68 68 70 217 217 218 180 180 182 142 142 145 51 51 53 83 40 79 KKR Real Estate Finance Trust Inc. 230 203 227 1st Quarter 2018 Supplemental Information 205 151 200 179 98 172 62 30 59 May 9, 2018

Legal Disclosures This presentation has been prepared for KKR Real Estate Finance Trust Inc. (NYSE: KREF) for the benefit of its stockholders. This presentation is solely for informational purposes in connection with evaluating the business, operations and financial results of KKR Real Estate Finance Trust Inc. and its subsidiaries (collectively, "KREF“ or the “Company”). This presentation is not and shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities, any investment advice or any other service by KREF. Nothing in this presentation constitutes the provision of any tax, accounting, financial, investment, regulatory, legal or other advice by KREF or its advisors. This presentation may not be referenced, quoted or linked by website by any third party, in whole or in part, except as agreed to in writing by KREF. This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current views with respect to, among other things, its future operations and financial performance. You can identify these forward looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations, taking into account all information currently available to it. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company or are within its control. Such forward-looking statements are subject to various risks and uncertainties, including, among other things: the general political, economic and competitive conditions in the United States and in any foreign jurisdictions in which the Company invests; the level and volatility of prevailing interest rates and credit spreads; adverse changes in the real estate and real estate capital markets; general volatility of the securities markets in which the Company participates; changes in the Company’s business, investment strategies or target assets; difficulty in obtaining financing or raising capital; adverse legislative or regulatory developments; reductions in the yield on the Company’s investments and increases in the cost of the Company’s financing; acts of God such as hurricanes, earthquakes and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/ or losses to the Company or the owners and operators of the real estate securing the Company’s investments; deterioration in the performance of properties securing the Company’s investments that may cause deterioration in the performance of the Company’s investments and, potentially, principal losses to the Company; defaults by borrowers in paying debt service on outstanding indebtedness; the adequacy of collateral securing the Company’s investments and declines in the fair value of the Company’s investments; adverse developments in the availability of desirable investment opportunities whether they are due to competition, regulation or otherwise; difficulty in successfully managing the Company’s growth, including integrating new assets into the Company’s existing systems; the cost of operating the Company’s platform, including, but not limited to, the cost of operating a real estate investment platform and the cost of operating as a publicly traded company; the availability of qualified personnel and the Company’s relationship with our Manager; KKR controls the Company and its interests may conflict with those of the Company’s stockholders in the future; the Company’s qualification as a REIT for U.S. federal income tax purposes and the Company’s exclusion from registration under the Investment Company Act of 1940; authoritative GAAP or policy changes from such standard-setting bodies such as the Financial Accounting Standards Board, the Securities and Exchange Commission (the “SEC”), the Internal Revenue Service, the New York Stock Exchange and other authorities that the Company is subject to, as well as their counterparts in any foreign jurisdictions where the Company might do business; and other risks and uncertainties, including those described under Part I—Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the SEC on February 28, 2018, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this presentation. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and information included in this presentation and in the Company’s filings with the SEC. All forward looking statements in this presentation speak only as of May 9, 2018. KREF undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All financial information in this presentation is as of March 31, 2018 unless otherwise indicated. This presentation also includes non-GAAP financial measures, including Core Earnings, Core Earnings per Weighted Average Share, Net Core Earnings and Net Core Earnings per Weighted Average Share. Such non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with U.S. GAAP. 2

1Q18 Key Highlights • Net income attributable to common stockholders of $23.3 million, or $0.44 per share, up 37% QoQ; Net Core Earnings(1) of $18.9 million, or $0.35 per share, up 10% QoQ • Book value of $19.79 per share for 1Q compared to $19.73 for 4Q17 Financials • Paid 1Q dividend of $0.40 per share on April 13, 2018 • Subsequent to quarter end, declared 2Q dividend of $0.43 per share, equating to a 8.6% annualized dividend yield(2) and payable on July 13, 2018 to shareholders of record on June 29, 2018 • Originated $411.4 million of floating-rate senior loans with a weighted average LTV of 64%(3) Originations • LTM originations of $1.6 billion • Subsequent to quarter end, originated a $350 million floating-rate senior loan with an LTV of 71%(3) • Outstanding total loan portfolio of $2.5 billion, up 19% from 4Q • Portfolio weighted average LTV of 67%(3) • Senior loans weighted average LTV of 67%(3) Total Portfolio • Weighted average risk rating of 2.9 (Average Risk) • Subsequent to quarter end, sold CMBS B-Piece investments for net proceeds of $112.7 million and a realized gain of $11.9 million in 2Q, out of which $5.4 million was unrealized in 1Q • $0.5 billion of undrawn capacity on secured financing facilities Capitalization • Subsequent to quarter end, closed $400 million term loan financing facility providing matched-term financing on a non-mark to market and non-recourse basis • 94% of the portfolio is floating-rate Interest Rate • A 50 basis point increase in one-month USD LIBOR would increase net Sensitivity interest income by $3.0 million or $0.06 per share over the next twelve months(4) Note: Net income attributable to common stockholders per share and Net Core Earnings per share based on diluted weighted average shares outstanding as of March 31, 2018; book value per share and increase in net interest income per share due to an increase in one-month USD LIBOR based on shares outstanding at March 31, 2018. (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (2) Based on KREF closing price as of May 9, 2018. (3) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated. (4) Assumes spot one-month USD LIBOR rate of 1.88%. 3

1Q18 Financial Summary Income Statement Balance Sheet ($ in Millions, except per share data) ($ in Millions, except per share data) 1Q18 1Q18 Net Interest Income $21.0 Total Portfolio $2,473.8 Secured Debt Outstanding Face Other Income 9.2 1,287.1 Amount Operating Expenses and Other (6.9) Senior Loan Interests(2) 145.6 Net Income Attributable to Total Leverage $1,432.7 $23.3 Common Stockholders Total Stockholders' Equity 1,050.3 Weighted Average Shares 53,378,467 Outstanding, Diluted Cash 23.1 Net Income Per Share $0.44 Debt-to-Equity Ratio(3) 1.2x Net Core Earnings, Diluted(1) $18.9 Total Leverage Ratio(4) 1.3x Net Core Earnings per Share(1) $0.35 Shares Outstanding 53,075,575 Dividend per Share $0.40 Book Value per Share $19.79 (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (2) Includes $82.0 million of Loan Participations Sold and $63.6 million of Non-Consolidated Senior Interests, which resulted from non-recourse sales of senior loan interests in loans KREF originated. (3) Represents (i) total outstanding face amount of secured debt agreements less cash to (ii) total stockholders’ equity. (4) Represents (i) total outstanding face amount of secured debt agreements, loan participations sold and non-consolidated senior interests less cash to (ii) total stockholders’ equity. 4

