UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23027

John Hancock Collateral Trust

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4497

| Date of fiscal year end: | December 31 |

| Date of reporting period: | June 30, 2020 |

ITEM 1. REPORTS TO STOCKHOLDERS.

John Hancock

Collateral Trust

Semiannual report 6/30/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

John Hancock

Collateral Trust

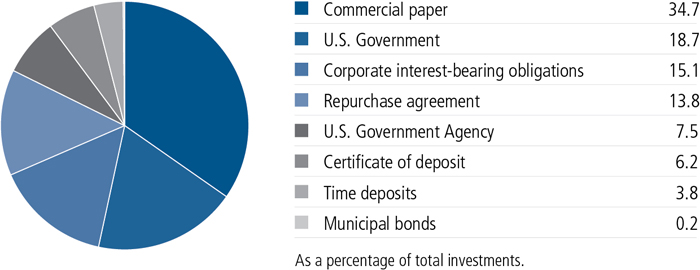

PORTFOLIO COMPOSITION AS OF 6/30/2020 (%)

TOP 10 ISSUERS AS OF 6/30/2020 (%)

| U.S. Treasury Bill, 0.099% to 0.152%, 7-7-20 to 8-20-20 | 18.8 |

| Cargill, Inc., 0.091% to 1.419%, 7-1-20 to 7-6-20 | 4.6 |

| Cummins, Inc., 0.152% to 0.507%, 7-1-20 to 8-26-20 | 3.7 |

| Credit Suisse AG, 0.365% to 0.665%, 7-7-20 to 11-9-20 | 3.3 |

| Salt River Project Agricultural Improvement & Power District, 0.152% to 0.243%, 7-2-20 to 8-20-20 | 3.2 |

| Federal Farm Credit Bank, 0.167% to 0.725%, 10-29-20 to 5-27-22 | 3.1 |

| Yale University, 0.152% to 1.673%, 7-6-20 to 8-18-20 | 2.9 |

| PSP Capital, Inc., 0.315% to 1.827%, 12-16-20 to 6-18-21 | 2.5 |

| BNP Paribas SA, 0.020%, 7-1-20 | 2.2 |

| Manhattan Asset Funding Company LLC, 0.203% to 0.274%, 8-6-20 to 10-6-20 | 2.2 |

| TOTAL | 46.5 |

| As a percentage of total investments. | |

A note about risks

The trust is subject to various risks as described in the trust's prospectus. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future, could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social, and economic risks. Any such impact could adversely affect the trust's performance, resulting in losses to your investment. For more information, please refer to the "Principal risks" section of the prospectus.

| 3 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT |

| Account value on 1-1-2020 | Ending value on 6-30-2020 | Expenses paid during 6-30-20201 | Annualized expense ratio | ||

| Actual expenses/actual returns | $1,000.00 | $1,005.20 | $0.40 | 0.08% | |

| Hypothetical example | 1,000.00 | 1,024.50 | 0.40 | 0.08% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| SEMIANNUAL REPORT | JOHN HANCOCK COLLATERAL TRUST | 4 |

| Maturity date | Yield (%) | Par value^ | Value | ||

| Commercial paper 34.9% | $1,158,103,348 | ||||

| (Cost $1,157,688,329) | |||||

| Apple, Inc. | 07-08-20 to 09-14-20 | 0.101 to 0.172 | 14,500,000 | 14,497,828 | |

| BASF SE | 07-07-20 to 09-16-20 | 0.406 to 0.610 | 22,075,000 | 22,032,101 | |

| CAFCO LLC | 07-06-20 to 07-07-20 | 0.122 to 0.142 | 18,000,000 | 17,999,705 | |

| Cargill Global Funding PLC | 07-01-20 | 0.091 | 130,000,000 | 129,999,665 | |

| Cargill, Inc. | 07-06-20 | 1.419 | 25,000,000 | 24,999,554 | |

| Chariot Acquisition LLC | 07-06-20 | 0.142 | 5,000,000 | 4,999,878 | |

| Cummins, Inc. | 07-01-20 to 08-26-20 | 0.152 to 0.507 | 124,084,000 | 124,065,993 | |

| Emerson Electric Company | 07-20-20 | 0.832 | 10,000,000 | 9,996,861 | |

| Henkel of America, Inc. | 09-16-20 to 04-27-21 | 0.254 to 0.356 | 14,000,000 | 13,963,857 | |

| Honeywell International, Inc. | 05-10-21 | 0.356 | 10,000,000 | 9,963,890 | |

| John Deere Canada ULC | 07-21-20 to 07-22-20 | 0.152 to 0.183 | 6,275,000 | 6,274,672 | |

| Jupiter Securitization Company LLC | 12-03-20 | 0.345 | 1,800,000 | 1,797,660 | |

| Lime Funding LLC | 09-10-20 | 0.304 | 22,000,000 | 21,989,088 | |

| Long Island Power Authority | 07-01-20 to 07-08-20 | 0.132 to 0.172 | 50,000,000 | 50,000,000 | |

| L'Oreal USA, Inc. | 07-06-20 | 0.122 | 8,000,000 | 7,999,924 | |

| Manhattan Asset Funding Company LLC | 08-06-20 to 10-06-20 | 0.203 to 0.274 | 73,805,000 | 73,771,956 | |

| Merck & Company, Inc. | 07-08-20 | 0.710 | 3,025,000 | 3,024,964 | |

| MUFG Bank, Ltd. | 10-29-20 | 0.264 | 2,750,000 | 2,747,384 | |

| National Rural Utilities Cooperative Finance Corp. | 07-01-20 to 07-17-20 | 0.091 to 0.122 | 34,000,000 | 33,998,808 | |

| Novartis Finance Corp. | 07-06-20 to 08-11-20 | 0.101 to 0.152 | 28,150,000 | 28,148,931 | |

| NSTAR Electric Company | 07-06-20 | 0.101 | 67,500,000 | 67,498,988 | |

| Old Line Funding LLC | 07-13-20 to 09-03-20 | 0.172 to 0.913 | 9,525,000 | 9,521,524 | |

| ONE Gas, Inc. | 07-06-20 to 07-28-20 | 0.132 to 0.203 | 65,575,000 | 65,572,227 | |

| Pfizer, Inc. | 10-05-20 | 0.203 | 700,000 | 699,638 | |

| PSP Capital, Inc. | 12-16-20 to 06-18-21 | 0.315 to 1.827 | 84,175,000 | 84,039,512 | |

| Royal Bank of Canada | 12-21-20 to 01-21-21 | 1.269 to 1.270 | 6,800,000 | 6,789,782 | |

| Salt River Project Agricultural Improvement & Power District | 07-02-20 to 08-20-20 | 0.152 to 0.243 | 105,300,000 | 105,259,805 | |

| State of California | 08-18-20 | 0.170 | 18,000,000 | 18,000,000 | |

| Sumitomo Mitsui Trust Bank, Ltd. | 07-20-20 to 11-12-20 | 0.213 to 0.345 | 10,025,000 | 10,020,432 | |

