1 Accelerating Evolent’s Market Leadership in Value-Based Care June 29, 2022

2 Safe Harbor Statement Certain statements made in this presentation and in other written or oral statements made by us or on our behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like: “believe,” “anticipate,” “expect,” “estimate,” “aim,” “predict,” “potential,” “continue,” “plan,” “project,” “will,” “should,” “shall,” “may,” “might” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to the closing of the IPG transaction (including the financing thereof), the ability of the transaction to accelerate our strategic objectives, expand our specialty focus and be better positioned to meet client needs, our expectations that the IPG transaction will be immediately accretive to Adjusted EBITDA margins and cash flow, provide meaningful revenue cross-sell synergy opportunity and improve customer and revenue diversification, our guidance and business outlook and future performance or financial results, including of IPG. We claim the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. These statements are only predictions based on our current expectations and projections about future events. Forward-looking statements involve risks and uncertainties that may cause actual results, level of activity, performance or achievements to differ materially from the results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary materially, some of which are described within the forward-looking statements, include, among others: risks and uncertainties related to the possibility that the closing of the IPG transaction may be delayed or may not occur, and the risk that litigation or other matters could affect the closing, the significant portion of revenue we derive from our largest partners, and the potential loss, non- renewal, termination or renegotiation of our relationship or contract with any significant partner, or multiple partners in the aggregate; evolution in the market for value-based care; uncertainty in the health care regulatory framework, including the potential impact of policy changes; our ability to offer new and innovative products and services; risks related to completed and future acquisitions, investments, alliances and joint ventures, divert management resources, or result in unanticipated costs or dilute our stockholders; the financial benefits we expect to receive as a result of the sale of certain assets of Passport may not be realized; the growth and success of our partners, which is difficult to predict and is subject to factors outside of our control, including governmental funding reductions and other policy changes, enrollment numbers for our partners’ plans, premium pricing reductions, selection bias in at-risk membership and the ability to control and, if necessary, reduce health care costs; risks relating to our ability to maintain profitability for our total cost of care and New Century Health’s performance-based contracts and products, including capitation and risk-bearing contracts; our ability to effectively manage our growth and maintain an efficient cost structure, and to successfully implement cost cutting measures; changes in general economic conditions nationally and regionally in our markets, including inflation and economic and business conditions and the impact thereof on the economy resulting from the COVID-19 pandemic and other public health emergencies our ability to recover the significant upfront costs in our partner relationships; our ability to attract new partners and successfully capture new growth opportunities; the increasing number of risk-sharing arrangements we enter into with our partners; our ability to estimate the size of our target markets; our ability to maintain and enhance our reputation and brand recognition; consolidation in the health care industry; competition which could limit our ability to maintain or expand market share within our industry; risks related to governmental payer audits and actions, including whistleblower claims; our ability to partner with providers due to exclusivity provisions in our contracts; risks related to our offshore operations; our ability to contain health care costs, implement increases in premium rates on a timely basis, maintain adequate reserves for policy benefits or maintain cost effective provider agreements; our dependency on our key personnel, and our ability to attract, hire, integrate and retain key personnel; the impact of additional goodwill and intangible asset impairments on our results of operations; our indebtedness, our ability to service our indebtedness, and our ability to obtain additional financing; our ability to achieve profitability in the future; the impact of litigation, including the ongoing class action lawsuit; material weaknesses in the future may impact our ability to conclude that our internal control over financial reporting is not effective and we may be unable to produce timely and accurate financial statements; restrictions and penalties as a result of privacy and data protection laws; data loss or corruption due to failures or errors in our systems and service disruptions at our data centers; restrictions and penalties as a result of privacy and data protection laws; adequate protection of our intellectual property, including trademarks; any alleged infringement, misappropriation or violation of third-party proprietary rights; our use of “open source” software; our ability to protect the confidentiality of our trade secrets, know-how and other proprietary information; our reliance on third parties and licensed technologies; our ability to use, disclose, de-identify or license data and to integrate third-party technologies; our reliance on Internet infrastructure, bandwidth providers, data center providers, other third parties and our own systems for providing services to our partners; our reliance on third-party vendors to host and maintain our technology platform; our obligations to make payments to certain of our pre-IPO investors for certain tax benefits we may claim in the future; our ability to utilize benefits under the tax receivables agreement described herein; our obligations to make payments under the tax receivables agreement that may be accelerated or may exceed the tax benefits we realize; the terms of agreements between us and certain of our pre-IPO investors; the conditional conversion features of the 2024 and 2025 convertible notes, which, if triggered, could require us to settle the 2024 or 2025 convertible notes in cash; the potential volatility of our Class A common stock price; the potential decline of our Class A common stock price if a substantial number of shares are sold or become available for sale; provisions in our second amended and restated certificate of incorporation and third amended and restated by-laws and provisions of Delaware law that discourage or prevent strategic transactions, including a takeover of us; the ability of certain of our investors to compete with us without restrictions; provisions in our second amended and restated certificate of incorporation which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees; and our intention not to pay cash dividends on our Class A common stock. The risks included here are not exhaustive. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Our Annual Report on Form 10-K for the year ended December 31, 2021 (the "2021 Form 10-K") and other documents filed with the SEC include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, we disclaim any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any securities of any nature whatsoever, and it may not be relied upon in connection with the purchase of securities. The contents of this presentation do not constitute legal, tax or business advice. Anyone reading this presentation should seek advice based on their particular circumstances from independent legal, tax and business advisors.

