Exhibit 99.2

|

| | |

| | | |

| Community Healthcare Trust | | September 2015 |

| Incorporated | | |

Supplemental Information

Third Quarter 2015

|

|

| |

| |

| NYSE: CHCT |

| www.communityhealthcaretrust.com |

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

In addition to the historical information contained within, the matters discussed in this supplemental operating and financial information package may contain forward-looking statements that involve risks and uncertainties. These risks and uncertainties are discussed from time to time in the Company's filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein which speak only as of the date hereof. The Company undertakes no obligation to update forward-looking statements, whether as the result of new information, future developments, or otherwise, except as may be required by law.

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 2 |

CORPORATE INFORMATION

|

| | | | |

| Corporate Headquarters |

| | | | | |

| Community Healthcare Trust Incorporated |

| 354 Cool Springs Blvd., Suite 106 |

| Franklin, Tennessee 37067 |

| Phone: 615.771.3052 |

| E-mail: Investorrelations@communityhealthcaretrust.com |

| Website: www.communityhealthcaretrust.com |

| |

| |

| Board of Directors |

| | | | | |

| Timothy G. Wallace | Alan Gardner | Robert Hensley | Alfred Lumsdaine | R. Lawrence Van Horn |

| Chairman of the Board, Chief Executive Officer and President | Lead Independent Director | Audit Committee Chair | Compensation Committee Chair | Governance Committee Chair |

| | | | | |

| | | | | |

| Management Team |

| | | | | |

| Timothy G. Wallace | W. Page Barnes | Steve Harrison | Roland H. Hart | Leigh Ann Stach |

| Chief Executive Officer and President | Executive Vice President, Chief Financial Officer | Managing Director, Business Development | Vice President, Asset Management | Vice President, Financial Reporting and Chief Accounting Officer |

| | | | | |

| | Michael Willman | William R. Davis | James W. Short | |

| | Vice President, Real Estate | Vice President, Information Technology | Vice President, Special Projects | |

| | | | | |

| | | | | |

| Covering Analysts |

| | | | | |

| A. Goldfarb - Sandler O'Neil | | R. Stevenson - Janney Capital Markets |

| S. McGrath - Evercore ISI | | S. Manaker - Oppenheimer |

| E. Fleming - SunTrust Robinson Humphrey | | | |

| | | | | |

| | | | | |

| Professional Services |

| | | | | |

| Independent Registered Public Accounting Firm | Transfer Agent |

| BDO USA, LLP | American Stock Transfer & Trust Company, LLC |

| 414 Union Street, Suite 1800 | Operations Center |

| Nashville, Tennessee 37219 | 6201 15th Avenue |

| | | Brooklyn, NY 11219 |

| | | | 1.800.937.5449 |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 3 |

HISTORICAL FFO AND NORMALIZED FFO (1)

(dollars in thousands, except per share data)

|

| | | | | | | |

| | 2015 |

| | Q3 | | Q2 |

| Net loss | $ | (67 | ) | | $ | (1,509 | ) |

| Real estate depreciation and amortization | 2,211 |

| | 577 |

|

| Total adjustments | 2,211 |

| | 577 |

|

| Funds from Operations | $ | 2,144 |

| | $ | (932 | ) |

| Transaction costs | (101 | ) | | 1,546 |

|

| Normalized Funds From Operations | $ | 2,043 |

| | $ | 614 |

|

| Funds from Operations per Common Share-Diluted | $ | 0.29 |

| | $ | (0.26 | ) |

| Normalized Funds From Operations Per Common Share-Diluted | $ | 0.27 |

| | $ | 0.17 |

|

| Weighted Average Common Shares Outstanding-Diluted | 7,507,460 |

| | 3,574,392 |

|

| Weighted Average Common Shares Outstanding-Diluted for Normalized FFO | 7,507,460 |

| | 3,563,389 |

|

|

| | |

| (1 | ) | Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For that reason, the Company considers FFO and normalized FFO to be appropriate measures of operating performance of an equity REIT. In particular, the Company believes that normalized FFO is useful because it allows investors, analysts and Company management to compare the Company’s operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events.

