| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-191331-07 |

| | | |

February 6, 2015

Free Writing Prospectus

Structural and Collateral Term Sheet

$913,543,797

(Approximate Mortgage Pool Balance)

$805,060,000

(Offered Certificates)

GS Mortgage Securities Trust 2015-GC28

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2015-GC28

Goldman Sachs Mortgage Company

Cantor Commercial Real Estate Lending, L.P.

Starwood Mortgage Funding I LLC

Citigroup Global Markets Realty Corp.

MC-Five Mile Commercial Mortgage Finance LLC

As Sponsors

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc. or Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman, Sachs & Co. | | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| | | |

| Cantor Fitzgerald & Co. | Deutsche Bank Securities | Drexel Hamilton |

| Co-Managers |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the prospectus included as part of our registration statement (SEC File No. 333-191331) (the “Base Prospectus”) and a separate free writing prospectus, each anticipated to be dated February 9, 2015 (the “Free Writing Prospectus”). The Base Prospectus and the Free Writing Prospectus contain material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading ”Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus). The Base Prospectus and the Free Writing Prospectus are available upon request from Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc. or Drexel Hamilton, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Free Writing Prospectus or, if not defined in the Free Writing Prospectus, in the Base Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Base Prospectus and the Free Writing Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc. or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Free Writing Prospectus). See also “Legal Investment” in the Free Writing Prospectus.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED WITH THE STATE OF NEW HAMPSHIRE UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES (“RSA 421-B”), NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE, AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT ANY EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| OFFERED CERTIFICATES | |

| Expected Ratings (Moody’s / KBRA / DBRS)(1) | | Initial Certificate

Principal Amount or

Notional Amount(2) | | Approximate

Initial Credit

Support | | Initial Pass-

Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg. Life

(Yrs)(4) | | Expected

Principal

Window(4) | |

| Class A-1 | Aaa(sf) / AAA(sf) / AAA(sf) | | $35,865,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 2.66 | | 03/15 – 12/19 | |

| Class A-2 | Aaa(sf) / AAA(sf) / AAA(sf) | | $136,986,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 4.88 | | 12/19 – 02/20 | |

| Class A-3 | Aaa(sf) / AAA(sf) / AAA(sf) | | $8,225,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 6.87 | | 01/22 – 01/22 | |

| Class A-4 | Aaa(sf) / AAA(sf) / AAA(sf) | | $180,000,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 9.78 | | 11/24 – 01/25 | |

| Class A-5 | Aaa(sf) / AAA(sf) / AAA(sf) | | $224,609,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 9.87 | | 01/25 – 01/25 | |

| Class A-AB | Aaa(sf) / AAA(sf) / AAA(sf) | | $53,795,000 | | | | 30.000 | %(5) | | [ ]% | | (6) | | 7.40 | | 02/20 – 11/24 | |

| Class X-A | Aa1(sf) / AAA(sf) / AAA(sf) | | $696,577,000 | (8) | | | N/A | | | [ ]% | | Variable IO(9) | | N/A | | N/A | |

| Class X-B | Aa3(sf) / AAA(sf) / AAA(sf) | | $43,393,000 | (8) | | | N/A | | | [ ]% | | Variable IO(9) | | N/A | | N/A | |

Class A-S(10) | Aa1(sf) / AAA(sf) / AAA(sf) | | $57,097,000 | (11) | | | 23.750 | % | | [ ]% | | (6)(7) | | 9.87 | | 01/25 – 01/25 | |

Class B(10) | Aa3(sf) / AA(sf) / AA(sf) | | $43,393,000 | (11) | | | 19.000 | % | | [ ]% | | (6)(7) | | 9.87 | | 01/25 – 01/25 | |

Class PEZ(10) | A2(sf) / A-(sf) / A(low)(sf) | | $165,580,000 | (11) | | | 11.875 | %(12) | | (7) | | (7) | | 9.87 | | 01/25 – 01/25 | |

Class C(10) | NR / A-(sf) / A(low)(sf) | | $65,090,000 | (11) | | | 11.875 | %(12) | | [ ]% | | (6)(7) | | 9.87 | | 01/25 – 01/25 | |

| | |

| NON-OFFERED CERTIFICATES | |

| Expected Ratings (Moody’s / KBRA / DBRS)(1) | | Initial Certificate

Principal Amount or

Notional Amount(2) | | Approximate

Initial Credit

Support | | Initial Pass-

Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected

Principal

Window(4) | |

| Class X-C | NR / BB-(sf) / AAA(sf) | | $21,697,000 | (8) | | | N/A | | | [ ]% | | Variable IO(9) | | N/A | | N/A | |

| Class X-D | NR / B-(sf) / AAA(sf) | | $15,987,000 | (8) | | | N/A | | | [ ]% | | Variable IO(9) | | N/A | | N/A | |

| Class X-E | NR / NR / AAA(sf) | | $27,406,796 | (8) | | | N/A | | | [ ]% | | Variable IO(9) | | N/A | | N/A | |

| Class D | NR / BBB-(sf) / BBB(low)(sf) | | $43,393,000 | | | | 7.125 | % | | [ ]% | | (6) | | 9.93 | | 01/25 – 02/25 | |

| Class E | NR / BB-(sf) / BB(low)(sf) | | $21,697,000 | | | | 4.750 | % | | [ ]% | | (6) | | 9.95 | | 02/25 – 02/25 | |

| Class F | NR / B-(sf) / B(low)(sf) | | $15,987,000 | | | | 3.000 | % | | [ ]% | | (6) | | 9.95 | | 02/25 – 02/25 | |

| Class G | NR / NR / NR | | $27,406,796 | | | | 0.000 | % | | [ ]% | | (6) | | 9.95 | | 02/25 – 02/25 | |

Class R(13) | N/A | | N/A | | | | N/A | | | N/A | | N/A | | N/A | | N/A | |

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Kroll Bond Rating Agency, Inc. (“KBRA”) and DBRS, Inc. (“DBRS”). Subject to the discussion under “Ratings” in the Free Writing Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Free Writing Prospectus. Moody’s, KBRA and DBRS have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximate per annum rate as of the closing date. |

| (4) | Assuming no prepayments prior to the maturity date, as applicable, for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Free Writing Prospectus. |

| (5) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-AB certificates are represented in the aggregate. |

| (6) | For any distribution date, the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G certificates will each be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a fixed rate and the rate specified in clause (ii), or (iv) the rate specified in clause (ii) less a fixed percentage. |

| (7) | The Class PEZ certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, Class B and Class C trust components represented by the Class PEZ certificates. The pass-through rates on the Class A-S, Class B and Class C trust components will at all times be the same as the pass-through rates of the Class A-S, Class B and Class C certificates, respectively. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| CERTIFICATE SUMMARY (continued) |

| (8) | The Class X-A, Class X-B, Class X-C, Class X-D and Class X-E certificates (the “Class X Certificates”) will not have certificate principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B, Class X-C, Class X-D and Class X-E certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate certificate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-AB certificates and the Class A-S trust component. The notional amount of the Class X-B certificates will be equal to the certificate principal amount of the Class B trust component. The notional amount of the Class X-C certificates will be equal to the certificate principal amount of the Class E certificates. The notional amount of the Class X-D certificates will be equal to the certificate principal amount of the Class F certificates. The notional amount of the Class X-E certificates will be equal to the certificate principal amount of the Class G certificates. |

| (9) | The pass-through rate of the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-AB certificates and the Class A-S trust component, as described in the Free Writing Prospectus. The pass-through rate of the Class X-B certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class B trust component, as described in the Free Writing Prospectus. The pass-through rate of the Class X-C certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class E certificates, as described in the Free Writing Prospectus. The pass-through rate of the Class X-D certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class F certificates, as described in the Free Writing Prospectus. The pass-through rate of the Class X-E certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class G certificates, as described in the Free Writing Prospectus. |

| (10) | The Class A-S, Class B and Class C certificates may be exchanged for Class PEZ certificates, and Class PEZ certificates may be exchanged for the Class A-S, Class B and Class C certificates. The Class A-S, Class B, Class PEZ and Class C certificates are collectively referred to as the “Exchangeable Certificates”. |

| (11) | On the closing date, the issuing entity will issue the Class A-S, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $57,097,000, $43,393,000 and $65,090,000, respectively. The Class A-S, Class B, Class PEZ and Class C certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the Class A-S, Class B and Class C certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A-S, Class B and Class C trust components, respectively. The Class PEZ certificates will, at all times, represent a beneficial interest in the remaining percentages of each of the outstanding principal balances of the Class A-S, Class B and Class C trust components. Following any exchange of Class A-S, Class B and Class C certificates for Class PEZ certificates or any exchange of Class PEZ certificates for Class A-S, Class B and Class C certificates, the percentage interest of the outstanding principal balances of the Class A-S, Class B and Class C trust components that is represented by the Class A-S, Class B, Class PEZ and Class C certificates will be increased or decreased accordingly. The initial certificate principal amount of each of the Class A-S, Class B and Class C certificates shown in the table above represents the maximum certificate principal amount of such class without giving effect to any issuance of Class PEZ certificates. The initial certificate principal amount of the Class PEZ certificates shown in the table above is equal to the aggregate of the maximum initial certificate principal amounts of the Class A-S, Class B and Class C certificates, representing the maximum certificate principal amount of the Class PEZ certificates that could be issued in an exchange. The actual certificate principal amount of any class of the Class A-S, Class B, Class PEZ and Class C certificates issued on the closing date may be less than the maximum certificate principal amount of that class and may be zero. The certificate principal amounts of the Class A-S, Class B and Class C certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal amount of the Class PEZ certificates issued on the closing date. |

| (12) | The initial subordination levels for the Class C and Class PEZ certificates are equal to the subordination level of the underlying Class C trust component. |

| (13) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interest in each of two separate REMICs, as further described in the Free Writing Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| MORTGAGE POOL CHARACTERISTICS |

Mortgage Pool Characteristics(1) |

Initial Pool Balance(2) | $913,543,797 |

| Number of Mortgage Loans | 74 |

| Number of Mortgaged Properties | 112 |

| Average Cut-off Date Mortgage Loan Balance | $12,345,186 |

| Weighted Average Mortgage Interest Rate | 4.3512% |

| Weighted Average Remaining Term to Maturity (months) | 109 |

Weighted Average Remaining Amortization Term (months)(3) | 353 |

Weighted Average Cut-off Date LTV Ratio(4) | 67.3% |

Weighted Average Maturity Date LTV Ratio(5) | 59.7% |

Weighted Average Underwritten Debt Service Coverage Ratio(6) | 1.89x |

Weighted Average Debt Yield on Underwritten NOI(7) | 10.7% |

% of Mortgage Loans with Preferred Equity(8) | 1.6% |

| % of Mortgaged Properties with Single Tenants | 6.2% |

| (1) | Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Excludes mortgage loans that are interest-only for the entire term. |

| (4) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to 5 mortgage loans, representing approximately 6.1% of the initial pool balance, the respective Cut-off Date LTV Ratios were calculated using (i) the cut-off date principal balance of a mortgage loan less a reserve taken at origination or (ii) an “as stabilized” or “prospective as-is” appraised value because the applicable “as stabilized” or “prospective as-is” date has passed and the respective conditions have been met. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 67.5%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Cut-off Date LTV Ratio. |

| (5) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to 12 mortgage loans, representing approximately 18.6% of the initial pool balance, the respective Maturity Date LTV Ratios were each calculated using the related “as stabilized” appraised value instead of the related “as-is” appraised value. See ”Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Maturity Date LTV Ratio. |

| (6) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio for each mortgage loan is calculated by dividing the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (7) | Unless otherwise indicated, the Debt Yield on Underwritten NOI for each mortgage loan is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. With respect to 3 mortgage loans, representing approximately 2.2% of the initial pool balance, the respective Debt Yields on Underwritten NOI and Debt Yields on Underwritten NCF were calculated using the cut-off-date principal balance of a mortgage loan less a reserve taken at origination. The weighted average Debt Yield on Underwritten NOI and weighted average Debt Yield on Underwritten NCF for the mortgage pool without making any adjustments are 10.7% and 9.9%, respectively. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Free Writing Prospectus for descriptions of Debt Yield on Underwritten NOI and Debt Yield on Underwritten NCF. |

| (8) | With respect to the Schuyler Commons mortgage loan, an indirect owner of the borrower is entitled to a preferred equity distribution with a 12% annual preferred return on its $3,211,125 capital contribution (see “Description of the Mortgage Pool—Statistical Characteristics of the Mortgage Loans—Additional Indebtedness” in the Free Writing Prospectus). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| KEY FEATURES OF THE CERTIFICATES |

