May 4, 2021 First Quarter 2021 Supplemental Information Exhibit 99.2

Forward-Looking Statements and Other Disclosures The information contained in this earnings presentation contains “forward‐looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of the investments of TPG RE Finance Trust, Inc. (the “Company” or “TRTX”); the ultimate geographic spread, severity and duration of pandemics such as the recent outbreak of novel coronavirus (“COVID-19”), actions that have or may be taken by governmental authorities to contain or address the impact of such pandemics, and the potential negative impacts of such pandemics on the global economy and the Company’s financial condition and results of operations; the Company’s ability to originate loans that are in the Company’s pipeline and under evaluation by the Company; and financing needs and arrangements. Forward‐looking statements are generally identifiable by use of forward‐looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue” or other similar words or expressions. Forward‐looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition or state other forward‐looking information. Statements, among others, relating to the continuing impact of COVID-19 on the Company’s business, financial condition and results of operations and the Company’s ability to generate future growth and deliver returns are forward-looking statements, and the Company cannot assure you that TRTX will achieve such results. The ability of TRTX to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain. Although the Company believes that such forward‐looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward‐looking statements. You are cautioned not to place undue reliance on these forward‐looking statements, which reflect the Company’s views only as of the date of this earnings presentation. Except as required by law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward‐looking statements appearing in this earnings presentation. The Company does not undertake any obligation to update any forward-looking statements contained in this earnings presentation as a result of new information, future events or otherwise. Past performance is not indicative nor a guarantee of future returns. Yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors. TPG RE Finance Trust, Inc.| 1Q2021

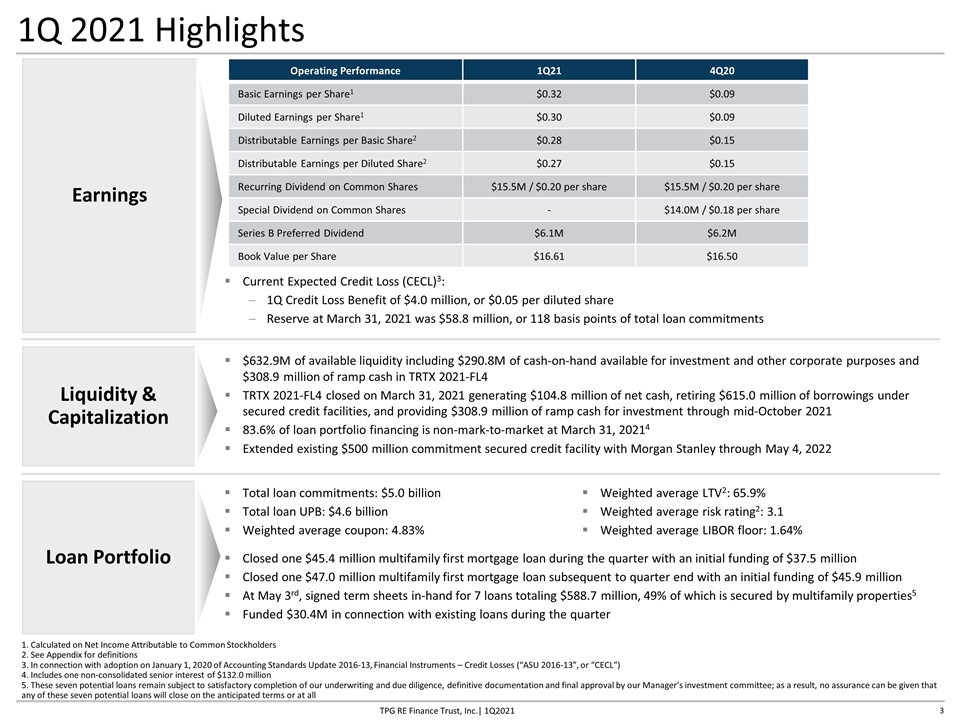

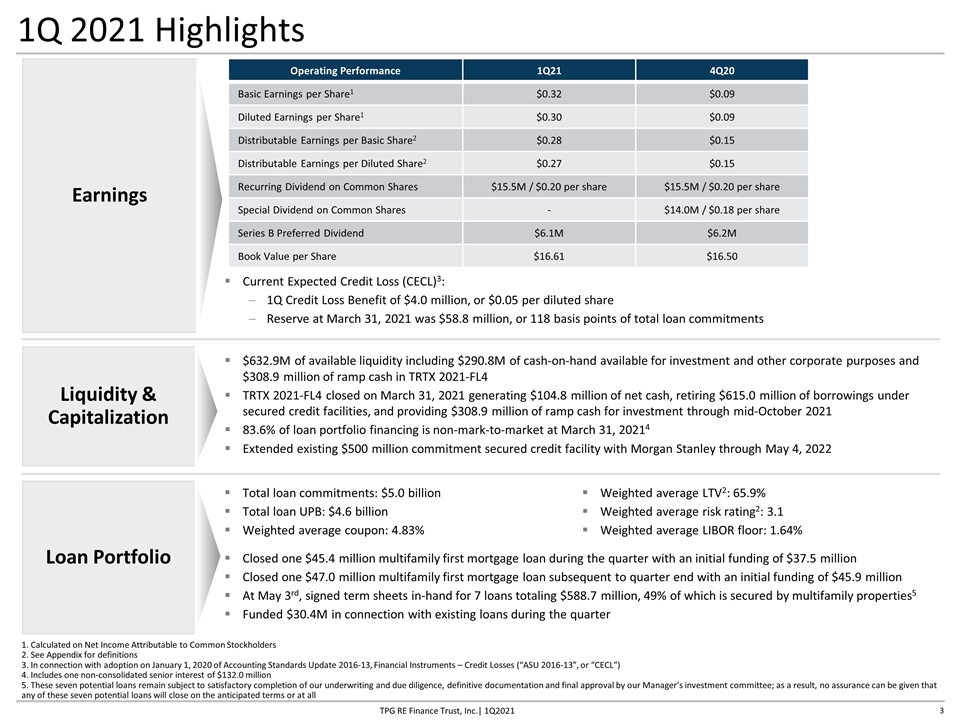

1Q 2021 Highlights Earnings Loan Portfolio Liquidity & Capitalization 1. Calculated on Net Income Attributable to Common Stockholders 2. See Appendix for definitions 3. In connection with adoption on January 1, 2020 of Accounting Standards Update 2016-13, Financial Instruments – Credit Losses (“ASU 2016-13”, or “CECL”) 4. Includes one non-consolidated senior interest of $132.0 million 5. These seven potential loans remain subject to satisfactory completion of our underwriting and due diligence, definitive documentation and final approval by our Manager’s investment committee; as a result, no assurance can be given that any of these seven potential loans will close on the anticipated terms or at all $632.9M of available liquidity including $290.8M of cash-on-hand available for investment and other corporate purposes and $308.9 million of ramp cash in TRTX 2021-FL4 TRTX 2021-FL4 closed on March 31, 2021 generating $104.8 million of net cash, retiring $615.0 million of borrowings under secured credit facilities, and providing $308.9 million of ramp cash for investment through mid-October 2021 83.6% of loan portfolio financing is non-mark-to-market at March 31, 20214 Extended existing $500 million commitment secured credit facility with Morgan Stanley through May 4, 2022 Total loan commitments: $5.0 billion Total loan UPB: $4.6 billion Weighted average coupon: 4.83% Weighted average LTV2: 65.9% Weighted average risk rating2: 3.1 Weighted average LIBOR floor: 1.64% Current Expected Credit Loss (CECL)3: 1Q Credit Loss Benefit of $4.0 million, or $0.05 per diluted share Reserve at March 31, 2021 was $58.8 million, or 118 basis points of total loan commitments Operating Performance 1Q21 4Q20 Basic Earnings per Share1 $0.32 $0.09 Diluted Earnings per Share1 $0.30 $0.09 Distributable Earnings per Basic Share2 $0.28 $0.15 Distributable Earnings per Diluted Share2 $0.27 $0.15 Recurring Dividend on Common Shares $15.5M / $0.20 per share $15.5M / $0.20 per share Special Dividend on Common Shares - $14.0M / $0.18 per share Series B Preferred Dividend $6.1M $6.2M Book Value per Share $16.61 $16.50 Closed one $45.4 million multifamily first mortgage loan during the quarter with an initial funding of $37.5 million Closed one $47.0 million multifamily first mortgage loan subsequent to quarter end with an initial funding of $45.9 million At May 3rd, signed term sheets in-hand for 7 loans totaling $588.7 million, 49% of which is secured by multifamily properties5 Funded $30.4M in connection with existing loans during the quarter TPG RE Finance Trust, Inc.| 1Q2021

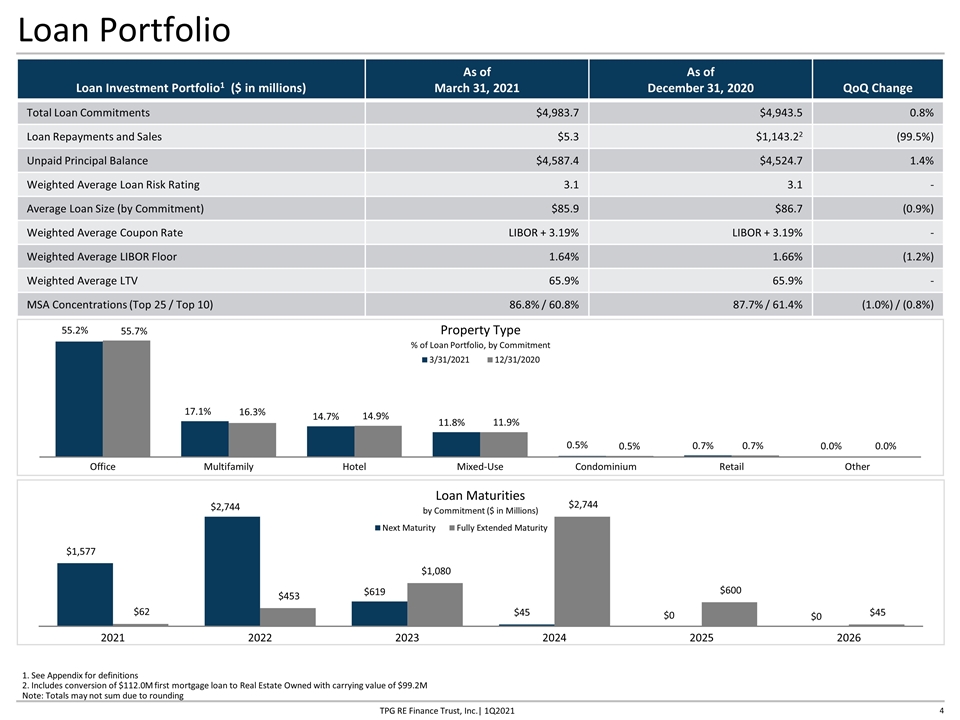

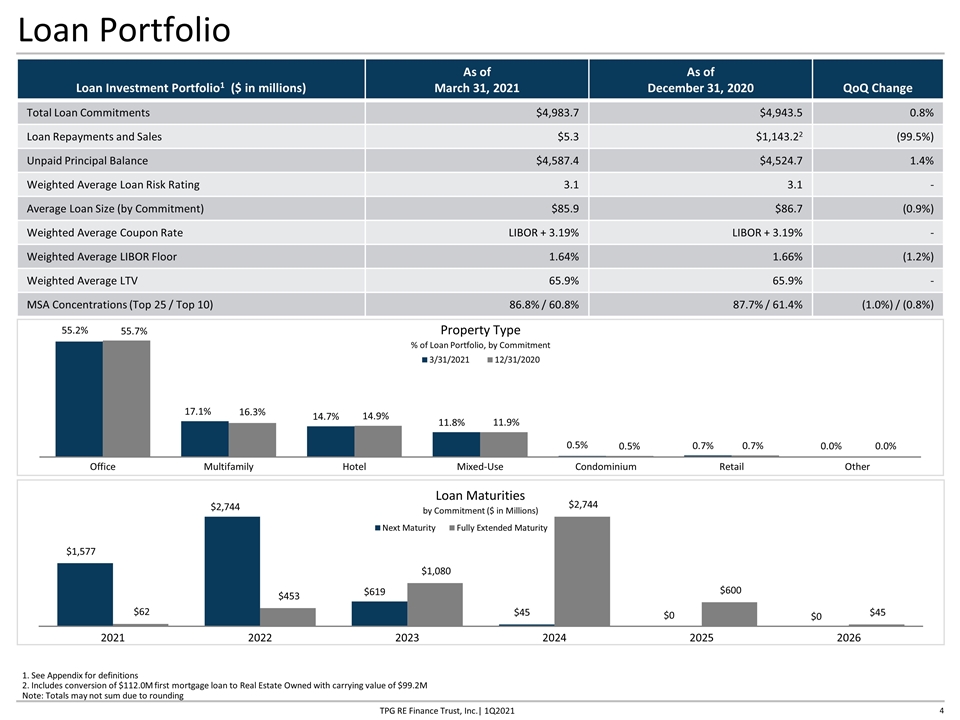

Loan Portfolio 1. See Appendix for definitions 2. Includes conversion of $112.0M first mortgage loan to Real Estate Owned with carrying value of $99.2M Note: Totals may not sum due to rounding Loan Investment Portfolio1 ($ in millions) As of March 31, 2021 As of December 31, 2020 QoQ Change Total Loan Commitments $4,983.7 $4,943.5 0.8% Loan Repayments and Sales $5.3 $1,143.22 (99.5%) Unpaid Principal Balance $4,587.4 $4,524.7 1.4% Weighted Average Loan Risk Rating 3.1 3.1 - Average Loan Size (by Commitment) $85.9 $86.7 (0.9%) Weighted Average Coupon Rate LIBOR + 3.19% LIBOR + 3.19% - Weighted Average LIBOR Floor 1.64% 1.66% (1.2%) Weighted Average LTV 65.9% 65.9% - MSA Concentrations (Top 25 / Top 10) 86.8% / 60.8% 87.7% / 61.4% (1.0%) / (0.8%) Property Type % of Loan Portfolio, by Commitment Loan Maturities by Commitment ($ in Millions) TPG RE Finance Trust, Inc.| 1Q2021

