Industry-leading US-Based Gold Ownership Per Share NYSE MKT: PZG March 2017 Exhibit 99.1

This Presentation contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold Nevada Corp. (“Paramount”, “we”, “us”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this presentation regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. For this purpose, any statements contained in this presentation that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Cautionary Note to U.S. Investors - All mineral resources have been estimated in accordance with the definition standards on mineral resources and mineral reserves of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in National Instrument 43-101. U.S. reporting requirements for disclosure of mineral properties are governed by the Securities and Exchange Commission (“SEC”) Industry Guide 7. Canadian and Guide 7 standards are substantially different. The SEC permits mining companies, in their filings, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this document, such as "reserves," "resources," "geologic resources," "proven," "probable," "measured," "indicated," and "inferred," which are not recognized under Industry Guide 7. U.S. Investors should be aware that the issuer has no "reserves" as defined by Industry Guide 7 and are cautioned not to assume that any part or all of mineral resources will be confirmed or converted into Industry Guide 7 compliant "reserves". Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute Industry Guide 7 "reserves" by SEC standards as in-place tonnage and grade without reference to unit measures. Mineral resources that are not mineral reserves do not have demonstrated economic viability. FORWARD LOOKING STATEMENTS paramountnevada.com | @ParamountNV

paramountnevada.com | @ParamountNV U.S.Only Nevada Oregon Defined Permitting Processes Changing Fiscal Tax Policy Low Political Risk

paramountnevada.com | @ParamountNV Advanced Stage Projects District Scale Land Packages Extensive Metallurgical Testing Exploration Upside All at PEA level Significant M&I Resources

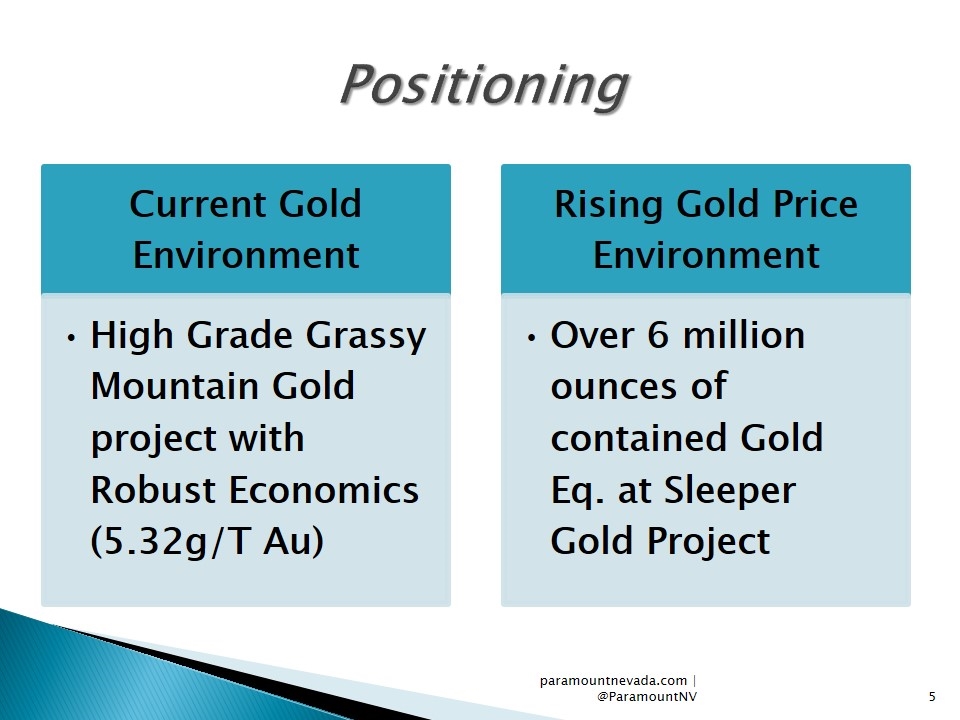

paramountnevada.com | @ParamountNV Positioning Current Gold Environment Rising Gold Price Environment High Grade Grassy Mountain Gold project with Robust Economics (5.32g/T Au) Over 6 million ounces of contained Gold Eq. at Sleeper Gold Project

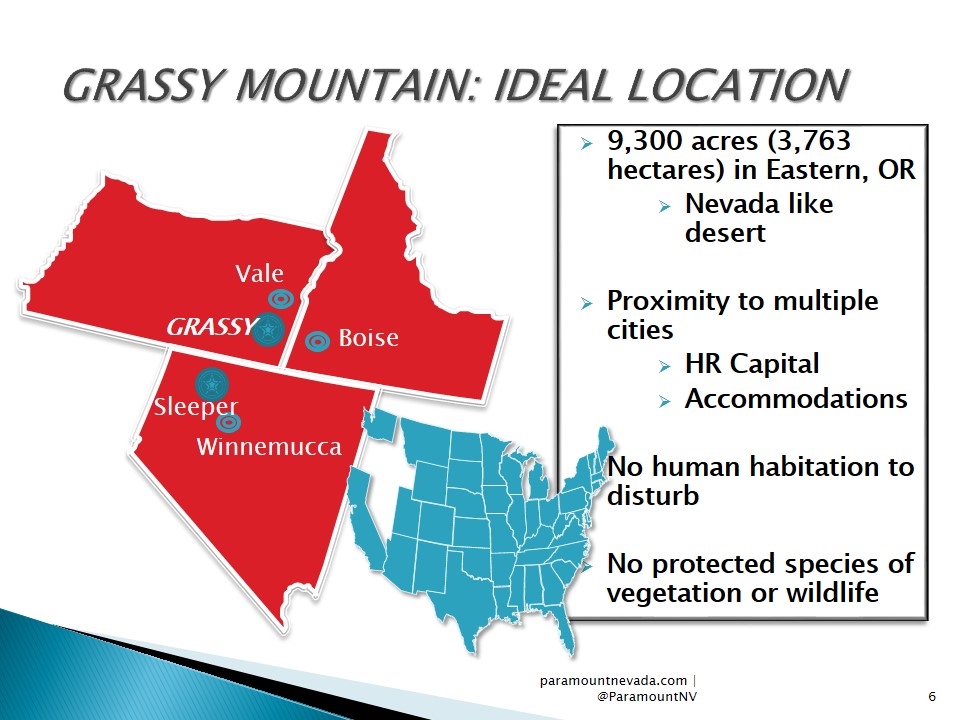

GRASSY MOUNTAIN: IDEAL LOCATION paramountnevada.com | @ParamountNV 9,300 acres (3,763 hectares) in Eastern, OR Nevada like desert Proximity to multiple cities HR Capital Accommodations No human habitation to disturb No protected species of vegetation or wildlife Vale Boise Winnemucca GRASSY Sleeper

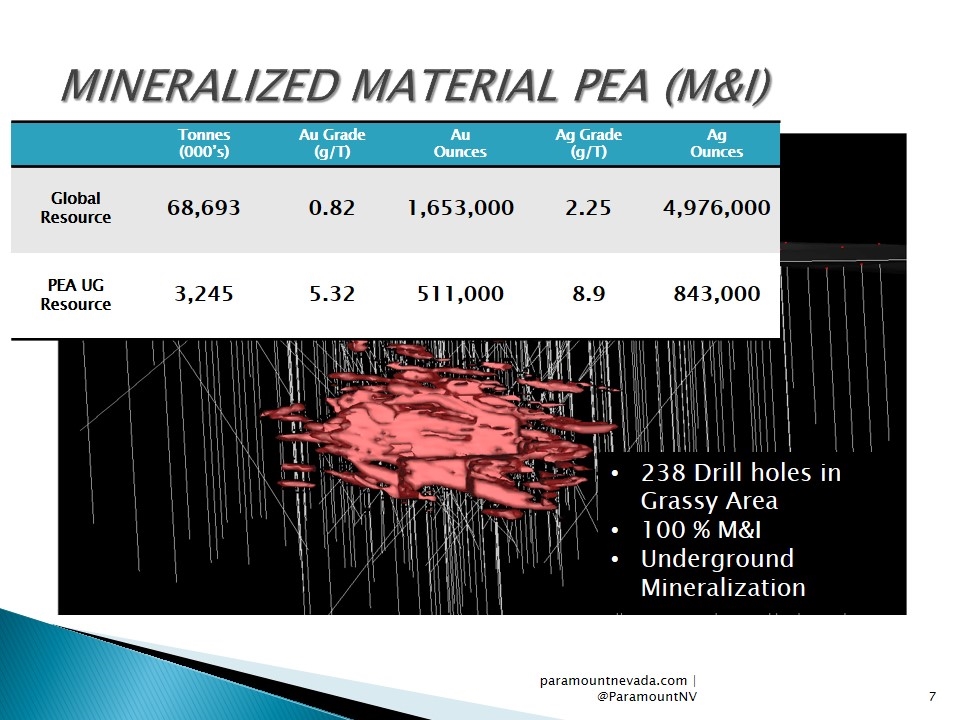

Grassy Exploration paramountnevada.com | @ParamountNV MINERALIZED MATERIAL PEA (M&I) 238 Drill holes in Grassy Area 100 % M&I Underground Mineralization Tonnes (000’s) Au Grade (g/T) Au Ounces Ag Grade (g/T) Ag Ounces Global Resource 68,693 0.82 1,653,000 2.25 4,976,000 PEA UG Resource 3,245 5.32 511,000 8.9 843,000

