68 68 70 217 217 218 180 180 182 142 142 145 51 51 53 83 40 79 KKR Real Estate Finance Trust Inc. 230 203 227 2nd Quarter 2018 Supplemental Information 205 151 200 179 98 172 62 30 59 August 6, 2018

Legal Disclosures This presentation has been prepared for KKR Real Estate Finance Trust Inc. (NYSE: KREF) for the benefit of its stockholders. This presentation is solely for informational purposes in connection with evaluating the business, operations and financial results of KKR Real Estate Finance Trust Inc. and its subsidiaries (collectively, "KREF“ or the “Company”). This presentation is not and shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities, any investment advice or any other service by KREF. Nothing in this presentation constitutes the provision of any tax, accounting, financial, investment, regulatory, legal or other advice by KREF or its advisors. This presentation may not be referenced, quoted or linked by website by any third party, in whole or in part, except as agreed to in writing by KREF. This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current views with respect to, among other things, its future operations and financial performance. You can identify these forward looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations, taking into account all information currently available to it. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company or are within its control. Such forward-looking statements are subject to various risks and uncertainties, including, among other things: the general political, economic and competitive conditions in the United States and in any foreign jurisdictions in which the Company invests; the level and volatility of prevailing interest rates and credit spreads; adverse changes in the real estate and real estate capital markets; general volatility of the securities markets in which the Company participates; changes in the Company’s business, investment strategies or target assets; difficulty in obtaining financing or raising capital; adverse legislative or regulatory developments; reductions in the yield on the Company’s investments and increases in the cost of the Company’s financing; acts of God such as hurricanes, earthquakes and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/ or losses to the Company or the owners and operators of the real estate securing the Company’s investments; deterioration in the performance of properties securing the Company’s investments that may cause deterioration in the performance of the Company’s investments and, potentially, principal losses to the Company; defaults by borrowers in paying debt service on outstanding indebtedness; the adequacy of collateral securing the Company’s investments and declines in the fair value of the Company’s investments; adverse developments in the availability of desirable investment opportunities whether they are due to competition, regulation or otherwise; difficulty in successfully managing the Company’s growth, including integrating new assets into the Company’s existing systems; the cost of operating the Company’s platform, including, but not limited to, the cost of operating a real estate investment platform and the cost of operating as a publicly traded company; the availability of qualified personnel and the Company’s relationship with our Manager; KKR controls the Company and its interests may conflict with those of the Company’s stockholders in the future; the Company’s qualification as a REIT for U.S. federal income tax purposes and the Company’s exclusion from registration under the Investment Company Act of 1940; authoritative GAAP or policy changes from such standard-setting bodies such as the Financial Accounting Standards Board, the Securities and Exchange Commission (the “SEC”), the Internal Revenue Service, the New York Stock Exchange and other authorities that the Company is subject to, as well as their counterparts in any foreign jurisdictions where the Company might do business; and other risks and uncertainties, including those described under Part I—Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the SEC on February 28, 2018, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this presentation. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and information included in this presentation and in the Company’s filings with the SEC. All forward looking statements in this presentation speak only as of August 6, 2018. KREF undertakes no obligation to publicly update or review any forward- looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All financial information in this presentation is as of June 30, 2018 unless otherwise indicated. This presentation also includes non-GAAP financial measures, including Core Earnings, Core Earnings per Weighted Average Share, Net Core Earnings and Net Core Earnings per Weighted Average Share. Such non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with U.S. GAAP. 2

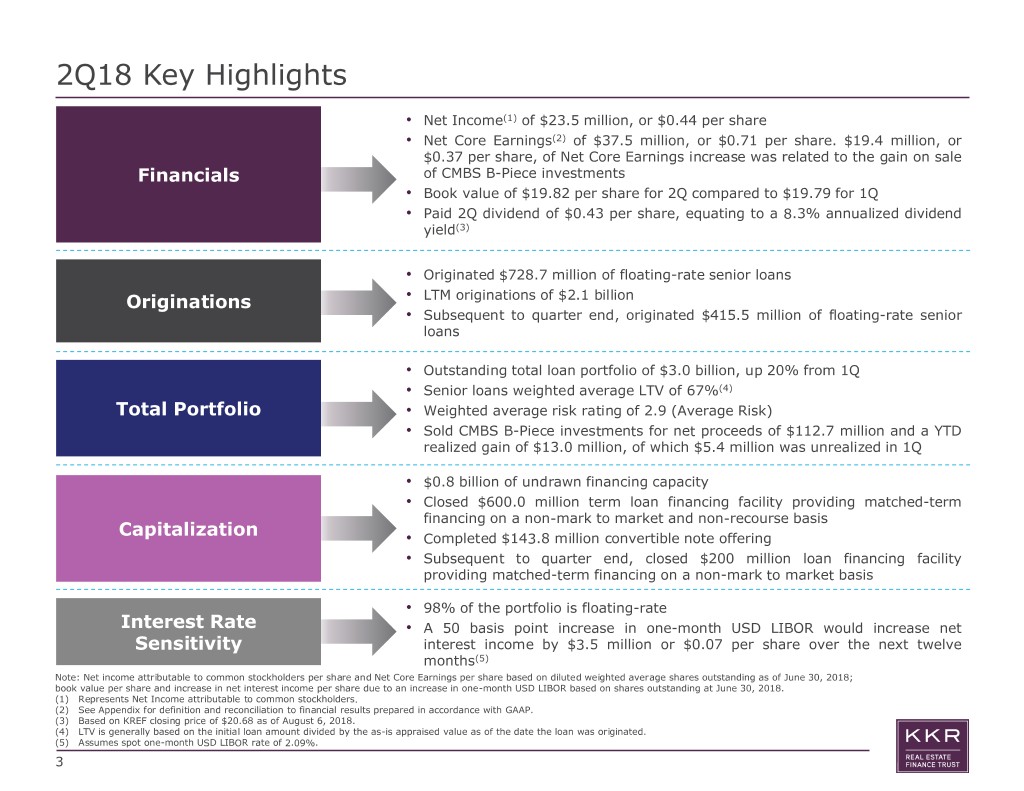

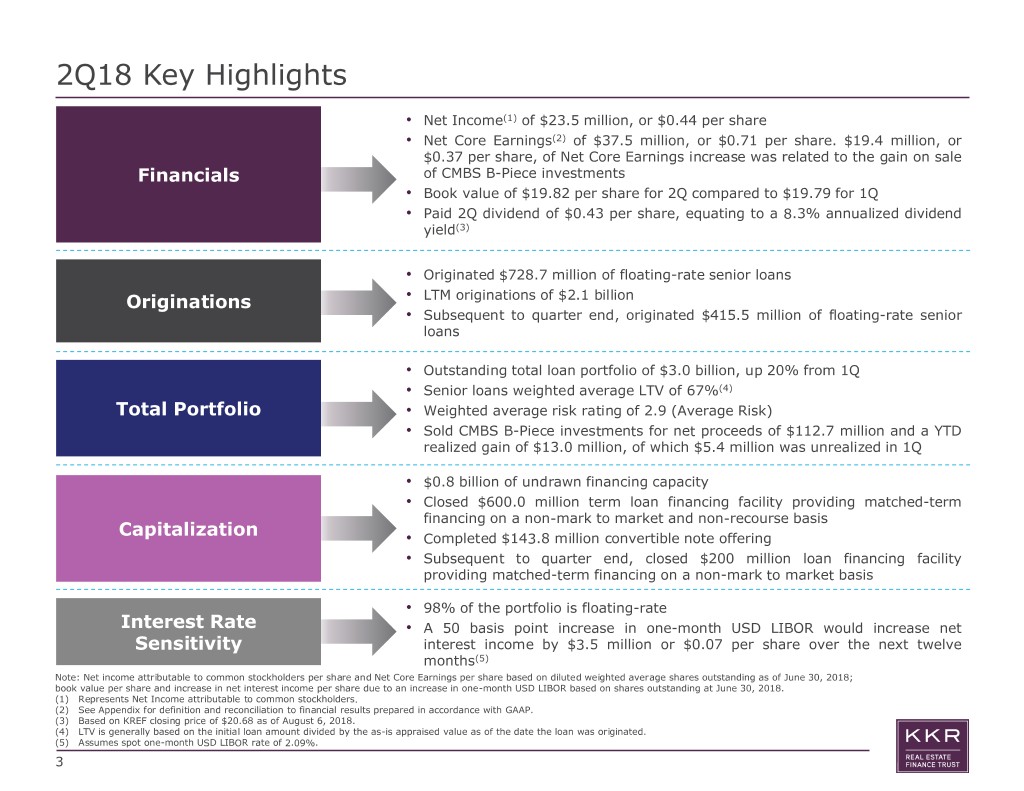

2Q18 Key Highlights • Net Income(1) of $23.5 million, or $0.44 per share • Net Core Earnings(2) of $37.5 million, or $0.71 per share. $19.4 million, or $0.37 per share, of Net Core Earnings increase was related to the gain on sale Financials of CMBS B-Piece investments • Book value of $19.82 per share for 2Q compared to $19.79 for 1Q • Paid 2Q dividend of $0.43 per share, equating to a 8.3% annualized dividend yield(3) • Originated $728.7 million of floating-rate senior loans Originations • LTM originations of $2.1 billion • Subsequent to quarter end, originated $415.5 million of floating-rate senior loans • Outstanding total loan portfolio of $3.0 billion, up 20% from 1Q • Senior loans weighted average LTV of 67%(4) Total Portfolio • Weighted average risk rating of 2.9 (Average Risk) • Sold CMBS B-Piece investments for net proceeds of $112.7 million and a YTD realized gain of $13.0 million, of which $5.4 million was unrealized in 1Q • $0.8 billion of undrawn financing capacity • Closed $600.0 million term loan financing facility providing matched-term financing on a non-mark to market and non-recourse basis Capitalization • Completed $143.8 million convertible note offering • Subsequent to quarter end, closed $200 million loan financing facility providing matched-term financing on a non-mark to market basis • 98% of the portfolio is floating-rate Interest Rate • A 50 basis point increase in one-month USD LIBOR would increase net Sensitivity interest income by $3.5 million or $0.07 per share over the next twelve months(5) Note: Net income attributable to common stockholders per share and Net Core Earnings per share based on diluted weighted average shares outstanding as of June 30, 2018; book value per share and increase in net interest income per share due to an increase in one-month USD LIBOR based on shares outstanding at June 30, 2018. (1) Represents Net Income attributable to common stockholders. (2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (3) Based on KREF closing price of $20.68 as of August 6, 2018. (4) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated. (5) Assumes spot one-month USD LIBOR rate of 2.09%. 3

