UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23027

John Hancock Collateral Trust

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4497

| Date of fiscal year end: | December 31 |

| Date of reporting period: | December 31, 2015 |

ITEM 1. REPORT TO STOCKHOLDERS.

John Hancock

Collateral Trust

Annual report 12/31/15

John Hancock

Collateral Trust

INVESTMENT OBJECTIVE

The fund seeks current income, while maintaining adequate liquidity, safeguarding the return of principal and minimizing risk of default.

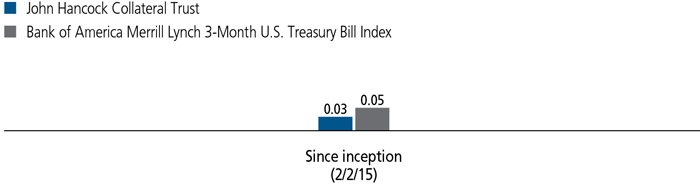

TOTAL RETURNS AS OF 12/31/15 (%)

The Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding U.S. Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would result in lower returns.

The past performance shown here reflects reinvested distributions and the beneficial effect of any expense reductions, and does not guarantee future results. Performance of the other share classes will vary based on the difference in the fees and expenses of those classes. Shares will fluctuate in value and, when redeemed, may be worth more or less than their original cost. Current month-end performance may be lower or higher than the performance cited, and can be found at jhinvestments.com or by calling 800-225-5291. For further information on the fund's objectives, risks, and strategy, see the fund's prospectus.

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

Fed finally raises interest rates in December

With continued strength in the U.S. labor market and indications that inflation would rise, the U.S. Federal Reserve hiked interest rates for the first time in nine years.

Reduced average maturity strategy aided fund

The fund benefited from a strategy to reduce its weighted average maturity, keeping it below the industry average during the second half of 2015.

Fund took advantage of rising rates

Fifty percent of the fund was invested at higher interest rates immediately after the rate hike.

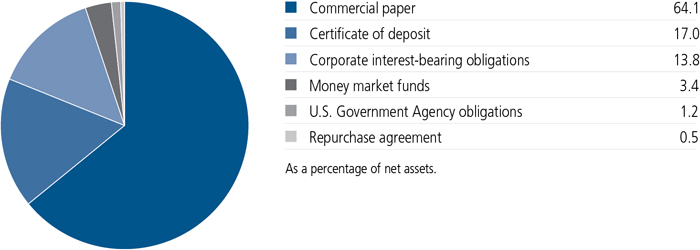

PORTFOLIO COMPOSITION AS OF 12/31/15 (%)

A note about risks

Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if a creditor or grantor is unable or unwilling to make principal or interest payments. Investing in foreign securities may entail the risk of currency fluctuations or heightened economic and political instability. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. Market volatility can cause greater likelihood of margin calls associated with securities on loan, reducing fund liquidity and potentially causing a dilutive impact to the fund. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. A fund that invests in particular sectors is particularly susceptible to the impact of market, economic, regulatory, and other factors affecting those sectors. Please see the fund's registration statement for additional risks.

An interview with Portfolio Manager Jeffrey N. Given, CFA, John Hancock Asset Management a division of Manulife Asset Management (US) LLC

Jeffrey N. Given, CFA

Portfolio Manager

John Hancock Asset Management

What factors impacted the market over the past year?

Over the period, the markets were driven by two factors: the probability and timing of the U.S. Federal Reserve (Fed) hiking interest rates and the impact of money market reform.

As we progressed through the period, the odds of the Fed hiking interest rates changed on what seemed like a weekly basis based on the latest market moves or data releases, leaving it somewhat difficult to predict exactly when and how many times the Fed would raise interest rates in 2015. Factors like the collapse of oil prices and China's slowing economy led to increased volatility domestically and globally. Conversely, the U.S. labor market continued to strengthen throughout the year, with the unemployment rate dropping to 5.0%. With reasonable confidence that inflation will rise to 2.0% over the medium term, the Fed decided to raise the federal funds rate target to 0.25% to 0.50% at the December meeting. The first rate hike in nine years proceeded in an orderly fashion and was not disruptive to markets.

Over the period, tier-1 commercial paper and certificates of deposits (CDs) widened materially, especially in the 6-month to 12-month part of the curve, as issuers and money managers prepared for rate hikes and decreased demand for credit thanks to hundreds of billions of money market reform-related conversions from institutional money market assets to government-only funds.

How did you prepare for the Fed's first interest rate hike?

Throughout the year, we consciously reduced the fund's interest rate risk by reducing the weighted average maturity year-over-year, keeping it below the industry average during the second half of 2015. A technique we used to accomplish this was to focus fixed-rate buying within three months and maintaining the fund's floating-rate exposure at approximately 30% of the fund's net assets.

How did the fund perform?

As the likelihood for interest rate hikes varied throughout the period, it was prudent to remain patient heading into both the September and December Federal Open Market Committee meetings. The sector distribution remained mostly in line throughout the year, with the highest allocation to commercial paper at approximately 64.1% at period end. Throughout the period, we continued to conduct a break-even analysis in preparation of at least one rate hike by year end. Because the fund's weighted average maturity was shorter than the industry average, when the Fed elected to hike interest rates in December, we were able to capture the higher yields more quickly over year end compared with other funds with longer weighted average maturities.

Where have you found good opportunities?

After the interest rate hike in December, we immediately took advantage of the higher yields. With year-end effects already in play, and issuers slowing down new issuances during the last two weeks of the year, we concentrated on investing at higher yields over the year-end turn. Some examples include Piedmont Natural Gas Company Inc.'s commercial paper and Manhattan Asset Funding Company LLC's asset-backed commercial paper. Our floating rate positions resetting in the fourth quarter benefited the fund as the one and three-month LIBOR rates steepened materially. Examples

TOP 10 ISSUERS AS OF 12/31/15 (%)

| Credit Suisse AG, 0.698% to 0.792%, 1-28-16 to 3-11-16 | 5.5 |

| Piedmont Natural Gas Company, Inc., 0.550% to 0.600%, 1-4-16 to 1-8-16 | 4.9 |

| Bank of Tokyo-Mitsubishi UFJ, Ltd., 0.350% to 0.370%, 1-5-16 to 1-26-16 | 4.8 |

| Manhattan Asset Funding Company LLC, 0.270% to 0.630%, 1-5-16 to 3-11-16 | 4.8 |

| Caisse Centrale Desjardins, 0.350% to 0.520%, 1-5-16 to 3-4-16 | 4.8 |

| Bank of Montreal, 0.389% to 0.535%, 1-5-16 to 1-19-16 | 4.7 |

| Exxon Mobil Corp., 0.250% to 0.390%, 1-6-16 to 1-12-16 | 4.7 |

| National Rural Utilities Cooperative Finance Corp., 0.400%, 1-8-16 to 2-8-16 | 4.4 |

| General Electric, 0.518% to 1.000%, 1-8-16 to 4-15-16 | 4.3 |

| Cargill Global Funding PLC, 0.340% to 0.350%, 1-4-16 to 1-5-16 | 4.2 |

| TOTAL | 47.1 |

| As a percentage of net assets. |

include floating-rate CDs issued by Credit Suisse AG and asset-backed commercial paper issued by Jupiter Securitization Company LLC. In general, we continue to find value in the financials sector, most notably our positions in foreign bank paper such as corporate bonds and CDs issued by Credit Suisse, UBS AG, and Macquarie Bank, Ltd.