| The Coca-Cola Company | 09-23-20 | 0.852 | 2,000,000 | 1,999,292 | |

| Toyota Credit Canada, Inc. | 11-23-20 | 0.498 | 25,000,000 | 24,960,965 | |

| Toyota Motor Finance Netherlands BV | 12-11-20 | 0.345 | 20,000,000 | 19,969,478 | |

| Trinity Health Corp. | 07-02-20 | 0.253 | 30,250,000 | 30,249,820 | |

| University of California | 07-02-20 | 0.274 | 9,000,000 | 8,996,220 | |

| Westpac Securities NZ, Ltd. | 07-08-20 | 0.142 | 5,000,000 | 4,999,877 | |

| Yale University | 07-06-20 to 08-18-20 | 0.152 to 1.673 | 97,260,000 | 97,253,069 | |

| 5 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Maturity date | Yield (%) | Par value^ | Value | ||

| U.S. Government 18.8% | $624,942,055 | ||||

| (Cost $624,938,602) | |||||

| U.S. Treasury Bill | 07-07-20 to 08-20-20 | 0.099 to 0.152 | 625,000,000 | 624,942,055 | |

| Corporate interest-bearing obligations 15.2% | $503,391,148 | ||||

| (Cost $502,770,781) | |||||

| Alphabet, Inc. | 05-19-21 | 0.384 | 3,308,000 | 3,403,350 | |

| Apple, Inc. | 11-13-20 to 05-06-21 | 0.310 to 1.208 | 47,000,000 | 47,947,361 | |

| Australia & New Zealand Banking Group, Ltd. | 08-19-20 | 1.940 | 3,445,000 | 3,452,380 | |

| Bank of Montreal | 07-13-20 | 3.087 | 572,000 | 572,482 | |

| BMW US Capital LLC (A) | 08-14-20 | 2.106 | 1,973,000 | 1,979,570 | |

| Children's Hospital Medical Center | 07-01-20 to 07-07-20 | 0.142 | 70,000,000 | 70,000,000 | |

| Cisco Systems, Inc. | 02-28-21 | 1.055 | 5,315,000 | 5,379,857 | |

| Commonwealth Bank of Australia (A) | 09-18-20 | 1.910 | 10,000,000 | 10,035,419 | |

| Credit Suisse AG | 08-05-20 | 0.665 | 2,745,000 | 2,754,839 | |

| Emerson Electric Company | 11-15-20 | 1.776 | 1,540,000 | 1,560,170 | |

| John Deere Capital Corp. (3 month LIBOR + 0.240%) (B) | 03-12-21 | 1.126 | 7,540,000 | 7,543,800 | |

| John Deere Capital Corp. (3 month LIBOR + 0.420%) (B) | 07-10-20 | 1.455 | 9,820,000 | 9,820,588 | |

| John Deere Capital Corp. | 01-08-21 to 06-07-21 | 0.305 to 1.759 | 8,795,000 | 8,895,688 | |

| Johnson & Johnson | 05-15-21 | 0.376 | 2,150,000 | 2,210,364 | |

| JP Morgan Securities LLC (1 month LIBOR + 0.290%) (A)(B) | 09-03-20 | 0.475 | 50,000,000 | 50,000,000 | |

| Macquarie Bank, Ltd. (3 month LIBOR + 1.120%) (A)(B) | 07-29-20 | 0.994 | 37,241,000 | 37,279,488 | |

| Macquarie Bank, Ltd. (A) | 07-29-20 | 1.701 | 7,100,000 | 7,113,384 | |

| Mitsubishi UFJ Trust & Banking Corp. (A) | 10-19-20 | 0.317 | 4,000,000 | 4,026,918 | |

| National Rural Utilities Cooperative Finance Corp. | 03-15-21 | 0.984 | 1,000,000 | 1,018,187 | |

| Old Line Funding LLC (A) | 09-10-20 | 0.365 | 30,000,000 | 29,962,500 | |

| PNC Bank NA | 11-05-20 to 01-22-21 | 1.880 to 1.992 | 32,118,000 | 32,356,899 | |

| Royal Bank of Canada | 10-30-20 to 04-30-21 | 0.297 to 1.806 | 17,900,000 | 18,069,899 | |

| State Street Corp. (3 month LIBOR + 0.900%) (B) | 08-18-20 | 0.438 | 38,573,000 | 38,622,759 | |

| State Street Corp. | 08-18-20 | 1.959 | 8,041,000 | 8,063,842 | |

| The Bank of New York Mellon Corp. | 08-17-20 to 05-03-21 | 0.477 to 2.005 | 11,140,000 | 11,235,312 | |

| The Bank of Nova Scotia (3 month LIBOR + 0.420%) (B) | 01-25-21 | 0.540 | 11,722,000 | 11,749,605 | |

| The Bank of Nova Scotia | 10-21-20 | 1.831 | 1,500,000 | 1,509,749 | |

| The Estee Lauder Companies, Inc. | 05-10-21 | 0.414 | 8,825,000 | 8,919,493 | |

| The Hershey Company | 05-15-21 | 0.260 | 5,535,000 | 5,671,932 | |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK COLLATERAL TRUST | 6 |

| Maturity date | Yield (%) | Par value^ | Value | ||

| The Toronto-Dominion Bank | 04-07-21 | 0.998 | 9,386,000 | $9,514,527 | |

| Thunder Bay Funding LLC (A) | 08-10-20 | 0.335 | 25,000,000 | 24,978,229 | |

| Toyota Motor Credit Corp. | 01-08-21 | 1.641 | 2,438,000 | 2,472,568 | |

| UBS AG | 08-04-20 | 1.939 | 8,882,000 | 8,917,278 | |

| Unilever Capital Corp. | 03-22-21 | 0.280 | 1,500,000 | 1,526,432 | |

| US Bancorp | 01-29-21 to 05-24-21 | 0.757 to 1.751 | 14,651,000 | 14,826,279 | |

| U.S. Government Agency 7.6% | $251,681,905 | ||||

| (Cost $251,621,844) | |||||

| Federal Agricultural Mortgage Corp. (SOFR + 0.100%) (B) | 04-01-21 to 08-23-21 | 0.183 | 11,000,000 | 10,997,694 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.085%) (B) | 03-10-21 | 0.167 | 15,000,000 | 14,983,617 | |

| Federal Farm Credit Bank (1 month LIBOR) (B) | 12-16-20 | 0.198 | 10,000,000 | 9,999,084 | |

| Federal Farm Credit Bank (Prime rate - 2.970%) (B) | 05-27-22 | 0.284 | 15,000,000 | 14,989,952 | |

| Federal Farm Credit Bank (3 month USBMMY + 0.250%) (B) | 02-22-22 | 0.375 | 10,000,000 | 10,011,791 | |

| Federal Farm Credit Bank (SOFR + 0.380%) (B) | 04-22-22 | 0.466 | 5,000,000 | 5,008,644 | |

| Federal Farm Credit Bank (Prime rate - 3.030%) (B) | 06-23-21 to 09-03-21 | 0.223 to 0.335 | 45,000,000 | 44,956,345 | |

