Exhibit 99.2

Supplemental Information

Third Quarter 2019

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

In addition to the historical information contained within, the matters discussed in this supplemental operating and financial information package may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “believes”, “expects”, “may”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, “anticipates” or other similar words or expressions, including the negative thereof. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections or other forward-looking information. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. Because forward-looking statements relate to future events, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of Community Healthcare Trust Incorporated (the "Company"). Thus, the Company’s actual results and financial condition may differ materially from those indicated in such forward-looking statements. Some factors that might cause such a difference include the following: general volatility of the capital markets and the market price of the Company’s common stock, changes in the Company’s business strategy, availability, terms and deployment of capital, the Company’s ability to refinance existing indebtedness at or prior to maturity on favorable terms, or at all, changes in the real estate industry in general, interest rates or the general economy, adverse developments related to the healthcare industry, the degree and nature of the Company’s competition, the ability to consummate acquisitions under contract and the other factors described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and the Company’s other filings with the Securities and Exchange Commission from time to time. Readers are therefore cautioned not to place undue reliance on the forward-looking statements contained herein which speak only as of the date hereof. The Company intends these forward-looking statements to speak only as of the time of this supplemental operating and financial information package and undertakes no obligation to update forward-looking statements, whether as a result of new information, future developments, or otherwise, except as may be required by law.

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 2 |

CORPORATE INFORMATION

|

| | | | |

| Corporate Headquarters |

| | | | | |

| Community Healthcare Trust Incorporated |

| 3326 Aspen Grove Drive, Suite 150 |

| Franklin, Tennessee 37067 |

| Phone: 615.771.3052 |

| E-mail: Investorrelations@chct.reit |

| Website: www.chct.reit |

| |

| |

| Board of Directors |

| | | | | |

| Timothy G. Wallace | Alan Gardner | Robert Hensley | Claire Gulmi | R. Lawrence Van Horn |

Chairman of the Board, Chief Executive Officer and President | Lead Independent Director | Audit Committee Chair | Compensation Committee Chair | Corporate Governance Committee Chair |

| | | | | |

| | | | | |

| Executive Management Team |

| | | | | |

| Timothy G. Wallace | W. Page Barnes | David H. Dupuy | Leigh Ann Stach | |

Chief Executive Officer and President | Executive Vice President, Chief Operating Officer | Executive Vice President, Chief Financial Officer | Executive Vice President Chief Accounting Officer | |

| | | | | |

| | | | | |

| Covering Analysts |

| | | | | |

| A. Goldfarb - Sandler O'Neill | | M. Lewis - SunTrust Robinson Humphrey |

| S. McGrath - Evercore ISI | | R. Stevenson - Janney Capital Markets |

| B. Maher - B. Riley FBR | | N. Crossett - Berenberg Capital Markets |

| D. Babin - Baird | | B. Oxford - D.A. Davidson & Co. |

| | | | | |

| Professional Services |

| | | | | |

| Independent Registered Public Accounting Firm | Transfer Agent |

| BDO USA, LLP | American Stock Transfer & Trust Company, LLC |

| 414 Union Street, Suite 1800 | Operations Center |

| Nashville, Tennessee 37219 | 6201 15th Avenue |

| | | Brooklyn, New York 11219 |

| | | | 1.800.937.5449 |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 3 |

HISTORICAL FFO AND AFFO (1)

(Amounts in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2019 | | 2018 | | 2017 |

| | Q3 | Q2 | Q1 | | Q4 | Q3 | Q2 | Q1 | | Q4 |

| Net income (loss) | $ | 2,647 |

| $ | 2,066 |

| $ | 1,450 |

| | $ | (1,885 | ) | $ | 1,999 |

| $ | 2,417 |

| $ | 1,872 |

| | $ | 1,552 |

|

| Real estate depreciation and amortization | 5,812 |

| 5,340 |

| 5,282 |

| | 5,109 |

| 4,918 |

| 4,624 |

| 4,911 |

| | 4,978 |

|

| Gain from sale of depreciable real estate | — |

| — |

| — |

| | (295 | ) | — |

| — |

| — |

| | — |

|

| Total adjustments | 5,812 |

| 5,340 |

| 5,282 |

| | 4,814 |

| 4,918 |

| 4,624 |

| 4,911 |

| | 4,978 |

|

| Funds from Operations | $ | 8,459 |

| $ | 7,406 |

| $ | 6,732 |

| | $ | 2,929 |

| $ | 6,917 |

| $ | 7,041 |

| $ | 6,783 |

| | $ | 6,530 |

|

Transaction costs | — |

| — |

| — |

| | — |

| — |

| 57 |

| — |

| | 25 |

|

| Straight-line rent | (603 | ) | (413 | ) | (336 | ) | | (126 | ) | (359 | ) | (391 | ) | (415 | ) | | (351 | ) |

| Stock-based compensation | 1,007 |

| 899 |

| 853 |

| | 747 |

| 690 |

| 801 |

| 614 |

| | 428 |

|

Impairment of note receivable (2) | — |

| — |

| — |

| | 5,000 |

| — |

| — |

| — |

| | — |

|

Income tax benefit (2) | — |

| — |

| — |

| | (1,321 | ) | — |

| — |

| — |

| | — |

|

| AFFO | $ | 8,863 |

| $ | 7,892 |

| $ | 7,249 |

| | $ | 7,229 |

| $ | 7,248 |

| $ | 7,508 |

| $ | 6,982 |

| | $ | 6,632 |

|

| Funds from Operations per Common Share-Diluted | $ | 0.44 |

| $ | 0.40 |

| $ | 0.37 |

| | $ | 0.16 |

| $ | 0.39 |

| $ | 0.40 |

| $ | 0.38 |

| | $ | 0.37 |

|

| AFFO Per Common Share-Diluted | $ | 0.46 |

| $ | 0.42 |

| $ | 0.40 |

| | $ | 0.41 |

| $ | 0.40 |

| $ | 0.42 |

| $ | 0.39 |

| | $ | 0.37 |

|

Weighted Average Common Shares Outstanding-Diluted (3) | 19,315 |

| 18,685 |

| 18,343 |

| | 17,848 |

| 17,948 |

| 17,800 |

| 17,791 |

| | 17,769 |

|

|

| | |

| (1 | ) | Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market conditions, many industry investors deem presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. For that reason, the Company considers funds from operations ("FFO") and adjusted funds from operations ("AFFO") to be appropriate measures of operating performance of an equity real estate investment trust ("REIT"). In particular, the Company believes that AFFO is useful because it allows investors, analysts and Company management to compare the Company's operating performance to the operating performance of other real estate companies and between periods on a consistent basis without having to account for differences caused by unanticipated items and other events.

The Company uses the National Association of Real Estate Investment Trusts, Inc. ("NAREIT") definition of FFO. FFO and FFO per share are operating performance measures adopted by NAREIT. NAREIT defines FFO as the most commonly accepted and reported measure of a REIT's operating performance equal to "net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures." The Company has included AFFO which it has defined as FFO excluding certain expenses related to closing costs of properties acquired accounted for as business combinations and mortgages funded, excluding straight-line rent and deferred compensation and may include other non-cash items from time to time. AFFO presented herein may not be comparable to similar measures presented by other real estate companies due to the fact that not all real estate companies use the same definition.

