|

Exhibit 99.2

|

INDAIA’S FASTEST GROWING DTH SERVICE HAS GROWN TO BECOME THE MOST VALUED INDIAN COMPANY ON

INVESTOR PRESENTATION January 27, 2016

Disclaimer

Forward Looking Statements

This presentation includes “forward-looking statements”, as defined in the safe harbor provisions of the US Private Securities Litigation Reform Act of 1995. In addition to statements which are forward-looking by reason of context, the words “may”, “will”, “should”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” and similar expressions identify forward-looking statements. We caution you that reliance on any forward-looking statement involves risks and uncertainties that might cause actual results to differ materially from those expressed or implied by such statements. These and other factors are more fully discussed in Videocon d2h’s annual report on Form 20-F filed with the SEC and available at http://www.sec.gov. All information provided in this presentation is as of the date hereof, unless the context otherwise requires. Other than as required by law, Videocon d2h does not undertake to update any forward-looking statements or other information in this presentation.

Industry and Market Data

In this presentation, Videocon d2h relies on and refers to information and statistics regarding market shares in the sectors in which it competes and other industry data. Videocon d2h obtained this information and statistics from third-party sources, including reports by market research firms, such as Media Partners Asia, Ltd. Videocon d2h has supplemented this information where necessary with information from discussions with Videocon d2h customers and its own internal estimates, taking into account publicly available information about other industry participants and Videocon d2h’s management’s best view as to information that is not publicly available.

Earnings before interest, tax and depreciation & amortization (EBITDA)

EBITDA presented in this presentation, is a supplemental measure of performance and liquidity that is not required by or represented in accordance with IFRS. Furthermore, EBITDA is not a measure of financial performance or liquidity under IFRS and should not be considered as an alternative to profit after tax, operating income or other income or any other performance measures derived in accordance with IFRS or as an alternative to cash flow from operating activities or as a measure of liquidity. In addition, EBITDA is not a standardized term, hence direct comparison between companies using the same term may not be possible. Other companies may calculate EBITDA differently from Videocon d2h, limiting their usefulness as comparative measures. Videocon d2h believes that EBITDA helps identify underlying trends in its business that could otherwise be distorted by the effect of the expenses that are excluded calculating EBITDA. Videocon d2h believes that EBITDA enhances the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

2

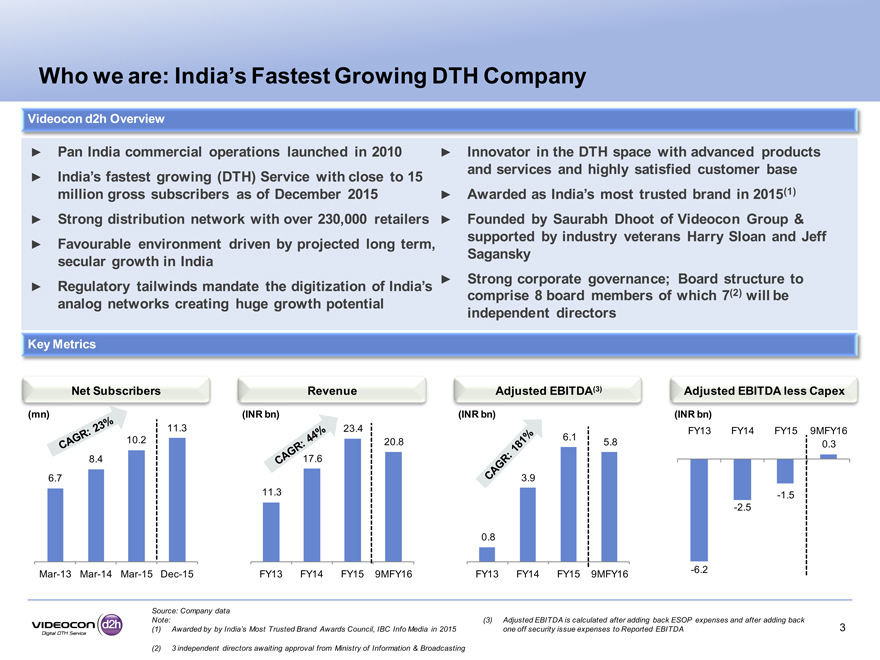

Who we are: India’s Fastest Growing DTH Company

Videocon d2h Overview

Pan India commercial operations launched in 2010

India’s fastest growing (DTH) Service with close to 15 million gross subscribers as of December 2015

Strong distribution network with over 230,000 retailers

Favourable environment driven by projected long term, secular growth in India

Regulatory tailwinds mandate the digitization of India’s analog networks creating huge growth potential

Innovator in the DTH space with advanced products and services and highly satisfied customer base

Awarded as India’s most trusted brand in 2015(1)

Founded by Saurabh Dhoot of Videocon Group & supported by industry veterans Harry Sloan and Jeff Sagansky Strong corporate governance; Board structure to comprise 8 board members of which 7(2) will be independent directors

Key Metrics

Key Metrics

Net Subscribers Revenue Adjusted EBITDA(3) Adjusted EBITDA less Capex

(INR bn) (INR bn) (INR bn)

(mn) (INR bn) (INR bn) (INR bn)

11.3 23.4 FY13 FY14 FY15 9MFY16

10.2 20.8 6.1 5.8 0.3

8.4 17.6

6.7 3.9

11.3 -1.5

-2.5

0.8

Mar-13 Mar-14 Mar-15 Dec-15 FY13 FY14 FY15 9MFY16 FY13 FY14 FY15 9MFY16 -6.2

Source: Company data

Note: (3) Adjusted EBITDA is calculated after adding back ESOP expenses and after adding back

(1) Awarded by by India’s Most Trusted Brand Awards Council, IBC Info Media in 2015 one off security issue expenses to Reported EBITDA

