Exhibit 99.1 Valuation and Portfolio Update Meeting December 12, 2019

Important The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Growth & Income Real Estate Investment Trust’s (the “Company or KBS Growth & Income REIT or KBS G&I REIT”) Annual Report on Form 10-K for the year ended December 31, 2018 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period Disclosures ended September 30, 2019 (the “Quarterly Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value KBS G&I REIT’s assets and liabilities in connection with the calculation of KBS G&I REIT’s estimated value per share, see KBS G&I REIT’s Current Report on Form 8-K dated December 4, 2019 (the “Valuation 8-K”). Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward- looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through September 30, 2019 have been funded in part with cash flow from operating activities and in part with debt financing, including advances from the Company’s advisor. In addition, distributions have been funded with cash resulting from the advisor’s waiver and deferral of its asset management fee. There are no guarantees that the Company will continue to pay distributions or that distributions at the current rate are sustainable. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the NAV per share, the appraisal methodology used for the appraised properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the appraised properties, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, are the respective party’s best estimates as of September 30, 2019, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties and the estimated value per share. These statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Company’s Annual Report. WWW. KBS.COM 2

Transactional volume in excess of $42.3 billion1, About KBS AUM of $11.2 billion1 and 35.3 million square feet under management1. Formed by Peter Bren and Chuck 8th Largest Office Owner Globally, National Schreiber in 1992. Real Estate Investor2. Over 26 years of investment and Among Top 44 Global Real Estate Investment management experience with Managers, Pensions & Investments3. extensive long-term investor relationships. Buyer and seller of well-located, yield- generating office and industrial properties. Advisor to public and private pension plans, endowments, foundations, sovereign wealth funds and publicly registered non-traded REITs. 1 As of September 30, 2019. A trusted landlord to thousands of office and 2 The ranking by National Real Estate Investor is based on volume of office space owned globally, as of December 31, industrial tenants nationwide. 2017. The results were generated from a survey conducted by National Real Estate Investor based on a combination of advertising and website promotion of the survey, direct solicitation of responses from participants, direct email to A preferred partner with the nation’s largest National Real Estate Investor subscribers and other identified office owners and daily newsletter promotion of the survey, all lenders. supplemented with a review of public company SEC filings. 3 KBS was ranked #44 on Pensions & Investments List of Largest Real Estate Investment Managers, September 30, 2019. Ranked by total worldwide real estate assets, in millions, as of June 30, 2019. Real estate assets were reported net of leverage, A development partner for office, mixed-use including contributions committed or received, but not yet and multi-family developments. invested. WWW. KBS.COM 3

Regional Focus Map Gateway Target First-tier Target Strong Employment / Growth KBS Offices WWW. KBS.COM 4

Investment Objectives Achieve long-term growth in the value of the portfolio Build a diverse portfolio of core real estate properties Preserve and return stockholders’ capital contributions Provide investors with attractive and stable cash distributions WWW. KBS.COM 5

Office Market EMPLOYMENT INDICATORS* Update Q3 18 Q3 19 12-Mo. Forecast Total Non-Farm Employment 149.4 M 151.5 M p According to Cushman & Wakefield’s Office-Using Employment 32.7 M 33.0 M p Third Quarter 2019 MarketBeat Report, the U.S. economy continued to grow at a Unemployment 3.8% 3.7% p steady pace in the third quarter of 2019, adding approximately 470,000 new jobs, of which 140,000 were in the key office- using sectors. Consumer confidence MARKET INDICATORS* remains solid, indicating shoppers are still Q3 18 Q3 19 12-Mo. Forecast optimistic. As of September 2019, the unemployment rate is at 3.7% . Net Absorption 10.9 M 9.8 M — Under Construction 112.6 M 126.6 M q Weighted Asking Rent (FS) $31.36 $32.63 p *Cushman & Wakefield, MarketBeats 3Q 2019 WWW. KBS.COM 6

