November 2022 TPG RE Finance Trust, Inc. Investor Presentation Exhibit 99.1

Forward-Looking Statements and Other Disclosures 2 This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will occur or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Such risks, uncertainties and other important factors include, among others, the risks, uncertainties and factors set forth under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 23, 2022, as such risk factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Such risks, uncertainties and other factors include, but are not limited to, the following: the general political, economic, regulatory, competitive and other conditions in the markets in which we invest; the level and volatility of prevailing interest rates and credit spreads, including as a result of the planned discontinuance of LIBOR and the transition to alternative reference rates such as term or compounded Secured Overnight Financing Rate ("SOFR"); adverse changes in the real estate and real estate capital markets; general volatility of the securities markets in which we participate; changes in our business, investment strategies or target assets; difficulty in obtaining financing or raising capital; reductions in the yield on our investments and increases in the cost of our financing; events giving rise to increases in our current expected credit loss reserve; adverse legislative or regulatory developments, including with respect to tax laws, securities laws and the laws governing financing and lending institutions; acts of God such as hurricanes, floods, earthquakes, wildfires, mudslides, volcanic eruptions, and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; global economic trends and economic conditions, including heightened inflation, slower growth or recession, changes to fiscal and monetary policy, higher interest rates, labor shortages, currency fluctuations and challenges in global supply chains; higher interest rates imposed by the Federal Reserve may lead to a decrease in prepayment speeds and an increase in the number of borrowers who exercise extension options, which could extend beyond the term of certain secured financing agreements we use to finance our loan investments; the ongoing impact of the COVID-19 pandemic on our business, U.S. and global economies, the real estate industry and our borrowers, and the performance of the properties securing our loans; reduced demand for office space, including as a result of the COVID-19 pandemic and/or hybrid work schedules which allow work from remote locations other than the employer’s office premises; changes in the availability of attractive loan and other investment opportunities, whether due to competition, regulation or otherwise; deterioration in the performance of properties securing our investments that may cause deterioration in the performance of our investments, adversely impact certain of our financing arrangements and our liquidity, and potentially expose us to principal losses on our investments; defaults by borrowers in paying debt service or principal on outstanding indebtedness; the adequacy of collateral securing our investments and declines in the fair value of our investments; adverse developments in the availability of desirable investment opportunities, whether due to competition, regulation or otherwise; difficulty or delays in redeploying the proceeds from repayments of our existing investments; increased competition from entities engaged in mortgage lending and/or investing in our target assets; difficulty in successfully managing our growth, including integrating new assets into our existing systems; the cost of operating our platform, including, but not limited to, the cost of operating a real estate investment platform and operating as a publicly traded company; the availability of qualified personnel and our relationship with our Manager; the potential unavailability of the London Interbank Offered Rate (“LIBOR”) after June 30, 2023; conflicts with TPG and its affiliates, including our Manager, the personnel of TPG providing services to us, including our officers, and certain funds managed by TPG; our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and our ability to maintain our exemption or exclusion from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and authoritative U.S. generally accepted accounting principles (or “GAAP”) or policy changes from standard-setting bodies such as the Financial Accounting Standards Board (“FASB”), the SEC, the Internal Revenue Service (“IRS”), the New York Stock Exchange (“NYSE”) and other authorities that we are subject to, as well as their counterparts in any foreign jurisdictions where we might do business. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this presentation apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this presentation and in other filings we make with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Investor Presentation |November 2022

