The Indenture Trustee, the Administrative Agent and the Collateral Agent

Computershare Trust Company, N.A., or Computershare Trust Company, will be the indenture trustee (in such capacity, the indenture trustee) under the Indenture, the administrative agent (in such capacity, the administrative agent) under the Exchange Note Supplement to the Credit and Security Agreement and the collateral agent (in such capacity, the collateral agent) under the Exchange Note Supplement. Computershare Trust Company is a national banking association and a wholly-owned subsidiary of Computershare Limited an Australian financial services company with approximately $5.1 billion (USD) in assets as of June 30, 2024. Computershare Limited and its affiliates have been engaging in financial service activities, including stock transfer related services, since 1997, and corporate trust related services since 2000. Computershare Trust Company provides corporate trust, custody, securities transfer, cash management, investment management and other financial and fiduciary services, and has been engaged in providing financial services, including corporate trust services, since 2000. The transaction parties may maintain commercial relationships with Computershare Trust Company and its affiliates. Computershare Trust Company maintains corporate trust offices at 9062 Old Annapolis Road, Columbia, Maryland 21045-1951 (among other locations), and its office for correspondence related to certificate transfer services is located at 1505 Energy Park Drive, St Paul, Minnesota 55108.

On November 1, 2021, Wells Fargo Bank, N.A. and Wells Fargo Delaware Trust Company, N.A. (collectively, “Wells Fargo”) sold substantially all of its Corporate Trust Services (“CTS”) business to Computershare Limited, Computershare Trust Company, and Computershare Delaware Trust Company (collectively, “Computershare”). Virtually all CTS employees of Wells Fargo, along with most existing CTS systems, technology, and offices transferred to Computershare as part of the sale. On and after November 1, 2021, Wells Fargo has been transferring its roles, duties, rights, and liabilities under the relevant transaction agreements to Computershare. For any transaction where the roles of Wells Fargo have not yet transferred to Computershare, Computershare, as of November 1, 2021, performs all or virtually all of the obligations of Wells Fargo as its agent as of such date.

Computershare Trust Company has provided corporate trust related services since 2000 through its predecessors and affiliates. Computershare Trust Company provides trustee services for a variety of transactions and asset types, including corporate and municipal bonds, mortgage-backed and asset-backed securities, and collateralized debt obligations. As of June 30, 2024, Computershare Trust Company was acting in most cases as the named trustee or indenture trustee, and in some cases as agent for the named trustee or indenture trustee, on approximately 496 asset-backed securities transactions with an aggregate outstanding principal balance of approximately $113 billion (USD). Computershare Trust Company maintains a corporate trust office for correspondence purposes at 1505 Energy Park Drive, St. Paul, Minnesota 55108, Attn: Asset-Backed Securities Department. As a result of Computershare Trust Company not being a deposit-taking institution, any cash credited to accounts that the indenture trustee is required to maintain pursuant to the Indenture will be held by one or more institutions in a manner satisfying the requirements of the Indenture, including any applicable eligibility criteria for account banks set forth in the Indenture.

Other than the above three paragraphs, Computershare Trust Company has not participated in the preparation of, and is not responsible for, any other information contained in this prospectus.

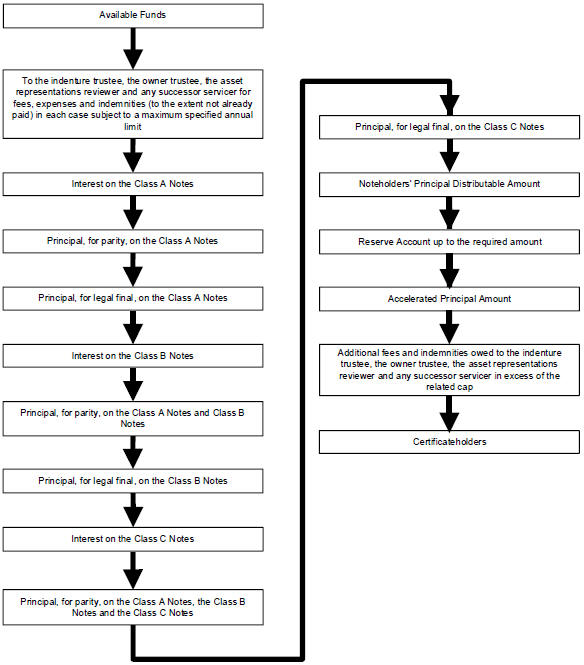

The fees, expenses and indemnities of the administrative agent, collateral agent and indenture trustee will be paid by the issuing entity, to the extent those amounts are not paid or reimbursed by the servicer or administrator.

The issuing entity will cause the administrator to indemnify the indenture trustee, collateral agent and their respective officers, directors, employees and agents against any and all loss, liability or expense (including attorneys’ fees, court costs and expenses, including any losses incurred in connection with (i) any action or suit brought by the indenture trustee or collateral agent to enforce any indemnification or

47