Exhibit 99.2

© KALYX PROPERTIES INC. 2017 May 2017 Investor Presentation

2 © KALYX PROPERTIES INC. 2017 Neither the U . S . Securities and Exchange Commission nor any state or non - U . S . securities commission has reviewed or passed upon the accuracy or adequacy of this presentation or the merits of the merger transaction (the “Merger”) or private placement offering (the “PIPE”) described herein . Any representation to the contrary is unlawful . This presentation is not an offer to sell to any person, or a solicitation to any person to buy, shares of common equity of either Atlantic Alliance Partnership Corp . (“AAPC”), Kaylx Development Inc . (“ Kaylx ”) or Kaylx Properties Inc . , the surviving corporation following the merger (“KPI”) in any state or jurisdiction in which such an offer would be prohibited by law or to any person who is not an “accredited investor” under the U . S . federal securities laws . To participate in the PIPE, each prospective purchaser will be required to execute a subscription agreement and other legally binding documentation . In the event that any terms, conditions, or other provisions of such agreement (or any related agreements) are inconsistent with or contrary to the description of terms set forth in this presentation, the terms, conditions, and other provisions of such agreements shall control . A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward - looking statements . These factors include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger (including the failure to consummate the PIPE) ; ( 2 ) the outcome of any legal proceedings that may be instituted against AAPC, Kalyx or others following announcement of the merger and the transactions contemplated therein ; ( 3 ) the inability to complete the transactions contemplated by the Merger due to the failure to obtain approval of the shareholders of AAPC or Kalyx or other conditions to closing in the Merger ; ( 4 ) the risk that we may be unable to secure a U . S . national exchange listing for KPI ; ( 5 ) the risk that the proposed transaction disrupts current plans and operations as a result of the announcement and consummation of the Merger and the transactions described herein ; ( 6 ) the ability to recognize the anticipated benefits of the Merger, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with tenants and retain its key employees ; ( 7 ) costs related to the proposed Merger ; ( 8 ) changes in applicable laws or regulations or their interpretation or application (including, notably, federal and state laws related to the use, cultivation and distribution of cannabis - based products) ; ( 9 ) the possibility that AAPC or Kalyx may be adversely affected by other economic, business, and/or competitive factors ; ( 10 ) future exchange and interest rates ; ( 11 ) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Merger ; and ( 12 ) other risks and uncertainties indicated in the proxy statement to be filed by AAPC with the SEC, including those under "Risk Factors" therein, and other filings with the SEC by AAPC or Kalyx . These factors are not intended to be an all - encompassing list of risks and uncertainties . The forward - looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on AAPC and Kalyx . Future developments affecting AAPC and Kalyx may not be those that we have anticipated . These forward - looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements . Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward - looking statements . We undertake no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . By their nature, forward - looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future . We caution you that forward - looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward - looking statements contained in this release . In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward - looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods . Disclaimer and Cautionary Note on Forward Looking Statements

3 © KALYX PROPERTIES INC. 2017 Where You Can Find More Information This presentation may be deemed to be solicitation material regarding the proposed Merger of Kalyx and AAPC, including the issuance of the common stock of KPI, the surviving public company . In connection with the proposed Merger, AAPC expects to file a registration statement on Form S - 4 (the "Form S - 4 ") and accompanying proxy materials with the Securities and Exchange Commission ("SEC") . INVESTORS AND SECURITY HOLDERS OF AAPC AND KALYX ARE URGED TO READ THESE MATERIALS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE MERGER THAT AAPC WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAPC, KALYX AND THE PROPOSED MERGER . The preliminary proxy statement, the definitive proxy statement, and Form S - 4 registration statement/prospectus, in each case as applicable, and other relevant materials in connection with the Merger (when they become available), and any other documents filed by AAPC with the SEC, may be obtained free of charge at the SEC's website at www . sec . gov . In addition, investors and security holders may obtain free copies of the documents filed with the SEC by contacting AAPC in writing at 590 Madison Ave, New York, NY, 10022 . Participants in Merger AAPC, Kalyx, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of AAPC in connection with the Merger . Information regarding the officers and directors of AAPC is set forth in AAPC's annual report on Form 10 - K for the year ended December 31 , 2016 , which was filed with the SEC on March 15 , 2017 . Additional information regarding the interests of such potential participants will also be included in the Form S - 4 (and accompanying proxy materials) and other relevant documents filed with the SEC . Note on Merger and Proxy Related Information

4 © KALYX PROPERTIES INC. 2017 • Kalyx Development Inc . (“Kalyx”, “we”, or the “Company”) entered into an agreement to merge with special purpose acquisition company (SPAC), Atlantic Alliance Partnership Corp . (NASDAQ : AAPC) on May 8 , 2017 . • Upon completion of the merger, Kalyx will contribute their portfolio of 9 properties totaling 652 , 685 square feet in exchange for common shares of AAPC creating the largest, by square footage, public cannabis REIT . • Ability to participate via real estate in one of the fastest growing industries in US . • Future dividend paying company with significant growth potential . • The transaction will be executed concurrently with a PIPE for common shares in AAPC, which will be re - domiciled to Maryland as part of the transaction . • Access to Public Capital – In present market conditions and company scale, it is anticipated that every $ 10 mm of invested capital can increase dividend yield by approximately 1 % . • Kalyx establishes a valuable currency for structuring future acquisitions . • Kalyx becomes a publicly traded company on a major US stock exchange immediately . • Results in new cash of at least $ 15 mm . Lead order of $ 5 . 5 mm from AAPC sponsor plus the net proceeds from the concurrent PIPE, together to be used in new acquisitions and working capital . Opportunity Strategic Rationale AAPC Acquisition & Concurrent PIPE Overview

5 © KALYX PROPERTIES INC. 2017 Strong and Diversified Operating Portfolio Attractive and Disciplined Investment Focus Extensive Relationships with Cannabis Operators, Intermediaries and Property Owners Experienced Management Team Real Estate and Investment Expertise Growth Oriented Capital Structure Significant Alignment of Interests Investment Opportunity

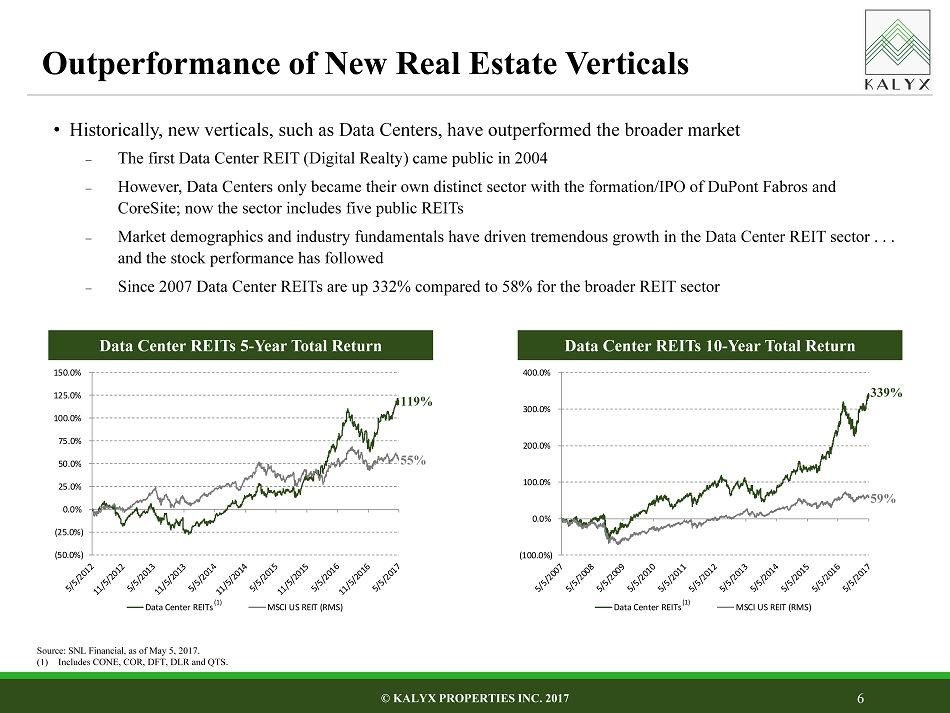

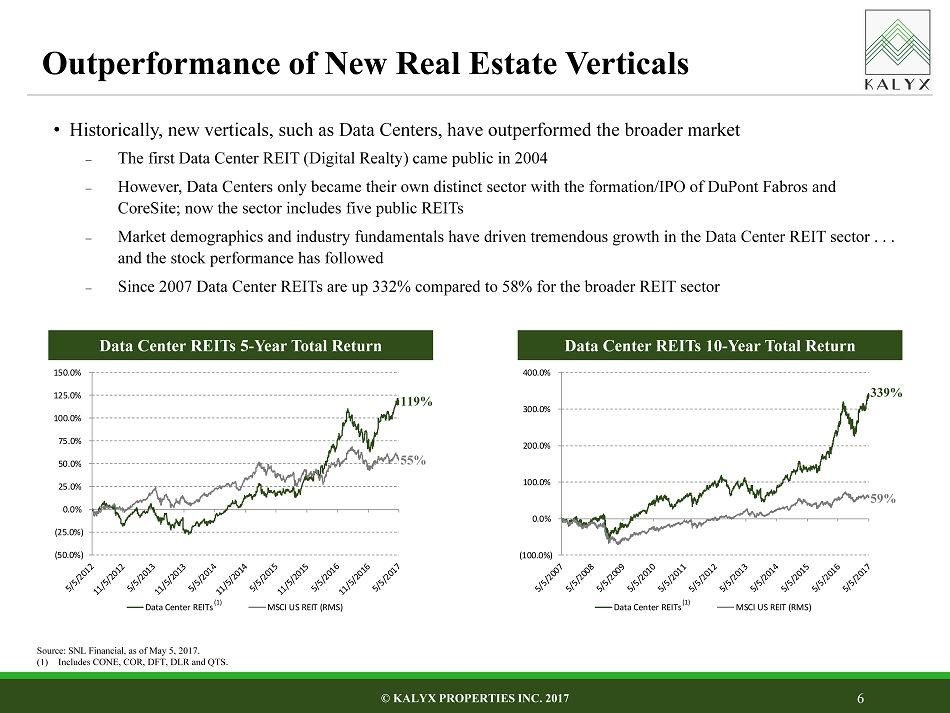

(100.0%) 0.0% 100.0% 200.0% 300.0% 400.0% Data Center REITs MSCI US REIT (RMS) (50.0%) (25.0%) 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% Data Center REITs MSCI US REIT (RMS) • Historically, new verticals, such as Data Centers, have outperformed the broader market ‒ The first Data Center REIT (Digital Realty) came public in 2004 ‒ However, Data Centers only became their own distinct sector with the formation/IPO of DuPont Fabros and CoreSite ; now the sector includes five public REITs ‒ Market demographics and industry fundamentals have driven tremendous growth in the Data Center REIT sector . . . and the stock performance has followed ‒ Since 2007 Data Center REITs are up 332% compared to 58% for the broader REIT sector 6 © KALYX PROPERTIES INC. 2017 Source: SNL Financial, as of May 5, 2017. (1) Includes CONE, COR, DFT, DLR and QTS. Outperformance of New Real Estate Verticals Data Center REITs 5 - Year Total Return 119% 55% Data Center REITs 10 - Year Total Return 339% 59% (1) (1)

