September 2022 TPG RE Finance Trust, Inc. Investor Presentation Exhibit 99.1

Forward-Looking Statements and Other Disclosures 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will occur or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Such risks, uncertainties and other important factors include, among others, the risks, uncertainties and factors set forth under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 23, 2022, as such risk factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Such risks, uncertainties and other factors include, but are not limited to, the following: the general political, economic, regulatory, and competitive conditions in the markets in which we invest; the level and volatility of prevailing interest rates and credit spreads, including as a result of the planned discontinuance of the London Interbank Offered Rate (“LIBOR”) and the transition to alternative reference rates such as term or compounded Secured Overnight Financing Rate ("SOFR"); adverse changes in the real estate and real estate capital markets; general volatility of the securities markets in which we participate; changes in our business, investment strategies or target assets; difficulty in obtaining financing or raising capital; reductions in the yield on our investments and increases in the cost of our financing; adverse legislative or regulatory developments, including with respect to tax laws; acts of God such as hurricanes, floods, earthquakes, wildfires, mudslides, volcanic eruptions, and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; global economic trends and economic conditions, including heightened inflation, slower growth or recession, changes to fiscal and monetary policy, higher interest rates, labor shortages, currency fluctuations and challenges in global supply chains; the ongoing impact of the COVID-19 pandemic on our business, U.S. and global economies, the real estate industry and our borrowers, and the performance of the properties securing our loans; changes in the availability of attractive loan and other investment opportunities, whether due to competition, regulation or otherwise; deterioration in the performance of properties securing our investments that may cause deterioration in the performance of our investments, adversely impact certain of our financing arrangements and our liquidity, and potentially expose us to principal losses on our investments; defaults by borrowers in paying debt service or principal on outstanding indebtedness; the adequacy of collateral securing our investments and declines in the fair value of our investments; adverse developments in the availability of desirable investment opportunities; difficulty in successfully managing our growth, including integrating new assets into our existing systems; the cost of operating our platform, including, but not limited to, the cost of operating a real estate investment platform and the cost of operating as a publicly traded company; the availability of qualified personnel and our relationship with our Manager, TPG RE Finance Trust Management, L.P. (“Manager”); the potential unavailability of LIBOR after June 30, 2023; conflicts with TPG Inc. (“TPG”) and its affiliates, including our Manager, the personnel of TPG providing services to us, including our officers, and certain funds managed by TPG; our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and our ability to maintain our exemption or exclusion from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and authoritative U.S. generally accepted accounting principles (or “GAAP”) or policy changes from standard-setting bodies such as the Financial Accounting Standards Board, the SEC, the Internal Revenue Service, the New York Stock Exchange and other authorities that we are subject to, as well as their counterparts in any foreign jurisdictions where we might do business. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this presentation apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this presentation and in other filings we make with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Investor Presentation | September 2022

3 TPG RE Finance Trust, Inc. $5.2 billion Total Loan Commitments 1. See Appendix for definitions, including LTV, Risk Ratings and Total Leverage Ratio 2. Includes one non-consolidated senior interest of $132.0 million; See Appendix for definitions, including non-consolidated senior interest 3. See page 8 for additional detail Note: Data as of June 30, 2022, unless otherwise noted Loan Portfolio $71.0 million Average Loan Size 3.44% Weighted Average Credit Spread 3.2 Weighted Average Risk Rating1 67.6% Weighted Average As-is LTV1 100% Floating Rate Portfolio $6.2 billion Financing Capacity2 Liquidity & Capitalization 73.7% Non-Mark-to-Market Financing2 2.6x Total Leverage Ratio1 1.81% Weighted Average Cost of Funds 80.0% Weighted Average Approved Advance Rate $771.7 million of Liquidity3 Investor Presentation | September 2022 $613.3 million of Originations 1H 2022 Investment Activity Multifamily Loans 73.3% of Originations 3.96% Weighted Average Credit Spread on Originations $717.3 million of Full Loan Repayments 5 point YTD Decline in Office Exposure by Total Loan Commitments to 37.2%

4Investor Presentation | September 2022 TPG – Premier Global Asset Manager Capital Real Estate Impact TPG Real Estate Partners (TREP) Market Solutions $62B $20B $15B$21B $9B Real Estate Thematic Advantage Core Plus (TAC+) TPG Real Estate Partners (TREP) TPG RE Finance Trust (TRTX) TPG Rise Climate The Rise Funds Evercare TPG Tech Adjacencies (TTAD) TPG Growth TPG Digital Media (TDM) SPACs Public Market Investing Capital Markets Private Market Solutions TPG Capital Continuation Vehicles TPG Healthcare Partners TPG Asia AU M Fu nd s Integrated Real Estate Platform Real Estate Equity $1.8B AUM $12.4B AUM Growth Real Estate Thematic Advantage Core Plus (TAC+) TPG RE Finance Trust (TRTX) $5.4B AUM Real Estate Debt TPG Integration Drives Competitive Advantage Experienced team with a long history of collaborative investing through numerous credit and macroeconomic cycles Established lending platform with strong capital markets capabilities and extensive financing relationships Long standing relationships with repeat borrowers, developers, investors, national brokerage firms, and financial institutions Deep knowledge of target markets, property types, and investable global trends Data-driven investment philosophy for 30 years TPG is a global alternative investment manager operating an integrated platform with $127 billion of assets under management Enhanced investing capabilities powered by an expansive and scaled platform Note: AUM as of June 30, 2022; Totals may not sum due to rounding Segment

5 Career Credit Investors Drive Investment Strategy Leadership team has invested through multiple business and real estate cycles Emphasis on credit quality and principal protection Engagement throughout the investment process Deep, extensive relationships with owners, borrowers, brokers and capital providers Investment team supported by TPG’s global infrastructure and leadership team Peter Smith Chief Investment Officer 30+ years of experience Select Experience Managing Director Ladder Capital Deborah Ginsberg General Counsel 20+ years of experience Select Experience Principal Blackstone RE Debt Strategies Select Experience Co-Founder, CFO and COO Gramercy Capital Corp. Bob Foley Chief Financial Officer 30+ years of experience Team combines investing expertise with public company C-level experience Matt Coleman President 20+ years of experience Select Experience Chief Operating Officer TPG Real Estate Investor Presentation | September 2022 Doug Bouquard Chief Executive Officer 18+ years of experience Select Experience Managing Director Goldman Sachs

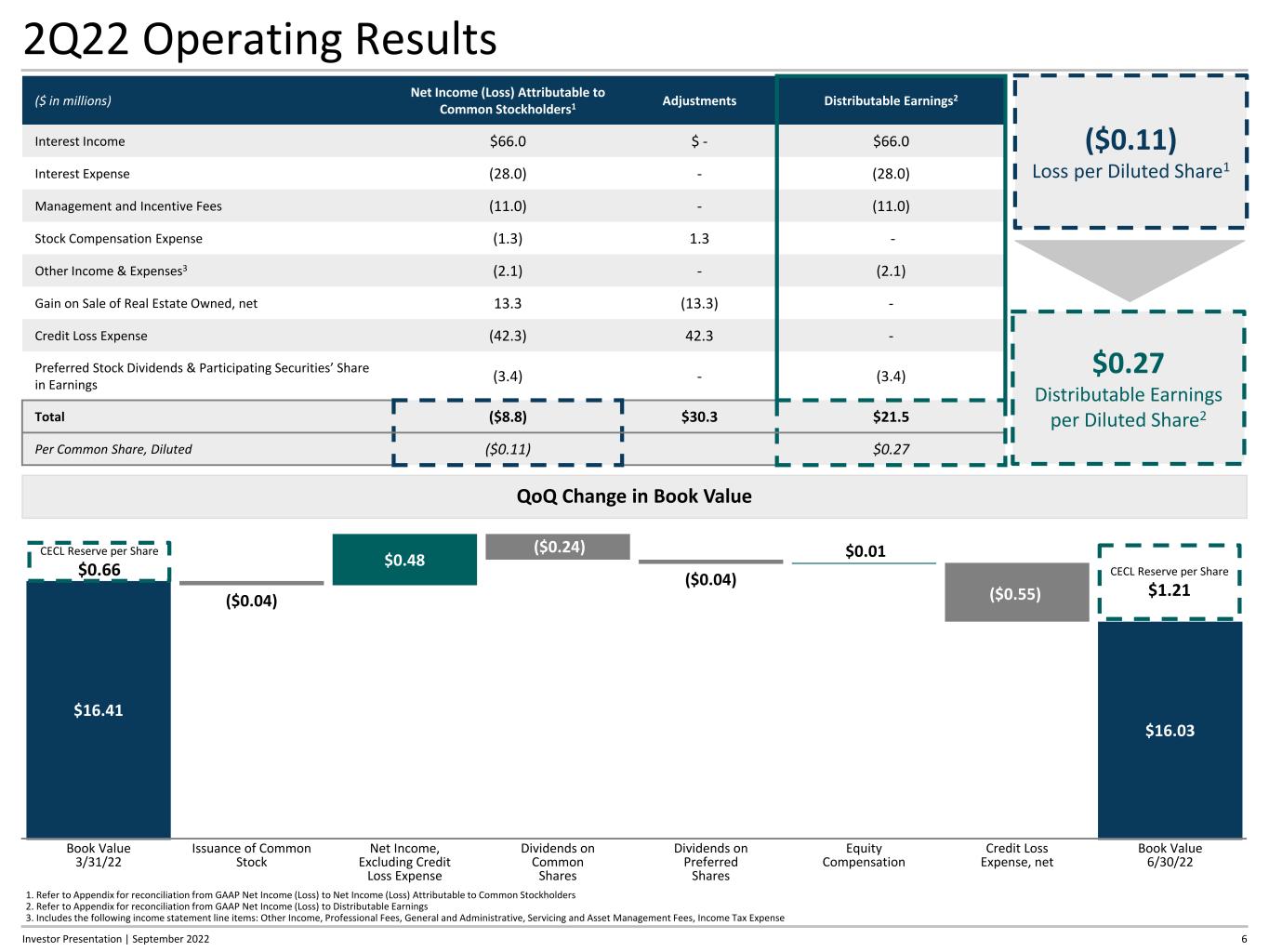

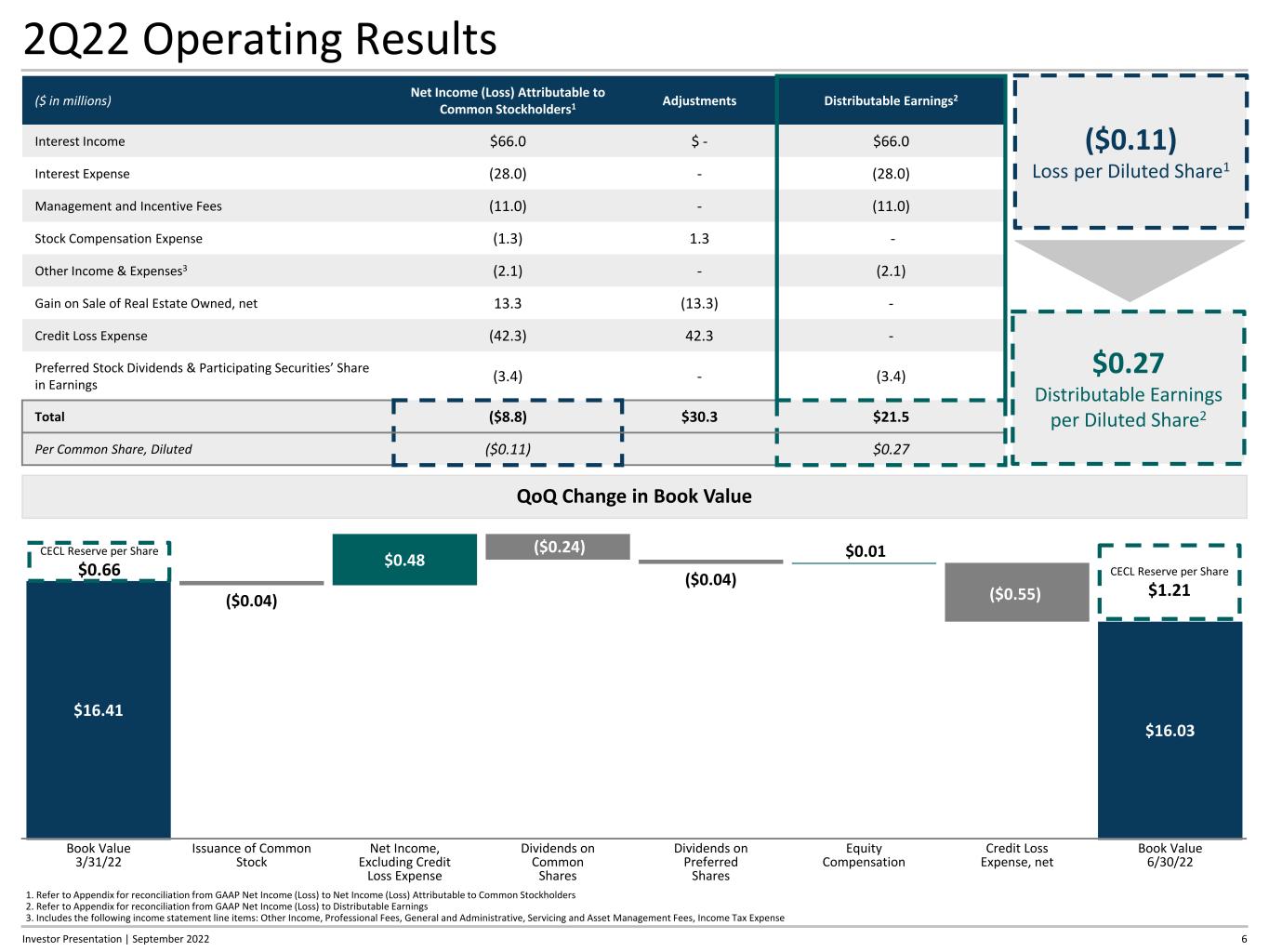

6Investor Presentation | September 2022 2Q22 Operating Results ($ in millions) Net Income (Loss) Attributable to Common Stockholders1 Adjustments Distributable Earnings2 Interest Income $66.0 $ - $66.0 Interest Expense (28.0) - (28.0) Management and Incentive Fees (11.0) - (11.0) Stock Compensation Expense (1.3) 1.3 - Other Income & Expenses3 (2.1) - (2.1) Gain on Sale of Real Estate Owned, net 13.3 (13.3) - Credit Loss Expense (42.3) 42.3 - Preferred Stock Dividends & Participating Securities’ Share in Earnings (3.4) - (3.4) Total ($8.8) $30.3 $21.5 Per Common Share, Diluted ($0.11) $0.27 ($0.11) Loss per Diluted Share1 $0.27 Distributable Earnings per Diluted Share2 ($0.04) ($0.24) ($0.04) ($0.55) $0.48 $0.01 $16.41 $16.03 00 50 00 50 00 50 00 Book Value 3/31/22 Issuance of Common Stock Net Income, Excluding Credit Loss Expense Dividends on Common Shares Dividends on Preferred Shares Equity Compensation Credit Loss Expense, net Book Value 6/30/22 QoQ Change in Book Value CECL Reserve per Share $1.21 CECL Reserve per Share $0.66 1. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Net Income (Loss) Attributable to Common Stockholders 2. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Distributable Earnings 3. Includes the following income statement line items: Other Income, Professional Fees, General and Administrative, Servicing and Asset Management Fees, Income Tax Expense