Co-Lead Managers and Joint Bookrunners: | Goldman, Sachs & Co. Citigroup Global Markets Inc. |

| Co-Managers: | Cantor Fitzgerald & Co. Deutsche Bank Securities Inc. Drexel Hamilton, LLC |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $913,543,797 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Pricing: | Week of February 9, 2015 |

| Closing Date: | February 27, 2015 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in February 2015 (or, in the case of any mortgage loan that has its first due date in March 2015, the date that would have been its due date in February 2015 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 6th day of each month or next business day |

| Distribution Date: | The 4th business day after the Determination Date, commencing in March 2015 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | February 2048 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to Class X-A and Class X-B: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| n | $913,543,796 (Approximate) New-Issue Multi-Borrower CMBS: |

| | — | Overview: The mortgage pool consists of 74 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $913,543,797 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $12,345,186 and are secured by 112 mortgaged properties located throughout 24 states |

| | — | LTV: 67.3% weighted average Cut-off Date LTV Ratio |

| | — | DSCR: 1.89x weighted average Underwritten Debt Service Coverage Ratio |

| | — | Debt Yield: 10.7% weighted average Debt Yield on Underwritten NOI |

| | — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-5 / A-AB |

| n | Loan Structural Features: |

| | — | Amortization: 70.2% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| | – | 35.2% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| | – | 34.9% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| | — | Hard Lockboxes: 38.1% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| | — | Cash Traps: 90.6% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.00x coverage, that fund an excess cash flow reserve |

| | — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| | – | Real Estate Taxes: 67 mortgage loans representing 91.3% of the Initial Pool Balance |

| | – | Insurance: 58 mortgage loans representing 66.0% of the Initial Pool Balance |

| | – | Replacement Reserves (Including FF&E Reserves): 70 mortgage loans representing 92.8% of the Initial Pool Balance |

| | – | Tenant Improvements / Leasing Commissions: 35 mortgage loans representing 61.2% of the portion of the Initial Pool Balance that is secured by office, retail, mixed use and industrial properties only |

| | — | Predominantly Defeasance: 89.2% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

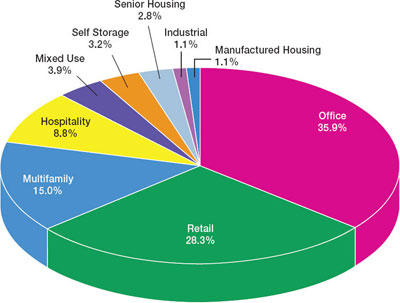

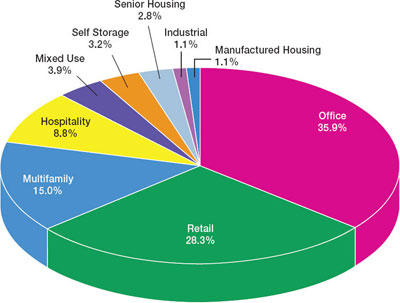

| n | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| | — | Office: 35.9% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| | — | Retail: 28.3% of the mortgaged properties by allocated Initial Pool Balance are retail properties (19.1% are anchored retail properties) |

| | — | Multifamily: 15.0% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| | — | Hospitality: 8.8% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

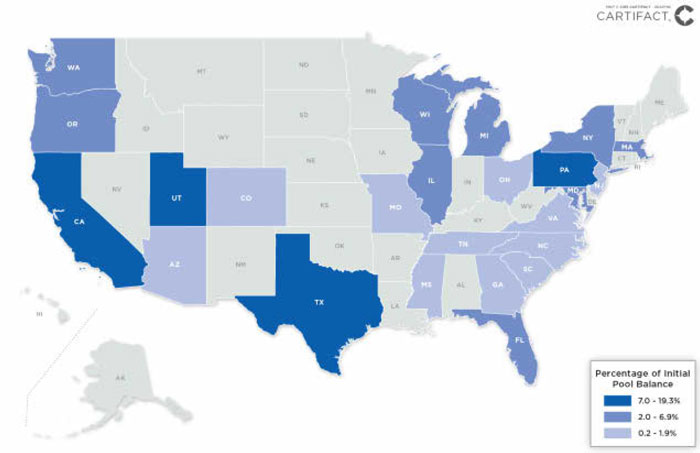

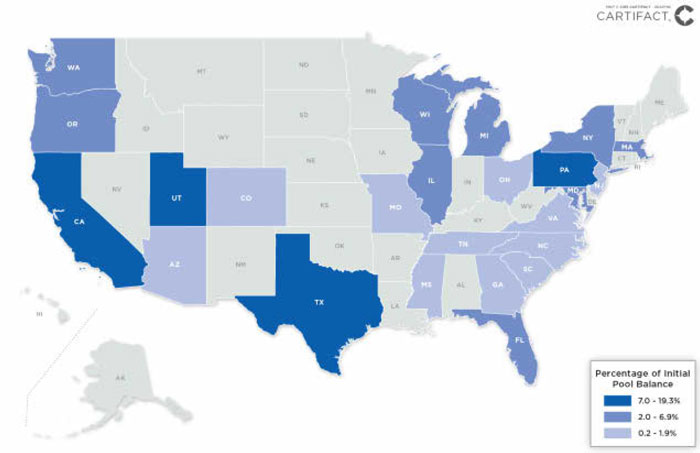

| n | Geographic Diversity: The 112 mortgaged properties are located throughout 24 states with only three states having greater than 10.0% of the allocated Initial Pool Balance: California (19.3%), Texas (12.3%) and Utah (11.9%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| Mortgage Loans by Loan Seller | | | | | | | | | | |

| | | | | | Aggregate Cut-off Date Balance | | |

| Goldman Sachs Mortgage Company | | 15 | | 16 | | $350,507,286 | | | 38.4 | % |

| Cantor Commercial Real Estate Lending, L.P. | | 18 | | 27 | | 160,922,702 | | | 17.6 | |

| Starwood Mortgage Funding I LLC | | 18 | | 46 | | 156,806,804 | | | 17.2 | |

| Citigroup Global Markets Realty Corp. | | 12 | | 12 | | 123,329,666 | | | 13.5 | |

| MC-Five Mile Commercial Mortgage Finance LLC | | | | | | | | | | |

| Total | | 74 | | 112 | | $913,543,797 | | | 100.0 | % |

Ten Largest Mortgage Loans |

| | | | | | | | Property Size SF / Beds /

Rooms | | Cut-off Date Balance Per SF / Bed / Room | | | | | | |

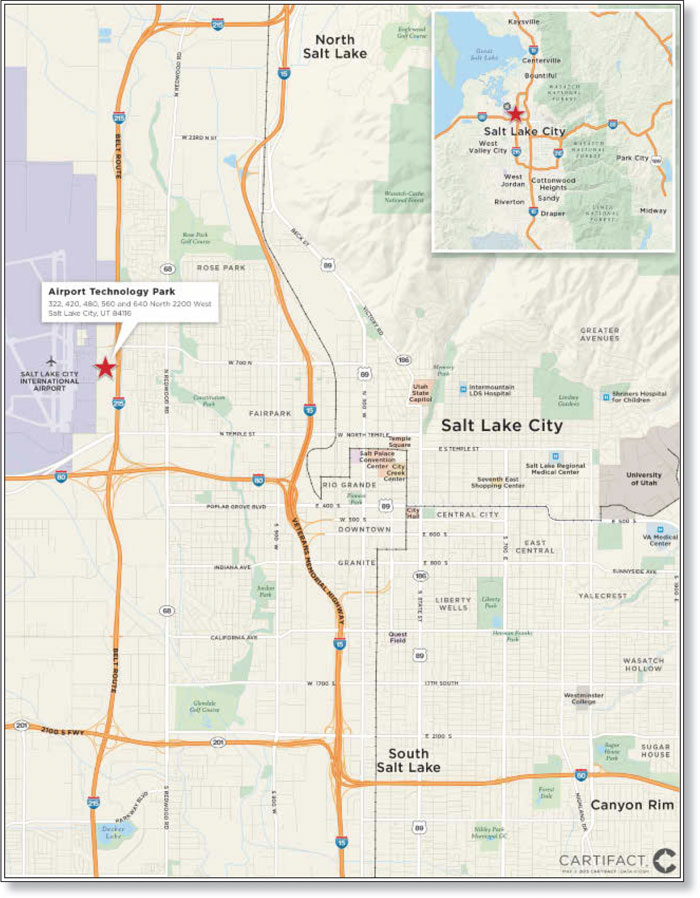

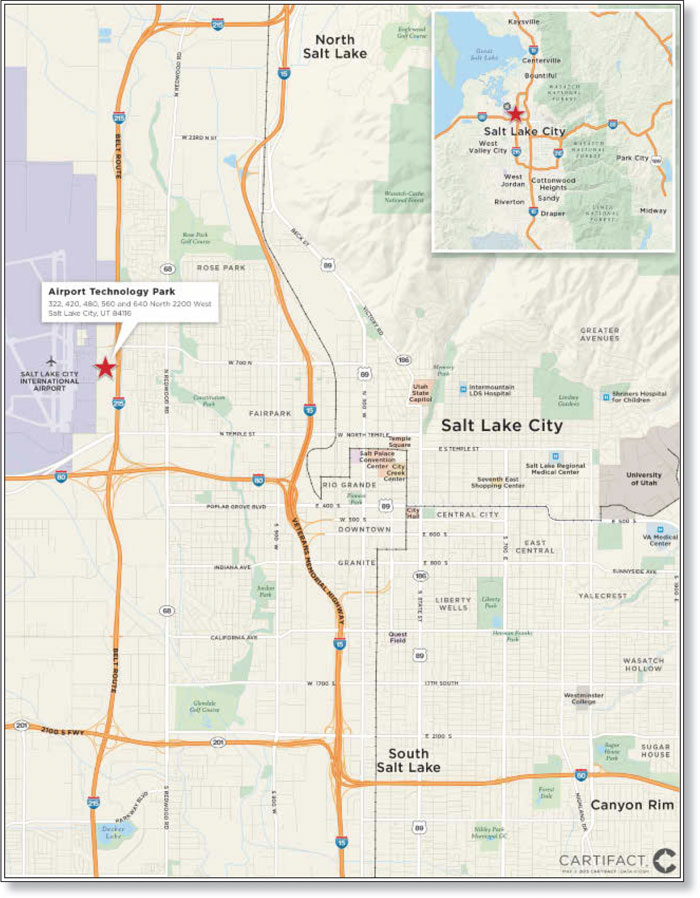

| Airport Technology Park | | $108,750,000 | | | 11.9 | % | | Office | | 1,030,049 | | | $106 | | | 2.96x | | 12.9 | % | | 63.2% |

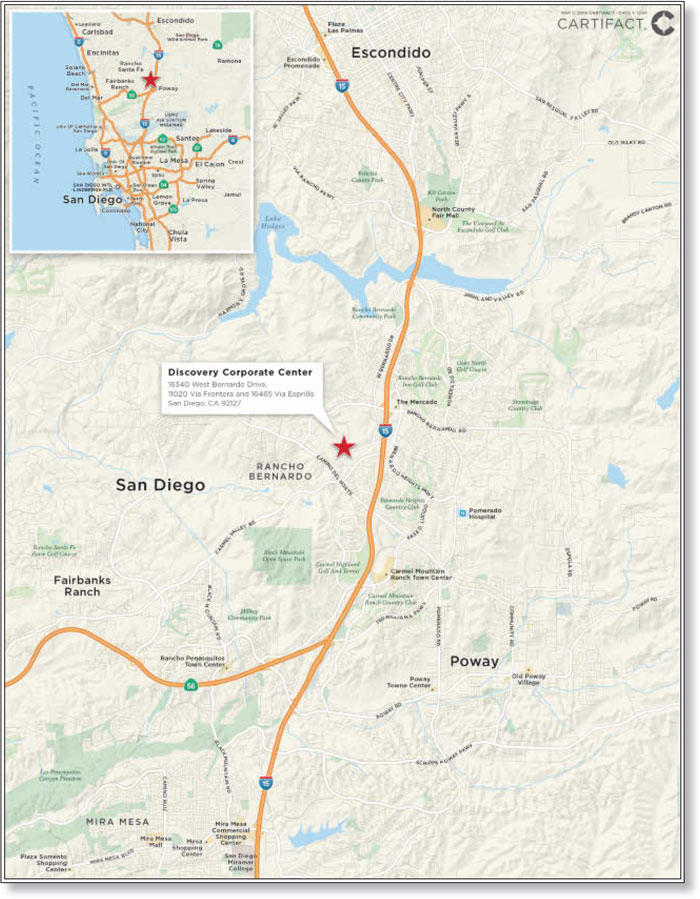

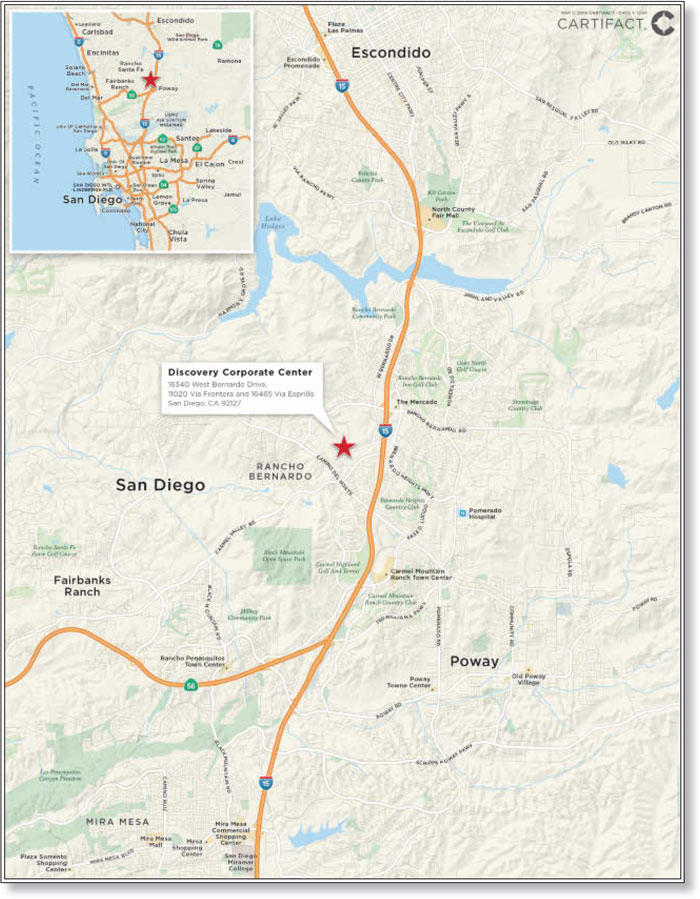

| Discovery Corporate Center | | 50,000,000 | | | 5.5 | | | Office | | 228,048 | | | $219 | | | 2.51x | | 10.9 | % | | 56.5% |