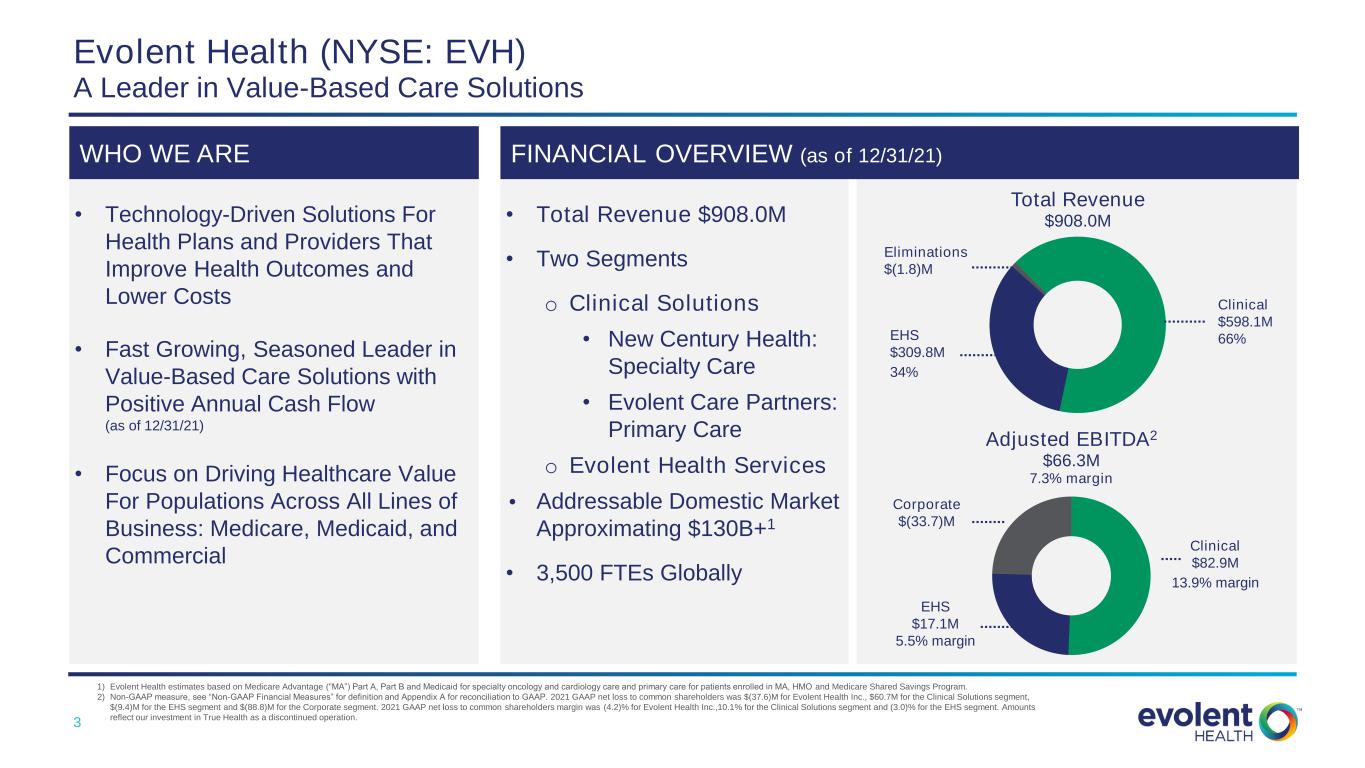

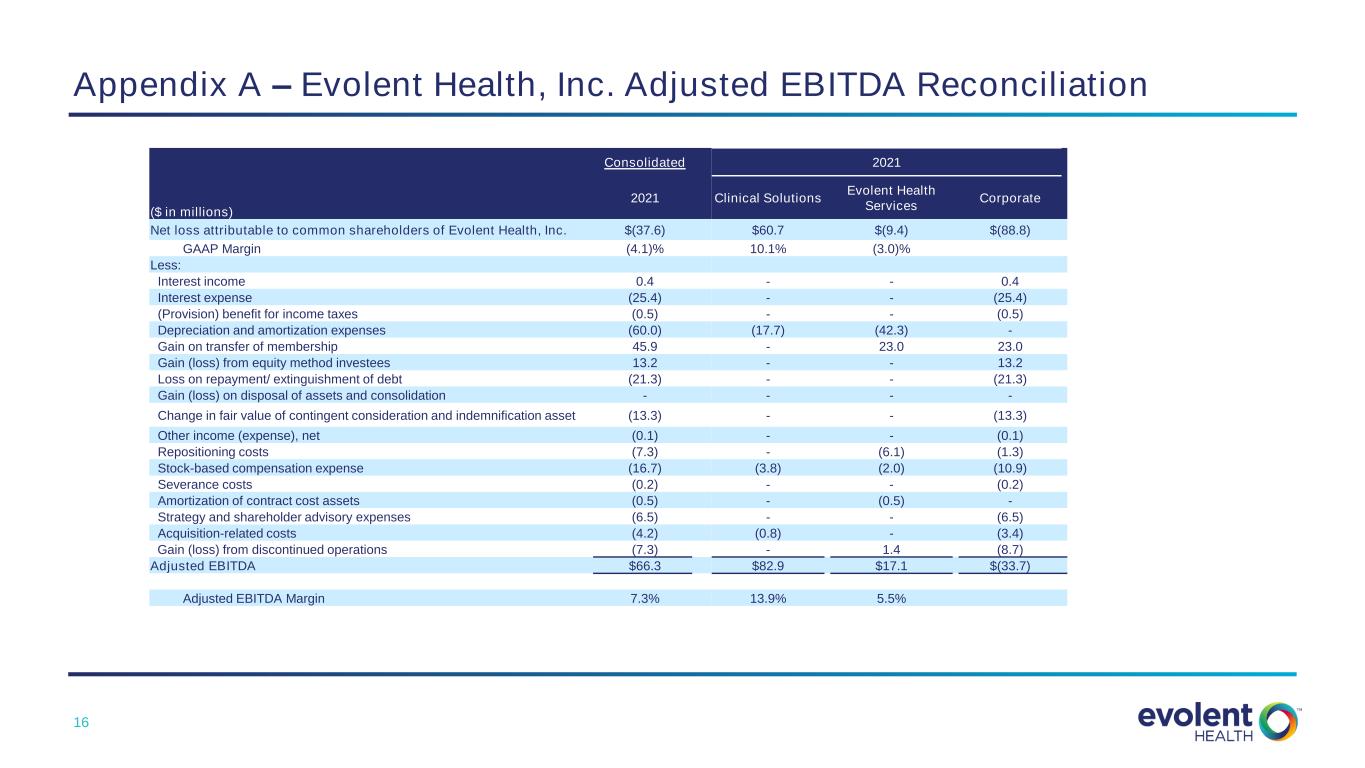

3 FINANCIAL OVERVIEW (as of 12/31/21)WHO WE ARE • Technology-Driven Solutions For Health Plans and Providers That Improve Health Outcomes and Lower Costs • Fast Growing, Seasoned Leader in Value-Based Care Solutions with Positive Annual Cash Flow (as of 12/31/21) • Focus on Driving Healthcare Value For Populations Across All Lines of Business: Medicare, Medicaid, and Commercial • Total Revenue $908.0M • Two Segments o Clinical Solutions • New Century Health: Specialty Care • Evolent Care Partners: Primary Care o Evolent Health Services • Addressable Domestic Market Approximating $130B+1 • 3,500 FTEs Globally Evolent Health (NYSE: EVH) A Leader in Value-Based Care Solutions Adjusted EBITDA2 $66.3M 7.3% margin Clinical $82.9M 13.9% margin Corporate $(33.7)M EHS $17.1M 5.5% margin Total Revenue $908.0M Clinical $598.1M 66%EHS $309.8M 34% Eliminations $(1.8)M 1) Evolent Health estimates based on Medicare Advantage (“MA”) Part A, Part B and Medicaid for specialty oncology and cardiology care and primary care for patients enrolled in MA, HMO and Medicare Shared Savings Program. 2) Non-GAAP measure, see “Non-GAAP Financial Measures” for definition and Appendix A for reconciliation to GAAP. 2021 GAAP net loss to common shareholders was $(37.6)M for Evolent Health Inc., $60.7M for the Clinical Solutions segment, $(9.4)M for the EHS segment and $(88.8)M for the Corporate segment. 2021 GAAP net loss to common shareholders margin was (4.2)% for Evolent Health Inc.,10.1% for the Clinical Solutions segment and (3.0)% for the EHS segment. Amounts reflect our investment in True Health as a discontinued operation.

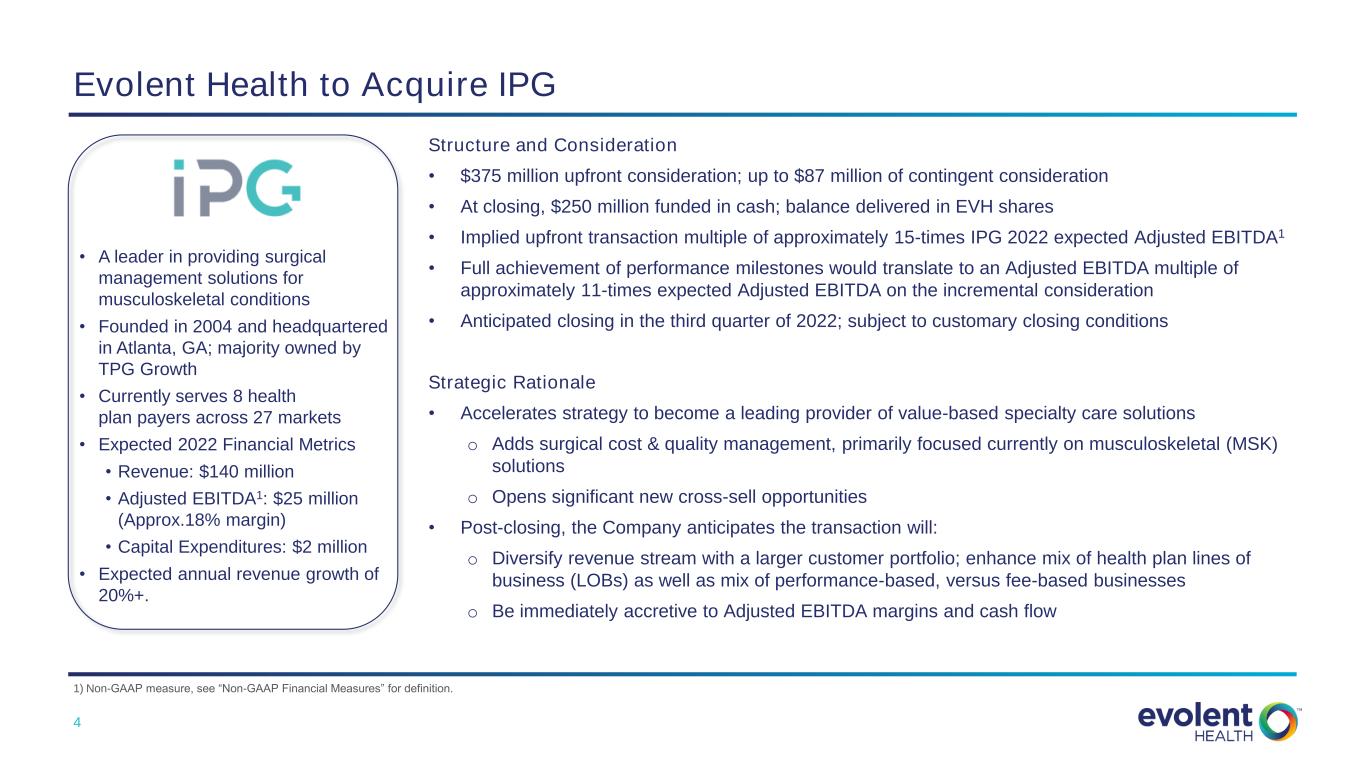

4 Evolent Health to Acquire IPG • A leader in providing surgical management solutions for musculoskeletal conditions • Founded in 2004 and headquartered in Atlanta, GA; majority owned by TPG Growth • Currently serves 8 health plan payers across 27 markets • Expected 2022 Financial Metrics • Revenue: $140 million • Adjusted EBITDA1: $25 million (Approx.18% margin) • Capital Expenditures: $2 million • Expected annual revenue growth of 20%+. 1) Non-GAAP measure, see “Non-GAAP Financial Measures” for definition. Structure and Consideration • $375 million upfront consideration; up to $87 million of contingent consideration • At closing, $250 million funded in cash; balance delivered in EVH shares • Implied upfront transaction multiple of approximately 15-times IPG 2022 expected Adjusted EBITDA1 • Full achievement of performance milestones would translate to an Adjusted EBITDA multiple of approximately 11-times expected Adjusted EBITDA on the incremental consideration • Anticipated closing in the third quarter of 2022; subject to customary closing conditions Strategic Rationale • Accelerates strategy to become a leading provider of value-based specialty care solutions o Adds surgical cost & quality management, primarily focused currently on musculoskeletal (MSK) solutions o Opens significant new cross-sell opportunities • Post-closing, the Company anticipates the transaction will: o Diversify revenue stream with a larger customer portfolio; enhance mix of health plan lines of business (LOBs) as well as mix of performance-based, versus fee-based businesses o Be immediately accretive to Adjusted EBITDA margins and cash flow