(2) 3 independent directors awaiting approval from Ministry of Information & Broadcasting

Videocon d2h Investment Highlights

1 World’s fastest growing pay TV market in the fastest growing “large economy”

2 Strong market presence and industry leading share of subscriber additions

3 Leading distribution, customer service and content offerings

4 Strong revenue and EBITDA growth driven by operating leverage

5 Robust free cash flow generation potential

6 Strong balance sheet with low leverage

Source: Company estimates

4

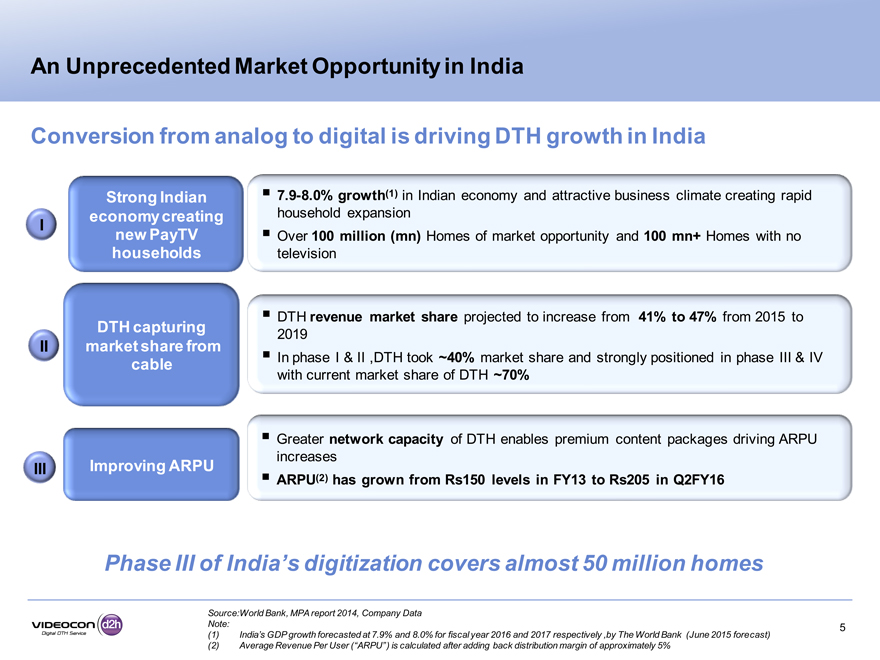

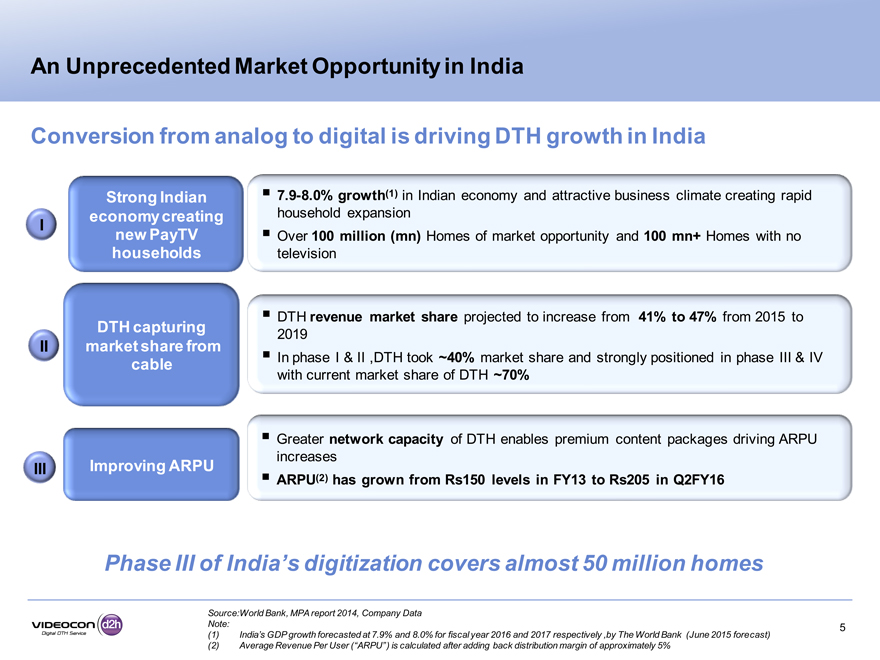

An Unprecedented Market Opportunity in India

Conversion from analog to digital is driving DTH growth in India

Strong Indian 7.9-8.0% growth(1) in Indian economy and attractive business climate creating rapid

economy creating household expansion

I new PayTV Over 100 million (mn) Homes of market opportunity and 100 mn+ Homes with no

households television

? DTH revenue market share projected to increase from 41% to 47% from 2015 to

DTH capturing 2019

II market share from In phase I & II ,DTH took ~40% market share and strongly positioned in phase III & IV

cable

with current market share of DTH ~70%

? Greater network capacity of DTH enables premium content packages driving ARPU

Improving ARPU increases

III ARPU(2) has grown from Rs150 levels in FY13 to Rs205 in Q2FY16

Phase III of India’s digitization covers almost 50 million homes

Source:World Bank, MPA report 2014, Company Data

Note:

(1) India’s GDP growth forecasted at 7.9% and 8.0% for fiscal year 2016 and 2017 respectively ,by The World Bank (June 2015 forecast)

(2) Average Revenue Per User (“ARPU” ) is calculated after adding back distribution margin of approximately 5%