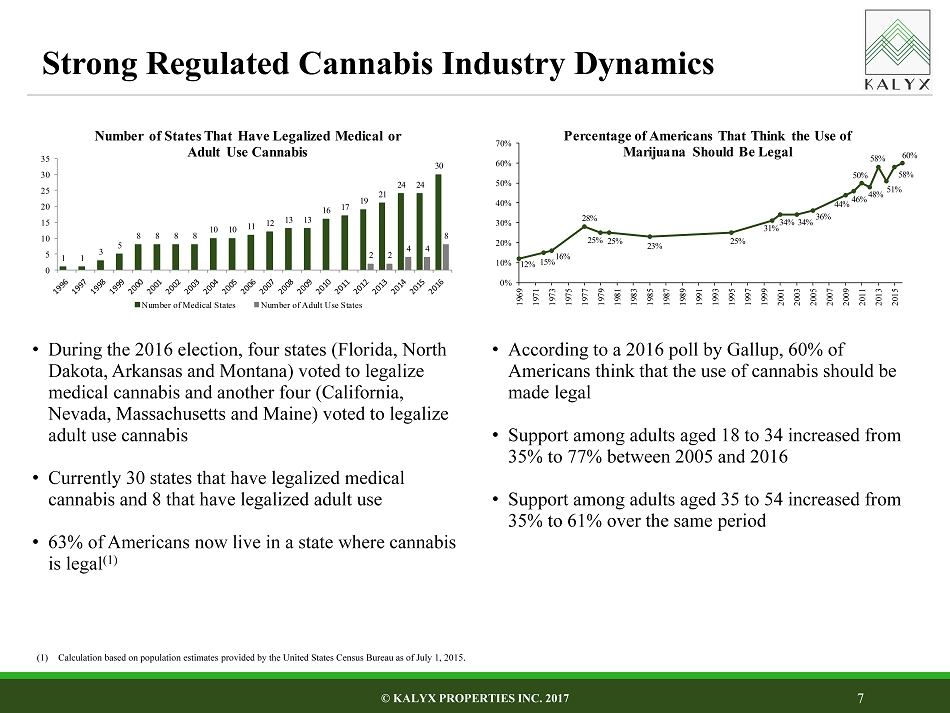

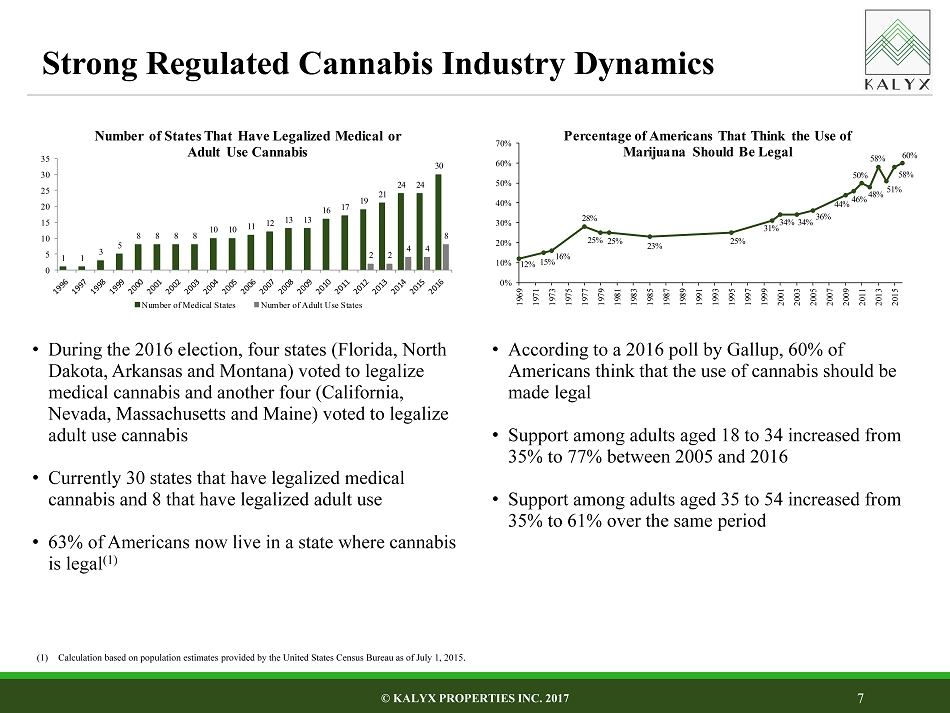

7 © KALYX PROPERTIES INC. 2017 • During the 2016 election, four states (Florida, North Dakota, Arkansas and Montana) voted to legalize medical cannabis and another four (California, Nevada, Massachusetts and Maine) voted to legalize adult use cannabis • Currently 30 states that have legalized medical cannabis and 8 that have legalized adult use • 63% of Americans now live in a state where cannabis is legal (1) (1) Calculation based on population estimates provided by the United States Census Bureau as of July 1, 2015. • According to a 2016 poll by Gallup, 60% of Americans think that the use of cannabis should be made legal • Support among adults aged 18 to 34 increased from 35% to 77% between 2005 and 2016 • Support among adults aged 35 to 54 increased from 35% to 61% over the same period Strong Regulated Cannabis Industry Dynamics 1 1 3 5 8 8 8 8 10 10 11 12 13 13 16 17 19 21 24 24 30 2 2 4 4 8 0 5 10 15 20 25 30 35 Number of States That Have Legalized Medical or Adult Use Cannabis Number of Medical States Number of Adult Use States 12% 15% 16% 28% 25% 25% 23% 25% 31% 34% 34% 36% 44% 46% 50% 48% 58% 51% 58% 60% 0% 10% 20% 30% 40% 50% 60% 70% 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 Percentage of Americans That Think the Use of Marijuana Should Be Legal

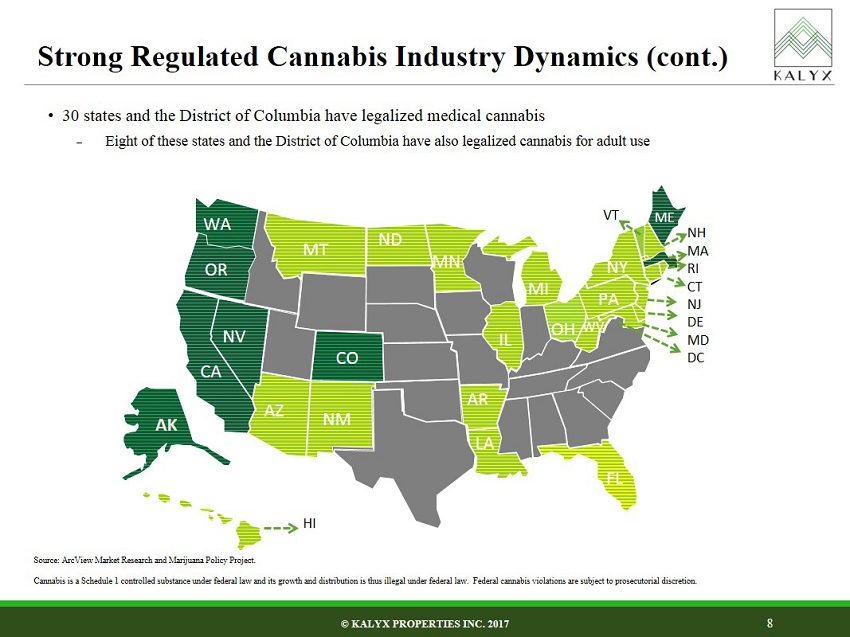

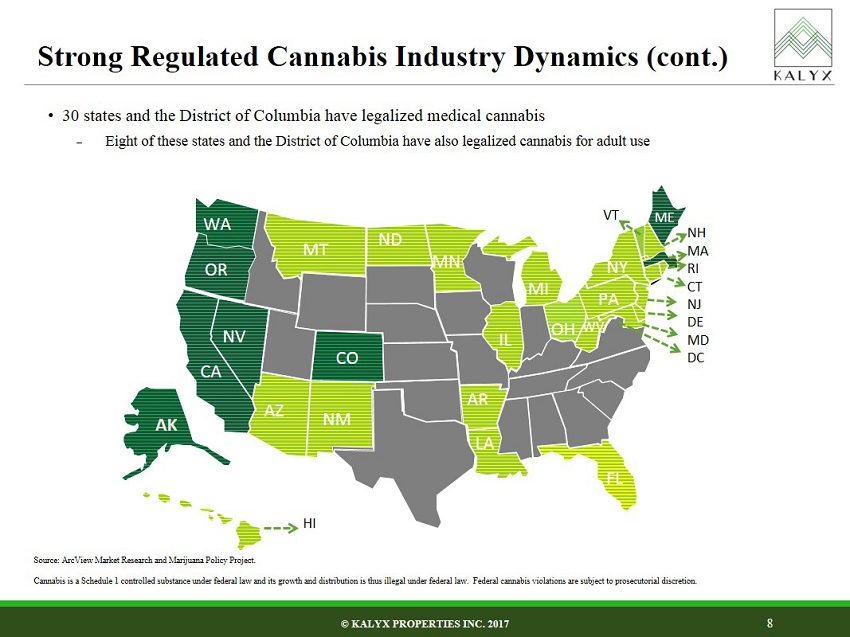

8 © KALYX PROPERTIES INC. 2017 Source: ArcView Market Research and Marijuana Policy Project. • 30 states and the District of Columbia have legalized medical cannabis ‒ Eight of these states and the District of Columbia have also legalized cannabis for adult use Strong Regulated Cannabis Industry Dynamics (cont.) NH MA RI CT NJ DE MD DC IL NY ME AZ LA NM AR CO CA MI NV OR WA MT ND MN FL FLFL WV OH PA AK HI VT

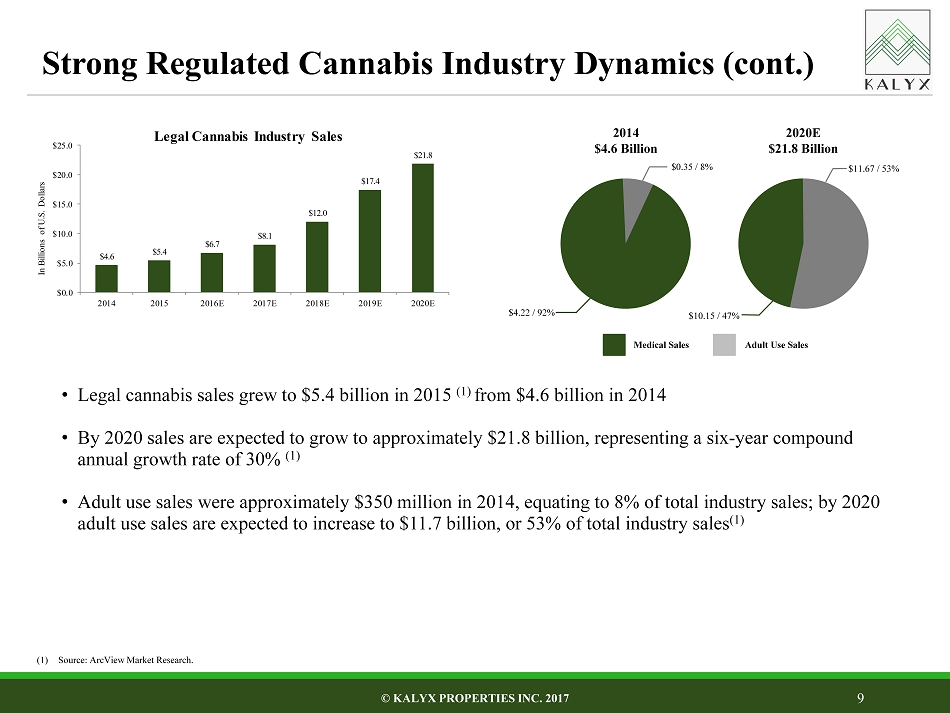

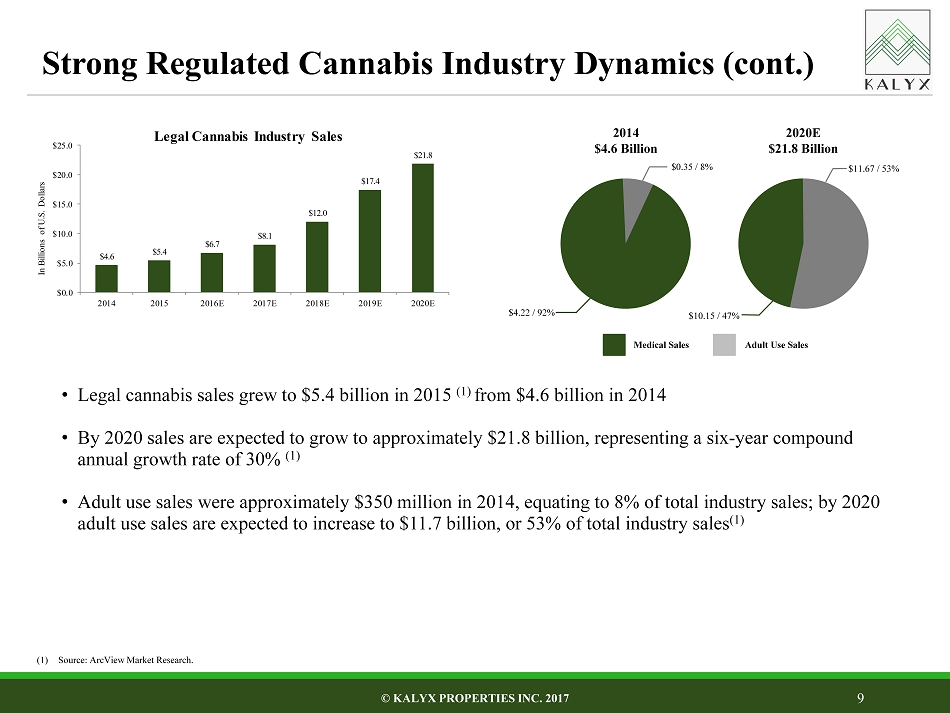

$4.22 / 92% $0.35 / 8% 9 © KALYX PROPERTIES INC. 2017 • Legal cannabis sales grew to $5.4 billion in 2015 (1) from $4.6 billion in 2014 • By 2020 sales are expected to grow to approximately $21.8 billion, representing a six - year compound annual growth rate of 30% (1) • Adult use sales were approximately $350 million in 2014, equating to 8% of total industry sales; by 2020 adult use sales are expected to increase to $11.7 billion, or 53% of total industry sales (1) (1) Source: ArcView Market Research. 2014 $4.6 Billion 2020E $21.8 Billion $10.15 / 47% $11.67 / 53% Medical Sales Adult Use Sales Strong Regulated Cannabis Industry Dynamics (cont.) $4.6 $5.4 $6.7 $8.1 $12.0 $17.4 $21.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2014 2015 2016E 2017E 2018E 2019E 2020E In Billions of U.S. Dollars Legal Cannabis Industry Sales

