DEBT PURCHASE AND ASSIGNMENT AGREEMENT

THIS DEBT PURCHASE AND ASSIGNMENT AGREEMENT(this"Agreement"),is

entered into on December 7,2016,by and between Village Partners LLC (the"Assignor") and Coronado Ventures Number One, LLC (the"Assignee") (the Assignor and Assignee are collectively referred to as the"Parties"herein).

WHEREAS,Assignor is thelegaland beneficial owner of aggregate indebtedness of Grey Cloak Tech,Inc.,Inc.,a Nevada corporation (the"Company") in aprincipalamount of $20,000.00,consisting of aPromissoryNotedatedJune 9,2016,whichhasaccrued interest in an amount of18% perannum,(the"Debt").

WHEREAS,Assignordesiresto assign all of theprincipalto Assignee and Assignee desires to accept from Assignor such principal of theDebt,on thebasisof therepresentations,warranties and agreements contained in this Agreement.

WHEREAS,as consideration for the assignment of theDebt byAssignor,the Assigneehasagreed topayAssignor the sum of Twenty ThousandDollars($20,000) (the"Purchase Price").

NOW, THEREFORE,in consideration of the foregoing and for other good and valuable consideration,the adequacy of whichis hereby acknowledged,theparties heretoagree as follows:

| 1.1 | Transfer of Debt:On the ClosingDate(as set forthbelow),for thepaymentof thePurchase Price,theAssignor herebysells,assigns,andtransfers to the Assignee all of the rights and interests to the $20,000principal balanceofthe Debt(the"AssignedDebt"),consisting of $20,000.00ofprincipaland none of the accrued andunpaidinterest,owned by the Assignor and all of the rights and benefits thereunder and the Assignee accepts such assignment. The Purchase Price shallbe paidto Assignor on orbefore theClosingDate.If the Assignorhas not receivedthe entire PurchasePriceon orbeforethe ClosingDate,then the Assignor shallhave the right in itssolediscretiontodeemthis Agreementnull andvoidandofno further forceor effect.By itssignaturehereto,the Company agreesto and approves thisassignment and agrees tothechanges to the changes to thePromissoryNote set forth inparagraph4below. |

| 1.2 | Closing Procedures.The closing of the assignment contemplatedhereundershall takeplaceon orbefore December 9,2016 (the"ClosingDate").Onorbefore theClosingDate,the Assignee shallpaythePurchase Priceof $20,000toAssignorand the Company willhave paidthe $900 in accrued interest on theNotetotheAssignor. |

| 2. | ADDITIONAL DOCUMENTS.The Assignor agrees to take such further action andtoexecuteand de live r,orcauseto beexecuted anddelivered,any and allotherdocumentswhich are,intheopinion of the Assignee oritscounsel,necessaryto carry out the terms and conditions oftheassignment effectedby theAgreement. |

| 3. | EFFECTIVE DATE AND COUNTERPART SIGNATURE.This Agreement shallbeeffectiveasofthe date firstwrittenabove.This Agreement,andacceptance of same,may beexecutedinone ormorecounterparts,eachof which shallbe deemedan origin al,butall of which together shall constituteone andthe sameinstrument.Confirmationofexecutionbyemail of a scanned signaturepageshall bebinding upon that partyso confirming. |

