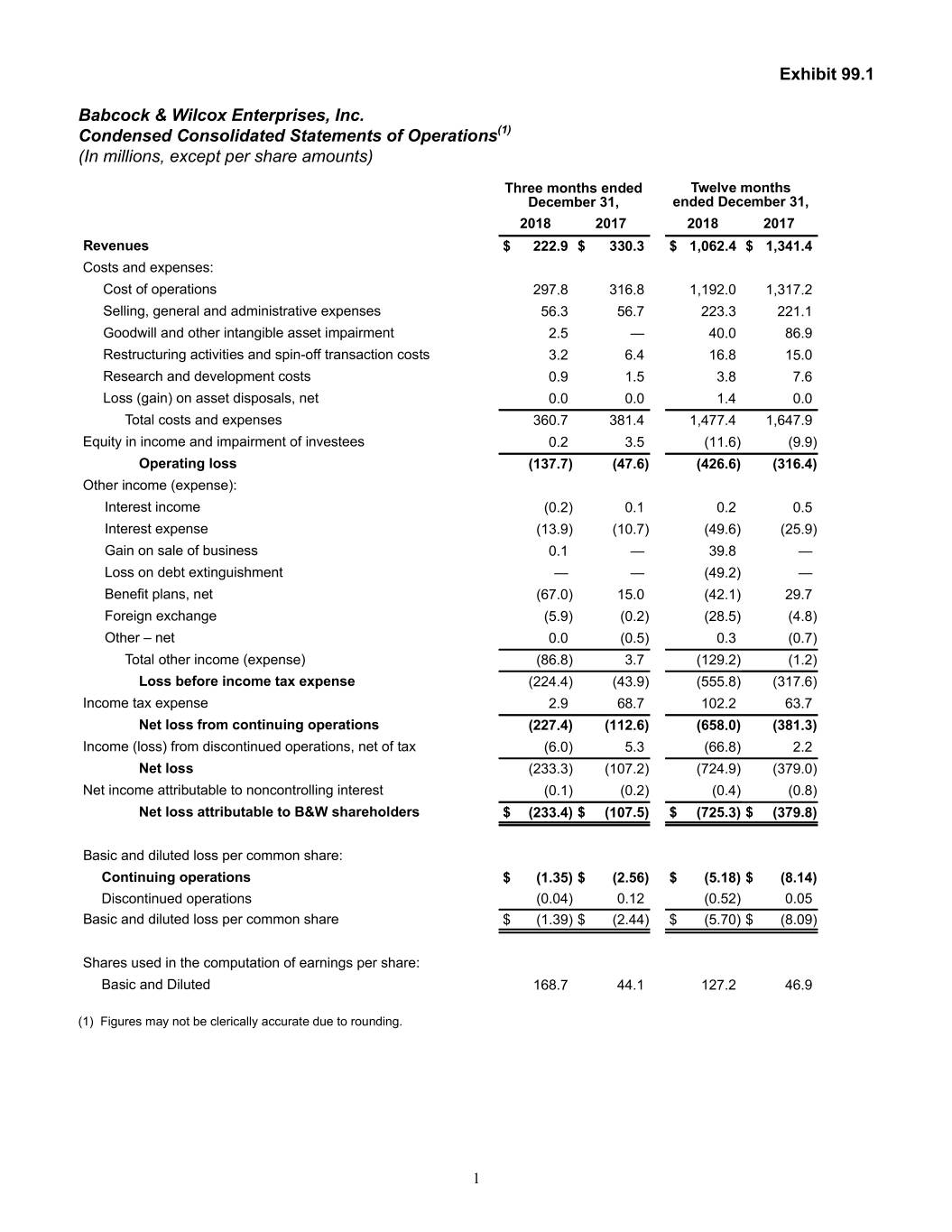

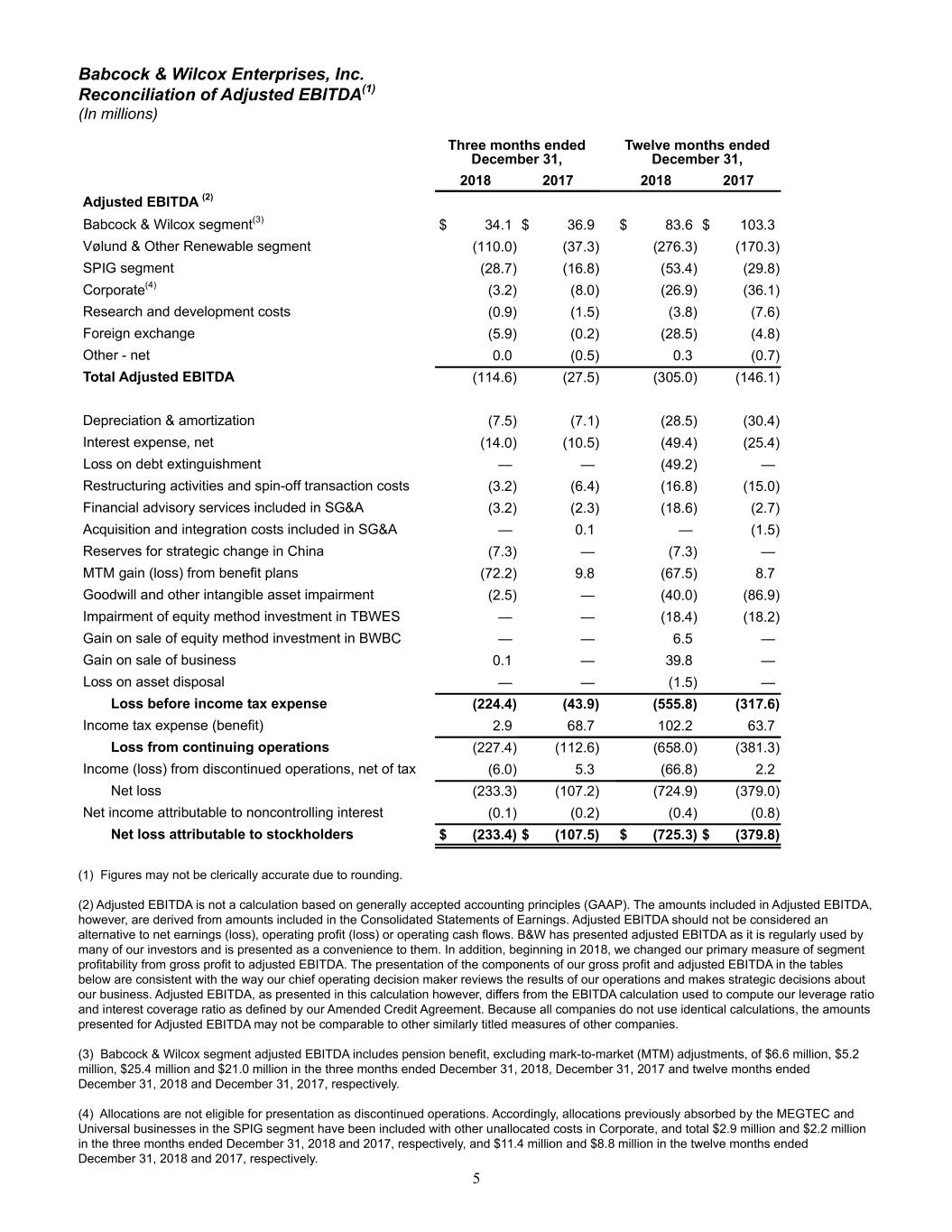

Exhibit 99.1 Babcock & Wilcox Enterprises, Inc. Condensed Consolidated Statements of Operations(1) (In millions, except per share amounts) Three months ended Twelve months December 31, ended December 31, 2018 2017 2018 2017 Revenues $ 222.9 $ 330.3 $ 1,062.4 $ 1,341.4 Costs and expenses: Cost of operations 297.8 316.8 1,192.0 1,317.2 Selling, general and administrative expenses 56.3 56.7 223.3 221.1 Goodwill and other intangible asset impairment 2.5 — 40.0 86.9 Restructuring activities and spin-off transaction costs 3.2 6.4 16.8 15.0 Research and development costs 0.9 1.5 3.8 7.6 Loss (gain) on asset disposals, net 0.0 0.0 1.4 0.0 Total costs and expenses 360.7 381.4 1,477.4 1,647.9 Equity in income and impairment of investees 0.2 3.5 (11.6) (9.9) Operating loss (137.7) (47.6) (426.6) (316.4) Other income (expense): Interest income (0.2) 0.1 0.2 0.5 Interest expense (13.9) (10.7) (49.6) (25.9) Gain on sale of business 0.1 — 39.8 — Loss on debt extinguishment — — (49.2) — Benefit plans, net (67.0) 15.0 (42.1) 29.7 Foreign exchange (5.9) (0.2) (28.5) (4.8) Other – net 0.0 (0.5) 0.3 (0.7) Total other income (expense) (86.8) 3.7 (129.2) (1.2) Loss before income tax expense (224.4) (43.9) (555.8) (317.6) Income tax expense 2.9 68.7 102.2 63.7 Net loss from continuing operations (227.4) (112.6) (658.0) (381.3) Income (loss) from discontinued operations, net of tax (6.0) 5.3 (66.8) 2.2 Net loss (233.3) (107.2) (724.9) (379.0) Net income attributable to noncontrolling interest (0.1) (0.2) (0.4) (0.8) Net loss attributable to B&W shareholders $ (233.4) $ (107.5) $ (725.3) $ (379.8) Basic and diluted loss per common share: Continuing operations $ (1.35) $ (2.56) $ (5.18) $ (8.14) Discontinued operations (0.04) 0.12 (0.52) 0.05 Basic and diluted loss per common share $ (1.39) $ (2.44) $ (5.70) $ (8.09) Shares used in the computation of earnings per share: Basic and Diluted 168.7 44.1 127.2 46.9 (1) Figures may not be clerically accurate due to rounding. 1

