February 26, 2018 Fourth Quarter and Full Year 2017 Operating Results Exhibit 99.2

TPG RE Finance Trust, Inc. Reports Fourth Quarter and Full Year 2017 Operating Results ABOUT TRTX TPG RE Finance Trust, Inc. (NYSE:TRTX) (the “Company” or “TRTX”) is a commercial real estate finance company, operating as a real estate investment trust (“REIT”), that focuses primarily on directly originating, acquiring, and managing commercial mortgage loans and other commercial real estate-related debt instruments for its balance sheet. The Company is externally managed by TPG RE Finance Trust Management, L.P., an affiliate of TPG Global, LLC (“TPG”), a leading global alternative investment firm with a 25-year history and approximately $79 billion of assets under management. For more information regarding TRTX, visit www.tpgrefinance.com. FORWARD-LOOKING STATEMENTS The information contained in this earnings presentation contains “forward‐looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of the Company’s investments, the Company’s ability to originate loans that are in the pipeline and under evaluation by the Company, and financing needs and arrangements. Forward‐looking statements are generally identifiable by use of forward‐looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue” or other similar words or expressions. Forward‐looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition or state other forward‐looking information. Statements relating to the Company’s ability to fund loans that are under signed term sheets and in closing and originate loans in the pipeline the Company is evaluating are forward-looking statements, and the Company cannot assure you that TRTX will close loans that are under signed term sheets and in closing, or enter into definitive documents and close any of the loans in the pipeline that the Company is evaluating. The ability of TRTX to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain. Although the Company believes that such forward‐looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward‐looking statements. You are cautioned not to place undue reliance on these forward‐looking statements, which reflect the Company’s views only as of the date of this earnings presentation. Except as required by law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward‐looking statements appearing in this earnings presentation. The Company does not undertake any obligation to update any forward-looking statements contained in this earnings presentation as a result of new information, future events or otherwise. INVESTOR RELATIONS CONTACT (212) 405-8500 IR@tpgrefinance.com MEDIA CONTACT TPG RE Finance Trust Luke Barrett (415) 743-1550 media@tpg.com

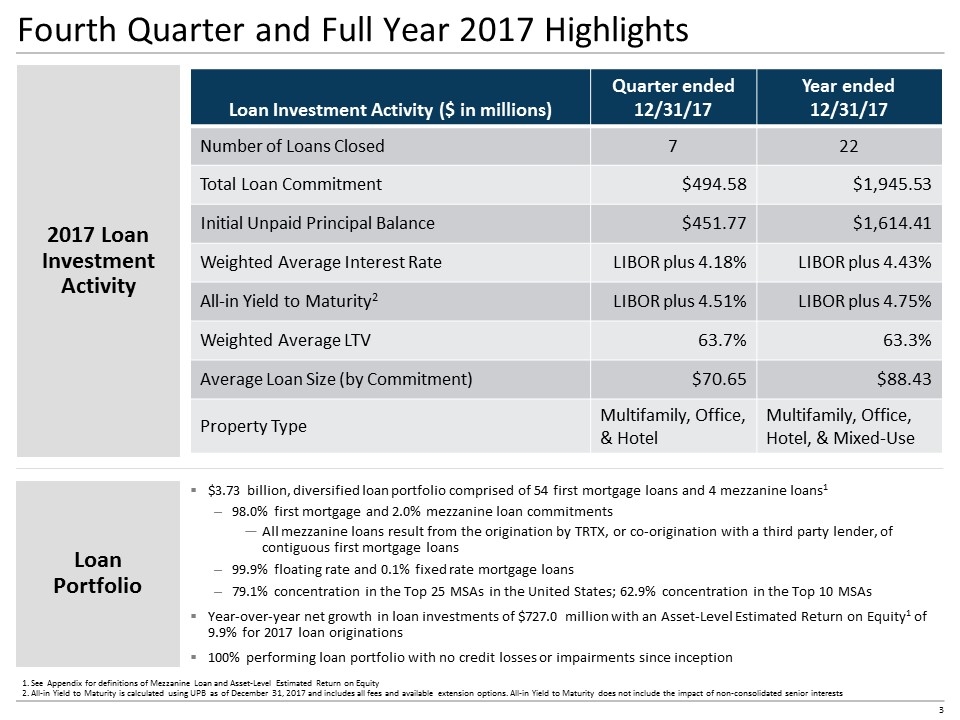

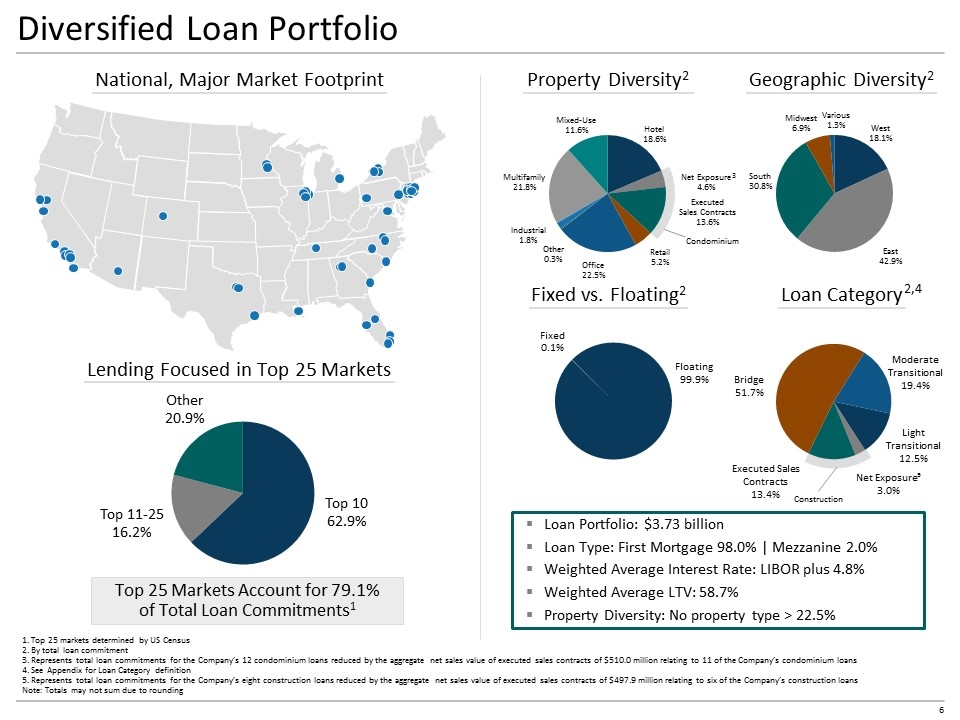

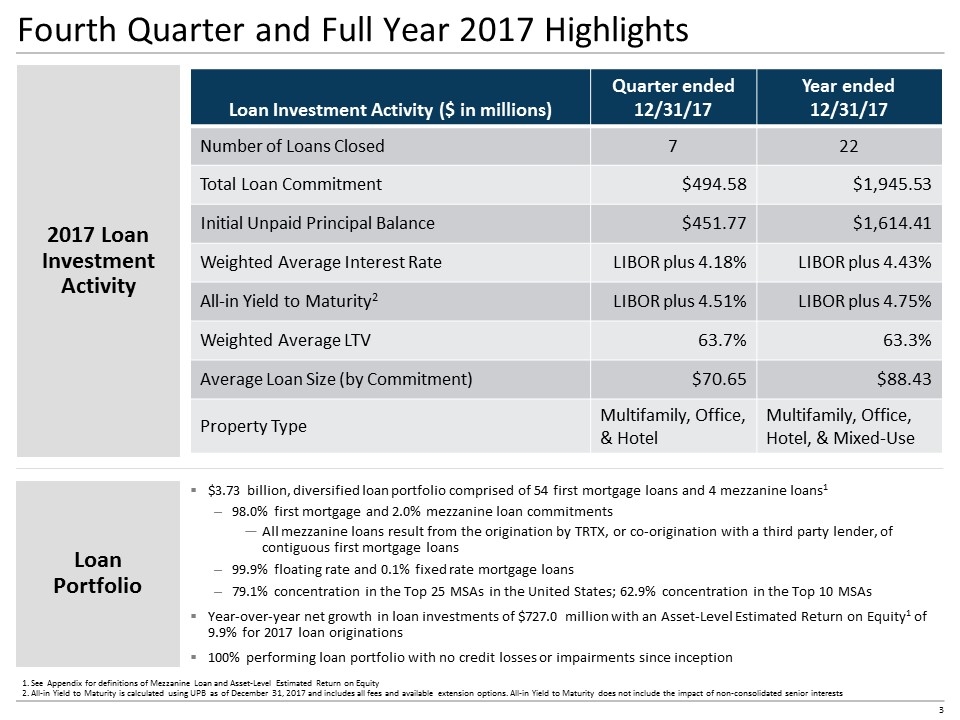

Fourth Quarter and Full Year 2017 Highlights 2017 Loan Investment Activity Loan Portfolio $3.73 billion, diversified loan portfolio comprised of 54 first mortgage loans and 4 mezzanine loans1 98.0% first mortgage and 2.0% mezzanine loan commitments All mezzanine loans result from the origination by TRTX, or co-origination with a third party lender, of contiguous first mortgage loans 99.9% floating rate and 0.1% fixed rate mortgage loans 79.1% concentration in the Top 25 MSAs in the United States; 62.9% concentration in the Top 10 MSAs Year-over-year net growth in loan investments of $727.0 million with an Asset-Level Estimated Return on Equity1 of 9.9% for 2017 loan originations 100% performing loan portfolio with no credit losses or impairments since inception 1. See Appendix for definitions of Mezzanine Loan and Asset-Level Estimated Return on Equity 2. All-in Yield to Maturity is calculated using UPB as of December 31, 2017 and includes all fees and available extension options. All-in Yield to Maturity does not include the impact of non-consolidated senior interests Loan Investment Activity ($ in millions) Quarter ended 12/31/17 Year ended 12/31/17 Number of Loans Closed 7 22 Total Loan Commitment $494.58 $1,945.53 Initial Unpaid Principal Balance $451.77 $1,614.41 Weighted Average Interest Rate LIBOR plus 4.18% LIBOR plus 4.43% All-in Yield to Maturity2 LIBOR plus 4.51% LIBOR plus 4.75% Weighted Average LTV 63.7% 63.3% Average Loan Size (by Commitment) $70.65 $88.43 Property Type Multifamily, Office, & Hotel Multifamily, Office, Hotel, & Mixed-Use

