Exhibit 99.2

Supplemental Information

Third Quarter 2016

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

In addition to the historical information contained within, the matters discussed in this supplemental operating and financial information package may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “believes”, “expects”, “may”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, “anticipates” or other similar words or expressions, including the negative thereof. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections or other forward-looking information. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. Because forward-looking statements relate to future events, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of Community Healthcare Trust Incorporated (the "Company"). Thus, the Company’s actual results and financial condition may differ materially from those indicated in such forward-looking statements. Some factors that might cause such a difference include the following: general volatility of the capital markets and the market price of the Company’s common stock, changes in the Company’s business strategy, availability, terms and deployment of capital, the Company’s ability to refinance existing indebtedness at or prior to maturity on favorable terms, or at all, changes in the real estate industry in general, interest rates or the general economy, adverse developments related to the healthcare industry, the degree and nature of the Company’s competition, the ability to consummate acquisitions under contract and the other factors described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, and the Company’s other filings with the Securities and Exchange Commission from time to time. Readers are therefore cautioned not to place undue reliance on the forward-looking statements contained herein which speak only as of the date hereof. The Company intends these forward-looking statements to speak only as of the time of this Supplemental operating and financial information package and undertakes no obligation to update forward-looking statements, whether as a result of new information, future developments, or otherwise, except as may be required by law.

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 2 |

CORPORATE INFORMATION

|

| | | | |

| Corporate Headquarters |

| | | | | |

| Community Healthcare Trust Incorporated |

| 3326 Aspen Grove Drive, Suite 150 |

| Franklin, Tennessee 37067 |

| Phone: 615.771.3052 |

| E-mail: Investorrelations@chct.reit |

| Website: www.chct.reit |

| |

| |

| Board of Directors |

| | | | | |

| Timothy G. Wallace | Alan Gardner | Robert Hensley | Alfred Lumsdaine | R. Lawrence Van Horn |

Chairman of the Board, Chief Executive Officer and President | Lead Independent Director | Audit Committee Chair | Compensation Committee Chair | Corporate Governance Committee Chair |

| | | | | |

| | | | | |

| Management Team |

| | | | | |

| Timothy G. Wallace | W. Page Barnes | Steve Harrison | Roland H. Hart | Leigh Ann Stach |

Chief Executive Officer and President | Executive Vice President, Chief Financial Officer | Managing Director, Business Development | Vice President, Asset Management | Vice President, Financial Reporting and Chief Accounting Officer |

| | | | | |

| | Michael Willman | William R. Davis | James W. Short | |

| | Vice President, Real Estate | Vice President, Information Technology | Vice President, Special Projects | |

| | | | | |

| | | | | |

| Covering Analysts |

| | | | | |

| A. Goldfarb - Sandler O'Neil | | R. Stevenson - Janney Capital Markets |

| S. McGrath - Evercore ISI | | S. Manaker - Oppenheimer |

| E. Fleming - SunTrust Robinson Humphrey | | | |

| | | | | |

| | | | | |

| Professional Services |

| | | | | |

| Independent Registered Public Accounting Firm | Transfer Agent |

| BDO USA, LLP | American Stock Transfer & Trust Company, LLC |

| 414 Union Street, Suite 1800 | Operations Center |

| Nashville, Tennessee 37219 | 6201 15th Avenue |

| | | Brooklyn, NY 11219 |

| | | | 1.800.937.5449 |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 3 |

HISTORICAL FFO, NORMALIZED FFO AND AFFO (1) (2)

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | | 2015 |

| | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 (4) |

| Net income (loss) | $ | 1,064 |

| | $ | 508 |

| | $ | 116 |

| | $ | 121 |

| | $ | (67 | ) | | $ | (1,509 | ) |

| Real estate depreciation and amortization | 3,493 |

| | 3,330 |

| | 2,813 |

| | 2,415 |

| | 2,211 |

| | 577 |

|

| Total adjustments | 3,493 |

| | 3,330 |

| | 2,813 |

| | 2,415 |

| | 2,211 |

| | 577 |

|

| Funds from Operations | $ | 4,557 |

| | $ | 3,838 |

| | $ | 2,929 |

| | $ | 2,536 |

| | $ | 2,144 |

| | $ | (932 | ) |

| Transaction costs | 137 |

| | 204 |

| | 288 |

| | 243 |

| | (101 | ) | | 1,546 |

|

Normalized Funds From Operations (3) | $ | 4,694 |

| | $ | 4,042 |

| | $ | 3,217 |

| | $ | 2,779 |

| | $ | 2,043 |

| | $ | 614 |

|

| Straight line rent | (171 | ) | | (138 | ) | | (95 | ) | | (69 | ) | | (50 | ) | | (14 | ) |