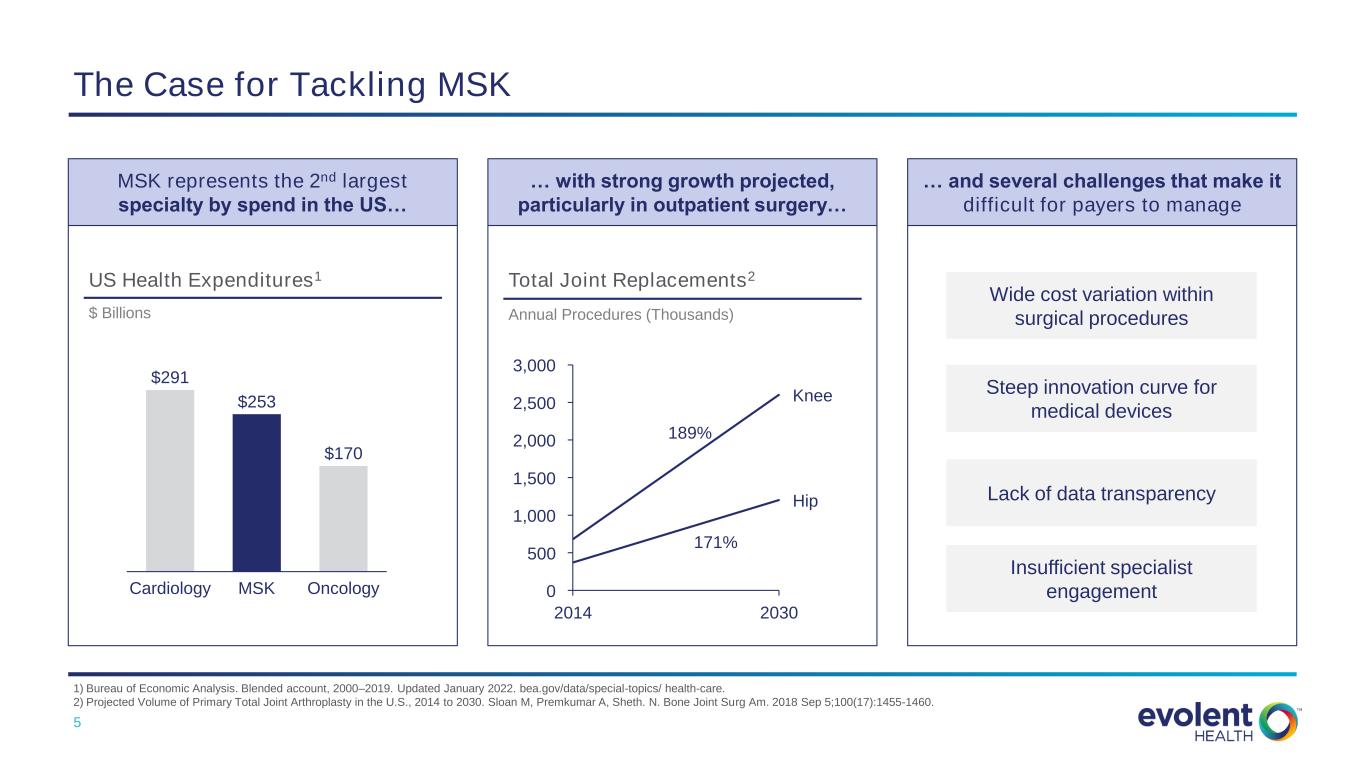

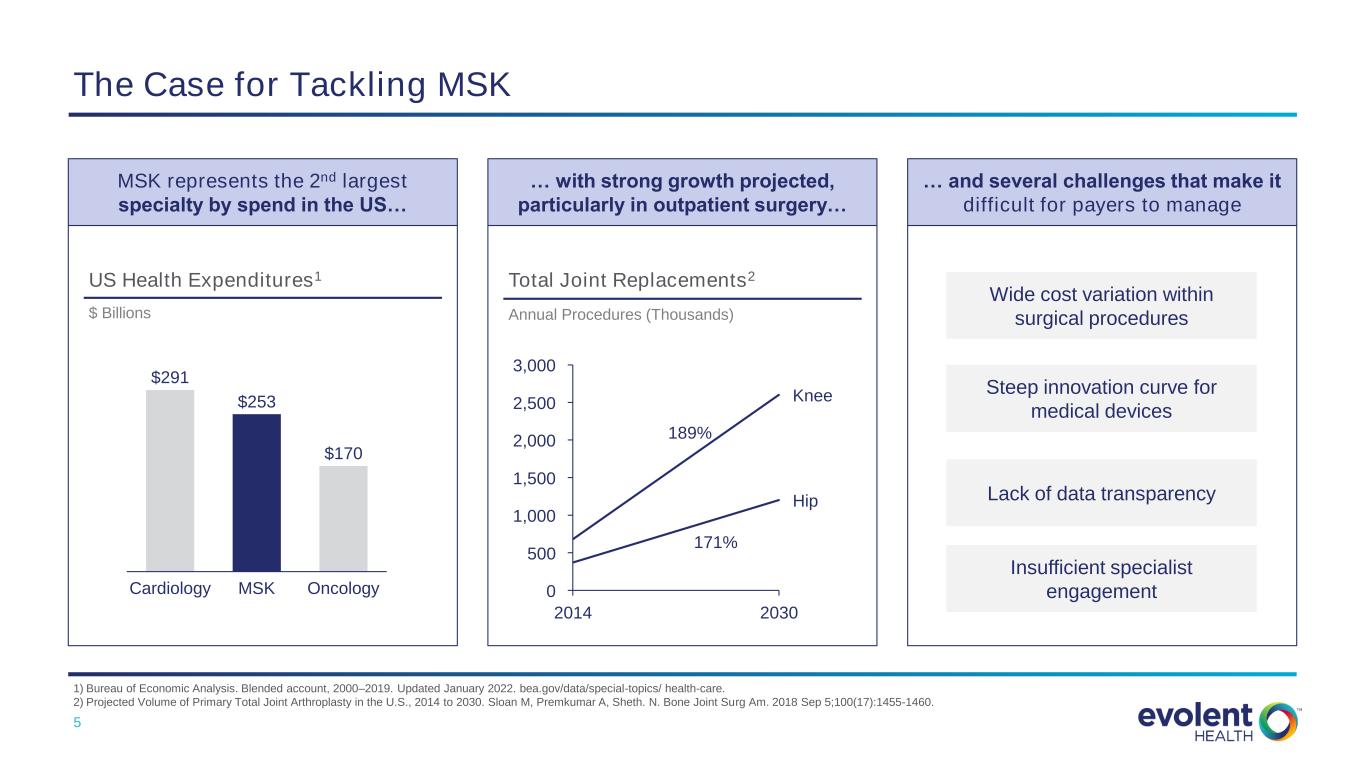

5 $291 $253 $170 MSKCardiology Oncology 189%2,000 2014 2030 0 1,000 3,000 500 1,500 2,500 Knee Hip US Health Expenditures1 Total Joint Replacements2 $ Billions Annual Procedures (Thousands) 171% MSK represents the 2nd largest specialty by spend in the US… … with strong growth projected, particularly in outpatient surgery… … and several challenges that make it difficult for payers to manage Wide cost variation within surgical procedures Steep innovation curve for medical devices Lack of data transparency Insufficient specialist engagement The Case for Tackling MSK 1) Bureau of Economic Analysis. Blended account, 2000–2019. Updated January 2022. bea.gov/data/special-topics/ health-care. 2) Projected Volume of Primary Total Joint Arthroplasty in the U.S., 2014 to 2030. Sloan M, Premkumar A, Sheth. N. Bone Joint Surg Am. 2018 Sep 5;100(17):1455-1460.

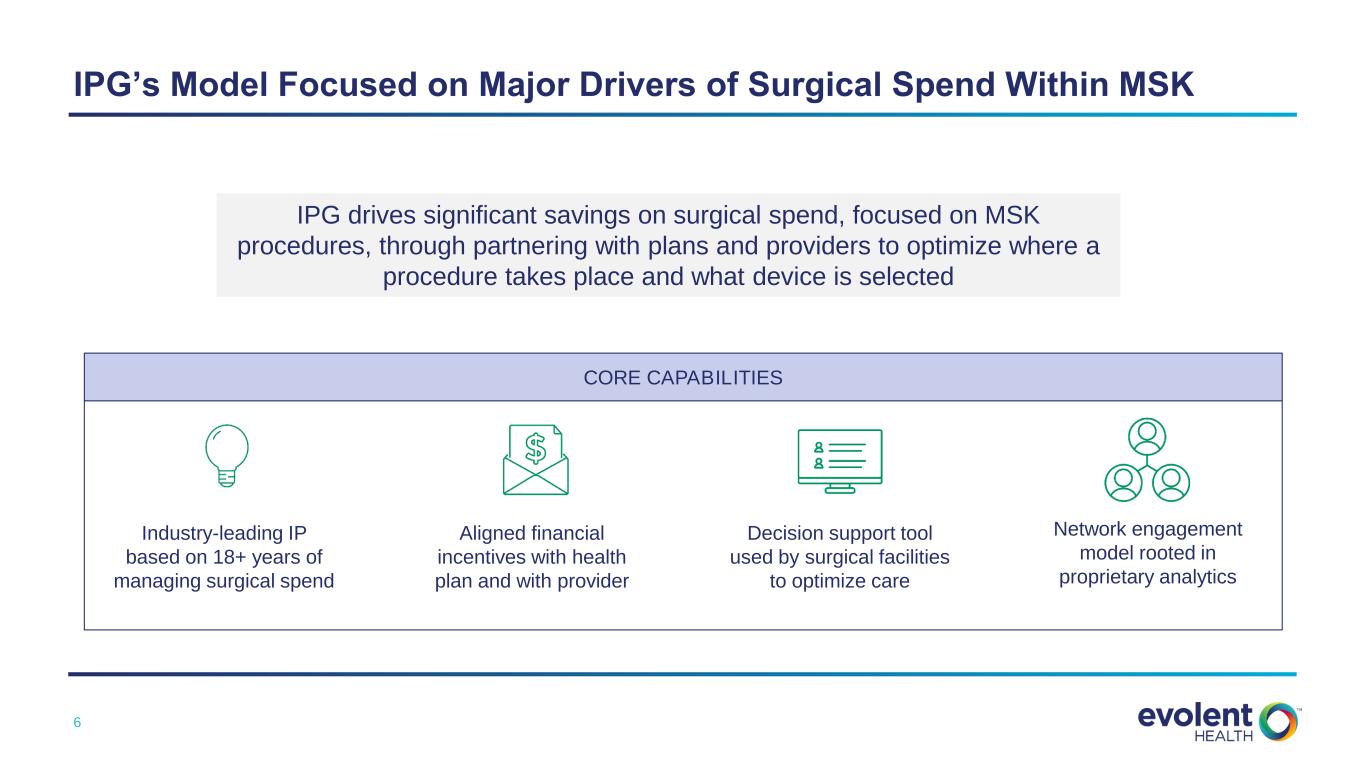

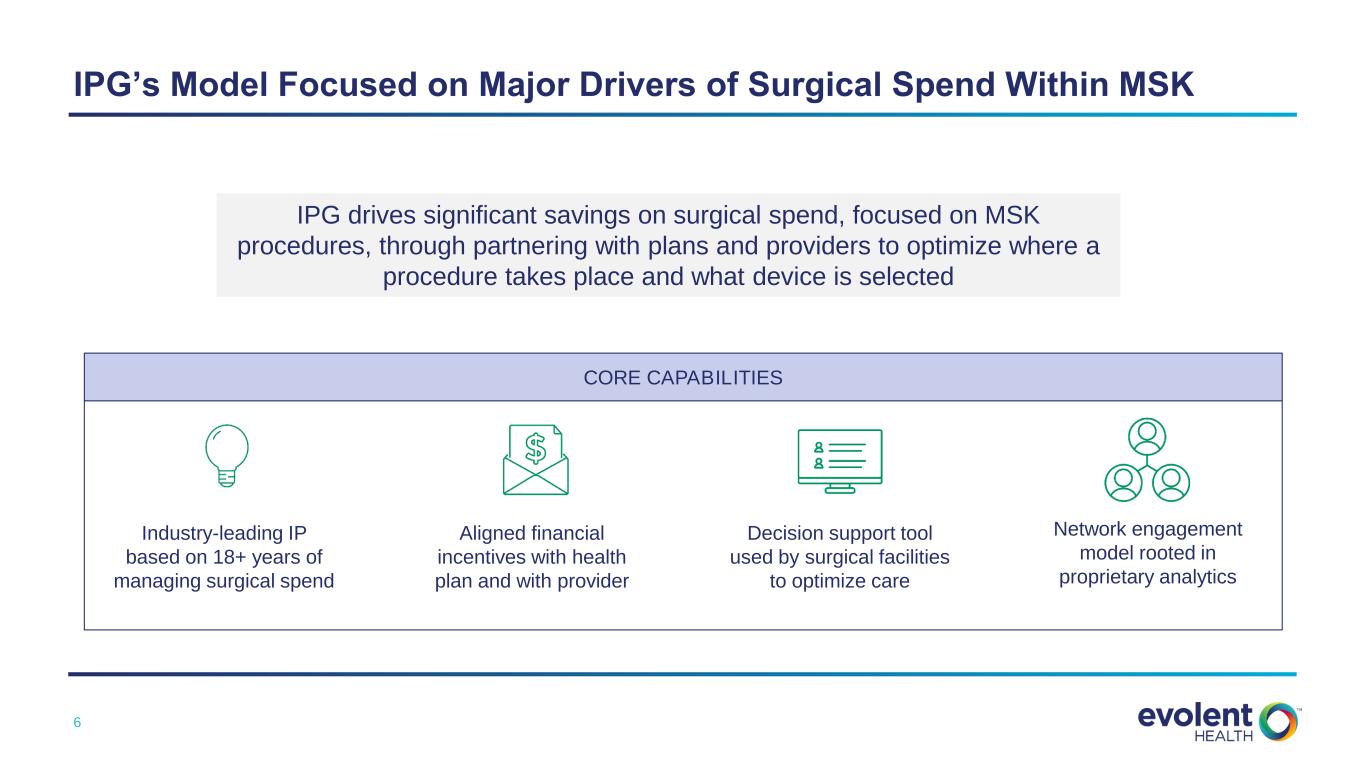

6 IPG’s Model Focused on Major Drivers of Surgical Spend Within MSK IPG drives significant savings on surgical spend, focused on MSK procedures, through partnering with plans and providers to optimize where a procedure takes place and what device is selected Industry-leading IP based on 18+ years of managing surgical spend Aligned financial incentives with health plan and with provider Decision support tool used by surgical facilities to optimize care Network engagement model rooted in proprietary analytics CORE CAPABILITIES