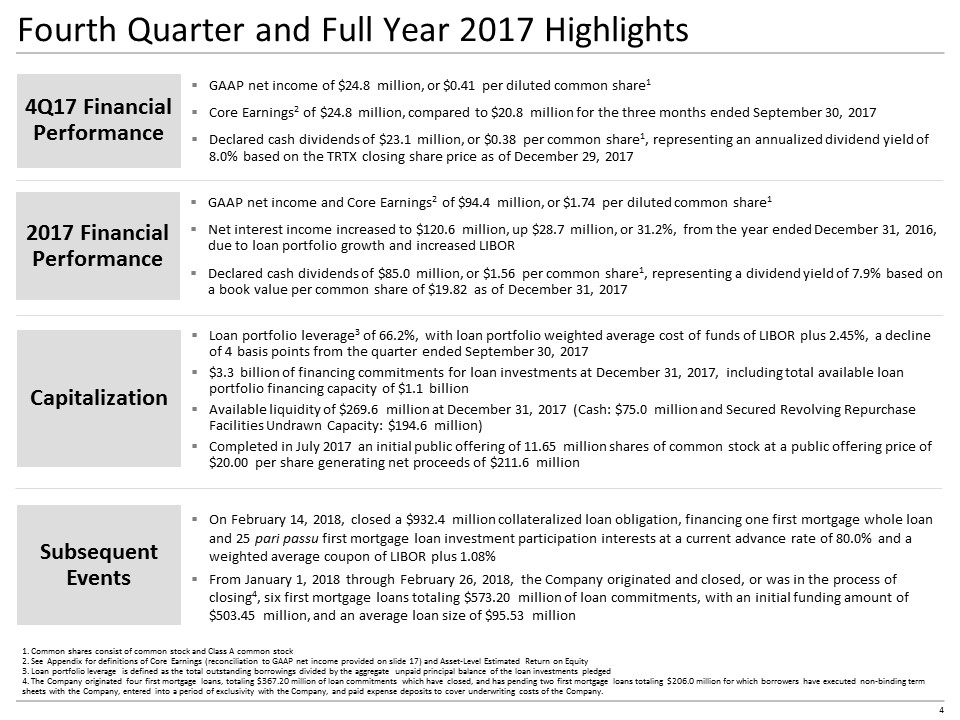

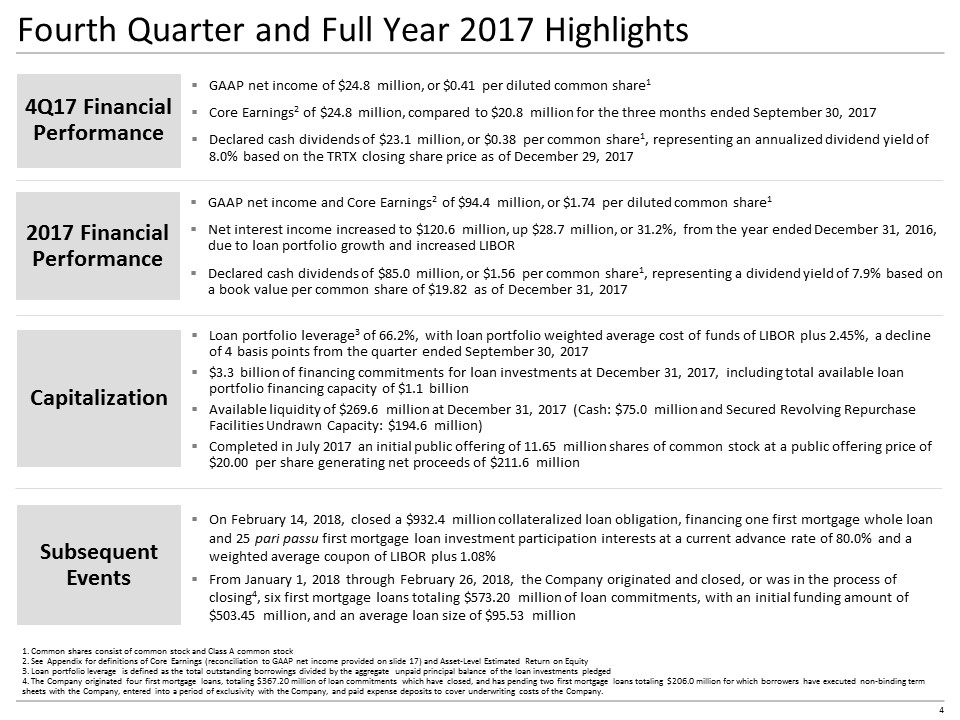

Fourth Quarter and Full Year 2017 Highlights Loan portfolio leverage3 of 66.2%, with loan portfolio weighted average cost of funds of LIBOR plus 2.45%, a decline of 4 basis points from the quarter ended September 30, 2017 $3.3 billion of financing commitments for loan investments at December 31, 2017, including total available loan portfolio financing capacity of $1.1 billion Available liquidity of $269.6 million at December 31, 2017 (Cash: $75.0 million and Secured Revolving Repurchase Facilities Undrawn Capacity: $194.6 million) Completed in July 2017 an initial public offering of 11.65 million shares of common stock at a public offering price of $20.00 per share generating net proceeds of $211.6 million Capitalization 2017 Financial Performance 1. Common shares consist of common stock and Class A common stock 2. See Appendix for definitions of Core Earnings (reconciliation to GAAP net income provided on slide 17) and Asset-Level Estimated Return on Equity 3. Loan portfolio leverage is defined as the total outstanding borrowings divided by the aggregate unpaid principal balance of the loan investments pledged 4. The Company originated four first mortgage loans, totaling $367.20 million of loan commitments which have closed, and has pending two first mortgage loans totaling $206.0 million for which borrowers have executed non-binding term sheets with the Company, entered into a period of exclusivity with the Company, and paid expense deposits to cover underwriting costs of the Company. GAAP net income of $24.8 million, or $0.41 per diluted common share1 Core Earnings2 of $24.8 million, compared to $20.8 million for the three months ended September 30, 2017 Declared cash dividends of $23.1 million, or $0.38 per common share1, representing an annualized dividend yield of 8.0% based on the TRTX closing share price as of December 29, 2017 4Q17 Financial Performance GAAP net income and Core Earnings2 of $94.4 million, or $1.74 per diluted common share1 Net interest income increased to $120.6 million, up $28.7 million, or 31.2%, from the year ended December 31, 2016, due to loan portfolio growth and increased LIBOR Declared cash dividends of $85.0 million, or $1.56 per common share1, representing a dividend yield of 7.9% based on a book value per common share of $19.82 as of December 31, 2017 Subsequent Events On February 14, 2018, closed a $932.4 million collateralized loan obligation, financing one first mortgage whole loan and 25 pari passu first mortgage loan investment participation interests at a current advance rate of 80.0% and a weighted average coupon of LIBOR plus 1.08% From January 1, 2018 through February 26, 2018, the Company originated and closed, or was in the process of closing4, six first mortgage loans totaling $573.20 million of loan commitments, with an initial funding amount of $503.45 million, and an average loan size of $95.53 million

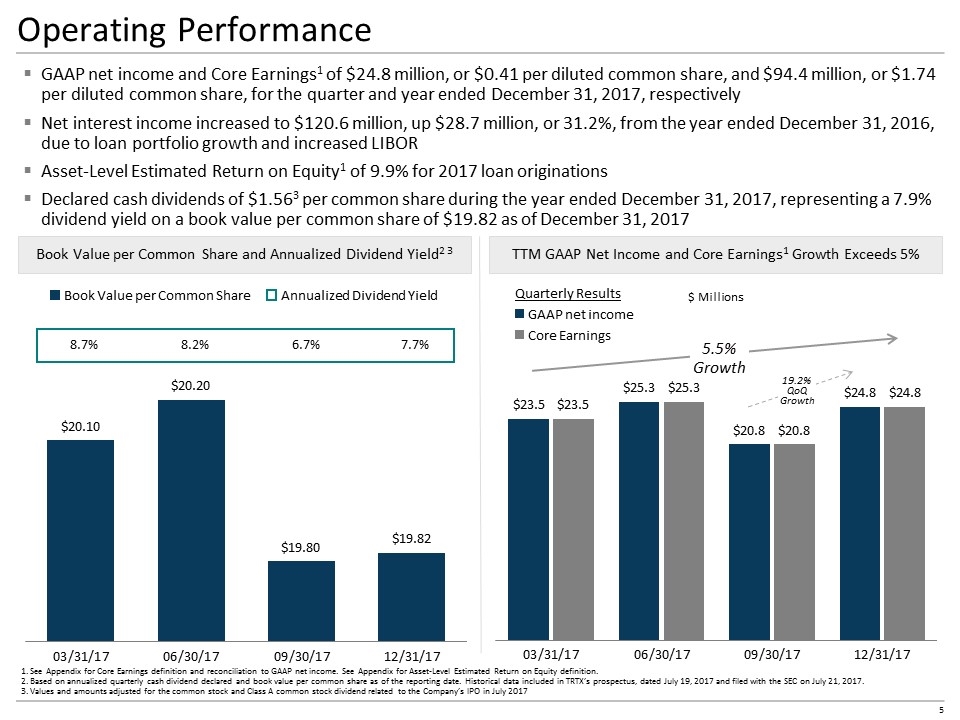

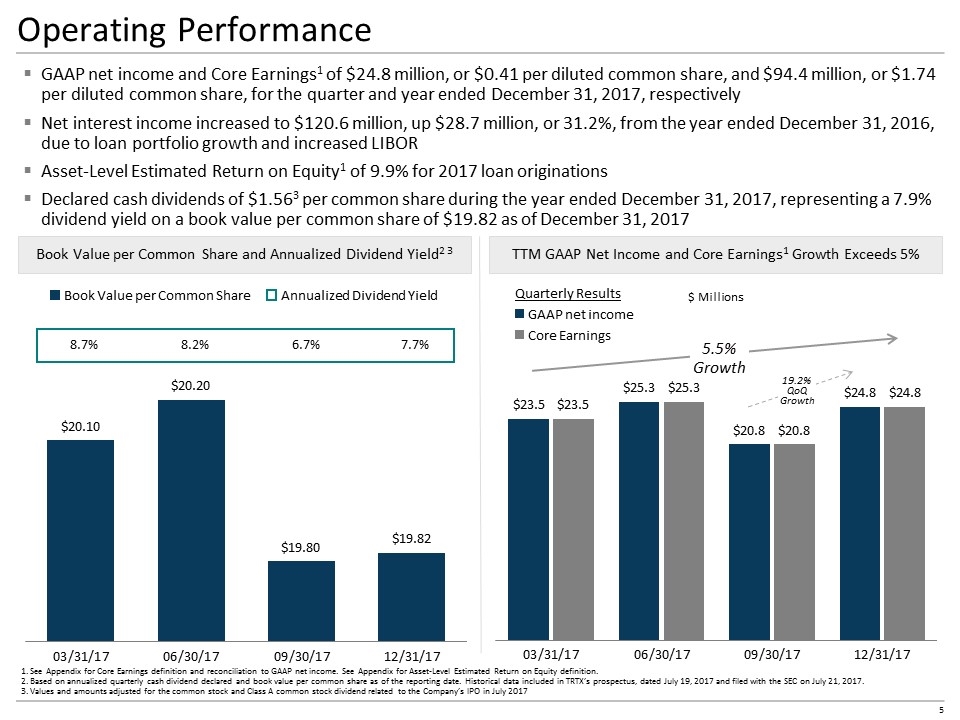

Operating Performance GAAP net income and Core Earnings1 of $24.8 million, or $0.41 per diluted common share, and $94.4 million, or $1.74 per diluted common share, for the quarter and year ended December 31, 2017, respectively Net interest income increased to $120.6 million, up $28.7 million, or 31.2%, from the year ended December 31, 2016, due to loan portfolio growth and increased LIBOR Asset-Level Estimated Return on Equity1 of 9.9% for 2017 loan originations Declared cash dividends of $1.563 per common share during the year ended December 31, 2017, representing a 7.9% dividend yield on a book value per common share of $19.82 as of December 31, 2017 1. See Appendix for Core Earnings definition and reconciliation to GAAP net income. See Appendix for Asset-Level Estimated Return on Equity definition. 2. Based on annualized quarterly cash dividend declared and book value per common share as of the reporting date. Historical data included in TRTX’s prospectus, dated July 19, 2017 and filed with the SEC on July 21, 2017. 3. Values and amounts adjusted for the common stock and Class A common stock dividend related to the Company’s IPO in July 2017 Book Value per Common Share and Annualized Dividend Yield2 3 TTM GAAP Net Income and Core Earnings1 Growth Exceeds 5% $ Millions 5.5% Growth Core Earnings GAAP net income Quarterly Results 8.7% 8.2% Book Value per Common Share Annualized Dividend Yield 19.2% QoQ Growth 6.7% 7.7%

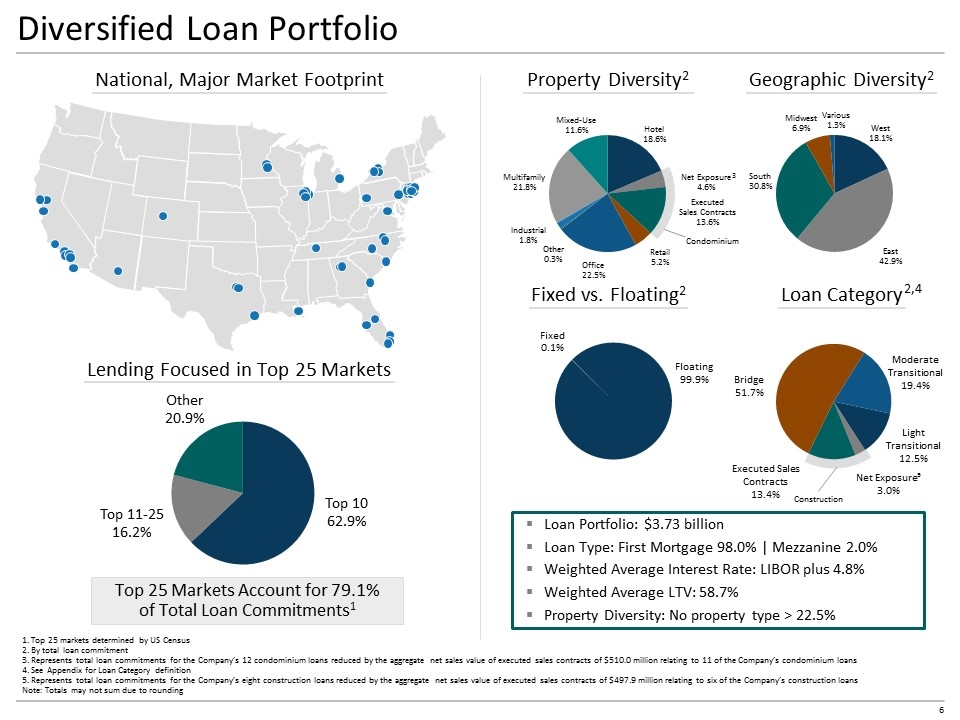

Geographic Diversity2 Diversified Loan Portfolio National, Major Market Footprint Property Diversity2 Lending Focused in Top 25 Markets Fixed vs. Floating2 Loan Category 1. Top 25 markets determined by US Census 2. By total loan commitment 3. Represents total loan commitments for the Company’s 12 condominium loans reduced by the aggregate net sales value of executed sales contracts of $510.0 million relating to 11 of the Company’s condominium loans 4. See Appendix for Loan Category definition 5. Represents total loan commitments for the Company’s eight construction loans reduced by the aggregate net sales value of executed sales contracts of $497.9 million relating to six of the Company’s construction loans Note: Totals may not sum due to rounding 2,4 Top 25 Markets Account for 79.1% of Total Loan Commitments1 3 Condominium Construction Loan Portfolio: $3.73 billion Loan Type: First Mortgage 98.0% | Mezzanine 2.0% Weighted Average Interest Rate: LIBOR plus 4.8% Weighted Average LTV: 58.7% Property Diversity: No property type > 22.5%

