Portfolio Update Meeting August 26, 2021

W W W . K B S . C O M The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Growth & Income Real Estate Investment Trust’s (the “Company or KBS Growth & Income REIT or KBS G&I REIT”) Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2021 (the “Quarterly Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value KBS G&I REIT’s assets and liabilities in connection with the calculation of KBS G&I REIT’s estimated value per share, see KBS G&I REIT’s Current Report on Form 8-K dated December 7, 2020 (the “Valuation 8-K”). Important Disclosures 2 Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. Forward-Looking Statements

W W W . K B S . C O M Important Disclosures The COVID-19 pandemic, together with the resulting measures imposed to help control the spread of the virus, has had a negative impact on the economy and business activity globally. The COVID-19 pandemic is negatively impacting almost every industry, including the U.S. office real estate industry and the industries of the Company’s tenants, directly or indirectly. The extent to which the COVID-19 pandemic impacts the Company’s operations and those of its tenants, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Reductions in property values related to the impact of the COVID-19 pandemic may limit the Company’s ability to draw on the revolving commitment under its term loan due to covenants described in the loan agreement. In addition, the timing in which the Company may be able to implement a liquidation strategy will be affected. The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through June 30, 2021 have been funded in part with cash flow from operating activities, from the proceeds from the sale of real estate and in part with debt financing, including advances from the Company’s advisor. In addition, distributions have been funded with cash resulting from the advisor’s waiver and deferral of its asset management fee. There are no guarantees that the Company will continue to pay distributions or that distributions at the current rate are sustainable. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the NAV per share, the appraisal methodology used for the appraised properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the appraised properties, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, are the respective party’s best estimates as of September 30, 2020, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties and the estimated value per share. These statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain occupancy levels and rental rates at its real estate properties; the Company’s ability to sell its real estate properties at the times and at the prices it expects; and other risks identified in Part I, Item 1A of the Company’s Annual Report for the year ended December 31, 2020 and in Part II, Item 1A of the Company’s Quarterly Report for the period ended March 31, 2021. Forward-Looking Statements 3

W W W . K B S . C O M The Impact of COVID-19 on Capital Markets and US Real Estate Investments 4