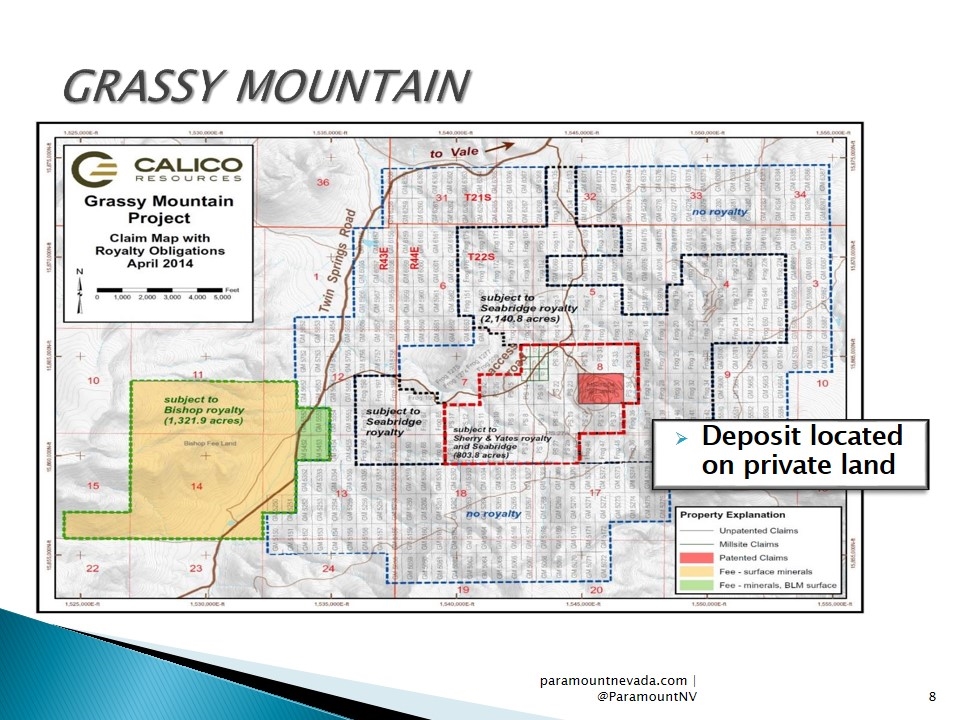

paramountnevada.com | @ParamountNV GRASSY MOUNTAIN Deposit located on private land

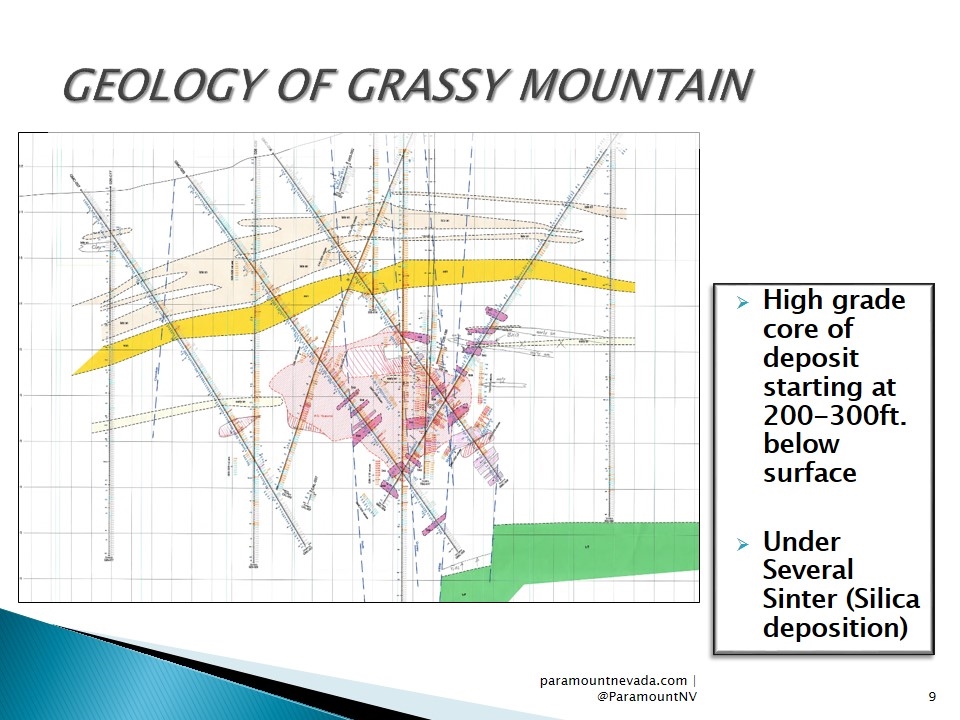

paramountnevada.com | @ParamountNV GEOLOGY OF GRASSY MOUNTAIN High grade core of deposit starting at 200-300ft. below surface Under Several Sinter (Silica deposition)

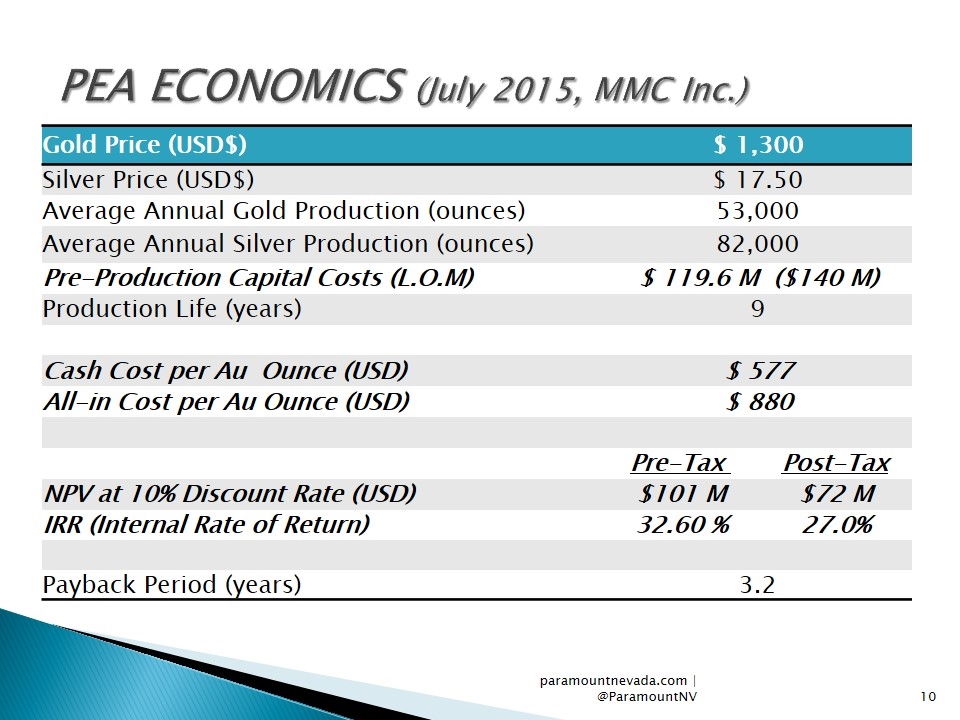

Gold Price (USD$) $ 1,300 Silver Price (USD$) $ 17.50 Average Annual Gold Production (ounces) 53,000 Average Annual Silver Production (ounces) 82,000 Pre-Production Capital Costs (L.O.M) $ 119.6 M ($140 M) Production Life (years) 9 Cash Cost per Au Ounce (USD) $ 577 All-in Cost per Au Ounce (USD) $ 880 Pre-Tax Post-Tax NPV at 10% Discount Rate (USD) $101 M $72 M IRR (Internal Rate of Return) 32.60 % 27.0% Payback Period (years) 3.2 PEA ECONOMICS (July 2015, MMC Inc.) paramountnevada.com | @ParamountNV