MANAGED BY

| Jeffrey N. Given, CFA On the fund since inception Investing since 1993 |

TOTAL RETURNS FOR THE PERIOD ENDED DECEMBER 31, 2015

| Average annual total returns (%) | Cumulative total returns (%) | |||||

| 1-year | 5-year | Since inception1 | 5-year | Since inception1 | ||

| John Hancock Collateral Trust | — | — | — | — | 0.03 | |

| Index† | — | — | — | — | 0.05 | |

Performance figures assume all distributions are reinvested.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee

waivers and/or expense limitations), are set forth according to the Financial highlights of the fund's annual report dated December 31, 2015. The net expenses and gross expense annualized ratios are 0.07% and 0.52%, respectively.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the fund's current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund's website at jhinvestments.com.

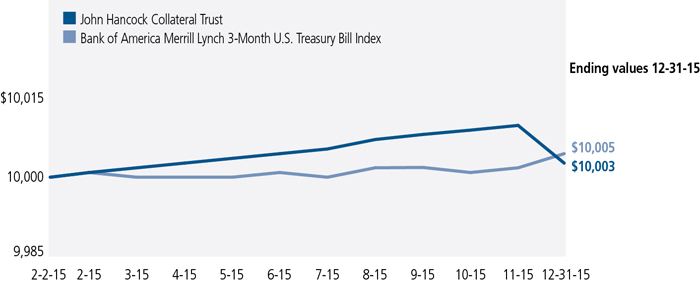

The performance table above and the chart below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund's performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| † | Index is the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index. |

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Collateral Trust for the periods indicated, assuming all distributions were reinvested. For comparison, we've shown the same investment in the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index.

The Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding U.S. Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would result in lower returns.

| 1 | From 2-2-15. |

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

| • | Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc. |

| • | Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses. |

We are presenting only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund's actual ongoing operating expenses, and is based on the fund's actual return. It assumes an account value of $1,000.00 on July 1, 2015, with the same investment held until December 31, 2015.

| Account value on 7-1-2015 | Ending value on 12-31-2015 | Expenses paid during period ended 12-31-20151 | Annualized expense ratio | |

| Shares | $1,000.00 | $999.80 | $0.55 | 0.11% |

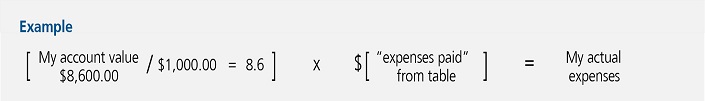

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at December 31, 2015, by $1,000.00, then multiply it by the "expenses paid" for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Hypothetical example for comparison purposes

This table allows you to compare the fund's ongoing operating expenses with those of any other fund. It provides an example of the fund's hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund's actual return). It assumes an account value of $1,000.00 on July 1, 2015, with the same investment held until December 31, 2015. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| Account value on 7-1-2015 | Ending value on 12-31-2015 | Expenses paid during period ended 12-31-20151 | Annualized expense ratio | |

| Shares | $1,000.00 | $1,024.70 | $0.56 | 0.11% |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the registration statement for details regarding transaction costs.

| 1 | Expenses are equal to the fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Fund's investments

| As of 12-31-15 | |||||||||||||||||||||||||||||

| Maturity Date | Yield* (%) | Par value^ | Value | ||||||||||||||||||||||||||

| Commercial paper 64.1% | $1,030,132,335 | ||||||||||||||||||||||||||||

| (Cost $1,030,132,335) | |||||||||||||||||||||||||||||

| Air Liquide US LLC | 01-29-16 to 03-10-16 | 0.280 to 0.470 | 11,000,000 | 10,990,774 | |||||||||||||||||||||||||

| Apple, Inc. | 01-05-16 | 0.320 | 10,000,000 | 9,999,644 | |||||||||||||||||||||||||

| Bank of Tokyo-Mitsubishi UFJ, Ltd. | 01-05-16 to 01-26-16 | 0.350 to 0.370 | 78,000,000 | 77,993,042 | |||||||||||||||||||||||||

| CAFCO LLC | 03-07-16 | 0.400 | 16,948,000 | 16,935,571 | |||||||||||||||||||||||||

| Caisse Centrale Desjardins | 01-05-16 to 03-04-16 | 0.350 to 0.520 | 77,000,000 | 76,990,074 | |||||||||||||||||||||||||

| Cargill Global Funding PLC | 01-04-16 to 01-05-16 | 0.340 to 0.350 | 67,000,000 | 66,997,986 | |||||||||||||||||||||||||

| Chariot Funding LLC | 01-14-16 to 01-15-16 | 0.400 | 32,400,000 | 32,395,098 | |||||||||||||||||||||||||

| Electricite de France SA | 01-06-16 | 0.500 | 16,000,000 | 15,998,889 | |||||||||||||||||||||||||

| Emerson Electric Company | 01-04-16 | 0.250 | 18,000,000 | 17,999,625 | |||||||||||||||||||||||||

| Essilor International SA | 01-04-16 to 01-29-16 | 0.280 to 0.390 | 35,000,000 | 34,993,583 | |||||||||||||||||||||||||

| Exxon Mobil Corp. | 01-06-16 to 01-12-16 | 0.250 to 0.390 | 75,000,000 | 74,993,000 | |||||||||||||||||||||||||

| Illinois Tool Works, Inc. | 01-05-16 to 01-06-16 | 0.330 | 65,000,000 | 64,997,387 | |||||||||||||||||||||||||

| Jupiter Securitization Company LLC | 02-04-16 | 0.400 | 25,000,000 | 24,990,556 | |||||||||||||||||||||||||

| L'Oreal USA, Inc. | 01-06-16 | 0.350 | 10,000,000 | 9,999,514 | |||||||||||||||||||||||||

| Manhattan Asset Funding Company LLC | 01-05-16 to 03-11-16 | 0.270 to 0.630 | 77,200,000 | 77,159,346 | |||||||||||||||||||||||||

| MetLife Short Term Funding LLC | 02-16-16 | 0.500 | 5,158,000 | 5,154,705 | |||||||||||||||||||||||||

| National Rural Utilities Cooperative Finance Corp. | 01-08-16 to 02-08-16 | 0.400 | 70,000,000 | 69,980,745 | |||||||||||||||||||||||||