| Federal Farm Credit Bank (3 month LIBOR - 0.135%) (B) | 10-29-20 | 0.725 | 5,000,000 | 4,998,452 | |

| Federal Home Loan Bank (SOFR + 0.070%) (B) | 10-02-20 | 0.152 | 5,000,000 | 4,999,551 | |

| Federal Home Loan Bank (SOFR + 0.100%) (B) | 10-09-20 | 0.183 | 25,000,000 | 24,999,486 | |

| Federal Home Loan Bank (3 month LIBOR - 0.170%) (B) | 01-08-21 | 0.913 | 25,000,000 | 25,024,022 | |

| Federal Home Loan Mortgage Corp. (SOFR + 0.400%) (B) | 10-21-21 | 0.424 | 20,600,000 | 20,616,335 | |

| Federal National Mortgage Association (SOFR + 0.190%) (B) | 05-19-22 | 0.274 | 5,000,000 | 5,000,656 | |

| Federal National Mortgage Association (SOFR + 0.200%) (B) | 06-15-22 | 0.284 | 10,000,000 | 9,996,046 | |

| Federal National Mortgage Association (SOFR + 0.220%) (B) | 03-16-22 | 0.304 | 25,000,000 | 25,022,459 | |

| Federal National Mortgage Association (SOFR + 0.390%) (B) | 04-15-22 | 0.475 | 20,000,000 | 20,077,771 | |

| 7 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Maturity date | Yield (%) | Par value^ | Value | ||

| Certificate of deposit 6.3% | $208,059,727 | ||||

| (Cost $207,990,345) | |||||

| Credit Suisse AG (SOFR + 0.280%) (B) | 07-07-20 | 0.365 | 50,000,000 | 50,002,333 | |

| Credit Suisse AG (SOFR + 0.150%) (B) | 09-01-20 | 0.549 | 18,000,000 | 18,001,260 | |

| Credit Suisse AG (SOFR + 0.480%) (B) | 11-09-20 | 0.567 | 40,000,000 | 40,052,482 | |

| The Toronto-Dominion Bank | 07-28-21 | 0.426 | 50,000,000 | 49,998,903 | |

| Wells Fargo Bank NA (U.S. Federal Funds Effective Rate + 0.310%) (B) | 08-10-20 | 0.395 | 50,000,000 | 50,004,749 | |

| Time deposits 3.8% | $125,000,000 | ||||

| (Cost $125,000,000) | |||||

| BNP Paribas SA | 07-01-20 | 0.020 | 75,000,000 | 75,000,000 | |

| Sumitomo Mitsui Banking Corp. | 12-02-20 | 0.375 | 50,000,000 | 50,000,000 | |

| Municipal bonds 0.2% | $7,144,410 | ||||

| (Cost $7,147,777) | |||||

| Florida State Board of Administration Finance Corp. | 07-01-21 | 0.552 | 7,000,000 | 7,144,410 | |

| Par value^ | Value | ||||

| Repurchase agreement 13.8% | $460,000,000 | ||||

| (Cost $460,000,000) | |||||

| Barclays Tri-Party Repurchase Agreement dated 6-30-20 at 0.060% to be repurchased at $310,000,517 on 7-1-20, collateralized by $140,375,300 U.S. Treasury Bonds, 4.500% due 2-15-36 (valued at $217,825,012) and $95,379,800 U.S. Treasury Notes, 1.750% due 6-30-22 (valued at $98,375,584) | 310,000,000 | 310,000,000 | |||

| Repurchase Agreement with State Street Corp. dated 6-30-20 at 0.000% to be repurchased at $50,000,000 on 7-1-20, collateralized by $46,882,500 U.S. Treasury Inflation Indexed Notes, 0.125% due 4-15-21 (valued at $51,000,098) | 50,000,000 | 50,000,000 | |||

| Repurchase Agreement with State Street Corp. dated 6-30-20 at 0.070% to be repurchased at $100,000,194 on 7-1-20, collateralized by $89,649,400 U.S. Treasury Inflation Indexed Notes, 0.125% due 7-15-26 (valued at $102,000,094) | 100,000,000 | 100,000,000 | |||

| Total investments (Cost $3,337,157,678) 100.6% | $3,338,322,593 | ||||

| Other assets and liabilities, net (0.6)% | (20,019,049) | ||||

| Total net assets 100.0% | $3,318,303,544 | ||||

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. | |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK COLLATERAL TRUST | 8 |

| Security Abbreviations and Legend | |

| LIBOR | London Interbank Offered Rate |

| SOFR | Secured Overnight Financing Rate |

| USBMMY | U.S. Treasury Bill Money Market Yield |

| (A) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. |

| (B) | Variable rate obligation. The coupon rate shown represents the rate at period end. |

| 9 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Assets | |

| Unaffiliated investments, at value (Cost $2,877,157,678) | $2,878,322,593 |

| Repurchase agreements, at value (Cost $460,000,000) | 460,000,000 |

| Total investments, at value (Cost $3,337,157,678) | 3,338,322,593 |

| Cash | 15,012,319 |

| Interest receivable | 2,125,482 |

| Other assets | 23,971 |

| Total assets | 3,355,484,365 |

| Liabilities | |

| Distributions payable | 413,405 |

| Payable for investments purchased | 36,517,235 |

| Payable to affiliates | |

| Administrative services fees | 148,605 |

| Transfer agent fees | 9,854 |

| Trustees' fees | 3,020 |

| Other liabilities and accrued expenses | 88,702 |

| Total liabilities | 37,180,821 |

| Net assets | $3,318,303,544 |

| Net assets consist of | |

| Paid-in capital | $3,317,093,501 |

| Total distributable earnings (loss) | 1,210,043 |

| Net assets | $3,318,303,544 |

| Net asset value per share | |

| Based on 331,457,358 shares of beneficial interest outstanding - unlimited number of shares authorized with no par value | $10.01 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK COLLATERAL TRUST | 10 |

| Investment income | |

| Interest | $12,269,733 |

| Expenses | |

| Investment management fees | 5,913,543 |

| Administrative services fees | 240,842 |

| Transfer agent fees | 29,854 |

| Trustees' fees | 22,149 |

| Custodian fees | 97,215 |

| Printing and postage | 8,871 |

| Professional fees | 52,311 |

| Other | 24,884 |

| Total expenses | 6,389,669 |

| Less expense reductions | (5,404,090) |

| Net expenses | 985,579 |

| Net investment income | 11,284,154 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Unaffiliated investments | 19,770 |

| 19,770 | |

| Change in net unrealized appreciation (depreciation) of | |

| Unaffiliated investments | 1,309,398 |

| 1,309,398 | |

| Net realized and unrealized gain | 1,329,168 |

| Increase in net assets from operations | $12,613,322 |

| 11 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Six months ended 6-30-20 (unaudited) | Year ended 12-31-19 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment income | $11,284,154 | $48,826,955 |