5

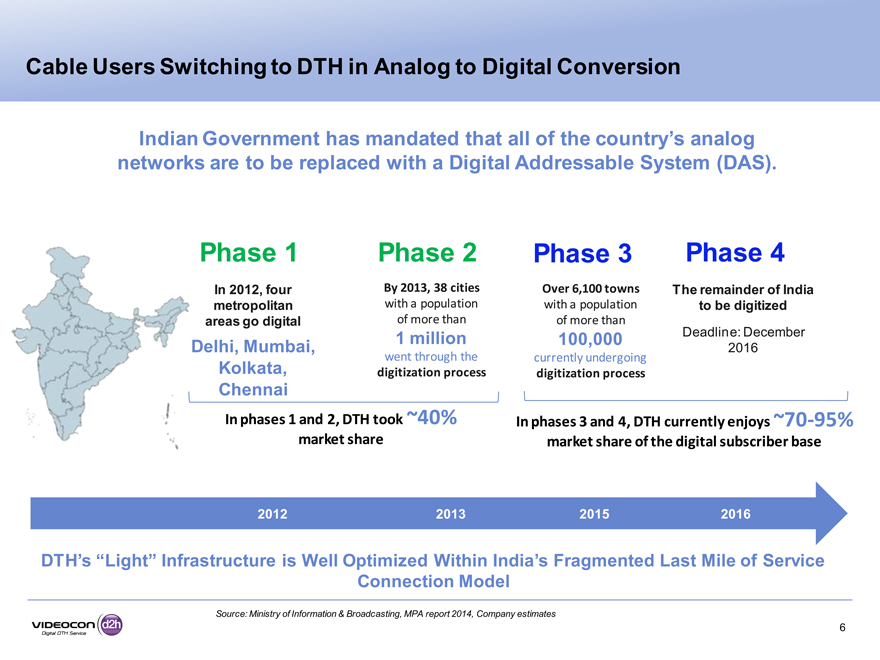

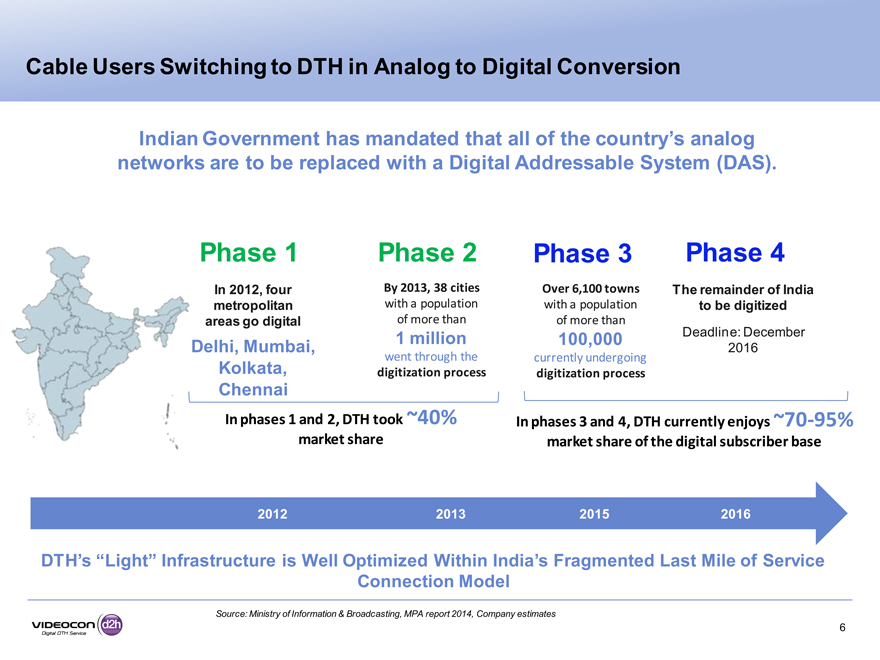

Cable Users Switching to DTH in Analog to Digital Conversion

Indian Government has mandated that all of the country’s analog networks are to be replaced with a Digital Addressable System (DAS).

Phase 1 Phase 2 Phase 3 Phase 4

In 2012, four By 2013, 38 cities Over 6,100 towns The remainder of India metropolitan with a population with a population to be digitized areas go digital of more than of more than

1 million 100,000 Deadline: December

Delhi, Mumbai, 2016

went through the currently undergoing

Kolkata, digitization process digitization process

Chennai

In phases 1 and 2, DTH took ~40% In phases 3 and 4, DTH currently enjoys ~70-95% market share market share of the digital subscriber base

2012 2013 2015 2016

DTH’s “Light” Infrastructure is Well Optimized Within India’s Fragmented Last Mile of Service

Connection Model

Source: Ministry of Information & Broadcasting, MPA report 2014, Company estimates