KBS Growth & Income REIT 3rd Quarter Portfolio Highlights 7

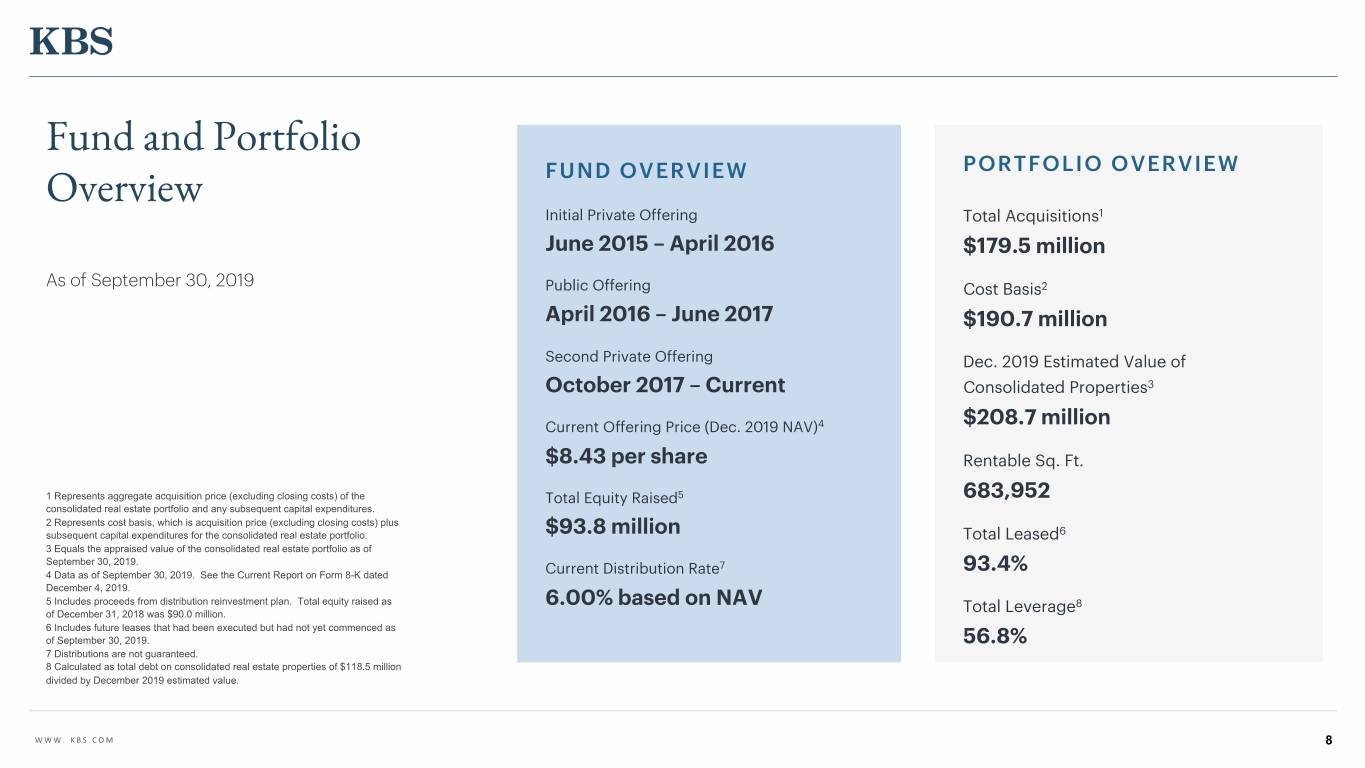

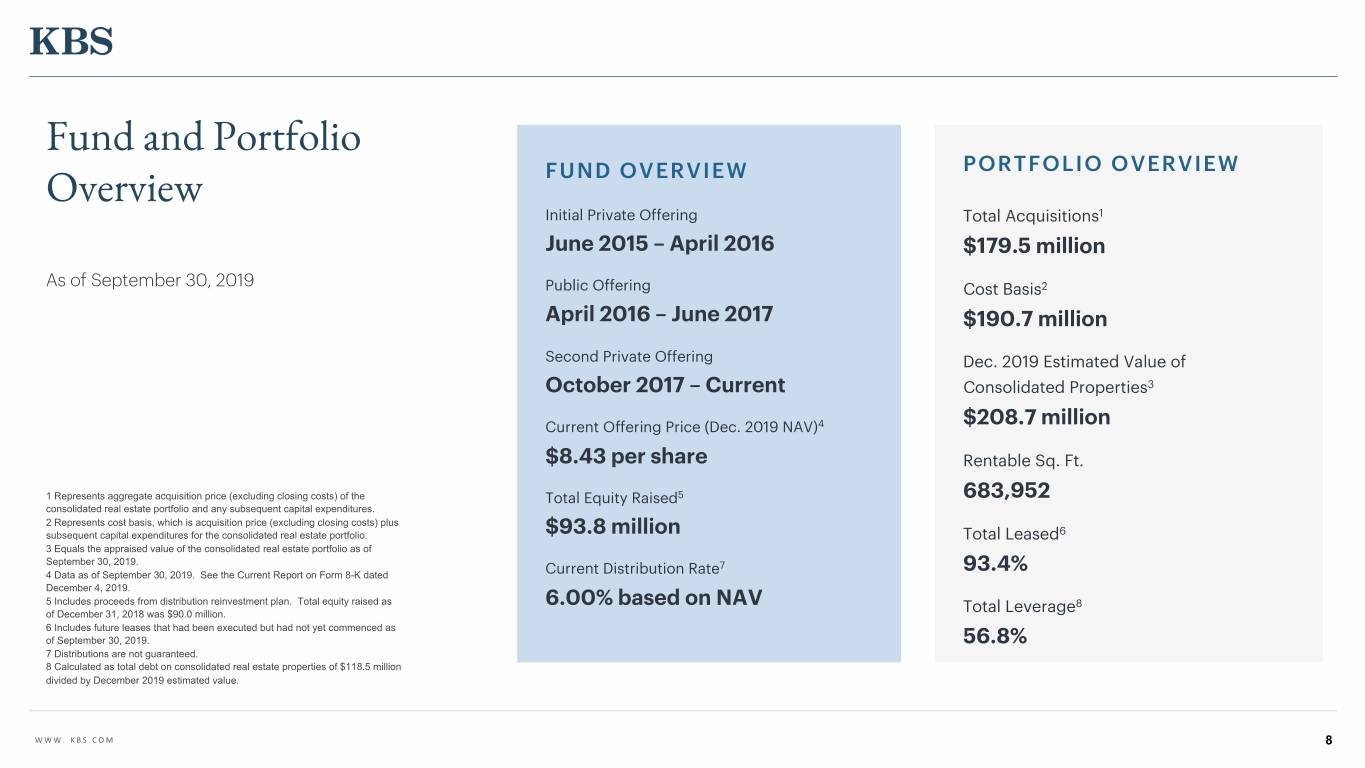

Fund and Portfolio PORTFOLIO OVERVIEW Overview FUND OVERVIEW Initial Private Offering Total Acquisitions1 June 2015 – April 2016 $179.5 million As of September 30, 2019 Public Offering Cost Basis2 April 2016 – June 2017 $190.7 million Second Private Offering Dec. 2019 Estimated Value of October 2017 – Current Consolidated Properties3 Current Offering Price (Dec. 2019 NAV)4 $208.7 million $8.43 per share Rentable Sq. Ft. 1 Represents aggregate acquisition price (excluding closing costs) of the Total Equity Raised5 683,952 consolidated real estate portfolio and any subsequent capital expenditures. 2 Represents cost basis, which is acquisition price (excluding closing costs) plus subsequent capital expenditures for the consolidated real estate portfolio. $93.8 million Total Leased6 3 Equals the appraised value of the consolidated real estate portfolio as of September 30, 2019. 7 93.4% 4 Data as of September 30, 2019. See the Current Report on Form 8-K dated Current Distribution Rate December 4, 2019. 5 Includes proceeds from distribution reinvestment plan. Total equity raised as 6.00% based on NAV 8 of December 31, 2018 was $90.0 million. Total Leverage 6 Includes future leases that had been executed but had not yet commenced as of September 30, 2019. 56.8% 7 Distributions are not guaranteed. 8 Calculated as total debt on consolidated real estate properties of $118.5 million divided by December 2019 estimated value. WWW. KBS.COM 8

OCCUPANCY PROPERTY NAME, CITY PROPERTY TYPE / ACQUISITION PURCHASE LEASED % AS Portfolio SIZE (SF) % AT STATE NO. OF BUILDINGS DATE PRICE1 OF 9/30/192 ACQUISITION Highlights Von Karman Tech 3 As of September 30, 2019 Center Office 1 Building 8/12/2015 101,161 $21,277,000 100% 88% Irvine, CA Commonwealth Building Office 1 Building 6/30/2016 224,122 68,545,000 96% 97% Portland, OR The Offices at Greenhouse Office 1 Building 11/14/2016 203,284 46,489,000 95% 100% Houston, TX 213 West Institute Place Office 1 Building 11/9/2017 155,385 43,155,000 92% 84% Chicago, IL 1 Purchase price reflects contractual purchase price, net of closing credits, and excludes acquisition fees and expenses. 2 Total leased percentage includes future leases that have been executed but have not yet commenced as of September TOTAL / WEIGHTED AVG. 683,952 $179,466,000 96% 93% 30, 2019. 3 On November 25, 2019, KBS G&I REIT entered into an agreement to sell Von Karman Tech Center to an unaffiliated purchaser for a gross sales price of $25.4 million. WWW. KBS.COM 9

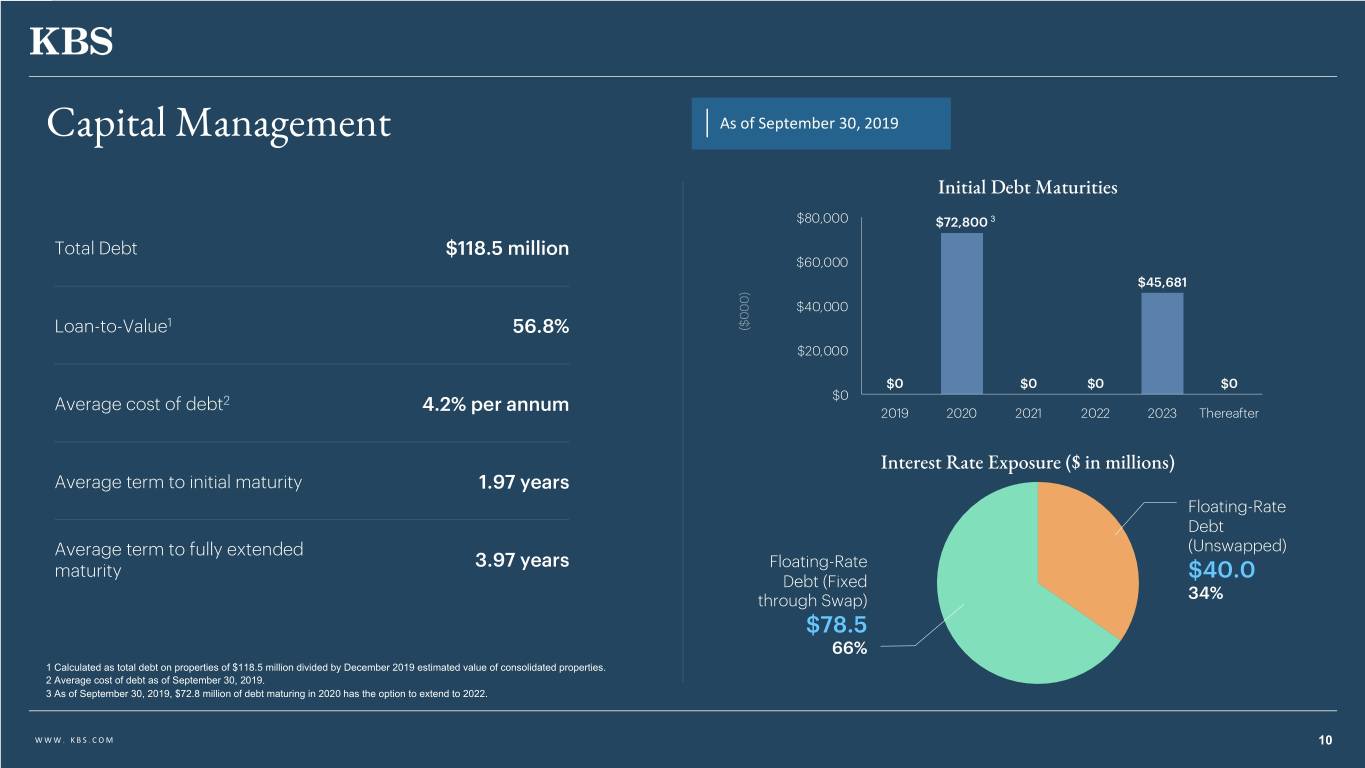

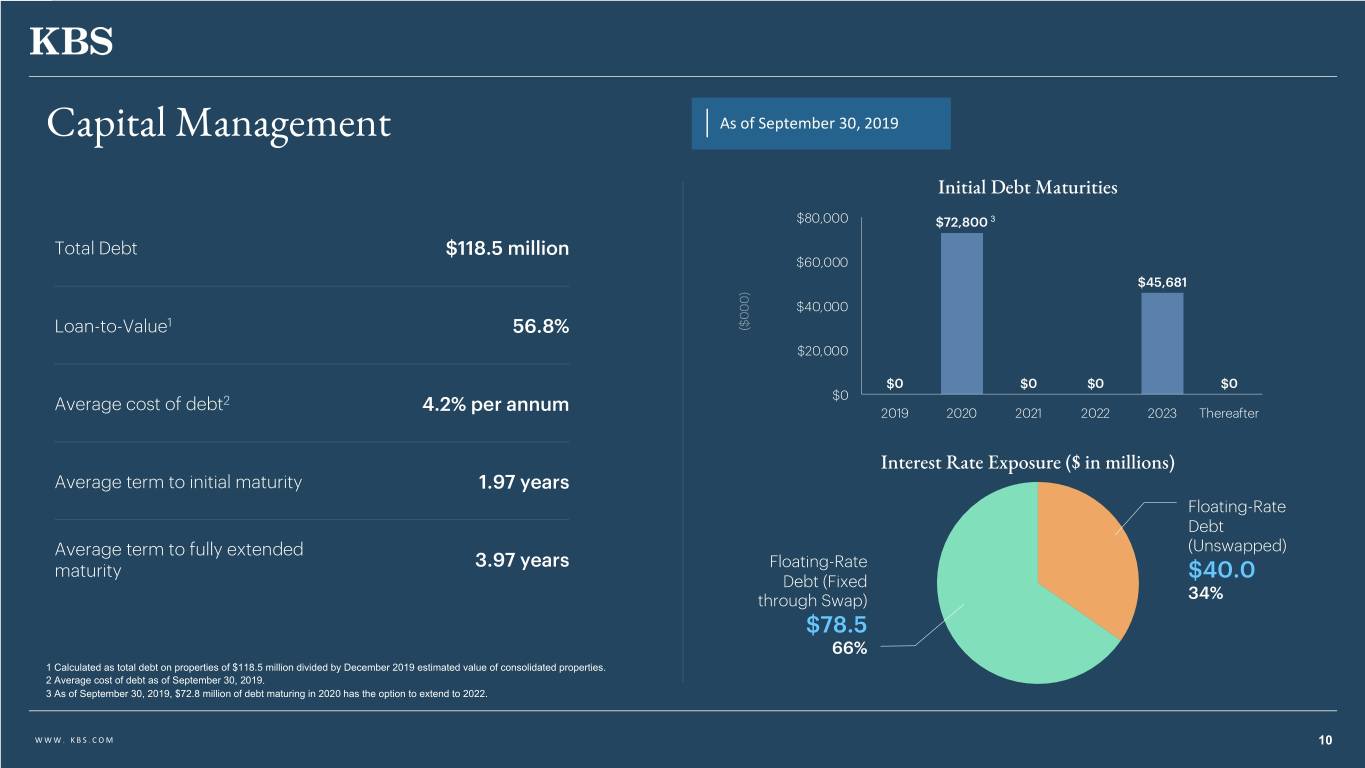

Capital Management As of September 30, 2019 Initial Debt Maturities $80,000 $72,800 3 Total Debt $118.5 million $60,000 $45,681 $40,000 Loan-to-Value1 56.8% $20,000 $0 $0 $0 $0 Average cost of debt2 $0 4.2% per annum 2019 2020 2021 2022 2023 Thereafter Interest Rate Exposure ($ in millions) Average term to initial maturity 1.97 years Floating-Rate Debt Average term to fully extended (Unswapped) 3.97 years Floating-Rate maturity $40.0 Debt (Fixed through Swap) 34% $78.5 66% 1 Calculated as total debt on properties of $118.5 million divided by December 2019 estimated value of consolidated properties. 2 Average cost of debt as of September 30, 2019. 3 As of September 30, 2019, $72.8 million of debt maturing in 2020 has the option to extend to 2022. WWW. KBS.COM 10