| Deferred compensation | 192 |

| | 140 |

| | 121 |

| | 70 |

| | 69 |

| | 26 |

|

AFFO (3) | $ | 4,715 |

| | $ | 4,044 |

| | $ | 3,243 |

| | $ | 2,780 |

| | $ | 2,062 |

| | $ | 626 |

|

| Funds from Operations per Common Share-Diluted | $ | 0.36 |

| | $ | 0.32 |

| | $ | 0.39 |

| | $ | 0.34 |

| | $ | 0.29 |

| | $ | (0.26 | ) |

| Normalized Funds From Operations Per Common Share-Diluted | $ | 0.37 |

| | $ | 0.34 |

| | $ | 0.43 |

| | $ | 0.37 |

| | $ | 0.27 |

| | $ | 0.17 |

|

| AFFO Per Common Share-Diluted | $ | 0.37 |

| | $ | 0.34 |

| | $ | 0.43 |

| | $ | 0.37 |

| | $ | 0.27 |

| | $ | 0.18 |

|

| Weighted Average Common Shares Outstanding-Diluted | 12,750,967 |

| | 12,064,839 |

| | 7,562,644 |

| | 7,511,815 |

| | 7,511,183 |

| | 3,574,392 |

|

| Weighted Average Common Shares Outstanding-Diluted for Normalized FFO and AFFO | 12,750,967 |

| | 12,064,839 |

| | 7,562,644 |

| | 7,511,815 |

| | 7,511,183 |

| | 3,563,389 |

|

|

| | |

| (1 | ) | Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For that reason, the Company considers funds from operations ("FFO"), normalized FFO and adjusted funds from operations ("AFFO") to be appropriate measures of operating performance of an equity real estate investment trust ("REIT"). In particular, the Company believes that normalized FFO and AFFO are useful because they allows investors, analysts and Company management to compare the Company’s operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events.

The Company uses the National Association of Real Estate Investment Trusts, Inc. ("NAREIT") definition of FFO. FFO and FFO per share are operating performance measures adopted by NAREIT. NAREIT defines FFO as the most commonly accepted and reported measure of a REIT's operating performance equal to "net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures." The Company has included normalized FFO which it has defined as FFO excluding certain expenses related to equity offerings and closing costs of properties acquired and mortgages funded and has included AFFO which it has defined as normalized FFO excluding straight-line rent and deferred compensation and may include other non-cash items from time to time. Normalized FFO and AFFO presented herein may not be comparable to similar measures presented by other real estate companies due to the fact that not all real estate companies use the same definitions.

FFO, normalized FFO and AFFO should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company’s financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are they necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO, normalized FFO and AFFO should be examined in conjunction with net income as presented elsewhere herein.

|

| (2 | ) | There were no revenue-generating operations prior to the Company's initial public offering in May 2015, therefore, there were no funds from operations prior to the second quarter of 2015. |

| (3 | ) | Normalized FFO has been restated for prior periods, to remove adjustments for straight line rent and deferred compensation, and AFFO has been calculated and added for all periods presented to more closely agree to similar presentations used by the industry. |

| (4 | ) | Weighted average common shares outstanding used in calculating Normalized FFO and AFFO for the three months ended June 30, 2015 includes the dilutive effect of 11,003 shares of restricted common stock that were excluded in calculating the weighted average common shares outstanding for FFO because the effect was anti-dilutive due to the net loss incurred in the period. |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 4 |

BALANCE SHEET INFORMATION

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | 2015 | 2014 |

| | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 |

| ASSETS | | | | | | | | |

| Real estate properties | | | | | | | | |

| Land and land improvements | $ | 24,109 |

| $ | 22,601 |

| $ | 19,317 |

| $ | 13,216 |

| $ | 10,407 |

| $ | 9,357 |

| $ | — |

| $ | — |

|

| Buildings, improvements, and lease intangibles | 182,474 |

| 171,407 |

| 140,322 |

| 119,716 |

| 90,721 |

| 78,349 |

| — |

| — |

|

| Personal property | 97 |

| 81 |

| 69 |

| 35 |

| — |

| — |

| — |

| — |

|

| Total real estate properties | 206,680 |

| 194,089 |

| 159,708 |

| 132,967 |

| 101,128 |

| 87,706 |

| — |

| — |

|

| Less accumulated depreciation | (14,846 | ) | (11,350 | ) | (8,018 | ) | (5,203 | ) | (2,788 | ) | (577 | ) | — |