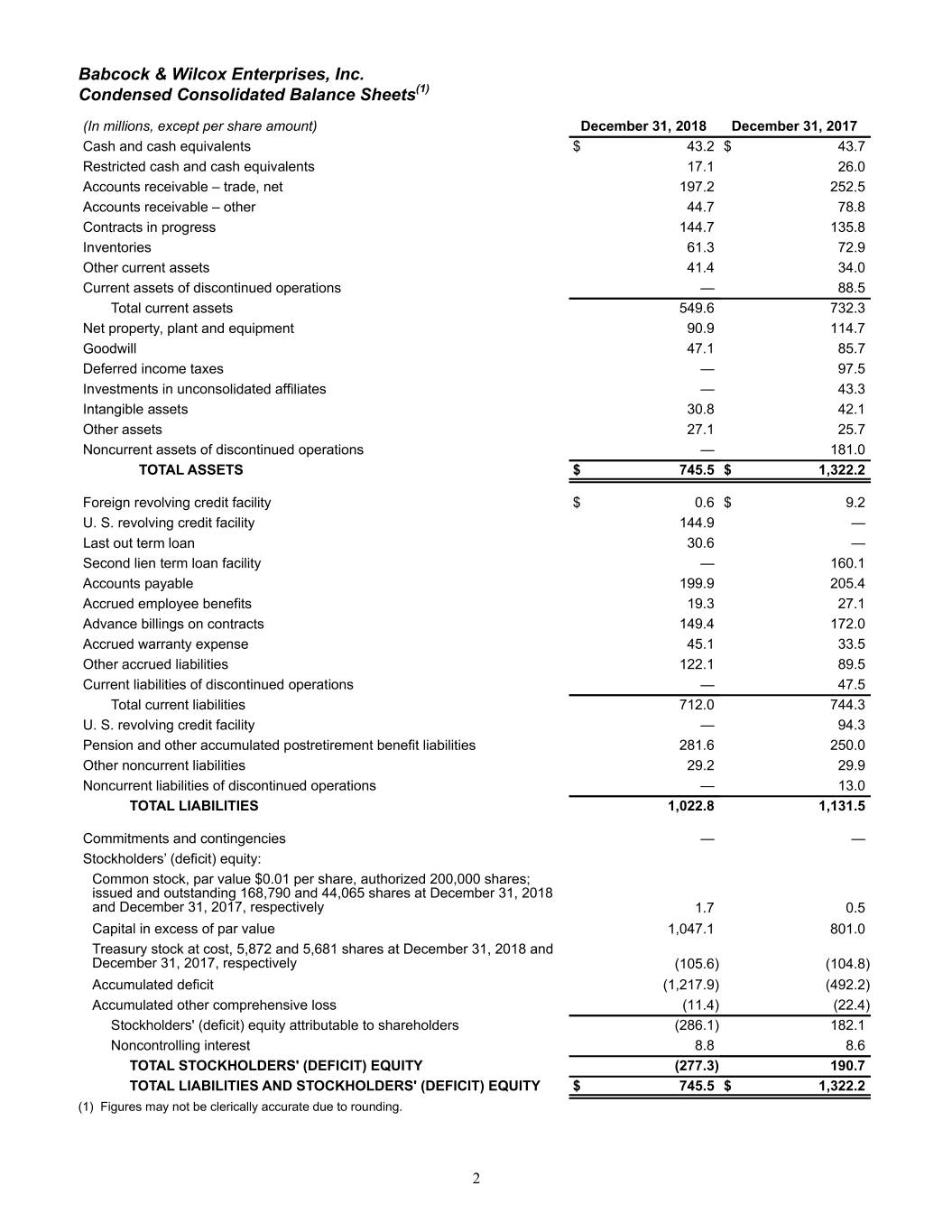

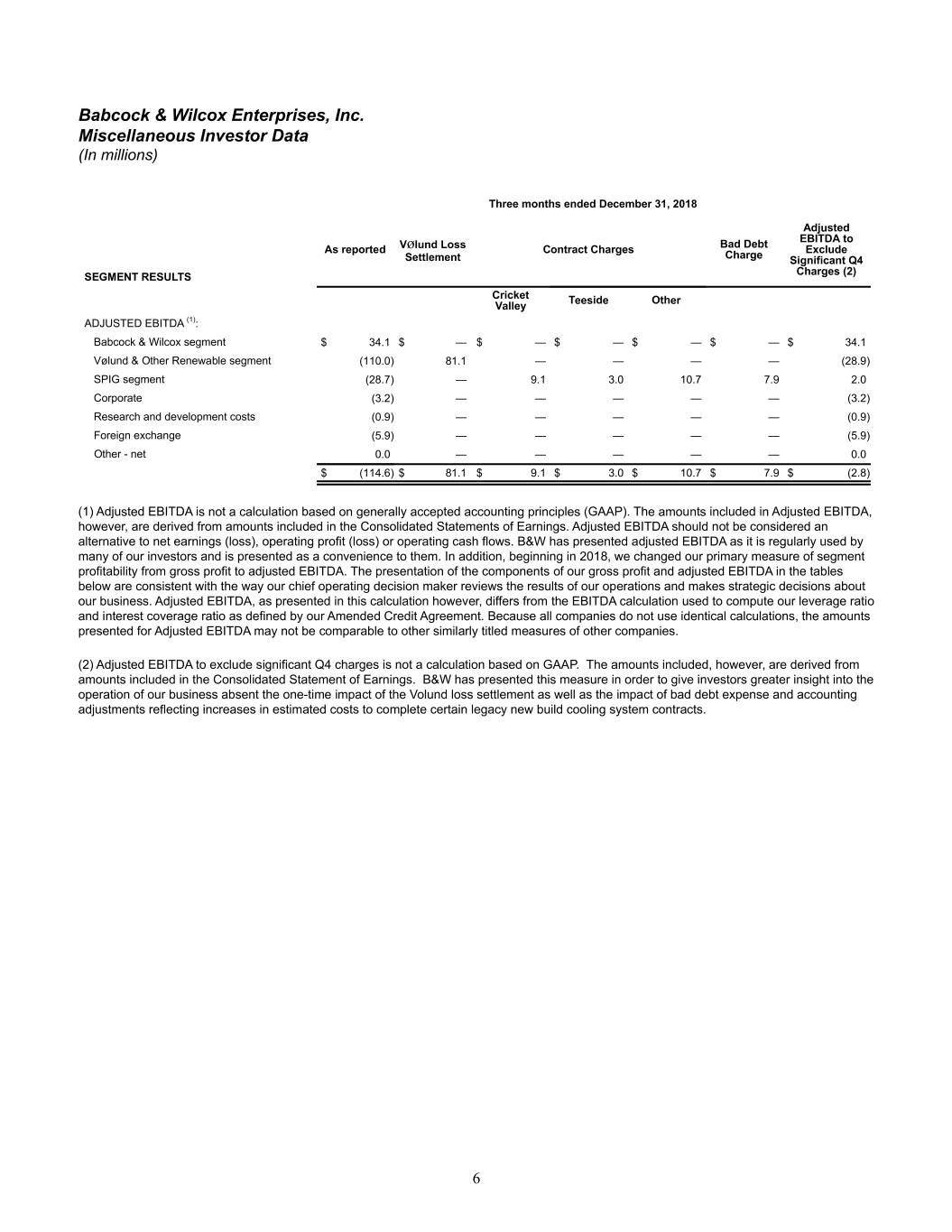

Babcock & Wilcox Enterprises, Inc. Condensed Consolidated Balance Sheets(1) (In millions, except per share amount) December 31, 2018 December 31, 2017 Cash and cash equivalents $ 43.2 $ 43.7 Restricted cash and cash equivalents 17.1 26.0 Accounts receivable – trade, net 197.2 252.5 Accounts receivable – other 44.7 78.8 Contracts in progress 144.7 135.8 Inventories 61.3 72.9 Other current assets 41.4 34.0 Current assets of discontinued operations — 88.5 Total current assets 549.6 732.3 Net property, plant and equipment 90.9 114.7 Goodwill 47.1 85.7 Deferred income taxes — 97.5 Investments in unconsolidated affiliates — 43.3 Intangible assets 30.8 42.1 Other assets 27.1 25.7 Noncurrent assets of discontinued operations — 181.0 TOTAL ASSETS $ 745.5 $ 1,322.2 Foreign revolving credit facility $ 0.6 $ 9.2 U. S. revolving credit facility 144.9 — Last out term loan 30.6 — Second lien term loan facility — 160.1 Accounts payable 199.9 205.4 Accrued employee benefits 19.3 27.1 Advance billings on contracts 149.4 172.0 Accrued warranty expense 45.1 33.5 Other accrued liabilities 122.1 89.5 Current liabilities of discontinued operations — 47.5 Total current liabilities 712.0 744.3 U. S. revolving credit facility — 94.3 Pension and other accumulated postretirement benefit liabilities 281.6 250.0 Other noncurrent liabilities 29.2 29.9 Noncurrent liabilities of discontinued operations — 13.0 TOTAL LIABILITIES 1,022.8 1,131.5 Commitments and contingencies — — Stockholders’ (deficit) equity: Common stock, par value $0.01 per share, authorized 200,000 shares; issued and outstanding 168,790 and 44,065 shares at December 31, 2018 and December 31, 2017, respectively 1.7 0.5 Capital in excess of par value 1,047.1 801.0 Treasury stock at cost, 5,872 and 5,681 shares at December 31, 2018 and December 31, 2017, respectively (105.6) (104.8) Accumulated deficit (1,217.9) (492.2) Accumulated other comprehensive loss (11.4) (22.4) Stockholders' (deficit) equity attributable to shareholders (286.1) 182.1 Noncontrolling interest 8.8 8.6 TOTAL STOCKHOLDERS' (DEFICIT) EQUITY (277.3) 190.7 TOTAL LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY $ 745.5 $ 1,322.2 (1) Figures may not be clerically accurate due to rounding. 2