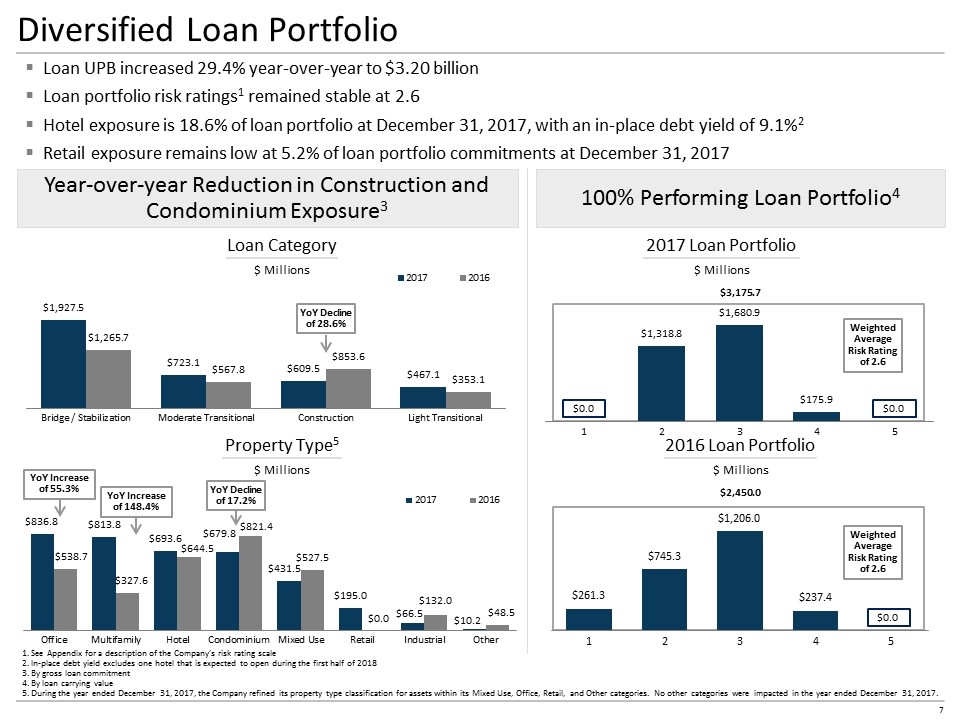

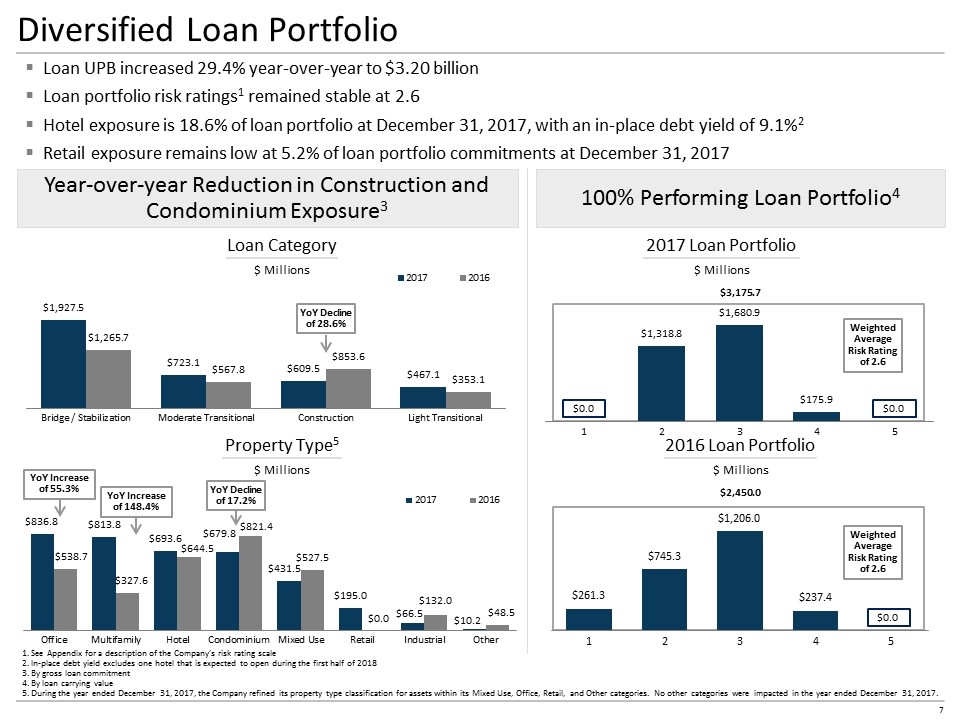

Diversified Loan Portfolio 1. See Appendix for a description of the Company’s risk rating scale 2. In-place debt yield excludes one hotel that is expected to open during the first half of 2018 3. By gross loan commitment 4. By loan carrying value 5. During the year ended December 31, 2017, the Company refined its property type classification for assets within its Mixed Use, Office, Retail, and Other categories. No other categories were impacted in the year ended December 31, 2017. Year-over-year Reduction in Construction and Condominium Exposure3 100% Performing Loan Portfolio4 Loan Category $ Millions 2017 Loan Portfolio $ Millions Property Type5 $ Millions 2016 Loan Portfolio $ Millions YoY Decline of 28.6% $3,175.7 YoY Decline of 17.2% $2,450.0 Loan UPB increased 29.4% year-over-year to $3.20 billion Loan portfolio risk ratings1 remained stable at 2.6 Hotel exposure is 18.6% of loan portfolio at December 31, 2017, with an in-place debt yield of 9.1%2 Retail exposure remains low at 5.2% of loan portfolio commitments at December 31, 2017 Weighted Average Risk Rating of 2.6 Weighted Average Risk Rating of 2.6 $0.0 $0.0 $0.0 YoY Increase of 55.3% YoY Increase of 148.4%

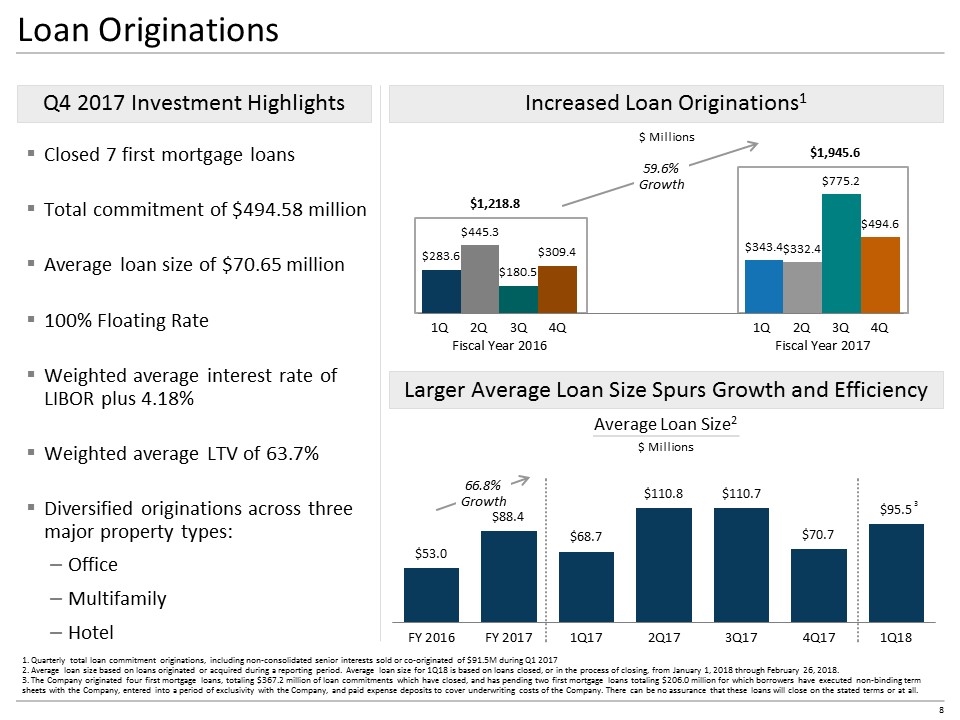

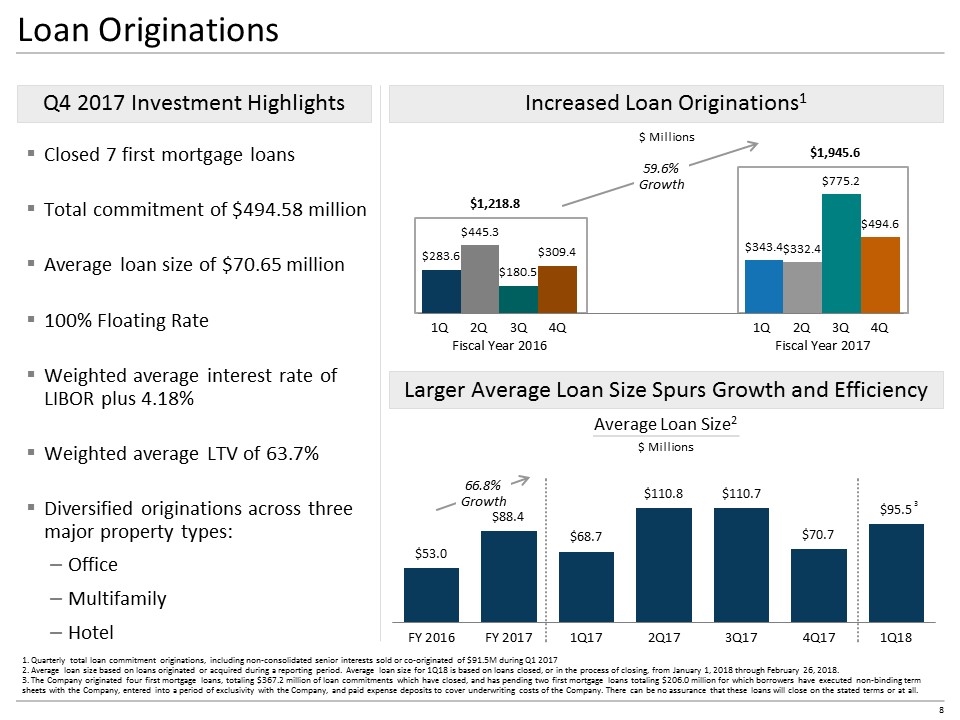

66.8% Growth Loan Originations Q4 2017 Investment Highlights Increased Loan Originations1 Closed 7 first mortgage loans Total commitment of $494.58 million Average loan size of $70.65 million 100% Floating Rate Weighted average interest rate of LIBOR plus 4.18% Weighted average LTV of 63.7% Diversified originations across three major property types: Office Multifamily Hotel 1. Quarterly total loan commitment originations, including non-consolidated senior interests sold or co-originated of $91.5M during Q1 2017 2. Average loan size based on loans originated or acquired during a reporting period. Average loan size for 1Q18 is based on loans closed, or in the process of closing, from January 1, 2018 through February 26, 2018. 3. The Company originated four first mortgage loans, totaling $367.2 million of loan commitments which have closed, and has pending two first mortgage loans totaling $206.0 million for which borrowers have executed non-binding term sheets with the Company, entered into a period of exclusivity with the Company, and paid expense deposits to cover underwriting costs of the Company. There can be no assurance that these loans will close on the stated terms or at all. Larger Average Loan Size Spurs Growth and Efficiency Average Loan Size2 $ Millions $ Millions 59.6% Growth 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q $1,218.8 $1,945.6 3

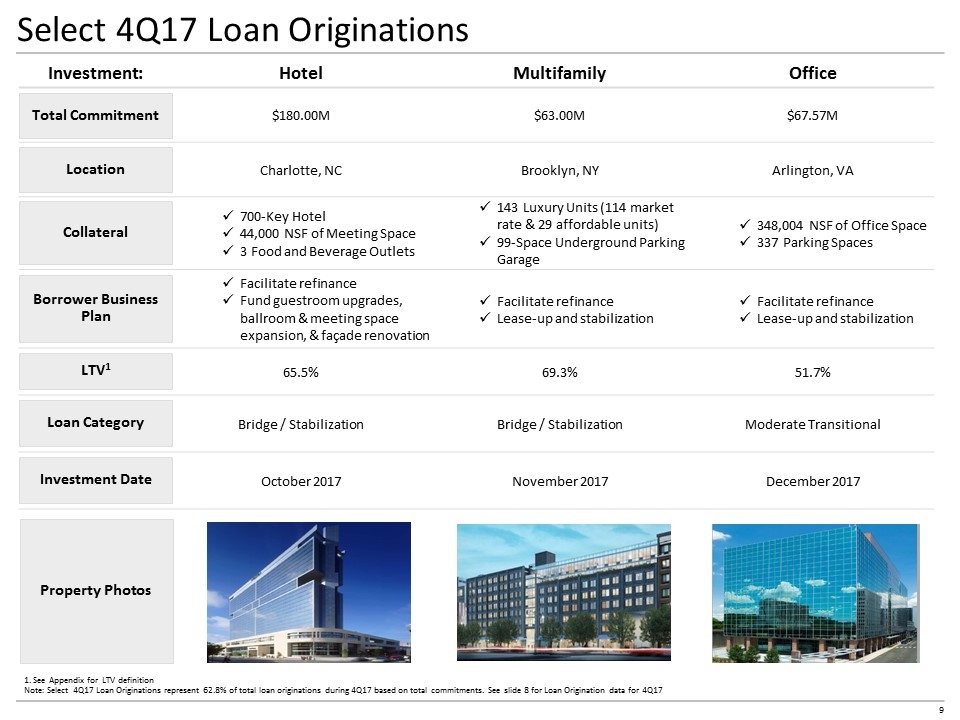

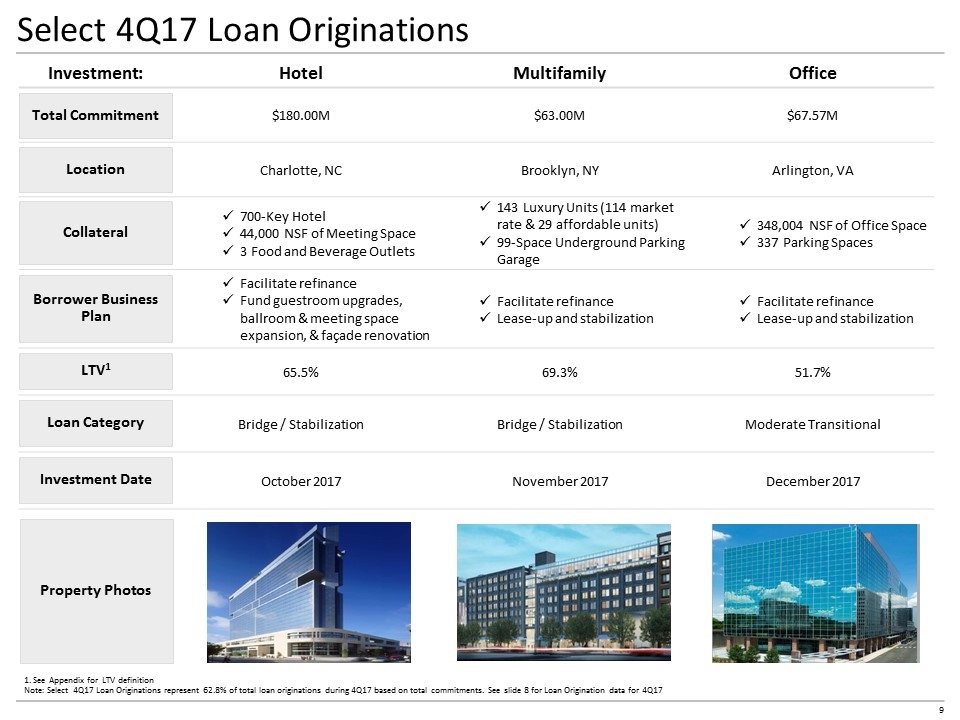

Select 4Q17 Loan Originations 1. See Appendix for LTV definition Note: Select 4Q17 Loan Originations represent 62.8% of total loan originations during 4Q17 based on total commitments. See slide 8 for Loan Origination data for 4Q17 Investment: Hotel Multifamily Office $180.00M $63.00M $67.57M Charlotte, NC Brooklyn, NY Arlington, VA 700-Key Hotel 44,000 NSF of Meeting Space 3 Food and Beverage Outlets 143 Luxury Units (114 market rate & 29 affordable units) 99-Space Underground Parking Garage 348,004 NSF of Office Space 337 Parking Spaces Facilitate refinance Fund guestroom upgrades, ballroom & meeting space expansion, & façade renovation Facilitate refinance Lease-up and stabilization Facilitate refinance Lease-up and stabilization 65.5% 69.3% 51.7% Bridge / Stabilization Bridge / Stabilization Moderate Transitional October 2017 November 2017 December 2017 Total Commitment Location Collateral Borrower Business Plan LTV1 Loan Category Property Photos Investment Date