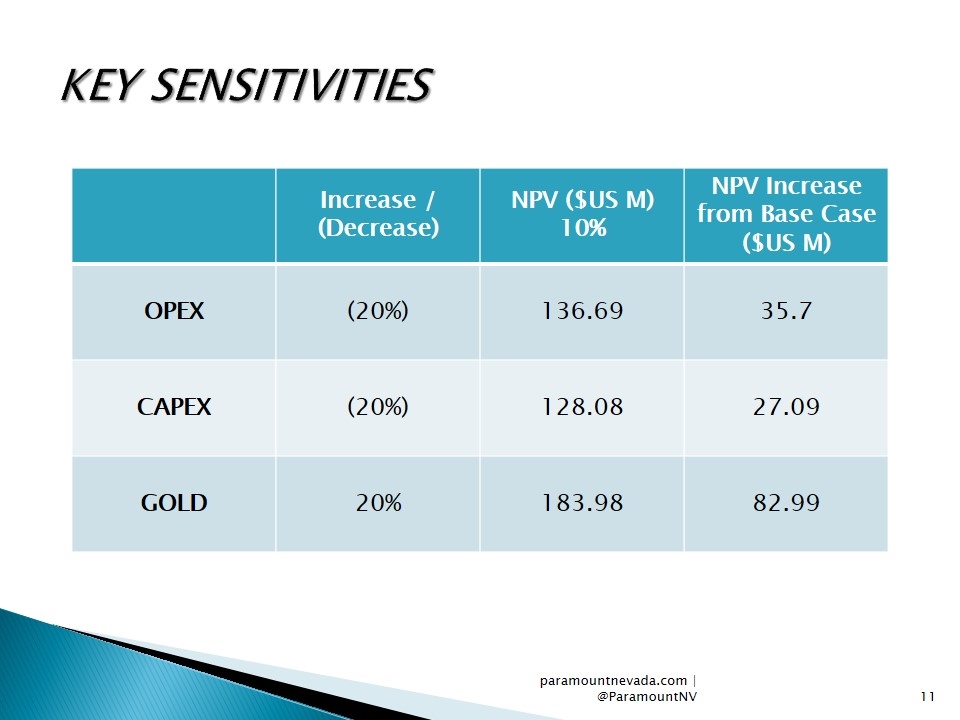

paramountnevada.com | @ParamountNV KEY SENSITIVITIES Increase / (Decrease) NPV ($US M) 10% NPV Increase from Base Case ($US M) OPEX (20%) 136.69 35.7 CAPEX (20%) 128.08 27.09 GOLD 20% 183.98 82.99

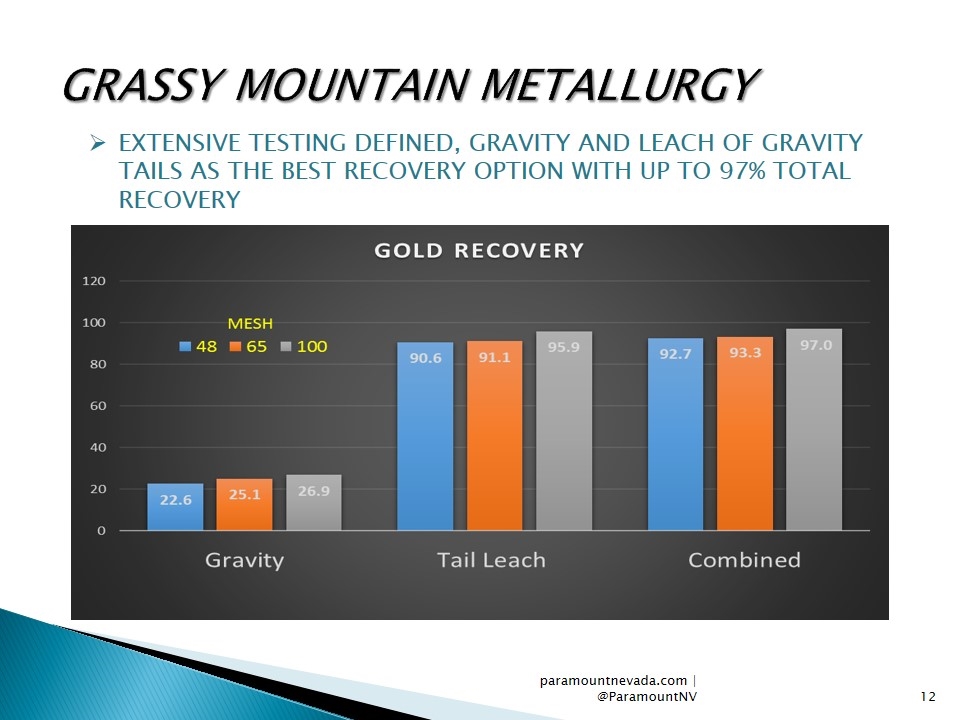

paramountnevada.com | @ParamountNV GRASSY MOUNTAIN METALLURGY EXTENSIVE TESTING DEFINED, GRAVITY AND LEACH OF GRAVITY TAILS AS THE BEST RECOVERY OPTION WITH UP TO 97% TOTAL RECOVERY

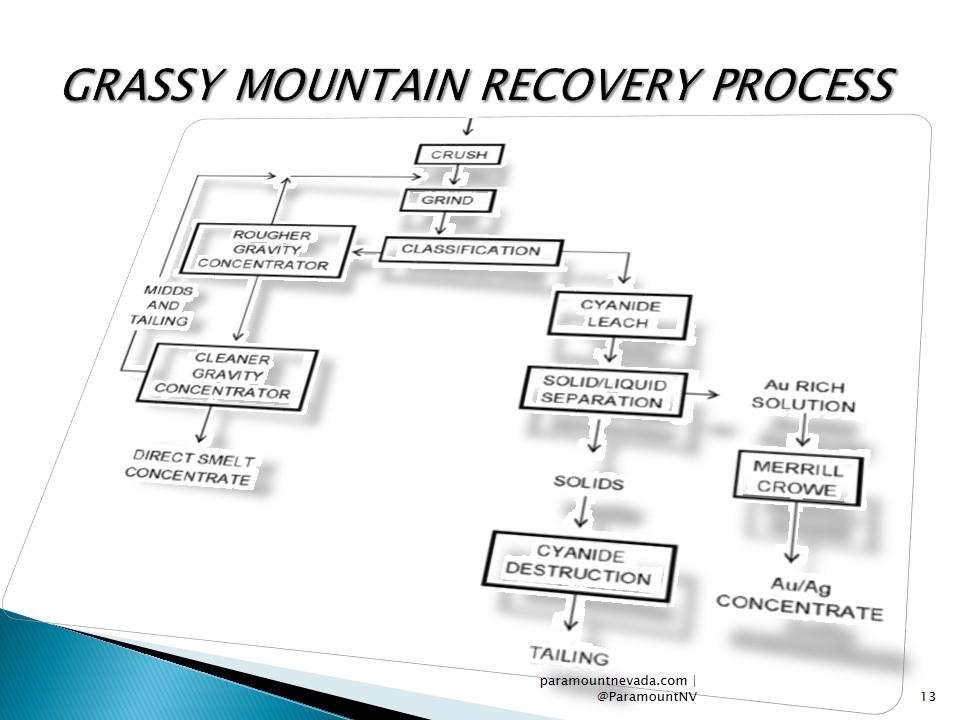

GRASSY MOUNTAIN RECOVERY PROCESS paramountnevada.com | @ParamountNV

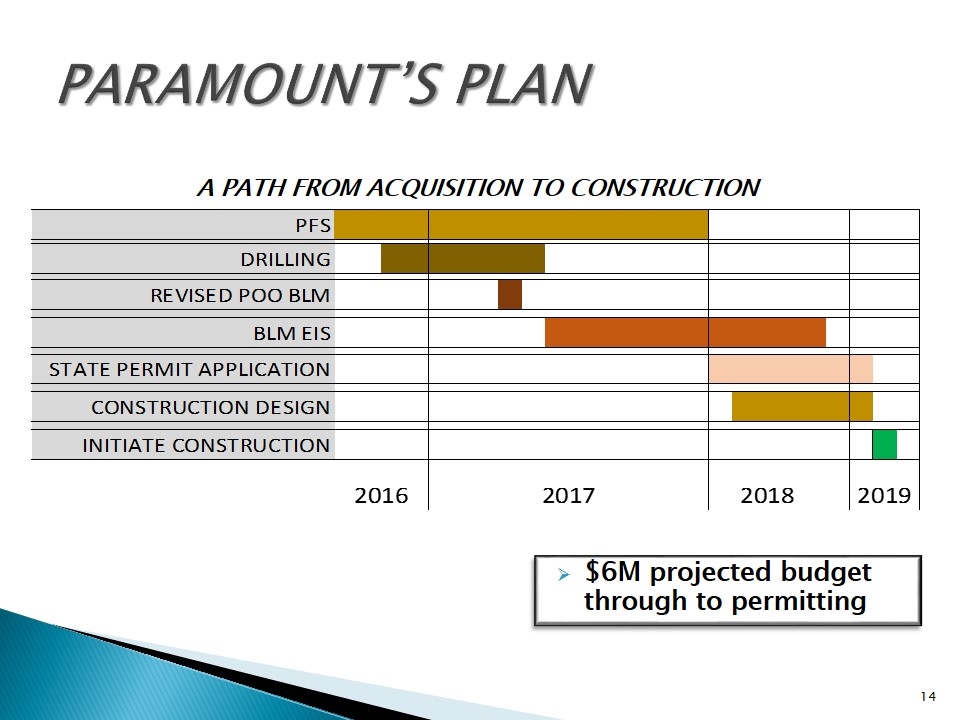

PARAMOUNT’S PLAN $6M projected budget through to permitting A PATH FROM ACQUISITION TO CONSTRUCTION PFS DRILLING REVISED POO BLM BLM EIS STATE PERMIT APPLICATION CONSTRUCTION DESIGN INITIATE CONSTRUCTION 2016 2017 2018 2019