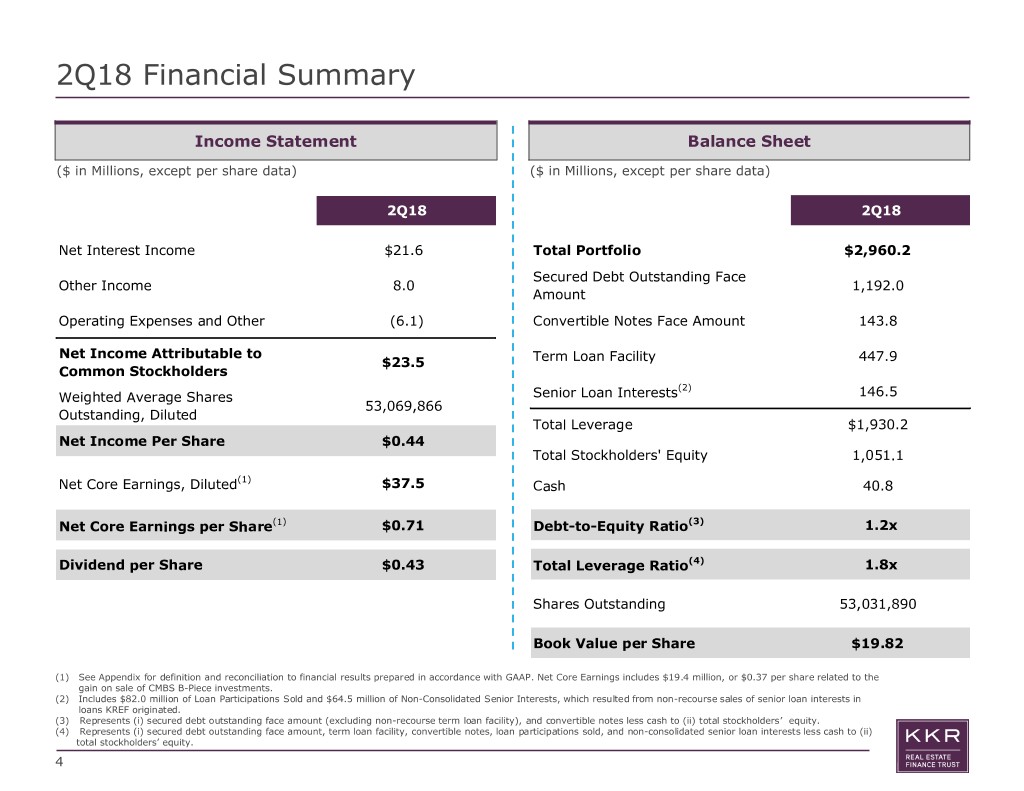

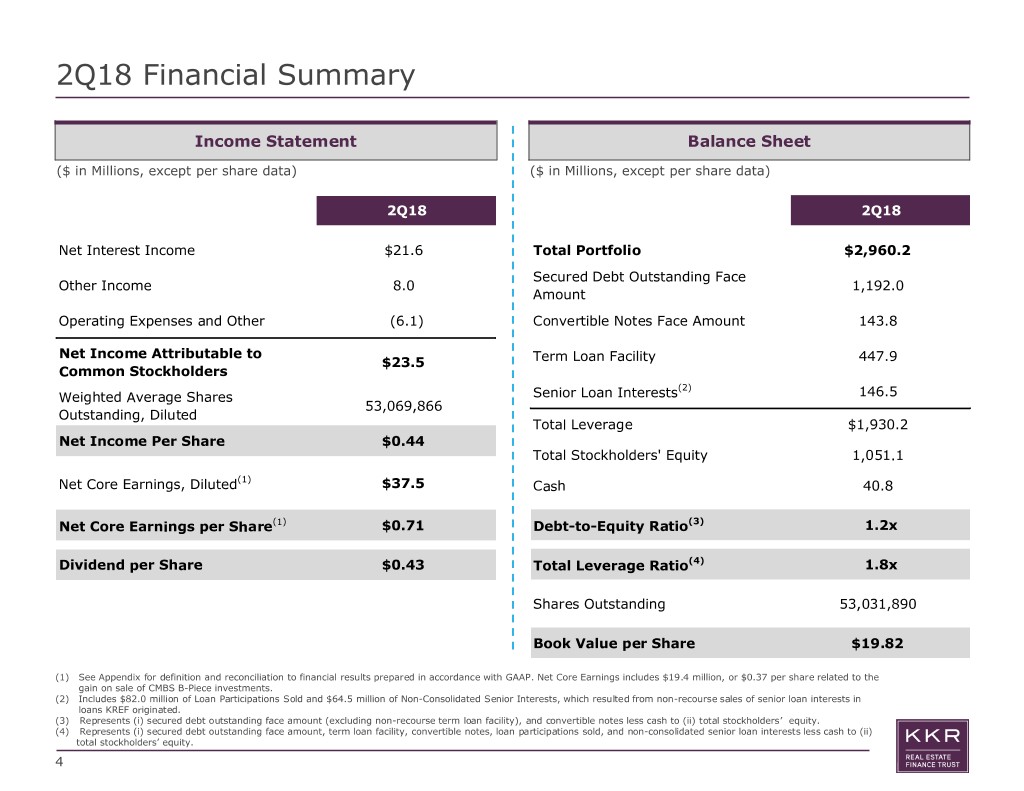

2Q18 Financial Summary Income Statement Balance Sheet ($ in Millions, except per share data) ($ in Millions, except per share data) 2Q18 2Q18 Net Interest Income $21.6 Total Portfolio $2,960.2 Secured Debt Outstanding Face Other Income 8.0 1,192.0 Amount Operating Expenses and Other (6.1) Convertible Notes Face Amount 143.8 Net Income Attributable to $23.5 Term Loan Facility 447.9 Common Stockholders (2) Weighted Average Shares Senior Loan Interests 146.5 53,069,866 Outstanding, Diluted Total Leverage $1,930.2 Net Income Per Share $0.44 Total Stockholders' Equity 1,051.1 (1) Net Core Earnings, Diluted $37.5 Cash 40.8 Net Core Earnings per Share(1) $0.71 Debt-to-Equity Ratio(3) 1.2x Dividend per Share $0.43 Total Leverage Ratio(4) 1.8x Shares Outstanding 53,031,890 Book Value per Share $19.82 (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. Net Core Earnings includes $19.4 million, or $0.37 per share related to the gain on sale of CMBS B-Piece investments. (2) Includes $82.0 million of Loan Participations Sold and $64.5 million of Non-Consolidated Senior Interests, which resulted from non-recourse sales of senior loan interests in loans KREF originated. (3) Represents (i) secured debt outstanding face amount (excluding non-recourse term loan facility), and convertible notes less cash to (ii) total stockholders’ equity. (4) Represents (i) secured debt outstanding face amount, term loan facility, convertible notes, loan participations sold, and non-consolidated senior loan interests less cash to (ii) total stockholders’ equity. 4

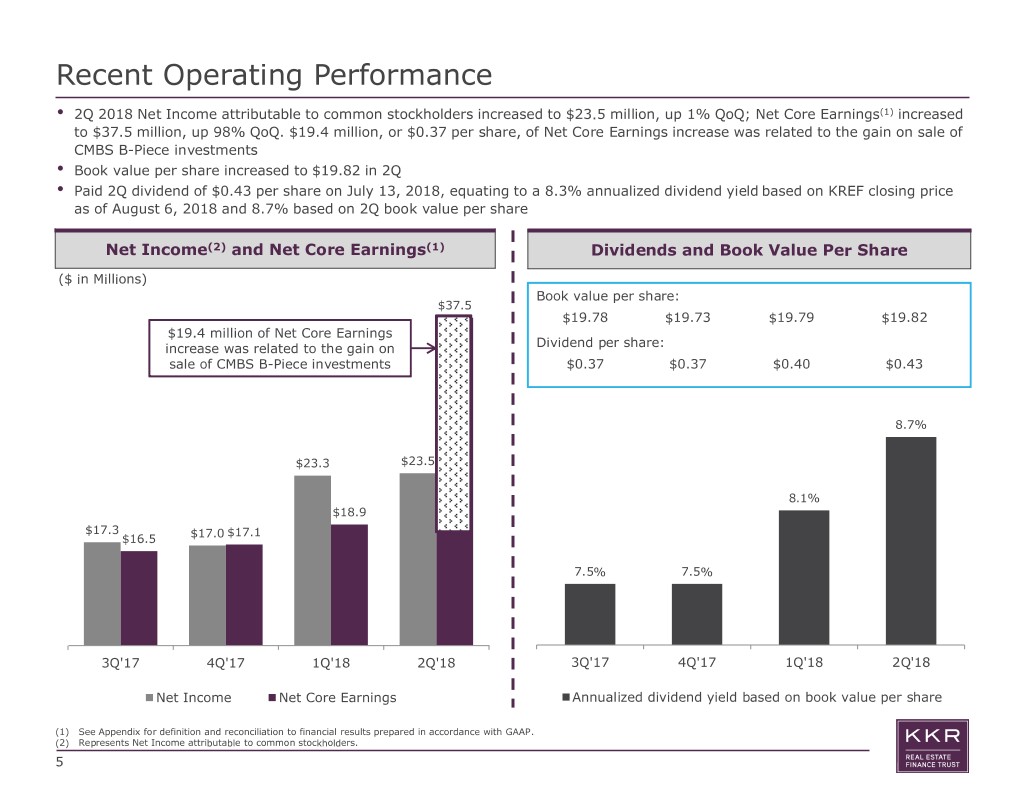

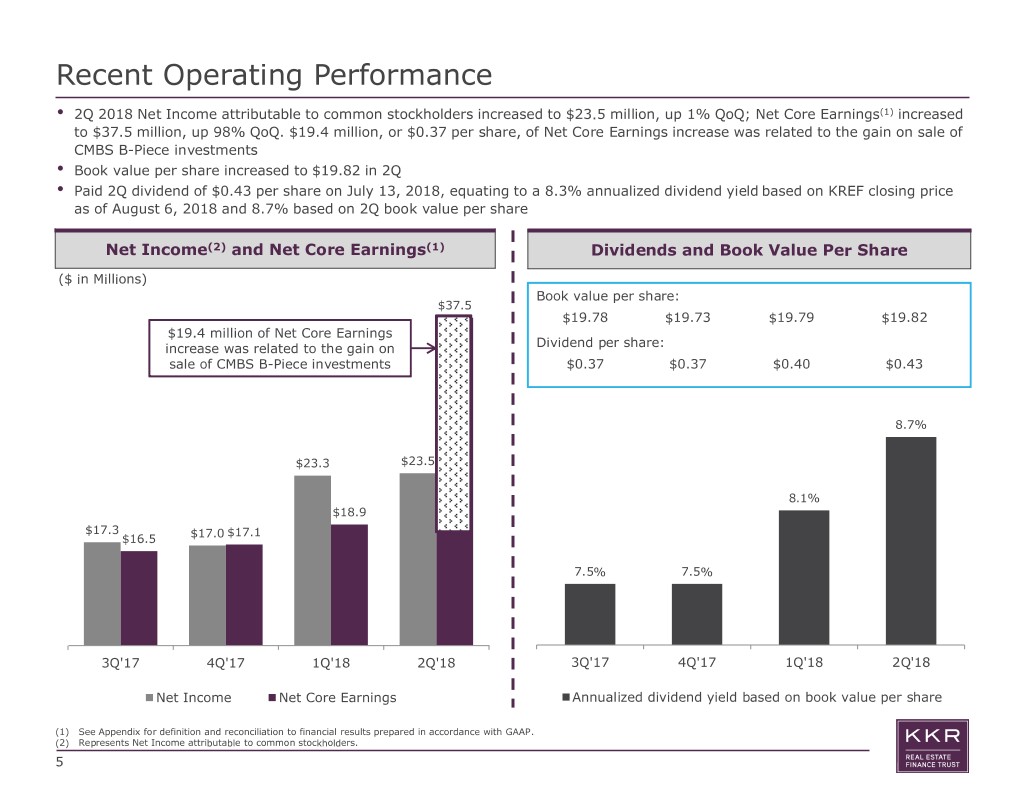

Recent Operating Performance • 2Q 2018 Net Income attributable to common stockholders increased to $23.5 million, up 1% QoQ; Net Core Earnings(1) increased to $37.5 million, up 98% QoQ. $19.4 million, or $0.37 per share, of Net Core Earnings increase was related to the gain on sale of CMBS B-Piece investments • Book value per share increased to $19.82 in 2Q • Paid 2Q dividend of $0.43 per share on July 13, 2018, equating to a 8.3% annualized dividend yield based on KREF closing price as of August 6, 2018 and 8.7% based on 2Q book value per share Net Income(2) and Net Core Earnings(1) Dividends and Book Value Per Share ($ in Millions) Book value per share: $37.5 $19.78 $19.73 $19.79 $19.82 $19.4 million of Net Core Earnings increase was related to the gain on Dividend per share: sale of CMBS B-Piece investments $0.37 $0.37 $0.40 $0.43 8.7% $23.3 $23.5 8.1% $18.9 $17.3 $17.1 $16.5 $17.0 7.5% 7.5% N/A 3Q'17 4Q'17 1Q'18 2Q'18 3Q'17 4Q'17 1Q'18 2Q'18 Net Income Net Core Earnings Annualized dividend yield based on book value per share (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (2) Represents Net Income attributable to common stockholders. 5