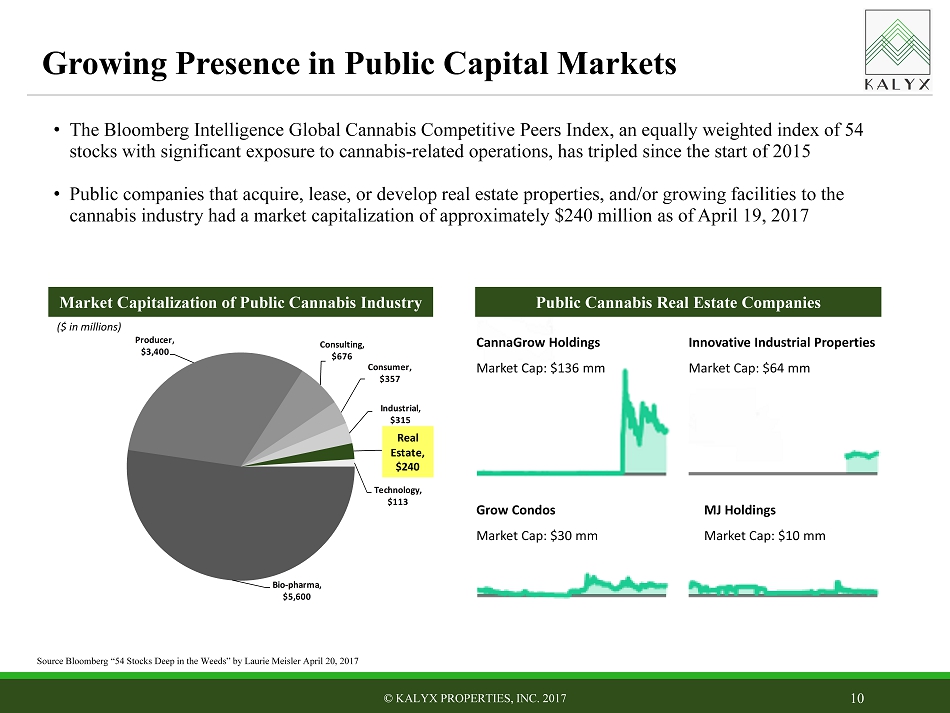

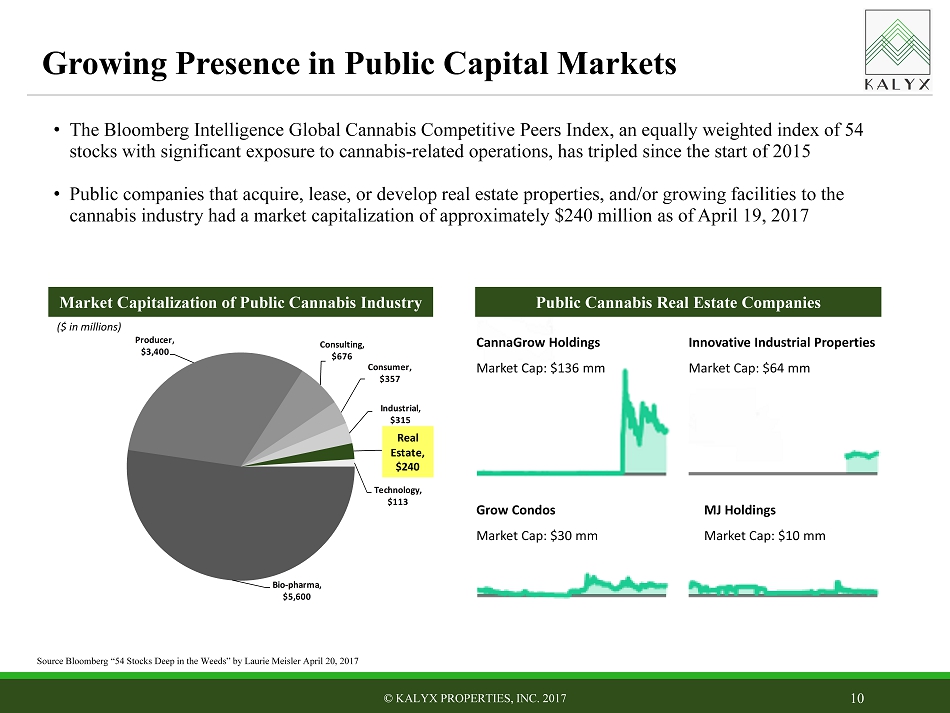

Bio - pharma , $5,600 Producer , $3,400 Consulting , $676 Consumer , $357 Industrial , $315 Real Estate , $240 Technology , $113 • The Bloomberg Intelligence Global Cannabis Competitive Peers Index, an equally weighted index of 54 stocks with significant exposure to cannabis - related operations, has tripled since the start of 2015 • Public companies that acquire, lease, or develop real estate properties, and/or growing facilities to the cannabis industry had a market capitalization of approximately $240 million as of April 19, 2017 © KALYX PROPERTIES, INC. 2017 10 Growing Presence in Public Capital Markets Source Bloomberg “54 Stocks Deep in the Weeds” by Laurie Meisler April 20, 2017 Market Capitalization of Public Cannabis Industry ($ in millions) Public Cannabis Real Estate Companies CannaGrow Holdings Market Cap: $136 mm Innovative Industrial Properties Market Cap: $64 mm Grow Condos Market Cap: $30 mm MJ Holdings Market Cap: $10 mm

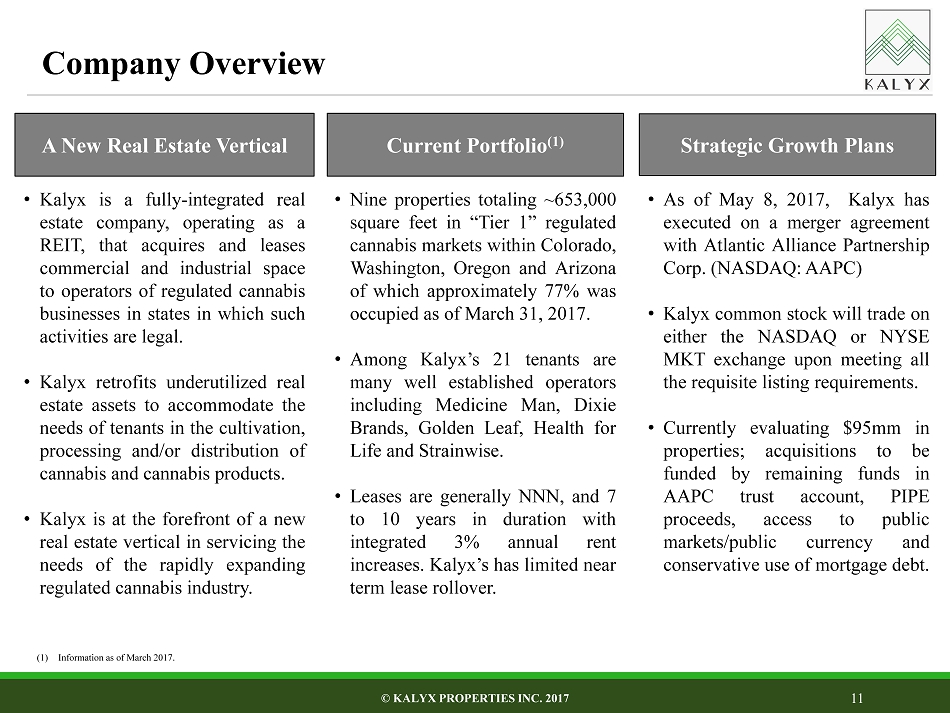

11 © KALYX PROPERTIES INC. 2017 Current Portfolio (1) A New Real Estate Vertical Strategic Growth Plans • Kalyx is a fully - integrated real estate company, operating as a REIT, that acquires and leases commercial and industrial space to operators of regulated cannabis businesses in states in which such activities are legal . • Kalyx retrofits underutilized real estate assets to accommodate the needs of tenants in the cultivation, processing and/or distribution of cannabis and cannabis products . • Kalyx is at the forefront of a new real estate vertical in servicing the needs of the rapidly expanding regulated cannabis industry . • Nine properties totaling ~ 653 , 000 square feet in “Tier 1 ” regulated cannabis markets within Colorado, Washington, Oregon and Arizona of which approximately 77 % was occupied as of March 31 , 2017 . • Among Kalyx’s 21 tenants are many well established operators including Medicine Man, Dixie Brands, Golden Leaf, Health for Life and Strainwise . • Leases are generally NNN, and 7 to 10 years in duration with integrated 3 % annual rent increases . Kalyx’s has limited near term lease rollover . • As of May 8 , 2017 , Kalyx has executed on a merger agreement with Atlantic Alliance Partnership Corp . (NASDAQ : AAPC) • Kalyx common stock will trade on either the NASDAQ or NYSE MKT exchange upon meeting all the requisite listing requirements . • Currently evaluating $ 95 mm in properties ; acquisitions to be funded by remaining funds in AAPC trust account, PIPE proceeds, access to public markets/public currency and conservative use of mortgage debt . (1) Information as of March 2017. Company Overview

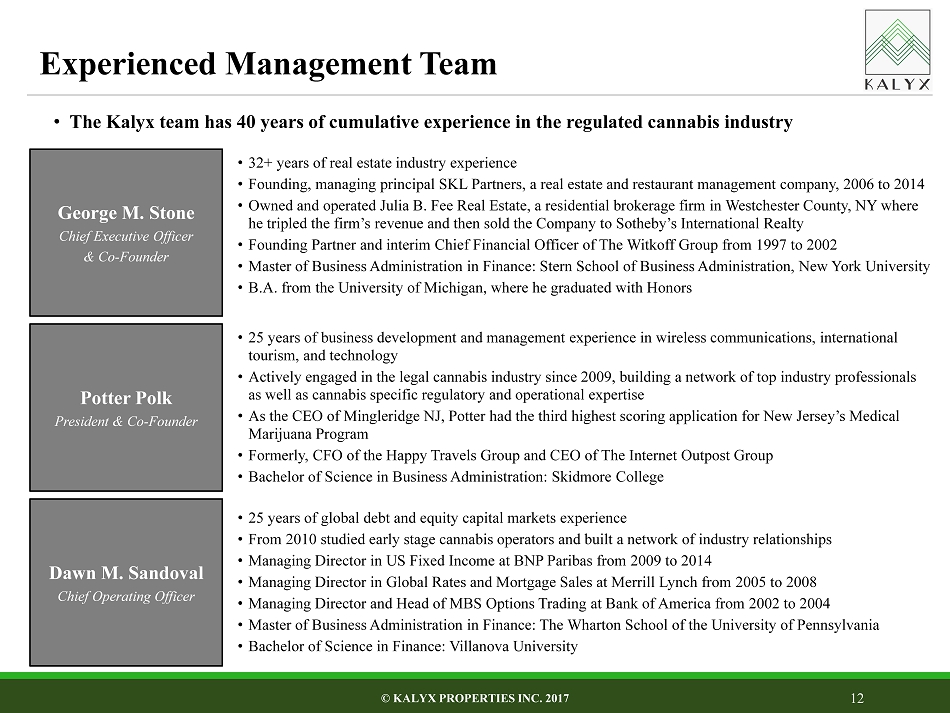

12 Experienced Management Team © KALYX PROPERTIES INC. 2017 Potter Polk President & Co - Founder • 25 years of business development and management experience in wireless communications, international tourism, and technology • Actively engaged in the legal cannabis industry since 2009, building a network of top industry professionals as well as cannabis specific regulatory and operational expertise • As the CEO of Mingleridge NJ, Potter had the third highest scoring application for New Jersey’s Medical Marijuana Program • Formerly, CFO of the Happy Travels Group and CEO of The Internet Outpost Group • Bachelor of Science in Business Administration: Skidmore College George M. Stone Chief Executive Officer & Co - Founder Dawn M. Sandoval Chief Operating Officer • 32+ years of real estate industry experience • Founding, managing principal SKL Partners, a real estate and restaurant management company, 2006 to 2014 • Owned and operated Julia B. Fee Real Estate, a residential brokerage firm in Westchester County, NY where he tripled the firm’s revenue and then sold the Company to Sotheby’s International Realty • Founding Partner and interim Chief Financial Officer of The Witkoff Group from 1997 to 2002 • Master of Business Administration in Finance: Stern School of Business Administration, New York University • B.A. from the University of Michigan, where he graduated with Honors • 25 years of global debt and equity capital markets experience • From 2010 studied early stage cannabis operators and built a network of industry relationships • Managing Director in US Fixed Income at BNP Paribas from 2009 to 2014 • Managing Director in Global Rates and Mortgage Sales at Merrill Lynch from 2005 to 2008 • Managing Director and Head of MBS Options Trading at Bank of America from 2002 to 2004 • Master of Business Administration in Finance: The Wharton School of the University of Pennsylvania • Bachelor of Science in Finance: Villanova University • The Kalyx team has 40 years of cumulative experience in the regulated cannabis industry