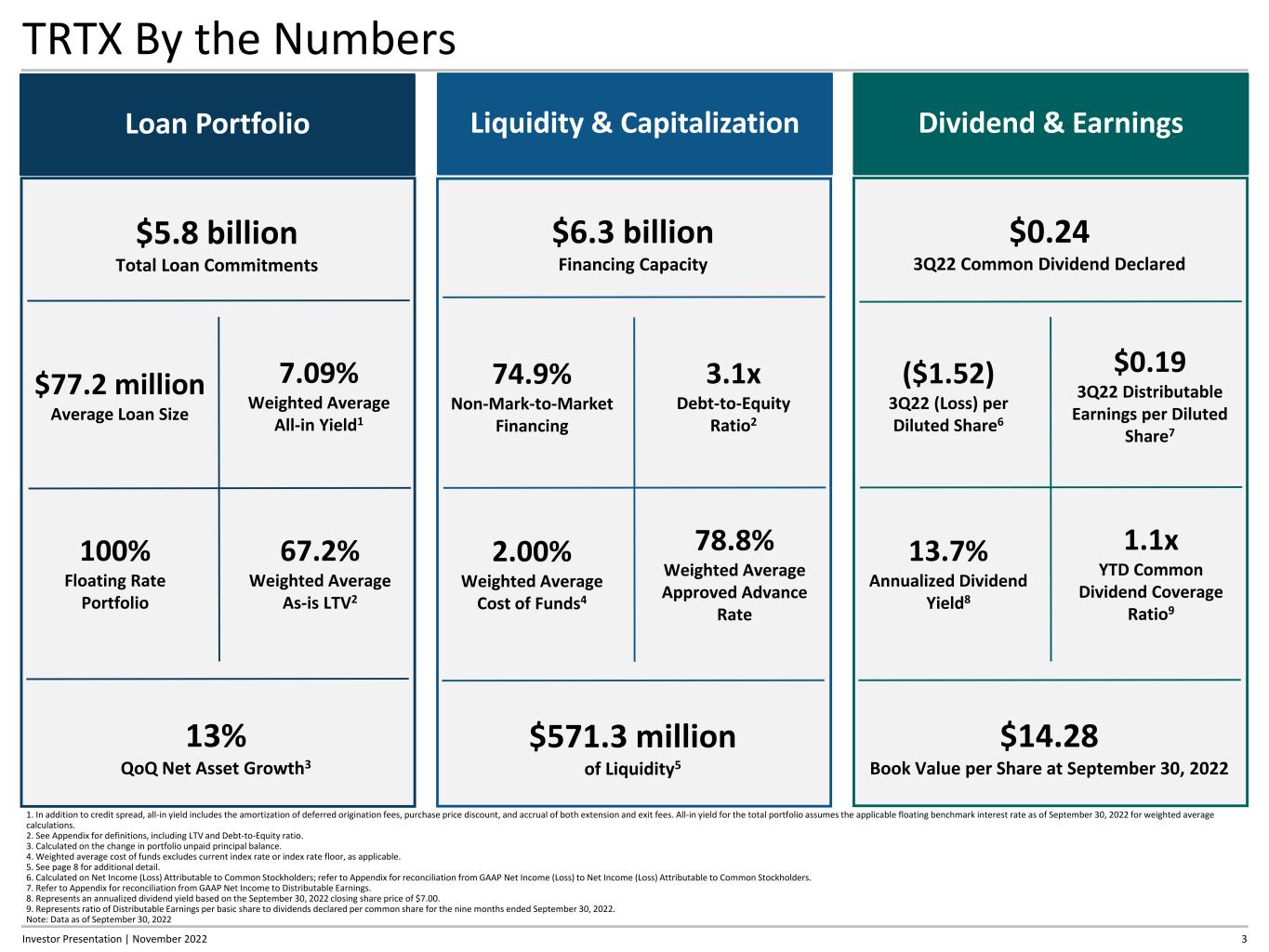

3 TRTX By the Numbers $5.8 billion Total Loan Commitments 1. In addition to credit spread, all-in yield includes the amortization of deferred origination fees, purchase price discount, and accrual of both extension and exit fees. All-in yield for the total portfolio assumes the applicable floating benchmark interest rate as of September 30, 2022 for weighted average calculations. 2. See Appendix for definitions, including LTV and Debt-to-Equity ratio. 3. Calculated on the change in portfolio unpaid principal balance. 4. Weighted average cost of funds excludes current index rate or index rate floor, as applicable. 5. See page 8 for additional detail. 6. Calculated on Net Income (Loss) Attributable to Common Stockholders; refer to Appendix for reconciliation from GAAP Net Income (Loss) to Net Income (Loss) Attributable to Common Stockholders. 7. Refer to Appendix for reconciliation from GAAP Net Income to Distributable Earnings. 8. Represents an annualized dividend yield based on the September 30, 2022 closing share price of $7.00. 9. Represents ratio of Distributable Earnings per basic share to dividends declared per common share for the nine months ended September 30, 2022. Note: Data as of September 30, 2022 Loan Portfolio $77.2 million Average Loan Size 7.09% Weighted Average All-in Yield1 100% Floating Rate Portfolio 67.2% Weighted Average As-is LTV2 13% QoQ Net Asset Growth3 $0.24 3Q22 Common Dividend Declared Dividend & Earnings ($1.52) 3Q22 (Loss) per Diluted Share6 $0.19 3Q22 Distributable Earnings per Diluted Share7 13.7% Annualized Dividend Yield8 1.1x YTD Common Dividend Coverage Ratio9 $14.28 Book Value per Share at September 30, 2022 Liquidity & Capitalization $6.3 billion Financing Capacity 74.9% Non-Mark-to-Market Financing 3.1x Debt-to-Equity Ratio2 2.00% Weighted Average Cost of Funds4 78.8% Weighted Average Approved Advance Rate $571.3 million of Liquidity5 Investor Presentation | November 2022

4Investor Presentation | November 2022 TPG – Premier Global Asset Manager Capital Real Estate Impact TPG Real Estate Partners (TREP) Market Solutions $68B $20B $16B$22B $10B Real Estate Thematic Advantage Core Plus (TAC+) TPG Real Estate Partners (TREP) TPG RE Finance Trust (TRTX) TPG Rise Climate The Rise Funds Evercare TPG Tech Adjacencies (TTAD) TPG Growth TPG Digital Media (TDM) SPACs Public Market Investing Capital Markets Private Market Solutions TPG Capital Continuation Vehicles TPG Healthcare Partners TPG Asia AU M Fu nd s Integrated Real Estate Platform Real Estate Equity $1.8B AUM $11.7B AUM Growth Real Estate Thematic Advantage Core Plus (TAC+) TPG RE Finance Trust (TRTX) $5.7B AUM Real Estate Debt TPG Integration Drives Competitive Advantage Experienced team with a long history of collaborative investing through numerous credit and macroeconomic cycles Established lending platform with strong capital markets capabilities and extensive financing relationships Long standing relationships with repeat borrowers, developers, investors, national brokerage firms, and financial institutions Deep knowledge of target markets, property types, and investable global trends Data-driven investment philosophy for 30 years TPG is a global alternative investment manager operating an integrated platform with $135 billion of assets under management Enhanced investing capabilities powered by an expansive and scaled platform Note: AUM as of September 30, 2022; Totals may not sum due to rounding Segment

5 Career Credit Investors Drive Investment Strategy Leadership team has invested through multiple business and real estate cycles Emphasis on credit quality and principal protection Engagement throughout the investment process Deep, extensive relationships with owners, borrowers, brokers and capital providers Investment team supported by TPG’s global infrastructure and leadership team Peter Smith Chief Investment Officer 30+ years of experience Select Experience Managing Director Ladder Capital Deborah Ginsberg General Counsel 20+ years of experience Select Experience Principal Blackstone RE Debt Strategies Team combines investing expertise with public company C-level experience Matt Coleman President 20+ years of experience Select Experience Chief Operating Officer TPG Real Estate Investor Presentation | November 2022 Doug Bouquard Chief Executive Officer 18+ years of experience Select Experience Managing Director Goldman Sachs Select Experience Co-Founder, CFO and COO Gramercy Capital Corp. Bob Foley Chief Financial Officer 30+ years of experience

6 3Q22 Operating Results ($ in millions) Net Income (Loss) Attributable to Common Stockholders1 Adjustments Distributable Earnings2 Interest Income $75.5 $ - $75.5 Interest Expense (45.1) - (45.1) Net Interest Income $30.4 - $30.4 Management Fees (5.9) - (5.9) Stock Compensation Expense (0.9) 0.9 - Other Income & Expense3 (1.5) - (1.5) Credit Loss Expense (136.7) 132.34 (4.4) Preferred Stock Dividends & Participating Securities’ Share in Earnings (3.3) - (3.3) Total ($117.9) $133.2 $15.3 Per Common Share, Diluted ($1.52) $1.71 $0.19 ($1.52) Loss per Diluted Share1 $0.19 Distributable Earnings per Diluted Share2 QoQ Change in Book Value 1. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Net Income (Loss) Attributable to Common Stockholders 2. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Distributable Earnings 3. Includes the following income statement line items: Other Income, Professional Fees, General and Administrative, Servicing and Asset Management Fees, Income Tax Expense 4. Add-back net of $4.4 million write-off associated with the discounted repayment in-full of a non-performing retail loan ($0.24) ($0.04) ($1.71) ($0.05) $0.28 $0.01 $16.03 $14.28 Book Value 6/30/22 Net Income, Excluding Credit Loss Expense Dividends on Common Shares Dividends on Preferred Shares Equity Compensation Increase to CECL Reserve Write-off Book Value 9/30/22 CECL Reserve per Share $1.21 CECL Reserve per Share $2.92 Market Price at 6/30/2022 $9.01 Market Price at 9/30/2022 $7.00 Investor Presentation | November 2022