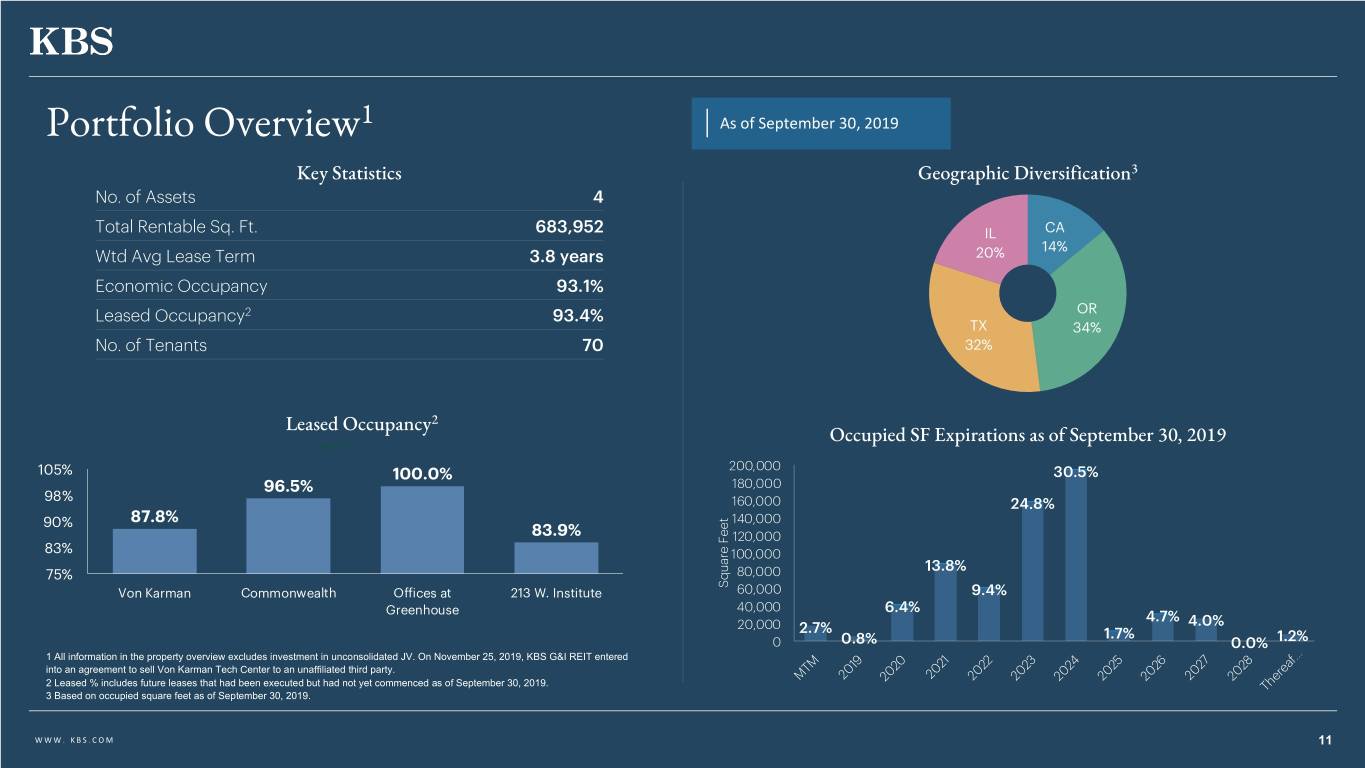

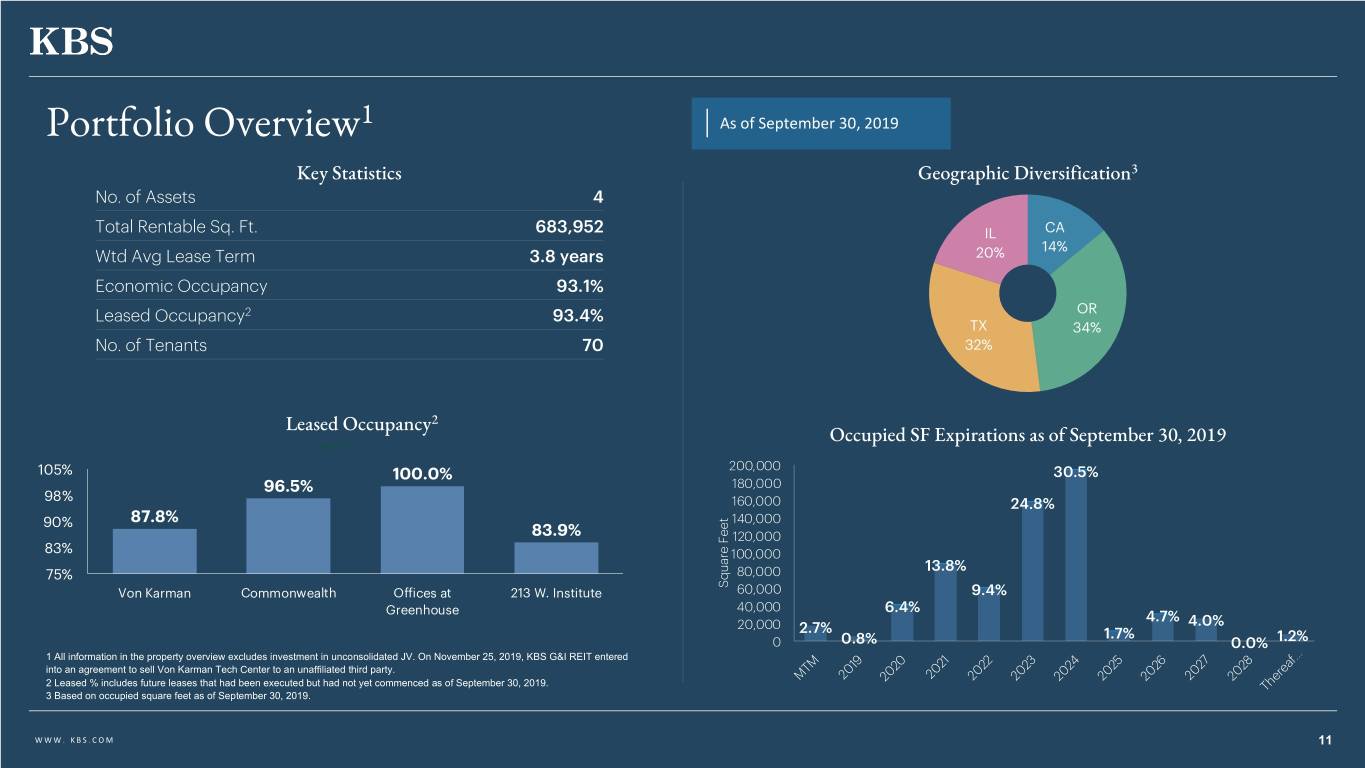

Portfolio Overview1 As of September 30, 2019 Key Statistics Geographic Diversification3 No. of Assets 4 Total Rentable Sq. Ft. 683,952 IL CA 14% Wtd Avg Lease Term 3.8 years 20% Economic Occupancy 93.1% Leased Occupancy2 93.4% OR TX 34% No. of Tenants 70 32% Leased Occupancy2 Region 1 Occupied SF Expirations as of September 30, 2019 105% 100.0% 200,000 30.5% 96.5% 180,000 98% 160,000 24.8% 90% 87.8% 140,000 83.9% 120,000 83% 100,000 13.8% 75% 80,000 Von Karman Commonwealth Offices at 213 W. Institute Square Feet 60,000 9.4% 40,000 6.4% Greenhouse 4.7% 20,000 4.0% 2.7% 1.7% 0 0.8% 0.0% 1.2% 1 All information in the property overview excludes investment in unconsolidated JV. On November 25, 2019, KBS G&I REIT entered into an agreement to sell Von Karman Tech Center to an unaffiliated third party. MTM 2019 2021 2022 2023 2025 2027 2 Leased % includes future leases that had been executed but had not yet commenced as of September 30, 2019. 2020 2024 2026 2028 Thereaf… 3 Based on occupied square feet as of September 30, 2019. WWW. KBS.COM 11