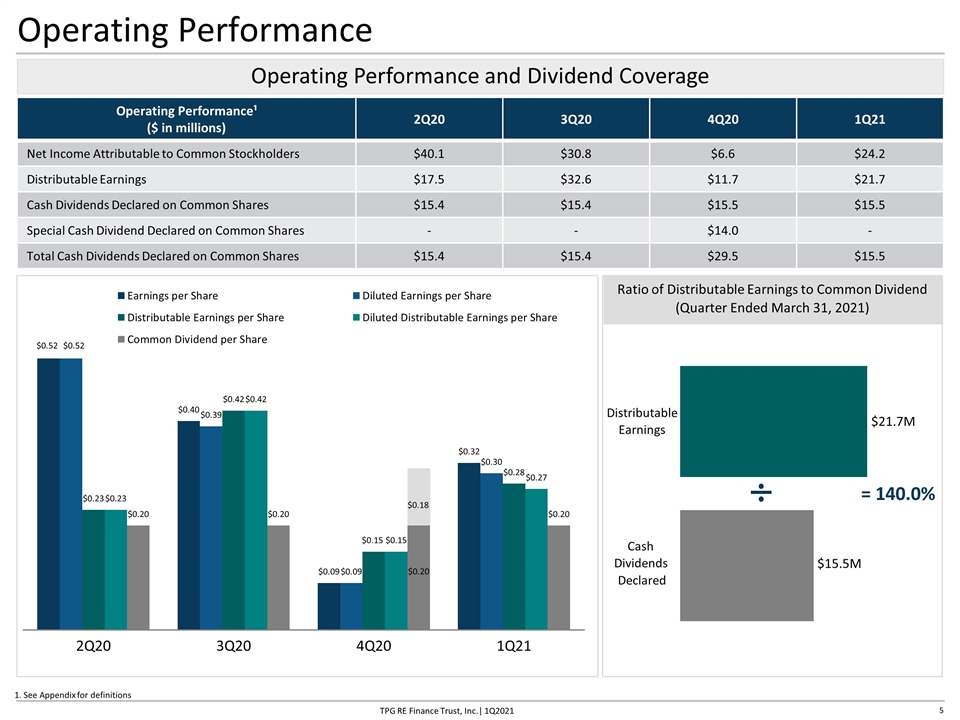

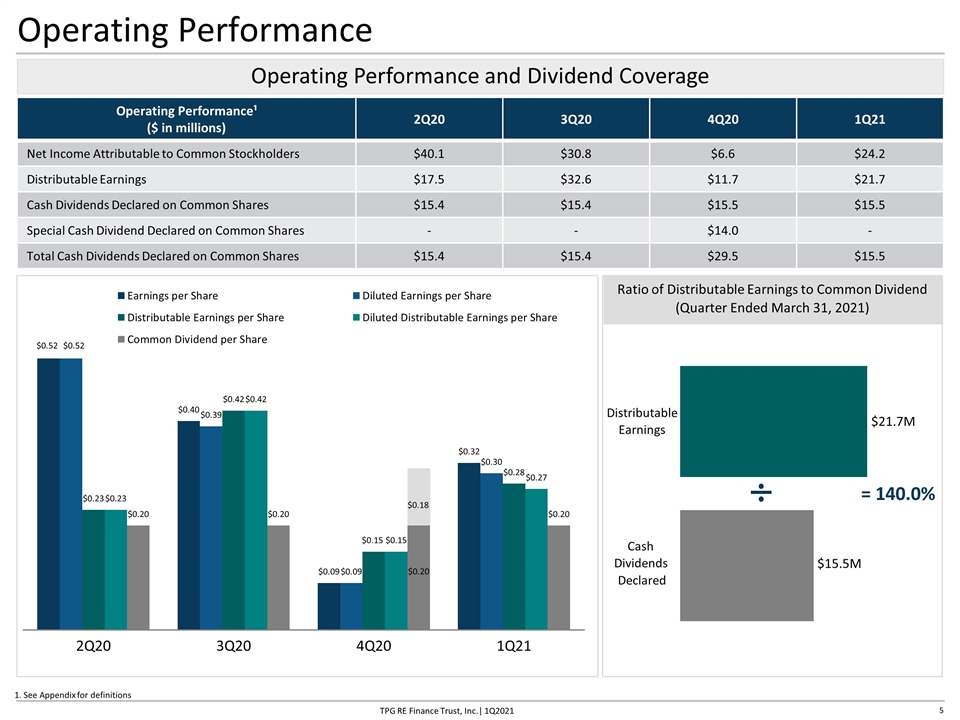

Operating Performance and Dividend Coverage Operating Performance 1. See Appendix for definitions Operating Performance¹ ($ in millions) 2Q20 3Q20 4Q20 1Q21 Net Income Attributable to Common Stockholders $40.1 $30.8 $6.6 $24.2 Distributable Earnings $17.5 $32.6 $11.7 $21.7 Cash Dividends Declared on Common Shares $15.4 $15.4 $15.5 $15.5 Special Cash Dividend Declared on Common Shares - - $14.0 - Total Cash Dividends Declared on Common Shares $15.4 $15.4 $29.5 $15.5 Ratio of Distributable Earnings to Common Dividend (Quarter Ended March 31, 2021) Cash Dividends Declared Distributable Earnings $21.7M $15.5M $0.18 = 140.0% TPG RE Finance Trust, Inc.| 1Q2021

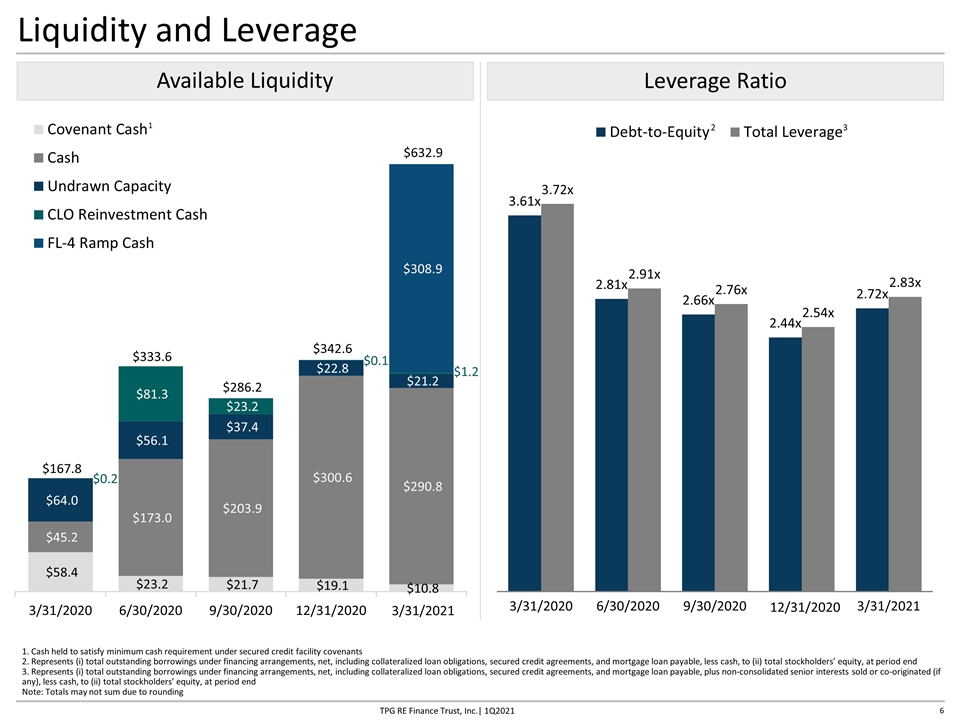

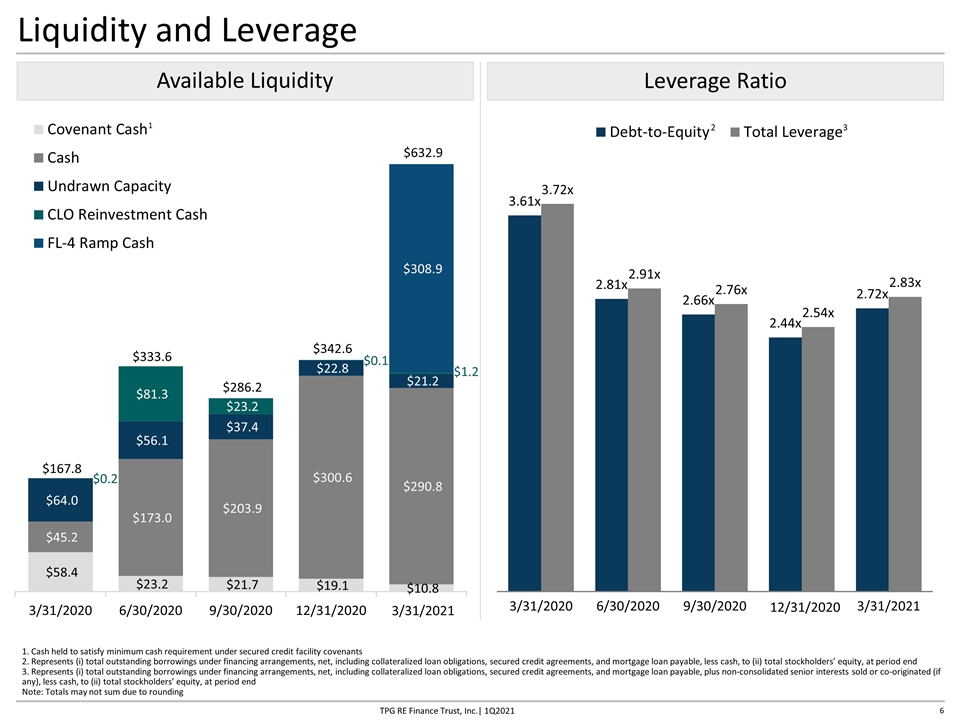

Liquidity and Leverage Available Liquidity Leverage Ratio 1. Cash held to satisfy minimum cash requirement under secured credit facility covenants 2. Represents (i) total outstanding borrowings under financing arrangements, net, including collateralized loan obligations, secured credit agreements, and mortgage loan payable, less cash, to (ii) total stockholders’ equity, at period end 3. Represents (i) total outstanding borrowings under financing arrangements, net, including collateralized loan obligations, secured credit agreements, and mortgage loan payable, plus non-consolidated senior interests sold or co-originated (if any), less cash, to (ii) total stockholders’ equity, at period end Note: Totals may not sum due to rounding 2 12/31/2020 3 1 3/31/2021 $1.2 TPG RE Finance Trust, Inc.| 1Q2021

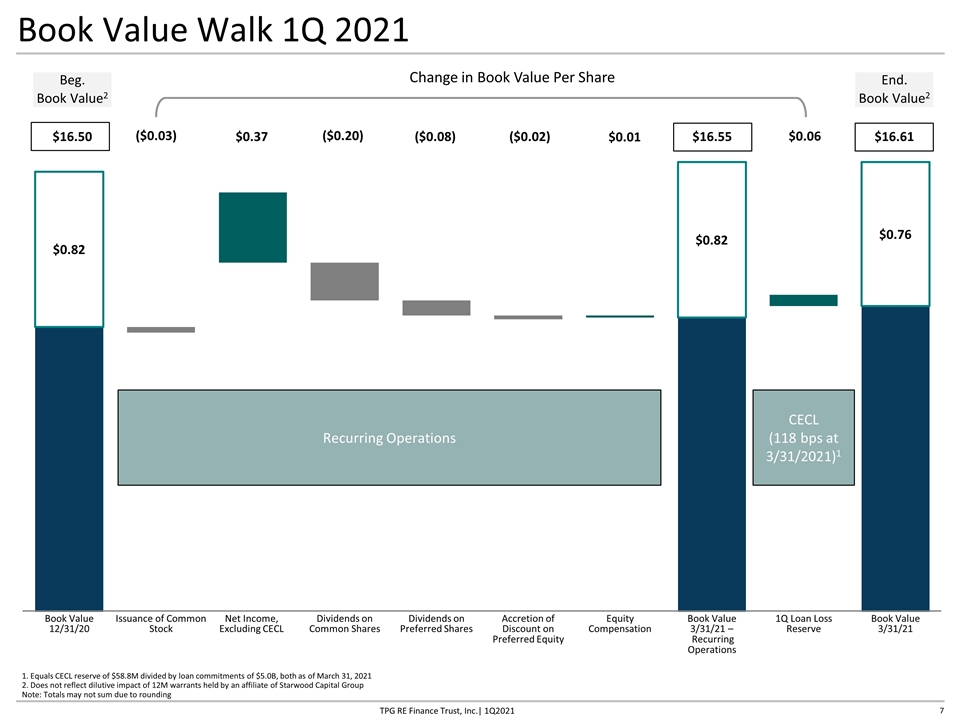

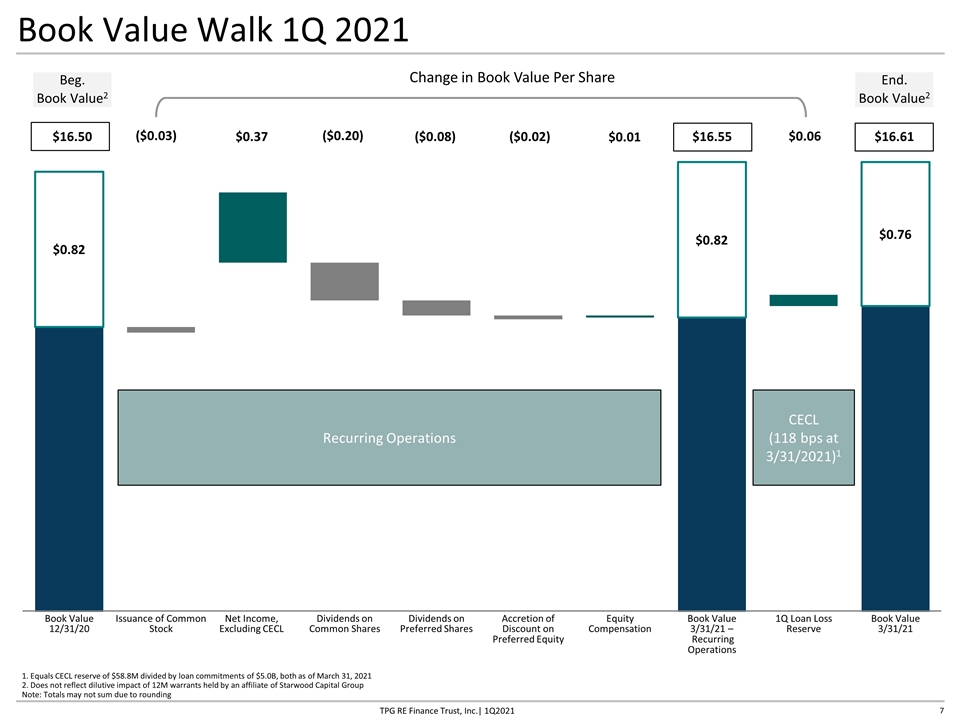

Book Value Walk 1Q 2021 $16.55 $16.61 1. Equals CECL reserve of $58.8M divided by loan commitments of $5.0B, both as of March 31, 2021 2. Does not reflect dilutive impact of 12M warrants held by an affiliate of Starwood Capital Group Note: Totals may not sum due to rounding Recurring Operations CECL (118 bps at 3/31/2021)1 $16.50 ($0.03) $0.37 ($0.20) $0.01 $0.06 Change in Book Value Per Share Beg. Book Value2 End. Book Value2 ($0.02) ($0.08) TPG RE Finance Trust, Inc.| 1Q2021