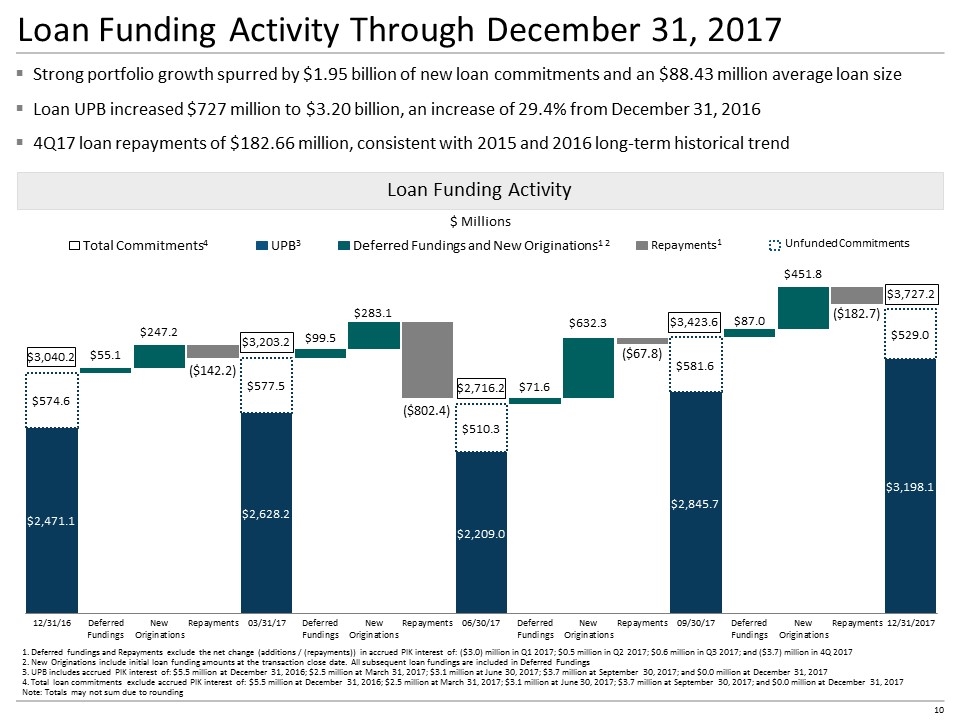

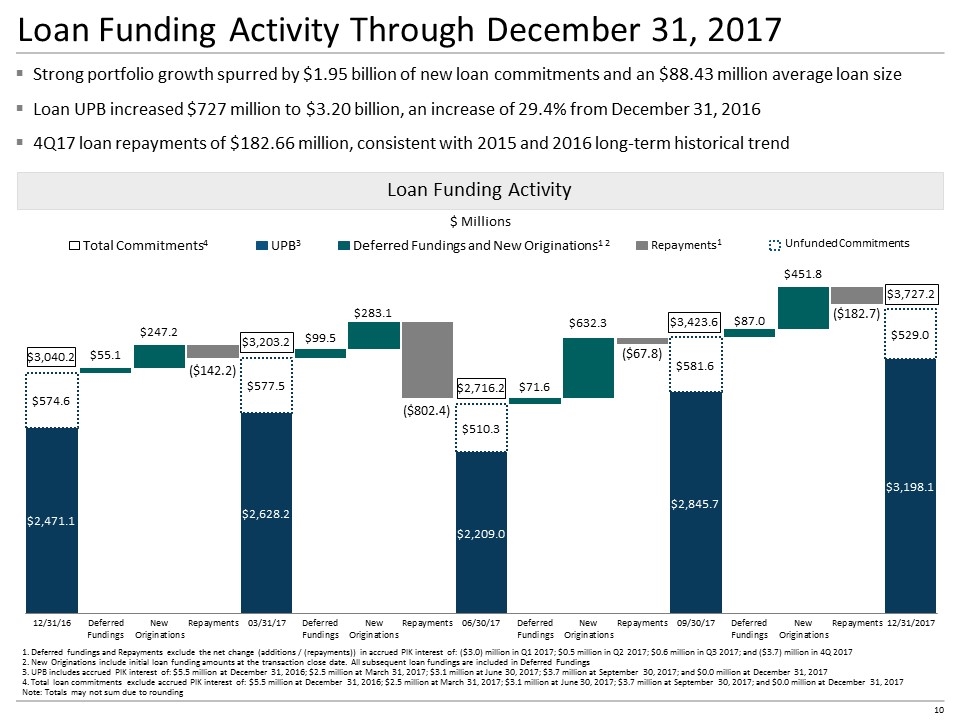

Loan Funding Activity Through December 31, 2017 Strong portfolio growth spurred by $1.95 billion of new loan commitments and an $88.43 million average loan size Loan UPB increased $727 million to $3.20 billion, an increase of 29.4% from December 31, 2016 4Q17 loan repayments of $182.66 million, consistent with 2015 and 2016 long-term historical trend Loan Funding Activity $ Millions Total Commitments4 UPB3 Deferred Fundings and New Originations1 2 Unfunded Commitments Repayments1 $3,040.2 $3,423.6 $3,203.2 $2,716.2 1. Deferred fundings and Repayments exclude the net change (additions / (repayments)) in accrued PIK interest of: ($3.0) million in Q1 2017; $0.5 million in Q2 2017; $0.6 million in Q3 2017; and ($3.7) million in 4Q 2017 2. New Originations include initial loan funding amounts at the transaction close date. All subsequent loan fundings are included in Deferred Fundings 3. UPB includes accrued PIK interest of: $5.5 million at December 31, 2016; $2.5 million at March 31, 2017; $3.1 million at June 30, 2017; $3.7 million at September 30, 2017; and $0.0 million at December 31, 2017 4. Total loan commitments exclude accrued PIK interest of: $5.5 million at December 31, 2016; $2.5 million at March 31, 2017; $3.1 million at June 30, 2017; $3.7 million at September 30, 2017; and $0.0 million at December 31, 2017 Note: Totals may not sum due to rounding

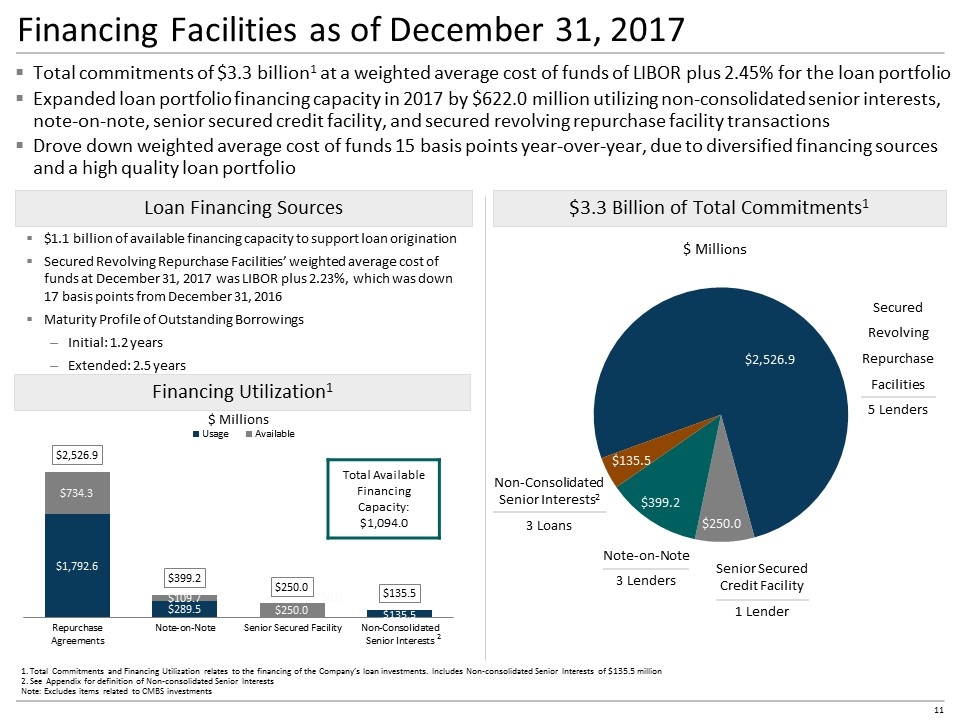

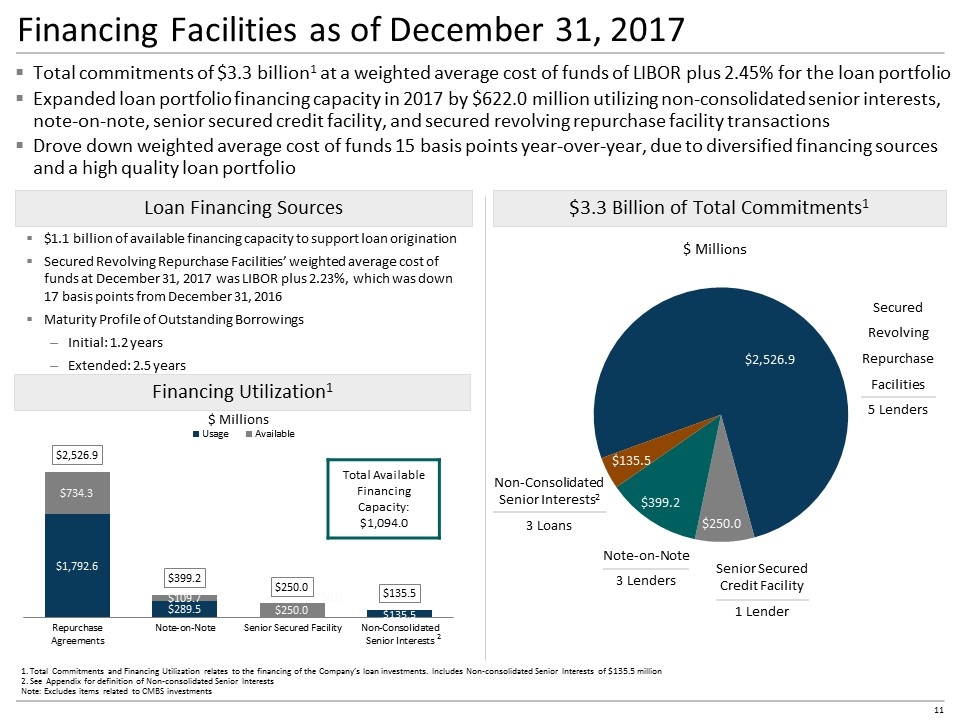

Financing Facilities as of December 31, 2017 Total commitments of $3.3 billion1 at a weighted average cost of funds of LIBOR plus 2.45% for the loan portfolio Expanded loan portfolio financing capacity in 2017 by $622.0 million utilizing non-consolidated senior interests, note-on-note, senior secured credit facility, and secured revolving repurchase facility transactions Drove down weighted average cost of funds 15 basis points year-over-year, due to diversified financing sources and a high quality loan portfolio 1. Total Commitments and Financing Utilization relates to the financing of the Company’s loan investments. Includes Non-consolidated Senior Interests of $135.5 million 2. See Appendix for definition of Non-consolidated Senior Interests Note: Excludes items related to CMBS investments Loan Financing Sources $1.1 billion of available financing capacity to support loan origination Secured Revolving Repurchase Facilities’ weighted average cost of funds at December 31, 2017 was LIBOR plus 2.23%, which was down 17 basis points from December 31, 2016 Maturity Profile of Outstanding Borrowings Initial: 1.2 years Extended: 2.5 years Financing Utilization1 $ Millions Total Available Financing Capacity: $1,094.0 $3.3 Billion of Total Commitments1 $ Millions Secured Revolving Repurchase Facilities 5 Lenders Note-on-Note 3 Lenders Non-Consolidated Senior Interests2 3 Loans Senior Secured Credit Facility 1 Lender 2