| NSTAR Electric Company | 01-04-16 | 0.350 | 37,500,000 | 37,498,906 | |||||||||||||||||||||||||

| Old Line Funding LLC | 05-20-16 | 0.620 | 25,000,000 | 24,939,722 | |||||||||||||||||||||||||

| PepsiCo, Inc. | 01-25-16 | 0.350 | 4,749,000 | 4,747,892 | |||||||||||||||||||||||||

| Piedmont Natural Gas Company, Inc. | 01-04-16 to 01-08-16 | 0.550 to 0.650 | 78,500,000 | 78,493,344 | |||||||||||||||||||||||||

| Praxair, Inc. | 01-11-16 | 0.320 | 18,000,000 | 17,998,400 | |||||||||||||||||||||||||

| Province of Ontario, Canada | 02-16-16 | 0.410 | 50,000,000 | 49,973,806 | |||||||||||||||||||||||||

| Sumitomo Mitsui Trust Bank, Ltd. | 01-29-16 to 04-14-16 | 0.420 to 0.500 | 46,000,000 | 45,961,742 | |||||||||||||||||||||||||

| Swedbank AB | 03-08-16 | 0.500 | 5,000,000 | 4,995,347 | |||||||||||||||||||||||||

| Telstra Corp., Ltd. | 01-11-16 to 01-20-16 | 0.350 to 0.400 | 28,500,000 | 28,495,217 | |||||||||||||||||||||||||

| Toyota Motor Credit Corp. | 04-04-16 | 0.480 | 32,000,000 | 31,959,893 | |||||||||||||||||||||||||

| United Technologies Corp. | 01-06-16 | 0.400 | 7,000,000 | 6,999,611 | |||||||||||||||||||||||||

| Washington Gas Light Company | 01-04-16 to 01-14-16 | 0.330 to 0.380 | 9,500,000 | 9,498,916 | |||||||||||||||||||||||||

| Corporate interest-bearing obligations 13.8% | $222,281,501 | ||||||||||||||||||||||||||||

| (Cost $222,434,120) | |||||||||||||||||||||||||||||

| Credit Suisse AG (P) | 03-11-16 | 0.792 | 6,590,000 | 6,584,866 | |||||||||||||||||||||||||

| GE Capital International Funding Company (S) | 04-15-16 | 0.964 | 33,523,000 | 33,565,326 | |||||||||||||||||||||||||

| General Electric Capital Corp. (P) | 01-08-16 | 0.518 to 0.918 | 23,282,000 | 23,282,340 | |||||||||||||||||||||||||

| General Electric Capital Corp. | 01-08-16 | 1.000 | 11,850,000 | 11,850,166 | |||||||||||||||||||||||||

| Jupiter Securitization Company LLC (P)(S) | 07-20-16 | 0.632 | 25,000,000 | 25,000,000 | |||||||||||||||||||||||||

| Macquarie Bank, Ltd. (P)(S) | 06-15-16 | 0.962 | 8,750,000 | 8,743,560 | |||||||||||||||||||||||||

| Total Capital Canada, Ltd. (P) | 01-15-16 | 0.701 | 10,930,000 | 10,929,858 | |||||||||||||||||||||||||

| UBS AG (P) | 09-26-16 | 1.103 | 6,895,000 | 6,895,221 | |||||||||||||||||||||||||

| US Bank NA (P) | 04-22-16 | 0.440 | 50,000,000 | 50,002,800 | |||||||||||||||||||||||||

| Wells Fargo & Company (P) | 07-20-16 | 0.847 | 45,460,000 | 45,427,364 | |||||||||||||||||||||||||

| Maturity Date | Yield* (%) | Par value^ | Value | ||||||||||||||||||||||||||

| U.S. Government Agency obligations 1.2% | $20,000,560 | ||||||||||||||||||||||||||||

| (Cost $20,000,000) | |||||||||||||||||||||||||||||

| Federal Home Loan Bank (P) | 02-09-16 | 0.247 | 20,000,000 | 20,000,560 | |||||||||||||||||||||||||

| Certificate of deposit 17.0% | $273,293,733 | ||||||||||||||||||||||||||||

| (Cost $273,293,733) | |||||||||||||||||||||||||||||

| Bank of Montreal (P) | 01-05-16 | 0.389 | 60,000,000 | 60,000,115 | |||||||||||||||||||||||||

| BMO Harris Bank NA (P) | 01-19-16 | 0.535 | 16,000,000 | 15,999,859 | |||||||||||||||||||||||||

| Credit Suisse AG (P) | 01-28-16 | 0.698 | 81,285,000 | 81,290,133 | |||||||||||||||||||||||||

| Rabobank USA Financial Corp. (P) | 02-05-16 | 0.384 | 20,000,000 | 19,999,791 | |||||||||||||||||||||||||

| Royal Bank of Canada (P) | 02-23-16 | 0.540 | 21,000,000 | 21,000,000 | |||||||||||||||||||||||||

| State Street Bank & Trust Company (P) | 05-20-16 | 0.602 | 25,000,000 | 25,000,000 | |||||||||||||||||||||||||

| Toronto-Dominion Bank (P) | 02-12-16 | 0.386 | 5,000,000 | 4,999,173 | |||||||||||||||||||||||||

| UBS AG (P) | 03-03-16 to 09-26-16 | 0.454 to 1.103 | 25,000,000 | 25,004,457 | |||||||||||||||||||||||||

| Wells Fargo Bank NA (P) | 01-11-16 | 0.397 | 20,000,000 | 20,000,205 | |||||||||||||||||||||||||

| Yield (%) | Shares | Value | |||||||||||||||||||||||||||

| Money market funds 3.4% | $54,000,000 | ||||||||||||||||||||||||||||

| (Cost $54,000,000) | |||||||||||||||||||||||||||||

| State Street Institutional Liquid Reserves Fund | 0.2259(Y) | 54,000,000 | 54,000,000 | ||||||||||||||||||||||||||

| Par value^ | Value | ||||||||||||||||||||||||||||

| Repurchase agreement 0.5% | $8,500,000 | ||||||||||||||||||||||||||||

| (Cost $8,500,000) | |||||||||||||||||||||||||||||

| Repurchase Agreement with State Street Corp. dated 12-31-15 at 0.030% to be repurchased at $8,500,028 on 1-4-16, collateralized by $8,685,000 U.S. Treasury Bonds, 3.000% due 11-15-44 (valued at $8,674,144, including interest) | 8,500,000 | 8,500,000 | |||||||||||||||||||||||||||

| Total investments (Cost $1,608,360,188)† 100.0% | $1,608,208,129 | ||||||||||||||||||||||||||||

| Other assets and liabilities, net 0.0% | $88,428 | ||||||||||||||||||||||||||||

| Total net assets 100.0% | $1,608,296,557 | ||||||||||||||||||||||||||||

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. | |||||||||||||||||||||||||||||

| ^All par values are denominated in U.S. dollars unless otherwise indicated. | |||||||||||||||||||||||||||||

| Key to Security Abbreviations and Legend | |||||||||||||||||||||||||||||

| (P) | Variable rate obligation. The coupon rate shown represents the rate at period end. | ||||||||||||||||||||||||||||

| (S) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. | ||||||||||||||||||||||||||||

| (Y) | The rate shown is the annualized seven-day yield as of 12-31-15. | ||||||||||||||||||||||||||||

| * | Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end. | ||||||||||||||||||||||||||||

| † | At 12-31-15, the aggregate cost of investment securities for federal income tax purposes was $1,608,360,188. Net unrealized depreciation aggregated $152,059 of which $560 related to appreciated investment securities and $152,619 related to depreciated investment securities. | ||||||||||||||||||||||||||||

