worldwide, perpetual, royalty-free license to inclacumab solely for any diagnostic use. We plan to develop inclacumab as a treatment for vaso-occlusive crises in patients with SCD.

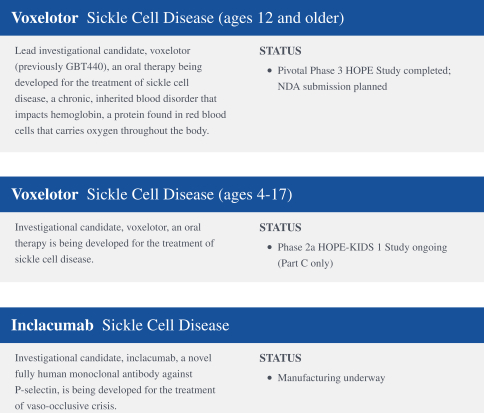

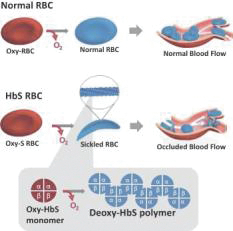

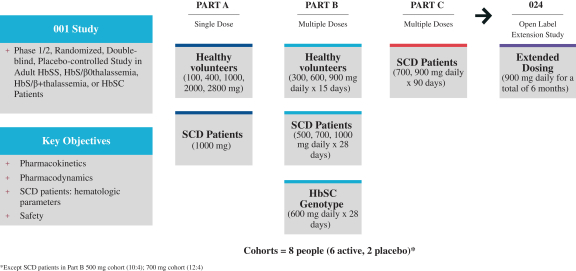

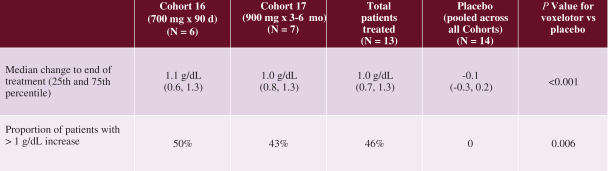

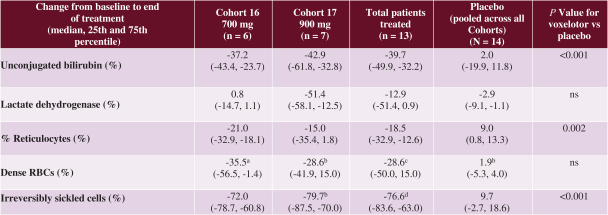

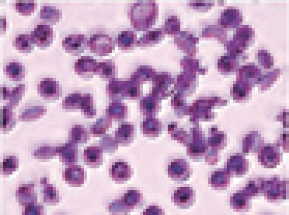

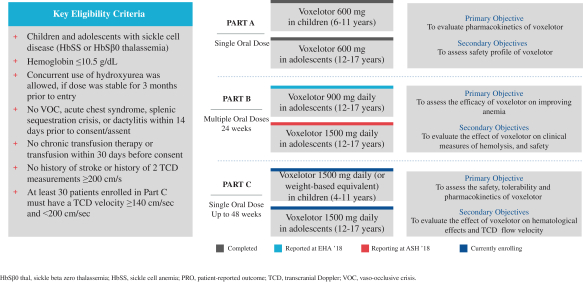

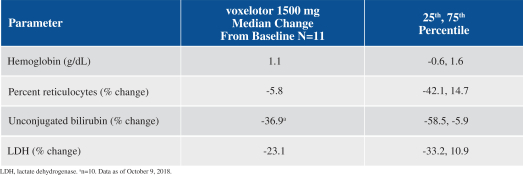

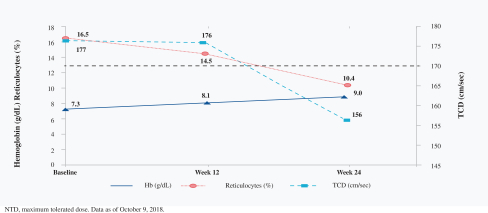

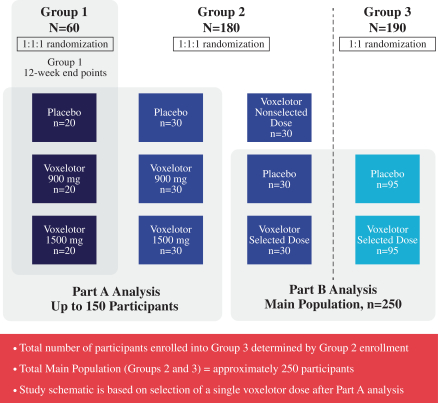

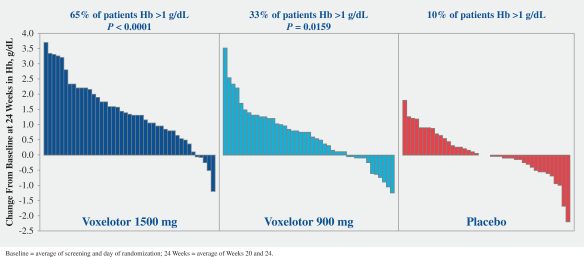

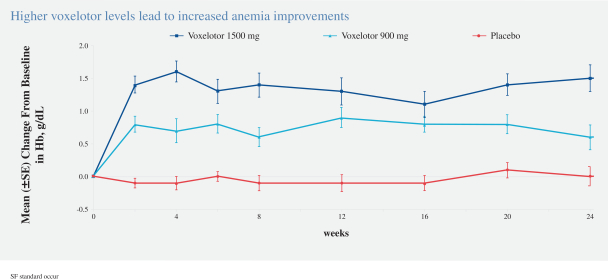

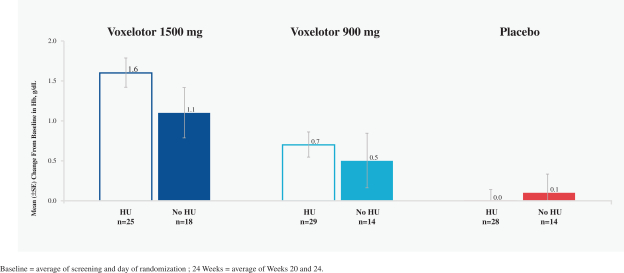

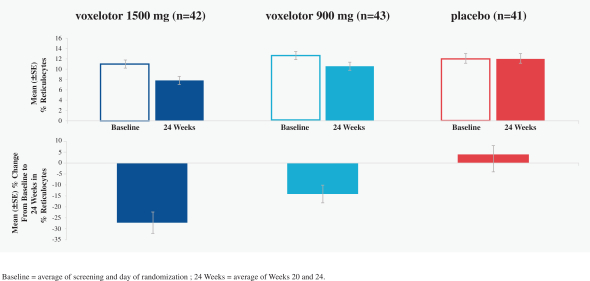

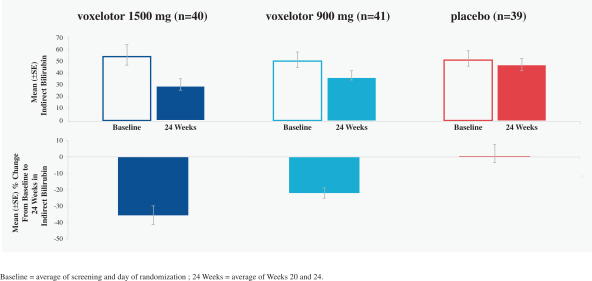

SCD is marked by red blood cell, or RBC, destruction and occluded blood flow and hypoxia, leading to anemia, stroke, multi-organ failure, severe pain crises, and shortened patient life span. Voxelotor inhibits abnormal hemoglobin polymerization, the underlying mechanism that causes sickling of RBCs. In our clinical trials to date of voxelotor in SCD patients, we observed reduced markers of red blood cell destruction, improvements in anemia, improvements in markers of tissue oxygenation, and reduced numbers of sickled RBCs.

We own or jointly own and have exclusively licensed rights to our product candidates in the United States, Europe and other major markets. We are the sole owner of issued U.S. patents covering voxelotor, including its composition of matter, methods of use, and a polymorph of voxelotor. These issued patents covering voxelotor will expire between 2032 and 2035, absent any applicable patent term extensions. We own orco-own additional pending patent applications in the United States and multiple foreign countries relating to our lead product candidate voxelotor.

Beyond evaluation voxelotor in SCD, we are also engaged in other research and development activities, all of which are currently in earlier development stages. In addition, we regularly evaluate opportunities toin-license, acquire or invest in new business, technology or assets or engage in related discussions with other business entities.

Since our inception in 2011, we have devoted substantially all of our resources to identifying and developing our product candidates, including conducting clinical trials and nonclinical studies and providing general and administrative support for these operations.

