infrastructure, offset by a reduction in acquisition expenses. The Bank’s number of employees increased from 137 as of December 31, 2019, to 179 as of June 30, 2020, which increase was due to the MBI acquisition, and further increased to 194 as of June 30, 2021.

Income Tax Expense

The amount of income tax expense we incur is influenced by the amounts of our pre-tax income, and other nondeductible expenses. Deferred tax assets and liabilities are reflected at current income tax rates in effect for the period in which the deferred tax assets and liabilities are expected to be realized or settled. As changes in tax laws or rates are enacted, such as the Tax Act, deferred tax assets and liabilities are adjusted through the provision for income taxes. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

Income tax expense was $2.8 million for the six months ended June 30, 2021, compared to $0.7 million for the six months ended June 30, 2020. Our effective tax rates for those periods were 20.4% and 28.8%, respectively. The change in the effective tax rate was due to the decrease in nondeductible expenses, primarily acquisition related costs, an increase in tax-exempt income, and an increase in excess tax benefits from stock-based compensation.

Financial Condition

Balance Sheet Analysis

The following sections provide expanded discussion of the significant changes in certain line items in asset, liability, and stockholder’s equity categories.

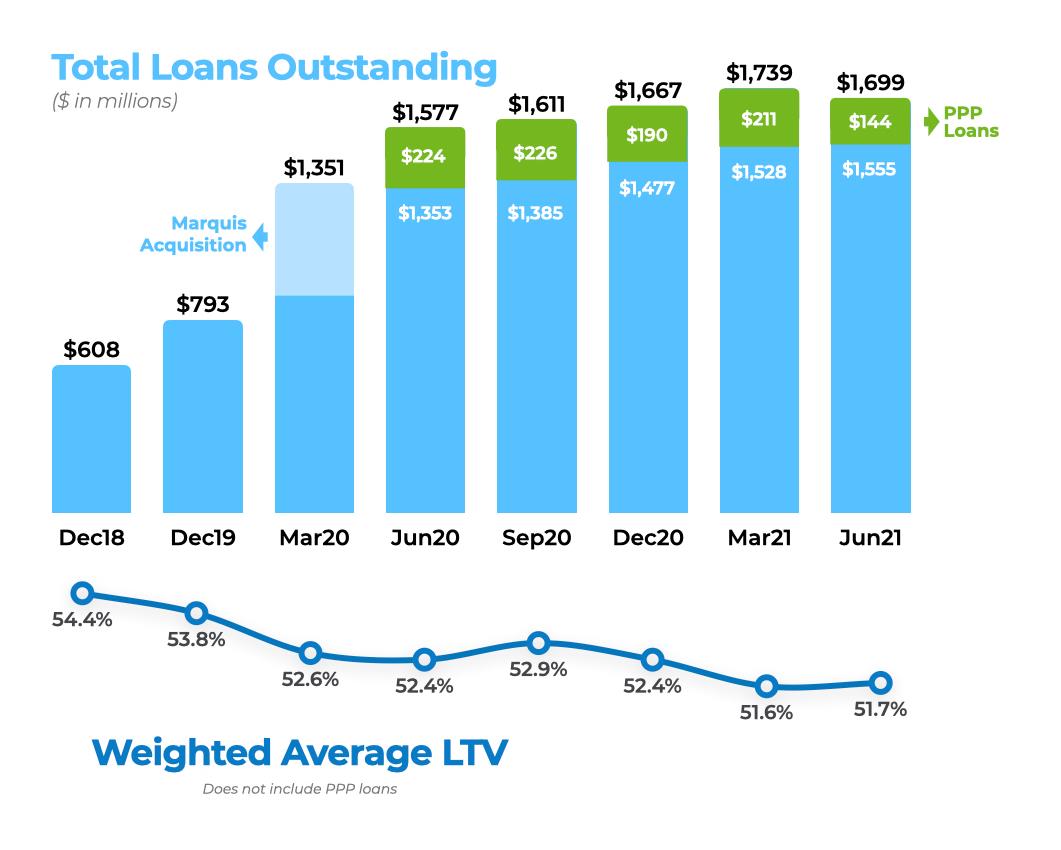

For the six months ended June 30, 2021, our total assets increased 24.5%, or $0.5 billion, compared to December 31, 2020. Total loans increased 2.2%, or $36.8 million, compared to December 31, 2020, as a result of the third round of the PPP and new organic loan origination. Interest-bearing deposits at other financial institutions increased due to our desire to maintain our excess liquidity in more liquid assets due to our continued robust demand for loans and cash associated with Correspondent Banking Relationship. Stockholders’ equity increased $7.5 million, or 3.5%, compared to December 31, 2020, primarily due to net income of $11.1 million for the six months ended June 30, 2021, offset by repurchases of the Company’s Class A voting common stock.

Cash and Cash Equivalents

Cash that is not immediately needed to fund loans by the Bank is invested in liquid assets that also earn interest, including deposits with other financial institutions. Due to our desire to maintain excess liquidity in more liquid assets to fund our loan growth and excess due to the Correspondent Banking Relationship, cash and cash equivalents increased $435.4 million, or 200.7%, compared to December 31, 2020, primarily due to an increase in interest-bearing deposits. As we continue to grow, so do our liquidity needs.

Banks are required to maintain cash reserves in the form of vault cash or in an account with the Federal Reserve Bank or in noninterest-earning accounts with other qualified banks. This requirement is based on the Bank’s amount of transaction deposit accounts. The Bank’s cash reserve requirements at June 30, 2021 and 2020, was $0 and $0, respectively.

Investment Securities

We use our securities portfolio to provide a secondary source of liquidity, achieve additional interest income through higher yields on funds invested (compared to other options, such as interest-bearing deposits at other banks or fed funds sold), manage interest rate risk, and meet both collateral and regulatory capital requirements.

Securities may be classified as either trading, held-to-maturity, available-for-sale, or equity. Trading securities (if any) are held principally for resale and recorded at their fair value with changes in fair value included in income. Held-to-maturity securities are those which the Company has the positive intent and ability to hold to maturity and are reported at amortized cost. Equity securities are carried at fair value, with changes in fair value reported in net income. Equity securities without readily determinable fair values are carried at cost, minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or a similar investment. Available-for-sale securities consist of securities not classified as trading securities nor as held-to maturity securities. Unrealized holding gains and losses on available-for-sale securities are excluded from income and reported in comprehensive income or