Financial statements

STATEMENT OF ASSETS AND LIABILITIES 12-31-15

| Assets | |||||||||||||||

| Investments, at value (Cost $1,608,360,188) | $1,608,208,129 | ||||||||||||||

| Cash | 92,502 | ||||||||||||||

| Interest receivable | 476,959 | ||||||||||||||

| Other receivables and prepaid expenses | 1,212 | ||||||||||||||

| Total assets | 1,608,778,802 | ||||||||||||||

| Liabilities | |||||||||||||||

| Distributions payable | 315,973 | ||||||||||||||

| Payable to affiliates | |||||||||||||||

| Administrative services fees | 51,357 | ||||||||||||||

| Transfer agent fees | 6,305 | ||||||||||||||

| Trustees' fees | 568 | ||||||||||||||

| Other liabilities and accrued expenses | 108,042 | ||||||||||||||

| Total liabilities | 482,245 | ||||||||||||||

| Net assets | $1,608,296,557 | ||||||||||||||

| Net assets consist of | |||||||||||||||

| Paid-in capital | $1,608,446,767 | ||||||||||||||

| Undistributed net investment income | 797 | ||||||||||||||

| Accumulated net realized gain (loss) on investments | 1,052 | ||||||||||||||

| Net unrealized appreciation (depreciation) on investments | (152,059 | ) | |||||||||||||

| Net assets | $1,608,296,557 | ||||||||||||||

| Net asset value per share | |||||||||||||||

| Based on 160,752,742 shares of beneficial interest outstanding — unlimited number of shares authorized with no par value | $10.00 | ||||||||||||||

STATEMENT OF OPERATIONS For the period ended 12-31-15 1

| Investment income | |||||||||||||||||||||||||||||||||

| Interest | $3,700,624 | ||||||||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||

| Investment management fees | 8,088,908 | ||||||||||||||||||||||||||||||||

| Administrative services fees | 321,245 | ||||||||||||||||||||||||||||||||

| Transfer agent fees | 57,971 | ||||||||||||||||||||||||||||||||

| Trustees' fees | 24,341 | ||||||||||||||||||||||||||||||||

| Professional fees | 75,503 | ||||||||||||||||||||||||||||||||

| Custodian fees | 194,241 | ||||||||||||||||||||||||||||||||

| Registration and filing fees | 17,726 | ||||||||||||||||||||||||||||||||

| Other | 15,777 | ||||||||||||||||||||||||||||||||

| Total expenses | 8,795,712 | ||||||||||||||||||||||||||||||||

| Less expense reductions | (7,328,825 | ) | |||||||||||||||||||||||||||||||

| Net expenses | 1,466,887 | ||||||||||||||||||||||||||||||||

| Net investment income | 2,233,737 | ||||||||||||||||||||||||||||||||

| Realized and unrealized gain (loss) | |||||||||||||||||||||||||||||||||

| Net realized gain (loss) on | |||||||||||||||||||||||||||||||||

| Investments | 1,849 | ||||||||||||||||||||||||||||||||

| Change in net unrealized appreciation (depreciation) of | |||||||||||||||||||||||||||||||||

| Investments | (152,059 | ) | |||||||||||||||||||||||||||||||

| Net realized and unrealized loss | (150,210 | ) | |||||||||||||||||||||||||||||||

| Increase in net assets from operations | $2,083,527 | ||||||||||||||||||||||||||||||||

| 1 | Period from 2-2-15 (commencement of operations) to 12-31-15. | ||||||||||||||||||||||

STATEMENT OF CHANGES IN NET ASSETS

| Period ended 12-31-151 | |||||||||||||||||

| Increase (decrease) in net assets | |||||||||||||||||

| From operations | |||||||||||||||||

| Net investment income | $2,233,737 | ||||||||||||||||

| Net realized gain | 1,849 | ||||||||||||||||

| Change in net unrealized appreciation (depreciation) | (152,059 | ) | |||||||||||||||

| Increase in net assets resulting from operations | 2,083,527 | ||||||||||||||||

| Distributions to shareholders | |||||||||||||||||

| From net investment income | (2,233,737 | ) | |||||||||||||||

| From fund share transactions | |||||||||||||||||

| Sold | 22,077,319,658 | ||||||||||||||||

| Repurchased | (20,468,872,891 | ) | |||||||||||||||

| Total from Fund share transactions | 1,608,446,767 | ||||||||||||||||

| Total increase | 1,608,296,557 | ||||||||||||||||

| Net assets | |||||||||||||||||

| Beginning of period | — | ||||||||||||||||

| End of period | $1,608,296,557 | ||||||||||||||||

| Undistributed net investment income | $797 | ||||||||||||||||

| Share activity | |||||||||||||||||

| Shares sold | 2,206,573,867 | ||||||||||||||||

| Shares repurchased | (2,045,821,125 | ) | |||||||||||||||

| End of period | 160,752,742 | ||||||||||||||||

| 1 | Period from 2-2-15 (commencement of operations) to 12-31-15. | ||||||||||||||||||||||

Financial highlights

| Period Ended | 12-31-15 | 1 | ||||||||||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||||||||||||

| Net asset value, beginning of period | $10.01 | |||||||||||||||||||||||||||||||

| Net investment income2 | 0.01 | |||||||||||||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.01 | ) | ||||||||||||||||||||||||||||||

| Total from investment operations | (0.00 | ) | ||||||||||||||||||||||||||||||

| Less distributions | ||||||||||||||||||||||||||||||||

| From net investment income | (0.01 | ) | ||||||||||||||||||||||||||||||

| Net asset value, end of period | $10.00 | |||||||||||||||||||||||||||||||

| Total return (%)3 | 0.03 | 4 | ||||||||||||||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||||||||||||||

| Net assets, end of period (in millions) | $1,608 | |||||||||||||||||||||||||||||||

| Ratios (as a percentage of average net assets): | ||||||||||||||||||||||||||||||||

| Expenses before reductions | 0.54 | 5 | ||||||||||||||||||||||||||||||

| Expenses including reductions | 0.09 | 5 | ||||||||||||||||||||||||||||||

| Net investment income | 0.14 | 5 | ||||||||||||||||||||||||||||||

| Portfolio turnover (%)6 | 0 | 7 | ||||||||||||||||||||||||||||||

| 1 | Period from 2-2-15 (commencement of operations) to 12-31-15. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Based on average daily shares outstanding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Total return would have been lower had certain expenses not been reduced during the period. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Not annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Annualized. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | The calculation of portfolio turnover excludes amounts from all securities whose maturities or expiration dates at the time of acquisition were one year or less, which represents a significant amount of the investments held by the fund. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | During the period ended December 31, 2015, securities purchased and/or sold by the fund utilized in the calculation of the portfolio turnover were acquired with less than one year until maturity. As a result, the portfolio turnover is 0%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Note 1 — Organization