Recent Operating Performance • 1Q 2018 Net Income attributable to common stockholders increased to $23.3 million, up 37% QoQ; Net Core Earnings(1) increased to $18.9 million, up 10% QoQ • Book value per share increased to $19.79 in 1Q • Subsequent to quarter end, declared 2Q dividend of $0.43 per share, equating to a 8.6% annualized dividend yield(2) based on KREF closing price as of May 9, 2019 and 8.7% based on 1Q book value per share Net Income(3) and Net Core Earnings(1) Dividends and Book Value Per Share ($ in Millions) Book value per share: $19.83 $19.78 $19.73 $19.79 $19.79(4) $23.3 Dividend per share: $0.25 $0.37 $0.37 $0.40 $0.43 $18.9 8.7% $17.3 $17.0 $17.1 $16.5 8.1% $14.1 $13.0 7.5% 7.5% N/A 2Q'17 3Q'17 4Q'17 1Q'18 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 Net Income Net Core Earnings Annualized dividend yield based on book value per share (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (2) Based on KREF closing price as of May 9, 2018. (3) Represents Net Income attributable to common stockholders. (4) Book value per share as of March 31, 2018. 5

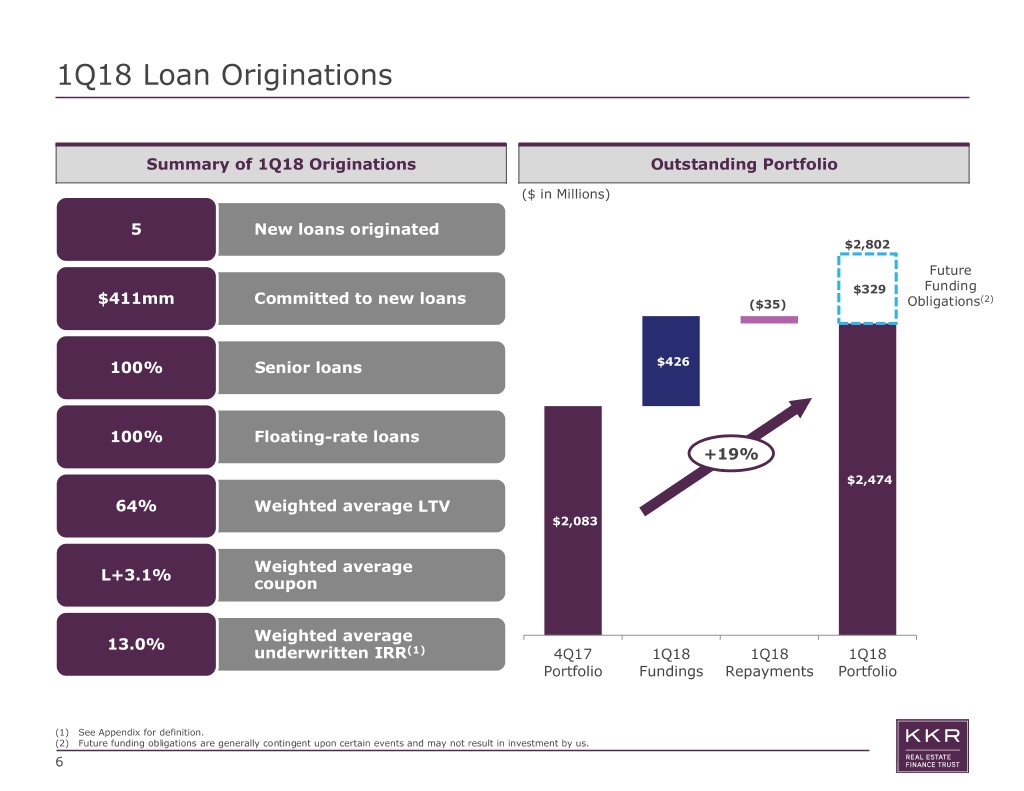

