- EVH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Evolent Health (EVH) CORRESPCorrespondence with SEC

Filed: 18 May 15, 12:00am

May 18, 2015

Evolent Health, Inc.

Registration Statement on Form S-1

File No. 333-203852

Dear Ms. Gowetski:

On behalf of Evolent Health, Inc. (the “Company”), set forth below is additional information to supplement the Company’s prior response to comment 4 contained in the letter dated March 26, 2015 (the “Comment Letter”) from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the Company’s Registration Statement on Form S-1 (File No. 333-203852) (the “Registration Statement”). Set forth below in bold font is comment 4 contained in the Comment Letter and immediately below such comment is the supplemental response of the Company with respect thereto. The Company initially responded to comment 4 in our letter dated April 10, 2015.

Preliminary Price Range

The Company expects to include an anticipated price range in an amendment to the Registration Statement that would be filed shortly before the commencement of the road show for the initial public offering (the “IPO”), which the Company anticipates could commence as soon as May 26, 2015.

To provide additional context and further information for the Staff’s consideration, the Company supplementally advises the Staff that, based on discussions with the Company’s Board of Directors and input provided by the underwriters, the Company currently anticipates that the price range for this offering will be within the range of $14.00 to $16.00 per share (the “Preliminary Price Range”), after giving effect to the offering reorganization in which, among other things, each share of common stock of Evolent Health Holdings, Inc. will be converted into four shares of common stock of the Company, which the Company plans to complete in connection with this offering.

The Preliminary Price Range is based on a number of factors, including the Company’s prospects and the history of and prospects for the Company’s industry, the general condition of the securities markets, the recent market prices of, and the demand for, publicly-traded common stock of generally comparable companies and preliminary discussions with the underwriters regarding potential valuations of the Company. The actual price range to be included in a subsequent amendment to the Registration Statement (which will comply with the Staff’s interpretation regarding the parameters of a bona fide price range) has not yet been determined and will not be established until shortly before the printing of the preliminary prospectus for the offering, taking into account all relevant market factors at that time. That price range will be subject to then-current market conditions, continuing discussions with the underwriters and any other factors affecting the Company or the proposed offering. However, the Company currently believes that the foregoing indicative price range will not be subject to significant change.

Staff Comment and Supplemental Company Response

Financial Statements of Evolent Health Holdings, Inc.

10. Stock-based incentive plan, pages F-49 to F-51

| 4. | We note your disclosure in this section and on pages 90 to 91 related to common stock valuation and the trend that as you approach the IPO the fair market value price per share has increased from $4.29 as of September 2013 to $27.46 as of December 2014. Please share your thoughts with respect to your decision to change from income-based approaches for valuation to a probability-weighted expected return method (PWERM) under three distinct liquidity events and to do so at December 31, 2014. In your response, tell us what were the three liquidity events used in the valuation model, whether or not you believe that the change to PWERM would result in a materially higher valuation, and briefly address some of the key factors listed on page 90 which have resulted in the significant increase in fair market value price per share between September 2013 and December 2014. |

To provide additional context and further information for the Staff’s consideration, the Company supplementally advises the Staff that the Company determined a fair market value of $42.58 per share as of March 31, 2015, with the assistance of a third party valuation firm. The Company utilized a probability weighted expected return method (“PWERM”) to determine the value in light of two distinct liquidity events considered as of such valuation date, which consisted of the following outcomes: (a) an IPO and (b) the continued operation of the business as a private enterprise until a later exit date. The value of each liquidity event at the time of each liquidity event was discounted back to the present using a risk-adjusted discount rate. The Company utilized a combination of the income-based approach and market approach for the distinct liquidity events.

The Company also advises the Staff that the primary factors contributing to the increase in the common stock valuation from $27.46 per share as of December 31, 2014, to $42.58 per share as of March 31, 2015, and then to the midpoint of the Preliminary Price Range (or $60.00 on a pre-offering reorganization basis), are set forth below.