John Hancock Collateral Trust (the fund) is a series of John Hancock Collateral Trust (the Trust), a Massachusetts business trust. The fund and the Trust were both organized on December 4, 2014. The fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). However, beneficial interests of the fund are not being registered under the Securities Act of 1933, as amended. The current investors in the fund are investment companies advised by John Hancock Advisers, LLC, the fund's investment advisor (the Advisor), or its affiliates. The fund serves primarily as an investment vehicle for cash received as collateral by such affiliated funds for participation in securities lending.

The investment objective of the fund is to seek current income, while maintaining adequate liquidity, safeguarding the return of principal and minimizing risk of default. The fund invests only in U.S. dollar-denominated securities rated, at the time of investment, within the two highest short-term credit categories and their unrated equivalents. The fund's net asset value (NAV) varies daily.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. In order to value the securities, the fund uses the following valuation techniques: Debt obligations are valued based on the evaluated prices provided by an independent pricing vendor or from broker-dealers. Independent pricing vendors utilize matrix pricing which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices. Securities that trade only in the over-the-counter (OTC) market are valued using bid prices. Investments by the fund in other open-end investment companies are valued at their respective net asset values each business day. Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

As of December 31, 2015, all investments are categorized as Level 2, except money market funds, which are categorized as Level 1 under the hierarchy described above.

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund's custodian for the benefit of the fund. The

collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. Collateral received by the fund for repurchase agreements is disclosed in the Fund's investments as part of the caption related to the repurchase agreement.

Repurchase agreements are typically governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net amounts owed. Absent an event of default, assets and liabilities resulting from repurchase agreements are not offset in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay back claims resulting from close-out of the transactions.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Line of credit. The fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund's custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the extent of any overdraft, and to the maximum extent permitted by law.

The fund and other affiliated funds have entered into a syndicated line of credit agreement, with Citibank, N.A. (Citibank) as the administrative agent, that enables them to participate in a $750 million unsecured committed line of credit. Prior to June 30, 2015, the fund and other affiliated funds had an agreement with Citibank that enabled them to participate in a $300 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the effective line of credit, is charged to each participating fund on a pro rata basis and is reflected in Other expenses on the Statement of operations. Commitment fees for the period ended December 31, 2015 were $2,277. For the period ended December 31, 2015, the fund had no borrowings under either line of credit.

Expenses. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of December 31, 2015, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are distributed annually.

The tax character of distributions for the period ended December 31, 2015 was as follows:

| December 31, 2015 | ||

| Ordinary income | $2,233,737 |

As of December 31, 2015, the components of distributable earnings on a tax basis consisted of $1,849 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP. Distributions in excess of tax basis earnings and profits, if any, are reported in the fund's financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. The fund had no material book-tax differences at December 31, 2015.

Note 3 — Guarantees and indemnifications

Under the Trust's organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

The Advisor serves as investment advisor for the fund. John Hancock Funds, LLC (the Placement Agent) performs services related to the offering and sale of shares of the fund. The Advisor and the Placement Agent are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The fund has an investment management agreement with the Advisor under which the fund pays a daily management fee to the Advisor, equivalent on an annual basis, to the sum of: (a) 0.500% of the first $1.5 billion of the fund's average daily net assets and b) 0.48% of the fund's average daily net assets in excess of $1.5 billion. The Advisor has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Advisor. The fund is not responsible for payment of the subadvisory fees.

Effective February 2, 2015, the Advisor has contractually agreed to waive its advisory fee by 0.45% of the fund's average net assets. The expense waiver will remain in effect until April 30, 2016, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at the time and may be terminated at any time thereafter.

The expense reductions described above amounted to $7,328,825 for the period ended December 31, 2015.

The investment management fees, including the impact of the waivers as described above, incurred for the period ended December 31, 2015 were equivalent to a net annual effective rate of 0.05% of the fund's average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These accounting and legal services fees incurred for the period ended December 31, 2015 amounted to an annual rate of 0.02% of the fund's average daily net assets.

Transfer agent fees. The fund has a transfer agent agreement with John Hancock Signature Services, Inc. (the Transfer Agent), an affiliate of the Advisor. Monthly, the fund pays the Transfer Agent a fee which is based on an annual rate of $60,000. Prior to April 1, 2015, the transfer agent fee was based on an annual rate of $100,000. The fund also pays certain out-of-pocket expenses to the Transfer Agent.

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates.

Note 5 — Purchase and sale of securities

Purchases and sales of securities, other than short-term investments, amounted to $126,152,071 and $0, respectively, for the period ended December 31, 2015.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of John Hancock Collateral Trust:

In our opinion, the accompanying statement of assets and liabilities, including the fund's investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Collateral Trust (the "Fund") at December 31, 2015, and the results of its operations, the changes in its net assets and the financial highlights for the period February 2, 2015 (commencement of operations) through December 31, 2015, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at December 31, 2015 by correspondence with the custodian and the application of alternative auditing procedures where securities purchased confirmations had not been received, provide a reasonable basis for the opinion expressed above.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 16, 2016

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the fund, if any, paid during its taxable year ended December 31, 2015.

The fund reports the maximum amount allowable of its net taxable income as eligible for the corporate dividends-received deduction.

The fund reports the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Eligible shareholders will be mailed a 2015 Form 1099-DIV in early 2016. This will reflect the tax character of all distributions paid in calendar year 2015.

Please consult a tax advisor regarding the tax consequences of your investment in the fund.

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the fund and execute policies formulated by the Trustees.