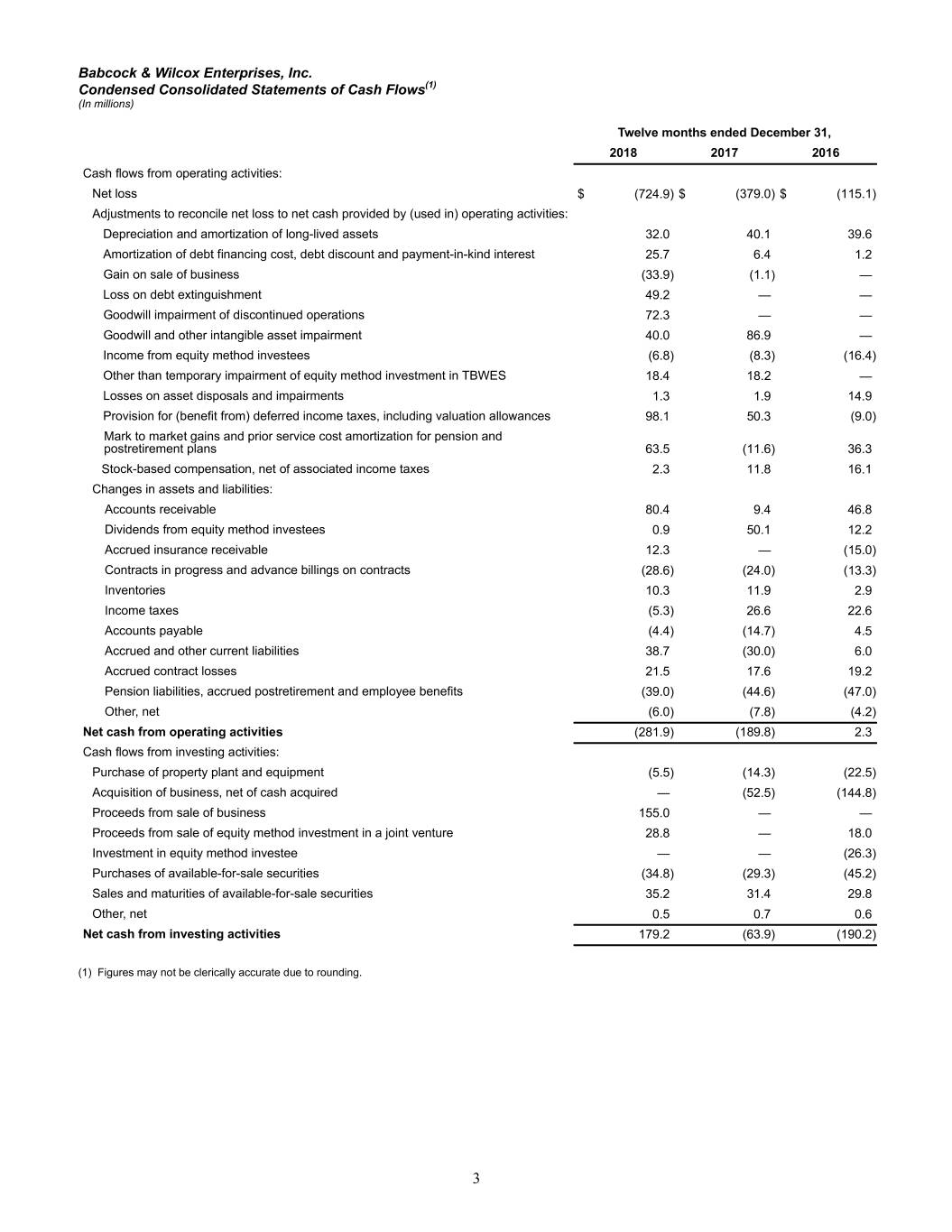

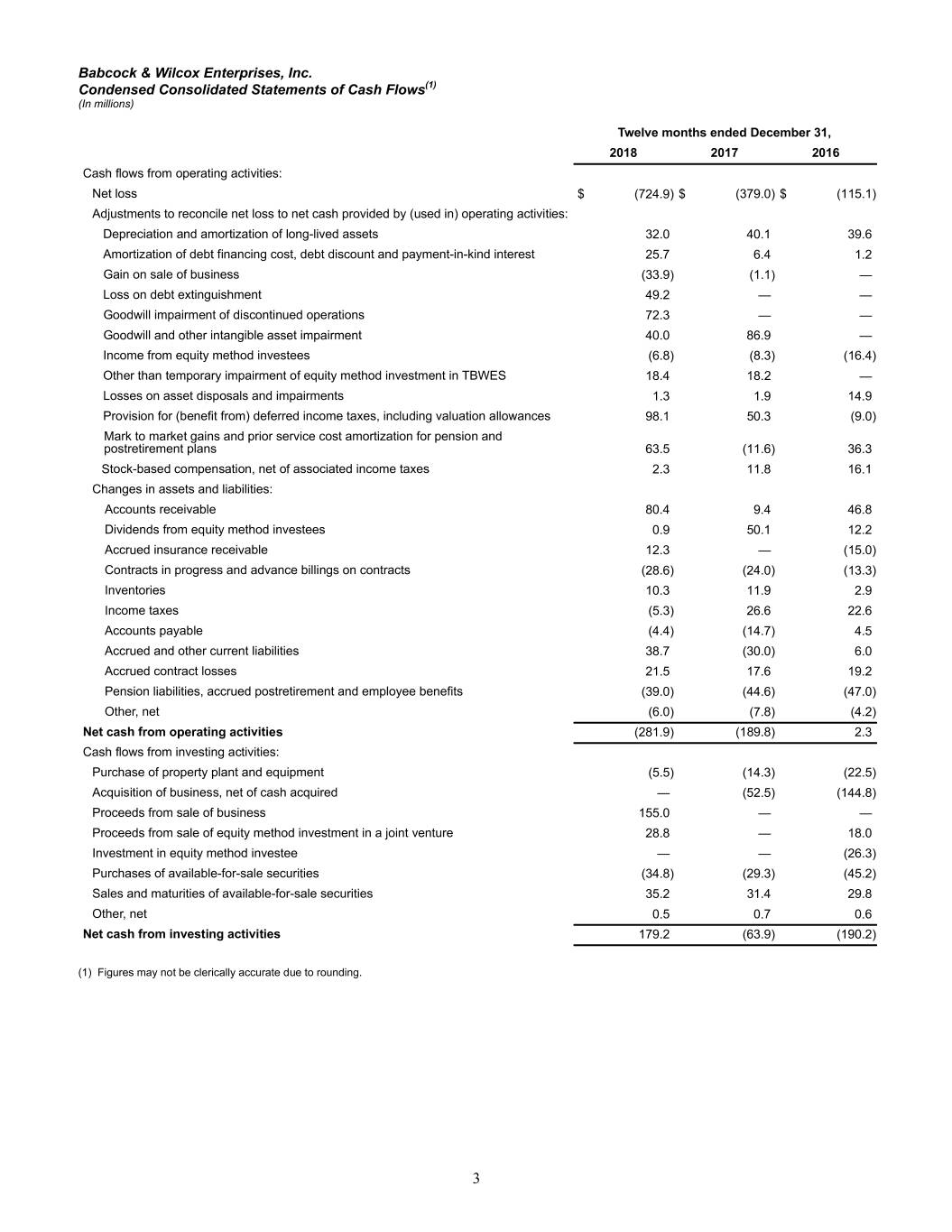

Babcock & Wilcox Enterprises, Inc. Condensed Consolidated Statements of Cash Flows(1) (In millions) Twelve months ended December 31, 2018 2017 2016 Cash flows from operating activities: Net loss $ (724.9) $ (379.0) $ (115.1) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization of long-lived assets 32.0 40.1 39.6 Amortization of debt financing cost, debt discount and payment-in-kind interest 25.7 6.4 1.2 Gain on sale of business (33.9) (1.1) — Loss on debt extinguishment 49.2 — — Goodwill impairment of discontinued operations 72.3 — — Goodwill and other intangible asset impairment 40.0 86.9 — Income from equity method investees (6.8) (8.3) (16.4) Other than temporary impairment of equity method investment in TBWES 18.4 18.2 — Losses on asset disposals and impairments 1.3 1.9 14.9 Provision for (benefit from) deferred income taxes, including valuation allowances 98.1 50.3 (9.0) Mark to market gains and prior service cost amortization for pension and postretirement plans 63.5 (11.6) 36.3 Stock-based compensation, net of associated income taxes 2.3 11.8 16.1 Changes in assets and liabilities: Accounts receivable 80.4 9.4 46.8 Dividends from equity method investees 0.9 50.1 12.2 Accrued insurance receivable 12.3 — (15.0) Contracts in progress and advance billings on contracts (28.6) (24.0) (13.3) Inventories 10.3 11.9 2.9 Income taxes (5.3) 26.6 22.6 Accounts payable (4.4) (14.7) 4.5 Accrued and other current liabilities 38.7 (30.0) 6.0 Accrued contract losses 21.5 17.6 19.2 Pension liabilities, accrued postretirement and employee benefits (39.0) (44.6) (47.0) Other, net (6.0) (7.8) (4.2) Net cash from operating activities (281.9) (189.8) 2.3 Cash flows from investing activities: Purchase of property plant and equipment (5.5) (14.3) (22.5) Acquisition of business, net of cash acquired — (52.5) (144.8) Proceeds from sale of business 155.0 — — Proceeds from sale of equity method investment in a joint venture 28.8 — 18.0 Investment in equity method investee — — (26.3) Purchases of available-for-sale securities (34.8) (29.3) (45.2) Sales and maturities of available-for-sale securities 35.2 31.4 29.8 Other, net 0.5 0.7 0.6 Net cash from investing activities 179.2 (63.9) (190.2) (1) Figures may not be clerically accurate due to rounding. 3