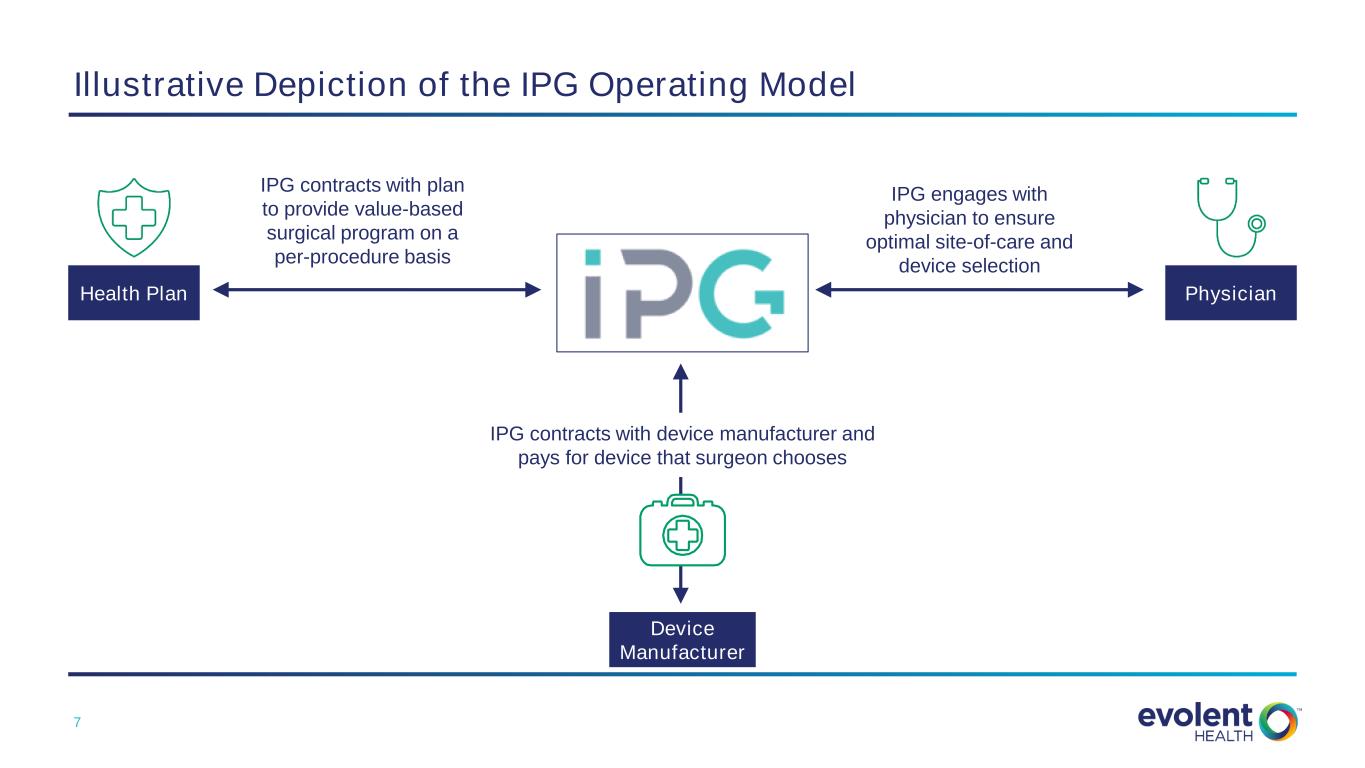

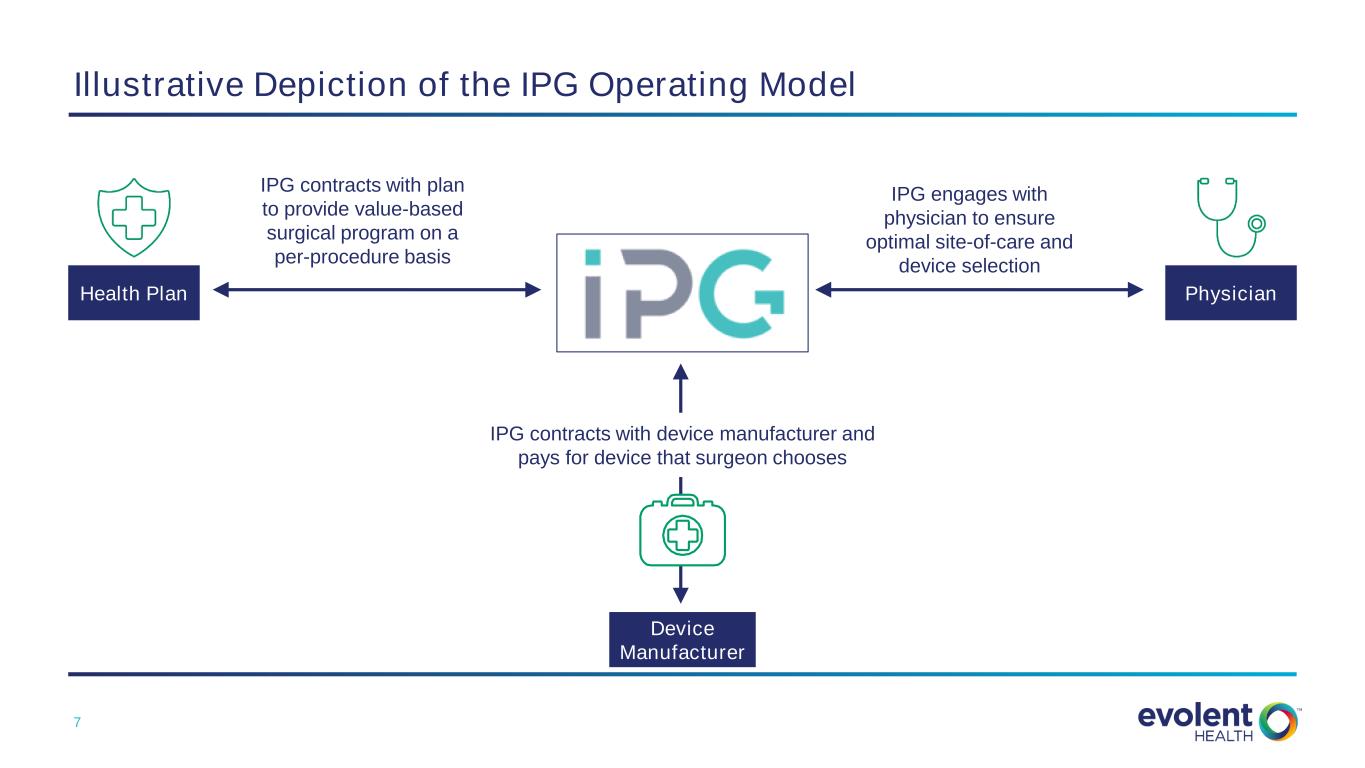

7 Illustrative Depiction of the IPG Operating Model Health Plan Device Manufacturer Physician IPG contracts with device manufacturer and pays for device that surgeon chooses IPG engages with physician to ensure optimal site-of-care and device selection IPG contracts with plan to provide value-based surgical program on a per-procedure basis