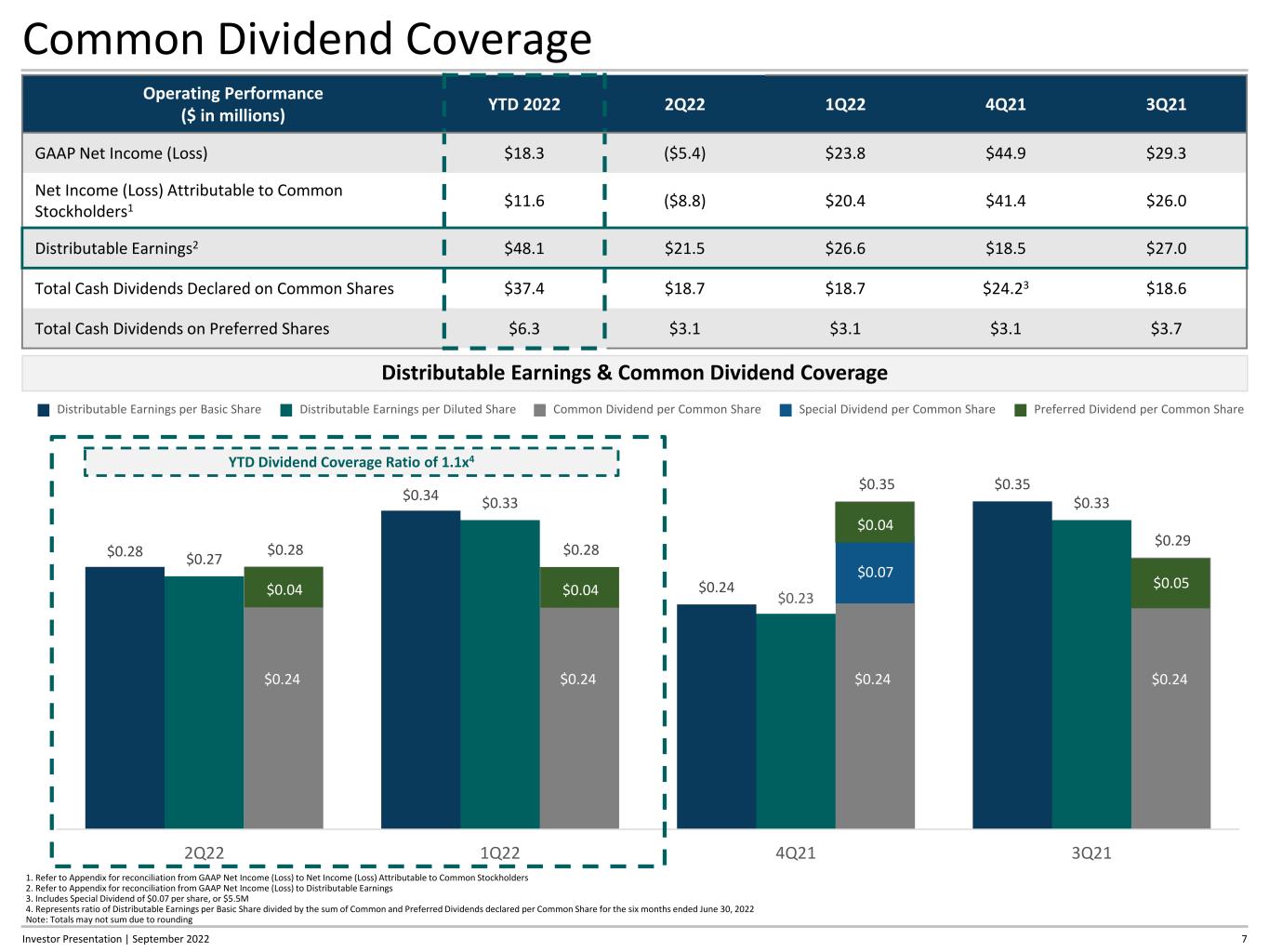

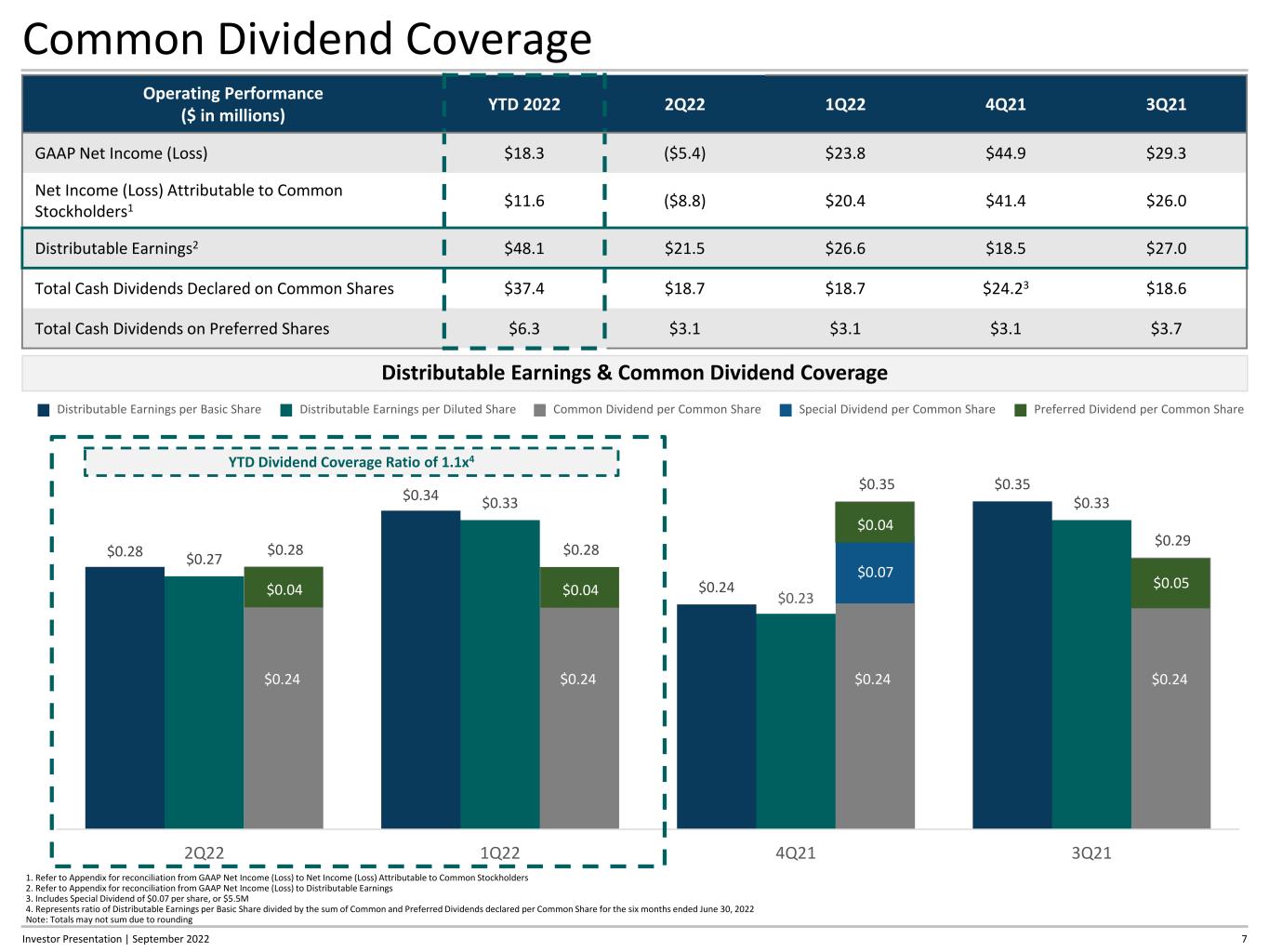

7 Common Dividend Coverage 1. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Net Income (Loss) Attributable to Common Stockholders 2. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Distributable Earnings 3. Includes Special Dividend of $0.07 per share, or $5.5M 4. Represents ratio of Distributable Earnings per Basic Share divided by the sum of Common and Preferred Dividends declared per Common Share for the six months ended June 30, 2022 Note: Totals may not sum due to rounding Operating Performance ($ in millions) YTD 2022 2Q22 1Q22 4Q21 3Q21 GAAP Net Income (Loss) $18.3 ($5.4) $23.8 $44.9 $29.3 Net Income (Loss) Attributable to Common Stockholders1 $11.6 ($8.8) $20.4 $41.4 $26.0 Distributable Earnings2 $48.1 $21.5 $26.6 $18.5 $27.0 Total Cash Dividends Declared on Common Shares $37.4 $18.7 $18.7 $24.23 $18.6 Total Cash Dividends on Preferred Shares $6.3 $3.1 $3.1 $3.1 $3.7 $0.28 $0.34 $0.24 $0.35 $0.27 $0.33 $0.23 $0.33 $0.28 $0.28 $0.35 $0.29 2Q22 1Q22 4Q21 3Q21 Distributable Earnings & Common Dividend Coverage $0.24 Investor Presentation | September 2022 $0.07 $0.04 $0.04 $0.24 $0.04 $0.24 $0.24 $0.05 Distributable Earnings per Basic Share Distributable Earnings per Diluted Share Common Dividend per Common Share Special Dividend per Common Share Preferred Dividend per Common Share YTD Dividend Coverage Ratio of 1.1x4

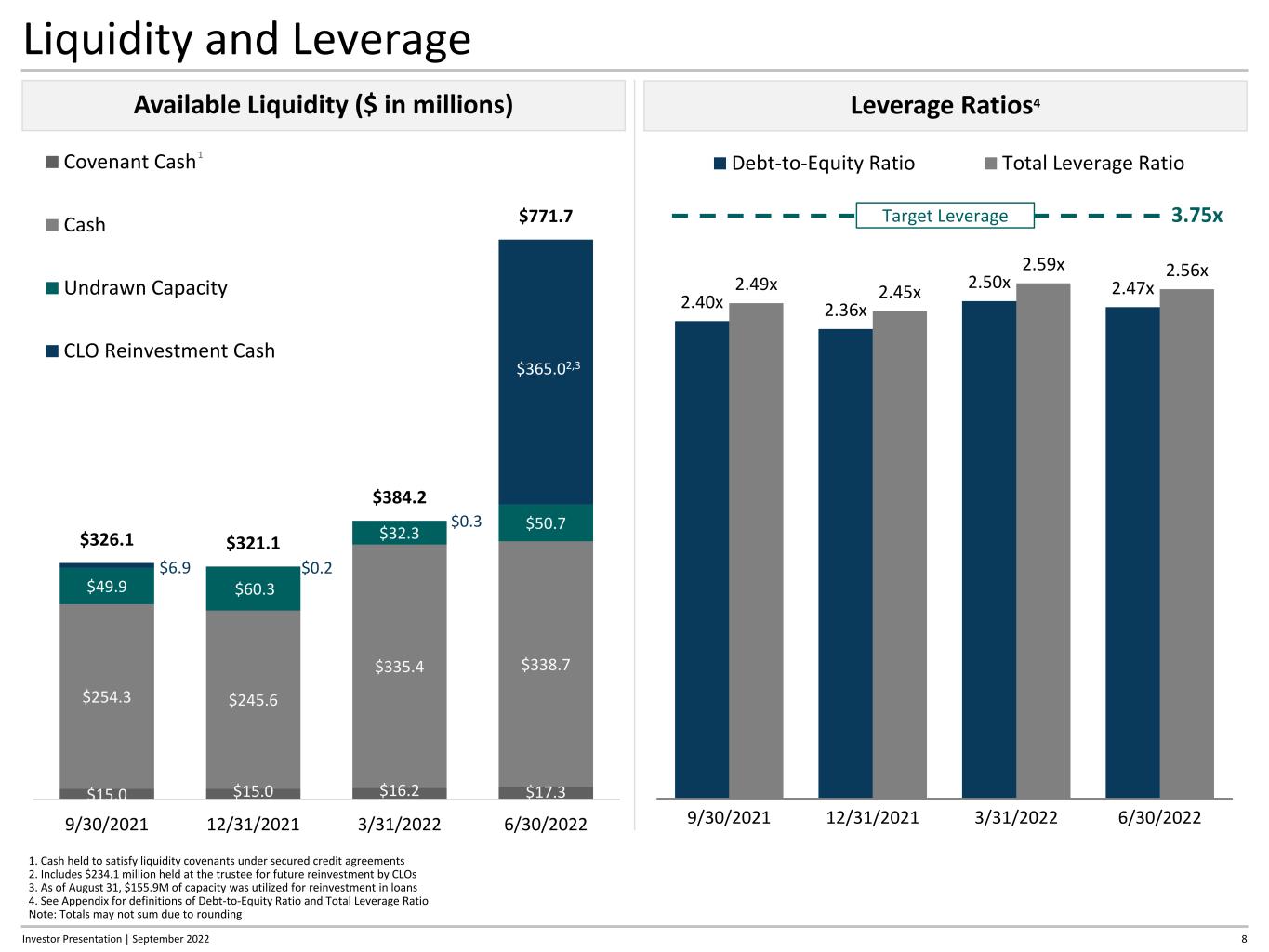

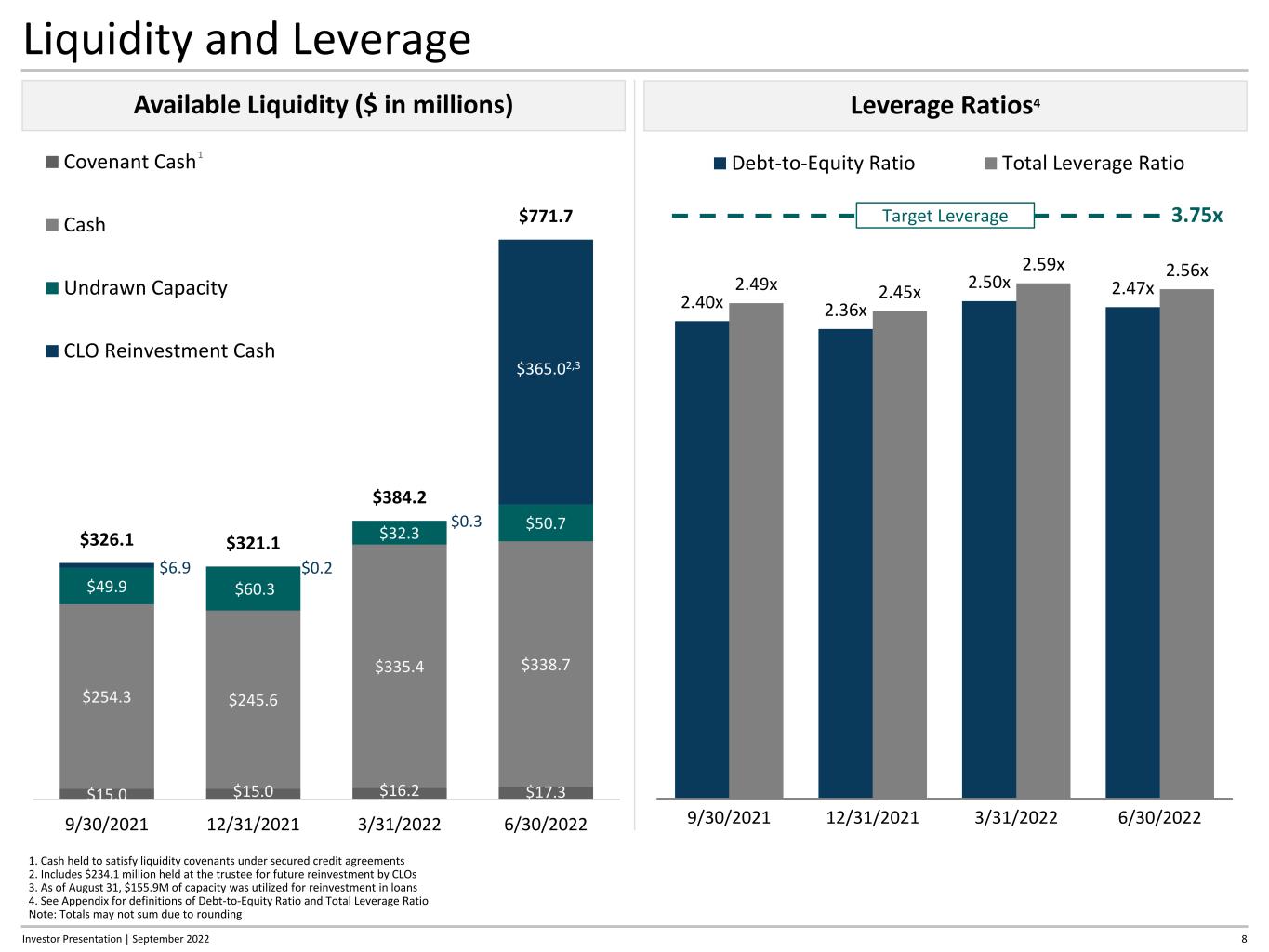

2.40x 2.36x 2.50x 2.47x2.49x 2.45x 2.59x 2.56x 9/30/2021 12/31/2021 3/31/2022 6/30/2022 Debt-to-Equity Ratio Total Leverage Ratio Liquidity and Leverage Available Liquidity ($ in millions) Leverage Ratios4 1. Cash held to satisfy liquidity covenants under secured credit agreements 2. Includes $234.1 million held at the trustee for future reinvestment by CLOs 3. As of August 31, $155.9M of capacity was utilized for reinvestment in loans 4. See Appendix for definitions of Debt-to-Equity Ratio and Total Leverage Ratio Note: Totals may not sum due to rounding 8 $15.0 $15.0 $16.2 $17.3 $254.3 $245.6 $335.4 $338.7 $49.9 $60.3 $32.3 $50.7 $6.9 $0.2 $0.3 $365.02,3 $326.1 $321.1 $384.2 $771.7 9/30/2021 12/31/2021 3/31/2022 6/30/2022 Covenant Cash Cash Undrawn Capacity CLO Reinvestment Cash 1 Investor Presentation | September 2022 3.75xTarget Leverage