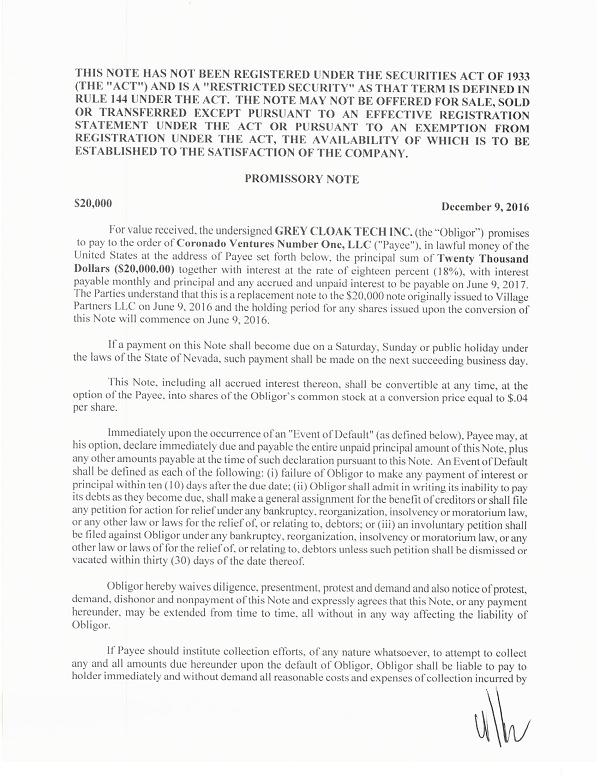

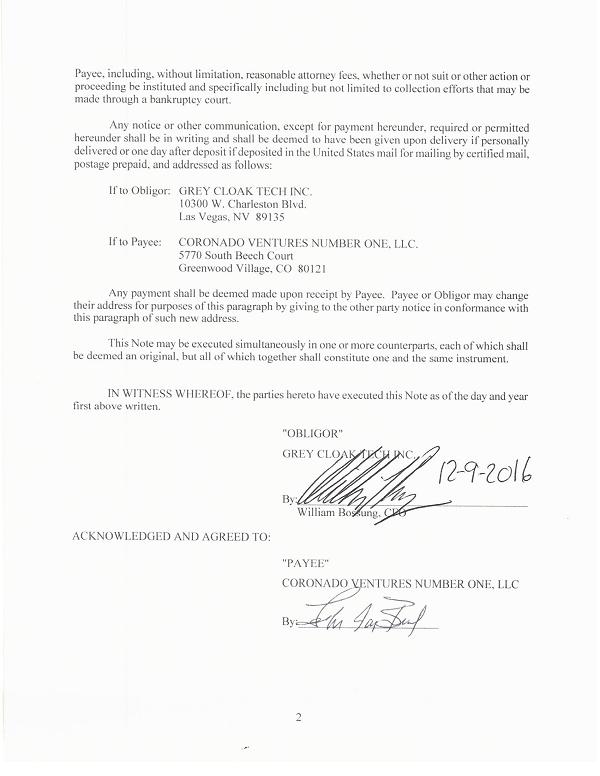

| 4. | CONSENT AND AGREEMENT OF THE COMPANY.The Company,asevidencedby itssignaturebelow,representsand warrants that,upon deliveryto the Company of the Note,theCompany shallpromptlycauseto be issued tothe Assignee anewNoteinthe amount of $20,000which shallbesimilar to the current Note exceptthatthematurity datewillbeextendeduntil June 9,2017 and it will be convertible at any time at $.04pershare.Itwill also refertothe original issuedateof the Note which wasJune9,2016.In addition,the Company agreesthat it has paidtotheAssignor the accruedinterestthroughDecember9,2016in theamount of $900. The Company also represents that the Note is currently outstandinginthe entire amount stated and itrepresentsabonafidedebtobligation of the Company. |

| 5. | MUTUAL REPRESENTATIONS AND WARRANTIES. |

| 5.1 | Organization; Authority.Each of the Partiesareentitiesdulyorganized,validly existing andingood standingunderthelawsof the jurisdiction ofitsorganization with full right,corporate,partnershipor other applicablepower andauthority to enterinto andto consummate the transactions contemplatedby thisAgreement and otherwise to carry out its obligations there under,and the execution,deliveryandperformance bythe Assignor of the transactions contemplated by this Agreement havebeenduly authorizedbyallnecessarycorporate or similar action on the part of the Assignee. |

| 5.2 | Binding Agreement:This Agreement,when executed and deliveredbythe Parties,will constitute a valid andlegally bindingobligation,enforceable in accordance with its terms,except (a) aslimited byapplicablebankruptcy,insolvency,reorganization,moratorium,fraudulent conveyance,and any otherlawsof general application affecting enforcement of creditors'rights generally,(b) aslimitedbylaws relatingto the availability of specificperformance,injunctiverelief,or other equitable remedies,or (c) to the extent theindemnification provisionscontainedherein may be limited byfederal or state securitieslaws. |

| 5.3 | No Conflicts.Neither the executionand deliveryof this Agreement,northe consummation of the transactions contemplatedhereby,door will violate any constitution,statute,regulation,rule,injunction,judgment,order,decree,ruling, charge or other restriction of any government,governmental agency,or court to which the Parties are subject or anyprovisionof its organizational documents or other similar governinginstruments,or conflict with,violate or constitute a defaultunderany agreement,credit facility,debtor other instrument or understanding. |

| 5.4 | Consents.No authorization,consent,approval or other order of,ordeclarationto or filing with,any governmental agency orbodyor otherPersonis required on thepartof Assignee for the valid authorization,execution,deliveryandperformance bythe Assignee of this Agreement and the consummation of thetransactionscontemplatedhereby |