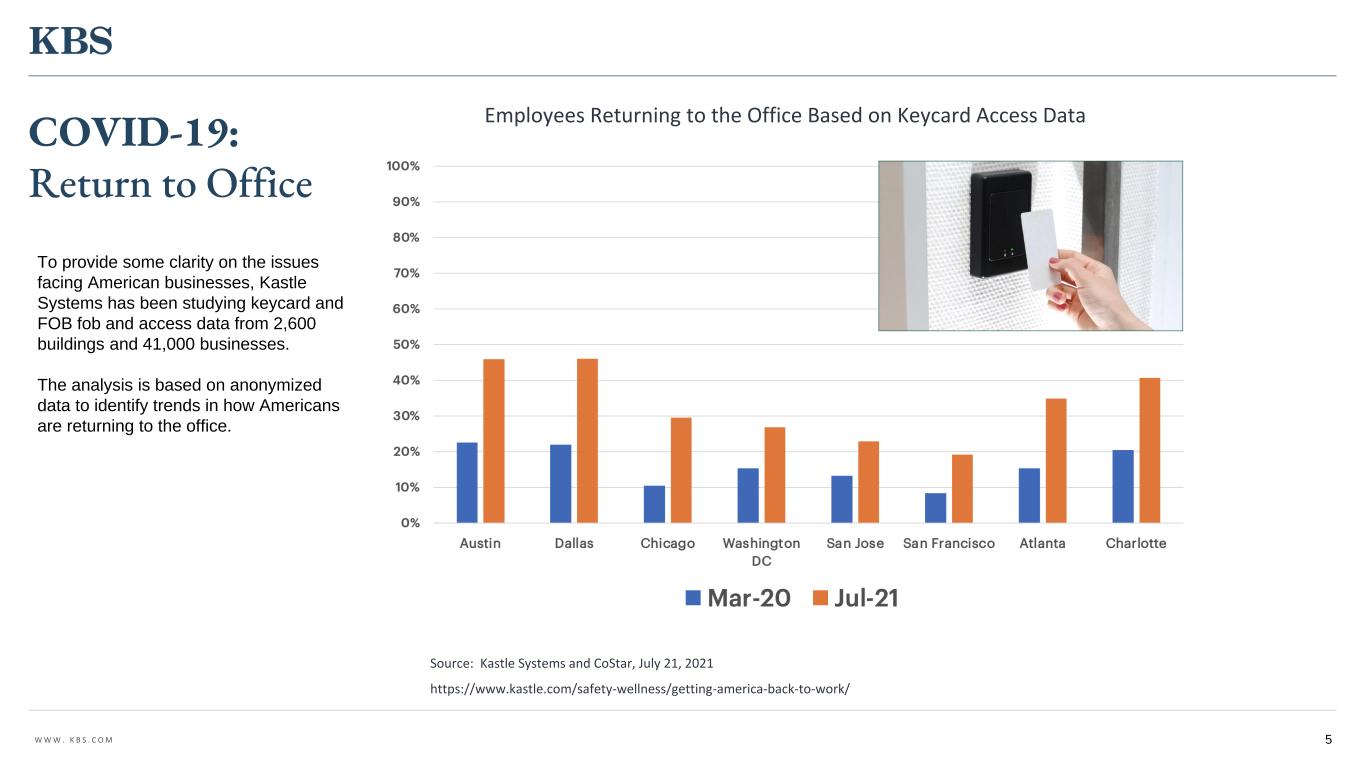

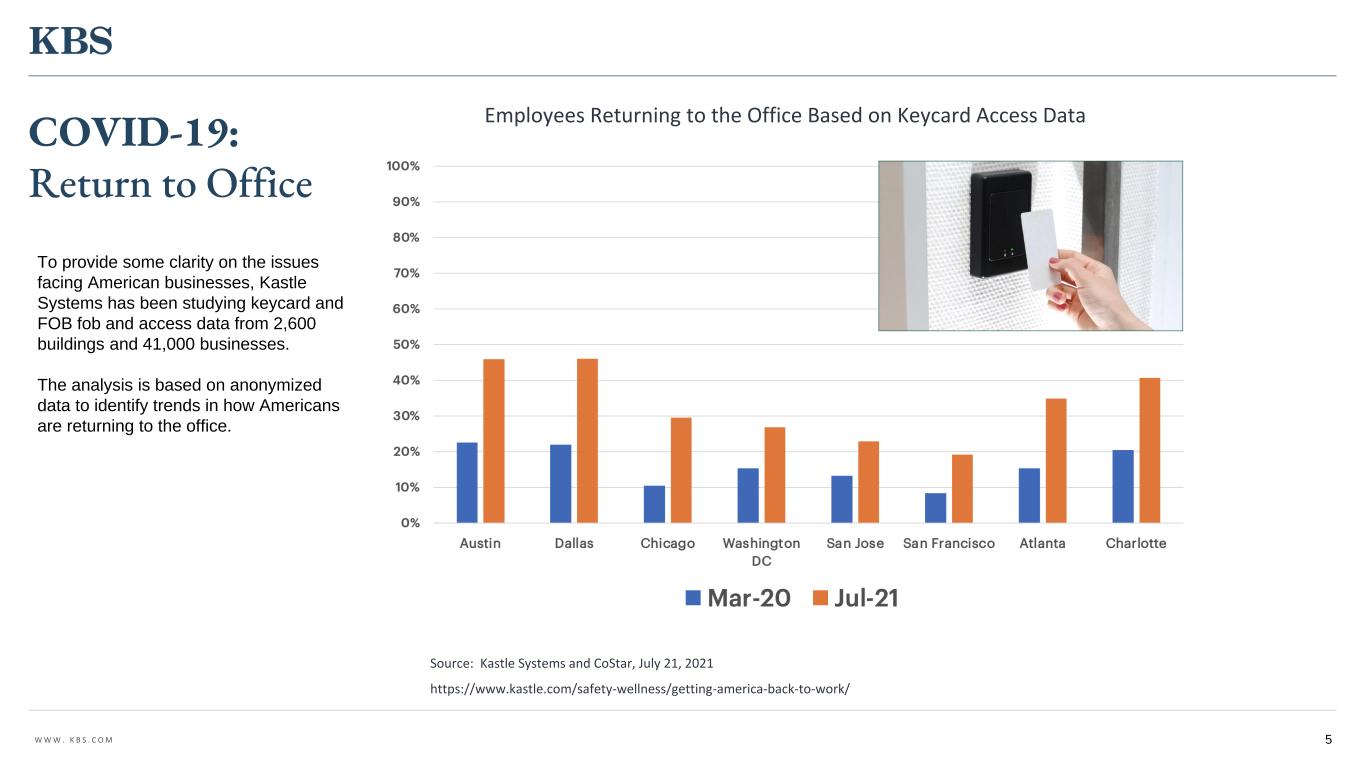

W W W . K B S . C O M COVID-19: Return to Office 5 To provide some clarity on the issues facing American businesses, Kastle Systems has been studying keycard and FOB fob and access data from 2,600 buildings and 41,000 businesses. The analysis is based on anonymized data to identify trends in how Americans are returning to the office. Source: Kastle Systems and CoStar, July 21, 2021 https://www.kastle.com/safety-wellness/getting-america-back-to-work/ Employees Returning to the Office Based on Keycard Access Data