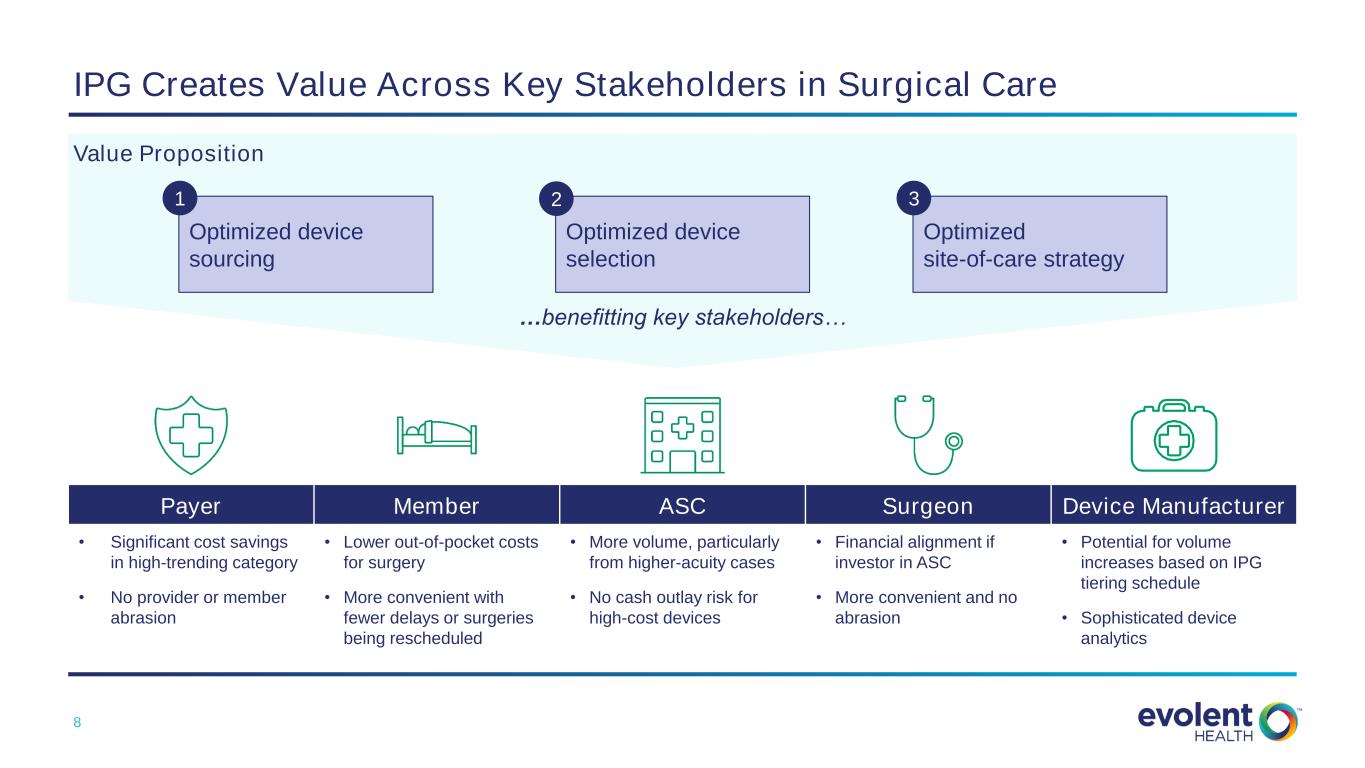

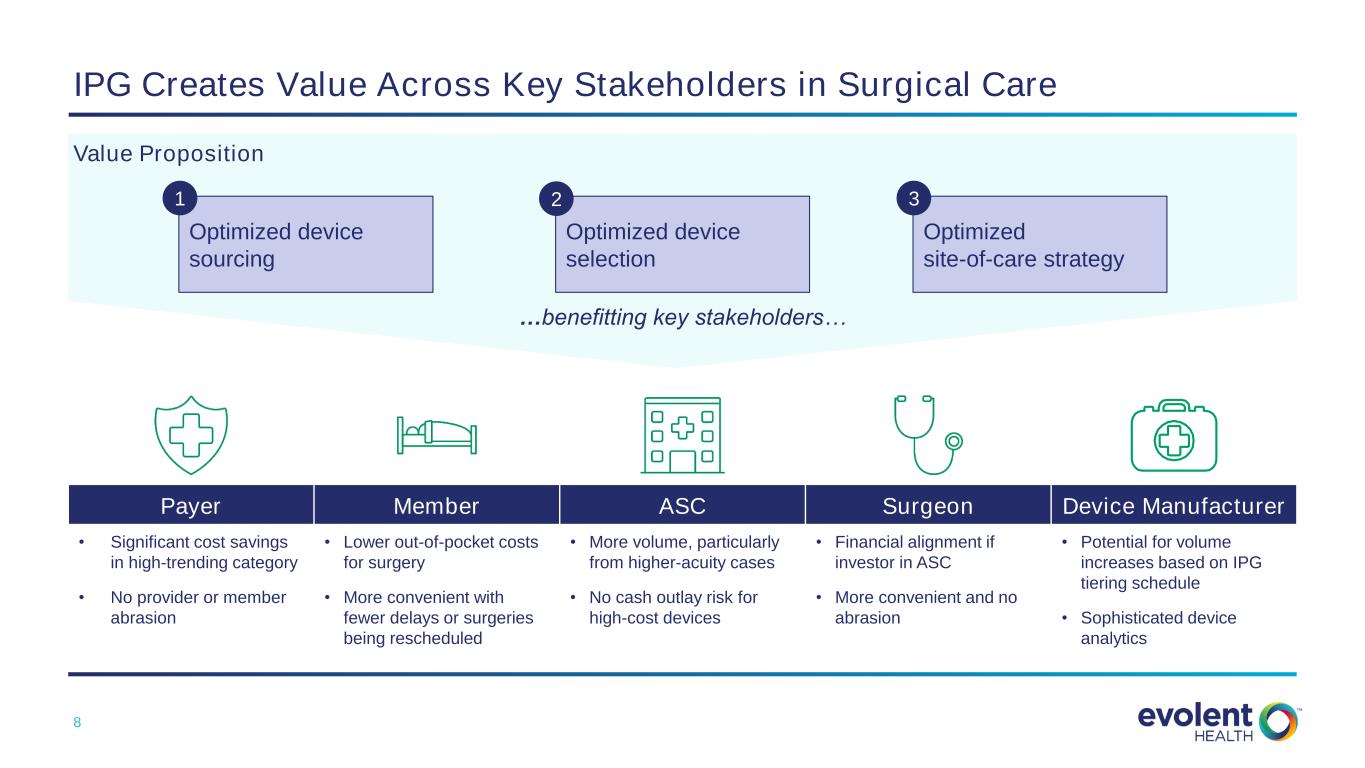

8 Value Proposition Payer Member ASC Surgeon Device Manufacturer • Significant cost savings in high-trending category • No provider or member abrasion • Lower out-of-pocket costs for surgery • More convenient with fewer delays or surgeries being rescheduled • More volume, particularly from higher-acuity cases • No cash outlay risk for high-cost devices • Financial alignment if investor in ASC • More convenient and no abrasion • Potential for volume increases based on IPG tiering schedule • Sophisticated device analytics IPG Creates Value Across Key Stakeholders in Surgical Care Optimized device sourcing Optimized device selection Optimized site-of-care strategy 1 2 3 …benefitting key stakeholders…

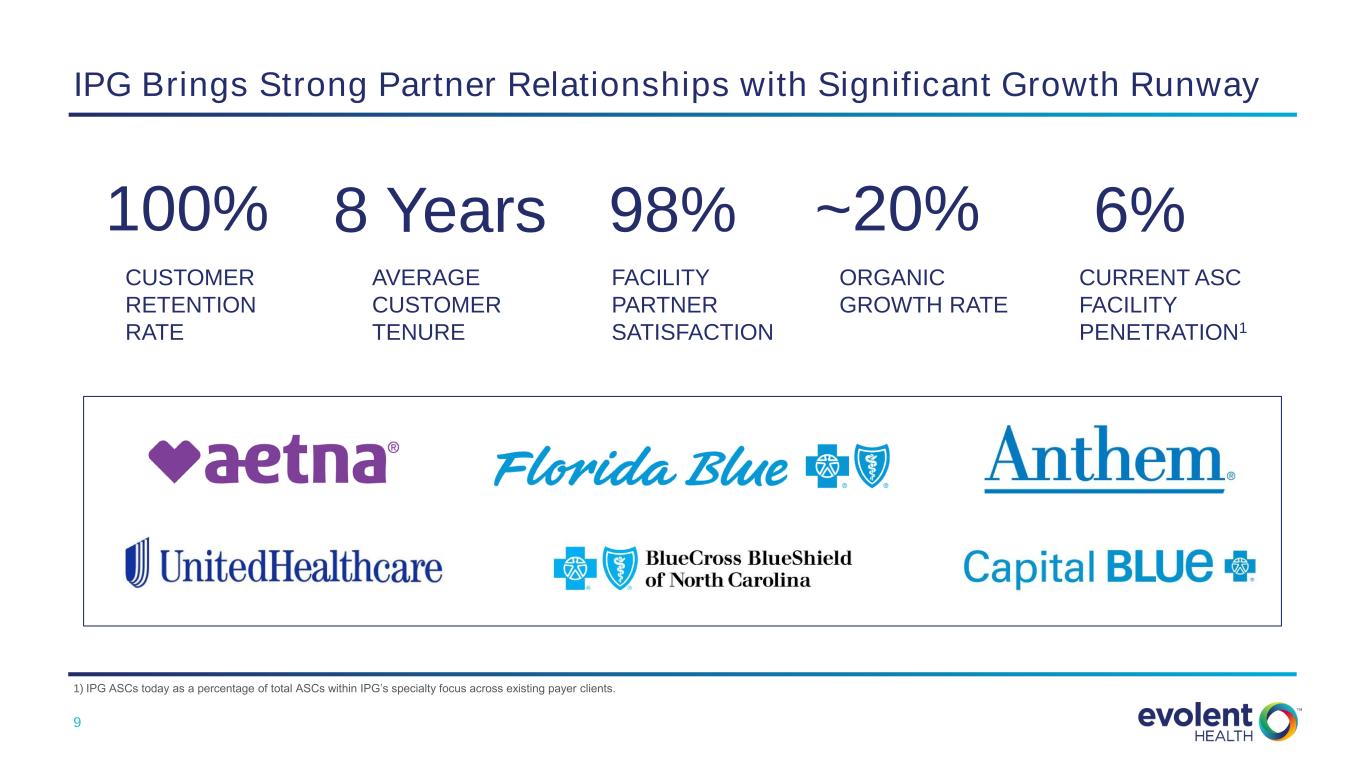

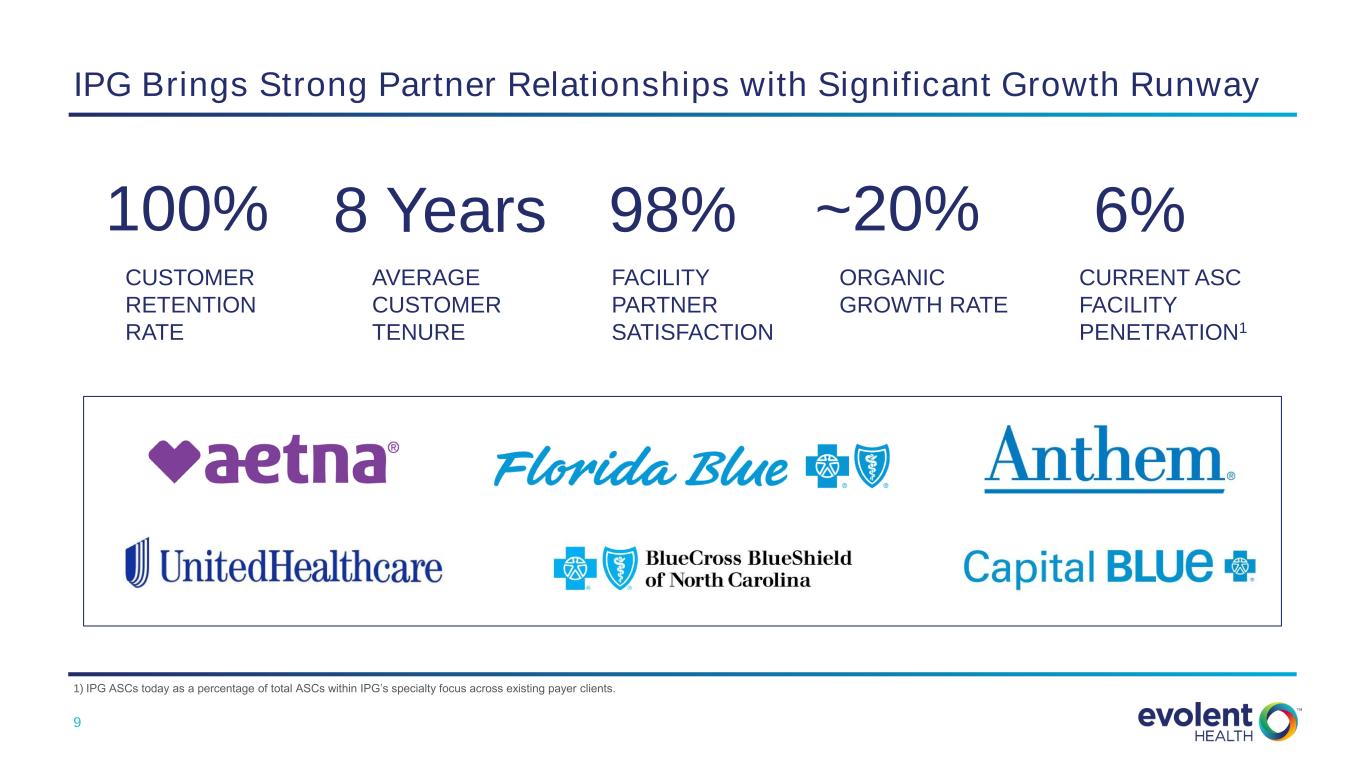

9 IPG Brings Strong Partner Relationships with Significant Growth Runway 100% CUSTOMER RETENTION RATE 8 Years AVERAGE CUSTOMER TENURE 98% FACILITY PARTNER SATISFACTION ~20% ORGANIC GROWTH RATE 6% CURRENT ASC FACILITY PENETRATION1 1) IPG ASCs today as a percentage of total ASCs within IPG’s specialty focus across existing payer clients.