Independent Trustees

| Name, year of birth Position(s) held with fund Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| James M. Oates, Born: 1946 | 2015 | 228 |

| Trustee and Chairperson of the Board Managing Director, Wydown Group (financial consulting firm) (since 1994); Chairman and Director, Emerson Investment Management, Inc. (since 2000); Independent Chairman, Hudson Castle Group, Inc. (formerly IBEX Capital Markets, Inc.) (financial services company) (1997-2011); Director, Stifel Financial (since 1996); Director, Investor Financial Services Corporation (1995-2007); Director, Connecticut River Bancorp (1998-2014); Director, Virtus Funds (formerly Phoenix Mutual Funds) (since 1988). Trustee and Chairperson of the Board, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee and Chairperson of the Board, John Hancock retail funds3 (since 2012); Trustee (2005-2006 and since 2012) and Chairperson of the Board (since 2012), John Hancock Funds III; Trustee (since 2004) and Chairperson of the Board (since 2005), John Hancock Variable Insurance Trust; Trustee and Chairperson of the Board, John Hancock Funds II (since 2005). | ||

| Charles L. Bardelis,2 Born: 1941 | 2015 | 228 |

| Trustee Director, Island Commuter Corp. (marine transport). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (since 2012); Trustee, John Hancock Funds III (2005-2006 and since 2012); Trustee, John Hancock Variable Insurance Trust (since 1988); Trustee, John Hancock Funds II (since 2005). | ||

| Peter S. Burgess,2 Born: 1942 | 2015 | 228 |

| Trustee Consultant (financial, accounting, and auditing matters) (since 1999); Certified Public Accountant; Partner, Arthur Andersen (independent public accounting firm) (prior to 1999); Director, Lincoln Educational Services Corporation (since 2004); Director, Symetra Financial Corporation (2010-2016); Director, PMA Capital Corporation (2004-2010). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (since 2012); Trustee, John Hancock Funds III (2005-2006 and since 2012); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2005). | ||

| William H. Cunningham, Born: 1944 | 2015 | 228 |

| Trustee Professor, University of Texas, Austin, Texas (since 1971); former Chancellor, University of Texas System and former President of the University of Texas, Austin, Texas; Chairman (since 2009) and Director (since 2006), Lincoln National Corporation (insurance); Director, Southwest Airlines (since 2000); former Director, LIN Television (2009-2014). Trustee, John Hancock retail funds3 (since 1986); Trustee, John Hancock Variable Insurance Trust (since 2012); Trustee, John Hancock Funds II (2005-2006 and since 2012); Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

| Grace K. Fey, Born: 1946 | 2015 | 228 |

| Trustee Chief Executive Officer, Grace Fey Advisors (since 2007); Director and Executive Vice President, Frontier Capital Management Company (1988-2007); Director, Fiduciary Trust (since 2009). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (since 2012); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2008). | ||

Independent Trustees (continued)

| Name, year of birth Position(s) held with fund Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| Theron S. Hoffman,2 Born: 1947 | 2015 | 228 |

| Trustee Chief Executive Officer, T. Hoffman Associates, LLC (consulting firm) (since 2003); Director, The Todd Organization (consulting firm) (2003-2010); President, Westport Resources Management (investment management consulting firm) (2006-2008); Senior Managing Director, Partner, and Operating Head, Putnam Investments (2000-2003); Executive Vice President, The Thomson Corp. (financial and legal information publishing) (1997-2000). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (since 2012); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2008). | ||

| Deborah C. Jackson, Born: 1952 | 2015 | 228 |

| Trustee President, Cambridge College, Cambridge, Massachusetts (since 2011); Chief Executive Officer, American Red Cross of Massachusetts Bay (2002-2011); Board of Directors of Eastern Bank Corporation (since 2001); Board of Directors of Eastern Bank Charitable Foundation (since 2001); Board of Directors of American Student Assistance Corporation (1996-2009); Board of Directors of Boston Stock Exchange (2002-2008); Board of Directors of Harvard Pilgrim Healthcare (health benefits company) (2007-2011). Trustee, John Hancock retail funds3 (since 2008); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2012); Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

| Hassell H. McClellan, Born: 1945 | 2015 | 228 |

| Trustee Trustee, Virtus Variable Insurance Trust (formerly Phoenix Edge Series Funds) (since 2008); Director, The Barnes Group (since 2010); Associate Professor, The Wallace E. Carroll School of Management, Boston College (retired 2013). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (since 2012); Trustee, John Hancock Funds III (2005-2006 and since 2012); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2005). | ||

| Steven R. Pruchansky, Born: 1944 | 2015 | 228 |

| Trustee and Vice Chairperson of the Board Chairman and Chief Executive Officer, Greenscapes of Southwest Florida, Inc. (since 2000); Director and President, Greenscapes of Southwest Florida, Inc. (until 2000); Member, Board of Advisors, First American Bank (until 2010); Managing Director, Jon James, LLC (real estate) (since 2000); Partner, Right Funding, LLC (since 2014); Director, First Signature Bank & Trust Company (until 1991); Director, Mast Realty Trust (until 1994); President, Maxwell Building Corp. (until 1991). Trustee (since 1992) and Chairperson of the Board (2011-2012), John Hancock retail funds3; Trustee and Vice Chairperson of the Board, John Hancock retail funds3 John Hancock Variable Insurance Trust, and John Hancock Funds II (since 2012); Trustee, and Vice Chairperson of the Board, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

Independent Trustees (continued)

| Name, year of birth Position(s) held with fund Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| Gregory A. Russo, Born: 1949 | 2015 | 228 |

| Trustee Director and Audit Committee Chairman (since 2012), and Member, Audit Committee and Finance Committee (since 2011), NCH Healthcare System, Inc. (holding company for multi-entity healthcare system); Director and Member (since 2012) and Finance Committee Chairman (since 2014), The Moorings, Inc. (nonprofit continuing care community); Vice Chairman, Risk & Regulatory Matters, KPMG LLP (KPMG) (2002-2006); Vice Chairman, Industrial Markets, KPMG (1998-2002); Chairman and Treasurer, Westchester County, New York, Chamber of Commerce (1986-1992); Director, Treasurer, and Chairman of Audit and Finance Committees, Putnam Hospital Center (1989-1995); Director and Chairman of Fundraising Campaign, United Way of Westchester and Putnam Counties, New York (1990-1995). Trustee, John Hancock retail funds3 (since 2008); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (since 2012); Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