FFO and AFFO should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company's financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are they necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO and AFFO should be examined in conjunction with net income as presented elsewhere herein.

|

| (2 | ) | In the fourth quarter of 2018, the Company recorded a $5.0 million impairment related to its mezzanine loan with Highlands and recorded a related tax benefit of approximately $1.3 million. |

| (3 | ) | Diluted weighted average common shares outstanding for FFO are calculated based on the treasury method, rather than the 2-class method used to calculate earnings per share. |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 4 |

WEIGHTED AVERAGE SHARES

(Amounts in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2019 | | 2018 | | 2017 |

| | | Q3 | Q2 | Q1 | | Q4 | Q3 | Q2 | Q1 | | Q4 |

| Weighted average common shares outstanding: | | | | | | | | | | |

| | Weighted average common shares outstanding | 19,698 |

| 19,055 |

| 18,736 |

| | 18,558 |

| 18,331 |

| 18,188 |

| 18,164 |

| | 18,086 |

|

| | Unvested restricted shares | (865 | ) | (809 | ) | (781 | ) | | (710 | ) | (661 | ) | (608 | ) | (590 | ) | | (512 | ) |

| | Weighted average common shares outstanding - EPS | 18,833 |

| 18,246 |

| 17,955 |

| | 17,848 |

| 17,670 |

| 17,580 |

| 17,574 |

| | 17,574 |

|

| | | | | | | | | | | | |

| | Weighted average common shares outstanding - FFO Basic | 18,833 |

| 18,246 |

| 17,955 |

| | 17,848 |

| 17,670 |

| 17,580 |

| 17,574 |

| | 17,574 |

|

| | Dilutive potential common shares (from below) (1) | 482 |

| 439 |

| 388 |

| | — |

| 278 |

| 220 |

| 217 |

| | 195 |

|

| | Weighted average common shares outstanding - FFO Diluted | 19,315 |

| 18,685 |

| 18,343 |

| | 17,848 |

| 17,948 |

| 17,800 |

| 17,791 |

| | 17,769 |

|

| | | | | | | | | | | | |

| Treasury share calculation: | | | | | | | | | | |

| Unrecognized deferred compensation-end of period | $ | 17,655 |

| $ | 13,645 |

| $ | 13,919 |

| | $ | 12,174 |

| $ | 12,921 |

| $ | 10,443 |

| $ | 10,360 |

| | $ | 8,536 |

|

| Unrecognized deferred compensation-beginning of period | $ | 14,554 |

| $ | 13,919 |

| $ | 12,174 |

| | $ | 12,921 |

| $ | 10,443 |

| $ | 10,360 |

| $ | 8,536 |

| | $ | 8,963 |

|

| | Average unrecognized deferred compensation | $ | 16,105 |

| $ | 13,782 |

| $ | 13,047 |

| | $ | 12,548 |

| $ | 11,682 |

| $ | 10,402 |

| $ | 9,448 |

| | $ | 8,750 |

|

| Average share price per share | $ | 42.13 |

| $ | 37.23 |

| $ | 33.23 |

| | $ | 29.70 |

| $ | 30.52 |

| $ | 26.82 |

| $ | 25.35 |

| | $ | 27.65 |

|

| Treasury shares | 383 |

| 370 |

| 393 |

| | 422 |

| 383 |

| 388 |

| 373 |

| | 317 |

|

| | | | | | | | | | | |

| Unvested restricted shares | 865 |

| 809 |

| 781 |

| | 710 |

| 661 |

| 608 |

| 590 |

| | 512 |

|

| Treasury shares | (383 | ) | (370 | ) | (393 | ) | | (422 | ) | (383 | ) | (388 | ) | (373 | ) | | (317 | ) |

| Dilutive potential common shares | 482 |

| 439 |

| 388 |

| | 288 |

| 278 |

| 220 |

| 217 |

| | 195 |

|

| _____________ | | | | | | | | | | |

| (1) The Company had a net loss for the 4th quarter of 2018. Including the dilutive effect of the restricted shares would have been anti-dilutive and were, therefore, excluded. |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 5 |

BALANCE SHEET INFORMATION

(dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2019 | 2018 | 2017 |

| | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 |

| ASSETS | | | | | | | | |

| Real estate properties | | | | | | | | |

| Land and land improvements | $ | 63,015 |

| $ | 57,388 |

| $ | 52,520 |

| $ | 50,270 |

| $ | 47,748 |

| $ | 47,080 |

| $ | 46,066 |

| $ | 44,419 |

|

Buildings, improvements, and lease intangibles | 503,110 |

| 454,050 |

| 425,763 |

| 394,527 |

| 376,310 |

| 369,563 |

| 356,530 |

| 343,955 |

|

| Personal property | 202 |

| 143 |

| 135 |

| 133 |

| 132 |

| 129 |

| 116 |

| 112 |

|

| Total real estate properties | 566,327 |

| 511,581 |

| 478,418 |

| 444,930 |

| 424,190 |

| 416,772 |

| 402,712 |

| 388,486 |

|

| Less accumulated depreciation | (71,617 | ) | (65,843 | ) | (60,544 | ) | (55,298 | ) | (50,607 | ) | (45,682 | ) | (41,052 | ) | (36,136 | ) |

| Total real estate properties, net | 494,710 |

| 445,738 |

| 417,874 |

| 389,632 |

| 373,583 |

| 371,090 |

| 361,660 |

| 352,350 |

|

| Cash and cash equivalents | 1,724 |

| 9,031 |

| 3,868 |

| 2,007 |

| 1,006 |

| 1,784 |

| 2,285 |

| 2,130 |

|

| Restricted cash | 224 |

| 234 |

| 166 |

| 385 |

| — |

| — |

| — |

| — |

|

| Mortgage note receivable, net | — |

| — |

| — |

| — |

| — |

| — |

| 10,633 |

| 10,633 |

|

| Other assets, net | 36,414 |

| 35,497 |

| 34,822 |

| 34,546 |

| 40,711 |

| 37,910 |

| 25,210 |

| 20,653 |

|

| Total assets | $ | 533,072 |

| $ | 490,500 |

| $ | 456,730 |

| $ | 426,570 |

| $ | 415,300 |

| $ | 410,784 |

| $ | 399,788 |

| $ | 385,766 |

|

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| Liabilities | | | | | | | | |

| Debt, net | $ | 215,460 |

| $ | 198,176 |

| $ | 179,117 |

| $ | 147,766 |

| $ | 127,449 |

| $ | 125,417 |

| $ | 111,385 |

| $ | 93,353 |

|

| Accounts payable and accrued liabilities | 4,004 |

| 3,395 |

| 3,351 |

| 3,196 |

| 3,818 |

| 4,439 |

| 3,806 |

| 4,056 |

|

| Other liabilities | 12,661 |

| 9,809 |

| 4,579 |

| 3,949 |

| 4,716 |

| 4,570 |

| 4,987 |

| 4,983 |

|

| Total liabilities | 232,125 |

| 211,380 |

| 187,047 |

| 154,911 |

| 135,983 |

| 134,426 |

| 120,178 |

| 102,392 |

|

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized | — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Common stock, $0.01 par value; 450,000,000 shares authorized | 202 |

| 194 |

| 189 |

| 186 |

| 185 |

| 182 |

| 182 |

| 181 |

|

| Additional paid-in capital | 391,247 |

| 361,913 |

| 342,654 |

| 337,180 |

| 333,468 |

| 325,719 |

| 324,918 |

| 324,303 |

|

| Cumulative net income | 15,341 |

| 12,694 |

| 10,628 |

| 9,178 |

| 11,063 |

| 9,064 |

| 6,647 |

| 4,775 |

|

| Accumulated other comprehensive (loss) income | (6,826 | ) | (4,769 | ) | (642 | ) | 633 |