| 6. | REPRESENTATIONS AND WARRANTIES – ASSIGNEE |

| 6.2 | Investment Experience; Access to Information and Preexisting Relationship.The Assignee (a) either alone or together with its representatives, has such knowledge and experience in financial andbusiness mattersas tobecapable of evaluating themerits and risksof thisinvestmentandmakeaninformed decisionto soin vest,andhasso evaluated therisks andmerits of suchinvestmentin the AssignedDebt,(b)hasthe ability tobear theeconomic risks of thisinvestmentand can afford a completelossof suchinvestment,(c)understandsthe terms ofandrisks associated with the acquisition of the Notes,including,without limitation,alackofliquidity,pricetransparency orpricingavailability andrisks associatedwiththeindustry in whichtheCompanyoperates,(d)hashad the opportunity toreviewsuchdisclosure regarding theCompany,itsbusiness,its financial condition and itsprospectsas the Assigneehasdetermined tobe necessary inconnection with the Assignment of the AssignedDebt,and (e) is an accredited investor as that term isdefinedinRule501 ofRegulation D. |

| 6.3 | Restrictions on Transfer.The Assigneeunderstandsthat the AssignedDebthasnot been registered underthe Securities Act of 1933,as amended("Securities Act") or the securitieslawsof any state. |

| 6.4 | Absence of General Solicitation.TheAssignee is not acceptingsuchAssignment as a result of any advertisement,article,notice or other communication regarding the Note published in any newspaper,magazine or similar media or broadcast over television or radio or presented at anyseminar or anyother generalsolicitationorgeneraladvertisement. |

| 7. | REPRESENTATIONS AND WARRANTIES OF THE ASSIGNOR |

| 7.2 | Ownership.Assignor hasgoodand marketable title to the Debt and is conveyingtoAssignee all rights, title and interest to the Debt. Said Debt,is free and clearofall liens, mortgages, pledges,securityinterests, encumbrances or charges of any kind ordescription. |

| 7.3 | Principal Amount of indebtedness,The amount of debt to be purchased byAssigneeis avaliddebt reported in the financialstatementsof the issuer,and noneof thedebt to be purchased has been assigned or promised to any third party.Additionally,the Debt has been fully funded and Assignor hasprovided proofof funding of the Debt to Assignee. |

| 7.4 | No Litigation,Thereis no action,suit,proceeding, judgment, claim or investigation pending,or to the knowledge of the Assignor,threatened against the Assignor,whichcould reasonably be expected in any manner to challenge orseekto prevent,enjoin,alter or delay the transactions contemplated hereby. |

| 7.5 | Not an Affiliate.Assignorisnot now,and has not been during the immediately preceding 90 days,an officer, direct or,10% or moreshareholderof Company or in any other way an"affiliate"ofCompany(as that term is defined in Rule 144(a)(l) adopted pursuant to the Securities Act of 1933, as amended). |

| 7.6 | Default of Representations and Warranties.It is understood and acknowledged by Assignor that any violation of this Section 6specificallywill result in an automatic and immediate default of this Agreement. |

| 8.2 | Termination,Should the Assignee fail to pay the Purchase Price to the Assignor on or before theClosingDate, then this Agreementshallbe automatically null andvoidand of no force or effect at the option of the Assignor, and all right,title and interest in and to the Debtshallremain fully vested in the Assignor. |

| 8.3 | Expenses,EachParty shall bear its own costs and expenses incurred in connection with its negotiations, execution and delivery of this Agreement,including,withoutlimitation,the fees and disbursement of its legal counsel. |

| 8.4 | Amendments.Noprovision hereof may be waivedormodified other than by an instrument in writingsignedby the party against whom enforcement is sought. |

| 8.5 | Severability.If any provision of this Agreementshallbeinvalid or unenforceable in any jurisdiction,suchinvalidity or unenforceabilityshallnot affect thevalidity orenforceability of the remainder of this Agreement in that jurisdiction or thevalidityor enforceability of any provision of this Agreement in any other jurisdiction. |

| 8.6 | Goyerning Law; Submissions to Jurisdiction.This Agreementshallbegovernedby andConstruedin accordancewiththe Laws of the State ofColoradowithoutregard to conflict ofLawprinciples.EachParty agrees that any action orproceedingarising outofor relating in anywayto this Agreement shall be brought in a U.S.Federalor StateCourtof competent jurisdictionsittingin the State ofColorado.EachParty hereby irrevocably and unconditionallywaivesany defenseof Forum Non Convenes or lack of person jurisdiction to the maintenance of any action or proceeding and any right of jurisdiction or venue due to the place of residence or domicile of any Party hereto. |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

ASSIGNOR:

Village Partners LLC

By:/s/ George Lee

George Lee, Member

ASSIGNEE:

Coronado Ventures Number One, LLC

By:/s/ Timothy J. Brasel

Timothy J. Brasel, Member

ACCEPTED AND AGREED:

GREY CLOAK TECH INC.

By:/s/ William Bossung

William Bossung, CFO