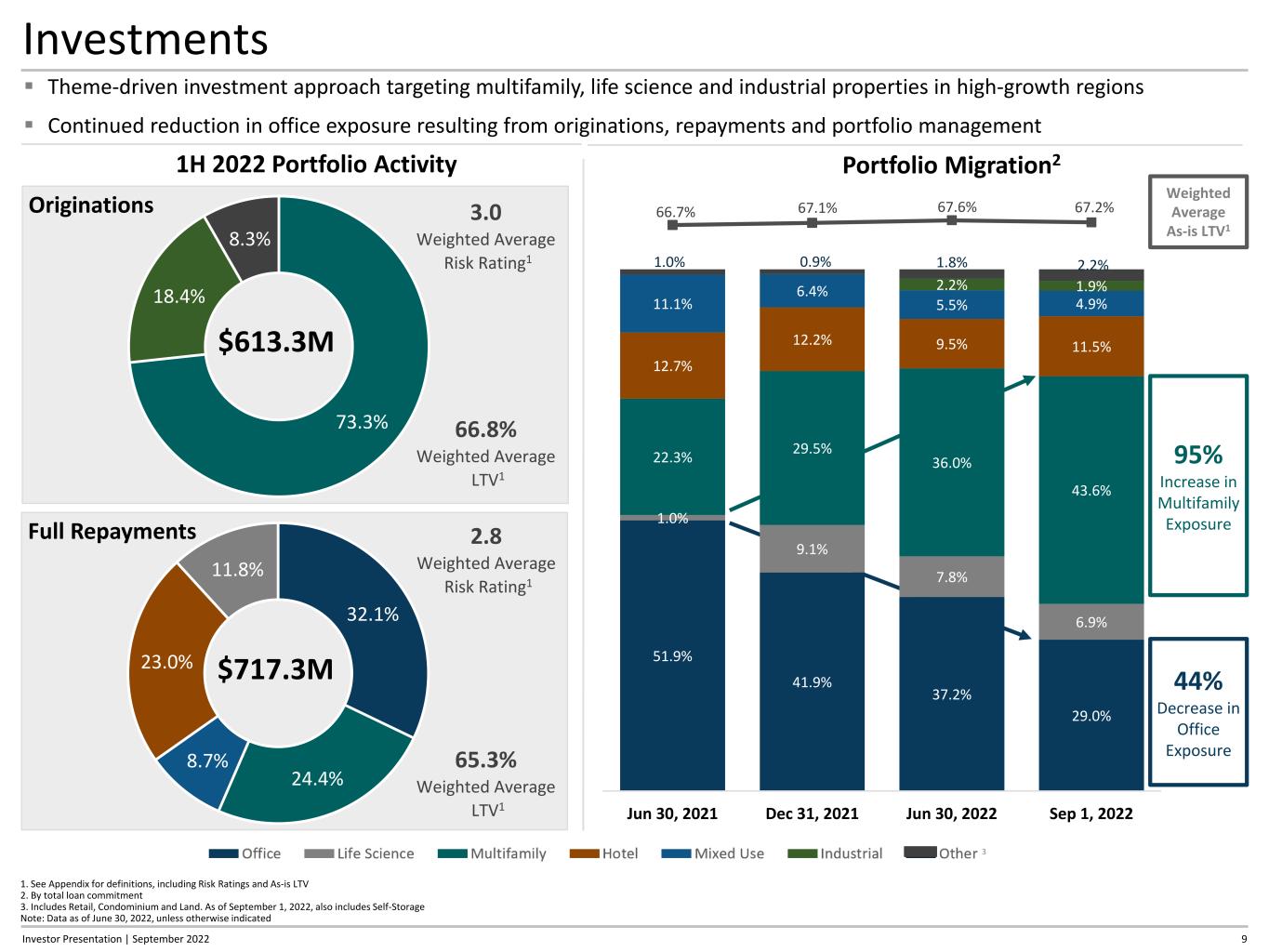

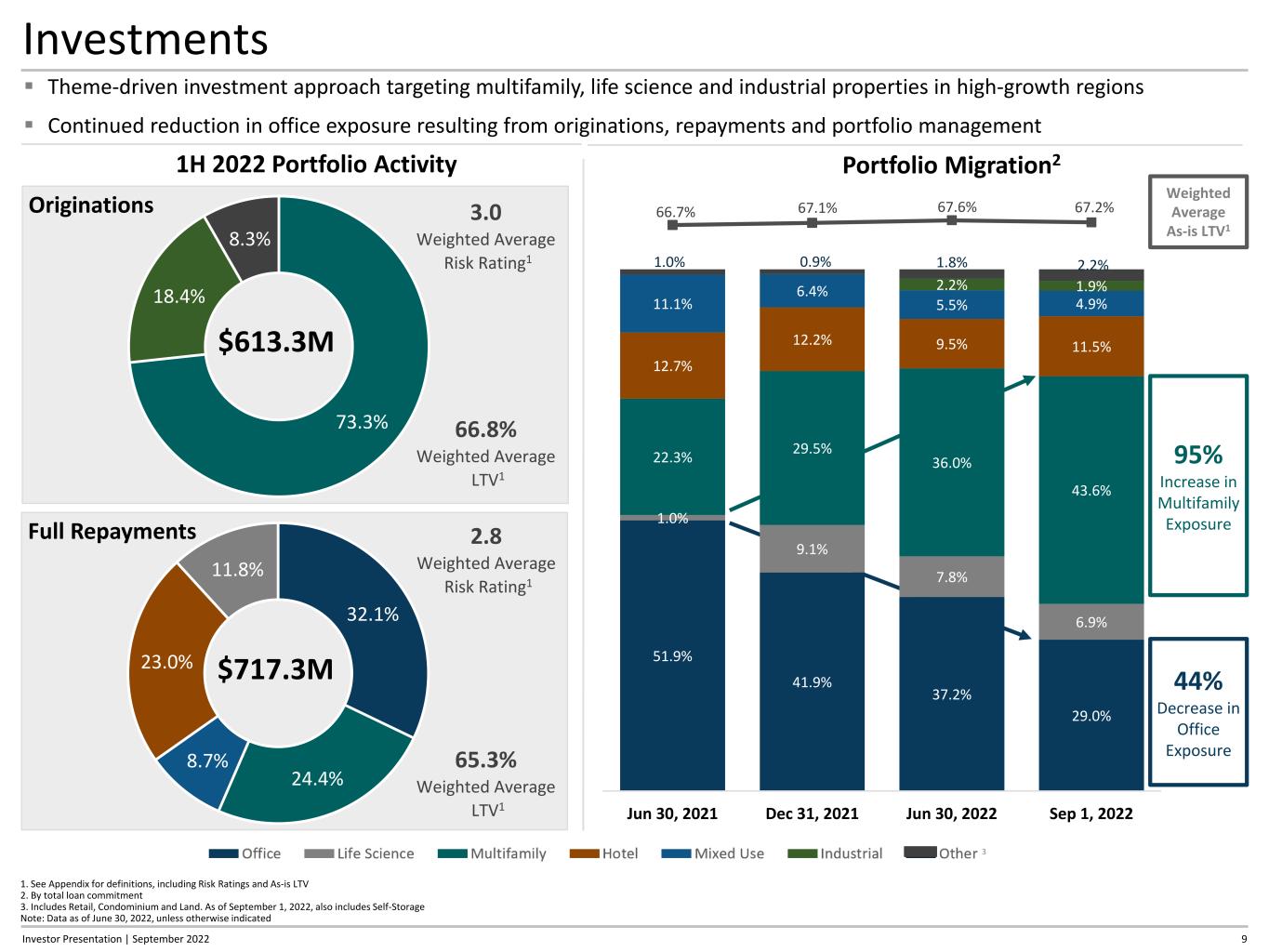

9Investor Presentation | September 2022 Investments Theme-driven investment approach targeting multifamily, life science and industrial properties in high-growth regions Continued reduction in office exposure resulting from originations, repayments and portfolio management 1H 2022 Portfolio Activity Originations 73.3% 18.4% 8.3% $613.3M Full Repayments 32.1% 24.4% 8.7% 23.0% 11.8% $717.3M 51.9% 41.9% 37.2% 29.0% 1.0% 9.1% 7.8% 6.9% 22.3% 29.5% 36.0% 43.6% 12.7% 12.2% 9.5% 11.5% 11.1% 6.4% 5.5% 4.9% 2.2% 1.9% 1.0% 0.9% 1.8% 2.2% 66.7% 67.1% 67.6% 67.2% Jun 30, 2021 Dec 31, 2021 Jun 30, 2022 Sep 1, 2022 Portfolio Migration2 1. See Appendix for definitions, including Risk Ratings and As-is LTV 2. By total loan commitment 3. Includes Retail, Condominium and Land. As of September 1, 2022, also includes Self-Storage Note: Data as of June 30, 2022, unless otherwise indicated 66.8% Weighted Average LTV1 65.3% Weighted Average LTV1 3 95% Increase in Multifamily Exposure 44% Decrease in Office Exposure Weighted Average As-is LTV1 3.0 Weighted Average Risk Rating1 2.8 Weighted Average Risk Rating1

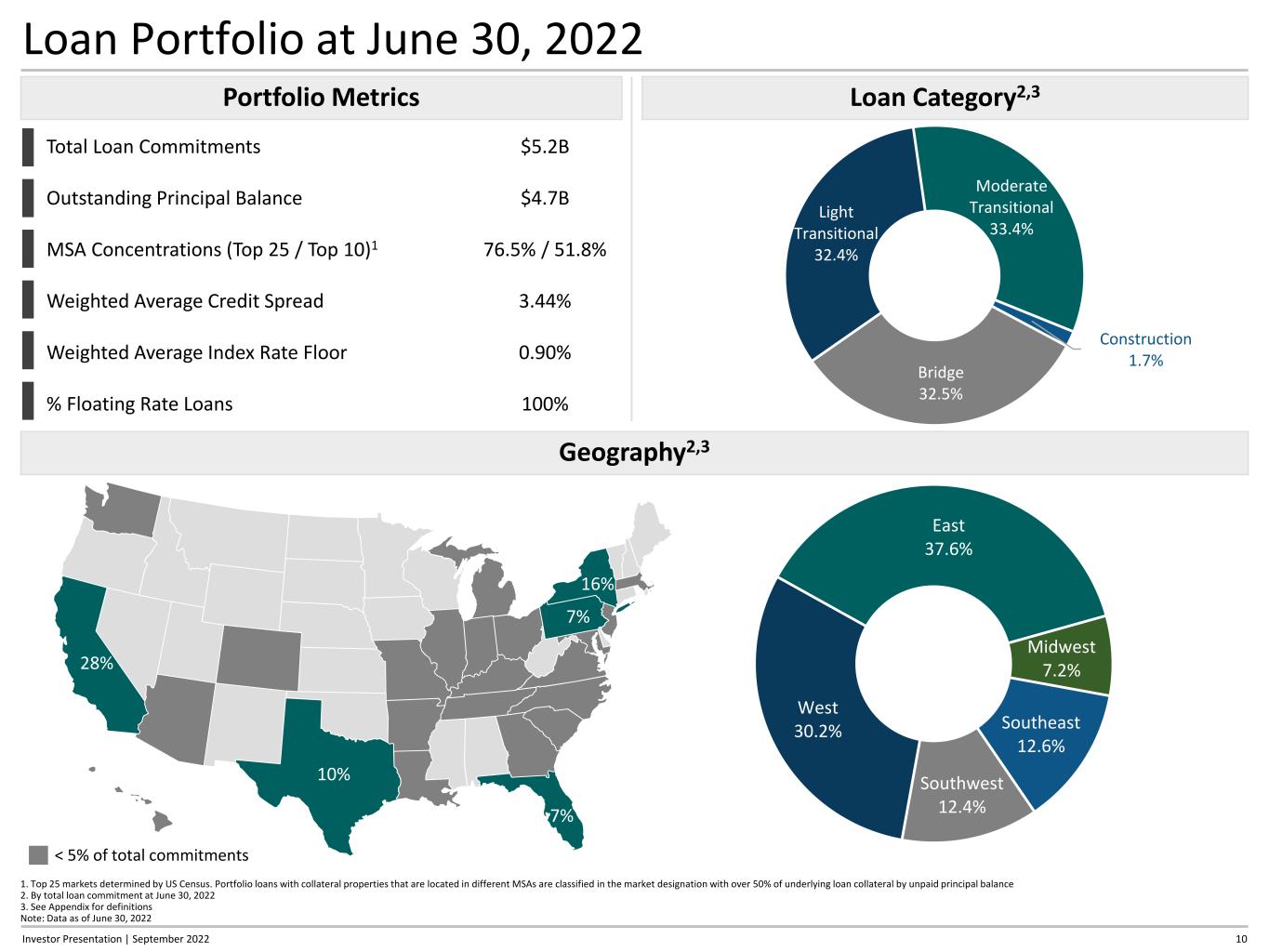

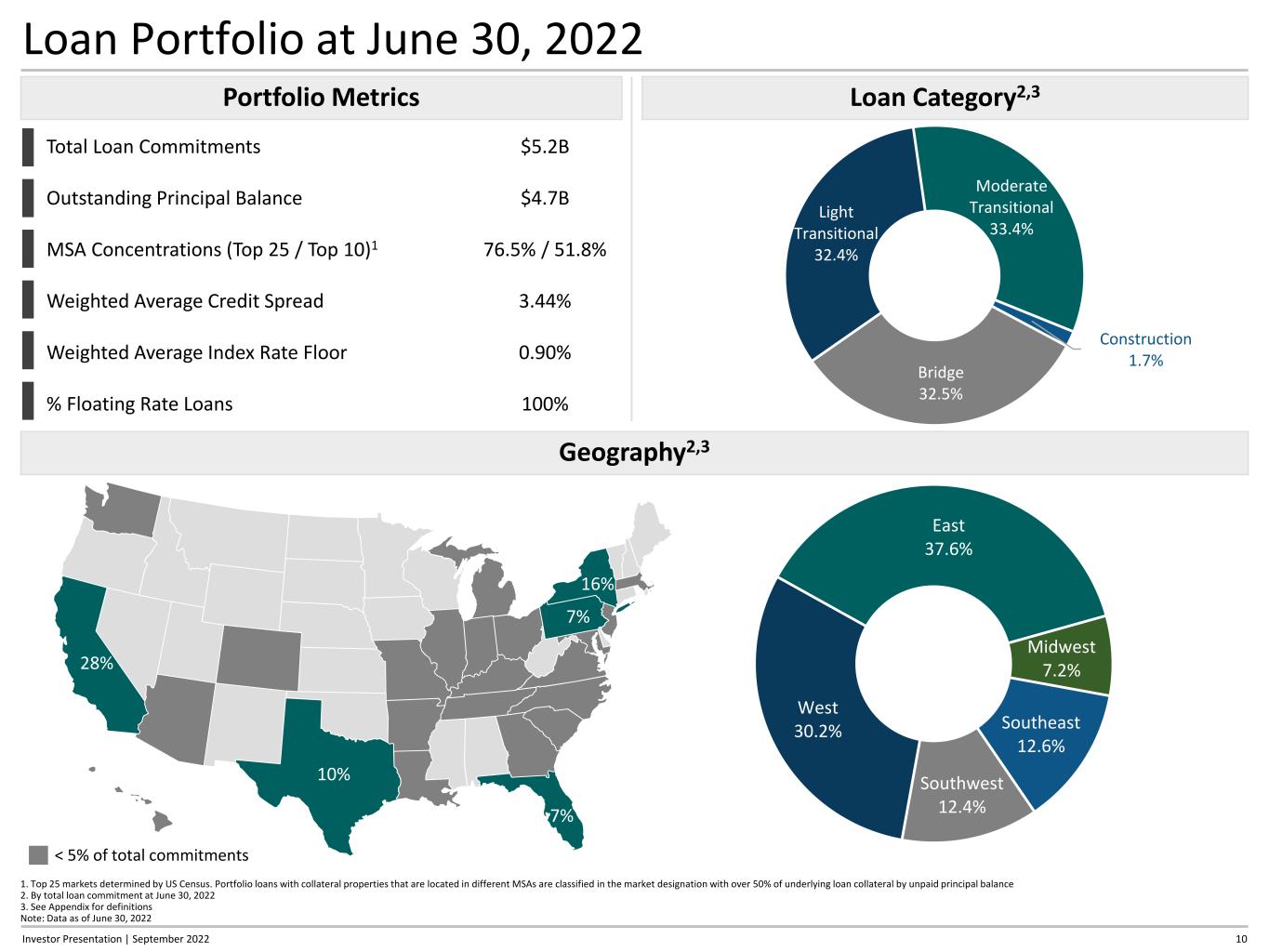

10Investor Presentation | September 2022 Loan Portfolio at June 30, 2022 28% 16% 10% 7% 7% Geography2,3 East 37.6% Midwest 7.2% Southeast 12.6% Southwest 12.4% West 30.2% Portfolio Metrics Total Loan Commitments $5.2B Outstanding Principal Balance $4.7B MSA Concentrations (Top 25 / Top 10)1 76.5% / 51.8% Weighted Average Credit Spread 3.44% Weighted Average Index Rate Floor 0.90% % Floating Rate Loans 100% Loan Category2,3 Construction 1.7% Bridge 32.5% Light Transitional 32.4% Moderate Transitional 33.4% < 5% of total commitments 1. Top 25 markets determined by US Census. Portfolio loans with collateral properties that are located in different MSAs are classified in the market designation with over 50% of underlying loan collateral by unpaid principal balance 2. By total loan commitment at June 30, 2022 3. See Appendix for definitions Note: Data as of June 30, 2022