7 Common Dividend Coverage 1. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Net Income (Loss) Attributable to Common Stockholders 2. Refer to Appendix for reconciliation from GAAP Net Income (Loss) to Distributable Earnings 3. Includes Special Dividend of $5.5M total, or $0.07 per share 4. Represents ratio of Distributable Earnings per Basic Share divided by the sum of Common and Preferred Dividends declared per Common Share for the nine months ended September 30, 2022 Note: Totals may not sum due to rounding Operating Performance ($ in millions) YTD 2022 3Q22 2Q22 1Q22 4Q21 GAAP Net Income (Loss) ($96.3) ($114.6) ($5.4) $23.8 $44.9 Net Income (Loss) Attributable to Common Stockholders1 ($106.3) ($117.9) ($8.8) $20.4 $41.4 Distributable Earnings2 $63.4 $15.3 $21.5 $26.6 $18.5 Total Cash Dividends Declared on Common Shares $56.1 $18.7 $18.7 $18.7 $24.23 Total Cash Dividends on Preferred Shares $9.4 $3.1 $3.1 $3.1 $3.1 $0.20 $0.28 $0.34 $0.24 $0.19 $0.27 $0.33 $0.23 $0.28 $0.28 $0.28 $0.35 3Q22 2Q22 1Q22 4Q21 Distributable Earnings & Common Dividend Coverage $0.24 Investor Presentation | November 2022 $0.07 $0.04 $0.04 $0.24 $0.04 $0.24 $0.24 Distributable Earnings per Basic Share Distributable Earnings per Diluted Share Common Dividend per Common Share Special Dividend per Common Share Preferred Dividend per Common Share YTD Dividend Coverage Ratio of 1.1x4 $0.04

2.36x 2.50x 2.47x 3.13x 2.45x 2.59x 2.56x 3.13x 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Debt-to-Equity Ratio Total Leverage Ratio Liquidity and Leverage Available Liquidity ($ in millions) Leverage Ratios4 1. Cash held to satisfy liquidity covenants under secured credit agreements 2. Available for Eligible Collateral, as defined in relevant CLO indentures 3. Includes $234.1 million held at the trustee for future reinvestment 4. See Appendix for definitions of Debt-to-Equity Ratio and Total Leverage Ratio 5. See Appendix for detailed covenant requirements Note: Totals may not sum due to rounding 8 $15.0 $16.2 $17.3 $25.4 $245.6 $335.4 $338.7 $210.7 $60.3 $32.3 $50.7 $48.6 $0.2 $0.3 $365.03 $286.6 $321.1 $384.2 $771.7 $571.3 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Covenant Cash Cash Undrawn Capacity CLO Reinvestment Cash 1 2 Financial Covenants for Outstanding Borrowings as of September 30, 20225 Minimum Cash Liquidity : SATISFIED Tangible Net Worth : SATISFIED Debt-to-Equity : SATISFIED Interest Coverage : SATISFIED Target Leverage 3.75x Investor Presentation | November 2022 Increase due to boost in CECL Reserve

9 Diversified Loan Portfolio 29% 16% 13% 7% Geography4,5 East 34.0% Midwest 6.4% Southeast 12.6% Southwest 15.6% West 31.4% Portfolio Metrics Total Loan Commitments $5.8B Outstanding Principal Balance $5.3B MSA Concentrations (Top 25 / Top 10)1 70.5% / 47.1% Weighted Average All-in Yield2 7.09% Weighted Average Credit Spread 3.46% Weighted Average Interest Rate Floor 0.85% Weighted Average Borrower Interest Rate Cap3 2.87% % Floating Rate Loans 100% Loan Category4,5 Construction 0.9% Bridge 42.0% Light Transitional 29.7% Moderate Transitional 27.4% < 5% of total commitments 1. Top 25 markets determined by US Census. Portfolio loans with collateral properties that are located in different MSAs are classified in the market designation with over 50% of underlying loan collateral by unpaid principal balance 2. In addition to credit spread, all-in yield includes the amortization of deferred origination fees, purchase price discount, and accrual of both extension and exit fees; All-in yield for the total portfolio assumes the applicable floating benchmark interest rate as of September 30, 2022 for weighted average calculations 3. Weighted Average Borrower Interest Rate Cap Strike Rate required by substantially all in-place loan agreements as of September 30, 2022, based on outstanding principal balances 4. By total loan commitment at September 30, 2022, based on classification at closing 5. See Appendix for definitions Note: Data as of September 30, 2022 Investor Presentation | November 2022