| — |

|

| Total real estate properties, net | 191,834 |

| 182,739 |

| 151,690 |

| 127,764 |

| 98,340 |

| 87,129 |

| — |

| — |

|

| Cash and cash equivalents | 1,742 |

| 10,920 |

| 1,571 |

| 2,018 |

| 16,053 |

| 39,552 |

| 2 |

| 2 |

|

| Mortgage note receivable, net | 10,875 |

| 10,872 |

| 23,277 |

| 10,897 |

| 10,862 |

| — |

| — |

| — |

|

| Other assets, net | 4,153 |

| 3,082 |

| 2,704 |

| 2,124 |

| 1,795 |

| 1,139 |

| — |

| — |

|

| Total assets | $ | 208,604 |

| $ | 207,613 |

| $ | 179,242 |

| $ | 142,803 |

| $ | 127,050 |

| $ | 127,820 |

| $ | 2 |

| $ | 2 |

|

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| Liabilities | | | | | | | | |

| Revolving credit facility | $ | 5,000 |

| $ | — |

| $ | 55,000 |

| $ | 17,000 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

| Accounts payable and accrued liabilities | 2,755 |

| 2,521 |

| 1,299 |

| 812 |

| 1,031 |

| 1,098 |

| — |

| — |

|

| Other liabilities | 3,095 |

| 3,625 |

| 3,349 |

| 2,721 |

| 1,060 |

| 687 |

| — |

| — |

|

| Total liabilities | 10,850 |

| 6,146 |

| 59,648 |

| 20,533 |

| 2,091 |

| 1,785 |

| — |

| — |

|

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Common stock, $0.01 par value; 450,000,000 shares authorized | 130 |

| 129 |

| 77 |

| 76 |

| 76 |

| 76 |

| 2 |

| 2 |

|

| Additional paid-in capital | 214,102 |

| 213,912 |

| 127,697 |

| 127,578 |

| 127,538 |

| 127,468 |

| — |

| — |

|

| Cumulative net income (loss) | 232 |

| (832 | ) | (1,340 | ) | (1,456 | ) | (1,576 | ) | (1,509 | ) | — |

| — |

|

| Cumulative dividends | (16,710 | ) | (11,742 | ) | (6,840 | ) | (3,928 | ) | (1,079 | ) | — |

| — |

| — |

|

| Total stockholders’ equity | 197,754 |

| 201,467 |

| 119,594 |

| 122,270 |

| 124,959 |

| 126,035 |

| 2 |

| 2 |

|

| Total liabilities and stockholders' equity | $ | 208,604 |

| $ | 207,613 |

| $ | 179,242 |

| $ | 142,803 |

| $ | 127,050 |

| $ | 127,820 |

| $ | 2 |

| $ | 2 |

|

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 5 |

STATEMENTS OF OPERATIONS INFORMATION

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2016 | 2015 | 2014 |

| | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 |

| | | | | | | | | |

| REVENUES | | | | | | | | |

| Rental income | $ | 4,985 |

| $ | 4,530 |

| $ | 3,673 |

| $ | 3,050 |

| $ | 2,585 |

| $ | 729 |

| $ | — |

| $ | — |

|

| Tenant reimbursements | 1,188 |

| 1,105 |

| 957 |

| 1,202 |

| 655 |

| 107 |

| — |

| — |

|

| Mortgage interest | 270 |

| 561 |

| 536 |

| 304 |

| — |

| — |

| — |

| — |

|

| | 6,443 |

| 6,196 |

| 5,166 |

| 4,556 |

| 3,240 |

| 836 |

| — |

| — |

|

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Property operating | 963 |

| 1,228 |

| 1,049 |

| 1,123 |

| 751 |

| 138 |

| — |

| — |

|

| General and administrative | 671 |

| 895 |

| 806 |

| 646 |

| 223 |

| 1,603 |

| — |

| — |

|

| Depreciation and amortization | 3,496 |

| 3,332 |

| 2,815 |

| 2,416 |

| 2,211 |

| 577 |

| — |

| — |

|

| Bad debts | 73 |

| 30 |

| — |

| 71 |

| — |

| — |

| — |

| — |

|

| | 5,203 |

| 5,485 |

| 4,670 |

| 4,256 |

| 3,185 |

| 2,318 |

| — |

| — |

|

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Interest expense | (185 | ) | (222 | ) | (380 | ) | (183 | ) | (140 | ) | (41 | ) | — |