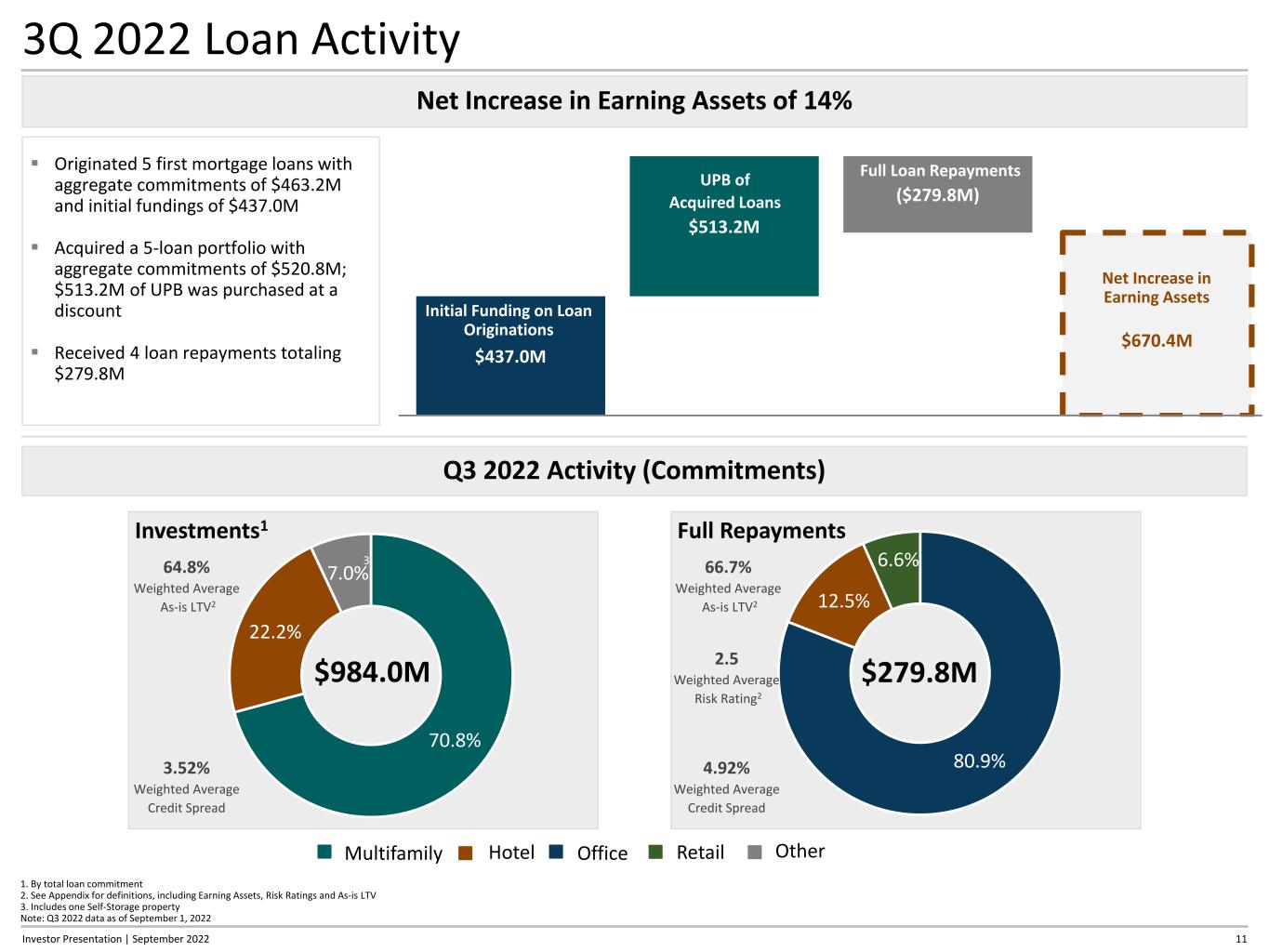

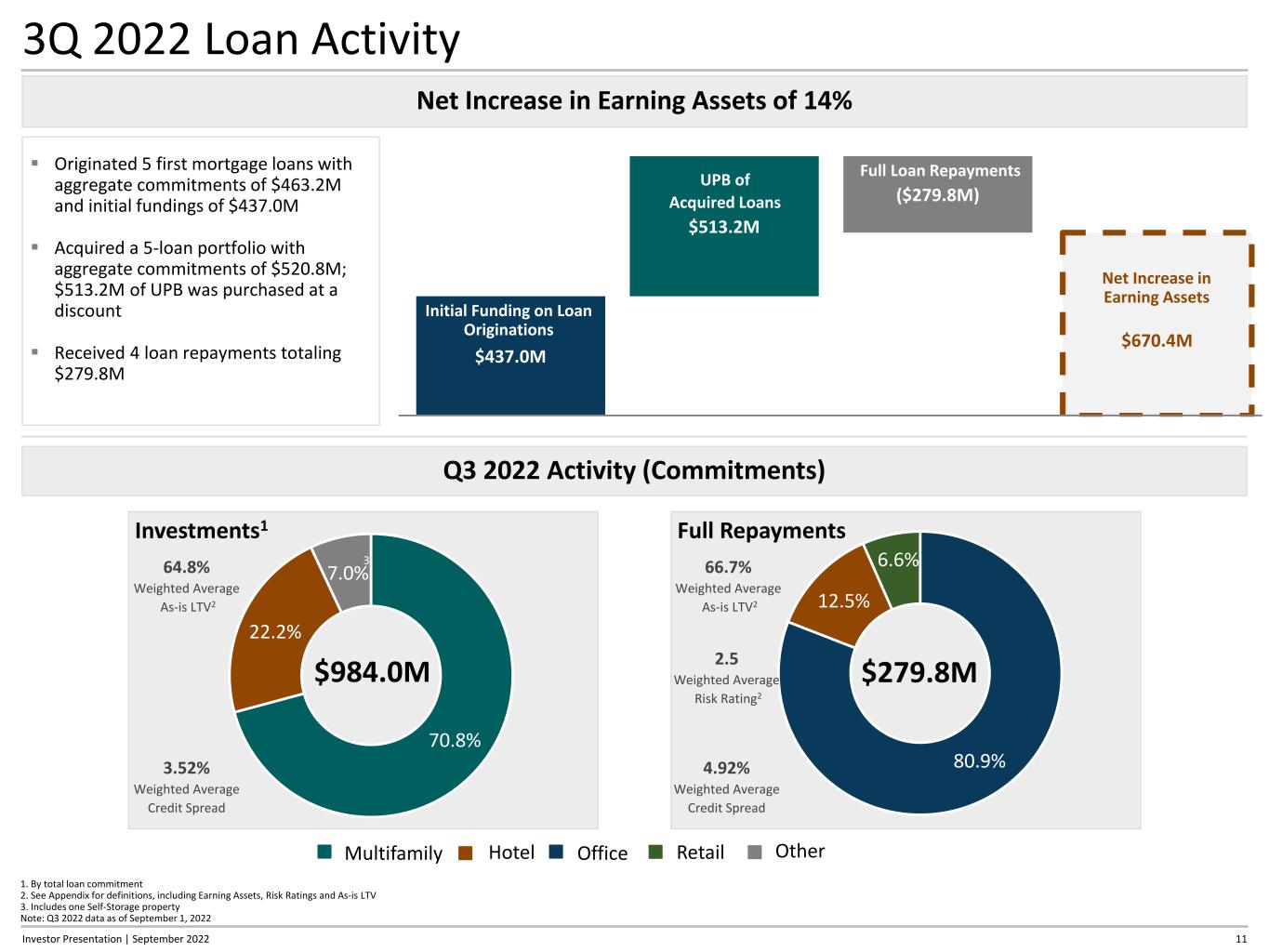

11Investor Presentation | September 2022 3Q 2022 Loan Activity Net Increase in Earning Assets of 14% ($279.8M) $513.2M $437.0M $670.4M Initial Funding on Loan Originations Purchased UPB on Acquired Loans Full RepaymentsNet Increase in Interest Earning Assets from Originations, Purcha Initial Funding on Loan Originations UPB of Acquired Loans Full Loan Repayments Net Increase in Earning Assets Originated 5 first mortgage loans with aggregate commitments of $463.2M and initial fundings of $437.0M Acquired a 5-loan portfolio with aggregate commitments of $520.8M; $513.2M of UPB was purchased at a discount Received 4 loan repayments totaling $279.8M Q3 2022 Activity (Commitments) Investments1 70.8% 22.2% 7.0% $984.0M 64.8% Weighted Average As-is LTV2 3.52% Weighted Average Credit Spread Full Repayments 80.9% 12.5% 6.6% $279.8M 66.7% Weighted Average As-is LTV2 2.5 Weighted Average Risk Rating2 4.92% Weighted Average Credit Spread 1. By total loan commitment 2. See Appendix for definitions, including Earning Assets, Risk Ratings and As-is LTV 3. Includes one Self-Storage property Note: Q3 2022 data as of September 1, 2022 3 Multifamily Hotel Retail OtherOffice

12 Portfolio Credit Weighted Average Risk Ratings Migration by Property Type3 by Amortized Cost 3.3 3.0 3.1 3.0 3.4 3.0 5.0 3.0 3.02.9 3.0 3.6 2.7 2.9 n/a 5.0 3.0 n/a Office Multifamily Hotel Life Science Mixed-Use Industrial Retail Condominium Other 2Q 2022 4Q 2021 4Q 2021 Weighted Average Risk Rating: 3.0 2Q 2022 Weighted Average Risk Rating: 3.2 1. Calculated on total reserve dollar value 2. See Appendix for definitions, including ITD Loan Loss Rate; there can be no assurance that this performance will continue; net loan loss rate includes the impact of $29.1M gain on sale of REO 3. See Appendix for definitions including Risk Ratings Note: Data as of June 30, 2022, unless otherwise noted Investor Presentation | September 2022 QoQ CECL Reserve bps of Total Loan Commitments 84 85 91 159 19 21 103 85 91 180 9/30/2021 12/31/2021 3/31/2022 6/30/2022 General Reserve Specifically Identified Loan Snapshot CECL reserve increase of 83% QoQ1 to address the potential impact of economic uncertainty and weakening credit indicators Weighted average risk rating of office properties increased from 2.9 to 3.3 YTD driven by ongoing concerns about weakening office fundamentals and increased market volatility During 1H 2022: − Downgraded 1 office loan from risk category “2” to “3” − Downgraded 6 office loans from risk category “3” to “4”, and subsequently downgraded 1 office loan from risk category “4” to “5” due to a near-term maturity and risk of principal loss Net ITD actual loan loss rate2: 13 bps 13

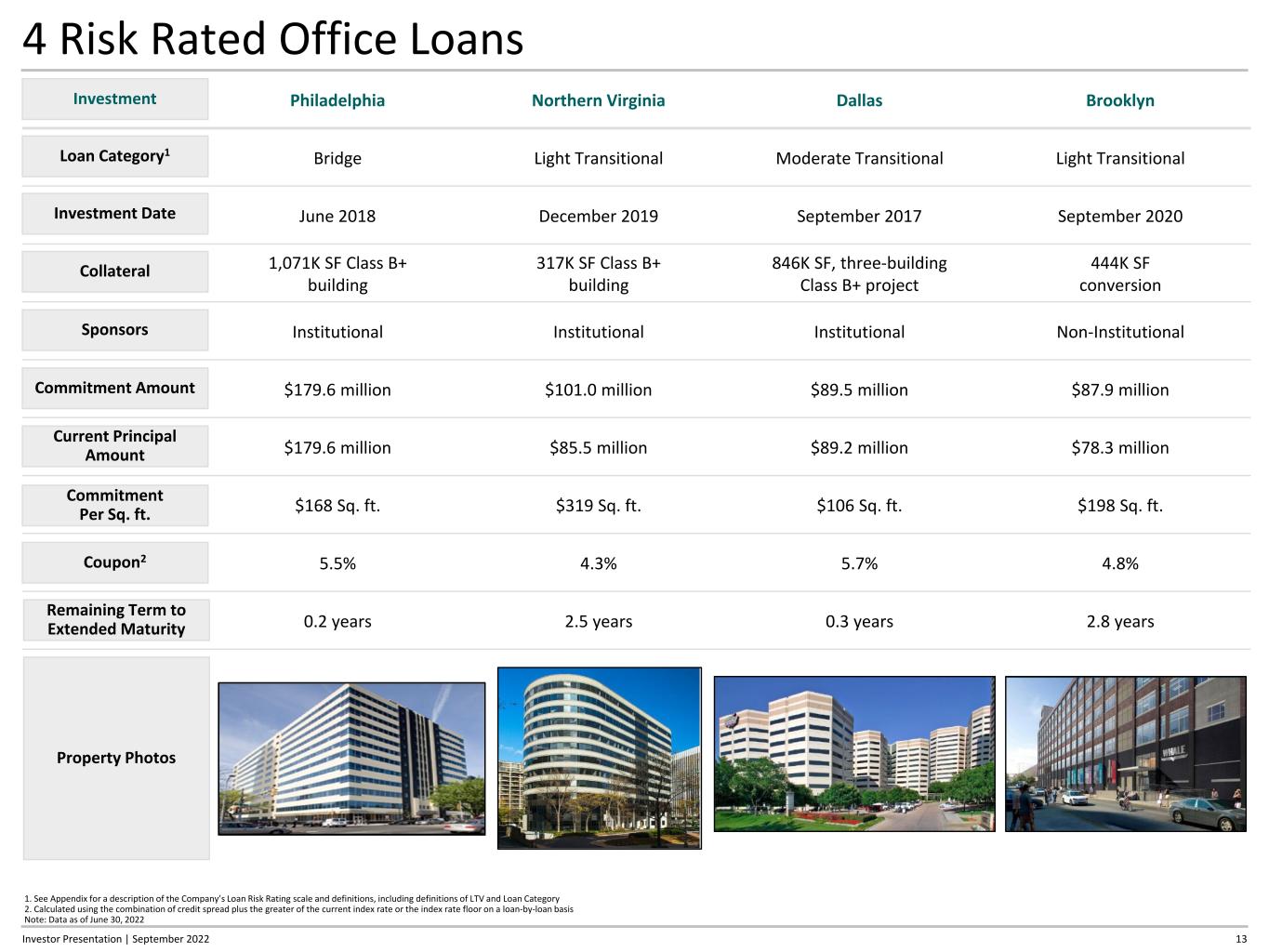

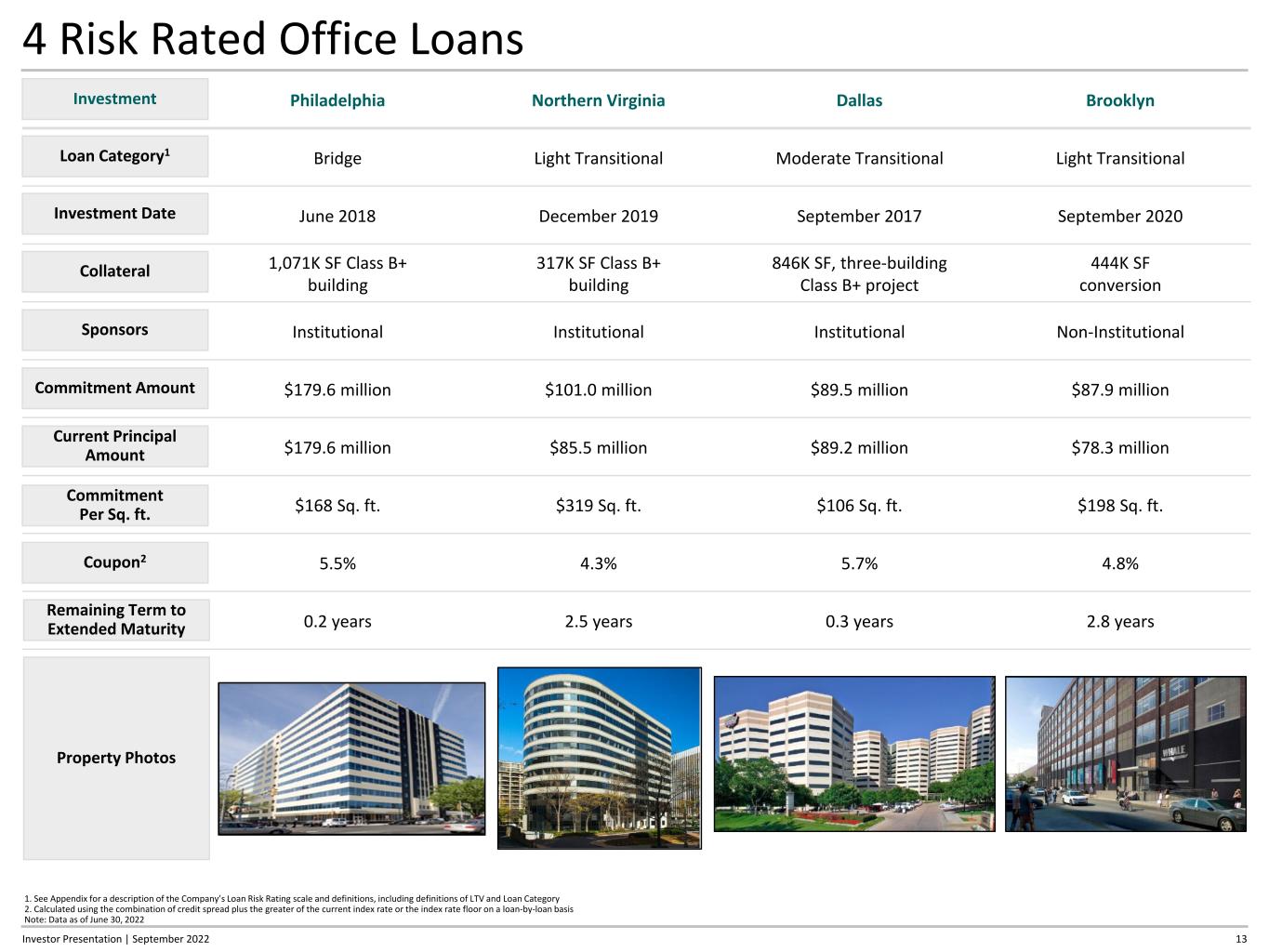

Philadelphia Northern Virginia Dallas Brooklyn Bridge Light Transitional Moderate Transitional Light Transitional June 2018 December 2019 September 2017 September 2020 1,071K SF Class B+ building 317K SF Class B+ building 846K SF, three-building Class B+ project 444K SF conversion Institutional Institutional Institutional Non-Institutional $179.6 million $101.0 million $89.5 million $87.9 million $179.6 million $85.5 million $89.2 million $78.3 million $168 Sq. ft. $319 Sq. ft. $106 Sq. ft. $198 Sq. ft. 5.5% 4.3% 5.7% 4.8% 0.2 years 2.5 years 0.3 years 2.8 years 4 Risk Rated Office Loans 13Investor Presentation | September 2022 Loan Category1 Investment Investment Date Collateral Sponsors Commitment Amount Current Principal Amount Commitment Per Sq. ft. Coupon2 Remaining Term to Extended Maturity Property Photos 1. See Appendix for a description of the Company’s Loan Risk Rating scale and definitions, including definitions of LTV and Loan Category 2. Calculated using the combination of credit spread plus the greater of the current index rate or the index rate floor on a loan-by-loan basis Note: Data as of June 30, 2022

Orange, California San Mateo, California Honolulu, Hawaii Santa Ana, California Moderate Transitional Moderate Transitional Light Transitional Light Transitional August 2019 December 2019 March 2018 January 2018 340K SF multi-tenant building 206K SF Class B, five building complex 288K SF building 197K SF Class B, two building project Institutional Institutional Institutional Institutional $76.5 million $75.8 million $43.3 million $35.2 million $63.1 million $60.5 million $41.3 million $30.4 million $225 Sq. ft. $368 Sq. ft. $150 Sq. ft. $178 Sq. ft. 4.7% 4.3% 5.4% 5.4% 2.1 years 2.4 years 0.8 years 0.5 years 4 Risk Rated Office Loans (cont’d) 14Investor Presentation | September 2022 1. See Appendix for a description of the Company’s Loan Risk Rating scale and definitions, including definitions of LTV and Loan Category 2. Calculated using the combination of credit spread plus the greater of the current index rate or the index rate floor on a loan-by-loan basis Note: Data as of June 30, 2022 Loan Category1 Investment Investment Date Collateral Sponsors Commitment Amount Current Principal Amount Commitment Per Sq. ft. Coupon2 Remaining Term to Extended Maturity Property Photos