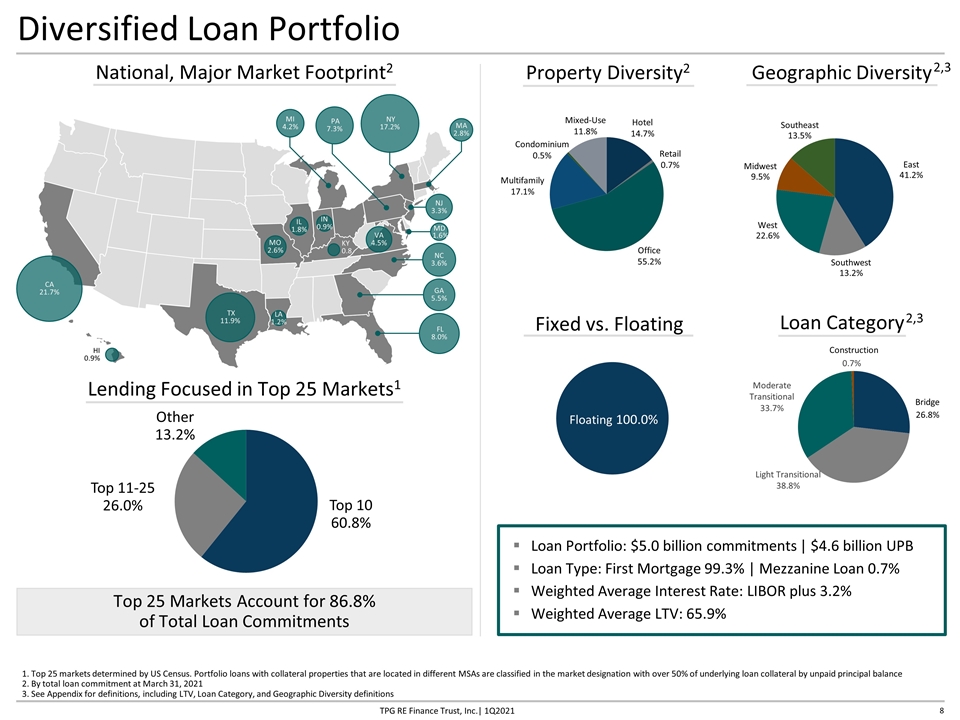

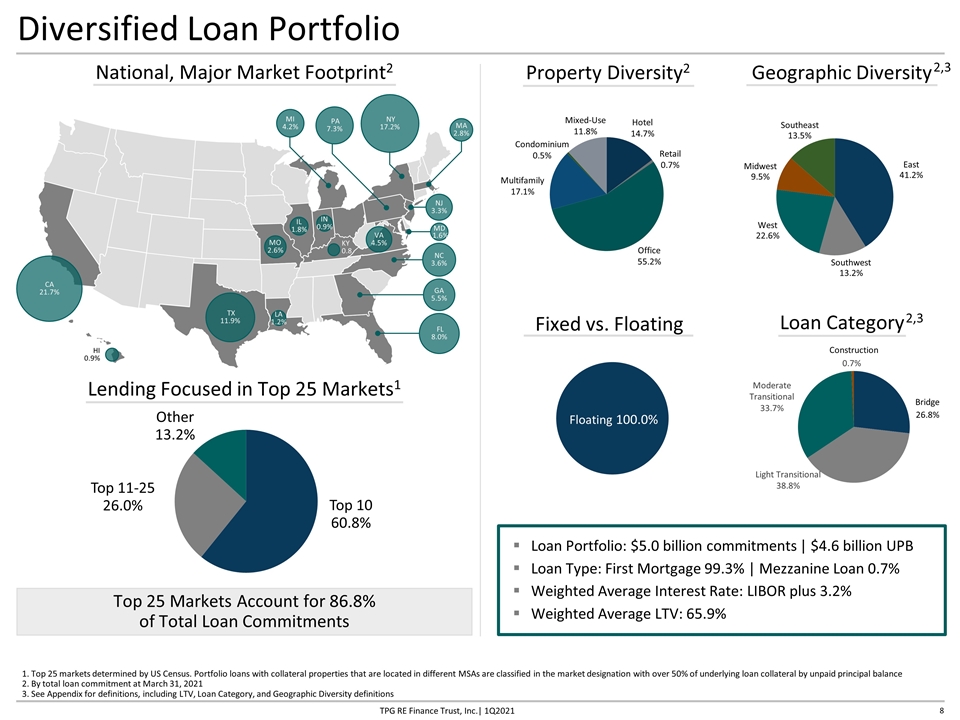

National, Major Market Footprint2 Lending Focused in Top 25 Markets1 Top 25 Markets Account for 86.8% of Total Loan Commitments Loan Category Geographic Diversity Diversified Loan Portfolio Property Diversity2 1. Top 25 markets determined by US Census. Portfolio loans with collateral properties that are located in different MSAs are classified in the market designation with over 50% of underlying loan collateral by unpaid principal balance 2. By total loan commitment at March 31, 2021 3. See Appendix for definitions, including LTV, Loan Category, and Geographic Diversity definitions 2,3 Loan Portfolio: $5.0 billion commitments | $4.6 billion UPB Loan Type: First Mortgage 99.3% | Mezzanine Loan 0.7% Weighted Average Interest Rate: LIBOR plus 3.2% Weighted Average LTV: 65.9% 2,3 Fixed vs. Floating CA 21.7% NY 17.2% TX 11.9% PA 7.3% FL 8.0% NC 3.6% GA 5.5% MI 4.2% NJ 3.3% VA 4.5% MA 2.8% MO 2.6% IL 1.8% LA 1.2% HI 0.9% KY 0.8 MD 1.6% Construction Bridge 26.8% IN 0.9% TPG RE Finance Trust, Inc.| 1Q2021

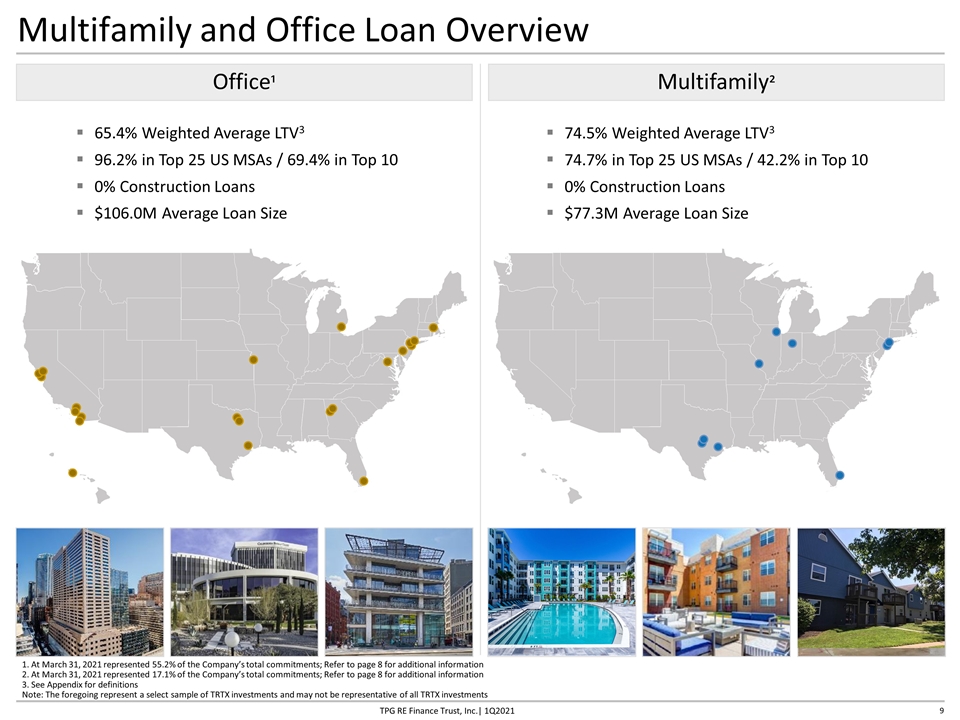

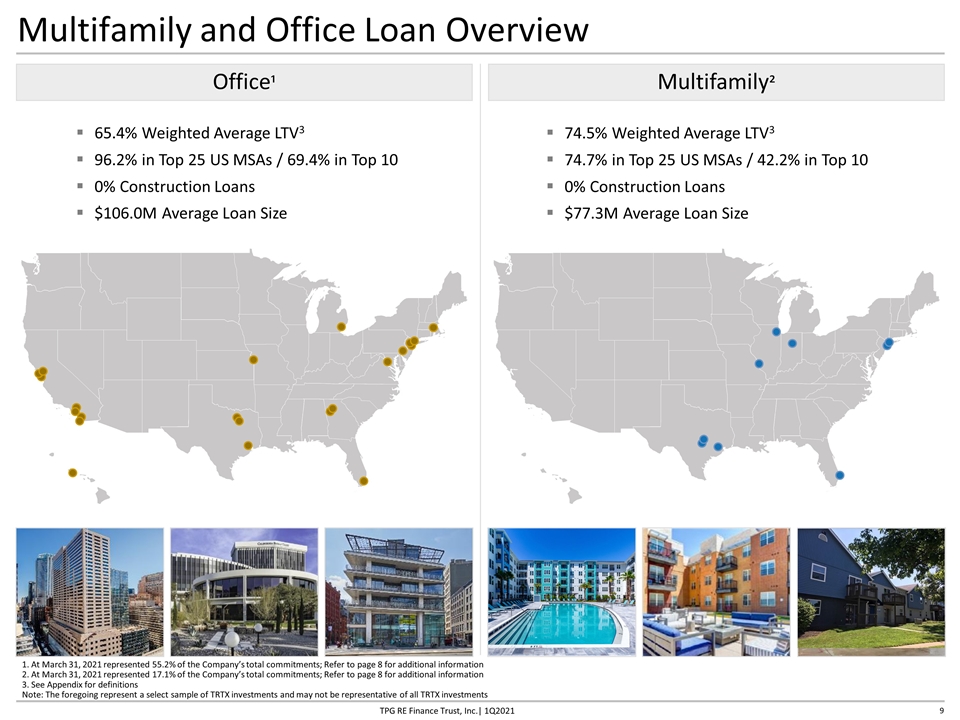

Multifamily and Office Loan Overview Office¹ 65.4% Weighted Average LTV3 96.2% in Top 25 US MSAs / 69.4% in Top 10 0% Construction Loans $106.0M Average Loan Size Multifamily² 74.5% Weighted Average LTV3 74.7% in Top 25 US MSAs / 42.2% in Top 10 0% Construction Loans $77.3M Average Loan Size 1. At March 31, 2021 represented 55.2% of the Company’s total commitments; Refer to page 8 for additional information 2. At March 31, 2021 represented 17.1% of the Company’s total commitments; Refer to page 8 for additional information 3. See Appendix for definitions Note: The foregoing represent a select sample of TRTX investments and may not be representative of all TRTX investments TPG RE Finance Trust, Inc.| 1Q2021

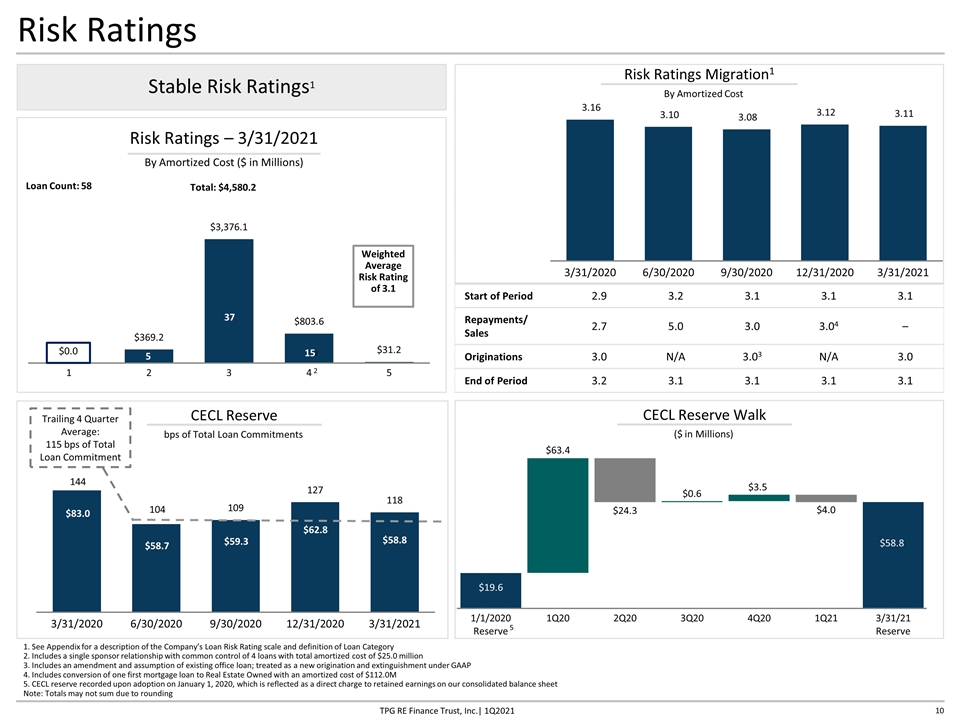

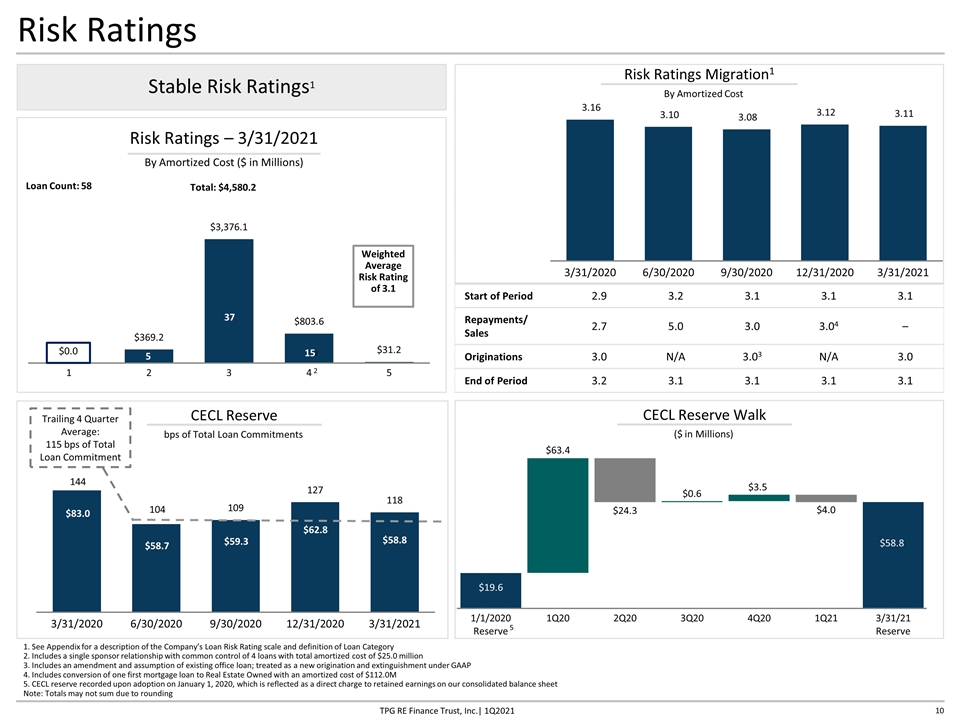

Risk Ratings 1. See Appendix for a description of the Company’s Loan Risk Rating scale and definition of Loan Category 2. Includes a single sponsor relationship with common control of 4 loans with total amortized cost of $25.0 million 3. Includes an amendment and assumption of existing office loan; treated as a new origination and extinguishment under GAAP 4. Includes conversion of one first mortgage loan to Real Estate Owned with an amortized cost of $112.0M 5. CECL reserve recorded upon adoption on January 1, 2020, which is reflected as a direct charge to retained earnings on our consolidated balance sheet Note: Totals may not sum due to rounding Stable Risk Ratings1 Risk Ratings Migration1 $58.7 $0.0 Risk Ratings – 3/31/2021 By Amortized Cost ($ in Millions) Total: $4,580.2 Loan Count: 58 5 37 15 $83.0 $59.3 $62.8 By Amortized Cost Start of Period 2.9 3.2 3.1 3.1 3.1 Repayments/ Sales 2.7 5.0 3.0 3.04 – Originations 3.0 N/A 3.03 N/A 3.0 End of Period 3.2 3.1 3.1 3.1 3.1 By Amortized Cost Risk Ratings Migration1 2 $58.8 CECL Reserve Walk ($ in Millions) $58.7 $83.0 $59.3 $62.8 Trailing 4 Quarter Average: 115 bps of Total Loan Commitment $58.8 CECL Reserve bps of Total Loan Commitments 5 TPG RE Finance Trust, Inc.| 1Q2021 2