| — |

|

| Interest and other income, net | 9 |

| 19 |

| — |

| 4 |

| 18 |

| 14 |

| — |

| — |

|

| | (176 | ) | (203 | ) | (380 | ) | (179 | ) | (122 | ) | (27 | ) | — |

| — |

|

| NET INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) | $ | 1,064 |

| $ | 508 |

| $ | 116 |

| $ | 121 |

| $ | (67 | ) | $ | (1,509 | ) | $ | — |

| $ | — |

|

| | | | | | | | | |

| NET INCOME (LOSS) PER COMMON SHARE | | | | | | | | |

| Net income (loss) per common share – Basic | $ | 0.08 |

| $ | 0.04 |

| $ | 0.02 |

| $ | 0.02 |

| $ | (0.01 | ) | $ | (0.42 | ) | $ | — |

| $ | — |

|

| Net income (loss) per common share – Diluted | $ | 0.08 |

| $ | 0.04 |

| $ | 0.02 |

| $ | 0.02 |

| $ | (0.01 | ) | $ | (0.42 | ) | $ | — |

| $ | — |

|

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-BASIC | 12,686,183 |

| 12,038,381 |

| 7,511,183 |

| 7,511,183 |

| 7,511,183 |

| 3,574,392 |

| 200,000 |

| 200,000 |

|

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-DILUTED | 12,750,967 |

| 12,064,839 |

| 7,562,644 |

| 7,511,815 |

| 7,511,183 |

| 3,574,392 |

| 200,000 |

| 200,000 |

|

| DIVIDENDS DECLARED, PER COMMON SHARE, DURING THE PERIOD | $ | 0.3825 |

| $ | 0.3800 |

| $ | 0.3775 |

| $ | 0.3750 |

| $ | 0.1420 |

| $ | — |

| $ | — |

| $ | — |

|

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 6 |

PROPERTY LOCATIONS

Approximately 53% of our property revenues are in MSAs with populations over 1,000,000 and approximately 92% are in MSAs with populations over 100,000.

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Revenue (1) | % of Revenue | Population | MSA/MISA | Rank |

| | | | | | | | ($ 000's) | | | | |

| Chicago Behavioral Hospital | BF | 1771 Rand Road | Des Plaines | IL | 85,000 |

| 7.41 | % | 1,900.0 |

| 8.86 | % | 7,340,454 |

| Chicago-Naperville-Arlington Heights, IL | 5 |

|

| Novamed Surgery Center | ASC | 6309 West 95th Street | Oak Lawn | IL | 30,455 |

| 2.66 | % | 616.9 |

| 2.88 | % | 7,340,454 |

| Chicago-Naperville-Arlington Heights, IL | 5 |

|

| Bayside Medical Center | MOB | 4001 Preston Avenue | Pasadena | TX | 51,316 |

| 4.47 | % | 719.8 |

| 3.36 | % | 6,656,947 |

| Houston-The Woodlands-Sugar Land, TX | 8 |

|

| Northwest Surgery Center | ASC | 5215 Hollister Street | Houston | TX | 11,200 |

| 0.98 | % | 466.4 |

| 2.18 | % | 6,656,947 |

| Houston-The Woodlands-Sugar Land, TX | 8 |

|

| Continuum Wellness Center | PC | 3941 E. Baseline Road | Gilbert | AZ | 8,200 |

| 0.71 | % | 224.5 |

| 1.05 | % | 4,574,531 |

| Phoenix-Mesa-Scottsdale, AZ | 17 |

|

| Desert Endoscopy Center | ASC | 610 E. Baseline Road | Tempe | AZ | 13,000 |

| 1.13 | % | 242.7 |

| 1.13 | % | 4,574,531 |

| Phoenix-Mesa-Scottsdale, AZ | 17 |

|

| Mountain View Surgery Center | ASC | 3131 West Peoria Avenue | Phoenix | AZ | 13,835 |

| 1.21 | % | 297.5 |

| 1.39 | % | 4,574,531 |

| Phoenix-Mesa-Scottsdale, AZ | 17 |

|

| Liberty Dialysis | DC | 4352 Trail Boss Drive | Castle Rock | CO | 8,450 |

| 0.74 | % | 301.5 |

| 1.41 | % | 2,814,330 |

| Denver-Aurora-Lakewood, CO | 27 |

|

| Berry Surgical Center | ASC | 28500 Orchard Lake Road | Farmington Hills | MI | 27,217 |

| 2.37 | % | 613.4 |

| 2.86 | % | 2,542,708 |

| Warren-Troy-Farmington Hills, MI | 32 |

|

| Bassin Center For Plastic Surgery | PC | 422 Alafaya Trail #32 | Orlando | FL | 2,420 |

| 0.21 | % | 126.0 |

| 0.59 | % | 2,387,138 |

| Orlando-Kissimmee-Sanford, FL | 37 |

|

| Bassin Center For Plastic Surgery | PC | 8575 NE 138th Lane Sts 103-104 | Lady Lake | FL | 2,894 |

| 0.25 | % | 272.2 |

| 1.27 | % | 2,387,138 |

| Orlando-Kissimmee-Sanford, FL | 37 |

|

| Medical Village at Wintergarden | MOB | 1210 E. Plant Street | Winter Garden | FL | 21,648 |

| 1.89 | % | 476.6 |

| 2.22 | % | 2,387,138 |

| Orlando-Kissimmee-Sanford, FL | 37 |

|

| Cavalier Medical & Dialysis Center | MOB | 47 & 51 Cavalier Blvd | Florence | KY | 36,362 |