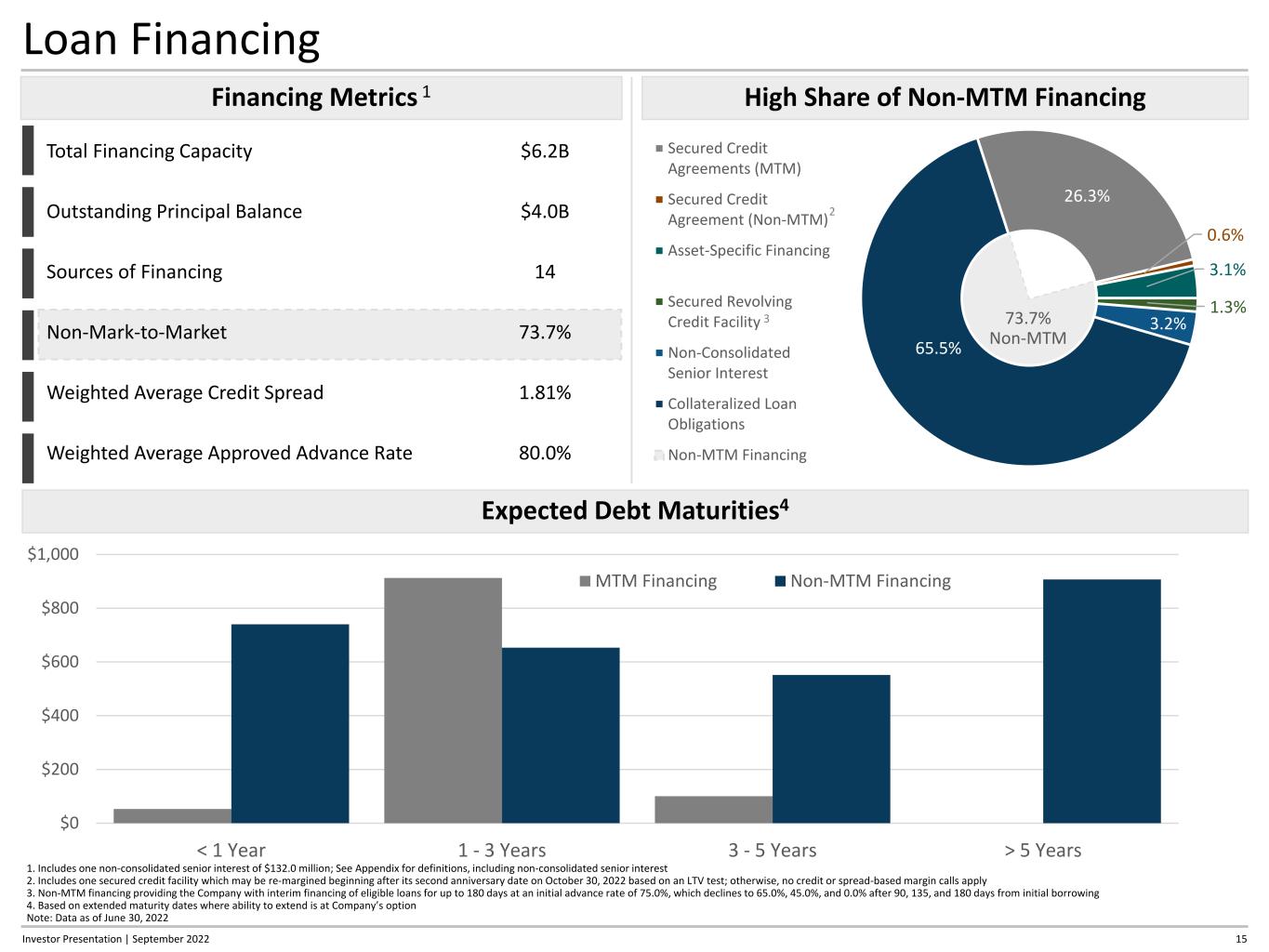

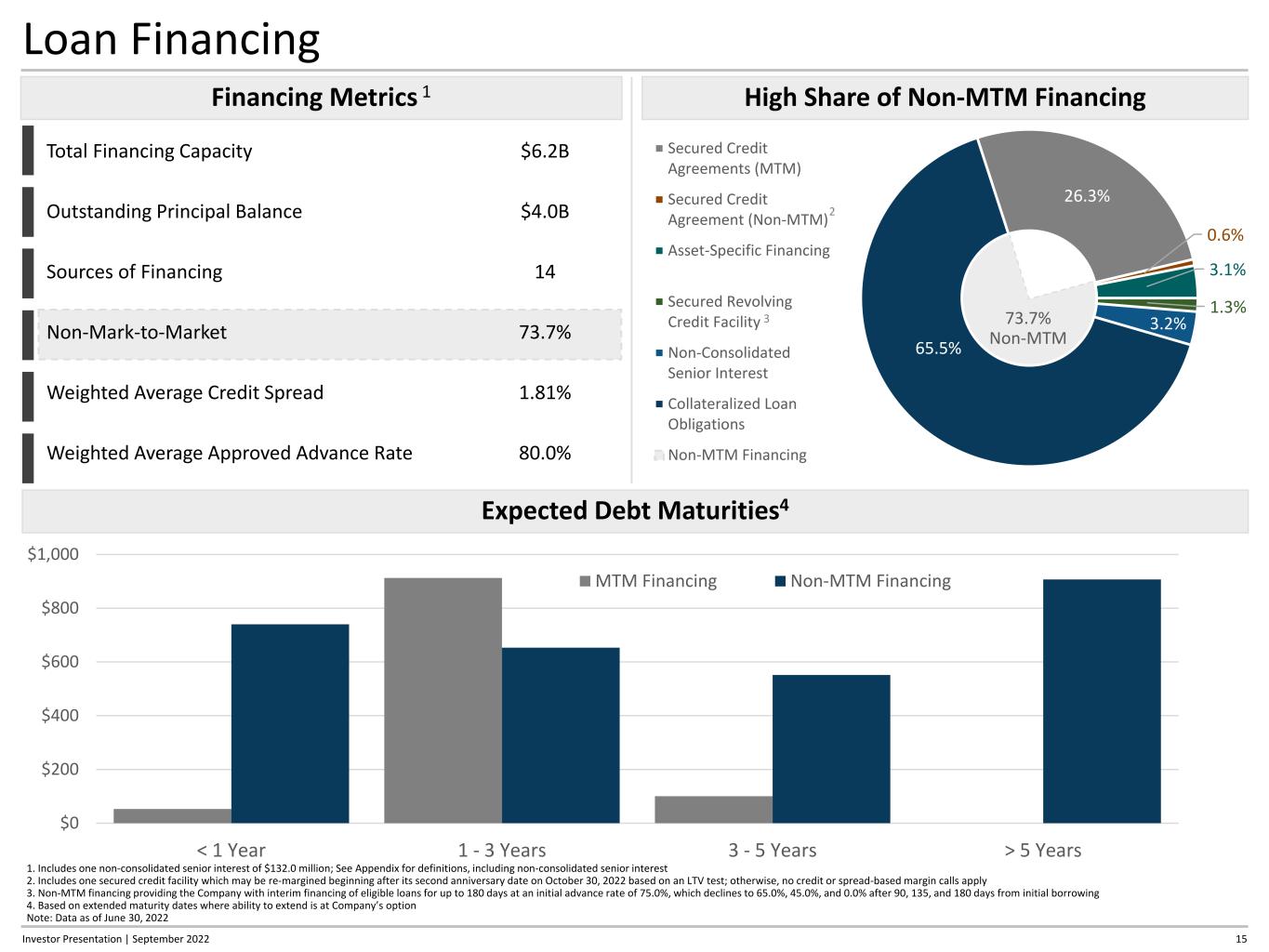

15Investor Presentation | September 2022 Loan Financing Financing Metrics 1 Total Financing Capacity $6.2B Outstanding Principal Balance $4.0B Sources of Financing 14 Non-Mark-to-Market 73.7% Weighted Average Credit Spread 1.81% Weighted Average Approved Advance Rate 80.0% 26.3% 0.6% 3.1% 1.3% 3.2% 65.5% Secured Credit Agreements (MTM) Secured Credit Agreement (Non-MTM) Asset-Specific Financing Secured Revolving Credit Facility Non-Consolidated Senior Interest Collateralized Loan Obligations Non-MTM Financing High Share of Non-MTM Financing $0 $200 $400 $600 $800 $1,000 < 1 Year 1 - 3 Years 3 - 5 Years > 5 Years MTM Financing Non-MTM Financing Expected Debt Maturities4 1. Includes one non-consolidated senior interest of $132.0 million; See Appendix for definitions, including non-consolidated senior interest 2. Includes one secured credit facility which may be re-margined beginning after its second anniversary date on October 30, 2022 based on an LTV test; otherwise, no credit or spread-based margin calls apply 3. Non-MTM financing providing the Company with interim financing of eligible loans for up to 180 days at an initial advance rate of 75.0%, which declines to 65.0%, 45.0%, and 0.0% after 90, 135, and 180 days from initial borrowing 4. Based on extended maturity dates where ability to extend is at Company’s option Note: Data as of June 30, 2022 3 2 73.7% Non-MTM

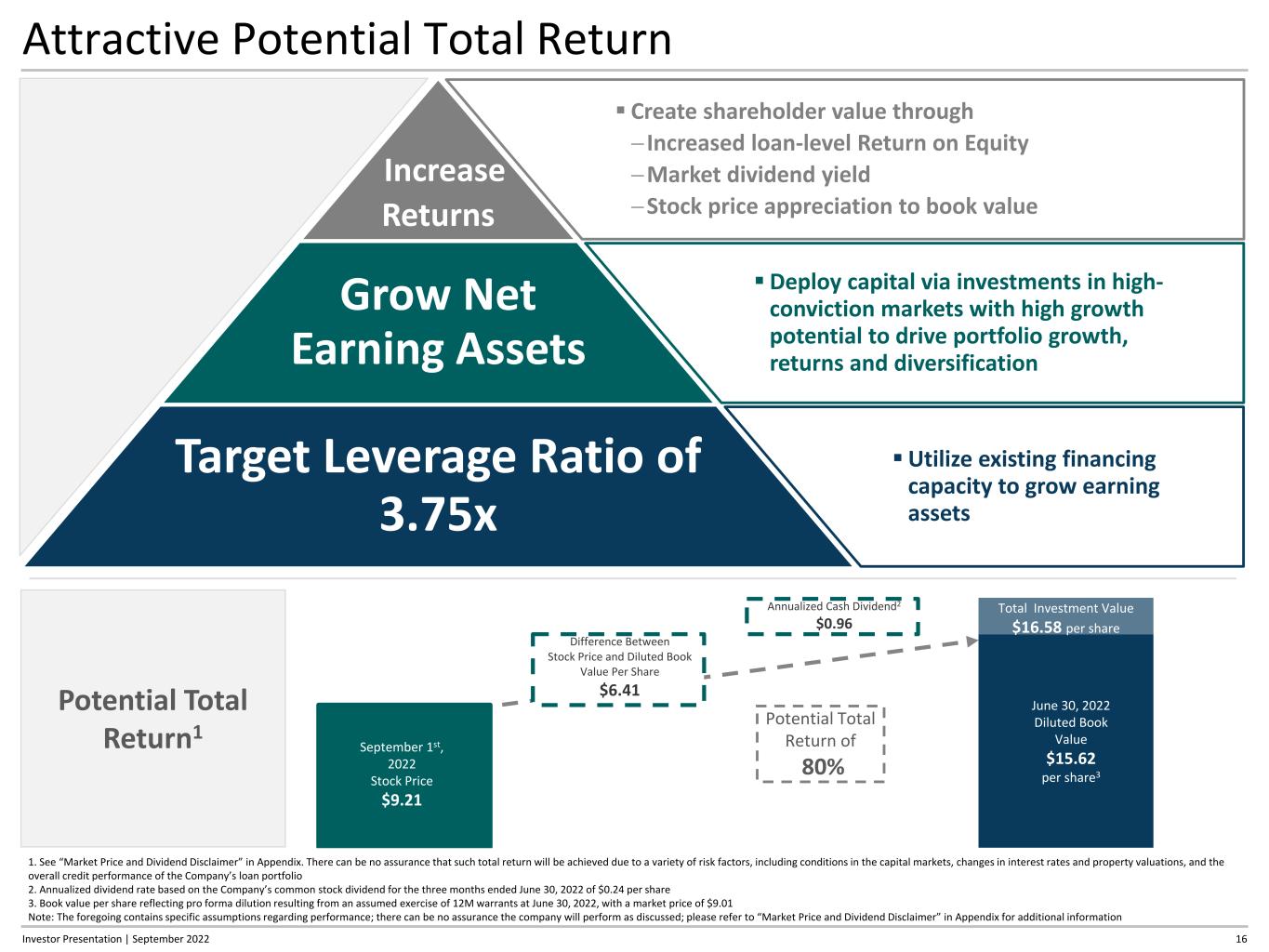

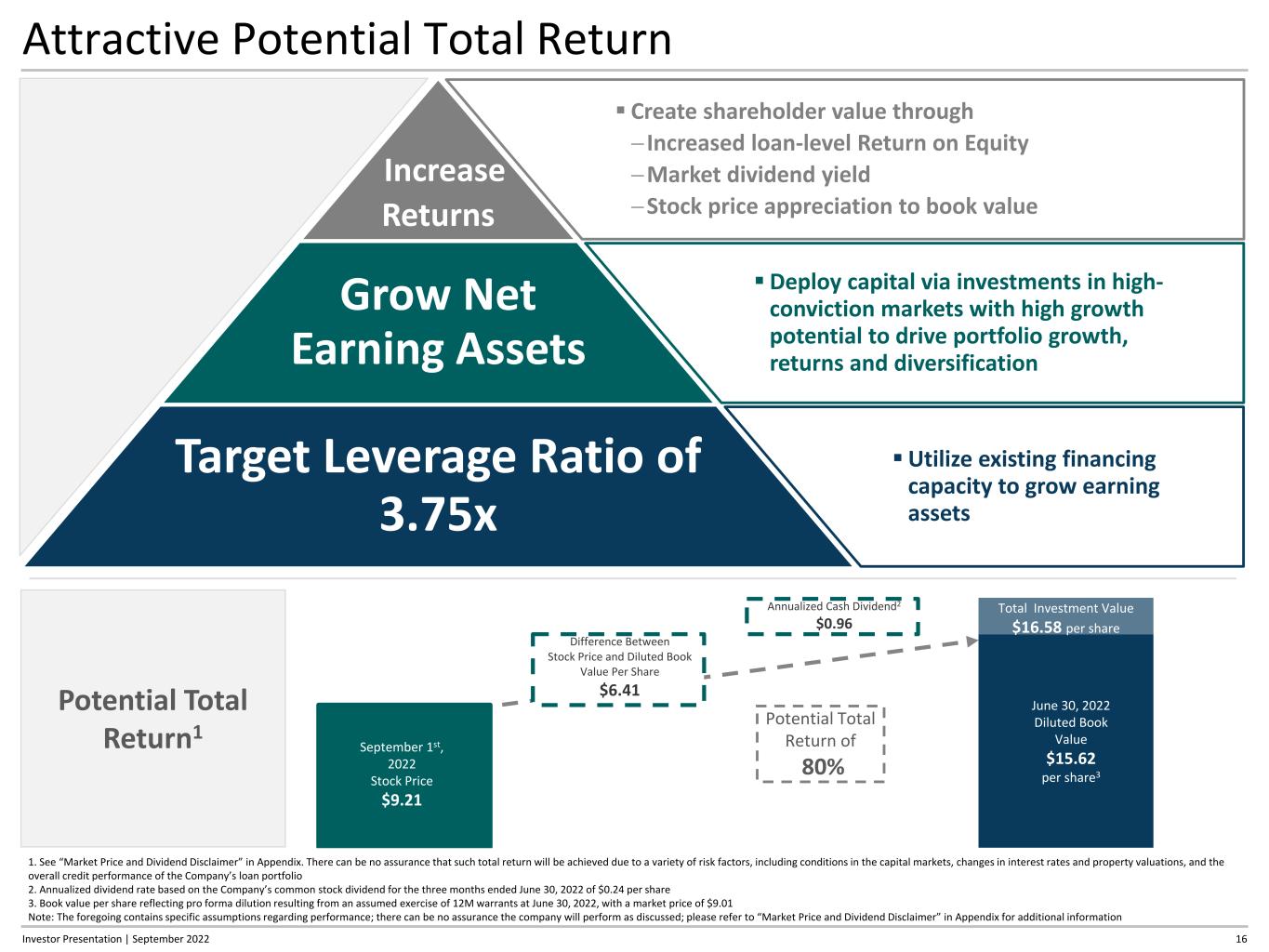

16Investor Presentation | September 2022 Attractive Potential Total Return Create shareholder value through − Increased loan-level Return on Equity −Market dividend yield −Stock price appreciation to book value Increase Returns Deploy capital via investments in high- conviction markets with high growth potential to drive portfolio growth, returns and diversification Grow Net Earning Assets Utilize existing financing capacity to grow earning assets Target Leverage Ratio of 3.75x Potential Total Return1 Difference Between Stock Price and Diluted Book Value Per Share $6.41 Annualized Cash Dividend2 $0.96 Total Investment Value $16.58 per share June 30, 2022 Diluted Book Value $15.62 per share3 September 1st, 2022 Stock Price $9.21 1. See “Market Price and Dividend Disclaimer” in Appendix. There can be no assurance that such total return will be achieved due to a variety of risk factors, including conditions in the capital markets, changes in interest rates and property valuations, and the overall credit performance of the Company’s loan portfolio 2. Annualized dividend rate based on the Company’s common stock dividend for the three months ended June 30, 2022 of $0.24 per share 3. Book value per share reflecting pro forma dilution resulting from an assumed exercise of 12M warrants at June 30, 2022, with a market price of $9.01 Note: The foregoing contains specific assumptions regarding performance; there can be no assurance the company will perform as discussed; please refer to “Market Price and Dividend Disclaimer” in Appendix for additional information Potential Total Return of 80%