| Net realized gain | 19,770 | 23,595 |

| Change in net unrealized appreciation (depreciation) | 1,309,398 | 503,400 |

| Increase in net assets resulting from operations | 12,613,322 | 49,353,950 |

| Distributions to shareholders | ||

| From earnings | (11,284,154) | (48,826,955) |

| Total distributions | (11,284,154) | (48,826,955) |

| Fund share transactions | ||

| Shares issued | 21,809,227,581 | 36,054,903,046 |

| Distributions reinvested | 47,358 | 78,216 |

| Repurchased | (20,761,891,203) | (36,051,305,638) |

| Total from fund share transactions | 1,047,383,736 | 3,675,624 |

| Total increase | 1,048,712,904 | 4,202,619 |

| Net assets | ||

| Beginning of period | 2,269,590,640 | 2,265,388,021 |

| End of period | $3,318,303,544 | $2,269,590,640 |

| Share activity | ||

| Shares outstanding | ||

| Beginning of period | 226,829,801 | 226,466,429 |

| Shares issued | 2,179,293,099 | 3,603,023,896 |

| Distributions reinvested | 4,733 | 7,816 |

| Shares repurchased | (2,074,670,275) | (3,602,668,340) |

| End of period | 331,457,358 | 226,829,801 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK COLLATERAL TRUST | 12 |

| Period ended | 6-30-20 1 | 12-31-19 | 12-31-18 | 12-31-17 | 12-31-16 | 12-31-15 2 |

| Per share operating performance | ||||||

| Net asset value, beginning of period | $10.01 | $10.00 | $10.00 | $10.01 | $10.00 | $10.01 |

| Net investment income3 | 0.05 | 0.23 | 0.20 | 0.11 | 0.05 | 0.01 |

| Net realized and unrealized gain (loss) on investments | — 4 | 0.01 | — 4 | (0.01) | 0.02 | (0.01) |

| Total from investment operations | 0.05 | 0.24 | 0.20 | 0.10 | 0.07 | 0.00 |

| Less distributions | ||||||

| From net investment income | (0.05) | (0.23) | (0.20) | (0.11) | (0.06) | (0.01) |

| Net asset value, end of period | $10.01 | $10.01 | $10.00 | $10.00 | $10.01 | $10.00 |

| Total return (%)5 | 0.52 6 | 2.43 | 2.00 | 1.00 | 0.66 | 0.03 6 |

| Ratios and supplemental data | ||||||

| Net assets, end of period (in millions) | $3,318 | $2,270 | $2,265 | $1,667 | $1,441 | $1,608 |

| Ratios (as a percentage of average net assets): | ||||||

| Expenses before reductions | 0.53 7 | 0.53 | 0.53 | 0.54 | 0.54 | 0.54 7 |

| Expenses including reductions | 0.08 7 | 0.08 | 0.08 | 0.09 | 0.09 | 0.09 7 |

| Net investment income | 0.94 7 | 2.28 | 1.99 | 1.07 | 0.55 | 0.14 7 |

| Portfolio turnover (%)8 | 36 | 106 | 70 | 132 | 97 | 0 9 |

| 1 | Six months ended 6-30-20. Unaudited. |

| 2 | Period from 2-2-15 (commencement of operations) to 12-31-15. |

| 3 | Based on average daily shares outstanding. |

| 4 | Less than $0.005 per share. |

| 5 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 6 | Not annualized. |

| 7 | Annualized. |

| 8 | The calculation of portfolio turnover excludes amounts from all securities whose maturities or expiration dates at the time of acquisition were one year or less, which represents a significant amount of the investments held by the fund. |

| 9 | During the period ended December 31, 2015, securities purchased and/or sold by the fund utilized in the calculation of the portfolio turnover were acquired with less than one year until maturity. As a result, the portfolio turnover is 0%. |

| 13 | JOHN HANCOCK COLLATERAL TRUST | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| SEMIANNUAL REPORT | JOHN HANCOCK Collateral Trust | 14 |

| 15 | JOHN HANCOCK Collateral Trust | SEMIANNUAL REPORT |

| SEMIANNUAL REPORT | JOHN HANCOCK Collateral Trust | 16 |

| 17 | JOHN HANCOCK Collateral Trust | SEMIANNUAL REPORT |

CONTINUATION OF INVESTMENT ADVISORY AND SUBADVISORY AGREEMENTS

Evaluation of Advisory and Subadvisory Agreements by the Board of Trustees

This section describes the evaluation by the Board of Trustees (the Board) of John Hancock Collateral Trust (the fund) of the Advisory Agreement (the Advisory Agreement) with John Hancock Investment LLC (the Advisor) and the Subadvisory Agreement (the Subadvisory Agreement) with Manulife Investment Management (US) LLC (the Subadvisor) for the fund. The Advisory Agreement and Subadvisory Agreement are collectively referred to as the Agreements. Prior to the June 23-25, 2020 telephonic1 meeting, at which the Agreements were approved, the Board also discussed and considered information regarding the proposed continuation of the Agreements at the telephonic meeting held on May 26-27, 2020.

Approval of Advisory and Subadvisory Agreements

At telephonic meetings held on June 23-25, 2020, the Board, including the Trustees who are not parties to any Agreement or considered to be interested persons of the fund under the Investment Company Act of 1940, as amended (the 1940 Act) (the Independent Trustees), reapproved for an annual period the continuation of the Advisory Agreement between the fund and the Advisor and the Subadvisory Agreement between the Advisor and the Subadvisor with respect to the fund.

In considering the Advisory Agreement and the Subadvisory Agreement, the Board received in advance of the meetings a variety of materials relating to the fund, the Advisor and the Subadvisor, including comparative performance, fee and expense information for a peer group of similar funds prepared by an independent third-party provider of fund data, performance information for an applicable benchmark index; and other information provided by the Advisor and the Subadvisor regarding the nature, extent and quality of services provided by the Advisor and the Subadvisor under their respective Agreements, as well as information regarding the Advisor's revenues and costs of providing services to the fund and any compensation paid to affiliates of the Advisor. At the meetings at which the renewal of the Advisory Agreement and Subadvisory Agreement are considered, particular focus is given to information concerning fund performance, comparability of fees and total expenses, and profitability. However, the Board notes that the evaluation process with respect to the Advisor and the Subadvisor is an ongoing one. In this regard, the Board also took into account discussions with management and information provided to the Board (including its various committees) at prior meetings with respect to the services provided by the Advisor and the Subadvisor to the fund. The information received and considered by the Board in connection with the May and June meetings and throughout the year was both written and oral. The Board noted the affiliation of the Subadvisor with the Advisor, noting any potential conflicts of interest. The Board also considered the nature, quality, and extent of non-advisory services, if any, to be provided to the fund by the Advisor's affiliates. The Board considered the Advisory

____________________

1 On March 25, 2020, as a result of health and safety measures put in place to combat the global COVID-19 pandemic, the Securities and Exchange Commission issued an exemptive order (the "Order") pursuant to Sections 6(c) and 38(a) of the Investment Company Act of 1940, as amended (the "1940 Act"), that temporarily exempts registered investment management companies from the in-person voting requirements under the 1940 Act, subject to certain requirements, including that votes taken pursuant to the Order are ratified at the next in-person meeting. The Board determined that reliance on the Order was necessary or appropriate due to the circumstances related to current or potential effects of COVID-19 and therefore, the Board's May and June meetings were held telephonically in reliance on the Order.