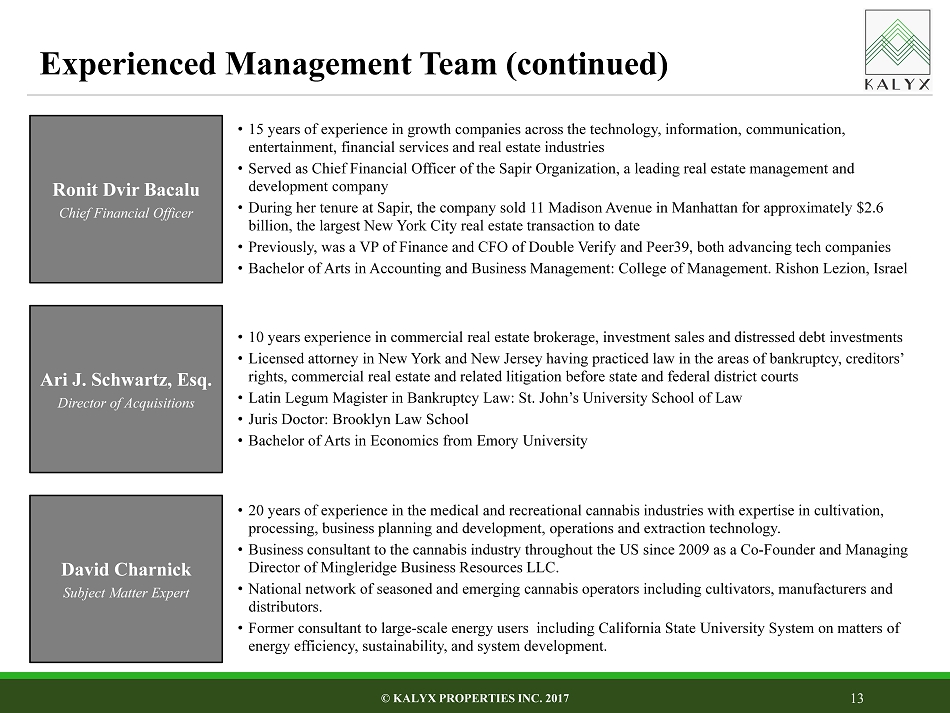

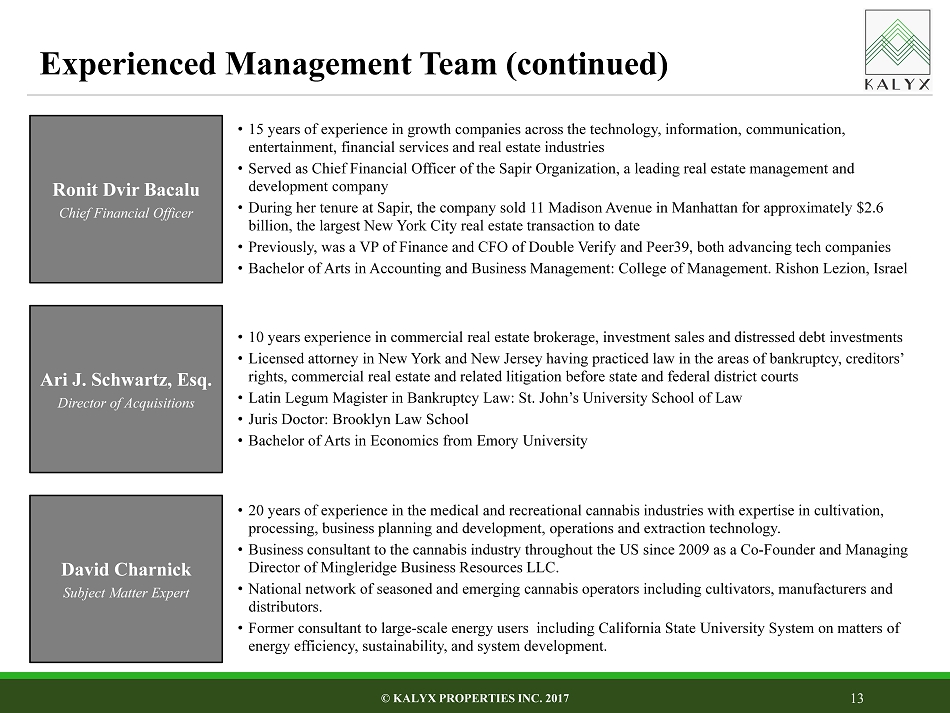

13 © KALYX PROPERTIES INC. 2017 Ronit Dvir Bacalu Chief Financial Officer • 15 years of experience in growth companies across the technology, information, communication, entertainment, financial services and real estate industries • Served as Chief Financial Officer of the Sapir Organization, a leading real estate management and development company • During her tenure at Sapir, the company sold 11 Madison Avenue in Manhattan for approximately $2.6 billion, the largest New York City real estate transaction to date • Previously, was a VP of Finance and CFO of Double Verify and Peer39, both advancing tech companies • Bachelor of Arts in Accounting and Business Management: College of Management. Rishon Lezion , Israel Ari J. Schwartz, Esq. Director of Acquisitions David Charnick Subject Matter Expert • 10 years experience in commercial real estate brokerage, investment sales and distressed debt investments • Licensed attorney in New York and New Jersey having practiced law in the areas of bankruptcy, creditors’ rights, commercial real estate and related litigation before state and federal district courts • Latin Legum Magister in Bankruptcy Law: St. John’s University School of Law • Juris Doctor: Brooklyn Law School • Bachelor of Arts in Economics from Emory University • 20 years of experience in the medical and recreational cannabis industries with expertise in cultivation, processing, business planning and development, operations and extraction technology. • Business consultant to the cannabis industry throughout the US since 2009 as a Co - Founder and Managing Director of Mingleridge Business Resources LLC. • National network of seasoned and emerging cannabis operators including cultivators, manufacturers and distributors. • Former consultant to large - scale energy users including California State University System on matters of energy efficiency, sustainability, and system development. Experienced Management Team (continued)

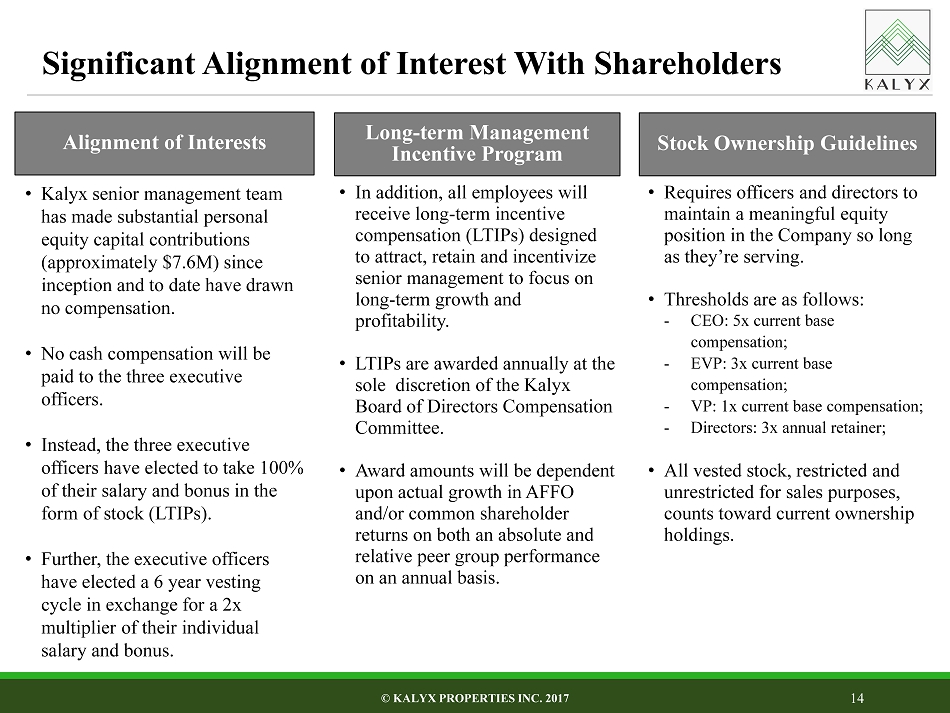

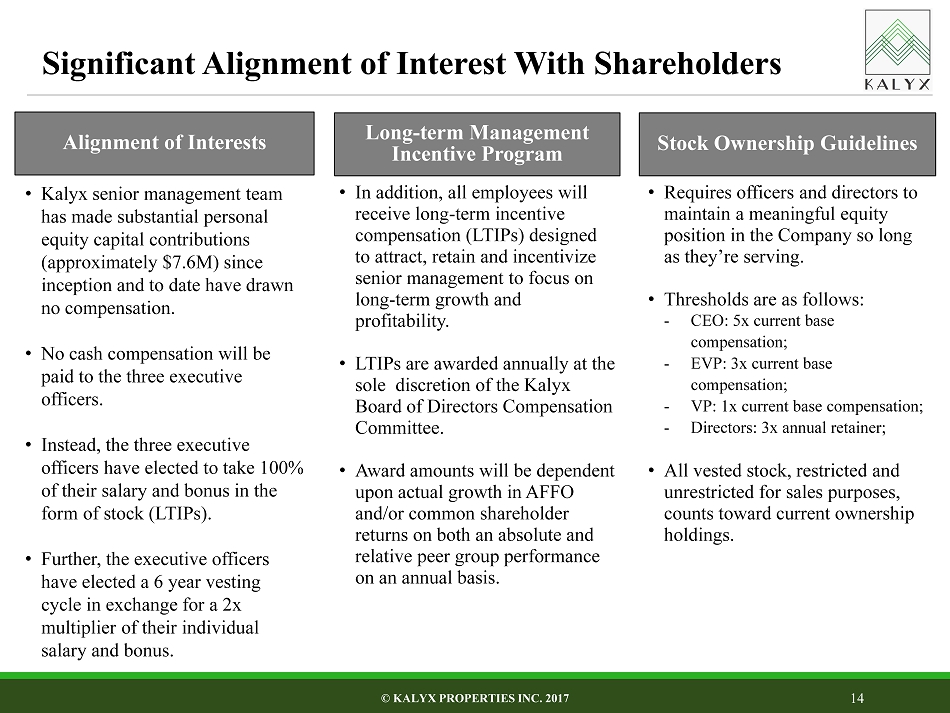

14 © KALYX PROPERTIES INC. 2017 Long - term Management Incentive Program Alignment of Interests Stock Ownership Guidelines • Kalyx senior management team has made substantial personal equity capital contributions (approximately $7.6M) since inception and to date have drawn no compensation. • No cash compensation will be paid to the three executive officers. • Instead, the three executive officers have elected to take 100% of their salary and bonus in the form of stock (LTIPs). • Further, the executive officers have elected a 6 year vesting cycle in exchange for a 2x multiplier of their individual salary and bonus. • In addition, all employees will receive long - term incentive compensation (LTIPs) designed to attract, retain and incentivize senior management to focus on long - term growth and profitability. • LTIPs are awarded annually at the sole discretion of the Kalyx Board of Directors Compensation Committee. • Award amounts will be dependent upon actual growth in AFFO and/or common shareholder returns on both an absolute and relative peer group performance on an annual basis. • Requires officers and directors to maintain a meaningful equity position in the Company so long as they’re serving. • Thresholds are as follows: - CEO: 5x current base compensation; - EVP: 3x current base compensation; - VP: 1x current base compensation; - Directors: 3x annual retainer; • All vested stock, restricted and unrestricted for sales purposes, counts toward current ownership holdings. Significant Alignment of Interest With Shareholders