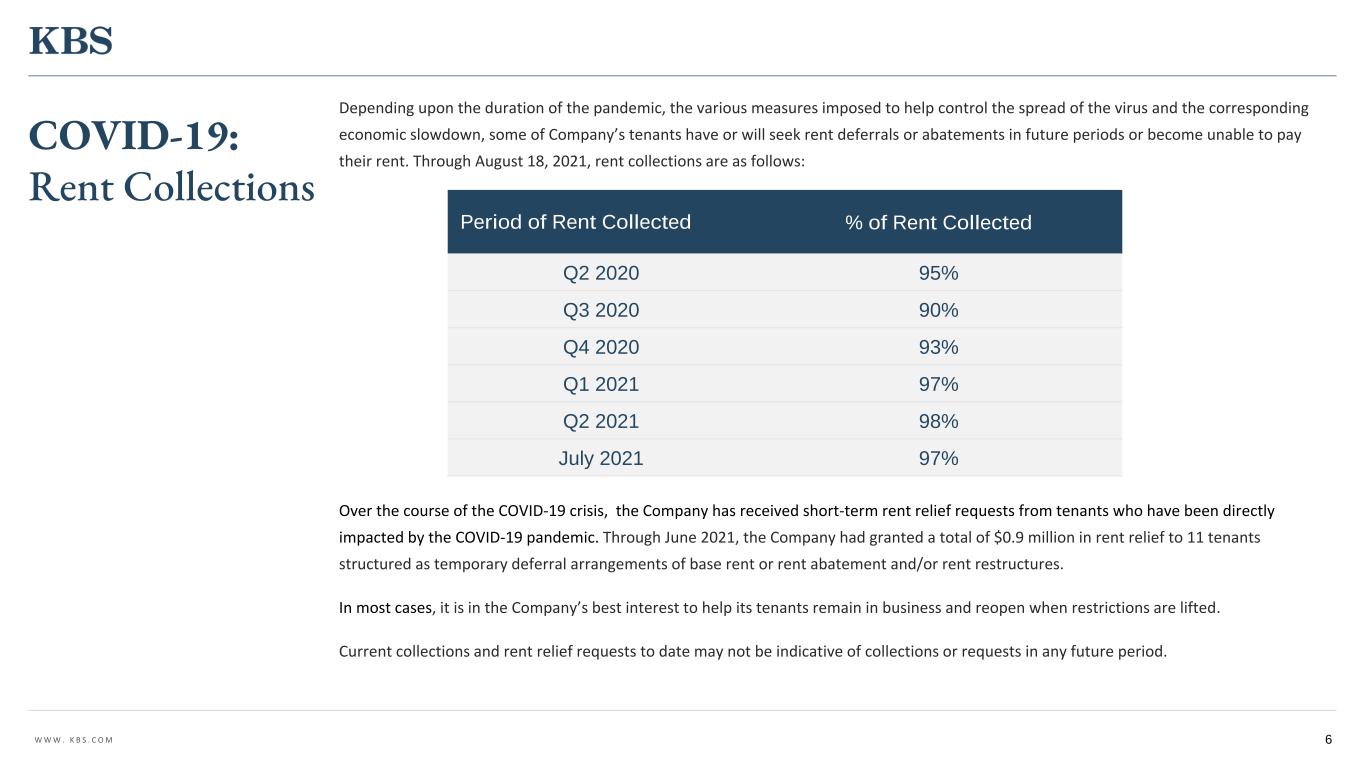

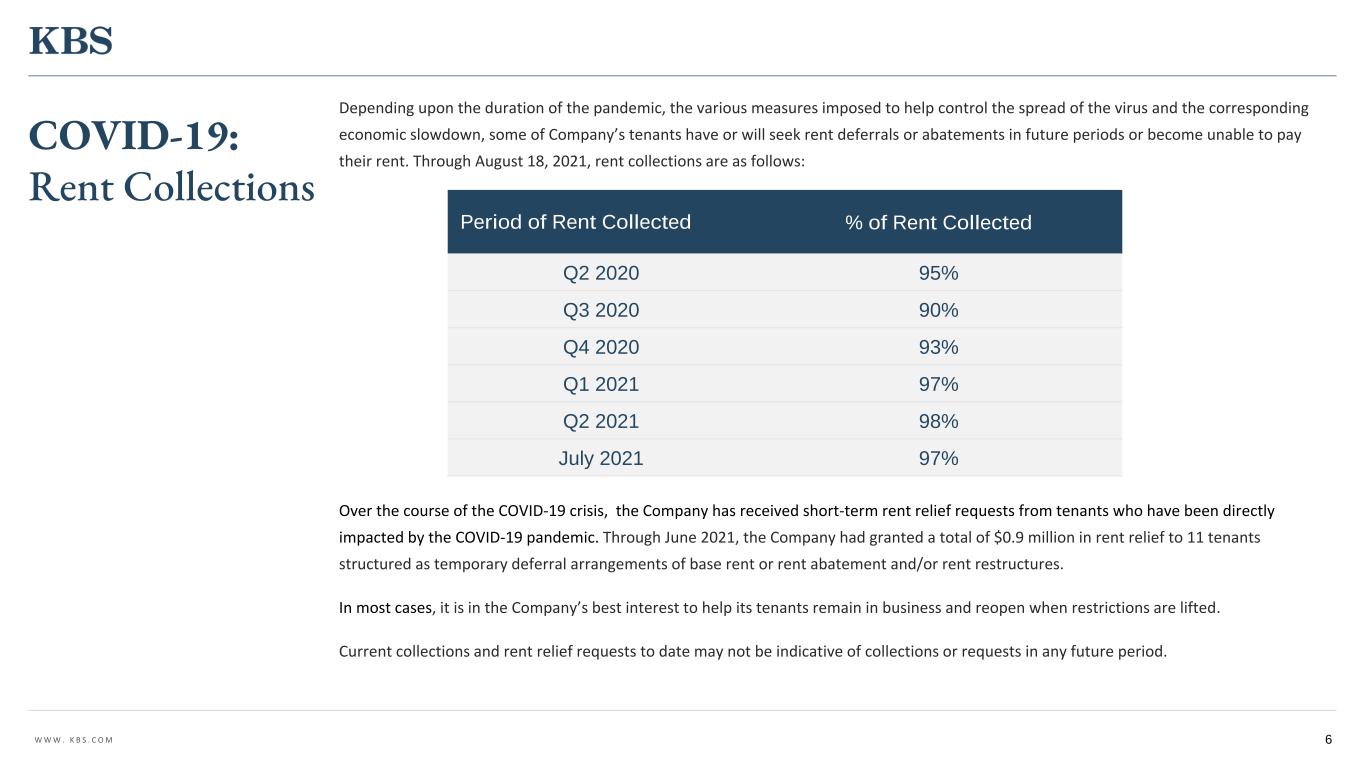

W W W . K B S . C O M Depending upon the duration of the pandemic, the various measures imposed to help control the spread of the virus and the corresponding economic slowdown, some of Company’s tenants have or will seek rent deferrals or abatements in future periods or become unable to pay their rent. Through August 18, 2021, rent collections are as follows: Over the course of the COVID-19 crisis, the Company has received short-term rent relief requests from tenants who have been directly impacted by the COVID-19 pandemic. Through June 2021, the Company had granted a total of $0.9 million in rent relief to 11 tenants structured as temporary deferral arrangements of base rent or rent abatement and/or rent restructures. In most cases, it is in the Company’s best interest to help its tenants remain in business and reopen when restrictions are lifted. Current collections and rent relief requests to date may not be indicative of collections or requests in any future period. 6 Period of Rent Collected % of Rent Collected Q2 2020 95% Q3 2020 90% Q4 2020 93% Q1 2021 97% Q2 2021 98% July 2021 97% COVID-19: Rent Collections