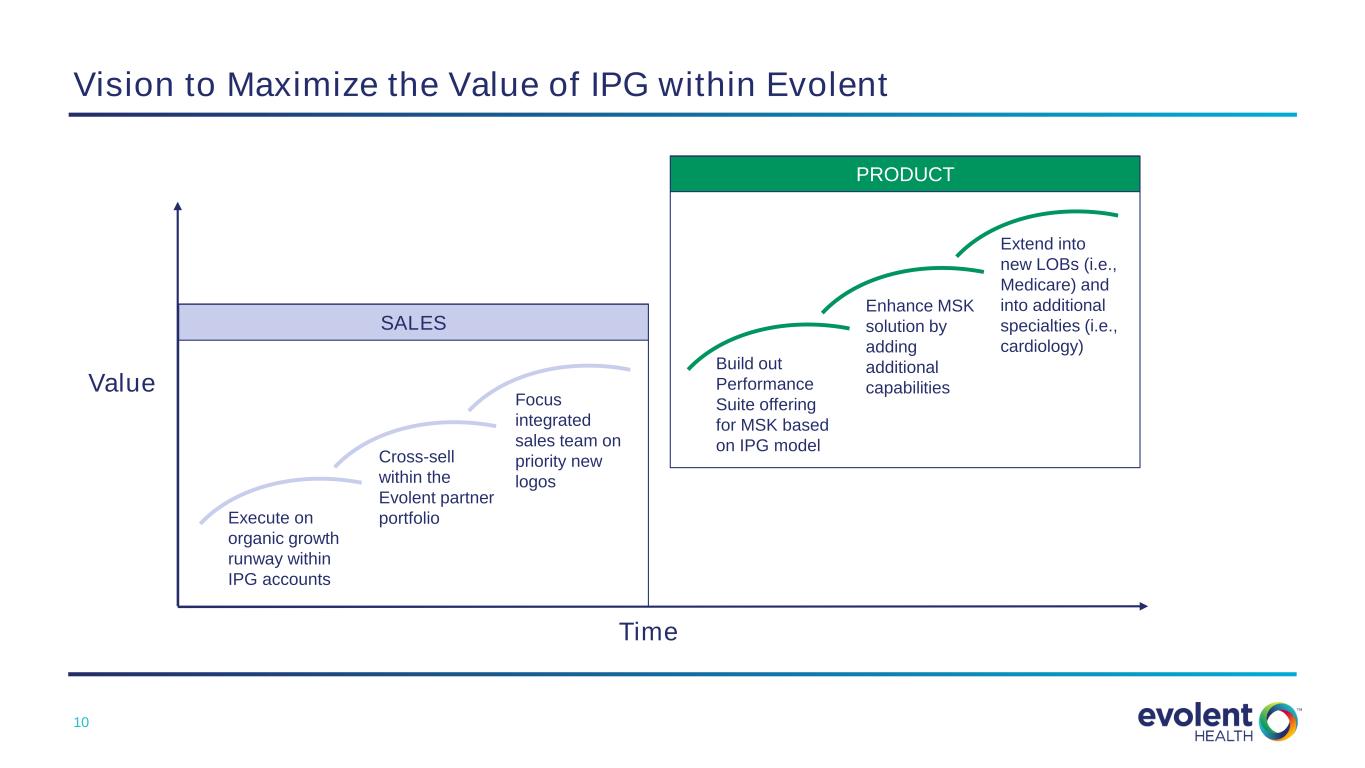

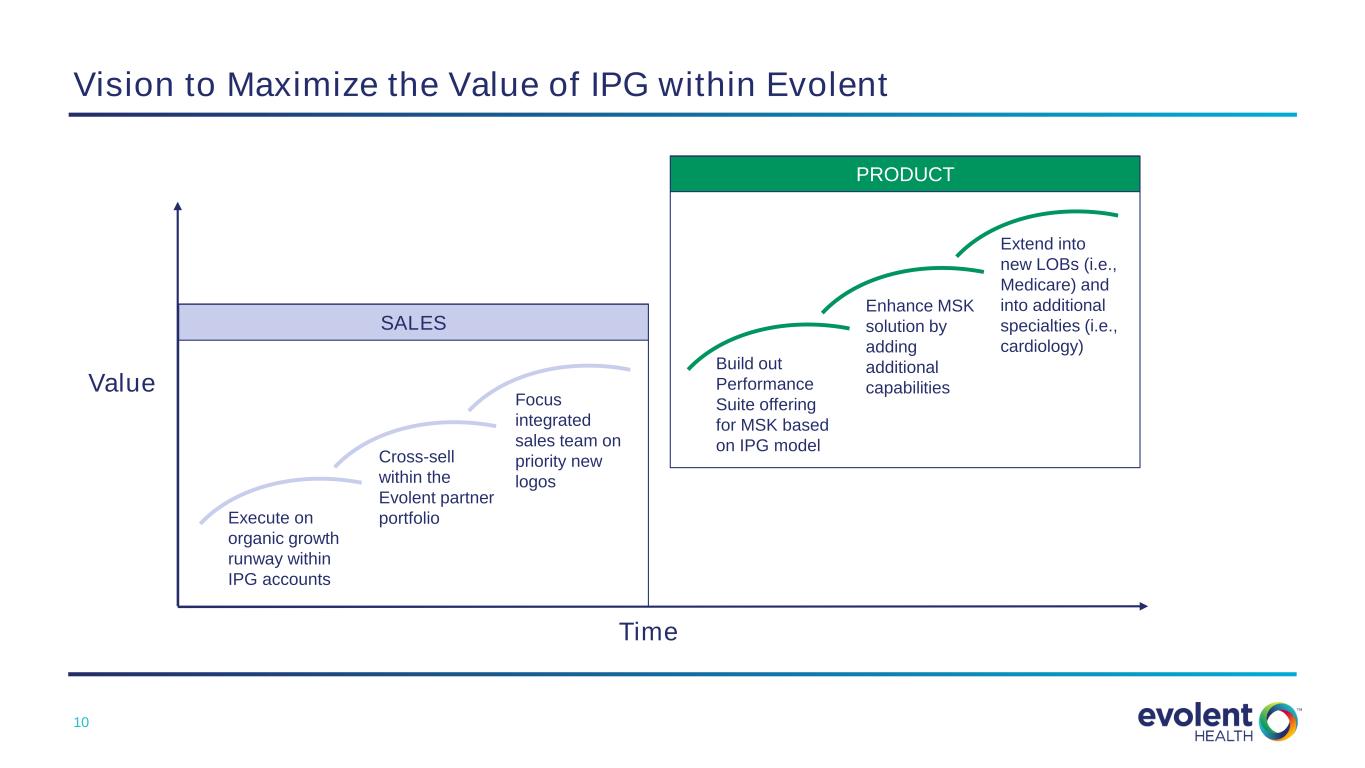

10 Value Vision to Maximize the Value of IPG within Evolent Time Execute on organic growth runway within IPG accounts Cross-sell within the Evolent partner portfolio Focus integrated sales team on priority new logos Build out Performance Suite offering for MSK based on IPG model Extend into new LOBs (i.e., Medicare) and into additional specialties (i.e., cardiology) Enhance MSK solution by adding additional capabilities SALES PRODUCT