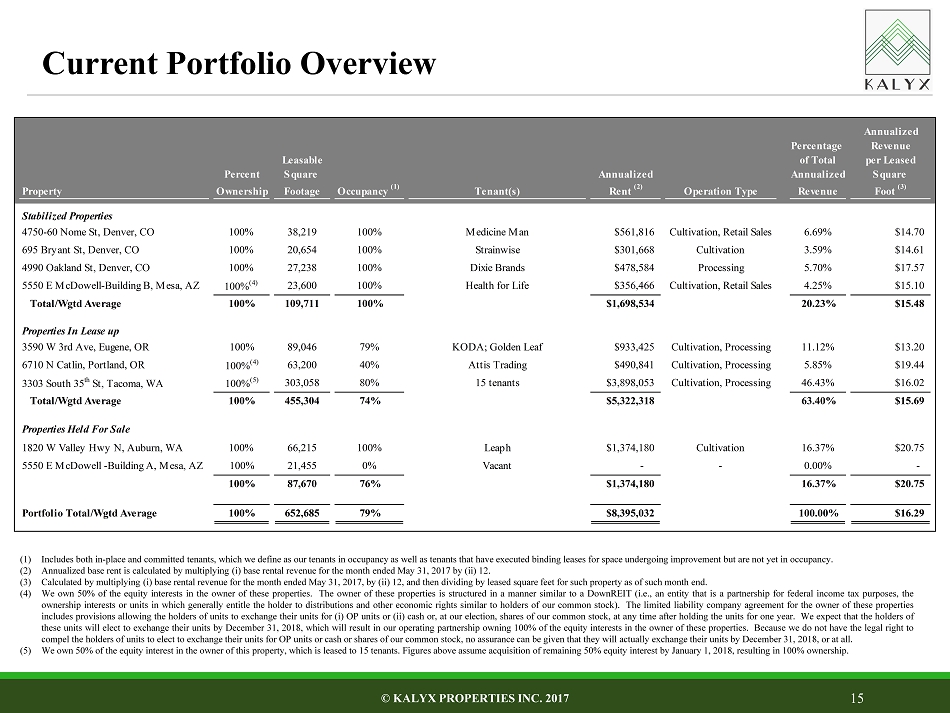

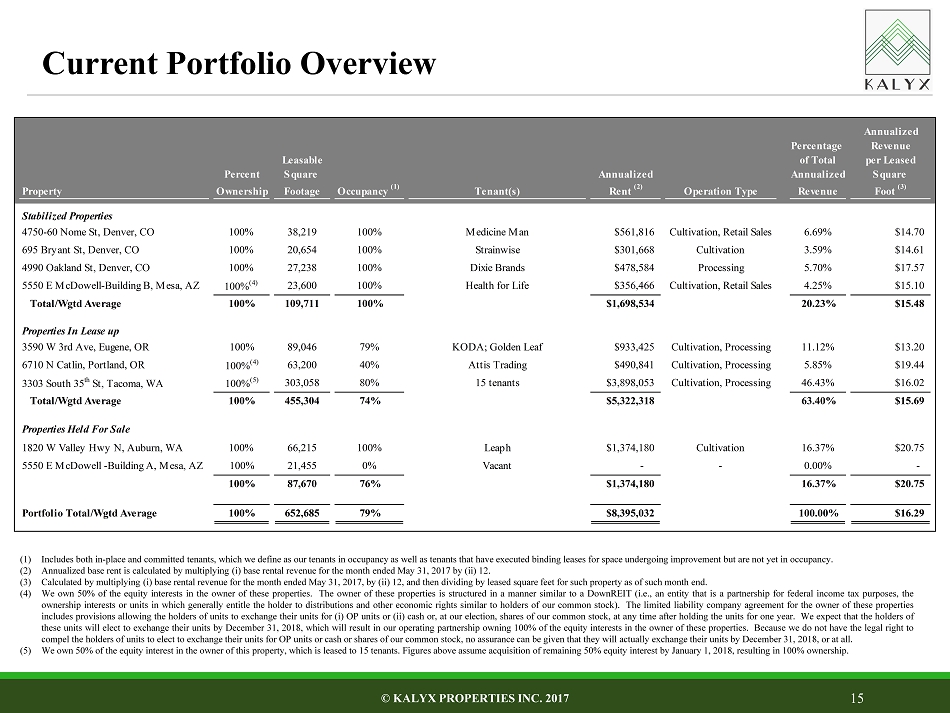

15 © KALYX PROPERTIES INC. 2017 (1) Includes both in - place and committed tenants, which we define as our tenants in occupancy as well as tenants that have executed binding leases for space undergoing improvement but are not yet in occupancy . (2) Annualized base rent is calculated by multiplying ( i ) base rental revenue for the month ended May 31 , 2017 by (ii) 12 . (3) Calculated by multiplying ( i ) base rental revenue for the month ended May 31 , 2017 , by (ii) 12 , and then dividing by leased square feet for such property as of such month end . (4) We own 50 % of the equity interests in the owner of these properties . The owner of these properties is structured in a manner similar to a DownREIT (i . e . , an entity that is a partnership for federal income tax purposes, the ownership interests or units in which generally entitle the holder to distributions and other economic rights similar to holders of our common stock) . The limited liability company agreement for the owner of these properties includes provisions allowing the holders of units to exchange their units for ( i ) OP units or (ii) cash or, at our election, shares of our common stock, at any time after holding the units for one year . We expect that the holders of these units will elect to exchange their units by December 31 , 2018 , which will result in our operating partnership owning 100 % of the equity interests in the owner of these properties . Because we do not have the legal right to compel the holders of units to elect to exchange their units for OP units or cash or shares of our common stock, no assurance can be given that they will actually exchange their units by December 31 , 2018 , or at all . (5) We own 50 % of the equity interest in the owner of this property, which is leased to 15 tenants . Figures above assume acquisition of remaining 50 % equity interest by January 1 , 2018 , resulting in 100 % ownership . Current Portfolio Overview Annualized Percentage Revenue Leasable of Total per Leased Percent Square Annualized Annualized Square Property Ownership Footage Occupancy (1) Tenant(s) Rent (2) Operation Type Revenue Foot (3) Stabilized Properties 4750-60 Nome St, Denver, CO 100% 38,219 100% Medicine Man $561,816 Cultivation, Retail Sales 6.69% $14.70 695 Bryant St, Denver, CO 100% 20,654 100% Strainwise $301,668 Cultivation 3.59% $14.61 4990 Oakland St, Denver, CO 100% 27,238 100% Dixie Brands $478,584 Processing 5.70% $17.57 5550 E McDowell-Building B, Mesa, AZ 100% (4) 23,600 100% Health for Life $356,466 Cultivation, Retail Sales 4.25% $15.10 Total/Wgtd Average 100% 109,711 100% $1,698,534 20.23% $15.48 3590 W 3rd Ave, Eugene, OR 100% 89,046 79% KODA; Golden Leaf $933,425 Cultivation, Processing 11.12% $13.20 6710 N Catlin, Portland, OR 100% (4) 63,200 40% Attis Trading $490,841 Cultivation, Processing 5.85% $19.44 3303 South 35 th St, Tacoma, WA 100% (5) 303,058 80% 15 tenants $3,898,053 Cultivation, Processing 46.43% $16.02 Total/Wgtd Average 100% 455,304 74% $5,322,318 63.40% $15.69 1820 W Valley Hwy N, Auburn, WA 100% 66,215 100% Leaph $1,374,180 Cultivation 16.37% $20.75 5550 E McDowell -Building A, Mesa, AZ 100% 21,455 0% Vacant - - 0.00% - 100% 87,670 76% $1,374,180 16.37% $20.75 Portfolio Total/Wgtd Average 100% 652,685 79% $8,395,032 100.00% $16.29 Properties In Lease up Properties Held For Sale

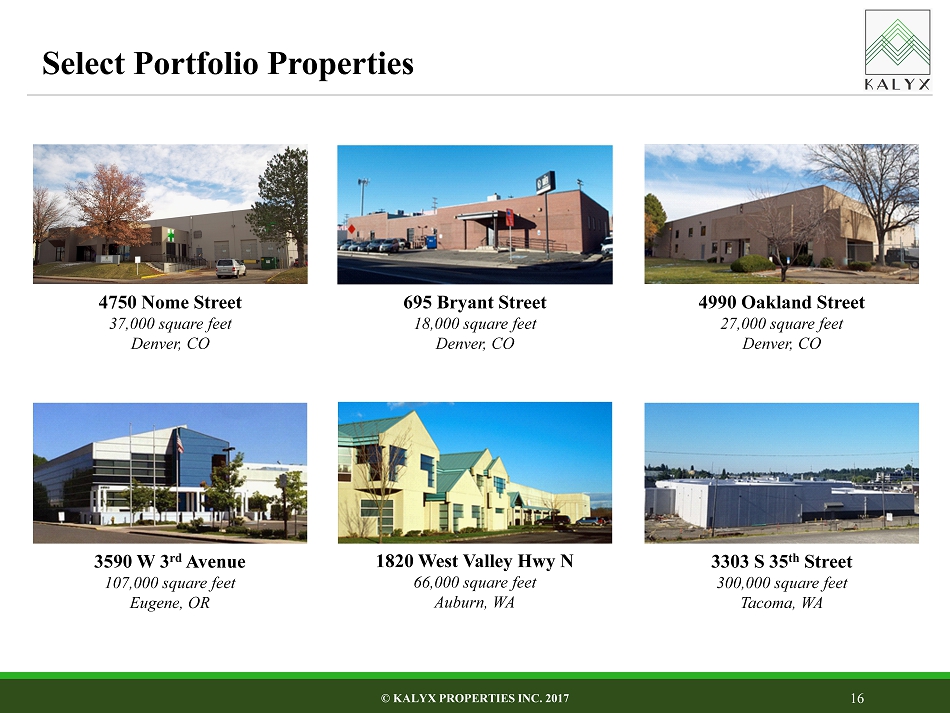

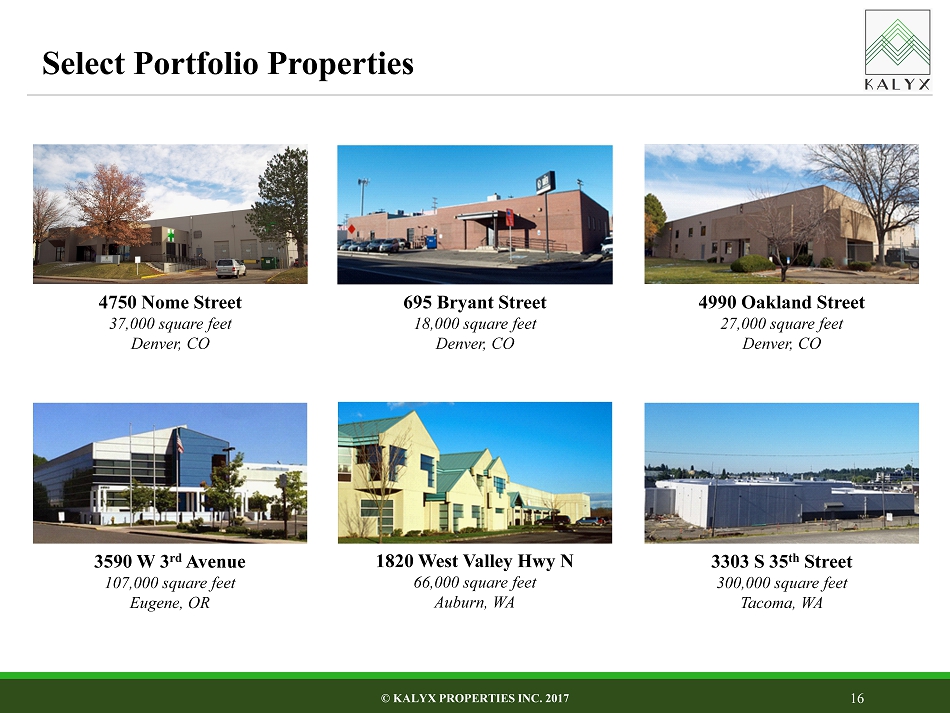

16 © KALYX PROPERTIES INC. 2017 4750 Nome Street 37,000 square feet Denver, CO 4990 Oakland Street 27,000 square feet Denver, CO 695 Bryant Street 18,000 square feet Denver, CO 3590 W 3 rd Avenue 107,000 square feet Eugene, OR 1820 West Valley Hwy N 66,000 square feet Auburn, WA 3303 S 35 th Street 300,000 square feet Tacoma, WA Select Portfolio Properties