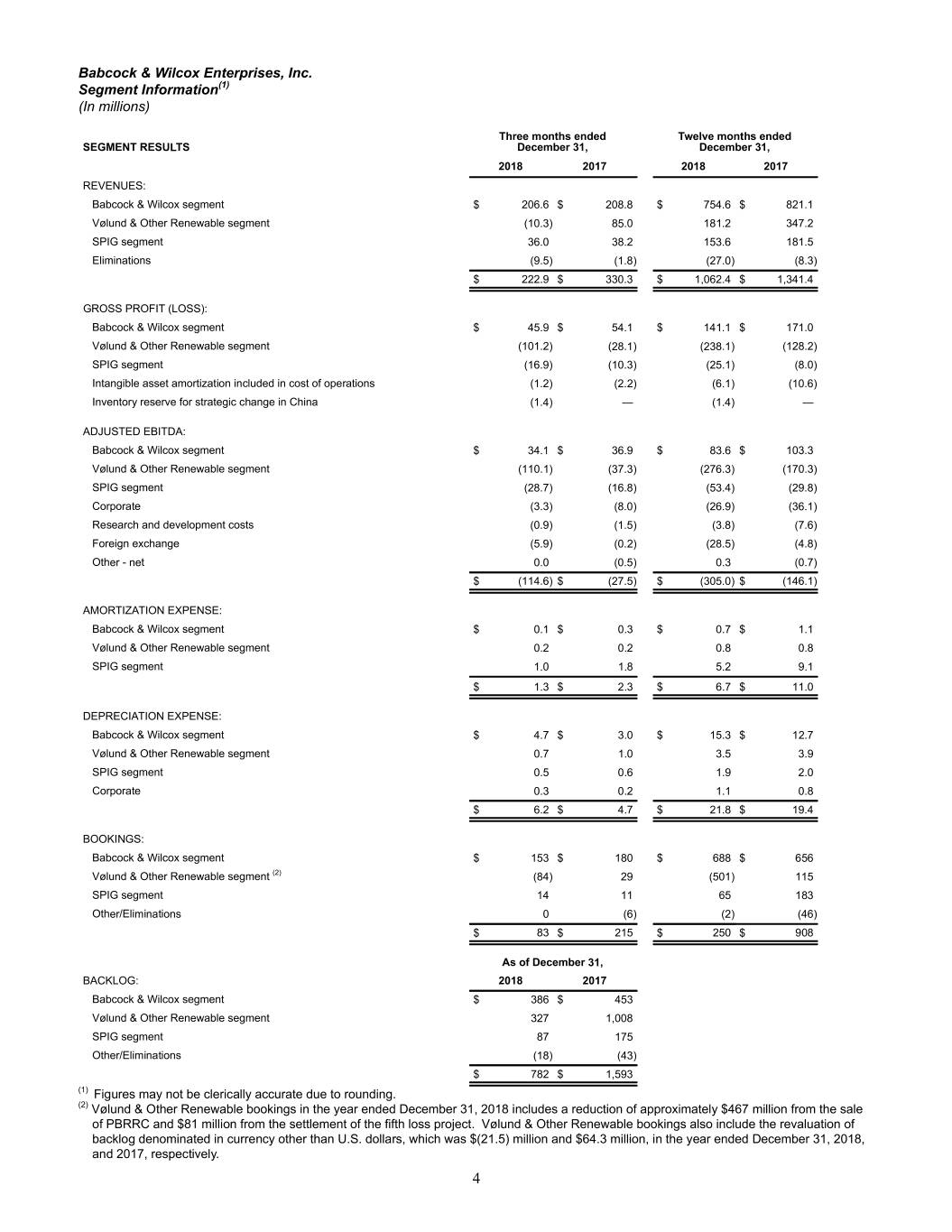

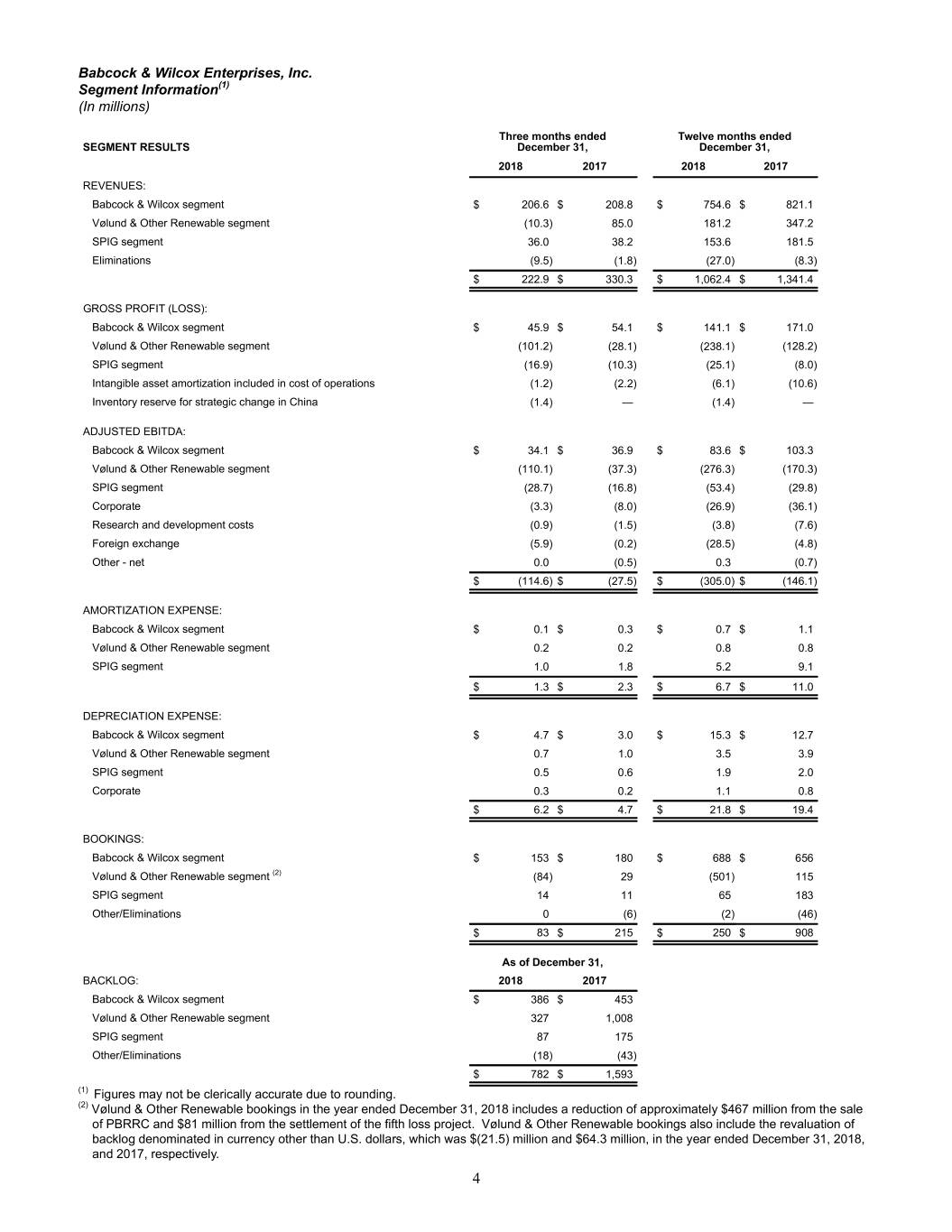

Babcock & Wilcox Enterprises, Inc. Segment Information(1) (In millions) Three months ended Twelve months ended SEGMENT RESULTS December 31, December 31, 2018 2017 2018 2017 REVENUES: Babcock & Wilcox segment $ 206.6 $ 208.8 $ 754.6 $ 821.1 Vølund & Other Renewable segment (10.3) 85.0 181.2 347.2 SPIG segment 36.0 38.2 153.6 181.5 Eliminations (9.5) (1.8) (27.0) (8.3) $ 222.9 $ 330.3 $ 1,062.4 $ 1,341.4 GROSS PROFIT (LOSS): Babcock & Wilcox segment $ 45.9 $ 54.1 $ 141.1 $ 171.0 Vølund & Other Renewable segment (101.2) (28.1) (238.1) (128.2) SPIG segment (16.9) (10.3) (25.1) (8.0) Intangible asset amortization included in cost of operations (1.2) (2.2) (6.1) (10.6) Inventory reserve for strategic change in China (1.4) — (1.4) — ADJUSTED EBITDA: Babcock & Wilcox segment $ 34.1 $ 36.9 $ 83.6 $ 103.3 Vølund & Other Renewable segment (110.1) (37.3) (276.3) (170.3) SPIG segment (28.7) (16.8) (53.4) (29.8) Corporate (3.3) (8.0) (26.9) (36.1) Research and development costs (0.9) (1.5) (3.8) (7.6) Foreign exchange (5.9) (0.2) (28.5) (4.8) Other - net 0.0 (0.5) 0.3 (0.7) $ (114.6) $ (27.5) $ (305.0) $ (146.1) AMORTIZATION EXPENSE: Babcock & Wilcox segment $ 0.1 $ 0.3 $ 0.7 $ 1.1 Vølund & Other Renewable segment 0.2 0.2 0.8 0.8 SPIG segment 1.0 1.8 5.2 9.1 $ 1.3 $ 2.3 $ 6.7 $ 11.0 DEPRECIATION EXPENSE: Babcock & Wilcox segment $ 4.7 $ 3.0 $ 15.3 $ 12.7 Vølund & Other Renewable segment 0.7 1.0 3.5 3.9 SPIG segment 0.5 0.6 1.9 2.0 Corporate 0.3 0.2 1.1 0.8 $ 6.2 $ 4.7 $ 21.8 $ 19.4 BOOKINGS: Babcock & Wilcox segment $ 153 $ 180 $ 688 $ 656 Vølund & Other Renewable segment (2) (84) 29 (501) 115 SPIG segment 14 11 65 183 Other/Eliminations 0 (6) (2) (46) $ 83 $ 215 $ 250 $ 908 As of December 31, BACKLOG: 2018 2017 Babcock & Wilcox segment $ 386 $ 453 Vølund & Other Renewable segment 327 1,008 SPIG segment 87 175 Other/Eliminations (18) (43) $ 782 $ 1,593 (1) Figures may not be clerically accurate due to rounding. (2) Vølund & Other Renewable bookings in the year ended December 31, 2018 includes a reduction of approximately $467 million from the sale of PBRRC and $81 million from the settlement of the fifth loss project. Vølund & Other Renewable bookings also include the revaluation of backlog denominated in currency other than U.S. dollars, which was $(21.5) million and $64.3 million, in the year ended December 31, 2018, and 2017, respectively. 4