Agreement and the Subadvisory Agreement separately in the course of its review. In doing so, the Board noted the respective roles of the Advisor and Subadvisor in providing services to the fund.

Throughout the process, the Board asked questions of and requested additional information from management. The Board is assisted by counsel for the fund and the Independent Trustees are also separately assisted by independent legal counsel throughout the process. The Independent Trustees also received a memorandum from their independent legal counsel discussing the legal standards for their consideration of the proposed continuation of the Agreements and discussed the proposed continuation of the Agreements in private sessions with their independent legal counsel at which no representatives of management were present.

Approval of Advisory Agreement

In approving the Advisory Agreement with respect to the fund, the Board, including the Independent Trustees, considered a variety of factors, including those discussed below. The Board also considered other factors (including conditions and trends prevailing generally in the economy, the securities markets, and the industry) and did not treat any single factor as determinative, and each Trustee may have attributed different weights to different factors. The Board's conclusions may be based in part on its consideration of the advisory and subadvisory arrangements in prior years and on the Board's ongoing regular review of fund performance and operations throughout the year.

Nature, extent, and quality of services. Among the information received by the Board from the Advisor relating to the nature, extent, and quality of services provided to the fund, the Board reviewed information provided by the Advisor relating to its operations and personnel, descriptions of its organizational and management structure, and information regarding the Advisor's compliance and regulatory history, including its Form ADV. The Board also noted that on a regular basis it receives and reviews information from the fund's Chief Compliance Officer (CCO) regarding the fund's compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board observed that the scope of services provided by the Advisor, and of the undertakings required of the Advisor in connection with those services, including maintaining and monitoring its own and the fund's compliance programs, risk management programs, liquidity management programs and cybersecurity programs, had expanded over time as a result of regulatory, market and other developments. The Board considered that the Advisor is responsible for the management of the day-to-day operations of the fund, including, but not limited to, general supervision of and coordination of the services provided by the Subadvisor, and is also responsible for monitoring and reviewing the activities of the Subadvisor and third-party service providers. The Board also considered the significant risks assumed by the Advisor in connection with the services provided to the fund including entrepreneurial risk in sponsoring new funds and ongoing risks including investment, operational, enterprise, litigation, regulatory and compliance risks with respect to all funds.

In considering the nature, extent, and quality of the services provided by the Advisor, the Trustees also took into account their knowledge of the Advisor's management and the quality of the performance of the Advisor's duties, through Board meetings, discussions and reports during the preceding year and through each Trustee's experience as a Trustee of the fund and of the other funds in the John Hancock group of funds complex (the John Hancock Fund Complex).

In the course of their deliberations regarding the Advisory Agreement, the Board considered, among other things:

| (a) | the skills and competency with which the Advisor has in the past managed the fund's affairs and its subadvisory relationship, the Advisor's oversight and monitoring of the Subadvisor's investment performance and compliance programs, such as the Subadvisor's compliance with fund policies and objectives, review of brokerage matters, including with respect to trade allocation and best execution and the Advisor's timeliness in responding to performance issues; | |

| (b) | the background, qualifications and skills of the Advisor's personnel; | |

| (c) | the Advisor's compliance policies and procedures and its responsiveness to regulatory changes and fund industry developments; | |

| (d) | the Advisor's administrative capabilities, including its ability to supervise the other service providers for the fund, as well as the Advisor's oversight of the Fund's securities lending activity, its monitoring of class action litigation and collection of class action settlements on behalf of the Fund, and bringing loss recovery actions on behalf of the Fund; | |

| (e) | the financial condition of the Advisor and whether it has the financial wherewithal to provide a high level and quality of services to the fund; | |

| (f) | the Advisor's initiatives intended to improve various aspects of the Trust's operations and investor experience with the fund; and | |

| (g) | the Advisor's reputation and experience in serving as an investment advisor to the fund and the benefit to shareholders of investing in funds that are part of a family of funds offering a variety of investments. |

The Board concluded that the Advisor may reasonably be expected to continue to provide a high quality of services under the Advisory Agreement with respect to the fund.

Investment performance. In connection with the consideration of the Advisory Agreement, the Board:

| (a) | reviewed information prepared by management regarding the fund's performance; | |

| (b) | considered the comparative performance of an applicable benchmark index; | |

| (c) | considered the performance of comparable funds, if any, as included in the report prepared by an independent third-party provider of fund data; and | |

| (d) | took into account the Advisor's analysis of the fund's performance and its plans and recommendations regarding the fund's subadvisory arrangement generally. |

The Board noted that while it found the data provided by the independent third-party generally useful it recognized its limitations, including in particular that the data may vary depending on the end date selected and the results of the performance comparisons may vary depending on the selection of the peer group. The Board noted that the fund outperformed its benchmark index and its peer group median, for the one- and three-year periods ended December 31, 2019. The Board took into account management's discussion of the fund's performance, including the favorable performance relative to the peer group median and benchmark index for the one- and three-year periods. The Board concluded that the fund's performance has generally outperformed the historical performance of comparable funds and the fund's benchmark index.

Fees and expenses. The Board reviewed comparative information prepared by an independent third-party provider of fund data, including, among other data, the fund's contractual and net management fees (and subadvisory fees, to the

extent available) and total expenses as compared to similarly situated investment companies deemed to be comparable to the fund in light of the nature, extent and quality of the management and advisory and subadvisory services provided by the Advisor and the Subadvisor. In comparing the fund's contractual and net management fees to those of comparable funds, the Board noted that such fees include both advisory and administrative costs. The Board noted the fund's net management fees and net total expenses are lower than the peer group median.

The Board took into account management's discussion with respect to the overall management fee, the fees of the Subadvisor, including the amount of the advisory fee retained by the Advisor after payment of the subadvisory fee, in each case in light of the services rendered for those amounts and the risks undertaken by the Advisor. The Board also noted that the Advisor pays the subadvisory fee. The Board also noted actions taken over the past several years to reduce the fund's operating expenses. The Board also noted that, in addition, the Advisor is currently waiving fees and/or reimbursing expenses with respect to the fund and that the fund has breakpoints in its contractual management fee schedule that reduces management fees as assets increase. The Board reviewed information provided by the Advisor concerning the investment advisory fee charged by the Advisor or one of its advisory affiliates to other clients (including other funds in the John Hancock Fund Complex) having similar investment mandates, if any. The Board considered any differences between the Advisor's and Subadvisor's services to the fund and the services they provide to other comparable clients or funds. The Board concluded that the advisory fee paid with respect to the fund is reasonable in light of the nature, extent and quality of the services provided to the fund under the Advisory Agreement.

