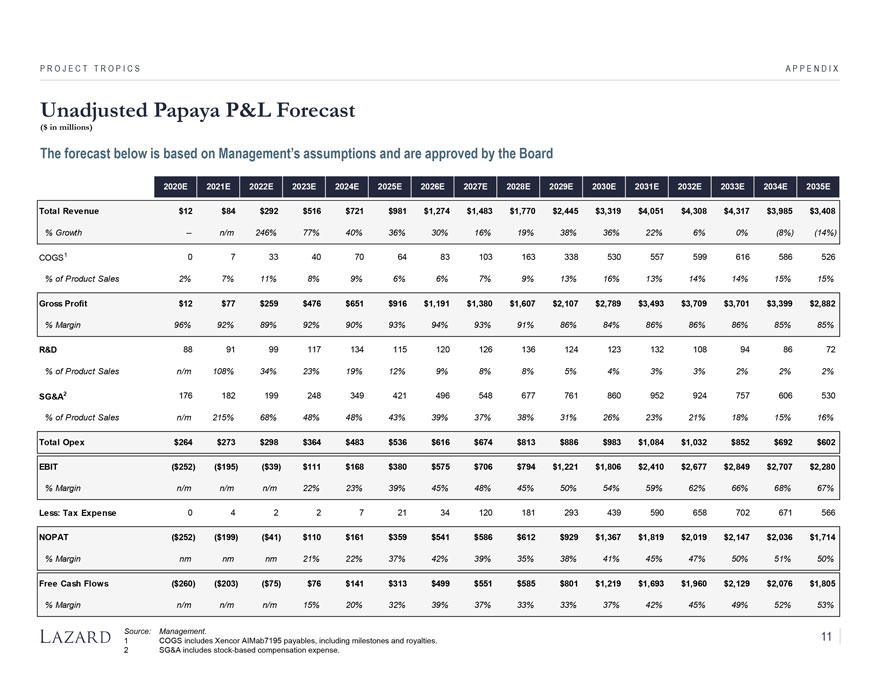

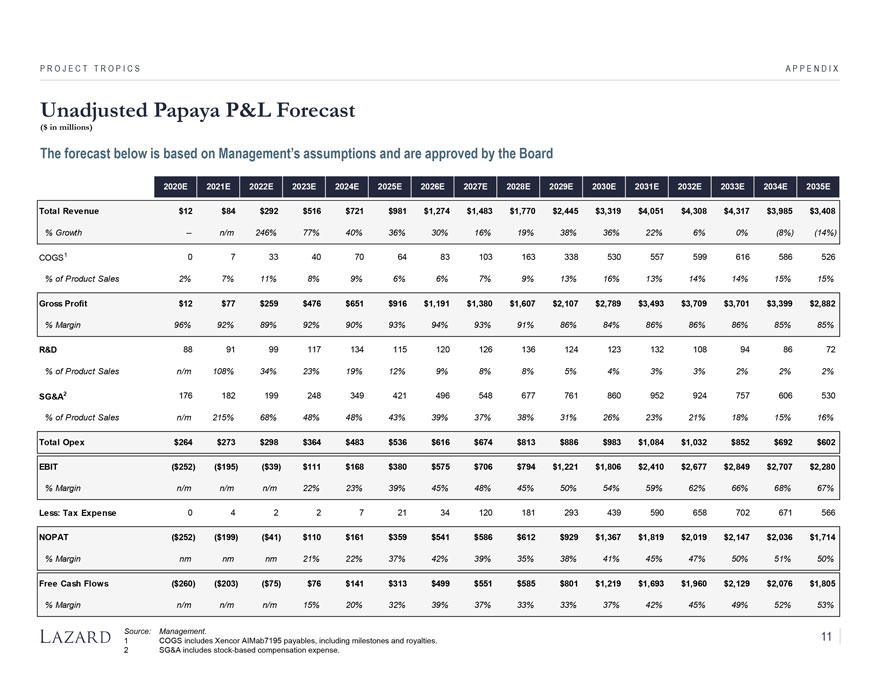

P R O J E C T T R O P I C S A P P E N D I X Unadjusted Papaya P&L Forecast ($ in millions) The forecast below is based on Management’s assumptions and are approved by the Board 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E 2031E 2032E 2033E 2034E 2035E Total Revenue $12 $84 $292 $516 $721 $981 $1,274 $1,483 $1,770 $2,445 $3,319 $4,051 $4,308 $4,317 $3,985 $3,408 % Growth — n/m 246% 77% 40% 36% 30% 16% 19% 38% 36% 22% 6% 0% (8%) (14%) COGS1 0 7 33 40 70 64 83 103 163 338 530 557 599 616 586 526 % of Product Sales 2% 7% 11% 8% 9% 6% 6% 7% 9% 13% 16% 13% 14% 14% 15% 15% Gross Profit $12 $77 $259 $476 $651 $916 $1,191 $1,380 $1,607 $2,107 $2,789 $3,493 $3,709 $3,701 $3,399 $2,882 % Margin 96% 92% 89% 92% 90% 93% 94% 93% 91% 86% 84% 86% 86% 86% 85% 85% R&D 88 91 99 117 134 115 120 126 136 124 123 132 108 94 86 72 % of Product Sales n/m 108% 34% 23% 19% 12% 9% 8% 8% 5% 4% 3% 3% 2% 2% 2% SG&A2 176 182 199 248 349 421 496 548 677 761 860 952 924 757 606 530 % of Product Sales n/m 215% 68% 48% 48% 43% 39% 37% 38% 31% 26% 23% 21% 18% 15% 16% Total Opex $264 $273 $298 $364 $483 $536 $616 $674 $813 $886 $983 $1,084 $1,032 $852 $692 $602 EBIT ($252) ($195) ($39) $111 $168 $380 $575 $706 $794 $1,221 $1,806 $2,410 $2,677 $2,849 $2,707 $2,280 % Margin n/m n/m n/m 22% 23% 39% 45% 48% 45% 50% 54% 59% 62% 66% 68% 67% Less: Tax Expense 0 4 2 2 7 21 34 120 181 293 439 590 658 702 671 566 NOPAT ($252) ($199) ($41) $110 $161 $359 $541 $586 $612 $929 $1,367 $1,819 $2,019 $2,147 $2,036 $1,714 % Margin nm nm nm 21% 22% 37% 42% 39% 35% 38% 41% 45% 47% 50% 51% 50% Free Cash Flows ($260) ($203) ($75) $76 $141 $313 $499 $551 $585 $801 $1,219 $1,693 $1,960 $2,129 $2,076 $1,805 % Margin n/m n/m n/m 15% 20% 32% 39% 37% 33% 33% 37% 42% 45% 49% 52% 53% Source: Management. 11 1 COGS includes Xencor AIMab7195 payables, including milestones and royalties. 2 SG&A includes stock-based compensation expense.