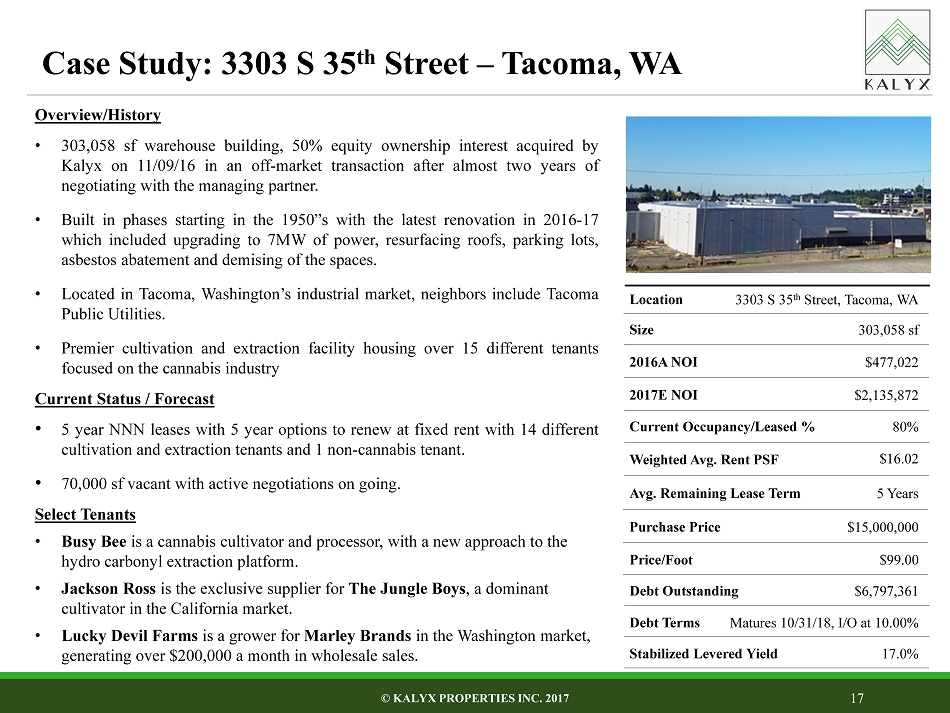

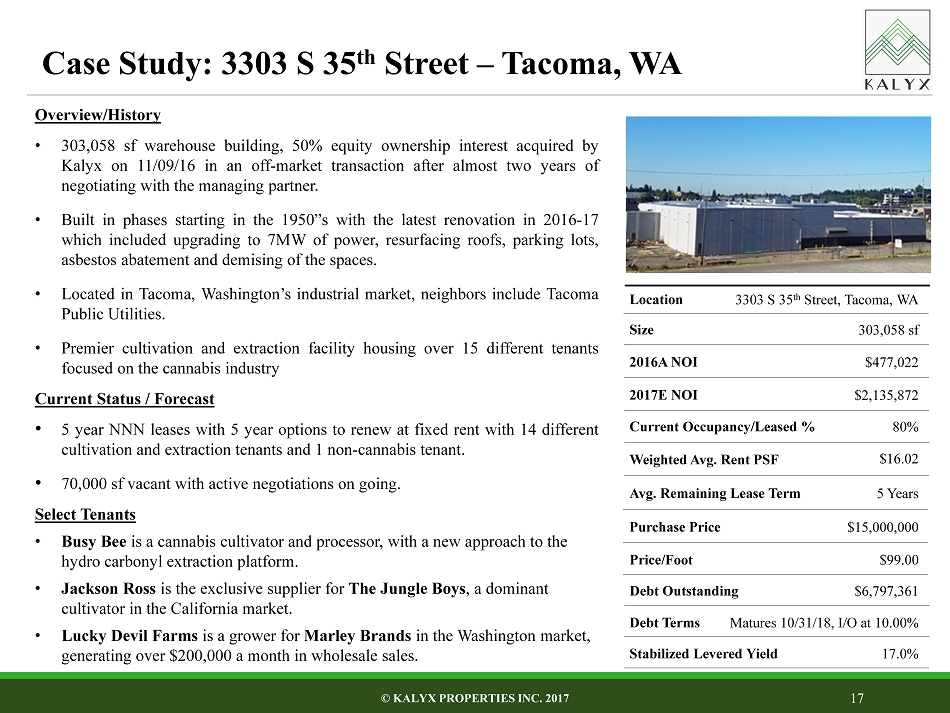

© KALYX PROPERTIES INC. 2017 17 Overview/History • 303 , 058 sf warehouse building, 50 % equity ownership interest acquired by Kalyx on 11 / 09 / 16 in an off - market transaction after almost two years of negotiating with the managing partner . • Built in phases starting in the 1950 ”s with the latest renovation in 2016 - 17 which included upgrading to 7 MW of power, resurfacing roofs, parking lots, asbestos abatement and demising of the spaces . • Located in Tacoma, Washington’s industrial market, neighbors include Tacoma Public Utilities . • Premier cultivation and extraction facility housing over 15 different tenants focused on the cannabis industry Current Status / Forecast • 5 year NNN leases with 5 year options to renew at fixed rent with 14 different cultivation and extraction tenants and 1 non - cannabis tenant . • 70 , 000 sf vacant with active negotiations on going . Select Tenants • Busy Bee is a cannabis cultivator and processor, with a new approach to the hydro carbonyl extraction platform. • Jackson Ross is the exclusive supplier for The Jungle Boys , a dominant cultivator in the California market. • Lucky Devil Farms is a grower for Marley Brands in the Washington market, generating over $200,000 a month in wholesale sales. Location Size 2016 A NOI Current Occupancy/Leased % Avg . Remaining Lease Term Purchase Price 3303 S 35 th Street, Tacoma, WA 303,058 sf $477,022 80% 5 Years $15,000,000 Weighted Avg . Rent PSF $16.02 2017 E NOI $2,135,872 Debt Terms Matures 10/31/18, I/O at 10.00% Debt Outstanding $6,797,361 Stabilized Levered Yield 17.0% Case Study: 3303 S 35 th Street – Tacoma, WA Price/Foot $99.00

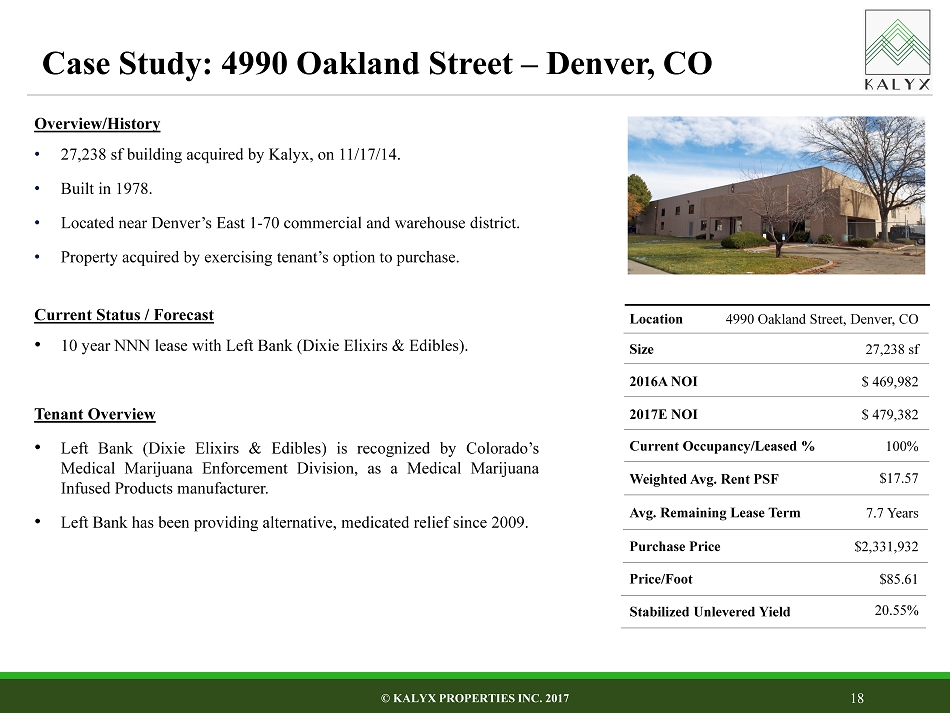

18 Overview/History • 27 , 238 sf building acquired by Kalyx, on 11 / 17 / 14 . • Built in 1978 . • Located near Denver’s East 1 - 70 commercial and warehouse district . • Property acquired by exercising tenant’s option to purchase . Current Status / Forecast • 10 year NNN lease with Left Bank (Dixie Elixirs & Edibles) . Tenant Overview • Left Bank (Dixie Elixirs & Edibles) is recognized by Colorado’s Medical Marijuana Enforcement Division, as a Medical Marijuana Infused Products manufacturer . • Left Bank has been providing alternative, medicated relief since 2009 . Location Size 2016 A NOI Current Occupancy/Leased % Avg . Remaining Lease Term Purchase Price Price/Foot 4990 Oakland Street, Denver, CO 27,238 sf $ 469,982 100% 7.7 Years $2,331,932 $85.61 Weighted Avg . Rent PSF $17.57 2017 E NOI $ 479,382 Stabilized Unlevered Yield 20.55% Case Study: 4990 Oakland Street – Denver, CO © KALYX PROPERTIES INC. 2017

19 © KALYX PROPERTIES INC. 2017 • Pipeline of potential acquisitions exceeding $95M. • Continue to employ a disciplined real estate investment strategy. • Diversify by expanding tenant operation and facility types in target markets. • Continue to expand geographically as new markets open and demand increases. • Systematically vet new tenants and strategically utilize local intermediaries. • Actively manage our property portfolio to increase rents and limit vacancies. • Conservatively utilize leverage. Growth Strategy

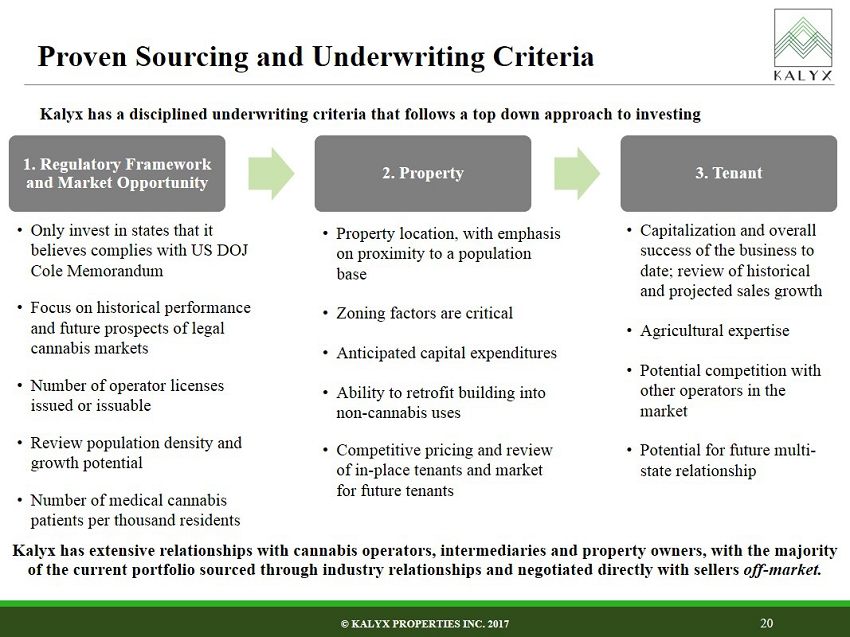

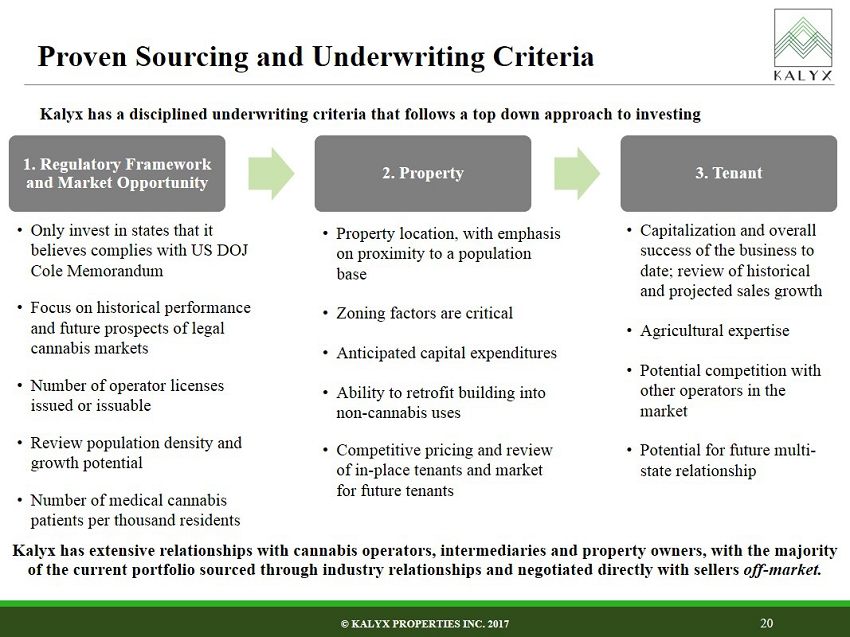

Kalyx has extensive relationships with cannabis operators, intediaries and property owners, with the majority of the current portfolio sourced through industry relationships and negotiated directly with sellers off - market. 20 © KALYX PROPERTIES INC. 2017 Kalyx has a disciplined underwriting criteria that follows a top down approach to investing • Only invest in Cole compliant states • Focus on historical performance and future prospects of legal cannabis markets • Number of operator licenses issued or issuable • Review population density and growth potential • Number of medical cannabis patients per thousand residents • Property location, with emphasis on proximity to a population base • Zoning factors are critical • Anticipated capital expenditures • Ability to retrofit building into non - cannabis uses • Competitive pricing and review of in - place tenants and market for future tenants • Capitalization and overall success of the business to date; review of historical and projected sales growth • Agricultural expertise • Potential competition with other operators in the market • Potential for future multi - state relationship 1. Regulatory Framework and Market Opportunity 2. Property 3. Tenant Proven Sourcing and Underwriting Criteria