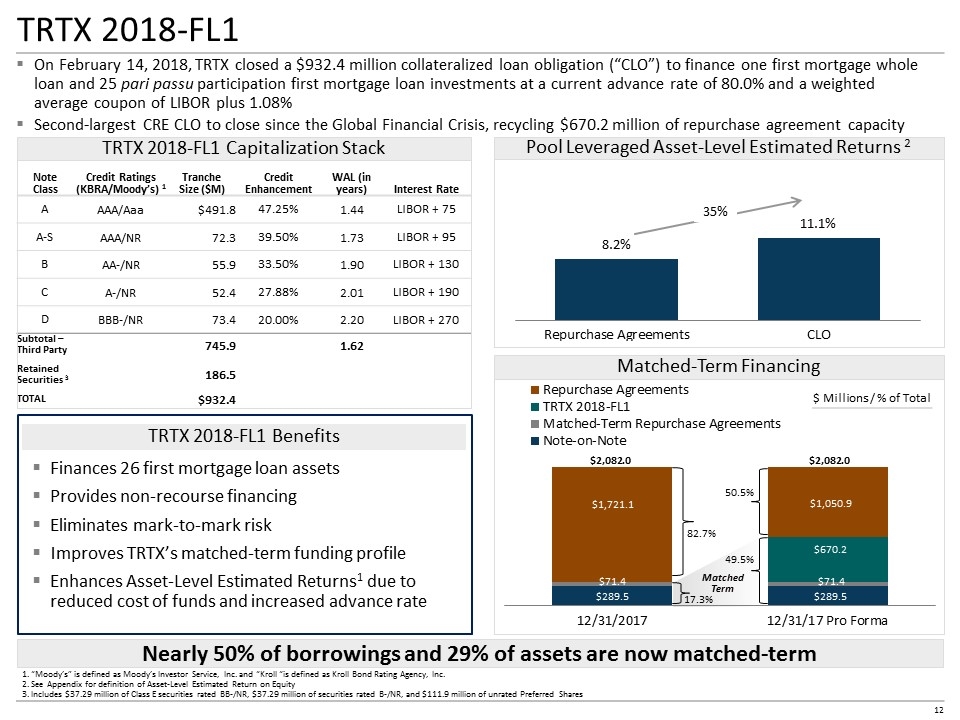

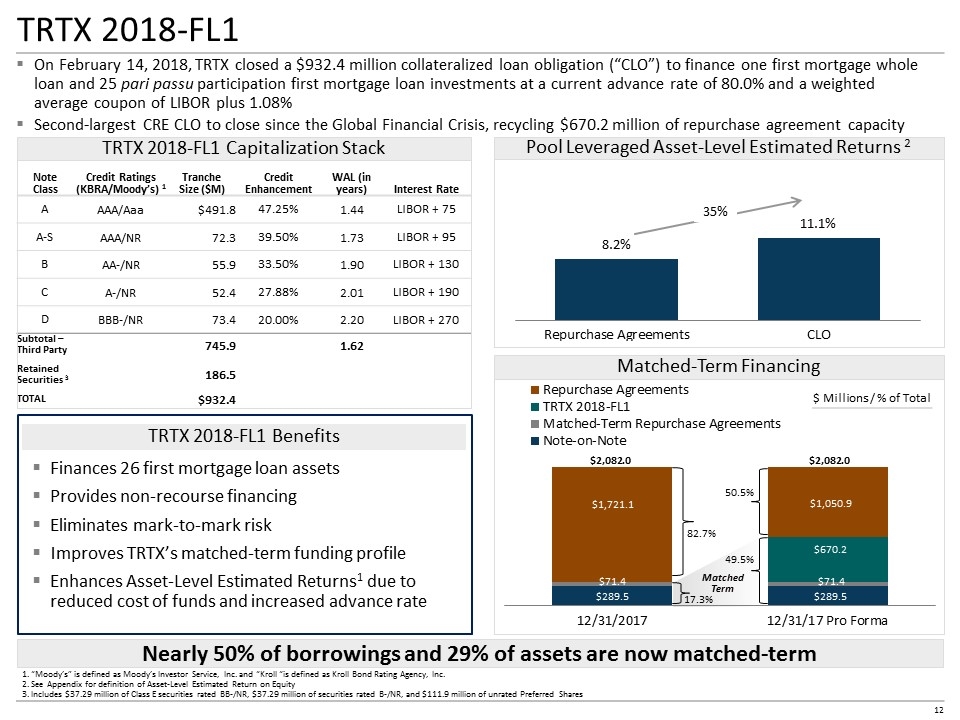

TRTX 2018-FL1 Nearly 50% of borrowings and 29% of assets are now matched-term Note Class Credit Ratings (KBRA/Moody’s) 1 Tranche Size ($M) Credit Enhancement WAL (in years) Interest Rate A AAA/Aaa $491.8 47.25% 1.44 LIBOR + 75 A-S AAA/NR 72.3 39.50% 1.73 LIBOR + 95 B AA-/NR 55.9 33.50% 1.90 LIBOR + 130 C A-/NR 52.4 27.88% 2.01 LIBOR + 190 D BBB-/NR 73.4 20.00% 2.20 LIBOR + 270 Subtotal – Third Party 745.9 1.62 Retained Securities 3 186.5 TOTAL $932.4 35% Finances 26 first mortgage loan assets Provides non-recourse financing Eliminates mark-to-mark risk Improves TRTX’s matched-term funding profile Enhances Asset-Level Estimated Returns1 due to reduced cost of funds and increased advance rate TRTX 2018-FL1 Benefits 1. “Moody’s” is defined as Moody’s Investor Service, Inc. and “Kroll “is defined as Kroll Bond Rating Agency, Inc. 2. See Appendix for definition of Asset-Level Estimated Return on Equity 3. Includes $37.29 million of Class E securities rated BB-/NR, $37.29 million of securities rated B-/NR, and $111.9 million of unrated Preferred Shares $2,082.0 $2,082.0 17.3% 82.7% 50.5% 49.5% $ Millions / % of Total Matched Term TRTX 2018-FL1 Capitalization Stack Pool Leveraged Asset-Level Estimated Returns 2 Matched-Term Financing On February 14, 2018, TRTX closed a $932.4 million collateralized loan obligation (“CLO”) to finance one first mortgage whole loan and 25 pari passu participation first mortgage loan investments at a current advance rate of 80.0% and a weighted average coupon of LIBOR plus 1.08% Second-largest CRE CLO to close since the Global Financial Crisis, recycling $670.2 million of repurchase agreement capacity

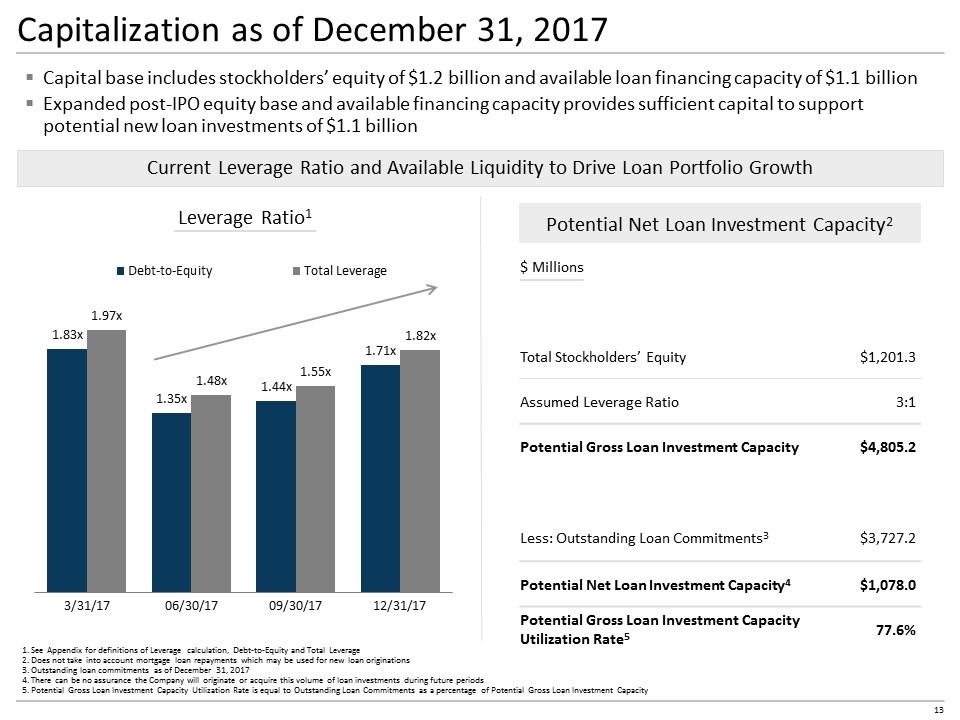

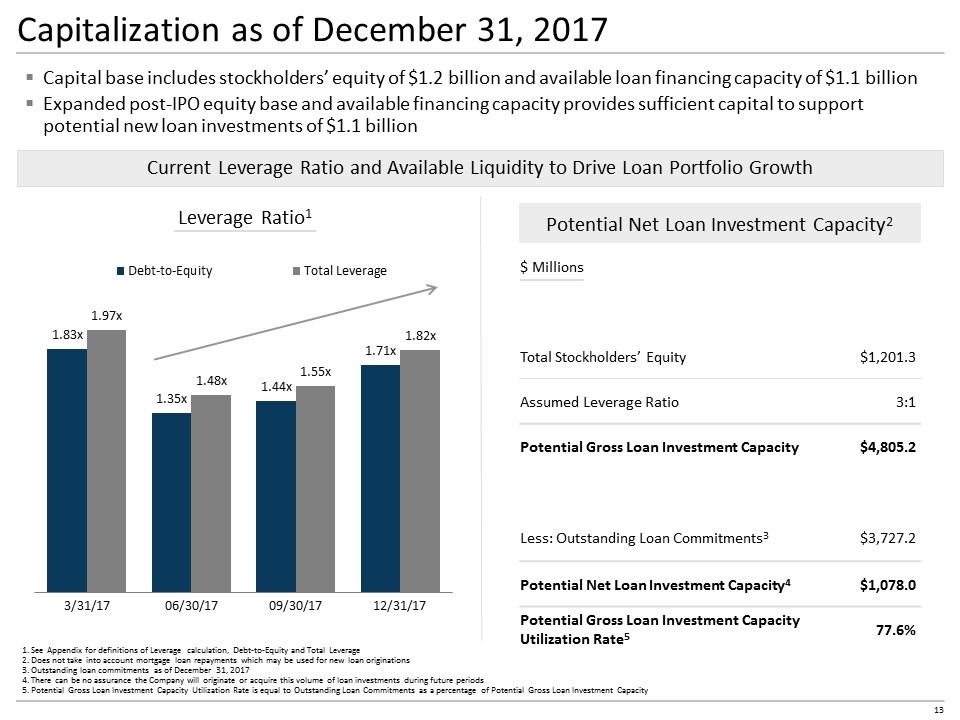

Capitalization as of December 31, 2017 Current Leverage Ratio and Available Liquidity to Drive Loan Portfolio Growth 1. See Appendix for definitions of Leverage calculation, Debt-to-Equity and Total Leverage 2. Does not take into account mortgage loan repayments which may be used for new loan originations 3. Outstanding loan commitments as of December 31, 2017 4. There can be no assurance the Company will originate or acquire this volume of loan investments during future periods 5. Potential Gross Loan Investment Capacity Utilization Rate is equal to Outstanding Loan Commitments as a percentage of Potential Gross Loan Investment Capacity Capital base includes stockholders’ equity of $1.2 billion and available loan financing capacity of $1.1 billion Expanded post-IPO equity base and available financing capacity provides sufficient capital to support potential new loan investments of $1.1 billion Financial Capacity Leverage Ratio1 Potential Net Loan Investment Capacity2 $ Millions Total Stockholders’ Equity $1,201.3 Assumed Leverage Ratio 3:1 Potential Gross Loan Investment Capacity $4,805.2 Less: Outstanding Loan Commitments3 $3,727.2 Potential Net Loan Investment Capacity4 $1,078.0 Potential Gross Loan Investment Capacity Utilization Rate5 77.6%