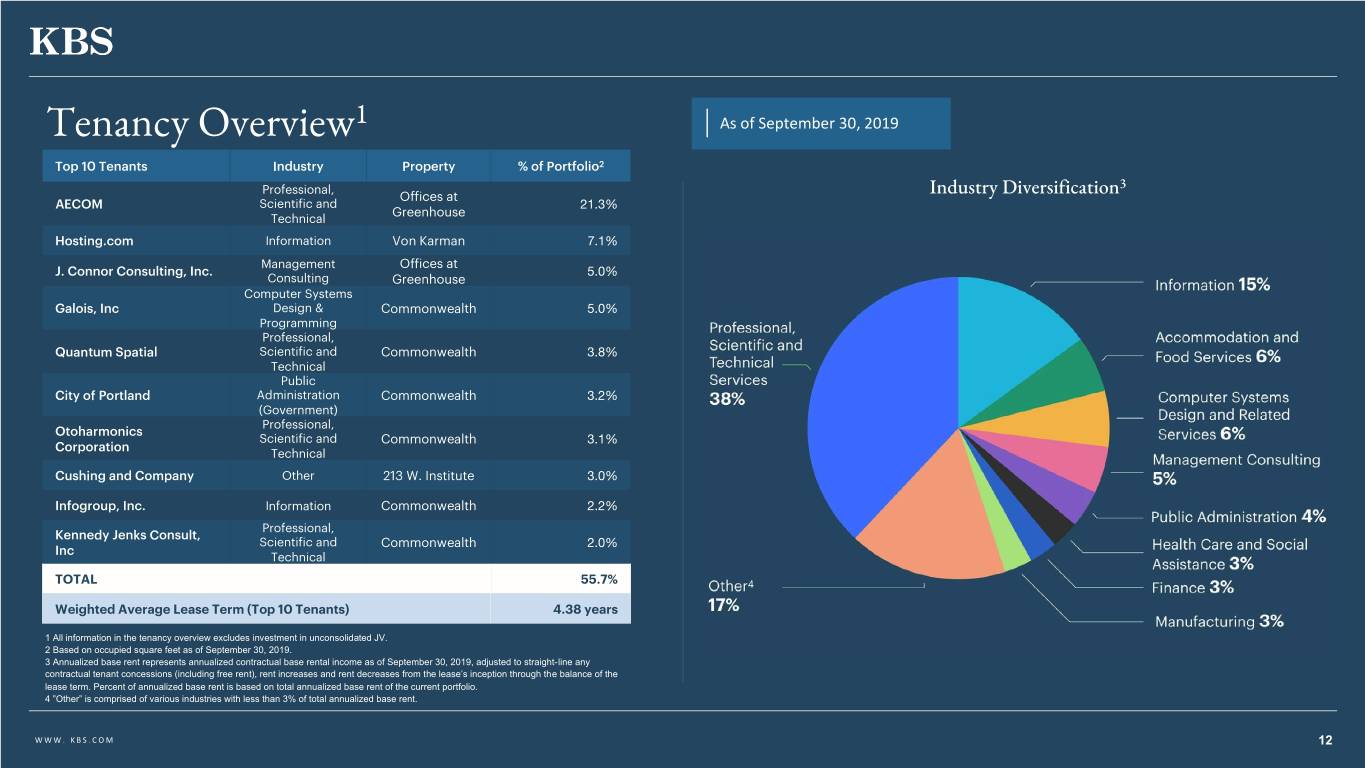

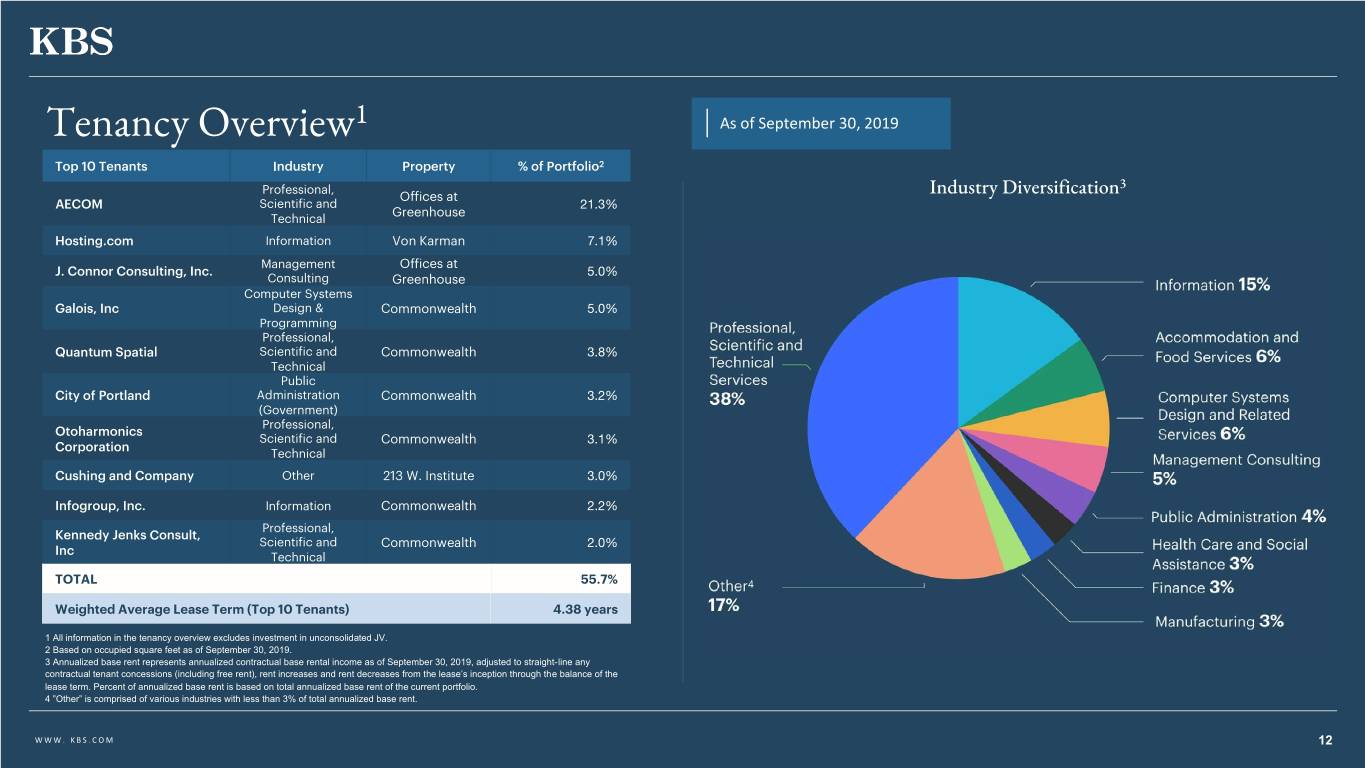

Tenancy Overview1 As of September 30, 2019 Top 10 Tenants Industry Property % of Portfolio2 Professional, 3 Offices at Industry Diversification AECOM Scientific and 21.3% Greenhouse Technical Hosting.com Information Von Karman 7.1% Management Offices at J. Connor Consulting, Inc. 5.0% Consulting Greenhouse Computer Systems Galois, Inc Design & Commonwealth 5.0% Programming Professional, Quantum Spatial Scientific and Commonwealth 3.8% Technical Public City of Portland Administration Commonwealth 3.2% (Government) Professional, Otoharmonics Scientific and Commonwealth 3.1% Corporation Technical Cushing and Company Other 213 W. Institute 3.0% Infogroup, Inc. Information Commonwealth 2.2% Professional, Kennedy Jenks Consult, Scientific and Commonwealth 2.0% Inc Technical TOTAL 55.7% Weighted Average Lease Term (Top 10 Tenants) 4.38 years 1 All information in the tenancy overview excludes investment in unconsolidated JV. 2 Based on occupied square feet as of September 30, 2019. 3 Annualized base rent represents annualized contractual base rental income as of September 30, 2019, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. 4 ”Other” is comprised of various industries with less than 3% of total annualized base rent. WWW. KBS.COM 12