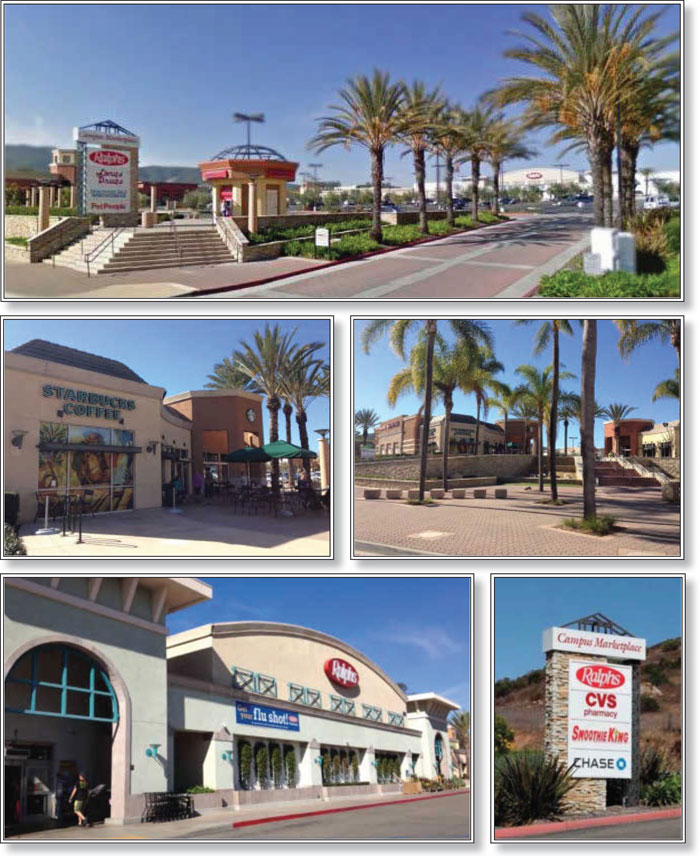

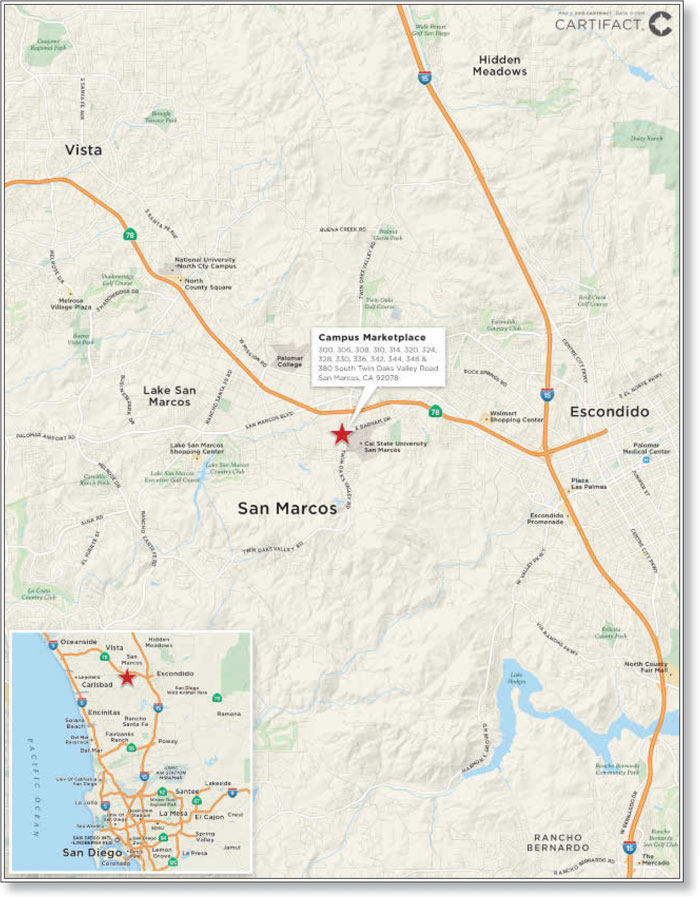

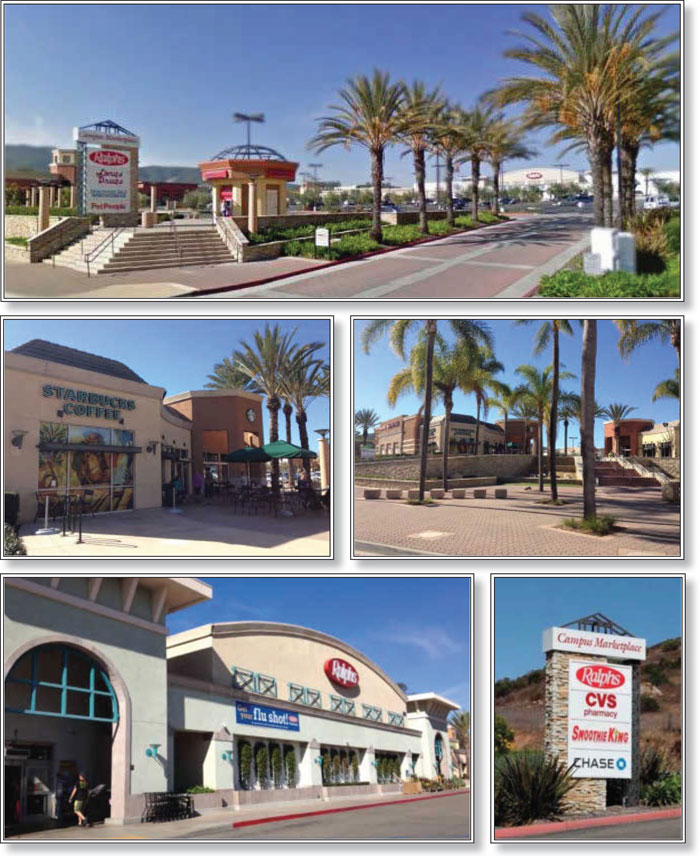

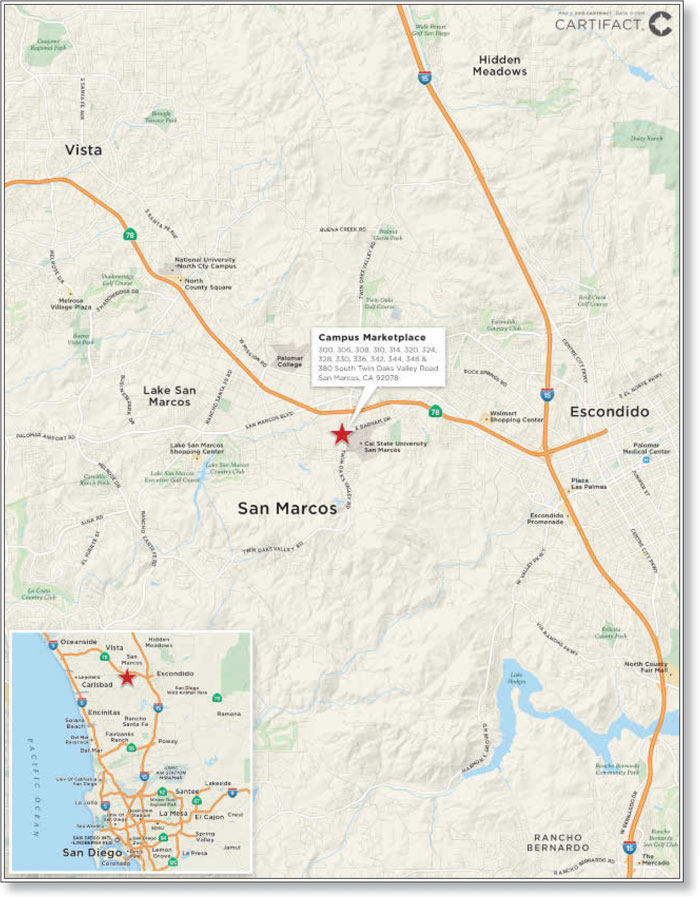

| Campus Marketplace | | 41,000,000 | | | 4.5 | | | Retail | | 144,291 | | | $284 | | | 1.80x | | 8.3 | % | | 67.9% |