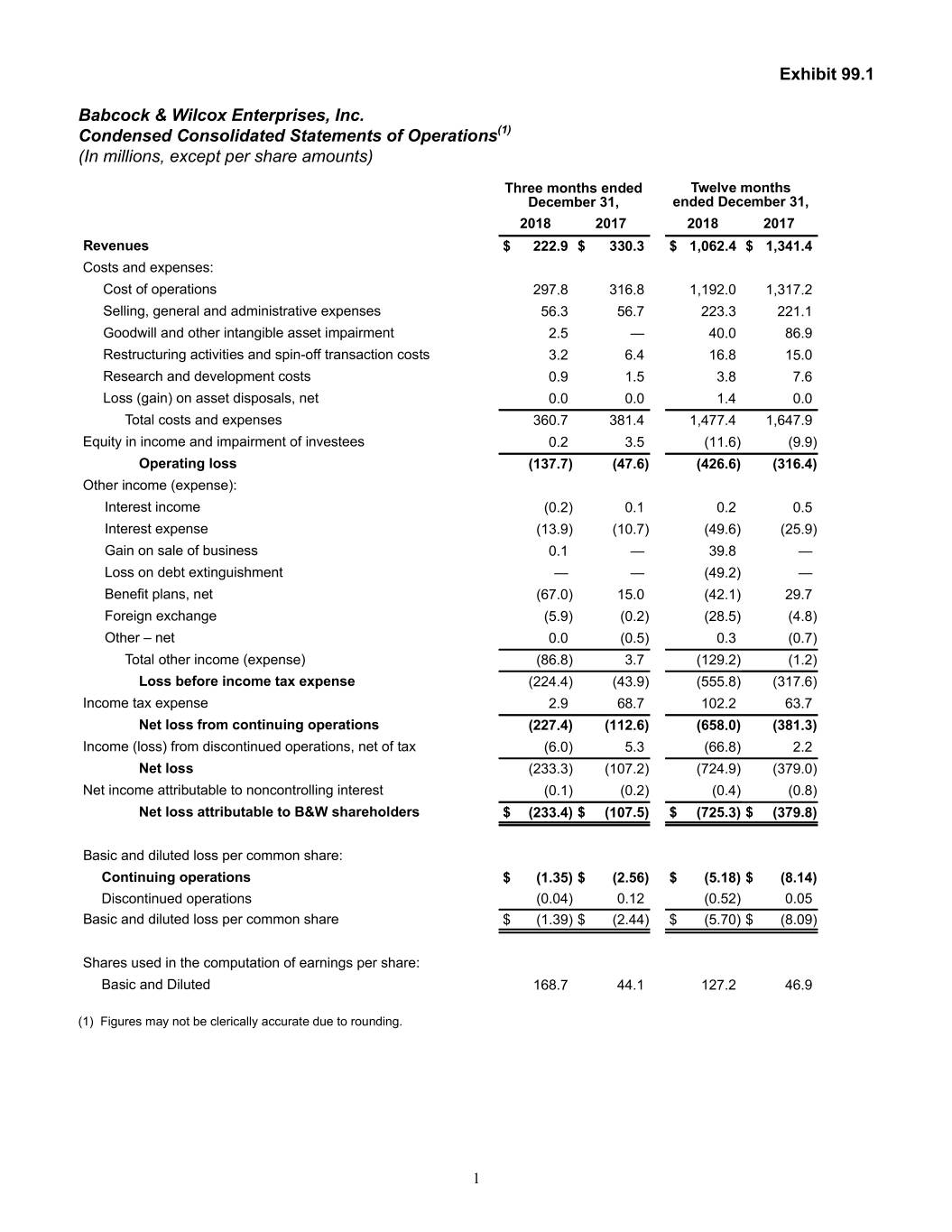

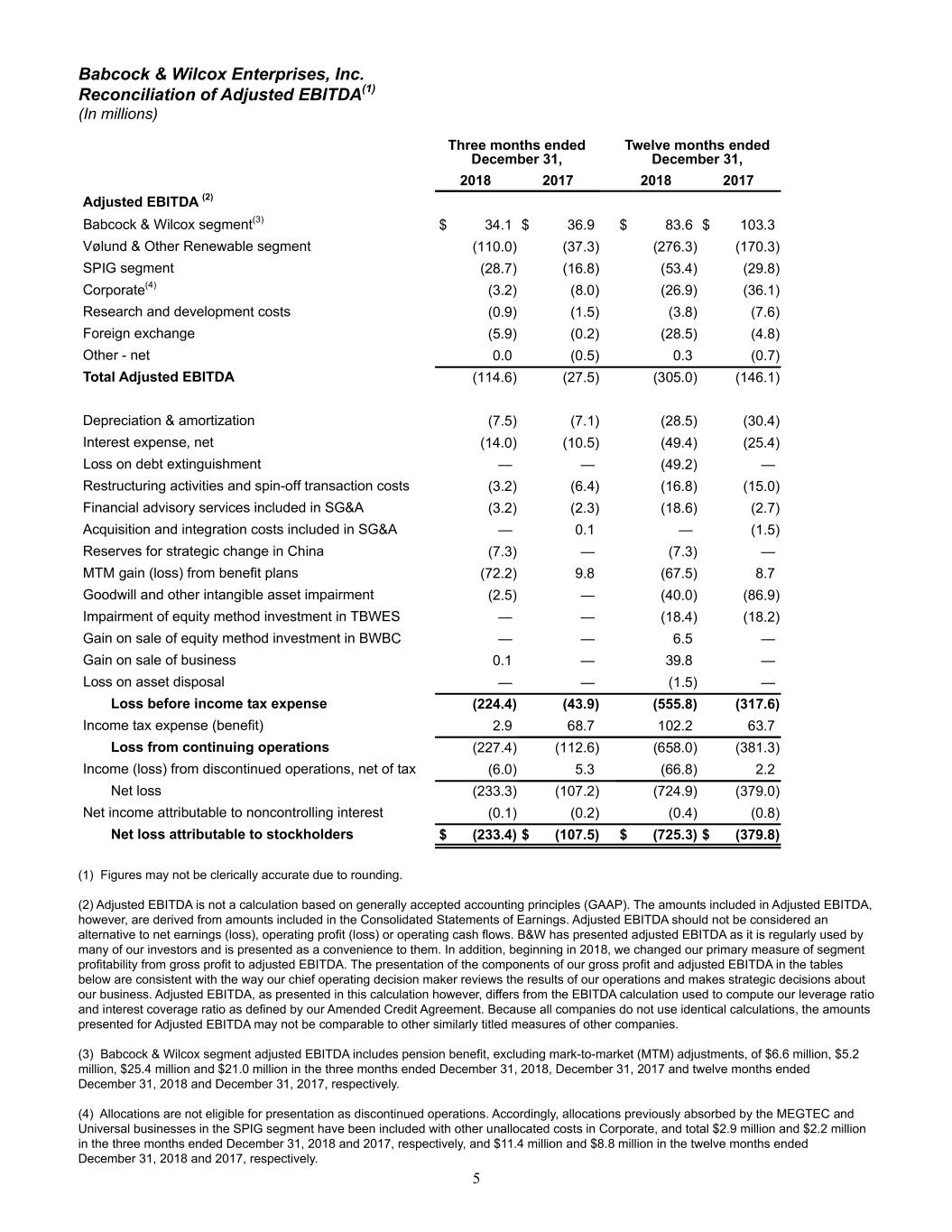

Babcock & Wilcox Enterprises, Inc. Reconciliation of Adjusted EBITDA(1) (In millions) Three months ended Twelve months ended December 31, December 31, 2018 2017 2018 2017 Adjusted EBITDA (2) Babcock & Wilcox segment(3) $ 34.1 $ 36.9 $ 83.6 $ 103.3 Vølund & Other Renewable segment (110.0) (37.3) (276.3) (170.3) SPIG segment (28.7) (16.8) (53.4) (29.8) Corporate(4) (3.2) (8.0) (26.9) (36.1) Research and development costs (0.9) (1.5) (3.8) (7.6) Foreign exchange (5.9) (0.2) (28.5) (4.8) Other - net 0.0 (0.5) 0.3 (0.7) Total Adjusted EBITDA (114.6) (27.5) (305.0) (146.1) Depreciation & amortization (7.5) (7.1) (28.5) (30.4) Interest expense, net (14.0) (10.5) (49.4) (25.4) Loss on debt extinguishment — — (49.2) — Restructuring activities and spin-off transaction costs (3.2) (6.4) (16.8) (15.0) Financial advisory services included in SG&A (3.2) (2.3) (18.6) (2.7) Acquisition and integration costs included in SG&A — 0.1 — (1.5) Reserves for strategic change in China (7.3) — (7.3) — MTM gain (loss) from benefit plans (72.2) 9.8 (67.5) 8.7 Goodwill and other intangible asset impairment (2.5) — (40.0) (86.9) Impairment of equity method investment in TBWES — — (18.4) (18.2) Gain on sale of equity method investment in BWBC — — 6.5 — Gain on sale of business 0.1 — 39.8 — Loss on asset disposal — — (1.5) — Loss before income tax expense (224.4) (43.9) (555.8) (317.6) Income tax expense (benefit) 2.9 68.7 102.2 63.7 Loss from continuing operations (227.4) (112.6) (658.0) (381.3) Income (loss) from discontinued operations, net of tax (6.0) 5.3 (66.8) 2.2 Net loss (233.3) (107.2) (724.9) (379.0) Net income attributable to noncontrolling interest (0.1) (0.2) (0.4) (0.8) Net loss attributable to stockholders $ (233.4) $ (107.5) $ (725.3) $ (379.8) (1) Figures may not be clerically accurate due to rounding. (2) Adjusted EBITDA is not a