December 2019 Estimated Value Per Share 13

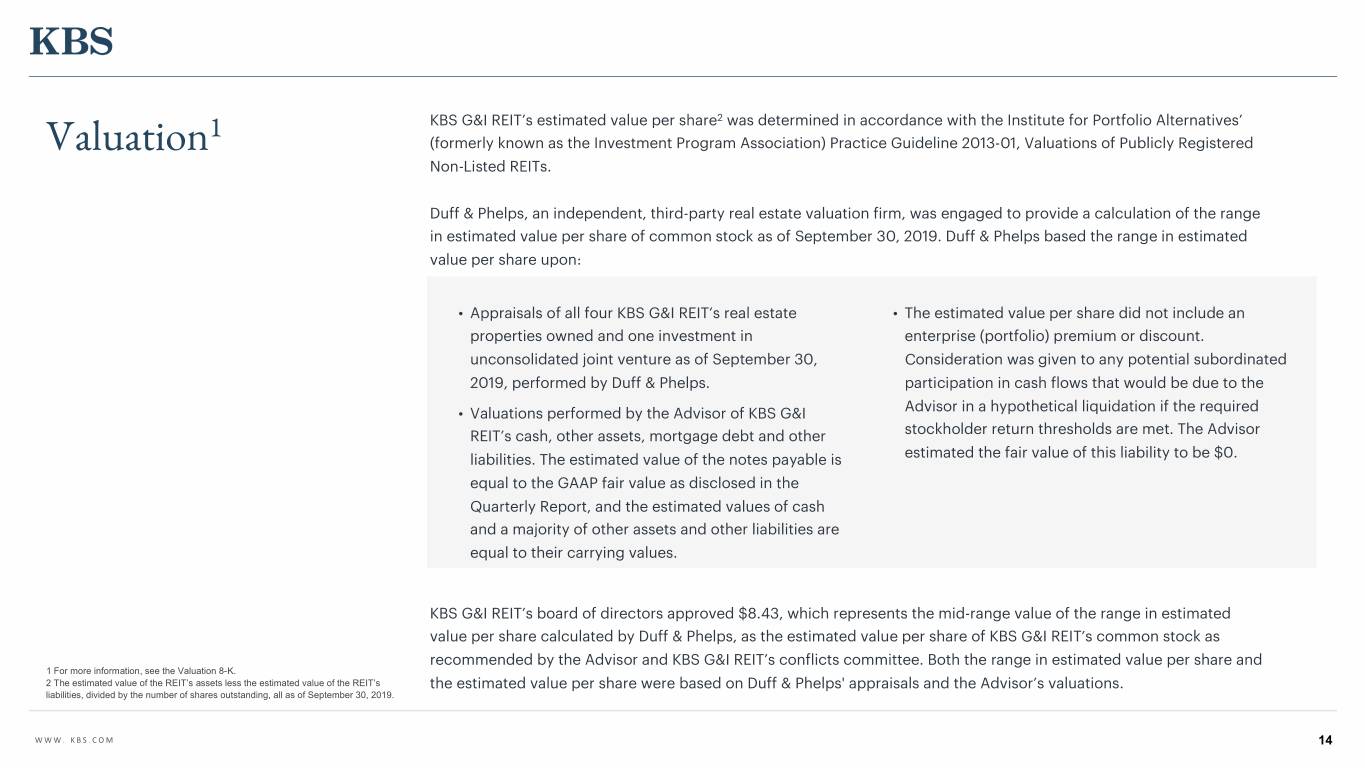

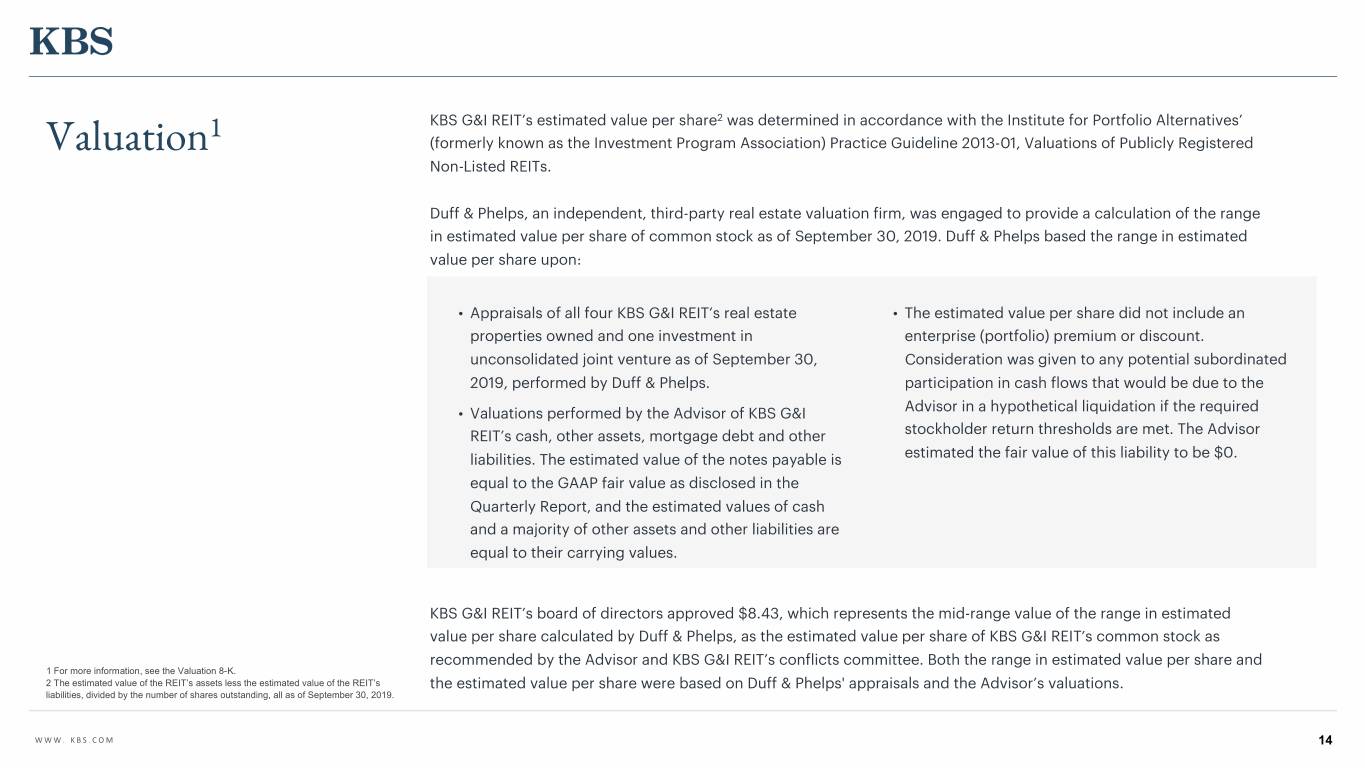

1 KBS G&I REIT’s estimated value per share2 was determined in accordance with the Institute for Portfolio Alternatives’ Valuation (formerly known as the Investment Program Association) Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs. Duff & Phelps, an independent, third-party real estate valuation firm, was engaged to provide a calculation of the range in estimated value per share of common stock as of September 30, 2019. Duff & Phelps based the range in estimated value per share upon: • Appraisals of all four KBS G&I REIT’s real estate • The estimated value per share did not include an properties owned and one investment in enterprise (portfolio) premium or discount. unconsolidated joint venture as of September 30, Consideration was given to any potential subordinated 2019, performed by Duff & Phelps. participation in cash flows that would be due to the • Valuations performed by the Advisor of KBS G&I Advisor in a hypothetical liquidation if the required REIT’s cash, other assets, mortgage debt and other stockholder return thresholds are met. The Advisor liabilities. The estimated value of the notes payable is estimated the fair value of this liability to be $0. equal to the GAAP fair value as disclosed in the Quarterly Report, and the estimated values of cash and a majority of other assets and other liabilities are equal to their carrying values. KBS G&I REIT’s board of directors approved $8.43, which represents the mid-range value of the range in estimated value per share calculated by Duff & Phelps, as the estimated value per share of KBS G&I REIT’s common stock as recommended by the Advisor and KBS G&I REIT’s conflicts committee. Both the range in estimated value per share and 1 For more information, see the Valuation 8-K. 2 The estimated value of the REIT’s assets less the estimated value of the REIT’s the estimated value per share were based on Duff & Phelps' appraisals and the Advisor’s valuations. liabilities, divided by the number of shares outstanding, all as of September 30, 2019. WWW. KBS.COM 14

