management’s opinion, there are no known pending legal proceedings, the outcome of which would, individually or in the aggregate, have a material adverse effect on our consolidated results of operations or consolidated financial position.

Item 1A. Risk Factors.

In addition to the other information set forth in this report, you should consider the factors d the risk factors previously disclosed in our second quarter 2020 Form 10-Q and first quarter 2020 Form 10-Q in response to Part II, Item 1A; and 2019 Form 10-K in response to Part I, Item 1A, which could materially affect our business, financial condition and prospective results. The risks described in this report, in our Annual Report on Form 10-K and our other SEC filings are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or future results.

The following Supplemental risk factors related to PPP participation and insurance coverage should be considered along with the Risk Factors found in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019, and Form 10-Q Part II, Item 1A for the second quarter 2020 and first quarter 2020.

By participating as a PPP lender, the Company may be subject to additional risks of litigation from customers or other parties regarding the processing of loans for the PPP and risks that the SBA may not fund some or all PPP guaranties.

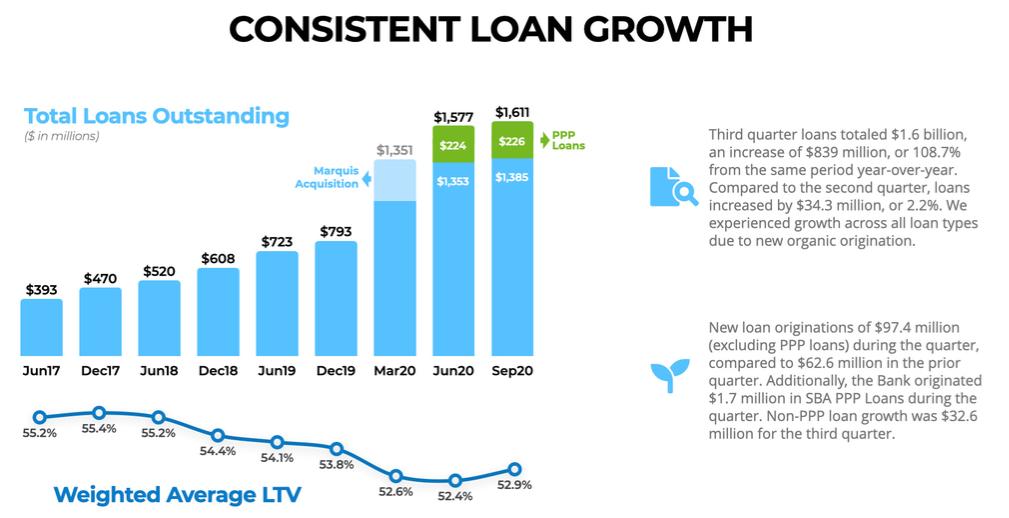

The Company, through the Bank, is a participant in the PPP. Under the PPP, small businesses and other entities and individuals could apply for loans from existing SBA lenders and other approved regulated lenders that enroll in the program, subject to numerous limitations and eligibility criteria. The Bank is participating as a lender in the PPP. Because of the short timeframe between the passing of the CARES Act and the opening of the PPP, there is ambiguity in the laws, rules and guidance regarding the operation of the PPP, which exposes the Company to risks relating to noncompliance with the PPP. Since the opening of the PPP, several financial institutions, including the Bank, have been subject to nuisance class-action litigation regarding the process and procedures that such banks used in processing applications for the PPP. The Company and the Bank may be exposed to the risk of additional litigation, from both customers and non-customers that approached the Bank regarding PPP loans, regarding its process and procedures used in processing applications for the PPP and loan forgiveness applications. If such litigation is not resolved in a manner favorable to the Company, it could adversely affect the Company’s reputation. In addition, litigation can be costly, regardless of outcome. The Company also has credit risk on PPP loans if a determination is made by the SBA that there is a deficiency in the manner in which the loan was originated, funded, or serviced by the Bank, such as an issue with the eligibility of a borrower to receive a PPP loan, which may or may not be related to the ambiguity in the laws, rules and guidance regarding the operation of the PPP. In the event of a loss resulting from a default on a PPP loan and a determination by the SBA that there was a deficiency in the manner in which the PPP loan was originated, funded, or serviced by the Company, the SBA may deny its liability under the guaranty, reduce the amount of the guaranty, or, if it has already paid under the guaranty, seek recovery of any loss related to the deficiency from the Company.

Levels or types of insurance coverage may not adequately cover claims.

We maintain insurance to protect against certain types of claims associated with our operations, but our coverage may not adequately cover all claims. Depending on our assumptions regarding level of risk, availability, cost and other considerations, we purchase differing amounts of insurance from time to time and for various business lines. Our coverage is subject to deductibles, exclusions and policy limits. If our level of insurance is inadequate or a loss isn’t covered, we could suffer a loss that may have a negative impact on our financial results or operations.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

On February 7, 2020, the Company completed its initial public offering of 3,565,000 shares of its Class A Common Stock at a public offering price of $18.50 per share, or an aggregate offering price of $57,350,000. The offering, for which the managing underwriters were Stephens Inc. and Keefe, Bruyette & Woods, was registered under the Securities Act (Registration No. 333-235822) and resulted in total