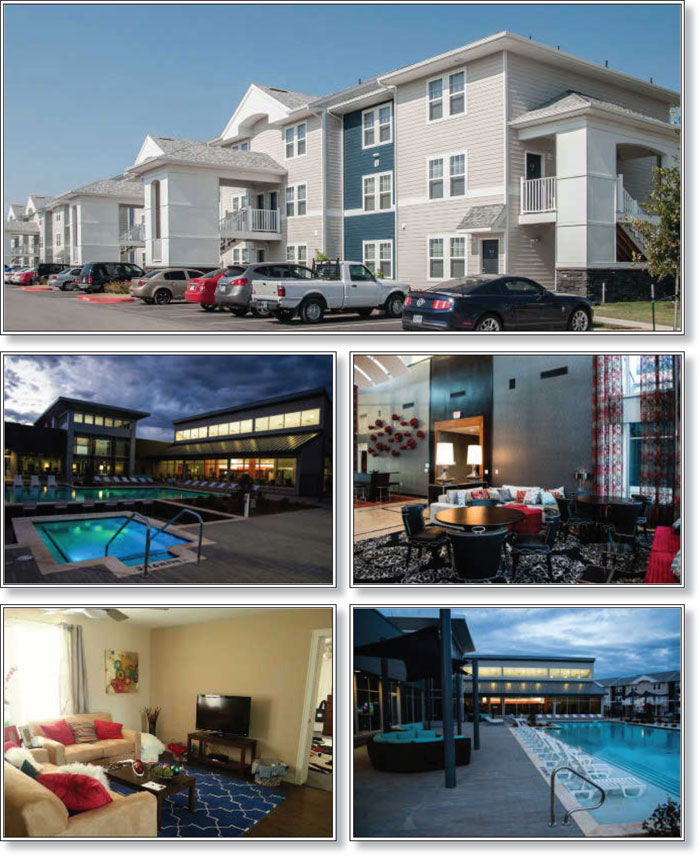

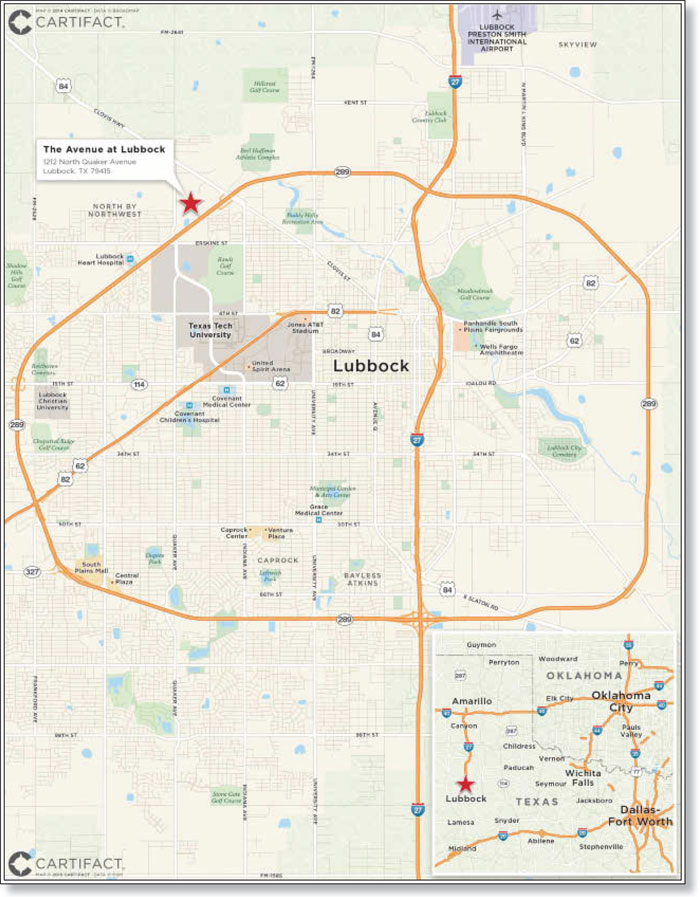

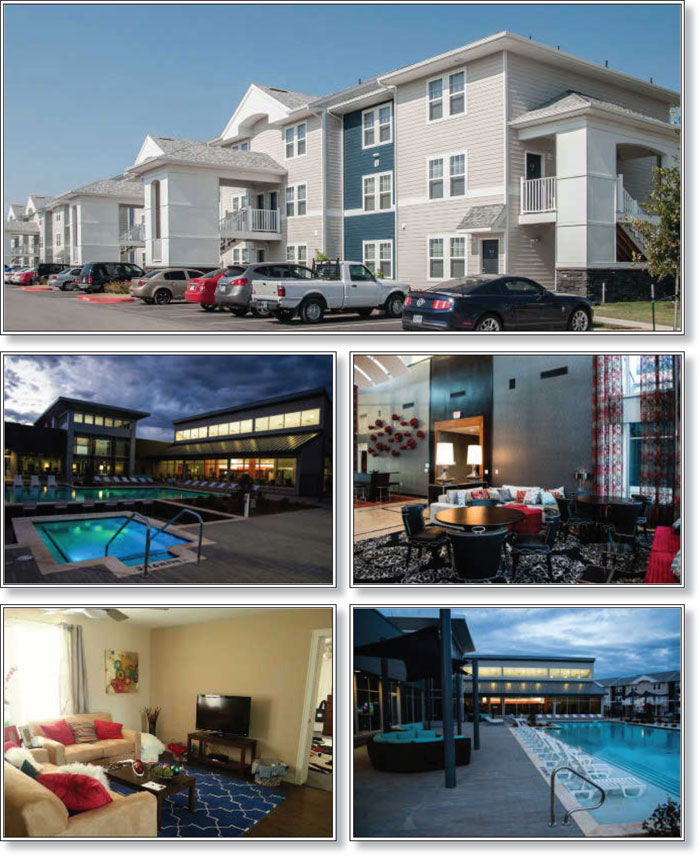

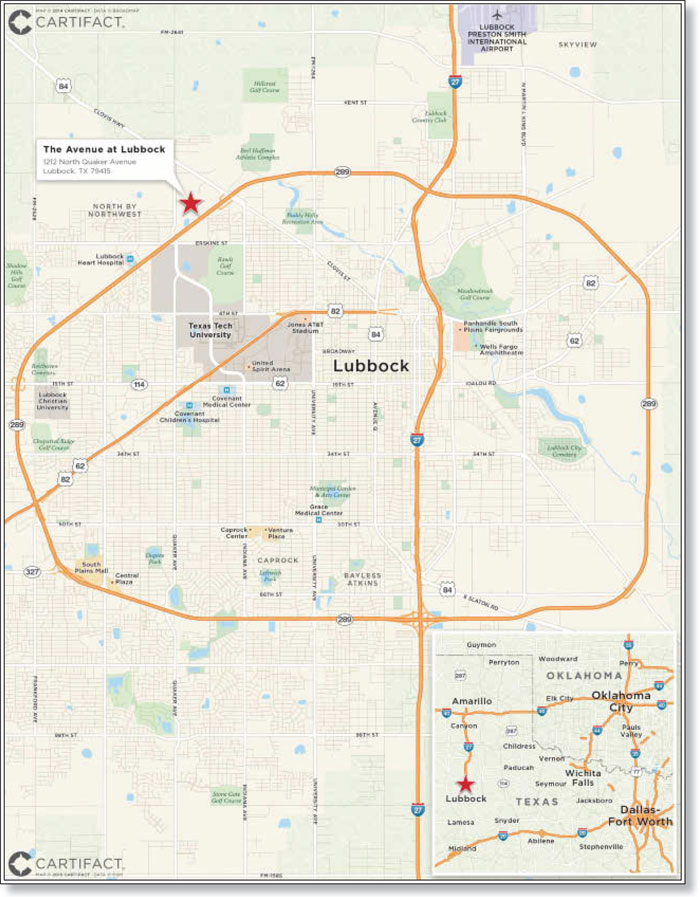

| The Avenue at Lubbock | | 39,200,000 | | | 4.3 | | | Multifamily | | 788 | | | $49,746 | | | 1.28x | | 7.9 | % | | 75.0% |

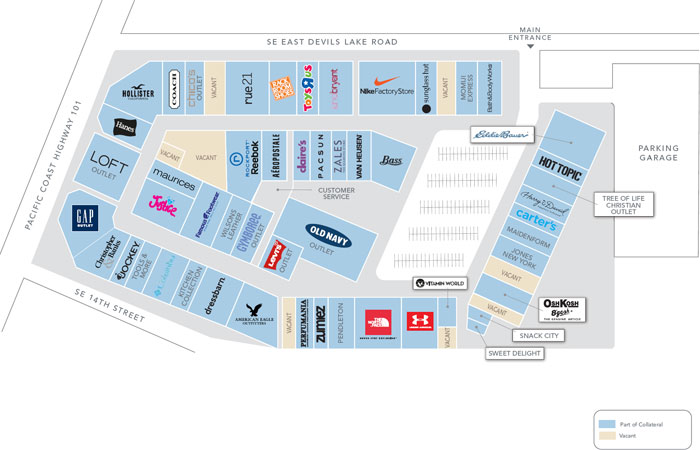

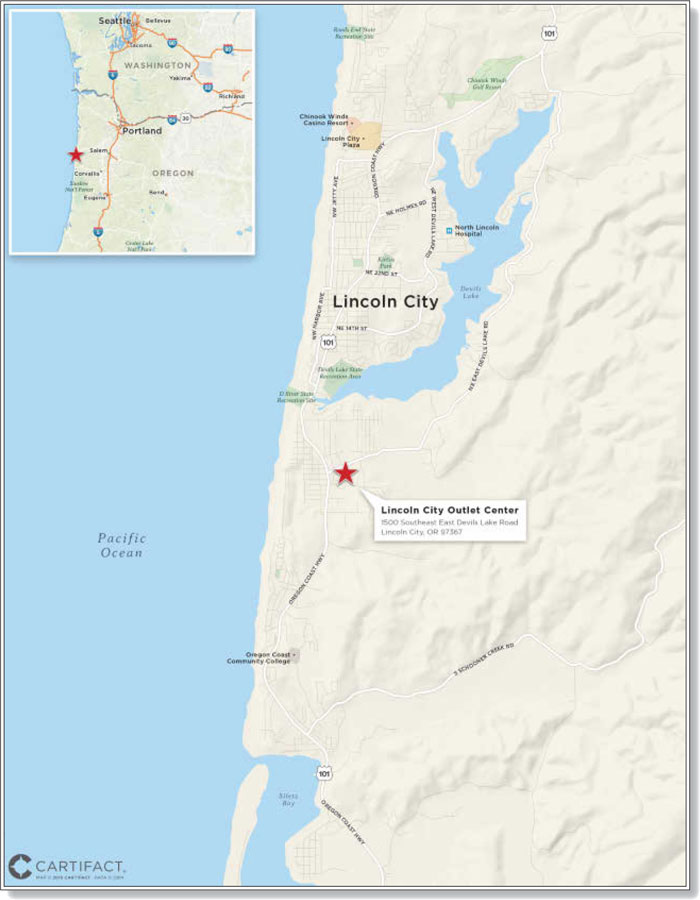

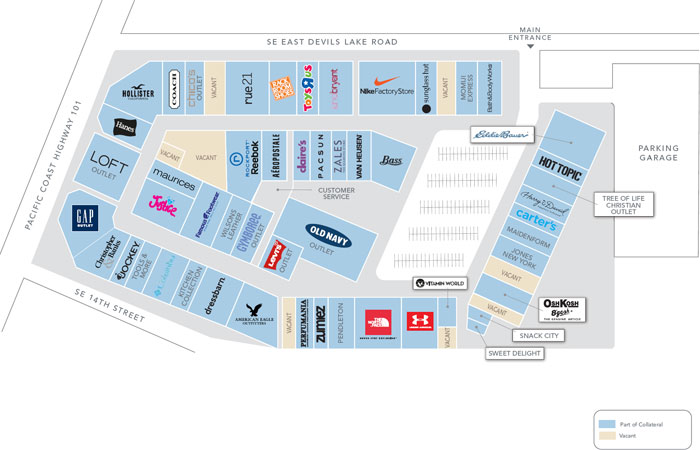

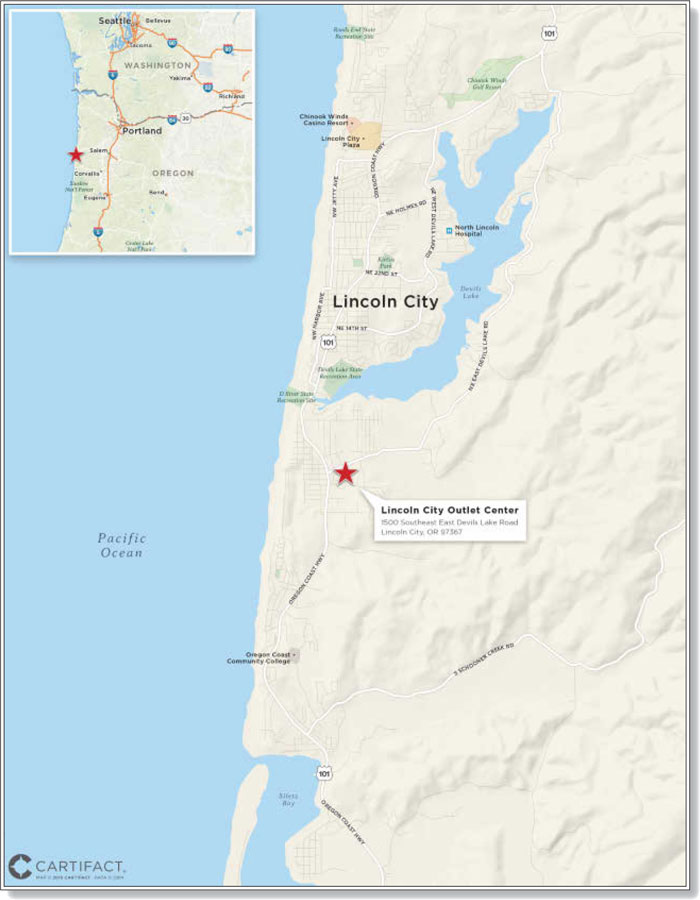

| Lincoln City Outlet Center | | 27,650,000 | | | 3.0 | | | Retail | | 270,212 | | | $102 | | | 3.10x | | 14.2 | % | | 65.7% |