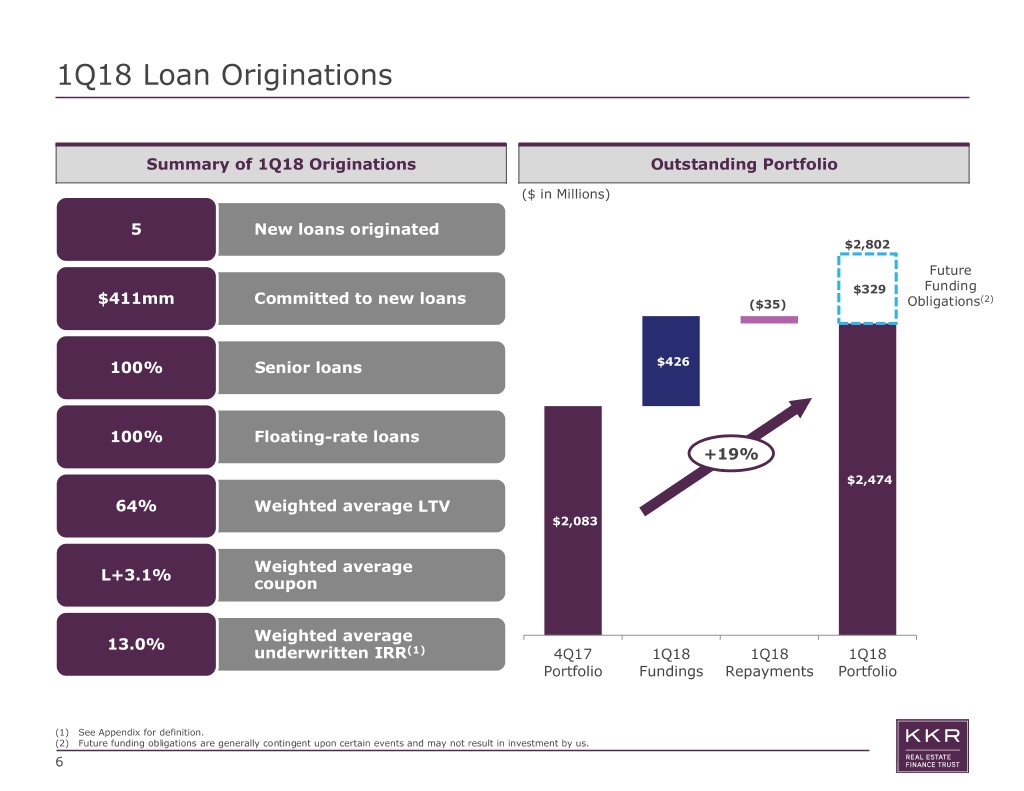

1Q18 Loan Originations Summary of 1Q18 Originations Outstanding Portfolio ($ in Millions) 5 • New loans originated $2,802 Future $329 Funding $411mm • Committed to new loans ($35) Obligations(2) 100% • Senior loans $426 100% • Floating-rate loans +19% $2,474 64% • Weighted average LTV $2,083 • Weighted average L+3.1% coupon • Weighted average 13.0% underwritten IRR(1) 4Q17 1Q18 1Q18 1Q18 Portfolio Fundings Repayments Portfolio (1) See Appendix for definition. (2) Future funding obligations are generally contingent upon certain events and may not result in investment by us. 6

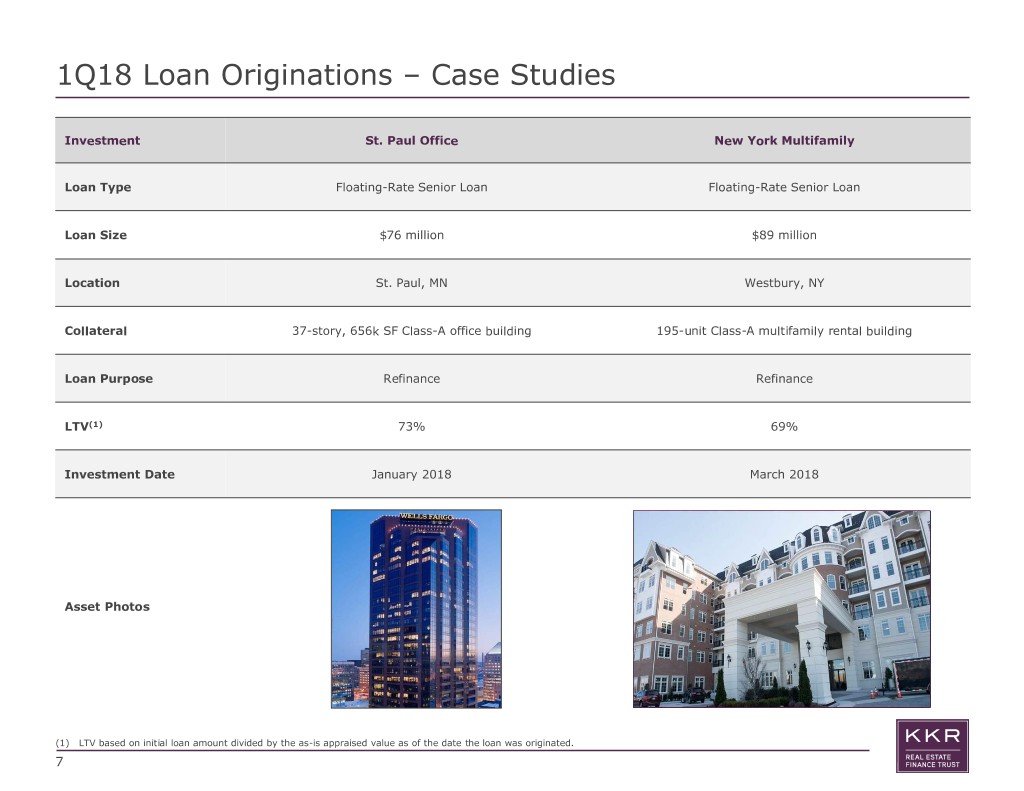

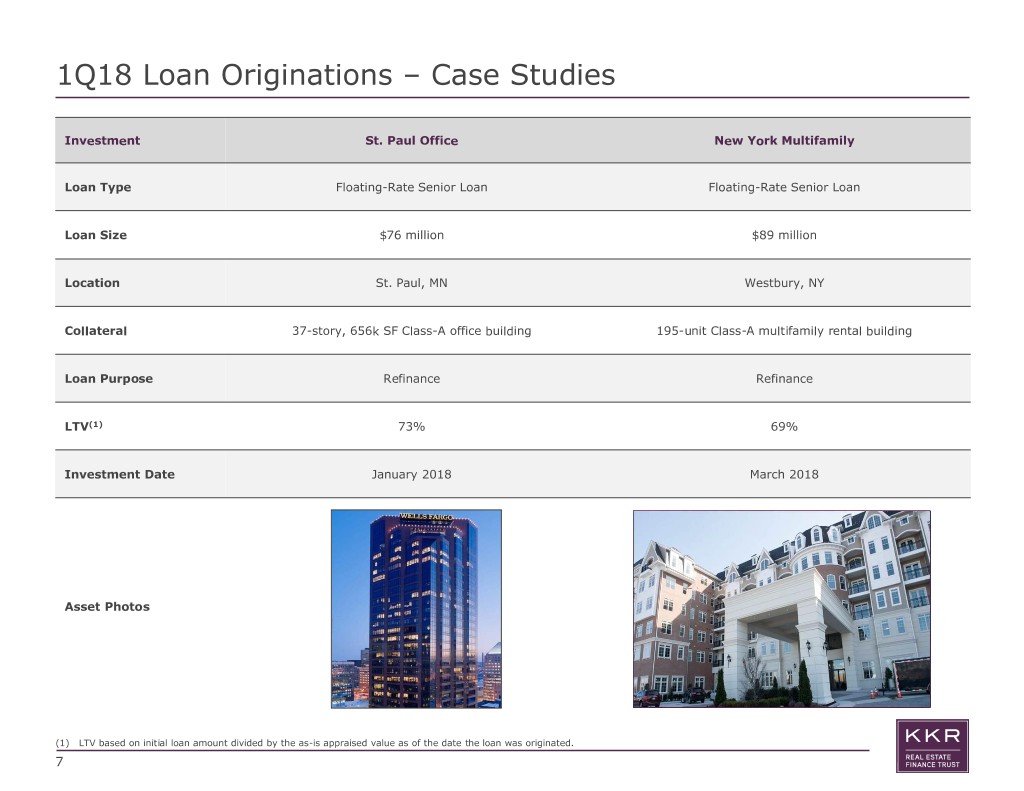

1Q18 Loan Originations – Case Studies Investment St. Paul Office New York Multifamily Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Loan Size $76 million $89 million Location St. Paul, MN Westbury, NY Collateral 37-story, 656k SF Class-A office building 195-unit Class-A multifamily rental building Loan Purpose Refinance Refinance LTV(1) 73% 69% Investment Date January 2018 March 2018 Asset Photos (1) LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. 7