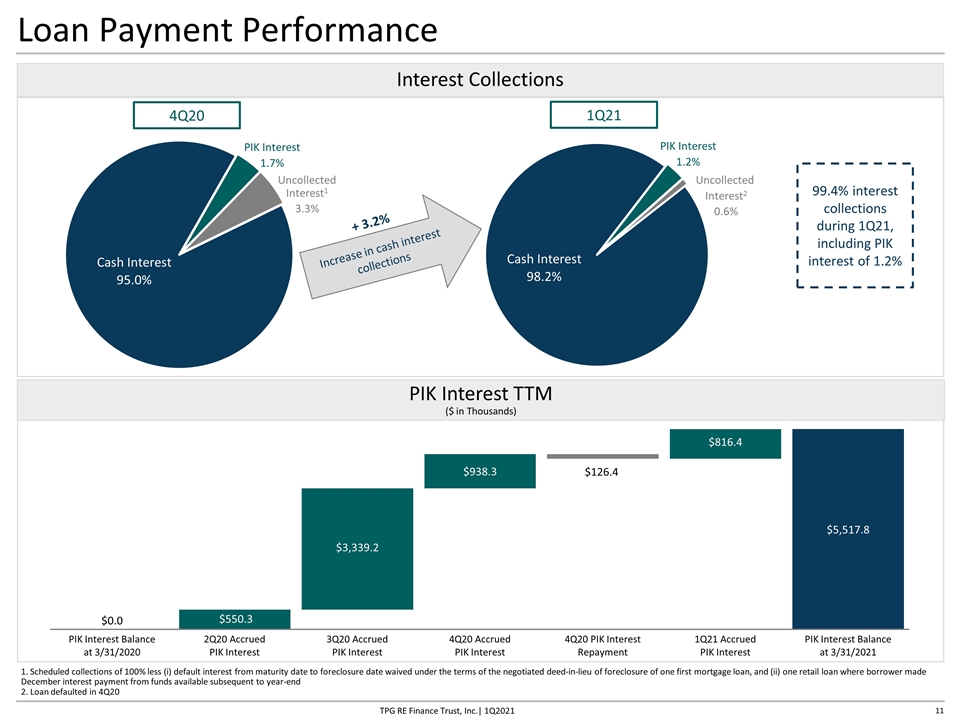

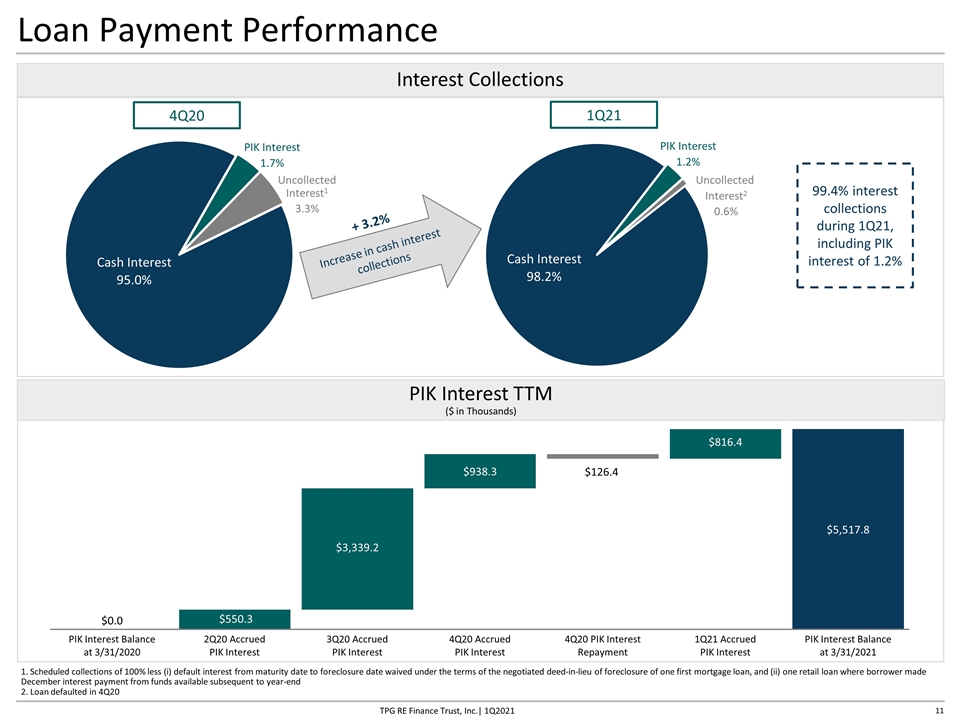

Interest Collections Loan Payment Performance PIK Interest TTM ($ in Thousands) Uncollected Interest1 3.3% 4Q20 1Q21 99.4% interest collections during 1Q21, including PIK interest of 1.2% 1. Scheduled collections of 100% less (i) default interest from maturity date to foreclosure date waived under the terms of the negotiated deed-in-lieu of foreclosure of one first mortgage loan, and (ii) one retail loan where borrower made December interest payment from funds available subsequent to year-end 2. Loan defaulted in 4Q20 Increase in cash interest collections + 3.2% TPG RE Finance Trust, Inc.| 1Q2021

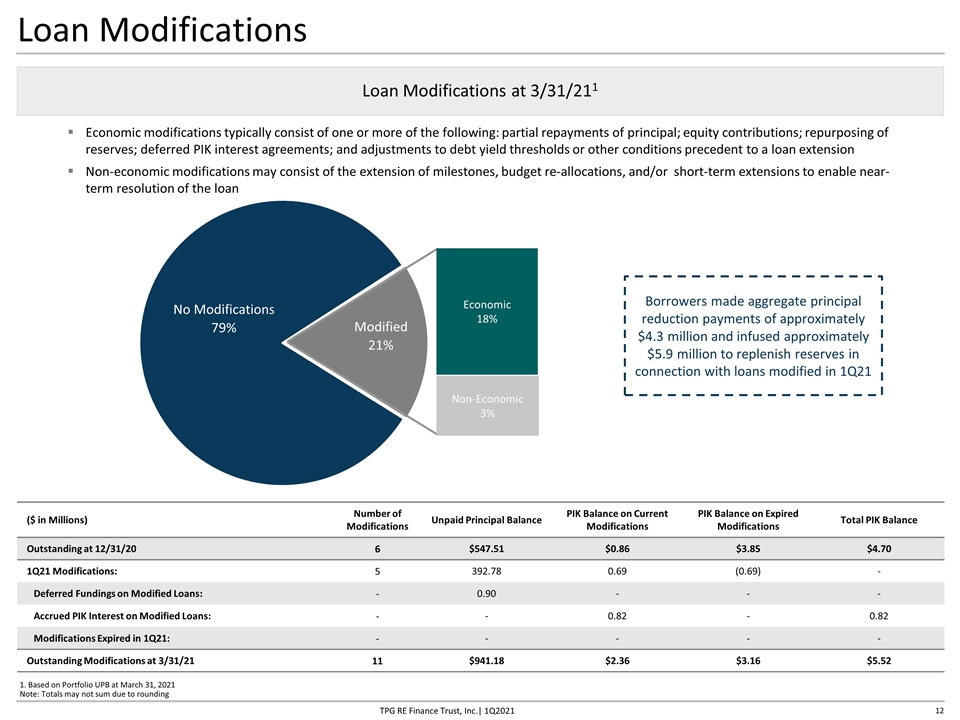

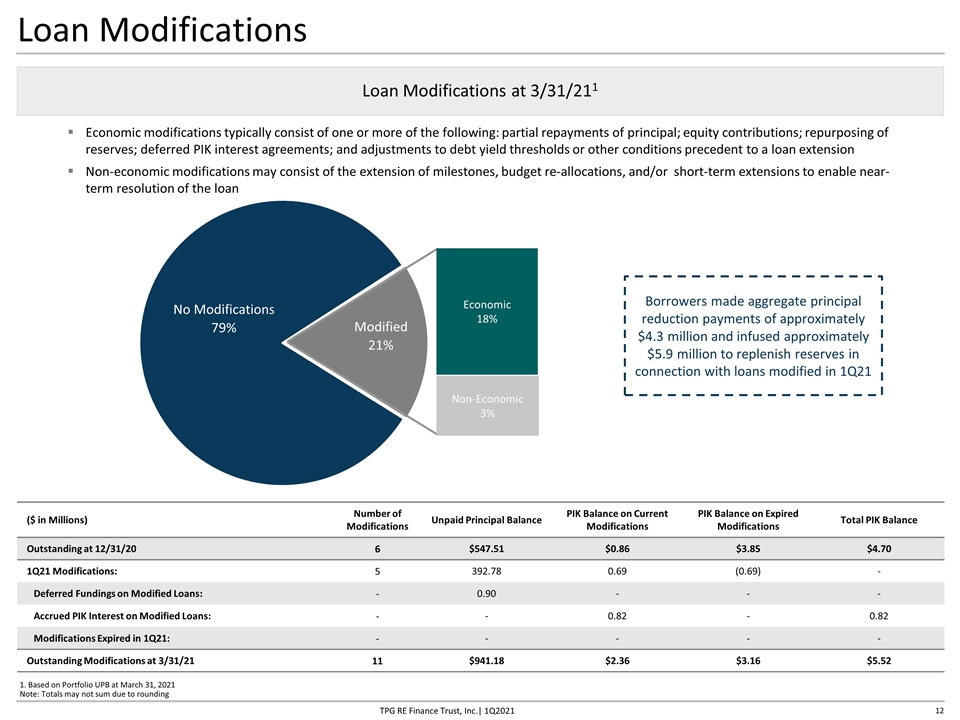

Loan Modifications Loan Modifications at 3/31/211 Economic modifications typically consist of one or more of the following: partial repayments of principal; equity contributions; repurposing of reserves; deferred PIK interest agreements; and adjustments to debt yield thresholds or other conditions precedent to a loan extension Non-economic modifications may consist of the extension of milestones, budget re-allocations, and/or short-term extensions to enable near-term resolution of the loan Borrowers made aggregate principal reduction payments of approximately $4.3 million and infused approximately $5.9 million to replenish reserves in connection with loans modified in 1Q21 1. Based on Portfolio UPB at March 31, 2021 Note: Totals may not sum due to rounding Economic 18% Non-Economic 3% ($ in Millions) Number of Modifications Unpaid Principal Balance PIK Balance on Current Modifications PIK Balance on Expired Modifications Total PIK Balance Outstanding at 12/31/20 6 $547.51 $0.86 $3.85 $4.70 1Q21 Modifications: 5 392.78 0.69 (0.69) - Deferred Fundings on Modified Loans: - 0.90 - - - Accrued PIK Interest on Modified Loans: - - 0.82 - 0.82 Modifications Expired in 1Q21: - - - - - Outstanding Modifications at 3/31/21 11 $941.18 $2.36 $3.16 $5.52 TPG RE Finance Trust, Inc.| 1Q2021

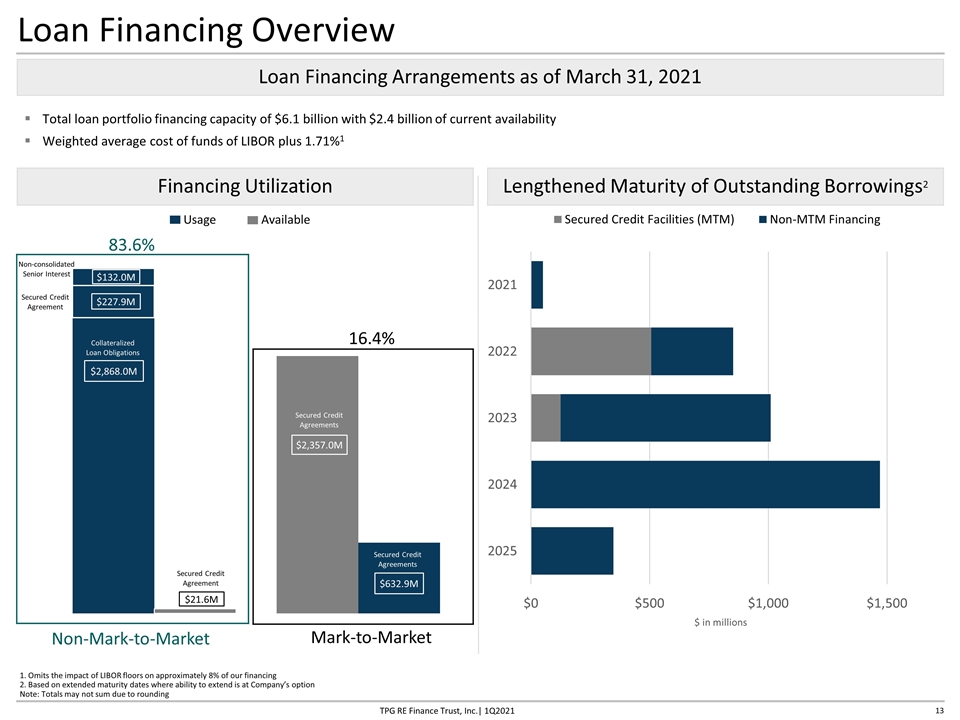

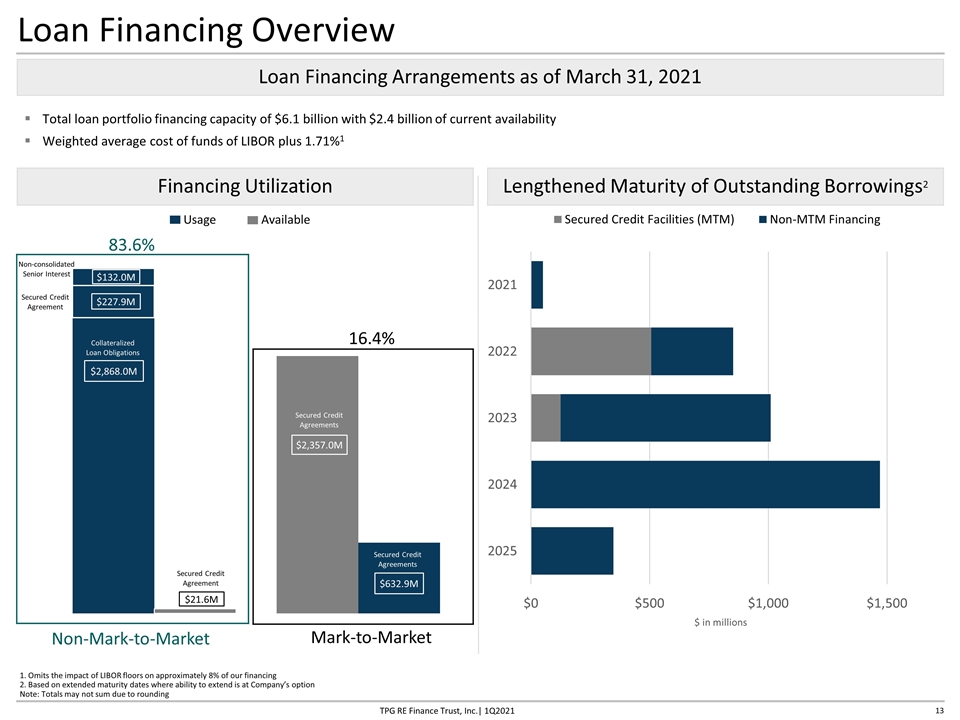

Loan Financing Overview 1. Omits the impact of LIBOR floors on approximately 8% of our financing 2. Based on extended maturity dates where ability to extend is at Company’s option Note: Totals may not sum due to rounding Loan Financing Arrangements as of March 31, 2021 Total loan portfolio financing capacity of $6.1 billion with $2.4 billion of current availability Weighted average cost of funds of LIBOR plus 1.71%1 Financing Utilization Lengthened Maturity of Outstanding Borrowings2 2.54x 2.64x Secured Credit Agreements Secured Credit Agreements Usage Available 3.38x 3.49x $249.5M Non-Mark-to-Market Mark-to-Market Secured Credit Agreement Secured Credit Agreements Secured Credit Agreements 83.6% TPG RE Finance Trust, Inc.| 1Q2021 Secured Credit Agreement