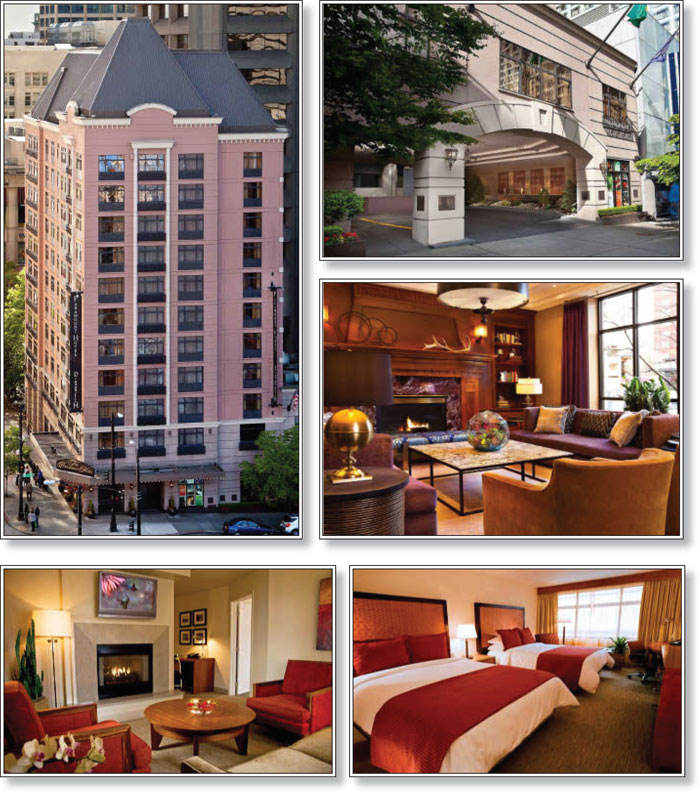

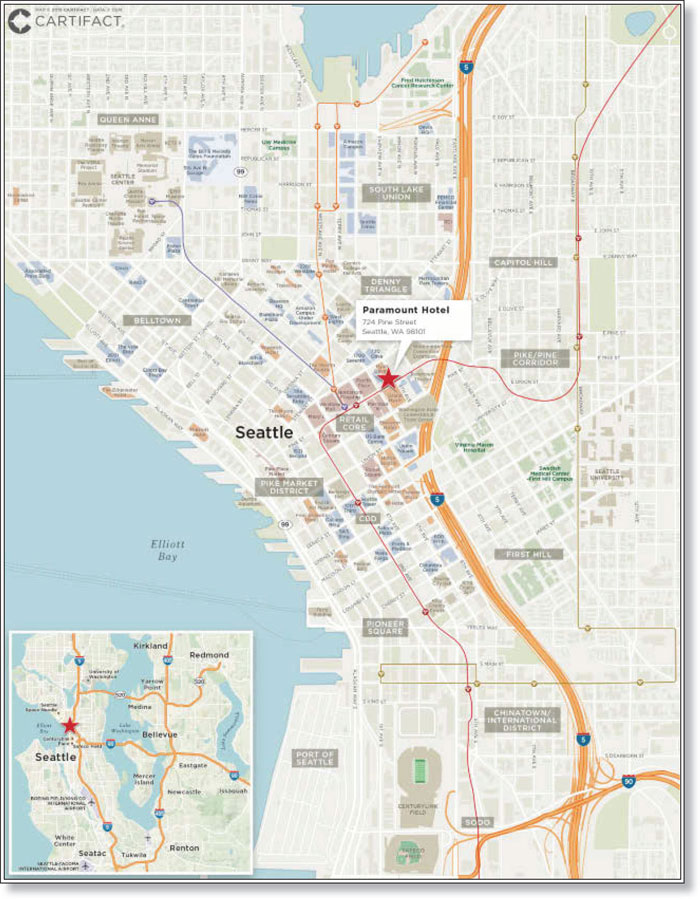

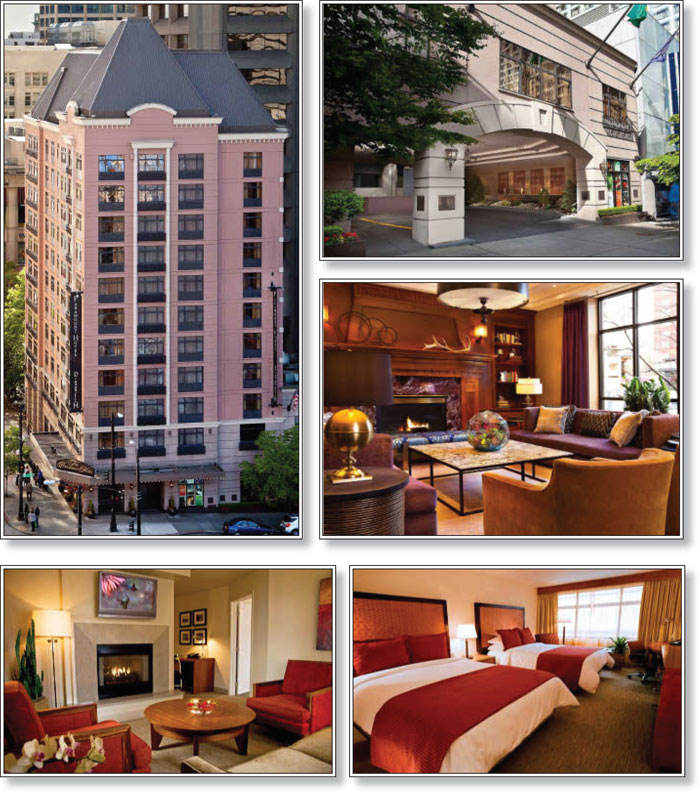

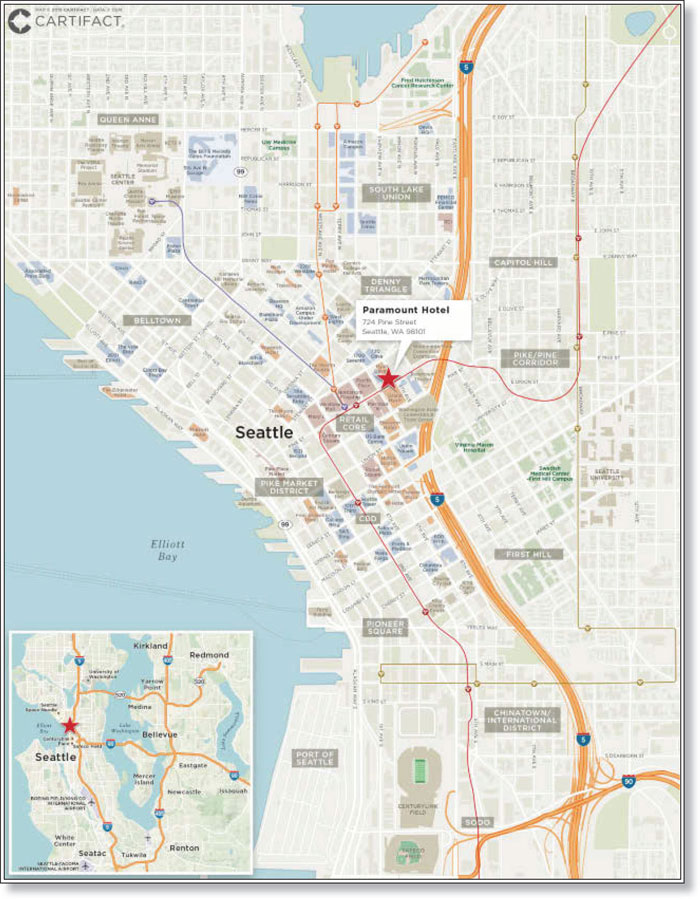

| Paramount Hotel | | 23,500,000 | | | 2.6 | | | Hospitality | | 146 | | | $160,959 | | | 3.76x | | 16.3 | % | | 50.1% |

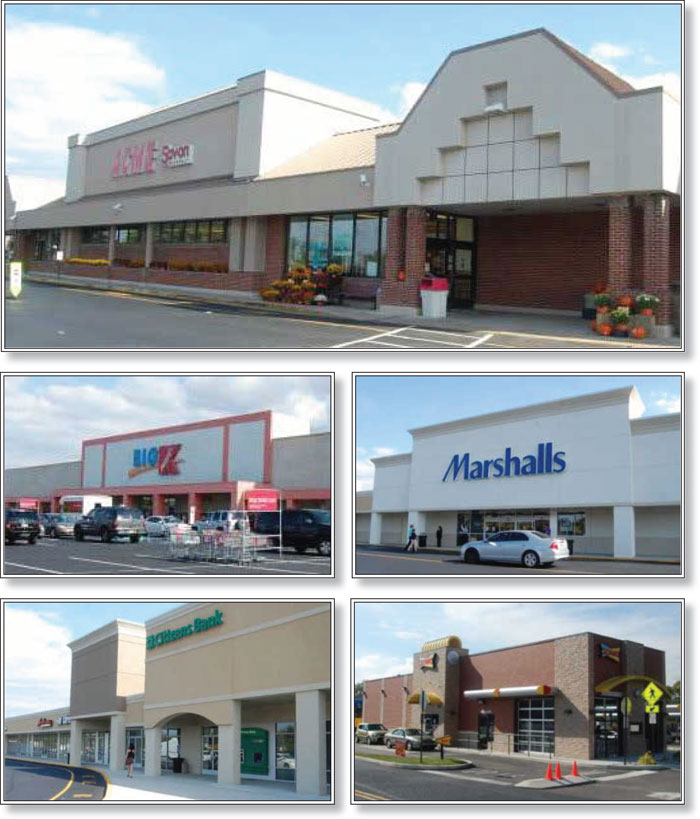

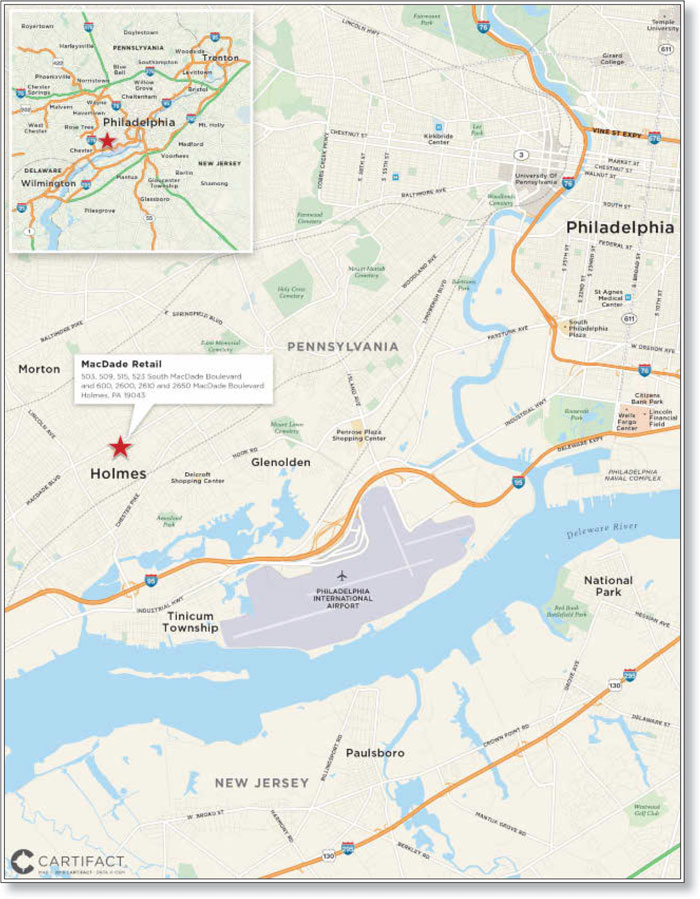

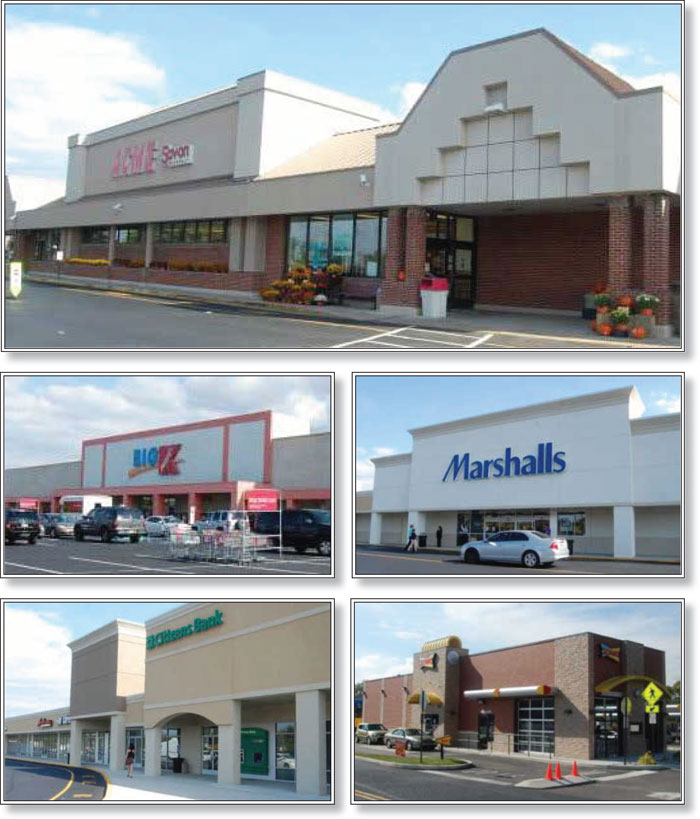

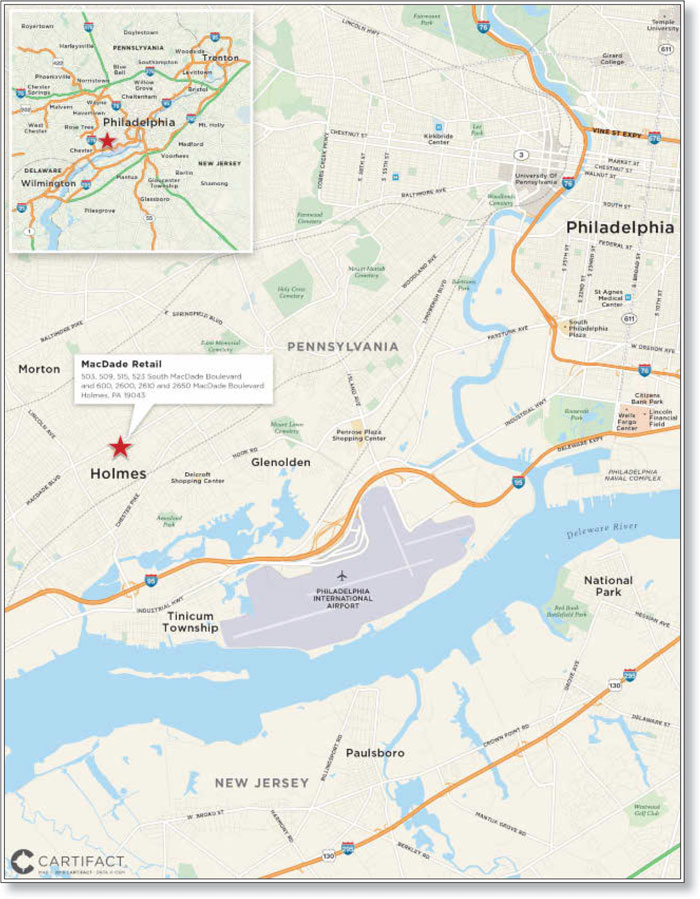

| MacDade Retail | | 22,920,187 | | | 2.5 | | | Retail | | 262,068 | | | $87 | | | 1.32x | | 8.4 | % | | 75.7% |