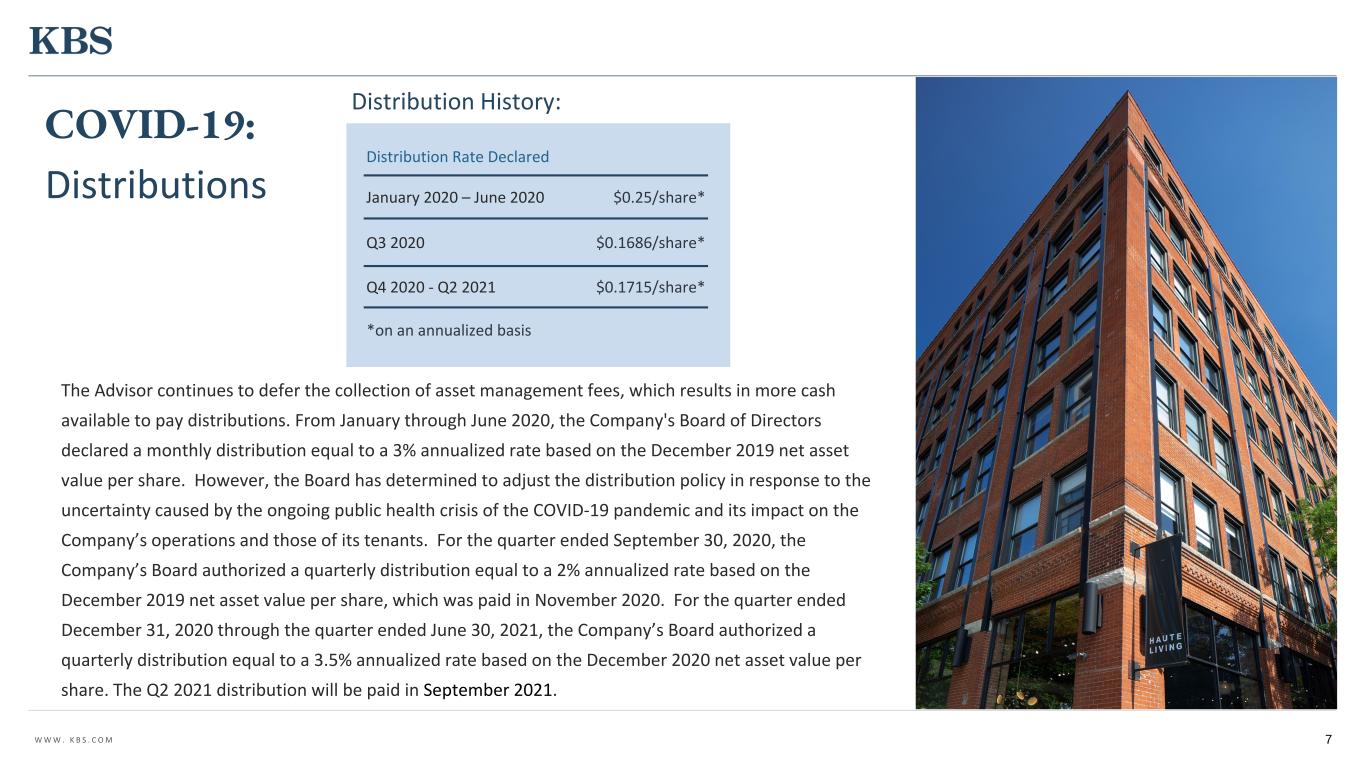

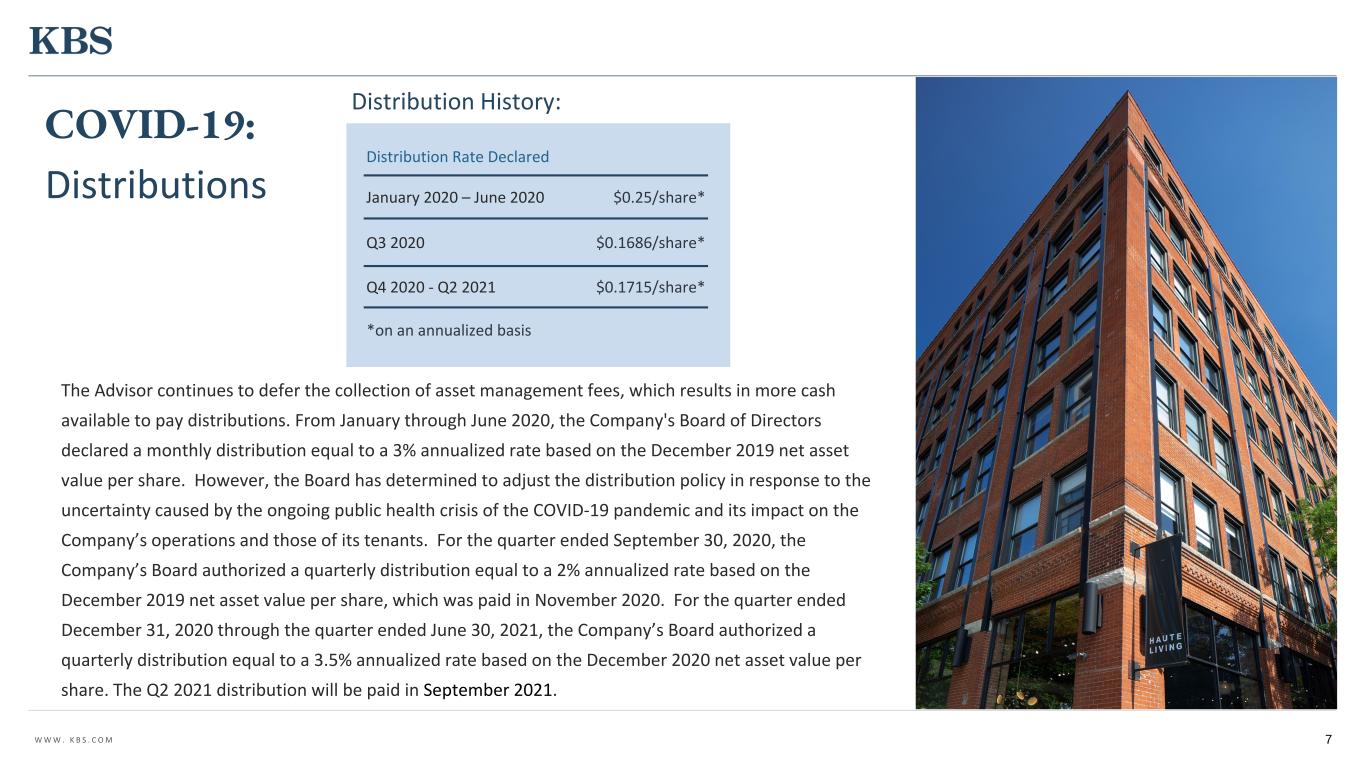

W W W . K B S . C O M 7 Distributions The Advisor continues to defer the collection of asset management fees, which results in more cash available to pay distributions. From January through June 2020, the Company's Board of Directors declared a monthly distribution equal to a 3% annualized rate based on the December 2019 net asset value per share. However, the Board has determined to adjust the distribution policy in response to the uncertainty caused by the ongoing public health crisis of the COVID-19 pandemic and its impact on the Company’s operations and those of its tenants. For the quarter ended September 30, 2020, the Company’s Board authorized a quarterly distribution equal to a 2% annualized rate based on the December 2019 net asset value per share, which was paid in November 2020. For the quarter ended December 31, 2020 through the quarter ended June 30, 2021, the Company’s Board authorized a quarterly distribution equal to a 3.5% annualized rate based on the December 2020 net asset value per share. The Q2 2021 distribution will be paid in September 2021. COVID-19: Distribution History: *on an annualized basis Distribution Rate Declared January 2020 – June 2020 $0.25/share* Q3 2020 $0.1686/share* Q4 2020 - Q2 2021 $0.1715/share*

Portfolio Highlights 8

W W W . K B S . C O M FUND OVERVIEW Initial Private Offering June 2015 – April 2016 Public Offering April 2016 – June 2017 Second Private Offering October 2017 – August 20205 Current NAV (Dec. 2020)6 $4.90 per share Total Equity Raised7 $94.7 million Current Distribution Rate9 3.50% based on Current NAV 1 Portfolio overview information reflects information as of June 30, 2021 for the current portfolio of real estate properties. 2 Represents aggregate acquisition price (excluding closing costs) of the current real estate portfolio. 3 Represents cost basis, which is acquisition price (excluding closing costs) plus subsequent capital expenditures for the current real estate portfolio. 4 Based solely on the appraised values as of September 30, 2020 as reflected in the December 2020 estimated share value for the current portfolio of real estate properties. 5 The Second Private Offering was suspended in December 2019 and officially terminated in August 2020. 6 Data as of September 30, 2020. See the Current Report on Form 8-K dated December 7, 2020 and the risk factors included in the Annual Report on Form-10K. 7 Includes proceeds from distribution reinvestment plan. However, on August 5, 2020, the Company’s board of directors approved the termination of the distribution reinvestment plan effective August 29, 2020. 8 Includes future leases of current real estate portfolio that had been executed but had not yet commenced as of June 30, 2021. 9 Distributions are not guaranteed. Current Distribution Rate is based on the December 2020 NAV and reflects the latest distribution declared in August 2021. 10 Calculated as total debt on real estate properties of $99.0 million as of June 30, 2021 divided by December 2020 estimated value of all properties of $154.6 million. PORTFOLIO OVERVIEW 1 Total Acquisitions2 $163.0 million Cost Basis of Current Portfolio of Properties 3 $177.1 million Dec. 2020 Estimated Value of Current Portfolio of Properties4 $154.6 million Rentable Sq. Ft. 599,030 Total Leased8 82.4% Total Leverage10 64.0% 9 Fund and Portfolio Overview As of June 30, 2021, unless otherwise noted;

W W W . K B S . C O M PROPERTY NAME CITY, STATE PROPERTY TYPE / NO. OF BUILDINGS ACQUISITION DATE SIZE (SF) PURCHASE PRICE2 LEASED % AS OF 6/30/213 Commonwealth Building Portland, OR Office 1 Building 6/30/2016 224,122 $68,545,000 67.0% The Offices at Greenhouse Houston, TX Office 1 Building 11/14/2016 203,284 46,489,000 100.0% Institute Property Chicago, IL Office 1 Building 11/9/2017 155,385 43,155,000 79.7% 210 West Chicago Chicago, IL 1 Office 1 Building 10/5/2020 16,239 4,780,000 100.0% TOTAL / WEIGHTED AVG. 599,030 $162,969,000 82.4% 10 Portfolio Highlights 1 On June 28, 2019, the Company entered into a joint venture agreement to purchase 210 W Chicago for $5.4M, which was recorded as an unconsolidated entity. On October 5, 2020, The Company bought out the JV partner’s equity interest, resulting in the consolidation of the property at the estimated fair value of $4.8M. 2 Purchase price reflects contractual purchase price, net of closing credits, and excludes acquisition fees and expenses. 3 Total leased percentage includes future leases that have been executed but have not yet commenced as of June 30, 2021. As of June 30, 2021