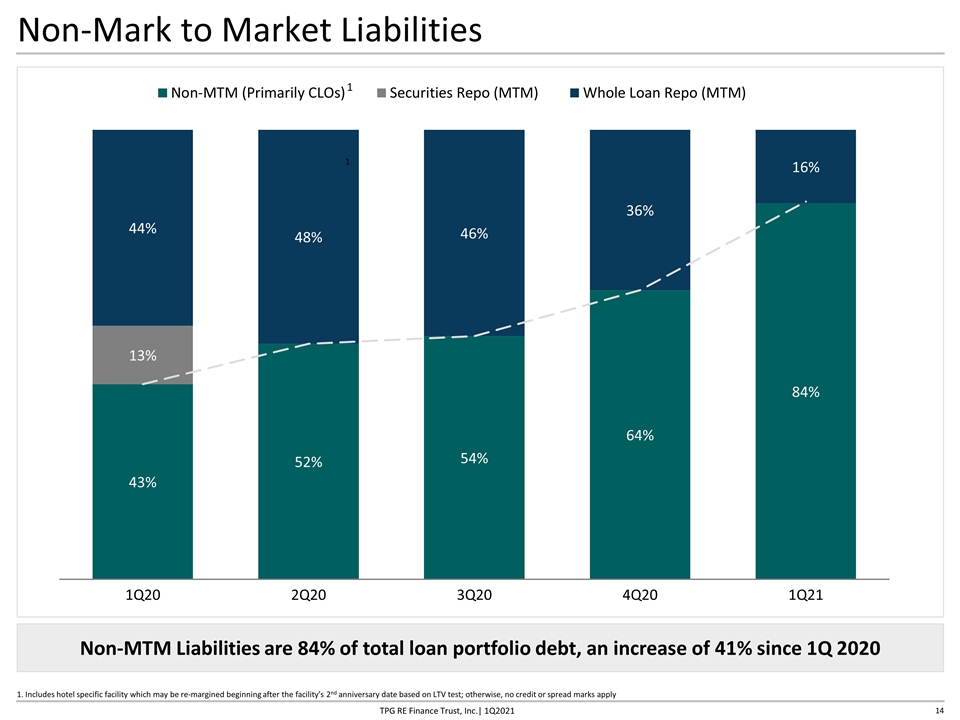

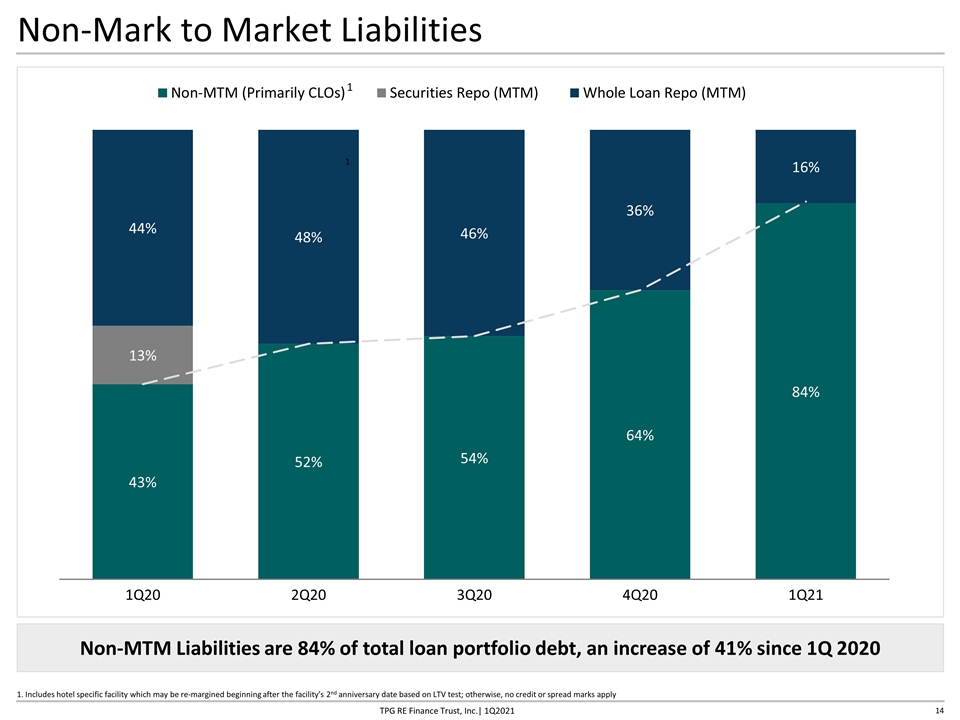

Non-Mark to Market Liabilities 1 1. Includes hotel specific facility which may be re-margined beginning after the facility’s 2nd anniversary date based on LTV test; otherwise, no credit or spread marks apply Non-MTM Liabilities are 84% of total loan portfolio debt, an increase of 41% since 1Q 2020 TPG RE Finance Trust, Inc.| 1Q2021 1

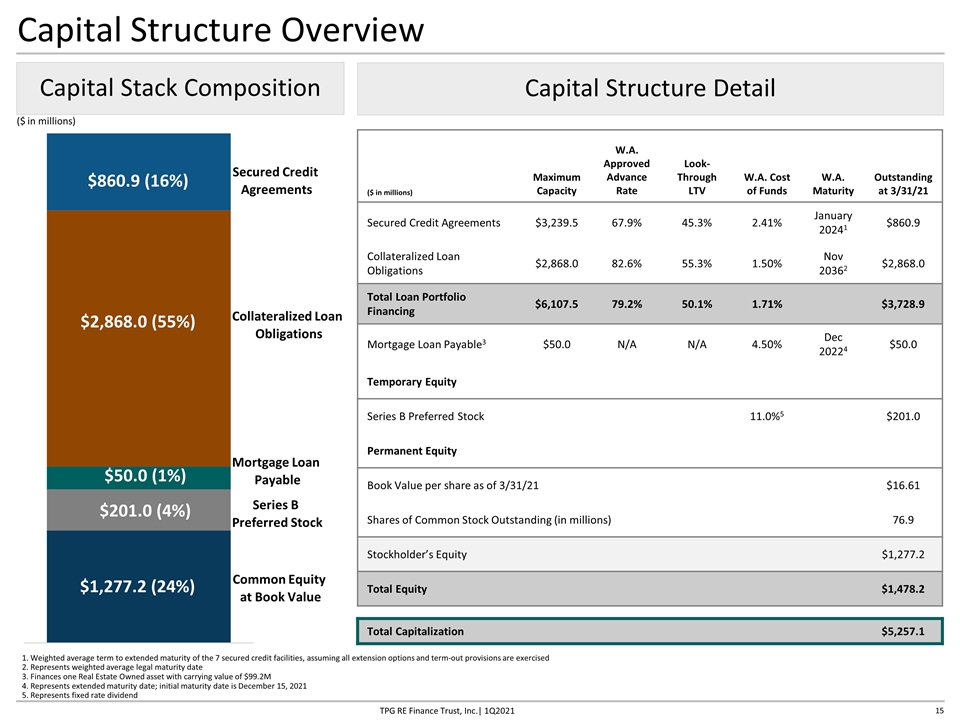

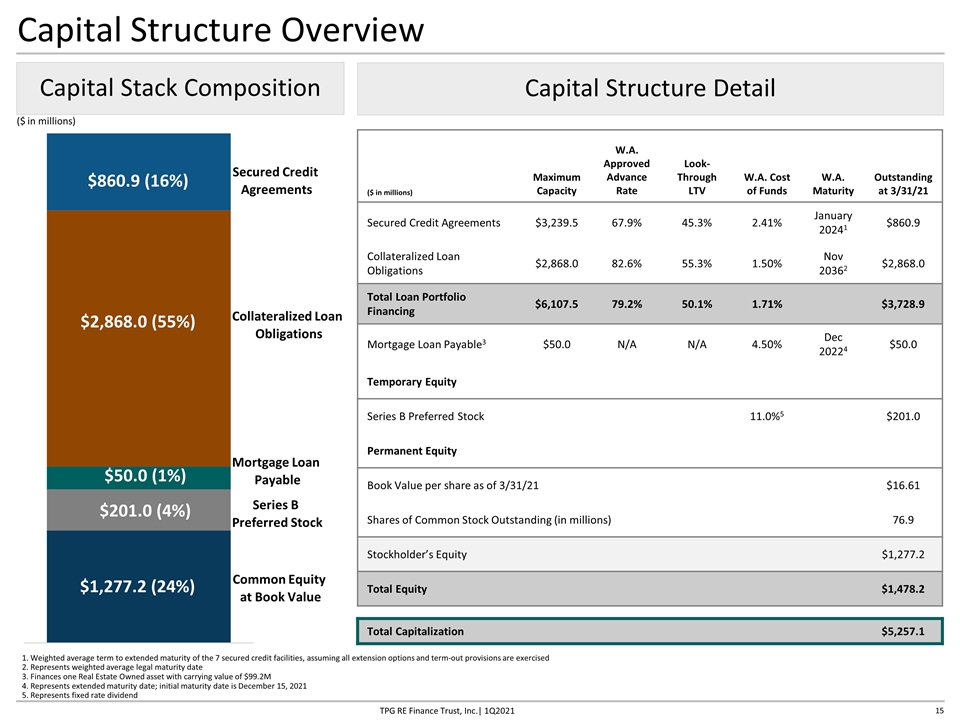

Capital Structure Overview $50.0 (1%) $2,868.0 (55%) $860.9 (16%) $201.0 (4%) $1,277.2 (24%) Series B Preferred Stock Mortgage Loan Payable Collateralized Loan Obligations Secured Credit Agreements Common Equity at Book Value ($ in millions) Maximum Capacity Maximum Capacity W.A. Approved Advance Rate Look-Through LTV W.A. Cost of Funds W.A. Maturity Outstanding at 3/31/21 Secured Credit Agreements $3,239.5 $3,239.5 67.9% 45.3% 2.41% January 20241 $860.9 Collateralized Loan Obligations $2,868.0 $2,868.0 82.6% 55.3% 1.50% Nov 20362 $2,868.0 Total Loan Portfolio Financing $6,107.5 $6,107.5 79.2% 50.1% 1.71% $3,728.9 Mortgage Loan Payable3 $50.0 $50.0 N/A N/A 4.50% Dec 20224 $50.0 Temporary Equity Series B Preferred Stock 11.0%5 $201.0 Permanent Equity Book Value per share as of 3/31/21 $16.61 Shares of Common Stock Outstanding (in millions) 76.9 Stockholder’s Equity $1,277.2 Total Equity $1,478.2 Total Capitalization $5,257.1 Capital Stack Composition Capital Structure Detail ($ in millions) 1. Weighted average term to extended maturity of the 7 secured credit facilities, assuming all extension options and term-out provisions are exercised 2. Represents weighted average legal maturity date 3. Finances one Real Estate Owned asset with carrying value of $99.2M 4. Represents extended maturity date; initial maturity date is December 15, 2021 5. Represents fixed rate dividend TPG RE Finance Trust, Inc.| 1Q2021

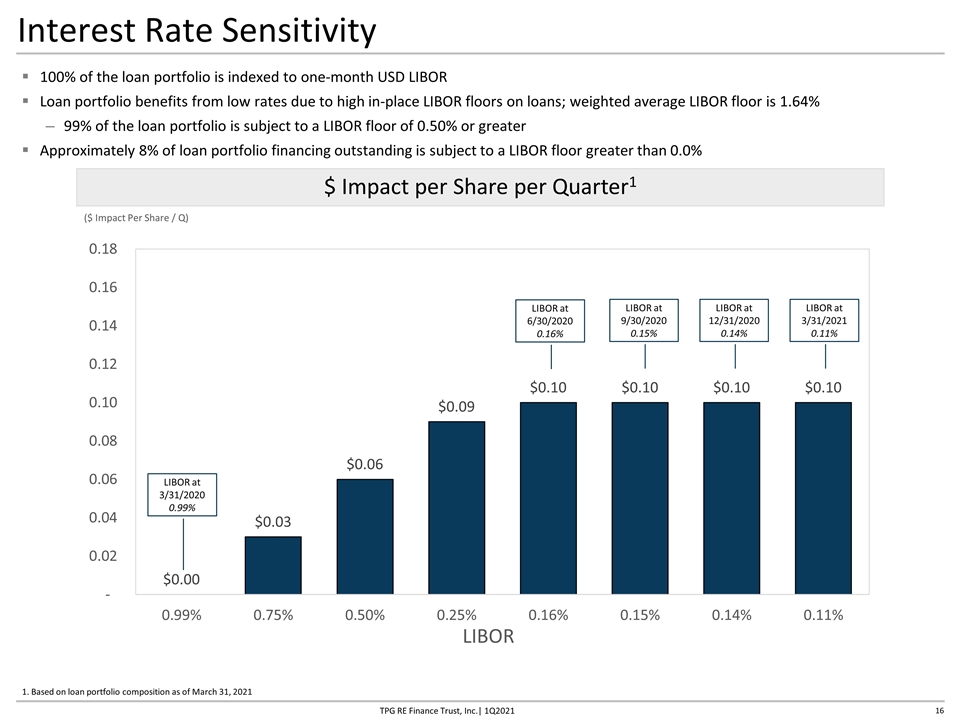

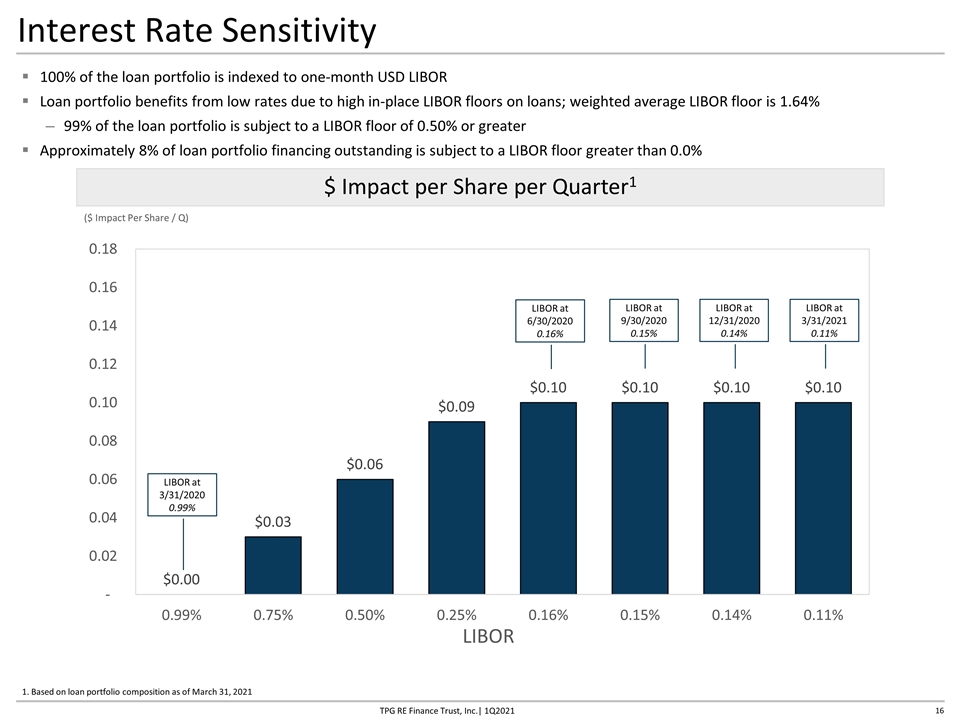

Interest Rate Sensitivity LIBOR $ Impact per Share per Quarter1 100% of the loan portfolio is indexed to one-month USD LIBOR Loan portfolio benefits from low rates due to high in-place LIBOR floors on loans; weighted average LIBOR floor is 1.64% 99% of the loan portfolio is subject to a LIBOR floor of 0.50% or greater Approximately 8% of loan portfolio financing outstanding is subject to a LIBOR floor greater than 0.0% 1. Based on loan portfolio composition as of March 31, 2021 LIBOR at 3/31/2020 0.99% LIBOR at 6/30/2020 0.16% LIBOR at 9/30/2020 0.15% LIBOR at 12/31/2020 0.14% LIBOR at 3/31/2021 0.11% TPG RE Finance Trust, Inc.| 1Q2021