| 3.17 | % | 407.3 |

| 1.90 | % | 2,157,719 |

| Cincinnati, OH-KY-IN | 42 |

|

| Fresenius Florence Dialysis Center | DC | 7205 Dixie Hwy | Florence | KY | 18,283 |

| 1.59 | % | 327.8 |

| 1.53 | % | 2,157,719 |

| Cincinnati, OH-KY-IN | 42 |

|

| Prairie Star Medical Facility I | PC | 6815 Hilltop Road | Shawnee | KS | 24,557 |

| 2.14 | % | 460.4 |

| 2.15 | % | 2,087,471 |

| Kansas City, MO-KS | 45 |

|

| Prarie Star Medical Facility II | MOB | 6850 Hilltop Road | Shawnee | KS | 24,840 |

| 2.17 | % | 451.6 |

| 2.11 | % | 2,087,471 |

| Kansas City, MO-KS | 45 |

|

| Brook Park Medical Building | MOB | 15900 Snow Road | Brook Park | OH | 18,444 |

| 1.61 | % | 369.1 |

| 1.72 | % | 2,060,810 |

| Cleveland-Elyria, OH | 46 |

|

| Rockside Medical Center | MOB | 6701 Rockside Road | Independence | OH | 54,611 |

| 4.76 | % | 1,289.6 |

| 6.02 | % | 2,060,810 |

| Cleveland-Elyria, OH | 46 |

|

| Court Street Surgery Center | ASC | 1235 South Court Street | Circleville | OH | 7,787 |

| 0.68 | % | 190.9 |

| 0.89 | % | 2,021,632 |

| Columbus, OH | 47 |

|

| Assurance Health, LLC | BF | 2725 Enterprise Drive | Anderson | IN | 10,200 |

| 0.89 | % | 315.0 |

| 1.47 | % | 1,988,817 |

| Indianapolis-Carmel-Anderson, IN | 49 |

|

| Associated Surgical Center of Dearborn | ASC | 24420 Ford Road | Dearborn Heights | MI | 12,400 |

| 1.08 | % | 338.7 |

| 1.58 | % | 1,759,335 |

| Detroit-Dearborn-Livonia, MI | 55 |

|

| Virgina Orthopaedic & Spine Specialists | PC | 3300 High Street | Portsmouth | VA | 8,445 |

| 0.74 | % | 168.9 |

| 0.79 | % | 1,724,876 |

| Virginia Beach-Norfolk-Newport News, VA-NC | 56 |

|

| Memphis Spine and Rehab Center | PC | 8132 Country Village Drive | Memphis | TN | 11,669 |

| 1.02 | % | 240.0 |

| 1.12 | % | 1,344,127 |

| Memphis, TN-MS-AR | 63 |

|

| Sterling Medical Center | MOB | 200 Sterling Drive | Orchard Park | NY | 28,697 |

| 2.50 | % | 479.9 |

| 2.24 | % | 1,135,230 |

| Buffalo-Cheektowaga-Niagara Falls, NY | 73 |

|

| Los Alamos Professional Plaza | MOB | 427 E. Duranta Avenue | Alamo | TX | 41,797 |

| 3.64 | % | 522.4 |

| 2.44 | % | 842,304 |

| McAllen-Edinburg-Mission, TX | 92 |

|

| Columbia Gastroenterology Surgery Ctr | ASC | 2739 Laurel Street | Columbia | SC | 16,969 |

| 1.48 | % | 321.7 |

| 1.50 | % | 810,068 |

| Columbia, SC | 96 |

|

| Parkway Professional Plaza | MOB | 4725 US Hwy 98 S | Lakeland | FL | 40,000 |

| 3.49 | % | 661.7 |

| 3.09 | % | 650,092 |

| Lakeland-Winter Haven, FL | 111 |

|

| Cypress Medical Center | MOB | 9300 E. 29th Street North | Wichita | KS | 43,945 |

| 3.83 | % | 910.1 |

| 4.25 | % | 644,610 |

| Wichita, KS | 112 |

|

| Family Medicine East | PC | 1709 S. Rock Road | Wichita | KS | 16,581 |

| 1.45 | % | 410.8 |

| 1.92 | % | 644,610 |

| Wichita, KS | 112 |

|

| Grene Vision Center | PC | 655 N. Woodlawn Blvd | Wichita | KS | 11,891 |

| 1.04 | % | 276.0 |

| 1.29 | % | 644,610 |

| Wichita, KS | 112 |

|

| UW Health Clinic- Portage | PC | 2977 County Highway CX | Portage | WI | 14,000 |