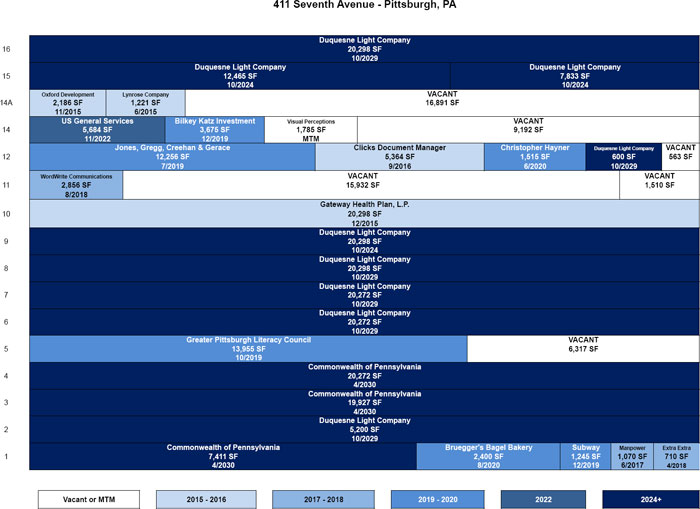

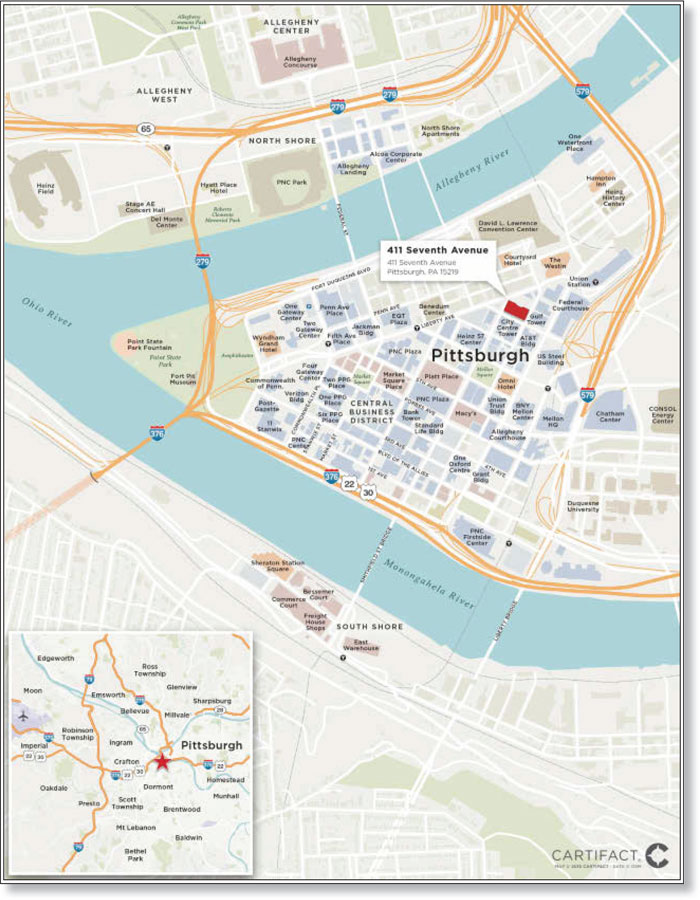

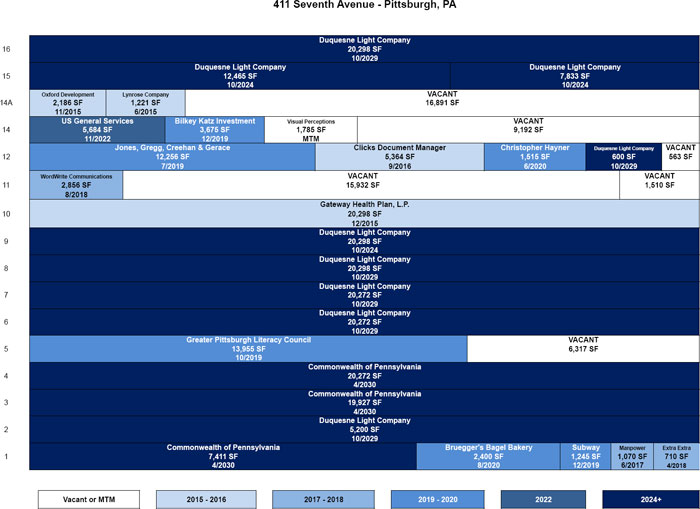

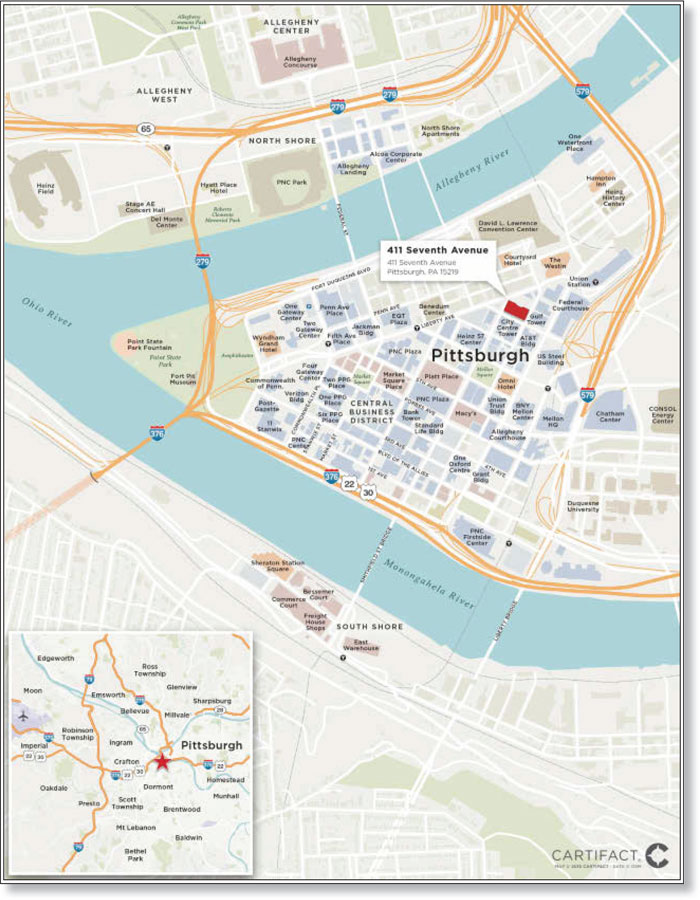

| 411 Seventh Avenue | | 22,323,362 | | | 2.4 | | | Office | | 301,771 | | | $74 | | | 1.61x | | 10.5 | % | | 69.5% |

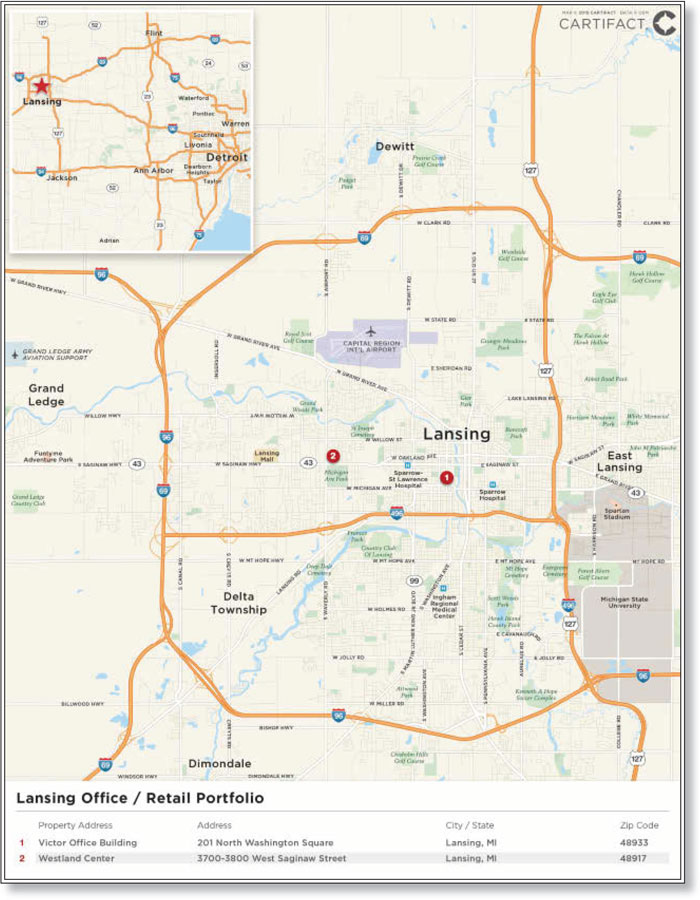

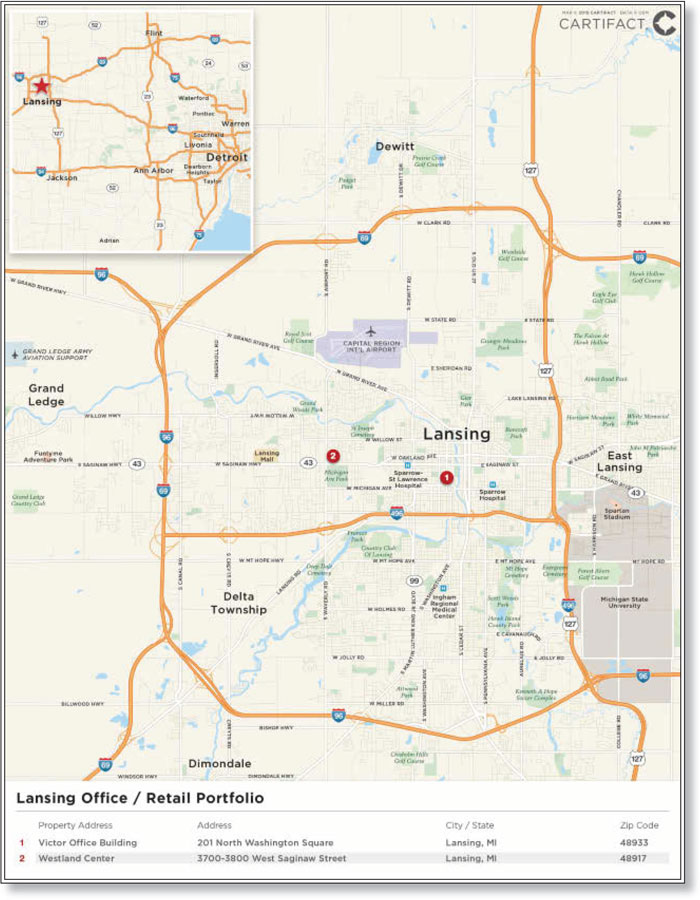

| Lansing Office/Retail Portfolio | | 21,223,604 | | | 2.3 | | | Office/Retail | | 286,864 | | | $74 | | | 1.62x | | 11.3 | % | | 74.2% |