| 2,612 |

| 2,039 |

| 1,232 |

| 258 |

|

| Cumulative dividends | (99,017 | ) | (90,912 | ) | (83,146 | ) | (75,518 | ) | (68,011 | ) | (60,646 | ) | (53,369 | ) | (46,143 | ) |

| Total stockholders’ equity | 300,947 |

| 279,120 |

| 269,683 |

| 271,659 |

| 279,317 |

| 276,358 |

| 279,610 |

| 283,374 |

|

| Total liabilities and stockholders' equity | $ | 533,072 |

| $ | 490,500 |

| $ | 456,730 |

| $ | 426,570 |

| $ | 415,300 |

| $ | 410,784 |

| $ | 399,788 |

| $ | 385,766 |

|

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 6 |

STATEMENTS OF OPERATIONS INFORMATION

(Amounts in thousands, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2019 | 2018 | 2017 |

| | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 |

| | | | | | | | | |

| REVENUES | | | | | | | | |

| Rental income | $ | 15,718 |

| $ | 13,361 |

| $ | 12,898 |

| $ | 11,715 |

| $ | 11,926 |

| $ | 11,810 |

| $ | 11,075 |

| $ | 10,554 |

|

| Mortgage interest | — |

| — |

| — |

| — |

| — |

| — |

| — |

| 248 |

|

| Other operating interest | 541 |

| 955 |

| 543 |

| 479 |

| 679 |

| 592 |

| 354 |

| 160 |

|

| | 16,259 |

| 14,316 |

| 13,441 |

| 12,194 |

| 12,605 |

| 12,402 |

| 11,429 |

| 10,962 |

|

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Property operating | 3,327 |

| 2,993 |

| 3,075 |

| 2,447 |

| 2,627 |

| 2,506 |

| 2,364 |

| 2,579 |

|

| General and administrative | 2,041 |

| 1,776 |

| 1,785 |

| 1,547 |

| 1,463 |

| 1,504 |

| 1,193 |

| 801 |

|

| Depreciation and amortization | 5,774 |

| 5,299 |

| 5,246 |

| 5,068 |

| 4,925 |

| 4,630 |

| 4,916 |

| 4,983 |

|

| | 11,142 |

| 10,068 |

| 10,106 |

| 9,062 |

| 9,015 |

| 8,640 |

| 8,473 |

| 8,363 |

|

| | | | | | | | | |

| INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES AND OTHER ITEMS | 5,117 |

| 4,248 |

| 3,335 |

| 3,132 |

| 3,590 |

| 3,762 |

| 2,956 |

| 2,599 |

|

| Gain on sale of real estate | — |

| — |

| — |

| 295 |

| — |

| — |

| — |

| — |

|

| Interest expense | (2,483 | ) | (2,251 | ) | (2,054 | ) | (1,817 | ) | (1,643 | ) | (1,571 | ) | (1,268 | ) | (1,051 | ) |

| Impairment of note receivable | — |

| — |

| — |

| (5,000 | ) | — |

| — |

| — |

| — |

|

| Income tax benefit | — |

| — |

| — |

| 1,547 |

| — |

| — |

| — |

| — |

|

| Interest and other income, net | 13 |

| 69 |

| 169 |

| (42 | ) | 52 |

| 226 |

| 184 |

| 4 |

|

| INCOME FROM CONTINUING OPERATIONS | 2,647 |

| 2,066 |

| 1,450 |

| (1,885 | ) | 1,999 |

| 2,417 |

| 1,872 |

| 1,552 |

|

| NET INCOME (LOSS) | $ | 2,647 |

| $ | 2,066 |

| $ | 1,450 |

| $ | (1,885 | ) | $ | 1,999 |

| $ | 2,417 |

| $ | 1,872 |

| $ | 1,552 |

|

| | | | | | | | | |

| NET INCOME (LOSS) PER COMMON SHARE | | | | | | | | |

| Net income (loss) per common share – Basic | $ | 0.12 |

| $ | 0.09 |

| $ | 0.06 |

| $ | (0.12 | ) | $ | 0.10 |

| $ | 0.12 |

| $ | 0.09 |

| $ | 0.08 |

|

| Net income (loss) per common share – Diluted | $ | 0.12 |

| $ | 0.09 |

| $ | 0.06 |

| $ | (0.12 | ) | $ | 0.10 |

| $ | 0.12 |

| $ | 0.09 |

| $ | 0.08 |

|

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-BASIC | 18,833 |

| 18,246 |

| 17,955 |

| 17,848 |

| 17,670 |

| 17,574 |

| 17,574 |

| 17,574 |

|

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING-DILUTED | 18,833 |

| 18,246 |

| 17,955 |

| 17,848 |

| 17,670 |

| 17,574 |

| 17,574 |

| 17,574 |

|

| DIVIDENDS DECLARED, PER COMMON SHARE, DURING THE PERIOD | $ | 0.4125 |

| $ | 0.4100 |

| $ | 0.4075 |

| $ | 0.4050 |

| $ | 0.4025 |

| $ | 0.4000 |

| $ | 0.3975 |

| $ | 0.3950 |

|

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 7 |

EXECUTIVE COMPENSATION

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Incentive Compensation | |

| Name and Position | Year | Salary Stock (1) | Bonus Stock (1) | Alignment of Interest Stock (2) | 1 Year Total Shareholder Return Stock | 3 Year Total Shareholder Return Stock | Other | Total Compensation |

| Timothy G. Wallace | 2019 | $ | 540,000 |

| $ | 216,000 |

| $ | 884,164 |

| $ | 405,000 |

| $ | 540,000 |

| $ | — |

| $ | 2,585,164 |

|

| | Chief Executive Officer and President | 2018 | $ | 458,167 |

| $ | 183,267 |

| $ | 690,209 |

| $ | 458,167 |

| $ | 458,167 |

| $ | — |

| $ | 2,247,977 |

|

| | | 2017 | $ | 376,333 |

| $ | 150,533 |

| $ | 500,651 |

| $ | 282,250 |

| $ | 282,250 |

| $ | — |

| $ | 1,592,017 |

|

| | | | | | | | | | |

David H. Dupuy | 2019 | $ | 233,333 |

| $ | 23,333 |

| $ | 321,216 |

| $ | 262,500 |

| $ | 350,000 |

| $ | 181,450 |

| $ | 1,371,832 |

|

| | Executive Vice President and Chief Financial Officer | 2018 | $ | — |

| $ | — |

| — |

| — |

| — |

| — |

| — |

|

| | | 2017 | $ | — |

| $ | — |

| — |

| — |

| — |

| — |

| — |

|

| | | | | | | | | | |

| W. Page Barnes | 2019 | $ | 328,000 |

| $ | 131,200 |

| $ | 537,109 |

| $ | 246,000 |

| $ | 328,000 |

| — |

| $ | 1,570,309 |

|

| | Executive Vice President and Chief Operating Officer | 2018 | $ | 271,167 |

| $ | 108,467 |

| $ | 408,549 |

| $ | 271,167 |

| $ | 271,167 |

| — |

| $ | 1,330,517 |

|

| | | 2017 | $ | 214,333 |

| $ | 85,723 |

| $ | 285,140 |

| $ | 160,750 |

| $ | 160,750 |

| — |

| $ | 906,696 |

|

| | | | | | | | | | |

| Leigh Ann Stach | 2019 | $ | 266,000 |

| $ | 106,400 |

| $ | 435,544 |

| $ | 199,500 |

| $ | 266,000 |

| — |

| $ | 1,273,444 |

|

| | Executive Vice President and Chief Accounting Officer | 2018 | $ | 220,500 |

| $ | 188,200 |

| $ | 435,216 |

| $ | 220,500 |

| $ | 220,500 |

| — |

| $ | 1,284,916 |

|

| | | 2017 | $ | 175,000 |

| $ | 70,000 |

| $ | 232,772 |

| $ | 131,250 |

| $ | 131,250 |

| — |

| $ | 740,272 |

|

| __________________ | | | | | | | | |

| (1) Each Executive Officer has elected to take 100% of their salary and cash bonus in deferred stock with an 8-year cliff vesting. |

| (2) Alignment of interest stock grants per the Alignment Interest Program which is part of the Company's Incentive Plan. |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 8 |

PROPERTY LOCATIONS

Approximately 52% of our property revenues are in MSAs with populations over 1,000,000 and approximately 91% are in MSAs with populations over 100,000.