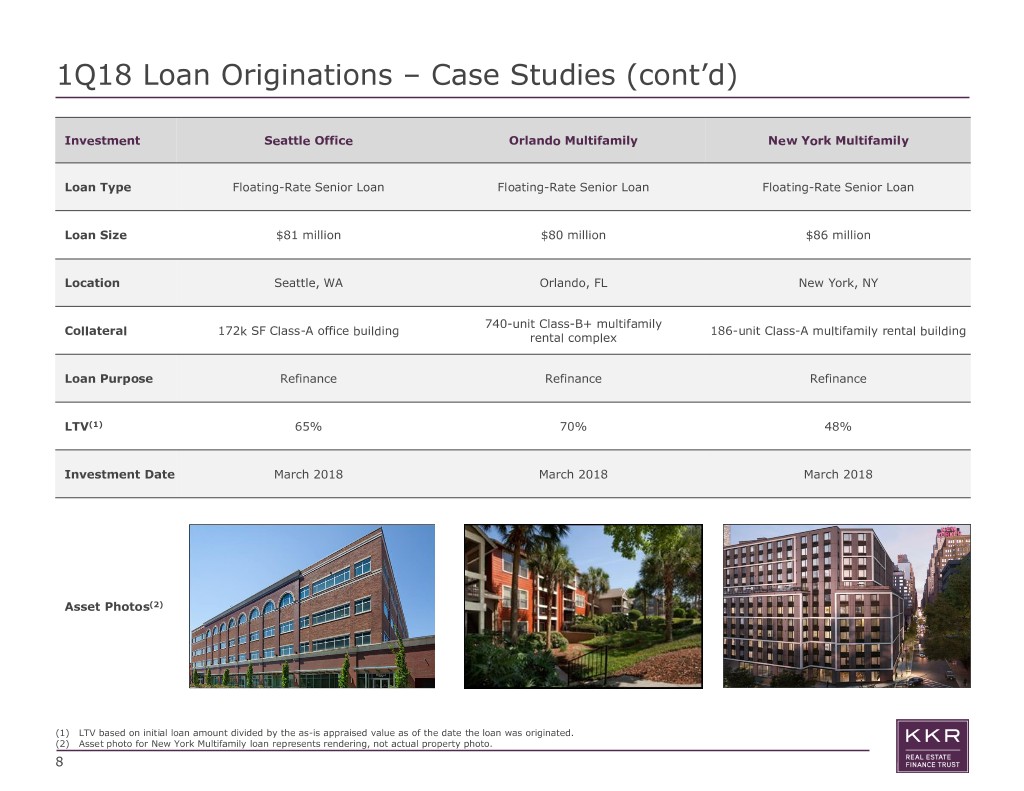

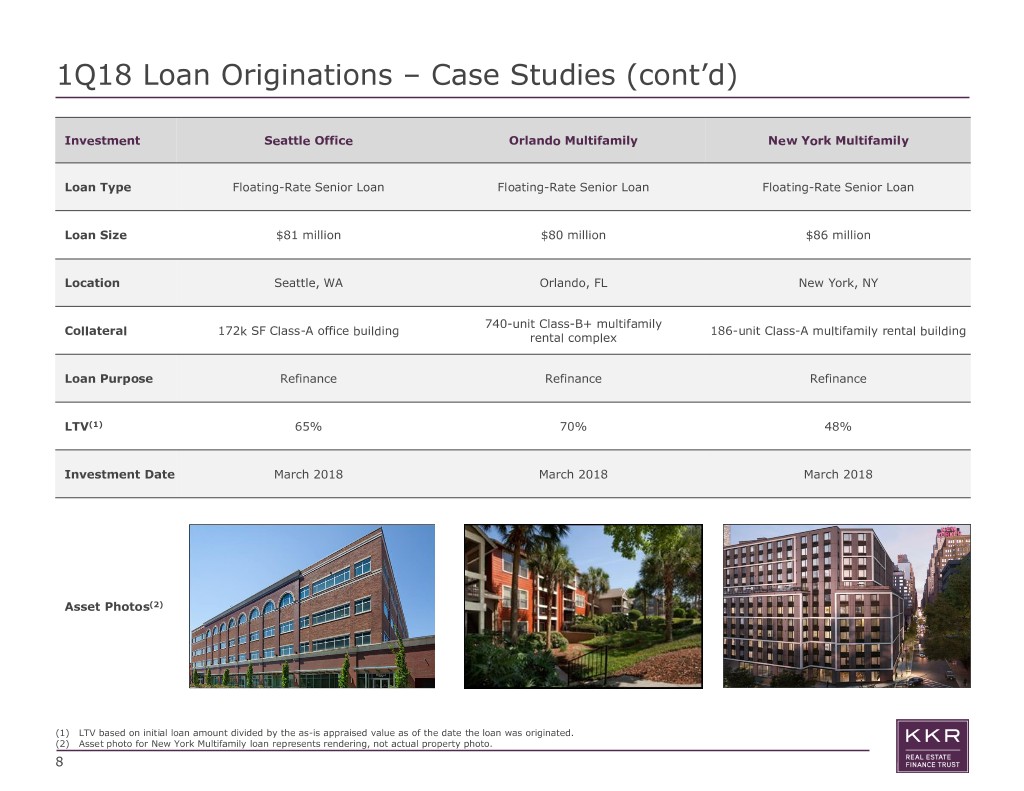

1Q18 Loan Originations – Case Studies (cont’d) Investment Seattle Office Orlando Multifamily New York Multifamily Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Loan Size $81 million $80 million $86 million Location Seattle, WA Orlando, FL New York, NY 740-unit Class-B+ multifamily Collateral 172k SF Class-A office building 186-unit Class-A multifamily rental building rental complex Loan Purpose Refinance Refinance Refinance LTV(1) 65% 70% 48% Investment Date March 2018 March 2018 March 2018 Asset Photos(2) (1) LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. (2) Asset photo for New York Multifamily loan represents rendering, not actual property photo. 8