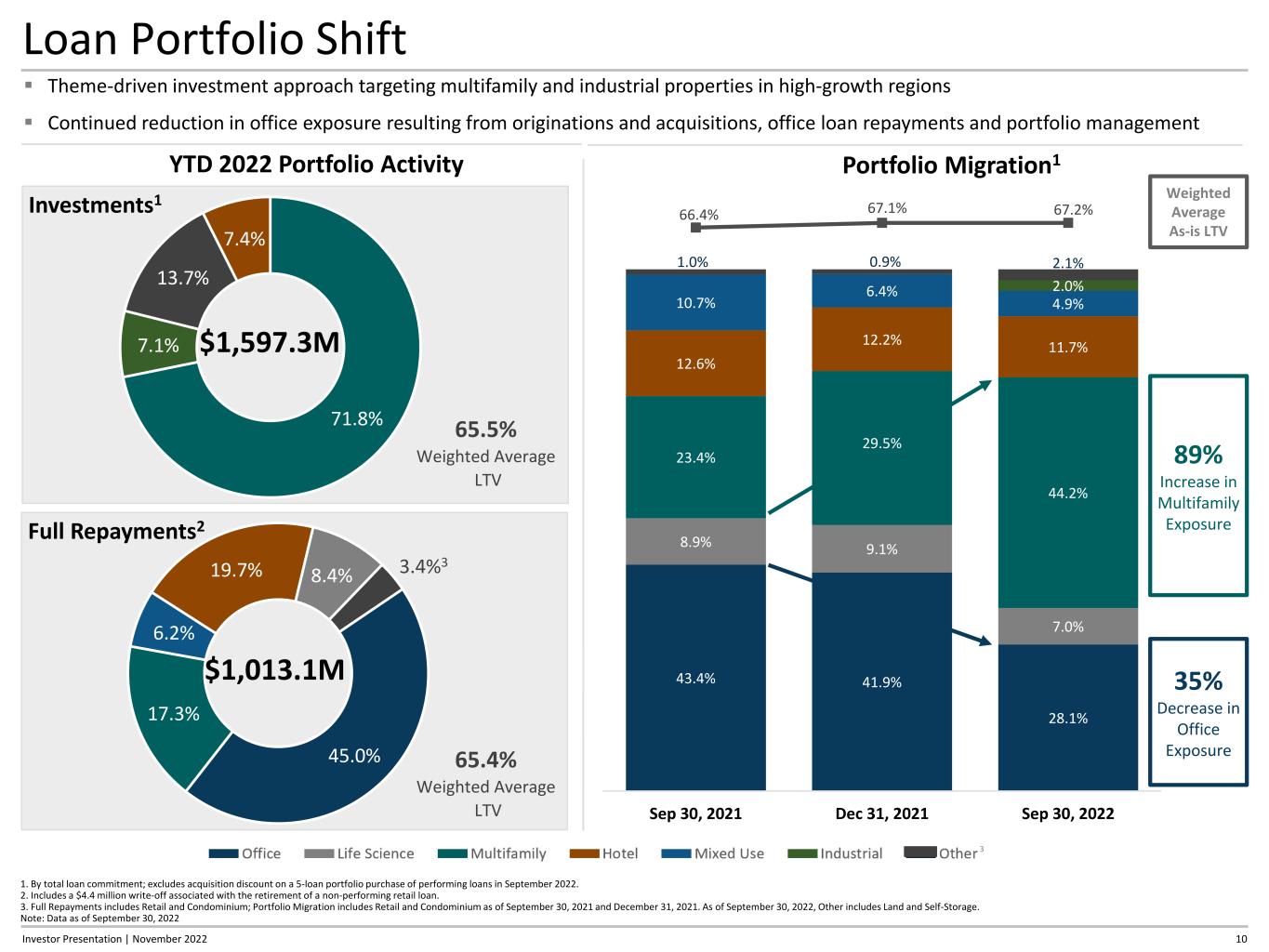

43.4% 41.9% 28.1% 8.9% 9.1% 7.0% 23.4% 29.5% 44.2% 12.6% 12.2% 11.7% 10.7% 6.4% 4.9% 2.0% 1.0% 0.9% 2.1% 66.4% 67.1% 67.2% Sep 30, 2021 Dec 31, 2021 Sep 30, 2022 10 Loan Portfolio Shift Theme-driven investment approach targeting multifamily and industrial properties in high-growth regions Continued reduction in office exposure resulting from originations and acquisitions, office loan repayments and portfolio management YTD 2022 Portfolio Activity Investments1 71.8% 7.1% 13.7% 7.4% $1,597.3M Full Repayments2 45.0% 17.3% 6.2% 19.7% 8.4% 3.4%3 $1,013.1M Portfolio Migration1 1. By total loan commitment; excludes acquisition discount on a 5-loan portfolio purchase of performing loans in September 2022. 2. Includes a $4.4 million write-off associated with the retirement of a non-performing retail loan. 3. Full Repayments includes Retail and Condominium; Portfolio Migration includes Retail and Condominium as of September 30, 2021 and December 31, 2021. As of September 30, 2022, Other includes Land and Self-Storage. Note: Data as of September 30, 2022 65.5% Weighted Average LTV 65.4% Weighted Average LTV 3 89% Increase in Multifamily Exposure 35% Decrease in Office Exposure Weighted Average As-is LTV Investor Presentation | November 2022

11 Select 3Q22 Investments Multifamily Multifamily Hotel3 $245.0M $72.0M $148.5M San Jose, CA Yonkers, NY Dallas, TX 551-unit, 2-building property with 35k SF of ground floor retail and 950 parking spaces; buildings were completed in 2019 and 2020 180-unit high-rise, completed in 2021, adjacent to a shopping center with tenants including Whole Foods, Apple, Lowe’s, and Showcase Cinemas Fee simple interest and leasehold interest in a 444-key portfolio of 2 full-service luxury hotels Lease to stabilized occupancy, burn-off concessions, and increase net effective rents Lease to stabilized occupancy with minimal to no concessions Continued operation of two fully-stabilized hotels; phased guest room renovations of 218 rooms at one of the hotels are expected to commence in 1Q23 75.9% / 4.7% 64.8% / 4.8% 54.2% / 16.5% Bridge Bridge Bridge July 2022 July 2022 September 2022 Commitment Location Collateral Borrower Business Plan LTV / In-Place Debt Yield1,2 Loan Category1 Property Photos Investment Date 1. See Appendix for definitions, including LTV and Loan Category 2. In-place debt yield for loans originated and acquired during 3Q22 is defined as the ratio of in-place net cash flow (annualized) divided by the initial funding amount, both as of the closing date 3. Investment is part of a 5-loan portfolio acquired at a discount with a weighted average credit spread of 3.35% and a weighted average discount margin of 4.98%, which represents the credit spread and annualized accretion of discount Investor Presentation | November 2022