| 1.22 | % | 296.0 |

| 1.38 | % | 641,385 |

| Madison, WI | 114 |

|

| Medical Village at Debary | MOB | 110 Pond Court | Debary | FL | 24,000 |

| 2.09 | % | 543.8 |

| 2.54 | % | 623,279 |

| Deltona-Daytona Beach-Ormond Beach, FL | 117 |

|

| Bassin Center For Plastic Surgery | PC | 1705 Berglund Lane | Viera | FL | 5,228 |

| 0.46 | % | 150.7 |

| 0.70 | % | 568,088 |

| Palm Bay-Melbourne-Titusville, FL | 123 |

|

| Eynon Surgery Center | ASC | 681 Scranton Carbondale Hwy | Eynon | PA | 6,500 |

| 0.57 | % | 157.2 |

| 0.73 | % | 558,166 |

| Scranton--Wilkes-Barre--Hazleton, PA | 125 |

|

AMG Specialty Hospital - Lafayette (2) | LTAC | 310 Youngville Highway | Lafayette | LA | 29,890 |

| 2.61 | % | 1,060.0 |

| 4.88 | % | 490,488 |

| Lafayette, LA Metro Area | 130 |

|

| | | | (CONTINUED) | | | | | | | | |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 7 |

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Revenue (1) | % of Revenue | Population | MSA/MISA | Rank |

| | | | | | | | ($ 000's) | | | | |

| Grandview Plaza | PC | 802 New Holland Avenue | Lancaster | PA | 20,000 |

| 1.74 | % | 461.4 |

| 2.15 | % | 536,624 |

| Lancaster, PA | 131 |

|

| Treasure Coast Medical Pavilion | MOB | 3498 NW Federal Hwy #C | Jensen Beach | FL | 56,457 |

| 4.92 | % | 839.0 |

| 3.91 | % | 454,846 |

| Port St. Lucie, FL | 141 |

|

| Londonderry Centre | MOB | 7030 New Sanger Avenue | Waco | TX | 19,495 |

| 1.70 | % | 417.2 |

| 1.95 | % | 262,813 |

| Waco, TX | 210 |

|

| Gulf Coast Cancer Centers | OC | 253 Professional Lane | Gulf Shores | AL | 6,398 |

| 0.56 | % | 196.7 |

| 0.92 | % | 203,709 |

| Daphne-Fairhope-Foley, AL | 248 |

|

| Gulf Coast Cancer Centers | OC | 1703 North Bunner Street | Foley | AL | 6,146 |

| 0.54 | % | 189.0 |

| 0.88 | % | 203,709 |

| Daphne-Fairhope-Foley, AL | 248 |

|

| Fresenius Ft. Valley | DC | 135 Avera Drive | Fort Valley | GA | 4,920 |

| 0.43 | % | 116.8 |

| 0.54 | % | 188,149 |

| Warner Robins, GA | 259 |

|

| Provena Medical Center | MOB | 600-680 N. Convent Street | Bourbonnais | IL | 54,000 |

| 4.71 | % | 871.8 |

| 4.07 | % | 110,879 |

| Kankakee, IL | 387 |

|

| Fresenius Gallipolis Dialysis Center | DC | 137 Pine Street | Gallipolis | OH | 15,110 |

| 1.32 | % | 134.8 |

| 0.63 | % | 57,179 |

| Point Pleasant, WV-OH Micro Area | 575 |

|

| Davita Etowah Dialysis Center | DC | 109 Grady Road | Etowah | TN | 4,720 |

| 0.41 | % | 66.1 |

| 0.31 | % | 52,639 |

| Athens, TN Micro Area | 604 |

|

| Fresenius Dialysis Center | DC | 1321 W. 2nd Avenue | Corsicana | TX | 17,699 |

| 1.54 | % | 132.0 |

| 0.62 | % | 48,323 |

| Corsicana, TX Micro Area | 636 |

|

| Arkansas Valley Surgery Center | ASC | 933 Sell Avenue | Canon City | CO | 10,165 |

| 0.89 | % | 256.0 |

| 1.19 | % | 46,692 |

| Canon City, CO Micro Area | 650 |

|

| Dahlonega Medical Mall | MOB | 134 Ansley Drive | Dahlonega | GA | 20,621 |

| 1.80 | % | 236.6 |

| 1.10 | % | 5,242 |

| N/A | |

| Gulf Coast Cancer Centers | OC | 1207 Azalea Place | Brewton | AL | 3,971 |

| 0.35 | % | 122.1 |

| 0.57 | % | 5,408 |

| N/A | |

| Haleyville Physicians Prof Bldg | MOB | 42030 Hwy 195 East | Haleyville | AL | 29,515 |

| 2.57 | % | 139.6 |

| 0.65 | % | 4,173 |

| N/A | |

| Russellville Medical Plaza | MOB | 15155 Hwy 43 NE | Russellville | AL | 29,129 |