Non-Independent Trustees4

| Name, year of birth Position(s) held with fund Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| James R. Boyle, Born: 1959 | 2015 | 228 |

| Non-Independent Trustee* Chairman and Chief Executive Officer, Zillion Group, Inc. (formerly HealthFleet, Inc.) (healthcare) (since 2014); Executive Vice President and Chief Executive Officer, U.S. Life Insurance Division of Genworth Financial, Inc. (insurance) (January 2014-July 2014); Senior Executive Vice President, Manulife Financial Corporation, President and Chief Executive Officer, John Hancock (1999-2012); Chairman and Director, John Hancock Advisers, LLC, John Hancock Funds, LLC, and John Hancock Investment Management Services, LLC (2005-2010). Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Trustee, John Hancock retail funds3 (2005-2010; 2012-2014 and since 2015); Trustee, John Hancock Variable Insurance Trust and John Hancock Funds II (2005-2014 and since 2015). *Effective 3-10-15. | ||

| Craig Bromley, Born: 1966 | 2015 | 228 |

| Non-Independent Trustee President, John Hancock Financial Service (since 2012); Senior Executive Vice President and General Manager, U.S. Division, Manulife Financial Corporation (since 2012); President and Chief Executive Officer, Manulife Insurance Company (Manulife Japan) (2005-2012, including prior positions). Trustee, John Hancock retail funds,3 John Hancock Variable Insurance Trust, and John Hancock Funds II (since 2012); Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

| Warren A. Thomson, Born: 1955 | 2015 | 228 |

| Non-Independent Trustee Senior Executive Vice President and Chief Investment Officer, Manulife Financial Corporation and The Manufacturers Life Insurance Company (since 2009); Chairman, Manulife Asset Management (since 2001, including prior positions); Director and Chairman, Manulife Asset Management Limited (since 2006); Director and Chairman, Hancock Natural Resources Group, Inc. (since 2013). Trustee, John Hancock retail funds,3 John Hancock Variable Insurance Trust, and John Hancock Funds II (since 2012); Trustee, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | ||

Principal officers who are not Trustees

| Name, year of birth Position(s) held with fund Principal occupation(s) and other directorships during past 5 years | Officer of the Trust since |

| Andrew G. Arnott, Born: 1971 | 2015 |

| President Senior Vice President, John Hancock Financial Services (since 2009); Director and Executive Vice President, John Hancock Advisers, LLC (since 2005, including prior positions); Director and Executive Vice President, John Hancock Investment Management Services, LLC (since 2006, including prior positions); President, John Hancock Funds, LLC (since 2004, including prior positions); President, John Hancock retail funds,3 John Hancock Variable Insurance Trust, and John Hancock Funds II (since 2007, including prior positions); President, John Hancock Collateral Trust (since 2015); President, John Hancock Exchange-Traded Fund Trust (since 2014). | |

| John J. Danello, Born: 1955 | 2015 |

| Senior Vice President, Secretary, and Chief Legal Officer Vice President and Chief Counsel, John Hancock Wealth Management (since 2005); Senior Vice President (since 2007) and Chief Legal Counsel (2007-2010), John Hancock Funds, LLC and The Berkeley Financial Group, LLC; Senior Vice President (since 2006, including prior positions) and Chief Legal Officer and Secretary (since 2014), John Hancock retail funds 3, John Hancock Funds II and John Hancock Variable Insurance Trust; Senior Vice President, Chief Legal Officer and Secretary, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015); Vice President, John Hancock Life & Health Insurance Company (since 2009); Vice President, John Hancock Life Insurance Company (USA) and John Hancock Life Insurance Company of New York (since 2010); and Senior Vice President, Secretary, and Chief Legal Counsel (2007-2014, including prior positions) of John Hancock Advisers, LLC and John Hancock Investment Management Services, LLC. | |

| Francis V. Knox, Jr., Born: 1947 | 2015 |

| Chief Compliance Officer Vice President, John Hancock Financial Services (since 2005); Chief Compliance Officer, John Hancock retail funds,3 John Hancock Variable Insurance Trust, John Hancock Funds II, John Hancock Advisers, LLC, and John Hancock Investment Management Services, LLC (since 2005); Chief Compliance Officer, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | |

| Charles A. Rizzo, Born: 1957 | 2015 |

| Chief Financial Officer Vice President, John Hancock Financial Services (since 2008); Senior Vice President, John Hancock Advisers, LLC and John Hancock Investment Management Services, LLC (since 2008); Chief Financial Officer, John Hancock retail funds,3 John Hancock Variable Insurance Trust and John Hancock Funds II (since 2007); Chief Financial Officer, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | |

| Salvatore Schiavone, Born: 1965 | 2015 |

| Treasurer Assistant Vice President, John Hancock Financial Services (since 2007); Vice President, John Hancock Advisers, LLC and John Hancock Investment Management Services, LLC (since 2007); Treasurer, John Hancock retail funds3 (since 2007, including prior positions); Treasurer, John Hancock Variable Insurance Trust and John Hancock Funds II (2007-2009 and since 2010, including prior positions); Treasurer, John Hancock Collateral Trust and John Hancock Exchange-Traded Fund Trust (since 2015). | |

The business address for all Trustees and Officers is 601 Congress Street, Boston, Massachusetts 02210-2805.

The Statement of Additional Information of the fund includes additional information about members of the Board of Trustees of the Trust and is available without charge, upon request, by calling 800-225-5291.

| 1 | Each Trustee holds office until his or her successor is elected and qualified, or until the Trustee's death, retirement, resignation, or removal. Mr. Boyle has served as Trustee at various times prior to the date listed in the table. |

| 2 | Member of the Audit Committee. |

| 3 | "John Hancock retail funds" comprises John Hancock Funds III and 36 other John Hancock funds consisting of 26 series of other John Hancock trusts and 10 closed-end funds. |

| 4 | The Trustee is a Non-Independent Trustee due to current or former positions with the Advisor and certain affiliates. |

Trustees James M. Oates, Chairperson Officers Andrew G. Arnott John J. Danello Francis V. Knox, Jr. Charles A. Rizzo Salvatore Schiavone | Investment advisor John Hancock Advisers, LLC Subadvisor John Hancock Asset Management a division of Manulife Asset Management (US) LLC Principal distributor John Hancock Funds, LLC Custodian State Street Bank and Trust Company Transfer agent John Hancock Signature Services, Inc. Legal counsel K&L Gates LLP Independent registered public accounting firm PricewaterhouseCoopers LLP |

*Member of the Audit Committee

†Non-Independent Trustee

The fund's proxy voting policies and procedures, as well as the fund proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

The fund's complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The fund's Form N-Q is available on our website and the SEC's website, sec.gov, and can be reviewed and copied (for a fee) at the SEC's Public Reference Room in Washington, DC. Call 800-SEC-0330 to receive information on the operation of the SEC's Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our website at jhinvestments.com or by calling 800-225-5291.

| You can also contact us: | |||

| 800-225-5291 jhinvestments.com | Regular mail: John Hancock Signature Services, Inc. | Express mail: John Hancock Signature Services, Inc. | |

John Hancock family of funds

DOMESTIC EQUITY FUNDS Balanced Blue Chip Growth Classic Value Disciplined Value Disciplined Value Mid Cap Equity Income Fundamental All Cap Core Fundamental Large Cap Value Large Cap Equity New Opportunities Select Growth Small Cap Equity Small Cap Value Small Company Strategic Growth U.S. Equity U.S. Global Leaders Growth Value Equity GLOBAL AND INTERNATIONAL EQUITY FUNDS Disciplined Value International Emerging Markets Emerging Markets Equity Global Equity Global Shareholder Yield Greater China Opportunities International Core International Growth International Small Company International Value Equity | INCOME FUNDS Bond California Tax-Free Income Core High Yield Emerging Markets Debt Floating Rate Income Focused High Yield Global Income Government Income High Yield Municipal Bond Income Investment Grade Bond Money Market Short Duration Credit Opportunities Spectrum Income Strategic Income Opportunities Tax-Free Bond ALTERNATIVE AND SPECIALTY FUNDS Absolute Return Currency Alternative Asset Allocation Enduring Assets Financial Industries Global Absolute Return Strategies Global Conservative Absolute Return Global Real Estate Natural Resources Redwood Regional Bank Seaport Technical Opportunities |

A fund's investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus contains this and other important information about the fund. To obtain a prospectus, contact your financial professional, call John Hancock Investments at 800-225-5291, or visit our website at jhinvestments.com. Please read the prospectus carefully before investing or sending money.