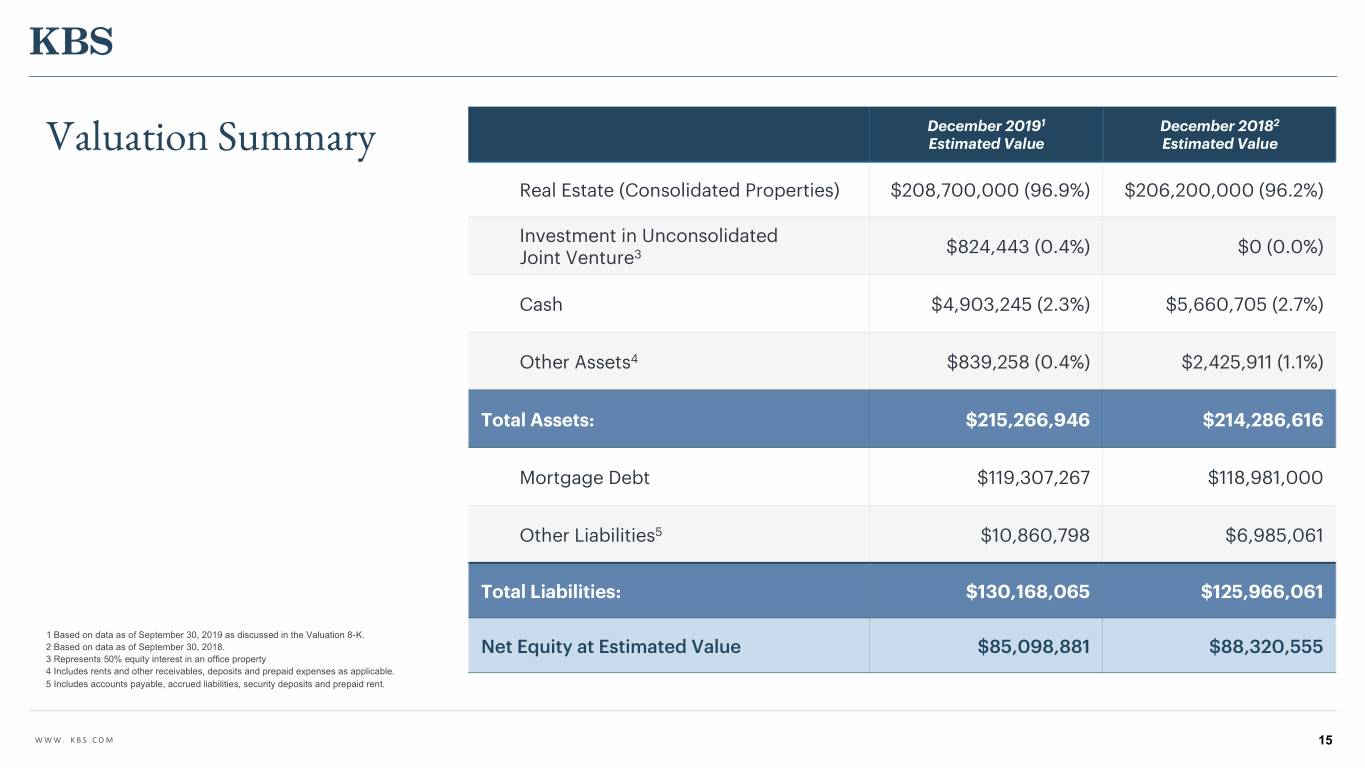

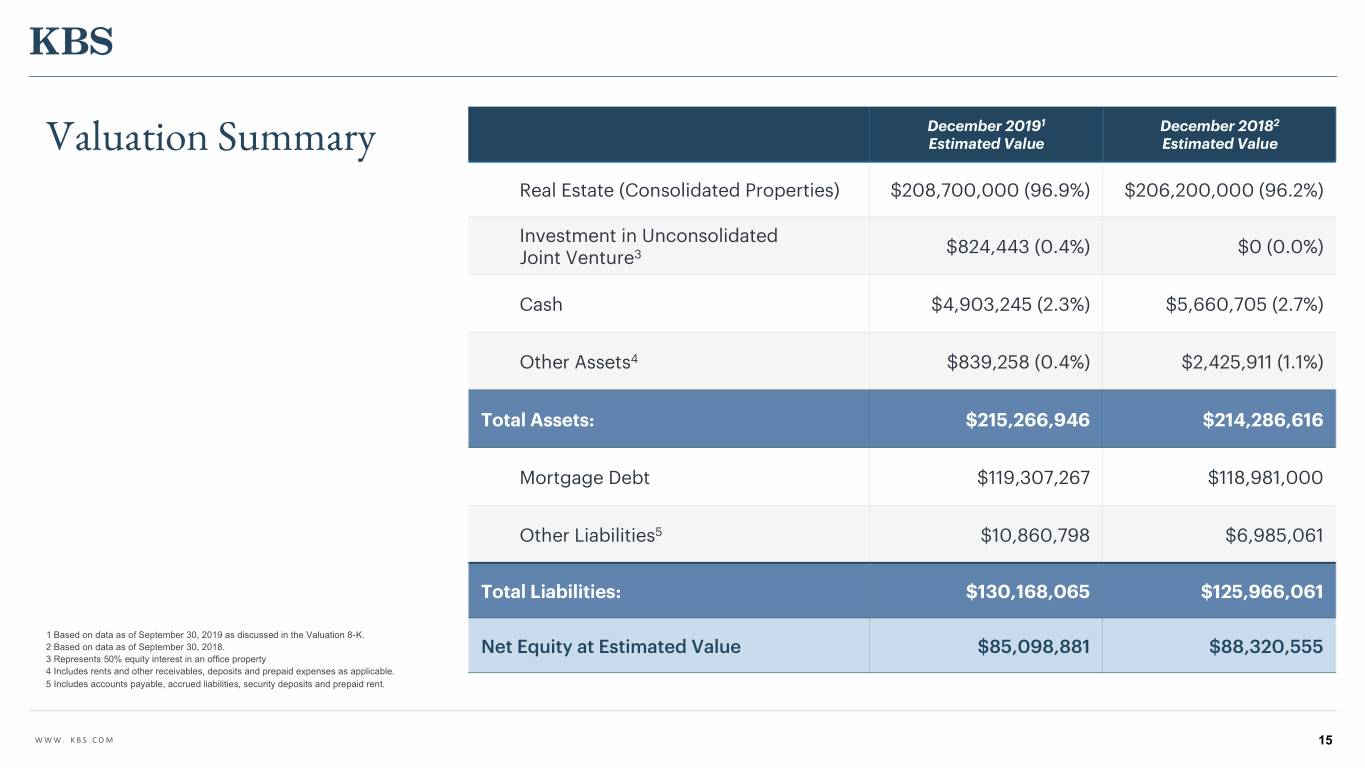

December 20191 December 20182 Valuation Summary Estimated Value Estimated Value Real Estate (Consolidated Properties) $208,700,000 (96.9%) $206,200,000 (96.2%) Investment in Unconsolidated $824,443 (0.4%) $0 (0.0%) Joint Venture3 Cash $4,903,245 (2.3%) $5,660,705 (2.7%) Other Assets4 $839,258 (0.4%) $2,425,911 (1.1%) Total Assets: $215,266,946 $214,286,616 Mortgage Debt $119,307,267 $118,981,000 Other Liabilities5 $10,860,798 $6,985,061 Total Liabilities: $130,168,065 $125,966,061 1 Based on data as of September 30, 2019 as discussed in the Valuation 8-K. 2 Based on data as of September 30, 2018. Net Equity at Estimated Value $85,098,881 $88,320,555 3 Represents 50% equity interest in an office property 4 Includes rents and other receivables, deposits and prepaid expenses as applicable. 5 Includes accounts payable, accrued liabilities, security deposits and prepaid rent. WWW. KBS.COM 15

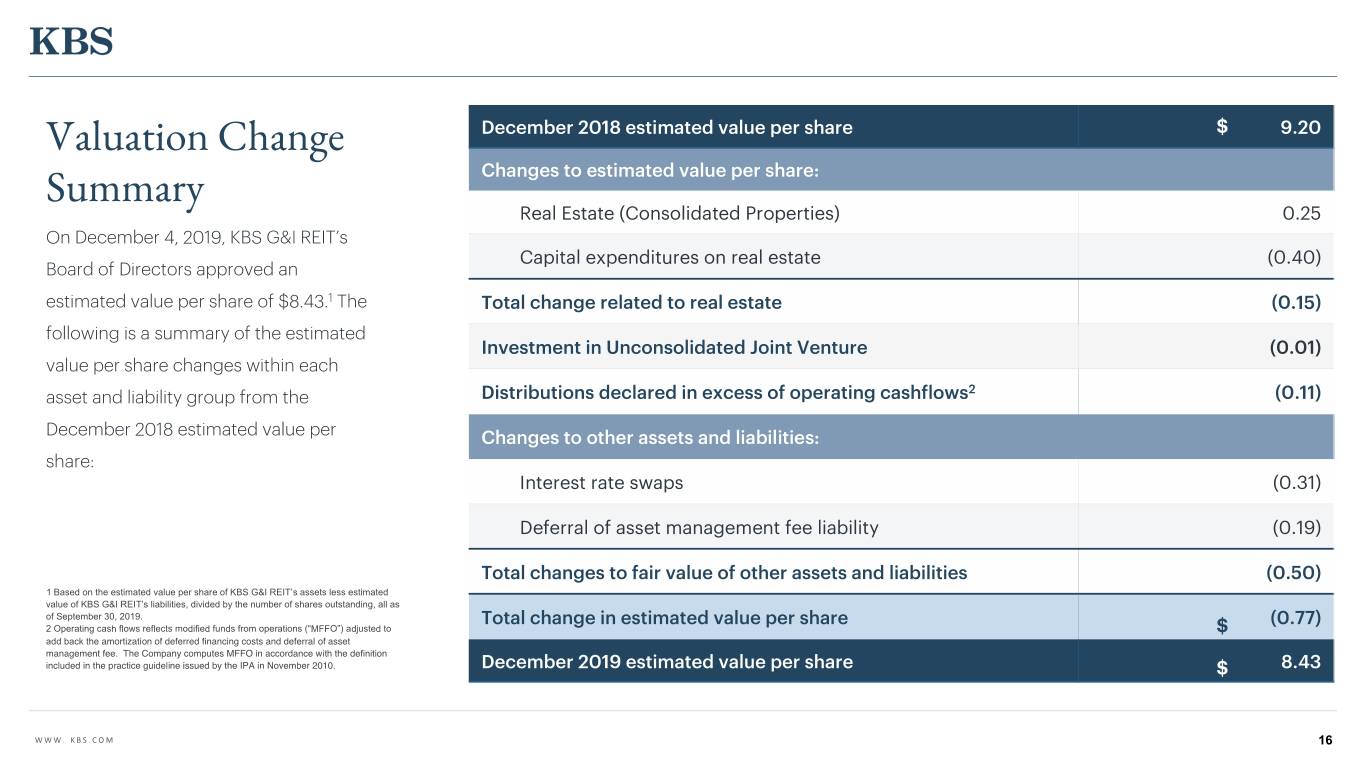

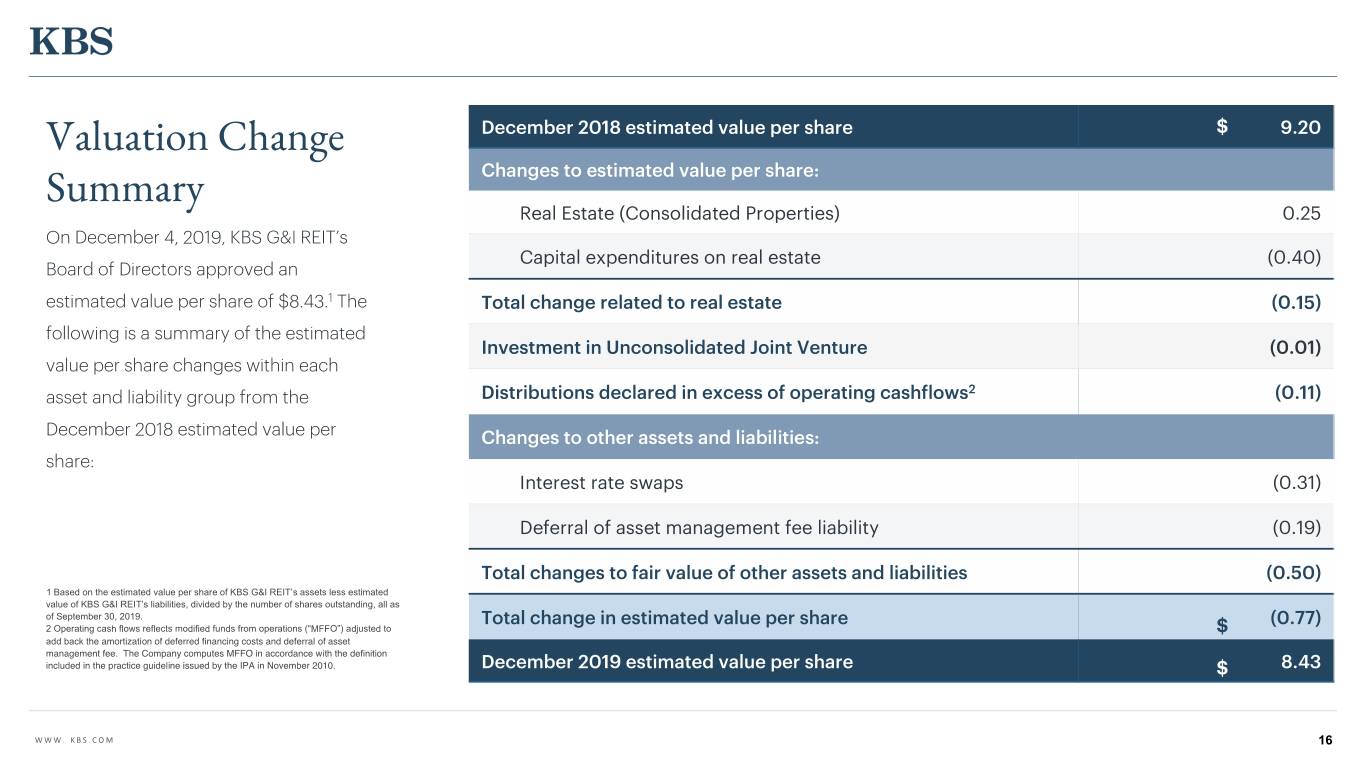

Valuation Change December 2018 estimated value per share $ 9.20 Changes to estimated value per share: Summary Real Estate (Consolidated Properties) 0.25 On December 4, 2019, KBS G&I REIT’s Capital expenditures on real estate (0.40) Board of Directors approved an estimated value per share of $8.43.1 The Total change related to real estate (0.15) following is a summary of the estimated Investment in Unconsolidated Joint Venture (0.01) value per share changes within each asset and liability group from the Distributions declared in excess of operating cashflows2 (0.11) December 2018 estimated value per Changes to other assets and liabilities: share: Interest rate swaps (0.31) Deferral of asset management fee liability (0.19) Total changes to fair value of other assets and liabilities (0.50) 1 Based on the estimated value per share of KBS G&I REIT’s assets less estimated value of KBS G&I REIT’s liabilities, divided by the number of shares outstanding, all as of September 30, 2019. Total change in estimated value per share (0.77) 2 Operating cash flows reflects modified funds from operations (“MFFO”) adjusted to $ add back the amortization of deferred financing costs and deferral of asset management fee. The Company computes MFFO in accordance with the definition included in the practice guideline issued by the IPA in November 2010. December 2019 estimated value per share $ 8.43 WWW. KBS.COM 16