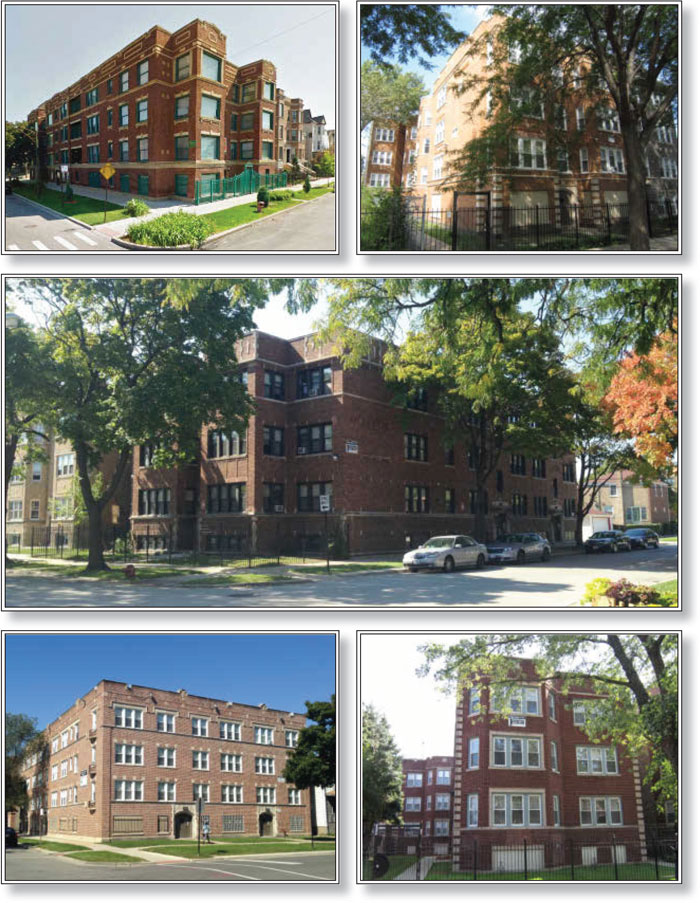

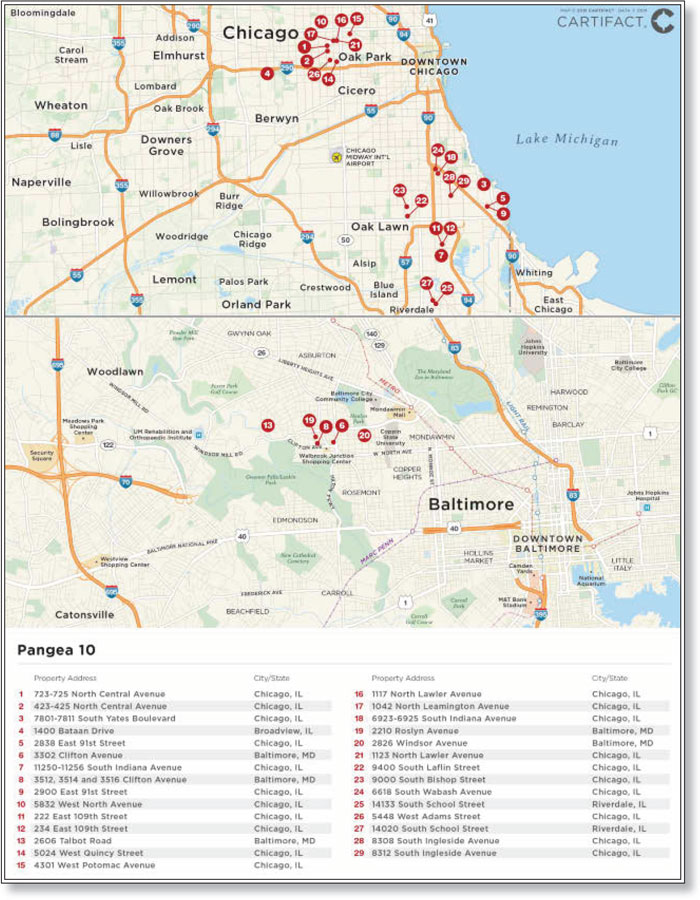

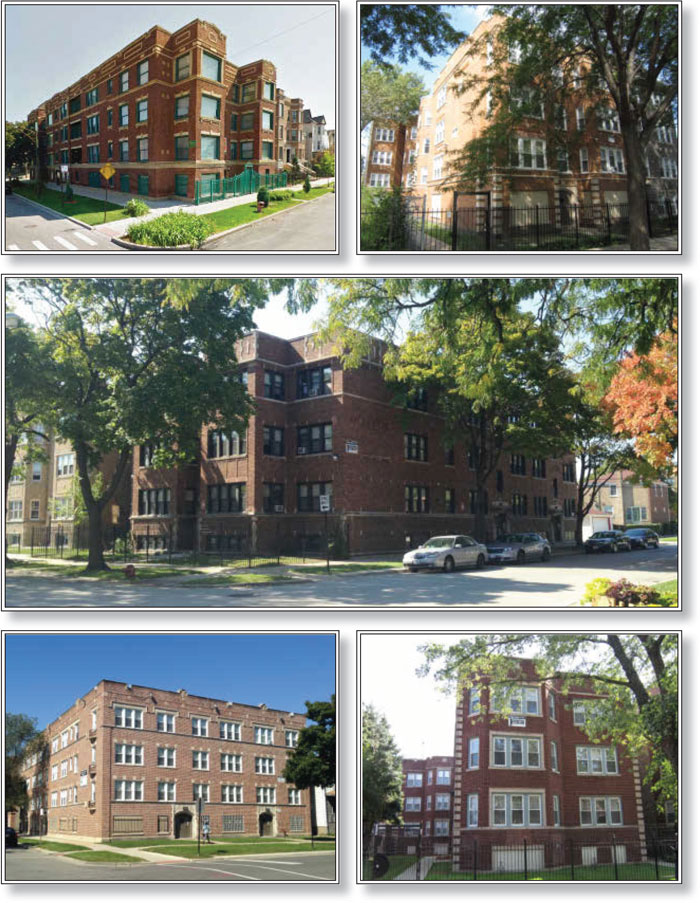

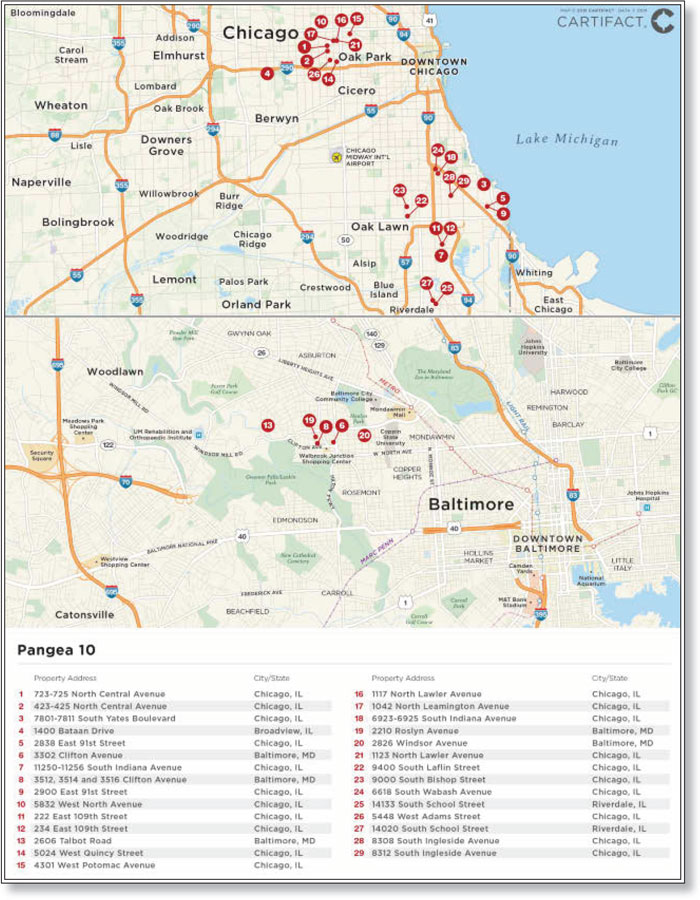

| Pangea 10 | | | | | | | | Multifamily | | 477 | | | $40,881 | | | | | | % | | |

| Top 10 Total / Wtd. Avg. | | $376,067,153 | | | 41.2 | % | | | | | | | | | | 2.34x | | 11.3 | % | | 64.9% |

| Remaining Total / Wtd. Avg. | | | | | | | | | | | | | | | | | | | % | | |

| Total / Wtd. Avg. | | $913,543,797 | | | 100.0 | % | | | | | | | | | | 1.89x | | 10.7 | % | | 67.3% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1)

| | | | | | | | | | Cut-off Date

Balance /

Allocated

Cut-off Date Balance(2) | | | | |

| Paramount Hotel | | GSMC | | Seattle | | Washington | | Hospitality | | $23,500,000 | | | 2.6% | | JPMCC 2006-LDP6 |

| Kingwood Lakes Apartments | | MC-Five Mile | | Kingwood | | Texas | | Multifamily | | $16,851,434 | | | 1.8% | | CSFB 2004-C5 |

| Manokeek Village Center | | CCRE | | Accokeek | | Maryland | | Retail | | $13,750,000 | | | 1.5% | | TIAAS 2007-C4 |

| 5950 Canoga Avenue | | CCRE | | Woodland Hills | | California | | Office | | $13,650,000 | | | 1.5% | | GSMS 2005-GG4 |

| Anaheim Hills Village | | SMF I | | Anaheim | | California | | Retail | | $10,274,551 | | | 1.1% | | GMACC 2004-C3 |

| River Knolls Apartments | | SMF I | | Redding | | California | | Multifamily | | $10,200,000 | | | 1.1% | | FNA 2013-M13 |

| Park West at Gateway Business Centre | | CGMRC | | Pinellas Park | | Florida | | Mixed Use | | $10,125,000 | | | 1.1% | | WBCMT 2003-C8 |

464 West 44th | | CCRE | | New York | | New York | | Retail | | $10,087,827 | | | 1.1% | | GSMS 2011-GC3 |

| Cordova Collection | | CGMRC | | Pensacola | | Florida | | Retail | | $8,802,500 | | | 1.0% | | WBCMT 2004-C10 |

| 7 Becker | | GSMC | | Roseland | | New Jersey | | Office | | $8,000,000 | | | 0.9% | | RAITF 2013-FL1 |

| Bradburn Village Retail Center | | GSMC | | Westminster | | Colorado | | Retail | | $6,847,170 | | | 0.7% | | JPMCC 2005-LDP1 |

| East Michigan Avenue Self Storage | | SMF I | | Saline | | Michigan | | Mixed Use | | $6,325,000 | | | 0.7% | | UBSBB 2012-C4 |

| Horizon Village | | CGMRC | | Phoenix | | Arizona | | Retail | | $6,250,000 | | | 0.7% | | BSCMS 2005-T18 |

| Ivanhoe Estates | | MC-Five Mile | | Urbana | | Illinois | | Manufactured Housing | | $6,250,000 | | | 0.7% | | GSMS 2011-GC5 |

29th Street Self Storage | | SMF I | | Grand Rapids | | Michigan | | Self Storage | | $5,575,000 | | | 0.6% | | UBSBB 2012-C4 |

| Pepper Tree Apartments | | MC-Five Mile | | College Station | | Texas | | Multifamily | | $5,505,973 | | | 0.6% | | CSFB 2004-C5 |

| Garners Ferry Crossing | | SMF I | | Columbia | | South Carolina | | Retail | | $5,380,837 | | | 0.6% | | JPMCC 2005-CB11 |

| Storage Pros New Bedford | | CGMRC | | New Bedford | | Massachusetts | | Self Storage | | $5,300,000 | | | 0.6% | | CD 2007-CD4 |

| Highland Road Self Storage | | SMF I | | Waterford | | Michigan | | Mixed Use | | $4,775,000 | | | 0.5% | | UBSBB 2012-C4 |

| Westerly Hills Plaza | | CGMRC | | Charlotte | | North Carolina | | Retail | | $4,336,497 | | | 0.5% | | RIAL 2012-LT1A |

| Pontiac Trail Self Storage | | SMF I | | Wixom | | Michigan | | Self Storage | | $3,976,000 | | | 0.4% | | UBSBB 2012-C4 |

| CVS Lakeland, FL | | CCRE | | Lakeland | | Florida | | Retail | | $3,530,000 | | | 0.4% | | JPMCC 2003-C1 |

| Rite Aid, Pittsburgh | | MC-Five Mile | | Pittsburgh | | Pennsylvania | | Retail | | $2,825,848 | | | 0.3% | | WBCMT 2005-C17 |

| Rite Aid Grafton, OH | | CCRE | | Grafton | | Ohio | | Retail | | $2,204,779 | | | 0.2% | | COMM 2006-C7 |

| South Dort Highway Self Storage | | SMF I | | Flint | | Michigan | | Self Storage | | $2,152,288 | | | 0.2% | | UBSBB 2012-C4 |

| | (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| | (2) | Reflects the allocated loan amount in cases where the applicable mortgaged property is one of a portfolio of mortgaged properties securing a particular mortgage loan. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

(THIS PAGE INTENTIONALLY LEFT BLANK)

| COLLATERAL OVERVIEW (continued) |

Property Types

| | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance(1) | | % of Initial

Pool Balance(1) | | Wtd. Avg.

Underwritten

NCF DSCR(2) | | Wtd. Avg. Cut-

off Date LTV

Ratio(2) | | Wtd. Avg. Debt Yield on

Underwritten NOI(2) |

| Office | | 17 | | | $327,761,317 | | | 35.9 | % | | 2.17x | | 65.4% | | 11.4% | |

| General Suburban | | 12 | | | 155,603,623 | | | 17.0 | | | 1.85x | | 64.7% | | 10.7% | |

| Office/R&D | | 1 | | | 108,750,000 | | | 11.9 | | | 2.96x | | 63.2% | | 12.9% | |

| CBD | | 4 | | | 63,407,694 | | | 6.9 | | | 1.59x | | 71.1% | | 10.4% | |

| Retail | | 32 | | | $258,849,861 | | | 28.3 | % | | 1.73x | | 69.5% | | 9.9% | |

| Anchored | | 10 | | | 124,103,065 | | | 13.6 | | | 1.64x | | 69.6% | | 9.5% | |

| Shadow Anchored | | 5 | | | 34,759,176 | | | 3.8 | | | 1.54x | | 68.4% | | 10.1% | |

| Single Tenant Retail | | 9 | | | 28,103,981 | | | 3.1 | | | 1.58x | | 67.7% | | 9.3% | |

| Outlet Center | | 1 | | | 27,650,000 | | | 3.0 | | | 3.10x | | 65.7% | | 14.2% | |

| Community Center | | 1 | | | 22,920,187 | | | 2.5 | | | 1.32x | | 75.7% | | 8.4% | |

| Unanchored | | 6 | | | 21,313,453 | | | 2.3 | | | 1.39x | | 71.4% | | 8.8% | |

| Multifamily | | 40 | | | $136,773,809 | | | 15.0 | % | | 1.49x | | 69.7% | | 9.7% | |

| Garden | | 38 | | | 93,828,129 | | | 10.3 | | | 1.59x | | 67.3% | | 10.5% | |

| Student Housing | | 1 | | | 39,200,000 | | | 4.3 | | | 1.28x | | 75.0% | | 7.9% | |

| Mid-Rise | | 1 | | | 3,745,679 | | | 0.4 | | | 1.27x | | 73.3% | | 8.0% | |

| Hospitality | | 7 | | | $80,062,720 | | | 8.8 | % | | 2.37x | | 60.4% | | 13.9% | |

| Full Service | | 2 | | | 43,000,000 | | | 4.7 | | | 2.88x | | 57.7% | | 15.0% | |

| Limited Service | | 5 | | | 37,062,720 | | | 4.1 | | | 1.77x | | 63.6% | | 12.6% | |

| Mixed Use | | 5 | | | $35,890,437 | | | 3.9 | % | | 1.54x | | 73.0% | | 10.0% | |

| Retail/Office | | 2 | | | 14,665,437 | | | 1.6 | | | 1.48x | | 73.5% | | 9.9% | |

| Self Storage/Retail | | 2 | | | 11,100,000 | | | 1.2 | | | 1.57x | | 73.0% | | 9.6% | |

| Office/Industrial | | 1 | | | 10,125,000 | | | 1.1 | | | 1.60x | | 72.3% | | 10.7% | |

| Self Storage | | 5 | | | $29,253,288 | | | 3.2 | % | | 1.56x | | 66.3% | | 9.6% | |

| Senior Housing – Independent Living | | 2 | | | $25,377,365 | | | 2.8 | % | | 1.23x | | 70.3% | | 8.4% | |

| Industrial | | 2 | | | $9,950,000 | | | 1.1 | % | | 2.50x | | 60.9% | | 11.0% | |

| Flex | | 1 | | | 5,150,000 | | | 0.6 | | | 2.49x | | 61.8% | | 11.3% | |

| Warehouse/Distribution | | 1 | | | 4,800,000 | | | 0.5 | | | 2.52x | | 60.0% | | 10.7% | |