Appendix

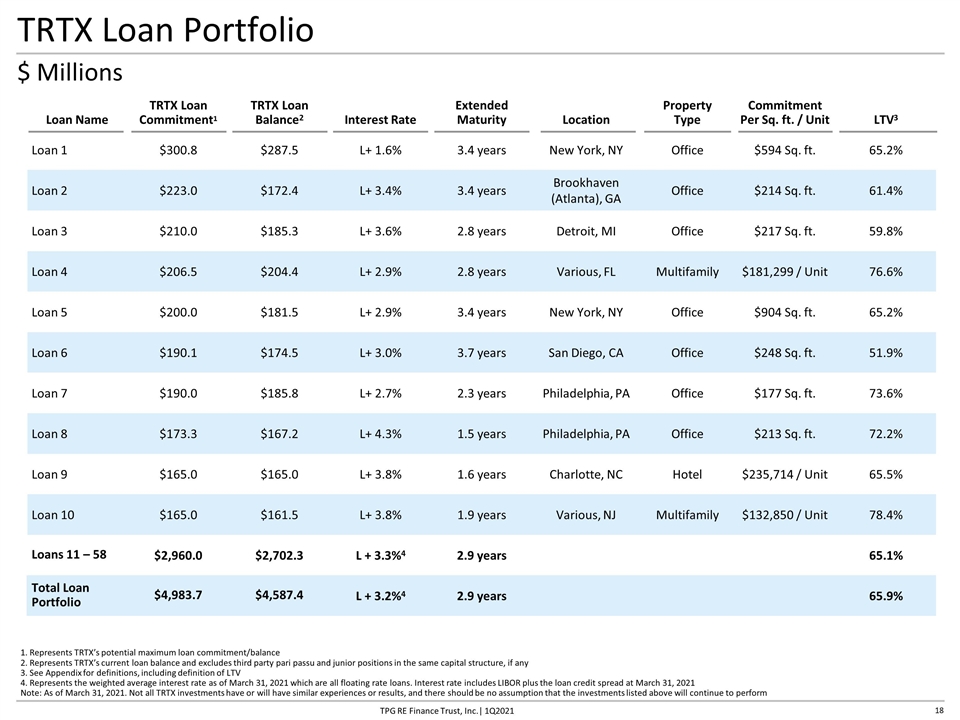

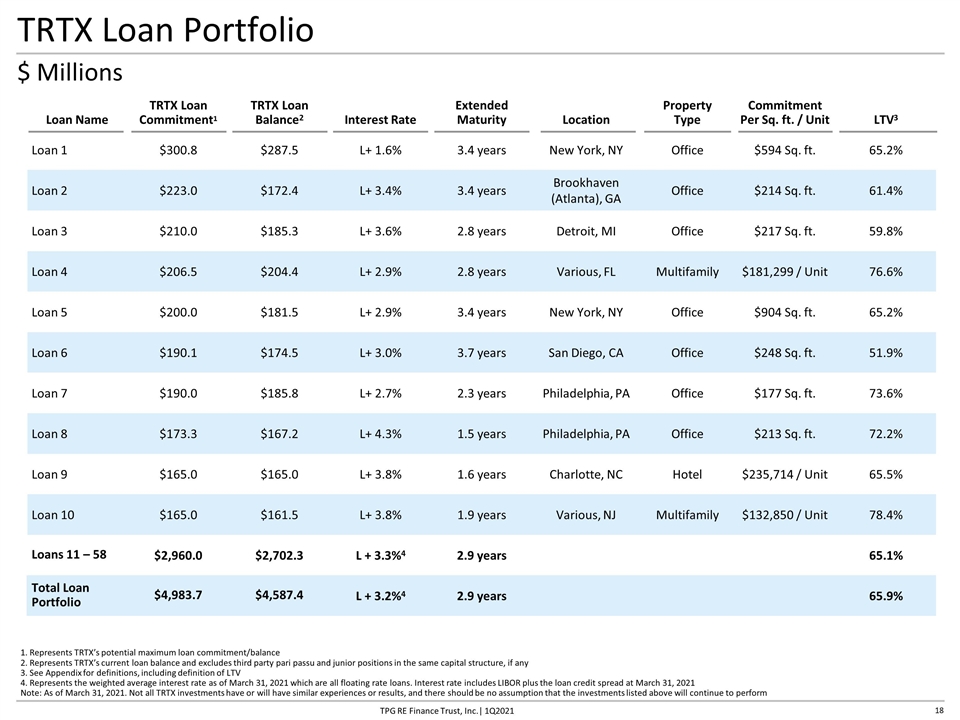

TRTX Loan Portfolio Loan Name TRTX Loan Commitment1 TRTX Loan Balance2 Interest Rate Extended Maturity Location Property Type Commitment Per Sq. ft. / Unit LTV3 Loan 1 $300.8 $287.5 L+ 1.6% 3.4 years New York, NY Office $594 Sq. ft. 65.2% Loan 2 $223.0 $172.4 L+ 3.4% 3.4 years Brookhaven (Atlanta), GA Office $214 Sq. ft. 61.4% Loan 3 $210.0 $185.3 L+ 3.6% 2.8 years Detroit, MI Office $217 Sq. ft. 59.8% Loan 4 $206.5 $204.4 L+ 2.9% 2.8 years Various, FL Multifamily $181,299 / Unit 76.6% Loan 5 $200.0 $181.5 L+ 2.9% 3.4 years New York, NY Office $904 Sq. ft. 65.2% Loan 6 $190.1 $174.5 L+ 3.0% 3.7 years San Diego, CA Office $248 Sq. ft. 51.9% Loan 7 $190.0 $185.8 L+ 2.7% 2.3 years Philadelphia, PA Office $177 Sq. ft. 73.6% Loan 8 $173.3 $167.2 L+ 4.3% 1.5 years Philadelphia, PA Office $213 Sq. ft. 72.2% Loan 9 $165.0 $165.0 L+ 3.8% 1.6 years Charlotte, NC Hotel $235,714 / Unit 65.5% Loan 10 $165.0 $161.5 L+ 3.8% 1.9 years Various, NJ Multifamily $132,850 / Unit 78.4% Loans 11 – 58 $2,960.0 $2,702.3 L + 3.3%4 2.9 years 65.1% Total Loan Portfolio $4,983.7 $4,587.4 L + 3.2%4 2.9 years 65.9% 1. Represents TRTX’s potential maximum loan commitment/balance 2. Represents TRTX’s current loan balance and excludes third party pari passu and junior positions in the same capital structure, if any 3. See Appendix for definitions, including definition of LTV 4. Represents the weighted average interest rate as of March 31, 2021 which are all floating rate loans. Interest rate includes LIBOR plus the loan credit spread at March 31, 2021 Note: As of March 31, 2021. Not all TRTX investments have or will have similar experiences or results, and there should be no assumption that the investments listed above will continue to perform $ Millions TPG RE Finance Trust, Inc.| 1Q2021

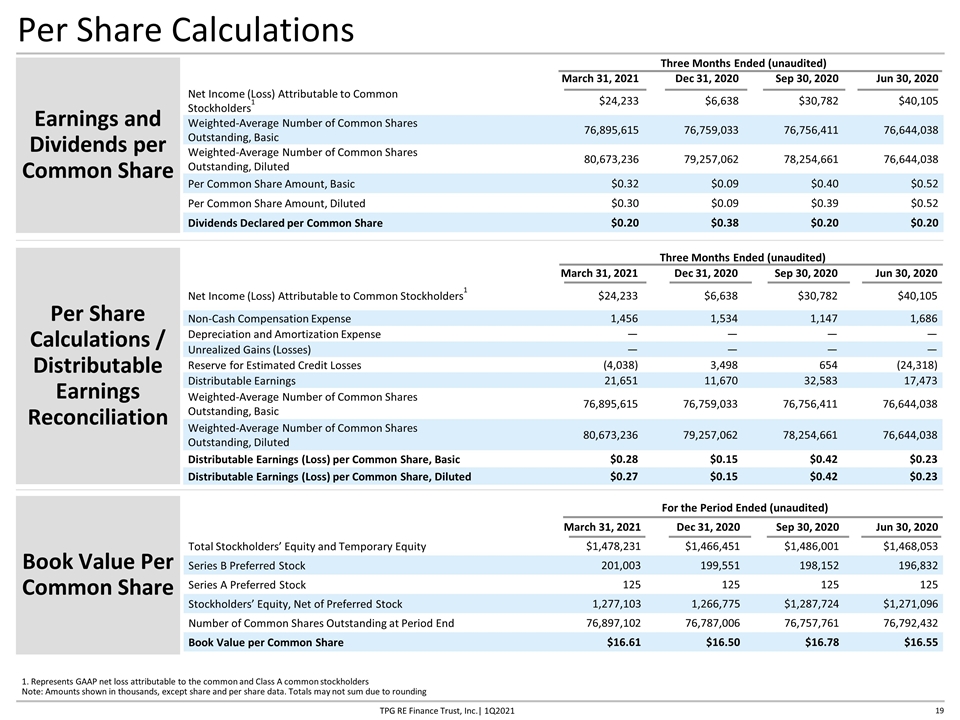

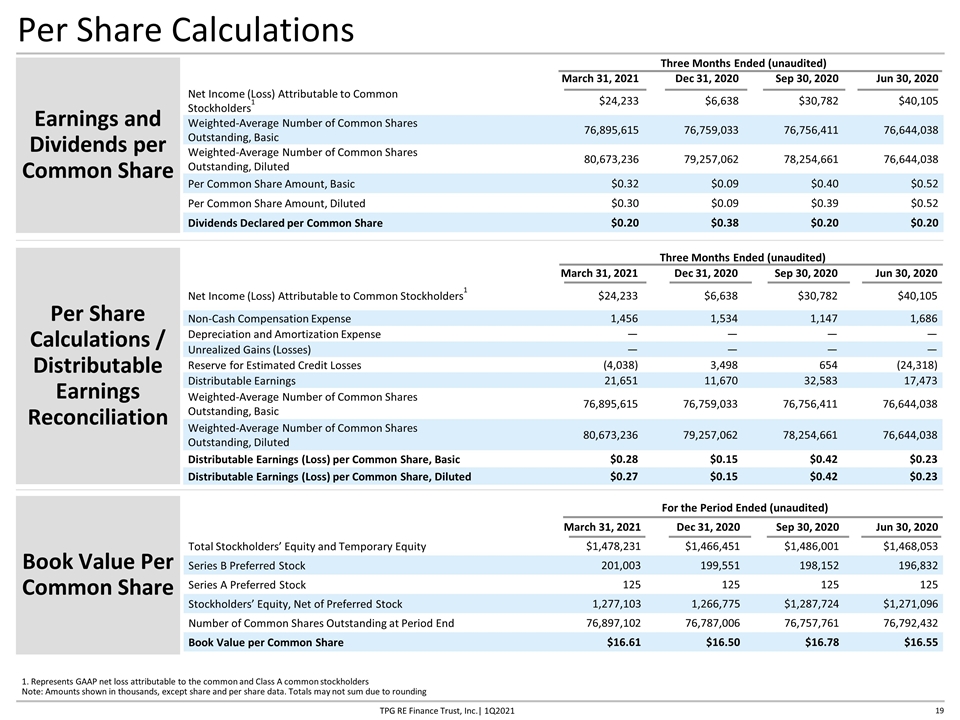

Per Share Calculations Per Share Calculations / Distributable Earnings Reconciliation Earnings and Dividends per Common Share Three Months Ended (unaudited) March 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Net Income (Loss) Attributable to Common Stockholders1 $24,233 $6,638 $30,782 $40,105 Weighted-Average Number of Common Shares Outstanding, Basic 76,895,615 76,759,033 76,756,411 76,644,038 Weighted-Average Number of Common Shares Outstanding, Diluted 80,673,236 79,257,062 78,254,661 76,644,038 Per Common Share Amount, Basic $0.32 $0.09 $0.40 $0.52 Per Common Share Amount, Diluted $0.30 $0.09 $0.39 $0.52 Dividends Declared per Common Share $0.20 $0.38 $0.20 $0.20 Three Months Ended (unaudited) March 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Net Income (Loss) Attributable to Common Stockholders1 $24,233 $6,638 $30,782 $40,105 Non-Cash Compensation Expense 1,456 1,534 1,147 1,686 Depreciation and Amortization Expense — — — — Unrealized Gains (Losses) — — — — Reserve for Estimated Credit Losses (4,038) 3,498 654 (24,318) Distributable Earnings 21,651 11,670 32,583 17,473 Weighted-Average Number of Common Shares Outstanding, Basic 76,895,615 76,759,033 76,756,411 76,644,038 Weighted-Average Number of Common Shares Outstanding, Diluted 80,673,236 79,257,062 78,254,661 76,644,038 Distributable Earnings (Loss) per Common Share, Basic $0.28 $0.15 $0.42 $0.23 Distributable Earnings (Loss) per Common Share, Diluted $0.27 $0.15 $0.42 $0.23 1. Represents GAAP net loss attributable to the common and Class A common stockholders Note: Amounts shown in thousands, except share and per share data. Totals may not sum due to rounding Book Value Per Common Share For the Period Ended (unaudited) March 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Total Stockholders’ Equity and Temporary Equity $1,478,231 $1,466,451 $1,486,001 $1,468,053 Series B Preferred Stock 201,003 199,551 198,152 196,832 Series A Preferred Stock 125 125 125 125 Stockholders’ Equity, Net of Preferred Stock 1,277,103 1,266,775 $1,287,724 $1,271,096 Number of Common Shares Outstanding at Period End 76,897,102 76,787,006 76,757,761 76,792,432 Book Value per Common Share $16.61 $16.50 $16.78 $16.55 TPG RE Finance Trust, Inc.| 1Q2021