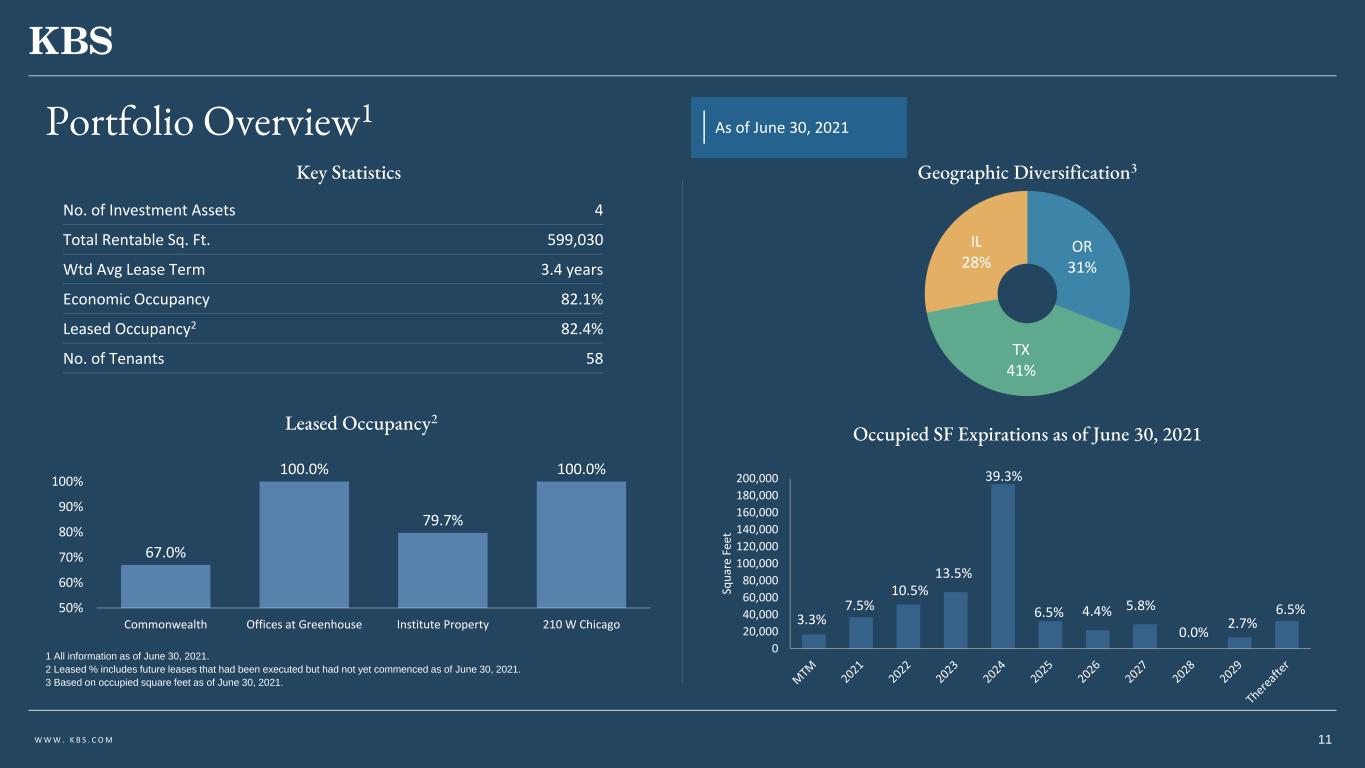

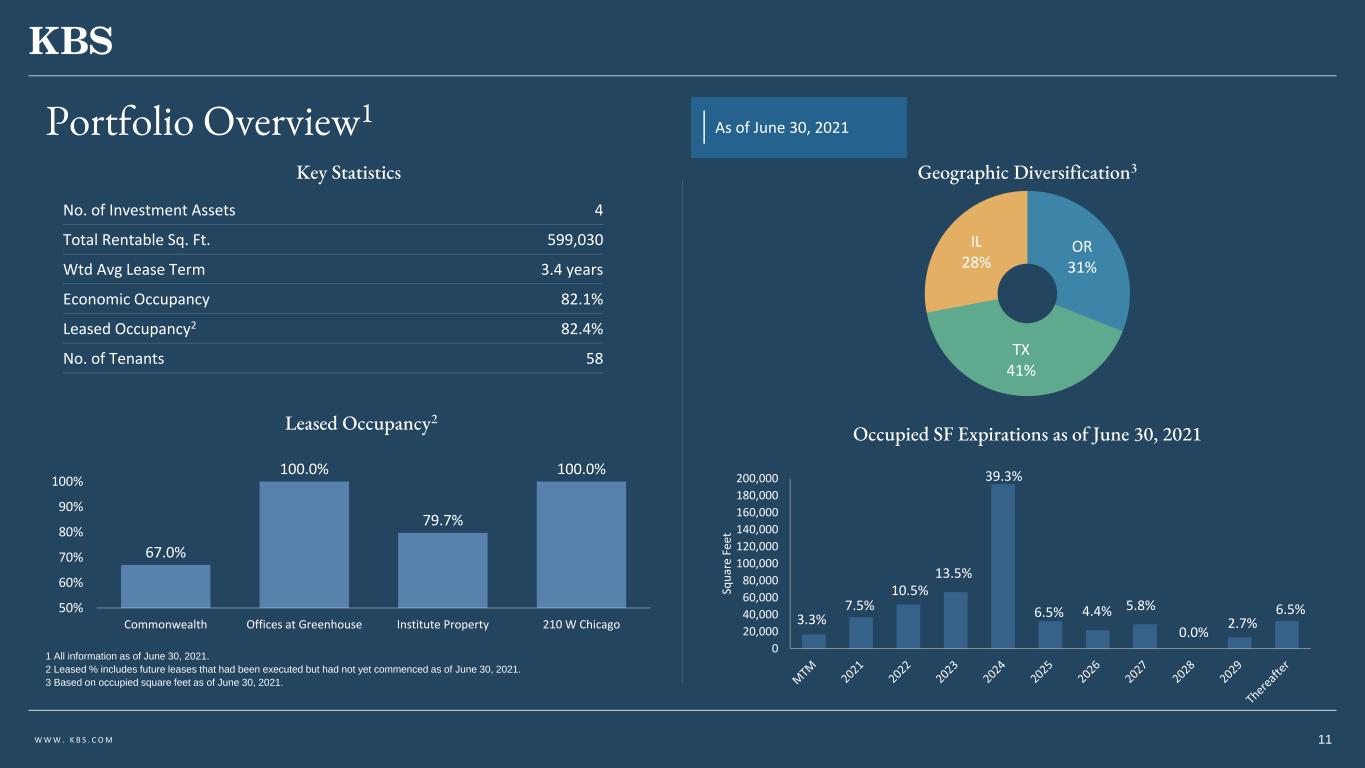

W W W . K B S . C O M Portfolio Overview1 Geographic Diversification3 1 All information as of June 30, 2021. 2 Leased % includes future leases that had been executed but had not yet commenced as of June 30, 2021. 3 Based on occupied square feet as of June 30, 2021. No. of Investment Assets 4 Total Rentable Sq. Ft. 599,030 Wtd Avg Lease Term 3.4 years Economic Occupancy 82.1% Leased Occupancy2 82.4% No. of Tenants 58 Occupied SF Expirations as of June 30, 2021 Key Statistics Leased Occupancy2 3.3% 7.5% 10.5% 13.5% 39.3% 6.5% 4.4% 5.8% 0.0% 2.7% 6.5% 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 200,000 Sq u ar e Fe et 11 As of June 30, 2021 OR 31% TX 41% IL 28% 67.0% 100.0% 79.7% 100.0% 50% 60% 70% 80% 90% 100% Commonwealth Offices at Greenhouse Institute Property 210 W Chicago