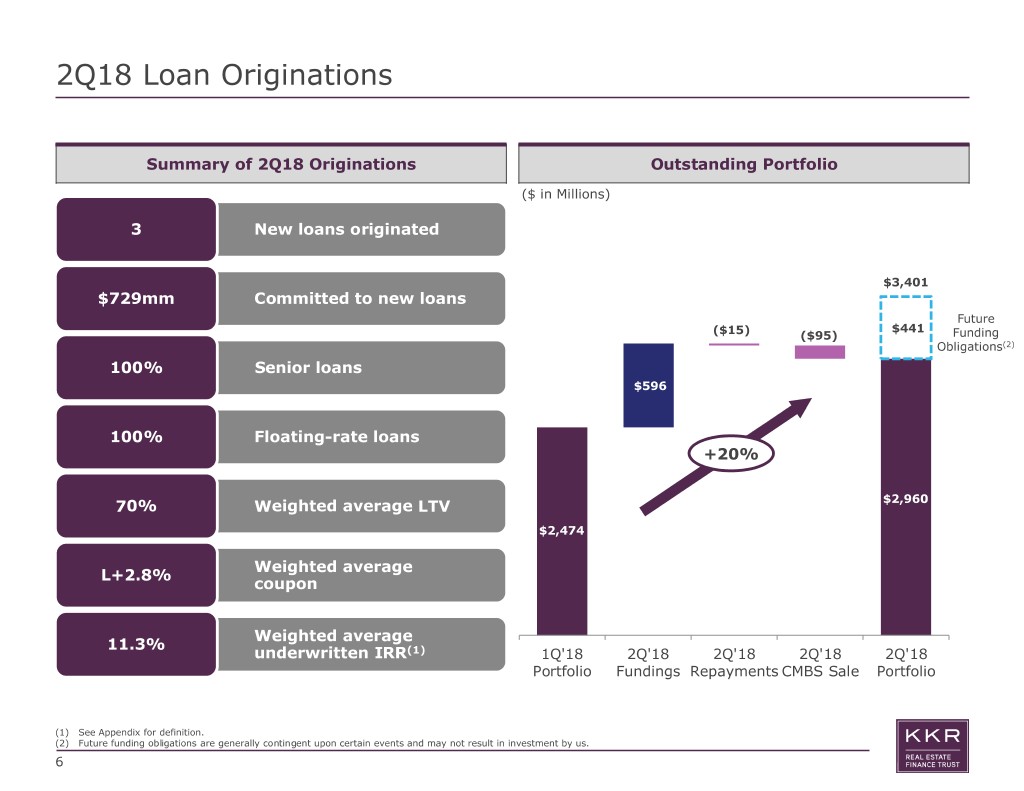

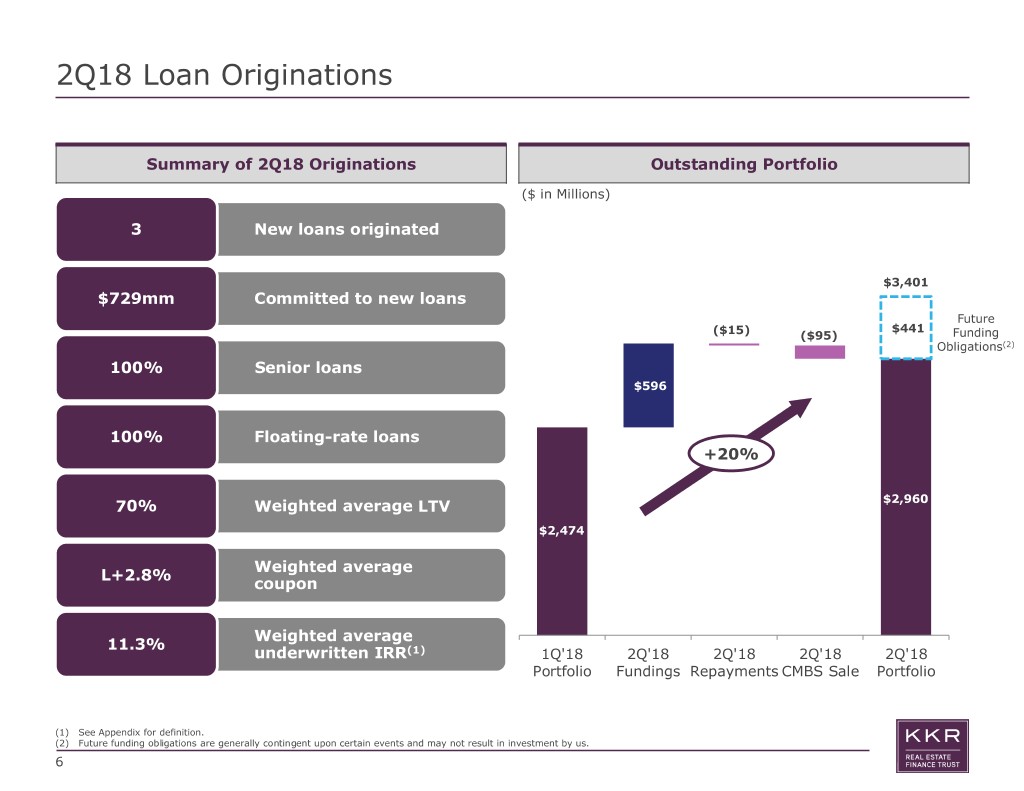

2Q18 Loan Originations Summary of 2Q18 Originations Outstanding Portfolio ($ in Millions) 3 • New loans originated $3,401 $729mm • Committed to new loans Future $441 ($15) ($95) Funding Obligations(2) 100% • Senior loans $596 100% • Floating-rate loans +20% 70% • Weighted average LTV $2,960 $2,474 • Weighted average L+2.8% coupon • Weighted average 11.3% underwritten IRR(1) 1Q'18 2Q'18 2Q'18 2Q'18 2Q'18 Portfolio Fundings Repayments CMBS Sale Portfolio (1) See Appendix for definition. (2) Future funding obligations are generally contingent upon certain events and may not result in investment by us. 6

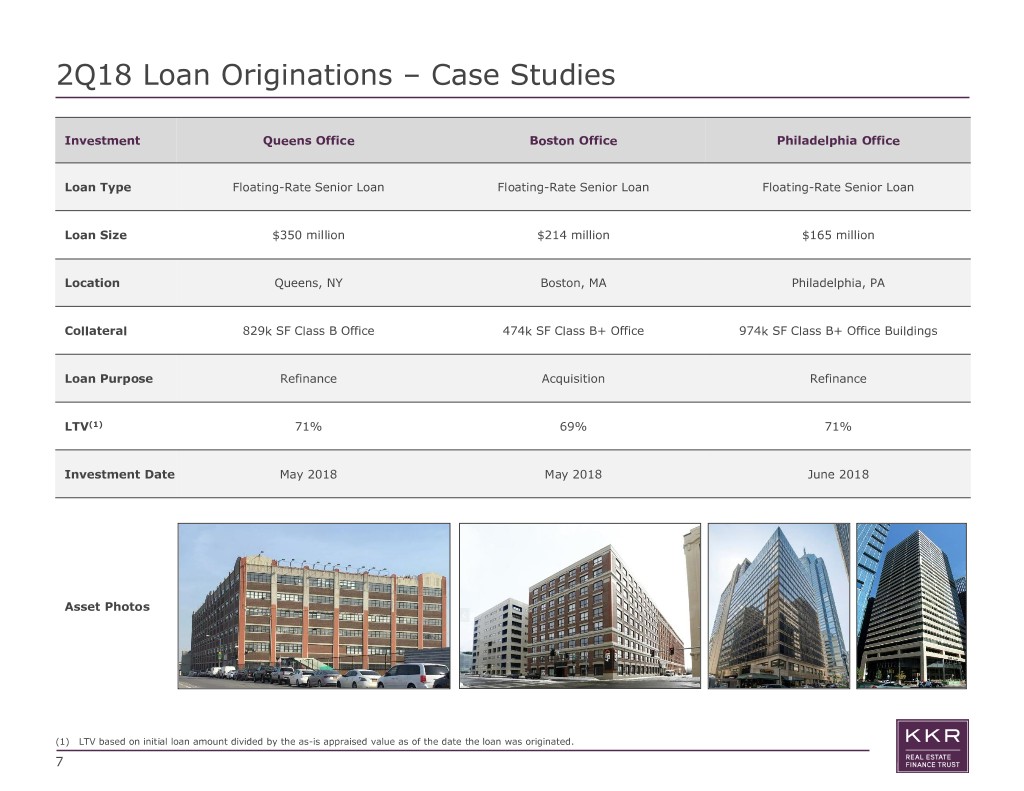

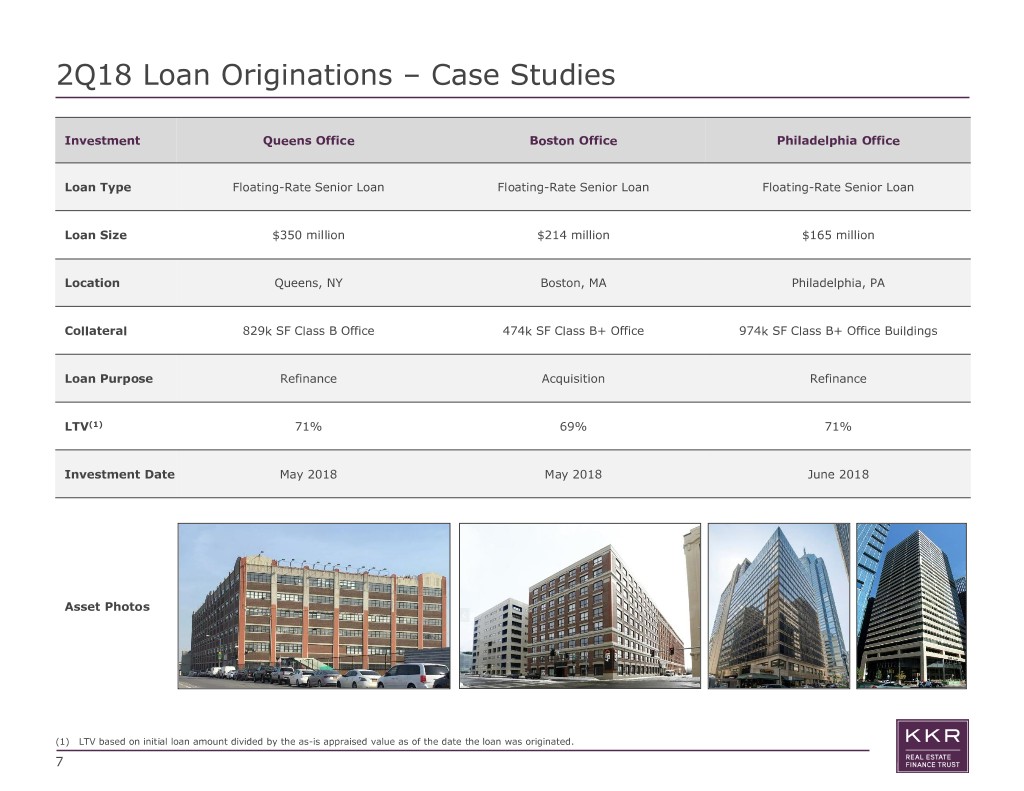

2Q18 Loan Originations – Case Studies Investment Queens Office Boston Office Philadelphia Office Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Loan Size $350 million $214 million $165 million Location Queens, NY Boston, MA Philadelphia, PA Collateral 829k SF Class B Office 474k SF Class B+ Office 974k SF Class B+ Office Buildings Loan Purpose Refinance Acquisition Refinance LTV(1) 71% 69% 71% Investment Date May 2018 May 2018 June 2018 Asset Photos (1) LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. 7