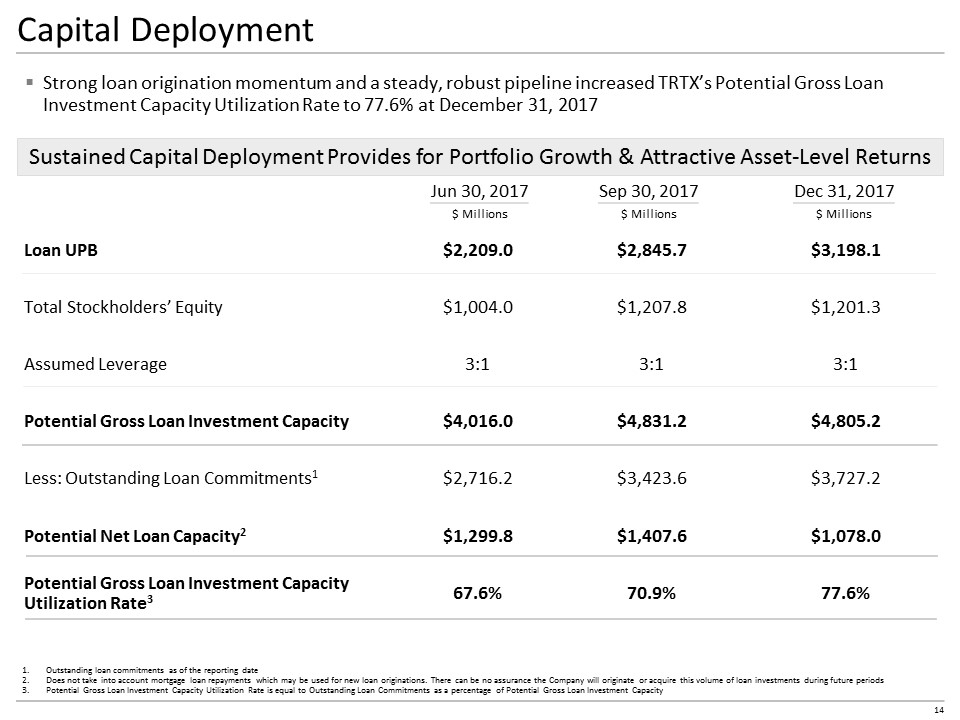

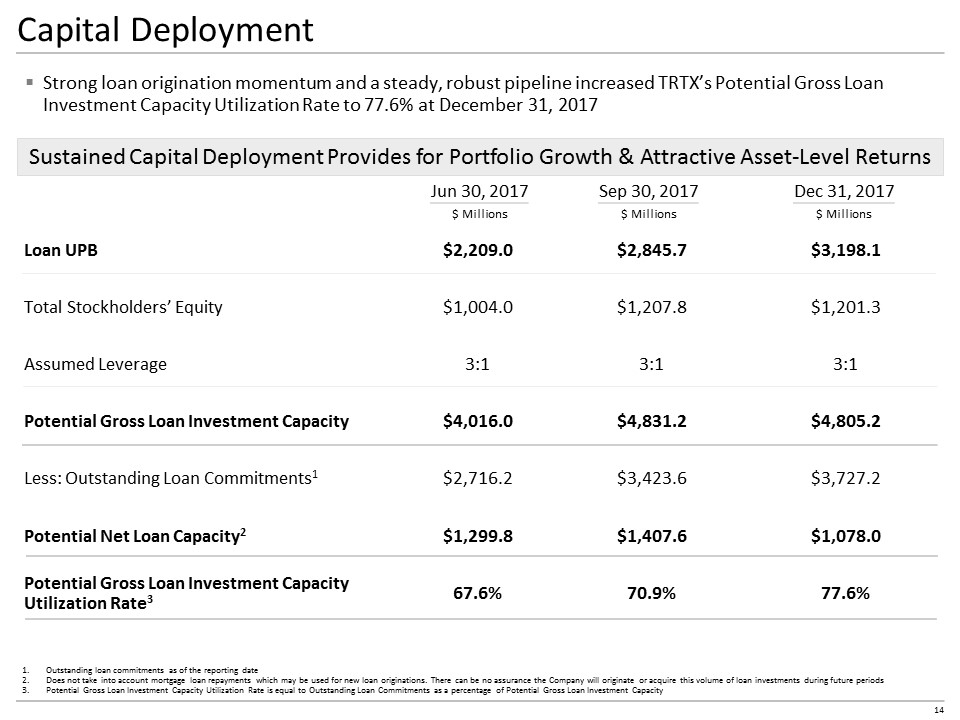

Capital Deployment Strong loan origination momentum and a steady, robust pipeline increased TRTX’s Potential Gross Loan Investment Capacity Utilization Rate to 77.6% at December 31, 2017 Loan UPB $2,209.0 $2,845.7 $3,198.1 Total Stockholders’ Equity $1,004.0 $1,207.8 $1,201.3 Assumed Leverage 3:1 3:1 3:1 Potential Gross Loan Investment Capacity $4,016.0 $4,831.2 $4,805.2 Less: Outstanding Loan Commitments1 $2,716.2 $3,423.6 $3,727.2 Potential Net Loan Capacity2 $1,299.8 $1,407.6 $1,078.0 Potential Gross Loan Investment Capacity Utilization Rate3 67.6% 70.9% 77.6% Sustained Capital Deployment Provides for Portfolio Growth & Attractive Asset-Level Returns Jun 30, 2017 $ Millions Sep 30, 2017 $ Millions Dec 31, 2017 $ Millions Outstanding loan commitments as of the reporting date Does not take into account mortgage loan repayments which may be used for new loan originations. There can be no assurance the Company will originate or acquire this volume of loan investments during future periods Potential Gross Loan Investment Capacity Utilization Rate is equal to Outstanding Loan Commitments as a percentage of Potential Gross Loan Investment Capacity

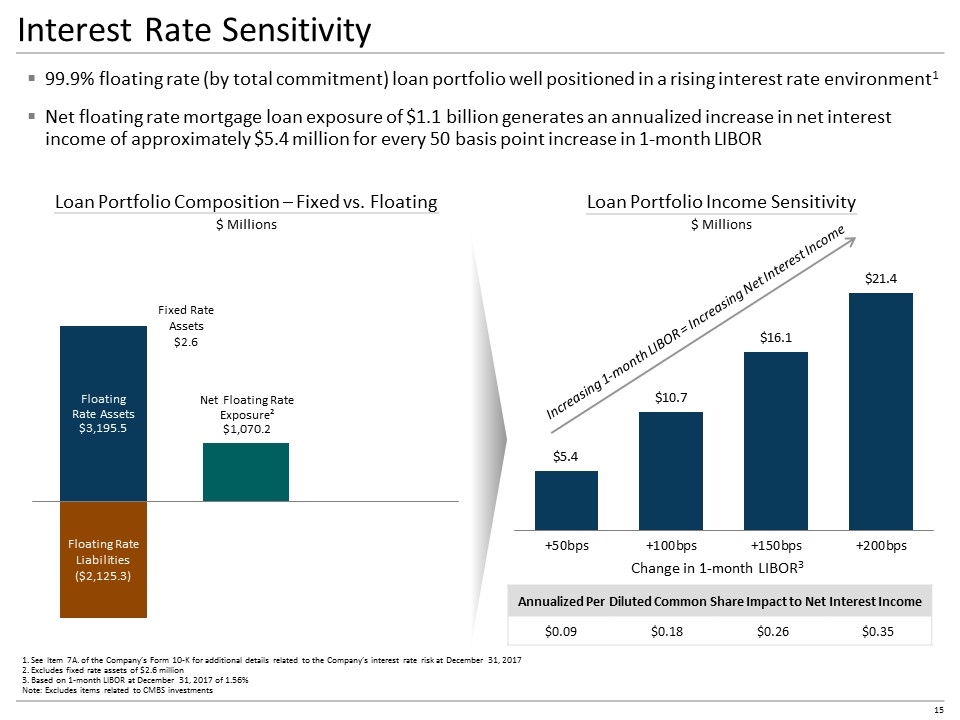

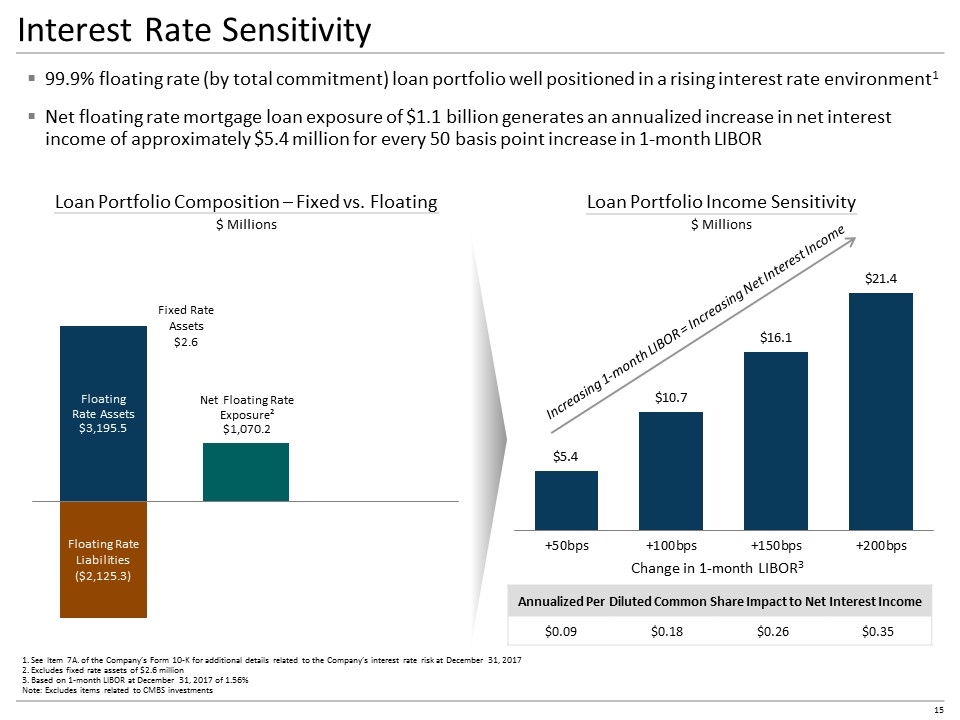

Interest Rate Sensitivity 99.9% floating rate (by total commitment) loan portfolio well positioned in a rising interest rate environment1 Net floating rate mortgage loan exposure of $1.1 billion generates an annualized increase in net interest income of approximately $5.4 million for every 50 basis point increase in 1-month LIBOR Loan Portfolio Composition – Fixed vs. Floating $ Millions Annualized Per Diluted Common Share Impact to Net Interest Income $0.09 $0.18 $0.26 $0.35 Loan Portfolio Income Sensitivity $ Millions Change in 1-month LIBOR3 Increasing 1-month LIBOR = Increasing Net Interest Income 1. See Item 7A. of the Company’s Form 10-K for additional details related to the Company’s interest rate risk at December 31, 2017 2. Excludes fixed rate assets of $2.6 million 3. Based on 1-month LIBOR at December 31, 2017 of 1.56% Note: Excludes items related to CMBS investments

Appendix

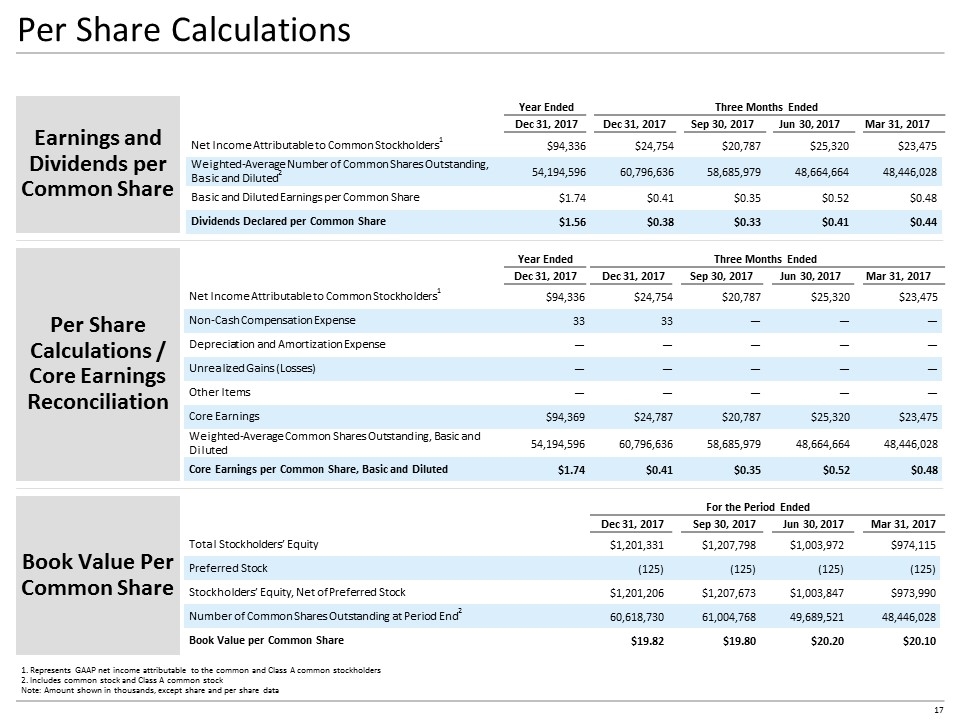

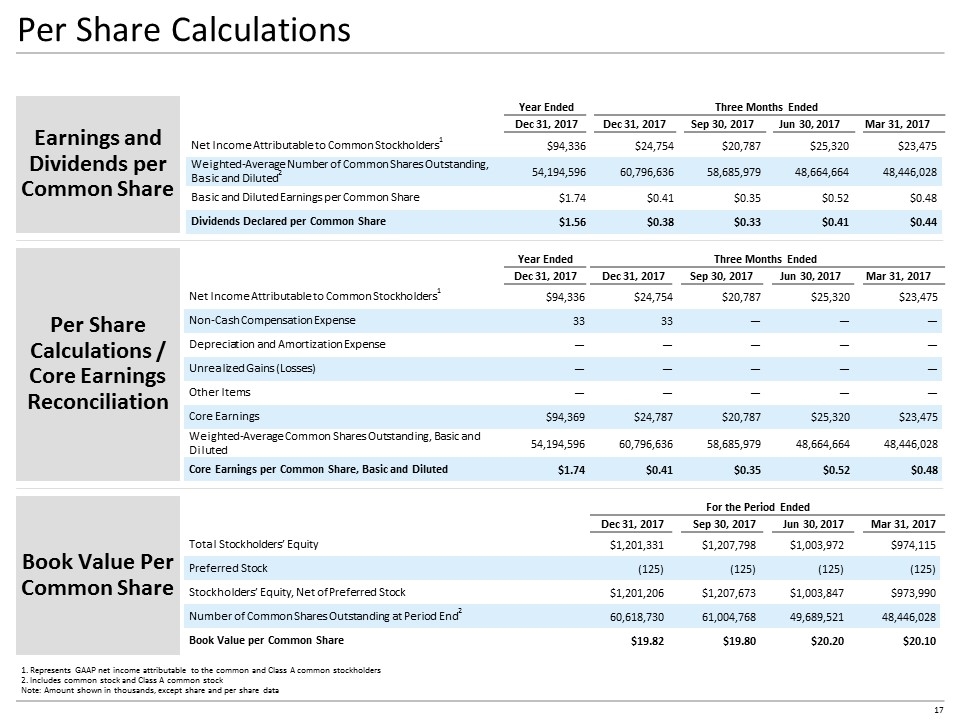

Per Share Calculations Per Share Calculations / Core Earnings Reconciliation Earnings and Dividends per Common Share Year Ended Three Months Ended Dec 31, 2017 Dec 31, 2017 Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 Net Income Attributable to Common Stockholders1 $94,336 $24,754 $20,787 $25,320 $23,475 Weighted-Average Number of Common Shares Outstanding, Basic and Diluted2 54,194,596 60,796,636 58,685,979 48,664,664 48,446,028 Basic and Diluted Earnings per Common Share $1.74 $0.41 $0.35 $0.52 $0.48 Dividends Declared per Common Share $1.56 $0.38 $0.33 $0.41 $0.44 Year Ended Three Months Ended Dec 31, 2017 Dec 31, 2017 Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 Net Income Attributable to Common Stockholders1 $94,336 $24,754 $20,787 $25,320 $23,475 Non-Cash Compensation Expense 33 33 — — — Depreciation and Amortization Expense — — — — — Unrealized Gains (Losses) — — — — — Other Items — — — — — Core Earnings $94,369 $24,787 $20,787 $25,320 $23,475 Weighted-Average Common Shares Outstanding, Basic and Diluted 54,194,596 60,796,636 58,685,979 48,664,664 48,446,028 Core Earnings per Common Share, Basic and Diluted $1.74 $0.41 $0.35 $0.52 $0.48 1. Represents GAAP net income attributable to the common and Class A common stockholders 2. Includes common stock and Class A common stock Note: Amount shown in thousands, except share and per share data Book Value Per Common Share For the Period Ended Dec 31, 2017 Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 Total Stockholders’ Equity $1,201,331 $1,207,798 $1,003,972 $974,115 Preferred Stock (125) (125) (125) (125) Stockholders’ Equity, Net of Preferred Stock $1,201,206 $1,207,673 $1,003,847 $973,990 Number of Common Shares Outstanding at Period End2 60,618,730 61,004,768 49,689,521 48,446,028 Book Value per Common Share $19.82 $19.80 $20.20 $20.10