Valuation Review On December 4, 2019, KBS G&I REIT’s Board of Directors approved an estimated value per share of $8.43.1 The decrease in the estimated value per share was primarily due to the following: • An increase in fair value of interest rate swap liabilities • Distributions paid in excess of operating cash flows • Accrued and deferred asset management fees • Change in real estate value 1 Data as of September 30, 2019. See the Valuation 8-K dated December 4, 2019. WWW. KBS.COM 17

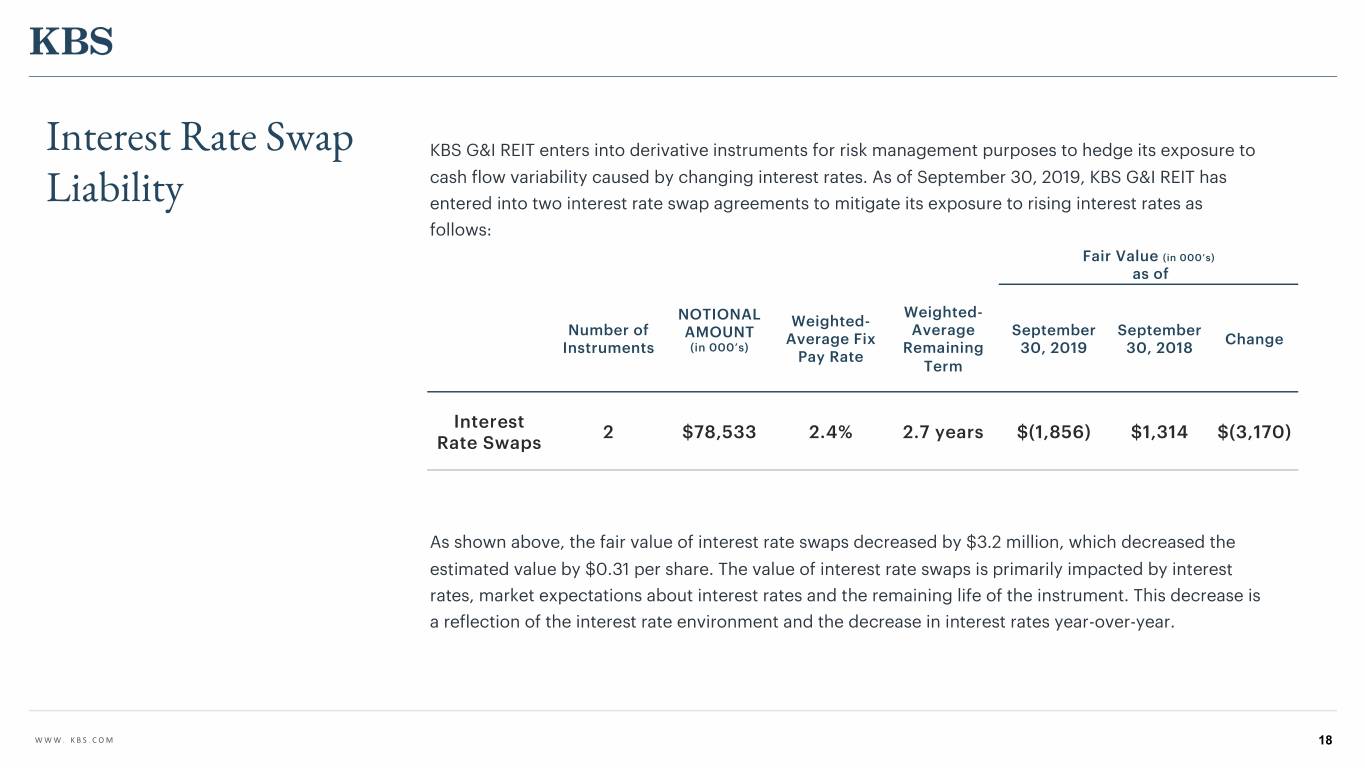

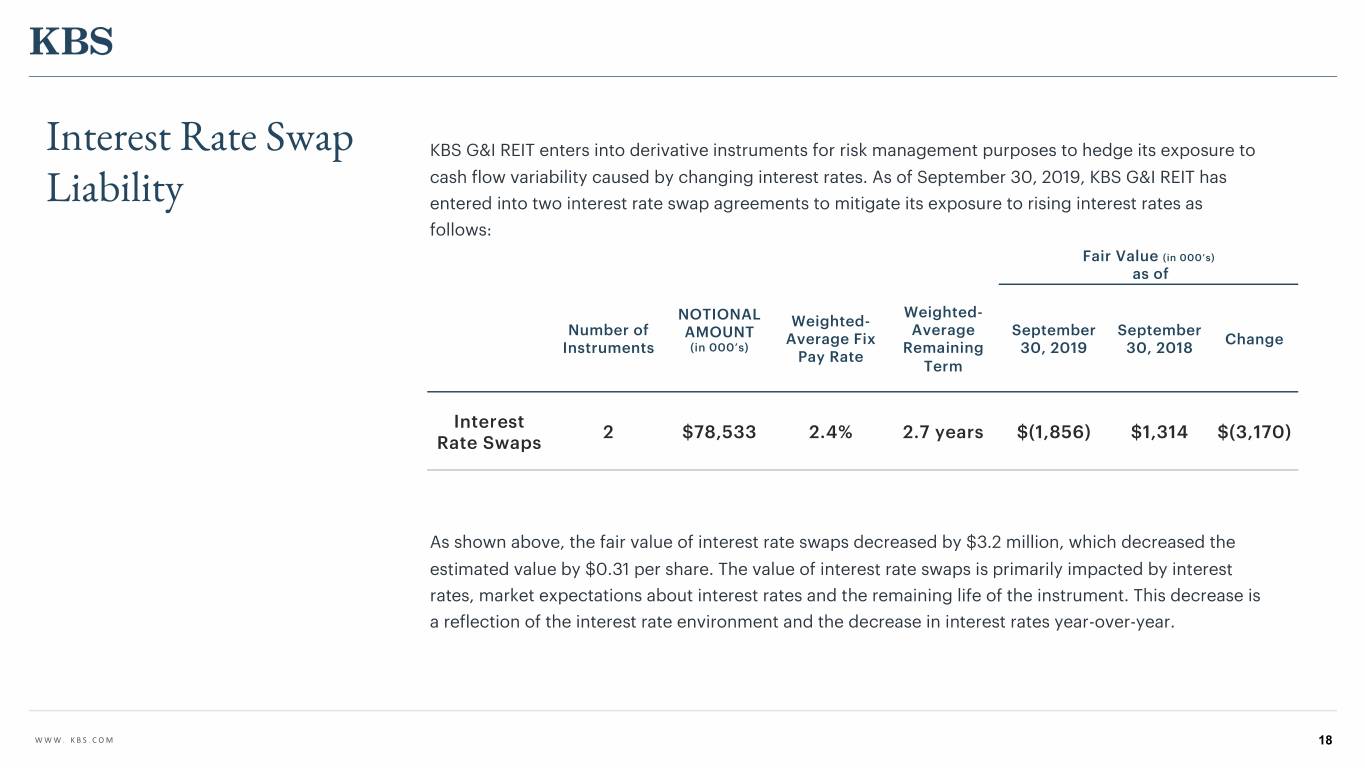

Interest Rate Swap KBS G&I REIT enters into derivative instruments for risk management purposes to hedge its exposure to cash flow variability caused by changing interest rates. As of September 30, 2019, KBS G&I REIT has Liability entered into two interest rate swap agreements to mitigate its exposure to rising interest rates as follows: Fair Value (in 000’s) as of Weighted- NOTIONAL Weighted- Number of Average September September AMOUNT Average Fix Change Instruments (in 000’s) Remaining 30, 2019 30, 2018 Pay Rate Term Interest 2 $78,533 2.4% 2.7 years $(1,856) $1,314 $(3,170) Rate Swaps As shown above, the fair value of interest rate swaps decreased by $3.2 million, which decreased the estimated value by $0.31 per share. The value of interest rate swaps is primarily impacted by interest rates, market expectations about interest rates and the remaining life of the instrument. This decrease is a reflection of the interest rate environment and the decrease in interest rates year-over-year. WWW. KBS.COM 18