Profitability/Fall Out benefits. In considering the costs of the services to be provided and the profits to be realized by the Advisor and its affiliates (including the Subadvisor) from the Advisor's relationship with the fund, the Board:

| (a) | reviewed financial information of the Advisor; | |

| (b) | reviewed and considered information presented by the Advisor regarding the net profitability to the Advisor and its affiliates with respect to the fund; | |

| (c) | received and reviewed profitability information with respect to the John Hancock Fund Complex as a whole and with respect to the fund; | |

| (d) | received information with respect to the Advisor's allocation methodologies used in preparing the profitability data and considered that the Advisor hired an independent third-party consultant to provide an analysis of the Advisor's allocation methodologies; | |

| (e) | considered that the Advisor also provides administrative services to the fund pursuant to an administrative services agreement; | |

| (f) | noted that the fund's Subadvisor is an affiliate of the Advisor; | |

| (g) | noted that affiliates of the Advisor provide transfer agency services and placement services to the fund; | |

| (h) | noted that the Advisor also derives reputational and other indirect benefits from providing advisory services to the fund; | |

| (i) | noted that the subadvisory fees for the fund are paid by the Advisor; | |

| (j) | considered the Advisor's ongoing costs and expenditures necessary to improve services, meet new regulatory and compliance requirements, and adapt to other challenges impacting the fund industry; and | |

| (k) | considered that the Advisor should be entitled to earn a reasonable level of profits in exchange for the level of services it provides to the fund and the risks that it assumes as Advisor, including entrepreneurial, operational, reputational, litigation and regulatory risk. |

Based upon its review, the Board concluded that the level of profitability, if any, of the Advisor and its affiliates (including the Subadvisor) from their relationship with the fund was reasonable and not excessive.

Economies of scale. In considering the extent to which the fund may realize any economies of scale and whether fee levels reflect these economies of scale for the benefit of the fund shareholders, the Board:

| (a) | considered that the Advisor has agreed to waive a portion of its management fee and/or reimburse or pay operating expenses of the fund to reduce operating expenses; | |

| (b) | reviewed the fund's advisory fee structure and concluded that (i) the fund's fee structure contains breakpoints at the subadvisory fee level and that such breakpoints are reflected as breakpoints in the advisory fees for the fund; and (ii) although economies of scale cannot be measured with precision, these arrangements permit shareholders of the fund to benefit from economies of scale if the fund grows. The Board also took into account management's discussion of the fund's advisory fee structure; and | |

| (c) | the Board also considered the potential effect of the fund's future growth in size on its performance and fees. The Board noted that if the fund's assets increase over time, the fund may realize other economies of scale. |

Approval of Subadvisory Agreement

In making its determination with respect to approval of the Subadvisory Agreement, the Board reviewed:

| (1) | information relating to the Subadvisor's business, including current subadvisory services to the fund (and other funds in the John Hancock Fund Complex); | |

| (2) | the historical and current performance of the fund and comparative performance information relating to an applicable benchmark index and comparable funds; and | |

| (3) | the subadvisory fee for the fund, including any breakpoints, and to the extent available, comparable fee information prepared by an independent third party provider of fund data. |

Nature, extent, and quality of services. With respect to the services provided by the Subadvisor, the Board received information provided to the Board by the Subadvisor, including the Subadvisor's Form ADV, as well as took into account information presented throughout the past year. The Board considered the Subadvisor's current level of staffing and its overall resources, as well as received information relating to the Subadvisor's compensation program. The Board reviewed the Subadvisor's history and investment experience, as well as information regarding the qualifications, background, and responsibilities of the Subadvisor's investment and compliance personnel who provide services to the fund. The Board also considered, among other things, the Subadvisor's compliance program and any disciplinary history. The Board also considered the Subadvisor's risk assessment and monitoring process. The Board reviewed the Subadvisor's regulatory history, including whether it was involved in any regulatory actions or investigations as well as material litigation, and any settlements and amelioratory actions undertaken, as appropriate. The Board noted that the Advisor conducts regular, periodic reviews of the Subadvisor and its operations, including regarding investment processes and organizational and staffing matters. The Board also noted that the fund's CCO and his staff conduct regular, periodic compliance reviews with the Subadvisor and present reports to the Independent Trustees regarding the same, which includes evaluating the regulatory compliance systems of the Subadvisor and procedures reasonably designed to assure compliance with the federal securities laws. The Board also took into account the financial condition of the Subadvisor.

The Board considered the Subadvisor's investment process and philosophy. The Board took into account that the Subadvisor's responsibilities include the development and maintenance of an investment program for the fund that is consistent with the fund's investment objective, the selection of investment securities and the placement of orders for the purchase and sale of such securities, as well as the implementation of compliance controls related to performance of these services. The Board also received information with respect to the Subadvisor's brokerage policies and practices, including with respect to best execution and soft dollars.

Subadvisor compensation. In considering the cost of services to be provided by the Subadvisor and the profitability to the Subadvisor of its relationship with the fund, the Board noted that the fees under the Subadvisory Agreement are paid by the Advisor and not the fund. The Board also considered any potential conflicts of interest the Advisor might have in connection with the Subadvisory Agreement.

In addition, the Board considered other potential indirect benefits that the Subadvisor and its affiliates may receive from the Subadvisor's relationship with the fund, such as the opportunity to provide advisory services to additional funds in the John Hancock Fund Complex and reputational benefits.

Subadvisory fees. The Board considered that the fund pays an advisory fee to the Advisor and that, in turn, the Advisor pays subadvisory fees to the Subadvisor. As noted above, the Board also considered the fund's subadvisory fees as compared to similarly situated investment companies deemed to be comparable to the fund as included in the report prepared by the independent third- party provider of fund data, to the extent available. The Board noted that the limited size of the Lipper peer group was not sufficient for comparative purposes. The Board also took into account the subadvisory fees paid by the Advisor to the Subadvisor with respect to the fund and compared them to fees charged by the Subadvisor to manage other subadvised portfolios and portfolios not subject to regulation under the 1940 Act, as applicable.

Subadvisor performance. As noted above, the Board considered the fund's performance as compared to the fund's peer group and the benchmark index. The Board noted the Advisor's expertise and resources in monitoring the performance, investment style and risk-adjusted performance of the Subadvisor. The Board was mindful of the Advisor's focus on the Subadvisor's performance. The Board also noted the Subadvisor's long-term performance record for similar accounts, as applicable.

The Board's decision to approve the Subadvisory Agreement was based on a number of determinations, including the following:

| (1) | the Subadvisor has extensive experience and demonstrated skills as a manager; | |

| (2) | the fund's performance has generally outperformed the historical performance of comparable funds and the fund's benchmark index; | |

| (3) | the subadvisory fees are reasonable in relation to the level and quality of services being provided under the Subadvisory Agreement; and | |

| (4) | noted that the subadvisory fees are paid by the Advisor and not the fund and that the subadvisory fee breakpoints are reflected as breakpoints in the advisory fees for the fund to permit shareholders to benefit from economies of scale if the fund grows. | |

| * * * | ||

Based on the Board's evaluation of all factors that the Board deemed to be material, including those factors described above, the Board, including the Independent Trustees, concluded that renewal of the Advisory Agreement and the

STATEMENT REGARDING LIQUIDITY RISK MANAGEMENT

Operation of the Liquidity Risk Management Program

This section describes operation and effectiveness of the Liquidity Risk Management Program (LRMP) established in accordance with Rule 22e-4 under the Investment Company Act of 1940, as amended (the Liquidity Rule). The Board of Trustees (the Board) of each Fund in the John Hancock Group of Funds (each a Fund and collectively, the Funds) that is subject to the requirements of the Liquidity Rule has appointed John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (together, the Advisor) to serve as Administrator of the LRMP with respect to each of the Funds, including Collateral Trust, subject to the oversight of the Board. In order to provide a mechanism and process to perform the functions necessary to administer the LRMP, the Advisor established the Liquidity Risk Management Committee (the Committee). The Fund's subadvisor, Manulife Investment Management (US) LLC, (the Subadvisor) executes the day-to-day investment management and security-level activities of the Fund in accordance with the requirements of the LRMP, subject to the supervision of the Advisor and the Board.