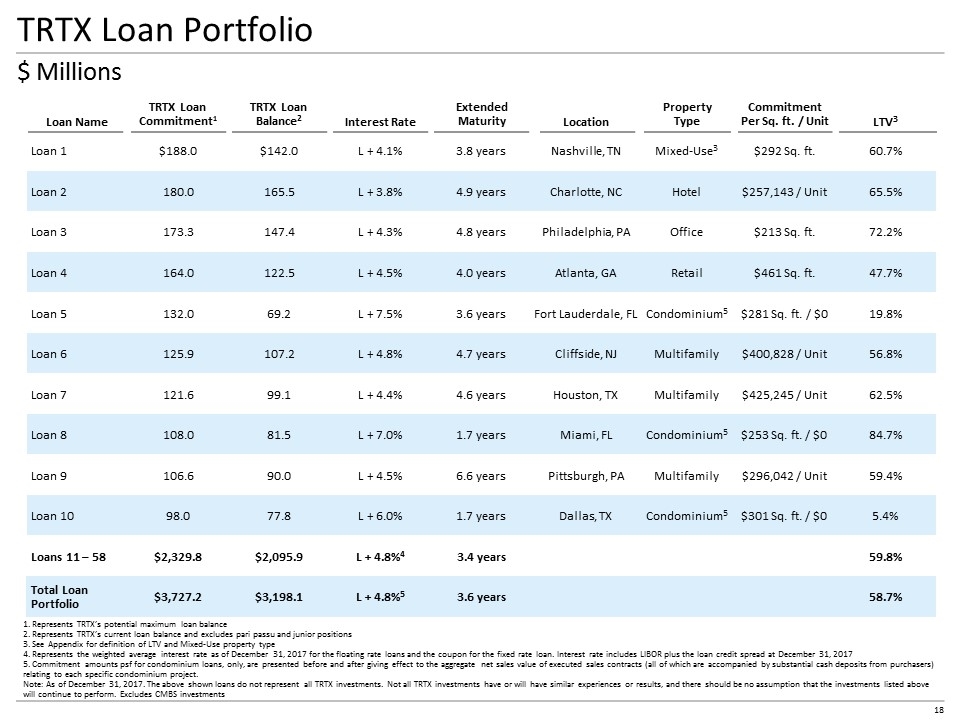

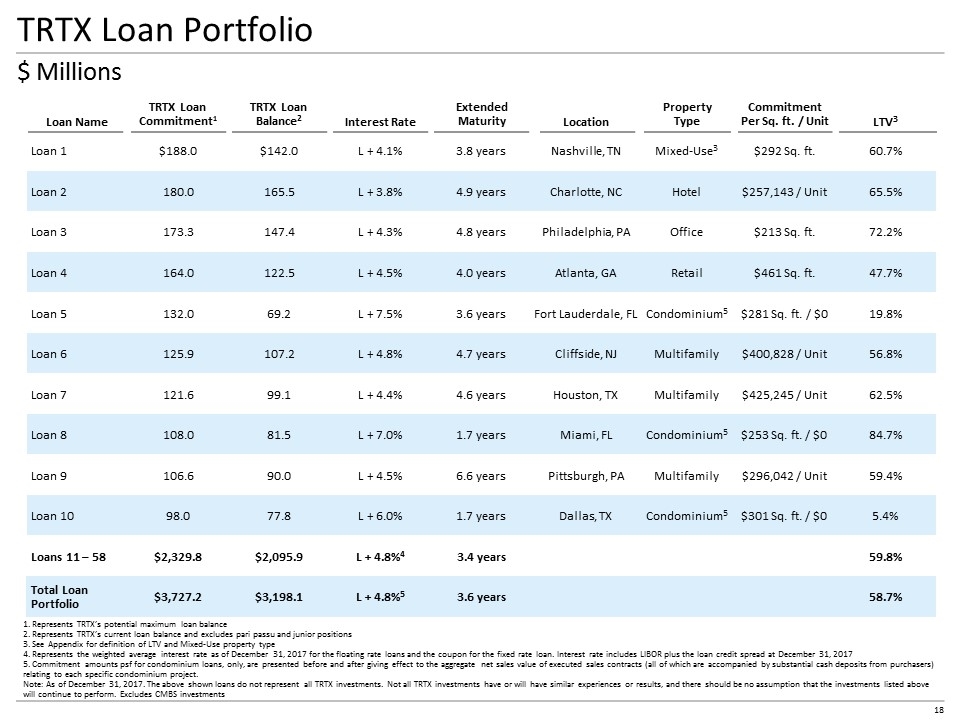

TRTX Loan Portfolio Loan Name TRTX Loan Commitment1 TRTX Loan Balance2 Interest Rate Extended Maturity Location Property Type Commitment Per Sq. ft. / Unit LTV3 Loan 1 $188.0 $142.0 L + 4.1% 3.8 years Nashville, TN Mixed-Use3 $292 Sq. ft. 60.7% Loan 2 180.0 165.5 L + 3.8% 4.9 years Charlotte, NC Hotel $257,143 / Unit 65.5% Loan 3 173.3 147.4 L + 4.3% 4.8 years Philadelphia, PA Office $213 Sq. ft. 72.2% Loan 4 164.0 122.5 L + 4.5% 4.0 years Atlanta, GA Retail $461 Sq. ft. 47.7% Loan 5 132.0 69.2 L + 7.5% 3.6 years Fort Lauderdale, FL Condominium5 $281 Sq. ft. / $0 19.8% Loan 6 125.9 107.2 L + 4.8% 4.7 years Cliffside, NJ Multifamily $400,828 / Unit 56.8% Loan 7 121.6 99.1 L + 4.4% 4.6 years Houston, TX Multifamily $425,245 / Unit 62.5% Loan 8 108.0 81.5 L + 7.0% 1.7 years Miami, FL Condominium5 $253 Sq. ft. / $0 84.7% Loan 9 106.6 90.0 L + 4.5% 6.6 years Pittsburgh, PA Multifamily $296,042 / Unit 59.4% Loan 10 98.0 77.8 L + 6.0% 1.7 years Dallas, TX Condominium5 $301 Sq. ft. / $0 5.4% Loans 11 – 58 $2,329.8 $2,095.9 L + 4.8%4 3.4 years 59.8% Total Loan Portfolio $3,727.2 $3,198.1 L + 4.8%5 3.6 years 58.7% 1. Represents TRTX’s potential maximum loan balance 2. Represents TRTX’s current loan balance and excludes pari passu and junior positions 3. See Appendix for definition of LTV and Mixed-Use property type 4. Represents the weighted average interest rate as of December 31, 2017 for the floating rate loans and the coupon for the fixed rate loan. Interest rate includes LIBOR plus the loan credit spread at December 31, 2017 5. Commitment amounts psf for condominium loans, only, are presented before and after giving effect to the aggregate net sales value of executed sales contracts (all of which are accompanied by substantial cash deposits from purchasers) relating to each specific condominium project. Note: As of December 31, 2017. The above shown loans do not represent all TRTX investments. Not all TRTX investments have or will have similar experiences or results, and there should be no assumption that the investments listed above will continue to perform. Excludes CMBS investments $ Millions

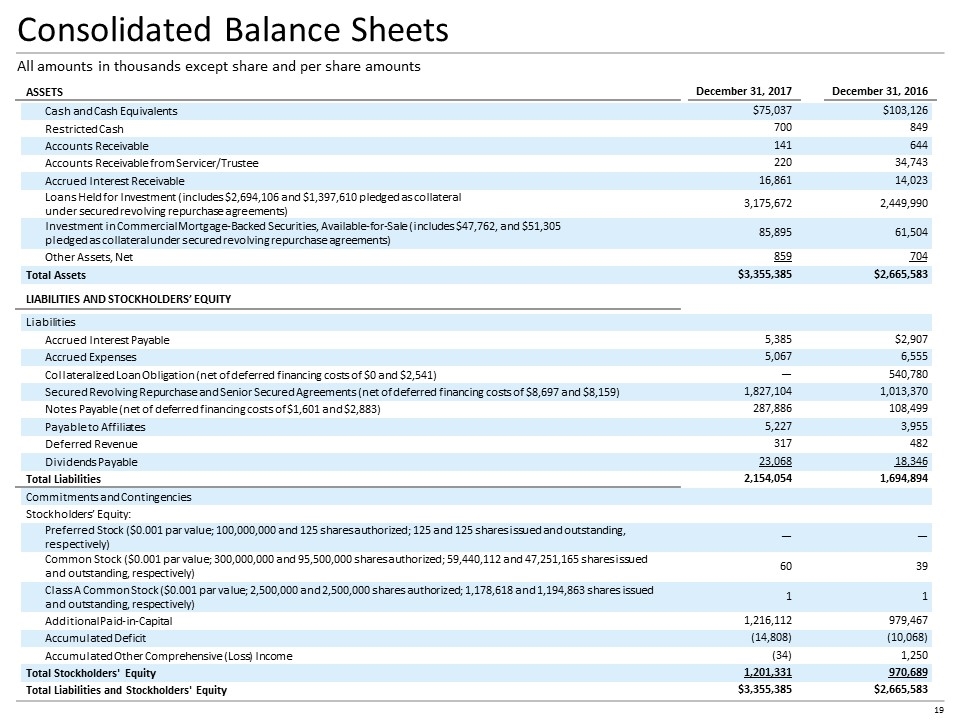

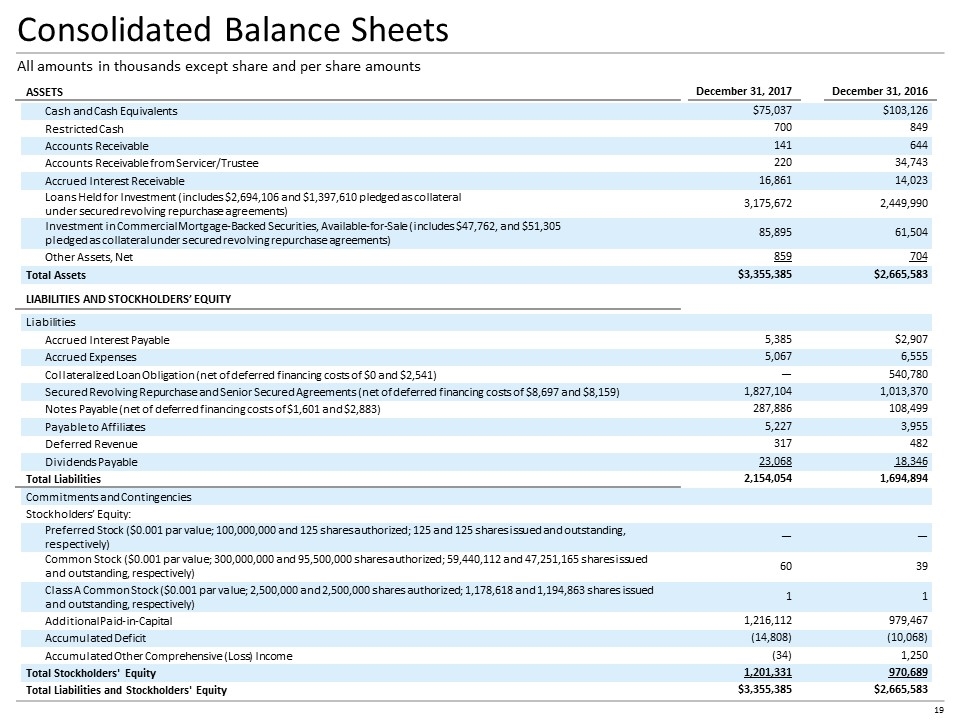

Consolidated Balance Sheets All amounts in thousands except share and per share amounts ASSETS December 31, 2017 December 31, 2016 Cash and Cash Equivalents $75,037 $103,126 Restricted Cash 700 849 Accounts Receivable 141 644 Accounts Receivable from Servicer/Trustee 220 34,743 Accrued Interest Receivable 16,861 14,023 Loans Held for Investment (includes $2,694,106 and $1,397,610 pledged as collateral under secured revolving repurchase agreements) 3,175,672 2,449,990 Investment in Commercial Mortgage-Backed Securities, Available-for-Sale (includes $47,762, and $51,305 pledged as collateral under secured revolving repurchase agreements) 85,895 61,504 Other Assets, Net 859 704 Total Assets $3,355,385 $2,665,583 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities Accrued Interest Payable 5,385 $2,907 Accrued Expenses 5,067 6,555 Collateralized Loan Obligation (net of deferred financing costs of $0 and $2,541) — 540,780 Secured Revolving Repurchase and Senior Secured Agreements (net of deferred financing costs of $8,697 and $8,159) 1,827,104 1,013,370 Notes Payable (net of deferred financing costs of $1,601 and $2,883) 287,886 108,499 Payable to Affiliates 5,227 3,955 Deferred Revenue 317 482 Dividends Payable 23,068 18,346 Total Liabilities 2,154,054 1,694,894 Commitments and Contingencies Stockholders’ Equity: Preferred Stock ($0.001 par value; 100,000,000 and 125 shares authorized; 125 and 125 shares issued and outstanding, respectively) — — Common Stock ($0.001 par value; 300,000,000 and 95,500,000 shares authorized; 59,440,112 and 47,251,165 shares issued and outstanding, respectively) 60 39 Class A Common Stock ($0.001 par value; 2,500,000 and 2,500,000 shares authorized; 1,178,618 and 1,194,863 shares issued and outstanding, respectively) 1 1 Additional Paid-in-Capital 1,216,112 979,467 Accumulated Deficit (14,808) (10,068) Accumulated Other Comprehensive (Loss) Income (34) 1,250 Total Stockholders' Equity 1,201,331 970,689 Total Liabilities and Stockholders' Equity $3,355,385 $2,665,583