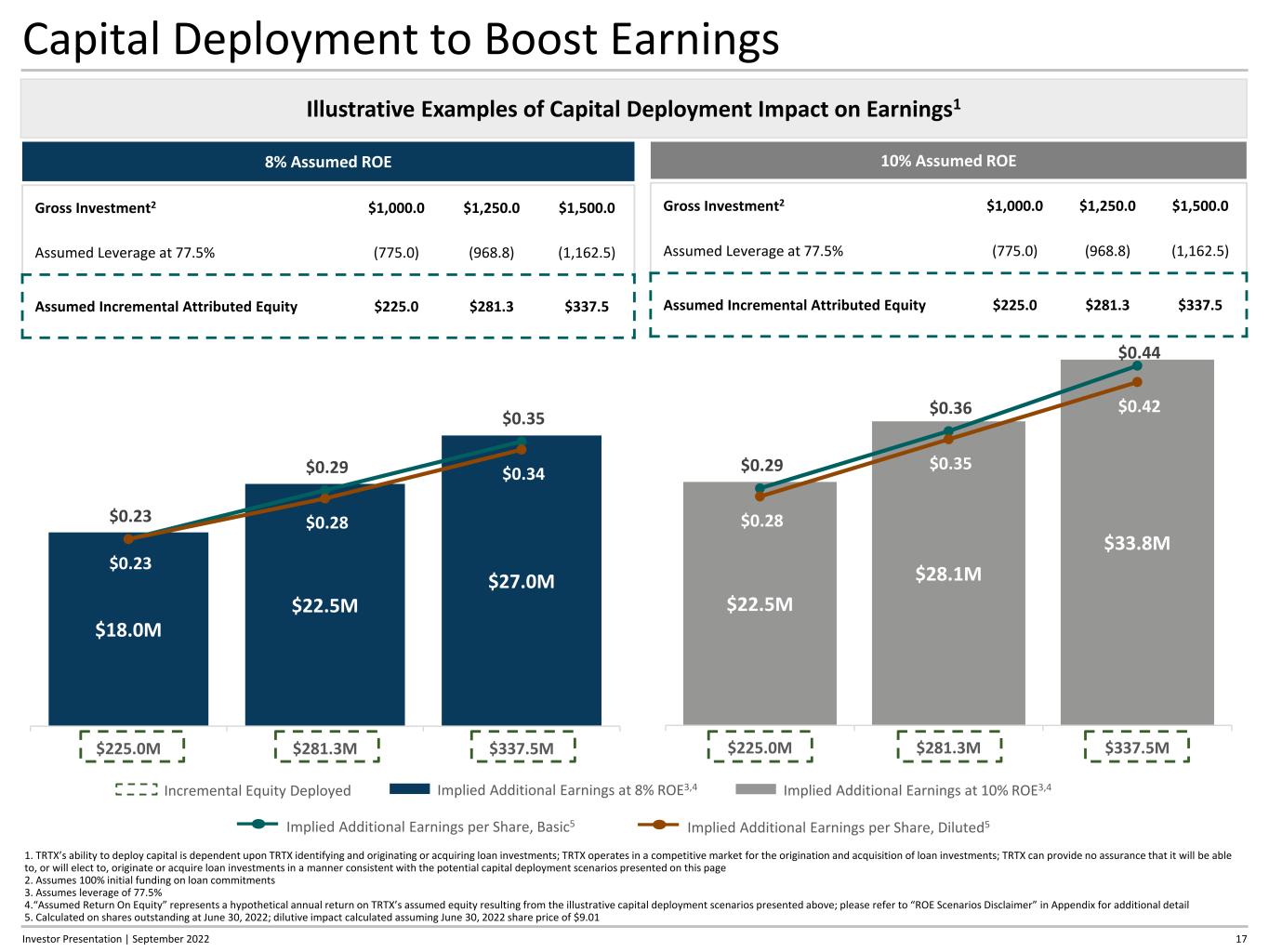

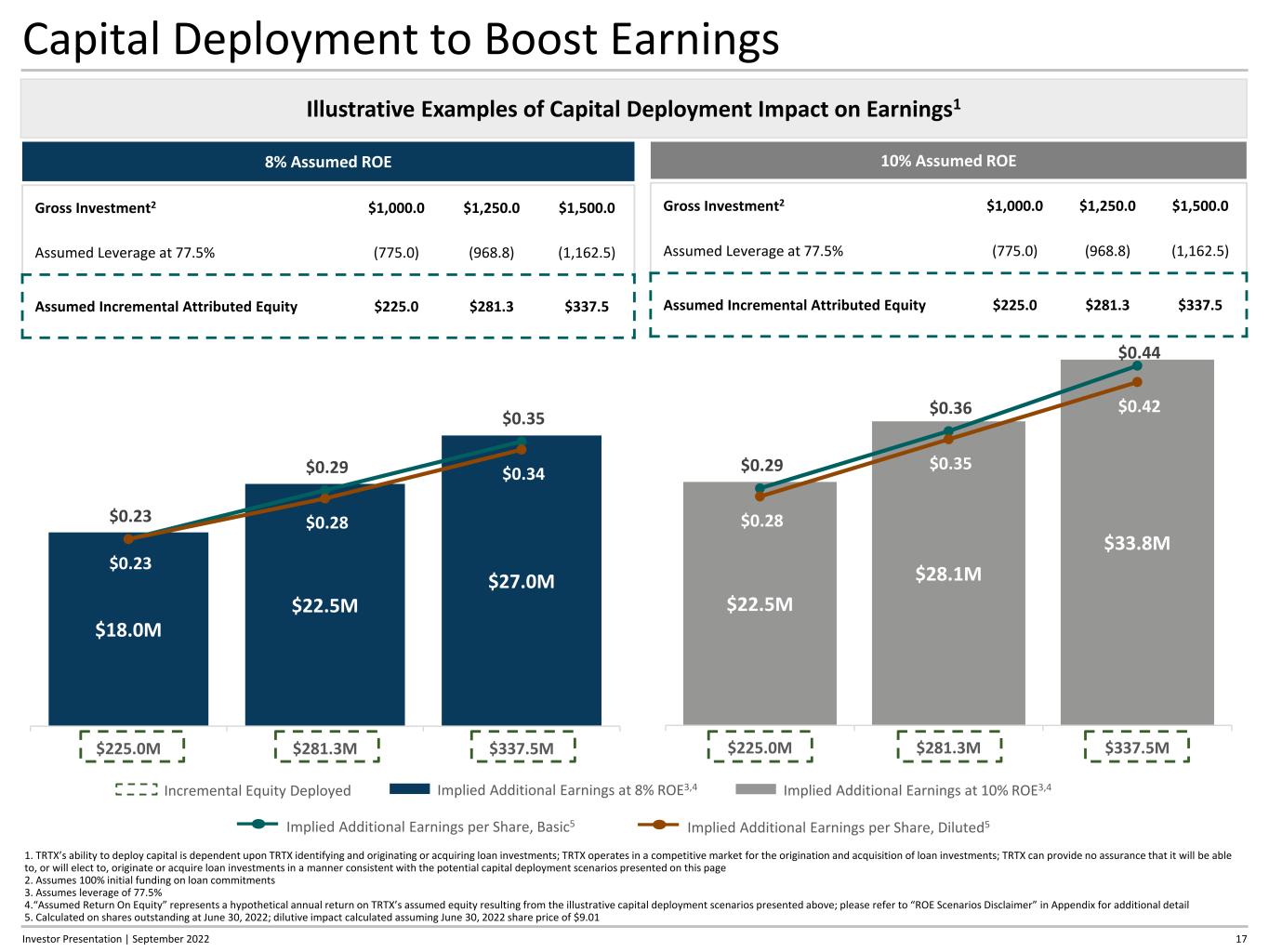

Capital Deployment to Boost Earnings Investor Presentation | September 2022 $22.5M $28.1M $33.8M $0.29 $0.36 $0.44 $0.28 $0.35 $0.42 $225.0M $281.3M $337.5M $18.0M $22.5M $27.0M $0.23 $0.29 $0.35 $0.23 $0.28 $0.34 $225.0M $281.3M $337.5M 1. TRTX’s ability to deploy capital is dependent upon TRTX identifying and originating or acquiring loan investments; TRTX operates in a competitive market for the origination and acquisition of loan investments; TRTX can provide no assurance that it will be able to, or will elect to, originate or acquire loan investments in a manner consistent with the potential capital deployment scenarios presented on this page 2. Assumes 100% initial funding on loan commitments 3. Assumes leverage of 77.5% 4.“Assumed Return On Equity” represents a hypothetical annual return on TRTX’s assumed equity resulting from the illustrative capital deployment scenarios presented above; please refer to “ROE Scenarios Disclaimer” in Appendix for additional detail 5. Calculated on shares outstanding at June 30, 2022; dilutive impact calculated assuming June 30, 2022 share price of $9.01 Implied Additional Earnings at 10% ROE3,4Implied Additional Earnings at 8% ROE3,4Incremental Equity Deployed Implied Additional Earnings per Share, Basic5 Implied Additional Earnings per Share, Diluted5 Gross Investment2 $1,000.0 $1,250.0 $1,500.0 Assumed Leverage at 77.5% (775.0) (968.8) (1,162.5) Assumed Incremental Attributed Equity $225.0 $281.3 $337.5 Gross Investment2 $1,000.0 $1,250.0 $1,500.0 Assumed Leverage at 77.5% (775.0) (968.8) (1,162.5) Assumed Incremental Attributed Equity $225.0 $281.3 $337.5 Illustrative Examples of Capital Deployment Impact on Earnings1 8% Assumed ROE 10% Assumed ROE 17

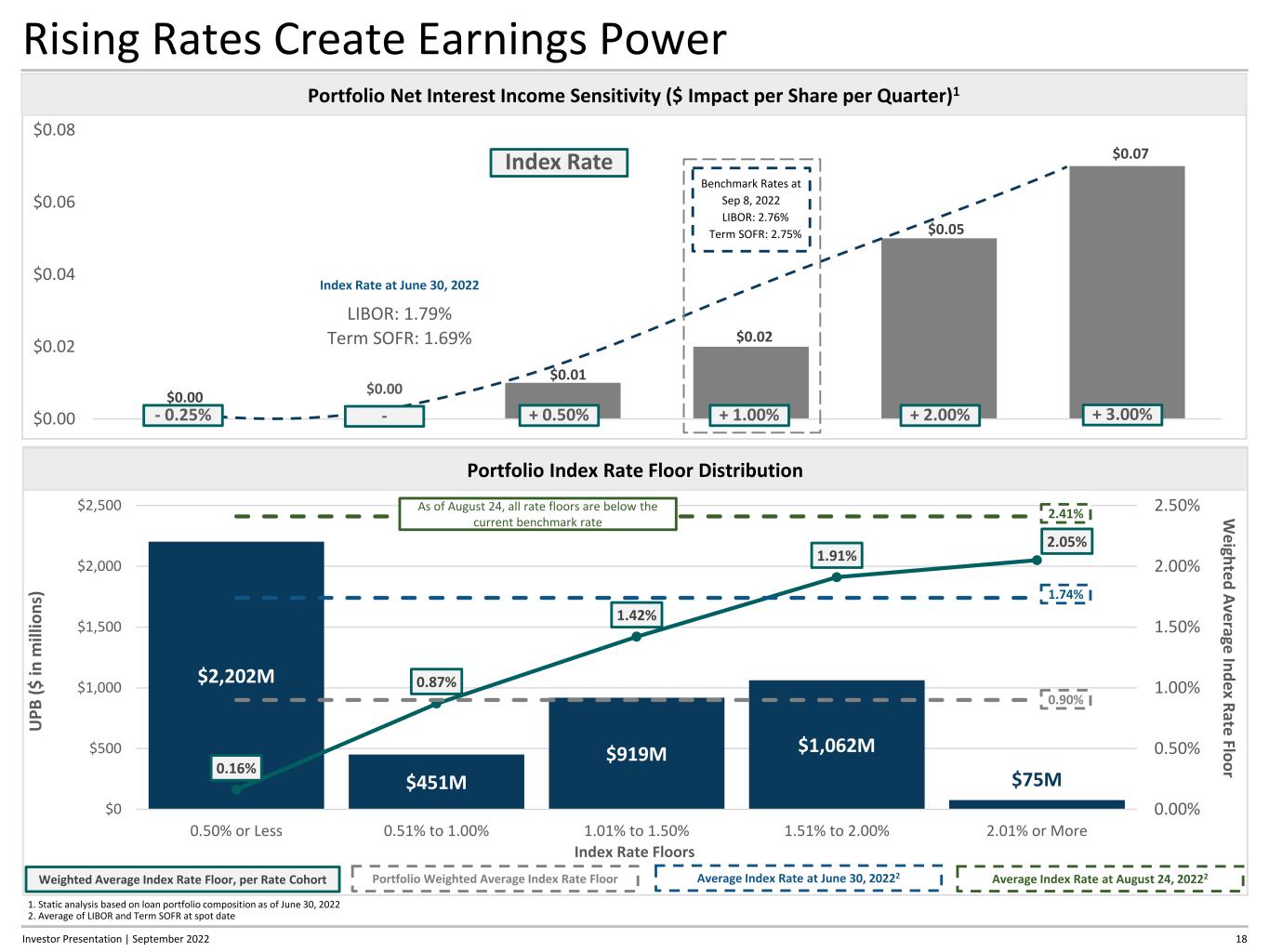

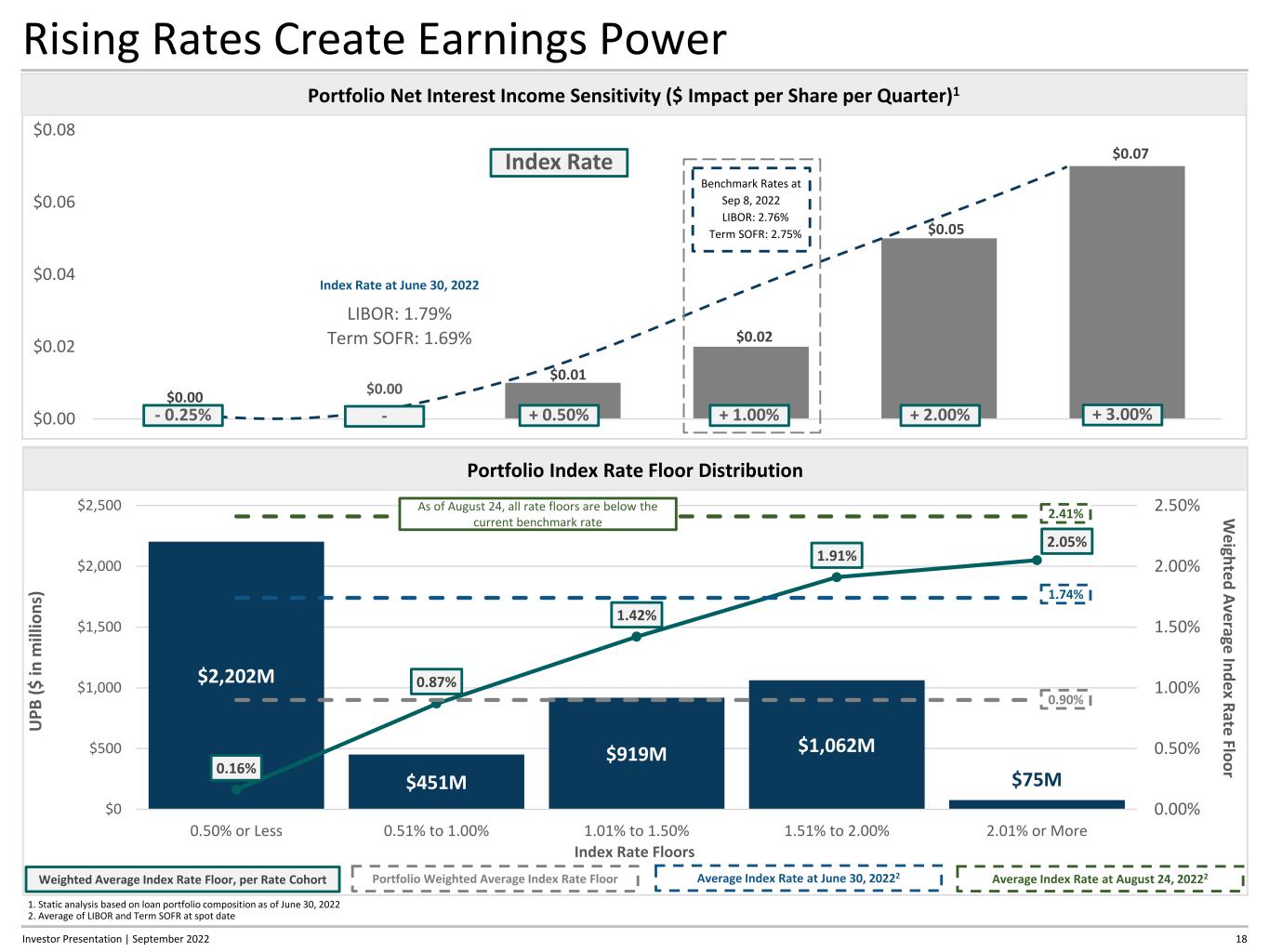

$0.00 $0.01 $0.02 $0.05 $0.07 $0.00 $0.02 $0.04 $0.06 $0.08 -0.25% 0.00% 0.50% 1.00% 2.00% 3.00% 18 Rising Rates Create Earnings Power Portfolio Net Interest Income Sensitivity ($ Impact per Share per Quarter)1 Index Rate 1. Static analysis based on loan portfolio composition as of June 30, 2022 2. Average of LIBOR and Term SOFR at spot date $0.00 Index Rate at June 30, 2022 LIBOR: 1.79% Term SOFR: 1.69% + 1.00%+ 0.50%- 0.2 % + 3.0 %+ 2. 0%- Portfolio Index Rate Floor Distribution $2,202M $451M $919M $1,062M $75M0.16% 0.87% 1.42% 1.91% 2.05% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $500 $1,000 $1,500 $2,000 $2,500 0.50% or Less 0.51% to 1.00% 1.01% to 1.50% 1.51% to 2.00% 2.01% or More W eighted Average Index Rate Floor U PB ($ in m ill io ns ) Index Rate Floors Portfolio Weighted Average Index Rate Floor Average Index Rate at June 30, 20222 Average Index Rate at August 24, 20222Weighted Average Index Rate Floor, per Rate Cohort Investor Presentation | September 2022 As of August 24, all rate floors are below the current benchmark rate 2.41% 1.74% 0.90% Benchmark Rates at Sep 8, 2022 LIBOR: 2.76% Term SOFR: 2.75%