calculation based on generally accepted accounting principles (GAAP). The amounts included in Adjusted EBITDA, however, are derived from amounts included in the Consolidated Statements of Earnings. Adjusted EBITDA should not be considered an alternative to net earnings (loss), operating profit (loss) or operating cash flows. B&W has presented adjusted EBITDA as it is regularly used by many of our investors and is presented as a convenience to them. In addition, beginning in 2018, we changed our primary measure of segment profitability from gross profit to adjusted EBITDA. The presentation of the components of our gross profit and adjusted EBITDA in the tables below are consistent with the way our chief operating decision maker reviews the results of our operations and makes strategic decisions about our business. Adjusted EBITDA, as presented in this calculation however, differs from the EBITDA calculation used to compute our leverage ratio and interest coverage ratio as defined by our Amended Credit Agreement. Because all companies do not use identical calculations, the amounts presented for Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. (3) Babcock & Wilcox segment adjusted EBITDA includes pension benefit, excluding mark-to-market (MTM) adjustments, of $6.6 million, $5.2 million, $25.4 million and $21.0 million in the three months ended December 31, 2018, December 31, 2017 and twelve months ended December 31, 2018 and December 31, 2017, respectively. (4) Allocations are not eligible for presentation as discontinued operations. Accordingly, allocations previously absorbed by the MEGTEC and Universal businesses in the SPIG segment have been included with other unallocated costs in Corporate, and total $2.9 million and $2.2 million in the three months ended December 31, 2018 and 2017, respectively, and $11.4 million and $8.8 million in the twelve months ended December 31, 2018 and 2017, respectively. 5