The Company uses the NAREIT definition of FFO. Funds from operations ("FFO") and FFO per share are operating performance measures adopted by the National Association of Real Estate Investment Trusts, Inc. ("NAREIT"). NAREIT defines FFO as the most commonly accepted and reported measure of a REIT's operating performance equal to "net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures." The Company has included normalized FFO above which it has defined as FFO excluding certain expenses related to the Company's initial public offering and closing costs of properties acquired and mortgages funded. Normalized FFO presented herein may not be comparable to similar measures presented by other real estate companies due to the fact that not all real estate companies use the same definition.

FFO, normalized FFO and FAD should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company’s financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are they necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO and normalized FFO should be examined in conjunction with net income as presented elsewhere herein. |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 4 |

BALANCE SHEET INFORMATION

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | |

| | 2015 | 2014 |

| | Q3 | Q2 | Q1 | Q4 |

| ASSETS | | | | |

| Real estate properties | | | | |

| Land | $ | 10,407 |

| $ | 9,357 |

| $ | — |

| $ | — |

|

| Buildings, improvements, and lease intangibles | 90,721 |

| 78,349 |

| — |

| — |

|

| Total real estate properties | 101,128 |

| 87,706 |

| — |

| — |

|

| Less accumulated depreciation | (2,788 | ) | (577 | ) | — |

| — |

|

| Total real estate properties, net | 98,340 |

| 87,129 |

| — |

| — |

|

| Cash and cash equivalents | 16,053 |

| 39,552 |

| 2 |

| 2 |

|

| Mortgage note receivable, net | 10,862 |

| — |

| — |

| — |

|

| Other assets | 1,795 |

| 1,139 |

| — |

| — |

|

| Total assets | $ | 127,050 |

| $ | 127,820 |

| $ | 2 |

| $ | 2 |

|

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Liabilities | | | | |

| Revolving credit facility | $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| Accounts payable and accrued liabilities | 1,031 |

| 1,098 |

| — |

| — |

|

| Other liabilities | 1,060 |

| 687 |

| — |

| — |

|

| Total liabilities | 2,091 |

| 1,785 |

| — |

| — |

|

| | | | | |

| Commitments and contingencies | | | | |

| | | | | |

| Stockholders' Equity | | | | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized | — |