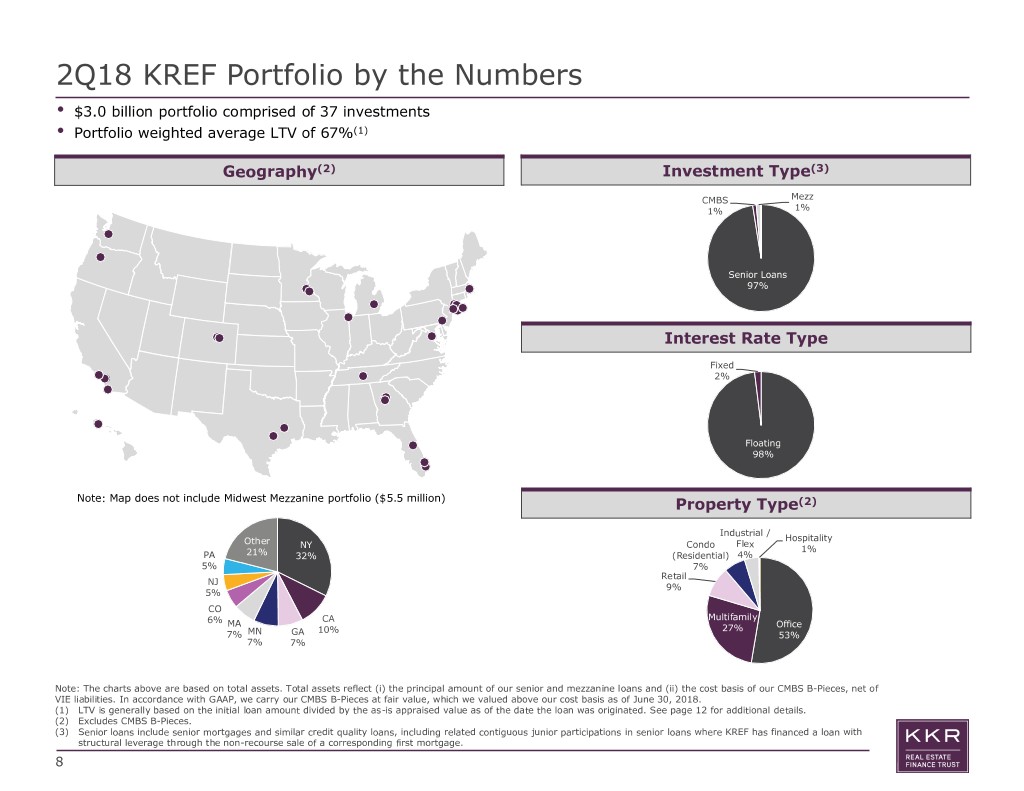

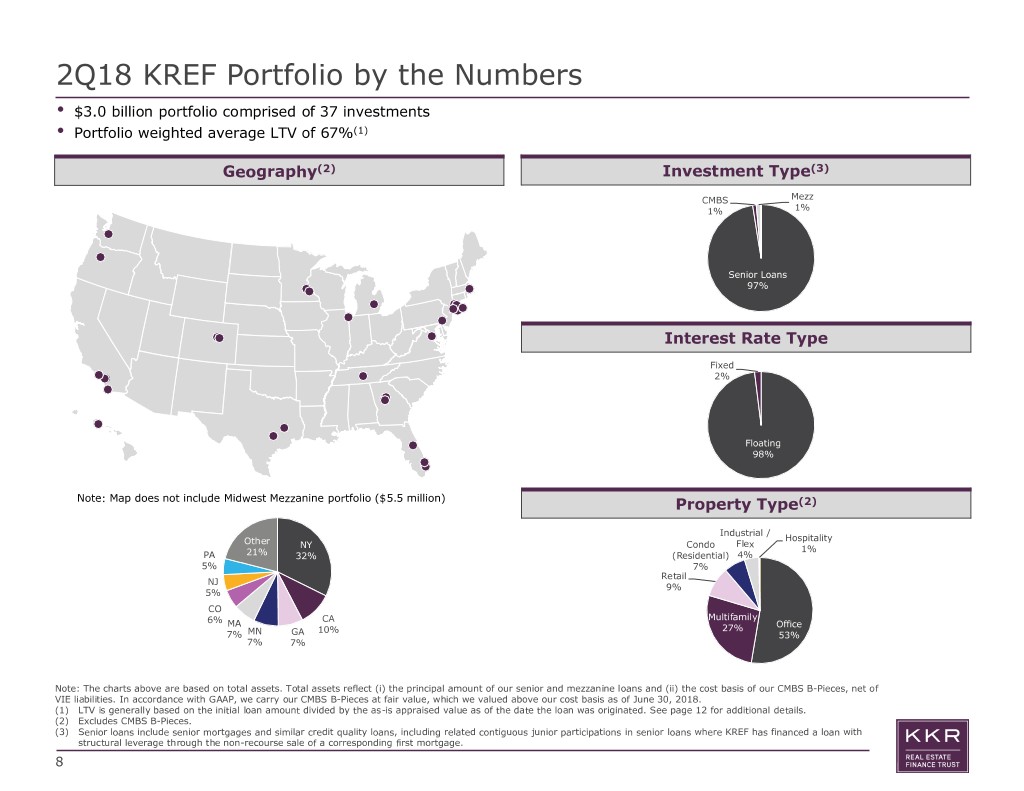

2Q18 KREF Portfolio by the Numbers • $3.0 billion portfolio comprised of 37 investments • Portfolio weighted average LTV of 67%(1) Geography(2) Investment Type(3) CMBS Mezz 1% 1% Senior Loans 97% Interest Rate Type Fixed 2% Floating 98% Note: Map does not include Midwest Mezzanine portfolio ($5.5 million) Property Type(2) Industrial / Hospitality Other Flex NY Condo 1% PA 21% 32% (Residential) 4% 5% 7% Retail NJ 9% 5% CO CA Multifamily 6% MA Office 10% 27% 7% MN GA 53% 7% 7% Note: The charts above are based on total assets. Total assets reflect (i) the principal amount of our senior and mezzanine loans and (ii) the cost basis of our CMBS B-Pieces, net of VIE liabilities. In accordance with GAAP, we carry our CMBS B-Pieces at fair value, which we valued above our cost basis as of June 30, 2018. (1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated. See page 12 for additional details. (2) Excludes CMBS B-Pieces. (3) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a corresponding first mortgage. 8

2Q18 Financing Overview • Total financing capacity of $2.6 billion(1) with $0.8 billion of undrawn capacity • Entered into $600 million term loan financing facility providing matched-term financing on a non-mark to market and non- recourse basis • Issued $144 million of 6.125% convertible senior notes due May 15, 2023 Summary of Outstanding Financing ($ in Millions) Outstanding Face Weighted Average Maximum Capacity Amount Coupon Term Credit Facilities $1,750(2) $1,192 L+2.0% Convertible Notes $144 $144 6.1% Corporate Revolving Facility $75 -- -- Total Corporate Obligations $1,969 $1,336 Term Loan Facility $600 $448 L+1.4% Senior Loan Interests(3) $147 $147 L+1.9% Total Leverage $2,716 $1,931 Debt-to-Equity Ratio of 1.2x(4) Total Leverage Ratio of 1.8x(5) (1) Excludes Senior Loan Interests. (2) Subject to customary conditions, KREF is permitted to request the Morgan Stanley facility be further increased by an additional $150 million. (3) Includes $82.0 million of Loan Participations Sold and $64.5 million of Non-Consolidated Senior Interests, which result from non-recourse sales of senior loan interests in loans KREF originated. (4) Represents (i) facilities outstanding face amount (excluding non-recourse term loan facility), and convertible notes less cash to (ii) total stockholders’ equity. (5) Represents (i) facilities outstanding face amount, convertible notes, loan participations sold, and non-consolidated senior loan interests less cash to (ii) total stockholders’ equity. 9