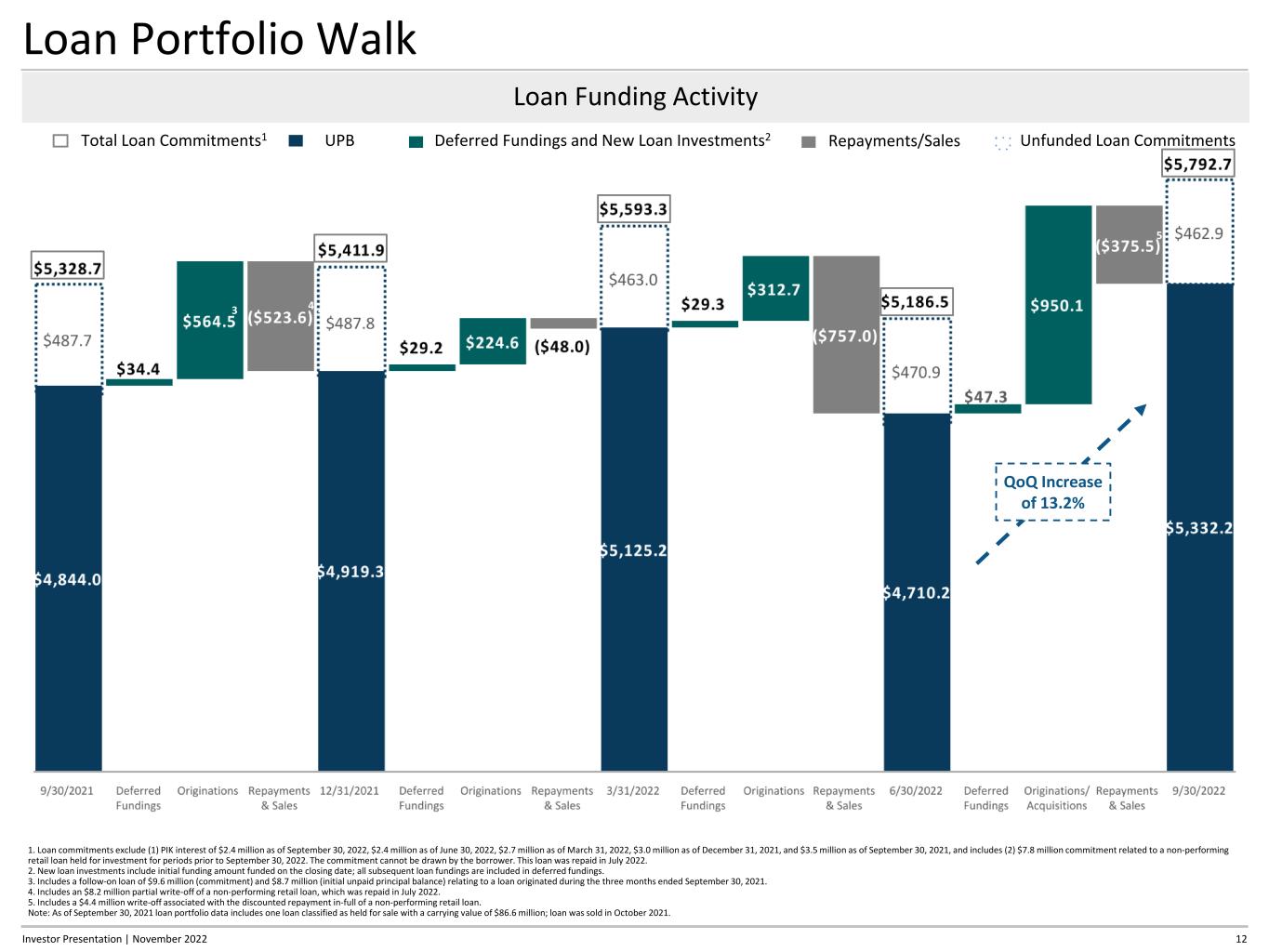

Loan Portfolio Walk 12 Loan Funding Activity Repayments/Sales Unfunded Loan CommitmentsDeferred Fundings and New Loan Investments2UPBTotal Loan Commitments1 3 44 5 QoQ Increase of 13.2% 1. Loan commitments exclude (1) PIK interest of $2.4 million as of September 30, 2022, $2.4 million as of June 30, 2022, $2.7 million as of March 31, 2022, $3.0 million as of December 31, 2021, and $3.5 million as of September 30, 2021, and includes (2) $7.8 million commitment related to a non-performing retail loan held for investment for periods prior to September 30, 2022. The commitment cannot be drawn by the borrower. This loan was repaid in July 2022. 2. New loan investments include initial funding amount funded on the closing date; all subsequent loan fundings are included in deferred fundings. 3. Includes a follow-on loan of $9.6 million (commitment) and $8.7 million (initial unpaid principal balance) relating to a loan originated during the three months ended September 30, 2021. 4. Includes an $8.2 million partial write-off of a non-performing retail loan, which was repaid in July 2022. 5. Includes a $4.4 million write-off associated with the discounted repayment in-full of a non-performing retail loan. Note: As of September 30, 2021 loan portfolio data includes one loan classified as held for sale with a carrying value of $86.6 million; loan was sold in October 2021. Investor Presentation | November 2022

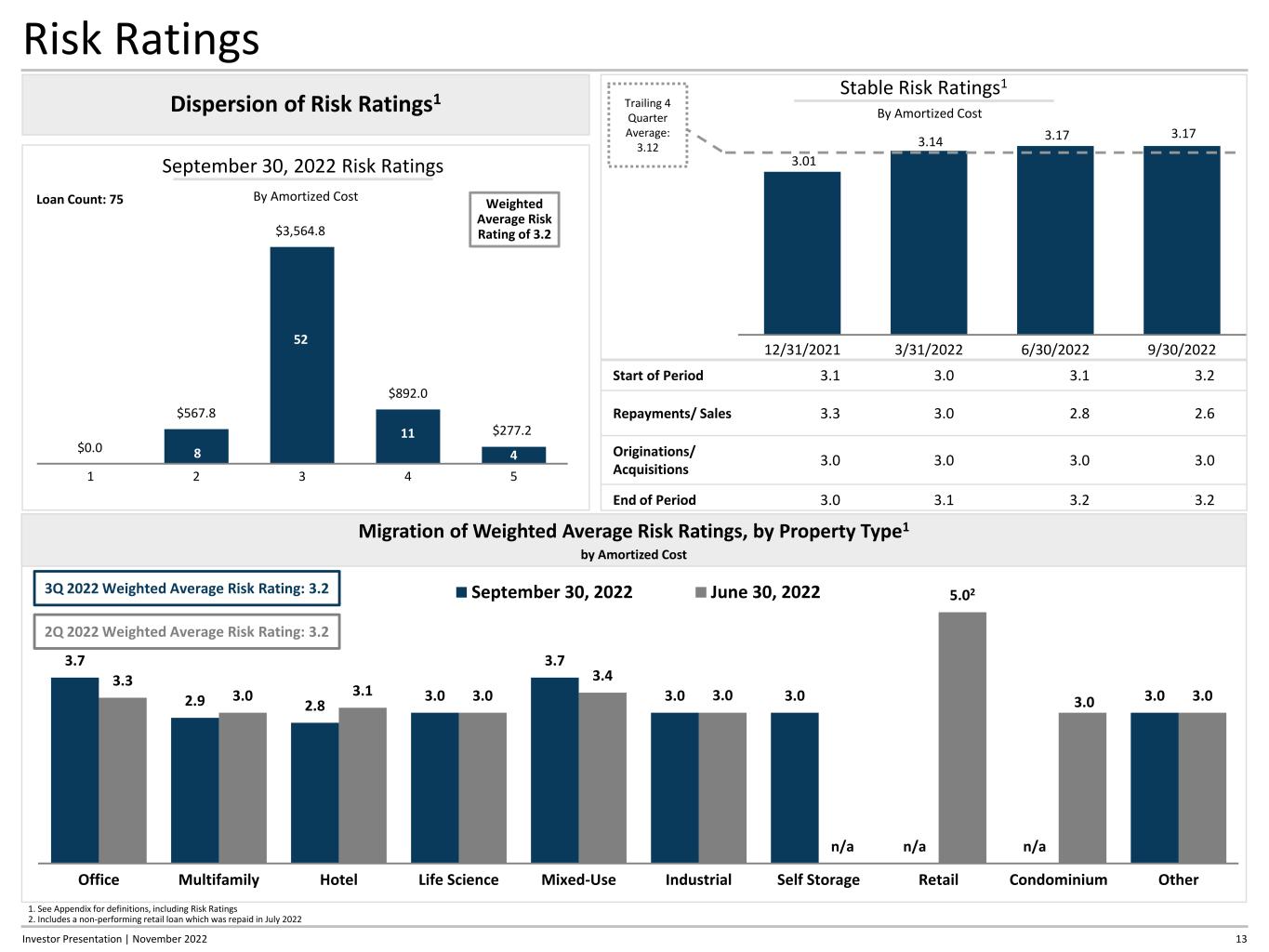

Risk Ratings Dispersion of Risk Ratings1 Stable Risk Ratings1 By Amortized Cost 5 13 3.01 3.14 3.17 3.17 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Start of Period 3.1 3.0 3.1 3.2 Repayments/ Sales 3.3 3.0 2.8 2.6 Originations/ Acquisitions 3.0 3.0 3.0 3.0 End of Period 3.0 3.1 3.2 3.2 Trailing 4 Quarter Average: 3.12 $567.8 $3,564.8 $892.0 $277.2 1 2 3 4 5 Weighted Average Risk Rating of 3.2 September 30, 2022 Risk Ratings By Amortized CostLoan Count: 75 $0.0 52 11 48 Migration of Weighted Average Risk Ratings, by Property Type1 by Amortized Cost 3.7 2.9 2.8 3.0 3.7 3.0 3.0 n/a n/a 3.0 3.3 3.0 3.1 3.0 3.4 3.0 n/a 5.02 3.0 3.0 Office Multifamily Hotel Life Science Mixed-Use Industrial Self Storage Retail Condominium Other September 30, 2022 June 30, 2022 2Q 2022 Weighted Average Risk Rating: 3.2 3Q 2022 Weighted Average Risk Rating: 3.2 1. See Appendix for definitions, including Risk Ratings 2. Includes a non-performing retail loan which was repaid in July 2022 Investor Presentation | November 2022