| Manufactured Housing | | 2 | | | $9,625,000 | | | 1.1 | % | | 1.74x | | 73.6% | | 11.5% | |

| Manufactured Housing | | 1 | | | 6,250,000 | | | 0.7 | | | 1.76x | | 74.9% | | 10.6% | |

| RV | | 1 | | | 3,375,000 | | | 0.4 | | | 1.70x | | 71.1% | | 13.3% | |

| Total / Wtd. Avg. | | | | | | | | | % | | | | | | | |

| | (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| | (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

| | Number of Mortgaged Properties | | Aggregate Cut-off

Date Balance(1) | | | | | | % of Total Appraised

Value | | | | % of Total Underwritten NOI |

| California | | 11 | | | $176,194,672 | | | 19.3 | % | | $284,580,000 | | | 20.8 | % | | $17,836,664 | | | 18.2 | % |

| Texas | | 9 | | | 112,264,142 | | | 12.3 | | | 156,310,000 | | | 11.4 | | | 10,908,518 | | | 11.2 | |

| Utah | | 1 | | | 108,750,000 | | | 11.9 | | | 172,000,000 | | | 12.6 | | | 14,002,342 | | | 14.3 | |

| Pennsylvania | | 5 | | | 70,151,790 | | | 7.7 | | | 96,700,000 | | | 7.1 | | | 6,734,481 | | | 6.9 | |

| Michigan | | 8 | | | 53,890,122 | | | 5.9 | | | 74,590,000 | | | 5.4 | | | 5,679,937 | | | 5.8 | |

| New York | | 5 | | | 51,052,912 | | | 5.6 | | | 73,100,000 | | | 5.3 | | | 4,799,399 | | | 4.9 | |

| Florida | | 6 | | | 48,747,937 | | | 5.3 | | | 67,700,000 | | | 4.9 | | | 4,613,256 | | | 4.7 | |

| Wisconsin | | 3 | | | 46,700,000 | | | 5.1 | | | 67,000,000 | | | 4.9 | | | 5,375,104 | | | 5.5 | |

| Maryland | | 15 | | | 45,308,879 | | | 5.0 | | | 68,060,000 | | | 5.0 | | | 4,339,015 | | | 4.4 | |

| Illinois | | 27 | | | 38,131,446 | | | 4.2 | | | 62,065,000 | | | 4.5 | | | 4,161,440 | | | 4.3 | |

| Oregon | | 1 | | | 27,650,000 | | | 3.0 | | | 42,100,000 | | | 3.1 | | | 3,933,577 | | | 4.0 | |

| Massachusetts | | 3 | | | 24,240,000 | | | 2.7 | | | 34,390,000 | | | 2.5 | | | 2,607,360 | | | 2.7 | |

| Washington | | 1 | | | 23,500,000 | | | 2.6 | | | 46,900,000 | | | 3.4 | | | 3,839,041 | | | 3.9 | |

| South Carolina | | 2 | | | 16,169,837 | | | 1.8 | | | 23,015,000 | | | 1.7 | | | 1,498,935 | | | 1.5 | |

| Tennessee | | 2 | | | 15,544,623 | | | 1.7 | | | 20,800,000 | | | 1.5 | | | 1,769,139 | | | 1.8 | |

| North Carolina | | 3 | | | 11,192,247 | | | 1.2 | | | 15,225,000 | | | 1.1 | | | 1,161,757 | | | 1.2 | |

| Arizona | | 2 | | | 10,000,000 | | | 1.1 | | | 15,500,000 | | | 1.1 | | | 1,024,254 | | | 1.0 | |

| Georgia | | 2 | | | 8,443,906 | | | 0.9 | | | 12,100,000 | | | 0.9 | | | 909,353 | | | 0.9 | |

| New Jersey | | 1 | | | 8,000,000 | | | 0.9 | | | 12,500,000 | | | 0.9 | | | 802,370 | | | 0.8 | |

| Colorado | | 1 | | | 6,847,170 | | | 0.7 | | | 9,400,000 | | | 0.7 | | | 648,156 | | | 0.7 | |

| Missouri | | 1 | | | 3,745,679 | | | 0.4 | | | 5,110,000 | | | 0.4 | | | 299,620 | | | 0.3 | |

| Mississippi | | 1 | | | 3,375,000 | | | 0.4 | | | 4,750,000 | | | 0.3 | | | 447,551 | | | 0.5 | |

| Ohio | | 1 | | | 2,204,779 | | | 0.2 | | | 3,400,000 | | | 0.2 | | | 245,860 | | | 0.3 | |

| Virginia | | 1 | | | 1,438,655 | | | 0.2 | | | 2,140,000 | | | 0.2 | | | 144,924 | | | 0.1 | |

| Total | | | | | | | | | % | | | | | | % | | | | | | % |

| | (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| Distribution of Cut-off Date Balances |

| | Range of Cut-off Date Balances ($) | | Number of Mortgage Loans | | Cut-off Date Balance | | % of Initial Pool Balance | |

| | 2,152,288 - 3,000,000 | | 5 | | | $12,592,490 | | | 1.4 | % | |

| | 3,000,001 - 5,000,000 | | 11 | | | 44,064,993 | | | 4.8 | | |

| | 5,000,001 - 10,000,000 | | 24 | | | 172,232,611 | | | 18.9 | | |

| | 10,000,001 - 15,000,000 | | 20 | | | 236,456,136 | | | 25.9 | | |

| | 15,000,001 - 20,000,000 | | 5 | | | 91,630,414 | | | 10.0 | | |

| | 20,000,001 - 30,000,000 | | 5 | | | 117,617,153 | | | 12.9 | | |

| | 30,000,001 - 60,000,000 | | 3 | | | 130,200,000 | | | 14.3 | | |

| | 60,000,001 - 108,750,000 | | 1 | | | 108,750,000 | | | 11.9 | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

| |

Distribution of Underwritten DSCRs(1) |

| | | | | | | | | |

| | 1.21 - 1.30 | | 6 | | | $89,199,871 | | | 9.8 | % | |

| | 1.31 - 1.40 | | 7 | | | 66,881,585 | | | 7.3 | | |

| | 1.41 - 1.50 | | 12 | | | 91,824,424 | | | 10.1 | | |

| | 1.51 - 1.60 | | 20 | | | 191,290,167 | | | 20.9 | | |

| | 1.61 - 1.70 | | 10 | | | 99,004,400 | | | 10.8 | | |

| | 1.71 - 1.80 | | 6 | | | 75,079,559 | | | 8.2 | | |

| | 1.81 - 1.90 | | 3 | | | 50,000,000 | | | 5.5 | | |

| | 1.91 - 2.00 | | 3 | | | 19,913,792 | | | 2.2 | | |

| | 2.01 - 2.50 | | 2 | | | 15,650,000 | | | 1.7 | | |

| | 2.51 - 3.00 | | 3 | | | 163,550,000 | | | 17.9 | | |

| | 3.01 - 3.76 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. |

| |

Distribution of Amortization Types(1) |

| | | | | | | | | |

| | Interest Only, Then Amortizing(2) | | 31 | | | $319,242,500 | | | 34.9 | % | |

| | Interest Only | | 9 | | | 272,320,000 | | | 29.8 | | |

| | Amortizing (30 Years) | | 25 | | | 263,646,800 | | | 28.9 | | |

| | Amortizing (25 Years) | | 7 | | | 52,754,718 | | | 5.8 | | |

| | Amortizing (20 Years) | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) All of the mortgage loans will have balloon payments at maturity date. (2) Original partial interest only periods range from 12 to 60 months. |

| |

| Distribution of Lockboxes |

| | | | | | | | | |

| | Springing | | 41 | | | $474,237,815 | | | 51.9 | % | |

| | Hard | | 21 | | | 348,130,702 | | | 38.1 | | |

| | None | | 6 | | | 42,303,288 | | | 4.6 | | |

| | Soft | | 4 | | | 28,846,992 | | | 3.2 | | |

| | Soft Springing | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

Distribution of Cut-off Date LTV Ratios(1) |

| | Range of Cut-off Date LTV (%) | | | | | | | |

| | 49.8 - 55.0 | | 3 | | | $34,652,288 | | | 3.8 | % | |

| | 55.1 - 60.0 | | 4 | | | 84,800,000 | | | 9.3 | | |

| | 60.1 - 65.0 | | 14 | | | 203,427,019 | | | 22.3 | | |

| | 65.1 - 70.0 | | 16 | | | 229,756,263 | | | 25.1 | | |

| | 70.1 - 75.0 | | 34 | | | 322,020,474 | | | 35.2 | | |

| | 75.1 - 77.7 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) See footnotes (1) and (4) to the table entitled “Mortgage Pool Characteristics” above. |

| |

Distribution of Maturity Date LTV Ratios(1) |

| | Range of Maturity Date LTV (%) | | | | | | | |

| | 35.9 - 40.0 | | 2 | | | $11,152,288 | | | 1.2 | % | |

| | 40.1 - 45.0 | | 3 | | | 13,042,499 | | | 1.4 | | |

| | 45.1 - 50.0 | | 4 | | | 48,100,398 | | | 5.3 | | |

| | 50.1 - 55.0 | | 10 | | | 136,363,483 | | | 14.9 | | |

| | 55.1 - 60.0 | | 19 | | | 193,442,326 | | | 21.2 | | |

| | 60.1 - 65.0 | | 23 | | | 311,710,440 | | | 34.1 | | |

| | 65.1 - 71.1 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) See footnotes (1) and (5) to the table entitled “Mortgage Pool Characteristics” above. |

| |

| Distribution of Loan Purpose |

| | | | | | | | | |

| | Refinance | | 41 | | | $449,577,226 | | | 49.2 | % | |

| | Acquisition | | 26 | | | 257,785,681 | | | 28.2 | | |

| | Recapitalization | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

| |

| Distribution of Mortgage Interest Rates |

| | Range of Mortgage Interest Rates (%) | | | | | | | |

| | 3.880 - 4.000 | | 2 | | | $32,500,000 | | | 3.6 | % | |

| | 4.001 - 4.250 | | 16 | | | 327,389,857 | | | 35.8 | | |

| | 4.251 - 4.500 | | 32 | | | 362,256,340 | | | 39.7 | | |

| | 4.501 - 4.750 | | 11 | | | 79,743,221 | | | 8.7 | | |

| | 4.751 - 5.050 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co., Deutsche Bank Securities Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

| |

Distribution of Debt Yield on Underwritten NOI(1) |

| | Range of Debt Yields on Underwritten NOI (%) | | | | | | | |

| | 7.4 - 8.0 | | 5 | | | $64,503,506 | | | 7.1 | % | |

| | 8.1 - 9.0 | | 8 | | | 126,717,673 | | | 13.9 | | |

| | 9.1 - 10.0 | | 19 | | | 184,668,791 | | | 20.2 | | |

| | 10.1 - 11.0 | | 21 | | | 222,399,604 | | | 24.3 | | |

| | 11.1 - 12.0 | | 9 | | | 81,450,422 | | | 8.9 | | |

| | 12.1 - 13.0 | | 5 | | | 134,692,065 | | | 14.7 | | |

| | 13.1 - 14.0 | | 5 | | | 47,961,736 | | | 5.3 | | |

| | 14.1 - 15.0 | | 1 | | | 27,650,000 | | | 3.0 | | |

| | 15.1 - 16.3 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. |

| |

Distribution of Debt Yield on Underwritten NCF(1) |

| | Range of Debt Yields on Underwritten NCF (%) | | | | | | | |

| | 7.3 - 8.0 | | 10 | | | $157,043,815 | | | 17.2 | % | |

| | 8.1 - 9.0 | | 15 | | | 130,921,552 | | | 14.3 | | |

| | 9.1 - 10.0 | | 26 | | | 240,594,415 | | | 26.3 | | |

| | 10.1 - 11.0 | | 12 | | | 170,680,215 | | | 18.7 | | |

| | 11.1 - 12.0 | | 6 | | | 47,442,065 | | | 5.2 | | |

| | 12.1 - 13.0 | | 4 | | | 143,361,736 | | | 15.7 | | |

| | 13.1 - 14.9 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

(1) See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. |

| |

| Mortgage Loans with Original Partial Interest Only Periods |

| | Original Partial Interest Only Period (months) | | | | | | | |

| | 12 | | 4 | | | $36,000,000 | | | 3.9 | % | |

| | 24 | | 7 | | | $66,664,000 | | | 7.3 | % | |

| | 36 | | 9 | | | $77,825,000 | | | 8.5 | % | |

| | 48 | | 1 | | | $14,000,000 | | | 1.5 | % | |

| | 60 | | 10 | | | $124,753,500 | | | 13.7 | % | |

| |

| Distribution of Original Terms to Maturity |

| | Original Term to Maturity (months) | | | | | | | |

| | 60 | | 9 | | | $140,462,362 | | | 15.4 | % | |

| | 84 | | 1 | | | 9,327,056 | | | 1.0 | | |

| | 120 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

| |

| Distribution of Remaining Terms to Maturity |

| | Range of Remaining Terms to Maturity (months) | | | | | | | |

| | 58 - 60 | | 9 | | | $140,462,362 | | | 15.4 | % | |

| | 61 - 120 | | | | | | | | | | |

| | Total | | 74 | | | $913,543,797 | | | 100.0 | % | |

| |

Distribution of Original Amortization Terms(1) |