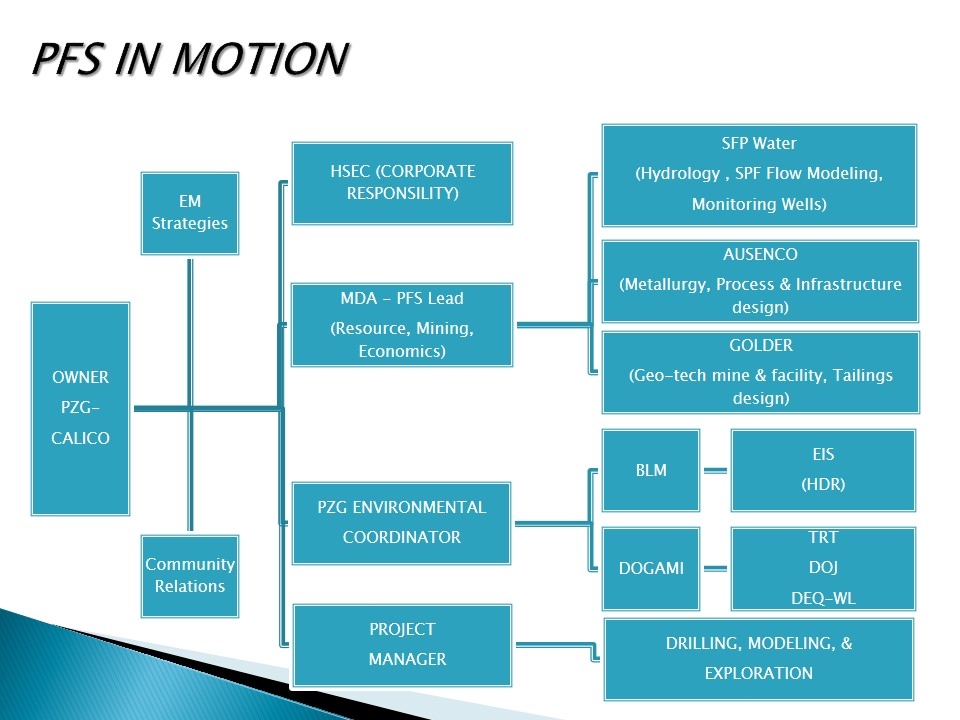

PFS IN MOTION EM Strategies PZG ENVIRONMENTAL COORDINATOR MDA - PFS Lead (Resource, Mining, Economics) PROJECT MANAGER SFP Water (Hydrology , SPF Flow Modeling, Monitoring Wells) AUSENCO (Metallurgy, Process & Infrastructure design) Community Relations GOLDER (Geo-tech mine & facility, Tailings design) BLM DOGAMI DRILLING, MODELING, & EXPLORATION EIS (HDR) TRT DOJ DEQ-WL HSEC (CORPORATE RESPONSILITY) OWNER PZG- CALICO

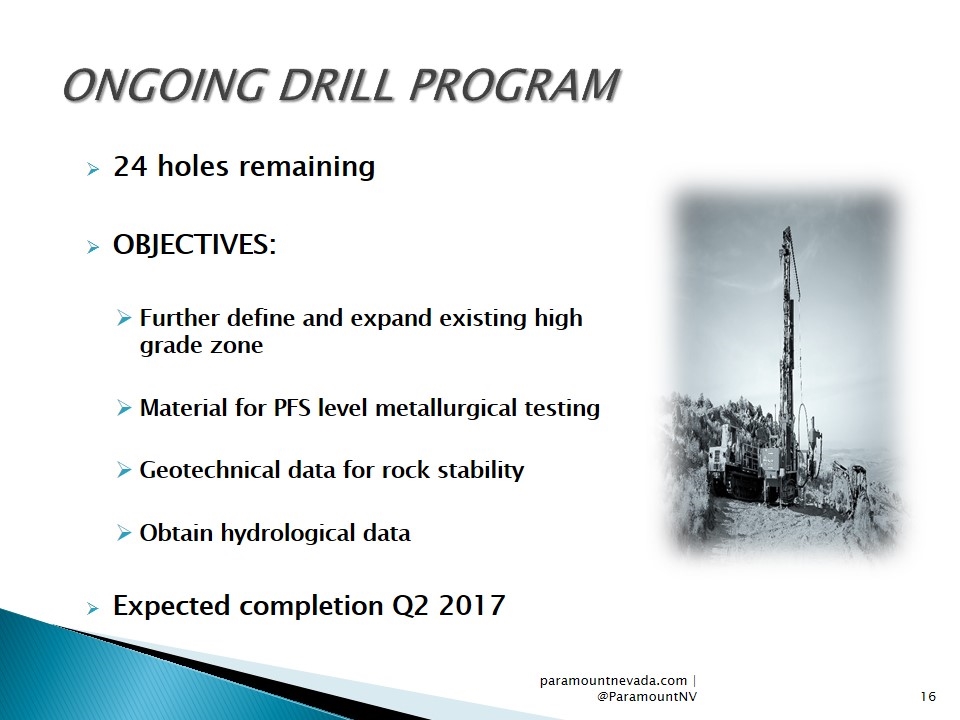

24 holes remaining OBJECTIVES: Further define and expand existing high grade zone Material for PFS level metallurgical testing Geotechnical data for rock stability Obtain hydrological data Expected completion Q2 2017 paramountnevada.com | @ParamountNV ONGOING DRILL PROGRAM

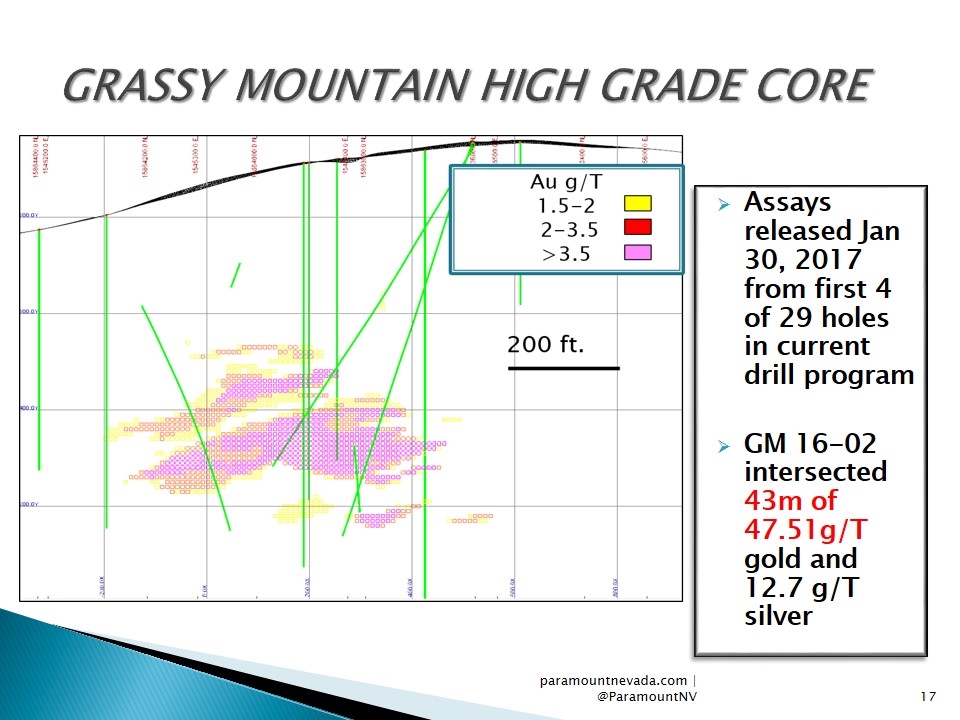

paramountnevada.com | @ParamountNV GRASSY MOUNTAIN HIGH GRADE CORE Assays released Jan 30, 2017 from first 4 of 29 holes in current drill program GM 16-02 intersected 43m of 47.51g/T gold and 12.7 g/T silver Including 1.5m of 1,090 g/T gold