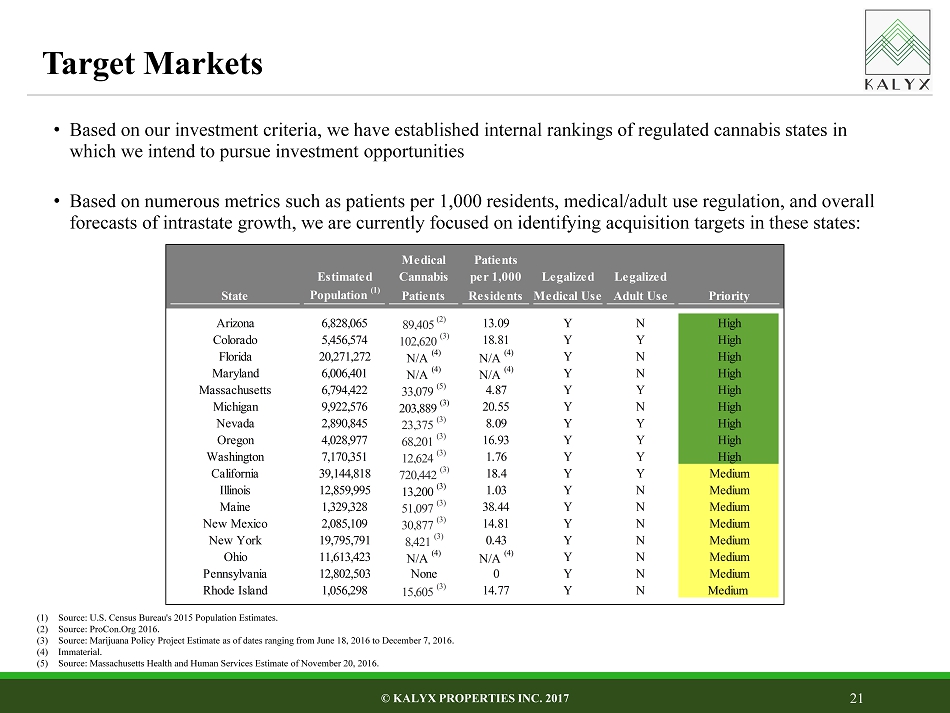

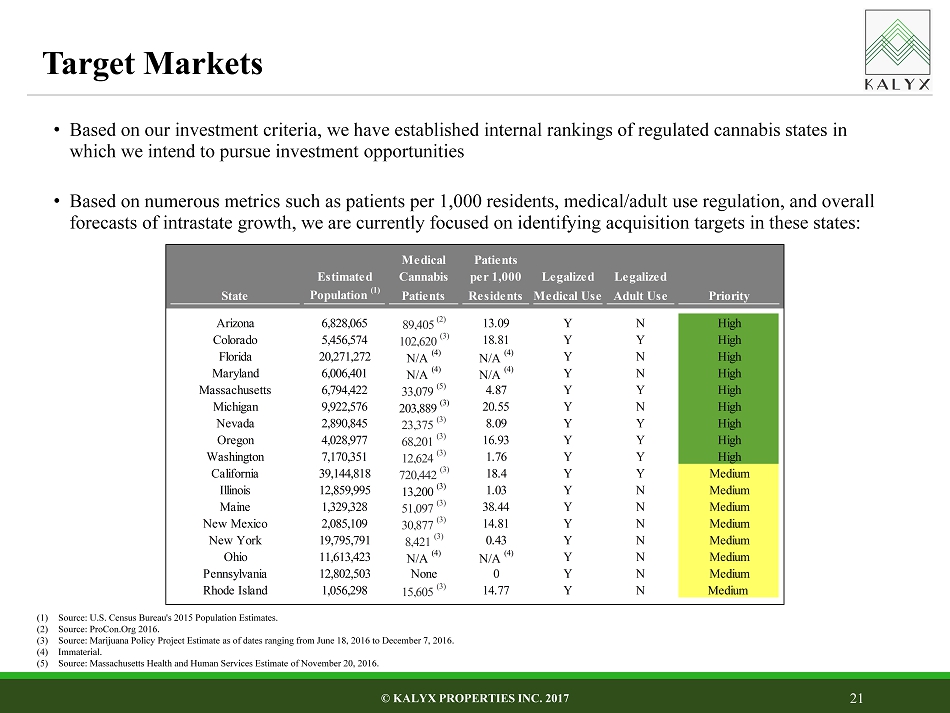

21 © KALYX PROPERTIES INC. 2017 • Based on our investment criteria, we have established internal rankings of regulated cannabis states in which we intend to pursue investment opportunities • Based on numerous metrics such as patients per 1,000 residents, medical/adult use regulation, and overall forecasts of intrastate growth, we are currently focused on identifying acquisition targets in these states: (1) Source: U.S. Census Bureau's 2015 Population Estimates. (2) Source: ProCon.Org 2016. (3) Source: Marijuana Policy Project Estimate as of dates ranging from June 18, 2016 to December 7, 2016. (4) Immaterial. (5) Source: Massachusetts Health and Human Services Estimate of November 20, 2016. Medical Patients Estimated Cannabis per 1,000 Legalized Legalized State Population (1) Patients Residents Medical Use Adult Use Priority Arizona 6,828,065 89,405 (2) 13.09 Y N High Colorado 5,456,574 102,620 (3) 18.81 Y Y High Florida 20,271,272 N/A (4) N/A (4) Y N High Maryland 6,006,401 N/A (4) N/A (4) Y N High Massachusetts 6,794,422 33,079 (5) 4.87 Y Y High Michigan 9,922,576 203,889 (3) 20.55 Y N High Nevada 2,890,845 23,375 (3) 8.09 Y Y High Oregon 4,028,977 68,201 (3) 16.93 Y Y High Washington 7,170,351 12,624 (3) 1.76 Y Y High California 39,144,818 720,442 (3) 18.4 Y Y Medium Illinois 12,859,995 13,200 (3) 1.03 Y N Medium Maine 1,329,328 51,097 (3) 38.44 Y N Medium New Mexico 2,085,109 30,877 (3) 14.81 Y N Medium New York 19,795,791 8,421 (3) 0.43 Y N Medium Ohio 11,613,423 N/A (4) N/A (4) Y N Medium Pennsylvania 12,802,503 None 0 Y N Medium Rhode Island 1,056,298 15,605 (3) 14.77 Y N Medium Target Markets

© KALYX PROPERTIES, INC. 2017 22 • The terms of the Merger attribute the current, pre - transaction value of Kalyx at approximately $60 million and a post - transaction market capitalization of approximately $75 million (subject to certain assumptions and variables). The surviving public company, which is expected to be organized as a Maryland corporation, will be Kalyx Properties Inc. (“KPI”). • With the terms of the Merger, AAPC attributed the current, pre - transaction value of Kalyx at approximately $60 million and a post - transaction market capitalization of approximately $75 million (subject to certain assumptions and variables). All shareholders of Kalyx will receive shares of KPI based on the aggregate pre - money equity valuation. • Holders of Kalyx warrants who do not elect to exchange their warrants for shares of Kalyx common stock (as described in the merger agreement) will have their warrants assumed by KPI (subject to a minimum threshold of such warrants being amended (as described in the merger agreement). • AAPC shareholders who do not elect to redeem their AAPC ordinary shares will receive a stock dividend immediately prior to the closing based on the difference between the trust liquidation value per share at the closing of the Merger and the $10 per share price. • AAPC’s sponsor, AAP Sponsor (PTC) Corp, has agreed to forfeit a portion of the KPI shares that it would receive in the Merger for its founder shares. Transaction Summary