2

| • | During 2015 through the date hereof, the business entered into long-term contractual relationships with two new partners in the platform and operations phase, which represented a long-term revenue stream as the initial term of these contracts ranges from three to seven years. The business has also continued to execute on new transformation phase contracts. The results of executing on the business’ strategy and the significant increase in the delivery of the business’ platform and operations services drove increases in the overall enterprise valuation and related common stock valuation as this provided increased confidence in future cash flows. |

| • | In April 2015, the Company amended its existing platform and operations agreement with one of its partners, which provided certainty with respect to the contractually guaranteed revenue over the service period for such partner. |

| • | On April 30, 2015, several of the Company’s largest investors agreed to purchase a block of 250,000 shares of capital stock of Evolent Health Holdings, Inc. from two of the Company’s other investors in exchange for $10.6 million in cash, which is equivalent on a per-share basis to the March 31, 2015 valuation of $42.58 per share. The purchase was based upon a put option the selling investors had recently obtained related to their shares that included a strike price equivalent to the fair value of the shares as determined by a third party valuation firm as of March 31, 2015. Although the put option was granted by the Company, the Company’s largest investors agreed to assume the Company’s obligation to purchase the shares. As the selling investors elected to exercise that option and the Company’s largest investors agreed to assume the Company’s obligation to purchase those shares at the agreed upon price, this transaction provides evidence of fair value at that date based upon a willing seller and buyer agreeing to the transaction. The transaction has since closed. |

| • | On May 1, 2015, the Company amended its existing commercial agreement with The Advisory Board Company, which provided certainty with respect to the Company’s business relationship with one of its largest existing investors. |

| • | The Preliminary Price Range reflects the increased visibility and confidence of the underwriters following the Company’s “testing-the-waters” meetings in late April and input from research analysts. As a result, the Company increased the multiple that is applied to the Company’s revenue in order to calculate the valuation of the Company from the midpoint of the range to the high end of such range. |

| • | The Preliminary Price Range was calculated based on an IPO-only liquidity event, as opposed to the prior valuations that utilized the PWERM, which considered multiple distinct liquidity events and resulted in a lower valuation. Given the expected commencement of the road show in the near term, the Company believes it is appropriate that the weighting of an IPO as the only liquidity event at the time of including the price range in the Registration Statement is appropriate as it appears to be a highly probable event at this time. |

| • | The Preliminary Price Range represents a future price for shares of Class A common stock that, if issued in the IPO, will be immediately freely tradable in a public market, whereas the estimated fair value of the common stock as of December 31, 2014 and March 31, 2015 represents a contemporaneous estimate of the fair value of shares that |

3

were then illiquid, might never become liquid and, even if an IPO were successfully completed, would remain illiquid for the 180-day lockup period following the IPO. This illiquidity accounts for a portion of the difference between the estimated fair values of the common stock through March 31, 2015 and the Preliminary Price Range. |

| • | The Preliminary Price Range reflects an improvement in the relevant market environment since December 31, 2014. This improvement is evidenced by, among other things, the 6.6% increase in the value of The NASDAQ Stock Market from December 31, 2014 through May 15, 2015. |

The proceeds from a successful initial public offering are expected to substantially strengthen the Company’s results of operations and financial position by providing additional working capital and cash for general corporate purposes. These projected improvements in the Company’s financial position are expected to have a beneficial effect on the Company’s results of operations and financial position, and as a result, have influenced the higher Preliminary Price Range.

Based on the foregoing, the Company respectfully seeks confirmation that the Staff has no further comments with respect to the matters discussed in this letter.

Understandings

The Company has authorized us to advise the Staff that it hereby acknowledges that:

| • | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

4

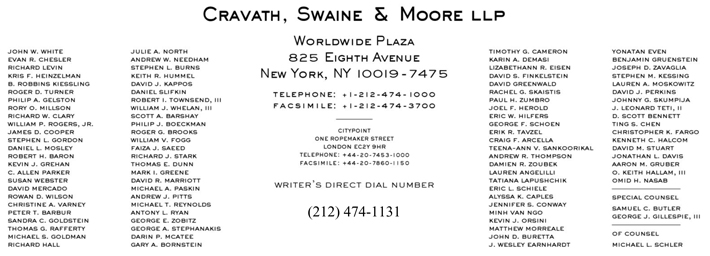

Please contact me at (212) 474-1131 with any questions or comments you may have regarding the Registration Statement or the supplemental response in this letter.

| Very truly yours, | ||

/s/ William V. Fogg | ||

| William V. Fogg | ||

| Jennifer Gowetski |

Senior Counsel |

U.S. Securities and Exchange Commission |

Division of Corporation Finance |

100 F Street, N.E. |

Washington, D.C. 20549 |

| Encl. |

| Copy w/encl. to: |

| Rahul Patel |

| Howard Efron |

| Robert Telewicz |

U.S. Securities and Exchange Commission |

Division of Corporation Finance |

100 F Street, N.E. |

Washington, D.C. 20549 |

| Jonathan Weinberg |

General Counsel |

Evolent Health, Inc. |

800 N. Glebe Road, Suite 500 |

Arlington, Virginia 22203 |

BY EDGAR; FED EX |