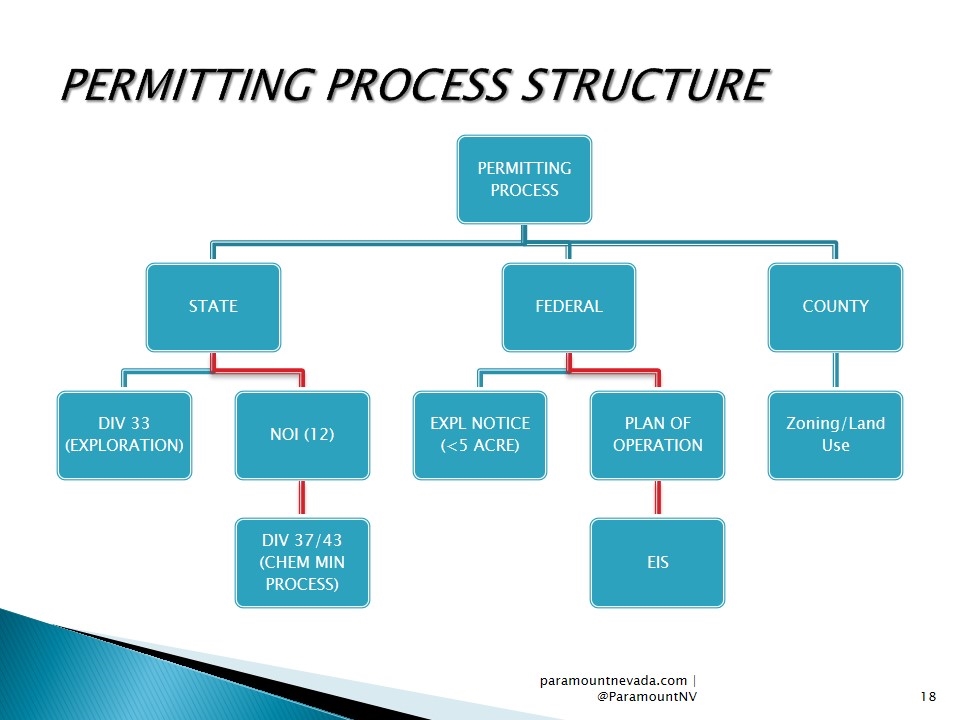

paramountnevada.com | @ParamountNV PERMITTING PROCESS STRUCTURE PERMITTING PROCESS STATE FEDERAL COUNTY DIV 33 (EXPLORATION) NOI (12) EXPL NOTICE (<5 ACRE) PLAN OF OPERATION Zoning/Land Use EIS DIV 37/43 (CHEM MIN PROCESS)

paramountnevada.com | @ParamountNV PERMITTING ACCOMPLISHMENTS Baseline Studies completed for the core of the project and expected facilities layout Plan Of Operations Initial Draft Plan submitted Updated Plan will be submitted in 2017 EIS Contractor HDR selected by BLM Work approved for PFS under DOGAMI Division 37 Permitted Drilling Resource, Geotechnical & Metallurgical Permitted Deep Monitoring water Wells Modeling aquifer Monitoring water quality

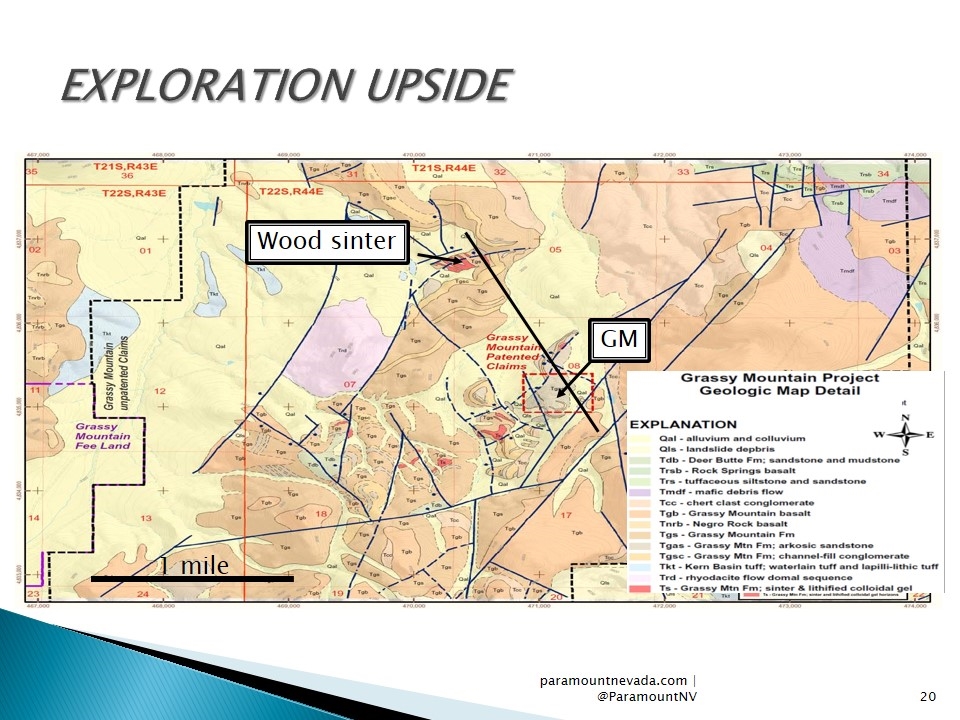

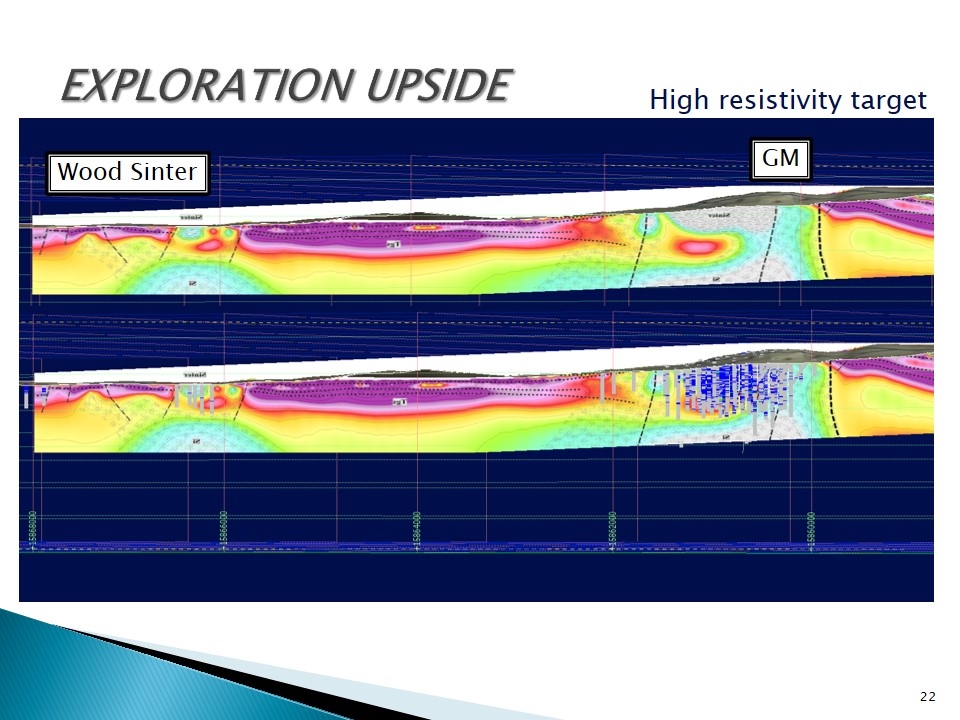

paramountnevada.com | @ParamountNV EXPLORATION UPSIDE 1 mile Wood sinter GM

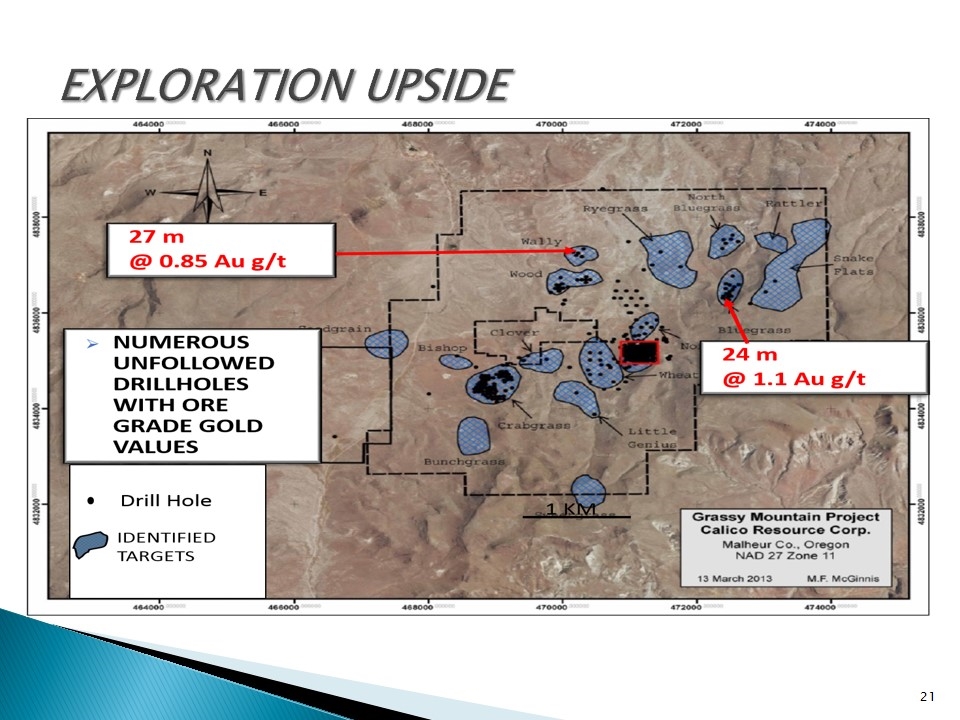

EXPLORATION UPSIDE

EXPLORATION UPSIDE High resistivity target GM Wood Sinter

Assay results Commencement of EIS (BLM process) Updated Resource Estimation & Conversion to Reserves Completion of PFS Commencement of the Consolidated Permit Application paramountnevada.com | @ParamountNV CATALYSTS 2017