ASSET ALLOCATION Income Allocation Fund Lifestyle Aggressive Portfolio Lifestyle Balanced Portfolio Lifestyle Conservative Portfolio Lifestyle Growth Portfolio Lifestyle Moderate Portfolio Retirement Choices Portfolios (2010-2055) Retirement Living Portfolios (2010-2055) Retirement Living II Portfolios (2010-2055) EXCHANGE-TRADED FUNDS John Hancock Multifactor Consumer Discretionary ETF John Hancock Multifactor Financials ETF John Hancock Multifactor Healthcare ETF John Hancock Multifactor Large Cap ETF John Hancock Multifactor Mid Cap ETF John Hancock Multifactor Technology ETF CLOSED-END FUNDS Financial Opportunities Hedged Equity & Income Income Securities Trust Investors Trust Preferred Income Preferred Income II Preferred Income III Premium Dividend Tax-Advantaged Dividend Income Tax-Advantaged Global Shareholder Yield |

"As an investment firm,

upholding the proud

tradition of John Hancock

comes down to one thing:

putting shareholders

first. We believe that if

our shareholders are

successful, then we will

be successful."

Andrew G. Arnott

President and Chief Executive Officer

John Hancock Investments

John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed

from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC, and are subadvised by Dimensional Fund Advisors LP.

Foreside is not affiliated with John Hancock Funds, LLC or Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP receives compensation from John Hancock in connection with licensing rights to the

John Hancock Dimensional indexes. Dimensional Fund Advisors LP does not sponsor, endorse, or sell, and makes no

representation as to the advisability of investing in, John Hancock Multifactor ETFs.

John Hancock Investments

A trusted brand

John Hancock Investments is a premier asset manager representing

one of America's most trusted brands, with a heritage of financial

stewardship dating back to 1862. Helping our shareholders pursue

their financial goals is at the core of everything we do. It's why we

support the role of professional financial advice and operate with the

highest standards of conduct and integrity.

A better way to invest

We build funds based on investor needs, then search the world to find

proven portfolio teams with specialized expertise in those strategies.

As a manager of managers, we apply vigorous oversight to ensure that

they continue to meet our uncompromising standards and serve the

best interests of our shareholders.

Results for investors

Our unique approach to asset management enables us to provide

a diverse set of investments backed by some of the world's best

managers, along with strong risk-adjusted returns across asset classes.

| John Hancock Funds, LLC n Member FINRA, SIPC 601 Congress Street n Boston, MA 02210-2805 800-225-5291 n jhinvestments.com | |

| This report is for the information of the shareholders of John Hancock Collateral Trust. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | ||

| 315A 12/15 2/16 | ||

ITEM 2. CODE OF ETHICS.

As of the end of the year, December 31, 2015, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the “Senior Financial Officers”). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Peter S. Burgess is the audit committee financial expert and is “independent”, pursuant to general instructions on Form N-CSR Item 3.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant(s) in connection with statutory and regulatory filings or engagements amounted to $33,514 for the fiscal year ended December 31, 2015 for the John Hancock Collateral Investment Trust. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(b) Audit-Related Services

Audit-related service fees amounted to $525 for the fiscal year ended December 31, 2015 for the John Hancock Collateral Investment Trust billed to the registrant or to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant ("control affiliates"). In addition, amounts billed to control affiliates for service provider internal controls reviews were $103,474 for the fiscal year ended December 31, 2015.

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant(s) for the tax compliance, tax advice and tax planning (“tax fees”) amounted to $2,725 for the fiscal year ended December 31, 2015 for the John Hancock Collateral Investment Trust. The nature of the services comprising the tax fees was the review of the registrant’s tax returns and tax distribution requirements. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(d) All Other Fees

Other fees amounted to $114 for the fiscal year ended December 31, 2015 for John Hancock Collateral Investment Trust billed to the registrant or to the control affiliates.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by the independent registered public accounting firm (the “Auditor”) relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The trust’s Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of audit-related and non-audit services by the Auditor. The policies and procedures require that any audit-related and non-audit service provided by the Auditor and any non-audit service provided by the Auditor to a fund service provider that relates directly to the operations and financial reporting of a fund are subject to

approval by the Audit Committee before such service is provided. Audit-related services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee. Tax services provided by the Auditor that are expected to exceed $10,000 per instance/per fund are subject to specific pre-approval by the Audit Committee.

All audit services, as well as the audit-related and non-audit services that are expected to exceed the amounts stated above, must be approved in advance of provision of the service by formal resolution of the Audit Committee. At the regularly scheduled Audit Committee meetings, the Committee reviews a report summarizing the services, including fees, provided by the Auditor.

(e)(2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

Audit-Related Fees, Tax Fees and All Other Fees:

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

(f) According to the registrant’s principal accountant, for the fiscal year ended December 31, 2015, the percentage of hours spent on the audit of the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons who were not full-time, permanent employees of principal accountant was less than 50%.

(g) The aggregate non-audit fees billed by the registrant's accountant(s) for services rendered to the registrant and rendered to the registrant's control affiliates of the registrant was $7,126,036 for the fiscal year ended December 31, 2015.

(h) The audit committee of the registrant has considered the non-audit services provided by the registrant’s principal accountant(s) to the control affiliates and has determined that the services that were not pre-approved are compatible with maintaining the principal accountant(s)' independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately-designated standing audit committee comprised of independent trustees. The members of the audit committee are as follows:

Peter S. Burgess - Chairman

Charles L. Bardelis

Theron S. Hoffman

.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) See attached Code of Ethics.

(a)(2) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c)(1) Submission of Matters to a Vote of Security Holders is attached. See attached “John Hancock Funds – Governance Committee Charter”.

(c)(2) Contact person at the registrant.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Collateral Trust

| By: | /s/ Andrew Arnott |

| Andrew Arnott President | |

| Date: | February 18, 2016 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Andrew Arnott |

| Andrew Arnott President | |

| Date: | February 18, 2016 |

| By: | /s/ Charles A. Rizzo |

| Charles A. Rizzo Chief Financial Officer | |

| Date: | February 18, 2016 |