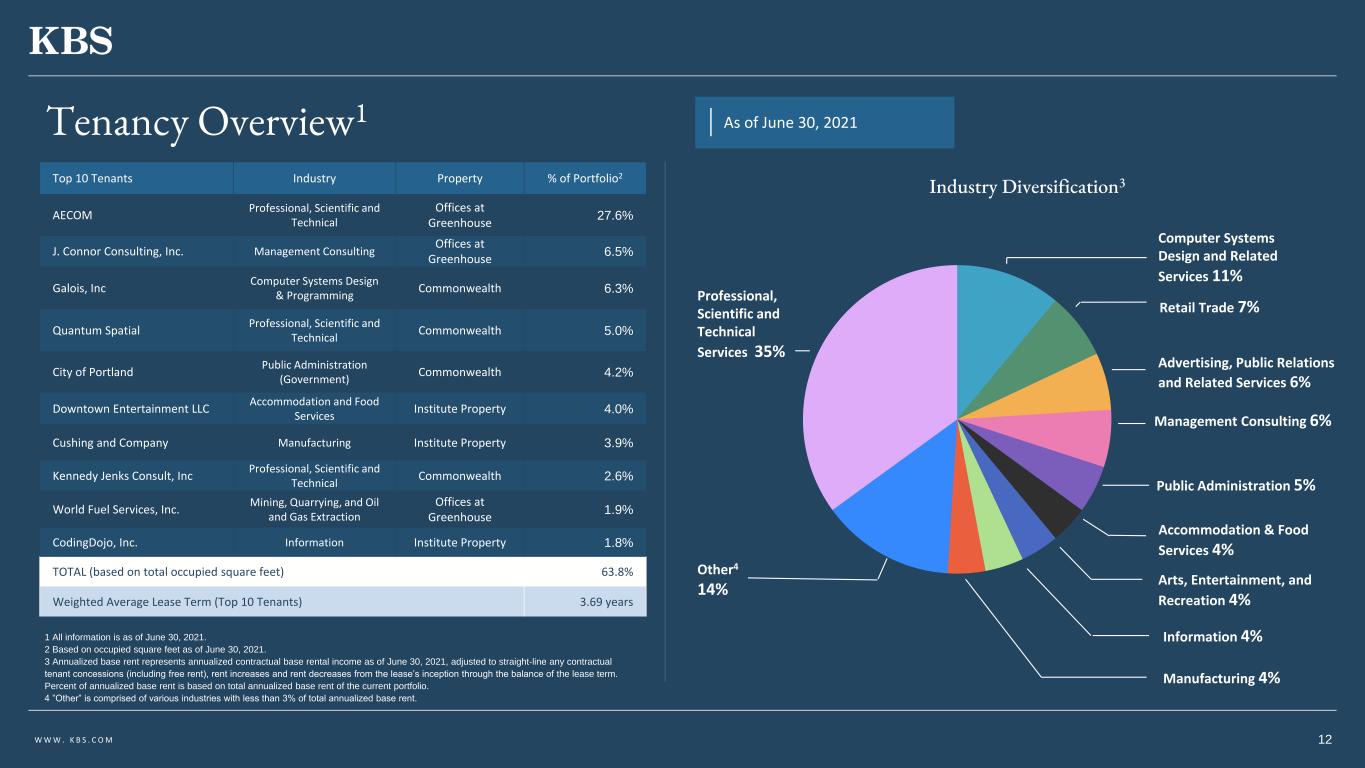

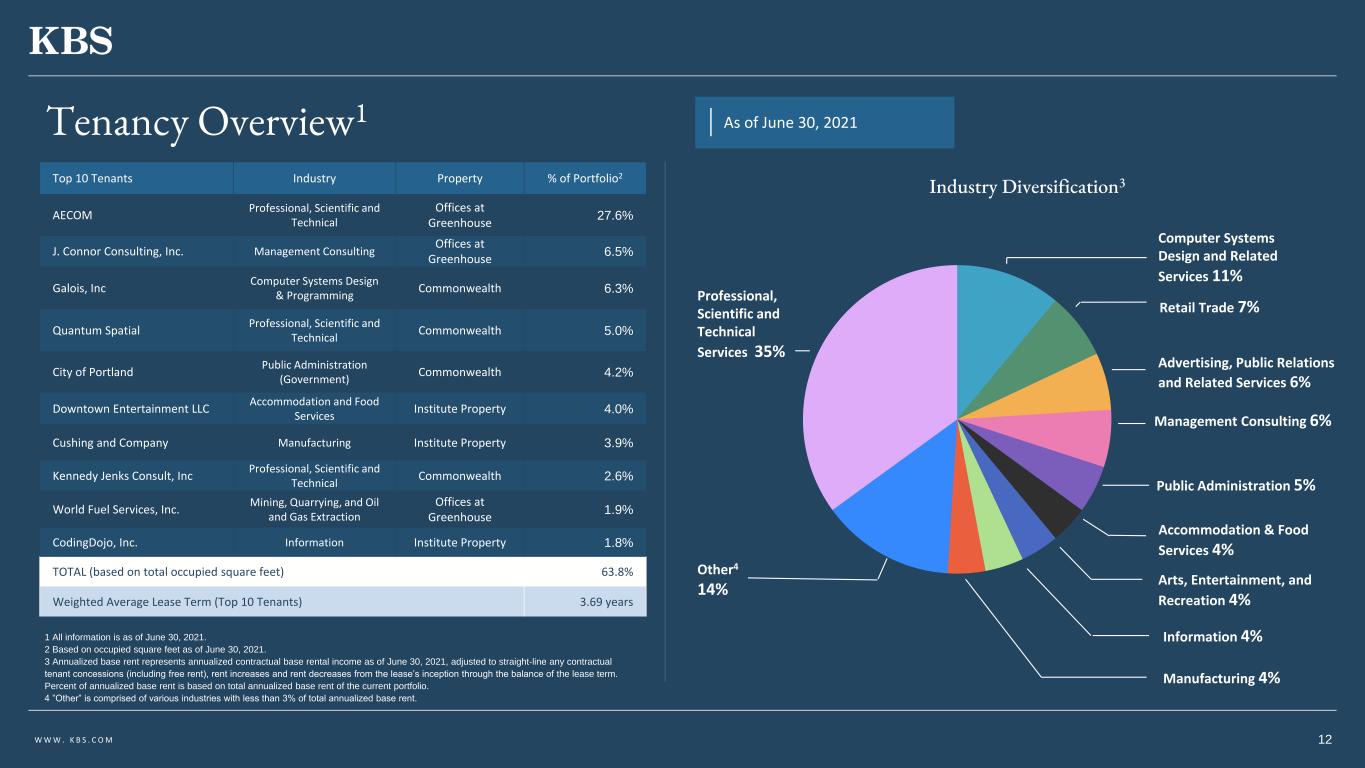

W W W . K B S . C O M Tenancy Overview1 Industry Diversification3Top 10 Tenants Industry Property % of Portfolio2 AECOM Professional, Scientific and Technical Offices at Greenhouse 27.6% J. Connor Consulting, Inc. Management Consulting Offices at Greenhouse 6.5% Galois, Inc Computer Systems Design & Programming Commonwealth 6.3% Quantum Spatial Professional, Scientific and Technical Commonwealth 5.0% City of Portland Public Administration (Government) Commonwealth 4.2% Downtown Entertainment LLC Accommodation and Food Services Institute Property 4.0% Cushing and Company Manufacturing Institute Property 3.9% Kennedy Jenks Consult, Inc Professional, Scientific and Technical Commonwealth 2.6% World Fuel Services, Inc. Mining, Quarrying, and Oil and Gas Extraction Offices at Greenhouse 1.9% CodingDojo, Inc. Information Institute Property 1.8% TOTAL (based on total occupied square feet) 63.8% Weighted Average Lease Term (Top 10 Tenants) 3.69 years 12 As of June 30, 2021 1 All information is as of June 30, 2021. 2 Based on occupied square feet as of June 30, 2021. 3 Annualized base rent represents annualized contractual base rental income as of June 30, 2021, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. 4 ”Other” is comprised of various industries with less than 3% of total annualized base rent. Management Consulting 6% Retail Trade 7% Public Administration 5% Arts, Entertainment, and Recreation 4% Professional, Scientific and Technical Services 35% Information 4% Computer Systems Design and Related Services 11% Manufacturing 4% Other4 14% Accommodation & Food Services 4% Advertising, Public Relations and Related Services 6%