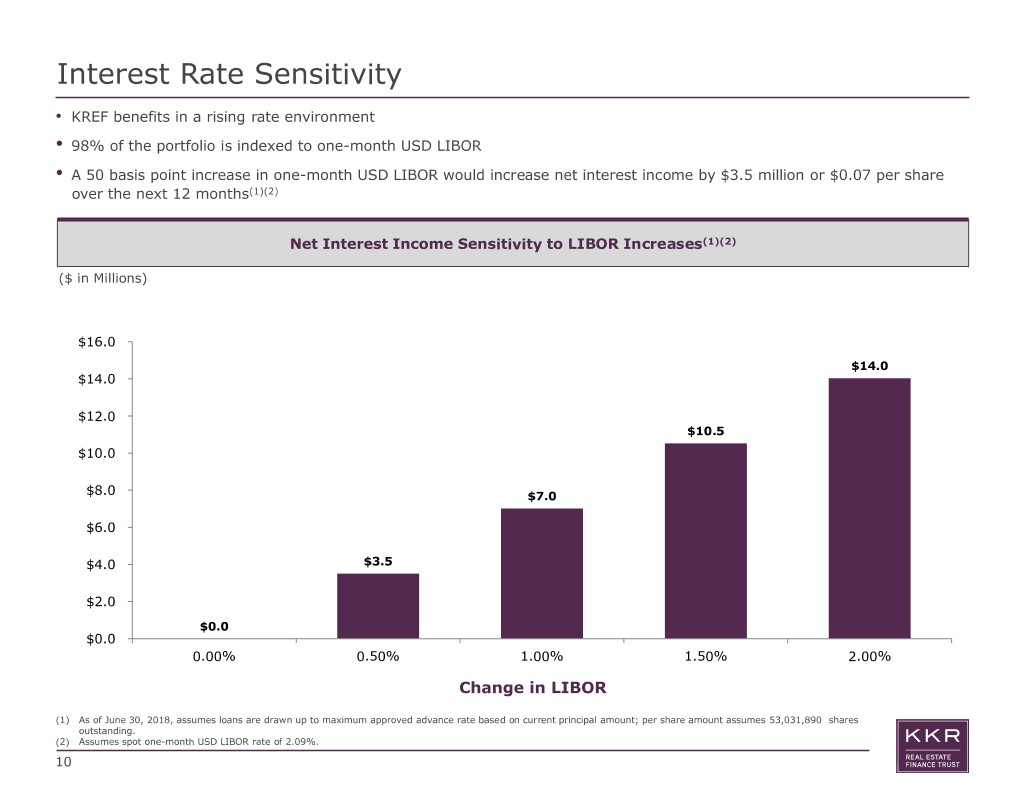

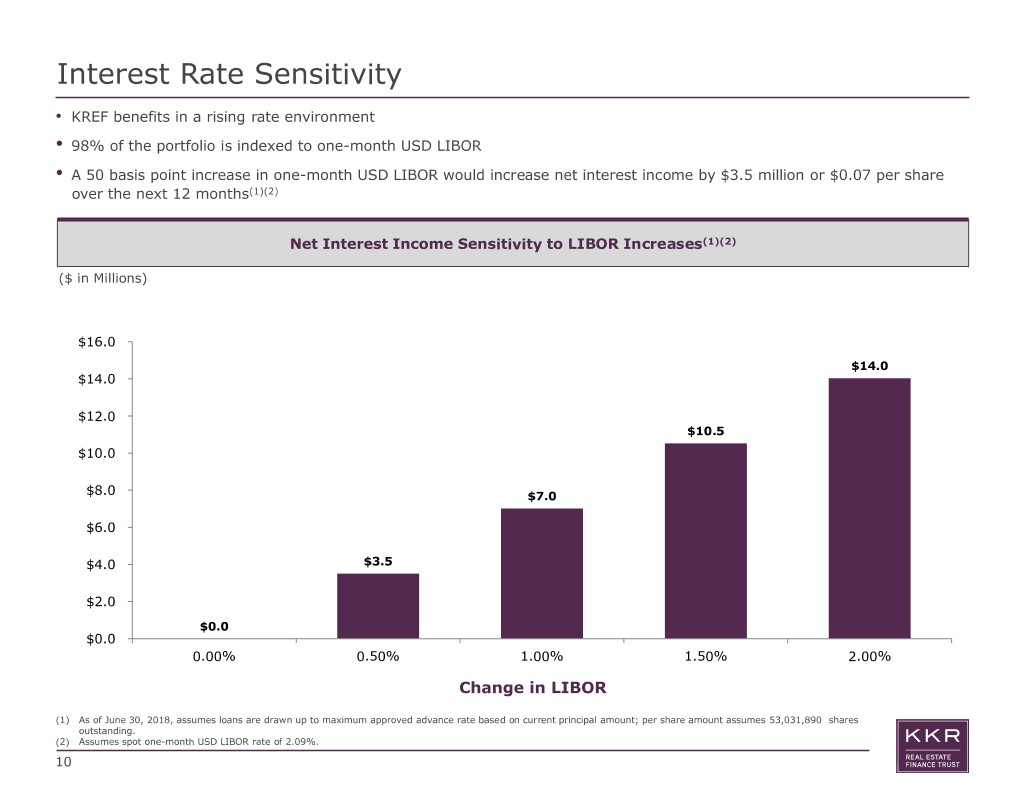

Interest Rate Sensitivity • KREF benefits in a rising rate environment • 98% of the portfolio is indexed to one-month USD LIBOR • A 50 basis point increase in one-month USD LIBOR would increase net interest income by $3.5 million or $0.07 per share over the next 12 months(1)(2) Net Interest Income Sensitivity to LIBOR Increases(1)(2) ($ in Millions) $16.0 $14.0 $14.0 $12.0 $10.5 $10.0 $8.0 $7.0 $6.0 $4.0 $3.5 $2.0 $0.0 $0.0 0.00% 0.50% 1.00% 1.50% 2.00% Change in LIBOR (1) As of June 30, 2018, assumes loans are drawn up to maximum approved advance rate based on current principal amount; per share amount assumes 53,031,890 shares outstanding. (2) Assumes spot one-month USD LIBOR rate of 2.09%. 10

68 68 70 217 217 218 180 180 182 142 142 145 51 51 53 83 40 79 230 203 227 205 151 200 179 98 172 62 30 59 Appendix 11

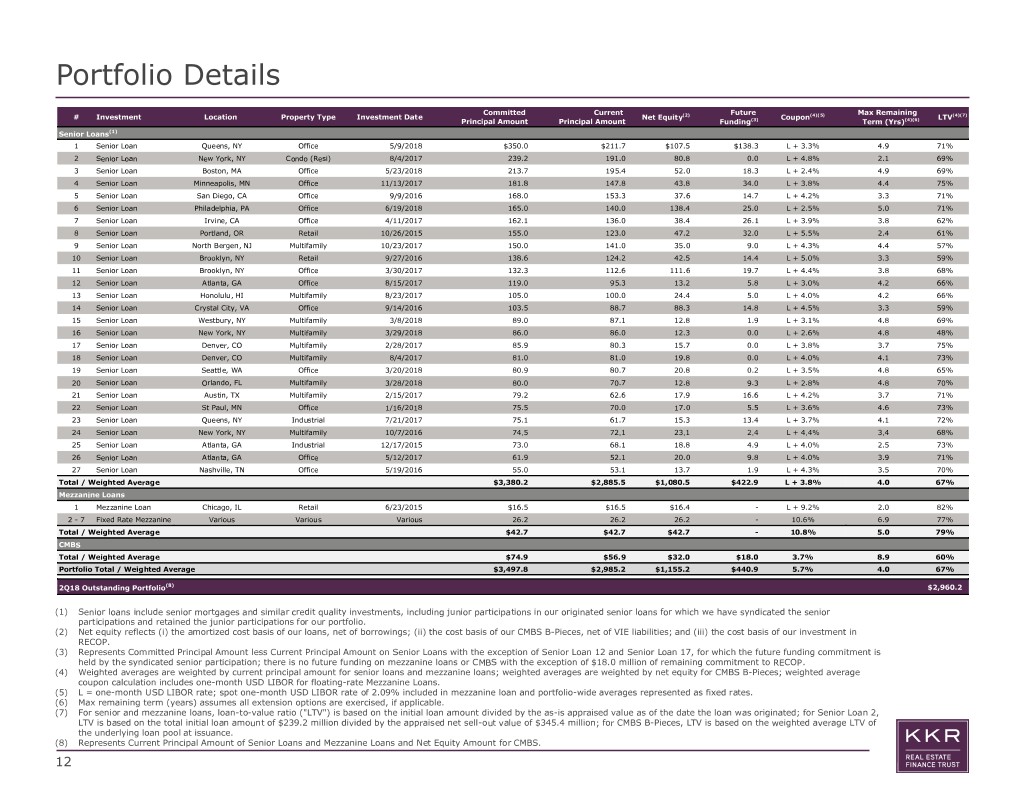

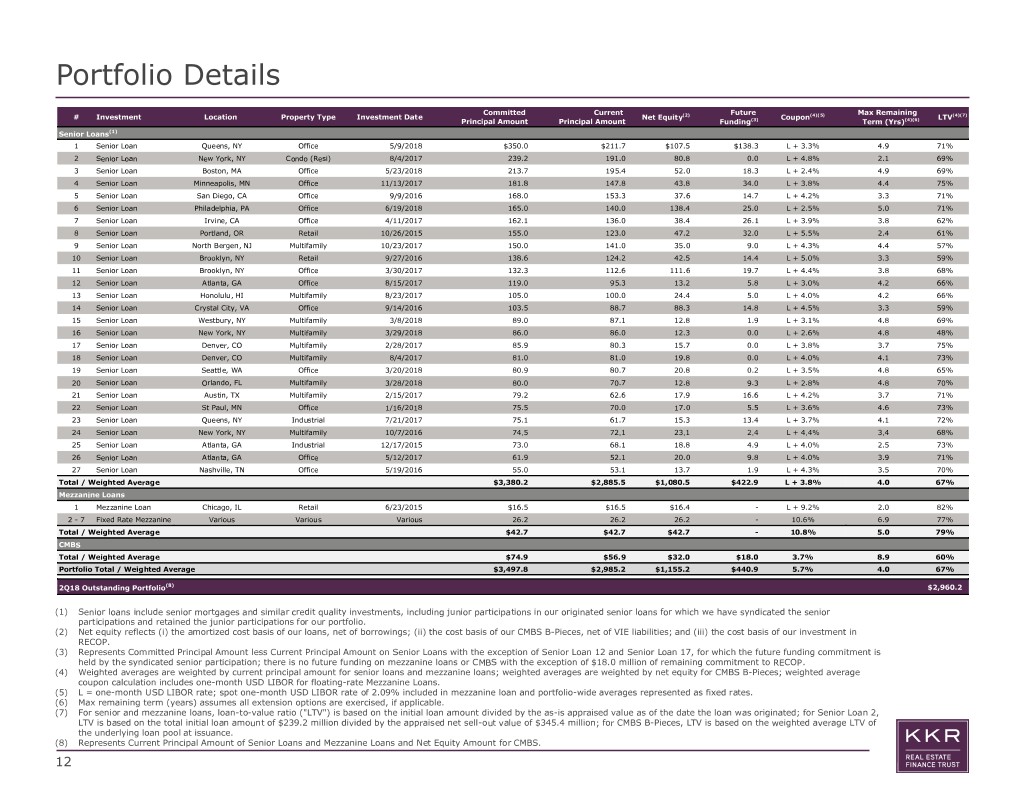

Portfolio Details Committed Current Future Max Remaining # Investment($ in millions) Location Property Type Investment Date Net Equity(2) Coupon(4)(5) LTV(4)(7) Principal Amount Principal Amount Funding(3) Term (Yrs)(4)(6) Senior Loans(1) 1 Senior Loan Queens, NY Office 5/9/2018 $350.0 $211.7 $107.5 $138.3 L + 3.3% 4.9 71% 2 Senior Loan New York, NY Condo (Resi) 8/4/2017 239.2 191.0 80.8 0.0 L + 4.8% 2.1 69% 3 Senior Loan Boston, MA Office 5/23/2018 213.7 195.4 52.0 18.3 L + 2.4% 4.9 69% 4 Senior Loan Minneapolis, MN Office 11/13/2017 181.8 147.8 43.8 34.0 L + 3.8% 4.4 75% 5 Senior Loan San Diego, CA Office 9/9/2016 168.0 153.3 37.6 14.7 L + 4.2% 3.3 71% 6 Senior Loan Philadelphia, PA Office 6/19/2018 165.0 140.0 138.4 25.0 L + 2.5% 5.0 71% 7 Senior Loan Irvine, CA Office 4/11/2017 162.1 136.0 38.4 26.1 L + 3.9% 3.8 62% 8 Senior Loan Portland, OR Retail 10/26/2015 155.0 123.0 47.2 32.0 L + 5.5% 2.4 61% 9 Senior Loan North Bergen, NJ Multifamily 10/23/2017 150.0 141.0 35.0 9.0 L + 4.3% 4.4 57% 10 Senior Loan Brooklyn, NY Retail 9/27/2016 138.6 124.2 42.5 14.4 L + 5.0% 3.3 59% 11 Senior Loan Brooklyn, NY Office 3/30/2017 132.3 112.6 111.6 19.7 L + 4.4% 3.8 68% 12 Senior Loan Atlanta, GA Office 8/15/2017 119.0 95.3 13.2 5.8 L + 3.0% 4.2 66% 13 Senior Loan Honolulu, HI Multifamily 8/23/2017 105.0 100.0 24.4 5.0 L + 4.0% 4.2 66% 14 Senior Loan Crystal City, VA Office 9/14/2016 103.5 88.7 88.3 14.8 L + 4.5% 3.3 59% 15 Senior Loan Westbury, NY Multifamily 3/8/2018 89.0 87.1 12.8 1.9 L + 3.1% 4.8 69% 16 Senior Loan New York, NY Multifamily 3/29/2018 86.0 86.0 12.3 0.0 L + 2.6% 4.8 48% 17 Senior Loan Denver, CO Multifamily 2/28/2017 85.9 80.3 15.7 0.0 L + 3.8% 3.7 75% 18 Senior Loan Denver, CO Multifamily 8/4/2017 81.0 81.0 19.8 0.0 L + 4.0% 4.1 73% 19 Senior Loan Seattle, WA Office 3/20/2018 80.9 80.7 20.8 0.2 L + 3.5% 4.8 65% 20 Senior Loan Orlando, FL Multifamily 3/28/2018 80.0 70.7 12.8 9.3 L + 2.8% 4.8 70% 21 Senior Loan Austin, TX Multifamily 2/15/2017 79.2 62.6 17.9 16.6 L + 4.2% 3.7 71% 22 Senior Loan St Paul, MN Office 1/16/2018 75.5 70.0 17.0 5.5 L + 3.6% 4.6 73% 23 Senior Loan Queens, NY Industrial 7/21/2017 75.1 61.7 15.3 13.4 L + 3.7% 4.1 72% 24 Senior Loan New York, NY Multifamily 10/7/2016 74.5 72.1 23.1 2.4 L + 4.4% 3.4 68% 25 Senior Loan Atlanta, GA Industrial 12/17/2015 73.0 68.1 18.8 4.9 L + 4.0% 2.5 73% 26 Senior Loan Atlanta, GA Office 5/12/2017 61.9 52.1 20.0 9.8 L + 4.0% 3.9 71% 27 Senior Loan Nashville, TN Office 5/19/2016 55.0 53.1 13.7 1.9 L + 4.3% 3.5 70% Total / Weighted Average $3,380.2 $2,885.5 $1,080.5 $422.9 L + 3.8% 4.0 67% Mezzanine Loans 1 Mezzanine Loan Chicago, IL Retail 6/23/2015 $16.5 $16.5 $16.4 - L + 9.2% 2.0 82% 2 - 7 Fixed Rate Mezzanine Loans Various Various Various 26.2 26.2 26.2 - 10.6% 6.9 77% Total / Weighted Average $42.7 $42.7 $42.7 - 10.8% 5.0 79% CMBS Total / Weighted Average $74.9 $56.9 $32.0 $18.0 3.7% 8.9 60% Portfolio Total / Weighted Average $3,497.8 $2,985.2 $1,155.2 $440.9 5.7% 4.0 67% 2Q18 Outstanding Portfolio(8) $2,960.2 (1) Senior loans include senior mortgages and similar credit quality investments, including junior participations in our originated senior loans for which we have syndicated the senior participations and retained the junior participations for our portfolio. (2) Net equity reflects (i) the amortized cost basis of our loans, net of borrowings; (ii) the cost basis of our CMBS B-Pieces, net of VIE liabilities; and (iii) the cost basis of our investment in RECOP. (3) Represents Committed Principal Amount less Current Principal Amount on Senior Loans with the exception of Senior Loan 12 and Senior Loan 17, for which the future funding commitment is held by the syndicated senior participation; there is no future funding on mezzanine loans or CMBS with the exception of $18.0 million of remaining commitment to RECOP. (4) Weighted averages are weighted by current principal amount for senior loans and mezzanine loans; weighted averages are weighted by net equity for CMBS B-Pieces; weighted average coupon calculation includes one-month USD LIBOR for floating-rate Mezzanine Loans. (5) L = one-month USD LIBOR rate; spot one-month USD LIBOR rate of 2.09% included in mezzanine loan and portfolio-wide averages represented as fixed rates. (6) Max remaining term (years) assumes all extension options are exercised, if applicable. (7) For senior and mezzanine loans, loan-to-value ratio ("LTV") is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated; for Senior Loan 2, LTV is based on the total initial loan amount of $239.2 million divided by the appraised net sell-out value of $345.4 million; for CMBS B-Pieces, LTV is based on the weighted average LTV of the underlying loan pool at issuance. (8) Represents Current Principal Amount of Senior Loans and Mezzanine Loans and Net Equity Amount for CMBS. 12