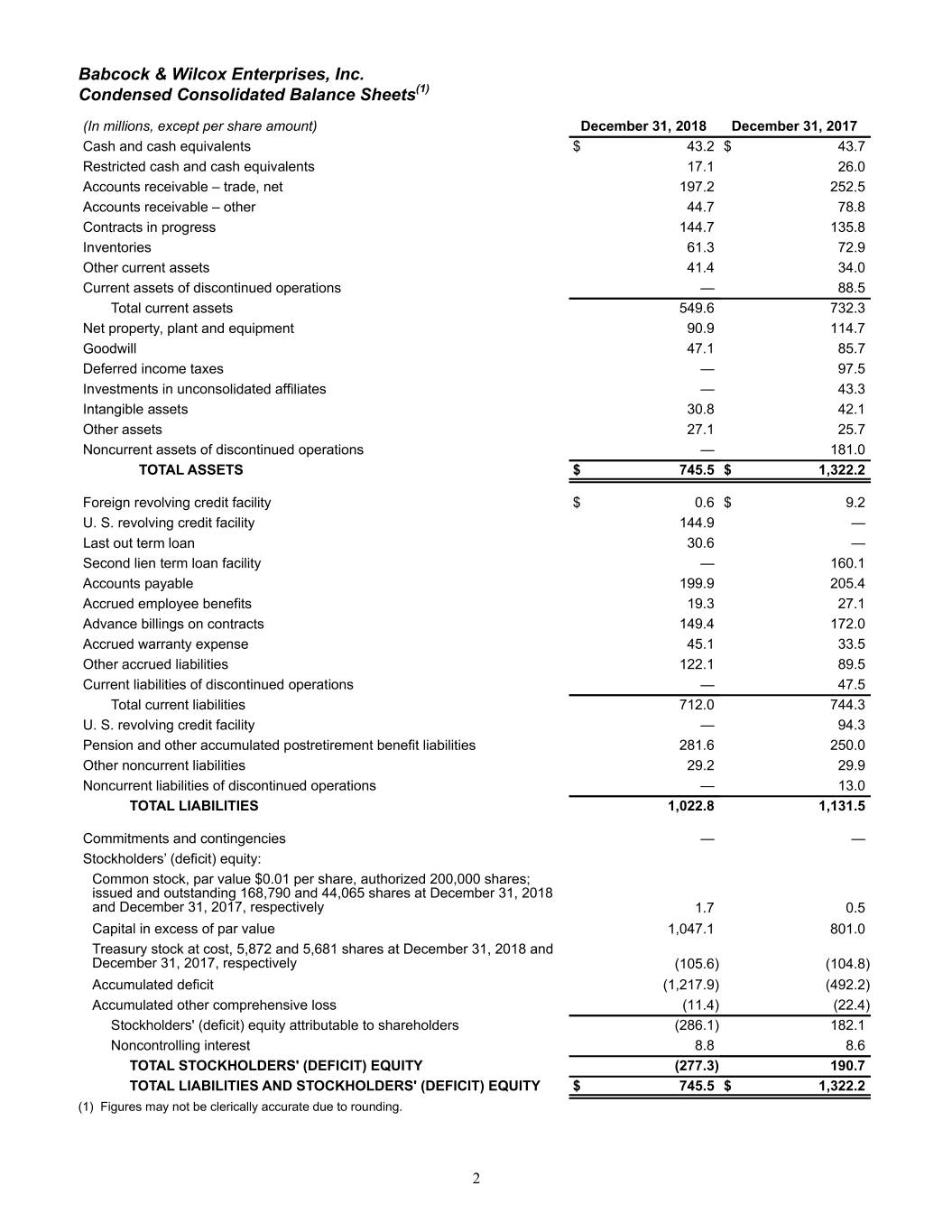

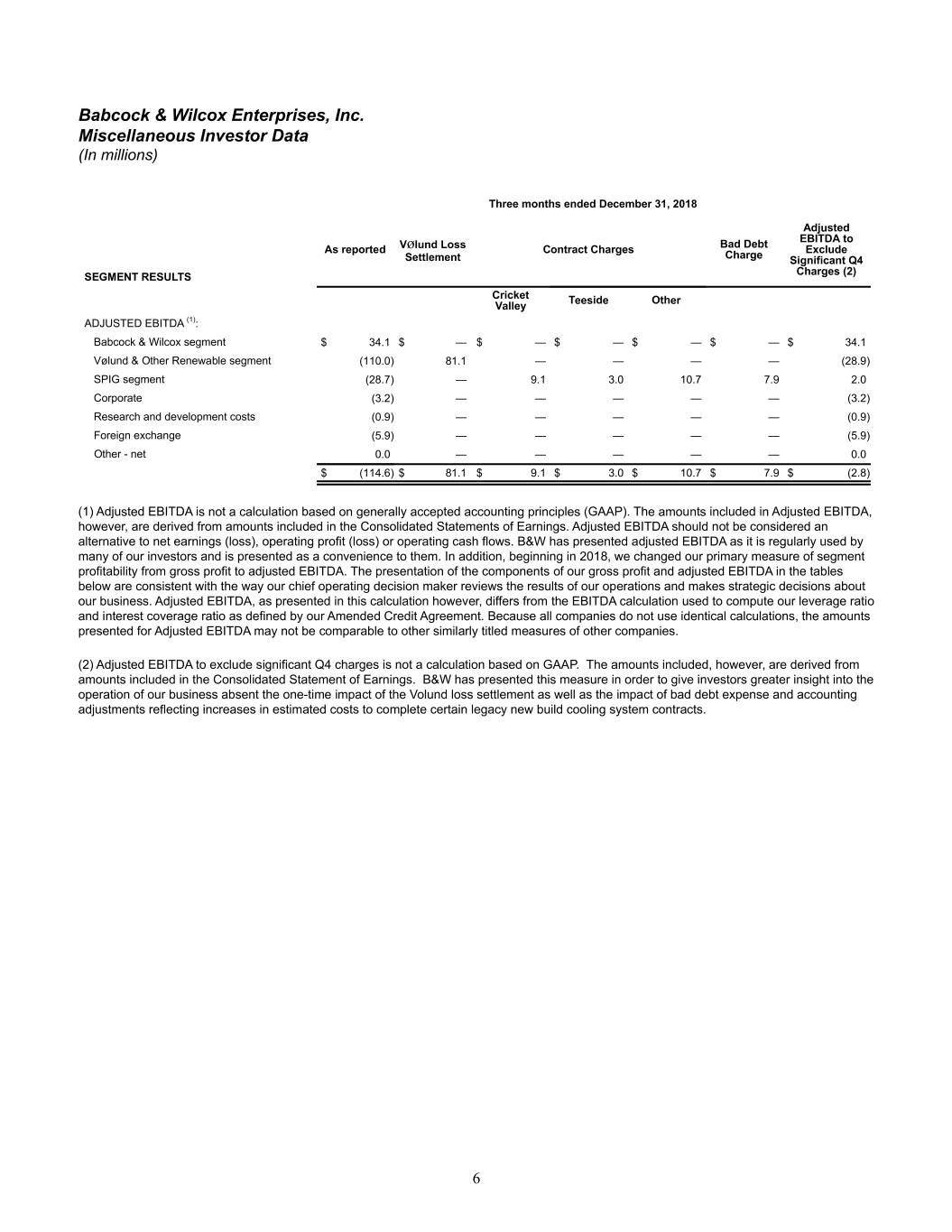

Babcock & Wilcox Enterprises, Inc. Miscellaneous Investor Data (In millions) Three months ended December 31, 2018 Adjusted EBITDA to As reported Vølund Loss Contract Charges Bad Debt Exclude Settlement Charge Significant Q4 Charges (2) SEGMENT RESULTS Cricket Teeside Other Valley ADJUSTED EBITDA (1): Babcock & Wilcox segment $ 34.1 $ — $ — $ — $ — $ — $ 34.1 Vølund & Other Renewable segment (110.0) 81.1 — — — — (28.9) SPIG segment (28.7) — 9.1 3.0 10.7 7.9 2.0 Corporate (3.2) — — — — — (3.2) Research and development costs (0.9) — — — — — (0.9) Foreign exchange (5.9) — — — — — (5.9) Other - net 0.0 — — — — — 0.0 $ (114.6) $ 81.1 $ 9.1 $ 3.0 $ 10.7 $ 7.9 $ (2.8) (1) Adjusted EBITDA is not a calculation based on generally accepted accounting principles (GAAP). The amounts included in Adjusted EBITDA, however, are derived from amounts included in the Consolidated Statements of Earnings. Adjusted EBITDA should not be considered an alternative to net earnings (loss), operating profit (loss) or operating cash flows. B&W has presented adjusted EBITDA as it is regularly used by many of our investors and is presented as a convenience to them. In addition, beginning in 2018, we changed our primary measure of segment profitability from gross profit to adjusted EBITDA. The presentation of the components of our gross profit and adjusted EBITDA in the tables below are consistent with the way our chief operating decision maker reviews the results of our operations and makes strategic decisions about our business. Adjusted EBITDA, as presented in this calculation however, differs from the EBITDA calculation used to compute our leverage ratio and interest coverage ratio as defined by our Amended Credit Agreement. Because all companies do not use identical calculations, the amounts presented for Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. (2) Adjusted EBITDA to exclude significant Q4 charges is not a calculation based on GAAP. The amounts included, however, are derived from amounts included in the Consolidated Statement of Earnings. B&W has presented this measure in order to give investors greater insight into the operation of our business absent the one-time impact of the Volund loss settlement as well as the impact of bad debt expense and accounting adjustments reflecting increases in estimated costs to complete certain legacy new build cooling system contracts. 6