14 CECL Reserve $46.2 $51.1 $82.3 $153.3 $11.1 $72.3 $46.2 $51.1 $93.4 $225.6 12/31/2021 3/31/2022 6/30/2022 9/30/2022 General Reserve Specifically Identified Loans QoQ CECL Reserve 85 91 159 265 21 125 85 91 180 390 1 12/31/2021 3/31/2022 6/30/2022 9/30/2022 General Reserve Specifically Identified Loans Reserve as bps of Total Loan Commitments Reserve as $M CECL Reserve Migration by Property Type as bps of Loan Commitments 952 97 226 64 801 77 540 n/a n/a 8 592 107 111 89 132 111 n/a 1,394 2 0 n/a Office Multifamily Hotel Life Science Mixed-Use Industrial Self Storage Retail Condominium Other September 30, 2022 June 30, 2022 Total 2Q 2022 Reserve as bps of Total Loan Commitments: 180 bps Total 3Q 2022 Reserve as bps of Total Loan Commitments: 390 bps 1. Represents the total CECL reserve expressed in basis points for the Company’s $5.8 billion loan portfolio measured by commitments. The CECL reserve for specifically-identified loans at September 30, 2022 is 2,518 bps, and for non-specifically identified loans is 279 bps, both measured by the related CECL reserve (in dollars) divided the related commitment (in dollars). 2. Includes a non-performing retail loan which was repaid in July 2022. Investor Presentation | November 2022

25.1% 13.1% 4.7%57.1% Secured Credit Agreements (MTM) Asset-Specific Financing Secured Revolving Credit Facility Collateralized Loan Obligations 15 Loan Financing Financing Metrics Total Financing Capacity $6.3B Outstanding Principal Balance $4.3B Sources of Financing 14 Non-Mark-to-Market 74.9% Weighted Average Credit Spread 2.00% Weighted Average Approved Advance Rate 78.8% High Share of Non-MTM Financing1 $0 $200 $400 $600 $800 $1,000 $1,200 < 1 Year 1 - 3 Years 3 - 5 Years > 5 Years MTM Financing Non-MTM Financing Expected Debt Maturities3,4 1. Calculated on outstanding balance as of September 30, 2022 2. Non-MTM financing of eligible loans for up to 180 days at an initial advance rate of 75.0%, which declines to 65.0%, 45.0%, and 0.0% after 90, 135, and 180 days from initial borrowing 3. Based on extended maturity dates where ability to extend is at Company’s option 4. Collateralized loan obligation liabilities are based on the fully extended maturity of mortgage loan collateral, considering the reinvestment window of our collateralized loan obligation Note: Data as of September 30, 2022 2 74.9% Non-MTM Investor Presentation | November 2022 ($ in millions)

Focus on Non-MTM Financing 16 31.2% 19.7% 13.3% 64.1% 31.2% 59.8% 0.0% 0.0% 68.8% 80.3% 86.7% 35.9% 68.8% 40.2% 100.0% 100.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% Office Multifamily Mixed-Use Life Science Hotel Industrial Self-Storage Land % MTM % Non-MTM Investor Presentation | November 2022 Financing Mix by Property Type1,2 1. Calculated on outstanding balance as of September 30, 2022 2. Excludes Non-MTM CLO liabilities of $286.6 million, equal to CLO cash available for Eligible Collateral, as defined in relevant CLO indentures, as of September 30, 2022 Note: Data as of September 30, 2022

17 Benefit of Rising Rates ($0.01) $0.01 $0.02 $0.03 $0.07 -$0.01 $0.01 $0.03 $0.05 $0.07 -0.25% 0.00% 0.25% 0.50% 1.00% 2.00% Portfolio Net Interest Income Sensitivity ($ Impact per Share per Quarter)1 $ .00 Index Rate at September 30, 2022 LIBOR: 3.14% Term SOFR: 3.04% + 0.50%+ 0.25%- 0.25% + 2.00%+ 1.00%- Benchmark Rates at Nov 14, 2022 LIBOR: 3.89% Term SOFR: 3.81% Index Rate 1. Static analysis based on loan portfolio composition as of September 30, 2022 Investor Presentation | November 2022

$2,635M $744M $678M $1,113M $161M 2.20% 3.39% 3.47% 3.69% 3.08% 0.16% 0.88% 1.48% 1.88% 2.23% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $0 $500 $1,000 $1,500 $2,000 $2,500 0.50% or Less 0.51% to 1.00% 1.01% to 1.50% 1.51% to 2.00% 2.01% or More W eighted Average Index Rate Floor U PB ($ in m ill io ns ) Interest Rate Floors 18 100% Asset Sensitive Weighted Average Borrower Interest Rate Cap2 Portfolio Interest Rate Floor & Borrower Interest Rate Cap Distribution 1. Assumes the applicable floating benchmark interest rate as of September 30, 2022, by loan 2. Weighted Average Borrower Interest Rate Cap Strike Rate required by substantially all in-place loan agreements as of September 30, 2022, based on outstanding principal balances Weighted Average Interest Rate Floor - Loans Weighted Average Interest Rate1 100% rate sensitive, which benefits net interest margin in a period of rising benchmark rates Borrower rate caps support loan-level interest coverage in a rising rate environment Investor Presentation | November 2022