Sleeper Gold Project 100% ownership of former high grade open pit gold producer AMAX Gold produced 1.7 million ounces of gold from 1986-96 Large, near surface, low grade resource with excellent exploration potential Large land position (15,500 hectares) and valuable infrastructure (Access by major roadways, water rights owned, electrical power on site) paramountnevada.com | @ParamountNV

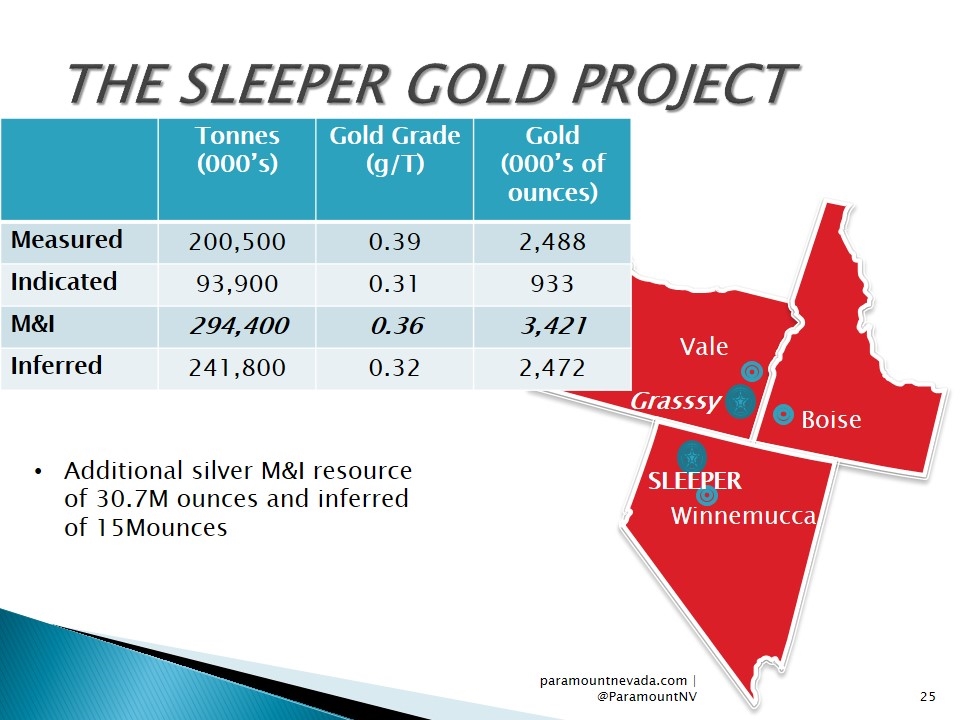

Vale Boise Winnemucca Grasssy SLEEPER THE SLEEPER GOLD PROJECT paramountnevada.com | @ParamountNV Tonnes (000’s) Gold Grade (g/T) Gold (000’s of ounces) Measured 200,500 0.39 2,488 Indicated 93,900 0.31 933 M&I 294,400 0.36 3,421 Inferred 241,800 0.32 2,472 Additional silver M&I resource of 30.7M ounces and inferred of 15Mounces

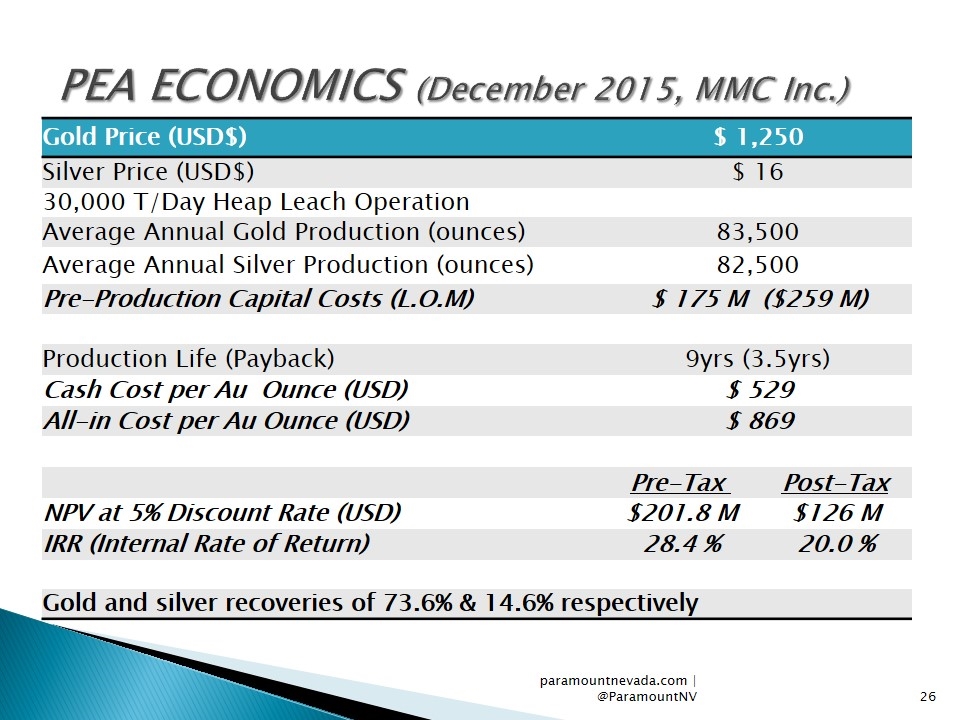

Gold Price (USD$) $ 1,250 Silver Price (USD$) $ 16 30,000 T/Day Heap Leach Operation Average Annual Gold Production (ounces) 83,500 Average Annual Silver Production (ounces) 82,500 Pre-Production Capital Costs (L.O.M) $ 175 M ($259 M) Production Life (Payback) 9yrs (3.5yrs) Cash Cost per Au Ounce (USD) $ 529 All-in Cost per Au Ounce (USD) $ 869 Pre-Tax Post-Tax NPV at 5% Discount Rate (USD) $201.8 M $126 M IRR (Internal Rate of Return) 28.4 % 20.0 % Gold and silver recoveries of 73.6% & 14.6% respectively PEA ECONOMICS (December 2015, MMC Inc.) paramountnevada.com | @ParamountNV

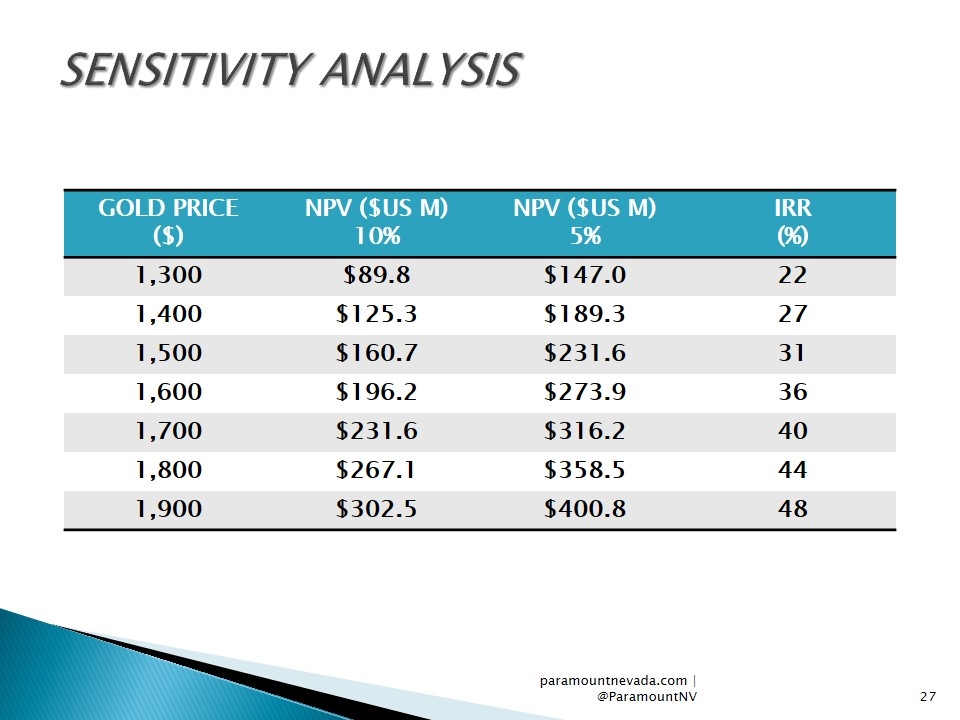

paramountnevada.com | @ParamountNV SENSITIVITY ANALYSIS GOLD PRICE ($) NPV ($US M) 10% NPV ($US M) 5% IRR (%) 1,300 $89.8 $147.0 22 1,400 $125.3 $189.3 27 1,500 $160.7 $231.6 31 1,600 $196.2 $273.9 36 1,700 $231.6 $316.2 40 1,800 $267.1 $358.5 44 1,900 $302.5 $400.8 48