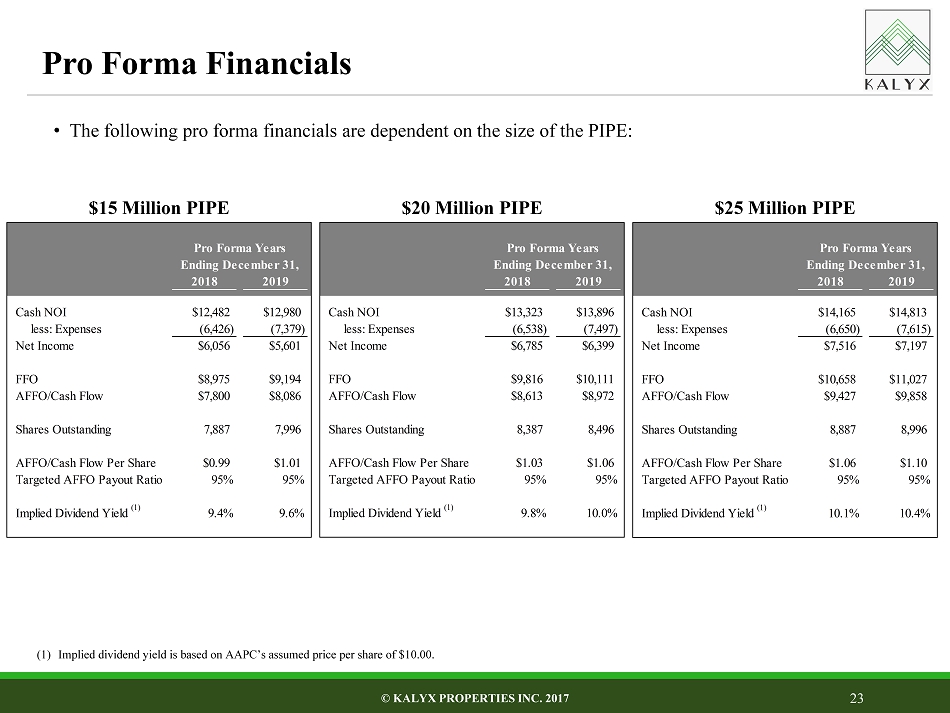

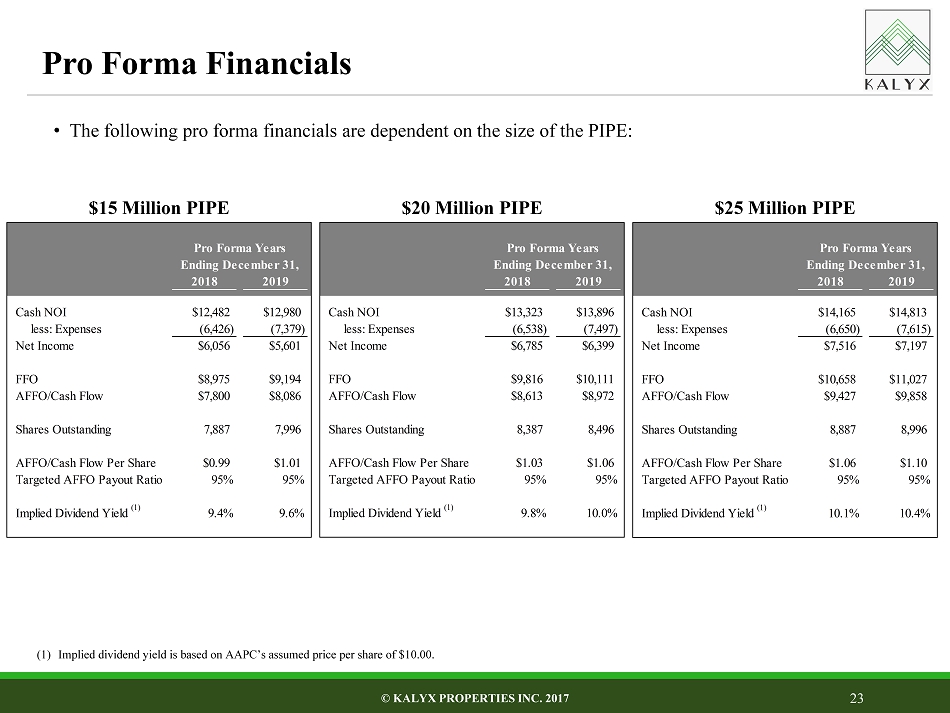

23 © KALYX PROPERTIES INC. 2017 • The following pro forma financials are dependent on the size of the PIPE: $15 Million PIPE $20 Million PIPE $25 Million PIPE Pro Forma Financials 2018 2019 Cash NOI $12,482 $12,980 less: Expenses (6,426) (7,379) Net Income $6,056 $5,601 FFO $8,975 $9,194 AFFO/Cash Flow $7,800 $8,086 Shares Outstanding 7,887 7,996 AFFO/Cash Flow Per Share $0.99 $1.01 Targeted AFFO Payout Ratio 95% 95% Implied Dividend Yield (1) 9.4% 9.6% Pro Forma Years Ending December 31, 2018 2019 Cash NOI $13,323 $13,896 less: Expenses (6,538) (7,497) Net Income $6,785 $6,399 FFO $9,816 $10,111 AFFO/Cash Flow $8,613 $8,972 Shares Outstanding 8,387 8,496 AFFO/Cash Flow Per Share $1.03 $1.06 Targeted AFFO Payout Ratio 95% 95% Implied Dividend Yield (1) 9.8% 10.0% Pro Forma Years Ending December 31, 2018 2019 Cash NOI $14,165 $14,813 less: Expenses (6,650) (7,615) Net Income $7,516 $7,197 FFO $10,658 $11,027 AFFO/Cash Flow $9,427 $9,858 Shares Outstanding 8,887 8,996 AFFO/Cash Flow Per Share $1.06 $1.10 Targeted AFFO Payout Ratio 95% 95% Implied Dividend Yield (1) 10.1% 10.4% Pro Forma Years Ending December 31, (1) Implied dividend yield is based on AAPC’s assumed price per share of $10.00.

24 © KALYX PROPERTIES INC. 2017 • The following pro forma balance sheet assumes a $20 million PIPE: Pro Forma Balance Sheet Pro Forma March 31, March 31, 2017 Adjustments 2017 Assets Real estate assets $99,029 $65,143 33,886 Cash and cash equivalents 5,000 4,497 503 Note receivable 2,335 - 2,335 Total Assets $106,365 $69,640 36,724 Liabilities Corporate loan $8,000 $8,000 $0 Property debt 15,580 6,797 8,782 Total Liabilities $23,580 $14,797 $8,782 Equity Preferred stock $0 ($27,942) $27,942 Common stock 74,568 74,568 - OP units 8,217 8,217 - Total equity + liabilities $106,365 $69,640 $36,724

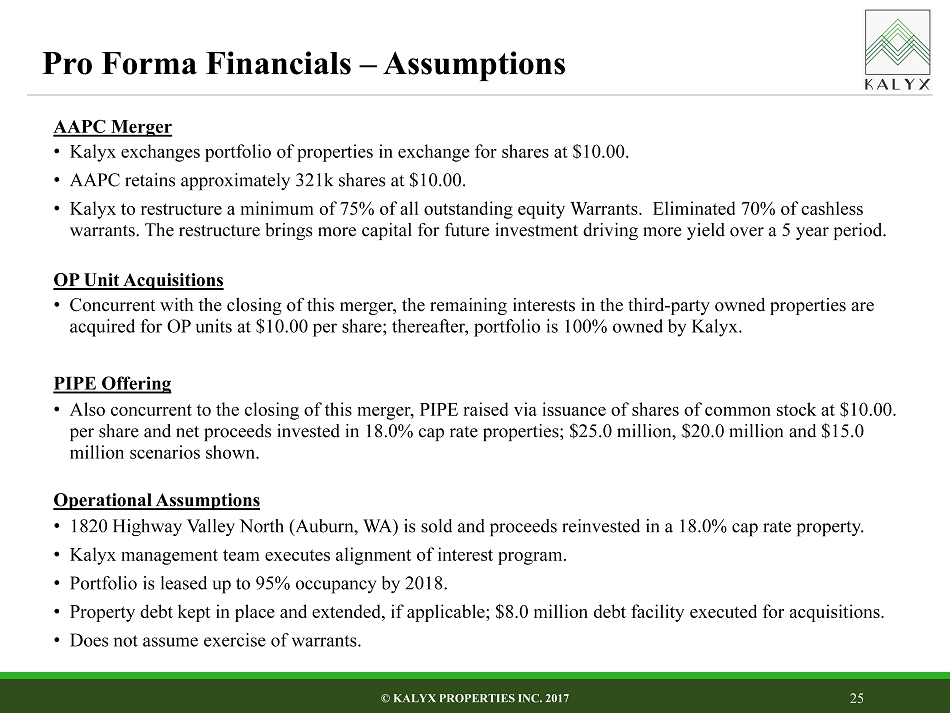

25 © KALYX PROPERTIES INC. 2017 AAPC Merger • Kalyx exchanges portfolio of properties in exchange for shares at $10.00. • AAPC retains approximately 321k shares at $10.00. • Kalyx to restructure a minimum of 75% of all outstanding equity Warrants. Eliminated 70% of cashless warrants. The restructure brings more capital for future investment driving more yield over a 5 year period. OP Unit Acquisitions • Concurrent with the closing of this merger, the remaining interests in the third - party owned properties are acquired for OP units at $10.00 per share; thereafter, portfolio is 100% owned by Kalyx. PIPE Offering • Also concurrent to the closing of this merger, PIPE raised via issuance of shares of common stock at $10.00. per share and net proceeds invested in 18.0% cap rate properties; $25.0 million, $20.0 million and $15.0 million scenarios shown. Operational Assumptions • 1820 Highway Valley North (Auburn, WA) is sold and proceeds reinvested in a 18.0% cap rate property. • Kalyx management team executes alignment of interest program. • Portfolio is leased up to 95% occupancy by 2018. • Property debt kept in place and extended, if applicable; $8.0 million debt facility executed for acquisitions. • Does not assume exercise of warrants. Pro Forma Financials – Assumptions

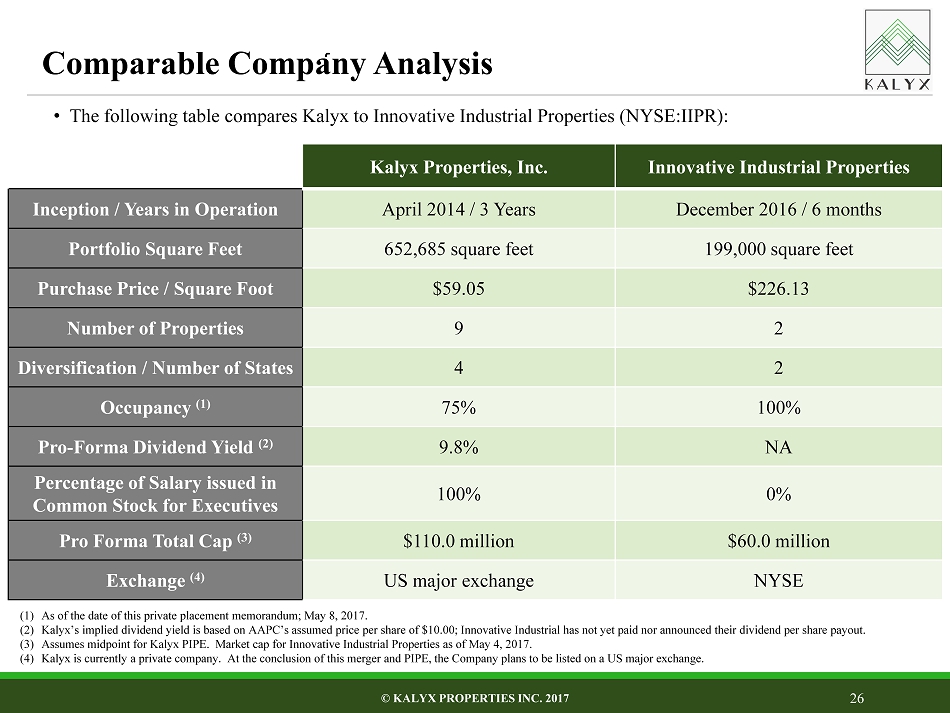

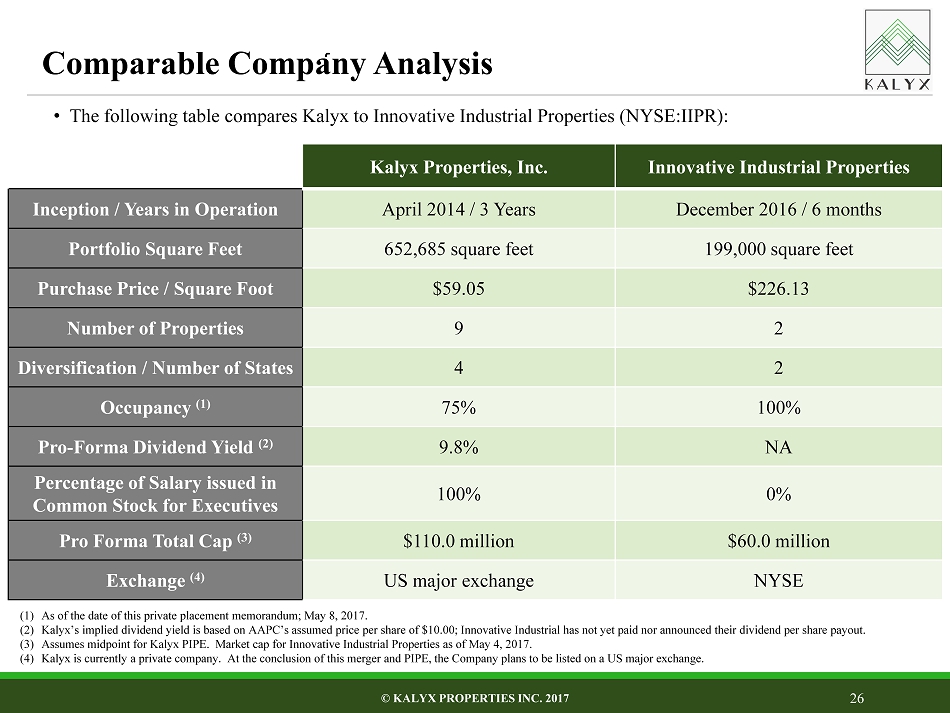

26 © KALYX PROPERTIES INC. 2017 Kalyx Properties, Inc. Innovative Industrial Properties Inception / Years in Operation April 2014 / 3 Years December 2016 / 6 months Portfolio Square Feet 652,685 square feet 199,000 square feet Purchase Price / Square Foot $59.05 $226.13 Number of Properties 9 2 Diversification / Number of States 4 2 Occupancy (1) 75% 100% Pro - Forma Dividend Yield (2) 9.8% NA Percentage of Salary issued in Common Stock for Executives 100% 0% Pro Forma Total Cap (3) $110.0 million $60.0 million Exchange (4) US major exchange NYSE (1) As of the date of this private placement memorandum ; May 8 , 2017 . (2) Kalyx’s implied dividend yield is based on AAPC’s assumed price per share of $ 10 . 00 ; Innovative Industrial has not yet paid nor announced their dividend per share payout . (3) Assumes midpoint for Kalyx PIPE . Market cap for Innovative Industrial Properties as of May 4 , 2017 . (4) Kalyx is currently a private company . At the conclusion of this merger and PIPE, the Company plans to be listed on a US major exchange . • The following table compares Kalyx to Innovative Industrial Properties (NYSE:IIPR): Comparable Company Analysis

7

© KALYX PROPERTIES INC. 2017 Strong and Diversified Operating Portfolio Attractive and Disciplined Investment Focus Extensive Relationships with Cannabis Operators, Intermediaries and Property Owners Experienced Management Team Real Estate and Investment Expertise Growth Oriented Capital Structure Significant Alignment of Interests Investment Opportunity