended Forms 3 to reflect a change in title and/or change in the name of the adviser on behalf of Lawrence S. Block, Jeffrey D. Blomstrom, Thomas C. Elliott, and Jeffrey P. Cohen, and (iii) Forms 5 filed to indicate they were no longer reporting persons subject to Section 16 on behalf of Resource Financial Fund Management, Inc. and Steven R. Saltzman, all of which had not been filed on a timely basis. Those described failures to file on a timely basis did not include any filings that were required due to a transaction in the Credit Fund and were subsequently reported on the appropriate Form during the Fund’s most recent fiscal year ended in 2019.

SHAREHOLDER PROPOSALS

The Fund has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the SEC, shareholder proposals may, under certain conditions, be included in the Fund’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Fund’s proxy materials must be received by the Fund within a reasonable time before the solicitation is made. The fact that the Fund receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders are not required as long as there is no particular requirement under the 1940 Act that must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Resource Credit Income Fund, Attention: Lawrence S. Block, Secretary, 717 Fifth Avenue, 18th Floor, New York, NY 10022. Shareholder proposals may also be raised from the floor at the Meeting without prior notice to the Trust.

COST OF SOLICITATION

The Board of Trustees is making this solicitation of proxies. The Fund has engaged Broadridge Financial Solutions, Inc., a proxy solicitation firm, to assist in the solicitation. The estimated fees anticipated to be paid to Broadridge Financial Solutions, Inc. are approximately $37,500. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any additional materials relating to the Meeting and the cost of soliciting proxies will be borne equally by Sierra Crest and the Current Manager. In addition to solicitation by mail, the Fund will request insurance companies, banks, brokers and other custodial nominees and fiduciaries, to supply proxy materials to the respective beneficial owners of shares of the Fund of whom they have knowledge, and Sierra Crest and the Current Manager will reimburse them for their expenses in so doing. Certain officers, employees and agents of the Fund and the Current Manager may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation.

OTHER MATTERS

The Board knows of no other matter to be presented at the Meeting other than as set forth above. If any other matter properly comes before the Meeting that the Trust did not have notice of by a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

Communications with the Board

A shareholder of the Trust wishing to communicate with the Board may do so in writing, signed by the shareholder and setting forth: (i) the name and address of the shareholder; (ii) the number of shares owned by the shareholder; and (iii) if the shares are owned indirectly through a broker or other record owner, the name of the broker or other record owner. These communications should be addressed as follows: Resource Credit Income Fund, Attention: Secretary, 717 Fifth Avenue, 18th Floor, New York, NY 10022.

PROXY DELIVERY

If you and another shareholder share the same address, the Fund may only send one Proxy Statement unless you or the other shareholder(s) request otherwise. Call or write to the Fund if you wish to receive a separate copy of the Proxy Statement, and the Fund will promptly mail a copy to you. You may also call or write to the Fund if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call the Fund at 1-855-747-9559.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on September 23, 2020 at 11:00 a.m.

A copy of the Notice of Shareholder Meeting, the Proxy Statement, and Proxy Card are available at www.resourcealts.com.

BY ORDER OF THE BOARD OF TRUSTEES

Lawrence S. Block, Secretary

Dated: August 20, 2020

If you have any questions before you vote, please call our proxy information line at 1-855-973-0089. Representatives are available Monday through Friday, 9:00 a.m. to 10:00 p.m. Eastern Time to answer your questions about the proxy material or about how to cast your vote. You may also receive a telephone call reminding you to vote your shares. Thank you for your participation in this important initiative.

Please date and sign the enclosed proxy and return it promptly in the enclosed reply envelope, fax YOUR PROXY CARD to THE NUMBER LISTED ON YOUR PROXY CARD.