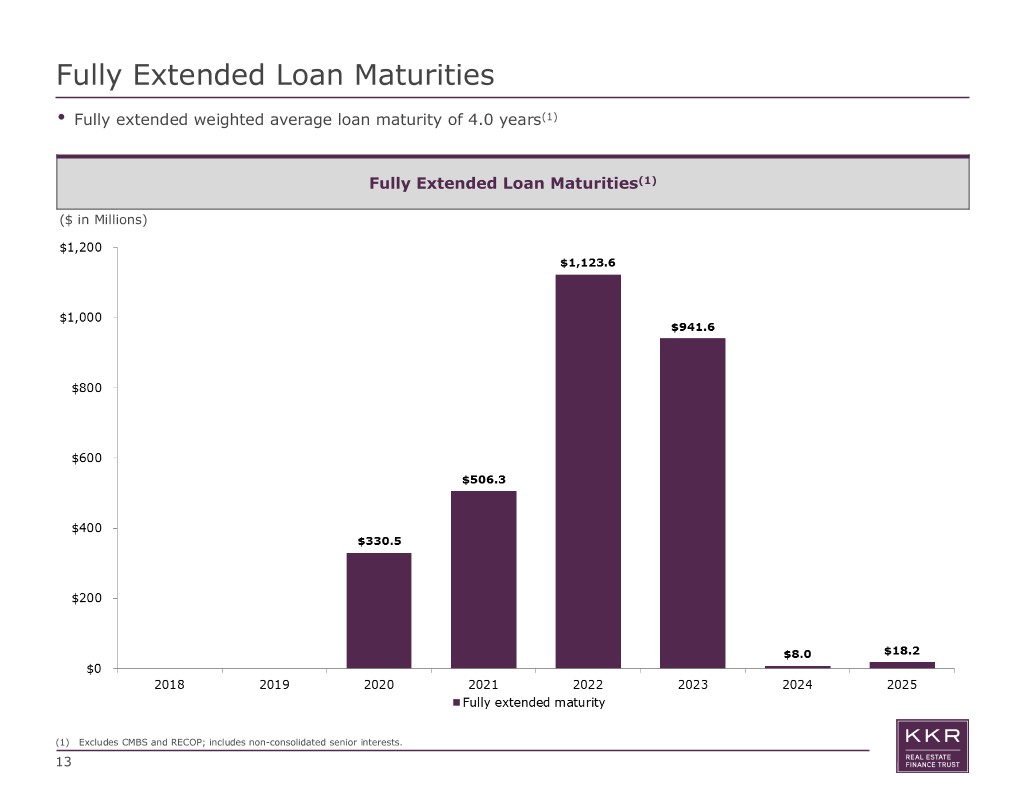

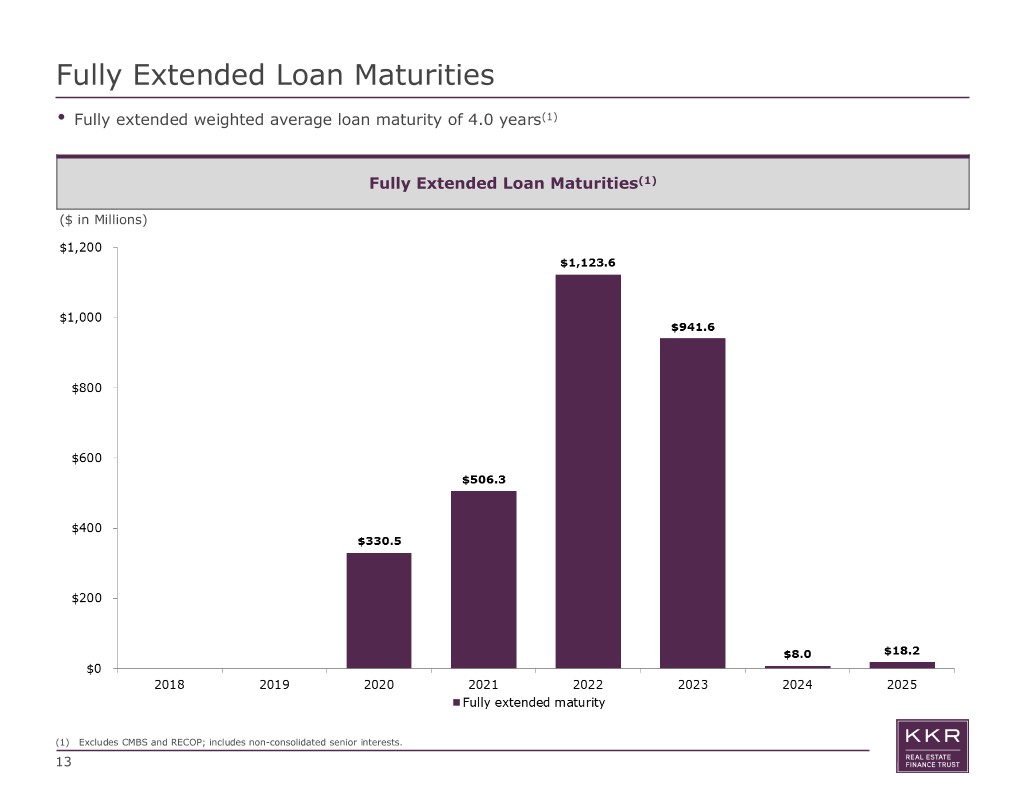

Fully Extended Loan Maturities • Fully extended weighted average loan maturity of 4.0 years(1) Fully Extended Loan Maturities(1) ($ in Millions) (1) Excludes CMBS and RECOP; includes non-consolidated senior interests. 13