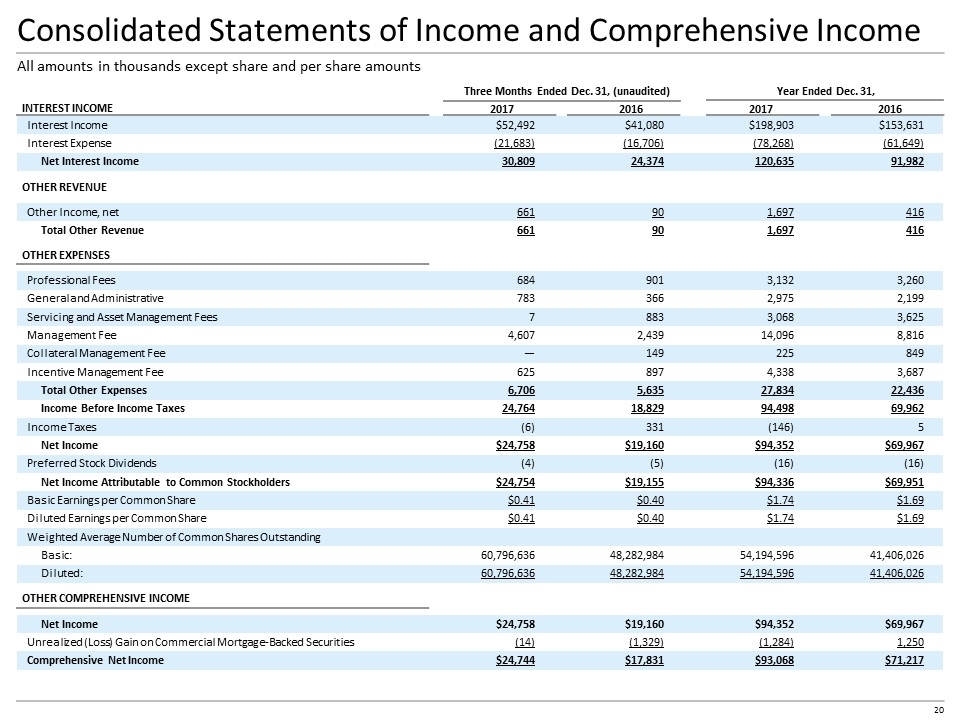

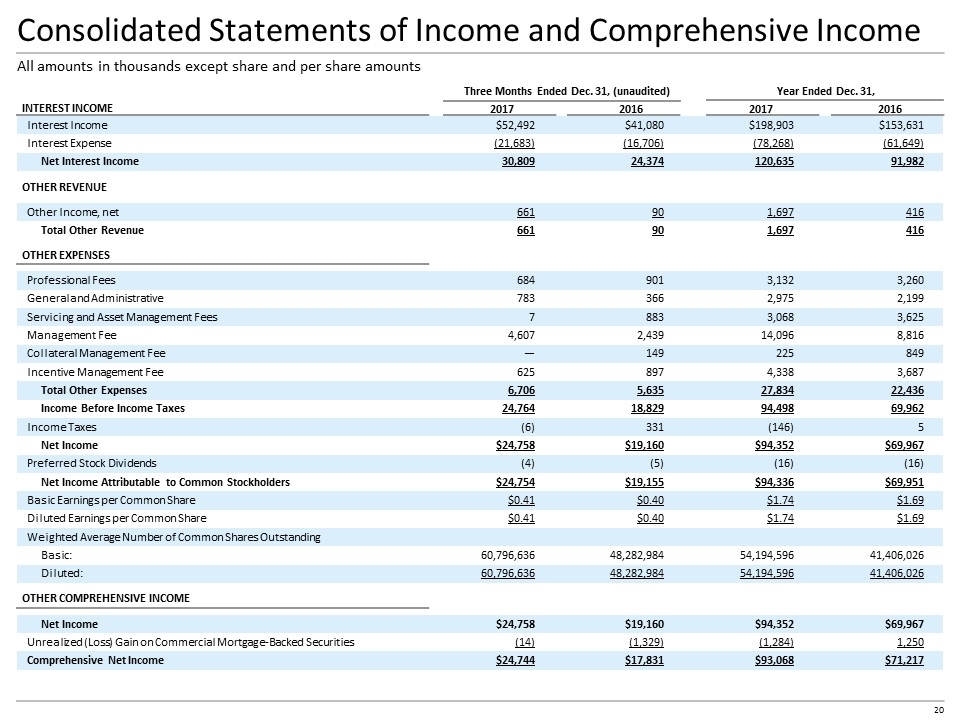

Consolidated Statements of Income and Comprehensive Income All amounts in thousands except share and per share amounts Three Months Ended Dec. 31, (unaudited) Year Ended Dec. 31, INTEREST INCOME 2017 2016 2017 2016 Interest Income $52,492 $41,080 $198,903 $153,631 Interest Expense (21,683) (16,706) (78,268) (61,649) Net Interest Income 30,809 24,374 120,635 91,982 OTHER REVENUE Other Income, net 661 90 1,697 416 Total Other Revenue 661 90 1,697 416 OTHER EXPENSES Professional Fees 684 901 3,132 3,260 General and Administrative 783 366 2,975 2,199 Servicing and Asset Management Fees 7 883 3,068 3,625 Management Fee 4,607 2,439 14,096 8,816 Collateral Management Fee — 149 225 849 Incentive Management Fee 625 897 4,338 3,687 Total Other Expenses 6,706 5,635 27,834 22,436 Income Before Income Taxes 24,764 18,829 94,498 69,962 Income Taxes (6) 331 (146) 5 Net Income $24,758 $19,160 $94,352 $69,967 Preferred Stock Dividends (4) (5) (16) (16) Net Income Attributable to Common Stockholders $24,754 $19,155 $94,336 $69,951 Basic Earnings per Common Share $0.41 $0.40 $1.74 $1.69 Diluted Earnings per Common Share $0.41 $0.40 $1.74 $1.69 Weighted Average Number of Common Shares Outstanding Basic: 60,796,636 48,282,984 54,194,596 41,406,026 Diluted: 60,796,636 48,282,984 54,194,596 41,406,026 OTHER COMPREHENSIVE INCOME Net Income $24,758 $19,160 $94,352 $69,967 Unrealized (Loss) Gain on Commercial Mortgage-Backed Securities (14) (1,329) (1,284) 1,250 Comprehensive Net Income $24,744 $17,831 $93,068 $71,217

Definitions TRTX uses Core Earnings to evaluate its performance excluding the effects of certain transactions and GAAP adjustments it believes are not necessarily indicative of its current loan activity and operations. Core Earnings is a non-GAAP measure, which TRTX defines as GAAP net income (loss) attributable to its stockholders, including realized gains and losses not otherwise included in GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Core Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by TRTX’s Manager, subject to approval by a majority of TRTX’s independent directors. The exclusion of depreciation and amortization from the calculation of Core Earnings only applies to debt investments related to real estate to the extent TRTX forecloses upon the property or properties underlying such debt investments TRTX believes that Core Earnings provides meaningful information to consider in addition to its net income and cash flow from operating activities determined in accordance with GAAP. This adjusted measure helps TRTX evaluate its performance excluding the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current loan portfolio and operations. Although pursuant to the Management Agreement TRTX calculates the incentive and base management fees due to its Manager using Core Earnings before incentive fees expense, TRTX reports Core Earnings after incentive fee expense, because TRTX believes this is a more meaningful presentation of the economic performance of TRTX’s common and Class A common stock. For additional information on the fees TRTX pays the Manager, see Note 10 to the consolidated financial statements included in TRTX’s Form 10-K Core Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to GAAP net income, or an indication of TRTX’s GAAP cash flows from operations, a measure of TRTX’s liquidity, or an indication of funds available for TRTX’s cash needs. In addition, TRTX’s methodology for calculating Core Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and accordingly, TRTX’s reported Core Earnings may not be comparable to the Core Earnings reported by other companies Core Earnings Asset-Level Estimated Return on Equity Asset-Level Estimated Return on Equity (ALEROE) – is a non-discounted estimate of a loan investment’s average annual return on equity during its initial term to maturity. ALEROE is determined for each loan, on a stand-alone basis, using the loan’s stated credit spread, spot LIBOR rate, origination and exit fees (if any) amortized on a straight line basis, the maximum advance rate approved by our lender against the loan investment, the all-in cost of funding (including commitment fees and amortized deferred financing costs), and estimates of MG&A, asset management and loan servicing costs, base management fee, and incentive fee, if any. TRTX’s calculation of ALEROE for a particular loan investment assumes deferred fundings related to such investment, if any, in accordance with TRTX’s underwriting of the borrower’s business plan, and that the all-in cost of funding for the investment is constant from origination through the initial maturity date. There can be no assurance that the actual asset-level return on equity for a particular loan investment will equal the ALEROE for such investment

Definitions (cont.) Debt-to-Equity - Represents (i) total outstanding borrowings under secured debt agreements (collateralized loan obligation, net), secured financing/repurchase agreements (net) and notes payable (net), less cash, to (ii) total stockholders’ equity, at period end Total Leverage - Represents (i) total outstanding borrowings under secured debt agreements (collateralized loan obligation, net), secured financing/repurchase agreements (net) and notes payable (net) plus non-consolidated senior interests sold or co-originated (if any), less cash, to (ii) total stockholders’ equity, at period end Leverage Bridge/Stabilization Loan - A loan with limited deferred fundings, generally less than 10% of the total loan commitment, which fundings are commonly conditioned on the borrower’s satisfaction of certain collateral performance tests. The related business plan generally involves little or no capital expenditure related to base building work (e.g., building mechanical systems, lobbies, elevators, common areas, or other amenities), with most deferred fundings related to leasing activity. The primary focus is on maintaining or improving current operating cash flow, or addressing minimal lease expirations or existing tenant vacancies. Light Transitional Loan - A transitional loan with deferred fundings ranging from 10% to 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan is to lease existing or forecasted tenant vacancy to achieve stabilized occupancy and cash flow. Capital expenditure is primarily to fund leasing commissions and tenant improvements for new tenant leases, and capital expenditure allocated to base building work generally does not to exceed 20%. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy. Moderate Transitional Loan - A transitional loan with deferred fundings greater than 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan generally involves capital expenditure for base building work needed before substantial leasing activity can be achieved, followed by capital expenditure for tenant improvements and leasing commissions to achieve stabilized occupancy and cash flow. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy. Construction Loan - A loan made to a borrower to fund the ground up construction of a commercial real estate property Loan Category LTV is calculated as the total outstanding principal balance of the loan or participation interest in a loan plus any financing that is pari passu with or senior to such loan or participation interest at the time of origination or acquisition, divided by the applicable real estate value at the time of origination or acquisition of such loan or participation interest in a loan. The real estate value is based on a third-party appraisal obtained by the Manager from an appraiser who is a member of the Appraisal Institute. Such appraisals are prepared in accordance with professional standards of the Appraisal Institute and applicable government regulations Loan-to-Value (LTV) Fundings made under existing loan commitments after loan closing date Deferred Fundings

Definitions (cont.) In connection with any origination or co‐origination of a mezzanine loan by TRTX, the senior mortgage loan that is contemporaneously issued by the borrower to a senior mortgage lender or that is transferred by TRTX to the co‐originating senior mortgage lender. In either case, the senior mortgage loan is not included on TRTX’s consolidated balance sheets. TRTX retains only the mezzanine loan on its consolidated balance sheets All of the Company’s mezzanine loans are contiguous with mortgage loans originated by TRTX and sold to a third party as a nonconsolidated senior interest, or co-originated with a third party lender Non-Consolidated Senior Interest Mixed-Use Loan TRTX classifies a loan as mixed-use if the property securing TRTX’s loan: (a) involves more than one use; and (b) no single use represents more than 60% of the collateral property’s total value. In certain instances, TRTX’s classification may be determined by its assessment of which multiple use is the principal driver of the property’s aggregate net operating income Mezzanine Loan Loan made to the owner of a borrower under a mortgage loan and secured by a pledge of the equity interest(s) in such borrower. Mezzanine loans are subordinate to a first mortgage loan but senior to the owner’s equity Risk Ratings Based on a 5-point scale, TRTX’s loans are rated “1” through “5,” from least risk to greatest risk, respectively, on a quarterly basis. The loan risk ratings are defined as follows: 1: Outperform—Exceeds performance metrics (for example, technical milestones, occupancy, rents, net operating income) included in original or current credit underwriting and business plan; 2: Meets or Exceeds Expectations—Collateral performance meets or exceeds substantially all performance metrics included in original or current underwriting / business plan; 3: Satisfactory—Collateral performance meets or is on track to meet underwriting; business plan is met or can reasonably be achieved; 4: Underperformance—Collateral performance falls short of original underwriting, and material differences exist from business plan; technical milestones have been missed; defaults may exist, or may soon occur absent material improvement; and 5: Risk of Impairment/Default—Collateral performance is significantly worse than underwriting; major variance from business plan; loan covenants or technical milestones have been breached; timely exit from loan via sale or refinancing is questionable.

Company Information Contact Information Headquarters: 888 Seventh Avenue 35th Floor New York, NY 10106 Investor Relations: (212) 405-8500 IR@tpgrefinance.com New York Stock Exchange: Symbol: TRTX Analyst Coverage Bank of America Merrill Lynch Kenneth Bruce (415) 676-3545 Deutsche Bank George Bahamondes (212) 250-1587 JP Morgan Richard Shane (415) 315-6701 Citigroup Arren Cyganovich (212) 816-3733 JMP Securities Steven DeLaney (212) 906-3517 Transfer Agent American Stock Transfer & Trust Company, LLC (800) 937-5449 help@astfinancial.com TPG RE Finance Trust, Inc. (NYSE:TRTX) (the “Company” or “TRTX”) is a commercial real estate finance company, operating as a real estate investment trust (“REIT”), that focuses primarily on directly originating, acquiring and managing commercial mortgage loans and other commercial real estate-related debt instruments for its balance sheet. The Company is externally managed and advised by TPG RE Finance Trust Management, L.P., an affiliate of TPG Global, LLC (“TPG”), a leading global alternative investment firm with a 25-year history and approximately $79 billion of assets under management. For more information regarding TRTX, visit www.tpgrefinance.com