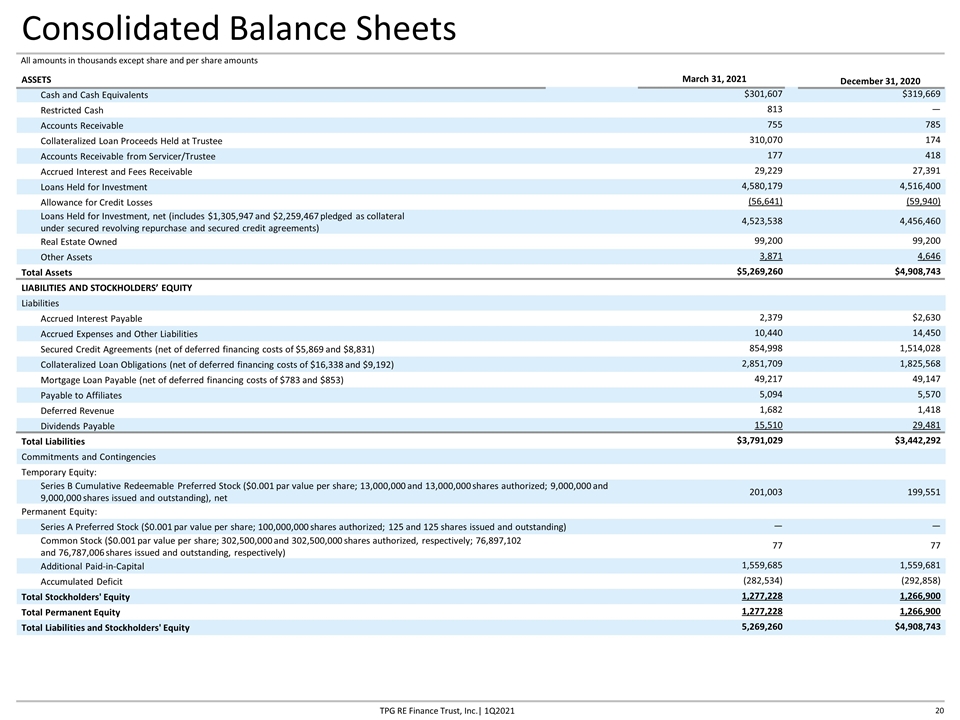

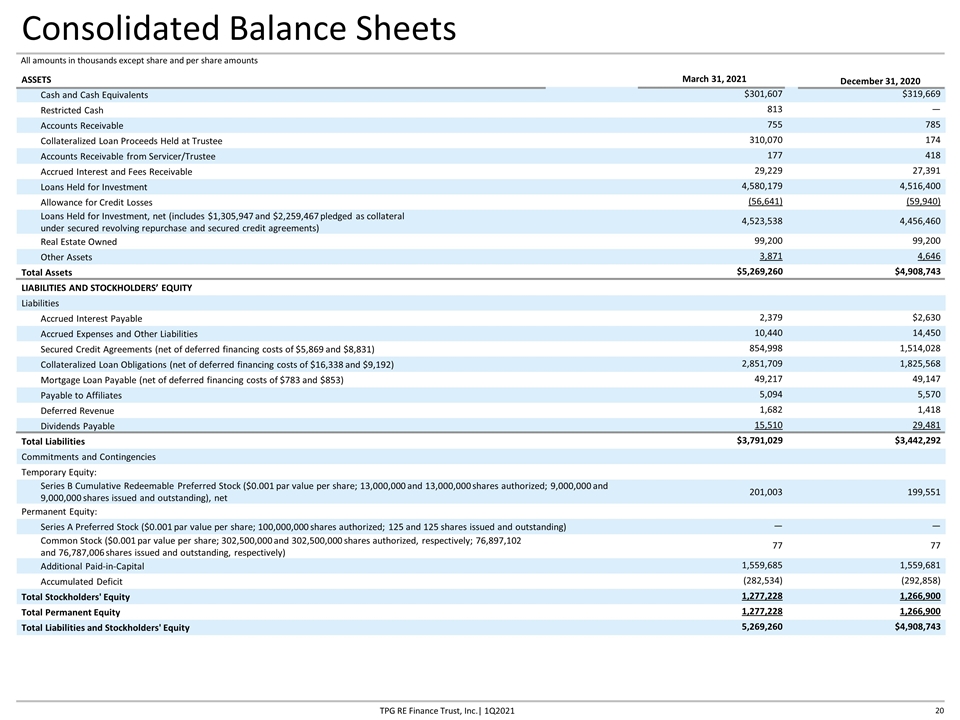

ASSETS March 31, 2021 December 31, 2020 Cash and Cash Equivalents $301,607 $319,669 Restricted Cash 813 — Accounts Receivable 755 785 Collateralized Loan Proceeds Held at Trustee 310,070 174 Accounts Receivable from Servicer/Trustee 177 418 Accrued Interest and Fees Receivable 29,229 27,391 Loans Held for Investment 4,580,179 4,516,400 Allowance for Credit Losses (56,641) (59,940) Loans Held for Investment, net (includes $1,305,947 and $2,259,467 pledged as collateral under secured revolving repurchase and secured credit agreements) 4,523,538 4,456,460 Real Estate Owned 99,200 99,200 Other Assets 3,871 4,646 Total Assets $5,269,260 $4,908,743 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Accrued Interest Payable 2,379 $2,630 Accrued Expenses and Other Liabilities 10,440 14,450 Secured Credit Agreements (net of deferred financing costs of $5,869 and $8,831) 854,998 1,514,028 Collateralized Loan Obligations (net of deferred financing costs of $16,338 and $9,192) 2,851,709 1,825,568 Mortgage Loan Payable (net of deferred financing costs of $783 and $853) 49,217 49,147 Payable to Affiliates 5,094 5,570 Deferred Revenue 1,682 1,418 Dividends Payable 15,510 29,481 Total Liabilities $3,791,029 $3,442,292 Commitments and Contingencies Temporary Equity: Series B Cumulative Redeemable Preferred Stock ($0.001 par value per share; 13,000,000 and 13,000,000 shares authorized; 9,000,000 and 9,000,000 shares issued and outstanding), net 201,003 199,551 Permanent Equity: Series A Preferred Stock ($0.001 par value per share; 100,000,000 shares authorized; 125 and 125 shares issued and outstanding) — — Common Stock ($0.001 par value per share; 302,500,000 and 302,500,000 shares authorized, respectively; 76,897,102 and 76,787,006 shares issued and outstanding, respectively) 77 77 Additional Paid-in-Capital 1,559,685 1,559,681 Accumulated Deficit (282,534) (292,858) Total Stockholders' Equity 1,277,228 1,266,900 Total Permanent Equity 1,277,228 1,266,900 Total Liabilities and Stockholders' Equity 5,269,260 $4,908,743 All amounts in thousands except share and per share amounts Consolidated Balance Sheets TPG RE Finance Trust, Inc.| 1Q2021

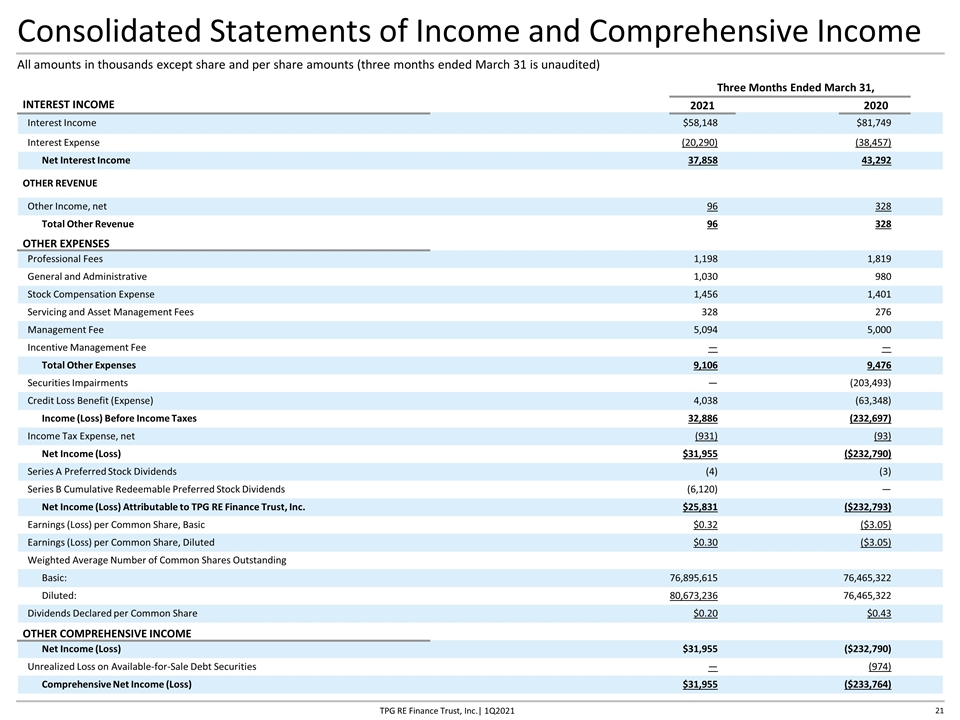

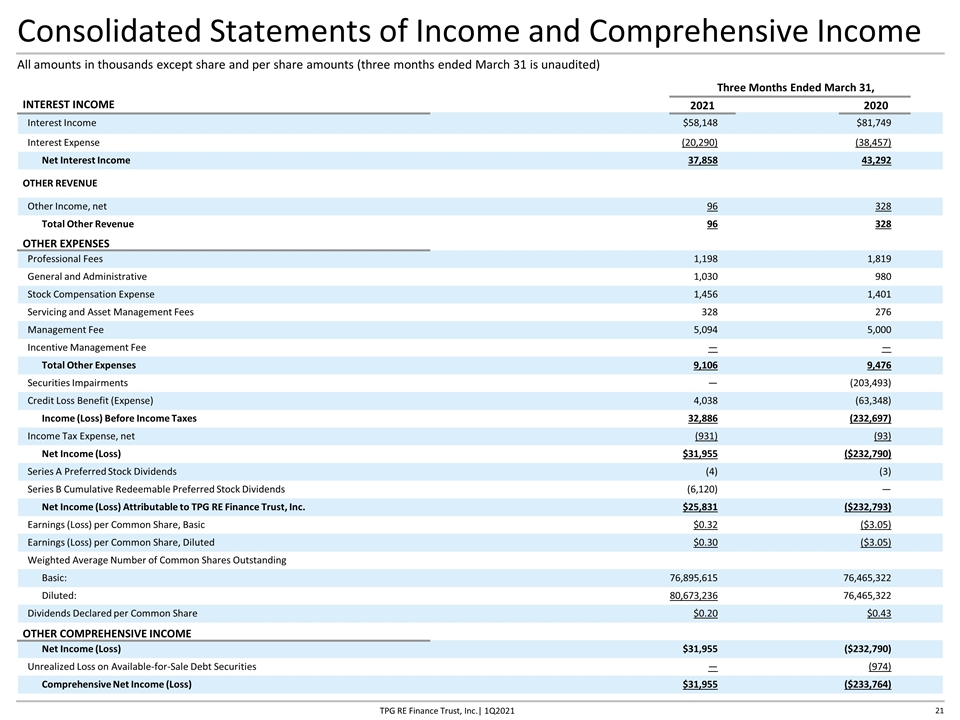

Consolidated Statements of Income and Comprehensive Income All amounts in thousands except share and per share amounts (three months ended March 31 is unaudited) Three Months Ended March 31, INTEREST INCOME 2021 2020 Interest Income $58,148 $81,749 Interest Expense (20,290) (38,457) Net Interest Income 37,858 43,292 OTHER REVENUE Other Income, net 96 328 Total Other Revenue 96 328 OTHER EXPENSES Professional Fees 1,198 1,819 General and Administrative 1,030 980 Stock Compensation Expense 1,456 1,401 Servicing and Asset Management Fees 328 276 Management Fee 5,094 5,000 Incentive Management Fee — — Total Other Expenses 9,106 9,476 Securities Impairments — (203,493) Credit Loss Benefit (Expense) 4,038 (63,348) Income (Loss) Before Income Taxes 32,886 (232,697) Income Tax Expense, net (931) (93) Net Income (Loss) $31,955 ($232,790) Series A Preferred Stock Dividends (4) (3) Series B Cumulative Redeemable Preferred Stock Dividends (6,120) — Net Income (Loss) Attributable to TPG RE Finance Trust, Inc. $25,831 ($232,793) Earnings (Loss) per Common Share, Basic $0.32 ($3.05) Earnings (Loss) per Common Share, Diluted $0.30 ($3.05) Weighted Average Number of Common Shares Outstanding Basic: 76,895,615 76,465,322 Diluted: 80,673,236 76,465,322 Dividends Declared per Common Share $0.20 $0.43 OTHER COMPREHENSIVE INCOME Net Income (Loss) $31,955 ($232,790) Unrealized Loss on Available-for-Sale Debt Securities — (974) Comprehensive Net Income (Loss) $31,955 ($233,764) TPG RE Finance Trust, Inc.| 1Q2021

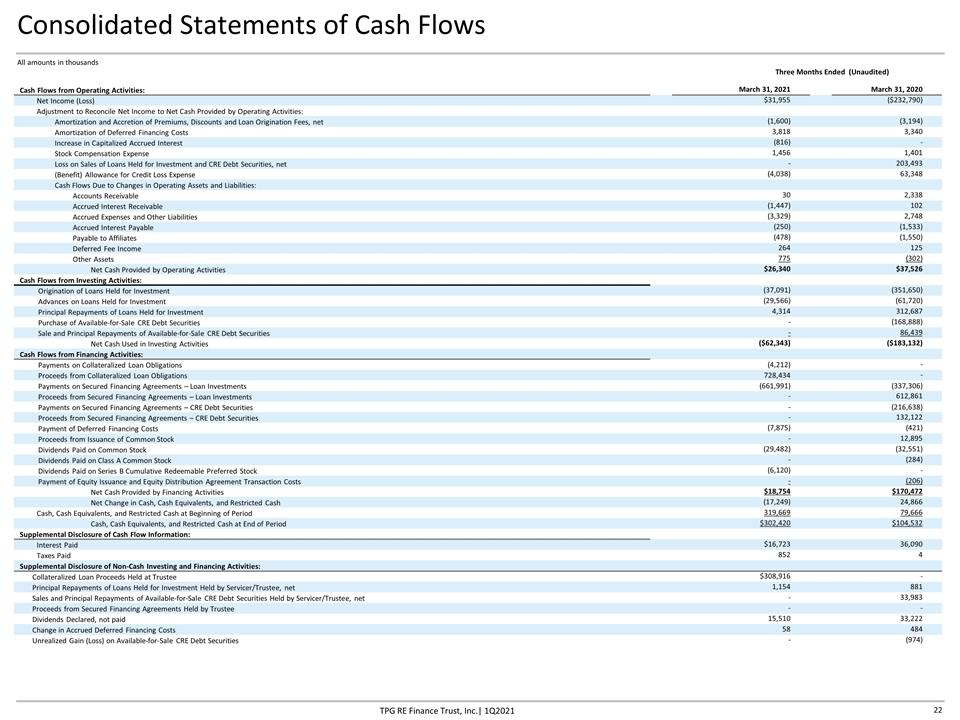

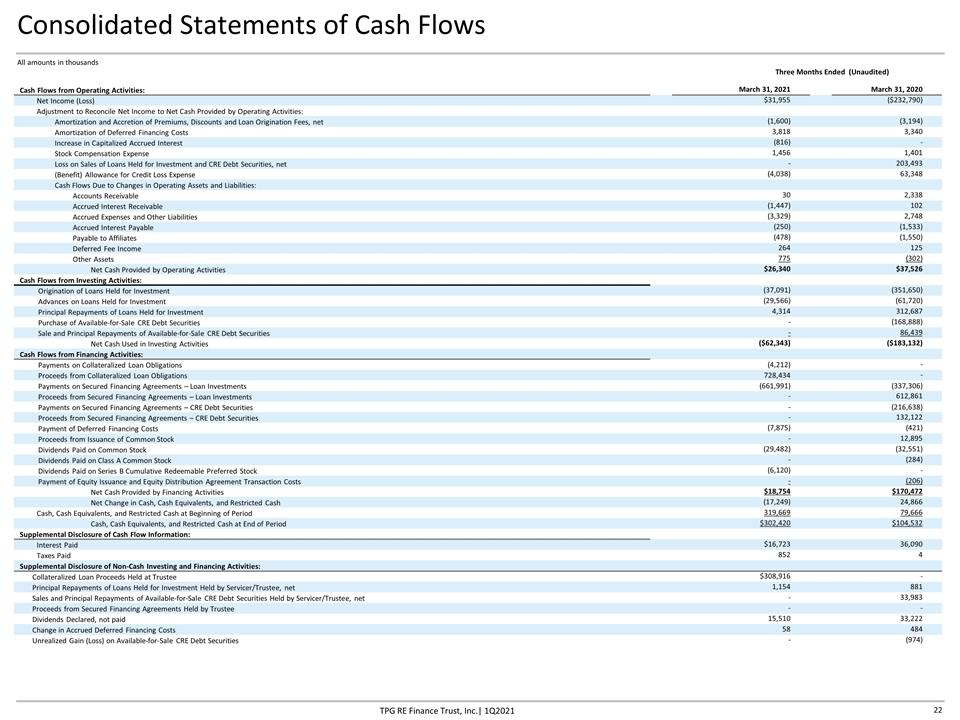

Cash Flows from Operating Activities: March 31, 2021 March 31, 2020 Net Income (Loss) $31,955 ($232,790) Adjustment to Reconcile Net Income to Net Cash Provided by Operating Activities: Amortization and Accretion of Premiums, Discounts and Loan Origination Fees, net (1,600) (3,194) Amortization of Deferred Financing Costs 3,818 3,340 Increase in Capitalized Accrued Interest (816) - Stock Compensation Expense 1,456 1,401 Loss on Sales of Loans Held for Investment and CRE Debt Securities, net - 203,493 (Benefit) Allowance for Credit Loss Expense (4,038) 63,348 Cash Flows Due to Changes in Operating Assets and Liabilities: Accounts Receivable 30 2,338 Accrued Interest Receivable (1,447) 102 Accrued Expenses and Other Liabilities (3,329) 2,748 Accrued Interest Payable (250) (1,533) Payable to Affiliates (478) (1,550) Deferred Fee Income 264 125 Other Assets 775 (302) Net Cash Provided by Operating Activities $26,340 $37,526 Cash Flows from Investing Activities: Origination of Loans Held for Investment (37,091) (351,650) Advances on Loans Held for Investment (29,566) (61,720) Principal Repayments of Loans Held for Investment 4,314 312,687 Purchase of Available-for-Sale CRE Debt Securities - (168,888) Sale and Principal Repayments of Available-for-Sale CRE Debt Securities - 86,439 Net Cash Used in Investing Activities ($62,343) ($183,132) Cash Flows from Financing Activities: Payments on Collateralized Loan Obligations (4,212) - Proceeds from Collateralized Loan Obligations 728,434 - Payments on Secured Financing Agreements – Loan Investments (661,991) (337,306) Proceeds from Secured Financing Agreements – Loan Investments - 612,861 Payments on Secured Financing Agreements – CRE Debt Securities - (216,638) Proceeds from Secured Financing Agreements – CRE Debt Securities - 132,122 Payment of Deferred Financing Costs (7,875) (421) Proceeds from Issuance of Common Stock - 12,895 Dividends Paid on Common Stock (29,482) (32,551) Dividends Paid on Class A Common Stock - (284) Dividends Paid on Series B Cumulative Redeemable Preferred Stock (6,120) - Payment of Equity Issuance and Equity Distribution Agreement Transaction Costs - (206) Net Cash Provided by Financing Activities $18,754 $170,472 Net Change in Cash, Cash Equivalents, and Restricted Cash (17,249) 24,866 Cash, Cash Equivalents, and Restricted Cash at Beginning of Period 319,669 79,666 Cash, Cash Equivalents, and Restricted Cash at End of Period $302,420 $104,532 Supplemental Disclosure of Cash Flow Information: Interest Paid $16,723 36,090 Taxes Paid 852 4 Supplemental Disclosure of Non-Cash Investing and Financing Activities: Collateralized Loan Proceeds Held at Trustee $308,916 - Principal Repayments of Loans Held for Investment Held by Servicer/Trustee, net 1,154 881 Sales and Principal Repayments of Available-for-Sale CRE Debt Securities Held by Servicer/Trustee, net - 33,983 Proceeds from Secured Financing Agreements Held by Trustee - - Dividends Declared, not paid 15,510 33,222 Change in Accrued Deferred Financing Costs 58 484 Unrealized Gain (Loss) on Available-for-Sale CRE Debt Securities - (974) Consolidated Statements of Cash Flows All amounts in thousands Three Months Ended (Unaudited) TPG RE Finance Trust, Inc.| 1Q2021