| 2.54 | % | 137.8 |

| 0.64 | % | 9,830 |

| N/A | |

| Sanderling Dialysis Center | DC | 102 Crestview Drive | Holdenville | OK | 5,217 |

| 0.45 | % | 237.5 |

| 1.11 | % | 5,795 |

| N/A | |

| Winfield Medical Office Buildings | PC | 191 Carraway Dr | Winfield | AL | 60,592 |

| 5.28 | % | 286.6 |

| 1.34 | % | 4,717 |

| N/A | |

| | | | | | | | | | | | |

(1) Annualized revenue for leases was calculated by multiplying base rent for the month of September 2016 by 12 and for the mortgage was calculated based on the principal outstanding at September 30, 2016 in accordance with the mortgage note. |

| (2) Mortgage investment. | | | | | | | | | | | |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 8 |

INVESTMENT ACTIVITY

(dollars in thousands)

|

| | | | | | | | | | |

| 2016 INVESTMENT ACTIVITY | | | | |

| | | | | | |

| | Location | Property Type | Acquisition/ Closing Date | Purchase Price/ Mortgage Funding | Square Feet | Aggregate Leased

% at Acquisition |

| | | | | | | |

| Property Acquisitions: | | | | | |

| | Waco, TX | MOB | 1/15/2016 | $ | 2,700 |

| 19,495 |

| 100.0 | % |

| | Lakeland, FL | MOB | 1/21/2016 | 6,750 |

| 40,036 |

| 84.1 | % |

| | Oak Lawn, IL | ASC | 3/30/2016 | 6,578 |

| 30,455 |

| 100.0 | % |

| | Jensen Beach, FL | MOB | 3/30/2016 | 9,400 |

| 56,457 |

| 100.0 | % |

| | Independence, OH | MOB | 4/19/2016 | 10,350 |

| 54,611 |

| 82.3 | % |

| | Des Plaines, IL (1) | BF | 5/23/2016 | 20,000 |

| 85,000 |

| 100.0 | % |

| | Phoenix, AZ | ASC | 6/21/2016 | 3,154 |

| 13,835 |

| 100.0 | % |

| | Holdenville, OK | DC | 9/26/2016 | 2,500 |

| 5,217 |

| 100.0 | % |

| | Orchard Park, NY | MOB | 9/29/2016 | 4,599 |

| 28,697 |

| 100.0 | % |

| | Cordova, TN | PC | 9/30/2016 | 2,050 |

| 11,669 |

| 100.0 | % |

| | Dearborn Heights, MI | ASC | 9/30/2016 | 3,000 |

| 12,400 |

| 100.0 | % |

| Total / Weighted Average | | | $ | 71,081 |

| 357,872 |

| 95.5 | % |

| | | | | | | |

| | (1) Included the conversion of a $12.5 million mortgage note upon the acquisition of the property that secured the note on May 23, 2016. |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 9 |

LEASING INFORMATION

LEASE EXPIRATION SCHEDULE (1)

|

| | | | | | | | | | | |

| | | Total Leased Square Footage | Annualized Lease Revenue |

| Year | Number of Leases Expiring | Amount | Percent (%) | Amount (in thousands) | Percent (%) |

| Q4 2016 | 5 |

| 23,979 |

| 2.3 | % | 600 |

| 2.9 | % |

| 2017 | 18 |

| 117,320 |

| 11.4 | % | 2,811 |

| 13.8 | % |

| 2018 | 30 |

| 159,949 |

| 15.5 | % | 3,281 |

| 16.1 | % |

| 2019 | 27 |

| 121,942 |

| 11.8 | % | 2,819 |

| 13.8 | % |

| 2020 | 17 |

| 122,072 |

| 11.8 | % | 2,128 |

| 10.5 | % |

| 2021 | 8 |

| 69,723 |

| 6.8 | % | 1,489 |

| 7.3 | % |

| 2022 | 12 |

| 86,706 |

| 8.4 | % | 1,640 |

| 8.0 | % |

| 2023 | 6 |

| 35,261 |

| 3.4 | % | 634 |

| 3.1 | % |

| 2024 | 1 |

| 5,390 |

| 0.5 | % | 187 |

| 0.9 | % |

| 2025 | 6 |

| 29,234 |

| 2.8 | % | 689 |

| 3.4 | % |

| Thereafter | 15 |

| 252,161 |

| 24.4 | % | 3,964 |

| 19.5 | % |

| Month-to-Month | 7 |

| 9,013 |

| 0.9 | % | 148 |

| 0.7 | % |

| Totals | 152 |

| 1,032,750 |

| 100.0 | % | $ | 20,390 |

| 100.0 | % |

(1) Total portfolio was approximately 92.4% leased in the aggregate at September 30, 2016 with lease expirations ranging from 2016 through 2031.