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Rent (1) | % of Annualized Rent | Population | MSA/MISA | Rank |

| | | | | | | | ($ 000's) | | | | |

| Chicago Behavioral Hospital | BF | 1771 Rand Road | Des Plaines | IL | 85,000.0 |

| 3.39 | % | $ | 2,016.3 |

| 3.90 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Future Diagnostics Group | SC | 254 Republic Avenue | Joliet | IL | 8,876.0 |

| 0.35 | % | $ | 375.7 |

| 0.73 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Gurnee Medical Office Building | MOB | 222 S. Greenleaf St. | Gurnee | IL | 22,943.0 |

| 0.92 | % | $ | 376.9 |

| 0.73 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Joliet Oncology-Hematology Associates | PC | 668 Cedar Crossing | New Lenox | IL | 7,905.0 |

| 0.32 | % | $ | 340.3 |

| 0.66 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Morris Cancer Center | SC | 1600 West US Route 6 | Morris | IL | 18,470.0 |

| 0.74 | % | $ | 574.5 |

| 1.11 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Novamed Surgery Center | SCH | 6309 West 95th Street | Oak Lawn | IL | 30,455.0 |

| 1.22 | % | $ | 558.0 |

| 1.08 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Presence | MOB | 7380 N. Lincoln Ave. | Lincolnwood | IL | 14,863.0 |

| 0.59 | % | $ | 318.8 |

| 0.62 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Presence Regional Cancer Center | SC | 2614 Jefferson Street | Joliet | IL | 44,888.0 |

| 1.79 | % | $ | 1,675.8 |

| 3.24 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Skin MD | PC | 16105 South LaGrange Road | Orland Park | IL | 13,565.0 |

| 0.54 | % | $ | 469.4 |

| 0.91 | % | 9,498,716 |

| Chicago-Naperville-Elgin, IL-IN-WI | 3 |

| Bayside Medical Center | MOB | 4001 Preston Avenue | Pasadena | TX | 50,593.1 |

| 1.99 | % | $ | 845.9 |

| 1.64 | % | 6,997,384 |

| Houston-The Woodlands-Sugar Land, TX | 5 |

| Kindred Healthcare | SC | 18839 McKay Blvd. | Humble | TX | 55,646.0 |

| 2.22 | % | $ | 2,639.2 |

| 5.11 | % | 6,997,384 |

| Houston-The Woodlands-Sugar Land, TX | 5 |

| Northwest Surgery Center | SCH | 5215 Hollister Street | Houston | TX | 11,200.0 |

| 0.45 | % | $ | 466.4 |

| 0.90 | % | 6,997,384 |

| Houston-The Woodlands-Sugar Land, TX | 5 |

| Haddon Hill Professional Center | MOB | 63 Kresson Road | Cherry Hill | NJ | 24,567.4 |

| 0.98 | % | $ | 491.9 |

| 0.95 | % | 6,096,372 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 8 |

| Continuum Wellness Center | PC | 3941 E. Baseline Road | Gilbert | AZ | 8,227.0 |

| 0.33 | % | $ | 146.7 |

| 0.28 | % | 4,857,962 |

| Phoenix-Mesa-Scottsdale, AZ | 11 |

| Desert Endoscopy Center | SCH | 610 E. Baseline Road | Tempe | AZ | 13,000.0 |

| 0.52 | % | $ | 270.5 |

| 0.52 | % | 4,857,962 |

| Phoenix-Mesa-Scottsdale, AZ | 11 |

| Mountain View Surgery Center | SCH | 3131 West Peoria Avenue | Phoenix | AZ | 13,835.0 |

| 0.55 | % | $ | 325.0 |

| 0.63 | % | 4,857,962 |

| Phoenix-Mesa-Scottsdale, AZ | 11 |

| Associated Surgical Center of Dearborn | SCH | 24420 Ford Road | Dearborn Heights | MI | 12,400.0 |

| 0.49 | % | $ | 370.2 |

| 0.72 | % | 4,326,442 |

| Detroit-Warren-Dearborn, MI | 14 |

| Berry Surgical Center | SCH | 28500 Orchard Lake Road | Farmington Hills | MI | 27,217.0 |

| 1.09 | % | $ | 568.6 |

| 1.10 | % | 4,326,442 |

| Detroit-Warren-Dearborn, MI | 14 |

| Smokey Point Behavioral | BF | 3955 156th Street | Marysville | WA | 70,100.0 |

| 2.80 | % | $ | 2,612.5 |

| 5.06 | % | 3,939,363 |

| Seattle-Tacoma-Bellevue, WA | 15 |

| Bay Area Physicians Surgery Center | SCH | 6043 Winthrop Commerce Avenue | Riverview | FL | 18,708.0 |

| 0.75 | % | $ | 698.3 |

| 1.35 | % | 3,142,663 |

| Tampa-St. Petersburg-Clearwater, FL | 18 |

| Liberty Dialysis | SC | 4352 Trail Boss Drive | Castle Rock | CO | 8,450.0 |

| 0.34 | % | $ | 245.1 |

| 0.47 | % | 2,932,415 |

| Denver-Aurora-Lakewood, CO | 19 |

| Eyecare Partners | PC | 1111 W Lincoln | Belleville | IL | 6,487.0 |

| 0.26 | % | $ | 126.4 |

| 0.24 | % | 2,805,465 |

| St. Louis, MO-IL | 20 |

| Eyecare Partners | PC | 1310 D'Adrian Professional Park | Godfrey | IL | 5,560.0 |

| 0.22 | % | $ | 41.2 |

| 0.08 | % | 2,805,465 |

| St. Louis, MO-IL | 20 |

| Eyecare Partners | SCH | 3990 N Illinois Street | Swansea | IL | 16,608.0 |

| 0.66 | % | $ | 282.3 |

| 0.55 | % | 2,805,465 |

| St. Louis, MO-IL | 20 |

| Eyecare Partners | PC | 204 Bradford Lane | Waterloo | IL | 6,311.0 |

| 0.25 | % | $ | 45.0 |

| 0.09 | % | 2,805,465 |

| St. Louis, MO-IL | 20 |

| Righttime Medical Care | SC | 2114 Generals Highway | Annapolis | MD | 6,236.0 |

| 0.25 | % | $ | 287.2 |

| 0.56 | % | 2,802,789 |

| Baltimore-Columbia-Towson, MD | 21 |

| Bassin Center For Plastic-Surgery-Villages | PC | 8575 NE 138th Lane Suites 103-104 | Lady Lake | FL | 2,894.0 |

| 0.12 | % | $ | 156.4 |

| 0.30 | % | 2,572,962 |

| Orlando-Kissimmee-Sanford, FL | 22 |

| Bassin Center For Plastic Surgery-Orlando | PC | 422 Alafaya Trail #32 | Orlando | FL | 2,420.0 |