1Q18 KREF Portfolio by the Numbers • $2.5 billion portfolio comprised of 37 investments • Portfolio weighted average LTV of 67%(1) Geography(2) Investment Type(3) CMBS Mezz 5% 2% Senior Loans 93% Interest Rate Type Fixed 6% Floating 94% Note: Map does not include Midwest Mezzanine portfolio ($5.5 million) Property Type(2) Industrial / Hospitality Other Flex NY Condo <1% OR 21% 5% 31% (Residential) 5% 9% NJ 6% Retail 11% Office CO 41% 7% CA MN GA Multifamily 12% 33% 9% 9% Note: The charts above are based on total assets. Total assets reflect (i) the principal amount of our senior and mezzanine loans and (ii) the cost basis of our CMBS B-Pieces, net of VIE liabilities. In accordance with GAAP, we carry our CMBS B-Pieces at fair value, which we valued above our cost basis as of March 31, 2018. (1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated. See page 13 for additional details. (2) Excludes CMBS B-Pieces. (3) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a corresponding first mortgage. 9

1Q18 Financing Overview • Total financing capacity of $1.8 billion with $0.5 billion of undrawn capacity • Subsequent to quarter end, closed a $400 million term loan financing facility providing matched-term financing on a non- mark to market and non-recourse basis Summary of Outstanding Financing ($ in Millions) Outstanding Face Weighted Average Maximum Capacity Amount Coupon Term Credit Facilities $1,750(1) $1,287 L+2.0% Corporate Revolving Facility $75 -- -- Total Secured Debt $1,825 $1,287 Senior Loan Interests(2) $146 $146 L+1.9% Total Leverage $1,971 $1,433 Debt-to-Equity Ratio of 1.2x(3) Total Leverage Ratio of 1.3x(4) (1) Subject to customary conditions, KREF is permitted to request the Morgan Stanley facility be further increased by an additional $150 million. (2) Includes $82.0 million of Loan Participations Sold and $63.6 million of Non-Consolidated Senior Interests, which result from non-recourse sales of senior loan interests in loans KREF originated. (3) Represents (i) total outstanding face amount of secured debt agreements less cash to (ii) total stockholders’ equity. (4) Represents (i) total outstanding face amount of secured debt agreements, loan participations sold and non-consolidated senior interests less cash to (ii) total stockholders’ equity. 10

Interest Rate Sensitivity • KREF benefits in a rising rate environment • 94% of the portfolio is indexed to one-month USD LIBOR • A 50 basis point increase in one-month USD LIBOR would increase net interest income by $3.0 million or $0.06 per share over the next 12 months(1)(2) Net Interest Income Sensitivity to LIBOR Increases(1)(2) ($ in Millions) $14.0 $12.0 $12.0 $10.0 $9.0 $8.0 $6.0 $6.0 $4.0 $3.0 $2.0 $0.0 $0.0 0.00% 0.50% 1.00% 1.50% 2.00% Change in LIBOR (1) As of March 31, 2018, assumes loans are drawn up to maximum approved advance rate based on current principal amount; per share amount assumes 53,075,575 shares outstanding. (2) Assumes spot one-month USD LIBOR rate of 1.88%. 11

68 68 70 217 217 218 180 180 182 142 142 145 51 51 53 83 40 79 230 203 227 205 151 200 179 98 172 62 30 59 Appendix 12

Portfolio Details Investment Committed Current Principal Future Max Remaining # Investment Location Property Type Net Equity(2) Coupon(4)(5) LTV(4)(7) ($ in millions) Date Principal Amount Amount Funding(3) Term (Yrs)(4)(6) Senior Loans(1) 1 Senior Loan New York, NY Condo (Resi) 8/4/2017 $239.2 $205.5 $84.4 $0.0 L + 4.8% 2.3 69% 2 Senior Loan Minneapolis, MN Office 11/13/2017 181.8 137.9 33.7 43.9 L + 3.8% 4.7 75% 3 Senior Loan Portland, OR Retail 10/26/2015 177.0 119.8 43.9 57.2 L + 5.5% 2.6 61% 4 Senior Loan San Diego, CA Office 9/9/2016 168.0 150.5 47.0 17.5 L + 4.2% 3.5 71% 5 Senior Loan Irvine, CA Office 4/11/2017 162.1 133.0 35.3 29.1 L + 3.9% 4.1 62% 6 Senior Loan North Bergen, NJ Multifamily 10/23/2017 150.0 138.4 62.2 11.6 L + 4.3% 4.6 57% 7 Senior Loan Brooklyn, NY Retail 9/27/2016 138.6 122.5 40.7 16.1 L + 5.0% 3.5 59% 8 Senior Loan Brooklyn, NY Office 3/30/2017 132.3 105.7 31.9 26.6 L + 4.4% 4.0 68% 9 Senior Loan Atlanta, GA Office 8/15/2017 119.0 95.3 13.2 5.8 L + 3.0% 4.4 66% 10 Senior Loan Honolulu, HI Multifamily 8/23/2017 105.0 100.0 24.4 5.0 L + 4.0% 4.4 66% 11 Senior Loan Crystal City, VA Office 9/14/2016 103.5 87.1 32.7 16.4 L + 4.5% 3.5 59% 12 Senior Loan Westbury, NY Multifamily 3/8/2018 89.0 87.0 86.6 2.0 L + 3.1% 5.0 69% 13 Senior Loan New York, NY Multifamily 3/29/2018 86.0 86.0 85.4 0.0 L + 2.6% 5.0 48% 14 Senior Loan Denver, CO Multifamily 2/28/2017 85.9 79.4 15.6 0.0 L + 3.8% 3.9 75% 15 Senior Loan Denver, CO Multifamily 8/4/2017 81.0 81.0 19.7 0.0 L + 4.0% 4.3 73% 16 Senior Loan Seattle, WA Office 3/20/2018 80.9 79.0 19.0 1.9 L + 3.5% 5.0 65% 17 Senior Loan Orlando, FL Multifamily 3/28/2018 80.0 67.8 67.5 12.2 L + 2.8% 5.0 70% 18 Senior Loan Austin, TX Multifamily 2/15/2017 79.2 61.9 17.1 17.3 L + 4.2% 3.9 71% 19 Senior Loan St Paul, MN Office 1/16/2018 75.5 70.0 17.0 5.5 L + 3.6% 4.9 73% 20 Senior Loan Queens, NY Industrial 7/21/2017 75.1 61.4 15.0 13.7 L + 3.7% 4.3 72% 21 Senior Loan New York, NY Multifamily 10/7/2016 74.5 70.3 21.3 4.2 L + 4.4% 3.6 68% 22 Senior Loan Atlanta, GA Industrial 12/17/2015 73.0 67.5 18.2 5.5 L + 4.0% 2.8 73% 23 Senior Loan Atlanta, GA Office 5/12/2017 61.9 48.8 16.7 13.1 L + 4.0% 4.2 71% 24 Senior Loan Nashville, TN Office 5/19/2016 55.0 52.8 13.3 2.2 L + 4.3% 3.8 70% Total / Weighted Average $2,673.4 $2,308.6 $861.8 $306.6 L + 4.0% 4.0 67% Mezzanine Loans 1 Mezzanine Loan Chicago, IL Retail 6/23/2015 $16.5 $16.5 $16.4 - L + 9.2% 2.3 82% 2 - 7 Fixed Rate Mezzanine Loans Various Various Various 26.2 26.2 24.9 - 10.6% 7.1 77% Total / Weighted Average $42.7 $42.7 $41.3 - 10.8% 5.3 79% CMBS Total / Weighted Average $349.2 $327.2 $122.5 $22.0 4.3% 7.9 64% Portfolio Total / Weighted Average $3,065.3 $2,678.5 $1,025.6 $328.6 5.9% 4.2 67% 1Q18 Outstanding Portfolio(8) $2,473.8 (1) Senior loans include senior mortgages and similar credit quality investments, including junior participations in our originated senior loans for which we have syndicated the senior participations and retained the junior participations for our portfolio. (2) Net equity reflects (i) the amortized cost basis of our loans, net of borrowings and a 5% noncontrolling interest in the entity that holds certain of our mezzanine loans; (ii) the cost basis of our CMBS B-Pieces, net of VIE liabilities; and (iii) the cost basis of our investment in RECOP. (3) Represents Committed Principal Amount less Current Principal Amount on Senior Loans with the exception of Senior Loan 9 and Senior Loan 14, for which the future funding commitment is held by the syndicated senior participation; there is no future funding on mezzanine loans or CMBS with the exception of $22.0 million of remaining commitment to RECOP. (4) Weighted averages are weighted by current principal amount for senior loans and mezzanine loans; weighted averages are weighted by net equity for CMBS B-Pieces; weighted average coupon calculation includes one-month USD LIBOR for floating-rate Mezzanine Loans. (5) L = one-month USD LIBOR rate; spot one-month USD LIBOR rate of 1.88% included in mezzanine loan and portfolio-wide averages represented as fixed rates. (6) Max remaining term (years) assumes all extension options are exercised, if applicable. (7) For senior and mezzanine loans, loan-to-value ratio ("LTV") is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated; for Senior Loan 1, LTV is based on the total initial loan amount of $239.2 million divided by the appraised net sell-out value of $345.4 million; for CMBS B-Pieces, LTV is based on the weighted average LTV of the underlying loan pool at issuance. (8) Represents Current Principal Amount of Senior Loans and Mezzanine Loans and Net Equity Amount for CMBS. 13