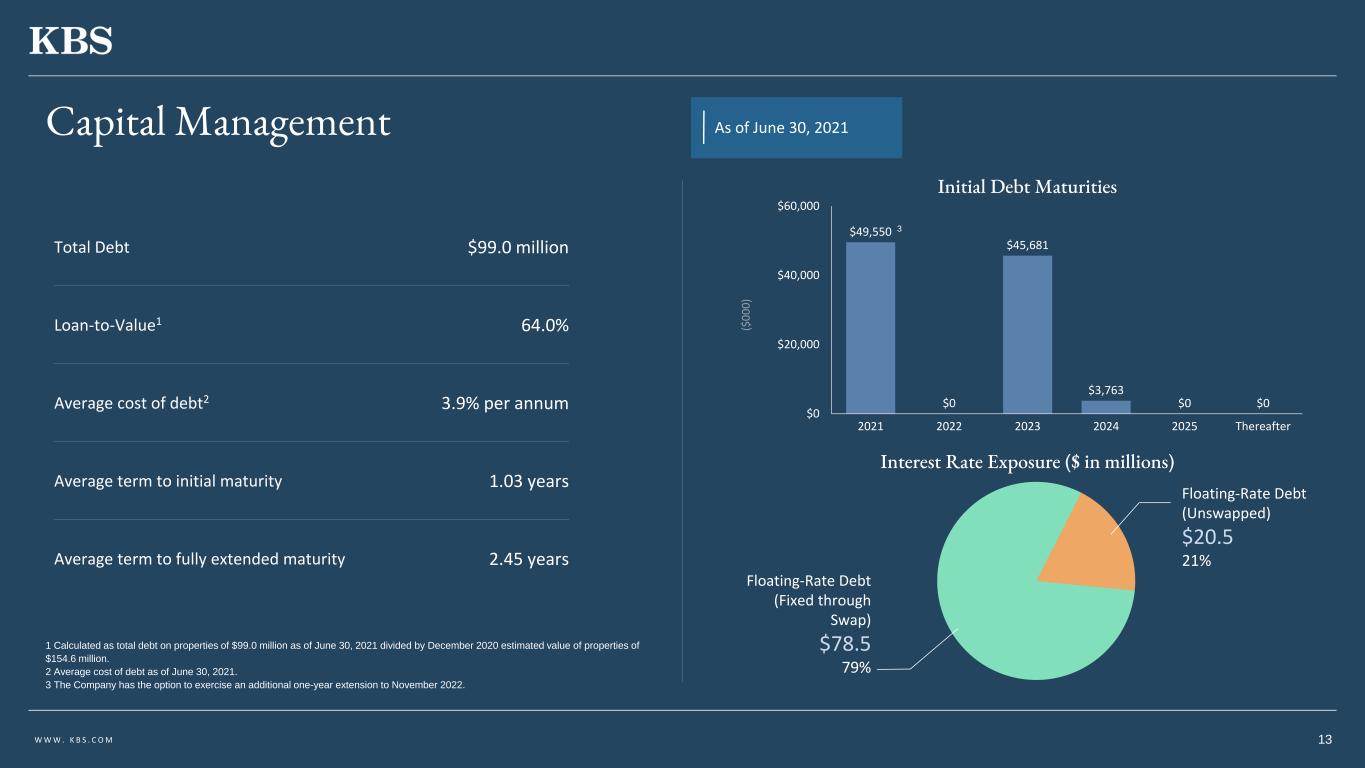

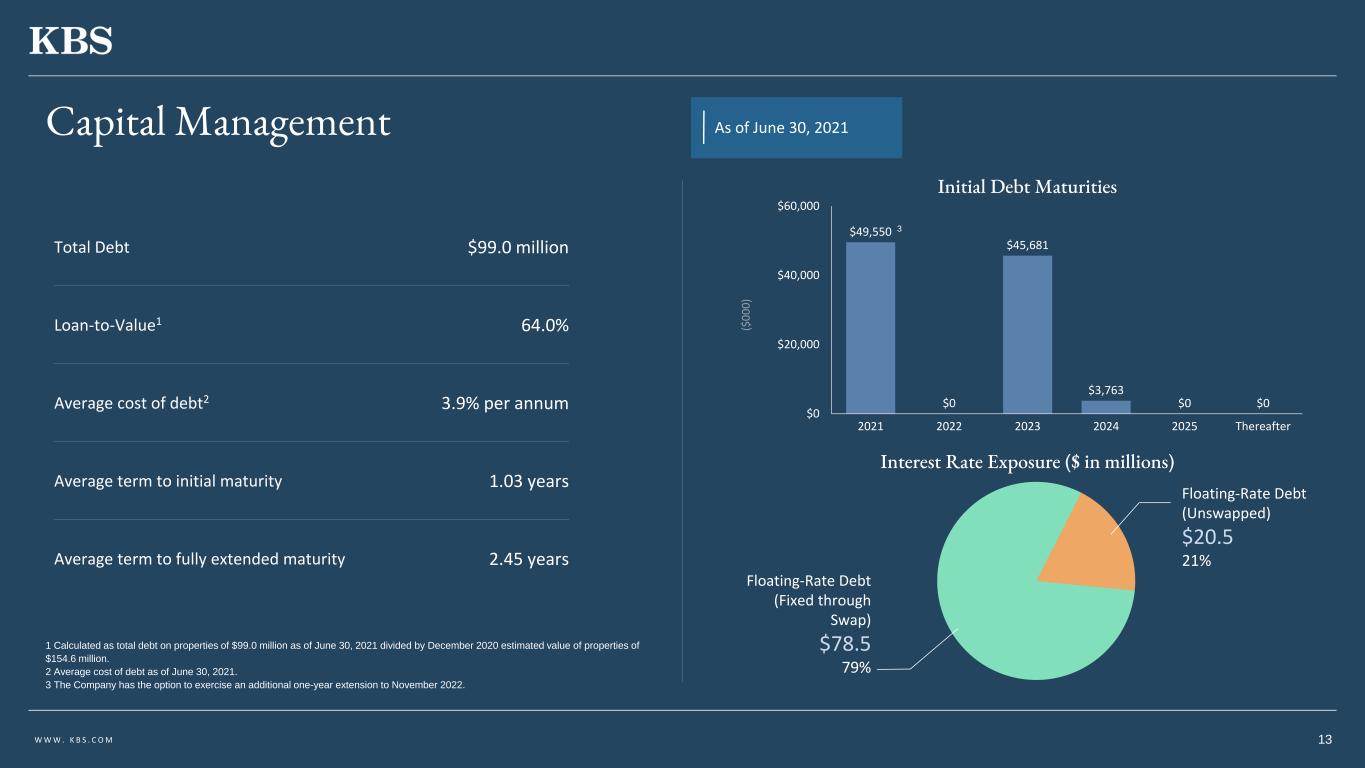

W W W . K B S . C O M $49,550 $0 $45,681 $3,763 $0 $0 $0 $20,000 $40,000 $60,000 2021 2022 2023 2024 2025 Thereafter 3 Capital Management Initial Debt Maturities 1 Calculated as total debt on properties of $99.0 million as of June 30, 2021 divided by December 2020 estimated value of properties of $154.6 million. 2 Average cost of debt as of June 30, 2021. 3 The Company has the option to exercise an additional one-year extension to November 2022. Total Debt $99.0 million Loan-to-Value1 64.0% Average cost of debt2 3.9% per annum Average term to initial maturity 1.03 years Average term to fully extended maturity 2.45 years Interest Rate Exposure ($ in millions) 13 As of June 30, 2021 Floating-Rate Debt (Unswapped) $20.5 21% Floating-Rate Debt (Fixed through Swap) $78.5 79%