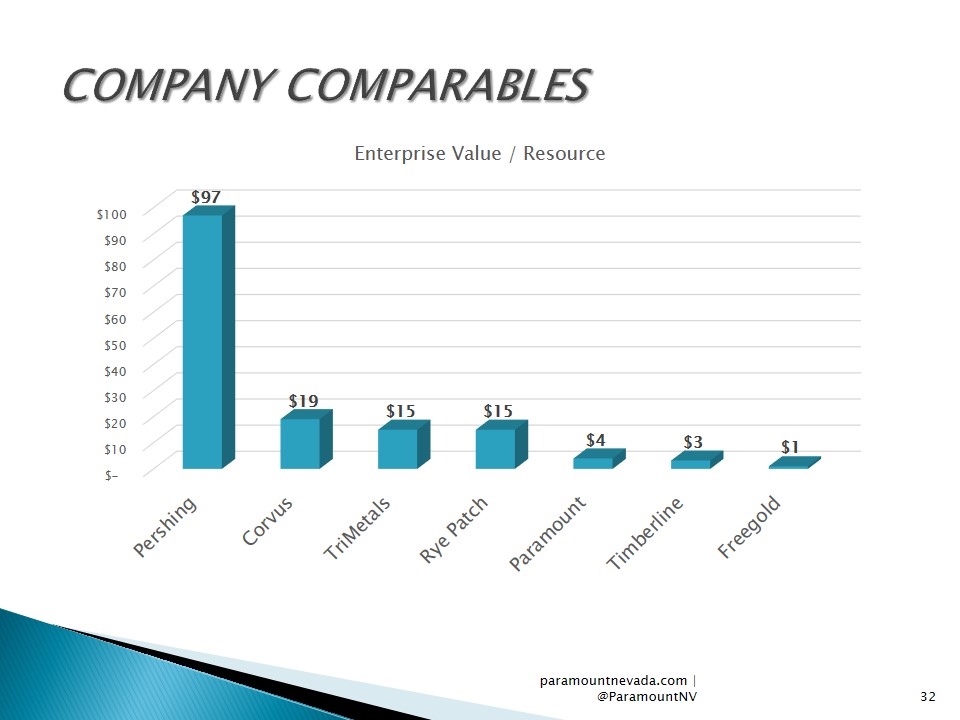

Multi-advanced stage projects in the US Short term opportunity to permit Grassy Mountain and advance to production Opportunity to leverage higher gold prices with Sleeper Enterprise EV/resources well below the industry average at $4 Pro-forma ACB of Grassy ~$21/oz. of Gold PARAMOUNT RECAP paramountnevada.com | @ParamountNV

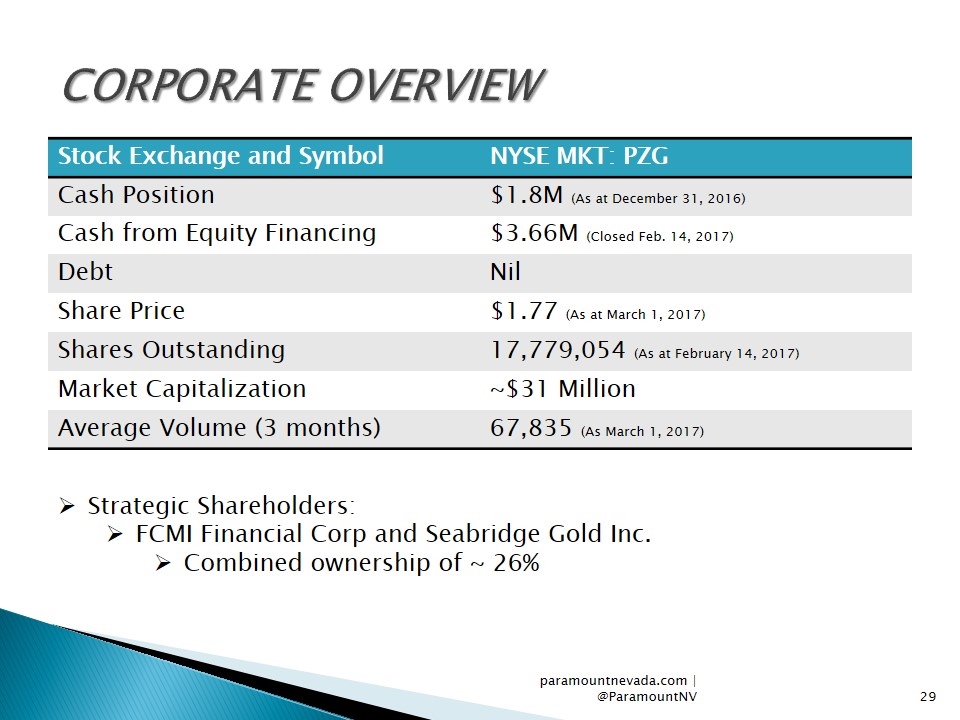

Stock Exchange and Symbol NYSE MKT: PZG Cash Position $1.8M (As at December 31, 2016) Cash from Equity Financing $3.66M (Closed Feb. 14, 2017) Debt Nil Share Price $1.77 (As at March 1, 2017) Shares Outstanding 17,779,054 (As at February 14, 2017) Market Capitalization ~$31 Million Average Volume (3 months) 67,835 (As March 1, 2017) paramountnevada.com | @ParamountNV CORPORATE OVERVIEW Strategic Shareholders: FCMI Financial Corp and Seabridge Gold Inc. Combined ownership of ~ 26%