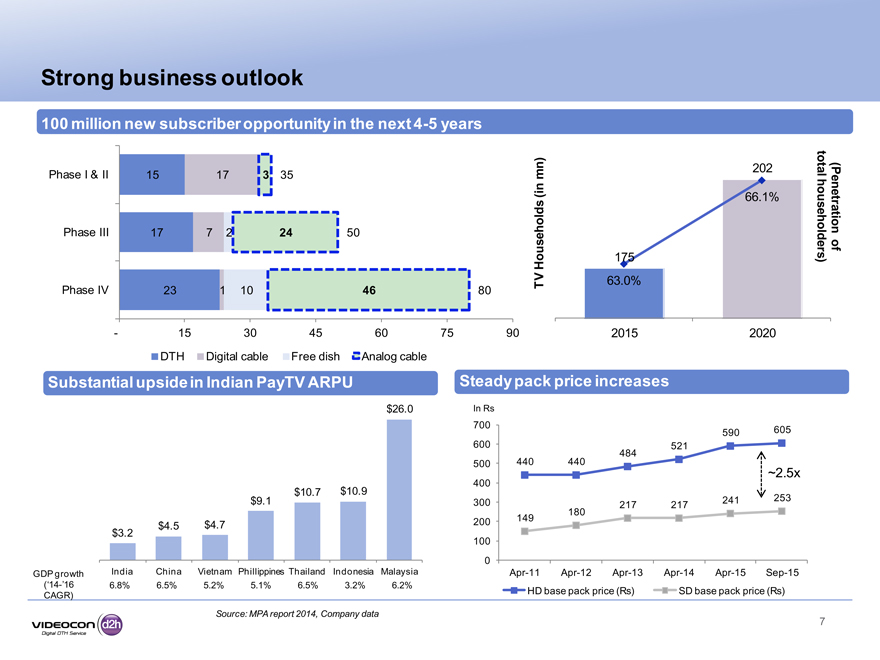

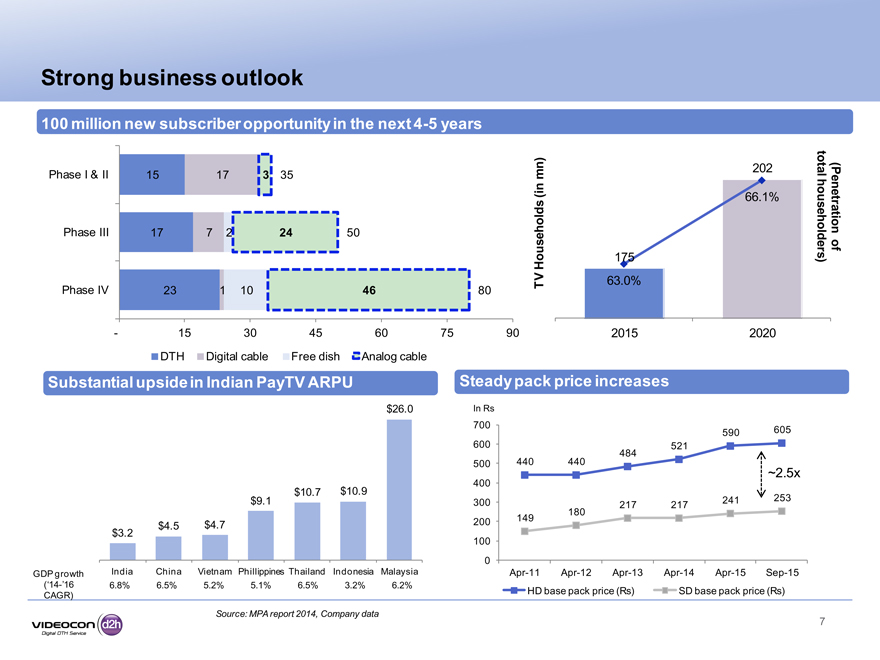

440 440

484

521

590

605

149

180

217

217

241

253 0 100 200

300

400 500

600

700

Apr-11

Apr-12

Apr-13

Apr-14

Apr-15

Sep-15

HD base pack price (Rs)

SD base pack price (Rs) 100 million new subscriber opportunity in the next 4-5 years Source: MPA report 2014, Company data

7

Source: MPA report 2014, Company data

Note: (1) Videocon d2h offer highest number of channels and services amongst DTH operators in India as of December 31, 2015

8

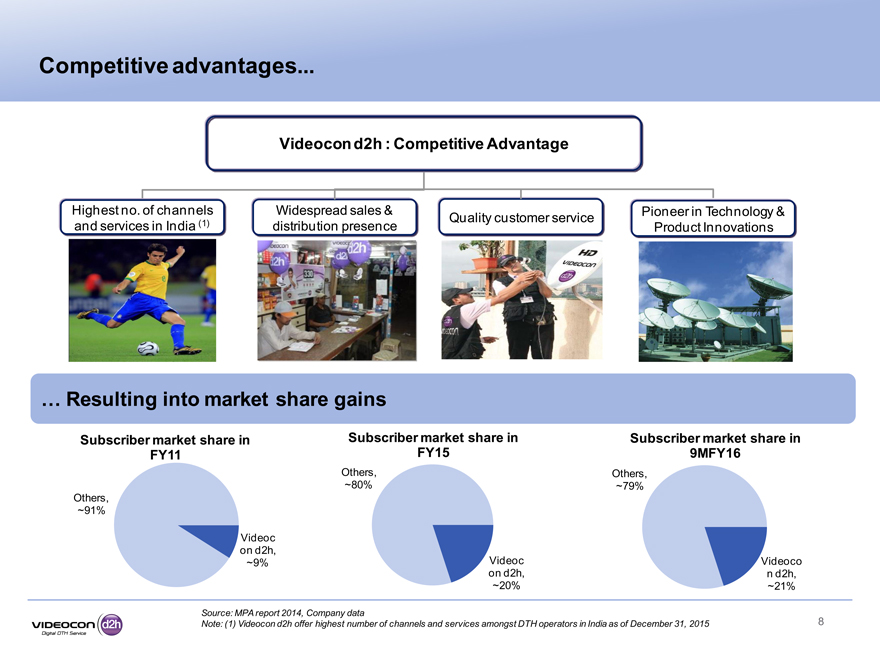

Videocon d2h : Competitive Advantage

Highest no. of channels and services in India (1)

Widespread sales & distribution presence

Pioneer in Technology & Product Innovations Quality customer service

Competitive advantages.