14 Property Updates

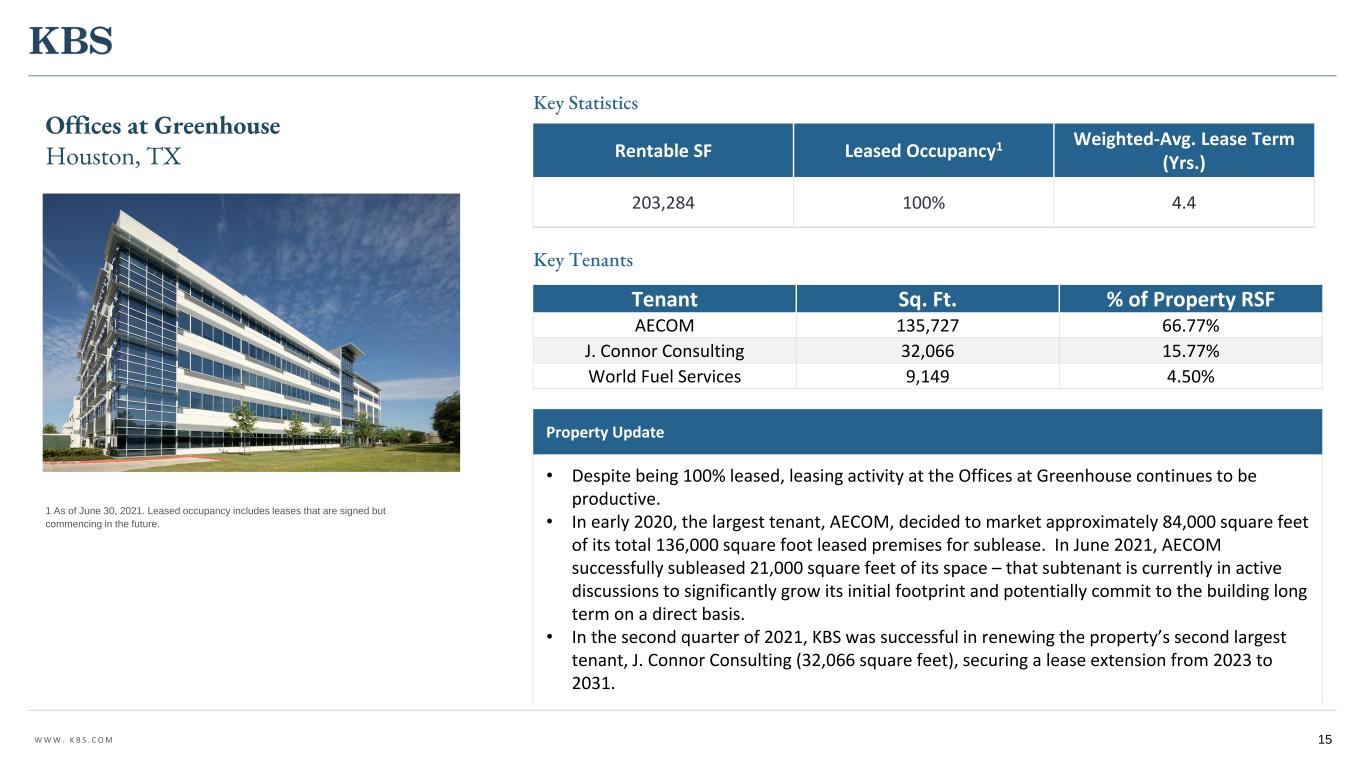

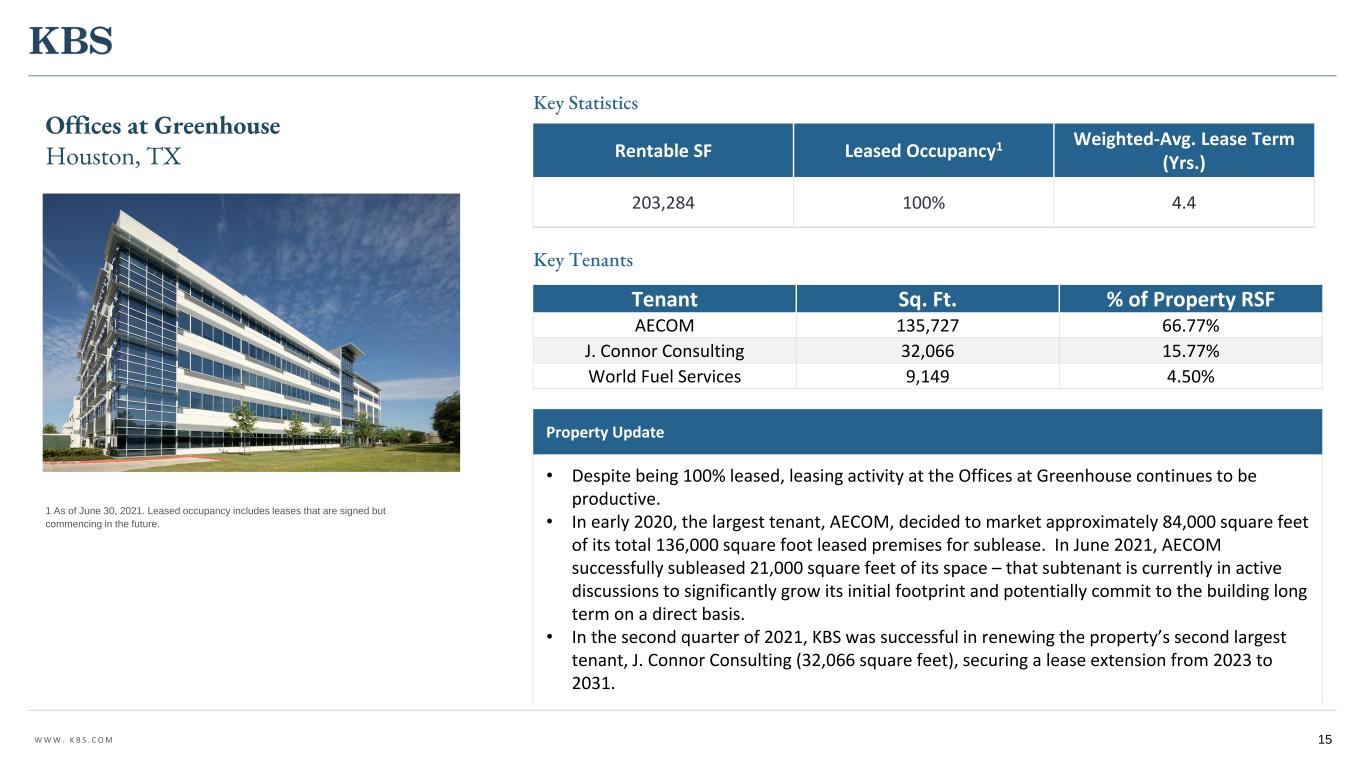

W W W . K B S . C O M 15 Property Update • Despite being 100% leased, leasing activity at the Offices at Greenhouse continues to be productive. • In early 2020, the largest tenant, AECOM, decided to market approximately 84,000 square feet of its total 136,000 square foot leased premises for sublease. In June 2021, AECOM successfully subleased 21,000 square feet of its space – that subtenant is currently in active discussions to significantly grow its initial footprint and potentially commit to the building long term on a direct basis. • In the second quarter of 2021, KBS was successful in renewing the property’s second largest tenant, J. Connor Consulting (32,066 square feet), securing a lease extension from 2023 to 2031. Rentable SF Leased Occupancy1 Weighted-Avg. Lease Term (Yrs.) 203,284 100% 4.4 Tenant Sq. Ft. % of Property RSF AECOM 135,727 66.77% J. Connor Consulting 32,066 15.77% World Fuel Services 9,149 4.50% Offices at Greenhouse Houston, TX Key Statistics Key Tenants 1 As of June 30, 2021. Leased occupancy includes leases that are signed but commencing in the future.

W W W . K B S . C O M Due to the minimal amount of capital raise in the REIT, which had been substantially impacted early on by regulatory changes, and the inability to significantly improve its size and scale in order to help offset the sizeable G&A costs of operating a non-traded REIT, the Board formed a special committee to evaluate strategic alternatives for the REIT. Based upon the special committee’s assessment and recommendation, in August of 2020, the special committee directed the Company’s advisor, with the assistance of the independent financial advisor of the special committee, to develop a plan of liquidation for approval by the board and submission to the stockholders. The Company initially expected to present a plan of liquidation for a vote of the stockholders of the Company within six months from its determination to pursue a liquidation strategy. However, as a result of the adverse market conditions caused by the civil unrest and disruption in Portland and Chicago, where several of the Company’s properties are located, and the ongoing uncertainty and business disruptions related to the COVID-19 pandemic, in November 2020, the board determined to delay any proposal to liquidate the Company until market conditions improve. In August 2021, the board of directors, including all the independent directors, determined to resume development of a formal plan of liquidation. 16 Update on Strategic Alternatives

W W W . K B S . C O M 2021 Goals 17 Develop the formal plan of liquidation Improve property cash flow through strategic leasing renewals with existing tenants and new leases for current vacant space Continue value enhancing capital projects to maintain the high level of occupancy

18 Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264