| 0.10 | % | $ | 130.8 |

| 0.25 | % | 2,572,962 |

| Orlando-Kissimmee-Sanford, FL | 23 |

| Kissimmee Physicians Clinic | PC | 611 Oak Commons Blvd | Kissimmee | FL | 4,902.0 |

| 0.20 | % | $ | 98.0 |

| 0.19 | % | 2,572,962 |

| Orlando-Kissimmee-Sanford, FL | 23 |

| Medical Village at Wintergarden | MOB | 1210 E. Plant Street | Winter Garden | FL | 21,648.0 |

| 0.86 | % | $ | 535.3 |

| 1.04 | % | 2,572,962 |

| Orlando-Kissimmee-Sanford, FL | 23 |

| Orthopaedic Associates of Osceola | PC | 604 Oak Commons Boulevard | Kissimmee | FL | 15,167.0 |

| 0.61 | % | $ | 337.0 |

| 0.65 | % | 2,572,962 |

| Orlando-Kissimmee-Sanford, FL | 23 |

| | | | (CONTINUED) | | |

|

| |

|

| | | |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 9 |

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Rent (1) | % of Annualized Rent | Population | MSA/MISA | Rank |

| | | | | | | | ($ 000's) | | | | |

| Vascular Access Centers of Southern Nevada | SC | 3150 West Charleston | Las Vegas | NV | 4,800.0 |

| 0.19 | % | $ | — |

| — | % | 2,231,647 |

| Las Vegas-Henderson-Paradise, NV | 28 |

| Assurance Health System | BF | 11690 Grooms Road | Cincinnati | OH | 14,381.0 |

| 0.57 | % | $ | 502.7 |

| 0.97 | % | 2,190,209 |

| Cincinnati, OH-KY-IN | 29 |

| Cavalier Medical & Dialysis Center | MOB | 47 & 51 Cavalier Blvd | Florence | KY | 37,084.4 |

| 1.48 | % | $ | 243.8 |

| 0.47 | % | 2,190,209 |

| Cincinnati, OH-KY-IN | 29 |

| Davita Commercial Way | SC | 90 Commercial Way | Springboro | OH | 4,980.0 |

| 0.20 | % | $ | 104.0 |

| 0.20 | % | 2,190,209 |

| Cincinnati, OH-KY-IN | 29 |

| Fresenius Florence Dialysis Center | SC | 7205 Dixie Hwy | Florence | KY | 17,845.5 |

| 0.71 | % | $ | 286.1 |

| 0.55 | % | 2,190,209 |

| Cincinnati, OH-KY-IN | 29 |

| Prairie Star Medical Facility I | MOB | 6815 Hilltop Road | Shawnee | KS | 24,724.0 |

| 0.99 | % | $ | 543.4 |

| 1.05 | % | 2,143,651 |

| Kansas City, MO-KS | 31 |

| Prairie Star Medical Facility II | MOB | 6850 Hilltop Road | Shawnee | KS | 24,840.0 |

| 0.99 | % | $ | 319.6 |

| 0.62 | % | 2,143,651 |

| Kansas City, MO-KS | 31 |

| Court Street Surgery Center | SCH | 125 South Court Street | Circleville | OH | 7,787.0 |

| 0.31 | % | $ | — |

| — | % | 2,106,541 |

| Columbus, OH | 32 |

| Sedalia Medical Center | MOB | 5345 Hendron Road | Groveport | OH | 20,064.0 |

| 0.80 | % | $ | 299.6 |

| 0.58 | % | 2,106,541 |

| Columbus, OH | 32 |

| Brook Park Medical Building | MOB | 15900 Snow Road | Brook Park | OH | 18,444.0 |

| 0.74 | % | $ | 375.1 |

| 0.73 | % | 2,057,009 |

| Cleveland-Elyria, OH | 33 |

| Rockside Medical Center | MOB | 6701 Rockside Road | Independence | OH | 54,870.1 |

| 2.19 | % | $ | 1,342.4 |

| 2.60 | % | 2,057,009 |

| Cleveland-Elyria, OH | 33 |

| Assurance Health System | BF | 900 N High School Road | Indianapolis | IN | 13,722.0 |

| 0.55 | % | $ | 452.8 |

| 0.88 | % | 2,048,703 |

| Indianapolis-Carmel-Anderson, IN | 34 |

| Assurance Health, LLC | BF | 2725 Enterprise Drive | Anderson | IN | 10,200.0 |

| 0.41 | % | $ | 337.5 |

| 0.65 | % | 2,048,703 |

| Indianapolis-Carmel-Anderson, IN | 34 |

| Kindred Hospital Indianapolis North | LTACH | Suite 2000 Box 82064, One American Square | Indianapolis | IN | 37,270.0 |

| 1.49 | % | $ | 1,412.4 |

| 2.73 | % | 2,048,703 |

| Indianapolis-Carmel-Anderson, IN | 34 |

| Virginia Orthopaedic & Spine Specialists | PC | 3300 High Street | Portsmouth | VA | 8,445.0 |

| 0.34 | % | $ | 144.3 |

| 0.28 | % | 1,728,733 |

| Virginia Beach-Norfolk-Newport News, VA-NC | 37 |

| Ortho RI - West Bay HQ | MOB | 120 Centerville Road | Warwick | RI | 21,252.0 |

| 0.85 | % | $ | 552.1 |

| 1.07 | % | 1,621,337 |

| Providence-Warwick, RI | 38 |

| Memphis Center | PC | 11221 Latting Road | Eads | TN | 11,669.0 |

| 0.47 | % | $ | 105.9 |

| 0.21 | % | 1,350,620 |

| Memphis, TN-MS-AR | 43 |

| Glastonbury | MOB | 622 Hebron Avenue | Glastonbury | CT | 50,519.0 |

| 2.02 | % | $ | 836.8 |

| 1.62 | % | 1,206,300 |

| Hartford-West Hartford-East Hartford, CT | 48 |

| Sterling Medical Center | MOB | 200 Sterling Drive | Orchard Park | NY | 28,702.0 |

| 1.15 | % | $ | 406.6 |

| 0.79 | % | 1,130,152 |

| Buffalo-Cheektowaga-Niagara Falls, NY | 50 |

| Worcester Behavioral | BF | 100 Century Drive | Worcester | MA | 81,972.0 |

| 3.27 | % | $ | 2,535.3 |

| 4.91 | % | 947,866 |

| Worcester, MA-CT (part) | 57 |

| Los Alamos Professional Plaza | MOB | 427 E. Duranta Avenue | Alamo | TX | 41,797.0 |

| 1.67 | % | $ | 438.0 |

| 0.85 | % | 865,939 |

| McAllen-Edinburg-Mission, TX | 65 |

| Cardiology Associates of Greater Waterbury | PC | 455 Chase Parkway | Waterbury | CT | 16,793.0 |

| 0.67 | % | $ | 310.7 |

| 0.60 | % | 857,620 |

| New Haven-Milford | 66 |

| Columbia Gastroenterology Surgery Center | SCH | 2739 Laurel Street | Columbia | SC | 15,949.0 |

| 0.64 | % | $ | 372.9 |

| 0.72 | % | 832,666 |

| Columbia, SC | 70 |

| Davita Business Center Court | SC | 1431 Business Center Court | Dayton | OH | 13,048.0 |