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 10 |

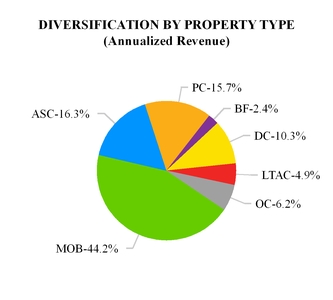

PROPERTY DIVERSIFICATION

(As of September 30, 2016)

|

| | | | | | |

| Property Type | Number of Properties |

Annualized Revenue (1) ($ in thousands) | Annualized Revenue (%) |

| Medical Office Building (MOB) | 17 | $ | 9,475 |

| 44.2 | % |

| Ambulatory Surgery Center (ASC) | 10 | 3,501 |

| 16.3 | % |

| Physicians Clinic (PC) | 12 | 3,373 |

| 15.7 | % |

Behavioral Facility (BF) | 2 | 508 |

| 2.4 | % |

| Dialysis Clinic (DC) | 7 | 2,215 |

| 10.3 | % |

Long-term Acute Care Center (LTAC) (2) | 1 | 1,060 |

| 4.9 | % |

| Oncology Center (OC) | 3 | 1,316 |

| 6.2 | % |

| Total | 52 | $ | 21,448 |

| 100.0 | % |

| ______________________ | | | |

| (1) Annualized revenue for leases was calculated by multiplying base rent for the month of September 2016 by 12 and for the mortgage was calculated based on the principal outstanding at September 30, 2016 in accordance with the mortgage note. |

| (2) Mortgage investment. | | | |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 11 |

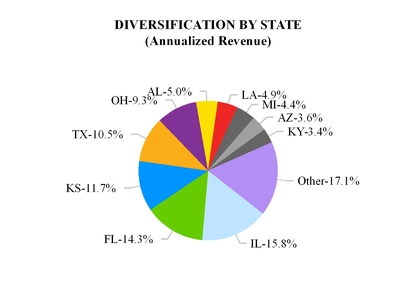

PROPERTY DIVERSIFICATION

(continued)

(As of September 30, 2016)

|

| | | | | | |

| State | Number of Properties |

Annualized Revenue (1) ($ in thousands) | Annualized Revenue (%) |

| IL | 3 | $ | 3,389 |

| 15.8 | % |

| FL | 7 | 3,070 |

| 14.3 | % |

| KS | 5 | 2,509 |

| 11.7 | % |

| TX | 5 | 2,258 |

| 10.5 | % |

| OH | 4 | 1,984 |

| 9.3 | % |

| AL | 6 | 1,072 |

| 5.0 | % |

| LA (2) | 1 | 1,060 |

| 4.9 | % |

| MI | 2 | 952 |

| 4.4 | % |

| AZ | 3 | 765 |

| 3.6 | % |

| KY | 2 | 735 |

| 3.4 | % |

| Other (Less than 3%) | 14 | 4,654 |

| 17.1 | % |

| Total | 52 | $ | 21,448 |

| 100.0 | % |

| _________________ | | | |

| (1) Annualized revenue for leases was calculated by multiplying base rent for the month of September 2016 by 12 and for the mortgage was calculated based on the principal outstanding at September 30, 2016 in accordance with the mortgage note. |

| (2) Mortgage investment. | | | |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 12 |

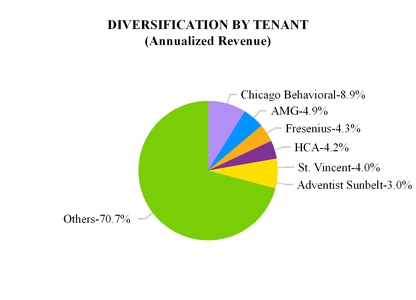

PROPERTY DIVERSIFICATION

(continued)

(As of September 30, 2016)

|

| | | | | |

| Tenant |

Annualized Revenue (1) ($ in thousands) | Annualized Revenue (%) |

| Chicago Behavioral Hospital | $ | 1,900 |

| 8.9 | % |

AMG Specialty Hospital (2) | 1,060 |

| 4.9 | % |

| Fresenius | 923 |

| 4.3 | % |

| HCA Physician Services Group | 892 |

| 4.2 | % |

| St. Vincent Medical Group | 851 |

| 4.0 | % |

| Adventist Health System Sunbelt Healthcare Corporation | 655 |

| 3.0 | % |

| Others (Less than 3%) | 15,167 |

| 70.7 | % |

| Total | $ | 21,448 |

| 100.0 | % |

| | | |

| (1) Annualized revenue for leases was calculated by multiplying base rent for the month of September 2016 by 12 and for the mortgage was calculated based on the principal outstanding at September 30, 2016 in accordance with the mortgage note. |

| (2) Mortgage investment. |

|

| | |

| Community Healthcare Trust / 3Q 2016 Supplemental Information | | Page 13 |