Appendix

Per Share Calculations Reconciliation of Net Income Attributable to Common Stockholders and Distributable Earnings 1. Includes preferred stock dividends declared and paid for Series A preferred stock and Series C Preferred Stock 2. For the three months ended June 30, 2022 and December 31, 2021, taxable income capital loss carryforwards were utilized to offset a $13.3 million and $15.8 million taxable gain realized from the partial sale of an REO Property, respectively 3. Credit Loss (Benefit) Expense for the three months ended December 31, 2021 excludes the reversal of a $8.2 million reduction in our credit loss reserve associated with the partial write-off of a loan held for investment (recognized as a partial worthlessness deduction for income tax purposes) related to a non-performing retail loan, which was repaid in July 2022; for the three months ended September 30, 2022 excludes a $4.4 million write-off associated with the discounted repayment in-full of a non-performing retail loan ▪ The following tables provide a reconciliation of GAAP net income to GAAP Net Income Attributable to Common Stockholders and Distributable Earnings (in thousands, except share and per share data): Book Value Per Common Share For the Period Ended Sep 30, 2022 June 30, 2022 Mar 31, 2022 Dec 31, 2021 Total Stockholders' Equity $1,306,394 $1,441,928 $1,467,908 $1,464,706 Series C Preferred Stock ($201,250 aggregate liquidation preference) (201,250) (201,250) (201,250) (201,250) Series A Preferred Stock ($125 aggregate liquidation preference) (125) (125) (125) (125) Stockholders' Equity, Net of Preferred Stock $1,105,019 $1,240,553 $1,266,533 $1,263,331 Number of Common Shares Outstanding at Period End 77,406,620 77,403,381 77,185,845 77,183,892 Book Value per Common Share $14.28 $16.03 $16.41 $16.37 Three Months Ended (unaudited) Sep 30, 2022 June 30, 2022 Mar 31, 2022 Dec 31, 2021 Net Income (Loss) ($114,607) ($5,434) $23,781 $44,878 Preferred Stock Dividends1 (3,148) (3,148) (3,148) (3,148) Participating Securities' Share in Earnings (Loss) (159) (226) (197) (301) Net (Loss) Income Attributable to Common Stockholders ($117,914) ($8,808) $20,436 $41,429 Weighted-Average Common Shares Outstanding, Basic 77,403,487 77,188,291 77,183,957 77,053,224 Weighted-Average Common Shares Outstanding, Diluted 77,403,487 77,188,291 81,788,723 81,983,310 (Loss) Earnings Per Common Share, Basic ($1.52) ($0.11) $0.26 $0.54 (Loss) Earnings Per Common Share, Diluted ($1.52) ($0.11) $0.25 $0.51 Utilization of Taxable Income Capital Loss Carryforwards2 — (13,291) — (15,790) Non-Cash Stock Compensation Expense 932 1,328 1,266 1,665 Credit Loss (Benefit) Expense3 132,266 42,290 4,884 (8,758) Distributable Earnings $15,284 $21,519 $26,586 $18,546 Weighted-Average Common Shares Outstanding, Basic 77,403,487 77,188,291 77,183,957 77,053,224 Weighted-Average Common Shares Outstanding, Diluted 79,939,764 80,592,302 81,788,723 81,983,310 Distributable Earnings per Common Share, Basic $0.20 $0.28 $0.34 $0.24 Distributable Earnings per Common Share, Diluted $0.19 $0.27 $0.33 $0.23 20Investor Presentation | November 2022

Definitions Distributable Earnings is a non-GAAP measure defined as GAAP net income (loss) attributable to our common stockholders, including realized gains and losses, regardless of whether such items are included in other comprehensive income or loss, or in GAAP net income (loss), and excluding (i) non-cash stock compensation expense, (ii) depreciation and amortization expense, (iii) unrealized gains (losses), and (iv) certain non-cash or income and expense items. The exclusion of depreciation and amortization expense from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent we foreclose upon the property or properties underlying such debt investments. We believe that Distributable Earnings provides meaningful information to consider in addition to our net income (loss) and cash flow from operating activities determined in accordance with GAAP. We generally must distribute at least 90% of our net taxable income annually, subject to certain adjustments and excluding any net capital gains, for us to continue to qualify as a REIT for U.S. federal income tax purposes. We believe that one of the primary reasons investors purchase our common stock is to receive our dividends. Because of our investors’ continued focus on our ability to pay dividends, Distributable Earnings is an important measure for us to consider when determining our distribution policy and dividends per common share. Further, Distributable Earnings helps us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan investment and operating activities. Distributable Earnings excludes the impact of our credit loss provision or reversals of our credit loss provision, but only to the extent that our credit loss provision exceeds any realized credit losses during the applicable reporting period. A loan will be written off as a realized loss when it is deemed non-recoverable, or upon a realization event. Realized losses are generally recognized when the loan receivable is settled, transferred or exchanged, or in the case of foreclosure, when the underlying property is foreclosed upon or sold. Non-recoverability may also be concluded by us if, in our determination, it is nearly certain that all amounts due will not be collected. A realized loss generally equals the difference between the cash or non-cash consideration received or expected to be received, and the net book value of the loan, reflecting our economics from the ultimate realization of the asset. Distributable Earnings does not represent net income (loss) or cash generated from operating activities and should not be considered as an alternative to GAAP net income (loss), an indication of our GAAP cash flows from operations, a measure of our liquidity, or an indication of funds available for our cash needs. In addition, our methodology for calculating Distributable Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. Distributable Earnings 21Investor Presentation | November 2022

Definitions (cont.) Fundings to borrowers that are made under existing loan commitments after a loan closing dateDeferred Fundings Geographic Diversity TRTX divides the South region into separate Southeast and Southwest regions using definitions established by The National Council of Real Estate Investment Fiduciaries (NCREIF). A reconciliation to TRTX’s Form 10-Q at September 30, 2022 follows (dollars in millions): Region Form 10-Q Reclassification Supplemental % Total Commitment East $1,932.4 $34.8 $1,967.2 34.0% South 1,586.6 (1,586.6) - - % West 1,761.9 56.8 1,818.7 31.4% Midwest 372.8 - 372.8 6.4% Southeast - 728.7 728.7 12.6% Southwest - 905.3 905.3 15.6% Various 139.0 (139.0) - - % Total $5,792.7 $ - $5,792.7 100.0% Note: Totals may not sum due to rounding 22Investor Presentation | November 2022 Earning Assets Earning assets refers to interest-earning assets that are comprised of a portfolio of floating rate, first mortgage loans, or in limited instances, mezzanine loans Financial Covenants Our financial covenants and guarantees for outstanding borrowings related to our secured financing agreements require TPG RE Finance Trust Holdco, LLC, a Delaware limited liability company that is wholly owned by TRTX, to maintain compliance with the following financial covenants (among others): – Cash Liquidity: Minimum cash liquidity of no less than the greater of: $15.0 million; and 5.0% of Holdco’s recourse indebtedness – Tangible Net Worth: $1.0 billion, plus 75% of all subsequent equity issuances (net of discounts, commissions, expense), minus 75% of the redeemed or repurchased preferred or redeemable equity or stock – Debt-to-Equity: Debt-to-Equity ratio not to exceed 4.25 to 1.0 with equity, as defined – Interest Coverage: Minimum interest coverage ratio of 1.5 to 1.0