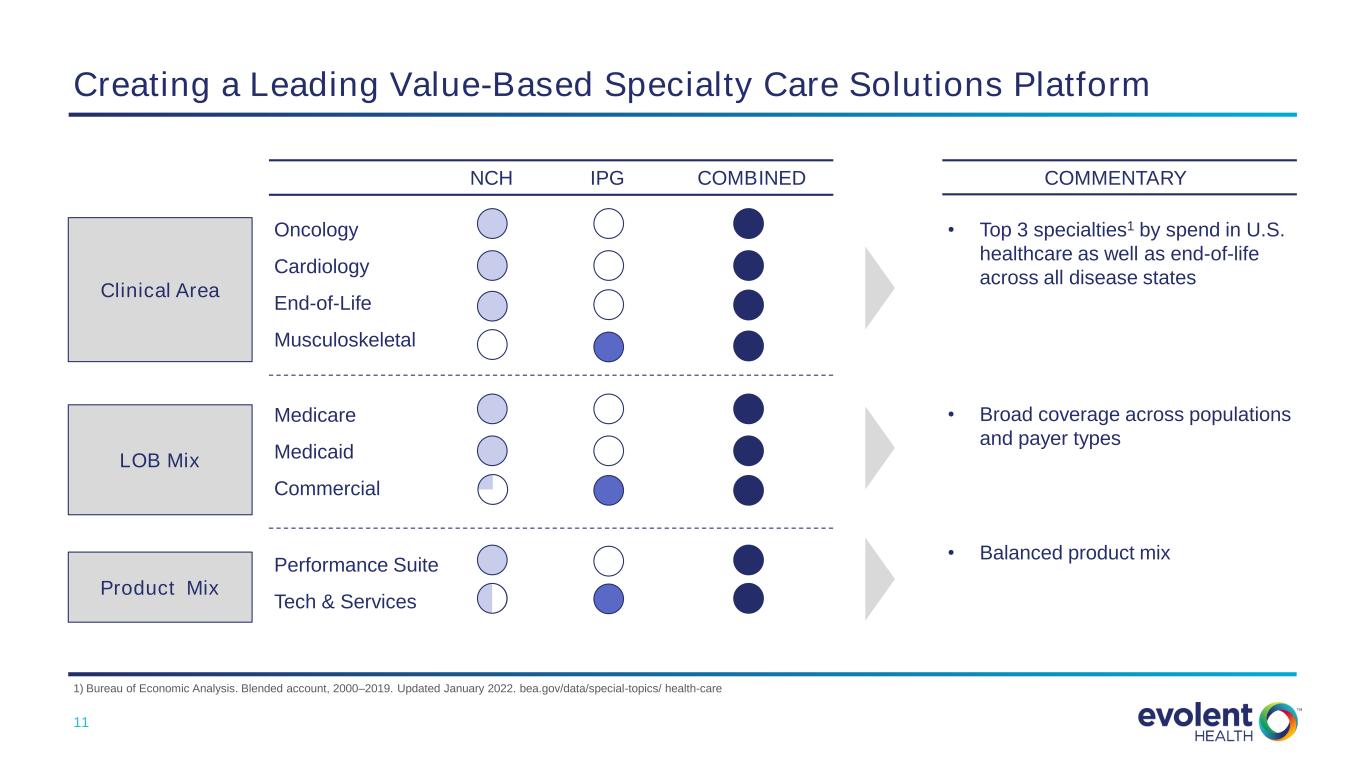

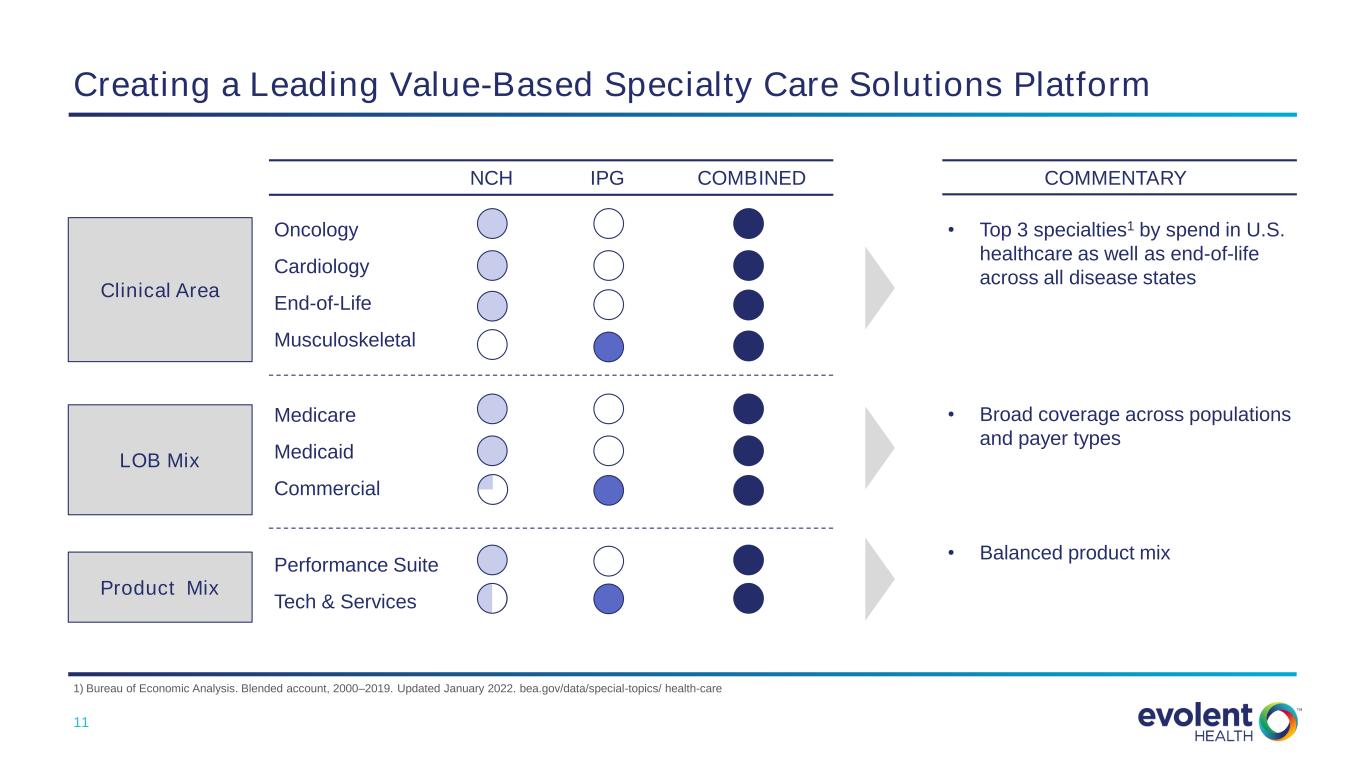

11 Oncology Cardiology End-of-Life Musculoskeletal Performance Suite Tech & Services COMBINEDNCH IPG Clinical Area Creating a Leading Value-Based Specialty Care Solutions Platform Medicare Medicaid Commercial LOB Mix Product Mix COMMENTARY • Top 3 specialties1 by spend in U.S. healthcare as well as end-of-life across all disease states • Broad coverage across populations and payer types • Balanced product mix 1) Bureau of Economic Analysis. Blended account, 2000–2019. Updated January 2022. bea.gov/data/special-topics/ health-care

12 Evolent: Accelerating Our Market Leadership In Value-Based Care Revenue Growth ✓ $140 million of incremental clinical revenue anticipated in 2022 ✓ IPG is a growth business with annual revenue increases expected of 20%+ ✓ Cross-sell and other revenue synergies Accelerate Margin Expansion ✓ 18% Adjusted EBITDA margin1 anticipated to expand further ✓ Increases Evolent’s mix of Technology and Services solutions Disciplined Capital Allocation ✓ Upfront consideration approximately 15x expected 2022 Adjusted EBITDA1 & full achievement of performance milestones yields a potential 11x multiple on earnout ✓ Modest incremental senior debt enhances overall financial profile ✓ Strong cash flow and capex light A Leader in Value-Based Specialty Solutions Emerging Primary Care Performance Suite Platform Administrative Services to Support Value-Based Care 1) Non-GAAP measure, see “Non-GAAP Financial Measures” for definition.

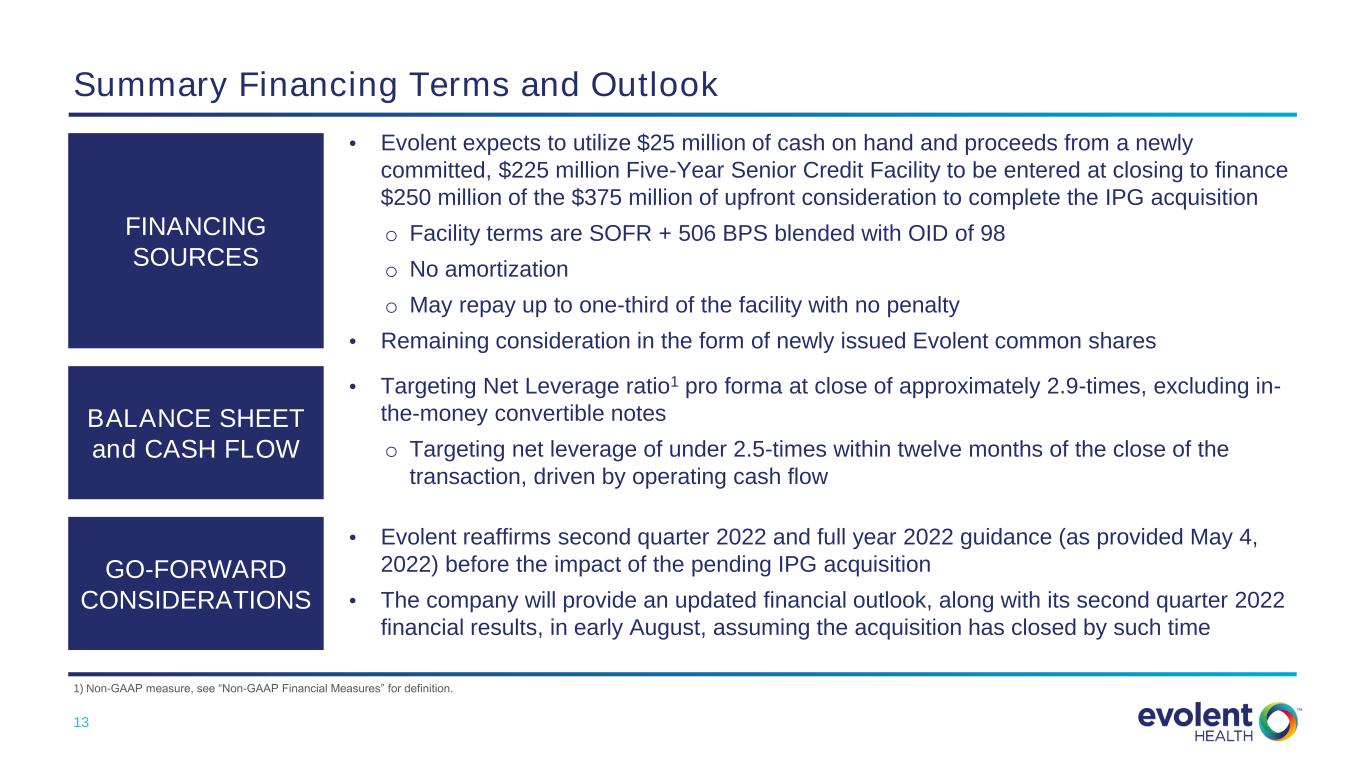

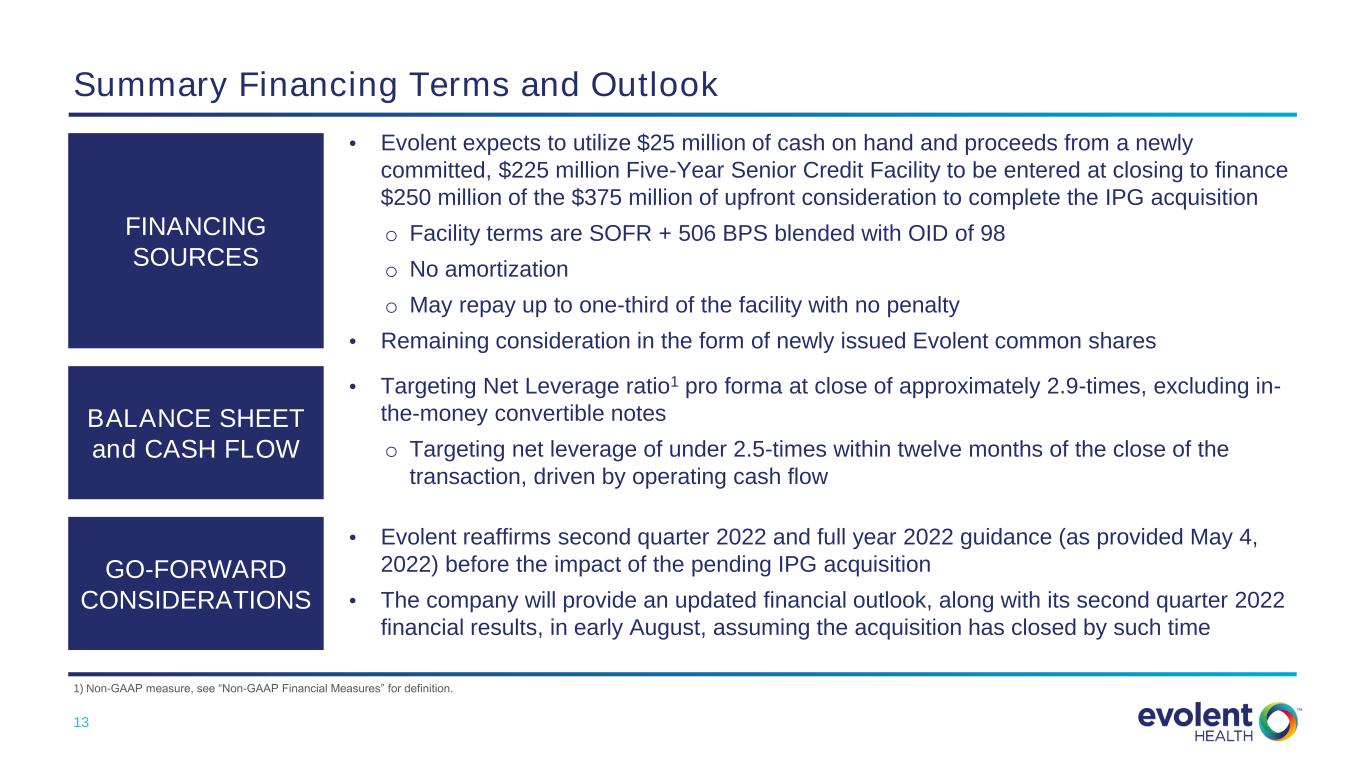

13 Summary Financing Terms and Outlook • Evolent expects to utilize $25 million of cash on hand and proceeds from a newly committed, $225 million Five-Year Senior Credit Facility to be entered at closing to finance $250 million of the $375 million of upfront consideration to complete the IPG acquisition o Facility terms are SOFR + 506 BPS blended with OID of 98 o No amortization o May repay up to one-third of the facility with no penalty • Remaining consideration in the form of newly issued Evolent common shares FINANCING SOURCES • Targeting Net Leverage ratio1 pro forma at close of approximately 2.9-times, excluding in- the-money convertible notes o Targeting net leverage of under 2.5-times within twelve months of the close of the transaction, driven by operating cash flow BALANCE SHEET and CASH FLOW GO-FORWARD CONSIDERATIONS • Evolent reaffirms second quarter 2022 and full year 2022 guidance (as provided May 4, 2022) before the impact of the pending IPG acquisition • The company will provide an updated financial outlook, along with its second quarter 2022 financial results, in early August, assuming the acquisition has closed by such time 1) Non-GAAP measure, see “Non-GAAP Financial Measures” for definition.