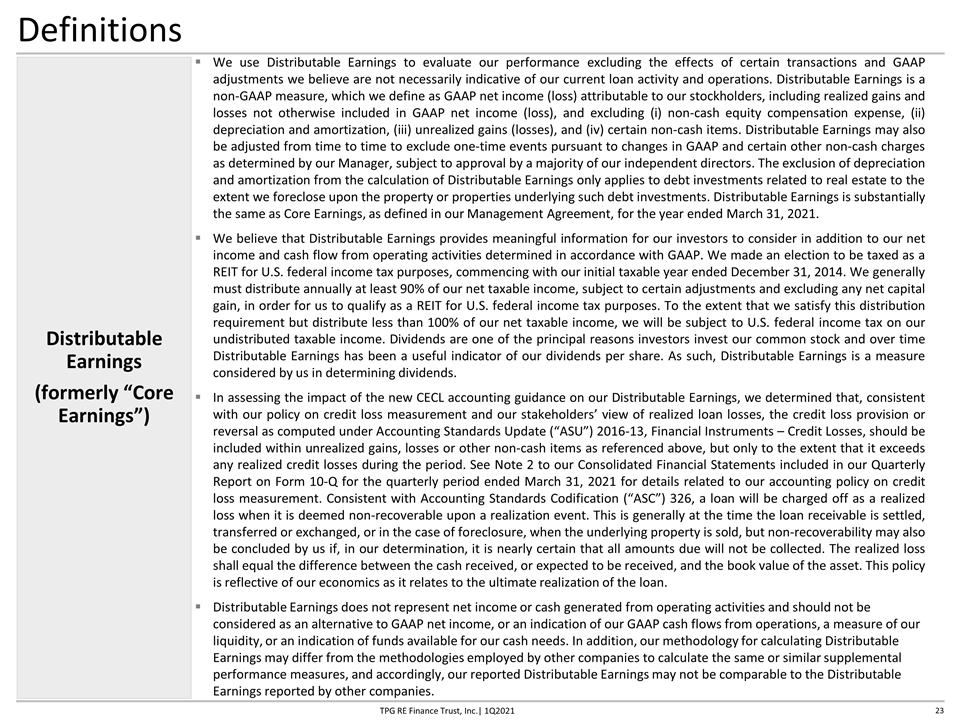

Definitions We use Distributable Earnings to evaluate our performance excluding the effects of certain transactions and GAAP adjustments we believe are not necessarily indicative of our current loan activity and operations. Distributable Earnings is a non-GAAP measure, which we define as GAAP net income (loss) attributable to our stockholders, including realized gains and losses not otherwise included in GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Distributable Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by our Manager, subject to approval by a majority of our independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. Distributable Earnings is substantially the same as Core Earnings, as defined in our Management Agreement, for the year ended March 31, 2021. We believe that Distributable Earnings provides meaningful information for our investors to consider in addition to our net income and cash flow from operating activities determined in accordance with GAAP. We made an election to be taxed as a REIT for U.S. federal income tax purposes, commencing with our initial taxable year ended December 31, 2014. We generally must distribute annually at least 90% of our net taxable income, subject to certain adjustments and excluding any net capital gain, in order for us to qualify as a REIT for U.S. federal income tax purposes. To the extent that we satisfy this distribution requirement but distribute less than 100% of our net taxable income, we will be subject to U.S. federal income tax on our undistributed taxable income. Dividends are one of the principal reasons investors invest our common stock and over time Distributable Earnings has been a useful indicator of our dividends per share. As such, Distributable Earnings is a measure considered by us in determining dividends. In assessing the impact of the new CECL accounting guidance on our Distributable Earnings, we determined that, consistent with our policy on credit loss measurement and our stakeholders’ view of realized loan losses, the credit loss provision or reversal as computed under Accounting Standards Update (“ASU”) 2016-13, Financial Instruments – Credit Losses, should be included within unrealized gains, losses or other non-cash items as referenced above, but only to the extent that it exceeds any realized credit losses during the period. See Note 2 to our Consolidated Financial Statements included in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021 for details related to our accounting policy on credit loss measurement. Consistent with Accounting Standards Codification (“ASC”) 326, a loan will be charged off as a realized loss when it is deemed non-recoverable upon a realization event. This is generally at the time the loan receivable is settled, transferred or exchanged, or in the case of foreclosure, when the underlying property is sold, but non-recoverability may also be concluded by us if, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss shall equal the difference between the cash received, or expected to be received, and the book value of the asset. This policy is reflective of our economics as it relates to the ultimate realization of the loan. Distributable Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to GAAP net income, or an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. Distributable Earnings (formerly “Core Earnings”) TPG RE Finance Trust, Inc.| 1Q2021

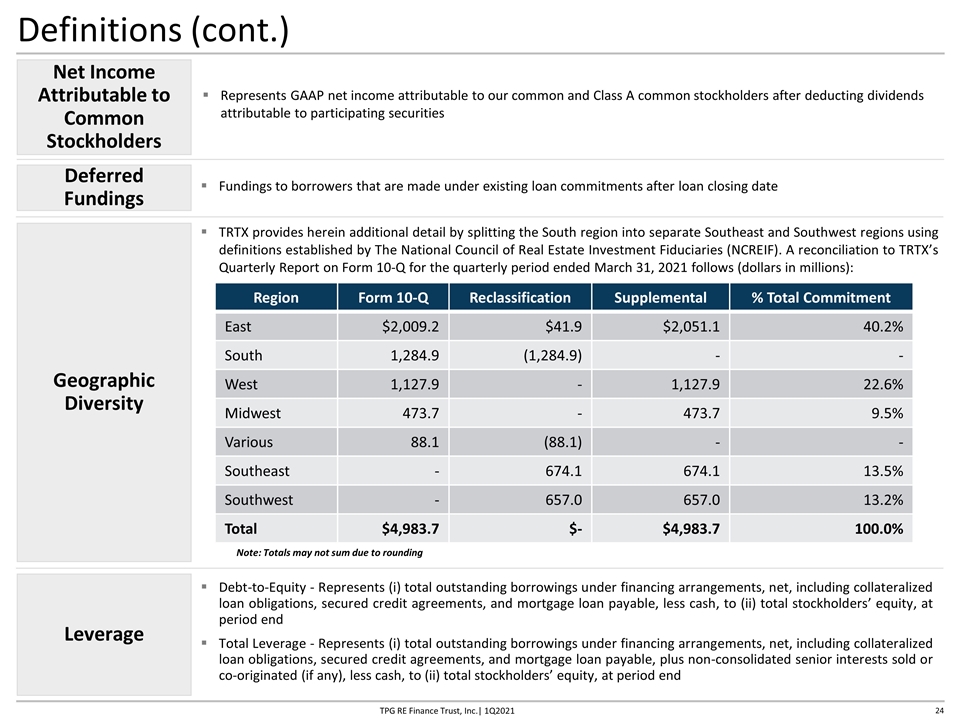

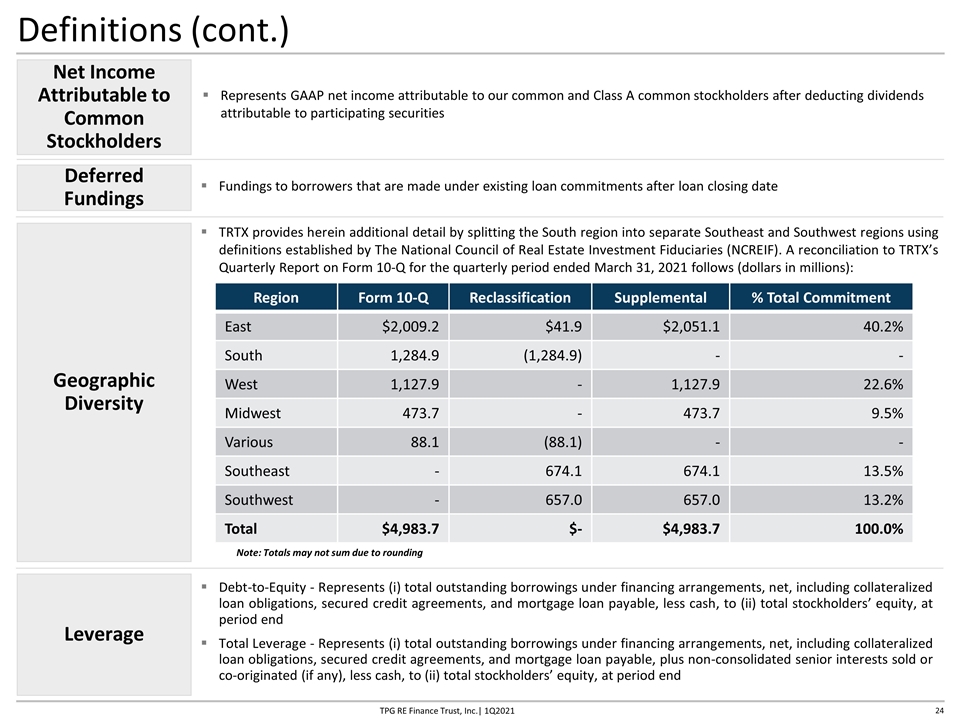

Definitions (cont.) Debt-to-Equity - Represents (i) total outstanding borrowings under financing arrangements, net, including collateralized loan obligations, secured credit agreements, and mortgage loan payable, less cash, to (ii) total stockholders’ equity, at period end Total Leverage - Represents (i) total outstanding borrowings under financing arrangements, net, including collateralized loan obligations, secured credit agreements, and mortgage loan payable, plus non-consolidated senior interests sold or co-originated (if any), less cash, to (ii) total stockholders’ equity, at period end Leverage Fundings to borrowers that are made under existing loan commitments after loan closing date Deferred Fundings Geographic Diversity TRTX provides herein additional detail by splitting the South region into separate Southeast and Southwest regions using definitions established by The National Council of Real Estate Investment Fiduciaries (NCREIF). A reconciliation to TRTX’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021 follows (dollars in millions): Region Form 10-Q Reclassification Supplemental % Total Commitment East $2,009.2 $41.9 $2,051.1 40.2% South 1,284.9 (1,284.9) - - West 1,127.9 - 1,127.9 22.6% Midwest 473.7 - 473.7 9.5% Various 88.1 (88.1) - - Southeast - 674.1 674.1 13.5% Southwest - 657.0 657.0 13.2% Total $4,983.7 $- $4,983.7 100.0% Note: Totals may not sum due to rounding Represents GAAP net income attributable to our common and Class A common stockholders after deducting dividends attributable to participating securities Net Income Attributable to Common Stockholders TPG RE Finance Trust, Inc.| 1Q2021

Definitions (cont.) Bridge/Stabilization Loan - A loan with limited deferred fundings, generally less than 10% of the total loan commitment, which fundings are commonly conditioned on the borrower’s satisfaction of certain collateral performance tests. The related business plan generally involves little or no capital expenditure related to base building work (e.g., building mechanical systems, lobbies, elevators, common areas, or other amenities), with most deferred fundings related to leasing activity. The primary focus is on maintaining or improving current operating cash flow, or addressing minimal lease expirations or existing tenant vacancies Light Transitional Loan - A transitional loan with deferred fundings ranging from 10% to 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan is to lease existing or forecasted tenant vacancy to achieve stabilized occupancy and cash flow. Capital expenditure is primarily to fund leasing commissions and tenant improvements for new tenant leases, and capital expenditure allocated to base building work generally does not exceed 20%. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Moderate Transitional Loan - A transitional loan with deferred fundings greater than 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan generally involves capital expenditure for base building work needed before substantial leasing activity can be achieved, followed by capital expenditure for tenant improvements and leasing commissions to achieve stabilized occupancy and cash flow. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Construction Loan - A loan made to a borrower to fund the ground-up construction of a commercial real estate property Loan Category Except for construction loans, LTV is calculated for loan originations and existing loans as the total outstanding principal balance of the loan or participation interest in a loan (plus any financing that is pari passu with or senior to such loan or participation interest) as of March 31, 2021, divided by the as-is appraised value of our collateral at the time of origination or acquisition of such loan or participation interest. For construction loans only, LTV is calculated as the total commitment amount of the loan divided by the as-stabilized value of the real estate securing the loan. The as-is or as-stabilized (as applicable) value reflects our Manager’s estimates, at the time of origination or acquisition of the loan or participation interest in a loan, of the real estate value underlying such loan or participation interest determined in accordance with our Manager’s underwriting standards and consistent with third-party appraisals obtained by our Manager Loan-to-Value (LTV) TPG RE Finance Trust, Inc.| 1Q2021

Definitions (cont.) Loan Risk Ratings Using on a 5-point scale, TRTX’s loans are rated “1” through “5,” from least risk to greatest risk, respectively, on a quarterly basis. Risk ratings are presented by amortized cost. The loan risk ratings are defined as follows: 1: Outperform—Exceeds performance metrics (for example, technical milestones, occupancy, rents, net operating income) included in original or current credit underwriting and business plan; 2: Meets or Exceeds Expectations—Collateral performance meets or exceeds substantially all performance metrics included in original or current underwriting / business plan; 3: Satisfactory—Collateral performance meets or is on track to meet underwriting; business plan is met or can reasonably be achieved; 4: Underperformance—Collateral performance falls short of original underwriting, material differences exist from business plan, or both; technical milestones have been missed; defaults may exist, or may soon occur absent material improvement; and 5: Default/Possibility of Loss—Collateral performance is significantly worse than underwriting; major variance from business plan; loan covenants or technical milestones have been breached; timely exit from loan via sale or refinancing is questionable; significant risk of principal loss. Non-consolidated Senior Interest TRTX creates structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third-party. In either case, the senior mortgage loan (i.e., the non-consolidated senior interest) is not included on our balance sheet. When we create structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third-party, we retain on our balance sheet a mezzanine loan Mixed-Use Loan TRTX classifies a loan as mixed-use if the property securing TRTX’s loan: (a) involves more than one use; and (b) no single use represents more than 60% of the collateral property’s total value. In certain instances, TRTX’s classification may be determined by its assessment of which use is the principal driver of the property’s aggregate net operating income TPG RE Finance Trust, Inc.| 1Q2021

Company Information Contact Information Headquarters: 888 Seventh Avenue 35th Floor New York, NY 10106 New York Stock Exchange: Symbol: TRTX TPG RE Finance Trust, Inc. Bob Foley Chief Financial Officer +1 (212) 430-4111 bfoley@tpg.com Investor Relations: +1 (212) 405-8500 IR@tpgrefinance.com Media Contact: TPG RE Finance Trust, Inc. Courtney Power +1 (415) 743-1550 media@tpg.com Analyst Coverage BTIG Tim Hayes +1 (212) 738-6199 Citigroup Securities Arren Cyganovich +1 (212) 816-3733 JMP Securities Steven DeLaney +1 (212) 906-3517 JP Morgan Charlie Arestia +1 (212) 622-0755 Raymond James Stephen Laws +1 (901) 579-4868 Wells Fargo Donald Fandetti +1 (212) 214-8069 Transfer Agent American Stock Transfer & Trust Company, LLC +1 (800) 937-5449 help@astfinancial.com TPG RE Finance Trust, Inc. is a commercial real estate finance company that originates, acquires, and manages primarily first mortgage loans secured by institutional properties located in primary and select secondary markets in the United States. The Company is externally managed by TPG RE Finance Trust Management, L.P., a part of TPG Real Estate, which is the real estate investment platform of global alternative asset firm TPG. For more information regarding TRTX, visit www.tpgrefinance.com. TPG RE Finance Trust, Inc.| 1Q2021