Benefits to Related Parties

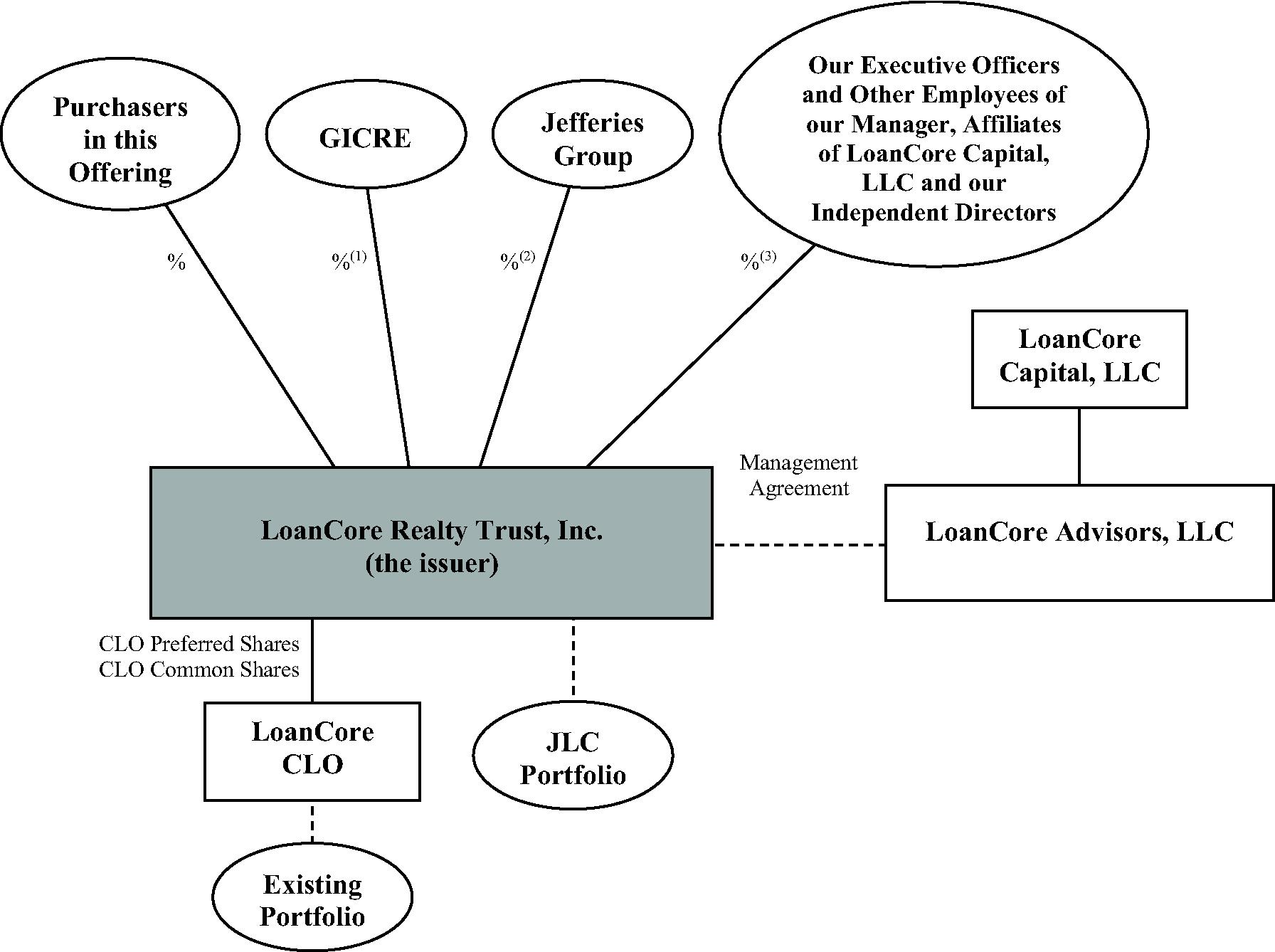

In connection with this offering, our concurrent private offerings and our formation transactions, our Manager, the members of our Manager’s senior management team, other employees of our Manager, our executive officers, the members of our board of directors, GICRE and Jefferies Group will receive material financial and other benefits, as described below. For a more detailed discussion of these benefits, see “Management,” “Our Manager and the Management Agreement” and “Certain Relationships and Related Person Transactions.”

Purchase of Our Outstanding Interests. As part of our formation transactions, we will use $ million of the net proceeds from this offering (subject to adjustment as discussed above) to repurchase all of our outstanding subordinate debt and shares of our common stock held by the DivCore Fund. Mark Finerman, our chairman, chief executive officer and president, owns an indirect 50% interest in DivCore Subordinate Debt Club I GP, LLC, the general partner of the DivCore Fund, which we refer to as the DivCore Fund GP and which has a 2% interest in the DivCore Fund, and Jordan Bock, our chief investment officer, holds a share of the profits interest that the DivCore Fund GP is entitled to receive from the DivCore Fund. Mr. Finerman will receive $ of such proceeds and Mr. Bock will receive $ of such proceeds. An affiliate of GICRE owns a 45% limited partnership interest in the DivCore Fund, and will receive $ million of such proceeds.

Purchase of JLC Portfolio. As part of our formation transactions, we will use $ million of the net proceeds from this offering and our concurrent private offerings and $ million in borrowings under our anticipated master repurchase facilities to acquire the JLC portfolio from JLC (subject to adjustment as discussed above). JLC is a joint venture among affiliates of each of Jefferies Group LLC, a wholly-owned subsidiary of Leucadia National Corporation and an affiliate of Jefferies LLC, one of the underwriters in this offering, and GIC Real Estate Private Limited, as well as certain individuals, including Mark Finerman, our chairman, chief executive officer and president, and Christopher McCormack, our chief financial officer. The Jefferies Group LLC affiliate has a 48.5% preferred and common interest in JLC, an affiliate of GIC Real Estate Private Limited has a 48.5% preferred and common interest in JLC, Mr. Finerman (individually and through an entity owned by Mr. Finerman) has a 1.7% preferred and common interest in JLC and Mr. McCormack has a 0.3% preferred and common interest in JLC.

Management Agreement. We will enter into a management agreement with our Manager effective upon the completion of this offering. Pursuant to our management agreement, our Manager will be entitled to receive from us a base management fee and incentive compensation, as well as the reimbursement of certain expenses incurred by our Manager. In addition, our Manager will be entitled to receive a termination fee from us under certain circumstances.

Share of Management Fees. Effective upon the completion of this offering and our concurrent private offerings, an affiliate of GICRE and Jefferies Group, an affiliate of Jefferies Group LLC, a wholly-owned subsidiary of Leucadia National Corporation, and Jefferies LLC, one of the underwriters in this offering, will be entitled to receive from our Manager payments equal to % and %, respectively, of the base management fees, incentive compensation and, if applicable, the termination fee received by our Manager under our management agreement.

Equity Incentive Plan Grants. Each of Mark Finerman, our chairman, chief executive officer and president, Jordan Bock, our chief investment officer, Christopher McCormack, our chief financial officer, Daniel Bennett, our head of capital markets, and Gary Berkman, our chief credit officer, is expected to be granted , , , and shares of restricted stock, respectively (or an aggregate of , , , and shares of restricted stock, respectively, if the underwriters exercise their over-allotment option in full), pursuant to our equity incentive plan on the date of this prospectus. These shares of restricted stock will vest ratably over three years. The actual number of shares of restricted stock to be granted will be determined based upon the number of shares of our common stock sold in this offering and in our concurrent private offerings.