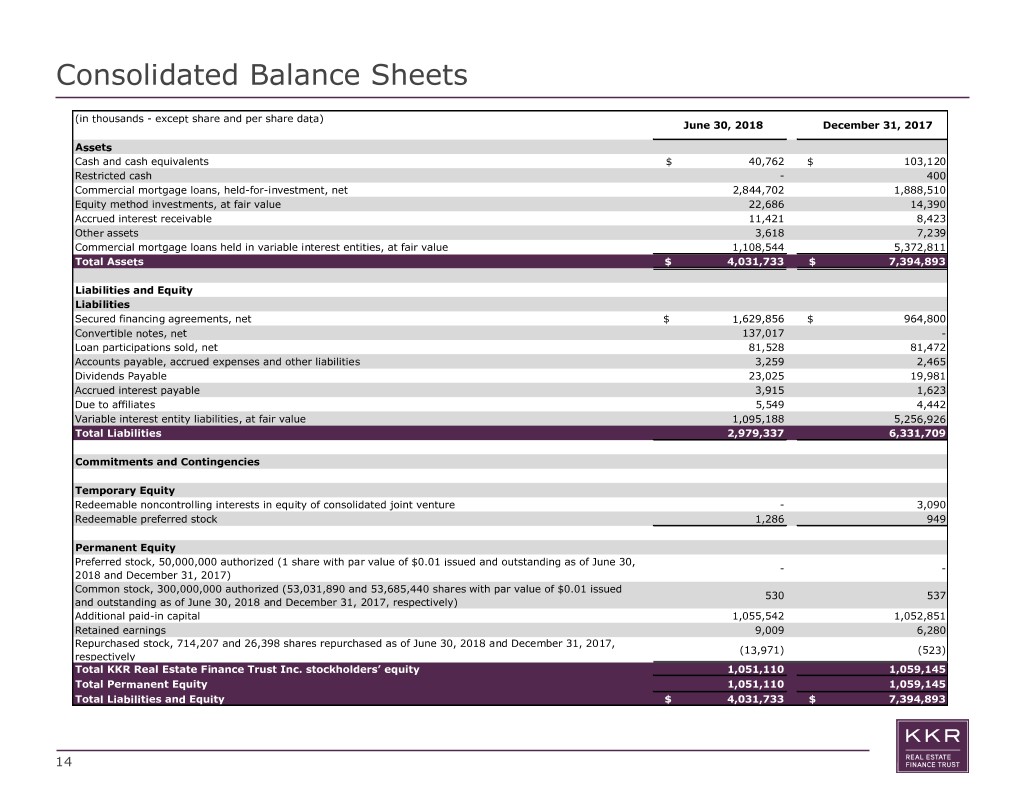

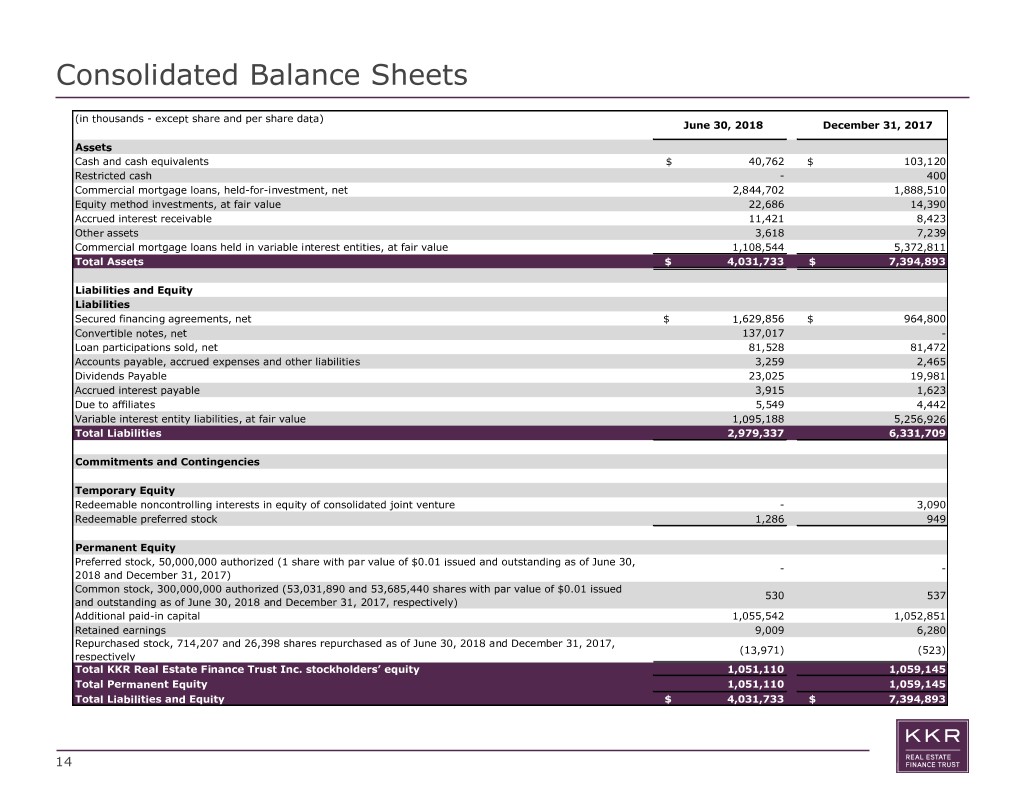

Consolidated Balance Sheets (in thousands - except share and per share data) June 30, 2018 December 31, 2017 Assets Cash and cash equivalents $ 40,762 $ 103,120 Restricted cash - 400 Commercial mortgage loans, held-for-investment, net 2,844,702 1,888,510 Equity method investments, at fair value 22,686 14,390 Accrued interest receivable 11,421 8,423 Other assets 3,618 7,239 Commercial mortgage loans held in variable interest entities, at fair value 1,108,544 5,372,811 Total Assets $ 4,031,733 $ 7,394,893 Liabilities and Equity Liabilities Secured financing agreements, net $ 1,629,856 $ 964,800 Convertible notes, net 137,017 - Loan participations sold, net 81,528 81,472 Accounts payable, accrued expenses and other liabilities 3,259 2,465 Dividends Payable 23,025 19,981 Accrued interest payable 3,915 1,623 Due to affiliates 5,549 4,442 Variable interest entity liabilities, at fair value 1,095,188 5,256,926 Total Liabilities 2,979,337 6,331,709 Commitments and Contingencies Temporary Equity Redeemable noncontrolling interests in equity of consolidated joint venture - 3,090 Redeemable preferred stock 1,286 949 Permanent Equity Preferred stock, 50,000,000 authorized (1 share with par value of $0.01 issued and outstanding as of June 30, - - 2018 and December 31, 2017) Common stock, 300,000,000 authorized (53,031,890 and 53,685,440 shares with par value of $0.01 issued 530 537 and outstanding as of June 30, 2018 and December 31, 2017, respectively) Additional paid-in capital 1,055,542 1,052,851 Retained earnings 9,009 6,280 Repurchased stock, 714,207 and 26,398 shares repurchased as of June 30, 2018 and December 31, 2017, (13,971) (523) respectively Total KKR Real Estate Finance Trust Inc. stockholders’ equity 1,051,110 1,059,145 Total Permanent Equity 1,051,110 1,059,145 Total Liabilities and Equity $ 4,031,733 $ 7,394,893 14

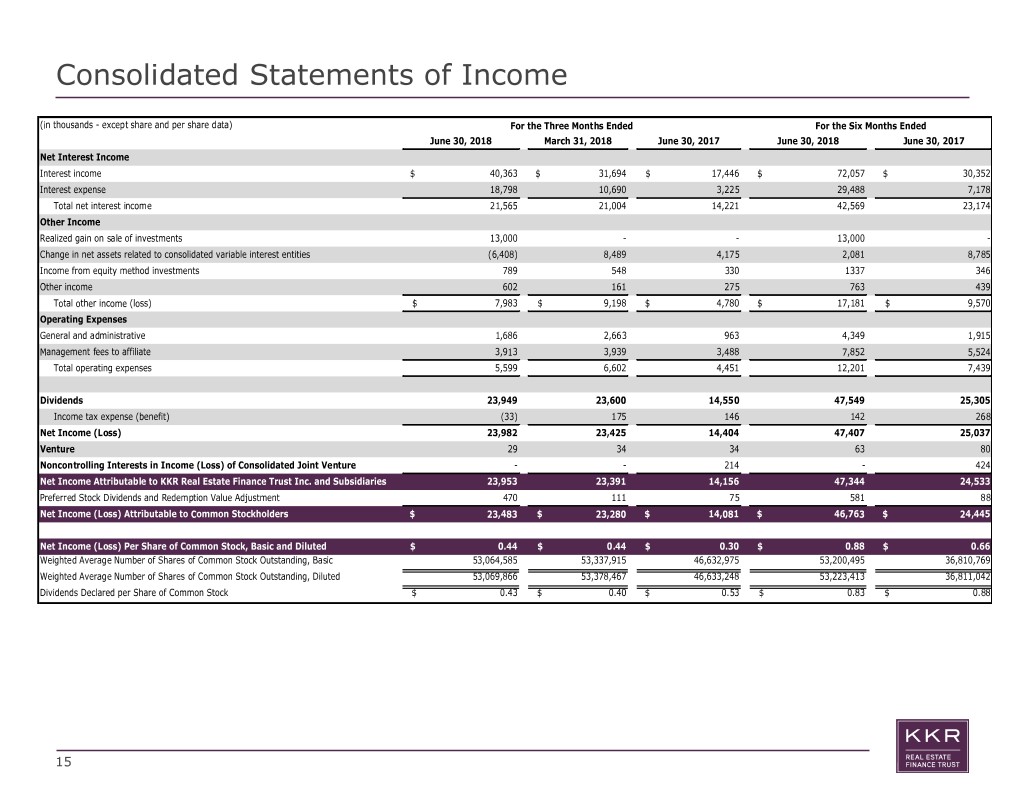

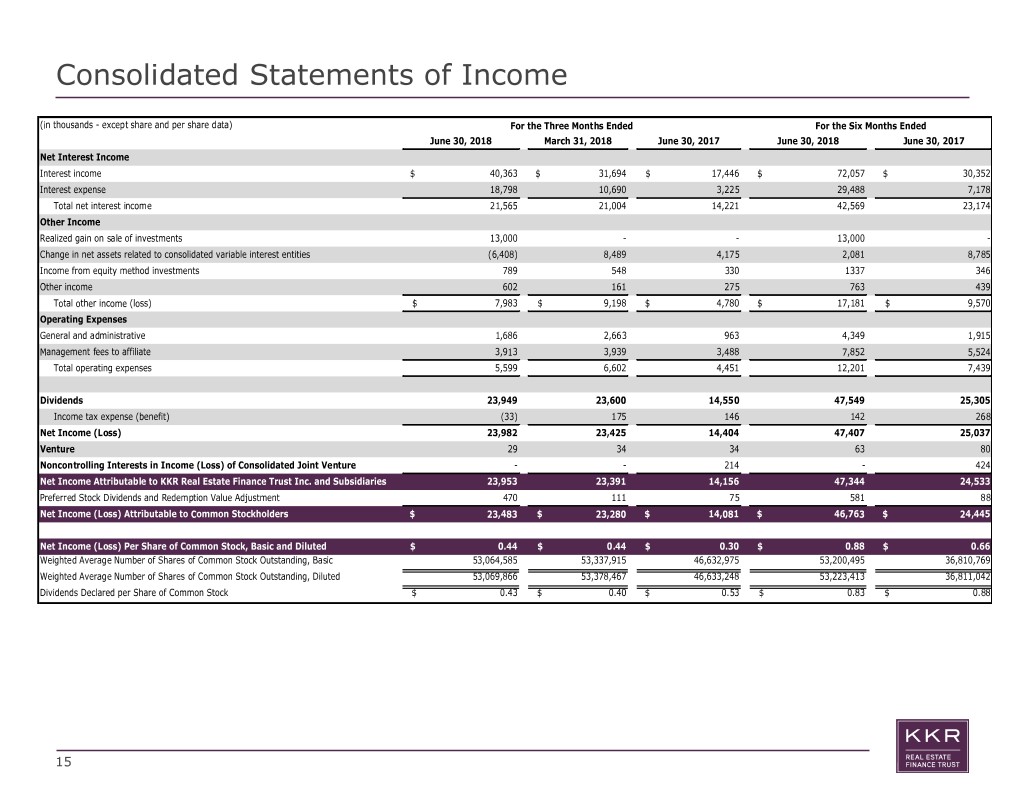

Consolidated Statements of Income (in thousands - except share and per share data) For the Three Months Ended For the Six Months Ended June 30, 2018 March 31, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Net Interest Income Interest income $ 40,363 $ 31,694 $ 17,446 $ 72,057 $ 30,352 Interest expense 18,798 10,690 3,225 29,488 7,178 Total net interest income 21,565 21,004 14,221 42,569 23,174 Other Income Realized gain on sale of investments 13,000 - - 13,000 - Change in net assets related to consolidated variable interest entities (6,408) 8,489 4,175 2,081 8,785 Income from equity method investments 789 548 330 1337 346 Other income 602 161 275 763 439 Total other income (loss) $ 7,983 $ 9,198 $ 4,780 $ 17,181 $ 9,570 Operating Expenses General and administrative 1,686 2,663 963 4,349 1,915 Management fees to affiliate 3,913 3,939 3,488 7,852 5,524 Total operating expenses 5,599 6,602 4,451 12,201 7,439 Income (Loss) Before Income Taxes, Noncontrolling Interests and Preferred Dividends 23,949 23,600 14,550 47,549 25,305 Income tax expense (benefit) (33) 175 146 142 268 RedeemableNet Income (Loss)Noncontrolling Interests in Income (Loss) of Consolidated Joint 23,982 23,425 14,404 47,407 25,037 Venture 29 34 34 63 80 Noncontrolling Interests in Income (Loss) of Consolidated Joint Venture - - 214 - 424 Net Income Attributable to KKR Real Estate Finance Trust Inc. and Subsidiaries 23,953 23,391 14,156 47,344 24,533 Preferred Stock Dividends and Redemption Value Adjustment 470 111 75 581 88 Net Income (Loss) Attributable to Common Stockholders $ 23,483 $ 23,280 $ 14,081 $ 46,763 $ 24,445 Net Income (Loss) Per Share of Common Stock, Basic and Diluted $ 0.44 $ 0.44 $ 0.30 $ 0.88 $ 0.66 Weighted Average Number of Shares of Common Stock Outstanding, Basic 53,064,585 53,337,915 46,632,975 53,200,495 36,810,769 Weighted Average Number of Shares of Common Stock Outstanding, Diluted 53,069,866 53,378,467 46,633,248 53,223,413 36,811,042 Dividends Declared per Share of Common Stock $ 0.43 $ 0.40 $ 0.53 $ 0.83 $ 0.88 15