The Committee holds monthly meetings to: (1) review the day-to-day operations of the LRMP; (2) review and approve month end liquidity classifications; (3) review quarterly testing and determinations, as applicable; and (4) review other LRMP related material. The Committee also conducts daily, monthly, quarterly, and annual quantitative and qualitative assessments of each subadvisor to a Fund that is subject to the requirements of the Liquidity Rule and is a part of the LRMP to monitor investment performance issues, risks and trends. In addition, the Committee may conduct ad-hoc reviews and meetings with subadvisors as issues and trends are identified, including potential liquidity and valuation issues.

The Committee provided the Board at a meeting held on March 15-17, 2020 with a written report which addressed the Committee's assessment of the adequacy and effectiveness of the implementation and operation of the LRMP and any material changes to the LRMP. The report, which covered the period December 1, 2018 through December 31, 2019, included an assessment of important aspects of the LRMP including, but not limited to:

| • | Operation of the Fund's Redemption-In-Kind Procedures; |

| • | Highly Liquid Investment Minimum (HLIM) determination; |

| • | Compliance with the 15% limit on illiquid investments; |

| • | Reasonably Anticipated Trade Size (RATS) determination; |

| • | Security-level liquidity classifications; and |

| • | Liquidity risk assessment. |

The report also covered material liquidity matters which occurred or were reported during this period applicable to the Fund, if any, and the Committee's actions to address such matters.

Redemption-In-Kind Procedures

Rule 22e-4 requires any fund that engages in or reserves the right to engage in in-kind redemptions to adopt and implement written policies and procedures regarding in-kind redemptions as part of the management of its liquidity risk. These procedures address the process for redeeming in kind, as well as the circumstances under which the Fund would consider redeeming in kind. Anticipated large redemption activity will be evaluated to identify situations where redeeming in securities instead of cash may be appropriate.

As part of its annual assessment of the LRMP, the Committee reviewed the implementation and operation of the Redemption-In-Kind Procedures and determined they are operating in a manner that such procedures are adequate and effective to manage in-kind redemptions on behalf of the Fund as part of the LRMP.

Highly Liquid Investment Minimum determination

The Committee uses an HLIM model to determine a Fund's HLIM. This process incorporates the Fund's investment strategy, historical redemptions, liquidity classification rollup percentages and cash balances, redemption policy, access to funding sources, distribution channels and client concentrations. If the Fund falls below its established HLIM for a period greater than 7 consecutive calendar days, the Committee prepares a report to the Board within one business day following the seventh consecutive calendar day with an explanation of how the Fund plans to restore its HLIM within a reasonable period of time.

Based on the HLIM model, the Committee has determined that the Fund qualifies as a Primarily Highly Liquid Fund (PHLF). It is therefore not required to establish a HLIM. The Fund is tested quarterly to confirm its PHLF status.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to HLIM and PHLF determinations, and determined that such policies and procedures are operating in a manner that is adequate and effective as part of the LRMP.

Compliance with the 15% limit on illiquid investments

Rule 22e-4 sets an aggregate illiquid investment limit of 15% for a fund. Funds are prohibited from acquiring an illiquid investment if this results in greater than 15% of its net assets being classified as illiquid. When applying this limit, the Committee defines "illiquid investment" to mean any investment that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. If a 15% illiquid investment limit breach occurs for longer than 1 business day, the Fund is required to notify the Board and provide a plan on how to bring illiquid investments within the 15% threshold, and after 7 days confidentially notify the Securities and Exchange Commission (the SEC).

In February 2019, as a result of extended security markets closures in connection with the Chinese New Year in certain countries, the SEC released guidance, and the Committee approved and adopted an Extended Market Holiday Policy to plan for and monitor known Extended Market Holidays (defined as all expected market holiday closures spanning four or more calendar days).

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to the 15% illiquid investment limit and determined such policies and procedures are operating in a manner that is adequate and effective as part of the LMRP.

Reasonably Anticipated Trade Size determination

In order to assess the liquidity risk of a Fund, the Committee considers the impact on the Fund that redemptions of a RATS would have under both normal and reasonably foreseeable stressed conditions. Modelling the Fund's RATS requires quantifying cash flow volatility and analyzing distribution channel concentration and redemption risk. The model is designed to estimate the amount of assets that the Fund could reasonably anticipate trading on a given day, during both normal and reasonably foreseeable stressed conditions, to satisfy redemption requests.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to RATS determinations and determined that such policies and procedures are operating in a manner that is adequate and effective at making RATS determinations as part of the LRMP.

Security-level liquidity classifications

When classifying the liquidity of portfolio securities, the Fund adheres to the liquidity classification procedures established by the Advisor. In assigning a liquidity classification to Fund portfolio holdings, the following key inputs, among others, are considered: the Fund's RATS, feedback from the applicable Subadvisor on market-, trading- and investment-specific considerations, an assessment of current market conditions and fund portfolio holdings, and a value impact standard. The Subadvisor also provides position-level data to the Committee for use in monthly classification reconciliation in order to identify any classifications that may need to be changed as a result of the above considerations.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to security-level liquidity classifications and determined that such policies and procedures are operating in a manner that is adequate and effective as part of the LRMP.

Liquidity risk assessment

The Committee periodically reviews and assesses, the Fund's liquidity risk, including its investment strategy and liquidity of portfolio investments during both normal and reasonably foreseeable stressed conditions (including whether the investment strategy is appropriate for an open-end fund, the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers, and the use of borrowings for investment purposes and derivatives), cash flow analysis during both normal and reasonably foreseeable stressed conditions, and holdings of cash and cash equivalents, as well as borrowing arrangements and other funding sources.

The Committee also monitors global events, such as the COVID-19 Coronavirus, that could impact the markets and liquidity of portfolio investments and their classifications.

As part of its annual assessment of the LRMP, the Committee reviewed Fund-Level Liquidity Risk Assessment Reports for each of the Funds and determined that the investment strategy for each Fund continues to be appropriate for an open-ended structure.

Adequacy and Effectiveness

Based on the review and assessment conducted by the Committee, the Committee has determined that the LRMP has been implemented, and is operating in a manner that is adequate and effective at assessing and managing the liquidity risk of each Fund.