| — |

| — |

| — |

|

| Common stock, $0.01 par value; 450,000,000 shares authorized | 76 |

| 76 |

| 2 |

| 2 |

|

| Additional paid-in capital | 127,538 |

| 127,468 |

| — |

| — |

|

| Cumulative net loss | (1,576 | ) | (1,509 | ) | — |

| — |

|

| Cumulative dividends | (1,079 | ) | — |

| — |

| — |

|

| Total stockholders’ equity | 124,959 |

| 126,035 |

| 2 |

| 2 |

|

| Total liabilities and stockholders' equity | $ | 127,050 |

| $ | 127,820 |

| $ | 2 |

| $ | 2 |

|

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 5 |

STATEMENTS OF OPERATIONS INFORMATION

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | |

| | 2015 | 2014 |

| | Q3 | Q2 | Q1 | Q4 |

| | | | | |

| REVENUES | | | | |

| Rental income | $ | 2,585 |

| $ | 729 |

| $ | — |

| $ | — |

|

| Tenant reimbursements | 655 |

| 107 |

| — |

| — |

|

| | 3,240 |

| 836 |

| — |

| — |

|

| | | | | |

| EXPENSES | | | | |

| Property operating | 751 |

| 138 |

| — |

| — |

|

| General and administrative | 223 |

| 1,603 |

| — |

| — |

|

| Depreciation and amortization | 2,211 |

| 577 |

| — |

| — |

|

| | 3,185 |

| 2,318 |

| — |

| — |

|

| OTHER INCOME (EXPENSE) | | | | |

| Interest expense | (140 | ) | (41 | ) | — |

| — |

|

| Interest and other income, net | 18 |

| 14 |

| — |

| — |

|

| | (122 | ) | (27 | ) | — |

| — |

|

| NET LOSS AND COMPREHENSIVE LOSS | $ | (67 | ) | $ | (1,509 | ) | $ | — |

| $ | — |

|

| | | | | |

| LOSS PER COMMON SHARE: | | | | |

| Net loss per common share – Basic | $ | (0.01 | ) | $ | (0.42 | ) | $ | — |

| $ | — |

|

| Net loss per common share – Diluted | $ | (0.01 | ) | $ | (0.42 | ) | $ | — |

| $ | — |

|

| WEIGHTED AVERAGE COMMON SHARE OUTSTANDING-BASIC | 7,511,183 |

| 3,574,392 |

| 200,000 |

| 200,000 |

|

| WEIGHTED AVERAGE COMMON SHARE OUTSTANDING-DILUTED | 7,511,183 |

| 3,574,392 |

| 200,000 |

| 200,000 |

|

| DIVIDENDS DECLARED, PER COMMON SHARE, DURING THE PERIOD | $ | 0.142 |

| $ | — |

| $ | — |

| $ | — |

|

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 6 |

INVESTMENT ACTIVITY

(dollars in thousands)

|

| | | | | | | | | | |

| 2015 INVESTMENT ACTIVITY | | | | |

| (As of September 30, 2015) | | | | | |

| | Location | Property Type | Acquisition/Closing Date | Purchase Price/Mortgage Funding | Square Feet | Aggregate Leased % at Acquisition |