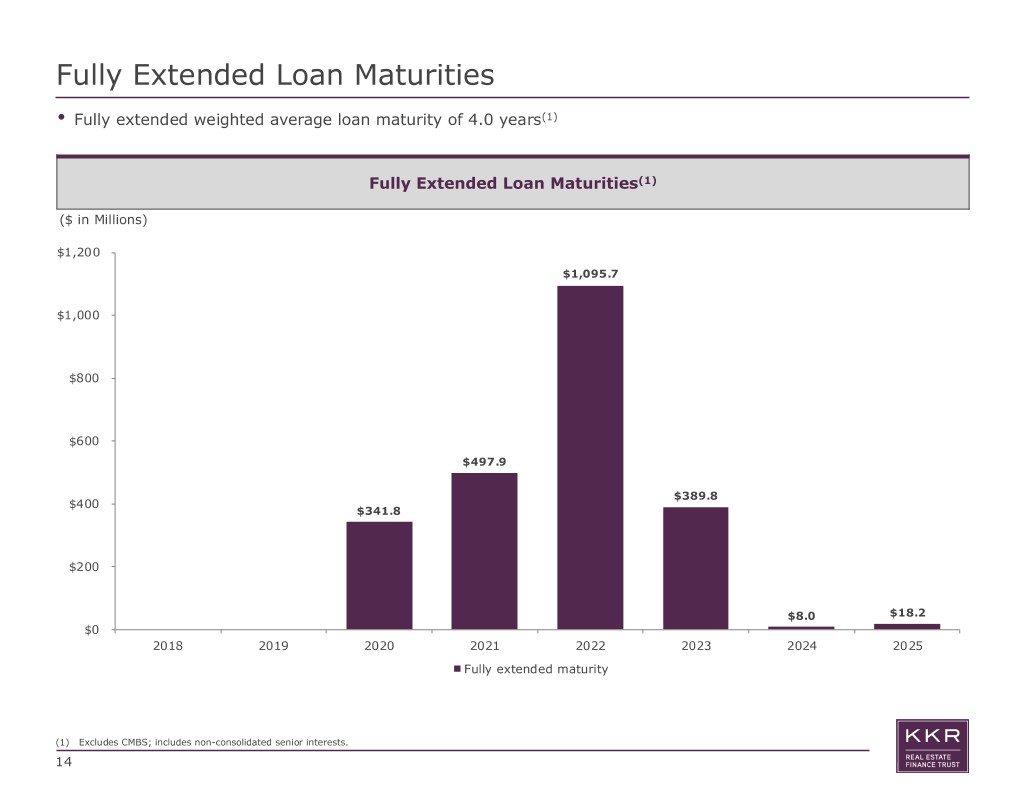

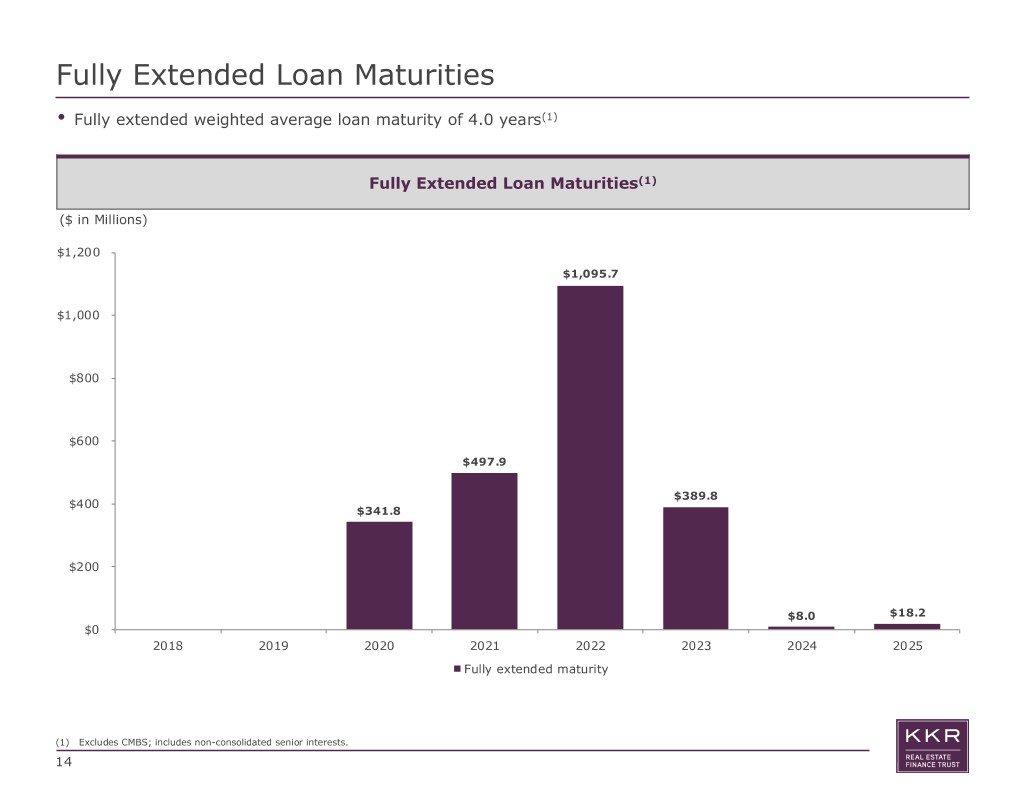

Fully Extended Loan Maturities • Fully extended weighted average loan maturity of 4.0 years(1) Fully Extended Loan Maturities(1) ($ in Millions) $1,200 $1,095.7 $1,000 $800 $600 $497.9 $389.8 $400 $341.8 $200 $8.0 $18.2 $0 2018 2019 2020 2021 2022 2023 2024 2025 Fully extended maturity (1) Excludes CMBS; includes non-consolidated senior interests. 14

Consolidated Balance Sheets (in thousands - except share and per share data) March 31, 2018 December 31, 2017 Assets Cash and cash equivalents $ 23,124 $ 103,120 Restricted cash - 400 Commercial mortgage loans, held-for-investment, net 2,273,190 1,888,510 Equity method investments, at fair value 18,295 14,390 Accrued interest receivable 8,796 8,423 Other assets 2,755 7,239 Commercial mortgage loans held in variable interest entities, at fair value 5,278,715 5,372,811 Total Assets $ 7,604,875 $ 7,394,893 Liabilities and Equity Liabilities Secured financing agreements, net $ 1,282,583 $ 964,800 Loan participations sold, net 81,500 81,472 Accounts payable, accrued expenses and other liabilities 3,111 2,465 Dividends Payable 21,458 19,981 Accrued interest payable 2,138 1,623 Due to affiliates 4,082 4,442 Variable interest entity liabilities, at fair value 5,157,430 5,256,926 Total Liabilities 6,552,302 6,331,709 Commitments and Contingencies Temporary Equity Redeemable noncontrolling interests in equity of consolidated joint venture 1,329 3,090 Redeemable preferred stock 949 949 Permanent Equity Preferred stock, 50,000,000 authorized (1 share with par value of $0.01 issued and outstanding as of March - - 31, 2018 and December 31, 2017, respectively) Common stock, 300,000,000 authorized (53,075,575 and 53,685,440 shares with par value of $0.01 issued 531 537 and outstanding as of March 31, 2018 and December 31, 2017, respectively) Additional paid-in capital 1,053,869 1,052,851 