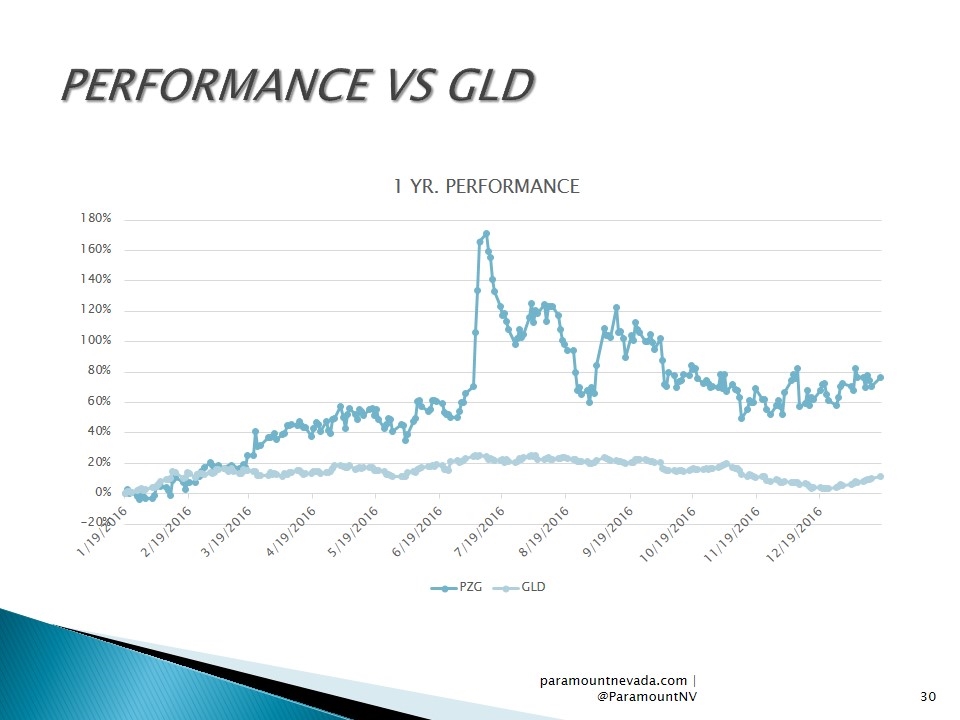

paramountnevada.com | @ParamountNV PERFORMANCE VS GLD

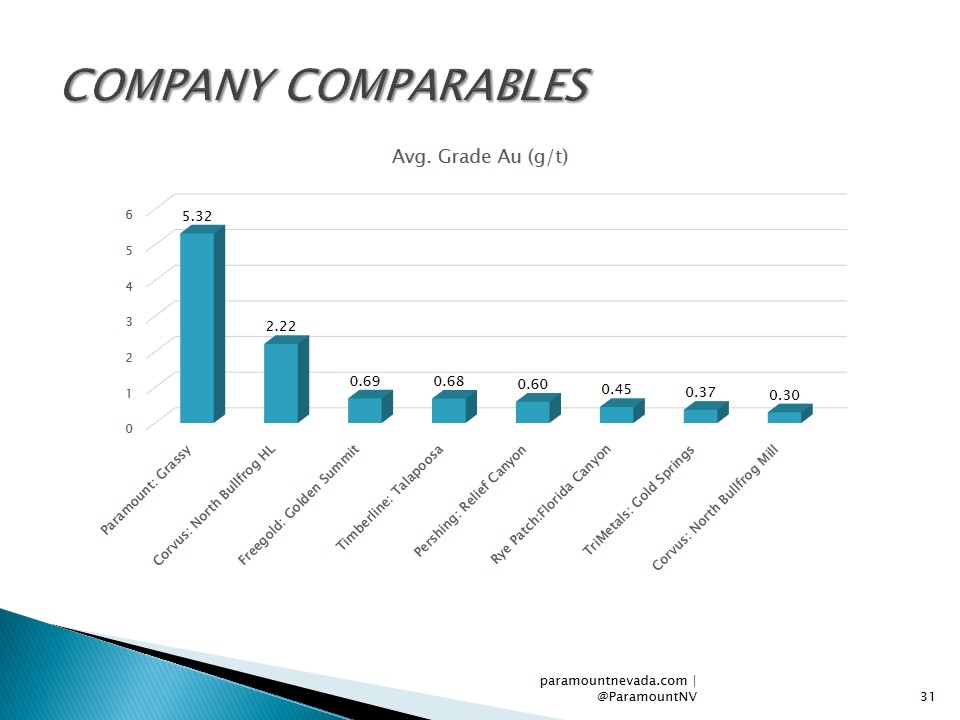

paramountnevada.com | @ParamountNV COMPANY COMPARABLES

paramountnevada.com | @ParamountNV COMPANY COMPARABLES

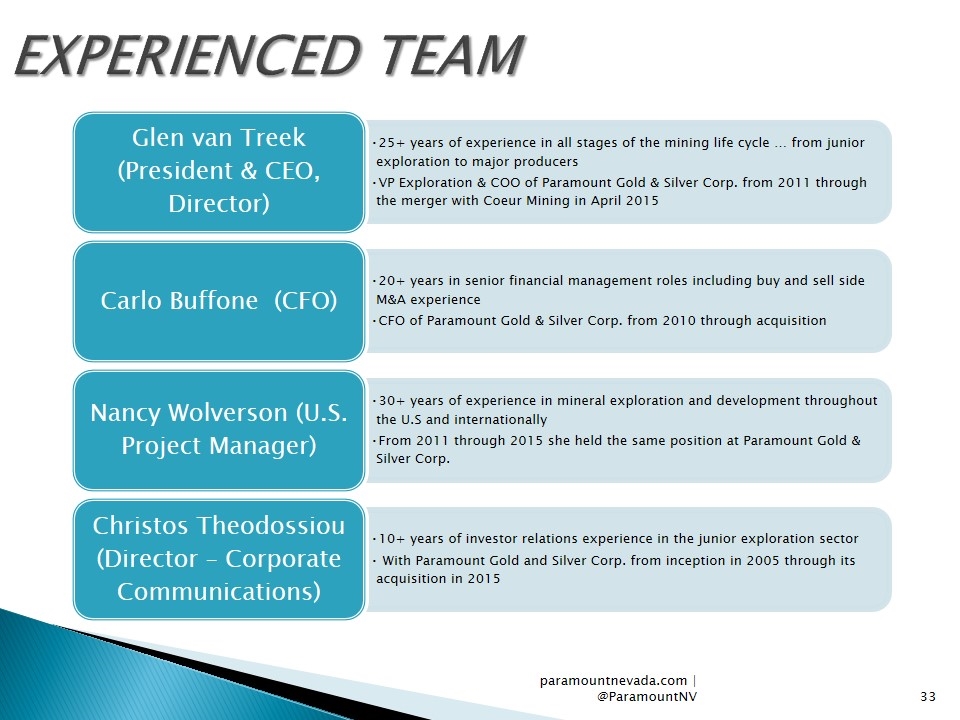

EXPERIENCED TEAM paramountnevada.com | @ParamountNV Glen van Treek (President & CEO, Director) 25+ years of experience in all stages of the mining life cycle … from junior exploration to major producers Carlo Buffone (CFO) 20+ years in senior financial management roles including buy and sell side M&A experience Nancy Wolverson (U.S. Project Manager) VP Exploration & COO of Paramount Gold & Silver Corp. from 2011 through the merger with Coeur Mining in April 2015 30+ years of experience in mineral exploration and development throughout the U.S and internationally From 2011 through 2015 she held the same position at Paramount Gold & Silver Corp. Christos Theodossiou (Director – Corporate Communications) 10+ years of investor relations experience in the junior exploration sector With Paramount Gold and Silver Corp. from inception in 2005 through its acquisition in 2015 CFO of Paramount Gold & Silver Corp. from 2010 through acquisition

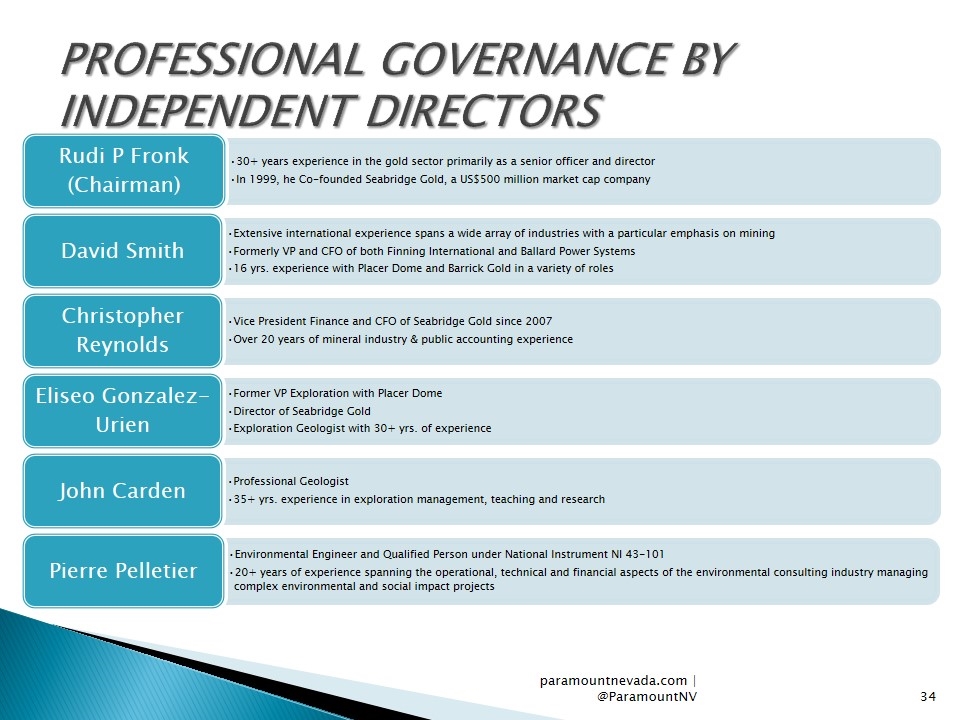

PROFESSIONAL GOVERNANCE BY INDEPENDENT DIRECTORS paramountnevada.com | @ParamountNV David Smith Christopher Reynolds Eliseo Gonzalez-Urien John Carden Vice President Finance and CFO of Seabridge Gold since 2007 Professional Geologist Former VP Exploration with Placer Dome Extensive international experience spans a wide array of industries with a particular emphasis on mining 35+ yrs. experience in exploration management, teaching and research Over 20 years of mineral industry & public accounting experience Director of Seabridge Gold Exploration Geologist with 30+ yrs. of experience Formerly VP and CFO of both Finning International and Ballard Power Systems 16 yrs. experience with Placer Dome and Barrick Gold in a variety of roles Pierre Pelletier Environmental Engineer and Qualified Person under National Instrument NI 43-101 20+ years of experience spanning the operational, technical and financial aspects of the environmental consulting industry managing complex environmental and social impact projects Rudi P Fronk (Chairman) 30+ years experience in the gold sector primarily as a senior officer and director In 1999, he Co-founded Seabridge Gold, a US$500 million market cap company