| | | | | | | |

| Property Acquisitions: | | | | | |

| | Portsmouth, VA | PC | 5/28/2015 | $ | 1,375 |

| 8,445 |

| 100.0 | % |

| | Circleville, OH | ASC | 5/28/2015 | 1,570 |

| 7,787 |

| 88.8 | % |

| | Tempe, AZ | ASC | 5/28/2015 | 2,700 |

| 13,000 |

| 100.0 | % |

| | Houston, TX | ASC | 5/28/2015 | 4,600 |

| 11,200 |

| 100.0 | % |

| | Brewton, AL | OC | 5/29/2015 | 1,154 |

| 3,971 |

| 100.0 | % |

| | Orlando, FL | PC | 5/29/2015 | 1,327 |

| 2,420 |

| 100.0 | % |

| | Lady Lake, FL | PC | 5/29/2015 | 1,585 |

| 2,894 |

| 100.0 | % |

| | Foley, AL | OC | 5/29/2015 | 1,786 |

| 6,146 |

| 100.0 | % |

| | Gulf Shores, AL | OC | 5/29/2015 | 1,860 |

| 6,398 |

| 100.0 | % |

| | Columbia, SC | ASC | 5/29/2015 | 2,200 |

| 16,969 |

| 94.0 | % |

| | Melbourne, FL | PC | 5/29/2015 | 2,858 |

| 5,228 |

| 100.0 | % |

| | Brook Park, OH | MOB | 5/29/2015 | 3,650 |

| 18,444 |

| 100.0 | % |

| | Shawnee, KS | MOB | 5/29/2015 | 4,236 |

| 24,840 |

| 89.5 | % |

| | Shawnee, KS | PC | 5/29/2015 | 4,978 |

| 24,557 |

| 100.0 | % |

| | Alamo, TX | MOB | 5/29/2015 | 5,300 |

| 41,797 |

| 96.1 | % |

| | Etowah, TN | DC | 6/1/2015 | 600 |

| 4,720 |

| 100.0 | % |

| | Fort Valley, GA | DC | 6/1/2015 | 1,100 |

| 4,920 |

| 100.0 | % |

| | Gallipolis, OH | DC | 6/1/2015 | 1,250 |

| 15,110 |

| 100.0 | % |

| | Gilbert, AZ | PC | 6/1/2015 | 1,700 |

| 8,200 |

| 100.0 | % |

| | Dahlonega, GA | MOB | 6/1/2015 | 3,450 |

| 20,621 |

| 100.0 | % |

| | Wichita, KS | MOB | 6/1/2015 | 7,350 |

| 43,945 |

| 92.5 | % |

| | Portage, WI | PC | 6/3/2015 | 3,000 |

| 14,000 |

| 100.0 | % |

| | Lancaster, PA | PC | 6/3/2015 | 3,100 |

| 20,000 |

| 100.0 | % |

| | Wichita, KS | PC | 6/5/2015 | 4,350 |

| 16,581 |

| 100.0 | % |

| | Pasadena, TX | MOB | 6/5/2015 | 6,500 |

| 51,316 |

| 67.8 | % |

| | Corsicana, TX | DC | 6/9/2015 | 2,625 |

| 17,699 |

| 82.6 | % |

| | Castle Rock, CO | DC | 6/12/2015 | 3,050 |

| 8,450 |

| 100.0 | % |

| | Florence, KY | DC | 6/30/2015 | 3,600 |

| 18,283 |

| 100.0 | % |

| | Florence, KY | MOB | 6/30/2015 | 4,600 |

| 36,362 |

| 86.6 | % |

| | Bourbonnais, IL | MOB | 7/1/2015 | 9,000 |

| 54,000 |

| 91.6 | % |

| | Eynon, PA | ASC | 8/13/2015 | 1,383 |

| 6,500 |

| 100.0 | % |

| | Canon City, CO | ASC | 9/24/2015 | 2,700 |

| 10,653 |

| 100.0 | % |

| Total / Weighted Average | | | $ | 100,536 |

| 545,456 |

| 92.9 | % |

| | | | | | | |

| Mortgage Note Fundings: | | | | | |

| | Lafayette, LA | LTAC | 9/30/2015 | $ | 11,000 |

| 29,890 |

| 100.0 | % |

| Total / Weighted Average | | | $ | 11,000 |

| 29,890 |

| 100.0 | % |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 7 |

LEASING INFORMATION

LEASE EXPIRATION SCHEDULE

(As of September 30, 2015)