Videoc on d2h, ~9%

Others, ~91% Subscriber market share in FY11

Videoc on d2h, ~20% Others, ~80%

Subscriber market share in FY15 Videoco n d2h, ~21%

Others, ~79%

Subscriber market share in 9MFY16

… Resulting into market share gains

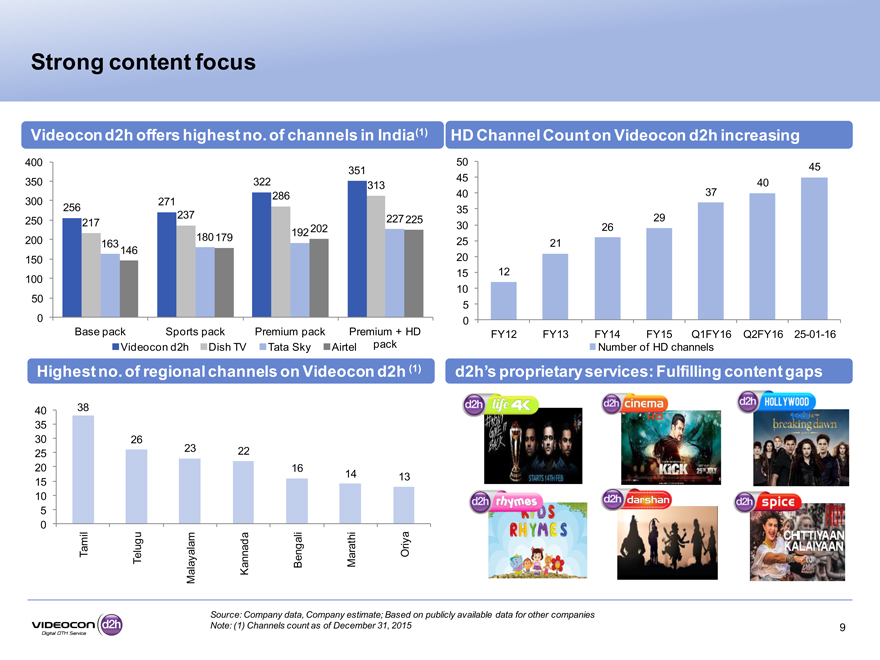

Strong content focus Source: Company data, Company estimate; Based on publicly available data for other companies Note: (1) Channels count as of December 31, 2015 38

26

23

22

16

14

13

0 5

10

15

20

25

30

35

40 Tamil

Telugu

Malayalam

Kannada

Bengali

Marathi

Oriya

256

271

322

351

217 237

286

313

163

180

192

227

146

179 202

225

0

50

100

150

200 250

300

350

400

Base pack

Sports pack

Premium pack

Premium + HD pack

Videocon d2h Dish TV

Tata Sky

Airtel

Videocon d2h offers highest no. of channels in India(1)

Highest no. of regional channels on Videocon d2h (1)

d2h’s proprietary services: Fulfilling content gaps

9 HD Channel Count on Videocon d2h increasing

12 21

26

29

37

40

45

0 5

10

15

20

25

30

35

40

45 50

FY12

FY13

FY14

FY15

Q1FY16

Q2FY16 25-01-16

Number of HD channels

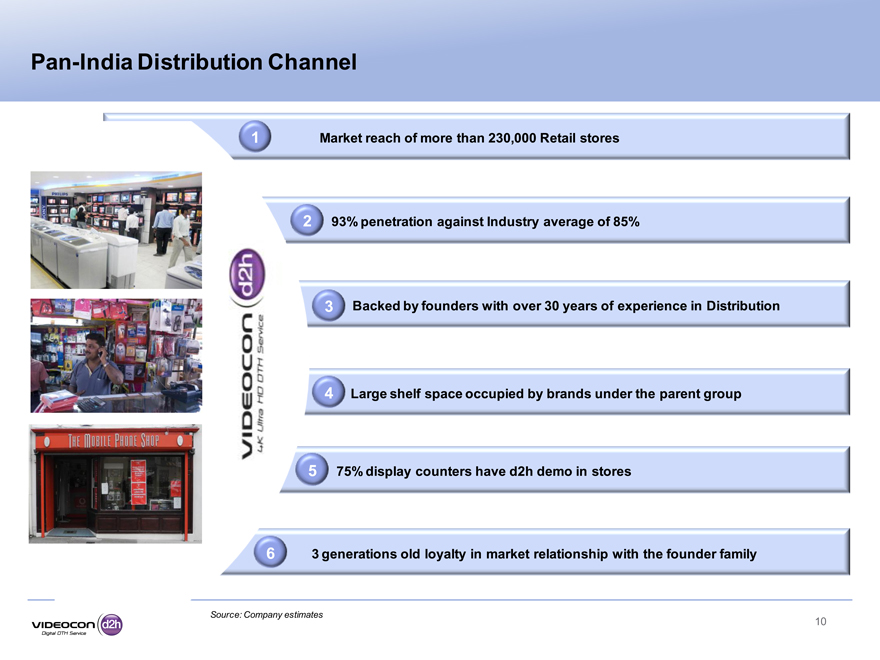

Backed by founders with over 30 years of experience in Distribution

3 generations old loyalty in market relationship with the founder family

75% display counters have d2h demo in stores

Large shelf space occupied by brands under the parent group

93% penetration against Industry average of 85% Market reach of more than 230,000 Retail stores