Definitions (cont.) 23 Bridge Loan - A loan with limited deferred fundings, generally less than 10% of the total loan commitment, which fundings are commonly conditioned on the borrower’s satisfaction of certain collateral performance tests. The related business plan generally involves little or no capital expenditure related to base building work (e.g., building mechanical systems, lobbies, elevators, common areas, or other amenities), with most deferred fundings related to leasing activity. The primary focus is on maintaining or improving current operating cash flow, or addressing minimal lease expirations or existing tenant vacancies Light Transitional Loan - A transitional loan with deferred fundings ranging from 10% to 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan is to lease existing or forecasted tenant vacancy to achieve stabilized occupancy and cash flow. Capital expenditure is primarily to fund leasing commissions and tenant improvements for new tenant leases, and capital expenditure allocated to base building work generally does not exceed 20%. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Moderate Transitional Loan - A transitional loan with deferred fundings greater than 20% of the total loan commitment, which fundings are commonly conditioned on the borrower’s completion of specified improvements to the property or satisfaction of certain collateral performance tests. The related business plan generally involves capital expenditure for base building work needed before substantial leasing activity can be achieved, followed by capital expenditure for tenant improvements and leasing commissions to achieve stabilized occupancy and cash flow. Deferred fundings may also be budgeted to fund operating deficits, or interest expense, during the period prior to stabilized occupancy Construction Loan - A loan made to a borrower to fund the ground-up construction of a commercial real estate property Loan Category Investor Presentation | November 2022 Except for construction loans, LTV is calculated for loan originations and existing loans as the total outstanding principal balance of the loan or participation interest in a loan (plus any financing that is pari passu with or senior to such loan or participation interest), divided by the as-is appraised value of our collateral at the time of origination or acquisition of such loan or participation interest. For construction loans only, LTV is calculated as the total commitment amount of the loan divided by the as-stabilized value of the real estate securing the loan. The as-is or as-stabilized (as applicable) value reflects our Manager’s estimates, at the time of origination or acquisition of the loan or participation interest in a loan, of the real estate value underlying such loan or participation interest determined in accordance with our Manager’s underwriting standards and consistent with third-party appraisals obtained by our Manager Loan-to-Value (LTV) Leverage Debt-to-Equity Ratio - Represents (i) total outstanding borrowings under secured financing arrangements, including collateralized loan obligations, secured credit agreements, asset-specific financing arrangements, a secured revolving credit facility, and mortgage loans payable (if any), less cash, to (ii) total stockholders’ equity, at period end Total Leverage Ratio - (i) total outstanding borrowings under secured financing arrangements, including collateralized loan obligations, secured credit agreements, asset-specific financing arrangements, a secured revolving credit facility, and mortgage loans payable (if any), plus non-consolidated senior interests sold or co-originated (if any), less cash, to (ii) total stockholders’ equity, at period end

Definitions (cont.) 24 Property Types Mixed-Use: TRTX classifies a loan as mixed-use if the property securing TRTX’s loan (a) involves more than one use; and (b) no single use represents more than 60% of the collateral property’s total value. In certain instances, TRTX’s classification may be determined by its assessment of which use is the principal driver of the property’s aggregate net operating income Life Science: TRTX classifies a loan as life science if more than 60% of the gross leasable area is leased to, or will be converted to, life science-related space. Life science-related space includes laboratory space, office space, or allied light manufacturing space used in support of biotechnology, pharmaceuticals, biomedical technologies, life systems technologies, and the design and manufacture of biomedical technology. Investor Presentation | November 2022 Market Price and Dividend Disclaimer TRTX can provide no assurance regarding future market prices of TRTX’s common stock. The market price of TRTX’s common stock may be significantly affected by numerous factors, some of which are beyond TRTX’s control and may not be directly related to TRTX’s operating performance. Additionally, no assurance can be given that TRTX will be able to pay dividends to TRTX’s stockholders at any time in the future or that the level of any dividends that TRTX does pay to its stockholders will achieve a market yield or increase or even be maintained over time. TRTX’s ability to pay dividends may be adversely affected by a number of factors, some of which are beyond TRTX’s control and may not be directly related to TRTX’s operating performance. Future dividend payments, if any, will be authorized by TRTX’s board of directors in its sole discretion out of funds legally available therefor and will be dependent upon a number of factors, including TRTX’s historical and projected results of operations, cash flows and financial condition, TRTX’s financing covenants, maintenance of TRTX’s REIT qualification, applicable provisions of Maryland law and such other factors as TRTX’s board of directors deems relevant.

Definitions (cont.) 25Investor Presentation | November 2022 Loan Risk Ratings Based on a 5-point scale, the Company’s loans are rated “1” through “5,” from least risk to greatest risk, respectively, which ratings are defined as follows: – 1 - Outperform—Exceeds performance metrics (for example, technical milestones, occupancy, rents, net operating income) included in original or current credit underwriting and business plan; – 2 - Meets or Exceeds Expectations—Collateral performance meets or exceeds substantially all performance metrics included in original or current underwriting / business plan; – 3 - Satisfactory—Collateral performance meets or is on track to meet underwriting; business plan is met or can reasonably be achieved; – 4 - Underperformance—Collateral performance falls short of original underwriting, material differences exist from business plan, or both; technical milestones have been missed; defaults may exist, or may soon occur absent material improvement; and – 5 - Default/Possibility of Loss—Collateral performance is significantly worse than underwriting; major variance from business plan; loan covenants or technical milestones have been breached; the loan is in default or substantially in default; timely exit from loan via sale or refinancing is questionable; significant risk of principal loss.

Company Information Contact Information Headquarters: 888 Seventh Avenue 35th Floor New York, NY 10106 New York Stock Exchange: Symbol: TRTX TPG RE Finance Trust, Inc. Bob Foley Chief Financial Officer +1 (212) 430-4111 bfoley@tpg.com Brandon Fox Chief Accounting Officer +1 (415) 706-2751 bfox@tpg.com Investor Relations: +1 (212) 405-8500 IR@tpgrefinance.com Media Contact: TPG RE Finance Trust, Inc. Courtney Power +1 (415) 743-1550 media@tpg.com Analyst Coverage BTIG Eric Hagen +1 (212) 738-6014 Citigroup Securities Arren Cyganovich +1 (212) 816-3733 JMP Securities Steven DeLaney +1 (212) 906-3517 JP Morgan Richard Shane +1 (415) 315-6701 Raymond James Stephen Laws +1 (901) 579-4868 Wells Fargo Donald Fandetti +1 (212) 214-8069 TPG RE Finance Trust, Inc. is a commercial real estate finance company that originates, acquires, and manages primarily first mortgage loans secured by institutional properties located in primary and select secondary markets in the United States. The Company is externally managed by TPG RE Finance Trust Management, L.P., a part of TPG Real Estate, which is the real estate investment platform of global alternative asset management firm TPG Inc. (NASDAQ: TPG). For more information regarding TRTX, visit www.tpgrefinance.com. 26 Transfer Agent American Stock Transfer & Trust Company, LLC +1 (800) 937-5449 help@astfinancial.com Investor Presentation | November 2022