Retained earnings 8,330 6,280 Repurchased stock, 636,263 and 26,398 shares repurchased as of March 31, 2018 and December 31, 2017, (12,435) (523) respectively Total KKR Real Estate Finance Trust Inc. stockholders’ equity 1,050,295 1,059,145 Total Permanent Equity 1,050,295 1,059,145 Total Liabilities and Equity $ 7,604,875 $ 7,394,893 15

Consolidated Statements of Income (in thousands - except share and per share data) For the Three Months Ended March 31, 2018 December 31, 2017 March 31, 2017 Net Interest Income Interest income $ 31,694 $ 28,385 $ 12,906 Interest expense 10,690 8,632 3,953 Total net interest income 21,004 19,753 8,953 Other Income Change in net assets related to consolidated variable interest entities 8,489 3,035 4,610 Income from equity method investments 548 414 16 Other income 161 352 164 Total other income (loss) 9,198 3,801 4,790 Operating Expenses General and administrative 2,663 1,682 952 Management fees to affiliate 3,939 3,979 2,036 Total operating expenses 6,602 5,661 2,988 Income (Loss) Before Income Taxes, Noncontrolling Interests and Preferred Dividends 23,600 17,893 10,755 Income tax expense 175 714 122 Net Income (Loss) 23,425 17,179 10,633 Redeemable Noncontrolling Interests in Income (Loss) of Consolidated Joint Venture 34 82 46 Noncontrolling Interests in Income (Loss) of Consolidated Joint Venture - - 210 Net Income Attributable to KKR Real Estate Finance Trust Inc. and Subsidiaries 23,391 17,097 10,377 Preferred Stock Dividends 111 63 13 Net Income (Loss) Attributable to Common Stockholders $ 23,280 $ 17,034 $ 10,364 Net Income (Loss) Per Share of Common Stock, Basic and Diluted $ 0.44 $ 0.32 $ 0.39 Weighted Average Number of Shares of Common Stock Outstanding, Basic 53,337,915 53,685,440 26,879,428 Weighted Average Number of Shares of Common Stock Outstanding, Diluted 53,378,467 53,688,027 26,879,428 Dividends Declared per Share of Common Stock $ 0.40 $ 0.37 $ 0.35 16