1

6

2

5

Pan-India Distribution Channel

4 3

Source: Company estimates

10

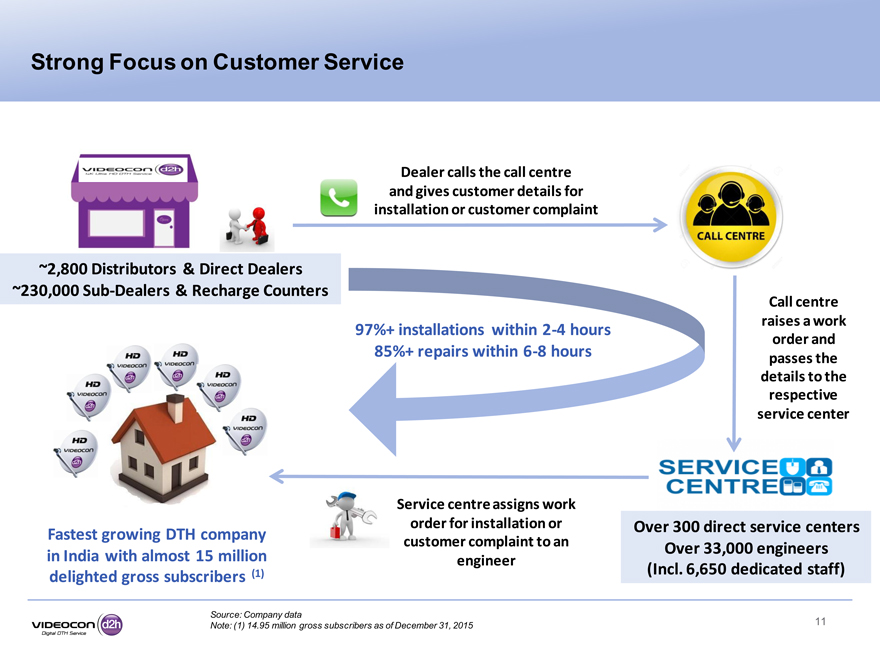

Strong Focus on Customer Service

Dealer calls the call centre

and gives customer details for installation or customer complaint

Call centre raises a work order and passes the details to the respective service center

Service centre assigns work order for installation or customer complaint to an engineer ~2,800 Distributors & Direct Dealers ~230,000 Sub-Dealers & Recharge Counters

Fastest growing DTH company in India with almost 15 million delighted gross subscribers (1)

Over 300 direct service centers

Over 33,000 engineers

(Incl. 6,650 dedicated staff)

97%+ installations within 2-4 hours

85%+ repairs within 6-8 hours

Source: Company data

Note: (1) 14.95 million gross subscribers as of December 31, 2015

11

Offering the Latest in Standards in Equipment, Service and Delivery

Source: Company data

Technology & Innovations

Latest Technology

New Offering

Product Innovation

12

HEVC DVB S2

Advertising

TV Everywhere

1000 GB HD DVR

Wireless DTH Headphone

MPEG4 dvb s2

4K

11 Proprietary Services

RF Remote

Key Metrics

Gross and Net Subscribers

Gross and Net Subscriber Base (mn)

14.0 12.0 10.0 09 8.0 45 . 18 . 13 6.0 . 44 . 02 71 10 . 10 8 8 4.0 48 84 .5 . 4 . 6 2.0

FY12 FY13 FY14 FY15

Gross base

Gross & Net Subscriber Additions (mn)

3.0 2.5 2.0 1.5 64 54 64. 43. 2 08 2 2 . 2 1.0 . 87 73 742 1 . . .1 1 0.5 —

FY12 FY13 FY14 FY15

Gross addition

Gross and Net Subscriber Base (mn)

16.0 14.0 12.0 10.0 8.0 14.95 14.27 6.0 11.21 11.82 9.46 12.47 9.82 13.09 10.18 13.70 10.64 10.84 11.27 4.0 9.09 2.0 —

Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Gross base Net base

Gross & Net Subscriber Additions (mn)

0.8 0.7 0.6 0.5 0.4 76 . 0 65 66 67. 62 . 61 . 61 57 0 0.3 0 . 0 .0 0 0 . 46 0 43 0.2 37 36 36 0 . .0 . . 0 0 0.1 0 20 0 .

—

Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Gross addition Net addition

Source: Company data

14

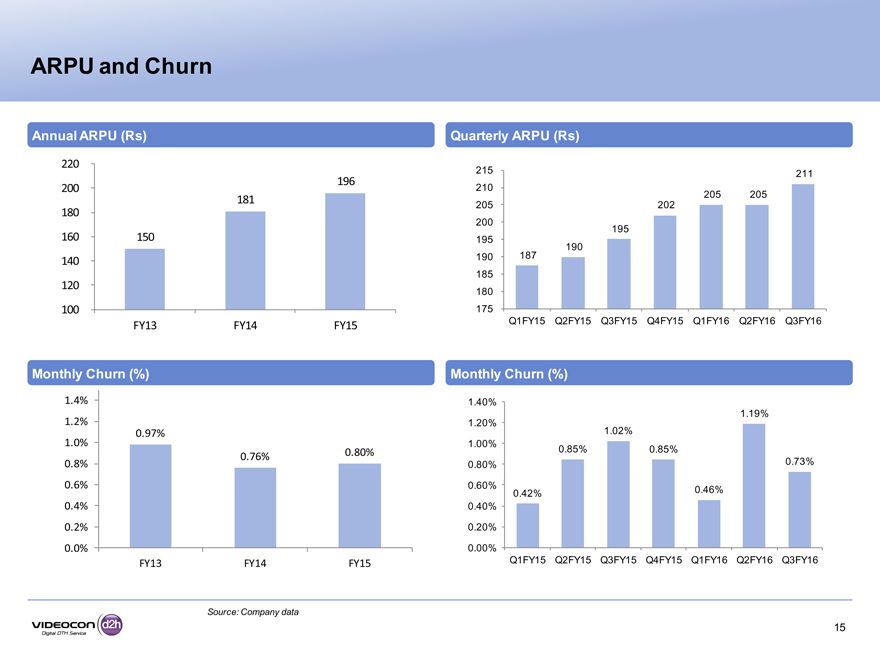

ARPU and Churn

Annual ARPU (Rs)

220 196 200 181 180 160 150 140 120 100

FY13 FY14 FY15

Quarterly ARPU (Rs)

215 211 210 205 205 205 202 200 195 195 187 190 190 185 180 175 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Monthly Churn (%)

1.4% 1.2% 0.97% 1.0% 0.76% 0.80% 0.8% 0.6% 0.4% 0.2% 0.0%

FY13 FY14 FY15

Monthly Churn (%)

1.40% 1.19% 1.20% 1.02% 1.00% 0.85% 0.85% 0.80% 0.73% 0.60% 0.46% 0.42% 0.40% 0.20% 0.00%

Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Source: Company data

15

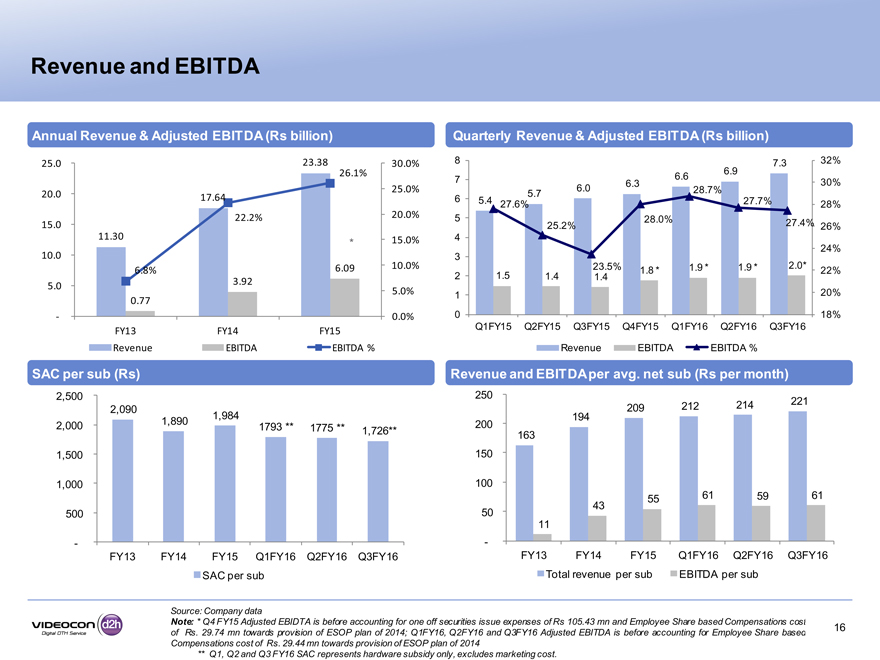

Revenue and EBITDA

Annual Revenue & Adjusted EBITDA (Rs billion)

25.0 23.38 30.0% 26.1% 25.0% 20.0 17.64 22.2% 20.0% 15.0 11.30 15.0%

* 10.0 6.09 10.0% 6.8% 3.92 5.0 5.0% 0.77 — 0.0%

FY13 FY14 FY15 Revenue EBITDA EBITDA %

Quarterly Revenue & Adjusted EBITDA (Rs billion)

8 7.3 32%6.6 6.9 7 6.3 30% 5.7 6.0 28.7% 6 5.4 27.6% 27.7% 28% 5 25.2% 28.0% 27.4% 26%

4 24% 3 23.5% 1.8 * 1.9 * 1.9 * 2.0* 22% 21.5 1.4 1.4 120% 0 18%

Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Revenue EBITDA EBITDA %

SAC per sub (Rs)

2,500 2,090 1,984 2,000 1,890 1793 ** 1775 ** 1,726** 1,500 1,000 500 —

FY13 FY14 FY15 Q1FY16 Q2FY16 Q3FY16 SAC per sub

Revenue and EBITDA per avg. net sub (Rs per month)

250 214 221 209 212 194 200 163 150 100 55 61 59 61 43 50 11 —

FY13 FY14 FY15 Q1FY16 Q2FY16 Q3FY16 Total revenue per sub EBITDA per sub

Source: Company data

Note: * Q4 FY15 Adjusted EBIDTA is before accounting for one off securities issue expenses of Rs 105.43 mn and Employee Share based Compensations cost of Rs. 29.74 mn towards provision of ESOP plan of 2014; Q1FY16, Q2FY16 and Q3FY16 Adjusted EBITDA is before accounting for Employee Share based

Compensations cost of Rs. 29.44 mn towards provision of ESOP plan of 2014

** Q1, Q2 and Q3 FY16 SAC represents hardware subsidy only, excludes marketing cost.

16

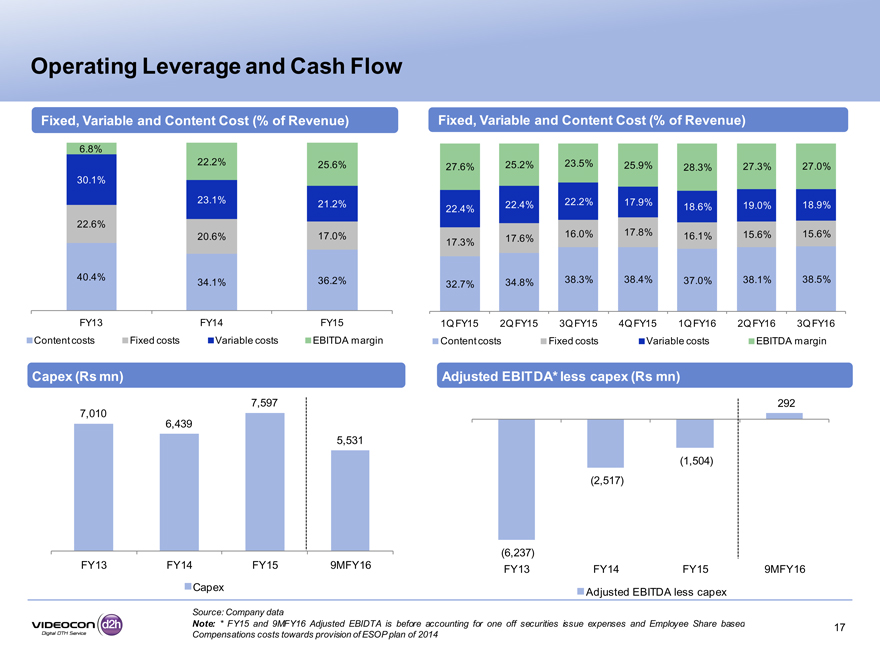

Operating Leverage and Cash Flow

Fixed, Variable and Content Cost (% of Revenue)