Trustees Hassell H. McClellan, Chairperson Officers Andrew G. Arnott Francis V. Knox, Jr.1 Charles A. Rizzo Salvatore Schiavone Christopher (Kit) Sechler Trevor Swanberg2 | Investment advisor John Hancock Investment Management LLC Subadvisor Manulife Investment Management (US) LLC Portfolio Managers Bridget Bruce Placement Agent John Hancock Investment Management Distributors LLC Custodian State Street Bank and Trust Company Transfer agent John Hancock Signature Services, Inc. Legal counsel K&L Gates LLP |

* Member of the Audit Committee

† Non-Independent Trustee

1 Retired on July 31, 2020

2 Effective July 31, 2020

The fund's proxy voting policies and procedures, as well as the fund proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

All of the fund's holdings as of the end of the third month of every fiscal quarter are filed with the SEC on Form N-PORT within 60 days of the end of the fiscal quarter. The fund's Form N-PORT filings are available on our website and the SEC's website, sec.gov.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our website at jhinvestments.com or by calling 800-225-5291.

| You can also contact us: | |||

| 800-225-5291 jhinvestments.com | Regular mail: John Hancock Signature Services, Inc. | Express mail: John Hancock Signature Services, Inc. | |

John Hancock family of funds

DOMESTIC EQUITY FUNDS Blue Chip Growth Classic Value Disciplined Value Disciplined Value Mid Cap Equity Income Financial Industries Fundamental All Cap Core Fundamental Large Cap Core New Opportunities Regional Bank Small Cap Core Small Cap Growth Small Cap Value U.S. Global Leaders Growth U.S. Quality Growth GLOBAL AND INTERNATIONAL EQUITY FUNDS Disciplined Value International Emerging Markets Emerging Markets Equity Fundamental Global Franchise Global Equity Global Shareholder Yield Global Thematic Opportunities International Dynamic Growth International Growth International Small Company | INCOME FUNDS Bond California Tax-Free Income Emerging Markets Debt Floating Rate Income Government Income High Yield High Yield Municipal Bond Income Investment Grade Bond Money Market Short Duration Bond Short Duration Credit Opportunities Strategic Income Opportunities Tax-Free Bond ALTERNATIVE AND SPECIALTY FUNDS Absolute Return Currency Alternative Asset Allocation Alternative Risk Premia Diversified Macro Infrastructure Multi-Asset Absolute Return Seaport Long/Short |

A fund's investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus contains this and other important information about the fund. To obtain a prospectus, contact your financial professional, call John Hancock Investment Management at 800-225-5291, or visit our website at jhinvestments.com. Please read the prospectus carefully before investing or sending money.

ASSET ALLOCATION Balanced Multi-Asset High Income Multi-Index Lifetime Portfolios Multi-Index Preservation Portfolios Multimanager Lifestyle Portfolios Multimanager Lifetime Portfolios Retirement Income 2040 EXCHANGE-TRADED FUNDS John Hancock Multifactor Consumer Discretionary ETF John Hancock Multifactor Consumer Staples ETF John Hancock Multifactor Developed International ETF John Hancock Multifactor Emerging Markets ETF John Hancock Multifactor Energy ETF John Hancock Multifactor Financials ETF John Hancock Multifactor Healthcare ETF John Hancock Multifactor Industrials ETF John Hancock Multifactor Large Cap ETF John Hancock Multifactor Materials ETF John Hancock Multifactor Media and John Hancock Multifactor Mid Cap ETF John Hancock Multifactor Small Cap ETF John Hancock Multifactor Technology ETF John Hancock Multifactor Utilities ETF | ENVIRONMENTAL, SOCIAL, AND ESG All Cap Core ESG Core Bond ESG International Equity ESG Large Cap Core CLOSED-END FUNDS Financial Opportunities Hedged Equity & Income Income Securities Trust Investors Trust Preferred Income Preferred Income II Preferred Income III Premium Dividend Tax-Advantaged Dividend Income Tax-Advantaged Global Shareholder Yield |

John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed

from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC, and are subadvised by Dimensional Fund Advisors LP.

Foreside is not affiliated with John Hancock Investment Management Distributors LLC or Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP receives compensation from John Hancock in connection with licensing rights to the

John Hancock Dimensional indexes. Dimensional Fund Advisors LP does not sponsor, endorse, or sell, and makes no

representation as to the advisability of investing in, John Hancock Multifactor ETFs.

John Hancock Investment Management

A trusted brand

John Hancock Investment Management is a premier asset manager

with a heritage of financial stewardship dating back to 1862. Helping

our shareholders pursue their financial goals is at the core of

everything we do. It's why we support the role of professional financial

advice and operate with the highest standards of conduct and integrity.

A better way to invest

We serve investors globally through a unique multimanager approach:

We search the world to find proven portfolio teams with specialized

expertise for every strategy we offer, then we apply robust investment

oversight to ensure they continue to meet our uncompromising

standards and serve the best interests of our shareholders.

Results for investors

Our unique approach to asset management enables us to provide

a diverse set of investments backed by some of the world's best

managers, along with strong risk-adjusted returns across asset classes.

John Hancock Investment Management Distributors LLC n Member FINRA, SIPC

200 Berkeley Street n Boston, MA 02116-5010 n 800-225-5291 n jhinvestments.com

This report is for the information of the shareholders of John Hancock Collateral Trust. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus.

| 315SA 6/20 8/2020 |

ITEM 2. CODE OF ETHICS.

Not applicable at this time.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable at this time.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable at this time.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable at this time.

ITEM 6. SCHEDULE OF INVESTMENTS.

| (a) | Not applicable. |

| (b) | Not applicable. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There were no material changes to previously disclosed John Hancock Funds – Nominating and Governance Committee Charter.

ITEM 11. CONTROLS AND PROCEDURES.

(a) EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in this Form N-CSR is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such disclosure controls and procedures include controls and procedures designed to ensure that such information is accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Within 90 days prior to the filing date of this Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant's management, including the Registrant's principal executive officer and the Registrant's principal financial officer, of the effectiveness of the design and operation of the Registrant's disclosure controls and procedures relating to information required to be disclosed on Form N-CSR. Based on such evaluation, the Registrant's principal executive officer and principal financial officer concluded that the Registrant's disclosure controls and procedures are operating effectively to ensure that:

(i) information required to be disclosed in this Form N-CSR is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission, and

(ii) information is accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

(b) CHANGE IN REGISTRANT'S INTERNAL CONTROL: Not Applicable.

ITEM 12. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.: Not applicable.

ITEM 13. EXHIBITS.

(a) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(c)(1) Submission of Matters to a Vote of Security Holders is attached. See attached “John Hancock Funds – Nominating, Governance and Administration Committee Charter.”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Collateral Trust

| By: | /s/ Andrew Arnott |

| Andrew Arnott | |

| President | |

| Date: | August 17, 2020 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Andrew Arnott |

| Andrew Arnott | |

| President | |

| Date: | August 17, 2020 |

| By: | /s/ Charles A. Rizzo |

| Charles A. Rizzo | |

| Chief Financial Officer | |

| Date: | August 17, 2020 |