14 Why Evolent Health? Investment Considerations Execution Drives Shareholder Value Efficient Capital Allocation Strong and Expanding Margins Compelling Long-Term Organic Growth Commitment to Shareholder Value

15 Non-GAAP Financial Measures In addition to disclosing financial results that are determined in accordance with GAAP, we present and discuss certain non-GAAP financial measures, as supplemental measures to help investors evaluate our fundamental operational performance. Net Debt is defined as the carrying value outstanding under the Company’s, 2024 Notes and 2025 Notes and senior secured debt adjusted to exclude the impact of net discounts and deferred financing costs less Available Cash. Management uses Net Debt as a supplemental performance measure because the netting of cash and cash equivalents from the principal amount of debt outstanding allows us to determine our debt repayment requirements in excess of available cash. We believe that this measure is also useful to investors because it allows further insight into the capital requirements of the Company that is comparable to other organizations in our industry and in the market in general. Net Leverage Ratio (or Net Leverage) is defined as Net Debt divided by LTM Adjusted EBITDA. Management uses Net Debt to LTM Adjusted EBITDA as a supplemental performance measure because it allows the investor to understand capital requirements compared to operating performance over time. We believe that this measure is also useful to investors because it allows further insight into the period over period operational performance in a manner that is comparable to other organizations in our industry and in the market in general. Available cash is defined as cash and cash equivalents and investments determined in accordance with GAAP adjusted to exclude cash, cash equivalents and investments held at Passport Health Plan. Management uses Available Cash a supplemental performance measure as it excludes cash held by Passport that is not readily accessible for expenditures outside of the Passport corporate entity without regulatory approval from the Kentucky Department of Insurance. Adjusted EBITDA is defined as EBITDA (net loss attributable to common shareholders of Evolent Health, Inc. before interest income, interest expense, (provision) benefit for income taxes, depreciation and amortization expenses, adjusted to exclude gain on transfer of membership, loss on repayment/extinguishment of debt, gain (loss) from equity method investees, changes in fair value of contingent consideration and indemnification asset, other income (expense), net, repositioning costs, stock-based compensation expense, severance costs, amortization of contract cost assets, strategy and shareholder advisory services, acquisition-related costs and gain (loss) from discontinued operations. Management uses Adjusted EBITDA as a supplemental performance measure because the removal of acquisition-related costs, one-time or non-cash items (e.g. depreciation, amortization and stock-based compensation expenses) allows us to focus on operational performance. We believe that this measure is also useful to investors because it allows further insight into the period over period operational performance in a manner that is comparable to other organizations in our industry and in the market in general. Adjusted EBITDA Margin is as defined Adjusted EBITDA divided by Revenue. Management uses Adjusted EBITDA margin as a supplemental performance measure because it allows the investor to understand operational performance compared to revenues over time. We believe that this measure is also useful to investors because it allows further insight into the period over period operational performance in a manner that is comparable to other organizations in our industry and in the market in general. The Company cannot reconcile future net leverage without unreasonable effort because certain items that impact this calculation such as net income or loss, Adjusted EBITDA, cash and debt balances are unpredictable with regard to those specific amounts and the timing of events associated with the closing of the acquisition of IPG, therefore they cannot be reasonably predicted at this time These adjusted measures do not represent and should not be considered as alternatives to GAAP measurements, and our calculations thereof may not be comparable to similarly entitled measures reported by other companies. A reconciliation of these adjusted measures to their most comparable GAAP financial measures is presented in the tables below. We believe these measures are useful across time in evaluating our fundamental core operating performance.

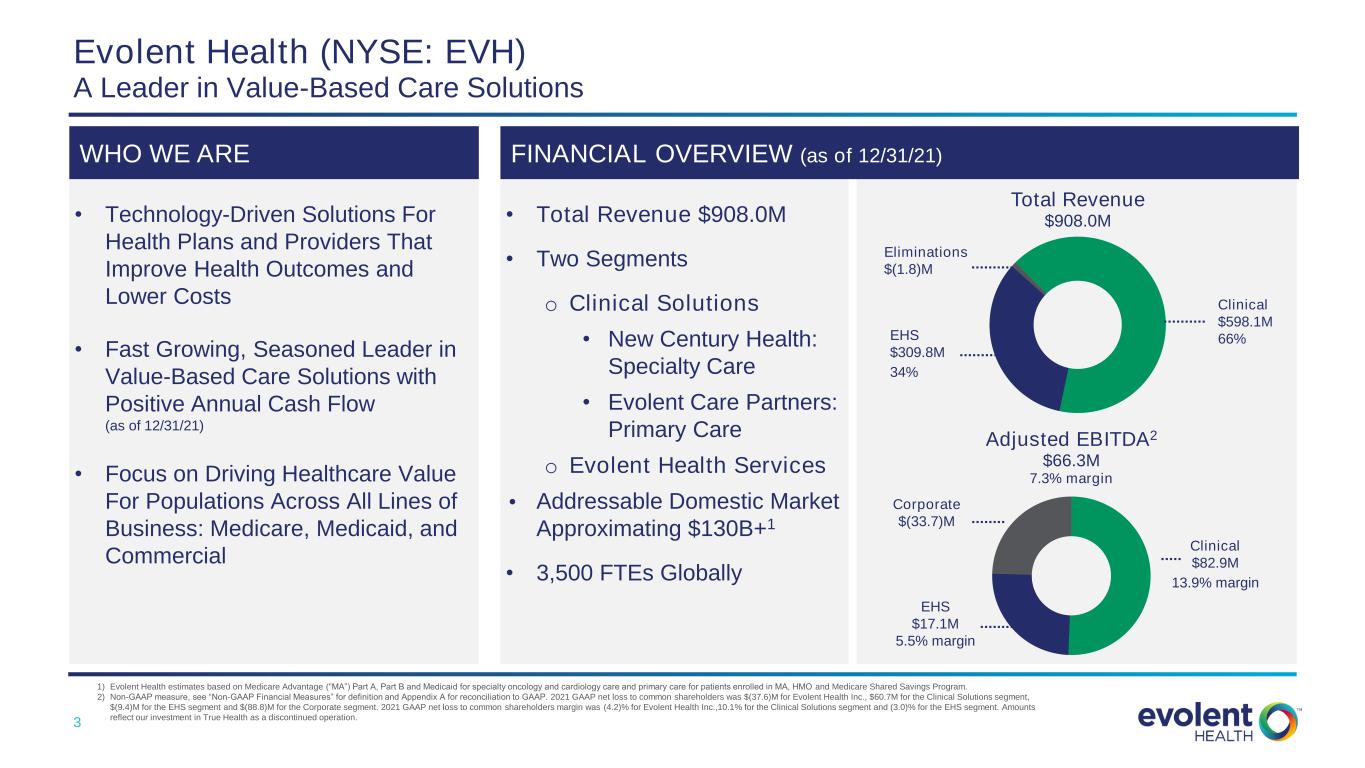

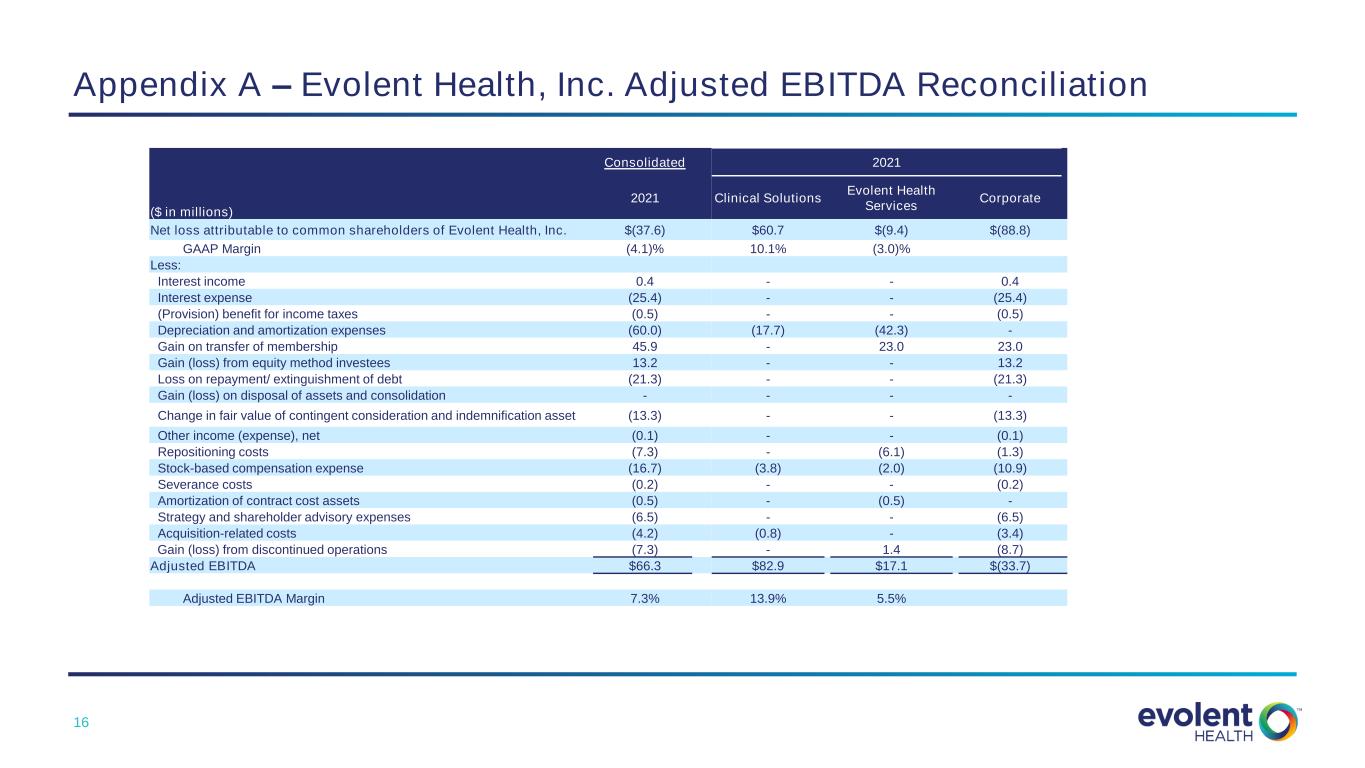

16 Appendix A – Evolent Health, Inc. Adjusted EBITDA Reconciliation Consolidated 2021 ($ in millions) 2021 Clinical Solutions Evolent Health Services Corporate Net loss attributable to common shareholders of Evolent Health, Inc. $(37.6) $60.7 $(9.4) $(88.8) GAAP Margin (4.1)% 10.1% (3.0)% Less: Interest income 0.4 - - 0.4 Interest expense (25.4) - - (25.4) (Provision) benefit for income taxes (0.5) - - (0.5) Depreciation and amortization expenses (60.0) (17.7) (42.3) - Gain on transfer of membership 45.9 - 23.0 23.0 Gain (loss) from equity method investees 13.2 - - 13.2 Loss on repayment/ extinguishment of debt (21.3) - - (21.3) Gain (loss) on disposal of assets and consolidation - - - - Change in fair value of contingent consideration and indemnification asset (13.3) - - (13.3) Other income (expense), net (0.1) - - (0.1) Repositioning costs (7.3) - (6.1) (1.3) Stock-based compensation expense (16.7) (3.8) (2.0) (10.9) Severance costs (0.2) - - (0.2) Amortization of contract cost assets (0.5) - (0.5) - Strategy and shareholder advisory expenses (6.5) - - (6.5) Acquisition-related costs (4.2) (0.8) - (3.4) Gain (loss) from discontinued operations (7.3) - 1.4 (8.7) Adjusted EBITDA $66.3 $82.9 $17.1 $(33.7) Adjusted EBITDA Margin 7.3% 13.9% 5.5%