Appendix

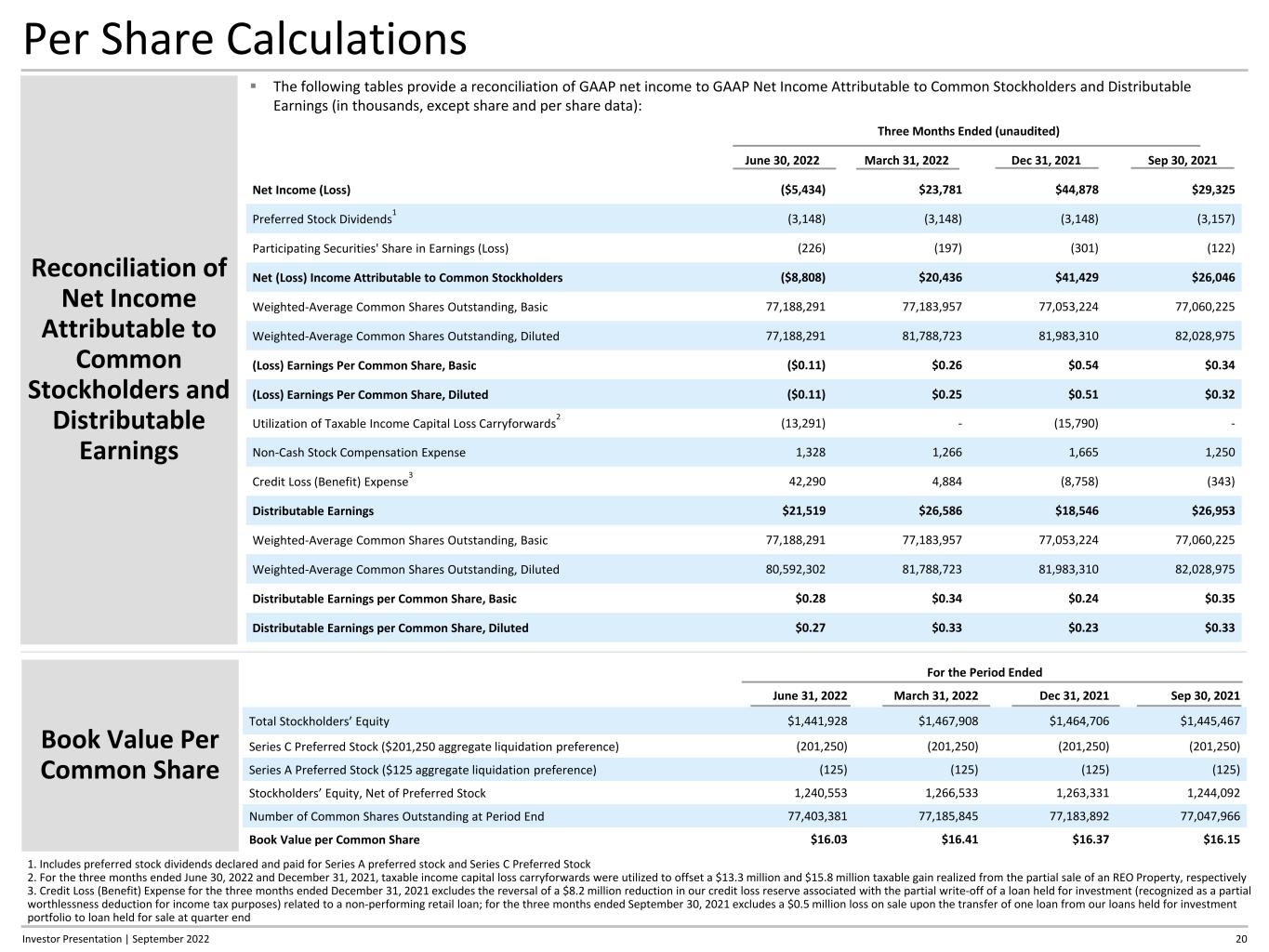

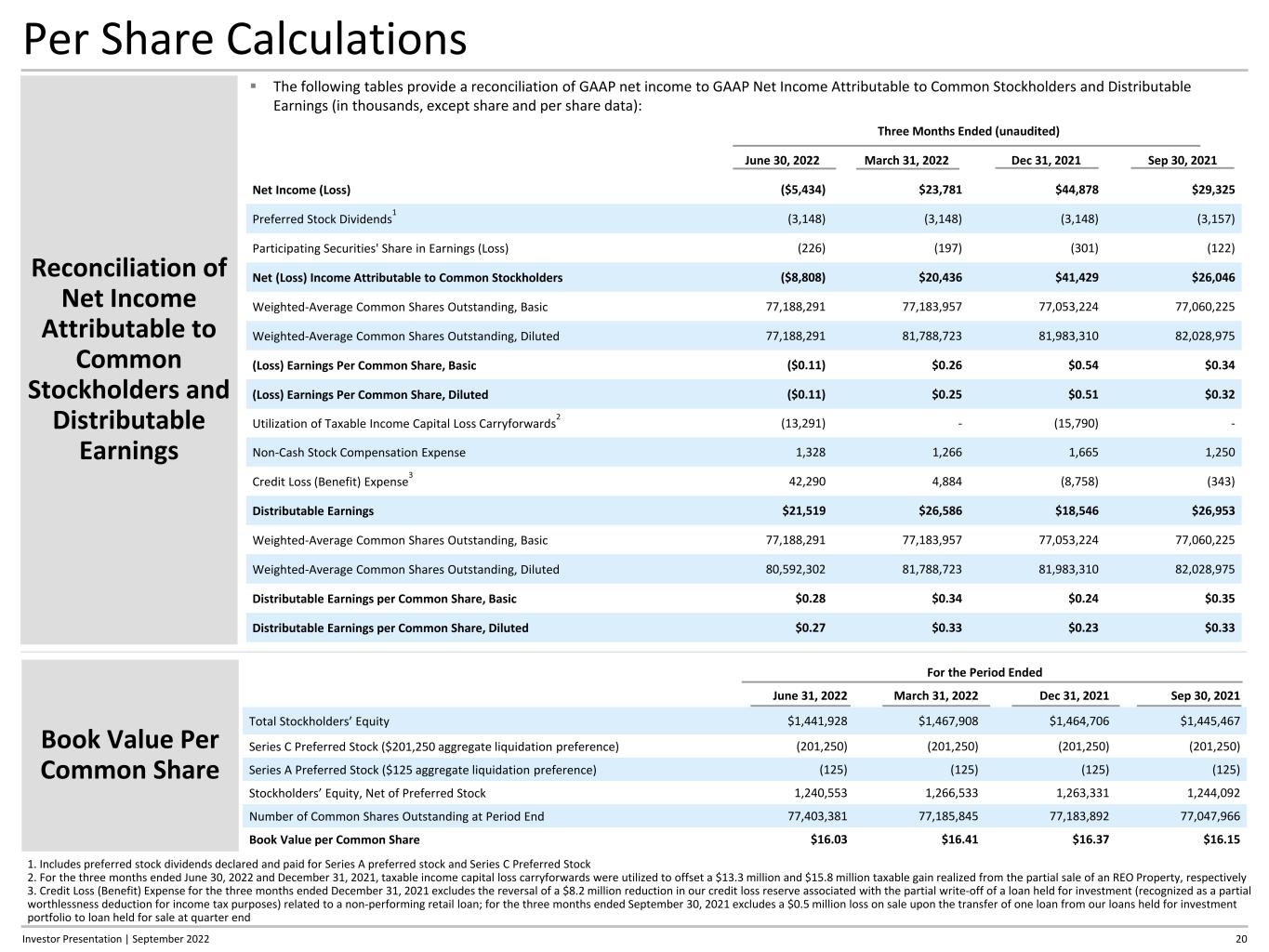

20 Per Share Calculations Reconciliation of Net Income Attributable to Common Stockholders and Distributable Earnings Three Months Ended (unaudited) June 30, 2022 March 31, 2022 Dec 31, 2021 Sep 30, 2021 Net Income (Loss) ($5,434) $23,781 $44,878 $29,325 Preferred Stock Dividends1 (3,148) (3,148) (3,148) (3,157) Participating Securities' Share in Earnings (Loss) (226) (197) (301) (122) Net (Loss) Income Attributable to Common Stockholders ($8,808) $20,436 $41,429 $26,046 Weighted-Average Common Shares Outstanding, Basic 77,188,291 77,183,957 77,053,224 77,060,225 Weighted-Average Common Shares Outstanding, Diluted 77,188,291 81,788,723 81,983,310 82,028,975 (Loss) Earnings Per Common Share, Basic ($0.11) $0.26 $0.54 $0.34 (Loss) Earnings Per Common Share, Diluted ($0.11) $0.25 $0.51 $0.32 Utilization of Taxable Income Capital Loss Carryforwards2 (13,291) - (15,790) - Non-Cash Stock Compensation Expense 1,328 1,266 1,665 1,250 Credit Loss (Benefit) Expense3 42,290 4,884 (8,758) (343) Distributable Earnings $21,519 $26,586 $18,546 $26,953 Weighted-Average Common Shares Outstanding, Basic 77,188,291 77,183,957 77,053,224 77,060,225 Weighted-Average Common Shares Outstanding, Diluted 80,592,302 81,788,723 81,983,310 82,028,975 Distributable Earnings per Common Share, Basic $0.28 $0.34 $0.24 $0.35 Distributable Earnings per Common Share, Diluted $0.27 $0.33 $0.23 $0.33 1. Includes preferred stock dividends declared and paid for Series A preferred stock and Series C Preferred Stock 2. For the three months ended June 30, 2022 and December 31, 2021, taxable income capital loss carryforwards were utilized to offset a $13.3 million and $15.8 million taxable gain realized from the partial sale of an REO Property, respectively 3. Credit Loss (Benefit) Expense for the three months ended December 31, 2021 excludes the reversal of a $8.2 million reduction in our credit loss reserve associated with the partial write-off of a loan held for investment (recognized as a partial worthlessness deduction for income tax purposes) related to a non-performing retail loan; for the three months ended September 30, 2021 excludes a $0.5 million loss on sale upon the transfer of one loan from our loans held for investment portfolio to loan held for sale at quarter end The following tables provide a reconciliation of GAAP net income to GAAP Net Income Attributable to Common Stockholders and Distributable Earnings (in thousands, except share and per share data): Book Value Per Common Share For the Period Ended June 31, 2022 March 31, 2022 Dec 31, 2021 Sep 30, 2021 Total Stockholders’ Equity $1,441,928 $1,467,908 $1,464,706 $1,445,467 Series C Preferred Stock ($201,250 aggregate liquidation preference) (201,250) (201,250) (201,250) (201,250) Series A Preferred Stock ($125 aggregate liquidation preference) (125) (125) (125) (125) Stockholders’ Equity, Net of Preferred Stock 1,240,553 1,266,533 1,263,331 1,244,092 Number of Common Shares Outstanding at Period End 77,403,381 77,185,845 77,183,892 77,047,966 Book Value per Common Share $16.03 $16.41 $16.37 $16.15 Investor Presentation | September 2022

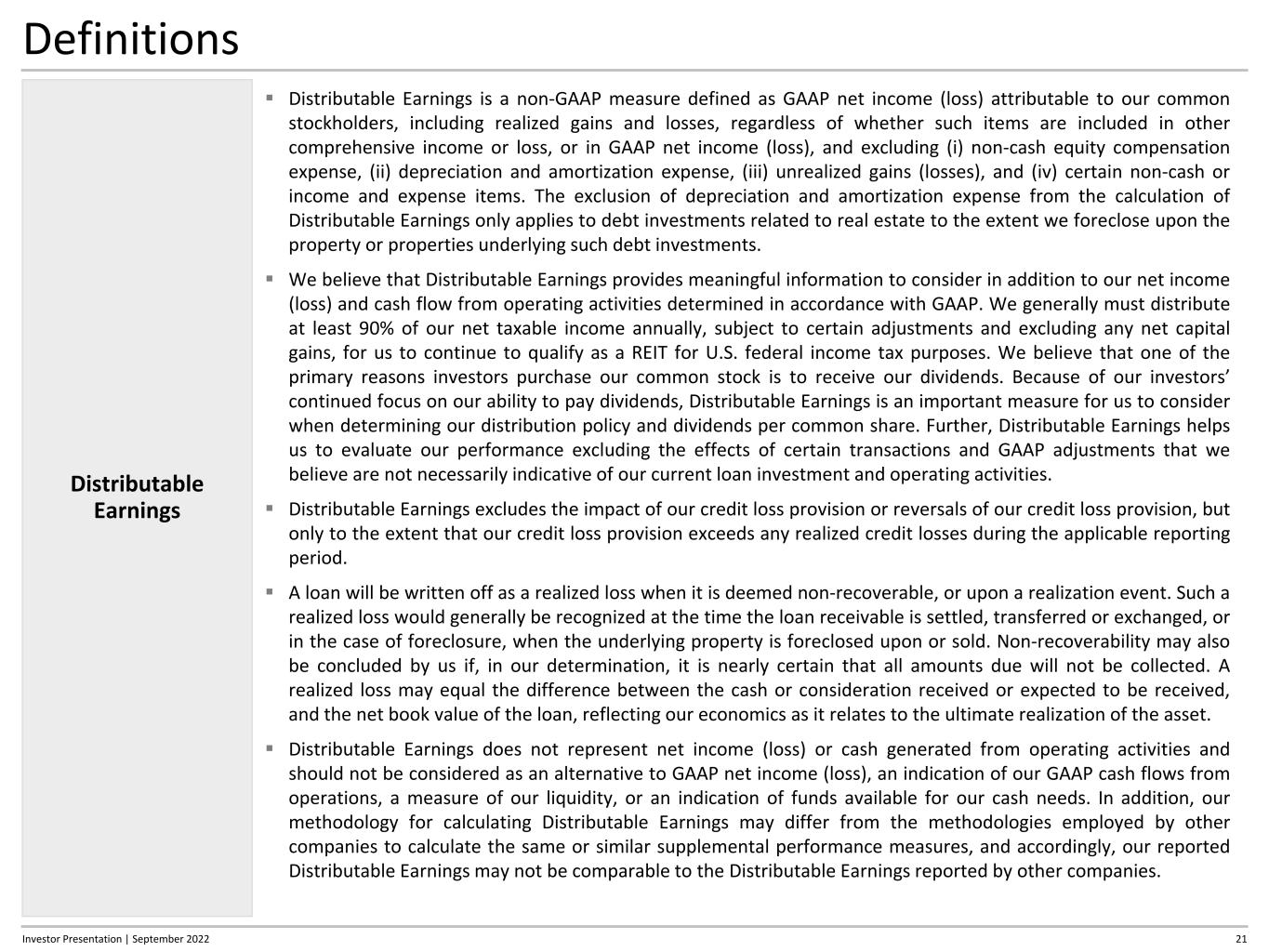

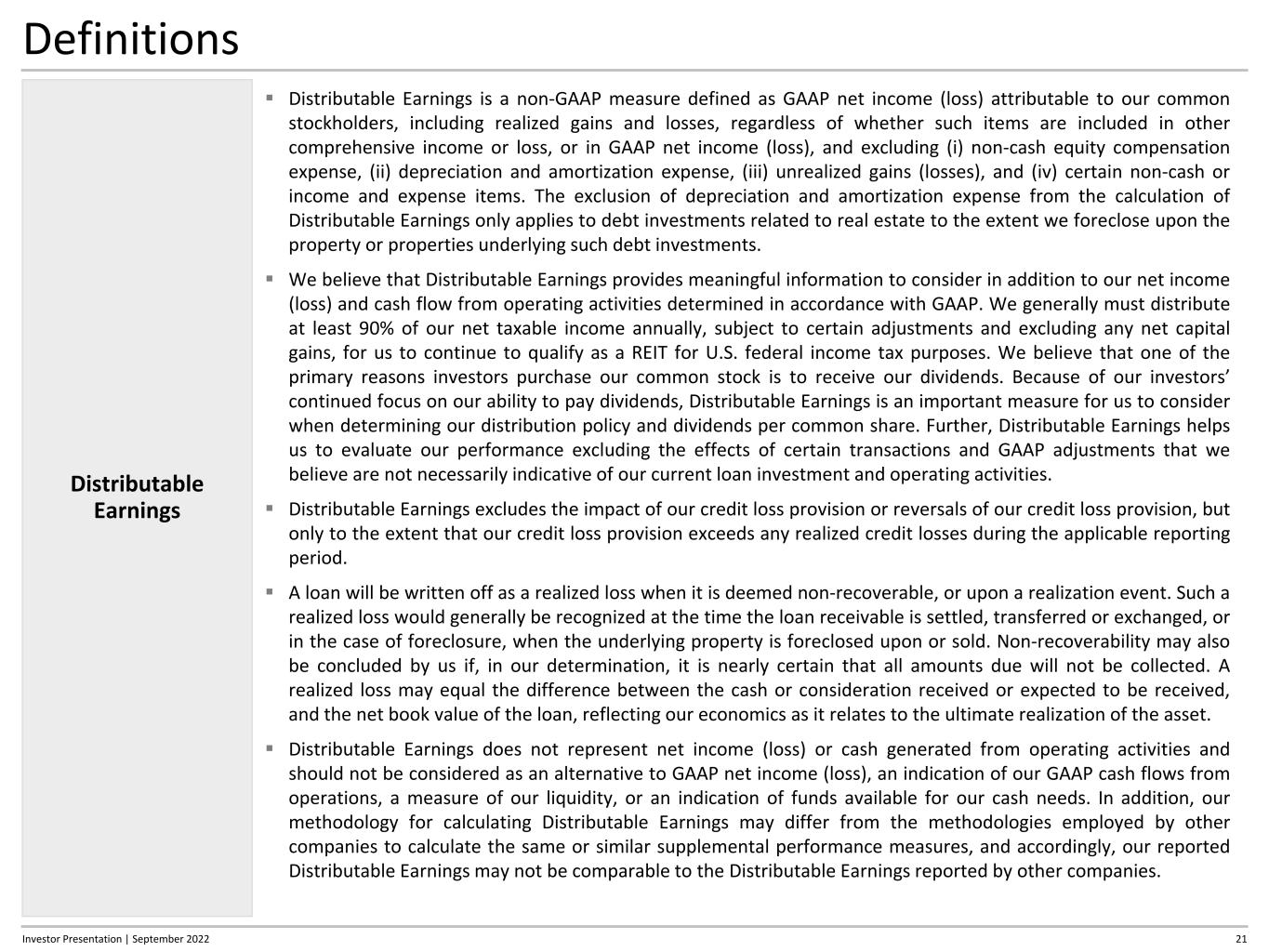

Definitions Distributable Earnings is a non-GAAP measure defined as GAAP net income (loss) attributable to our common stockholders, including realized gains and losses, regardless of whether such items are included in other comprehensive income or loss, or in GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization expense, (iii) unrealized gains (losses), and (iv) certain non-cash or income and expense items. The exclusion of depreciation and amortization expense from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and cash flow from operating activities determined in accordance with GAAP. We generally must distribute at least 90% of our net taxable income annually, subject to certain adjustments and excluding any net capital gains, for us to continue to qualify as a REIT for U.S. federal income tax purposes. We believe that one of the primary reasons investors purchase our common stock is to receive our dividends. Because of our investors’ continued focus on our ability to pay dividends, Distributable Earnings is an important measure for us to consider when determining our distribution policy and dividends per common share. Further, Distributable Earnings helps us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan investment and operating activities. Distributable Earnings excludes the impact of our credit loss provision or reversals of our credit loss provision, but only to the extent that our credit loss provision exceeds any realized credit losses during the applicable reporting period. A loan will be written off as a realized loss when it is deemed non-recoverable, or upon a realization event. Such a realized loss would generally be recognized at the time the loan receivable is settled, transferred or exchanged, or in the case of foreclosure, when the underlying property is foreclosed upon or sold. Non-recoverability may also be concluded by us if, in our determination, it is nearly certain that all amounts due will not be collected. A realized loss may equal the difference between the cash or consideration received or expected to be received, and the net book value of the loan, reflecting our economics as it relates to the ultimate realization of the asset. Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be considered as an alternative to GAAP net income (loss), an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. Distributable Earnings 21Investor Presentation | September 2022