| 0.52 | % | $ | 254.3 |

| 0.49 | % | 806,548 |

| Dayton, OH | 73 |

| Davita Springboro Pike | SC | 4700 Springboro Pike | Dayton | OH | 10,510.0 |

| 0.42 | % | $ | 209.0 |

| 0.40 | % | 806,548 |

| Dayton, OH | 73 |

| Davita Turner Road | SC | 455 Turner Road | Dayton | OH | 18,125.0 |

| 0.72 | % | $ | 367.4 |

| 0.71 | % | 806,548 |

| Dayton, OH | 73 |

| Parkway Professional Plaza | MOB | 4725 US Hwy 98 S | Lakeland | FL | 40,036.0 |

| 1.60 | % | $ | 621.1 |

| 1.20 | % | 708,009 |

| Lakeland-Winter Haven, FL | 81 |

| Novus Clinic | SCH | 518 West Avenue | Tallmadge | OH | 14,315.0 |

| 0.57 | % | $ | 283.3 |

| 0.55 | % | 704,845 |

| Akron, OH | 82 |

| UH Walden Health Center | PC | 1119 Aurora Hudson Road | Aurora | OH | 11,000.0 |

| 0.44 | % | $ | 320.5 |

| 0.62 | % | 704,845 |

| Akron, OH | 82 |

| UW Health Clinic- Portage | PC | 2977 County Highway CX | Portage | WI | 14,000.0 |

| 0.56 | % | $ | 300.0 |

| 0.58 | % | 660,422 |

| Madison, WI | 85 |

| Daytona Medical Office | MOB | 1620 Mason Avenue | Daytona Beach | FL | 19,156.0 |

| 0.76 | % | $ | 226.2 |

| 0.44 | % | 659,605 |

| Deltona-Daytona Beach-Ormond Beach, FL | 86 |

| Debary Professional Plaza | MOB | 110 Pond Court | Debary | FL | 23,643.0 |

| 0.94 | % | $ | 159.0 |

| 0.31 | % | 659,605 |

| Deltona-Daytona Beach-Ormond Beach, FL | 86 |

| Cypress Medical Center | MOB | 9300 E. 29th Street North | Wichita | KS | 39,748.1 |

| 1.59 | % | $ | 870.3 |

| 1.68 | % | 644,888 |

| Wichita, KS | 89 |

| Family Medicine East | PC | 1709 S. Rock Road | Wichita | KS | 16,581.0 |

| 0.66 | % | $ | 410.8 |

| 0.80 | % | 644,888 |

| Wichita, KS | 89 |

| | | | (CONTINUED) | | |

|

| |

|

| | | |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 10 |

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Rent (1) | % of Annualized Rent | Population | MSA/MISA | Rank |

| | | | | | | | ($ 000's) | | | | |

| Grene Vision Center | PC | 655 N. Woodlawn Blvd | Wichita | KS | 11,891.0 |

| 0.47 | % | $ | 306.0 |

| 0.59 | % | 644,888 |

| Wichita, KS | 89 |

| Perrysburg Medical Arts Building | MOB | 1103 Village Square Drive | Perrysburg | OH | 25,789.0 |

| 1.03 | % | $ | 383.1 |

| 0.74 | % | 602,871 |

| Toledo, OH | 93 |

| St. Vincent Mercy Medical Center, Inc. | MOB | 3930 Sunforest Court | Toledo | OH | 23,368.0 |

| 0.93 | % | $ | 301.4 |

| 0.58 | % | 602,871 |

| Toledo, OH | 93 |

| Bassin Center For Plastic Surgery-Melbourne | PC | 1705 Berglund Lane | Viera | FL | 5,228.0 |

| 0.21 | % | $ | 282.6 |

| 0.55 | % | 596,849 |

| Palm Bay-Melbourne-Titusville, FL | 94 |

| Eynon Surgery Center | SCH | 681 Scranton Carbondale Hwy | Eynon | PA | 6,500.0 |

| 0.26 | % | $ | 166.3 |

| 0.32 | % | 555,485 |

| Scranton--Wilkes-Barre--Hazleton, PA | 100 |

| Riverview Medical Center | SCH | 423 Third Avenue | Kingston | PA | 24,040.0 |

| 0.96 | % | $ | 531.5 |

| 1.03 | % | 555,485 |

| Scranton--Wilkes-Barre--Hazleton, PA | 100 |

| Grandview Plaza | PC | 802 New Holland Avenue | Lancaster | PA | 20,000.0 |

| 0.80 | % | $ | 284.7 |

| 0.55 | % | 543,557 |

| Lancaster, PA | 103 |

| AMG Specialty Hospital - Lafayette | BF | 310 Youngville Highway | Lafayette | LA | 29,061.9 |

| 1.16 | % | $ | — |

| — | % | 489,364 |

| Lafayette, LA | 109 |

| Treasure Coast Medical Pavilion | MOB | 3498 NW Federal Hwy #C | Jensen Beach | FL | 56,703.0 |

| 2.26 | % | $ | 688.6 |

| 1.33 | % | 482,040 |

| Port St. Lucie, FL | 110 |

| Martin Foot & Ankle Clinic | PC | 2300 Pleasant Valley Road | York | PA | 27,100.0 |

| 1.08 | % | $ | 383.5 |

| 0.74 | % | 448,273 |

| York-Hanover, PA | 120 |

| Affinity Health Center | MOB | 4455 Dressler Road NW | Canton | OH | 47,366.0 |

| 1.89 | % | $ | 707.2 |

| 1.37 | % | 398,655 |

| Canton-Massillon, OH | 135 |

| Bristol Pediatric Associates | MOB | 320 Steeles Road | Bristol | TN | 10,975.0 |

| 0.44 | % | $ | 230.8 |

| 0.45 | % | 306,616 |

| Kingsport-Bristol-Bristol, TN-VA | 162 |

| Wellmont Bristol Urgent Care | SC | 1220 Volunteer Parkway | Bristol | TN | 4,548.0 |

| 0.18 | % | $ | 72.8 |

| 0.14 | % | 306,616 |

| Kingsport-Bristol-Bristol, TN-VA | 162 |

| Londonderry Centre | MOB | 7030 New Sanger Avenue | Waco | TX | 19,801.0 |

| 0.78 | % | $ | 434.0 |

| 0.84 | % | 271,942 |

| Waco, TX | 179 |

| Everest Rehabilitation Hospital | IRF | 701 East Loop 281 | Longview | TX | 38,817.0 |

| 1.55 | % | $ | 2,090.0 |

| 4.05 | % | 219,417 |

| Longview,TX | 205 |

| Gulf Coast Cancer Centers- Gulf Shores | SC | 253 Professional Lane | Gulf Shores | AL | 6,398.0 |

| 0.26 | % | $ | — |

| — | % | 218,022 |

| Daphne-Fairhope-Foley, AL | 206 |

| Gulf Coast Cancer Centers-Foley | SC | 1703 North Bunner Street | Foley | AL | 6,146.0 |

| 0.25 | % | $ | 159.8 |

| 0.31 | % | 218,022 |

| Daphne-Fairhope-Foley, AL | 206 |

| Meridian Behavioral Health Systems | BF | 300 56th SW | Charleston | WV | 132,430.0 |

| 5.29 | % | $ | 2,494.4 |

| 4.83 | % | 211,037 |

| Charleston, WV | 213 |

| Fresenius Ft. Valley | SC | 135 Avera Drive | Fort Valley | GA | 4,920.0 |

| 0.20 | % | $ | 92.6 |

| 0.18 | % | 193,835 |

| Warner Robins, GA | 227 |

| Monroe Surgical Hosptial | SCH | 2408 Broadmoor Blvd | Monroe | LA | 58,121.0 |