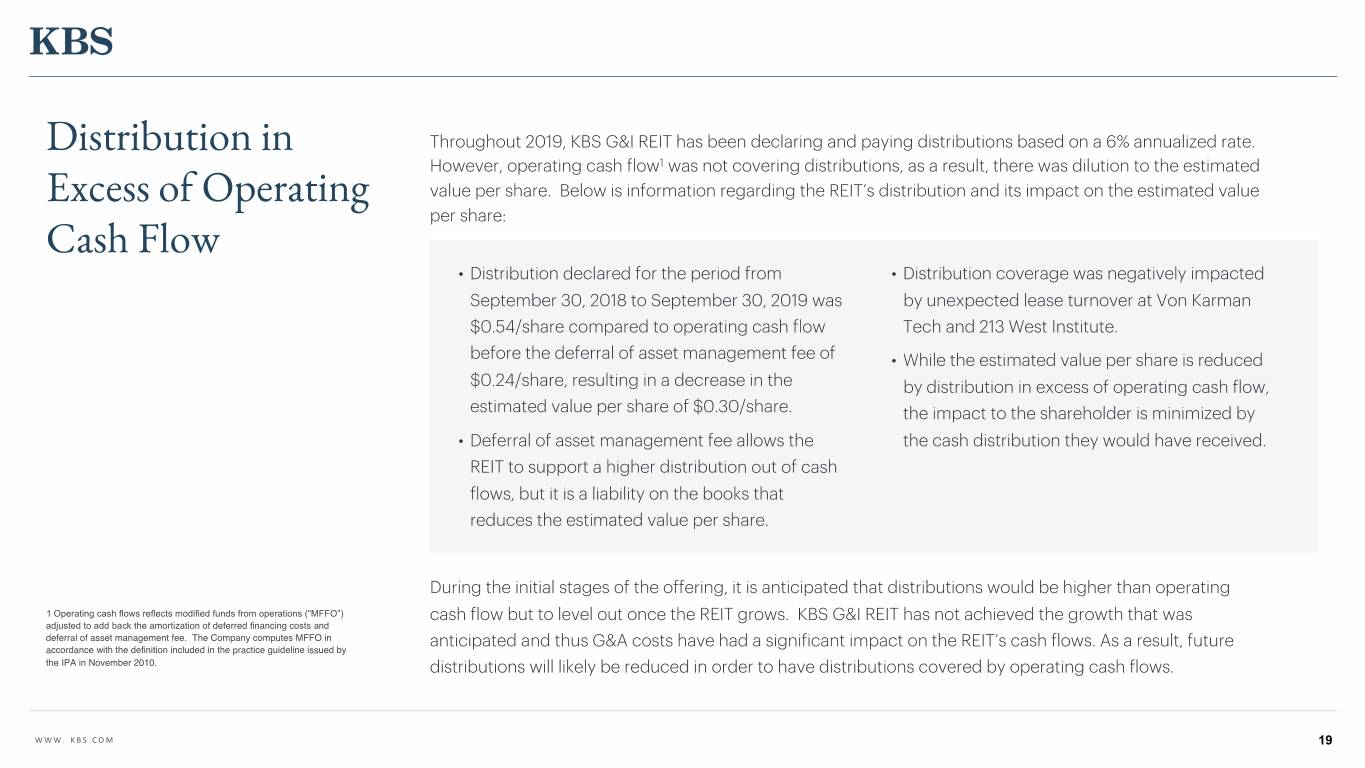

Distribution in Throughout 2019, KBS G&I REIT has been declaring and paying distributions based on a 6% annualized rate. However, operating cash flow1 was not covering distributions, as a result, there was dilution to the estimated Excess of Operating value per share. Below is information regarding the REIT’s distribution and its impact on the estimated value per share: Cash Flow • Distribution declared for the period from • Distribution coverage was negatively impacted September 30, 2018 to September 30, 2019 was by unexpected lease turnover at Von Karman $0.54/share compared to operating cash flow Tech and 213 West Institute. before the deferral of asset management fee of • While the estimated value per share is reduced $0.24/share, resulting in a decrease in the by distribution in excess of operating cash flow, estimated value per share of $0.30/share. the impact to the shareholder is minimized by • Deferral of asset management fee allows the the cash distribution they would have received. REIT to support a higher distribution out of cash flows, but it is a liability on the books that reduces the estimated value per share. During the initial stages of the offering, it is anticipated that distributions would be higher than operating 1 Operating cash flows reflects modified funds from operations (“MFFO”) cash flow but to level out once the REIT grows. KBS G&I REIT has not achieved the growth that was adjusted to add back the amortization of deferred financing costs and deferral of asset management fee. The Company computes MFFO in anticipated and thus G&A costs have had a significant impact on the REIT’s cash flows. As a result, future accordance with the definition included in the practice guideline issued by the IPA in November 2010. distributions will likely be reduced in order to have distributions covered by operating cash flows. WWW. KBS.COM 19

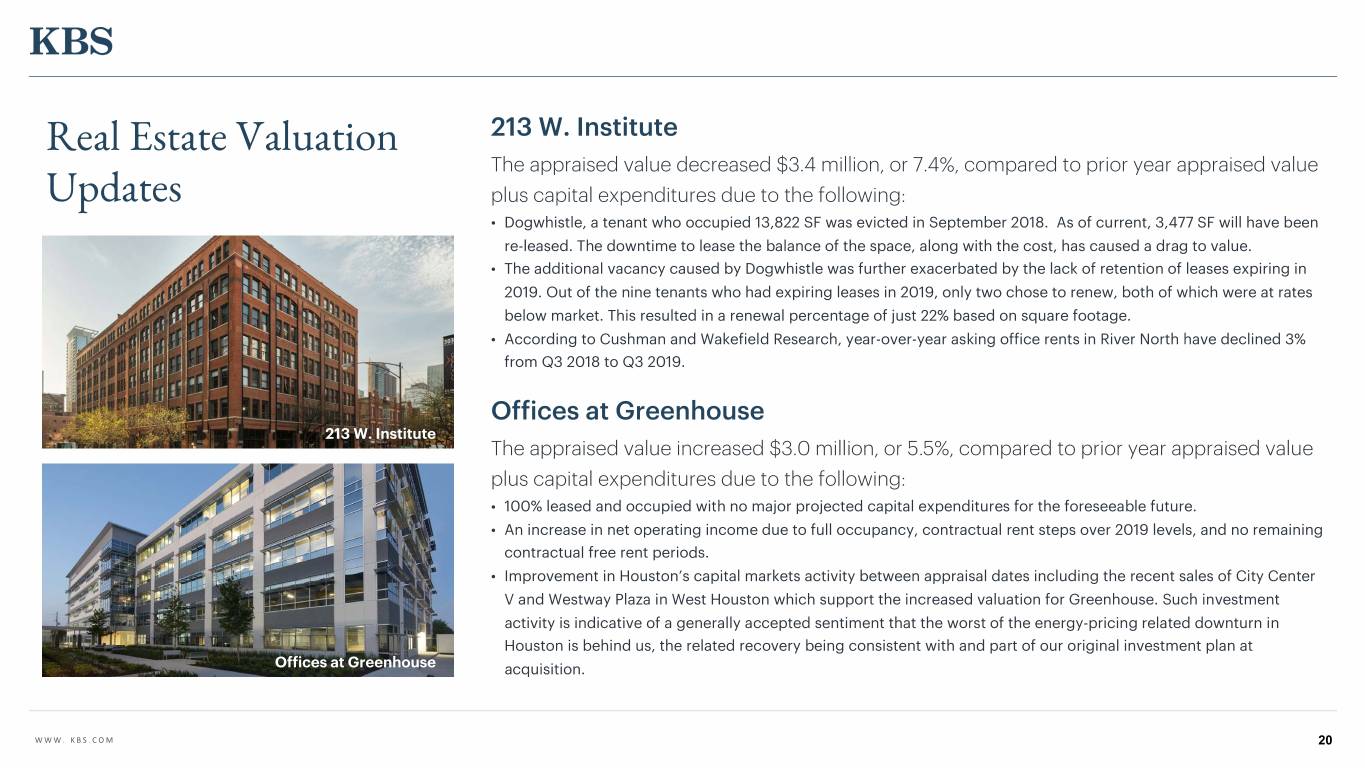

Real Estate Valuation 213 W. Institute The appraised value decreased $3.4 million, or 7.4%, compared to prior year appraised value Updates plus capital expenditures due to the following: • Dogwhistle, a tenant who occupied 13,822 SF was evicted in September 2018. As of current, 3,477 SF will have been re-leased. The downtime to lease the balance of the space, along with the cost, has caused a drag to value. • The additional vacancy caused by Dogwhistle was further exacerbated by the lack of retention of leases expiring in 2019. Out of the nine tenants who had expiring leases in 2019, only two chose to renew, both of which were at rates below market. This resulted in a renewal percentage of just 22% based on square footage. • According to Cushman and Wakefield Research, year-over-year asking office rents in River North have declined 3% from Q3 2018 to Q3 2019. Offices at Greenhouse 213 W. Institute The appraised value increased $3.0 million, or 5.5%, compared to prior year appraised value plus capital expenditures due to the following: • 100% leased and occupied with no major projected capital expenditures for the foreseeable future. • An increase in net operating income due to full occupancy, contractual rent steps over 2019 levels, and no remaining contractual free rent periods. • Improvement in Houston’s capital markets activity between appraisal dates including the recent sales of City Center V and Westway Plaza in West Houston which support the increased valuation for Greenhouse. Such investment activity is indicative of a generally accepted sentiment that the worst of the energy-pricing related downturn in Houston is behind us, the related recovery being consistent with and part of our original investment plan at Offices at Greenhouse acquisition. WWW. KBS.COM 20

Real Estate Valuation Updates Von Karman Tech Center The appraised value decreased $2.9 million, or 10.2%, compared to prior year appraised value due to the following: • The major tenant, Hosting.com (44,892 SF), recently merged with Ntirety, and as a part of the merger, Ntirety engaged Cushman & Wakefield to market a portfolio sale of seven data centers, including the one at Von Karman Tech. This raises the concern that Hosting.com will not renew its lease at expiration on 6/30/23. Furthermore, data center tenants’ have a strong preference to be in standalone buildings which Von Karman Tech is not able to offer and the Orange County Data Center market is currently 20% over capacity. We are increasing our capital projection Von Karman to re-tenant the space in case Hosting.com vacates. • Combatant Gentlemen, a tenant who leased 9,313 SF went out of business and vacated Suite 450 earlier than expected. • On November 25, 2019, KBS G&I REIT entered into an agreement to sell Von Karman Tech Center to an unaffiliated third party. Commonwealth WWW. KBS.COM 21

Fund Raising and KBS G&I REIT has been unable to raise substantial funds in its offering and the REIT has not acquired a diverse portfolio of real estate investments. Due to the lack of size, the cost of Status of the REIT operating the REIT constitutes a greater percentage of its net operating income and the estimated value per share has and will vary more widely with the performance of specific assets. Accordingly, the Board has formed a special committee to evaluate strategic alternatives for the REIT and has currently decided on the following: • Temporarily suspend the primary portion of its • Engage a financial advisor to assist with the ongoing offering while evaluating strategic evaluation of strategic alternatives. alternatives; although the REIT will continue to accept shares under the dividend reinvestment plan. • Distributions paid through December 2019 has been funded in part with debt financing and the deferral of asset management fees, which is dilutive to the estimated value per share. Moving forward, the Board will reassess and likely decrease the amount of ongoing distributions in 2020. WWW. KBS.COM 22

2020 Goals Evaluate strategic alternatives Improve property cash flow through strategic leasing renewals with existing tenants and new leases for current vacant space Continue value enhancing capital projects to maintain the high level of occupancy WWW. KBS.COM 23

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 24