68 68 70 Reconciliation of GAAP Net Income to Core Earnings and Net 217 217 218 Core Earnings 180 180 182 1Q18 4Q17 ($ in thousands, except share and per share data) • Current LIBOR levels influence asset yield and 142 142 145 therefore ROE Net Income Attributable to Common Stockholders $23,280 $17,034 • Business economics benefit from scale by 51 51 53 Adjustments spreading G&A expenses Non-cash equity compensation expense 1,018 25 • Asset mix impacts expected returns and risk 83 40 79 • Higher leverage increases business profitability Incentive compensation to affiliate - - during favorable economic cycles 230 203 227 Depreciation and amortization - - 205 151 200 Unrealized (gains) or losses (5,377) 79 (1) 179 98 172 Core Earnings $18,921 $17,138 Weighted Average Shares Outstanding 62 30 59 Basic 53,337,915 53,685,440 Diluted 53,378,467 53,688,027 Core Earnings per Weighted Average Share, Basic and diluted (1) $0.35 $0.32 Core Earnings(1) $18,921 $17,138 Less: Incentive compensation to affiliate - - Net Core Earnings(1) $18,921 $17,138 Net Core Earnings per Weighted Average Share, Basic and $0.35 $0.32 diluted(1) (1) See Appendix page 18 for definitions. Excludes $1.1 million and $1.1 million, or $0.02 and $0.02 per diluted weighted average share outstanding of net original issue discount on CMBS B-pieces accreted as a component of taxable income during 1Q18 and 4Q17, respectively. 17

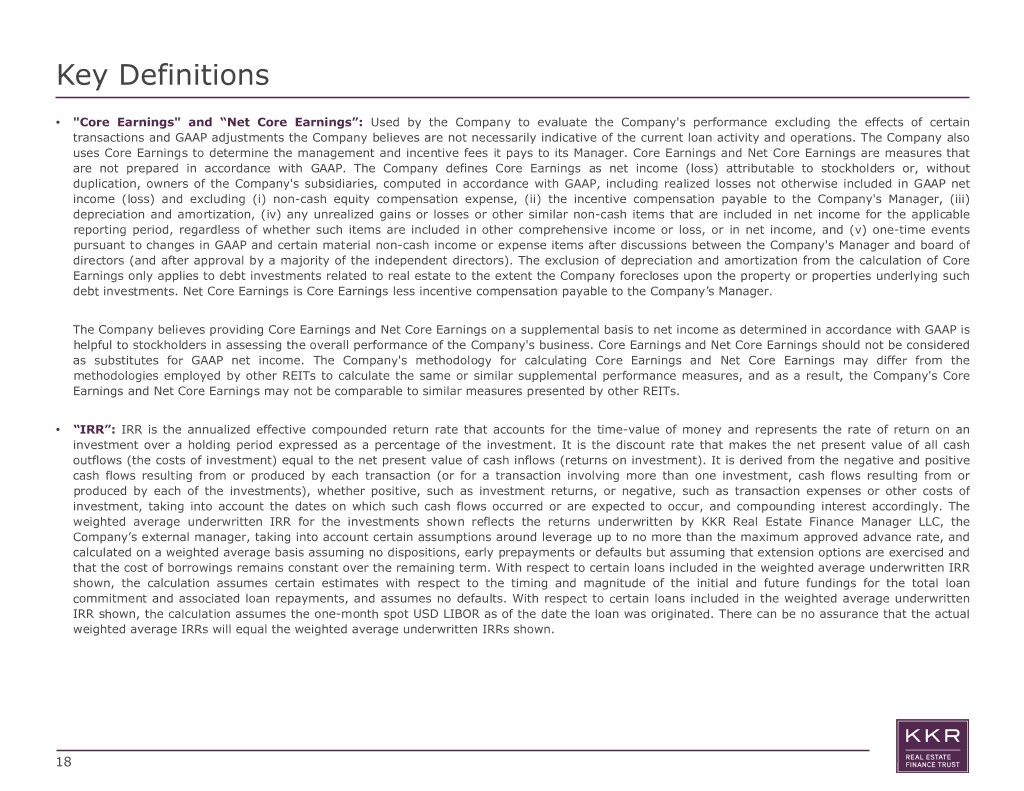

68 68 70 217 217 218 Key Definitions 180 180 182 • "Core Earnings" and “Net Core Earnings”: Used by the Company to evaluate the Company's performance excluding the effects of certain transactions and GAAP adjustments the Company believes are not necessarily indicative of the current loan activity and operations. The Company also uses Core Earnings to determine the management and incentive fees it pays to its Manager. Core Earnings and Net Core Earnings are measures that • Current LIBOR levels influence asset yield and 142 142 145 are not prepared in accordance with GAAP. The Company defines Core Earnings as net income (loss) attributable to stockholders or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not otherwise included in GAAP net therefore ROE income (loss) and excluding (i) non-cash equity compensation expense, (ii) the incentive compensation payable to the Company's Manager, (iii) • Business economics benefit from scale by 51 51 53 depreciation and amortization, (iv) any unrealized gains or losses or other similar non-cash items that are included in net income for the applicable spreading G&A expenses reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (v) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items after discussions between the Company's Manager and board of • Asset mix impacts expected returns and risk 83 40 79 directors (and after approval by a majority of the independent directors). The exclusion of depreciation and amortization from the calculation of Core Earnings only applies to debt investments related to real estate to the extent the Company forecloses upon the property or properties underlying such • Higher leverage increases business profitability debt investments. Net Core Earnings is Core Earnings less incentive compensation payable to the Company’s Manager. during favorable economic cycles 230 203 227 The Company believes providing Core Earnings and Net Core Earnings on a supplemental basis to net income as determined in accordance with GAAP is 205 151 200 helpful to stockholders in assessing the overall performance of the Company's business. Core Earnings and Net Core Earnings should not be considered as substitutes for GAAP net income. The Company's methodology for calculating Core Earnings and Net Core Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, the Company's Core 179 98 172 Earnings and Net Core Earnings may not be comparable to similar measures presented by other REITs. • “IRR”: IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an 62 30 59 investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. The weighted average underwritten IRR for the investments shown reflects the returns underwritten by KKR Real Estate Finance Manager LLC, the Company’s external manager, taking into account certain assumptions around leverage up to no more than the maximum approved advance rate, and calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings remains constant over the remaining term. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes certain estimates with respect to the timing and magnitude of the initial and future fundings for the total loan commitment and associated loan repayments, and assumes no defaults. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes the one-month spot USD LIBOR as of the date the loan was originated. There can be no assurance that the actual weighted average IRRs will equal the weighted average underwritten IRRs shown. 18