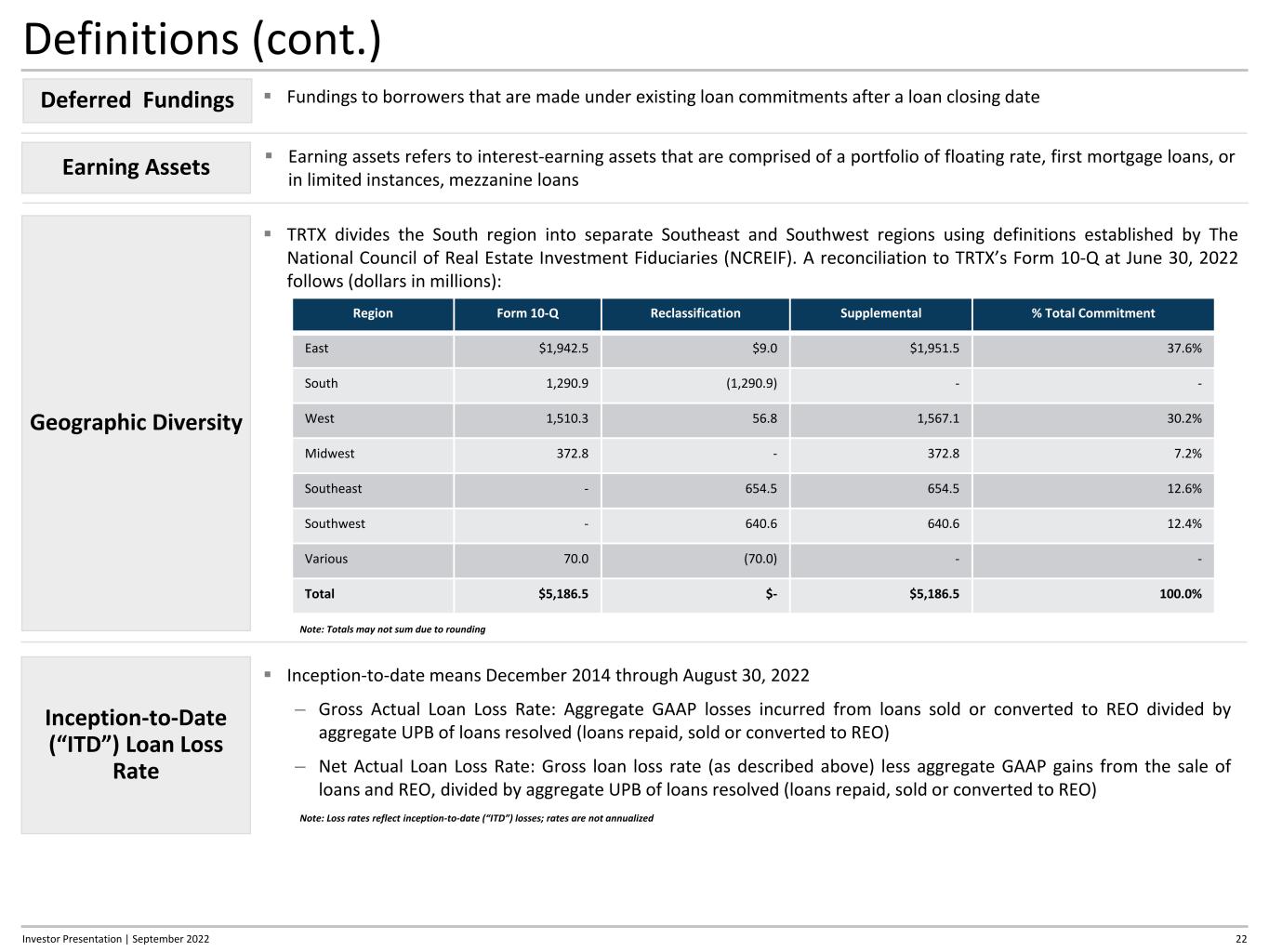

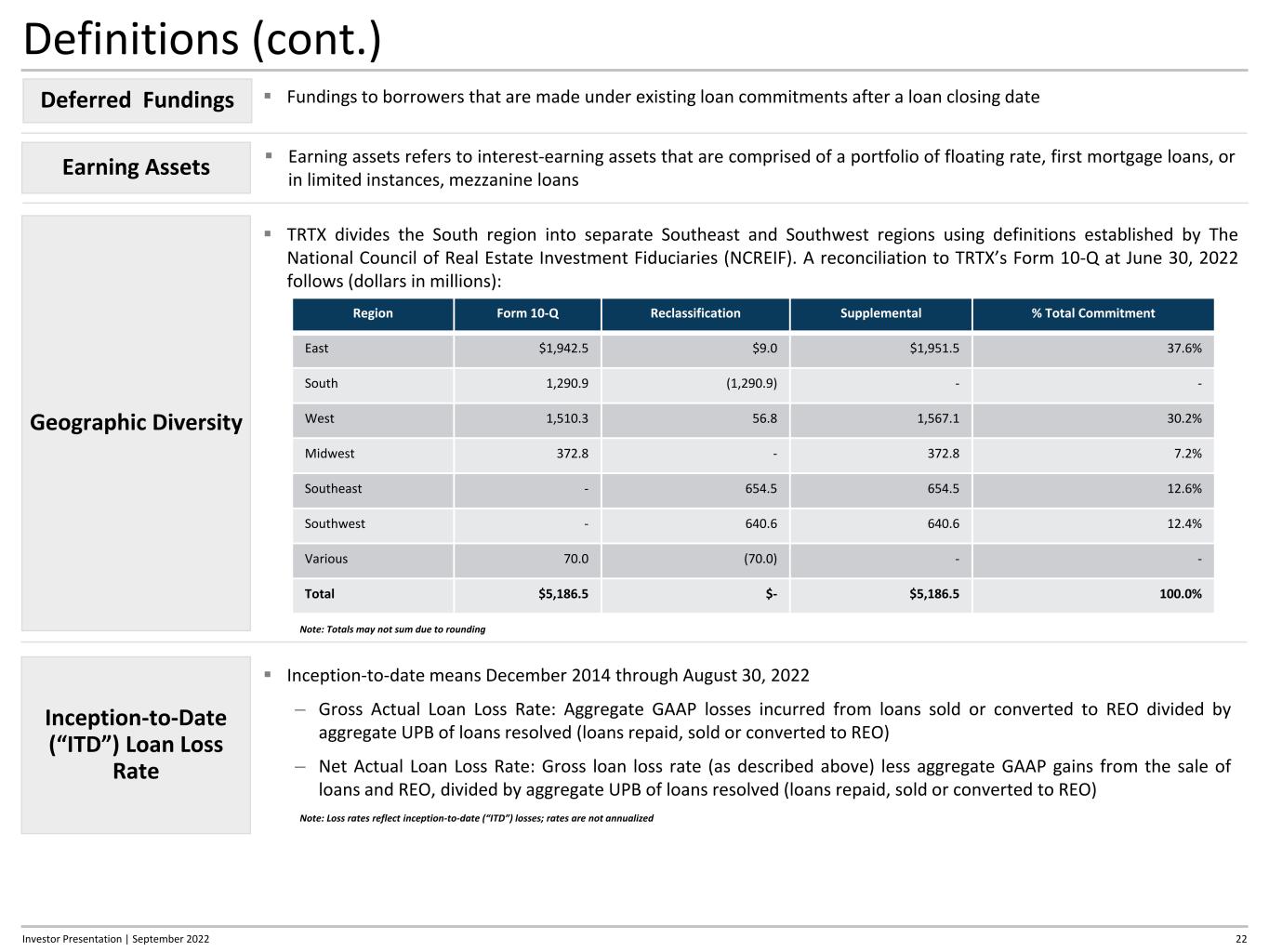

Definitions (cont.) Fundings to borrowers that are made under existing loan commitments after a loan closing dateDeferred Fundings Geographic Diversity TRTX divides the South region into separate Southeast and Southwest regions using definitions established by The National Council of Real Estate Investment Fiduciaries (NCREIF). A reconciliation to TRTX’s Form 10-Q at June 30, 2022 follows (dollars in millions): Region Form 10-Q Reclassification Supplemental % Total Commitment East $1,942.5 $9.0 $1,951.5 37.6% South 1,290.9 (1,290.9) - - West 1,510.3 56.8 1,567.1 30.2% Midwest 372.8 - 372.8 7.2% Southeast - 654.5 654.5 12.6% Southwest - 640.6 640.6 12.4% Various 70.0 (70.0) - - Total $5,186.5 $- $5,186.5 100.0% Note: Totals may not sum due to rounding 22Investor Presentation | September 2022 Inception-to-Date (“ITD”) Loan Loss Rate Inception-to-date means December 2014 through August 30, 2022 – Gross Actual Loan Loss Rate: Aggregate GAAP losses incurred from loans sold or converted to REO divided by aggregate UPB of loans resolved (loans repaid, sold or converted to REO) – Net Actual Loan Loss Rate: Gross loan loss rate (as described above) less aggregate GAAP gains from the sale of loans and REO, divided by aggregate UPB of loans resolved (loans repaid, sold or converted to REO) Note: Loss rates reflect inception-to-date (“ITD”) losses; rates are not annualized Earning Assets Earning assets refers to interest-earning assets that are comprised of a portfolio of floating rate, first mortgage loans, or in limited instances, mezzanine loans

Definitions (cont.) 23 Bridge Loan - A loan with limited deferred fundings, generally less than 10% of the total loan commitment, which fundings are commonly conditioned on the borrower’s satisfaction of certain collateral performance tests. The related business plan generally involves little or no capital expenditure related to base building work (e.g., building mechanical systems, lobbies, elevators, common areas, or other amenities), with most deferred fundings related to leasing activity. The primary focus is on maintaining or improving current operating cash flow, or addressing minimal lease expirations or existing tenant vacancies Light Transitional Loan - A transitional loan with deferred fundings ranging from 10% to 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan is to lease existing or forecasted tenant vacancy to achieve stabilized occupancy and cash flow. Capital expenditure is primarily to fund leasing commissions and tenant improvements for new tenant leases, and capital expenditure allocated to base building work generally does not exceed 20%. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Moderate Transitional Loan - A transitional loan with deferred fundings greater than 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan generally involves capital expenditure for base building work needed before substantial leasing activity can be achieved, followed by capital expenditure for tenant improvements and leasing commissions to achieve stabilized occupancy and cash flow. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Construction Loan - A loan made to a borrower to fund the ground-up construction of a commercial real estate property Loan Category Investor Presentation | September 2022 Except for construction loans, LTV is calculated for loan originations and existing loans as the total outstanding principal balance of the loan or participation interest in a loan (plus any financing that is pari passu with or senior to such loan or participation interest), divided by the as-is appraised value of our collateral at the time of origination or acquisition of such loan or participation interest. For construction loans only, LTV is calculated as the total commitment amount of the loan divided by the as-stabilized value of the real estate securing the loan. The as-is or as-stabilized (as applicable) value reflects our Manager’s estimates, at the time of origination or acquisition of the loan or participation interest in a loan, of the real estate value underlying such loan or participation interest determined in accordance with our Manager’s underwriting standards and consistent with third-party appraisals obtained by our Manager Loan-to-Value (LTV) Leverage Debt-to-Equity Ratio - Represents (i) total outstanding borrowings under secured financing arrangements, net, including collateralized loan obligations, secured credit agreements, a secured revolving credit facility, and a mortgage loan payable, less cash, to (ii) total stockholders’ equity, at period end Total Leverage Ratio - (i) total outstanding borrowings under secured financing arrangements, net, including collateralized loan obligations, secured credit agreements, a secured revolving credit facility, and a mortgage loan payable, plus non-consolidated senior interests sold or co-originated (if any), less cash, to (ii) total stockholders’ equity, at period end

Definitions (cont.) 24 Property Types Mixed-Use: TRTX classifies a loan as mixed-use if the property securing TRTX’s loan (a) involves more than one use; and (b) no single use represents more than 60% of the collateral property’s total value. In certain instances, TRTX’s classification may be determined by its assessment of which use is the principal driver of the property’s aggregate net operating income Life Science: TRTX classifies a loan as life science if more than 60% of the gross leasable area is leased to, or will be converted to, life science-related space. Life science-related space includes laboratory space, office space, or allied light manufacturing space used in support of biotechnology, pharmaceuticals, biomedical technologies, life systems technologies, and the design and manufacture of biomedical technology. Investor Presentation | September 2022 Non-Consolidated Senior Interest TRTX creates structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third-party. In either case, the senior mortgage loan (i.e., the non-consolidated senior interest) is not included on our balance sheet. When we create structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third-party, we retain on our balance sheet a mezzanine loan Market Price and Dividend Disclaimer TRTX can provide no assurance regarding future market prices of TRTX’s common stock. The market price of TRTX’s common stock may be significantly affected by numerous factors, some of which are beyond TRTX’s control and may not be directly related to TRTX’s operating performance. Additionally, no assurance can be given that TRTX will be able to pay dividends to TRTX’s stockholders at any time in the future or that the level of any dividends that TRTX does pay to its stockholders will achieve a market yield or increase or even be maintained over time. TRTX’s ability to pay dividends may be adversely affected by a number of factors, some of which are beyond TRTX’s control and may not be directly related to TRTX’s operating performance. Future dividend payments, if any, will be authorized by TRTX’s board of directors in its sole discretion out of funds legally available therefor and will be dependent upon a number of factors, including TRTX’s historical and projected results of operations, cash flows and financial condition, TRTX’s financing covenants, maintenance of TRTX’s REIT qualification, applicable provisions of Maryland law and such other factors as TRTX’s board of directors deems relevant.

Definitions (cont.) 25Investor Presentation | September 2022 ROE Scenarios Disclaimer TRTX has presented two Assumed ROE scenarios for illustrative purposes only. These Assumed ROE scenarios are based on current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to TRTX’s business, all of which are difficult to predict and many of which are beyond TRTX’s control. As a result, there can be no assurance that any of the Assumed ROE scenarios will be realized or that actual return on equity will not differ significantly from the Assumed ROE scenarios presented on this slide. The Assumed ROE scenarios are not fact and should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios. Loan Risk Ratings Based on a 5-point scale, the Company’s loans are rated “1” through “5,” from least risk to greatest risk, respectively, which ratings are defined as follows: – 1 - Outperform—Exceeds performance metrics (for example, technical milestones, occupancy, rents, net operating income) included in original or current credit underwriting and business plan; – 2 - Meets or Exceeds Expectations—Collateral performance meets or exceeds substantially all performance metrics included in original or current underwriting / business plan; – 3 - Satisfactory—Collateral performance meets or is on track to meet underwriting; business plan is met or can reasonably be achieved; – 4 - Underperformance—Collateral performance falls short of original underwriting, material differences exist from business plan, or both; technical milestones have been missed; defaults may exist, or may soon occur absent material improvement; and – 5 - Default/Possibility of Loss—Collateral performance is significantly worse than underwriting; major variance from business plan; loan covenants or technical milestones have been breached; the loan is in default or substantially in default; timely exit from loan via sale or refinancing is questionable; significant risk of principal loss.

Company Information Contact Information Headquarters: 888 Seventh Avenue 35th Floor New York, NY 10106 New York Stock Exchange: Symbol: TRTX TPG RE Finance Trust, Inc. Bob Foley Chief Financial Officer +1 (212) 430-4111 bfoley@tpg.com Brandon Fox Chief Accounting Officer +1 (415) 706-2751 bfox@tpg.com Investor Relations: +1 (212) 405-8500 IR@tpgrefinance.com Media Contact: TPG RE Finance Trust, Inc. Courtney Power +1 (415) 743-1550 media@tpg.com Analyst Coverage BTIG Eric Hagen +1 (212) 738-6014 Citigroup Securities Arren Cyganovich +1 (212) 816-3733 JMP Securities Steven DeLaney +1 (212) 906-3517 JP Morgan Richard Shane +1 (415) 315-6701 Raymond James Stephen Laws +1 (901) 579-4868 Wells Fargo Donald Fandetti +1 (212) 214-8069 TPG RE Finance Trust, Inc. is a commercial real estate finance company that originates, acquires, and manages primarily first mortgage loans secured by institutional properties located in primary and select secondary markets in the United States. The Company is externally managed by TPG RE Finance Trust Management, L.P., a part of TPG Real Estate, which is the real estate investment platform of global alternative asset management firm TPG Inc. (NASDAQ: TPG). For more information regarding TRTX, visit www.tpgrefinance.com. 26 Transfer Agent American Stock Transfer & Trust Company, LLC +1 (800) 937-5449 help@astfinancial.com Investor Presentation | September 2022