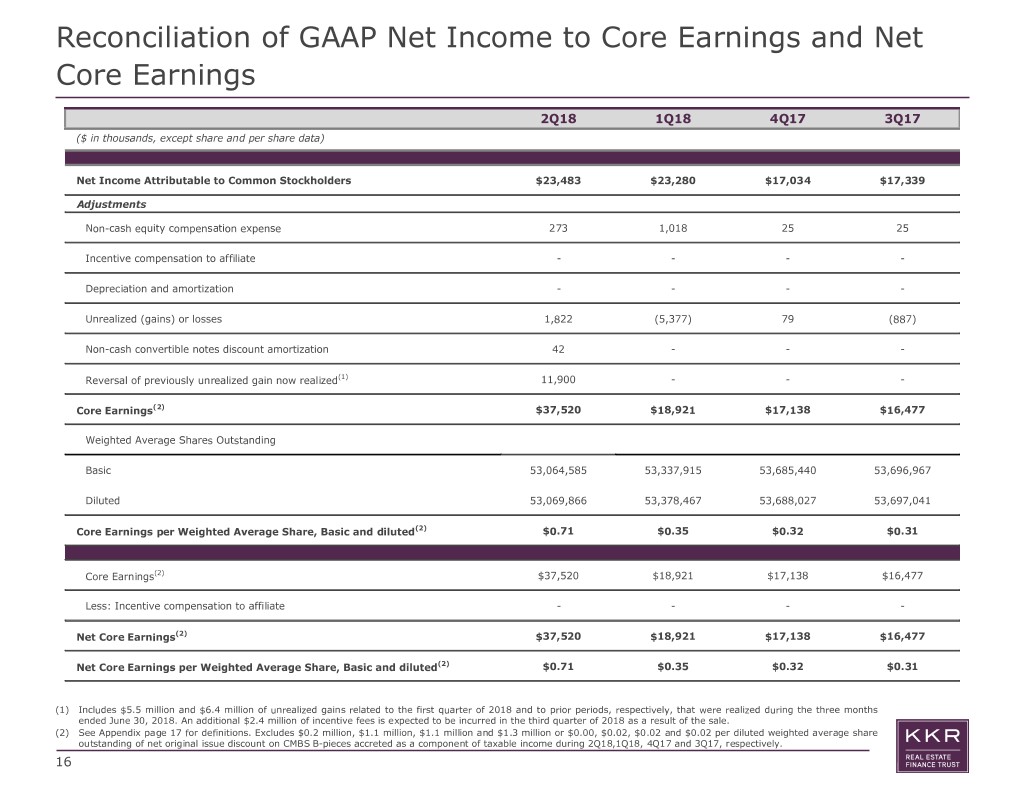

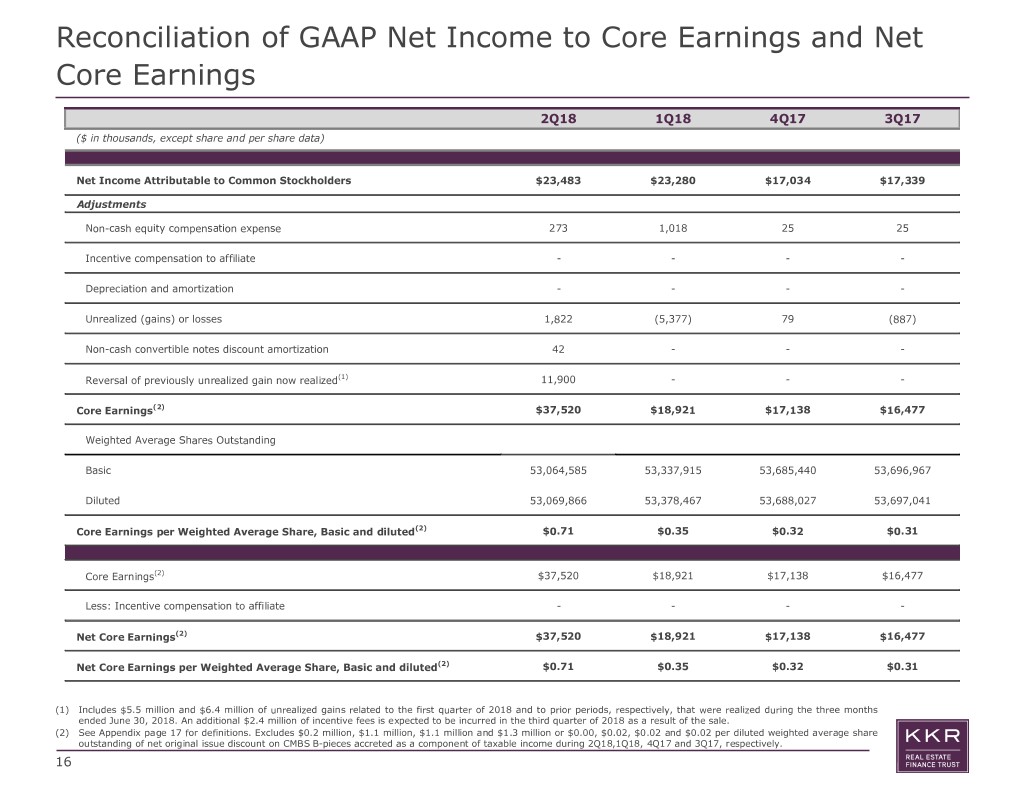

68 68 70 Reconciliation of GAAP Net Income to Core Earnings and Net 217 217 218 Core Earnings 2Q18 1Q18 4Q17 3Q17 180 180 182 ($ in thousands, except share and per share data) • Current LIBOR levels influence asset yield and 142 142 145 Net Income Attributable to Common Stockholders $23,483 $23,280 $17,034 $17,339 therefore ROE Adjustments • Business economics benefit from scale by 51 51 53 Non-cash equity compensation expense 273 1,018 25 25 spreading G&A expenses • Asset mix impacts expected returns and risk Incentive compensation to affiliate - - - - 83 40 79 • Higher leverage increases business profitability Depreciation and amortization - - - - during favorable economic cycles 230 203 227 Unrealized (gains) or losses 1,822 (5,377) 79 (887) 205 151 200 Non-cash convertible notes discount amortization 42 - - - Reversal of previously unrealized gain now realized(1) 11,900 - - - 179 98 172 Core Earnings(2) $37,520 $18,921 $17,138 $16,477 62 30 59 Weighted Average Shares Outstanding Basic 53,064,585 53,337,915 53,685,440 53,696,967 Diluted 53,069,866 53,378,467 53,688,027 53,697,041 Core Earnings per Weighted Average Share, Basic and diluted(2) $0.71 $0.35 $0.32 $0.31 Core Earnings(2) $37,520 $18,921 $17,138 $16,477 Less: Incentive compensation to affiliate - - - - Net Core Earnings(2) $37,520 $18,921 $17,138 $16,477 Net Core Earnings per Weighted Average Share, Basic and diluted(2) $0.71 $0.35 $0.32 $0.31 (1) Includes $5.5 million and $6.4 million of unrealized gains related to the first quarter of 2018 and to prior periods, respectively, that were realized during the three months ended June 30, 2018. An additional $2.4 million of incentive fees is expected to be incurred in the third quarter of 2018 as a result of the sale. (2) See Appendix page 17 for definitions. Excludes $0.2 million, $1.1 million, $1.1 million and $1.3 million or $0.00, $0.02, $0.02 and $0.02 per diluted weighted average share outstanding of net original issue discount on CMBS B-pieces accreted as a component of taxable income during 2Q18,1Q18, 4Q17 and 3Q17, respectively. 16

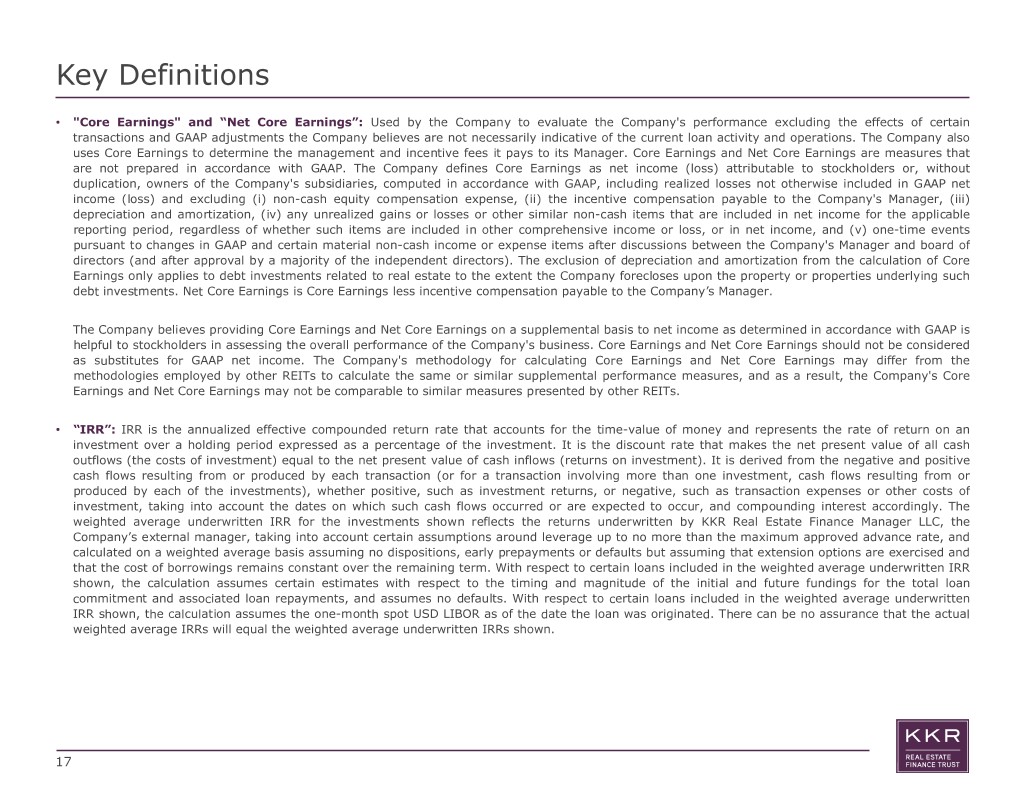

68 68 70 217 217 218 Key Definitions 180 180 182 • "Core Earnings" and “Net Core Earnings”: Used by the Company to evaluate the Company's performance excluding the effects of certain transactions and GAAP adjustments the Company believes are not necessarily indicative of the current loan activity and operations. The Company also uses Core Earnings to determine the management and incentive fees it pays to its Manager. Core Earnings and Net Core Earnings are measures that • Current LIBOR levels influence asset yield and 142 142 145 are not prepared in accordance with GAAP. The Company defines Core Earnings as net income (loss) attributable to stockholders or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not otherwise included in GAAP net therefore ROE income (loss) and excluding (i) non-cash equity compensation expense, (ii) the incentive compensation payable to the Company's Manager, (iii) • Business economics benefit from scale by 51 51 53 depreciation and amortization, (iv) any unrealized gains or losses or other similar non-cash items that are included in net income for the applicable spreading G&A expenses reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (v) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items after discussions between the Company's Manager and board of • Asset mix impacts expected returns and risk 83 40 79 directors (and after approval by a majority of the independent directors). The exclusion of depreciation and amortization from the calculation of Core Earnings only applies to debt investments related to real estate to the extent the Company forecloses upon the property or properties underlying such • Higher leverage increases business profitability debt investments. Net Core Earnings is Core Earnings less incentive compensation payable to the Company’s Manager. during favorable economic cycles 230 203 227 The Company believes providing Core Earnings and Net Core Earnings on a supplemental basis to net income as determined in accordance with GAAP is 205 151 200 helpful to stockholders in assessing the overall performance of the Company's business. Core Earnings and Net Core Earnings should not be considered as substitutes for GAAP net income. The Company's methodology for calculating Core Earnings and Net Core Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, the Company's Core 179 98 172 Earnings and Net Core Earnings may not be comparable to similar measures presented by other REITs. • “IRR”: IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an 62 30 59 investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. The weighted average underwritten IRR for the investments shown reflects the returns underwritten by KKR Real Estate Finance Manager LLC, the Company’s external manager, taking into account certain assumptions around leverage up to no more than the maximum approved advance rate, and calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings remains constant over the remaining term. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes certain estimates with respect to the timing and magnitude of the initial and future fundings for the total loan commitment and associated loan repayments, and assumes no defaults. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes the one-month spot USD LIBOR as of the date the loan was originated. There can be no assurance that the actual weighted average IRRs will equal the weighted average underwritten IRRs shown. 17