6.8%

22.2% 25.6% 30.1%

23.1% 21.2% 22.6% 20.6% 17.0%

40.4% 36.2% 34.1%

FY13 FY14 FY15

Content costs Fixed costs Variable costs EBITDA margin

Fixed, Variable and Content Cost (% of Revenue)

27.6% 25.2% 23.5% 25.9% 28.3% 27.3% 27.0%

22.4% 22.2% 17.9% 19.0% 18.9% 22.4% 18.6%

16.0% 17.8% 16.1% 15.6% 15.6% 17.3% 17.6%

34.8% 38.3% 38.4% 37.0% 38.1% 38.5% 32.7%

1Q FY15 2Q FY15 3Q FY15 4Q FY15 1Q FY16 2Q FY16 3Q FY16 Content costs Fixed costs Variable costs EBITDA margin

Capex (Rs mn)

7,597 7,010 6,439

5,531

FY13 FY14 FY15 9MFY16

Capex

Adjusted EBITDA* less capex (Rs mn)

292

(1,504) (2,517)

(6,237)

FY13 FY14 FY15 9MFY16

Adjusted EBITDA less capex

Source: Company data

Note: * FY15 and 9MFY16 Adjusted EBIDTA is before accounting for one off securities issue expenses and Employee Share based

Compensations costs towards provision of ESOP plan of 2014

17

Summary

Seizing India’s digital Pay TV Opportunity

Strong macro environment

Indian economy growing at ~8%(1) allowing new homes to afford PayTV & existing homes to up entertainment spend

Government led mandatory digitization to create over 100 million digital PayTV homes

Improving HD penetration

Significant potential to grow ARPU

Videocon d2h in the forefront with leading incremental market share

Strong technological leadership and product innovation

Sufficient satellite capacity to support future increase ability to provide HD channels

Improving financial fundamentals

Seasoned management team with a clear vision and strategy to capture growth

Strong content focus and HD offering

Top notch customer service, building structure for long-term growth

Deep knowledge of the of the local market

Expansive pan-India sales, service and distribution network

Focusing on driving revenue and EBITDA growth while investing in building a durable foundation for strong long term, profitable growth.

Source: MPA report 2014, Company data

Note:

(1) India’s GDP growth forecasted at 7.9% and 8.0% for fiscal year 2016 and 2017 respectively, by The World Bank (June 2015 forecast)

18

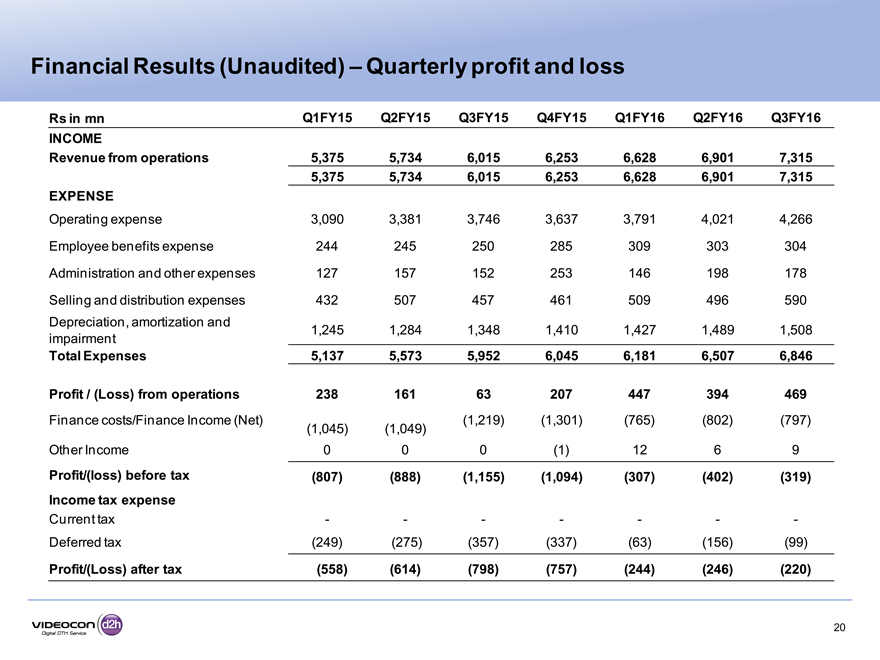

Appendix

Financial Results (Unaudited) – Quarterly profit and loss

Rs in mn Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

INCOME

Revenue from operations 5,375 5,734 6,015 6,253 6,628 6,901 7,315

5,375 5,734 6,015 6,253 6,628 6,901 7,315

EXPENSE

Operating expense 3,090 3,381 3,746 3,637 3,791 4,021 4,266

Employee benefits expense 244 245 250 285 309 303 304

Administration and other expenses 127 157 152 253 146 198 178

Selling and distribution expenses 432 507 457 461 509 496 590

Depreciation, amortization and 1,245 1,284 1,348 1,410 1,427 1,489 1,508

impairment

Total Expenses 5,137 5,573 5,952 6,045 6,181 6,507 6,846

Profit / (Loss) from operations 238 161 63 207 447 394 469

Finance costs/Finance Income (Net)(1,219)(1,301)(765)(802)(797)

(1,045)(1,049)

Other Income 0 0 0(1) 12 6 9

Profit/(loss) before tax(807)(888)(1,155)(1,094)(307)(402)(319)

Income tax expense

Current tax — — — -

Deferred tax(249)(275)(357)(337)(63)(156)(99)

Profit/(Loss) after tax(558)(614)(798)(757)(244)(246)(220)

20

Thank You

Investor Relation Contact

Nupur Agarwal nupur.agarwal@d2h.com

Christopher Chu

TeamVideocond2h@taylor-rafferty.com