We are not profitable and have incurred losses and negative cash flows from operations each year since our inception. We have financed our operations primarily through sale of equity securities. In January 2018, we completed afollow-on offering pursuant to which we issued an aggregate of 3,026,315 shares of our common stock at a price of $38.00 per share, including 2,631,579 shares sold at the initial closing in December 2017 and 394,736 shares sold pursuant to the exercise of the underwriter’s over-allotment option in January 2018, resulting in aggregate proceeds of approximately $111.0 million, net of underwriting discounts and commissions, and offering expenses. In March 2018, we completed afollow-on offering and issued an aggregate of 4,600,000 shares of our common stock at a price of $54.00 per share, including 600,000 shares of common stock sold directly to the underwriters when they exercised their over-allotment option at the price of $54.00 per share. We received total proceeds of $240.6 million from the offering, net of underwriting discounts and commissions, and offering expenses. In January 2019, we completed afollow-on offering and issued an aggregate of 3,920,453 shares of our common stock at a price of $44.00 per share, including 3,409,090 shares sold at the initial closing in December 2018 and 511,363 shares sold pursuant to the exercise of the underwriter’s over-allotment option in January 2019, resulting in aggregate proceeds of approximately $162.1 million from the offering, net of underwriting discounts and commissions, and estimated offering expenses.

Our net losses were $174.2 million for the year ended December 31, 2018, $117.0 million for the year ended December 31, 2017 and $82.5 million for the year ended December 31, 2016. As of December 31, 2018, we had an accumulated deficit of $472.2 million. To date, we have not generated any revenue. We do not expect to receive any revenue from any product candidates that we develop until we obtain regulatory approval and commercialize our products or enter into collaborative agreements with third parties. Substantially all of our net losses have resulted from costs incurred in connection with our research and development programs and from general and administrative costs associated with our operations. We had $275.4 million in cash and cash equivalents and $316.4 million in marketable securities as of December 31, 2018.

Critical Accounting Polices and Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles, or U.S. GAAP. The preparation of these consolidated financial statements

86