| 2.32 | % | $ | 2,152.6 |

| 4.17 | % | 176,805 |

| Monroe, LA | 243 |

| Kedplasma | SC | 505 East Webb Avenue | Burlington | NC | 12,870.0 |

| 0.51 | % | $ | 272.1 |

| 0.53 | % | 166,436 |

| Burlington, NC | 259 |

| Provena Medical Center | MOB | 600-680 N. Convent Street | Bourbonnais | IL | 53,653.0 |

| 2.14 | % | $ | 488.7 |

| 0.95 | % | 110,024 |

| Kankakee, IL | 359 |

| Fresenius Gallipolis Dialysis Center | SC | 137 Pine Street | Gallipolis | OH | 15,110.0 |

| 0.60 | % | $ | 159.3 |

| 0.31 | % | 56,697 |

| Point Pleasant, WV-OH | 545 |

| Wellmont Associates Complex | MOB | 338 Cueburn Avenue | Norton | VA | 32,542.0 |

| 1.30 | % | $ | 490.4 |

| 0.95 | % | 56,503 |

| Big Stone Gap, VA | 546 |

| Wellmont Norton Urgent Care | SC | 1014 Park Avenue | Norton | VA | 5,000.0 |

| 0.20 | % | $ | 57.5 |

| 0.11 | % | 56,503 |

| Big Stone Gap, VA | 546 |

| Davita Etowah Dialysis Center | SC | 109 Grady Road | Etowah | TN | 4,720.0 |

| 0.19 | % | $ | 70.2 |

| 0.14 | % | 53,285 |

| Athens, TN | 572 |

| Fresenius Dialysis Center | SC | 1321 W. 2nd Avenue | Corsicana | TX | 17,699.0 |

| 0.71 | % | $ | 132.0 |

| 0.26 | % | 48,701 |

| Corsicana, TX | 604 |

| Arkansas Valley Surgery Center | SCH | 933 Sell Avenue | Canon City | CO | 10,853.5 |

| 0.43 | % | $ | 227.7 |

| 0.44 | % | 48,021 |

| Cañon City, CO | 611 |

| Davita Dialysis | SC | 330 Lola Lane | Pahrump | NV | 12,545.0 |

| 0.50 | % | $ | 430.2 |

| 0.83 | % | 45,346 |

| Pahrump, NV | 638 |

| Ottumwa Medical Clinic | MOB | 1005 Pennsylvania Avenue | Ottumwa | IA | 74,915.5 |

| 3.05 | % | $ | 835.3 |

| 1.62 | % | 44,222 |

| Ottumwa, IA | 654 |

| Eyecare Partners | PC | 408 W Second Street | Centralia | IL | 8,421.0 |

| 0.34 | % | $ | 122.1 |

| 0.24 | % | 37,620 |

| Centralia, IL | 729 |

| Gulf Coast Cancer Centers-Brewton | SC | 1207 Azalea Place | Brewton | AL | 3,971.0 |

| 0.16 | % | $ | 103.2 |

| 0.20 | % | 36,748 |

| Atmore, AL | 742 |

| Sanderling Dialysis Center | SC | 780 East Washington Boulevard | Crescent City | CA | 4,186.0 |

| 0.17 | % | $ | 267.8 |

| 0.52 | % | 27,828 |

| Crescent City, CA | 834 |

| Batesville Regional Medical Center | MOB | 205 Medical Center Dr | Batesville | MS | 9,263.1 |

| 0.37% |

| $ | 44.9 |

| 0.09% |

| City: 7,463; County: 33,994 |

| RURAL - NO CBSA | N/A |

| | | | (CONTINUED) | | | | | | | | |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 11 |

|

| | | | | | | | | | | | | | | | | |

| Property Name | Property Type | Address | City | State | Area | % of Square Feet | Annualized Rent (1) | % of Annualized Rent | Population | MSA/MISA | Rank |

| Dahlonega Medical Mall | MOB | 134 Ansley Drive | Dahlonega | GA | 22,227.0 |

| 0.0089 |

| $ | 189.6 |

| 0.37 | % | City: 5,242; County: 32,873 |

| RURAL - NO CBSA | N/A |

| Haleyville Physicians Professional Building | MOB | 42030 Hwy 195 East | Haleyville | AL | 29,515.0 |

| 1.18% |

| $ | 148.1 |

| 0.29 | % | City: 3,982; County: 23,722 |

| RURAL - NO CBSA | N/A |

| North Mississippi Health Services | MOB | 1107 Earl Frye Blvd | Amory | MS | 17,628.8 |

| 0.70% |

| $ | 85.5 |

| 0.17 | % | City: 7,316; County: 36,989 |

| RURAL - NO CBSA | N/A |

| North Mississippi Health Services | MOB | 1111 Earl Frye Blvd, | Amory | MS | 27,743.2 |

| 1.11% |

| $ | 134.5 |

| 0.26 | % | City: 7,316; County: 36,989 |

| RURAL - NO CBSA | N/A |

| North Mississippi Health Services | MOB | 1127 Earl Frye Blvd | Amory | MS | 18,074.3 |

| 0.72% |

| $ | 87.7 |

| 0.17 | % | City: 7,316; County: 36,989 |

| RURAL - NO CBSA | N/A |

| North Mississippi Health Services | MOB | 404 Gilmore Drive | Amory | MS | 9,889.7 |

| 0.39% |

| $ | 48.0 |

| 0.09 | % | City: 7,316; County: 36,989 |

| RURAL - NO CBSA | N/A |

| North Mississippi Health Services | MOB | 305 Highway 45N | Aberdeen | MS | 3,377.7 |

| 0.13% |

| $ | 16.4 |

| 0.03 | % | City: 7,316; County: 36,989 |

| RURAL - NO CBSA | N/A |

| Rettig Family Healthcare | PC | 204 W Trinity Street | Groesbeck | TX | 12,000.0 |

| 0.48% |

| $ | 180.0 |

| 0.35 | % | City: 4,328; County: 23,384 |

| RURAL - NO CBSA | N/A |

| Russellville Medical Plaza | MOB | 15155 Hwy 43 NE | Russellville | AL | 29,129.0 |

| 1.16% |

| $ | 146.2 |

| 0.28 | % | City: 9,697; County: 31,432 |

| RURAL - NO CBSA | N/A |

| Sanderling Dialysis Center | SC | 102 Crestview Drive | Holdenville | OK | 5,217.0 |

| 0.21% |

| $ | 248.7 |

| 0.48 | % | City: 5,771; County: 14,003 |

| RURAL - NO CBSA | N/A |

| Tri Lakes Behavioral | BF | 155 Keating Road | Batesville | MS | 58,400.0 |

| 2.33% |

| $ | 506.3 |

| 0.98 | % | City: 7,463; County: 33,994 |

| RURAL - NO CBSA | N/A |

| Wellmont Lebanon Urgent Care | SC | 344 Overlook Drive | Lebanon | VA | 8,369.0 |

| 0.33% |

| $ | 97.7 |

| 0.19 | % | City: 3,424; County: 28,897 |

| RURAL - NO CBSA | N/A |

| | | | | | | | | | | | |

(1) Annualized rent was calculated by multiplying base rent for the month of September 2019 by 12. |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 12 |

INVESTMENT ACTIVITY

|

| | | | | | | | | | |

| 2019 INVESTMENT ACTIVITY | | | | |

| | | | | | |

| | Location | Property Type | Acquisition Date | Purchase Price (in thousands) | Square Feet | Aggregate Leased