|

| | | | | | | |

| | Expiring Leases | Expiring Lease Square Feet | % of Total Square Feet | |

| Q4 2015 | 5 |

| 12,967 |

| 2.6 | % | |

| Q1 2016 | 2 |

| 1,689 |

| 0.3 | % | |

| Q2 2016 | 6 |

| 46,141 |

| 9.1 | % | |

| Q3 2016 | 3 |

| 19,237 |

| 3.8 | % | |

| Q4 2016 | 6 |

| 31,355 |

| 6.2 | % | |

| 2017 | 7 |

| 42,052 |

| 8.3 | % | |

| 2018 | 22 |

| 137,303 |

| 27.1 | % | |

| 2019 | 18 |

| 94,297 |

| 18.6 | % | |

| 2020 | 9 |

| 51,474 |

| 10.2 | % | |

| 2021 | 1 |

| 8,500 |

| 1.7 | % | |

| 2022 | 5 |

| 34,277 |

| 6.8 | % | |

| 2023 | 2 |

| 11,800 |

| 2.3 | % | |

| 2024 | 1 |

| 5,390 |

| 1.1 | % | |

| Thereafter | 3 |

| 10,542 |

| 1.9 | % | |

| | 90 |

| 507,024 |

| 100.0 | % | |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 8 |

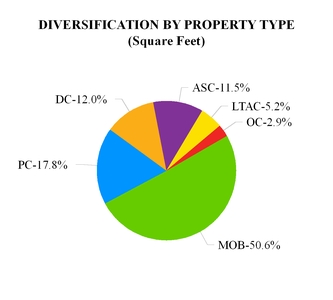

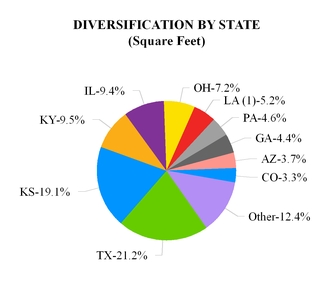

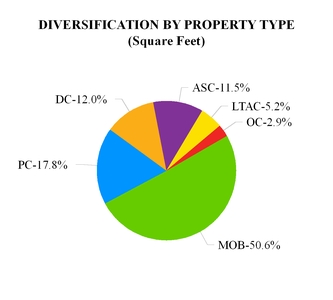

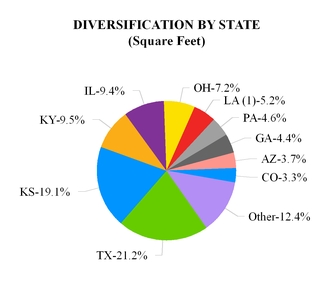

PROPERTY DIVERSIFICATION

(As of September 30, 2015)

|

| | | | | | | | | | | | | | |

| | Property Type | # of Properties | Square Feet | % | | State | # of Properties | Square Feet | % | |

| | MOB | 8 | 291,325 |

| 50.6 | % | | TX | 4 | 122,012 |

| 21.2 | % | |

| | PC | 9 | 102,325 |

| 17.8 | % | | KS | 4 | 109,923 |

| 19.1 | % | |

| | DC | 6 | 69,182 |

| 12.0 | % | | KY | 2 | 54,645 |

| 9.5 | % | |

| | ASC | 6 | 66,109 |

| 11.5 | % | | IL | 1 | 54,000 |

| 9.4 | % | |

| | LTAC (1) | 1 | 29,890 |

| 5.2 | % | | OH | 3 | 41,341 |

| 7.2 | % | |

| | OC | 3 | 16,515 |

| 2.9 | % | | LA (1) | 1 | 29,890 |

| 5.2 | % | |

| | Total | 33 | 575,346 |

| 100.0 | % | | PA | 2 | 26,500 |

| 4.6 | % | |

| | | | | | | GA | 2 | 25,541 |

| 4.4 | % | |

| | | | | | | AZ | 2 | 21,200 |

| 3.7 | % | |

| | | | | | | CO | 2 | 19,103 |

| 3.3 | % | |

| | | | | | | Other | 10 | 71,191 |

| 12.4 | % | |

| | | | | | | Total | 33 | 575,346 |

| 100.0 | % | |

| (1) Mortgage investment | | | | | | | | |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 9 |

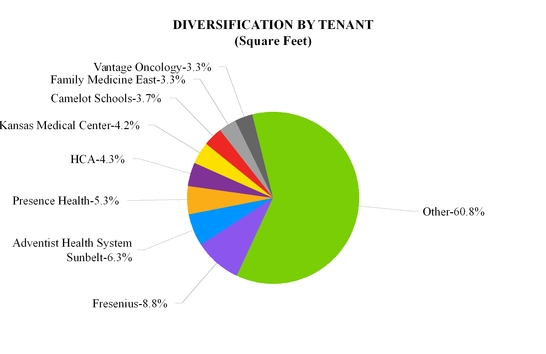

PROPERTY DIVERSIFICATION

(continued)

|

| | | | | |

| | Tenant | Square Feet | % | |

| | Fresenius | 44,643 | 8.8 | % | |

| | Adventist Health System Sunbelt Healthcare Corporation | 32,057 | 6.3 | % | |

| | Presence Health | 27,007 | 5.3 | % | |

| | HCA | 21,892 | 4.3 | % | |

| | Kansas Medical Center, LLC | 21,255 | 4.2 | % | |

| | Camelot Schools, LLC | 18,709 | 3.7 | % | |

| | Family Medicine East, Chartered and Heartland Research Associates, LLC | 16,581 | 3.3 | % | |

| | Vantage Oncology | 16,515 | 3.3 | % | |

| | Other (Less than 3%) | 308,365 | 60.8 | % | |

| | Total | 507,024 | 100.0 | % | |

|

| | |

| Community Healthcare Trust / 3Q 2015 Supplemental Information | | Page 10 |