% at Acquisition |

| Property Acquisitions: | | | | | |

| | Humble, TX | IRF | 2/22/2019 | $ | 28,459 |

| 55,646 |

| 100.0 | % |

| | York, PA | PC | 2/25/2019 | 4,265 |

| 27,100 |

| 100.0 | % |

| | Worcester, MA | BF | 4/30/2019 | 27,000 |

| 81,972 |

| 100.0 | % |

| | Gurnee, IL | MOB | 5/30/2019 | 3,819 |

| 22,943 |

| 91.3 | % |

| | Kissimmee, FL | MOB | 6/20/2019 | 1,059 |

| 4,902 |

| 100.0 | % |

| | Warwick, RI | MOB | 7/22/2019 | 6,059 |

| 21,252 |

| 100.0 | % |

| | Longview, TX | IRF | 7/25/2019 | 19,000 |

| 38,817 |

| 100.0 | % |

| | Marysville, WA | BF | 8/6/2019 | 27,500 |

| 70,100 |

| 100.0 | % |

| | | | | | | |

| Total / Weighted Average | | | $ | 117,161 |

| 322,732 |

| 99.4 | % |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 13 |

LEASING INFORMATION

LEASE EXPIRATION SCHEDULE (1)

|

| | | | | | | | | | | |

| | | Total Leased Square Footage | Annualized Lease Revenue |

| Year | Number of Leases Expiring | Amount | Percent (%) | Amount ($) (in thousands) | Percent (%) |

| 2019 | 10 |

| 42,996 |

| 1.9 | % | 862,819 |

| 1.7 | % |

| 2020 | 44 |

| 215,527 |

| 9.6 | % | 4,371,920 |

| 8.4 | % |

| 2021 | 23 |

| 165,561 |

| 7.4 | % | 3,438,945 |

| 6.6 | % |

| 2022 | 33 |

| 202,311 |

| 9.1 | % | 4,371,865 |

| 8.4 | % |

| 2023 | 40 |

| 222,730 |

| 10.0 | % | 4,393,063 |

| 8.4 | % |

| 2024 | 18 |

| 100,989 |

| 4.5 | % | 2,388,546 |

| 4.6 | % |

| 2025 | 14 |

| 143,123 |

| 6.4 | % | 4,434,379 |

| 8.5 | % |

| 2026 | 11 |

| 156,063 |

| 7.0 | % | 3,566,141 |

| 6.8 | % |

| 2027 | 4 |

| 12,325 |

| 0.5 | % | 353,612 |

| 0.7 | % |

| 2028 | 4 |

| 66,789 |

| 3.0 | % | 1,124,970 |

| 2.2 | % |

| Thereafter | 36 |

| 897,854 |

| 40.2 | % | 22,605,691 |

| 43.4 | % |

| Month-to-Month | 6 |

| 8,622 |

| 0.4 | % | 154,890 |

| 0.3 | % |

| Totals | 243 |

| 2,234,890 |

| 100.0 | % | $ | 52,066,841 |

| 100.0 | % |

(1) Total portfolio was approximately 89.3% leased in the aggregate at September 30, 2019 with lease expirations ranging from 2019 through 2034.

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 14 |

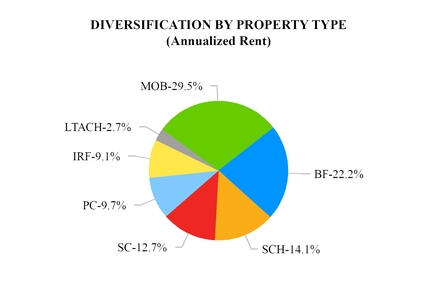

PROPERTY DIVERSIFICATION

|

| | | | | | |

Property Type (1) | Number of Properties |

Annualized Rent (1) ($ in thousands) | Annualized Rent (%) |

| Medical Office Building (MOB) | 37 | $ | 15,263 |

| 29.5 | % |

| Behavioral Facilities (BF) | 9 | 11,458 |

| 22.2 | % |

| Surgical Centers and Hospitals (SCH) | 15 | 7,274 |

| 14.1 | % |

| Specialty Centers (SC) | 25 | 6,543 |

| 12.7 | % |

| Physician Clinics (PC) | 22 | 5,042 |

| 9.7 | % |

| Inpatient Rehabilitation Facilities (IRF) | 2 | 4,729 |

| 9.1 | % |

| Long-term Acute Care Hospitals (LTACH) | 1 | 1,413 |

| 2.7 | % |

| Total | 111 | $ | 51,722 |

| 100.0 | % |

| ______________________ | | | |

| (1) Annualized rent was calculated based on the contractual monthly rent amount for September 2019. |

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 15 |

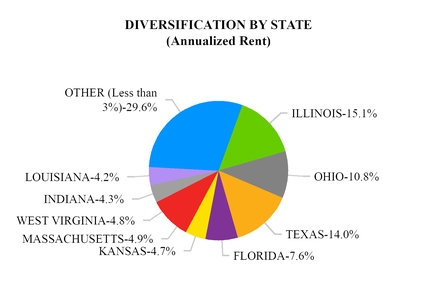

PROPERTY DIVERSIFICATION

(continued)

|

| | | | | | |

| State | Number of Properties | Annualized Rent (1) ($ in thousands) | Annualized Rent (%) |

| ILLINOIS | 15 | $ | 7,811 |

| 15.1 | % |

| OHIO | 15 | 5,609 |

| 10.8 | % |

| TEXAS | 8 | 7,226 |

| 14.0 | % |

| FLORIDA | 11 | 3,934 |

| 7.6 | % |

| KANSAS | 5 | 2,450 |

| 4.7 | % |

| MASSACHUSETTS | 1 | 2,535 |

| 4.9 | % |

| WEST VIRGINIA | 1 | 2,494 |

| 4.8 | % |

| INDIANA | 3 | 2,203 |

| 4.3 | % |

| LOUISIANA | 2 | 2,153 |

| 4.2 | % |

| OTHER (Less than 3%) | 50 | 15,307 |

| 29.6 | % |

| TOTAL | 111 | $ | 51,722 |

| 100.0 | % |

| _________________ | | | |

(1) Annualized rent was calculated based on the contractual monthly rent amount for September 2019.

|

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 16 |

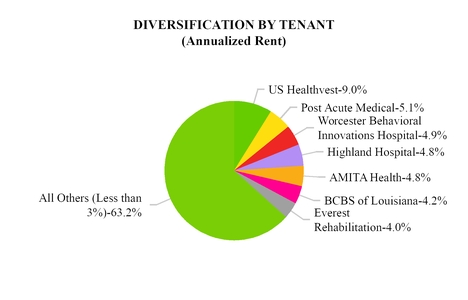

PROPERTY DIVERSIFICATION

(continued)

|

| | | | | |

| Tenant | Annualized Rent (1) ($ in thousands) | Annualized Rent (%) |

| US Healthvest | $ | 4,629 |

| 9.0 | % |

| Post Acute Medical | 2,639 |

| 5.1 | % |

| Worcester Behavioral Innovations Hospital | 2,535 |

| 4.9 | % |

| Highland Hospital | 2,495 |

| 4.8 | % |

| AMITA Health | 2,483 |

| 4.8 | % |

| BCBS of Louisiana | 2,153 |

| 4.2 | % |

| Everest Rehabilitation | 2,090 |

| 4.0 | % |

| All Others (Less than 3%) | 32,698 |

| 63.2 | % |

| | $ | 51,722 |

| 100.0 | % |

| __________________ | | |

(1) Annualized rent was calculated based on the contractual monthly rent amount for September 2019.

|

|

| | |

| Community Healthcare Trust / 3Q 2019 Supplemental Information | | Page 17 |